- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Surveys Questionnaire

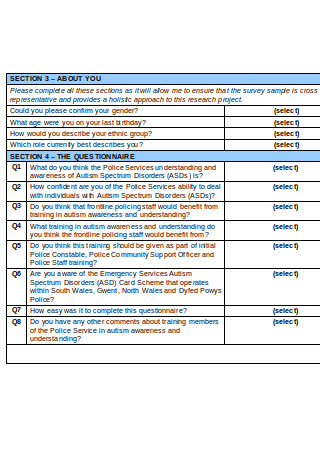

21 Questionnaire Templates: Examples and Samples

Questionnaire: Definition

A questionnaire is defined a market research instrument that consists of questions or prompts to elicit and collect responses from a sample of respondents. A questionnaire is typically a mix of open-ended questions and close-ended questions ; the latter allowing for respondents to enlist their views in detail.

A questionnaire can be used in both, qualitative market research as well as quantitative market research with the use of different types of questions .

LEARN ABOUT: Open-Ended Questions

Types of Questionnaires

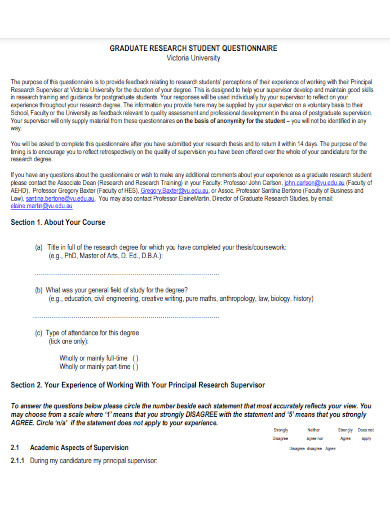

We have learnt that a questionnaire could either be structured or free-flow. To explain this better:

- Structured Questionnaires: A structured questionnaires helps collect quantitative data . In this case, the questionnaire is designed in a way that it collects very specific type of information. It can be used to initiate a formal enquiry on collect data to prove or disprove a prior hypothesis.

- Unstructured Questionnaires: An unstructured questionnaire collects qualitative data . The questionnaire in this case has a basic structure and some branching questions but nothing that limits the responses of a respondent. The questions are more open-ended.

LEARN ABOUT: Structured Question

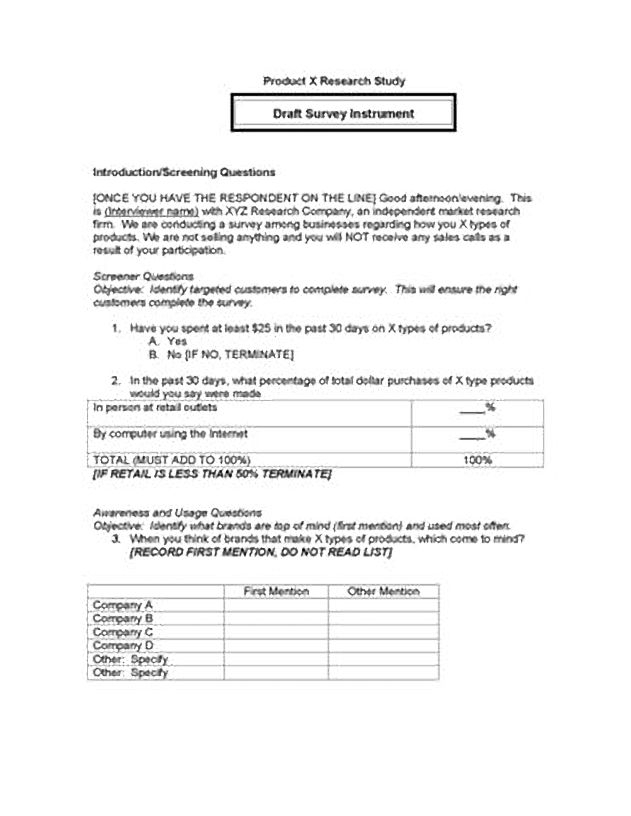

Types of Questions used in a Questionnaire

A questionnaire can consist of many types of questions . Some of the commonly and widely used question types though, are:

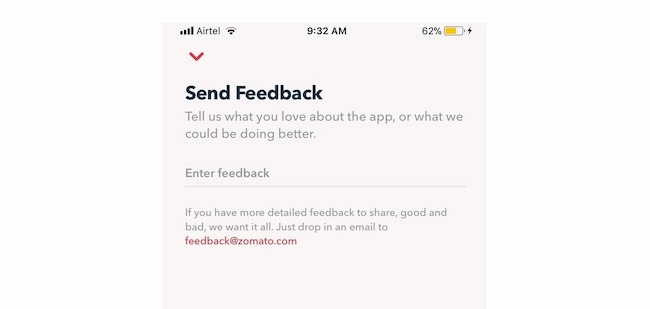

- Open-Ended Questions: One of the commonly used question type in questionnaire is an open-ended question . These questions help collect in-depth data from a respondent as there is a huge scope to respond in detail.

- Dichotomous Questions: The dichotomous question is a “yes/no” close-ended question . This question is generally used in case of the need of basic validation. It is the easiest question type in a questionnaire.

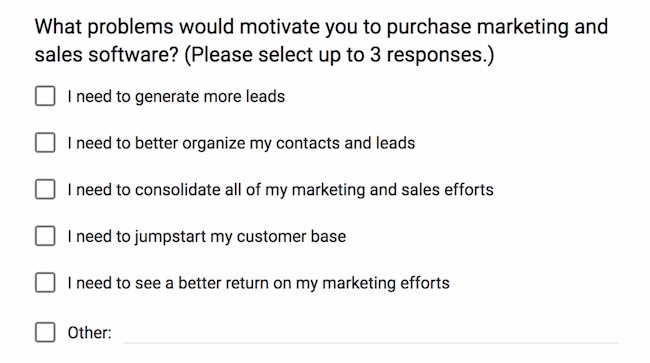

- Multiple-Choice Questions: An easy to administer and respond to, question type in a questionnaire is the multiple-choice question . These questions are close-ended questions with either a single select multiple choice question or a multiple select multiple choice question. Each multiple choice question consists of an incomplete stem (question), right answer or answers, close alternatives, distractors and incorrect answers. Depending on the objective of the research, a mix of the above option types can be used.

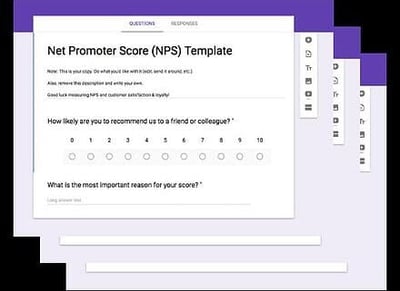

- Net Promoter Score (NPS) Question: Another commonly used question type in a questionnaire is the Net Promoter Score (NPS) Question where one single question collects data on the referencability of the research topic in question.

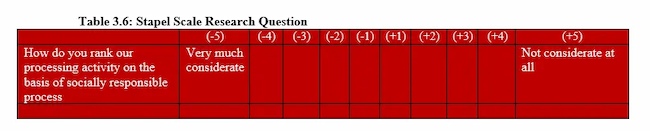

- Scaling Questions: Scaling questions are widely used in a questionnaire as they make responding to the questionnaire, very easy. These questions are based on the principles of the 4 measurement scales – nominal, ordinal, interval and ratio .

Questionnaires help enterprises collect valuable data to help them make well-informed business decisions. There are powerful tools available in the market that allows using multiple question types, ready to use survey format templates, robust analytics, and many more features to conduct comprehensive market research.

LEARN ABOUT: course evaluation survey examples

For example, an enterprise wants to conduct market research to understand what pricing would be best for their new product to capture a higher market share. In such a case, a questionnaire for competitor analysis can be sent to the targeted audience using a powerful market research survey software which can help the enterprise conduct 360 market research that will enable them to make strategic business decisions.

Now that we have learned what a questionnaire is and its use in market research , some examples and samples of widely used questionnaire templates on the QuestionPro platform are as below:

LEARN ABOUT: Speaker evaluation form

Customer Questionnaire Templates: Examples and Samples

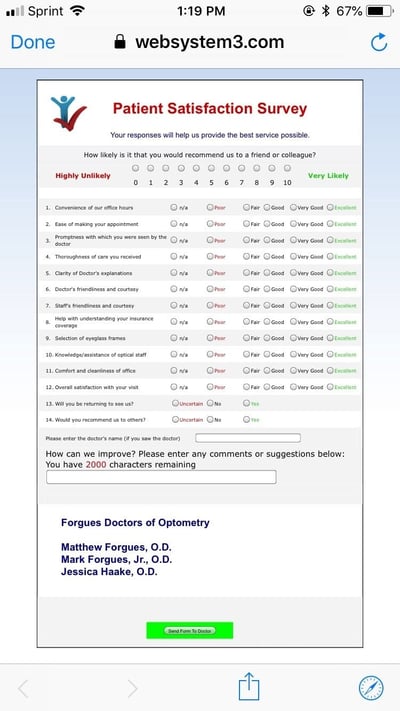

QuestionPro specializes in end-to-end Customer Questionnaire Templates that can be used to evaluate a customer journey right from indulging with a brand to the continued use and referenceability of the brand. These templates form excellent samples to form your own questionnaire and begin testing your customer satisfaction and experience based on customer feedback.

LEARN ABOUT: Structured Questionnaire

USE THIS FREE TEMPLATE

Employee & Human Resource (HR) Questionnaire Templates: Examples and Samples

QuestionPro has built a huge repository of employee questionnaires and HR questionnaires that can be readily deployed to collect feedback from the workforce on an organization on multiple parameters like employee satisfaction, benefits evaluation, manager evaluation , exit formalities etc. These templates provide a holistic overview of collecting actionable data from employees.

Community Questionnaire Templates: Examples and Samples

The QuestionPro repository of community questionnaires helps collect varied data on all community aspects. This template library includes popular questionnaires such as community service, demographic questionnaires, psychographic questionnaires, personal questionnaires and much more.

Academic Evaluation Questionnaire Templates: Examples and Samples

Another vastly used section of QuestionPro questionnaire templates are the academic evaluation questionnaires . These questionnaires are crafted to collect in-depth data about academic institutions and the quality of teaching provided, extra-curricular activities etc and also feedback about other educational activities.

MORE LIKE THIS

Employee Engagement App: Top 11 For Workforce Improvement

Apr 10, 2024

Top 15 Employee Evaluation Software to Enhance Performance

Event Feedback Software: Top 11 Best in 2024

Apr 9, 2024

Top 10 Free Market Research Tools to Boost Your Business

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

How to Design Effective Research Questionnaires for Robust Findings

As a staple in data collection, questionnaires help uncover robust and reliable findings that can transform industries, shape policies, and revolutionize understanding. Whether you are exploring societal trends or delving into scientific phenomena, the effectiveness of your research questionnaire can make or break your findings.

