Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Accounts Payable Resume Guide & Examples

Accounts Receivable Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Accounts Receivable

- Accounts Payable Specialist

Get advice on each section of your resume:

Jump to a resource:

- Accounts Receivable Resume Tips

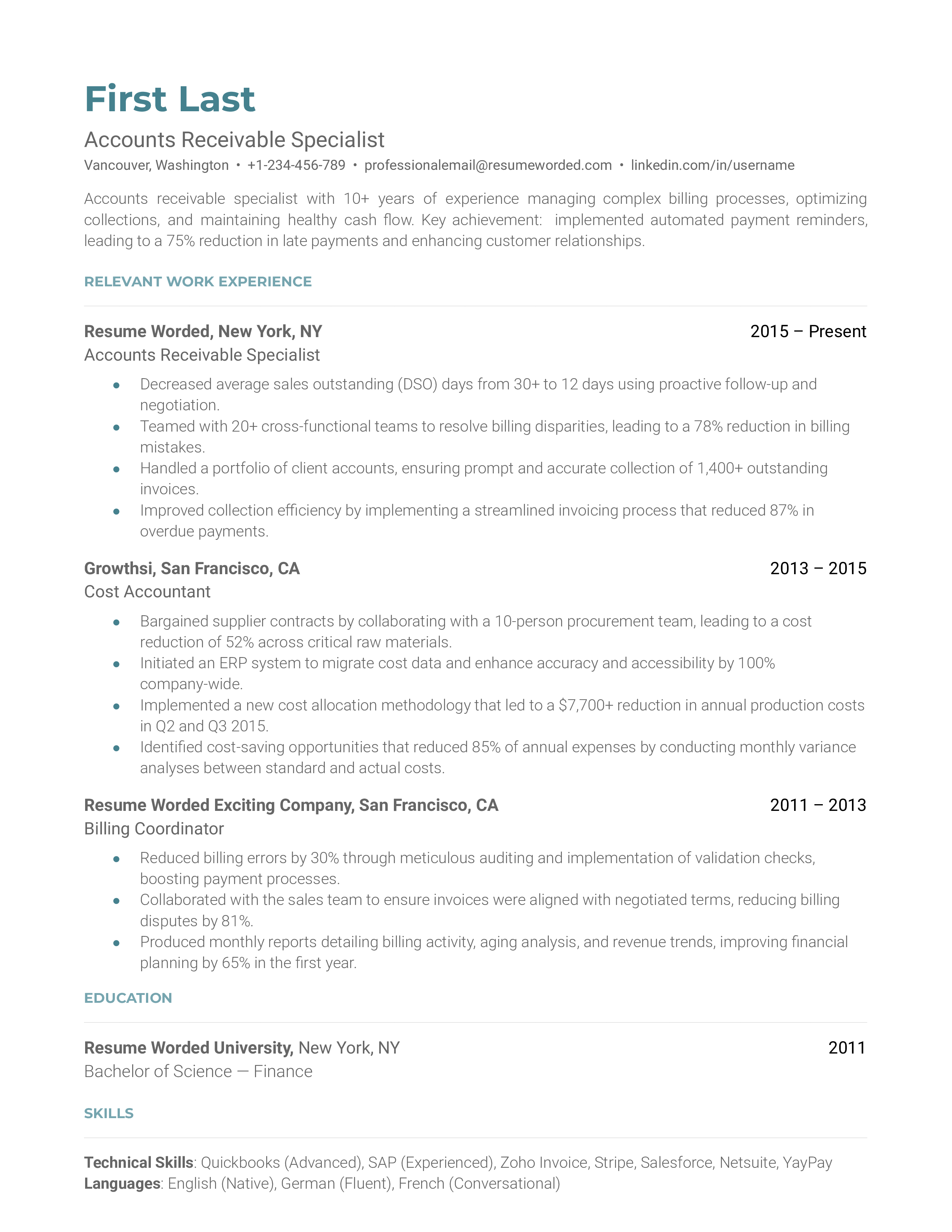

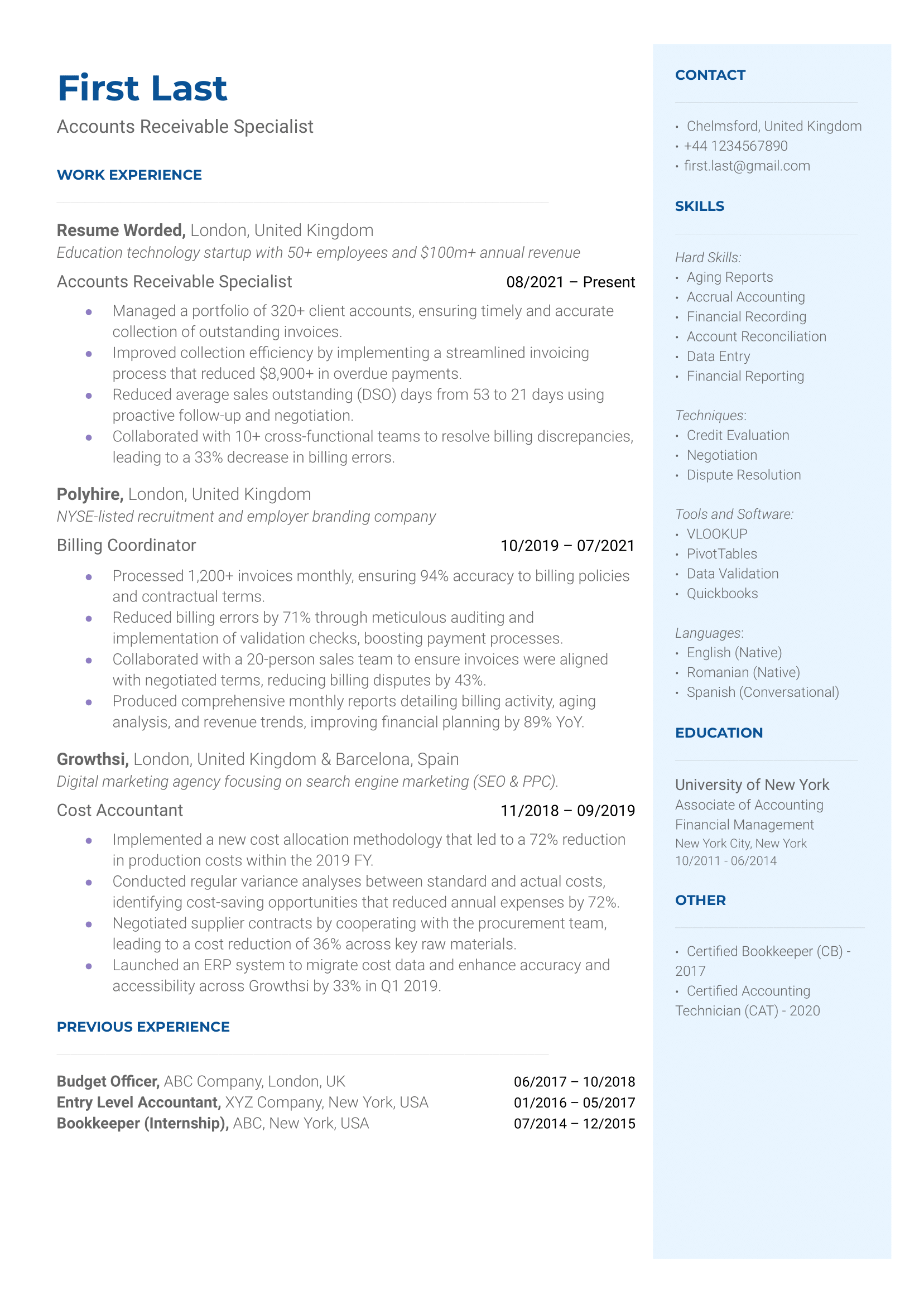

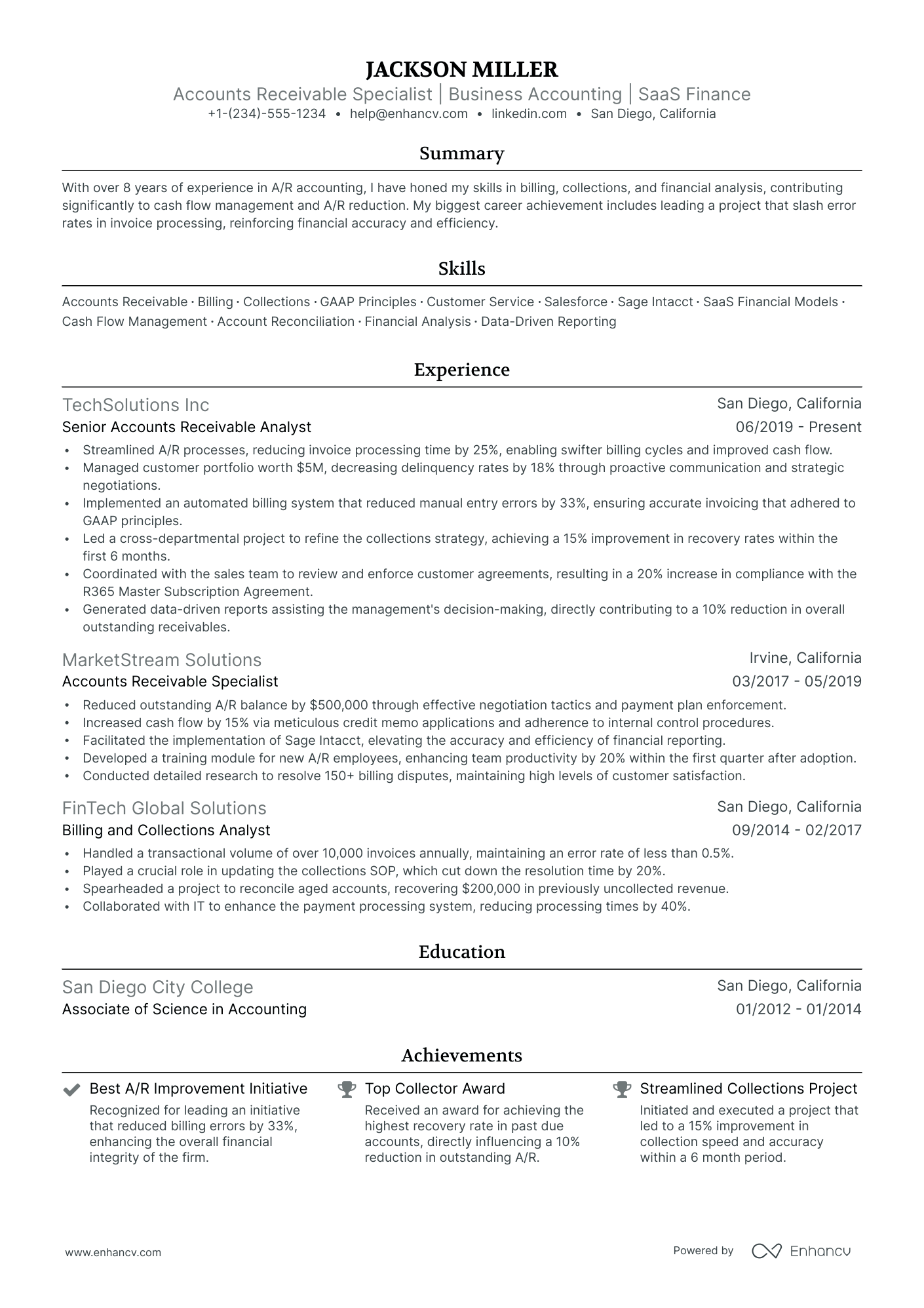

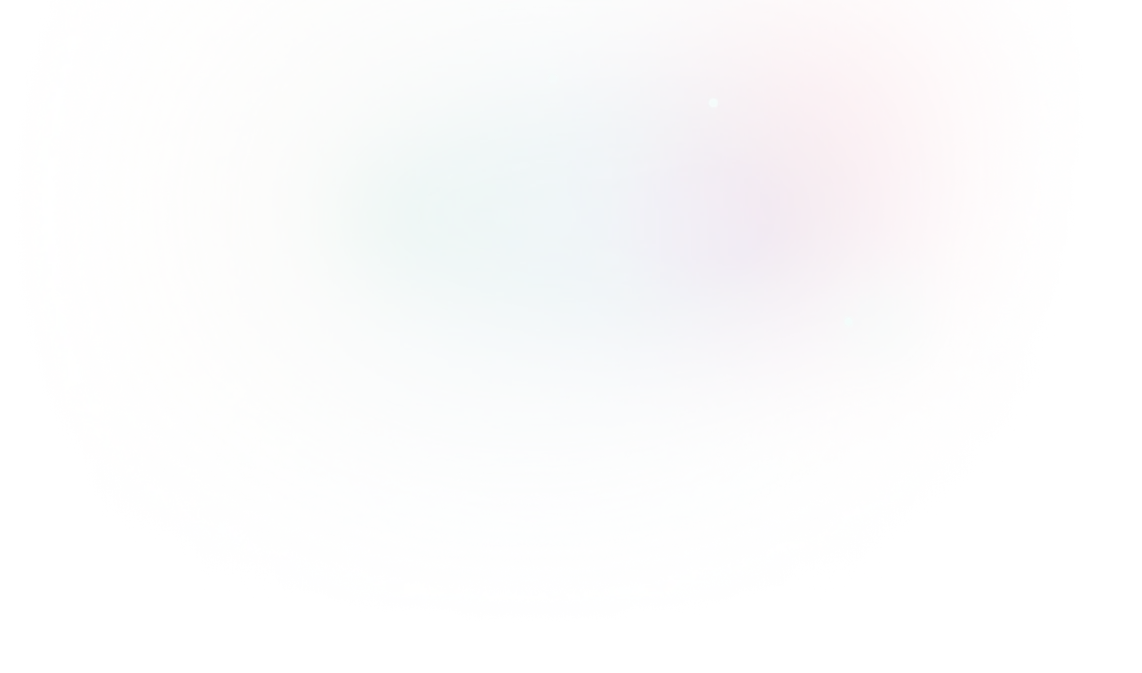

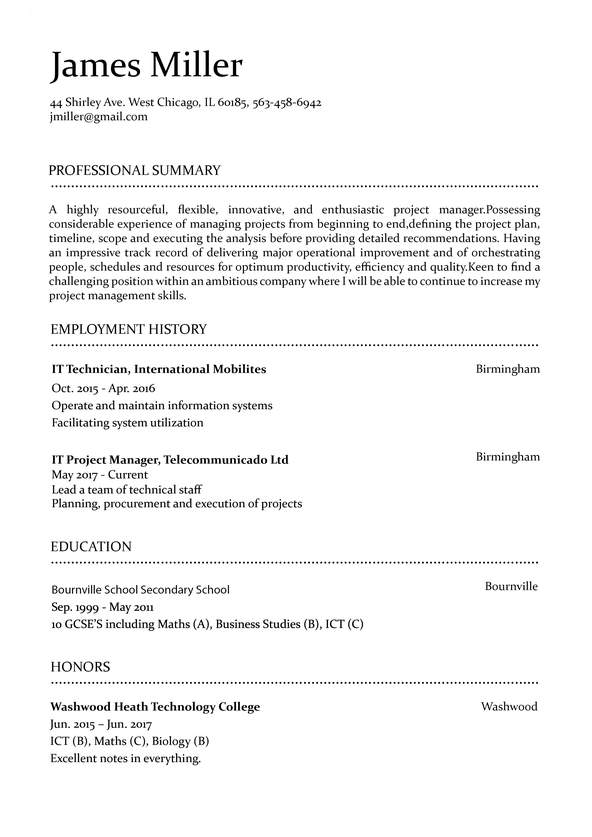

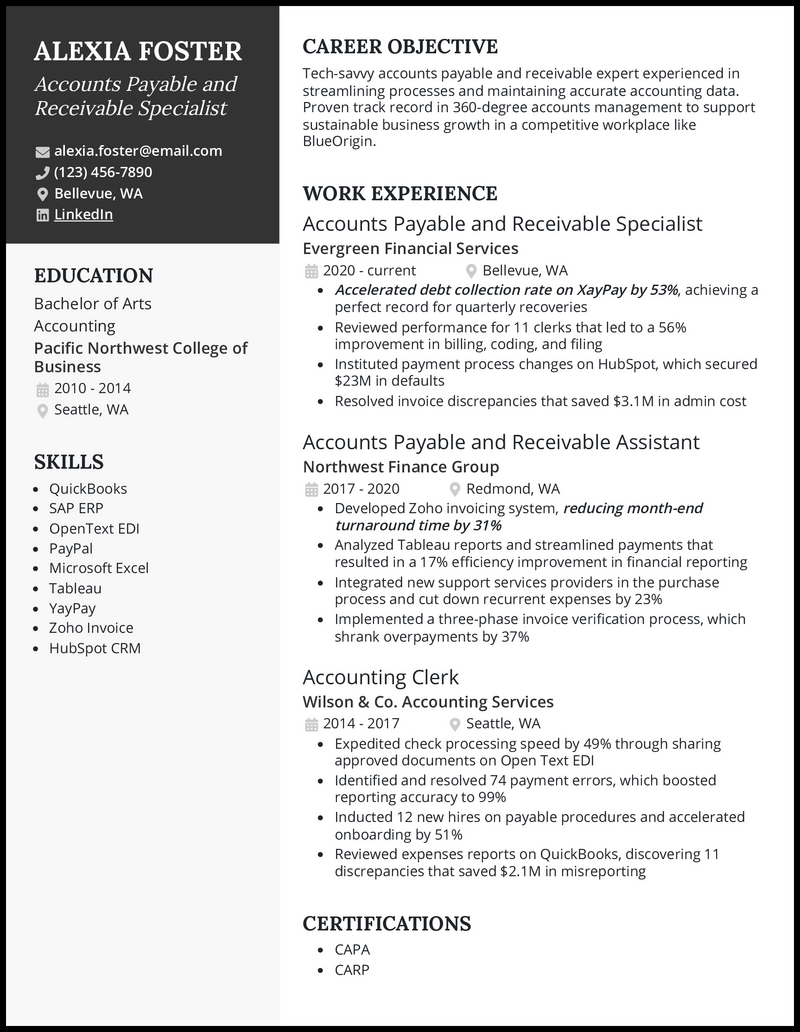

Accounts Receivable Resume Template

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., accounts receivable resume sample.

An accounts receivable role is integral to a company's financial health. You're the gatekeeper of incoming funds, and your management skills directly impact the company's cash flow. While the industry is becoming increasingly digital, speed and accuracy remain paramount, so resume-wise, you need to portray a blend of technical skill and precision thinking. The market for accounts receivable roles is competitive. Today, companies typically look for candidates with a mix of traditional accounting skills, familiarity with modern financial software, and data-analysis abilities. When drafting your resume, keep these requirements and trends in mind and frame your skills and experience accordingly.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

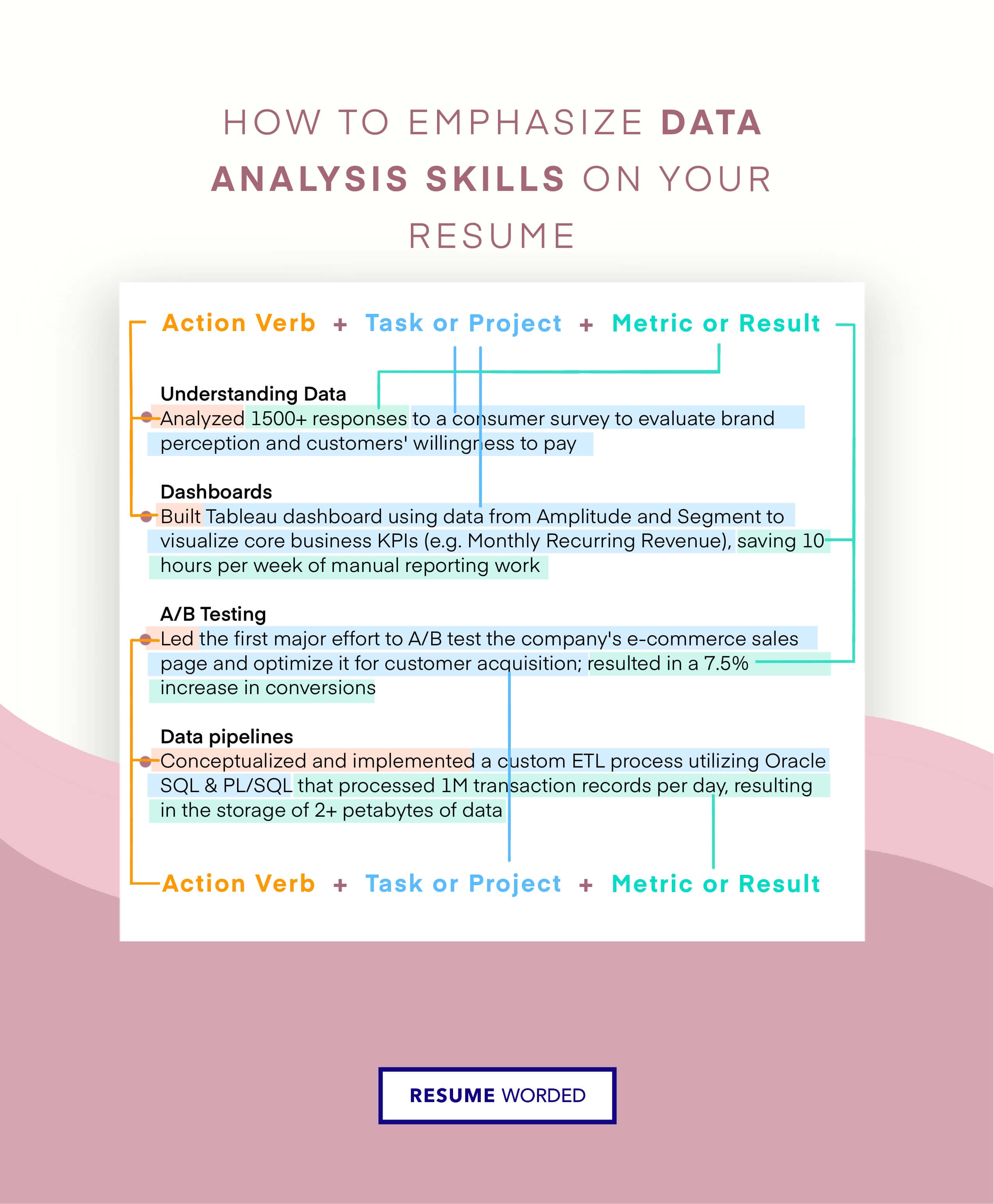

Tips to help you write your accounts receivable resume in 2024, emphasize your data proficiency.

Since the domain is increasingly data-driven, make sure to mention your familiarity with financial software like Quickbooks or Excel. Include any tangible achievements using these tools, like improving collection time or identifying revenue patterns.

Detail your collection strategies

