Real Estate Broker Business Plan PDF Example

- June 17, 2024

- Business Plan

Creating a comprehensive business plan is crucial for launching and running a successful real estate broker. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your real estate broker’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a real estate broker business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the real estate industry, this guide, complete with a business plan example, lays the groundwork for turning your real estate broker business concept into reality. Let’s dive in!

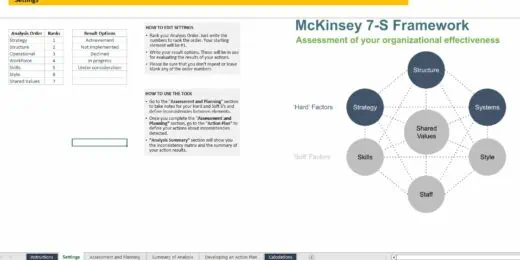

Our real estate broker business plan is structured to cover all essential aspects needed for a comprehensive strategy. It outlines the business’s operations, marketing strategy , market environment, competitors, management team, and financial forecasts.

- Executive Summary : Offers an overview of your real estate broker business’s concept, market analysis , management, and financial strategy.

- Facility & Location: Describes the business’s operational base, amenities, and why its location is appealing to potential clients.

- Services & Rates: Lists the services provided by your real estate broker business, including types of brokerage services offered and pricing structure.

- Key Stats: Shares industry size , growth trends, and relevant statistics for the real estate brokerage market.

- Key Trends: Highlights recent trends affecting the real estate sector.

- Key Competitors : Analyzes main competitors nearby and how your business differs from them.

- SWOT : Strengths, weaknesses, opportunities, and threats analysis.

- Marketing Plan : Strategies for attracting and retaining customers.

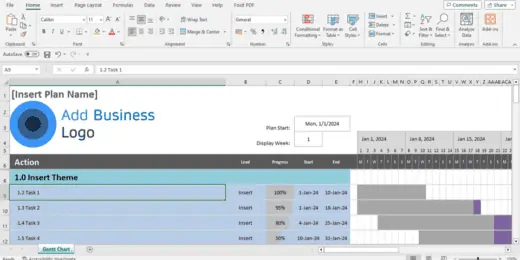

- Timeline : Key milestones and objectives from start-up through the first year of operation.

- Management: Information on who manages the real estate broker business and their roles.

- Financial Plan: Projects the business’s 5-year financial performance, including revenue, profits, and expected expenses.

Real Estate Broker Business Plan

Fully editable 30+ slides Powerpoint presentation business plan template.

Download an expert-built 30+ slides Powerpoint business plan template

Executive Summary

The Executive Summary introduces your real estate brokerage’s business plan, offering a concise overview of your brokerage and its services. It should detail your market positioning, the range of real estate services you offer, its location, size, and an outline of day-to-day operations.

This section should also explore how your real estate brokerage will integrate into the local market, including the number of direct competitors within the area, identifying who they are, along with your brokerage’s unique selling points that differentiate it from these competitors.

Furthermore, you should include information about the management and co-founding team, detailing their roles and contributions to the brokerage’s success. Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be presented here to provide a clear picture of your brokerage’s financial plan.

Make sure to cover here _ Business Overview _ Market Overview _ Management Team _ Financial Plan

Business Overview

For a Real estate broker, the Business Overview section can be concisely divided into 2 main slides:

Facility & Location

Briefly describe the brokerage’s office environment, emphasizing its design, comfort, and the overall atmosphere that welcomes clients. Mention the office location, highlighting its accessibility and the convenience it offers to clients, such as proximity to major business districts, shopping centers, or ease of parking. Explain why this location is advantageous in attracting your target clientele.

Services & Rates

Detail the range of real estate services offered, from residential and commercial property sales to property management , leasing, and real estate consulting. Outline your pricing strategy , ensuring it reflects the quality of services provided and matches the market you’re targeting. Highlight any packages, commission structures, or special deals that provide added value to your clients, encouraging repeat business and customer loyalty.

Make sure to cover here _ Facility & Location _ Services & Rates

Market Overview

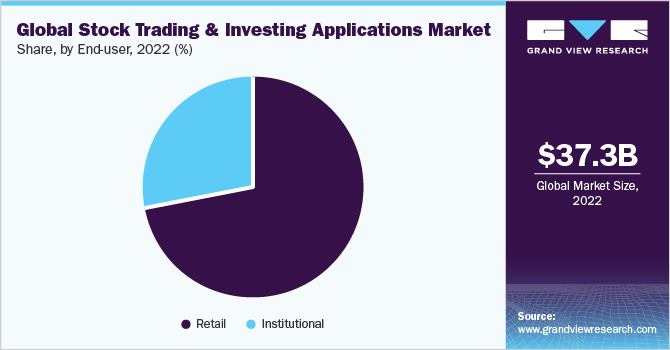

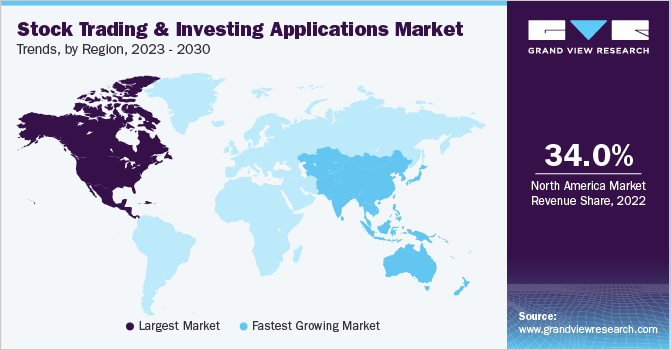

Industry size & growth.

In the Market Overview of your real estate brokerage business plan, start by examining the size of the real estate industry and its growth potential. This analysis is crucial for understanding the market’s scope and identifying expansion opportunities.

Key Market Trends

Proceed to discuss recent market trends , such as the increasing consumer interest in smart home technology, sustainable and energy-efficient properties, and virtual property tours. For example, highlight the demand for services that cater to first-time homebuyers, luxury property seekers, and commercial real estate investors. Emphasize the growing importance of online listings and digital marketing strategies in attracting and engaging potential clients.

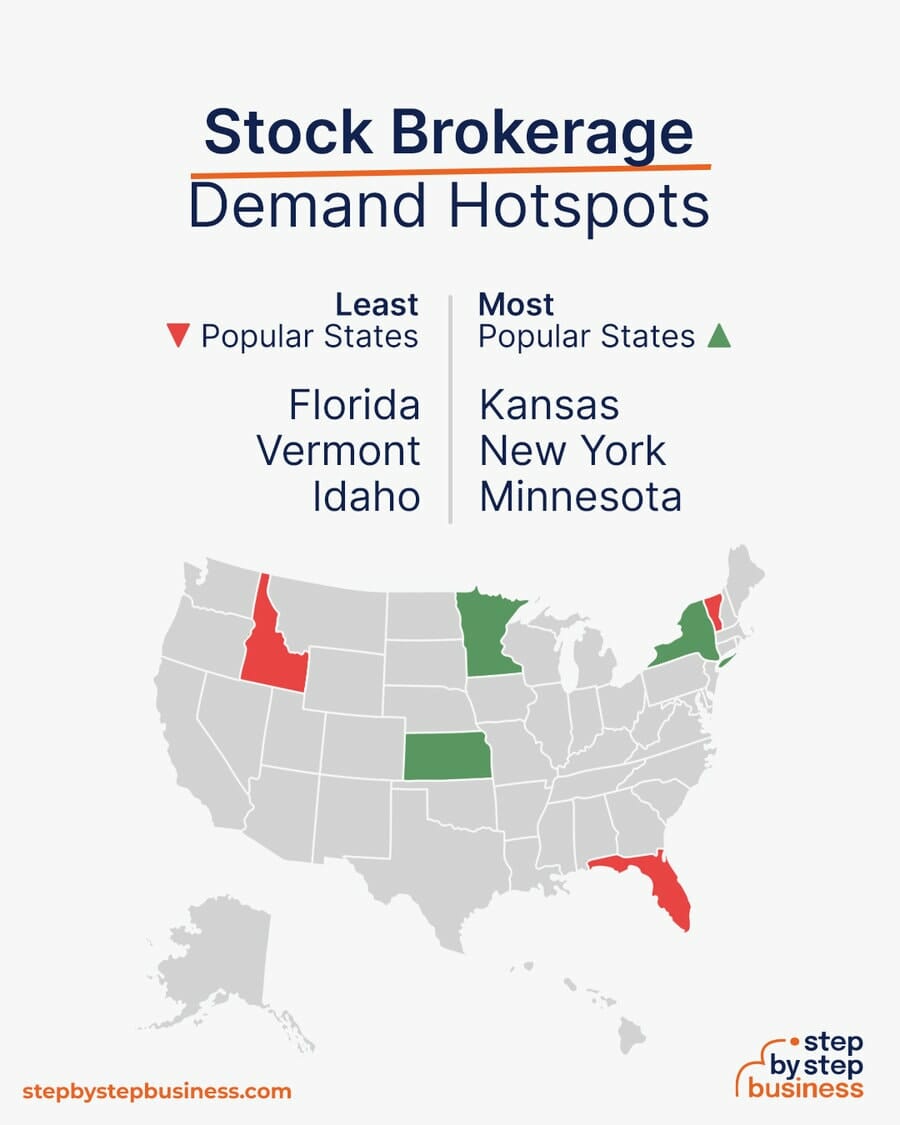

Key Competitors

Then, consider the competitive landscape, which includes a range of real estate firms from large national chains to local independent brokers, as well as online real estate platforms. For example, emphasize what makes your brokerage distinctive, whether it’s through exceptional customer service, a comprehensive range of services, or specialization in certain property types or market segments. This section will help articulate the demand for real estate services, the competitive environment, and how your brokerage is positioned to thrive within this dynamic market.