In this article, we aim to understand the core purpose of questionnaires, exploring how they serve as essential tools for gathering systematic data, both qualitative and quantitative, from diverse respondents. Read on as we explore the key elements that make up a winning questionnaire, the art of framing questions which are both compelling and rigorous, and the careful balance between simplicity and depth.

Table of Contents

The Role of Questionnaires in Research

So, what is a questionnaire? A questionnaire is a structured set of questions designed to collect information, opinions, attitudes, or behaviors from respondents. It is one of the most commonly used data collection methods in research. Moreover, questionnaires can be used in various research fields, including social sciences, market research, healthcare, education, and psychology. Their adaptability makes them suitable for investigating diverse research questions.

Questionnaire and survey are two terms often used interchangeably, but they have distinct meanings in the context of research. A survey refers to the broader process of data collection that may involve various methods. A survey can encompass different data collection techniques, such as interviews , focus groups, observations, and yes, questionnaires.

Pros and Cons of Using Questionnaires in Research:

While questionnaires offer numerous advantages in research, they also come with some disadvantages that researchers must be aware of and address appropriately. Careful questionnaire design, validation, and consideration of potential biases can help mitigate these disadvantages and enhance the effectiveness of using questionnaires as a data collection method.

Structured vs Unstructured Questionnaires

Structured questionnaire:.

A structured questionnaire consists of questions with predefined response options. Respondents are presented with a fixed set of choices and are required to select from those options. The questions in a structured questionnaire are designed to elicit specific and quantifiable responses. Structured questionnaires are particularly useful for collecting quantitative data and are often employed in surveys and studies where standardized and comparable data are necessary.

Advantages of Structured Questionnaires:

- Easy to analyze and interpret: The fixed response options facilitate straightforward data analysis and comparison across respondents.

- Efficient for large-scale data collection: Structured questionnaires are time-efficient, allowing researchers to collect data from a large number of respondents.

- Reduces response bias: The predefined response options minimize potential response bias and maintain consistency in data collection.

Limitations of Structured Questionnaires:

- Lack of depth: Structured questionnaires may not capture in-depth insights or nuances as respondents are limited to pre-defined response choices. Hence, they may not reveal the reasons behind respondents’ choices, limiting the understanding of their perspectives.

- Limited flexibility: The fixed response options may not cover all potential responses, therefore, potentially restricting respondents’ answers.

Unstructured Questionnaire:

An unstructured questionnaire consists of questions that allow respondents to provide detailed and unrestricted responses. Unlike structured questionnaires, there are no predefined response options, giving respondents the freedom to express their thoughts in their own words. Furthermore, unstructured questionnaires are valuable for collecting qualitative data and obtaining in-depth insights into respondents’ experiences, opinions, or feelings.

Advantages of Unstructured Questionnaires:

- Rich qualitative data: Unstructured questionnaires yield detailed and comprehensive qualitative data, providing valuable and novel insights into respondents’ perspectives.

- Flexibility in responses: Respondents have the freedom to express themselves in their own words. Hence, allowing for a wide range of responses.

Limitations of Unstructured Questionnaires:

- Time-consuming analysis: Analyzing open-ended responses can be time-consuming, since, each response requires careful reading and interpretation.

- Subjectivity in interpretation: The analysis of open-ended responses may be subjective, as researchers interpret and categorize responses based on their judgment.

- May require smaller sample size: Due to the depth of responses, researchers may need a smaller sample size for comprehensive analysis, making generalizations more challenging.

Types of Questions in a Questionnaire

In a questionnaire, researchers typically use the following most common types of questions to gather a variety of information from respondents:

1. Open-Ended Questions:

These questions allow respondents to provide detailed and unrestricted responses in their own words. Open-ended questions are valuable for gathering qualitative data and in-depth insights.

Example: What suggestions do you have for improving our product?

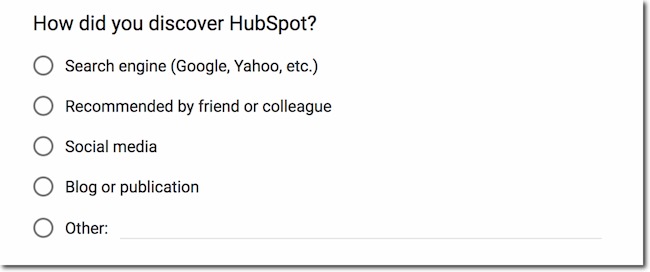

2. Multiple-Choice Questions

Respondents choose one answer from a list of provided options. This type of question is suitable for gathering categorical data or preferences.

Example: Which of the following social media/academic networking platforms do you use to promote your research?

- ResearchGate

- Academia.edu

3. Dichotomous Questions

Respondents choose between two options, typically “yes” or “no”, “true” or “false”, or “agree” or “disagree”.

Example: Have you ever published in open access journals before?

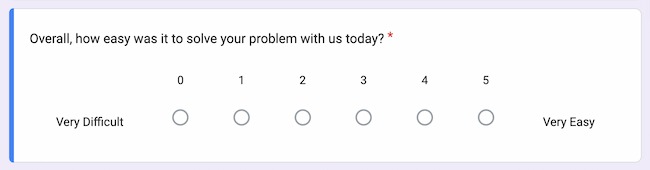

4. Scaling Questions

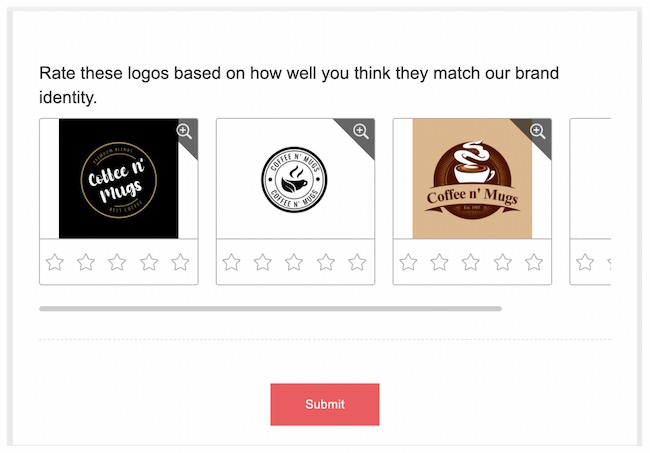

These questions, also known as rating scale questions, use a predefined scale that allows respondents to rate or rank their level of agreement, satisfaction, importance, or other subjective assessments. These scales help researchers quantify subjective data and make comparisons across respondents.

There are several types of scaling techniques used in scaling questions:

i. Likert Scale:

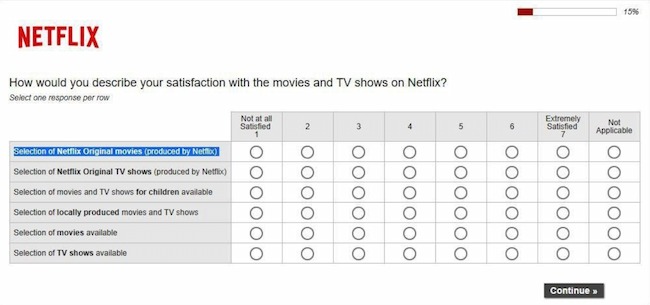

The Likert scale is one of the most common scaling techniques. It presents respondents with a series of statements and asks them to rate their level of agreement or disagreement using a range of options, typically from “strongly agree” to “strongly disagree”.For example: Please indicate your level of agreement with the statement: “The content presented in the webinar was relevant and aligned with the advertised topic.”

- Strongly Agree

- Strongly Disagree

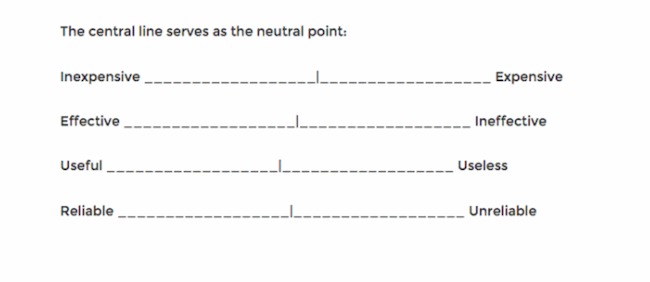

ii. Semantic Differential Scale:

The semantic differential scale measures respondents’ perceptions or attitudes towards an item using opposite adjectives or bipolar words. Respondents rate the item on a scale between the two opposites. For example:

- Easy —— Difficult

- Satisfied —— Unsatisfied

- Very likely —— Very unlikely

iii. Numerical Rating Scale:

This scale requires respondents to provide a numerical rating on a predefined scale. It can be a simple 1 to 5 or 1 to 10 scale, where higher numbers indicate higher agreement, satisfaction, or importance.

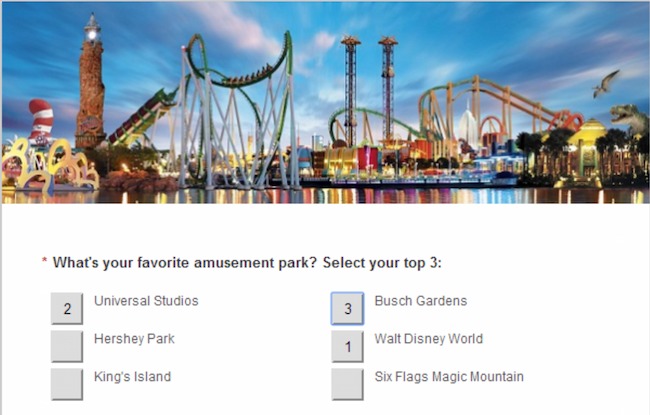

iv. Ranking Questions:

Respondents rank items in order of preference or importance. Ranking questions help identify preferences or priorities.

Example: Please rank the following features of our app in order of importance (1 = Most Important, 5 = Least Important):

- User Interface

- Functionality

- Customer Support

By using a mix of question types, researchers can gather both quantitative and qualitative data, providing a comprehensive understanding of the research topic and enabling meaningful analysis and interpretation of the results. The choice of question types depends on the research objectives , the desired depth of information, and the data analysis requirements.

Methods of Administering Questionnaires

There are several methods for administering questionnaires, and the choice of method depends on factors such as the target population, research objectives , convenience, and resources available. Here are some common methods of administering questionnaires:

Each method has its advantages and limitations. Online surveys offer convenience and a large reach, but they may be limited to individuals with internet access. Face-to-face interviews allow for in-depth responses but can be time-consuming and costly. Telephone surveys have broad reach but may be limited by declining response rates. Researchers should choose the method that best suits their research objectives, target population, and available resources to ensure successful data collection.