In accounts receivable roles, your ability to collect payment is a crucial skill. You should showcase your strategies for timely collection, such as maintaining positive customer relationships or negotiating payment plans, and their success rates on your resume.

In the world of finance and accounting, Accounts Receivable (AR) is the key role that ensures the company's incoming cash flow. As an AR specialist, you're the one holding the strings to the company's collections, effectively making you an integral part of the firm's financial strength. Recently, there has been a strong desire for individuals who can utilize cutting-edge accounting software and have a keen eye for detail. When you're preparing your resume, remember, hiring managers are looking for someone who can seamlessly handle financial data, build strong relationships with clients, and contribute to the company's healthy cash flow.

Show proficiency in accounting software

As an Accounts Receivable specialist, you need to display your proficiency in accounting software like QuickBooks or SAP. This demonstrates that you can effortlessly navigate through different platforms, thus ensuring efficiency and accuracy in your work.

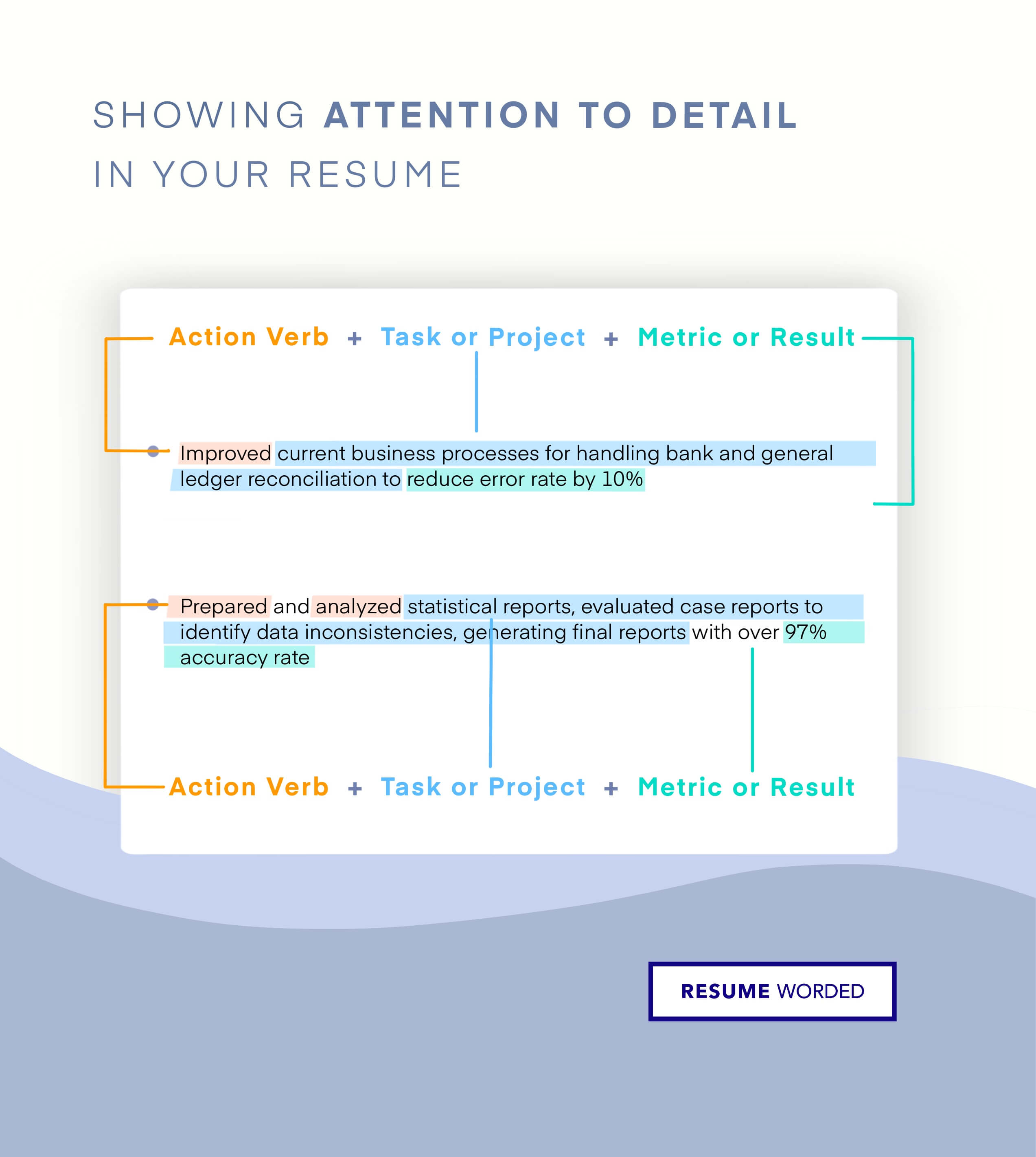

Emphasize your strong attention to detail

An Accounts Receivable role means dealing with a plethora of numbers daily. You should emphasize your strong attention to detail on your resume. Indicate past situations where your keen observation prevented financial mishaps or led to process improvements.

Accounts Payable Specialist Resume Sample

We spoke with hiring managers who recruit for Accounts Receivable roles at companies like Deloitte, PwC, and EY. They shared insider tips on what they look for in resumes that stand out. Here are some key tips to improve your Accounts Receivable resume and increase your chances of landing an interview.

