G/L Account Determination in SAP SD

Most of the transactions in SAP are recorded against the GL account. During creation of billing document form a sales order , an accounting document is created where material value is posted against a G/L account. The post describes how the system determines the G/L account for a material sold to a particular customer by the GL account determination technique.

Lets try to create a sales order for a customer with some material and then creating a billing document from the sales order which also generated the accounting document.

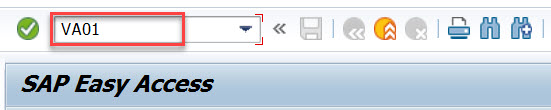

To create sales order go to Tx- Va01

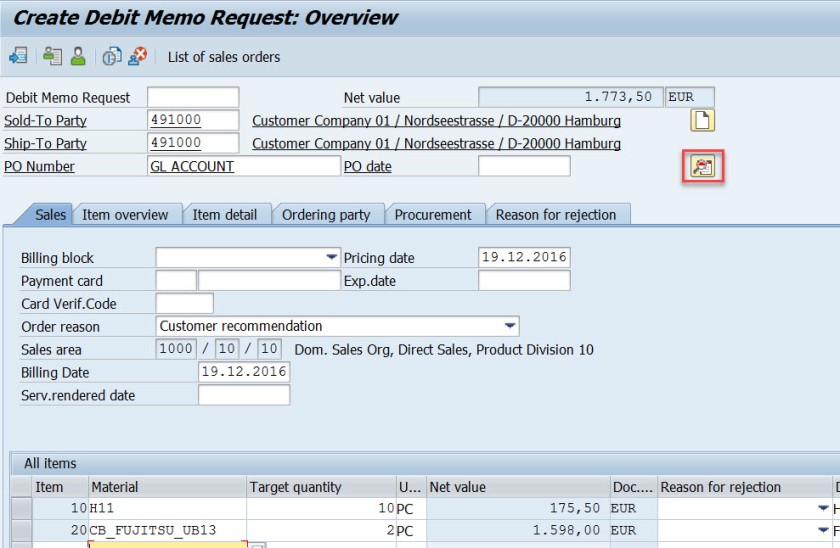

Lets create a debit memo request for the sales area 1000/10/10.

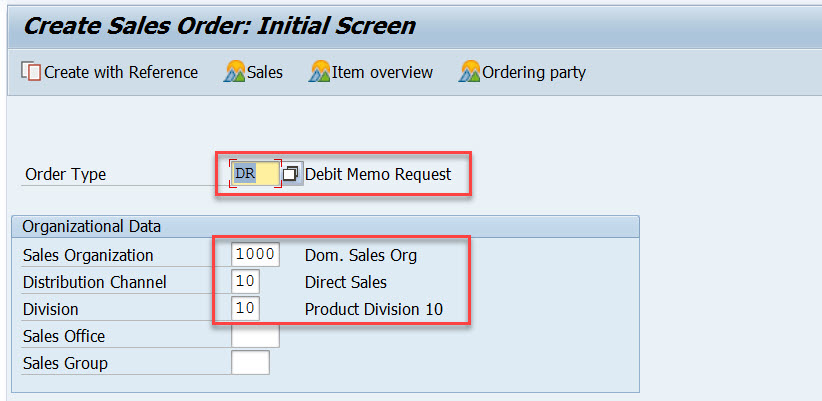

Provide the customer number and few materials and its quantity and double click on the first material to see the item details.

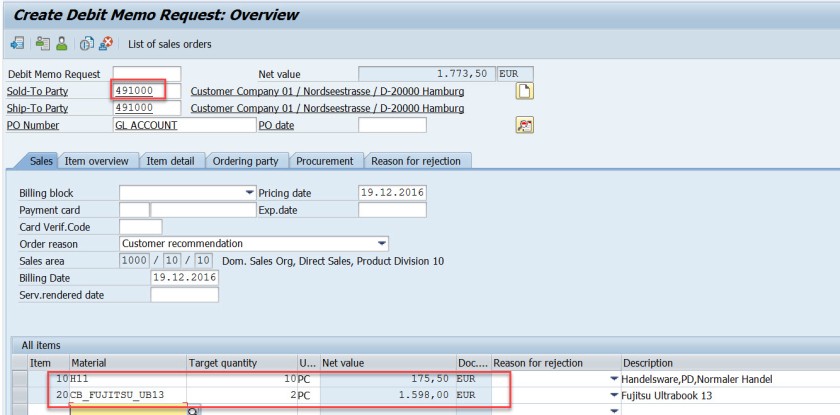

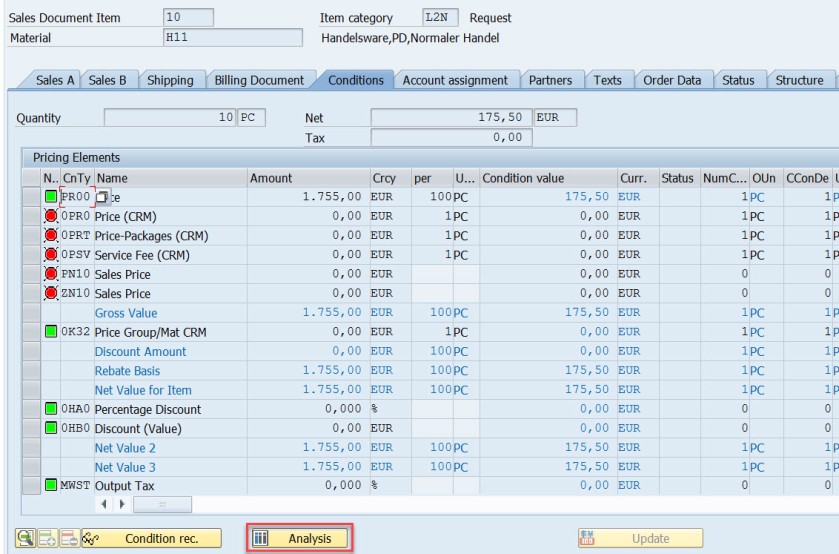

From the pricing procedure – for the pricing condition type- PR00 material value is calculated as 175.50 EUR.

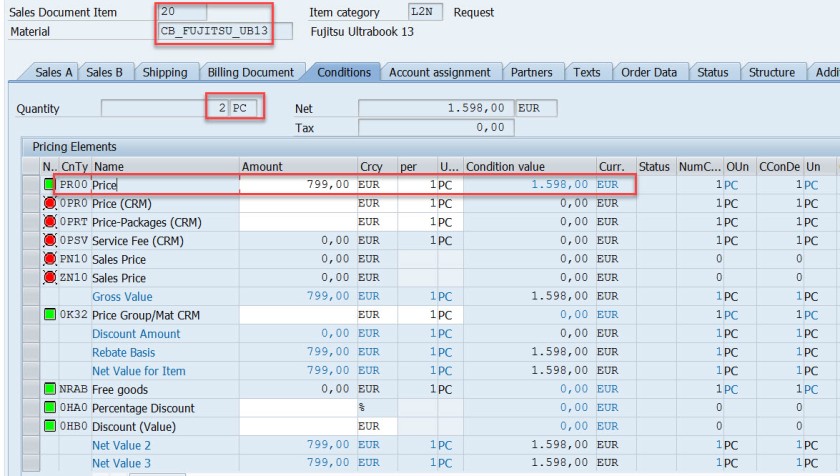

For the second material for the pricing condition type- PR00 material value is calculated as 1598.00 EUR. Go back.

Select the header button.

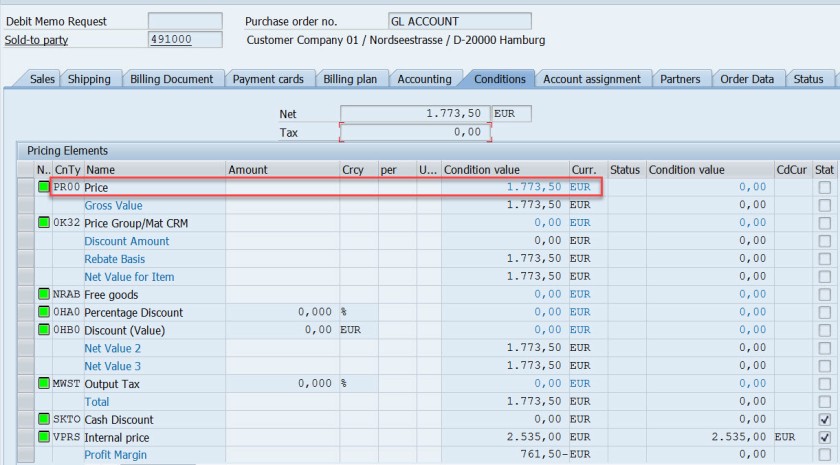

In the header section, in the Conditions tab, the total price is the sum of two materials.

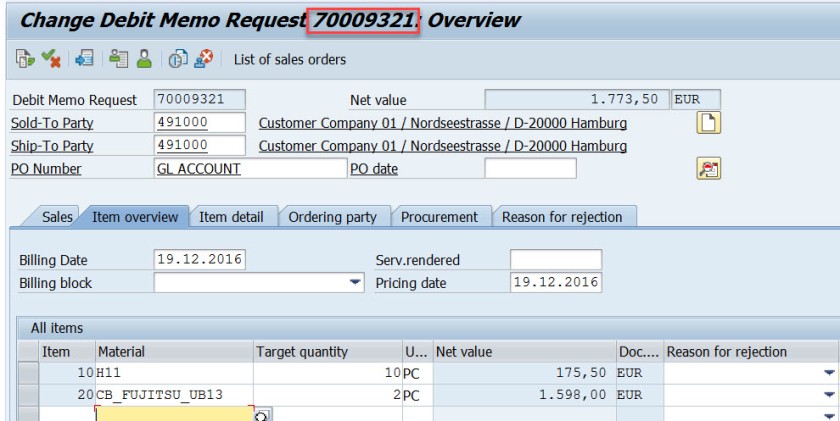

Save and DMR is created.

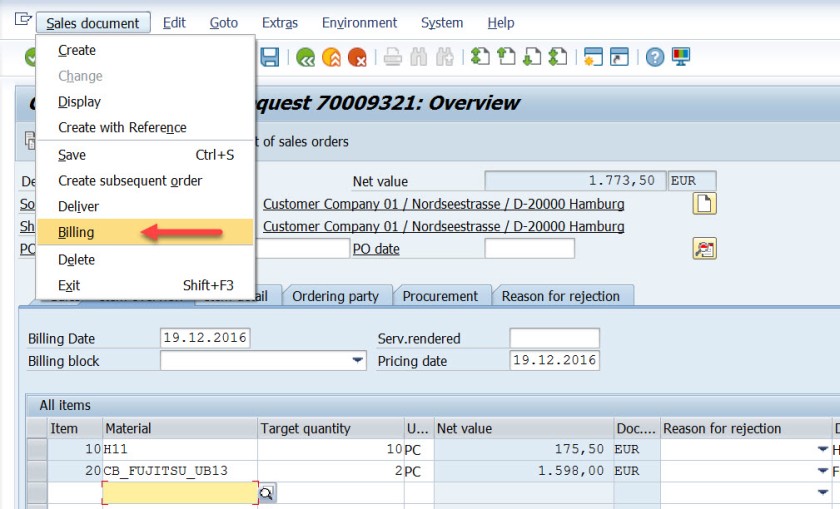

Go to Tx- VA02 and from the menu choose Billing.