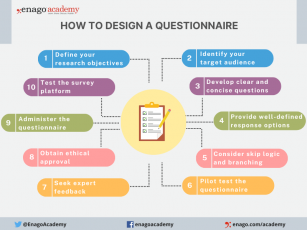

How to Design a Questionnaire

Designing a good questionnaire is crucial for gathering accurate and meaningful data that aligns with your research objectives. Here are essential steps and tips to create a well-designed questionnaire:

1. Define Your Research Objectives : Clearly outline the purpose and specific information you aim to gather through the questionnaire.

2. Identify Your Target Audience : Understand respondents’ characteristics and tailor the questionnaire accordingly.

3. Develop the Questions :

- Write Clear and Concise Questions

- Avoid Leading or Biasing Questions

- Sequence Questions Logically

- Group Related Questions

- Include Demographic Questions

4. Provide Well-defined Response Options : Offer exhaustive response choices for closed-ended questions.

5. Consider Skip Logic and Branching : Customize the questionnaire based on previous answers.

6. Pilot Test the Questionnaire : Identify and address issues through a pilot study .

7. Seek Expert Feedback : Validate the questionnaire with subject matter experts.

8. Obtain Ethical Approval : Comply with ethical guidelines , obtain consent, and ensure confidentiality before administering the questionnaire.

9. Administer the Questionnaire : Choose the right mode and provide clear instructions.

10. Test the Survey Platform : Ensure compatibility and usability for online surveys.

By following these steps and paying attention to questionnaire design principles, you can create a well-structured and effective questionnaire that gathers reliable data and helps you achieve your research objectives.

Characteristics of a Good Questionnaire

A good questionnaire possesses several essential elements that contribute to its effectiveness. Furthermore, these characteristics ensure that the questionnaire is well-designed, easy to understand, and capable of providing valuable insights. Here are some key characteristics of a good questionnaire:

1. Clarity and Simplicity : Questions should be clear, concise, and unambiguous. Avoid using complex language or technical terms that may confuse respondents. Simple and straightforward questions ensure that respondents interpret them consistently.

2. Relevance and Focus : Each question should directly relate to the research objectives and contribute to answering the research questions. Consequently, avoid including extraneous or irrelevant questions that could lead to data clutter.

3. Mix of Question Types : Utilize a mix of question types, including open-ended, Likert scale, and multiple-choice questions. This variety allows for both qualitative and quantitative data collections .

4. Validity and Reliability : Ensure the questionnaire measures what it intends to measure (validity) and produces consistent results upon repeated administration (reliability). Validation should be conducted through expert review and previous research.

5. Appropriate Length : Keep the questionnaire’s length appropriate and manageable to avoid respondent fatigue or dropouts. Long questionnaires may result in incomplete or rushed responses.

6. Clear Instructions : Include clear instructions at the beginning of the questionnaire to guide respondents on how to complete it. Explain any technical terms, formats, or concepts if necessary.

7. User-Friendly Format : Design the questionnaire to be visually appealing and user-friendly. Use consistent formatting, adequate spacing, and a logical page layout.

8. Data Validation and Cleaning : Incorporate validation checks to ensure data accuracy and reliability. Consider mechanisms to detect and correct inconsistent or missing responses during data cleaning.

By incorporating these characteristics, researchers can create a questionnaire that maximizes data quality, minimizes response bias, and provides valuable insights for their research.

In the pursuit of advancing research and gaining meaningful insights, investing time and effort into designing effective questionnaires is a crucial step. A well-designed questionnaire is more than a mere set of questions; it is a masterpiece of precision and ingenuity. Each question plays a vital role in shaping the narrative of our research, guiding us through the labyrinth of data to meaningful conclusions. Indeed, a well-designed questionnaire serves as a powerful tool for unlocking valuable insights and generating robust findings that impact society positively.

Have you ever designed a research questionnaire? Reflect on your experience and share your insights with researchers globally through Enago Academy’s Open Blogging Platform . Join our diverse community of 1000K+ researchers and authors to exchange ideas, strategies, and best practices, and together, let’s shape the future of data collection and maximize the impact of questionnaires in the ever-evolving landscape of research.

Frequently Asked Questions

A research questionnaire is a structured tool used to gather data from participants in a systematic manner. It consists of a series of carefully crafted questions designed to collect specific information related to a research study.

Questionnaires play a pivotal role in both quantitative and qualitative research, enabling researchers to collect insights, opinions, attitudes, or behaviors from respondents. This aids in hypothesis testing, understanding, and informed decision-making, ensuring consistency, efficiency, and facilitating comparisons.

Questionnaires are a versatile tool employed in various research designs to gather data efficiently and comprehensively. They find extensive use in both quantitative and qualitative research methodologies, making them a fundamental component of research across disciplines. Some research designs that commonly utilize questionnaires include: a) Cross-Sectional Studies b) Longitudinal Studies c) Descriptive Research d) Correlational Studies e) Causal-Comparative Studies f) Experimental Research g) Survey Research h) Case Studies i) Exploratory Research

A survey is a comprehensive data collection method that can include various techniques like interviews and observations. A questionnaire is a specific set of structured questions within a survey designed to gather standardized responses. While a survey is a broader approach, a questionnaire is a focused tool for collecting specific data.

The choice of questionnaire type depends on the research objectives, the type of data required, and the preferences of respondents. Some common types include: • Structured Questionnaires: These questionnaires consist of predefined, closed-ended questions with fixed response options. They are easy to analyze and suitable for quantitative research. • Semi-Structured Questionnaires: These questionnaires combine closed-ended questions with open-ended ones. They offer more flexibility for respondents to provide detailed explanations. • Unstructured Questionnaires: These questionnaires contain open-ended questions only, allowing respondents to express their thoughts and opinions freely. They are commonly used in qualitative research.

Following these steps ensures effective questionnaire administration for reliable data collection: • Choose a Method: Decide on online, face-to-face, mail, or phone administration. • Online Surveys: Use platforms like SurveyMonkey • Pilot Test: Test on a small group before full deployment • Clear Instructions: Provide concise guidelines • Follow-Up: Send reminders if needed

Thank you, Riya. This is quite helpful. As discussed, response bias is one of the disadvantages in the use of questionnaires. One way to help limit this can be to use scenario based questions. These type of questions may help the respondents to be more reflective and active in the process.

Thank you, Dear Riya. This is quite helpful.

Rate this article Cancel Reply

Your email address will not be published.

Enago Academy's Most Popular Articles

- Publishing Research

- Reporting Research

How to Optimize Your Research Process: A step-by-step guide

For researchers across disciplines, the path to uncovering novel findings and insights is often filled…

- Industry News

- Trending Now

Breaking Barriers: Sony and Nature unveil “Women in Technology Award”

Sony Group Corporation and the prestigious scientific journal Nature have collaborated to launch the inaugural…

Achieving Research Excellence: Checklist for good research practices

Academia is built on the foundation of trustworthy and high-quality research, supported by the pillars…

- Promoting Research

Plain Language Summary — Communicating your research to bridge the academic-lay gap

Science can be complex, but does that mean it should not be accessible to the…

Science under Surveillance: Journals adopt advanced AI to uncover image manipulation

Journals are increasingly turning to cutting-edge AI tools to uncover deceitful images published in manuscripts.…

Choosing the Right Analytical Approach: Thematic analysis vs. content analysis for…

Comparing Cross Sectional and Longitudinal Studies: 5 steps for choosing the right…

Research Recommendations – Guiding policy-makers for evidence-based decision making

Sign-up to read more

Subscribe for free to get unrestricted access to all our resources on research writing and academic publishing including:

- 2000+ blog articles

- 50+ Webinars

- 10+ Expert podcasts

- 50+ Infographics

- 10+ Checklists

- Research Guides

We hate spam too. We promise to protect your privacy and never spam you.

I am looking for Editing/ Proofreading services for my manuscript Tentative date of next journal submission:

What should universities' stance be on AI tools in research and academic writing?

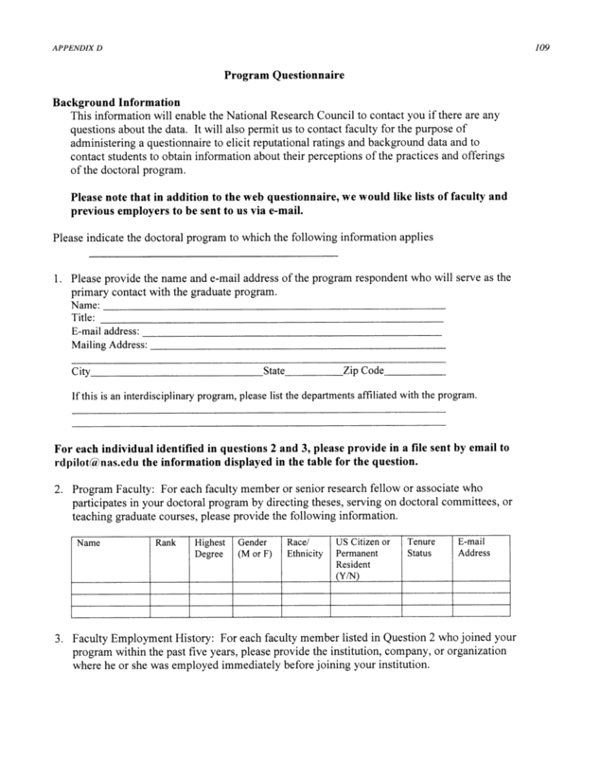

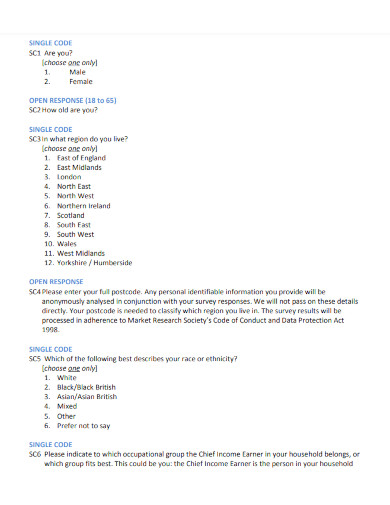

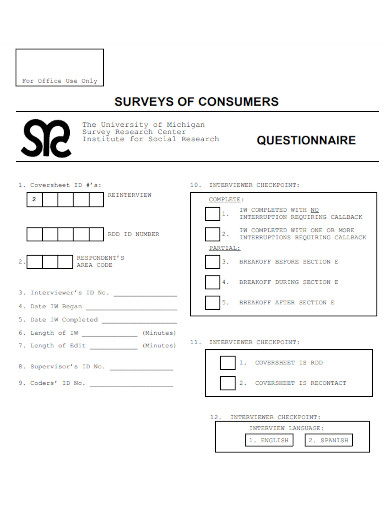

Research Questionnaire

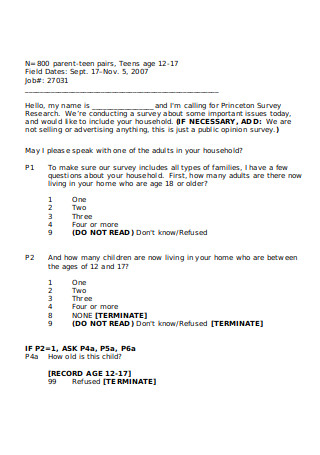

When a researcher creates a research paper using the scientific method they will need to use a gathering method that is adjacent to the research topic. This means that the researcher will use a quantitative research method for a quantitive topic and a qualitative method for a qualitative one. The research questionnaire is one of the quantitative data-gathering methods a researcher can use in their research paper.