Highlight your experience with accounting software

Hiring managers want to see that you have hands-on experience with the accounting software and tools commonly used in Accounts Receivable. Highlight your proficiency in your resume, such as:

- Proficient in QuickBooks, Xero, and SAP accounting software

- Skilled in using Oracle NetSuite ERP system for A/R processes

- Experience with Sage Intacct and Microsoft Dynamics GP

Quantify your experience where possible to give context to your skills. For example:

- Managed A/R processes using QuickBooks for 50+ corporate clients

- Processed 200+ customer invoices per month using Oracle NetSuite

Demonstrate your impact on key A/R metrics

Effective Accounts Receivable directly impacts a company's cash flow and revenue. Hiring managers look for candidates who can demonstrate their ability to drive key A/R metrics. Compare the following examples:

- Responsible for collecting on overdue invoices

- Collaborated with sales team to ensure timely payment

Instead, quantify your impact with specific numbers and results:

- Reduced average days sales outstanding (DSO) from 45 days to 30 days

- Improved collection rate from 80% to 95%, adding $500K to cash flow

- Recovered $250K in overdue receivables within 6 months

Show your experience in credit and collections

A/R roles often involve credit assessment and collections on past due accounts. Highlight your experience in these areas, especially if you've helped improve processes or results. For example:

- Analyzed credit reports and financials to set credit limits up to $1M

- Implemented new collection process, reducing past-due A/R by 30%

- Negotiated payment plans with delinquent accounts, collecting 90% of balances

If you have experience making collection calls, mention the volume of calls and your success rate. Hiring managers value candidates who can maintain positive client relationships while ensuring debts are paid.

Include your month-end close experience

The monthly close process is critical for A/R roles. Hiring managers look for accountants who can accurately close the books on time. Emphasize your experience with month-end tasks:

- Reconciled A/R aging to GL balance sheet, investigating discrepancies

- Prepared journal entries to apply cash receipts and clear A/R

- Accrued for earned revenue to recognize in current accounting period

Quantify the scope and impact of your work. For example:

Closed A/R sub-ledger for $10M+ in monthly revenue, reconciling to within 0.5% of GL balance

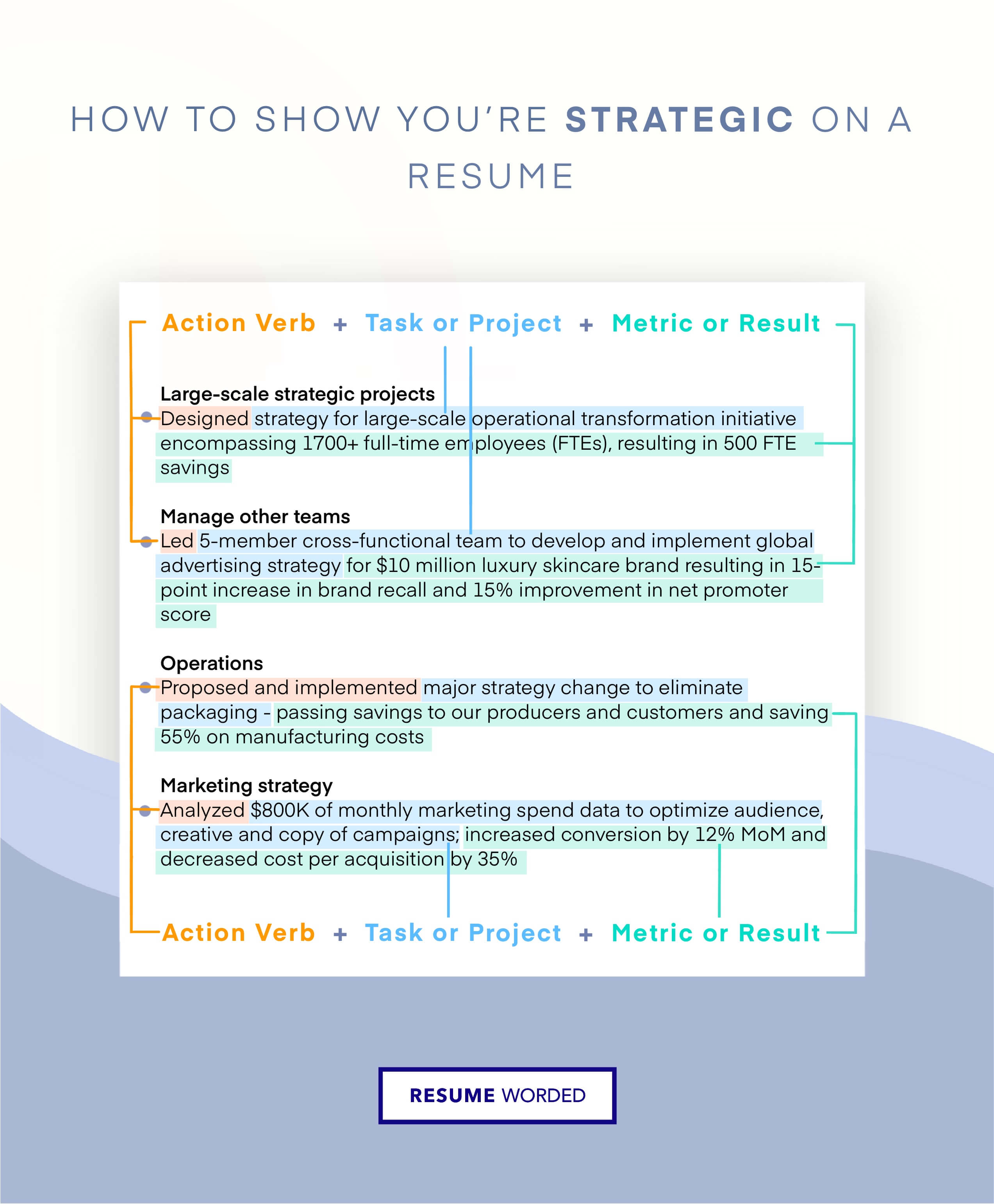

Showcase your problem-solving skills with examples

A/R roles involve problem-solving, such as resolving invoice disputes, discrepancies, and accounting errors. Show hiring managers how you've investigated and fixed A/R issues. Weak examples include:

- Resolved invoice disputes with customers

- Fixed billing errors to ensure accurate records

Instead, provide specific examples of problems you solved and the impact:

- Investigated $50K discrepancy in A/R aging, traced to unapplied credits, and corrected issue before month-end close

- Identified recurring billing error that understated revenue by $10K/month and implemented fix, resulting in $120K additional annual revenue

Mention your collaboration with other teams

A/R accountants work cross-functionally with sales, customer service, and collections teams. Hiring managers value candidates who can collaborate effectively. Include examples like:

- Partnered with sales to improve invoicing process, reducing billing errors by 20%

- Worked with customer service to resolve invoice disputes, maintaining 95% customer satisfaction score

- Collaborated with collections agency to recover $100K in overdue receivables

Mentioning your teamwork skills shows you can work well with other departments to achieve A/R goals. Quantify the results of your collaboration where possible.

Writing Your Accounts Receivable Resume: Section By Section

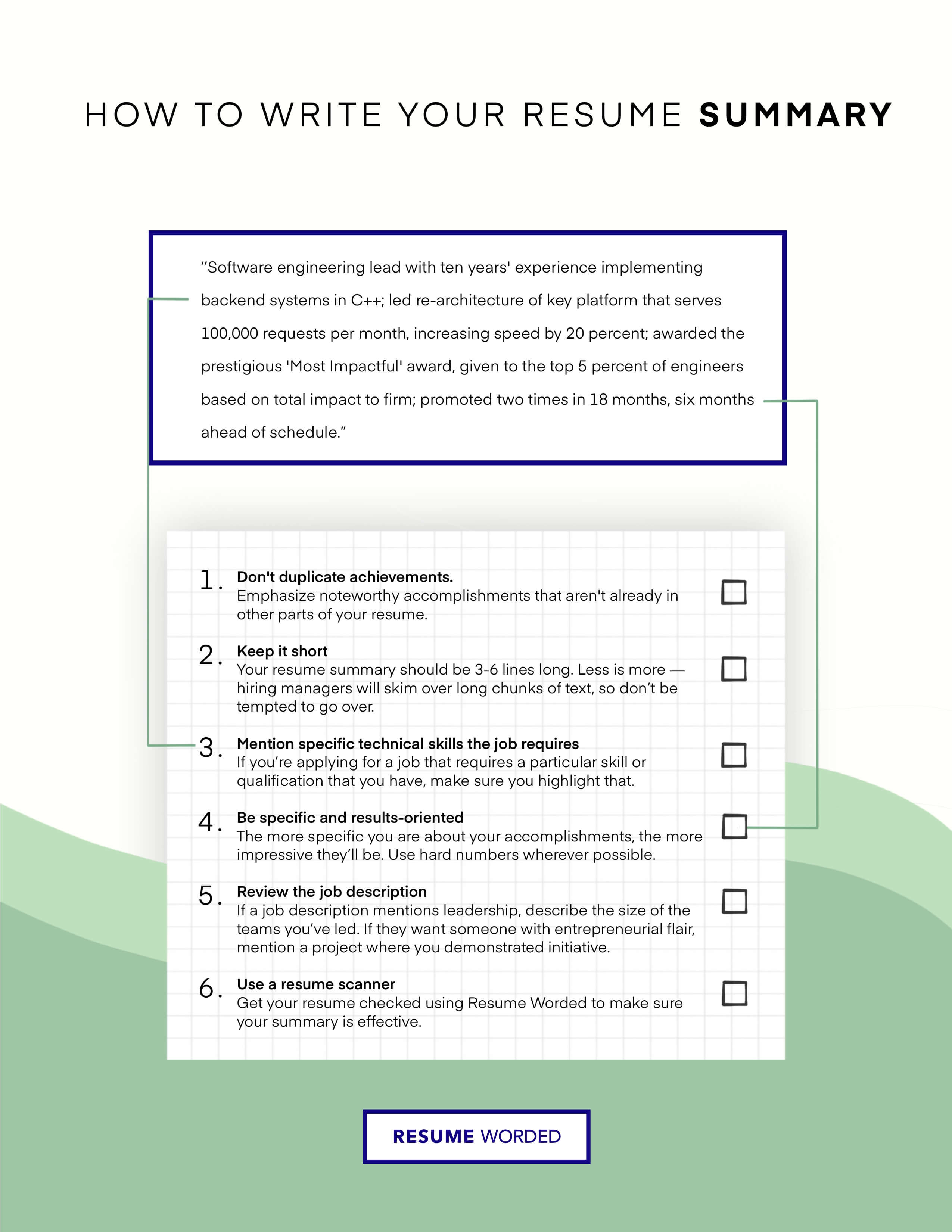

summary.

A resume summary for an Accounts Receivable position is optional, but it can be a valuable addition if you want to provide context or highlight details not already covered in your resume. It's especially useful if you're changing careers and your past experience doesn't directly align with Accounts Receivable, or if you're an executive with extensive experience. However, never use an objective statement, as it's outdated and ineffective.

When writing your summary, avoid repeating information already included in other sections of your resume. Instead, focus on mentioning your target job title and relevant keywords to optimize for applicant tracking systems (ATS). Keep your summary concise, ideally no more than one paragraph. Avoid directly mentioning soft skills or using corporate buzzwords like "proven track record." Bullet points are also not recommended in this section.

To learn how to write an effective resume summary for your Accounts Receivable resume, or figure out if you need one, please read Accounts Receivable Resume Summary Examples , or Accounts Receivable Resume Objective Examples .

1. Highlight accounts receivable expertise

When crafting your summary for an Accounts Receivable role, it's crucial to showcase your expertise in this specific field. Instead of using generic statements, provide concrete examples of your Accounts Receivable skills and accomplishments.

- Experienced professional with a strong work ethic and attention to detail.

- Skilled in various aspects of accounting and financial management.

To make your summary more impactful, focus on Accounts Receivable-specific competencies and quantifiable achievements:

- 5+ years of experience in Accounts Receivable, consistently maintaining a 98% collection rate and reducing DSO by 10 days.

- Proficient in managing high-volume invoicing, credit analysis, and dispute resolution for a $10M+ portfolio.

2. Demonstrate your impact on the company

An effective Accounts Receivable resume summary should not only list your responsibilities but also highlight the impact you've made in your previous roles. Employers want to see how you can contribute to their organization's success.

Accounts Receivable professional experienced in invoicing, collections, and customer service. Skilled in using accounting software and maintaining accurate records. Seeking a challenging role in a growth-oriented company.

Instead, quantify your achievements and demonstrate your value:

Results-driven Accounts Receivable Specialist with a proven track record of reducing aged receivables by 30% and improving cash flow by $500K annually. Implemented process improvements that increased efficiency and customer satisfaction. Seeking to leverage expertise in collections and credit management to drive financial success for [Company Name].

Experience

The work experience section is the heart of your accounts receivable resume. It's where you show hiring managers how you've applied your skills and knowledge to real-world situations. To make this section stand out, focus on highlighting your achievements and the impact you've made in previous roles.