Make sure to cover here _ Industry size & growth _ Key competitors _ Key market trends

Dive deeper into Key competitors

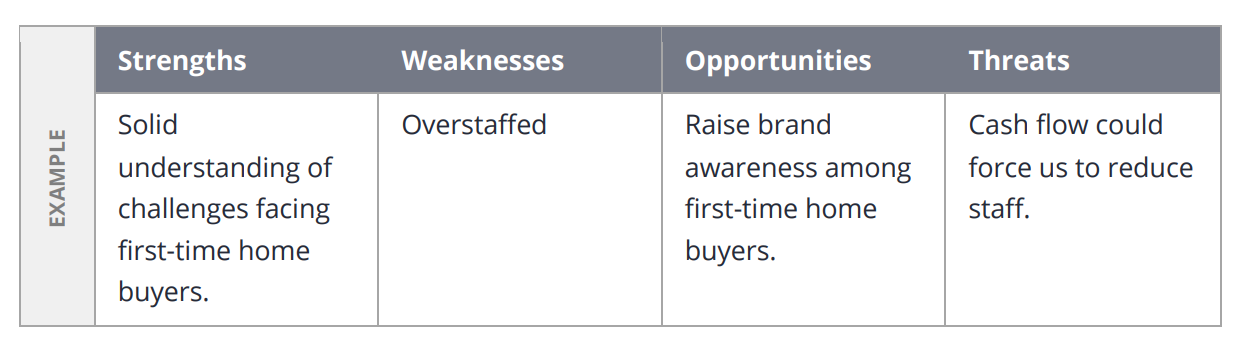

First, conduct a SWOT analysis for the real estate broker , highlighting Strengths (such as experienced agents and a comprehensive range of services), Weaknesses (including high operational costs or strong competition), Opportunities (for example, an increasing demand for sustainable properties), and Threats (such as economic downturns that may decrease consumer spending on real estate).

Marketing Plan

Next, develop a marketing strategy that outlines how to attract and retain clients through targeted advertising, promotional discounts, engaging social media presence, and community involvement.

Finally, create a detailed timeline that outlines critical milestones for the real estate brokerage’s launch, marketing efforts, client base growth, and expansion objectives, ensuring the business moves forward with clear direction and purpose.

Make sure to cover here _ SWOT _ Marketing Plan _ Timeline

Dive deeper into SWOT

Dive deeper into Marketing Plan

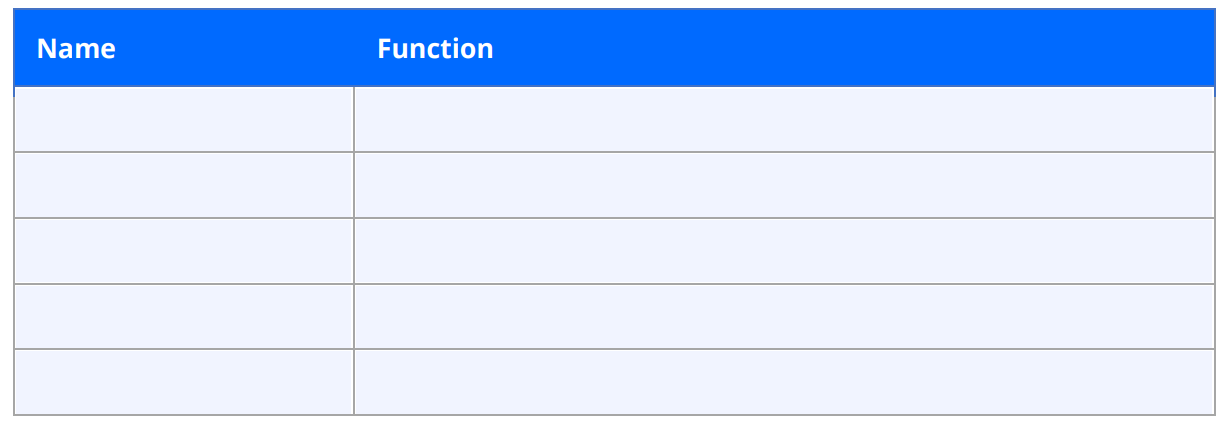

The Management section focuses on the optician business’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the real estate broker toward its financial and operational goals.

For your real estate broker business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

Financial Plan

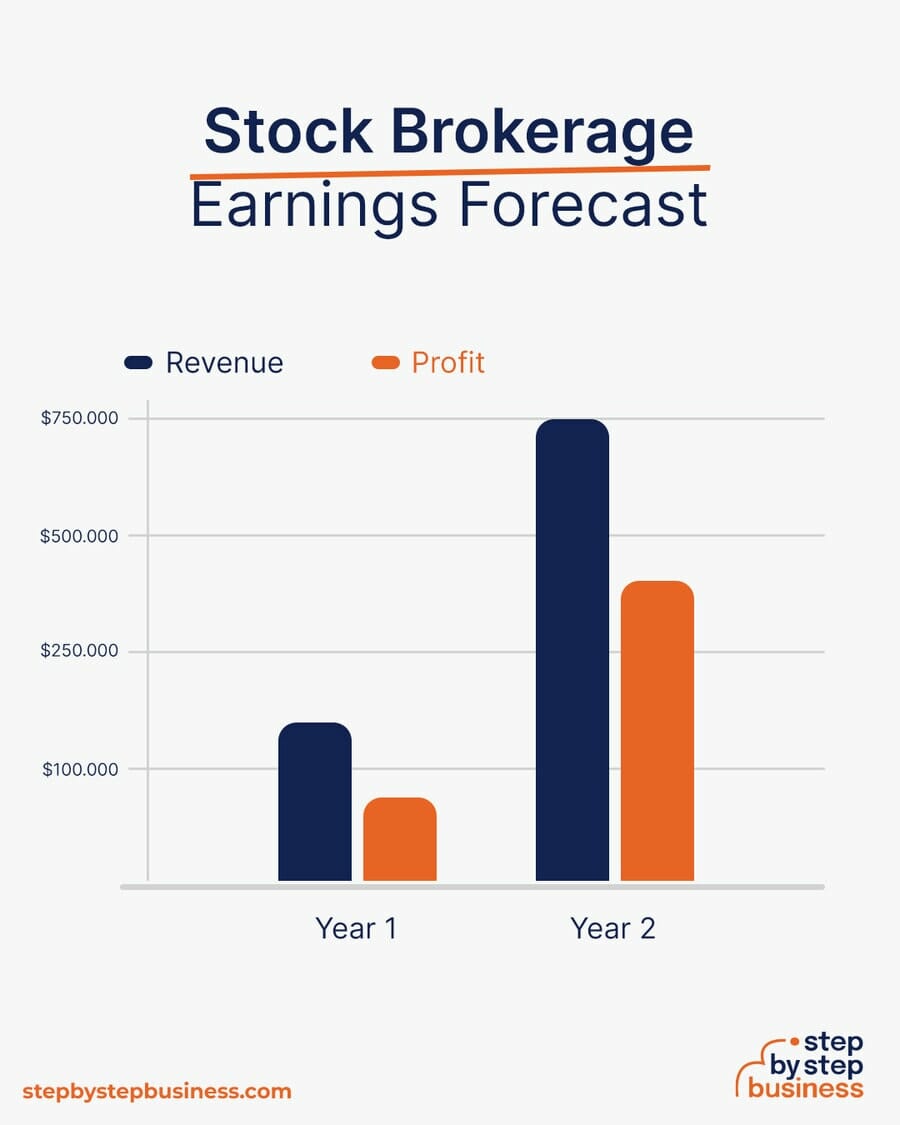

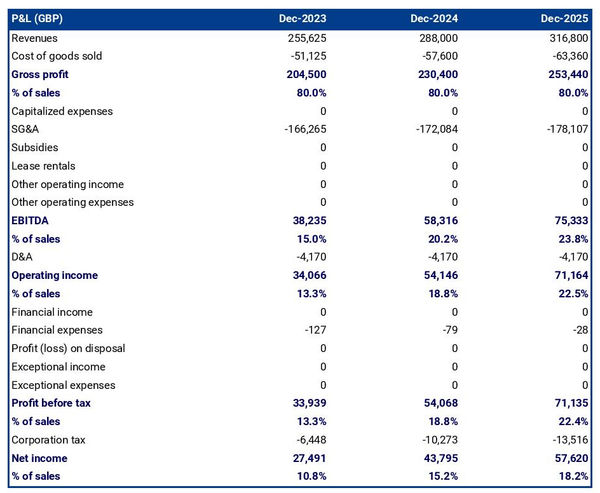

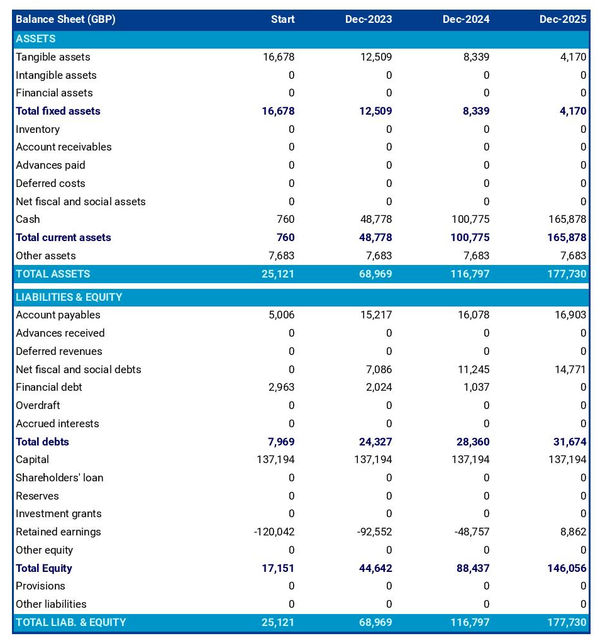

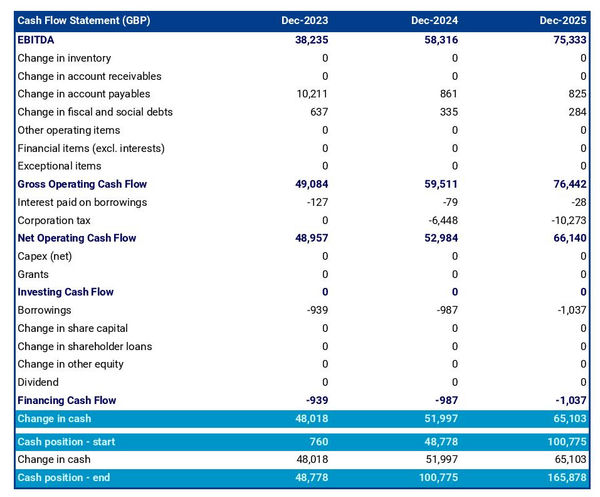

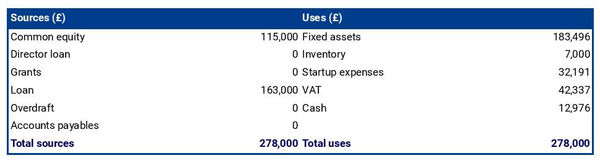

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your real estate broker’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs and capital expenditures.