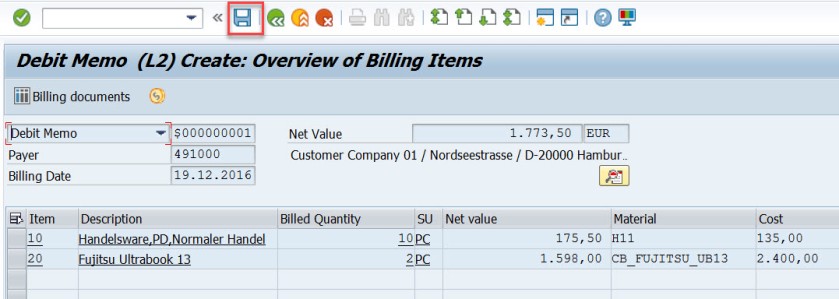

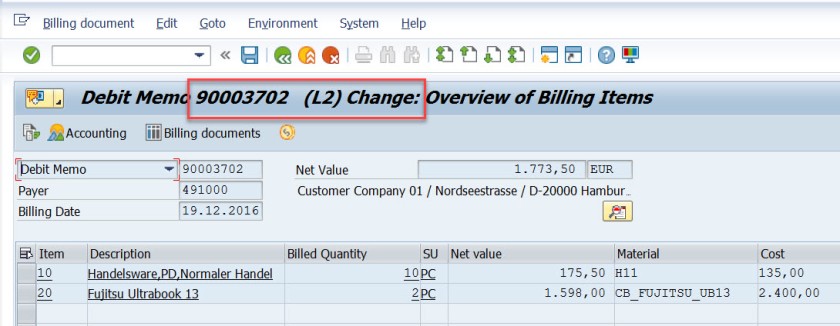

Select Save button to create a billing document. mark billing document type is determined as – L2.

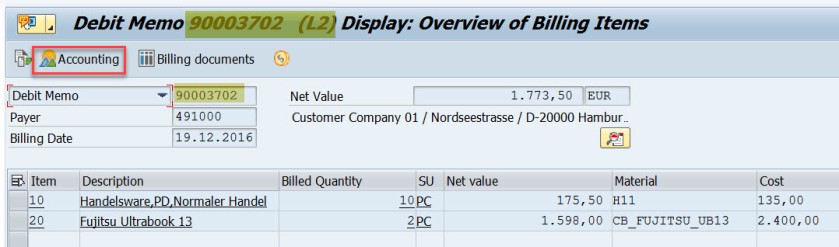

Go to Tx- VF03 and display the billing document. Choose Accounting button.

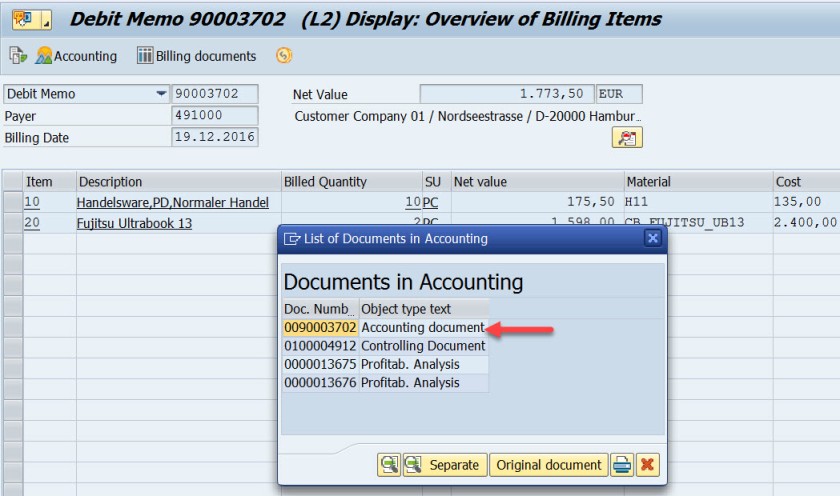

Choose Accounting document.

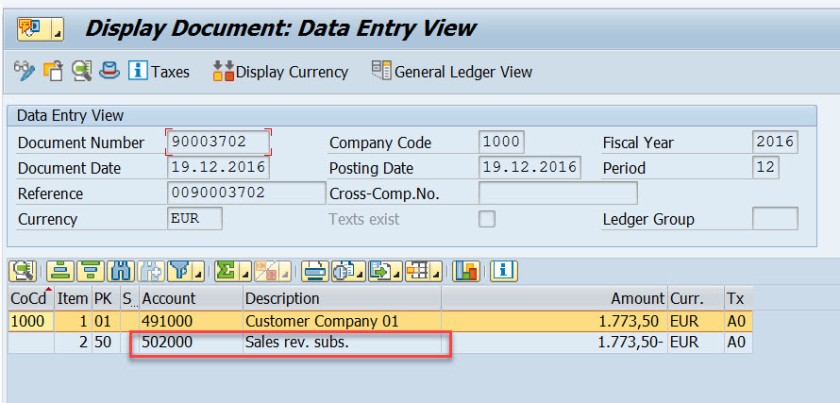

Here is the accounting doc with few lines.

First entry is for the customer as we used the customer – 491000, the account becomes 491000 for the customer.

For the second line, the GL account calculated as 502000. Let’s figure it out how this g/L account is determined.

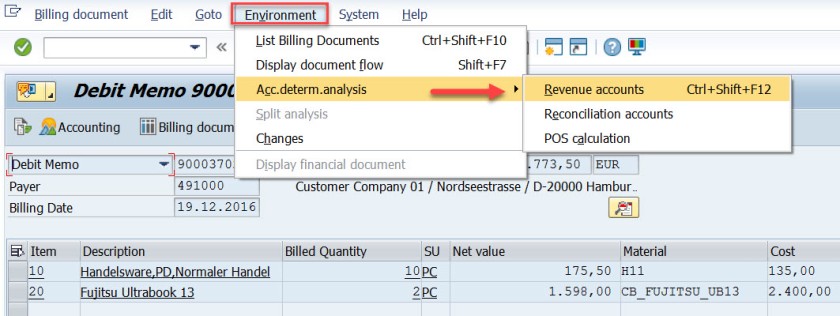

Go to Tx- VF02 and edit the billing document.

From menu, navigate along the highlighted path.

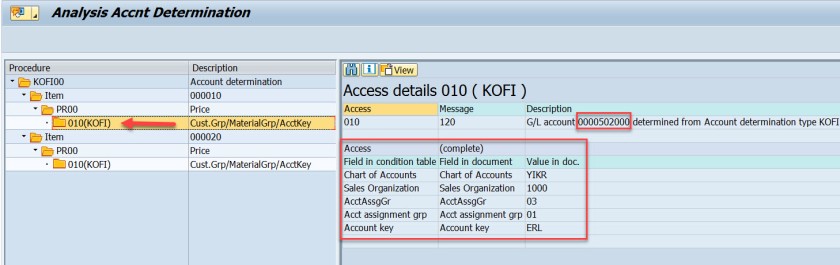

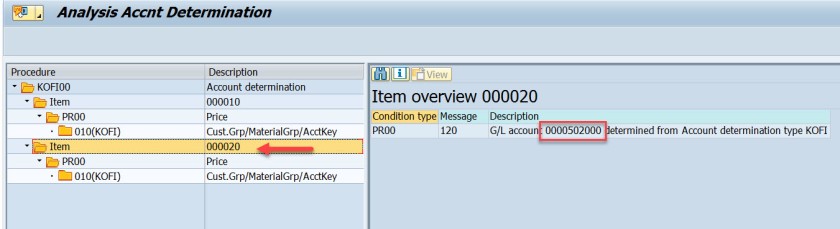

Well, it says the Account Determination procedure is KOFI00 and for the first item , for the pricing condition type PR00, the G/L account as 502000.

Same for the second item.

The G/L account determination requires few customizing steps.

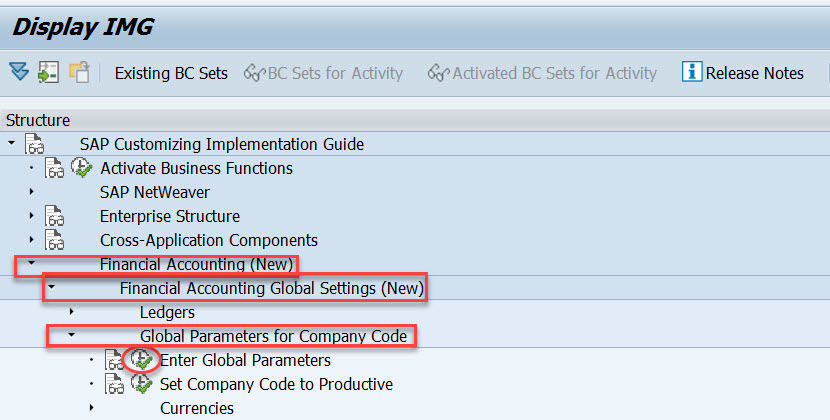

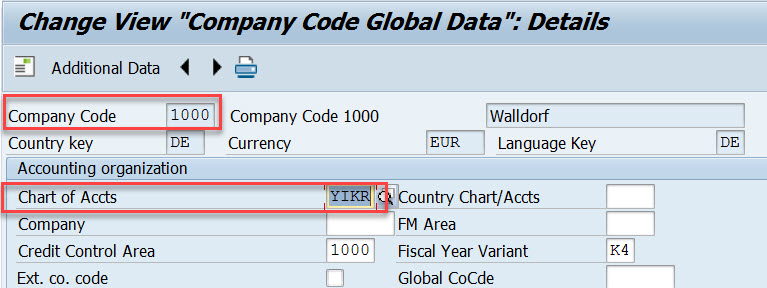

First check what is the chart of account assigned to the company code. In SPRO IMG structure navigate along the highlighted path to see the chart of account assigned to the company code.