Here are some key tips to keep in mind as you write your work experience section:

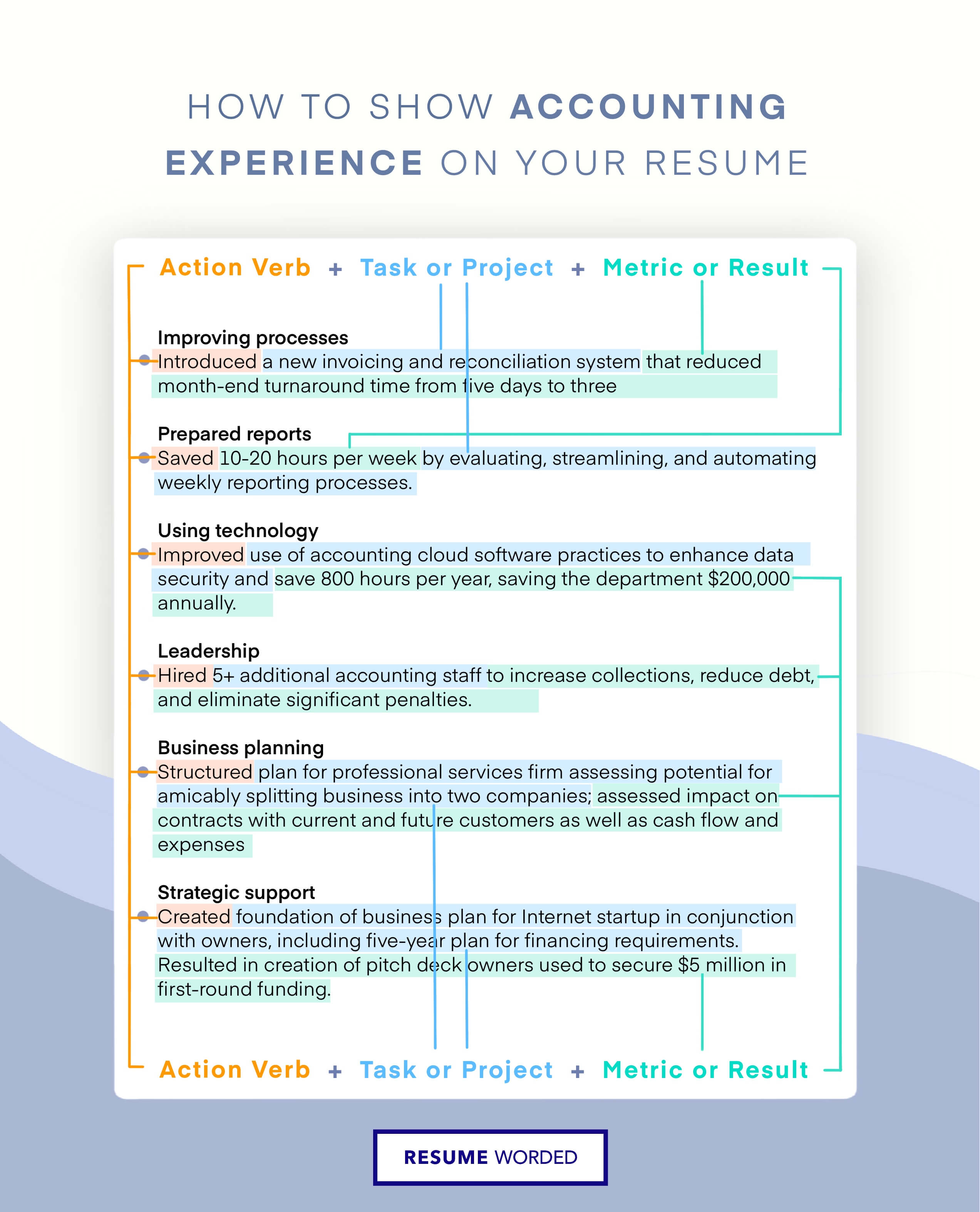

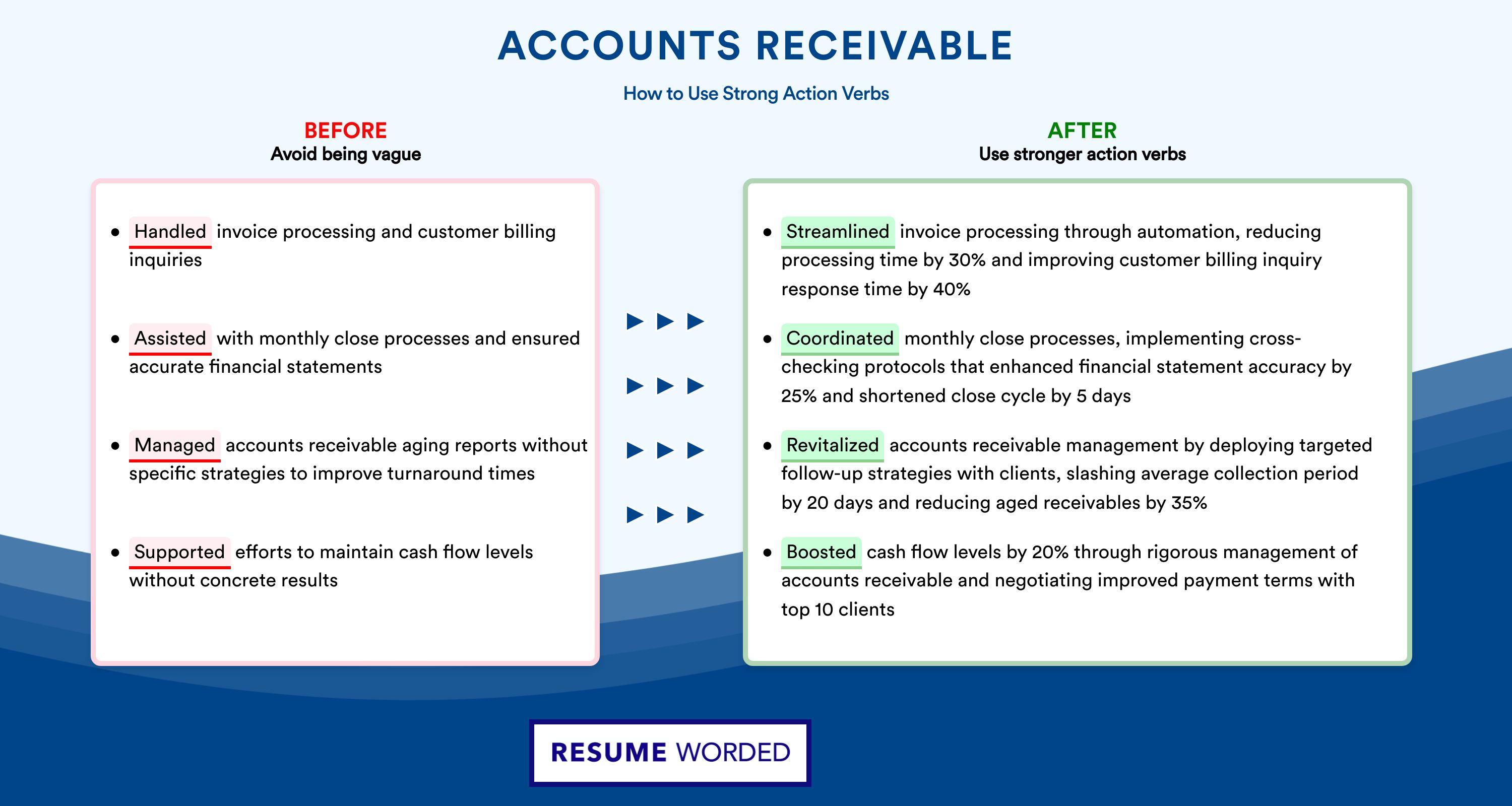

1. Use strong accounts receivable action verbs

When describing your work experience, use powerful action verbs that are relevant to accounts receivable roles. This helps paint a vivid picture of your contributions and makes your resume more impactful. For example:

- Collected on overdue accounts, reducing outstanding balances by 25%

- Reconciled discrepancies between invoices and payments, ensuring 100% accuracy

- Collaborated with cross-functional teams to streamline billing processes, saving 10 hours per week

Avoid using weak or passive language like:

- Responsible for collecting payments

- Helped with invoicing

- Participated in process improvements

2. Quantify your achievements with metrics

Numbers are a powerful way to demonstrate your impact and value to potential employers. Whenever possible, include specific metrics and data points that show the results you achieved. For example:

- Reduced DSO (Days Sales Outstanding) from 45 days to 30 days within first 6 months

- Improved collection rates by 20% year-over-year

- Processed an average of 100 invoices per day while maintaining 99.9% accuracy

If you don't have access to exact numbers, you can still provide a sense of scale:

- Managed accounts receivable for a portfolio of 50+ clients

- Consistently exceeded monthly collection targets

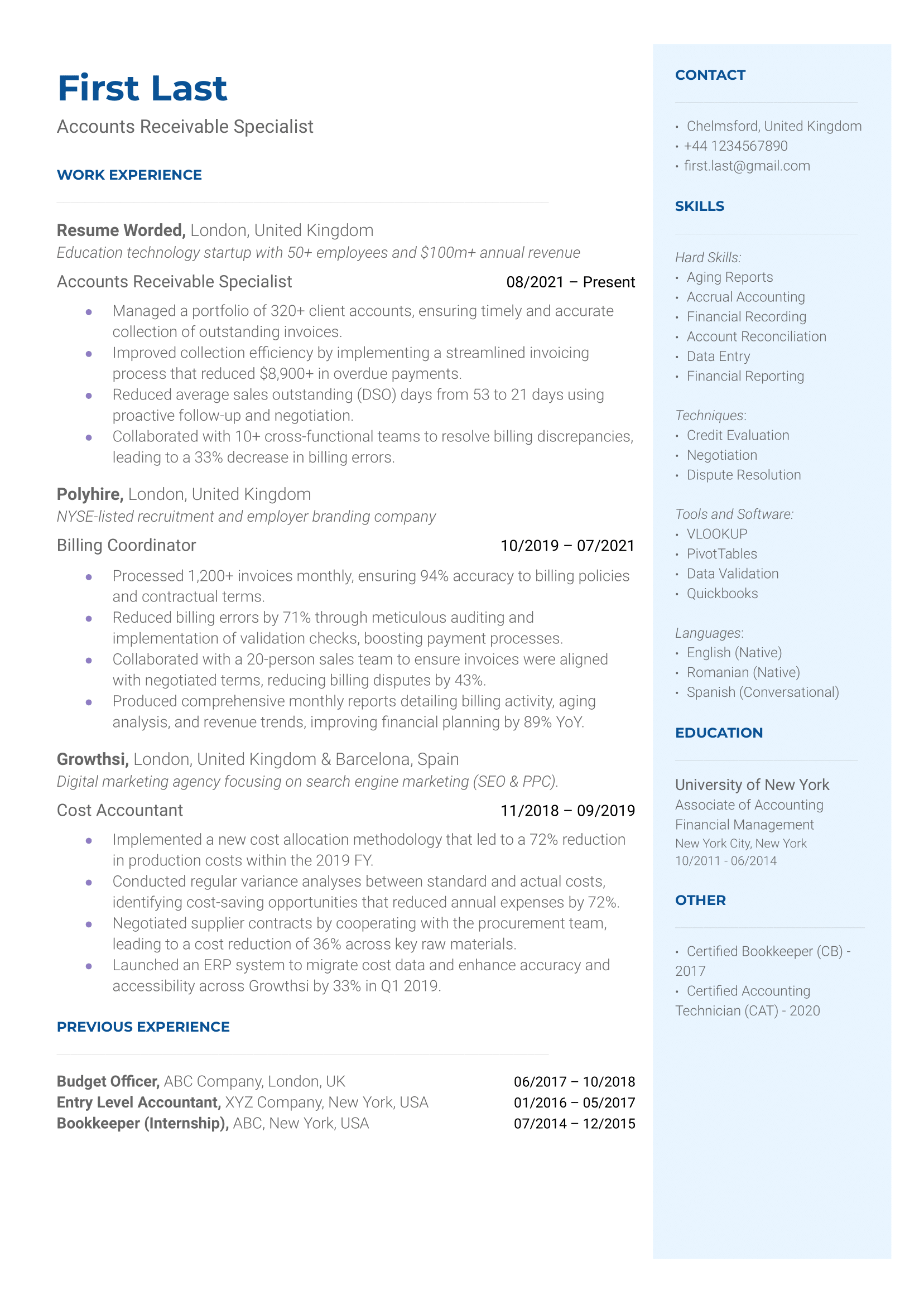

3. Showcase your career progression

Hiring managers love to see candidates who have grown and advanced in their careers. If you've been promoted or taken on increasing levels of responsibility, make sure to highlight that in your work experience section. Here's an example of how you might show progression:

Accounts Receivable Specialist, XYZ Company January 2018 - June 2020 Promoted to Accounts Receivable Team Lead, June 2020 - Present Manage a team of 5 AR specialists Oversee AR processes for the entire organization Reduced average days delinquent by 10 days through implementing new collection strategies

Even if your job title didn't change, you can still show growth by highlighting how your role or responsibilities expanded over time.

4. Tailor your experience to the job description

One of the biggest mistakes job seekers make is using the same generic work experience for every application. To stand out, you need to customize your resume for each position. Look closely at the job description and identify the key skills and qualifications the employer is seeking. Then, focus on highlighting the experiences and accomplishments that are most relevant.

For example, if a job description emphasizes experience with a specific accounts receivable software, make sure to call that out:

- Proficient in SAP Accounts Receivable module, including invoice processing, cash application, and reporting

If it mentions a focus on collections, prioritize achievements in that area:

- Spearheaded initiative to revamp collections process, resulting in a 15% reduction in bad debt write-offs

Education

The education section of your accounts receivable resume should be concise and highlight your relevant qualifications. It's important to tailor this section to the job requirements and showcase your academic achievements that align with the position.

1. List your highest degree first

Start with your most recent or highest level of education. For accounts receivable positions, a bachelor's degree in accounting, finance, or a related field is often preferred.

Here's an example of how to list your education:

Bachelor of Science in Accounting University of XYZ, City, State Graduation Date: May 2020 GPA: 3.8/4.0

2. Include relevant coursework for entry-level positions

If you are a recent graduate or have limited work experience, you can include relevant coursework to demonstrate your knowledge and skills in accounts receivable.

For example:

- Advanced Accounting

- Financial Reporting and Analysis

- Auditing and Assurance Services

However, avoid listing irrelevant or basic courses that do not add value to your application, such as:

- Introduction to Psychology

- English Composition

3. Highlight your accounting certifications

If you have obtained any professional certifications in accounting or finance, include them in your education section to showcase your expertise and commitment to the field.

Certified Public Accountant (CPA) American Institute of Certified Public Accountants (AICPA) Completion Date: December 2021

Avoid listing certifications that are not relevant to accounts receivable or are outdated, such as:

- First Aid and CPR Certification

- Microsoft Office Specialist (MOS) - Word 2010

4. Keep it concise for senior-level positions

If you are a senior-level accounts receivable professional with extensive work experience, you can keep your education section brief and focus on your most recent and relevant degree.

Here's an example:

Master of Business Administration (MBA) University of ABC, City, State

Avoid listing outdated or irrelevant information, such as:

Bachelor of Arts in English Literature XYZ College, City, State Graduation Date: May 1995 GPA: 3.2/4.0 Relevant Coursework: Creative Writing, British Literature, American Literature

Skills

The skills section of your accounts receivable resume is where you highlight your most relevant abilities and expertise. It's a quick way for hiring managers to see if you have the right qualifications for the role. Here are some tips for crafting a compelling skills section:

1. Focus on accounts receivable-specific skills

When listing your skills, prioritize those that are most relevant to accounts receivable roles. These may include:

- Accounts receivable software (e.g., SAP, Oracle, QuickBooks)

- Invoicing and billing

- Payment processing

- Collections and dispute resolution

- Financial reporting

By showcasing your expertise in these areas, you demonstrate to employers that you have the specific knowledge and abilities needed to succeed in the role.