For your real estate broker business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here _ Profit and Loss _ Cash Flow Statement _ Balance Sheet _ Use of Funds

Related Posts

Home Inspection Business Plan PDF Example

Competitive Analysis for a Real Estate Broker Business (Example)

- May 14, 2024

- Business Plan , Competitive Analysis

Competitive Analysis for a Home Inspection Business (Example)

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Premier Agent Toolkit

How to create a real estate agent business plan.

In this article:

Why agents need a real estate business plan

How to write a real estate business plan, free real estate business plan template.

Every agent needs a plan to succeed. A real estate business plan keeps you accountable and on track. An optimal business plan for real estate agents includes firm goals, but it’s also fluid — you’ll want to update your real estate business plan as you grow and the market evolves.

A real estate business plan allows you to stay current with market trends and ahead of the competition. It also helps you track results over time, test lead generation strategies and develop new marketing approaches. Zillow’s Bret Calltharp, a former training leader for a large brokerage group, saw his agents’ business increase by an average of 27% when implementing a business plan for the first time.

Here’s what a good real estate agent business plan will show you:

- Where you are today

- Where you want to be

- How you’ll get there

- How to measure your performance

- When and where to make a course correction

The benefits are clear, and you’re convinced — but where do you start? Here are our recommended steps for creating a business plan for real estate agents:

Write an executive summary

Real estate business planning should always start with a summary of who you are, what services you offer, where you operate and who you serve.

Define your mission statement

Your mission statement is the foundation that supports your entire real estate business plan. It should clearly state your guiding principles and goals.

Create a team management summary

If you’re working with a team, include all members who contribute to your success and how they help. Create a table that shows their roles, responsibilities and time frames for specific tasks.

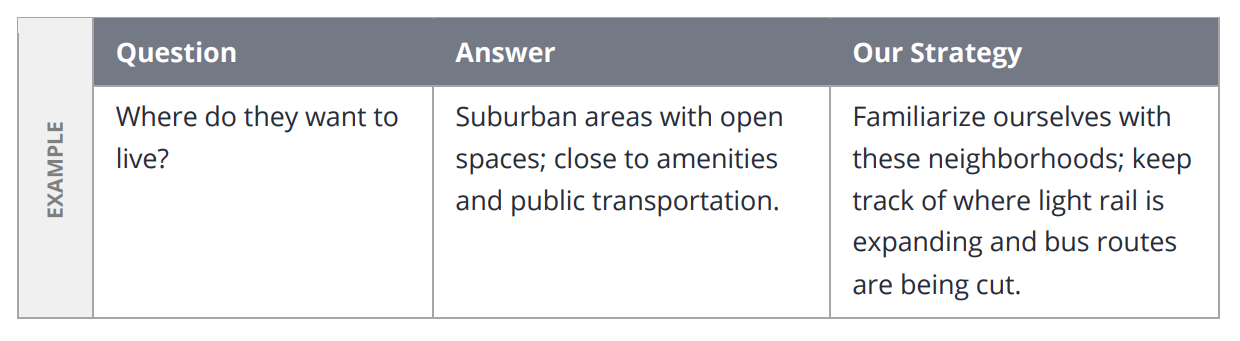

Know your target client

Determine who your target client is and figure out their story. The more personal you can get, the better you’ll serve your clients.

Who, specifically, is your target client? This could be a first-time home buyer, a home seller, a renter — or a more specific subset like retirees or investors.

What is your target client’s story? Ask your clients specific questions and create a strategy based on their answers. Where do they want to live? What is their annual household income? What do they want from their home?

Outline SMART business goals

Your goals should be specific, measurable, attainable, realistic and timely — in other words, SMART . Once your real estate business goals are SMART, break down each goal into objectives. These should be the specific tasks and activities required to accomplish the goal.

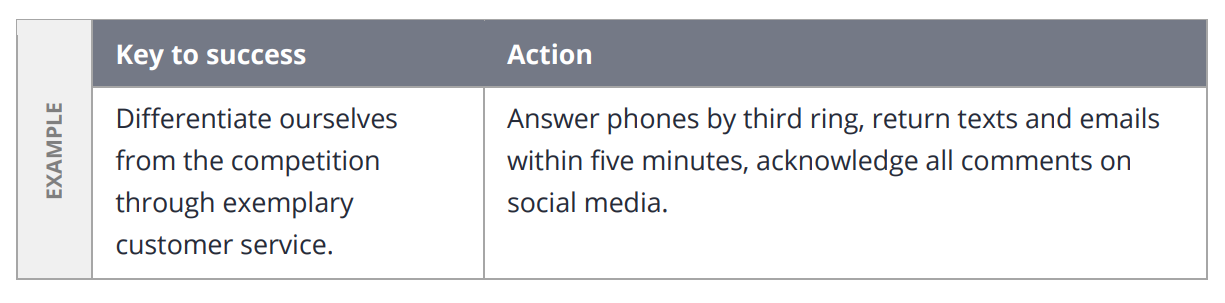

Map out your keys to success

Every real estate agent business plan template should include a table that lists the top three ways to achieve business success — and more importantly, the actions required to fulfill them.

Breakeven analysis

A critical part of real estate business planning is determining your breakeven point. What average commission rate do you need to achieve per unit to break even each month? How many homes must you sell at your average commission rate to break even by your target goal?

Understand your market

It’s crucial to stay on top of your target client’s market. A successful agent will know how the market has behaved in the past few years, as well as where it’s headed (and why).

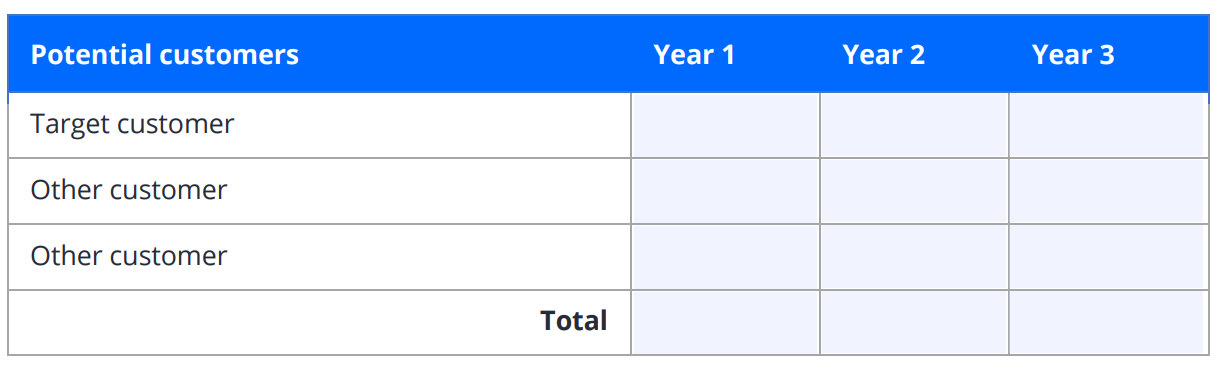

Segment your market

Let’s look at a target client in a sample real estate business plan.

Suppose the target client is a first-time home buyer. How can we segment that market further to include even more detailed and relevant information? Here are two potential market segments for our first-time home buyer:

- First-time home buyers, single family

- First-time home buyers, multigenerational

Plan for market growth

Map out how much growth you anticipate in your market, and use it to forecast the number of potential clients over the next few years.

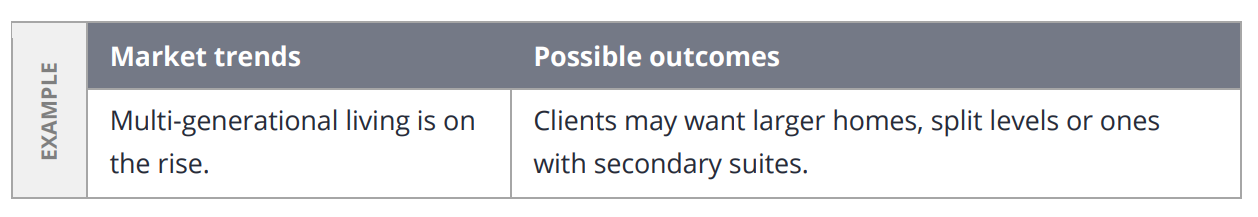

Track market trends in your real estate business plan with a table listing possible outcomes on the right and trends on the left.

Track market trends

What market trends do you foresee impacting your business and market segments? Here’s a real estate business plan sample that projects a possible outcome for a rise in multigenerational living:

Develop a SWOT analysis

Every business plan needs a SWOT analysis: strengths, weaknesses, opportunities and threats. Some sample real estate business plan SWOT questions include:

- What sets me apart from my competition?

- What skills need improving?

- Are there any opportunities I’m overlooking?

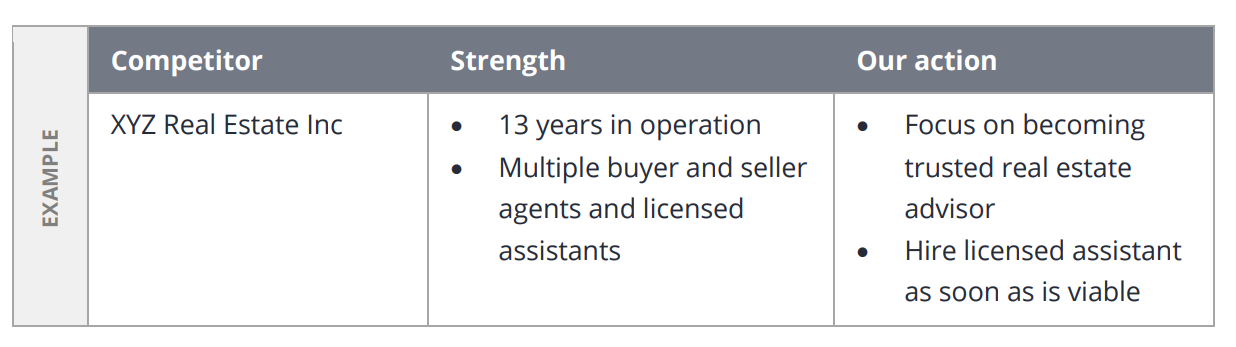

Recognize your competition

Who’s your primary competition in your target market, and what makes them your primary competition? How will you outperform them?