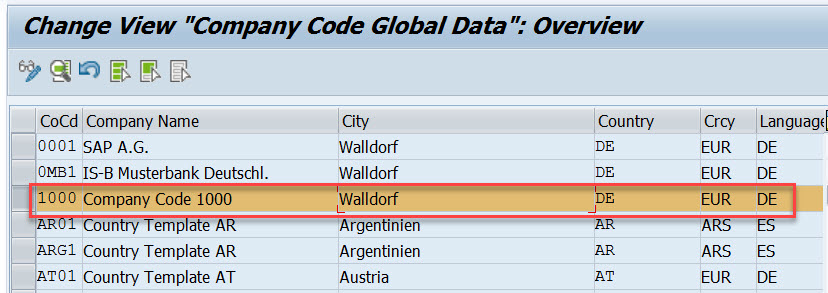

For the demo we use company code- 1000

The chart of account is – YIKR

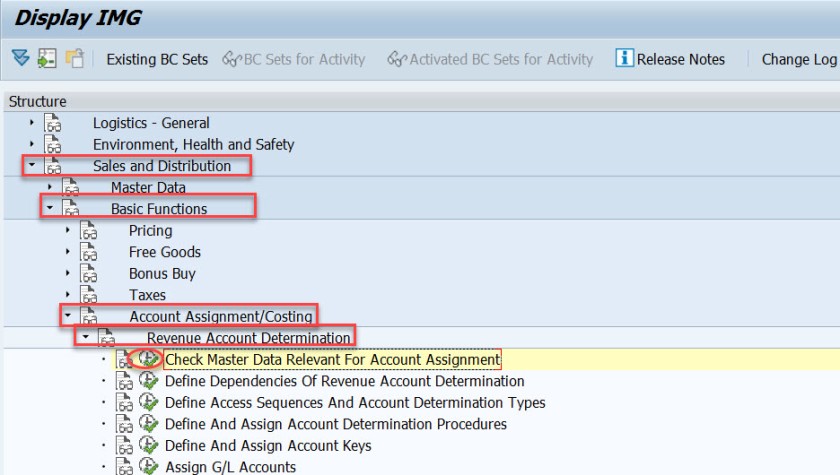

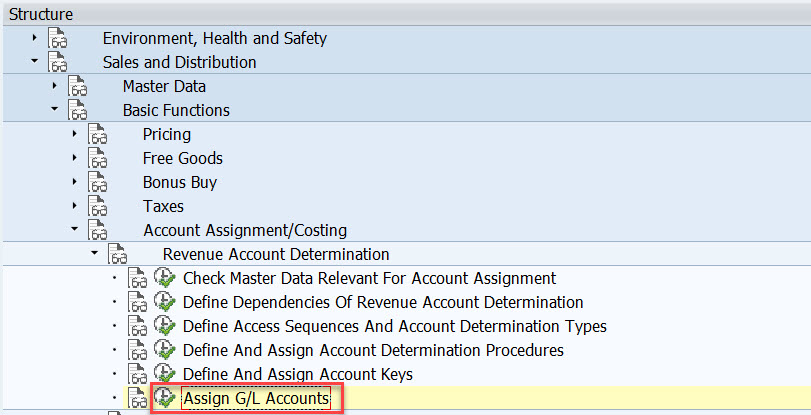

Next step , the customizing in the Sales&Distribution section for the Account Assignment/Costing.

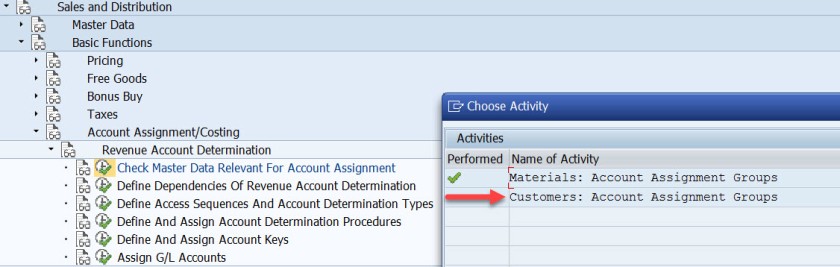

First execute – Check master data relevant for account assignment.

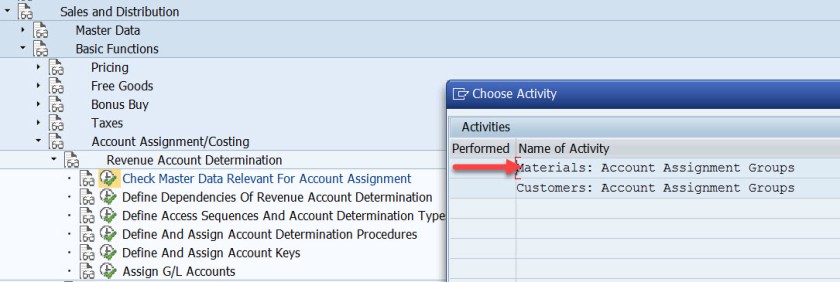

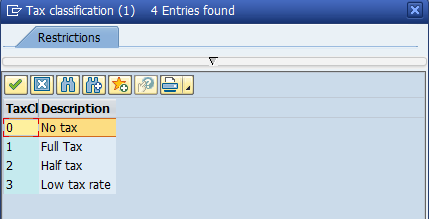

Select first option- Materials : Account Assignment Groups.

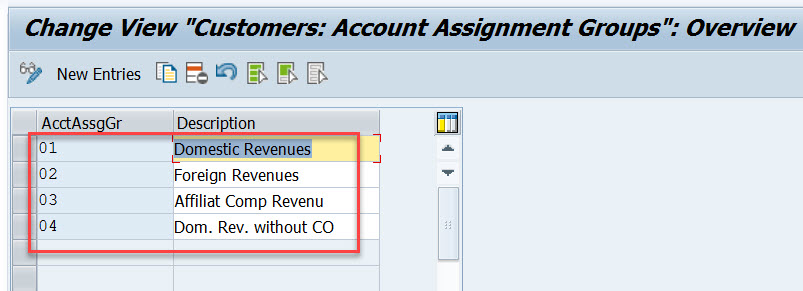

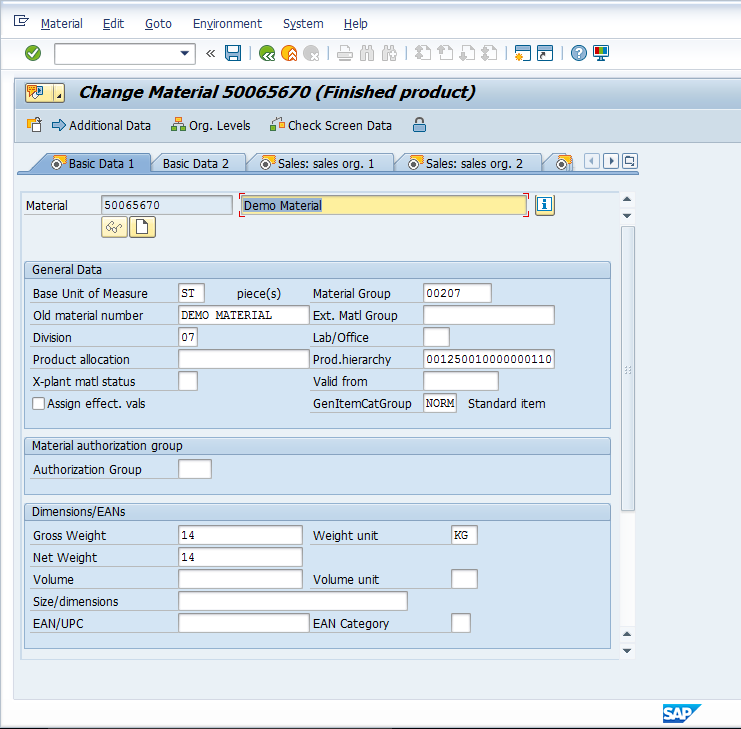

Here Material account assignment group is created which is assigned to the material master when created in Tx- MM01

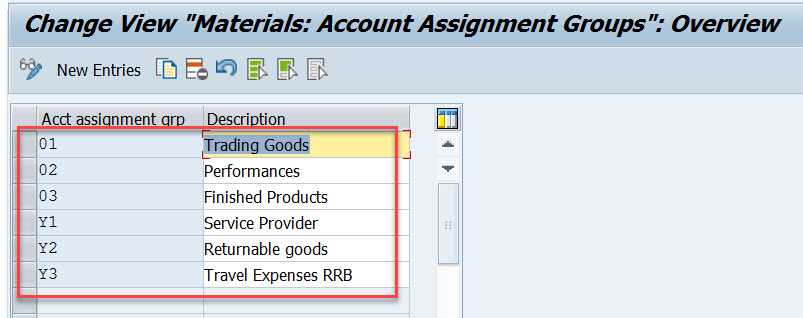

Select second option- Customer : Account Assignment Groups.

Here Cusomter account assignment group is created which is assigned to the customer master when created in Tx- XD01