2. Avoid listing generic or irrelevant skills

Many job seekers make the mistake of including generic or outdated skills in their resume, such as:

Microsoft Office Communication Teamwork Problem-solving

Instead, focus on skills that are specific to accounts receivable and demonstrate your expertise in the field, like this:

Accounts receivable automation tools (e.g., Highradius, Yaypay) Credit analysis and risk assessment Cash application and reconciliation Deduction management

3. Categorize your skills for easy scanning

To make your skills section easy to read and navigate, consider grouping your skills into categories. For example:

- Accounts Receivable : Invoicing, Collections, Deduction Management, Credit Analysis

- Accounting Software : SAP, Oracle, QuickBooks, Microsoft Dynamics

- Financial Analysis : Variance Analysis, Forecasting, Budgeting, Financial Reporting

This format helps hiring managers quickly identify your key areas of expertise and see how they align with the role's requirements.

4. Beat the bots with ATS-friendly formatting

Many companies use applicant tracking systems (ATS) to automatically screen resumes for relevant skills and keywords. To ensure your resume makes it past these filters:

- Use simple, standard fonts like Arial or Calibri

- Avoid tables, columns, or graphics in your skills section

- Spell out acronyms in addition to including the shortened version (e.g., 'Accounts Receivable (AR)')

By following these formatting best practices, you increase the likelihood that your resume will be successfully parsed by the ATS and make it into the hands of a human recruiter.

Skills For Accounts Receivable Resumes

Here are examples of popular skills from Accounts Receivable job descriptions that you can include on your resume.

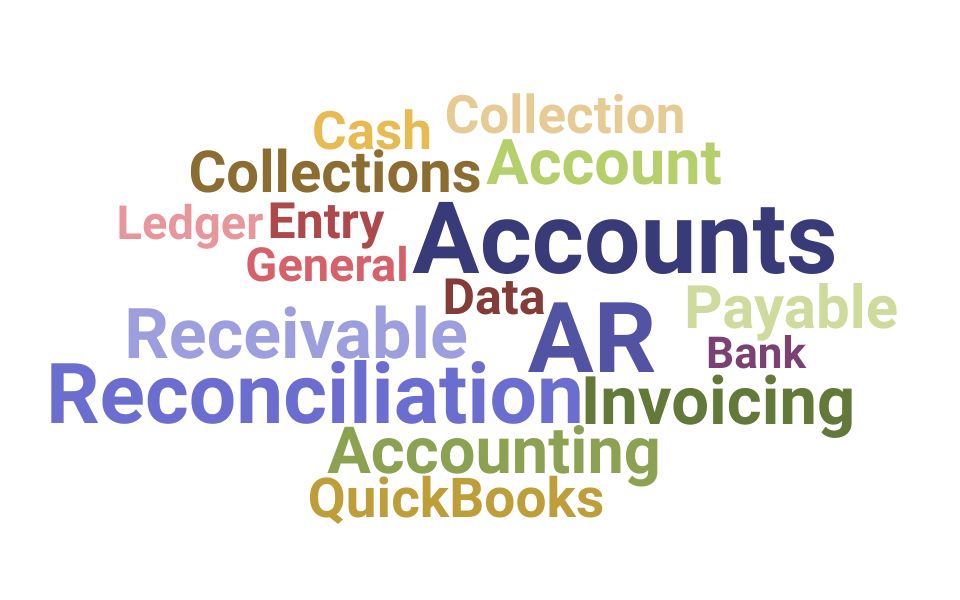

Skills Word Cloud For Accounts Receivable Resumes

This word cloud highlights the important keywords that appear on Accounts Receivable job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

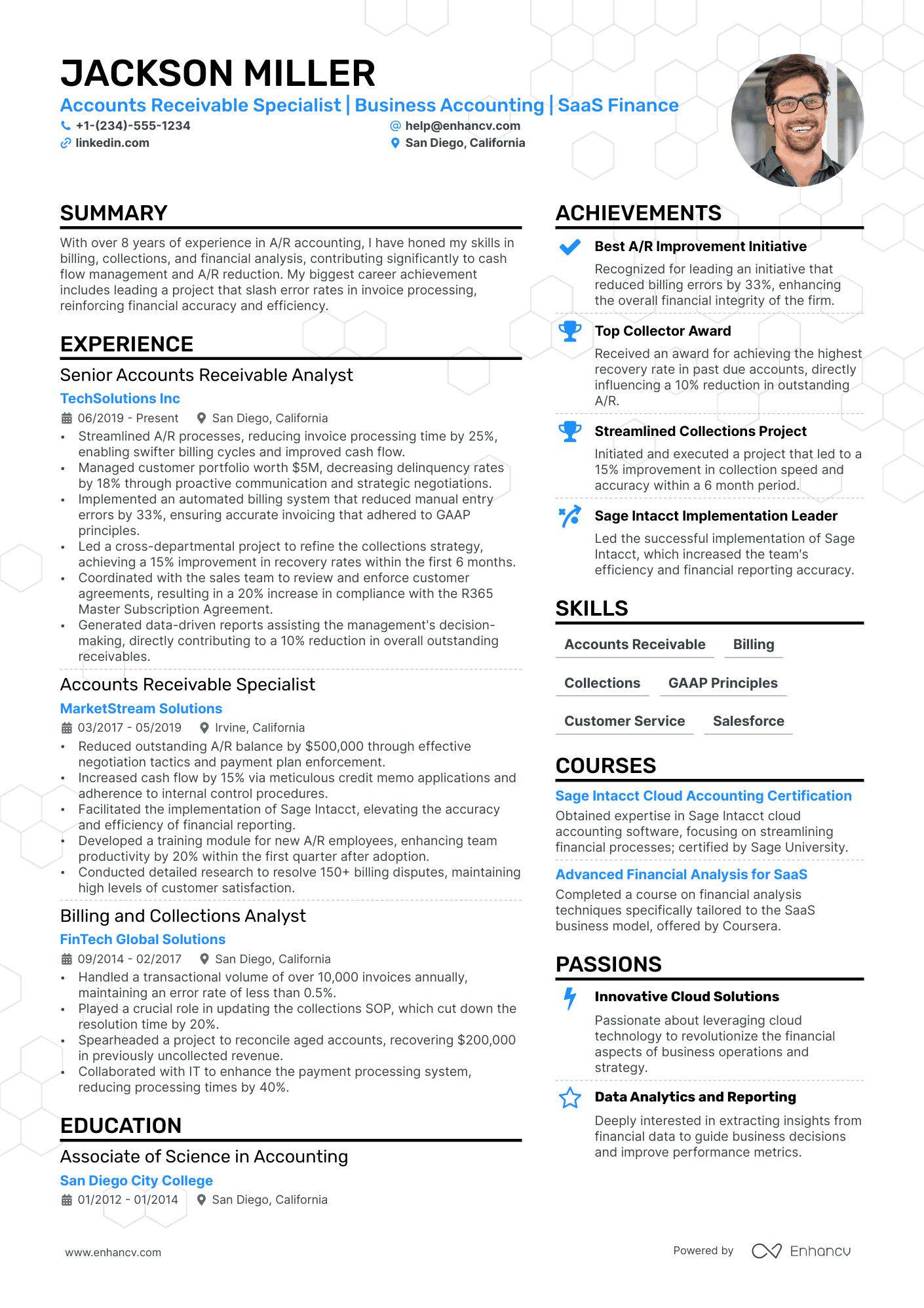

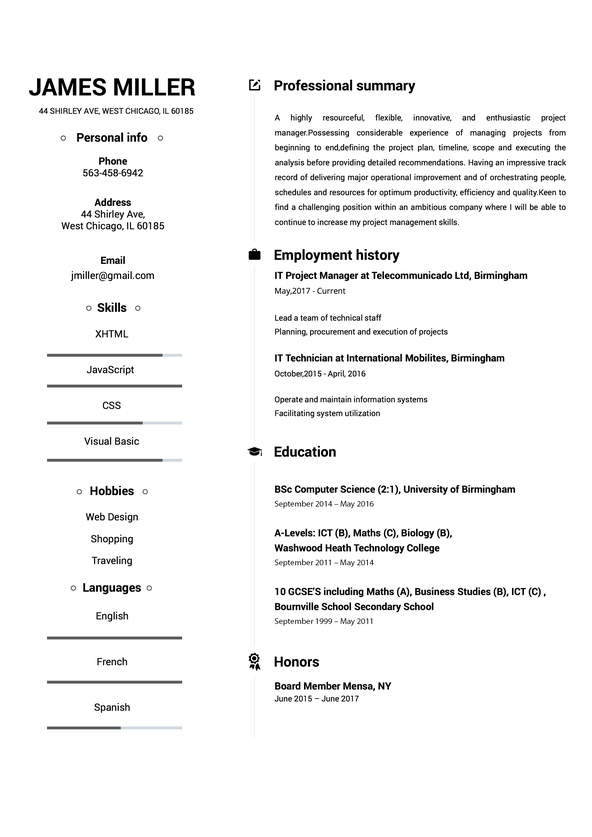

Similar resume templates, accounts payable.

- C-Level and Executive Resume Guide

- Finance Director Resume Guide

- Claims Adjuster Resume Guide

- Accounts Payable Resume Guide

- Collections Specialist Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Accounts Payable Resume Guide & Examples for 2022

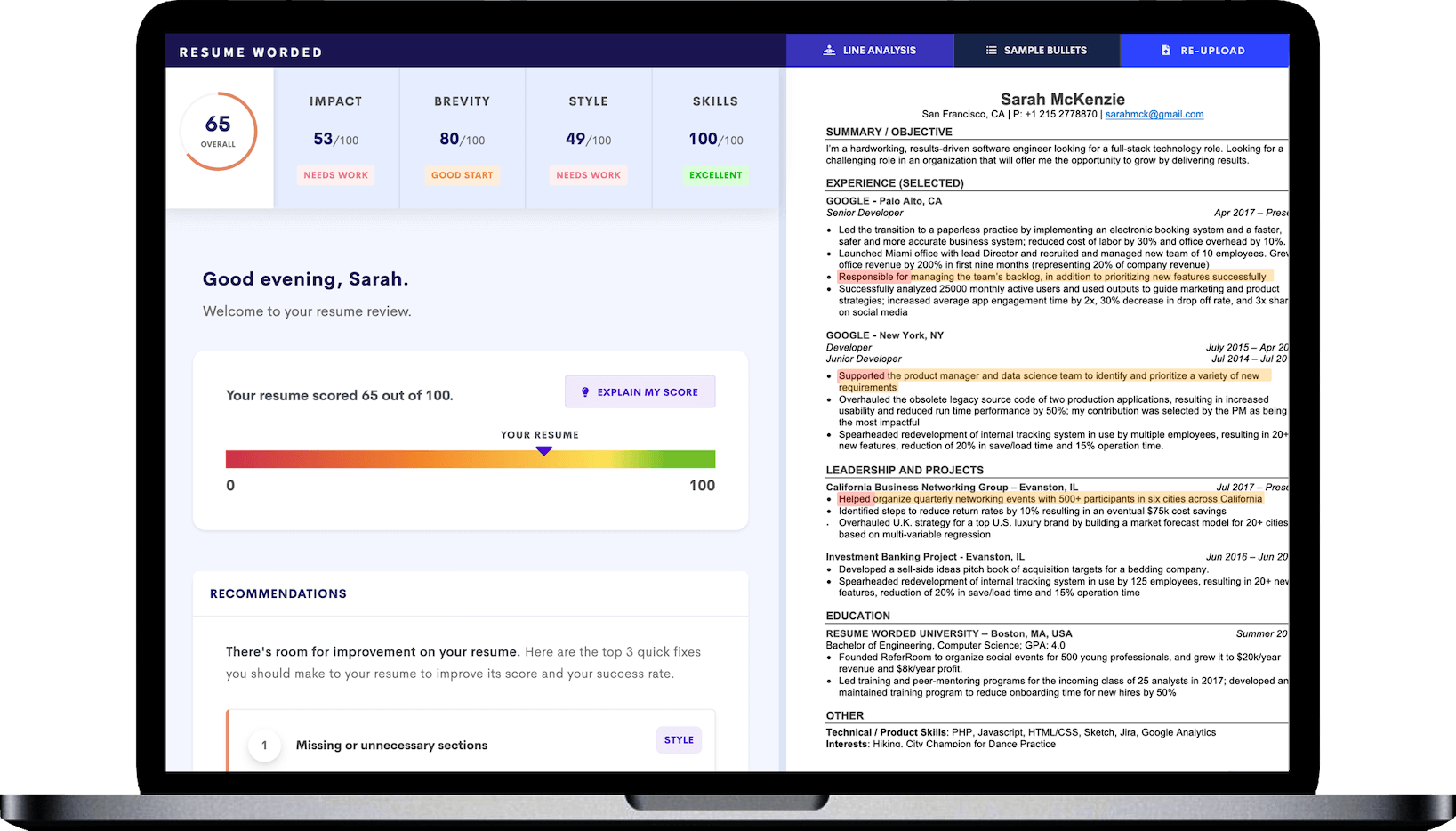

Improve your Accounts Receivable resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Accounts Receivable resumes in your industry.

• Fix all your resume's mistakes.