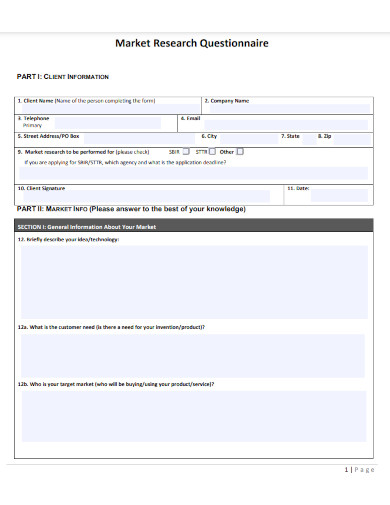

1. Market Research Questionnaire Template Example

- Google Docs

- Apple Pages

Size: 38 KB

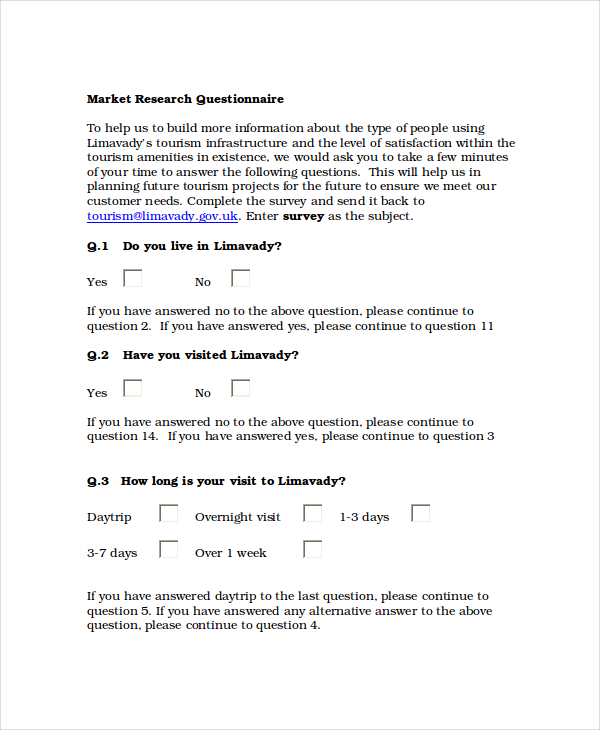

2. Market Research Questionnaire Example

Size: 94 KB

3. Research Questionnaire Example

4. Sample Market Research Questionnaire

Size: 35 KB

5. Research Survey Questionnaire

Size: 42 KB

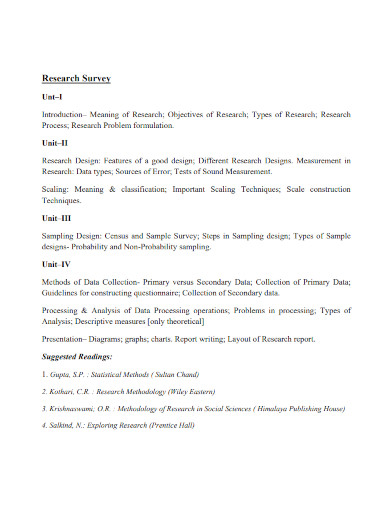

6. Research Survey Questionnaire Construction

Size: 80 KB

7. Research Questionnaire Survey of Consumers

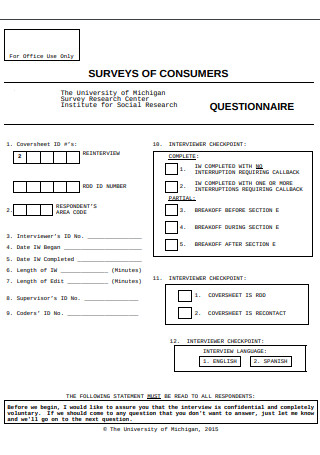

Size: 39 KB

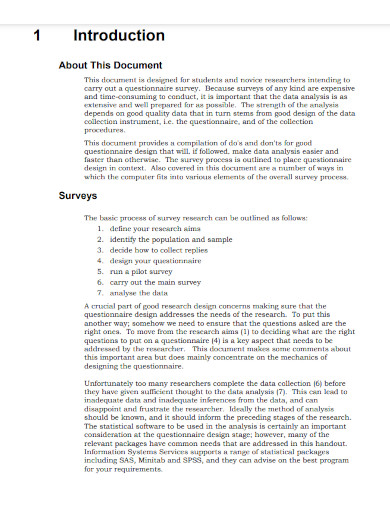

8. Guide to the Design of Research Questionnaires

Size: 77 KB

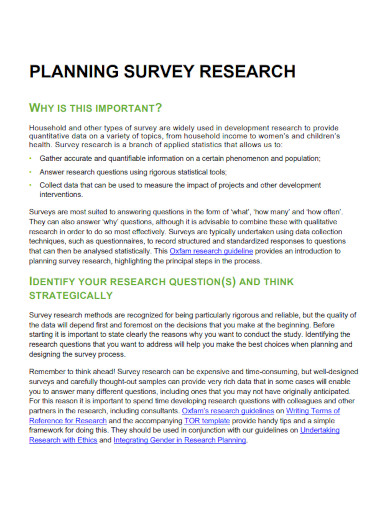

9. Planning Survey Research Questionnaires

Size: 85 KB

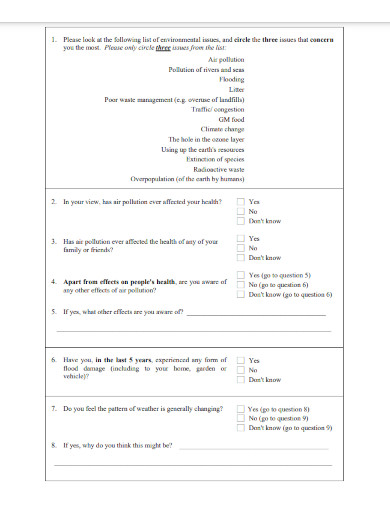

10. Climate Change Survey Questionnaires

Size: 41 KB

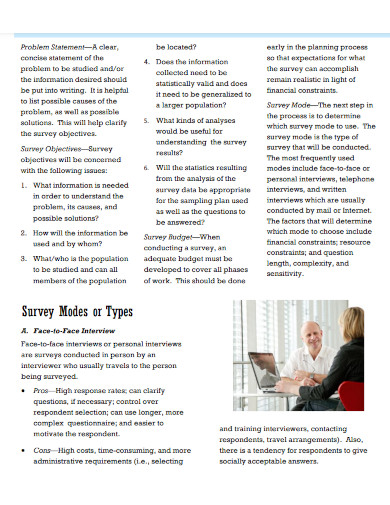

11. Survey Questionnaire Design

Size: 96 KB

12. Developing Questionnaires for Educational Research

Size: 81 KB

13. Graudate Research Student Questionnaires

14. Sample Research Survey Questionnaires

Size: 46 KB

15. Market Research Questionnaire Example

16. Research Survey Questionnaire Example

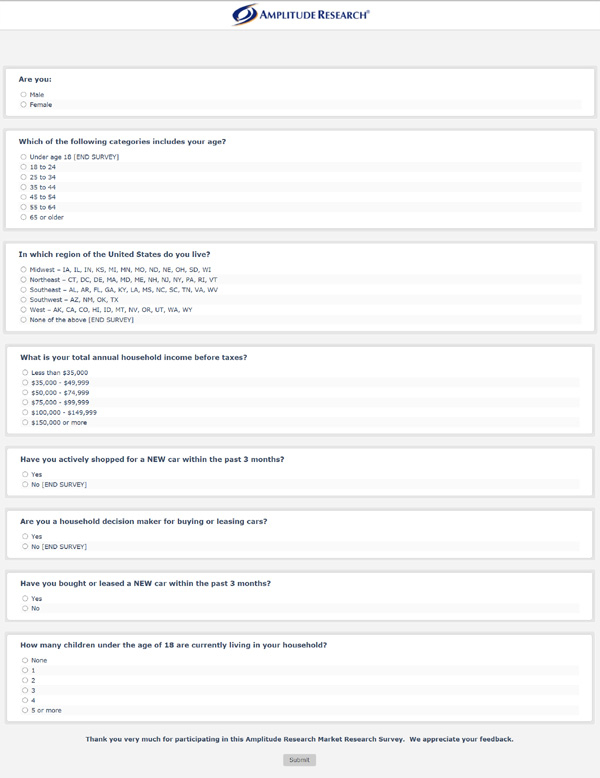

17. Product X Research Study Questionnaire Example

What Is a Research Questionnaire?

A research questionnaire is a physical or digital questionnaire that researchers use to obtain quantitative data. The research questionnaire is a more in-depth version of a survey as its questions often delve deeper than survey questions .

How to Write a Research Questionnaire

A well-made research questionnaire can effectively and efficiently gather data from the population. Creating a good research questionnaire does not require that many writing skills , soft skills , or hard skills , it just requires the person to properly understand the data set they are looking for.

Step 1: Select a Topic or Theme for the Research Questionnaire

Begin by choosing a topic or theme for the research questionnaire as this will provide much-needed context for the research questionnaire. Not only that but the topic will also dictate the tone of the questions in the questionnaire.

Step 2: Obtain or Use a Research Questionnaire Outline

You may opt to use a research questionnaire outline or outline format for your research questionnaire. This outline will provide you with a structure you can use to easily make your research questionnaire.

Step 3: Create your Research Questionnaire

Start by creating questions that will help provide you with the necessary data to prove or disprove your research question. You may conduct brainstorming sessions to formulate the questions for your research questionnaire.

Step 4: Edit and Have Someone Proofread the Questionnaire

After you have created and completed the research questionnaire, you must edit the contents of the questionnaire. Not only that but it is wise to have someone proofread the contents of your questionnaire before deploying the questionnaire.