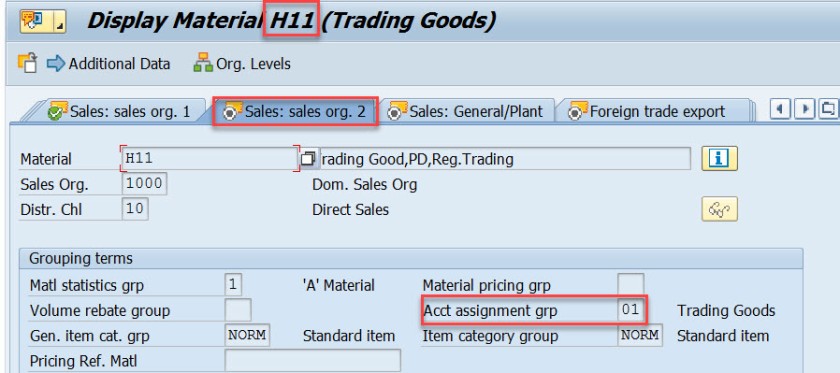

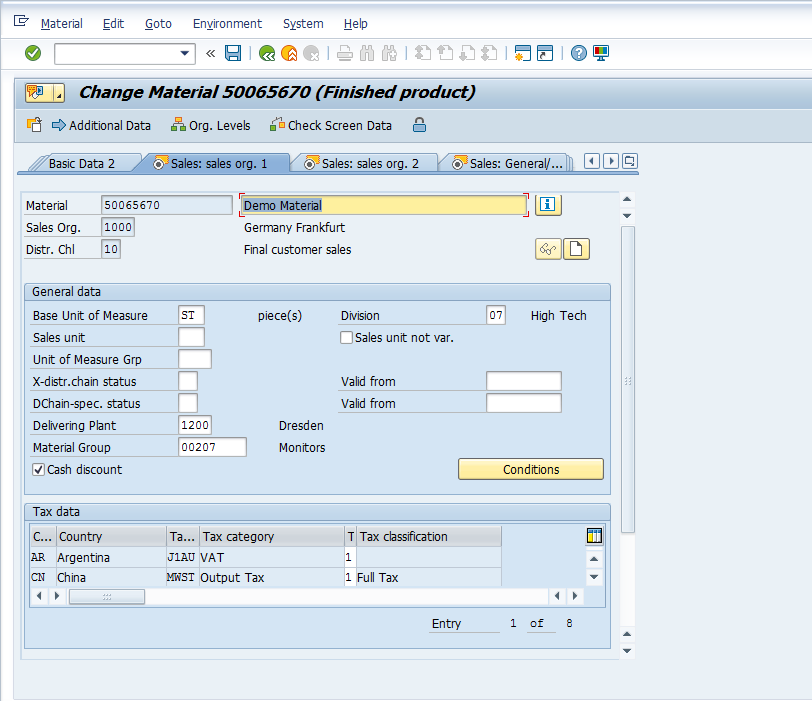

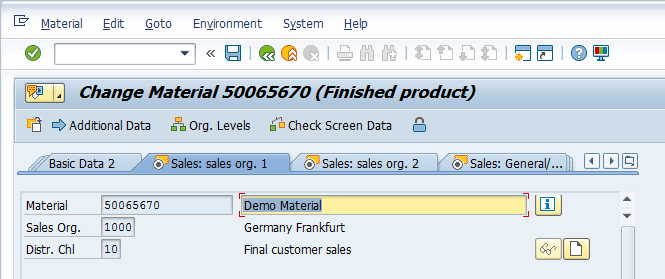

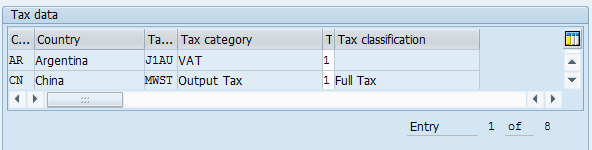

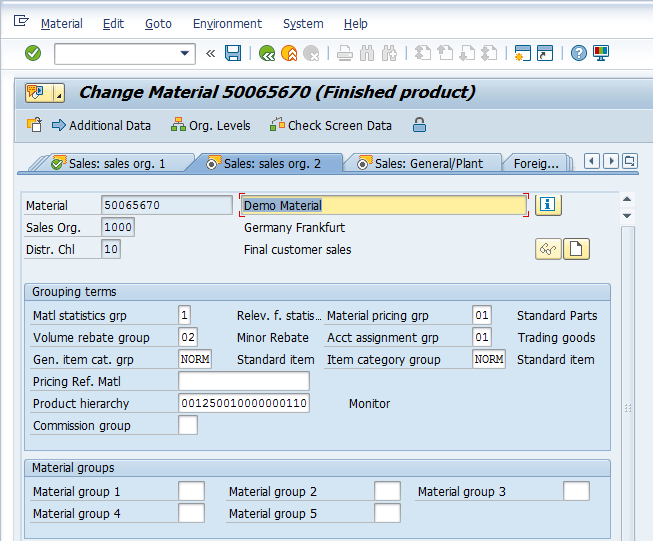

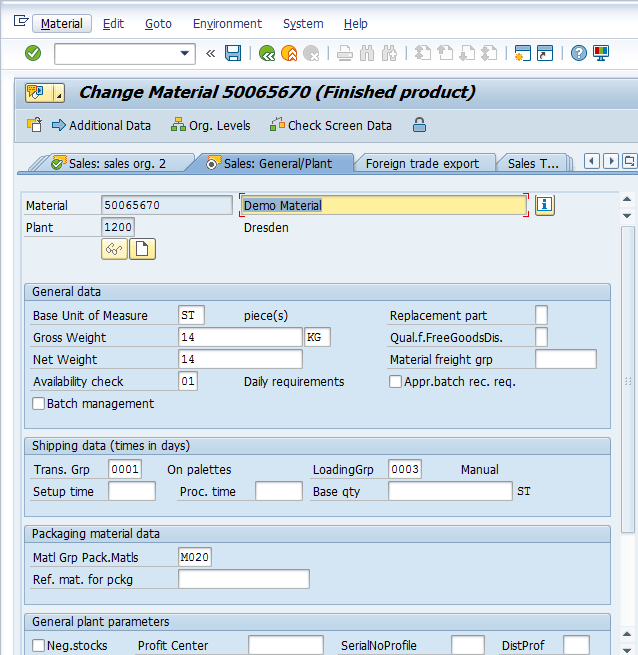

For our used material in sales order- H11, open this material in Tx- MM03 and in the Sales: sales org.2 tab, the material account assignment group is assigned to the material.

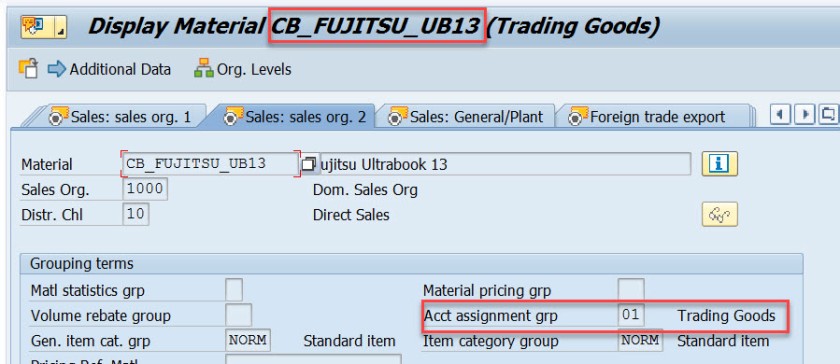

Similarly for another material used in sales order, it is assigned to the material account assignment group.

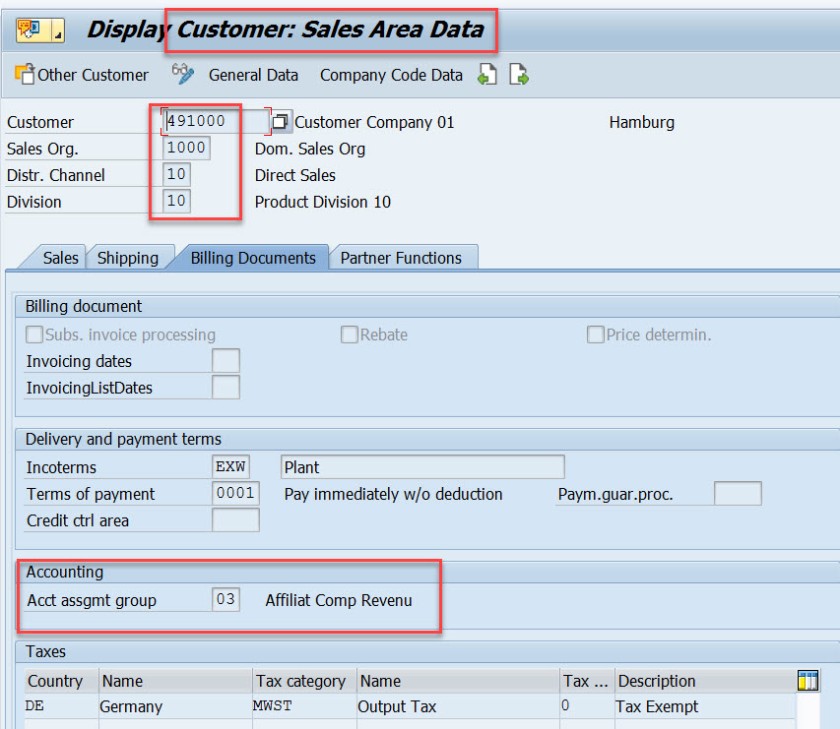

For our customer – 491000, open this customer in Tx- XD03 and go to the sales area data & in the billing document tab, customer account assignment group is assigned to the customer.

This customer and material account assignment group will help to determine the GL account.

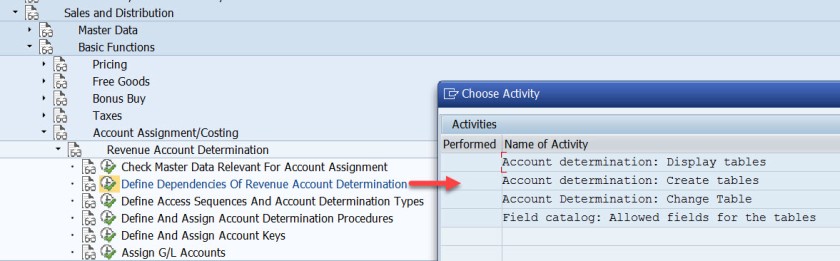

GL account determination uses the condition technique. Now the next step is to define the condition tables. So choose option- Define Dependencies of Revenue Account Determination. If you want to create new tables you can choose Create Table option. For this demo we are leaving this as already we have few condition tables.

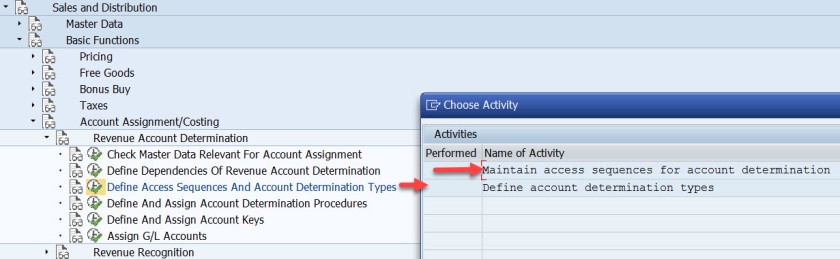

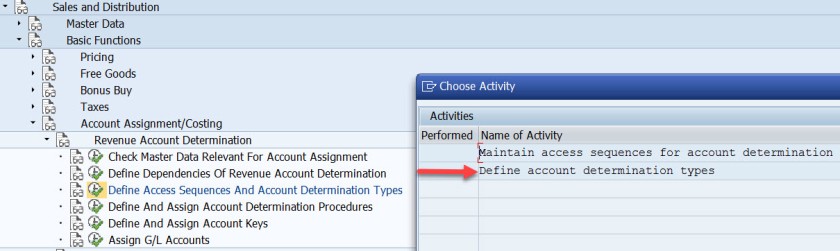

Next is defining the access sequence and the condition type. So choose the highlighted opton.