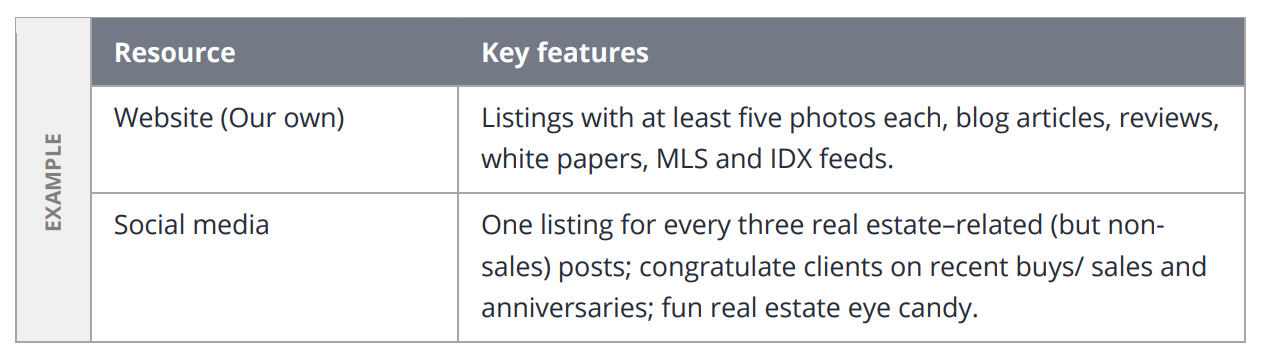

Create a marketing strategy

Every real estate business plan template needs a marketing strategy table. Highlight your resources and key features, like this sample:

List ways to generate leads

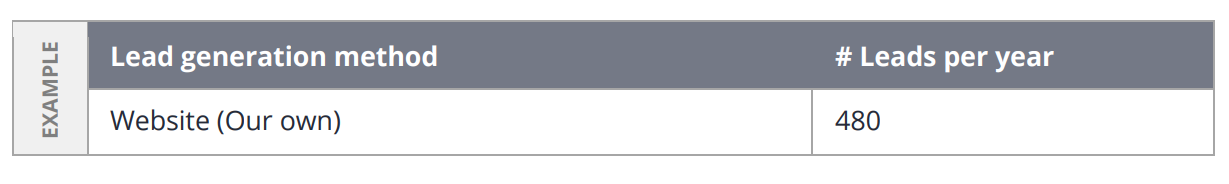

Always keep a list of effective methods to generate leads , and always update the list when new strategies come up. The lead generation list in your real estate development business plan is as simple as this:

Project yearly sales forecast

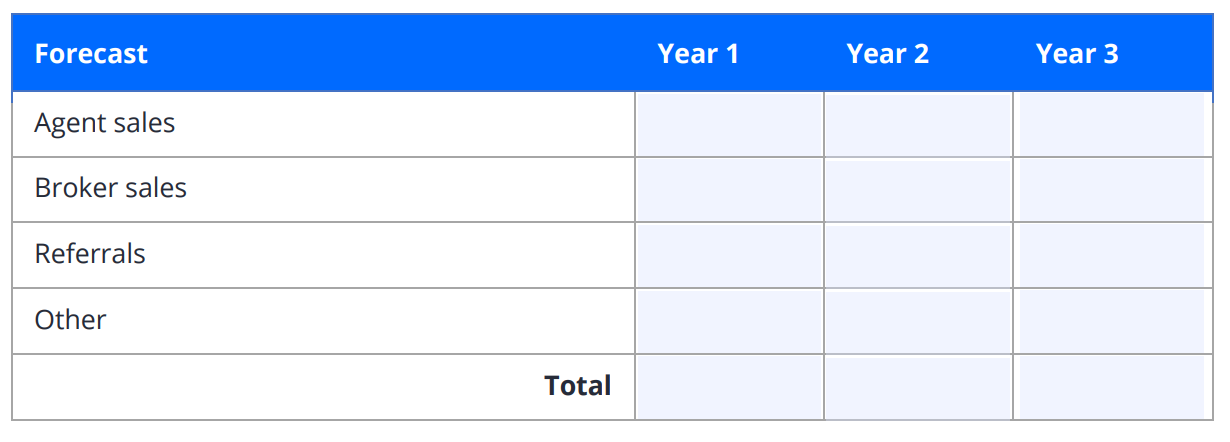

Use market growth, trends and other real estate marketing strategies to predict your annual sales for the next three years. Here’s an example table from our real estate business plan PDF:

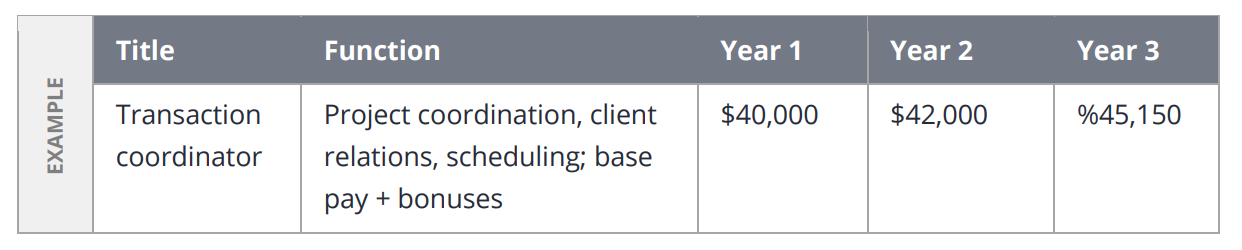

Outline your personnel expenses

Knowing what you’ll spend in a year will help you determine your breakeven point and set reasonable expectations for growth. A simple expense table, like this one from our free real estate business plan, allows you to project your personnel expenses through the next three years:

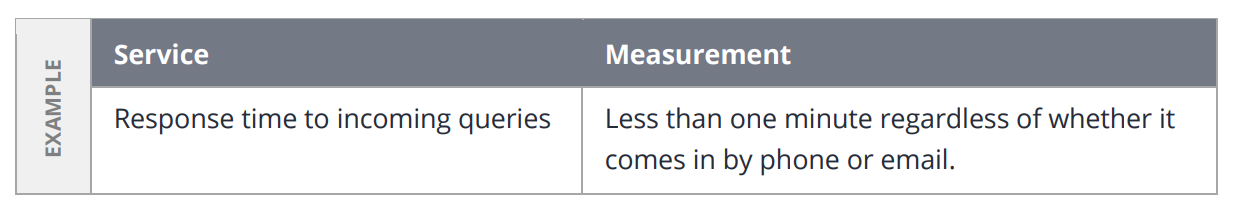

Measure client experience

Keep track of all the services you offer — and measure how quickly you deliver them. This is crucial in any real estate business planning document, as it helps you build a strong client relationship and track the results over time. Here’s an example for measuring response time:

Use a client relationship management (CRM) tool

There are many CRM tools out there, so it’s easy to find one that fits your needs. Do you want to track analytics? Use it for email marketing? Keep track of property and listing details? Automate your marketing efforts?

As a Zillow Premier Agent , you can use a CRM to manage all your leads and connections, along with their progress through the real estate journey. You can prioritize leads who are actively looking, submitting offers and under contract. Jot down other tools you’re using, especially transaction management tools and their specific functions.

Calculate your business plan performance

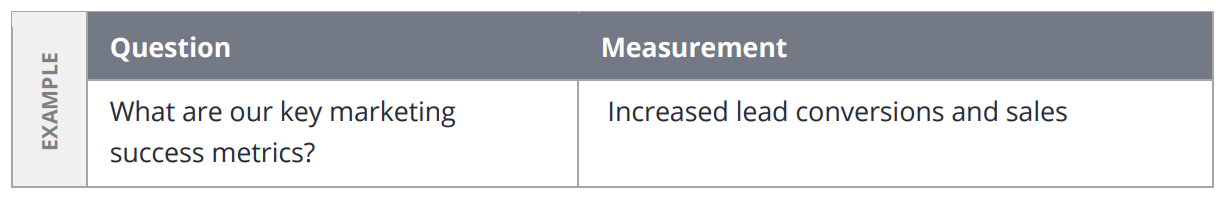

The final step in your real estate business plan template is measuring the plan’s performance. Track performance-related questions and how you’ll measure them. Here’s a sample question and measurement example that many agents use for real estate business planning:

Our customizable template helps you create a real estate business plan that outlines what success looks like — for you and your clients — so you can have your best year yet. This sample real estate business plan gives clear examples and allows for complete customization to your personal goals and your real estate market. Jot down your real estate business goals, clarify the state of your finances, profile your target customers and track other data that’s vital to successful real estate business planning.

Best of all — you can get started today! Just download our free real estate business plan template and add your own goals, projections, expenses and data. Don’t forget to update it regularly to accurately track your progress, evolve with the market and stay current with your target client’s needs.

Related Resources

How to Create a Real Estate Marketing Plan

Learn how to write a real estate marketing plan with a free template, and meet your goals.

Real Estate Flyer Template

Real estate listing flyers are an essential part of promoting your property listings. Here are 3 templates to streamline the process.

Real Estate Postcards (Free Templates)

Learn how to make real estate postcards, and use our real estate postcard templates to get the most return for your investment.

- Agent Toolkit

Get the real estate agent tools you need to win and wow your clients.

Get free scripts to help you convert leads and connect with clients.

Free real estate templates to make you more efficient.

Get free client handouts to exceed your clients’ expectations.

- Advertising

- Agent Account

- Home Tour Highlights

Become a Zillow Premier Agent today

Get in front of buyers and sellers in the largest online real estate network.

or call 855-885-0115

We respect your privacy. See our privacy policy .

By pressing 'Get started', you agree that Zillow Group may contact you via phone/text about your inquiry, which may involve the use of automated means. You are not required to consent as a condition of purchasing any goods or services. Message/data rates may apply.

- Search for a home

- List your home for FREE

- See your home's estimated value

- Find a real estate agent

- I'm a lender or loan officer

- I'm a property manager

- I'm a brand advertiser

- REALTOR® Store

Resources and updates on NAR’s settlement agreement related to broker commissions.