• Find the Accounts Receivable skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Accounts Receivable Resumes

- Template #1: Accounts Receivable

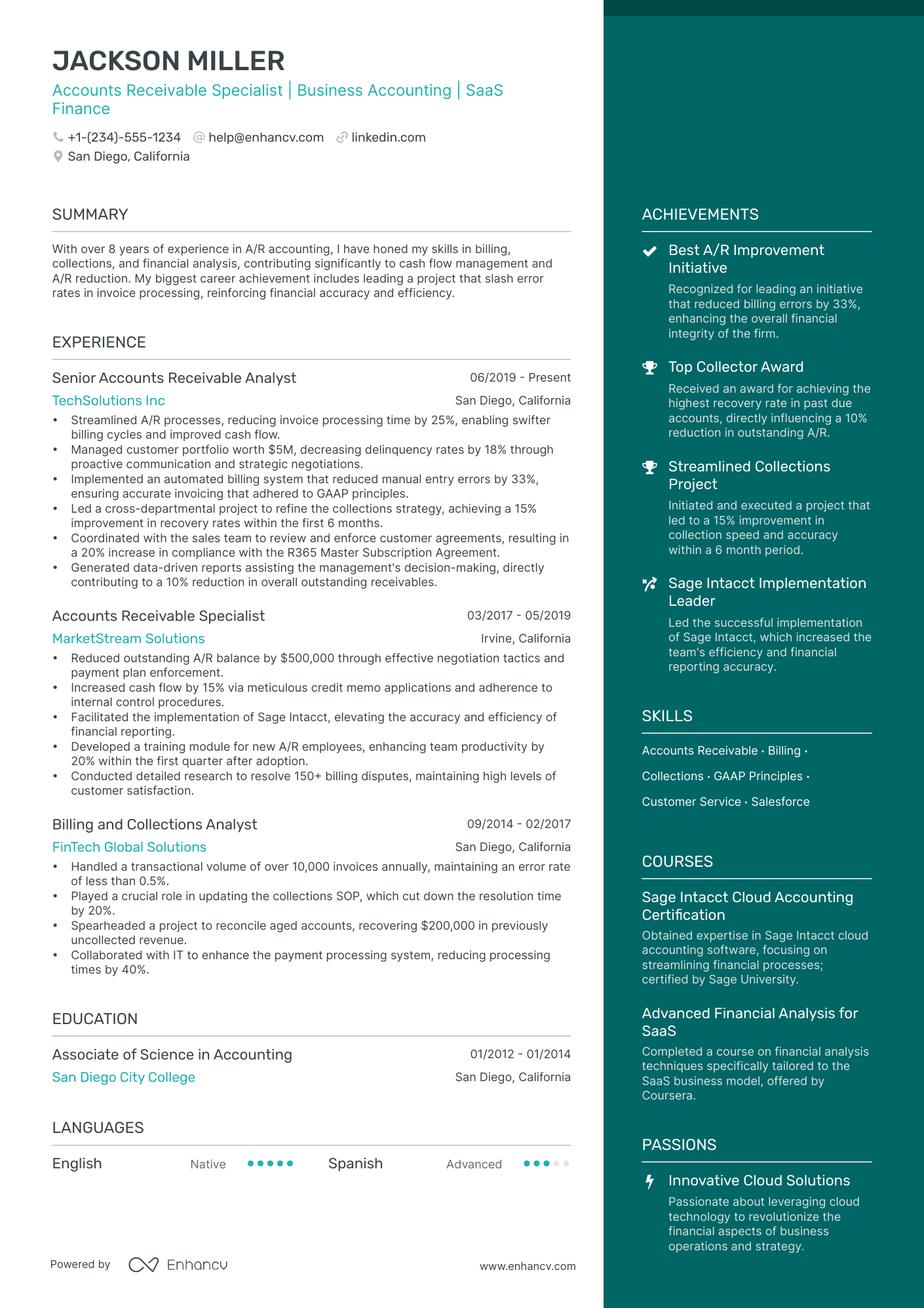

- Template #2: Accounts Receivable

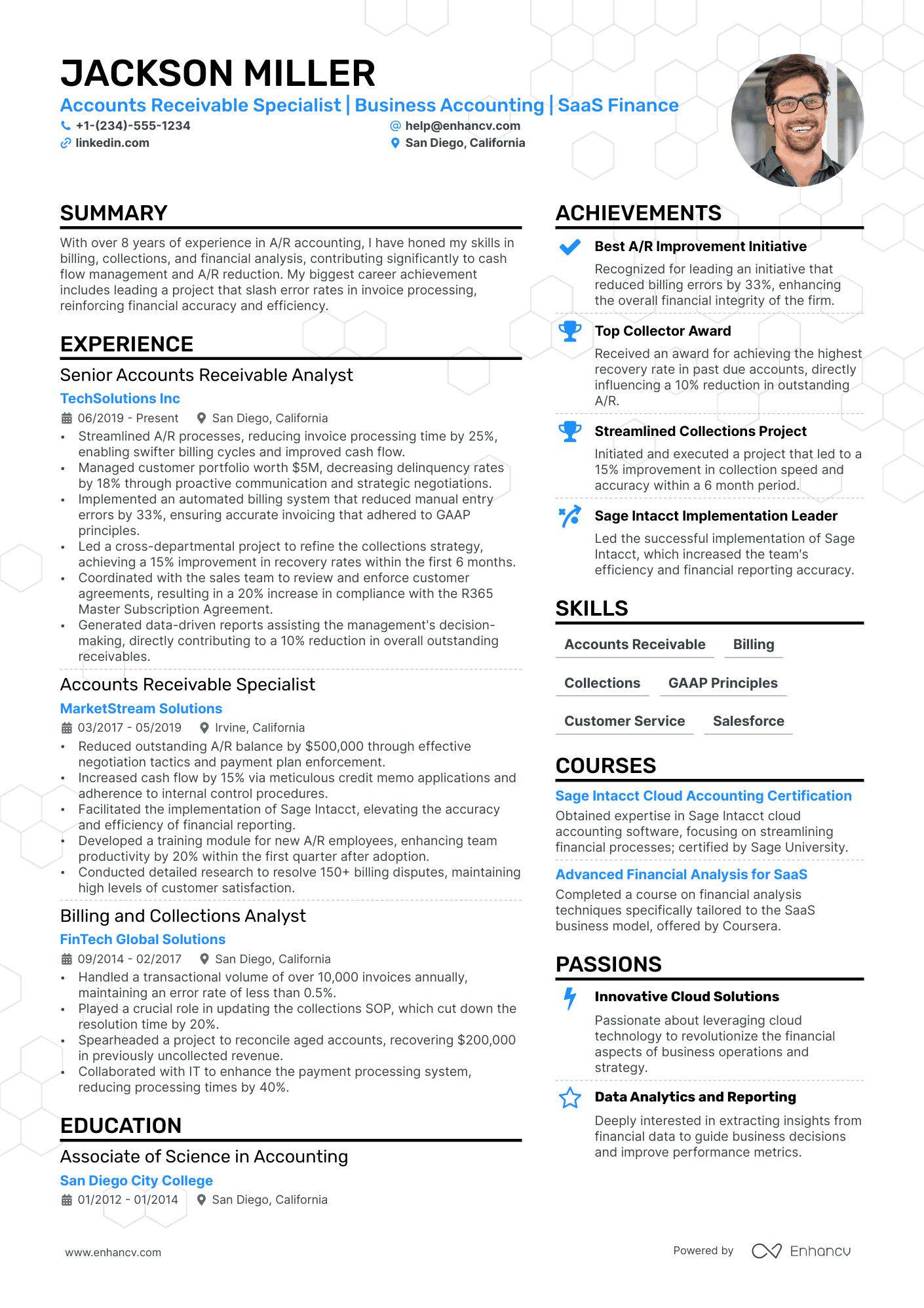

- Template #3: Accounts Payable Specialist

- Skills for Accounts Receivable Resumes

- Free Accounts Receivable Resume Review

- Other Finance Resumes

- Accounts Receivable Interview Guide

- Accounts Receivable Sample Cover Letters

- Alternative Careers to a Accounts Receivable

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 5 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 5 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

- • Streamlined A/R processes, reducing invoice processing time by 25%, enabling swifter billing cycles and improved cash flow.

- • Managed customer portfolio worth $5M, decreasing delinquency rates by 18% through proactive communication and strategic negotiations.

- • Implemented an automated billing system that reduced manual entry errors by 33%, ensuring accurate invoicing that adhered to GAAP principles.

- • Led a cross-departmental project to refine the collections strategy, achieving a 15% improvement in recovery rates within the first 6 months.

- • Coordinated with the sales team to review and enforce customer agreements, resulting in a 20% increase in compliance with the R365 Master Subscription Agreement.

- • Generated data-driven reports assisting the management's decision-making, directly contributing to a 10% reduction in overall outstanding receivables.

- • Reduced outstanding A/R balance by $500,000 through effective negotiation tactics and payment plan enforcement.

- • Increased cash flow by 15% via meticulous credit memo applications and adherence to internal control procedures.

- • Facilitated the implementation of Sage Intacct, elevating the accuracy and efficiency of financial reporting.

- • Developed a training module for new A/R employees, enhancing team productivity by 20% within the first quarter after adoption.

- • Conducted detailed research to resolve 150+ billing disputes, maintaining high levels of customer satisfaction.

- • Handled a transactional volume of over 10,000 invoices annually, maintaining an error rate of less than 0.5%.

- • Played a crucial role in updating the collections SOP, which cut down the resolution time by 20%.

- • Spearheaded a project to reconcile aged accounts, recovering $200,000 in previously uncollected revenue.

- • Collaborated with IT to enhance the payment processing system, reducing processing times by 40%.

5 Accounts Receivable Resume Examples & Guide for 2024

Your resume must clearly showcase your expertise in managing accounts receivable. Highlight your ability to monitor and record incoming payments accurately and efficiently. Ensure to demonstrate your proficiency in reducing delinquency rates and improving cash flow. Your experience with credit management and negotiation skills should be evident.

All resume examples in this guide

Traditional

Resume Guide

Resume Format Tips

Resume Experience

Skills on Resume

Education & Certifications

Resume Summary Tips

Additional Resume Sections

Key Takeaways

Crafting a resume that effectively highlights your proficiency in reducing days sales outstanding (DSO) and managing a clean aged receivables report is a common challenge for accounts receivable professionals. Our guide offers detailed strategies and examples on how to showcase your financial skills and successes, ensuring your resume stands out to potential employers.

- Find different accounts receivable resume examples to serve as inspiration to your professional presentation.

- How to use the summary or objective to highlight your career achievements.

- How to create the experience section to tell your story.

- Must have certificates and what to include in the education section of your resume.

If the accounts receivable resume isn't the right one for you, take a look at other related guides we have:

- Accounts Clerk Resume Example

- Management Accounting Resume Example

- Finance Intern Resume Example

- Portfolio Manager Resume Example

- Bank Manager Resume Example

- Business Analyst Accounting Resume Example

- Account Executive Resume Example

- Accounting Assistant Resume Example

- Tax Accountant Resume Example

- CPA Resume Example

Accounts Receivable resume format made simple

You don't need to go over the top when it comes to creativity in your Accounts Receivable resume format .

What recruiters care about more is the legibility of your Accounts Receivable resume, alongside the relevancy of your application to the role.

That's why we're presenting you with four simple steps that could help your professional presentation check all the right boxes:

- The reverse-chronological resume format is the one for you, if you happen to have plenty of relevant (and recent) professional experience you'd like to showcase. This format follows a pretty succinct logic and puts the focus on your experience.

- Keep your header simple with your contact details; a headline that details the role you're applying for or your current job; and a link to your portfolio.

- Ensure your resume reaches an up-to-two-page limit, only if you happen to be applying for a more senior role or you have over a decade of relevant experience.

- Save your Accounts Receivable resume as a PDF to retain its structure and presentation.

Upload & Check Your Resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Don't forget to include these six sections on your accounts receivable resume:

- Header and summary for your contact details and to highlight your alignment with the accounts receivable job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Demonstration of proficiency in accounting software and systems, such as QuickBooks or SAP.

- Experience with billing, invoicing, and following up on overdue accounts.

- Strong understanding of credit controls and risk management practices.

- Proven ability to reconcile accounts and resolve discrepancies.

- Detail-oriented with a strong track record of accurate and timely accounts receivable reporting.

What to include in the experience section of your accounts receivable resume

The resume experience section is perhaps the most important element in your application as it needs to showcase how your current profile matches the job.

While it may take some time to perfect your accounts receivable experience section, here are five tips to keep in mind when writing yours:

- Assess the advert to make a list of key requirements and look back on how each of your past jobs answers those;

- Don't just showcase you know a particular skill, instead, you need proof in the form of tangible results (e.g. numbers, percent, etc.);

- It's perfectly fine to leave off experience items that don't bring anything extra to your skill set or application;

- Recruiters want to understand what the particular value is of working with you, so instead of solely featuring technologies, think about including at least one bullet that's focused on your soft skills;

- Take care with wording each bullet to demonstrate what you've achieved, using a particular skill, and an action verb.

The below accounts receivable resume examples can help guide you to curate your professional experience, following industry-leading tips and advice.

- Managed a portfolio of over 500 client accounts, consistently maintaining a 98% rate for on-time collections, thus enhancing cash flow for the company.

- Implemented a new automated billing system that reduced invoice errors by 35% and increased overall team efficiency.

- Negotiated payment plans with delinquent accounts, successfully recovering more than $2 million in outstanding receivables.

- Reconciled daily AR transactions, maintaining accurate ledgers across various currencies for a global financial service company.

- Collaborated cross-departmentally to resolve billing discrepancies, resulting in a 15% reduction in disputed invoices.

- Provided comprehensive monthly reports on account statuses, critical for executive decision-making and fiscal strategy revisions.

- Streamlined the collections process, reducing the average Days Sales Outstanding (DSO) from 45 to 30 days.

- Developed and maintained strong relationships with key clients, leading to a 20% decrease in late payments.

- Oversaw the successful implementation of credit management software, enhancing the accuracy of credit risk assessments.

- Initiated a client education program on best billing practices which expedited payment times by 25%.

- Played a key role in the transition to a paperless AR system, cutting physical mail processing time by 50%.

- Prepared detailed financial forecasts, contributing to the company's strategic planning and short-term resource allocation.

- Instrumental in reducing the bad debt reserve by 40% through improved collection strategies and meticulous credit checks.

- Efficiently managed an AR ledger of over $50 million while ensuring compliance with all financial regulations.

- Directed a team of 10 AR associates, fostering a collaborative environment that prioritized skill development and effective communication.

- Performed in-depth financial analysis on accounts receivable trends, identifying patterns that informed policy changes reducing charge-offs by 30%.

- Championed a customer relationship management initiative that improved client satisfaction scores by 10%.

- Coordinated with the sales department to align credit and billing policies, which helped to increase sales closure rates by 5% without increasing financial risk.

- Reduced errors in invoice processing by 22% through meticulous oversight and the introduction of quality control measures.

- Fostered a culture of continuous improvement leading to the adoption of optimized AR practices that sped up invoice-to-cash cycles.

- Promoted from within the department due to exemplary performance and leadership, elevating the overall team's productivity by 15%.

- Led a project for the integration of AR functionalities with the CRM system, leading to a 20% increase in dispute resolution efficiency.

- Oversaw audit preparations for the AR department, ensuring 100% compliance with internal and external reporting standards.

- Trained and mentored new hires on AR processes and software, leading to a decrease in training time by 30%.

Quantifying impact on your resume

- Managed a portfolio of 200+ accounts amounting to $5 million in receivables.

- Reduced average days sales outstanding (DSO) by 15% through improved collection processes.

- Increased cash flow by implementing more stringent credit checks, reducing bad debt by 25%.

- Processed an average of 300 invoices per month with a 99% accuracy rate.

- Improved customer satisfaction scores by 20% by developing a streamlined dispute resolution process.

- Achieved a 90% rate of on-time payments through effective account monitoring and reminder systems.

- Conducted monthly reconciliation of accounts receivable ledger, resolving discrepancies worth over $100K.