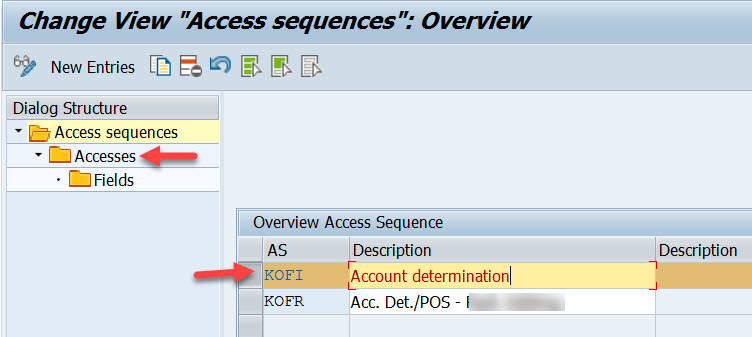

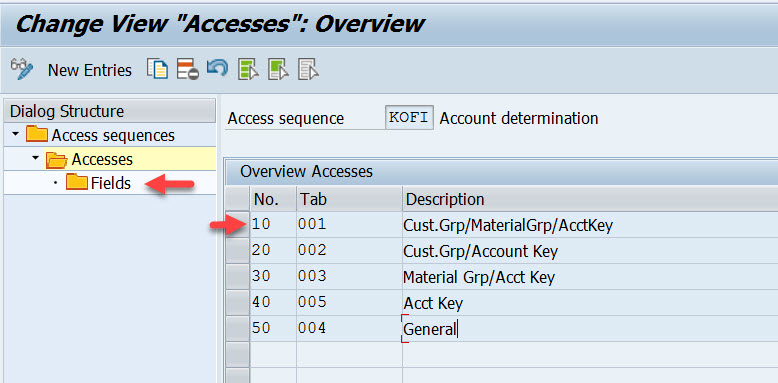

Access Sequence is defined as – KOFI( a new access sequence can be created bu New Entries button ). Select the access sequence and choose Accesses from left hand section to see all the access lines with condition table.

Well this access sequence KOFI has five access line each refers to one condition table.

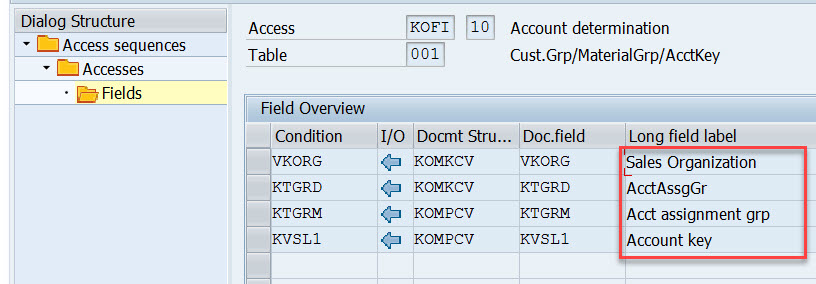

Select one access line and choose Fields button to see all the fields included in the condition table to form the access line 10.

Access line-10 with condition table 001 has 4 fields.

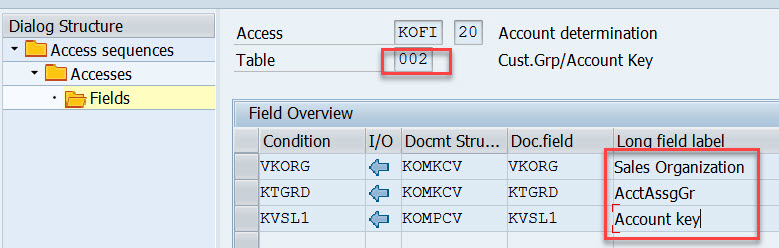

Similarly for other access lines with condition tables other fields are there.

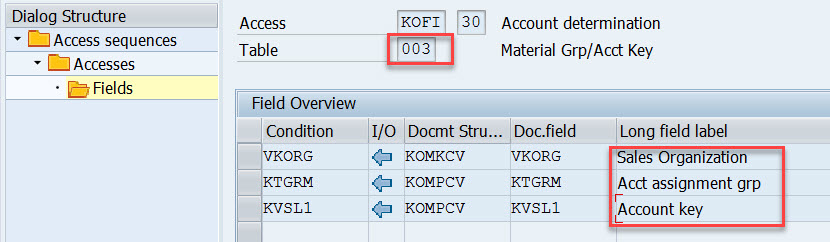

For access line 30.

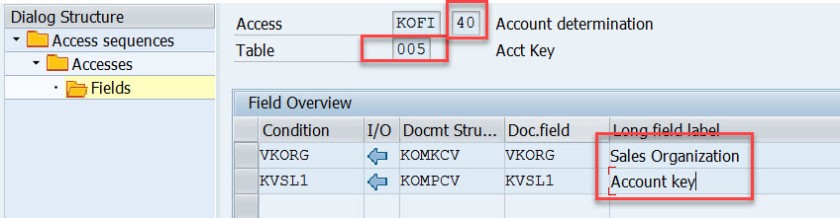

For access line 40.

Choose Define Account Determination type.

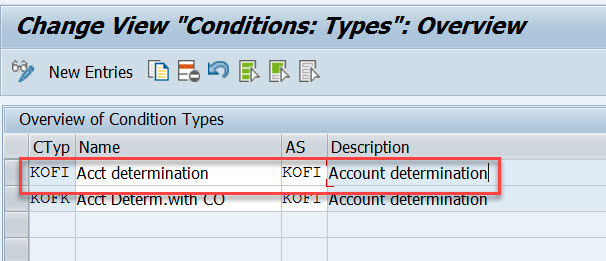

Here Condition type- KOFI is created which is assigned to the access sequence KOFI which has 5 access lines with different condition tables.

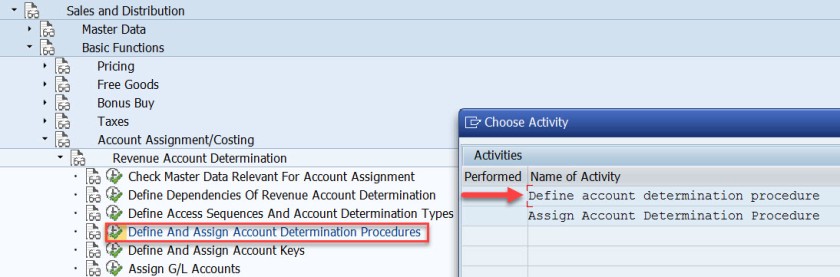

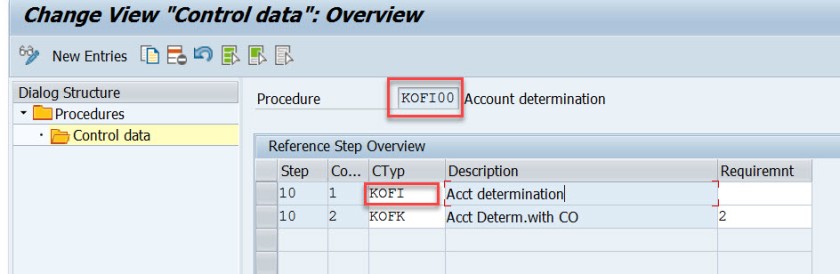

Choose the option as pointed to create account determination procedure.

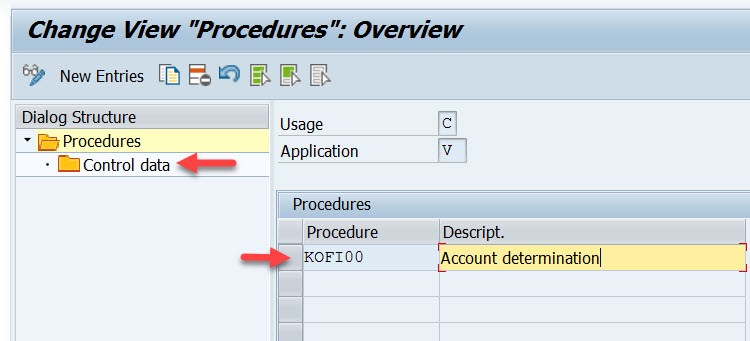

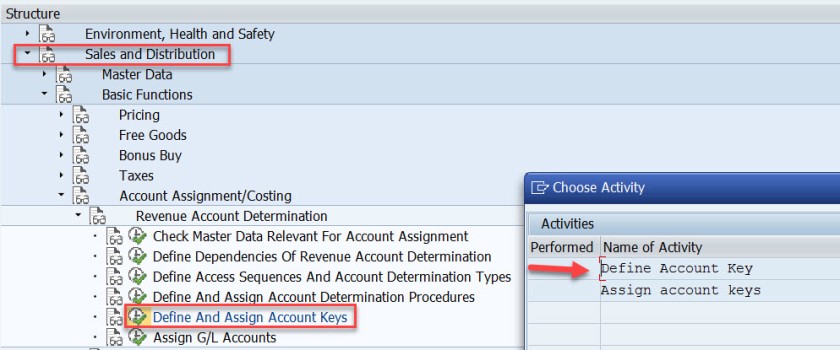

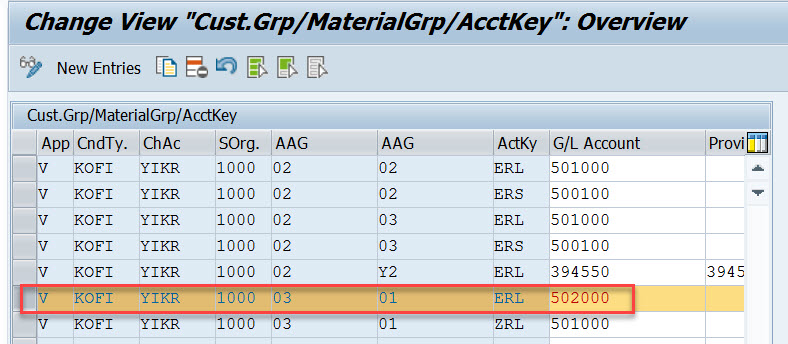

Procedure KOFI00 is created and assigned to the account condition types. Choose the procedure and select Control data from left side.

Here the account determination procedure is assigned to the condition type.

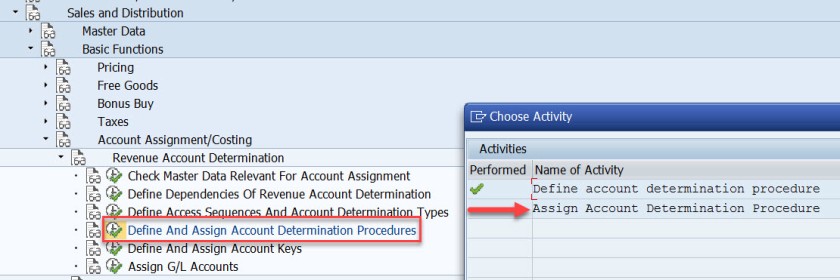

Choose the option – Assign account determination procedure.

Here the account determination procedure is assigned to the billing type.