How does a research questionnaire help businesses?

A successful business or company utilizes research questionnaires to not only obtain data from their customers but also to gather data about the performance and quality of the employees in the business. The research questionnaire provides the business or company with actionable data, which they can use to improve the product, service, or commodity to obtain more customers.

Do I need to provide a consent form when I ask someone to answer the research questionnaire?

Yes, consent is very important as without this the data you have gathered from your questionnaires or surveys are useless. Therefore it is important to provide a consent form with your research questionnaire when you are asking a participant to answer the document.

What type of answers are allowed in the research questionnaire?

Research questionnaires can host a multitude of types of questions each with its specific way of answering. A questionnaire can use multiple-choice questions, open-ended questions, and closed questions. Just be sure to properly pace the questions as having too many different types of answering styles can demotivate or distract the target audience, which might lead to errors.

A research questionnaire is a data-gathering document people can use to obtain information and data from a specific group of people. Well-made and crafted research questionnaires will provide much-needed information one can use to answer a specific research question.

Questionnaire Generator

Text prompt

- Instructive

- Professional

Create a fun quiz to find out which historical figure you're most like in your study habits

Design a survey to discover students' favorite school subjects and why they love them.

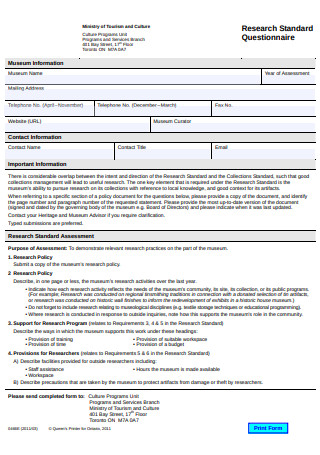

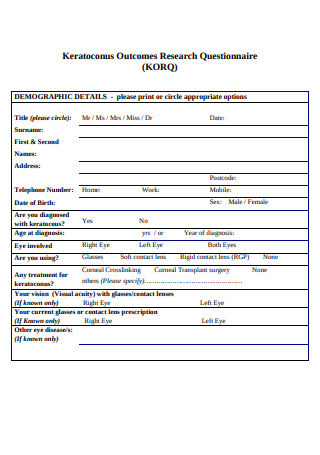

20+ SAMPLE Research Questionnaires Templates in PDF | MS Word | Google Docs | Apple Pages

Research questionnaires templates | ms word | google docs | apple pages, 20+ sample research questionnaires templates, what is a research questionnaire, types of research questionnaires, how to make an effective research questionnaire, research questionnaire vs. research survey, the dos and don’ts of a research questionnaire.

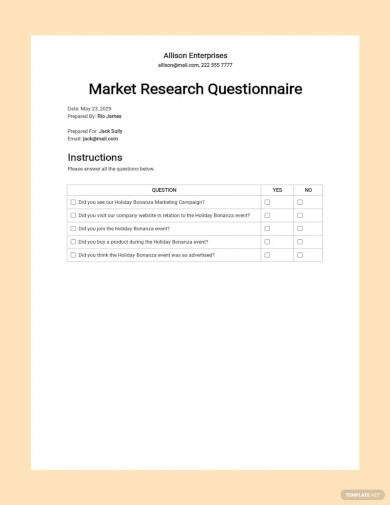

Market Research Questionnaire Template

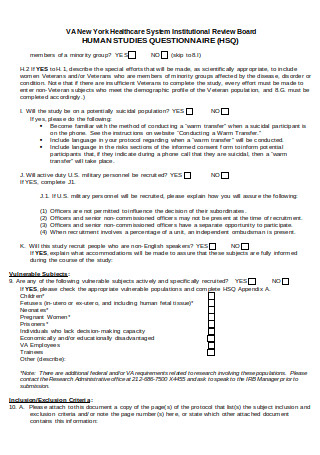

Veterans Health Care Survey Questionnaire

Basic Market Survey Questionnaire

Market Research Questionnaires Format

Research Protocol Survey

Clinical Study PI Questionnaire

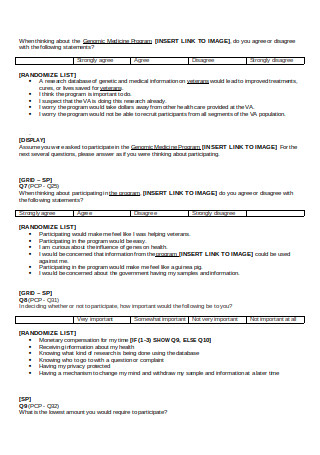

Human Study Questionnaire

Research Interest Questionnaire

Research Financial Disclosure Questionnaire

Research Project Questionnaire

Questionnaire for Legal Practitioners

Sample Research Questionnaire

Research Survey Questionnaires

Research Standard Questionnaires

Auto Compensation Research Questionnaire

Orientation Research Questionnaire

Research Questionnaire Format

Social Research Questionnaire

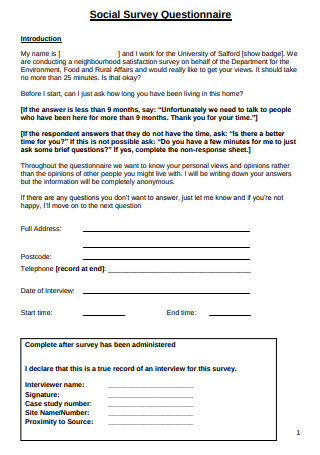

Social Survey Questionnaire

Research into Questionnaire Design

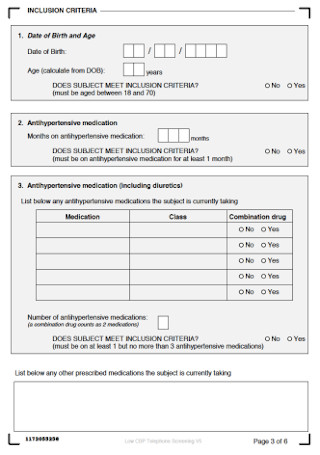

Questionnaires in Clinical Research

1. open-ended questionnaires, 2. closed-ended questionnaires, 3. mixed questionnaires, 4. pictorial questionnaires, step 1: identify the goals of your research questionnaire , step 2: define your target respondents, step 3: create questions , step 4: choose an appropriate question type , step 5: design the sequence and layout of the questions.

- The instrument used for data collection

- Is a tool that is distributed

- May contain open- or closed-ended questions

- Collects information on a topic

- Process of gathering and analyzing data

- Is an activity that is conducted

- Mainly comprised of closed-ended questions

- Aims to draw data for statistical analysis

Dont’s

Share this post on your network, file formats, word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates, you may also like these articles, 51+ sample food questionnaire templates in pdf | ms word | google docs | apple pages.

A food questionnaire can be used for a lot of purposes by a variety of businesses in the food service, hospitality, catering, and restaurant industry. Developing a food questionnaire is…

42+ SAMPLE Audit Questionnaire Templates in PDF | MS Word

Whether you come from a startup business to a long-time respected company, any work contains inevitable problems. Indeed, every success, even the smallest ones, deserves to be celebrated. But…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

- Privacy Policy

Buy Me a Coffee

Home » Questionnaire – Definition, Types, and Examples

Questionnaire – Definition, Types, and Examples

Table of Contents

Questionnaire

Definition:

A Questionnaire is a research tool or survey instrument that consists of a set of questions or prompts designed to gather information from individuals or groups of people.

It is a standardized way of collecting data from a large number of people by asking them a series of questions related to a specific topic or research objective. The questions may be open-ended or closed-ended, and the responses can be quantitative or qualitative. Questionnaires are widely used in research, marketing, social sciences, healthcare, and many other fields to collect data and insights from a target population.

History of Questionnaire

The history of questionnaires can be traced back to the ancient Greeks, who used questionnaires as a means of assessing public opinion. However, the modern history of questionnaires began in the late 19th century with the rise of social surveys.

The first social survey was conducted in the United States in 1874 by Francis A. Walker, who used a questionnaire to collect data on labor conditions. In the early 20th century, questionnaires became a popular tool for conducting social research, particularly in the fields of sociology and psychology.

One of the most influential figures in the development of the questionnaire was the psychologist Raymond Cattell, who in the 1940s and 1950s developed the personality questionnaire, a standardized instrument for measuring personality traits. Cattell’s work helped establish the questionnaire as a key tool in personality research.

In the 1960s and 1970s, the use of questionnaires expanded into other fields, including market research, public opinion polling, and health surveys. With the rise of computer technology, questionnaires became easier and more cost-effective to administer, leading to their widespread use in research and business settings.

Today, questionnaires are used in a wide range of settings, including academic research, business, healthcare, and government. They continue to evolve as a research tool, with advances in computer technology and data analysis techniques making it easier to collect and analyze data from large numbers of participants.

Types of Questionnaire

Types of Questionnaires are as follows:

Structured Questionnaire

This type of questionnaire has a fixed format with predetermined questions that the respondent must answer. The questions are usually closed-ended, which means that the respondent must select a response from a list of options.

Unstructured Questionnaire

An unstructured questionnaire does not have a fixed format or predetermined questions. Instead, the interviewer or researcher can ask open-ended questions to the respondent and let them provide their own answers.

Open-ended Questionnaire

An open-ended questionnaire allows the respondent to answer the question in their own words, without any pre-determined response options. The questions usually start with phrases like “how,” “why,” or “what,” and encourage the respondent to provide more detailed and personalized answers.

Close-ended Questionnaire

In a closed-ended questionnaire, the respondent is given a set of predetermined response options to choose from. This type of questionnaire is easier to analyze and summarize, but may not provide as much insight into the respondent’s opinions or attitudes.

Mixed Questionnaire

A mixed questionnaire is a combination of open-ended and closed-ended questions. This type of questionnaire allows for more flexibility in terms of the questions that can be asked, and can provide both quantitative and qualitative data.

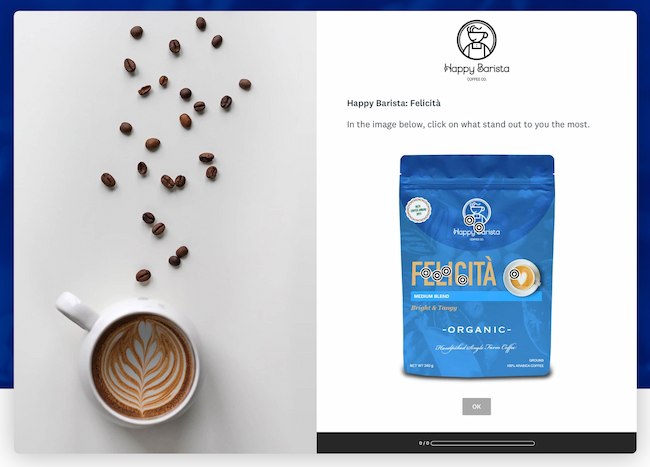

Pictorial Questionnaire:

In a pictorial questionnaire, instead of using words to ask questions, the questions are presented in the form of pictures, diagrams or images. This can be particularly useful for respondents who have low literacy skills, or for situations where language barriers exist. Pictorial questionnaires can also be useful in cross-cultural research where respondents may come from different language backgrounds.