- Coordinated with sales and customer service departments to introduce a loyalty program that increased repeat business by 30%.

Action verbs for your accounts receivable resume

Writing your accounts receivable experience section without any real-world experience

Professionals, lacking experience, here's how to kick-start your accounts receivable career:

- Substitute experience with relevant knowledge and skills, vital for the accounts receivable role

- Highlight any relevant certifications and education - to showcase that you have the relevant technical training for the job

- Definitely include a professional portfolio of your work so far that could include university projects or ones you've done in your free time

- Have a big focus on your transferable skills to answer what further value you'd bring about as a candidate for the accounts receivable job

- Include an objective to highlight how you see your professional growth, as part of the company

Recommended reads:

- How To Include Your Relevant Coursework On A Resume

- How to List Continuing Education on Your Resume

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

The heart and soul of your accounts receivable resume: hard skills and soft skills

If you read between the lines of the accounts receivable role you're applying for, you'll discover that all requirements are linked with candidates' hard skills and soft skills.

What do those skills have to do with your application?

Hard or technical skills are the ones that hint at your aptitude with particular technologies. They are easy to quantify via your professional experience or various certifications.

Meanwhile, your soft skills are more difficult to assess as they are personality traits, you've gained thanks to working in different environments/teams/organizations.

Your accounts receivable resume skills section is the perfect opportunity to shine a light on both types of skills by:

- Dedicating a technical skills section to list up to six technologies you're apt at.

- Focusing a strengths section on your achievements, thanks to using particular people skills or technologies.

- Including a healthy balance of hard and soft skills in the skills section to answer key job requirements.

- Creating a language skills section with your proficiency level - to hint at an abundance of soft skills you've obtained, thanks to your dedication to learning a particular language.

Within the next section of this guide, stay tuned for some of the most trending hard skills and soft skills across the industry.

Top skills for your accounts receivable resume:

Accounting software proficiency (e.g., QuickBooks, SAP, Oracle)

Data entry and management

Knowledge of accounts receivable principles

Understanding of basic bookkeeping

Invoicing and billing

Financial reporting

Credit management

Knowledge of collection laws and regulations

Risk analysis

Spreadsheet proficiency (e.g., Excel)

Attention to detail

Communication skills

Organizational skills

Problem-solving

Time management

Customer service orientation

Analytical thinking

Adaptability

Negotiation

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

Qualifying your relevant certifications and education on your accounts receivable resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your accounts receivable resume:

- Certified Accounts Receivable Professional (CARP) - The Institute of Financial Operations

- Certified Bookkeeper (CB) - American Institute of Professional Bookkeepers

- Certified Public Accountant (CPA) - American Institute of CPAs

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Credit Business Associate (CBA) - National Association of Credit Management

List your educational qualifications and certifications in reverse chronological order.

- When You Should (And Not) Add Dean's List On Your Resume

- Should I Put In An Incomplete Degree On A Resume?

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your accounts receivable resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world accounts receivable professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a accounts receivable job

- Seasoned Accounts Receivable Specialist with over 10 years of experience managing high-volume invoicing, maintaining an exceptional record of accurate and timely collections, and leading cross-departmental collaboration to improve cash flow processes. Spearheaded the reduction of outstanding receivables by 20% at a top-tier retail chain through strategic negotiations and persistent follow-up.

- Experienced Certified Public Accountant transitioning into accounts receivable, bringing 12 years of comprehensive financial management and auditing skills. Boasts a track record of enhancing revenue assurance practices by identifying and rectifying discrepancies that resulted in a 15% boost in revenue recognition for a prominent financial services firm.

- Human Resources professional pivoting into accounts receivable, offering a robust understanding of payroll systems and employee reimbursement processes. Over 8 years in industry-leading corporations has honed exemplary organizational, communication skills and a strong acumen for numbers, eager to apply these talents to ensure meticulous financial tracking and improve receivable operations.

- Eager to leverage a Bachelor's in Finance and a passion for numbers to excel in accounts receivable management. Holds a 3-year tenure in fast-paced startup environments where rapid adaptability and keen attention to detail were key to maintaining meticulous financial records. Adept at using accounting software to streamline invoicing and receivables tracking.

- Dynamic professional eager to embark on an accounts receivable career, filled with enthusiasm to contribute to the financial robustness of a forward-thinking organization. Dedicated to mastering industry-specific financial software and regulations to ensure precision in tracking and reporting financial transactions, despite having no formal experience in the field.

- Aspiring finance specialist graduating summa cum laude, targeting an accounts receivable role to jumpstart a promising career. Ardent about translating academic knowledge including advanced math skills and fluency in accounting software into effective financial management practices. Exceptional analytical acumen with a commitment to achieving peak accuracy in tracking and handling receivables.

Taking your accounts receivable resume to the next level with these four additional resume sections

Your accounts receivable resume can feature a variety of skills (both hard and soft) in diverse sections . Choose those that align best with the job requirements and reflect your suitability for the company culture.

Consider these four additional resume sections recommended by our experts:

- Languages - State any languages you are proficient in and your level of proficiency. This demonstrates your commitment to communication and potential for international growth.

- Projects - Highlight up to three significant projects you've completed outside of work, showcasing skill development. Include a link to your project portfolio in the accounts receivable resume header, if applicable.

- My Time - How you allocate your time outside work can indicate your organizational skills and cultural fit within the company.

- Volunteering - Detail causes you're passionate about, roles you've held, and achievements in volunteering. Such experiences likely have honed a range of soft skills crucial for your dream job.

Key takeaways

At the end of our guide, we'd like to remind you to:

- Invest in a simple, modern resume design that is ATS friendly and keeps your experience organized and legible;

- Avoid just listing your responsibilities in your experience section, but rather focus on quantifiable achievements;

- Always select resume sections that are relevant to the role and can answer job requirements. Sometimes your volunteering experience could bring more value than irrelevant work experience;

- Balance your technical background with your personality traits across various sections of your resume to hint at how much time employers would have to invest in training you and if your profile would be a good cultural fit to the organization;

- Include your academic background (in the form of your relevant higher education degrees and certifications) to show recruiters that you have the technical basics of the industry covered.

Looking to build your own Accounts Receivable resume?

- Resume Examples

How to Decline an Interview: With Tips and Templates to Help You Succeed

8 common questions for a second interview (with answers), resume for one year of experience, how to show recruiters you're willing to relocate on your resume, changing job title on resume, resume headings to stand out in 2024.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

7 Accounts Receivable Resume Examples & Writing Guide

Want to land an accounts receivable job? This role manages customer billing and collections. We've compiled 7 real accounts receivable resume samples and a comprehensive writing guide. You'll learn what skills to feature and how to describe your experience. Use these expert tips to build a resume that gets interviews. Includes examples for all experience levels.

A well-written resume is essential for landing a great accounts receivable position. In the busy finance field, hiring managers often review resumes quickly. Your resume needs to grab their attention and show that you're the right person for the job.

But what exactly should you include in your accounts receivable resume? How can you highlight your skills and experience to stand out from other applicants?

This guide provides 7 accounts receivable resume examples along with expert tips for crafting each section of your resume. Whether you're an experienced AR professional or just starting your career, you'll learn how to create a resume that gets results.

By following the strategies in this article, you can build a compelling resume that helps you get hired faster. Let's dive into the examples and techniques that will take your accounts receivable resume to the next level.

Common Responsibilities Listed on Accounts Receivable Resumes

- Maintaining accurate records of customer accounts and transactions

- Issuing invoices and statements to customers

- Processing customer payments and applying them to the appropriate accounts

- Reconciling accounts and resolving discrepancies

- Following up on overdue accounts and delinquent payments

- Preparing aging reports and monitoring accounts receivable balances

- Coordinating with sales and customer service teams to resolve billing disputes

- Ensuring compliance with accounting standards and company policies

- Assisting with month-end and year-end closing procedures related to accounts receivable

How to write a Resume Summary

Creating an optimal and captivating summary or objective section for an Accounts Receivable position requires focusing on your unique skills, experiences, accomplishments, and the values you bring. This summary is the initial impression recruiters will have of you and your professional background, making it potentially determinative in the selection process.

The Purpose and Importance of a Summary

The summary or objective section provides an overview of your qualifications, highlighting what makes you an ideal fit for the role. It’s a concise presentation of your skills, achievements, and professional interests tailored exclusively towards the Accounts Receivable role you aim to fill. It’s much more than just a simple introduction. It displays your understanding of the industry, presents your familiarity with financial procedures, showcases your experience with collections, invoicing, or billing processes, and bridges the gap between what the employer needs and what you offer.

Essential Elements of an Account Receivable Summary

An effective summary for an Accounts Receivable role should encapsulate the following aspects:

Professional Experience - Summarize years of relevant experience you have in accounts, billing, or a related financial field. It can range from generic experience in Accounts Receivable to specific areas like credit control or cash handling skills.

Core Competencies : Every summary should include the key skills relevant to the job. For an Accounts Receivable role, this could include proficiency with accounting software, tracking payments, managing client relationships, or adherence to financial regulations.

Career Achievements : It can be very beneficial to highlight any accomplishments that indicate effective job execution, such as notable decreases in outstanding balances, improvement in timely payments due to your efforts, or successful management of significant Accounts Receivable portfolios.

Keywords : These terms typically originate from the job description. Integrating these phrases – for instance, "receivables management", "financial reporting", "invoice processing" – can show that your expertise aligns directly with what the employer is seeking.

How to Provide Value

Avoid being overly self-focused in your summary. Instead, aim to demonstrate how your skills and experience can add value to the potential employer. Explicitly align your abilities with what the company needs, focusing on your track record of reducing overdue payments, improving cash flow, fostering client relationships, or optimizing financial procedures.

Keeping It Precise and Authentic

Summaries are typically a few sentences long, so they require careful construction to display what you offer in a crisp, coherent manner. Being authentic is just as important as being concise. Maintaining professional tone while highlighting your individual strengths and accomplishments can lend your summary a characteristic voice that sets it apart.

Revise and Refine

Ensure your summary meets the highest standards by going through several iterations and polishing it. It might take several drafts to create a summary that balances brevity, completeness, and appeal. Each revision should help to make certain that every word contributes to the portrayal of you as an accomplished professional in Accounts Receivable.

Understanding all these facets and meticulously constructing your summary will maximize the positive impression generated by your resume. An effective summary is a golden opportunity to get noticed and to communicate who you are beyond just the bare job qualifications. It can turn into an influential tool that ensures your resume doesn’t just get scanned, but gets seriously considered.

Strong Summaries

- Detail-oriented Accounts Receivable Specialist with over 5 years of experience managing all aspects of client invoicing, processing, and payments. Known for accurately maintaining detailed records, generating reports, and carrying out collection duties.

- Ambitious financial professional with 7 years of experience in accounts receivable and a proven record of successful account management. Excellent ability to maintain customer relationships and deliver effective solutions for accounting issues.

- Experienced Accounts Receivable Lead with an extensive background in transaction processing and cash application. Exceptional team working and leadership skills, with a flair for reducing late payments and managing invoicing efficiently.

- Proactive Accounts Receivable Clerk bringing forth 3 years of management of receivable operations for major organizations. Talented in negotiation, problem solving and customer service, and known for reducing company's delinquent receivable accounts.

Why these are strong ?

The above examples are good practices because they clearly emphasize the candidates' experience, skills, and achievements related to accounts receivable. These career summaries provide potential employers with valuable information about the candidates' proficiency in managing all aspects of invoicing, processing, and payments. They also emphasize the candidates' ability to maintain customer relationships, handle account management, and keep detailed financial records, all key qualities in the accounts receivable role. Such summaries also showcase the candidates' leadership skills and their effectiveness in reducing late payments, which directly contributes to the company's financial stability. Explicitly mentioning the number of years of experience and the professional area (Accounts Receivable Specialist, financial professional, Accounts Receivable Lead, Accounts Receivable Clerk) brings credibility and clarity to the professional summaries.

Weak Summaries

- Experienced Accounts Receivable professional with much accounting knowledge. Dedicated team player who can be relied upon to help your company achieve its goals.

- Desire Accounts Receivable position for aiding company's financial health. Have a great deal of experience tracking and resolving outstanding payment issues.

- Searching for an Accounts Receivable role. Experienced with reducing the amount of outstanding debtors aged over 30 days.

- Highly detail oriented. Looking to bring my passion for great customer service, superb numeracy skills, and sharp attention to details to a dynamic accounting position.

Why these are weak ?

The examples given are bad practices for several reasons. In the first case, the summary is overly vague, which will not be helpful for prospective employers looking for specific qualifications or experiences that make the candidate suitable for the position. In the second example, the start of the sentence is too passive and fails to engage with the reader immediately. In the third example, the statement only states what the individual is searching for and does not specify what they can bring to the position or company. Lastly, the fourth example simply lists traits without providing context or specific instances where these skills have been applied, making it difficult for employers to assess the validity or level of these skills. Effective Professional Summary sections should be concise, specific, tailored to the role, and showcase what the candidate can bring to the position and company.

Showcase your Work Experience

In the quest to present an optimized representation of career journey, the "Work Experience" section of a resume often becomes the centerstage, swinging the impressions that potential employers will form about you. This segment is more than just a pithy summary of your past. For an Accounts Receivable profession, it is a unique opportunity to showcase your skills, demonstrate your industry know-how and manifest your unwavering dedication to fine-tuned financial efficiency.

Understand the Purpose and Importance

The Work Experience section is undeniably important. It validates your professional journey, highlights your expertise, and reinforces your suitability for a role. The essence of this part is to transmit your career narrative in a manner that's brief, meaningful and relatable to the prospective role.

For Accounts Receivable, this is an opportunity to exhibit your abilities to manage finances, handle data with precision, navigate through complex financial software, and maintain excellent relationships with clients. Remember, this part is designed not to sell but to inform, explain and resonate.

Incorporate the Right Information

Moreover, what you include matters. Each entry within this section should touch upon the company name and location, your title, the timeline of your tenure and a concise list of responsibilities and achievements. Be careful of empty buzzwords; instead opt to use descriptions that explain, in palpable terms, what you've accomplished in each role.

In any account-related role, accuracy is king. Include any specific figures or percentages to back up your achievements - be it the money flowed back into a company due to effective accounts receivable management, or a reduction in invoicing errors during your tenure.

Quantify your achievements and impact using concrete numbers, metrics, and percentages to demonstrate the value you brought to your previous roles.