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- The Advocacy Scoop

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today The Advocacy Scoop Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

- Establishing Your Business

Quick Takeaways

- Create your brand

- Build your technology platform

- Establish a lead generation funnel

Source: 8-Steps to Start a Real Estate Brokerage & Actually Make Money ( Kyle Handy , Oct. 27, 2021)

You’ve finally made the decision to open your own brokerage. What do you need to know? Learn the steps to make a successful transition from agent to owner.

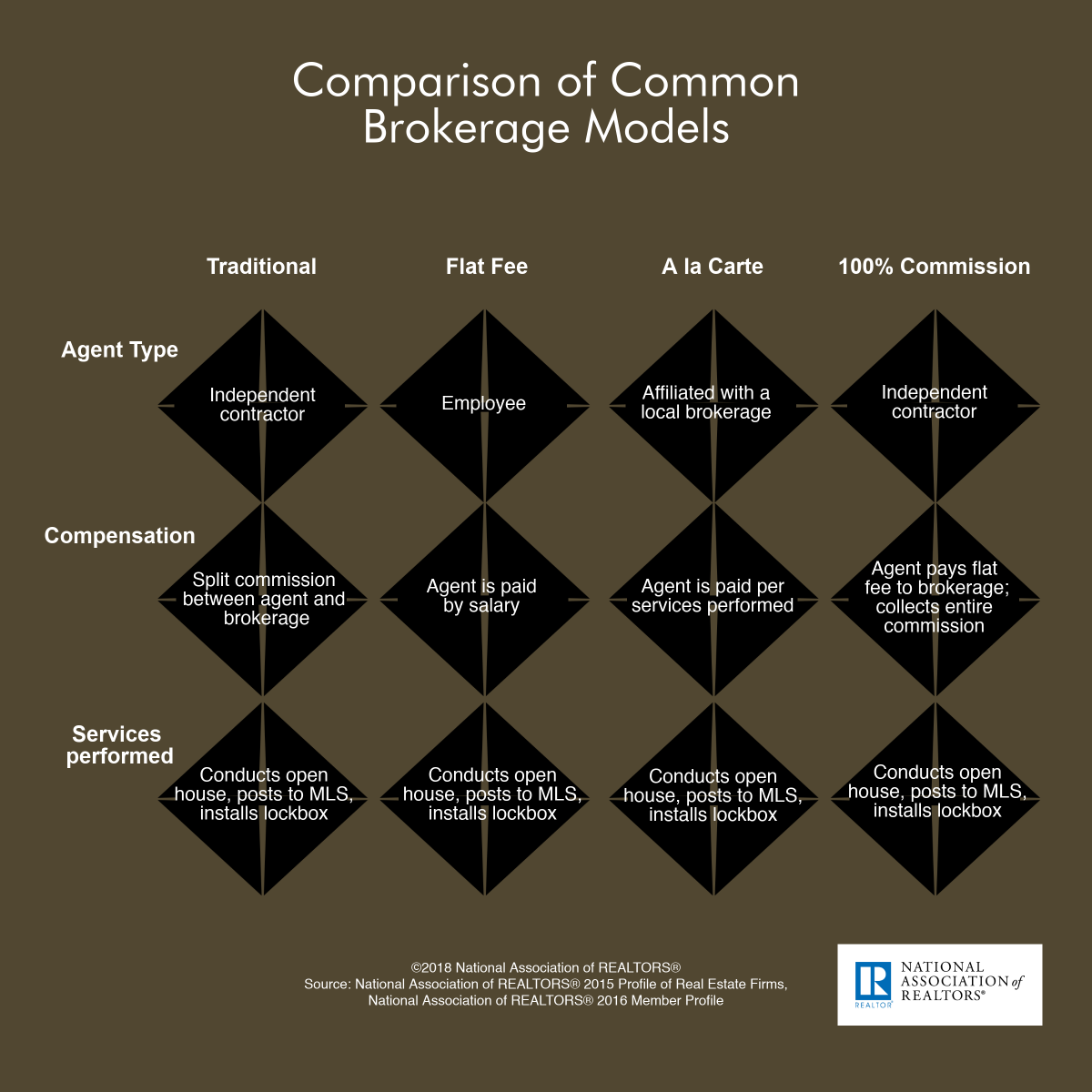

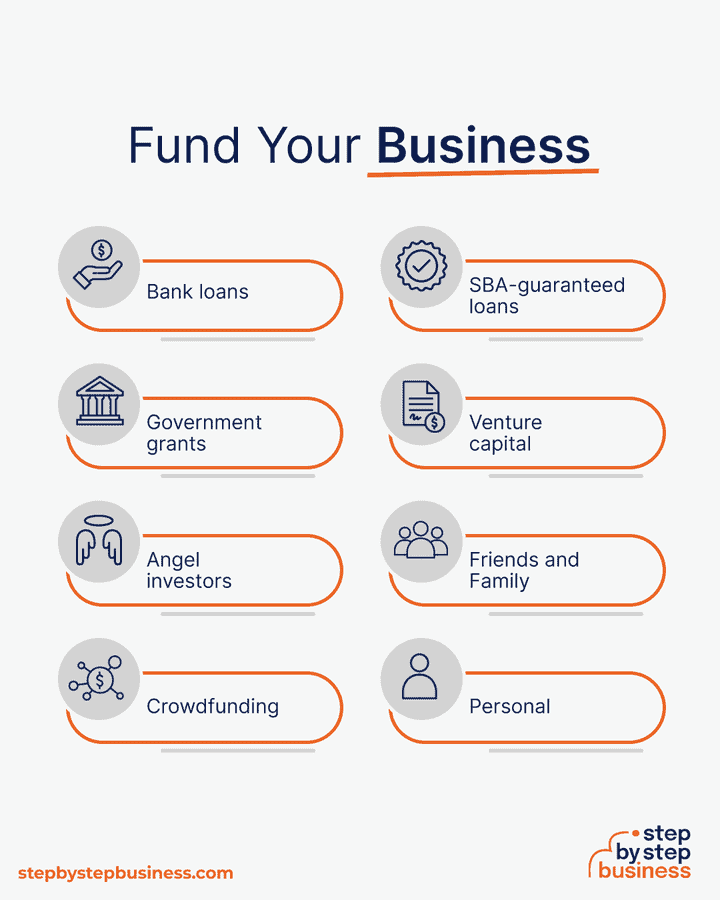

There are a variety of brokerage business models to choose from—traditional, flat fee, a la carte and 100% commission. Find out which model will work best for your brokerage. Writing a business plan allows you to create a detailed roadmap for your firm’s future and how you will achieve those plans. In your business plan, you should include financial planning, marketing strategies and hiring and personnel.

NAR has curated a list of useful websites providing more information to help you establish your new brokerage.

See References for more information.

Latest on this topic

Common Brokerage Models

Education: Management and Leadership

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

From the REALTOR® Store

Real Estate Brokerage Essentials® - Real Estate Brokerage Essentials®: Navigating Legal Risks and Managing a Successful Brokerage, Fourth Edition is the most comprehensive business tool for brokers to run their offices efficiently and minimize their risk for legal liability. This is a must have for all Brokers! (Item 126-359)

Broker to Broker: Management Lessons from America's Most Successful Real Estate Companies - Broker to Broker takes a unique approach to brokerage management by bringing you the ideas, strategies and lessons brokers and sales managers are implementing today. Compiled from the "For Brokers" section of REALTOR® Magazine it offers the best tips and advice on how to manage a residential real estate brokerage. (Item 141-60)

Sample Employee Manual for Brokers - Are you looking for assistance in developing an employee manual? NAR has a sample manual for you to tailor for your employees! (Item E126-155) Note: This employee manual is NOT intended to be used as a policy manual for independent contractors.

Striking Out on Your Own

How to Start & Grow a Real Estate Business in 2024 ( Kaplan Real Estate Education )

Top sales agents focus on sales activities and outsource the administrative and transactional activities. They realize that it’s these sales activities that will lead to the growth of their business. For example, reach out to 15 contacts, add two contacts to your Book of Business, knock on 30 doors, make 75 telemarketing calls, send out 30 emails, and mail out 20 flyers. Hold open houses on Saturdays and Sundays.

The 8-Step Guide to Starting a Real Estate Brokerage ( Fit Small Business , Mar. 1, 2024)

If you are a leader (a person who guides and communicates well with others), you have the first building block to being a successful broker. However, if you are the “bossy type” who likes to bark orders, tell others what to do, or believe that only your opinion counts, then being a broker is not for you.

How to Start a Real Estate Brokerage ( TRUIC , Nov, 1, 2023)

- Typical startup costs are:

- Real Estate Broker’s License - $1,500

- Office lease deposit - $2,000

- First month’s rent - $2,000

- Utilities, Telephone, Internet - $250 per month

- Office signage - $2,000

- Marketing expenses - $2,000 per month

- Employee expenses - (depends on the number of agents)

5 Mistakes I Made Opening My Real Estate Brokerage ( Janis Benstock Real Estate Academy , May 25, 2023)

The best thing I ever did for the health of my brokerage was to ask for help by hiring a business strategist. It has saved me so much time on the learning curve and it’s difficult to even put a number on the return on my investment.

Making the Transition From Top Producer to Broker-owner ( REALTOR® Magazine , May 4, 2021)

For other real estate practitioners thinking about making the transition from top producer to broker-owner, consider joining your local chamber of commerce. Get to know other professionals in your marketplace. Ask the chamber to support your office’s grand opening, which can help spread the word about your new brokerage and build those valuable relationships with members of the community.

How to Start a Real Estate Brokerage ( Placester )

Depending on the type of real estate brokerage you want to start, you’re looking at startup costs of at least $10,000. And that’s if you’re bootstrapping it and jumping in with the bare essentials. Thinking about opening up a brokerage under a franchise? Costs can easily hit $200,000, and that doesn’t include the ongoing fees you’ll be liable for like license renewals.

Creating a Business Plan and Choosing a Brokerage Model

7 Steps to Writing a Real Estate Business Plan (+ Worksheet) ( The Close , Apr. 3, 2024)

A killer business plan forces you to think through your goals and objectives, as well as your budget, so that you have a real chance of success right from the beginning. It keeps you realistic and establishes a way for you to clearly monitor and evaluate your success.