Types of Questions in Questionnaire

The types of Questions in Questionnaire are as follows:

Multiple Choice Questions

These questions have several options for participants to choose from. They are useful for getting quantitative data and can be used to collect demographic information.

- a. Red b . Blue c. Green d . Yellow

Rating Scale Questions

These questions ask participants to rate something on a scale (e.g. from 1 to 10). They are useful for measuring attitudes and opinions.

- On a scale of 1 to 10, how likely are you to recommend this product to a friend?

Open-Ended Questions

These questions allow participants to answer in their own words and provide more in-depth and detailed responses. They are useful for getting qualitative data.

- What do you think are the biggest challenges facing your community?

Likert Scale Questions

These questions ask participants to rate how much they agree or disagree with a statement. They are useful for measuring attitudes and opinions.

How strongly do you agree or disagree with the following statement:

“I enjoy exercising regularly.”

- a . Strongly Agree

- c . Neither Agree nor Disagree

- d . Disagree

- e . Strongly Disagree

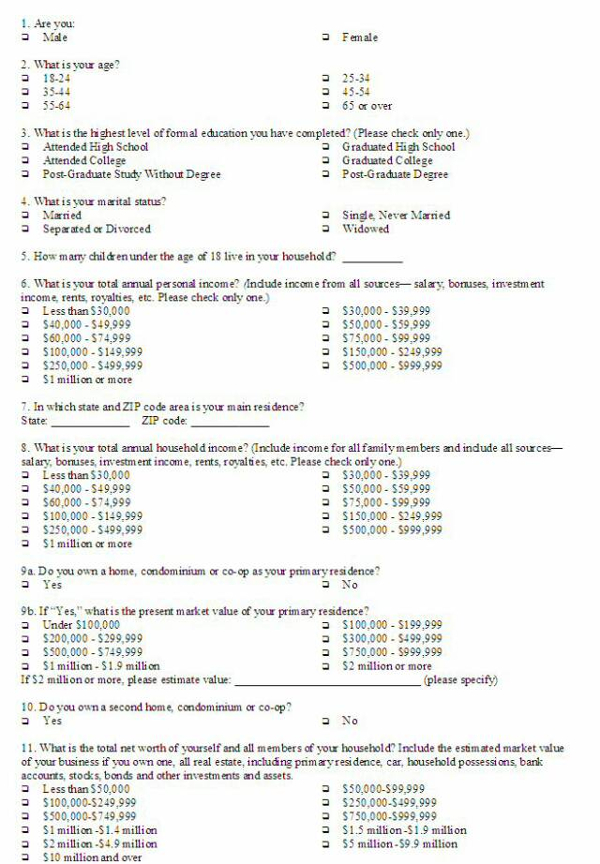

Demographic Questions

These questions ask about the participant’s personal information such as age, gender, ethnicity, education level, etc. They are useful for segmenting the data and analyzing results by demographic groups.

- What is your age?

Yes/No Questions

These questions only have two options: Yes or No. They are useful for getting simple, straightforward answers to a specific question.

Have you ever traveled outside of your home country?

Ranking Questions

These questions ask participants to rank several items in order of preference or importance. They are useful for measuring priorities or preferences.

Please rank the following factors in order of importance when choosing a restaurant:

- a. Quality of Food

- c. Ambiance

- d. Location

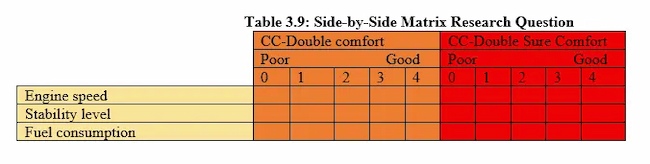

Matrix Questions

These questions present a matrix or grid of options that participants can choose from. They are useful for getting data on multiple variables at once.

Dichotomous Questions

These questions present two options that are opposite or contradictory. They are useful for measuring binary or polarized attitudes.

Do you support the death penalty?

How to Make a Questionnaire

Step-by-Step Guide for Making a Questionnaire:

- Define your research objectives: Before you start creating questions, you need to define the purpose of your questionnaire and what you hope to achieve from the data you collect.

- Choose the appropriate question types: Based on your research objectives, choose the appropriate question types to collect the data you need. Refer to the types of questions mentioned earlier for guidance.

- Develop questions: Develop clear and concise questions that are easy for participants to understand. Avoid leading or biased questions that might influence the responses.

- Organize questions: Organize questions in a logical and coherent order, starting with demographic questions followed by general questions, and ending with specific or sensitive questions.

- Pilot the questionnaire : Test your questionnaire on a small group of participants to identify any flaws or issues with the questions or the format.

- Refine the questionnaire : Based on feedback from the pilot, refine and revise the questionnaire as necessary to ensure that it is valid and reliable.

- Distribute the questionnaire: Distribute the questionnaire to your target audience using a method that is appropriate for your research objectives, such as online surveys, email, or paper surveys.

- Collect and analyze data: Collect the completed questionnaires and analyze the data using appropriate statistical methods. Draw conclusions from the data and use them to inform decision-making or further research.

- Report findings: Present your findings in a clear and concise report, including a summary of the research objectives, methodology, key findings, and recommendations.

Questionnaire Administration Modes

There are several modes of questionnaire administration. The choice of mode depends on the research objectives, sample size, and available resources. Some common modes of administration include:

- Self-administered paper questionnaires: Participants complete the questionnaire on paper, either in person or by mail. This mode is relatively low cost and easy to administer, but it may result in lower response rates and greater potential for errors in data entry.

- Online questionnaires: Participants complete the questionnaire on a website or through email. This mode is convenient for both researchers and participants, as it allows for fast and easy data collection. However, it may be subject to issues such as low response rates, lack of internet access, and potential for fraudulent responses.

- Telephone surveys: Trained interviewers administer the questionnaire over the phone. This mode allows for a large sample size and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Face-to-face interviews : Trained interviewers administer the questionnaire in person. This mode allows for a high degree of control over the survey environment and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Mixed-mode surveys: Researchers use a combination of two or more modes to administer the questionnaire, such as using online questionnaires for initial screening and following up with telephone interviews for more detailed information. This mode can help overcome some of the limitations of individual modes, but it requires careful planning and coordination.

Example of Questionnaire

Title of the Survey: Customer Satisfaction Survey

Introduction:

We appreciate your business and would like to ensure that we are meeting your needs. Please take a few minutes to complete this survey so that we can better understand your experience with our products and services. Your feedback is important to us and will help us improve our offerings.

Instructions:

Please read each question carefully and select the response that best reflects your experience. If you have any additional comments or suggestions, please feel free to include them in the space provided at the end of the survey.

1. How satisfied are you with our product quality?

- Very satisfied

- Somewhat satisfied

- Somewhat dissatisfied

- Very dissatisfied

2. How satisfied are you with our customer service?

3. How satisfied are you with the price of our products?

4. How likely are you to recommend our products to others?

- Very likely

- Somewhat likely

- Somewhat unlikely

- Very unlikely

5. How easy was it to find the information you were looking for on our website?

- Somewhat easy

- Somewhat difficult

- Very difficult

6. How satisfied are you with the overall experience of using our products and services?

7. Is there anything that you would like to see us improve upon or change in the future?

…………………………………………………………………………………………………………………………..

Conclusion:

Thank you for taking the time to complete this survey. Your feedback is valuable to us and will help us improve our products and services. If you have any further comments or concerns, please do not hesitate to contact us.

Applications of Questionnaire

Some common applications of questionnaires include:

- Research : Questionnaires are commonly used in research to gather information from participants about their attitudes, opinions, behaviors, and experiences. This information can then be analyzed and used to draw conclusions and make inferences.

- Healthcare : In healthcare, questionnaires can be used to gather information about patients’ medical history, symptoms, and lifestyle habits. This information can help healthcare professionals diagnose and treat medical conditions more effectively.

- Marketing : Questionnaires are commonly used in marketing to gather information about consumers’ preferences, buying habits, and opinions on products and services. This information can help businesses develop and market products more effectively.

- Human Resources: Questionnaires are used in human resources to gather information from job applicants, employees, and managers about job satisfaction, performance, and workplace culture. This information can help organizations improve their hiring practices, employee retention, and organizational culture.

- Education : Questionnaires are used in education to gather information from students, teachers, and parents about their perceptions of the educational experience. This information can help educators identify areas for improvement and develop more effective teaching strategies.

Purpose of Questionnaire

Some common purposes of questionnaires include:

- To collect information on attitudes, opinions, and beliefs: Questionnaires can be used to gather information on people’s attitudes, opinions, and beliefs on a particular topic. For example, a questionnaire can be used to gather information on people’s opinions about a particular political issue.

- To collect demographic information: Questionnaires can be used to collect demographic information such as age, gender, income, education level, and occupation. This information can be used to analyze trends and patterns in the data.

- To measure behaviors or experiences: Questionnaires can be used to gather information on behaviors or experiences such as health-related behaviors or experiences, job satisfaction, or customer satisfaction.

- To evaluate programs or interventions: Questionnaires can be used to evaluate the effectiveness of programs or interventions by gathering information on participants’ experiences, opinions, and behaviors.

- To gather information for research: Questionnaires can be used to gather data for research purposes on a variety of topics.

When to use Questionnaire

Here are some situations when questionnaires might be used:

- When you want to collect data from a large number of people: Questionnaires are useful when you want to collect data from a large number of people. They can be distributed to a wide audience and can be completed at the respondent’s convenience.

- When you want to collect data on specific topics: Questionnaires are useful when you want to collect data on specific topics or research questions. They can be designed to ask specific questions and can be used to gather quantitative data that can be analyzed statistically.

- When you want to compare responses across groups: Questionnaires are useful when you want to compare responses across different groups of people. For example, you might want to compare responses from men and women, or from people of different ages or educational backgrounds.

- When you want to collect data anonymously: Questionnaires can be useful when you want to collect data anonymously. Respondents can complete the questionnaire without fear of judgment or repercussions, which can lead to more honest and accurate responses.

- When you want to save time and resources: Questionnaires can be more efficient and cost-effective than other methods of data collection such as interviews or focus groups. They can be completed quickly and easily, and can be analyzed using software to save time and resources.