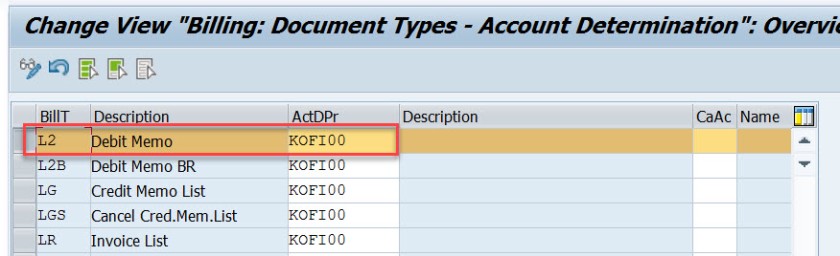

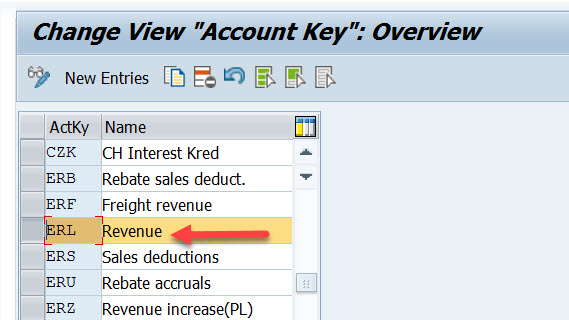

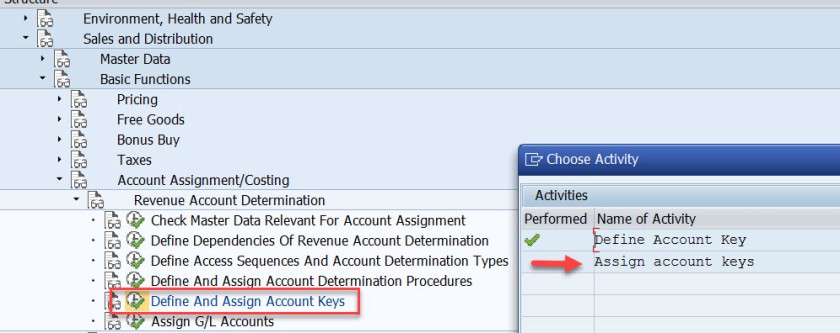

Next step is to define account key. Choose the marked option.

For different types like revenue, tax and other different account keys are defined. For revenue its ERL.

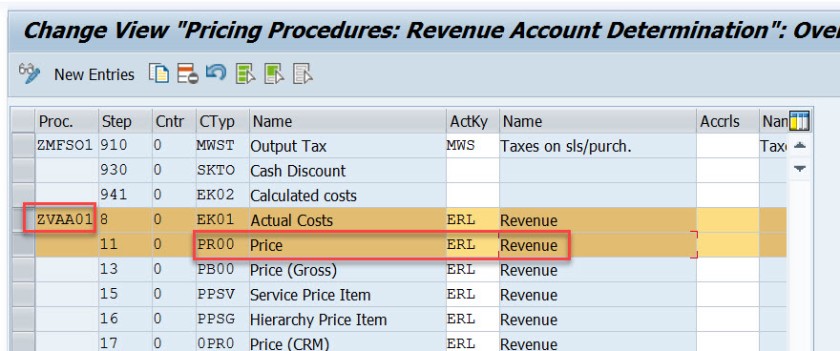

Next step is to assign the account key to the pricing procedure – condition type PR00.

Here for the pricing procedure ZVAA01 and condition type PR00, the account key is assigned as ERL.

In the above created sales order, item we can check the pricing procedure as below bu selecting the Analysis button in the conditions tab of the item detailed screen.

Next time is to assign the G/L account. Choose the marked option.

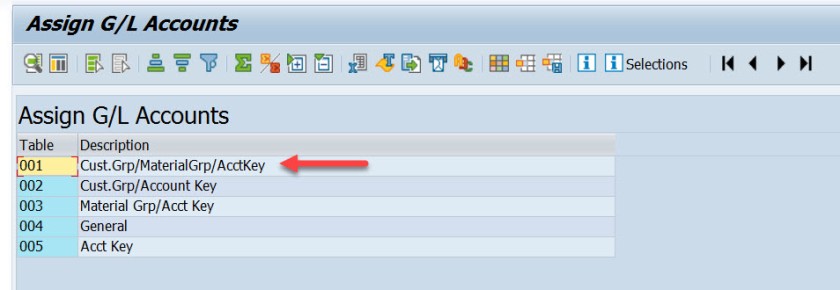

Here we have five options. as account condition type KOFI of the account determination procedure KOFI00 is assigned to the access sequence – KOFI with five access lines.

This is like maintaining the condition records. During the GL account determination process, it checks to find the GL account by taking all the values from the billing document and checking against the condition records for table 001. If found it calculated the G/L account and if not found then checks for the condition records for the second table and so on upto 005 until it finds a G/L account.

Choose/double click on the first line.

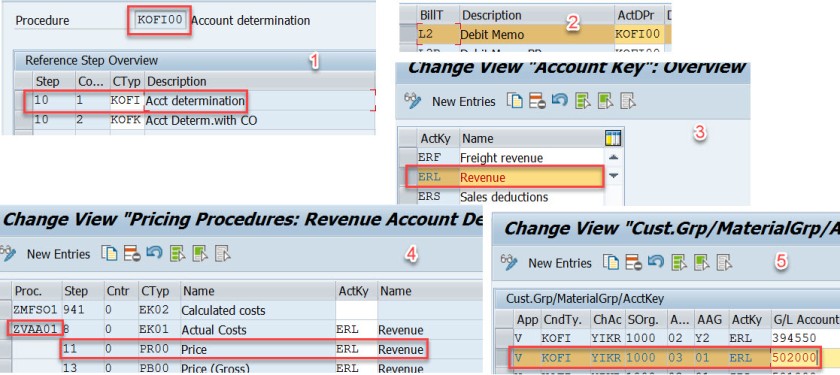

Here we have maintained for V-Sales, KOFI- account condition type, YIKR as the chart of account and other four fields like sales org, customer account group, material account group and account key comes from the condition table, for our demo purpose we have assigned the G/L account as- 502000.

( Before assigning to the G/L account here it should be created first).

For our demo

- From Billing Type L2 it derives the account determination procedure as- KOFI00

- From account determination procedure- KOFI00 it find the account condition type as – KOFI

- During creation of billing its finds for the item, pricing procedure and the condition type as PR00

- Then it finds the account key for the pricing procedure with condition type PR00 as ERL

- The customer account assignment group is – 03

- The material account assignment group is – 01

- The chart of account as- YIKR fot the company code- 1000

- By taking all these values, the G/l account number calculated as – 502000

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

12 comments

Very well explained

Can you please explain me how to assign different GL account while creating accounting document? What changes do I have to make?

is there any way to do a mass analysis on how account assignment has been done over a period of time? ie which tables were used with with criteria? We want tot clean up the SD account assigment tables which currently have over 100.000 entries and are not manageble anymore.

It’s truly a nice and useful piece of info. I’m happy that you shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

Hi. I have an inquiry regarding the classification of ERL account group. In my current company, there are two GL accounts which are currently tagged to ERL (Revenue) – one is cash and another is VAT adjustment (based on their description). My question is, are those two accounts valid to be determined under ERL? If so, what is the impact if this matter is unresolved? Hope someone can take up and provide me a good input. Many thanks in advance.

this is how the fucking a document must be. excellent!

Thank you so much, detail explanation. Appreciate the hard work

Could you add little detail on ” how does the pricing procedure ZVAA01 and condition type PR00 linked/determined for an item”

Pricing procedure is not determined on the item level. Pricing Procedure is determined on the header level. In tx- OVKK , the determination of pricing procedure customizing are maintained. The sales area, document pricing procedure and the customer pricing procedure determines the pricing procedure. When an order is created we know the sales area(sales org, dist channel and division), the document pricing procedure derived from the document type and from the sold-to-party (customer) the customer pricing procedure is derived. With all these information, Pricing procedure is derived.

The pricing procedure contains condition types like PR00 and others. In Tx- VK11/VK12/Vk13 we can maintain pricing condition records against each condition types. When we enter a material in an item, from the already determined pricing procedure it gets the condition types and tries to find the pricing condition record for the material. This is how the price is found for that item condition type.

Hope this helps!

Like Liked by 1 person

Thanks to you Siva and Manish, I am not in to SD but was trying to have extended understanding between FI-SD integration and found your tutorial, its really help full. I was going through with the tutorial and played your videos as well in you tube. It helps me to understand the process and bridge the gaps from SD side. Really appreciate your effort on preparing and sharing the knowledge

Thanks for the details .suggest reading the note on account-determination helpful things are described there

execellent..well done..thank you

Leave a Reply Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- What is SAP SD?

- SAP SD Training Tutorials for Beginners

- SAP SD T-codes

- SAP SD User Exit for Billing Document

- SAP SD User Exits for Sales Order

- SAP Customer Down Payment Configuration

- SAP PGI (Post Goods Issue)

- SAP IS-Retail Module

- SAP Incoterms

- SAP SD Variant Configuration Steps

- SAP SD Configuration Step by Step Guide

- SAP SD Credit Management Interview Questions

- Account Assignment Group In SAP

- Subcontracting Process In SAP SD

- Rebate Processing In SAP SD

- Difference Between Rebate And Discount

- Movement Type In SAP

- SAP SD Availability Check Configuration

- Debit And Credit Note in SAP

- Sales Documents List

- Intercompany vs Intracompany

- SAP SD Pricing Routines & User Exit

- Shipping Condition In Sales Order

- SAP SD Invoice Table

- SAP SD Certification & Course Fees

- SAP SD Interview Questions

Define Account Assignment Group

Updated May 18, 2018

Field found in Material Master Sales Organization 2. To define the General Ledger Posting:- IMG -> Sales and Distribution -> Account Assignment/Costing -> Revenue Account Determination -> Assign G/L Accounts With this link, the material that used this account assignment group will be posted with the desired G/L accounts during Billing. User will not be able to Release the billing document to Accounting if this is not setup. If you happened to assign it via Cust.Grp/MaterialGrp/AcctKey, then you can let your user use this report to check the material assignment. * Transaction code VKOA REPORT ZMATNR_AC_ASSIGN LINE-SIZE 132 NO STANDARD PAGE HEADING LINE-COUNT 044(001).

- 05 Apr 2010 6:12 am Manzoor Ahmad Its very good and helpful for SD Trainee.

- 08 Oct 2010 8:24 am Guest very nice.....

- Terms of Use

- Privacy Policy

- SAP ERP Solutions

- What does SAP stands for

ETCircle.com SAP FI and CO consultant information

Customers: account assignment groups | ovk8.

In this configuration activity we are able to define account assignment groups for customers used in Sales and Distribution Module ( SD ).