Tailor it for Every Application

Additionally, adopting a one-size-fits-all approach tends not to work when it comes to the job-seeking journey. Aspirations might be the same, but no two job descriptions are exactly alike. Consequently, tailoring the work experience section to correspond with the requirements of each specific job description is key. Extract key phrases and responsibilities from the job posting that resonate with your experience, and ensure they're reflected in your resume.

For an Accounts Receivable role, understanding the focus of the company can help here. For instance, if the organization stresses on customer relationships, highlight your experience in handling client queries and maintaining customer satisfaction despite financial conflicts.

Strike a Balance Between Duties and Achievements

As you ponder upon your with past duties and triumphs, strike a balance. Whilst detailing your everyday tasks gives an idea of your potential duties, employers are equally interested in the achievements. This could be times when you've gone above and beyond, or perhaps major problems that you've solved. As an Accounts Receivable professional, think in terms of efficiency achieved, procedure improvements, error reduction, or quantifiable enhancements in receivables.

Maintain Simplicity and Cleanliness

Avoid turning your resume into a dense, intimidating block of text. Space out your information, use bullet points, and maintain a consistent, easy-to-read font. The hiring manager will likely spend only a few seconds for initial screening, and you want those to count.

With these considerations in mind, sculpting a detailed, meaningful Work Experience section becomes less daunting. Practice articulating your professional journey in a concise, clear and relevant manner, and you're halfway to landing that desired Accounts Receivable position. Remember, honesty and transparency are as integral to a resume as they are to the area of finance.

Strong Experiences

- Managed accounts receivable for up to 20 accounts entailing amounts totaling over $1 million

- Balanced AR accounts, resolving discrepancies by coordinating with clients and reducing irreconcilable accounts by 30%

- Implemented a new software system for tracking and collecting payments, cutting inefficiencies by 20%

- Negotiated payment plans and terms with delinquent account holders, reducing late payments by 40%

- Conducted monthly, quarterly, and yearly audits of AR accounts, maintaining 100% accuracy

- Created and presented detailed reports regarding the status of accounts receivables to senior management teams

These examples are considered good because they demonstrate various skills and abilities necessary for an Accounts Receivable job. They include numerical accomplishments which add credibility and demonstrate the extent of the candidate's experience. By showing the candidate's ability to implement change, manage significant accounts, and successfully negotiate, these points present a strong case for their ability to excel in an Accounts Receivable role.

Weak Experiences

- Worked here, did this

- Was good at my job

- Talked to customers

- Received money

- Updated customer records sometimes

- Answered phone calls

- Kept track of something called Accounts Receivable

These example bullet points are vague, impersonal, and provide no tangible evidence of skills or achievements. Good bullet points should be specific, measured, and clearly convey the value you brought to the role. Phrases like 'work here, did this' can be applied to any job and don't provide any indications of your expertise in Accounts Receivable. 'Was good at my job' and 'talked to customers' are similarly too broad and don't specify the specific tasks managed or the outcome. 'Received money', 'updated customer records sometimes', 'answered phone calls', and 'kept track of something called Accounts Receivable' demonstrates an unprofessional attitude, not taking the tasks seriously, suggesting a lack of knowledge about common tasks within Accounts Receivable. It's important to demonstrate a clear understanding of your role and the important details within it.

Skills, Keywords & ATS Tips

Before we dive into the juicy core of this matter, it's important to note that creating an effective Accounts Receivable resume is like brewing a unique concoction. Yes, the skills section of your resume is one of the crucial ingredients.

Let's start with hard and soft skills. Hard skills refer to your technical knowledge and abilities, directly relating to your job role. These could be software proficiency, bookkeeping, or financial reporting. Truth be told, these skills are the backbone of your Accounts Receivable role. An employer would look for these to ensure you can handle tasks effectively.

Soft skills , on the other hand, are all about your attributes and personal traits. They revolve around how you work and interact with others. For an Accounts Receivable role, soft skills could include problem-solving, communication, and attention to detail. Remember, employers often use these skills to gauge whether you're a good fit for their team and can handle workplace challenges.

Now, let's discuss the connection between keywords, ATS, and matching skills. Keywords are specific words or phrases that define what the job is about. They showcase your important skills and experiences that align with the job role. When crafting your resume, use keywords from the job description in your skills section. This will mirror your skills with what the employer is looking for.

And where does ATS (Applicant Tracking System) fit into all this? ATS is used by companies to sort and filter resumes. It screens your resume for keywords that match the job description. This is why having those keywords is crucial. In fact, if you want your resume to pass through this robot gatekeeper and reach the hiring manager, matching your skills with the right keywords becomes essential.

So, every piece of the puzzle is important. The hard and soft skills prove your capabilities. The right keywords make sure your resume speaks the language of the employer. And the ATS... well, that's the bridge your resume needs to cross to reach the hiring manager. Each complements the other, ensuring your resume stands out and you move one step closer to landing your desired Accounts Receivable role.

Top Hard & Soft Skills for Full Stack Developers

Hard skills.

- Financial Analysis

- Credit Management

- Microsoft Excel

- Accounts Receivable Management

- Cash Application

- Reconciliation

- Collections

- Financial Reporting

- Risk Assessment

- Account Reconciliation

Soft Skills

- Attention to Detail

- Communication

- Problem-Solving

- Time Management

- Organization

- Analytical Thinking

- Adaptability

- Stress Management

- Customer Service

- Critical Thinking

- Interpersonal Skills

- Negotiation

- Conflict Resolution

- Decision Making

Top Action Verbs

Use action verbs to highlight achievements and responsibilities on your resume.

- Communicated

- Collaborated

- Followed up

- Investigated

- Implemented

- Prioritized

- Coordinated

- Followed through

- Processed payments

- Managed credit limits

- Handled disputes

- Reduced outstanding balances

- Issued credit memos

- Applied cash receipts

- Followed collection procedures

Education & Certifications

To add education or certificates to your resume, find a section towards the top, usually following your career summary, titled "Education" or "Certifications". Underneath, list your degrees or certifications along with the institution and graduation date. For an Accounts Receivable role, relevant qualifications could include a degree in accounting or finance, or certifications from recognized financial institutions. Remember, always match the qualifications with the job description to ensure their relevance. Ensure the format is consistent for a professional appearance.

Some of the most important certifications for Accounts Receivables

This certification covers credit and risk analysis, financial statement analysis, and accounts receivable management.

This certification is for experienced credit professionals and covers advanced credit management topics.

Resume FAQs for Accounts Receivables

What is the ideal format for an accounts receivable resume.

The ideal format for an Accounts Receivable resume is a reverse-chronological format, which lists your most recent experience first. This format highlights your relevant skills and accomplishments in a clear and organized manner.

How long should an Accounts Receivable resume be?

An Accounts Receivable resume should typically be one page in length for candidates with less than 10 years of experience, and no more than two pages for those with more extensive experience. The key is to be concise and highlight only the most relevant information.

What are the most important sections to include in an Accounts Receivable resume?

The most important sections to include in an Accounts Receivable resume are: a summary or objective statement, professional experience, relevant skills, and any necessary certifications or licenses.

How should I highlight my Accounts Receivable skills on my resume?

To highlight your Accounts Receivable skills on your resume, use specific examples and quantifiable achievements. For instance, you could mention the percentage by which you reduced past-due accounts or the amount of revenue you recovered through effective collections.

Should I include technical skills on my Accounts Receivable resume?

Yes, it's important to include any relevant technical skills on your Accounts Receivable resume, such as proficiency with accounting software, spreadsheet applications, or billing systems. These skills demonstrate your ability to perform the job effectively.

How can I make my Accounts Receivable resume stand out?

To make your Accounts Receivable resume stand out, tailor it to the specific job you're applying for by using relevant keywords from the job description. Additionally, highlight any specialized training or certifications you have, and quantify your achievements whenever possible.

An Accounts Receivable professional plays a critical role in maintaining a company's cash flow by overseeing the collection of payments owed by customers. Key responsibilities include processing invoices, monitoring aging reports, resolving discrepancies, and diplomatically handling collections while providing exceptional customer service. When crafting a resume for this role, highlight your experience with accounts receivable procedures and software like QuickBooks. Demonstrate your analytical skills by quantifying achievements like reducing past-due balances or streamlining processes for efficiency. Emphasize your strong communication abilities for collections, as well as meticulous attention to detail for data entry and record-keeping. With a clear, organized format highlighting your relevant expertise, you can craft a compelling resume showcasing your fit for the role.

Highly motivated and detail-oriented Accounts Receivable professional with over 8 years of experience in managing financial transactions, optimizing cash flow, and enhancing customer relationships. Demonstrated expertise in developing and implementing effective strategies to maximize revenue collection and minimize delinquent accounts. Proven ability to work collaboratively with cross-functional teams to streamline processes and improve overall financial performance.

- Managed a portfolio of high-value client accounts, ensuring timely and accurate processing of invoices and payments.

- Implemented a new accounts receivable aging report, resulting in a 25% reduction in outstanding receivables within 6 months.

- Collaborated with the sales team to develop customized payment plans for clients, increasing customer satisfaction and loyalty.

- Spearheaded the automation of the invoice generation process, saving the company over 200 hours annually.

- Trained and mentored a team of 5 junior accounts receivable specialists, fostering a high-performance culture.

- Analyzed and reconciled daily cash receipts, ensuring accurate posting to customer accounts.

- Developed and maintained a comprehensive database of client payment terms and conditions, improving billing accuracy.

- Collaborated with the collections team to develop and execute strategies for resolving delinquent accounts.

- Prepared monthly accounts receivable reports for management, providing valuable insights into financial performance.

- Assisted in the successful implementation of a new accounts receivable software, enhancing efficiency and productivity.

- Processed daily cash receipts and applied payments to customer accounts accurately and efficiently.

- Investigated and resolved customer inquiries and discrepancies in a timely manner, maintaining high customer satisfaction.

- Assisted in the month-end closing process, ensuring accurate and timely reporting of accounts receivable balances.

- Maintained organized and up-to-date customer files and documentation, ensuring compliance with company policies.

- Collaborated with the accounting team to identify and correct billing errors, improving overall financial accuracy.

- Cash Flow Optimization

- Customer Relationship Management

- Data Reconciliation

- Billing and Invoicing

- Month-End Closing

- Process Improvement

- Team Leadership

- Software Proficiency (SAP, Oracle, Microsoft Office)

An Accounts Receivable Analyst manages customer accounts, processes invoices, and ensures timely collections. To craft an effective resume, highlight expertise in accounts receivable procedures, data analysis using accounting software, problem-solving skills, and strong communication abilities. Quantify achievements through metrics like accelerated payment cycles or resolved discrepancies.

Detail-oriented Accounts Receivable Analyst with over 5 years of experience in managing and optimizing the accounts receivable process. Adept at developing effective strategies to improve cash flow, reduce DSO, and enhance overall financial performance. Skilled in building strong relationships with clients and cross-functional teams to ensure timely payments and resolve complex billing issues.

- Implemented a new accounts receivable management system, resulting in a 25% reduction in DSO and a 15% increase in cash flow.

- Collaborated with sales and finance teams to develop and execute effective collection strategies, leading to a 95% on-time payment rate.

- Analyzed aging reports and conducted regular customer account reviews to identify and address potential payment issues proactively.

- Streamlined the invoice dispute resolution process, reducing the average resolution time by 40% and improving customer satisfaction.

- Trained and mentored a team of 5 junior analysts, fostering a high-performance and customer-centric culture.

- Managed a portfolio of 200+ client accounts, ensuring accurate and timely billing and collections.

- Developed and implemented a risk assessment model to identify high-risk accounts and mitigate potential bad debt write-offs.

- Collaborated with the sales team to establish and maintain positive client relationships, facilitating smooth communication and issue resolution.

- Conducted regular accounts receivable aging analysis and provided actionable insights to senior management.

- Participated in the implementation of a new ERP system, contributing to the design and testing of accounts receivable modules.

- Assisted in the management of accounts receivable for a diverse client portfolio, ensuring accurate invoicing and timely collections.

- Conducted daily cash reconciliations and prepared weekly accounts receivable reports for management review.

- Collaborated with the collections team to develop and execute targeted collection strategies for overdue accounts.

- Maintained accurate customer records in the ERP system, ensuring data integrity and compliance with internal policies.

- Participated in process improvement initiatives, contributing ideas to streamline accounts receivable workflows and enhance efficiency.

- DSO Reduction Strategies

- Aging Analysis

- Collections Strategies

- Invoice Dispute Resolution

- ERP Systems

- Data Analysis

- Accounting Principles

- Cross-functional Collaboration

- Mentoring and Training

- Sage Intacct

- Google Suite

An Accounts Receivable Manager is a vital role that ensures the efficient management of customer invoices, collections, and cash flow. They oversee the entire credit and collections process, facilitating timely customer payments and minimizing bad debt. Key responsibilities include supervising accounts receivable staff, managing customer invoicing, negotiating payment terms, conducting debt recovery efforts, and generating detailed financial reports. When crafting a resume for this position, it's crucial to highlight your extensive experience in managing accounts receivable teams and processes. Showcase your expertise in data analysis, problem-solving, and effective communication with customers and cross-functional teams. Quantify your achievements, such as successfully reducing past-due receivables, improving cash flow, or implementing process improvements that enhanced operational efficiencies. Emphasize your strong leadership abilities, attention to detail, and proficiency in accounts receivable software and tools.

Accomplished Accounts Receivable Manager with over a decade of experience in optimizing financial operations and driving revenue growth. Proven track record of implementing effective strategies to enhance cash flow, reduce DSO, and improve collections performance. Skilled in building strong relationships with clients and cross-functional teams to ensure smooth and efficient billing and payment processes.

- Implemented a new accounts receivable process, reducing DSO by 20% and improving cash flow by $1.5 million annually.

- Led a team of 10 AR specialists, providing training and guidance to ensure accurate and timely billing and collections.

- Developed and maintained strong relationships with key clients, resolving payment issues and ensuring customer satisfaction.

- Collaborated with sales and finance teams to streamline invoicing and payment processes, enhancing overall efficiency.

- Introduced automated dunning processes, increasing on-time payments by 25% and reducing bad debt write-offs.

- Managed a portfolio of high-value accounts, ensuring timely and accurate billing and collections.

- Developed and implemented process improvements, reducing billing errors by 30% and enhancing customer satisfaction.

- Collaborated with the legal team to manage and resolve payment disputes, successfully recovering over $500,000 in overdue payments.