How to Write a Solid Real Estate Business Plan in 2024 ( Luxury Prescence , Mar. 13, 2024)

For an agent or a broker, a real estate business plan is essential for determining your identity in the luxury market and what you can offer clients. It helps you hone in on your ideal customer and allows you to assess the financial viability of your business easily.

Your real estate business plan is a guide to your goals and a clear-cut strategy for how you can stand out from the competition, grow your business, and fulfill your overarching mission.

12 Easy Steps to Creating a Perfect Real Estate Business Plan (2024 Updated!) ( Agent Advice , Dec. 29, 2023)

You should also look out for underserved niches and competitive saturation.

When it comes to underserved niches, there may be plenty of agents in your area specializing in family residential properties. But how many are serving the commercial sector? Or the luxury sector?

What Are the Different Brokerage Models an Agent Can Choose From? ( PropStream , Jan. 4, 2023)

Taking a cue from popular subscription-based businesses in other industries (like Netflix and Spotify), subscription-based brokerages usually offer agents monthly or yearly service plans.

Agents can often choose from multiple pricing tiers based on their needs. For example, you might pay a base fee for using the brokerage as a storefront and co-working space (where you can meet clients) and a higher fee for additional access to marketing software, training, and other tools and resources.

National vs. Boutique vs. Virtual Brokerages: Which is Right for You? ( Aceable Agent , Jan. 20, 2023)

Virtual brokerages, also known as cloud brokerages, are online only with no physical location. Since most agents do the bulk of their work from a home office, a virtual brokerage makes a lot of sense. This this especially true for seasoned agents that have a large contact list and don’t need as much training.

The Ultimate Guide to Creating a Real Estate Business Plan + Free Template ( Placester )

The length of business plans vary, but they generally outline between one and five years. For our purposes, we’ve used a length of three years. Few agents are able to fully develop their business in only a year, while planning five years into the future can be very speculative. For most new agents, three years is a reasonable time frame for achieving a degree of financial success and establishing a viable career in the industry.

Most business plans fall into one of two common categories: traditional or lean startup. Traditional business plans are more common, use a standard structure, and encourage you to go into detail in each section. They tend to require more work upfront and can be dozens of pages long. Lean startup business plans are less common but still use a standard structure. They focus on summarizing only the most important points of the key elements of your plan. They can take as little as one hour to make and are typically only one page.

Useful Websites

U.S. Small Business Administration — This website should be the first stop for anyone wanting to start a business. Topics covered include startup basics, writing a business plan, financing, marketing, employment, and tax topics. This site also has special areas for women business owners, veterans, minorities, Native Americans and young entrepreneurs. You can also find a local SBA office for further assistance.

SCORE Association — SCORE, the nation’s largest network of volunteer, expert business mentors, is dedicated to helping small businesses get off the ground, grow and achieve their goals. Since 1964, we have provided education and mentorship to more than 11 million entrepreneurs.

Entrepreneur Magazine — From choosing a business structure to naming your business, this website highlights the nitty-gritty basics of business star-ups. How-to guides, online newsletters and a resource center of articles provide helpful information for your start-up.

Inc.com — Inc.'s website provides information on starting, growing, and leading your business.

America’s Small Business Development Centers ( SBDC) — America’s SBDC represents America’s nationwide network of Small Business Development Centers (SBDCs) – the most comprehensive small business assistance network in the United States and its territories. There are nearly 1,000 local centers available to provide no-cost business consulting and low-cost training to new and existing businesses. Small business owners and aspiring entrepreneurs can go to their local SBDCs for FREE face-to-face business consulting and at-cost training on a variety of topics.

Minority Business Development Agency - MBDA is an agency of the U.S. Department of Commerce that promotes the growth of minority-owned businesses through the mobilization and advancement of public and private sector programs, policy, and research.

National Association of Women Business Owners (NAWBO) — NAWBO is the only dues-based organization representing the interests of all women entrepreneurs across all industries; and with chapters across the country. With far-reaching clout and impact, NAWBO is a one-stop resource to propelling women business owners into greater economic, social and political spheres of power worldwide.

Books, eBooks & Other Resources

Ebooks.realtor.org.

The following eBooks and digital audiobooks are available to NAR members:

18 Steps for Starting Your Business (eBook)

The Accidental Startup (eBook)

Business Made Simple (Audiobook)

Business Plans Kit for Dummies (eBook)

Business Plans That Work: A Guide for Small Business (eBook)

The Complete Idiot's Guide to Starting Your Own Business (eBook)

The Fearless Woman's Guide to Starting a Business (Audiobook)

How to Grow Your Small Business (Audiobook)

How to Write a Business Plan (eBook)

Launching While Female (eBook)

The Real Estate Entrepreneur: Everything You Need to Know to Grow Your Own Brokerage (eBook)

Six Steps to Small Business Success (eBook)

Start a New Real Estate Brokerage, Economically! (eBook)

Starting a Business for Dummies (eBook)

Write Your Business Plan (eBook)

Your First Business Plan (eBook)

Books, Videos, Research Reports & More

As a member benefit, the following resources and more are available for loan through the NAR Library. Items will be mailed directly to you or made available for pickup at the REALTOR® Building in Chicago.

Real Estate Brokerage: A Management Guide (Chicago: Dearborn, 2004) HF 1375 C99 Ed. 6

Have an idea for a real estate topic? Send us your suggestions .

The inclusion of links on this page does not imply endorsement by the National Association of REALTORS®. NAR makes no representations about whether the content of any external sites which may be linked in this page complies with state or federal laws or regulations or with applicable NAR policies. These links are provided for your convenience only and you rely on them at your own risk.

Item added to your cart

Here is a free business plan sample for a mortgage brokerage firm.

Embarking on a journey as a mortgage broker can be both exciting and daunting, especially if you're unsure about the first steps to take.

In the content that follows, we will present you with a comprehensive business plan tailored specifically for mortgage brokers.

As an aspiring entrepreneur in the financial sector, you're likely aware that a meticulously formulated business plan is crucial for laying the foundation of a successful practice. It serves as a roadmap, guiding you through the intricacies of the industry while setting clear objectives and strategies.

To streamline your planning process and get started on the right foot, feel free to utilize our mortgage broker business plan template. Our team of professionals is also on standby to provide a free review and fine-tuning of your plan.

How to draft a great business plan for your mortgage brokerage firm?

A good business plan for a mortgage broker must be tailored to the nuances of the mortgage industry.

To start, it's crucial to provide a comprehensive overview of the mortgage market. This includes up-to-date statistics and an analysis of emerging trends in the industry, similar to what we've included in our mortgage broker business plan template .

Your business plan should articulate your vision clearly. Define your target market (such as first-time homebuyers, property investors, or those refinancing) and your unique value proposition (expertise in specific loan types, personalized service, etc.).

Market analysis is a key component. You need to understand the competitive landscape, regulatory environment, and the needs and behaviors of potential clients.

For a mortgage broker, it's important to outline the range of mortgage products and services you plan to offer. Describe how these will cater to the diverse needs of your clientele, such as fixed-rate mortgages, adjustable-rate mortgages, government-backed loans, and refinancing options.

The operational plan should detail your brokerage's structure, including your office location, the technology you will use for loan processing, your network of lenders, and your approach to client consultations and application processing.

Compliance with financial regulations and maintaining a high standard of ethical practices should be emphasized in your plan.

Discuss your marketing and client acquisition strategies. How will you build trust and establish a reputation in the market? Consider your approach to networking, partnerships, online marketing, and customer service excellence.

Incorporating digital strategies, such as a professional website, online application tools, and a social media presence, is vital in the modern marketplace.

The financial section is critical. It should include your startup costs, revenue projections, operating expenses, and the point at which you expect to become profitable.

As a mortgage broker, understanding your commission structures and potential volume bonuses is essential for accurate financial forecasting. For assistance, you can refer to our financial forecast for a mortgage brokerage .

Compared to other business plans, a mortgage broker's plan must pay special attention to industry-specific regulations, the importance of building strong relationships with lenders, and strategies for maintaining a steady flow of clients.

A well-crafted business plan will not only help you clarify your strategies and goals but also serve as a tool to attract investors or secure lines of credit.

Lenders and investors will look for a thorough market analysis, realistic financial projections, and a clear plan for client engagement and compliance.

By presenting a detailed and substantiated business plan, you showcase your professionalism and dedication to the success of your brokerage.

To achieve these goals efficiently, you can fill out our mortgage broker business plan template .

A free example of business plan for a mortgage brokerage firm

Here, we will provide a concise and illustrative example of a business plan for a specific project.

This example aims to provide an overview of the essential components of a business plan. It is important to note that this version is only a summary. As it stands, this business plan is not sufficiently developed to support a profitability strategy or convince a bank to provide financing.

To be effective, the business plan should be significantly more detailed, including up-to-date market data, more persuasive arguments, a thorough market study, a three-year action plan, as well as detailed financial tables such as a projected income statement, projected balance sheet, cash flow budget, and break-even analysis.

All these elements have been thoroughly included by our experts in the business plan template they have designed for a mortgage broker .

Here, we will follow the same structure as in our business plan template.

Market Opportunity

Market data and figures.

The mortgage brokerage industry is a vital component of the real estate sector, facilitating a significant volume of home loans every year.

Recent data indicates that the mortgage brokerage market in the United States is robust, with mortgage brokers originating approximately 15% of all residential mortgages. This translates to billions of dollars in home loans, showcasing the critical role mortgage brokers play in the housing market.

With a growing population and a steady demand for housing, the mortgage brokerage industry is poised for continued growth, emphasizing the need for professional and reliable brokerage services.

The mortgage industry is experiencing several key trends that are shaping the future of home financing.

Technology is playing an increasingly important role, with the rise of online mortgage platforms and digital loan processing. This shift towards digital services is streamlining the application process and improving the customer experience.

There is also a growing demand for more flexible and tailored mortgage products, as consumers seek options that fit their unique financial situations.

Regulatory changes continue to influence the industry, with brokers needing to stay informed and compliant with the latest laws and guidelines to protect consumers.

Sustainability is becoming a consideration for borrowers, with green mortgages and incentives for energy-efficient homes gaining traction.

Lastly, the importance of financial education is being recognized, as brokers increasingly provide valuable advice and guidance to help clients make informed decisions.