Characteristics of Questionnaire

Here are some of the characteristics of questionnaires:

- Standardization : Questionnaires are standardized tools that ask the same questions in the same order to all respondents. This ensures that all respondents are answering the same questions and that the responses can be compared and analyzed.

- Objectivity : Questionnaires are designed to be objective, meaning that they do not contain leading questions or bias that could influence the respondent’s answers.

- Predefined responses: Questionnaires typically provide predefined response options for the respondents to choose from, which helps to standardize the responses and make them easier to analyze.

- Quantitative data: Questionnaires are designed to collect quantitative data, meaning that they provide numerical or categorical data that can be analyzed using statistical methods.

- Convenience : Questionnaires are convenient for both the researcher and the respondents. They can be distributed and completed at the respondent’s convenience and can be easily administered to a large number of people.

- Anonymity : Questionnaires can be anonymous, which can encourage respondents to answer more honestly and provide more accurate data.

- Reliability : Questionnaires are designed to be reliable, meaning that they produce consistent results when administered multiple times to the same group of people.

- Validity : Questionnaires are designed to be valid, meaning that they measure what they are intended to measure and are not influenced by other factors.

Advantage of Questionnaire

Some Advantage of Questionnaire are as follows:

- Standardization: Questionnaires allow researchers to ask the same questions to all participants in a standardized manner. This helps ensure consistency in the data collected and eliminates potential bias that might arise if questions were asked differently to different participants.

- Efficiency: Questionnaires can be administered to a large number of people at once, making them an efficient way to collect data from a large sample.

- Anonymity: Participants can remain anonymous when completing a questionnaire, which may make them more likely to answer honestly and openly.

- Cost-effective: Questionnaires can be relatively inexpensive to administer compared to other research methods, such as interviews or focus groups.

- Objectivity: Because questionnaires are typically designed to collect quantitative data, they can be analyzed objectively without the influence of the researcher’s subjective interpretation.

- Flexibility: Questionnaires can be adapted to a wide range of research questions and can be used in various settings, including online surveys, mail surveys, or in-person interviews.

Limitations of Questionnaire

Limitations of Questionnaire are as follows:

- Limited depth: Questionnaires are typically designed to collect quantitative data, which may not provide a complete understanding of the topic being studied. Questionnaires may miss important details and nuances that could be captured through other research methods, such as interviews or observations.

- R esponse bias: Participants may not always answer questions truthfully or accurately, either because they do not remember or because they want to present themselves in a particular way. This can lead to response bias, which can affect the validity and reliability of the data collected.

- Limited flexibility: While questionnaires can be adapted to a wide range of research questions, they may not be suitable for all types of research. For example, they may not be appropriate for studying complex phenomena or for exploring participants’ experiences and perceptions in-depth.

- Limited context: Questionnaires typically do not provide a rich contextual understanding of the topic being studied. They may not capture the broader social, cultural, or historical factors that may influence participants’ responses.

- Limited control : Researchers may not have control over how participants complete the questionnaire, which can lead to variations in response quality or consistency.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

Survey Research – Types, Methods, Examples

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Methodology

- Questionnaire Design | Methods, Question Types & Examples

Questionnaire Design | Methods, Question Types & Examples

Published on 6 May 2022 by Pritha Bhandari . Revised on 10 October 2022.

A questionnaire is a list of questions or items used to gather data from respondents about their attitudes, experiences, or opinions. Questionnaires can be used to collect quantitative and/or qualitative information.

Questionnaires are commonly used in market research as well as in the social and health sciences. For example, a company may ask for feedback about a recent customer service experience, or psychology researchers may investigate health risk perceptions using questionnaires.

Table of contents

Questionnaires vs surveys, questionnaire methods, open-ended vs closed-ended questions, question wording, question order, step-by-step guide to design, frequently asked questions about questionnaire design.

A survey is a research method where you collect and analyse data from a group of people. A questionnaire is a specific tool or instrument for collecting the data.

Designing a questionnaire means creating valid and reliable questions that address your research objectives, placing them in a useful order, and selecting an appropriate method for administration.

But designing a questionnaire is only one component of survey research. Survey research also involves defining the population you’re interested in, choosing an appropriate sampling method , administering questionnaires, data cleaning and analysis, and interpretation.

Sampling is important in survey research because you’ll often aim to generalise your results to the population. Gather data from a sample that represents the range of views in the population for externally valid results. There will always be some differences between the population and the sample, but minimising these will help you avoid sampling bias .

Prevent plagiarism, run a free check.

Questionnaires can be self-administered or researcher-administered . Self-administered questionnaires are more common because they are easy to implement and inexpensive, but researcher-administered questionnaires allow deeper insights.

Self-administered questionnaires

Self-administered questionnaires can be delivered online or in paper-and-pen formats, in person or by post. All questions are standardised so that all respondents receive the same questions with identical wording.

Self-administered questionnaires can be:

- Cost-effective

- Easy to administer for small and large groups

- Anonymous and suitable for sensitive topics

But they may also be:

- Unsuitable for people with limited literacy or verbal skills

- Susceptible to a nonreponse bias (most people invited may not complete the questionnaire)

- Biased towards people who volunteer because impersonal survey requests often go ignored

Researcher-administered questionnaires

Researcher-administered questionnaires are interviews that take place by phone, in person, or online between researchers and respondents.

Researcher-administered questionnaires can:

- Help you ensure the respondents are representative of your target audience

- Allow clarifications of ambiguous or unclear questions and answers

- Have high response rates because it’s harder to refuse an interview when personal attention is given to respondents

But researcher-administered questionnaires can be limiting in terms of resources. They are:

- Costly and time-consuming to perform

- More difficult to analyse if you have qualitative responses

- Likely to contain experimenter bias or demand characteristics

- Likely to encourage social desirability bias in responses because of a lack of anonymity

Your questionnaire can include open-ended or closed-ended questions, or a combination of both.

Using closed-ended questions limits your responses, while open-ended questions enable a broad range of answers. You’ll need to balance these considerations with your available time and resources.

Closed-ended questions

Closed-ended, or restricted-choice, questions offer respondents a fixed set of choices to select from. Closed-ended questions are best for collecting data on categorical or quantitative variables.

Categorical variables can be nominal or ordinal. Quantitative variables can be interval or ratio. Understanding the type of variable and level of measurement means you can perform appropriate statistical analyses for generalisable results.

Examples of closed-ended questions for different variables

Nominal variables include categories that can’t be ranked, such as race or ethnicity. This includes binary or dichotomous categories.

It’s best to include categories that cover all possible answers and are mutually exclusive. There should be no overlap between response items.

In binary or dichotomous questions, you’ll give respondents only two options to choose from.

White Black or African American American Indian or Alaska Native Asian Native Hawaiian or Other Pacific Islander

Ordinal variables include categories that can be ranked. Consider how wide or narrow a range you’ll include in your response items, and their relevance to your respondents.

Likert-type questions collect ordinal data using rating scales with five or seven points.

When you have four or more Likert-type questions, you can treat the composite data as quantitative data on an interval scale . Intelligence tests, psychological scales, and personality inventories use multiple Likert-type questions to collect interval data.

With interval or ratio data, you can apply strong statistical hypothesis tests to address your research aims.

Pros and cons of closed-ended questions

Well-designed closed-ended questions are easy to understand and can be answered quickly. However, you might still miss important answers that are relevant to respondents. An incomplete set of response items may force some respondents to pick the closest alternative to their true answer. These types of questions may also miss out on valuable detail.

To solve these problems, you can make questions partially closed-ended, and include an open-ended option where respondents can fill in their own answer.

Open-ended questions

Open-ended, or long-form, questions allow respondents to give answers in their own words. Because there are no restrictions on their choices, respondents can answer in ways that researchers may not have otherwise considered. For example, respondents may want to answer ‘multiracial’ for the question on race rather than selecting from a restricted list.

- How do you feel about open science?

- How would you describe your personality?

- In your opinion, what is the biggest obstacle to productivity in remote work?

Open-ended questions have a few downsides.

They require more time and effort from respondents, which may deter them from completing the questionnaire.

For researchers, understanding and summarising responses to these questions can take a lot of time and resources. You’ll need to develop a systematic coding scheme to categorise answers, and you may also need to involve other researchers in data analysis for high reliability .

Question wording can influence your respondents’ answers, especially if the language is unclear, ambiguous, or biased. Good questions need to be understood by all respondents in the same way ( reliable ) and measure exactly what you’re interested in ( valid ).

Use clear language

You should design questions with your target audience in mind. Consider their familiarity with your questionnaire topics and language and tailor your questions to them.

For readability and clarity, avoid jargon or overly complex language. Don’t use double negatives because they can be harder to understand.

Use balanced framing

Respondents often answer in different ways depending on the question framing. Positive frames are interpreted as more neutral than negative frames and may encourage more socially desirable answers.

Use a mix of both positive and negative frames to avoid bias , and ensure that your question wording is balanced wherever possible.

Unbalanced questions focus on only one side of an argument. Respondents may be less likely to oppose the question if it is framed in a particular direction. It’s best practice to provide a counterargument within the question as well.

Avoid leading questions

Leading questions guide respondents towards answering in specific ways, even if that’s not how they truly feel, by explicitly or implicitly providing them with extra information.

It’s best to keep your questions short and specific to your topic of interest.

- The average daily work commute in the US takes 54.2 minutes and costs $29 per day. Since 2020, working from home has saved many employees time and money. Do you favour flexible work-from-home policies even after it’s safe to return to offices?

- Experts agree that a well-balanced diet provides sufficient vitamins and minerals, and multivitamins and supplements are not necessary or effective. Do you agree or disagree that multivitamins are helpful for balanced nutrition?

Keep your questions focused

Ask about only one idea at a time and avoid double-barrelled questions. Double-barrelled questions ask about more than one item at a time, which can confuse respondents.

This question could be difficult to answer for respondents who feel strongly about the right to clean drinking water but not high-speed internet. They might only answer about the topic they feel passionate about or provide a neutral answer instead – but neither of these options capture their true answers.

Instead, you should ask two separate questions to gauge respondents’ opinions.

Strongly Agree Agree Undecided Disagree Strongly Disagree

Do you agree or disagree that the government should be responsible for providing high-speed internet to everyone?

You can organise the questions logically, with a clear progression from simple to complex. Alternatively, you can randomise the question order between respondents.

Logical flow

Using a logical flow to your question order means starting with simple questions, such as behavioural or opinion questions, and ending with more complex, sensitive, or controversial questions.

The question order that you use can significantly affect the responses by priming them in specific directions. Question order effects, or context effects, occur when earlier questions influence the responses to later questions, reducing the validity of your questionnaire.