Transaction: OVK8

IMG Path: Sales and Distribution -> Basic Functions -> Account Assignment/Costing -> Revenue Account Determination -> Check Master Data Relevant For Account Assignment

Tables: TVKT, TVKTT

If you use the IMG Menu, you will have to choose the second option on the pre-selection screen.

On the main screen there is a list of Account Assignment Groups for Customers. You can create new here if you need.

Tags Account Assignment OVK8 TVKT TVKTT

About Emiliyan Tanev

Related articles, assign g/l accounts | vkoa, materials: account assignment groups | ovk5, define automatic credit control | ova8, configure automatic postings | omwb.

In this FICO configuration activity we are able to define account determination for automatic postings …

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of followup comments via e-mail. You can also subscribe without commenting.

Blog about all things SAP

ERProof » SAP SD » SAP SD Training » SAP SD Material Master

SAP SD Material Master

The importance of Master Data can be understood by this example that many companies have experienced and dedicated Master Data Management resources in their Master Data Management team meaning, there are set of employees who are dedicated and solely look after Master Data they are usually called the Master Data Management (MDM) team. They carefully consider the Master Data, responsible for entering accurate data in prescribed fields. They also closely observe, look vigilantly and check thoroughly if there’s any repetition, duplication and redundancy of the Master Data.

Material master in SAP is used by different modules. Here you can find tutorials about using SAP material master in other modules:

- SAP PP Material Master

- SAP MM Material Master

Introduction to SAP SD Material Master

SAP SD Material Master is a centrally shared data used by all logistics modules. Information captured in the Material Master record can be descriptive or can have functional control depending on the usage. This information can be maintained across several organization levels or can be maintained for specific organization level (e.g., plant, storage location, sales organization, etc.)

SAP SD Material Master Data in SAP has several material types. Each material type has its own set of ‘Views’. By ‘Views’ in SAP Material Master data we mean areas (tabs) and their fields which are required to be filled up or populated for smooth processing of transaction and processes.

Material Master in SAP is used by following modules:

- Material Master

- Production Planning

- Quality Management

- Plant Maintenance

- Controlling

- Warehouse Management

Each view has its own functionality and their fields have their own meaning. If any of the view is not maintained, the respective module cannot perform their activity. E.g., to make a material salable, Sales and Distribution Views must be maintained. Similarly, to carry out quality check on the received material, Quality Management View in SAP material must be maintained with accurate settings.

Material Types

The Material Type groups materials with similar characteristics and attributes. It also determines whether the material will be valued at a standard price or at a moving average price. It also maintains which screens are to be maintained depending upon the screen sequence assigned. Once a material has been maintained in the SAP system and if any change is needed, the Material Master record can either be:

- Extended : SAP SD Material Master extension is done when organizational level data or departmental data has not been maintained. The extension process allows the user to define these levels (e.g., the purchasing data view has not been maintained or the material has not been extended for a certain storage location)

- Changed : If the data maintained needs to be altered, the record can be changed using the material master change transaction

SAP Material Master Data for Sales & Distribution

Sales processing is based on the following basic structures:

- In Sales and Distribution, products are sold to Customers and / or services are performed for them. Related Master Data about the products and services are maintained in the SAP SD Material Master Data. Sales processing with the SAP System require that the master data has been stored in the system.

- The processing of business transactions in Sales and Distribution is based on the Master Data. In the SAP System, business transactions are stored in the form of documents. These Sales and Distribution documents are structured in such a way that all necessary information in the document is stored in a systematic way.

A Material Master record is either created or extended when:

- No Material Master Data record exists for the material in the first place.

- Material master record exists for the material but has not been created for a certain organizational level, e.g. Plant, Sales Organization or Storage Location.

When an end user in the Sales department needs to sell a material, this user will search for the Material in the SAP. If the material is not available, the user will raise a request with the concerned department or a person responsible for Master Data creation/maintenance, so that the material master record is created in the system. The department/ person responsible for creating SAP Material Master will create Master Data by selecting correct material type and entering all the relevant information.

Master data relevant to materials is more specifically pertaining to the Materials Management (MM) module’s domain. However, each salable material is extended to a combination of Sales Organization and Distribution Channel (sales line), for carrying out sales.

Unless a material is not extended to at least one sales line, the system will not allow the user to record sales in the SAP. Material Master can be extended to multiple combinations of Sales Organizations and Distribution Channels (sales lines) by maintaining sales related views.

The following ‘Sales Views’ are relevant for all salable materials:

- Basic sales relevant data, tax classifications, delivering plant, units of measure (e.g., base & sales unit of measure)

- Account Assignment Group of Material, Material groupings (e.g., product hierarchy, material group)

- Sales and Shipping data (e.g., gross and net weight, availability check strategy, transportation group, loading group), profit centre can also be entered here

Important SAP SD Material Master Transactions

Following are the key transaction related to SAP SD Material Master:

- MM01 – Create Material Master

- MM02 – Change Material Master

- MM03 – Display Material Master

- MM06 – Flag for Deletion

- MM60 – Material Master List

How to Create SAP SD Material Master

There are two options to start the transaction for creating a new material.

- Enter MM01 in Transaction Command Field or executing Material Master – Creation Transaction / Screen

- Navigate through ‘Tree’

SAP SD Material Master Data – Sales & Distribution ‘Views’

As a responsible for SAP SD module, chances are likely that Material Master’s basic information will be maintained by a person from SAP MM team and the material number will be generated. You will be responsible for maintaining SAP Sales & Distribution relevant data in the Master Master’s Sales Views.

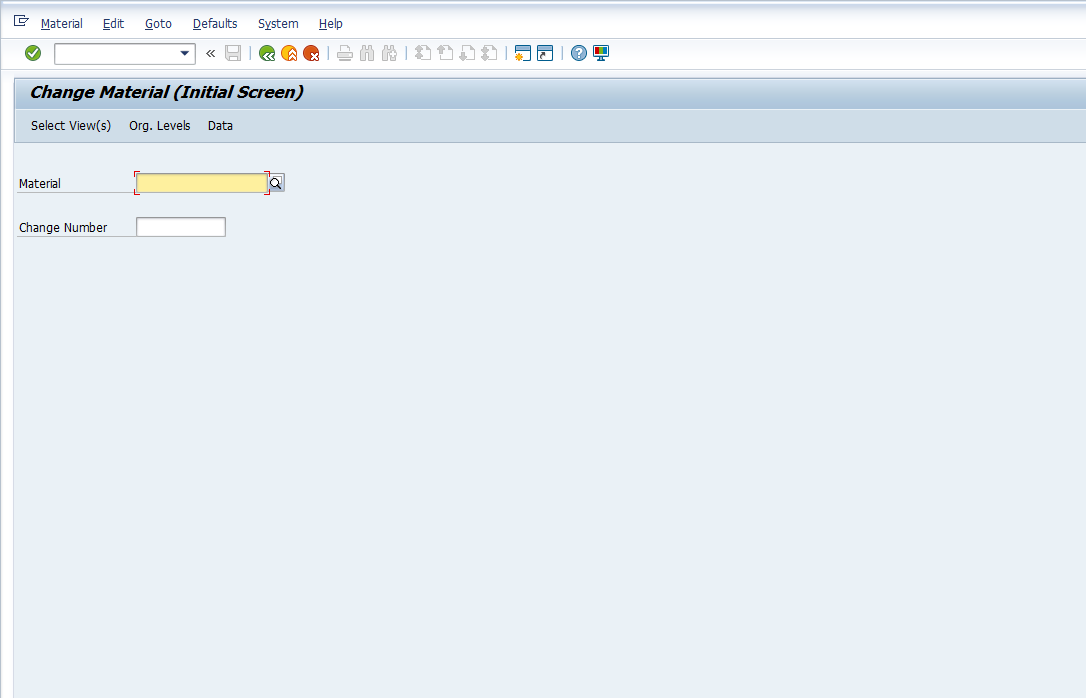

Let’s look at SAP’s Material Master Data Views related to Sales & Distribution Module. In the main screen of Material Master transaction (MM01), enter the material you wish to maintain SD’s views and press Enter.

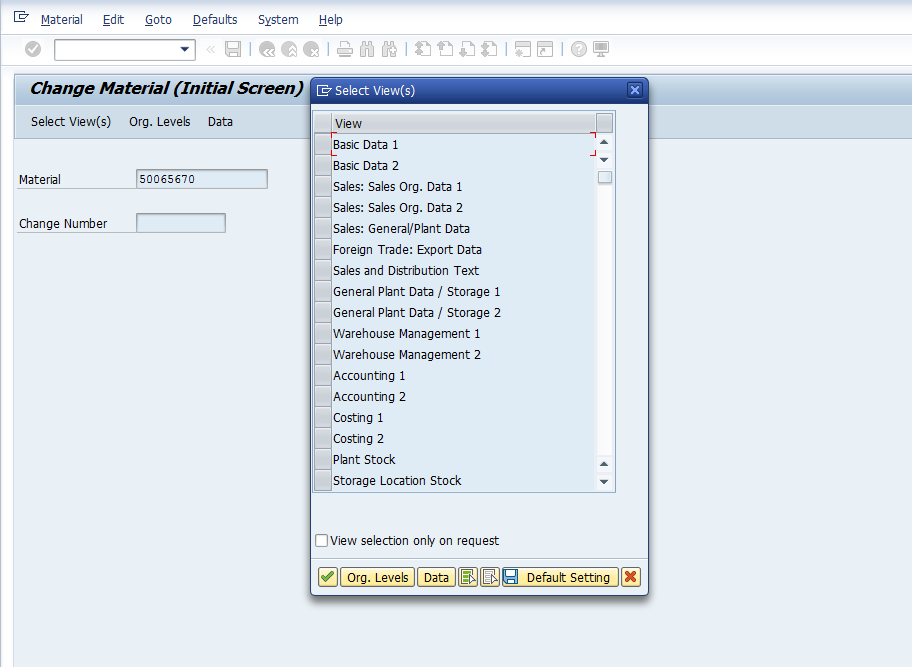

Once you press Enter a dialog box will appear to select the views you wish to maintain, change or display.