Success Factors

Several factors contribute to the success of a mortgage brokerage.

Trustworthiness and transparency are paramount in building long-term relationships with clients. A broker who consistently acts in the best interest of their clients is more likely to secure repeat business and referrals.

Expertise in the mortgage industry is essential. A broker with a deep understanding of various loan products, regulations, and market conditions can provide superior service and advice.

Networking and partnerships with lenders and real estate professionals can greatly enhance a broker's ability to offer competitive rates and diverse loan options.

Customer service is also a critical component. Prompt and clear communication, personalized attention, and a commitment to guiding clients through the entire loan process can set a brokerage apart.

Finally, effective marketing strategies and a strong online presence are important for attracting new clients in a digital age where many consumers begin their search for mortgage information online.

The Project

Project presentation.

Our mortgage brokerage project is designed to address the needs of a diverse clientele seeking reliable and personalized mortgage solutions. Strategically located in an area with a booming real estate market, our brokerage will offer a comprehensive range of mortgage services, including first-time homebuyer loans, refinancing options, and investment property financing. We will work with a variety of lenders to ensure competitive rates and terms tailored to each client's unique financial situation.

The emphasis will be on transparency, trust, and tailored advice to ensure clients make informed decisions about their mortgage options.

This mortgage brokerage aims to become a trusted advisor in the community, guiding clients through the complexities of the mortgage process and helping them achieve their property ownership or investment goals.

Value Proposition

The value proposition of our mortgage brokerage project is centered on providing expert, unbiased mortgage advice and facilitating access to a wide range of financing options. Our commitment to personalized service ensures that each client receives a mortgage plan that aligns with their financial objectives and lifestyle.

We are dedicated to simplifying the mortgage process, offering clarity and support at every step, and building long-term relationships with our clients based on trust and integrity.

Our brokerage aspires to empower clients with the knowledge and resources they need to make confident mortgage decisions, contributing to their financial stability and peace of mind.

Project Owner

The project owner is a seasoned mortgage broker with a comprehensive understanding of the real estate and finance industries.

With a track record of successful client relationships and a deep knowledge of mortgage products, the owner is committed to establishing a brokerage that stands out for its dedication to client success, ethical practices, and market expertise.

Driven by a vision of financial empowerment and education, the owner is determined to offer tailored mortgage solutions that support the community's homeownership dreams and investment strategies.

His commitment to professionalism and his passion for helping others navigate the mortgage landscape make him the driving force behind this project, aiming to enhance the financial well-being of clients and contribute to the growth of the local economy.

The Market Study

Market segments.

The market segments for a mortgage brokerage are diverse and can be categorized as follows:

Firstly, there are first-time homebuyers who are navigating the complex process of purchasing their initial property and require guidance and financing options.

Next, existing homeowners looking to refinance their mortgages to take advantage of lower interest rates or to consolidate debt form another significant segment.

Investors who are interested in purchasing properties for rental or resale purposes also represent a key market segment for mortgage brokers.

Lastly, real estate agents and financial advisors can be influential by referring clients who are in need of mortgage financing expertise.

SWOT Analysis

A SWOT analysis of the mortgage brokerage business reveals several key points:

Strengths include a deep understanding of the mortgage industry, strong relationships with various lenders, and the ability to offer a wide range of mortgage products to clients.

Weaknesses might involve the highly competitive nature of the mortgage industry and the sensitivity to interest rate fluctuations and economic cycles.

Opportunities can be found in the growing housing market, the potential to leverage technology for improved customer service, and the ability to specialize in niche markets such as eco-friendly or sustainable housing loans.

Threats include regulatory changes that could affect lending practices, the entry of new fintech competitors in the mortgage space, and the potential for economic downturns which can impact the housing market.

Competitor Analysis

Competitor analysis in the mortgage brokerage industry indicates a crowded and competitive landscape.

Direct competitors include other local and national mortgage brokers, banks, credit unions, and online lending platforms.

These entities compete on interest rates, customer service, speed of processing, and the diversity of their loan products.

Key competitive advantages may include personalized customer service, a wide network of lender relationships, expertise in specific types of loans, and advanced technology for efficient processing.

Understanding the strengths and weaknesses of competitors is crucial for carving out a unique value proposition and for client acquisition and retention strategies.

Competitive Advantages

Our mortgage brokerage's competitive advantages lie in our personalized approach to client service and our commitment to finding the best financial solutions for our clients.

We offer a comprehensive suite of mortgage products, including conventional loans, government-backed loans, and innovative financing options for unique property types.

Our expertise in navigating complex financial situations and our dedication to educating our clients on their mortgage options set us apart in the industry.

We also pride ourselves on our agility in adapting to market changes and our use of cutting-edge technology to streamline the mortgage application and approval process, enhancing the overall customer experience.

You can also read our articles about: - how to become a mortgage broker: a complete guide - the customer segments of a mortgage brokerage firm - the competition study for a mortgage brokerage firm

The Strategy

Development plan.

Our three-year development plan for the mortgage brokerage firm is designed to establish us as a trusted leader in the industry.

In the first year, we will concentrate on building a strong client base by offering personalized mortgage solutions and exceptional customer service.

The second year will focus on expanding our services to include refinancing options, debt consolidation, and financial advisory services to provide comprehensive financial solutions to our clients.

In the third year, we aim to form strategic alliances with real estate agencies and financial institutions to broaden our service offerings and enhance our market reach.

Throughout this period, we will remain dedicated to maintaining the highest standards of integrity, transparency, and professionalism to meet the evolving needs of our clients and secure a dominant position in the market.

Business Model Canvas

The Business Model Canvas for our mortgage brokerage firm targets individuals and families looking to purchase or refinance their homes, as well as real estate investors.

Our value proposition is centered on providing expert mortgage advice, competitive rates, and a seamless application process.

We offer our services through our office, online platforms, and mobile consultations, utilizing key resources such as our industry knowledge and network of lending partners.

Key activities include client consultations, loan application processing, and market analysis.

Our revenue streams are generated from commissions on successful mortgage placements, consultation fees, and potential partnerships with financial institutions.

Find a complete and editable real Business Model Canvas in our business plan template .

Marketing Strategy

Our marketing strategy is built on trust and expertise.

We aim to educate potential clients on the mortgage process and the benefits of working with a broker. Our strategy includes online educational content, mortgage calculators, and workshops on home buying and financing.

We will also establish referral programs with real estate agents and previous clients to expand our network.

Additionally, we plan to leverage social media, search engine optimization, and targeted advertising to reach a wider audience and showcase our success stories and client testimonials.

Risk Policy

The risk policy of our mortgage brokerage firm is to minimize financial and operational risks.

We adhere to strict compliance with industry regulations and ethical standards, ensuring all loan options presented to clients are in their best interest.

We conduct thorough risk assessments on loan products and maintain a diversified portfolio to mitigate market volatility.

Prudent financial management and a contingency plan are in place to safeguard against economic downturns.

Additionally, we carry professional indemnity insurance to protect against potential legal claims. Our priority is to provide secure and reliable mortgage brokerage services while ensuring client satisfaction.

Why Our Project is Viable

We are committed to establishing a mortgage brokerage firm that addresses the needs of homebuyers and investors in a changing financial landscape.

With our focus on customer-centric services, market expertise, and strategic partnerships, we are poised for success in the competitive mortgage industry.

We are enthusiastic about empowering our clients to make informed financial decisions and are prepared to adapt to market changes to achieve our objectives.

We look forward to the promising future of our mortgage brokerage firm and the opportunity to serve our community.

You can also read our articles about: - the Business Model Canvas of a mortgage brokerage firm - the marketing strategy for a mortgage brokerage firm

The Financial Plan

Of course, the text presented below is far from sufficient to serve as a solid and credible financial analysis for a bank or potential investor. They expect specific numbers, financial statements, and charts demonstrating the profitability of your project.

All these elements are available in our business plan template for a mortgage broker and our financial plan for a mortgage broker .

Initial expenses for our mortgage brokerage include securing a professional office space, obtaining the necessary licenses and certifications, investing in industry-specific software for loan processing and customer relationship management, as well as costs related to brand creation and launching targeted marketing campaigns to reach potential homebuyers and those looking to refinance.

Our revenue assumptions are based on a thorough analysis of the local housing market, interest rate trends, and the demand for mortgage advisory services, considering the growing need for personalized mortgage solutions.

We anticipate progressively increasing client acquisition, starting modestly and growing as the reputation of our mortgage brokerage develops.

The projected income statement indicates expected revenues from our service fees, commission from lenders, and potential consulting services, minus the operating expenses (office rent, marketing, salaries, etc.), and the cost of maintaining our professional credentials.

This results in a forecasted net profit crucial for evaluating the profitability of our business over time.

The projected balance sheet reflects assets specific to our business, such as office equipment, software, and liabilities including debts and anticipated operating expenses.

It shows the overall financial health of our mortgage brokerage at the end of each period.

Our projected cash flow budget details incoming and outgoing cash flows, allowing us to anticipate our cash needs at any given time. This will help us effectively manage our finances and avoid cash flow problems.

The projected financing plan lists the specific financing sources we plan to use to cover our startup expenses, such as business loans or investor capital.

The working capital requirement for our mortgage brokerage will be closely monitored to ensure we have the necessary liquidity to finance our daily operations, including office expenses, marketing initiatives, and salary payments.

The break-even point specific to our project is the level of transactions needed to cover all our costs, including startup expenses, and start making a profit.

It will indicate when our business will be financially sustainable.

Performance indicators we will track include the conversion rate of leads to closed loans, the average commission per transaction, the liquidity ratio to assess our ability to cover financial obligations, and the return on investment to measure the effectiveness of our capital invested in the project.

These indicators will help us evaluate the financial health and overall success of our mortgage brokerage.

If you want to know more about the financial analysis of this type of activity, please read our article about the financial plan for a mortgage brokerage firm .

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Financial modeling spreadsheets and templates in Excel & Google Sheets

- Your cart is empty.

Inside Look: Brokerage Firm Business Plan Essentials

A Brokerage Firm Business Plan must pinpoint target markets and detail robust revenue strategies. Essential components include market analysis, regulatory compliance outlines, and a clear operational model.

Crafting a standout Business Plan for a brokerage firm is a strategic process that requires an intricate understanding of the financial services industry and its evolving landscape. Entrepreneurial brokers must outline the foundation of their business practice effectively to attract investors, secure capital, and establish a roadmap for successful operations.