While demographic questions are usually unaffected by order effects, questions about opinions and attitudes are more susceptible to them.

- How knowledgeable are you about Joe Biden’s executive orders in his first 100 days?

- Are you satisfied or dissatisfied with the way Joe Biden is managing the economy?

- Do you approve or disapprove of the way Joe Biden is handling his job as president?

It’s important to minimise order effects because they can be a source of systematic error or bias in your study.

Randomisation

Randomisation involves presenting individual respondents with the same questionnaire but with different question orders.

When you use randomisation, order effects will be minimised in your dataset. But a randomised order may also make it harder for respondents to process your questionnaire. Some questions may need more cognitive effort, while others are easier to answer, so a random order could require more time or mental capacity for respondents to switch between questions.

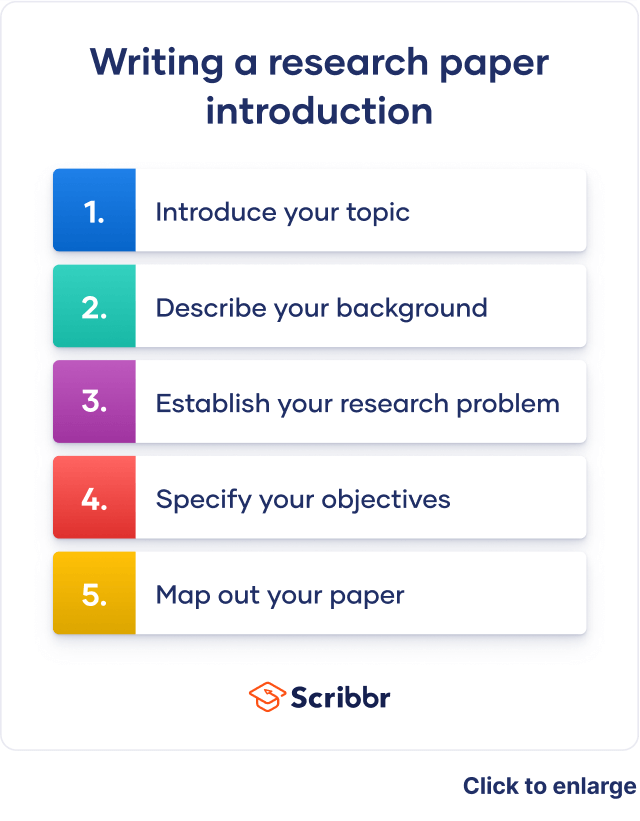

Follow this step-by-step guide to design your questionnaire.

Step 1: Define your goals and objectives

The first step of designing a questionnaire is determining your aims.

- What topics or experiences are you studying?

- What specifically do you want to find out?

- Is a self-report questionnaire an appropriate tool for investigating this topic?

Once you’ve specified your research aims, you can operationalise your variables of interest into questionnaire items. Operationalising concepts means turning them from abstract ideas into concrete measurements. Every question needs to address a defined need and have a clear purpose.

Step 2: Use questions that are suitable for your sample

Create appropriate questions by taking the perspective of your respondents. Consider their language proficiency and available time and energy when designing your questionnaire.

- Are the respondents familiar with the language and terms used in your questions?

- Would any of the questions insult, confuse, or embarrass them?

- Do the response items for any closed-ended questions capture all possible answers?

- Are the response items mutually exclusive?

- Do the respondents have time to respond to open-ended questions?

Consider all possible options for responses to closed-ended questions. From a respondent’s perspective, a lack of response options reflecting their point of view or true answer may make them feel alienated or excluded. In turn, they’ll become disengaged or inattentive to the rest of the questionnaire.

Step 3: Decide on your questionnaire length and question order

Once you have your questions, make sure that the length and order of your questions are appropriate for your sample.

If respondents are not being incentivised or compensated, keep your questionnaire short and easy to answer. Otherwise, your sample may be biased with only highly motivated respondents completing the questionnaire.

Decide on your question order based on your aims and resources. Use a logical flow if your respondents have limited time or if you cannot randomise questions. Randomising questions helps you avoid bias, but it can take more complex statistical analysis to interpret your data.

Step 4: Pretest your questionnaire

When you have a complete list of questions, you’ll need to pretest it to make sure what you’re asking is always clear and unambiguous. Pretesting helps you catch any errors or points of confusion before performing your study.

Ask friends, classmates, or members of your target audience to complete your questionnaire using the same method you’ll use for your research. Find out if any questions were particularly difficult to answer or if the directions were unclear or inconsistent, and make changes as necessary.

If you have the resources, running a pilot study will help you test the validity and reliability of your questionnaire. A pilot study is a practice run of the full study, and it includes sampling, data collection , and analysis.

You can find out whether your procedures are unfeasible or susceptible to bias and make changes in time, but you can’t test a hypothesis with this type of study because it’s usually statistically underpowered .

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analysing data from people using questionnaires.

Closed-ended, or restricted-choice, questions offer respondents a fixed set of choices to select from. These questions are easier to answer quickly.

Open-ended or long-form questions allow respondents to answer in their own words. Because there are no restrictions on their choices, respondents can answer in ways that researchers may not have otherwise considered.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviours. It is made up of four or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with five or seven possible responses, to capture their degree of agreement.

You can organise the questions logically, with a clear progression from simple to complex, or randomly between respondents. A logical flow helps respondents process the questionnaire easier and quicker, but it may lead to bias. Randomisation can minimise the bias from order effects.

Questionnaires can be self-administered or researcher-administered.

Researcher-administered questionnaires are interviews that take place by phone, in person, or online between researchers and respondents. You can gain deeper insights by clarifying questions for respondents or asking follow-up questions.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the ‘Cite this Scribbr article’ button to automatically add the citation to our free Reference Generator.

Bhandari, P. (2022, October 10). Questionnaire Design | Methods, Question Types & Examples. Scribbr. Retrieved 9 April 2024, from https://www.scribbr.co.uk/research-methods/questionnaire-design/

Is this article helpful?

Pritha Bhandari

Other students also liked, doing survey research | a step-by-step guide & examples, what is a likert scale | guide & examples, reliability vs validity in research | differences, types & examples.

28 Questionnaire Examples, Questions, & Templates to Survey Your Clients

Published: May 15, 2023

The adage "the customer is always right" has received some pushback in recent years, but when it comes to conducting surveys , the phrase is worth a deeper look. In the past, representatives were tasked with solving client problems as they happened. Now, they have to be proactive by solving problems before they come up.

Salesforce found that 63% of customers expect companies to anticipate their needs before they ask for help. But how can a customer service team recognize these customer needs in advance and effectively solve them on a day-to-day basis?

![sample questionnaire for a research paper → Free Download: 5 Customer Survey Templates [Access Now]](https://no-cache.hubspot.com/cta/default/53/9d36416b-3b0d-470c-a707-269296bb8683.png)

A customer questionnaire is a tried-and-true method for collecting survey data to inform your customer service strategy . By hearing directly from the customer, you'll capture first-hand data about how well your service team meets their needs. In this article, you'll get free questionnaire templates and best practices on how to administer them for the most honest responses.

Table of Contents:

Questionnaire Definition

Survey vs. questionnaire, questionnaire templates.

- Questionnaire Examples

Questionnaire Design

Survey question examples.

- Examples of Good Survey Questions

How to Make a Questionnaire

A questionnaire is a research tool used to conduct surveys. It includes specific questions with the goal to understand a topic from the respondents' point of view. Questionnaires typically have closed-ended, open-ended, short-form, and long-form questions.

The questions should always stay as unbiased as possible. For instance, it's unwise to ask for feedback on a specific product or service that’s still in the ideation phase. To complete the questionnaire, the customer would have to imagine how they might experience the product or service rather than sharing their opinion about their actual experience with it.

Ask broad questions about the kinds of qualities and features your customers enjoy in your products or services and incorporate that feedback into new offerings your team is developing.

What makes a good questionnaire?

Define the goal, make it short and simple, use a mix of question types, proofread carefully, keep it consistent.

A good questionnaire should find what you need versus what you want. It should be valuable and give you a chance to understand the respondent’s point of view.

Make the purpose of your questionnaire clear. While it's tempting to ask a range of questions simultaneously, you'll get more valuable results if you stay specific to a set topic.

According to HubSpot research , 47% of those surveyed say their top reason for abandoning a survey is the time it takes to complete.

So, questionnaires should be concise and easy to finish. If you're looking for a respondent’s experience with your business, focus on the most important questions.

.webp)

5 Free Customer Satisfaction Survey Templates

Easily measure customer satisfaction and begin to improve your customer experience.

- Net Promoter Score

- Customer Effort Score

You're all set!

Click this link to access this resource at any time.

5 Customer Survey Templates

Featured resource.

Your questionnaire should include a combination of question types, like open-ended, long-form, or short-ended questions.

Open-ended questions give users a chance to share their own answers. But closed-ended questions are more efficient and easy to quantify, with specific answer choices.

If you're not sure which question types are best, read here for more survey question examples .

While it's important to check spelling and grammar, there are two other things you'll want to check for a great questionnaire.

First, edit for clarity. Jargon, technical terms, and brand-specific language can be confusing for respondents. Next, check for leading questions. These questions can produce biased results that will be less useful to your team.

Consistency makes it easier for respondents to quickly complete your questionnaire. This is because it makes the questions less confusing. It can also reduce bias.

Being consistent is also helpful for analyzing questionnaire data because it makes it easier to compare results. With this in mind, keep response scales, question types, and formatting consistent.

In-Depth Interviews vs. Questionnaire

Questionnaires can be a more feasible and efficient research method than in-depth interviews. They are a lot cheaper to conduct. That’s because in-depth interviews can require you to compensate the interviewees for their time and give accommodations and travel reimbursement.

Questionnaires also save time for both parties. Customers can quickly complete them on their own time, and employees of your company don't have to spend time conducting the interviews. They can capture a larger audience than in-depth interviews, making them much more cost-effective.

It would be impossible for a large company to interview tens of thousands of customers in person. The same company could potentially get feedback from its entire customer base using an online questionnaire.

When considering your current products and services (as well as ideas for new products and services), it's essential to get the feedback of existing and potential customers. They are the ones who have a say in purchasing decisions.

A questionnaire is a tool that’s used to conduct a survey. A survey is the process of gathering, sampling, analyzing, and interpreting data from a group of people.

The confusion between these terms most likely stems from the fact that questionnaires and data analysis were treated as very separate processes before the Internet became popular. Questionnaires used to be completed on paper, and data analysis occurred later as a separate process. Nowadays, these processes are typically combined since online survey tools allow questionnaire responses to be analyzed and aggregated all in one step.