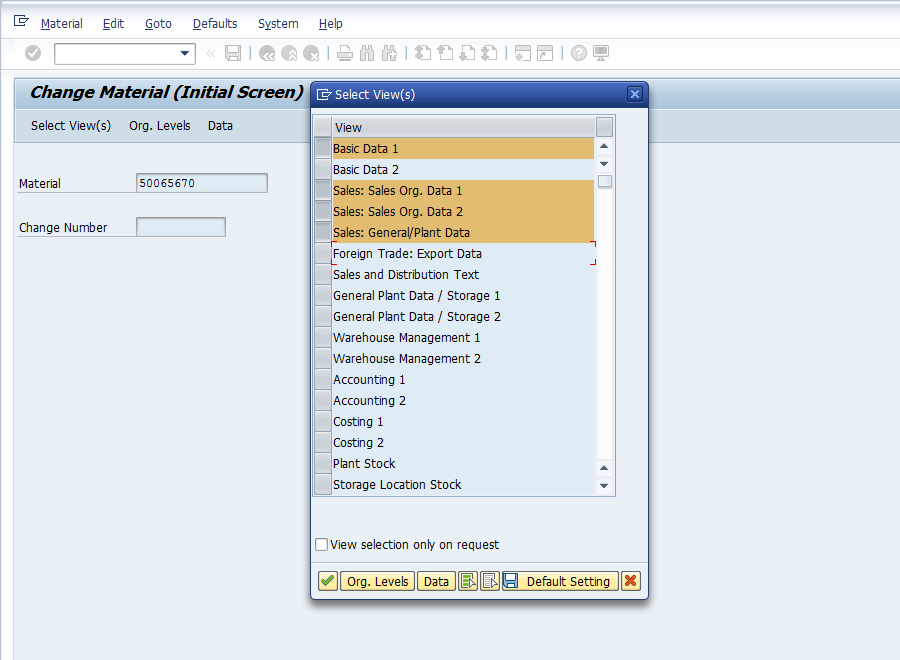

In this case, we will select Basic Data 1 and SD’s Views and press Enter .

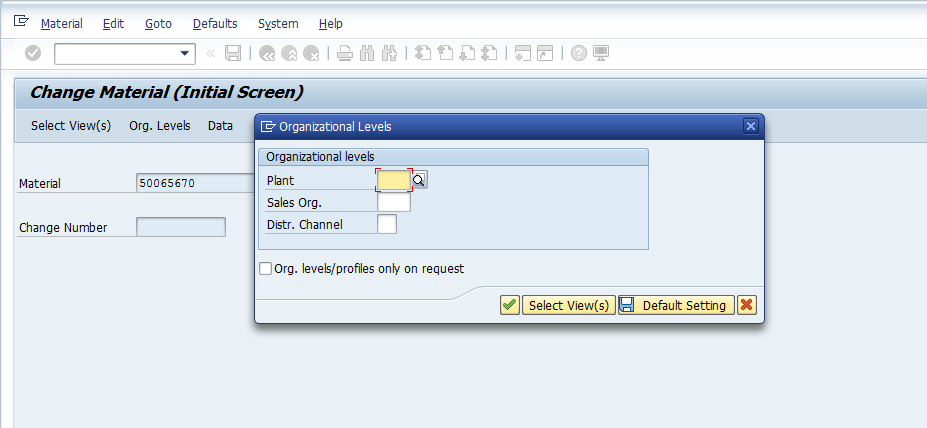

Once you press Enter, another dialog box will appear. Enter relevant Plant, Sales Organization and Distribution Channel for which you wish to maintain, change and display SD’s Material Master values and press Enter.

Once you press Enter , you will reach the view which you have selected.

In the Basic Data tab, as the name suggests, it contains information basic information about the product. Product’s description, Base Unit of Measure / stock keeping unit, Material Group to which it belongs, old material number, Division, Weight, Volume, Dimensions, etc. When you press Enter , after maintaining, changing or viewing the data in the tab, the system will take you to the next tab which you have selected in the previous screen.

On the screenshot above is the Sales: sales org. 1 screen. The header part contains the information which you have selected initially.

Below is the General data part:

It contains basic information like the Base Unit of Measure which have been selected by the warehouse as the lowest stock keeping unit.

Sales Unit which can be same or different to Base unit of measure. Example: warehouse stocks a material in Pieces whereas the Sales is carried out in boxes or cartons. For this, an alternate unit of measure shall be maintained which we will have a look at the later part of this tutorial.

Unit of Measure Group is the option that you can use for grouping several units of measure.

Division – the product line or group of materials to which this material belongs.

Delivering Plant – the plant from where the said material is shipped to a customer.

Material Group – option to group materials and services due to their distinct nature.

Conditions – takes you to the pricing master where you can maintain the base price of the selected material.

Tax Data contains the taxation details for the material country wise. A material can either be non-taxed material, half tax, full tax or exempted.

Quantity stipulations contain information regarding the minimum order and delivery quantity that the customer should order so that goods can be shipped.

Delivery Unit – specific multiples in which goods can be shipping.

After you are done with Sales: sales org. 1 view, press Enter and the system will take you to the second view Sales: sales org. 2 provided that you have selected the said view on the initial views selection dialog box.

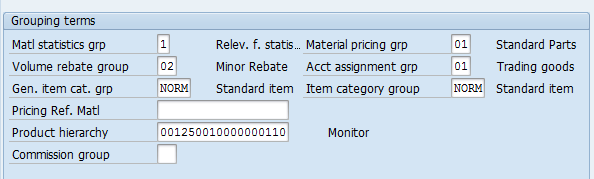

Grouping terms allows to group the material on certain criteria

Material statistics grp – is required for SIS (LIS) reporting.

Material pricing grp – is used for pricing condition purposes. Example, if you want to have a certain set of materials with the same base price or discounts, etc.

Volume rebate group – group used for rebate settlement.

Account assignment grp – used for account determination and selection relevant G/L at the time of posting Sales invoice.

Gen. item cat. grp – grouping materials to define item categories and selection of relevant item categories during sales order processing.

Item category group – used for selection of relevant item category in the Sales Order automatically.

Pricing Ref. Matl – master record that the system uses as a reference for pricing purposes.

Product Hierarchy – for grouping together materials by combining different characteristics. It is used for analyses and price determination.

Material Groups are used to classify the material based on its different attributes, e.g. size, packaging, color, etc. for analysis purposes.

Once you are done with Sales: sales org. 2 view, press Enter and the system will take you to the third view Sales: General/Plant view provided that you have selected the said view on the initial views selection dialog box.

Base Unit of Measure, Gross and Net Weight – will be copied from the Basic Data screen, if they were populated there.

Availability Check – check group which defines whether and how the system checks the material’s availability and generates requirements for materials planning.

Batch Management – if the material is managed, stored and shipped in batches.

Material freight grp – is used to group materials so that they can be classified according the shipping and freight requirements.

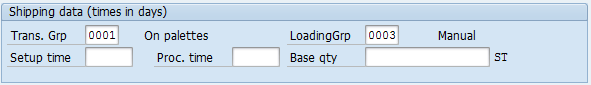

Shipping data contains information which is relevant for shipping and should be maintained in the material master for smooth shipping activities at the Distribution Center.

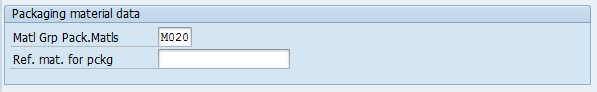

Packaging Material Data contains information if this material requires packaging and what type of packaging at the time of shipment / dispatch.

General Plant Parameters contain information if the negative of the material is all allowed. Profit Center to which this material belongs to. It is important for Profit Center Accounting in Controlling.

Additional Data – Alternate Units of Measure

As discussed briefly above, if your stock keeping unit at warehouse is different than your sales unit, the conversion of the same can be maintained in the Alternate Units of Measure. It contains, for example, ‘X’ number of Base Unit of Measure contains ‘Y’ number of Sales Unit.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP SD tutorials.

Navigation Links

Go to next lesson: SAP Customer-Material Info Record

Go to previous lesson: SAP Customer Master Data

Go to overview of the course: Free SAP SD Training

2 thoughts on “SAP SD Material Master”

Love the clarity of this.. I had gone through so many training’s but nothing do very well structured , Simple and clear.

could provide relevant interview questions

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

/support/notes/service/sap_logo.png)

2769314 - Account Assignment Group VBAP-KTGRM is editable in the sales order item

- Account assignment group field in sales order item is editable, the value can be changed

- In old versions, Account assignment group field in sales order item was disabled, could not be edited

Environment

- Sales And Distribution (SD)

- SAP ERP Central Component

- SAP Enhancement package for SAP ERP

- SAP Enhancement package for SAP ERP, version for SAP HANA

Account Assignment Group, Kontierungsgruppe, KTGRM, screen 4453, D200569, SCREEN-ACTIVE , KBA , SD-SLS-SO , Sales Orders , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

IMAGES

VIDEO

COMMENTS

Here Cusomter account assignment group is created which is assigned to the customer master when created in Tx- XD01. For our used material in sales order- H11, open this material in Tx- MM03 and in the Sales: sales org.2 tab, the material account assignment group is assigned to the material. Similarly for another material used in sales order ...

Here are the codes for defining Account Assignment Group in SAP SD, User will not be able to Release the billing document to Accounting if this is not setup. ... TOP-OF-PAGE. FORMAT COLOR COL_TOTAL. WRITE: / SY-DATUM, SY-UZEIT, SY-REPID, 050 'Material Sales Account Assignment', 120 SY-UNAME, SY-PAGNO. SKIP. WRITE: /001 'Material', 020 'Cust Grp ...

In this configuration activity we are able to define account assignment groups for customers used in Sales and Distribution Module (SD).Transaction: OVK8 IMG Path: Sales and Distribution -> Basic Functions -> Account Assignment/Costing -> Revenue Account Determination -> Check Master Data Relevant For Account Assignment Tables: TVKT, TVKTT If you use the IMG Menu, you will have to choose the ...

In SAP S4HANA / ECC we can assign different GL accounts in SD to different Customers and Materials using the Account Assignment Groups, this video explains t...

Material Master Record; Pricing Procedure and Account Key; Configuration. Below is picture indicating the path in the implementation guide of SD Account Determination: Additionally some transactions to be used: OVK5 : Account Assignment Groups (for material), its table is TVKM; OVK8: Account Assignment Groups (for customer), its table is TVKT

Instead a Material Group is assigned to a Valuation Class using SSCUI 102424. Keywords New material groups, Define Material Groups, G/L account, S/4hana cloud, LO-MD-MM , KBA , LO-MD-MM , Material Master , How To

Account assignment group of the customer (from the customer master record, Billing screen, Account group field) Account assignment group of the material (from the material master record, Sales 2 screen, Account assignment group field) Account key (from the pricing procedure) The system carries out account assignment using the condition technique.

Learn how to create and maintain SAP SD material master data for sales and distribution. Find out how to use MM01 transaction, material types, sales views and other relevant fields.

SAP ERP 6.0 ; SAP ERP Central Component 6.0 ; SAP S/4HANA all versions Keywords Account Assignment Group, Kontierungsgruppe, KTGRM, screen 4453, D200569, SCREEN-ACTIVE , KBA , SD-SLS-SO , Sales Orders , Problem

Account assignment group of the material (in the material master record, see Sales: sales or. 2 screen, Account Assignment Group field) Account key (from the pricing procedure) A configurable range of additional billing document header and item fields such as company code, item category, tax code, and so on. The system carries out account ...