This document serves as a blueprint, highlighting the firm’s value proposition, identifying potential client segments, and setting actionable goals matched with financial projections. Transparency in operational procedures, risk management, and an effective marketing strategy is crucial. A strategic brokerage business plan garners trust, ensures adherence to stringent financial regulations, and sets the stage for sustainable growth in a competitive marketplace. With a clear direction and solid financial projections, brokerage firms lay the groundwork for establishing trust and credibility in the financial sector.

Introduction To Brokerage Firms

A deep dive into the bustling world of brokerage firms uncovers the cornerstones of financial markets. Brokerage firms are the powerful engines behind the scenes. They fuel investment opportunities for individuals and organizations alike. From stocks to bonds, their vibrant palette of services colors the canvas of our financial decisions. This section illuminates the essentials of these firms’ business plans.

Defining Brokerage Firms

At their core, brokerage firms act as a bridge. They connect investors with the markets. They provide a platform to buy and sell securities. This could be stocks, bonds, or mutual funds. Imagine a marketplace buzzing with activity. Here, brokerage firms offer the stall space for transactions.

Evolution Of Brokerage Services

Brokerage services have evolved with time. Once dominated by traditional, in-person dealings, they now thrive online. Technological advances have redefined accessibility. Speed and convenience now headline the show. Services varying from self-directed accounts to full-service advisories reflect diverse investor needs .

The Role Of Brokerage Firms In Financial Markets

- Connecting buyers and sellers: They make it easy for people to trade.

- Providing access: They open doors to various markets.

- Offering advice: Expert insights help clients make informed decisions.

- Ensuring security: Safe, regulated environments protect participants.

Structuring A Brokerage Firm

An integral component of launching a successful brokerage firm lies in its structure. Careful planning and meticulous attention to detail are the building blocks to withstand the financial industry’s rigor. Structuring a brokerage firm demands an understanding of its variety, compliance with legalese, state-of-the-art technology, and a team of experts.

Deciding The Type Of Brokerage Firm

Your brokerage firm’s niche sets the foundation. Determine whether you’ll cater to stock trading, commodities, real estate, or other financial instruments . Each type demands different resources, marketing strategies, and client management systems.

Legal And Regulatory Considerations

Legal and regulatory compliance shields your firm from liabilities. Secure necessary licenses , and ensure policies adhere to financial regulations. Regular audits and transparent operations are must-haves for credibility and trust.

- Series 7: General Securities Representative

- Series 63: Uniform Securities Agent State Law

- Series 65: NASAA Investment Advisors Law Exam

Technology Infrastructure For Modern Brokerages

In the digital age, brokerages need robust technology infrastructure . From client-facing platforms to backend processing, systems must be secure, reliable, and user-friendly.

- Trading platforms

- Customer Relationship Management (CRM) tools

- Data analysis and security systems

Personnel And Expertise Necessary

Your team is your firm’s backbone. Hire staff with the necessary expertise and invest in continual training. Financial analysts , compliance officers, and customer service representatives are central to your firm’s operations.

| Role | Function |

|---|---|

| Market Research and Investment Strategies | |

| Regulatory Oversight and Risk Management | |

| Client Support and Issue Resolution |

Business Plan Components For Brokerage Firms

Creating a robust business plan is crucial for success in the competitive world of brokerage firms. It lays out a roadmap for business operations, strategies, and financials. Let’s delve into the essential components that make up a solid business plan for brokerage firms.

Executive Summary And Company Overview

The executive summary paints a clear picture of your brokerage firm’s mission, objectives, and how you’ll achieve them. This section includes:

- Mission statement: What your firm stands for.

- Objectives: Short and long-term goals.

- Vision: The future you see for your firm.

The company overview provides key details about your brokerage, such as:

- Business history

- Leadership team

- Legal structure

Market Analysis And Strategy

Here, you dissect your target market and outline strategies to conquer it. Key components include:

- Industry description and outlook

- Target market analysis: size, growth rate, trends

- Competitive analysis : strengths and weaknesses of competitors

- Marketing strategies : positioning, branding, sales tactics

Operations Plan

The operations plan details your brokerage firm’s daily activities. It covers:

- Location and facilities: Where you’ll operate, and the resources you need.

- Technology: Tools and software to serve clients effectively.

- Staffing: Your team’s roles and responsibilities.

Financial Projections And Funding Requirements

This section must convince readers of your firm’s financial viability. It includes:

| Projected income over time. | |

| Critical costs and overheads. | |

| When and how cash enters and exits your business. | |

| Capital required to start or expand. |

Risk Analysis And Mitigation Strategies

In this final piece, you highlight potential risks and your plans to address them. Key areas include:

- Identifying risks: Market changes, regulatory updates, competitive landscape.

- Mitigation tactics: Risk management plans and insurance coverage.

- Contingency plans: Steps to navigate unforeseen challenges.

Growth Strategies For Brokerage Firms

Are you ready to level up your brokerage firm? Let’s talk about growth strategies . A solid business plan is not complete without them. Think of them as your roadmap to success. For your brokerage firm to stand out, we’re diving into tactics that help you grow.

Developing A Unique Selling Proposition

A unique selling proposition (USP) is key. It’s what makes your firm different. Ask yourself, what can you offer that others don’t? Perhaps it’s exclusive market insights or unmatched customer service. Make it clear and compelling. This will attract clients.

Customer Acquisition And Retention Tactics

Gaining new clients is great, but keeping them is essential. Use these tactics:

- Networking events: Build relationships face-to-face.

- Referral programs: Reward clients for spreading the word.

- Personalized service: Cater to client’s individual needs.

Focus on creating an unforgettable experience . Happy clients stay longer and refer others.

Adapting To Emerging Trends And Technologies

The brokerage world changes fast. Stay ahead by embracing new technology . Use tools that streamline trading and provide up-to-date market analysis. Keep an eye on trends like cryptocurrency and sustainable investing. Then, educate your team and clients.

Adopt tech that enhances client interactions and back-office efficiency. Examples:

| Technology | Benefit |

|---|---|

| Faster trades | |

| Better client relations | |

| Insightful market forecasts |

Conclusion: Staying Competitive In The Brokerage Industry

An effective business plan marks the first step toward success in the brokerage industry. A broker must adapt and grow to stay competitive. The final analysis of any plan revolves around its execution and relevance in the face of evolving market dynamics.

The Importance Of Continuous Improvement

In a business where client trust defines success, constant enhancement is key. For brokerage firms, this means:

- Keeping pace with technology advancements to service clients efficiently

- Updating training programs to ensure team expertise

- Regularly reviewing market strategies to capitalize on new opportunities

Challenges Ahead For Brokerage Firms

- Increasing regulatory demands force firms to adapt quickly.

- With cutting-edge fintech developments , staying relevant is tough.

- Consumer behavior shifts constantly, pushing brokers to refine outreach and services.

Future Outlook For The Brokerage Business Model

The future shines bright for adaptable brokerage firms. Successful brokers will:

- Embrace digital transformation to improve client interaction

- Invest in data analysis tools for personalized services

- Foster a culture of innovation for sustained growth

Frequently Asked Questions For Inside Look: Brokerage Firm Business Plan Essentials

What are the essential elements of a business plan.

Essential elements of a business plan include an executive summary, market analysis, company description, organization structure, product/service line, marketing & sales strategy, funding request, and financial projections .

What Four Items Must Be Set Out In The Business Plan?

A business plan typically includes an executive summary, market analysis, company description, and financial projections.

What Should Be Included In My Business Plan?

Your business plan should include an executive summary, company description, market analysis, organization structure, product line or services, marketing and sales strategy, funding requests, financial projections, and an appendix.

What Is The Business Model Of A Brokerage Firm?

A brokerage firm operates on a business model where it charges fees or commissions for executing buy and sell orders submitted by an investor.

Crafting a robust business plan is crucial for brokerage firms aiming for success. It sets a clear path for operations, growth, and profitability. Remember, a plan well-made invites stability and investor confidence. Keep refining your strategy and stay ahead in the dynamic financial market.

Start planning your firm’s future today!

Beverage Manufacturing Start-up Financial Model

The beverage manufacturing industry is a dynamic and rapidly growing sector that caters to a diverse market ranging from soft drinks and juices to alc... read more

- Excel Model – $199.95 Version 5.2

- PDF Demo – $0.00 Version 5.2

Liquor Distillery Financial Plan Template

Distilleries, with their rich history of crafting spirits, have experienced a resurgence in popularity, driven by consumer interest in artisanal and l... read more

- Excel Version – $199.95 Version 5.5

- PDF Demo Version – $0.00 Version 5.5

Corporate Finance Toolkit – 25 Financial Models Excel Templates

The toolkit is an essential resource for any organization, providing a comprehensive collection of tools and templates designed to streamline financia... read more

- All Excel Model Templates – $249.00 Version 1

- PDF Demo & Excel Free Download – $0.00 Version 1

Taxi Company Business Financial Model

Embark on the road to success by starting your own Taxi Company Business. This comprehensive 10-year monthly Excel financial model template offers an ... read more

- Excel Version – $129.95 Version 1.5

- PDF Demo Version – $0.00 Version 1.5

Trucking Company Financial Model

Embrace the road ahead, where every mile traveled isn’t just a journey—it’s a commitment to keeping the gears of the global economy turning. Sta... read more

- Excel Version – $129.95 Version 1.2

- PDF Version – $0.00 Version 1.2

Crypto Trading Platform – 5 Year Financial Model

Financial Model presenting an advanced 5-year financial plan of a Crypto Trading Platform allowing customers to trade cryptocurrencies or digital curr... read more

- Excel Financial Model – $139.00 Version 1

- PDF Free Demo – $0.00 Version 1

Truck Rental Company Financial Model

This detailed 10-year monthly Excel template is specifically designed to formulate a business plan for a Truck Rental Business. It employs a thorough ... read more

- Excel Version – $129.95 Version 2.3

- PDF Version – $0.00 Version 2.3

Kayak Boat Rental Business Model

Dive into the future of your kayak boat rental business with our cutting-edge 10-year monthly financial model, tailored to empower entrepreneurs and b... read more

- PDF Demo Version – $0.00 Version .5

Event Organizer Business Model Template