- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

How To Write A Business Plan: A Comprehensive Guide

The Startups Team

How To Write A Business Plan: A Comprehensive Guide

A comprehensive, step-by-step guide - complete with real examples - on writing business plans with just the right amount of panache to catch an investor's attention and serve as a guiding star for your business.

Introduction to Business Plans

So you've got a killer startup idea. Now you need to write a business plan that is equally killer.

You fire up your computer, open a Google doc, and stare at the blank page for several minutes before it suddenly dawns on you that, Hm…maybe I have no idea how to write a business plan from scratch after all.

Don't let it get you down. After all, why would you know anything about business planning? For that very reason we have 4 amazing business plan samples to share with you as inspiration.

For most founders, writing a business plan feels like the startup equivalent of homework. It's the thing you know you have to do, but nobody actually wants to do.

Here's the good news: writing a business plan doesn't have to be this daunting, cumbersome chore.

Once you understand the fundamental questions that your business plan should answer for your readers and how to position everything in a way that compels your them to take action, writing a business plan becomes way more approachable.

Before you set fingers to the keyboard to turn your business idea into written documentation of your organizational structure and business goals, we're going to walk you through the most important things to keep in mind (like company description, financials, and market analysis, etc.) and to help you tackle the writing process confidently — with plenty of real life business plan examples along the way to get you writing a business plan to be proud of!

Keep It Short and Simple.

There's this old-school idea that business plans need to be ultra-dense, complex documents the size of a doorstop because that's how you convey how serious you are about your company.

Not so much.

Complexity and length for complexity and length's sake is almost never a good idea, especially when it comes to writing a business plan. There are a couple of reasons for this.

1. Investors Are Short On Time

If your chief goal is using your business plan to secure funding, then it means you intend on getting it in front of an investor. And if there's one thing investors are, it's busy. So keep this in mind throughout writing a business plan.

Investors wade through hundreds of business plans a year. There's no version of you presenting an 80-page business plan to an investor and they enthusiastically dive in and take hours out of their day to pour over the thing front to back.

Instead, they're looking for you to get your point across as quickly and clearly as possible so they can skim your business plan and get to the most salient parts to determine whether or not they think your opportunity is worth pursuing (or at the very least initiating further discussions).

You should be able to refine all of the key value points that investors look for to 15-20 pages (not including appendices where you will detail your financials). If you find yourself writing beyond that, then it's probably a case of either over explaining, repeating information, or including irrelevant details in your business plan (you don't need to devote 10 pages to how you're going to set up your website, for example).

Bottom line: always be on the lookout for opportunities to “trim the fat" while writing a business plan (and pay special attention to the executive summary section below), and you'll be more likely to secure funding.

2. Know Your Audience

If you fill your business plan with buzzwords, industry-specific jargon or acronyms, and long complicated sentences, it might make sense to a handful of people familiar with your niche and those with superhuman attention spans (not many), but it alienates the vast majority of readers who aren't experts in your particular industry. And if no one can understand so much as your company overview, they won't make it through the rest of your business plan.

Your best bet here is to use simple, straightforward language that's easily understood by anyone — from the most savvy of investor to your Great Aunt Bertha who still uses a landline.

How To Format Your Business Plan

You might be a prodigy in quantum mechanics, but if you show up to your interview rocking cargo shorts and lime green Crocs, you can probably guess what the hiring manager is going to notice first.

In the same way, how you present your business plan to your readers equally as important as what you present to them. So don't go over the top with an extensive executive summary, or get lazy with endless bullet points on your marketing strategy.

If your business plan is laden with inconsistent margins, multiple font types and sizes, missing headings and page numbers, and lacks a table of contents, it's going to create a far less digestible reading experience (and totally take away from your amazing idea and hours of work writing a business plan!)

While there's no one right way to format your business plan, the idea here is to ensure that it presents professionally. Here's some easy formatting tips to help you do just that.

If your margins are too narrow, it makes the page look super cluttered and more difficult to read.

A good rule of thumb is sticking to standard one-inch margins all around.

Your business plan is made up of several key sections, like chapters in a book.

Whenever you begin a section (“Traction” for example) you'll want to signify it using a header so that your reader immediately knows what to expect from the content that follows.

This also helps break up your content and keep everything nice and organized in your business plan.

Subheadings

Subheadings are mini versions of headings meant to break up content within each individual section and capture the attention of your readers to keep them moving down the page.

In fact, we're using sub-headers right now in this section for that very purpose!

Limit your business plan to two typefaces (one for headings and one for body copy and subheadings, for example) that you can find in a standard text editor like Microsoft Word or Google Docs.

Only pick fonts that are easy to read and contain both capital and lowercase letters.

Avoid script-style or jarring fonts that distract from the actual content. Modern, sans-serif fonts like Helvetica, Arial, and Proxima Nova are a good way to go.

Keep your body copy between 11 and 12-point font size to ensure readability (some fonts are more squint-inducing than others).

You can offset your headings from your body copy by simply upping the font size and by bolding your subheadings.

Sometimes it's better to show instead of just tell.

Assume that your readers are going to skim your plan rather than read it word-for-word and treat it as an opportunity to grab their attention with color graphics, tables, and charts (especially with financial forecasts), as well as product images, if applicable.

This will also help your reader better visualize what your business model is all about.

Need some help with this?

Our business planning wizard comes pre-loaded with a modular business plan template that you can complete in any order and makes it ridiculously easy to generate everything you need from your value proposition, mission statement, financial projections, competitive advantage, sales strategy, market research, target market, financial statements, marketing strategy, in a way that clearly communicates your business idea.

Refine Your Business Plans. Then Refine Them Some More.

Your business isn't static, so why should your business plan be?

Your business strategy is always evolving, and so are good business plans. This means that the early versions of your business plans probably won't (and shouldn't be) your last. The details of even even the best business plans are only as good as their last update.

As your business progresses and your ideas about it shift, it's important revisit your business plan from time to time to make sure it reflects those changes, keeping everything as accurate and up-to-date as possible. What good is market analysis if the market has shifted and you have an entirely different set of potential customers? And what good would the business model be if you've recently pivoted? A revised business plan is a solid business plan. It doesn't ensure business success, but it certainly helps to support it.

This rule especially holds true when you go about your market research and learn something that goes against your initial assumptions, impacting everything from your sales strategy to your financial projections.

At the same time, before you begin shopping your business plan around to potential investors or bankers, it's imperative to get a second pair of eyes on it after you've put the final period on your first draft.

After you run your spell check, have someone with strong “English teacher skills” run a fine-tooth comb over your plan for any spelling, punctuation, and grammatical errors you may have glossed over. An updated, detailed business plan (without errors!) should be constantly in your business goals.

More than that, your trusty business plan critic can also give you valuable feedback on how it reads from a stylistic perspective. While different investors prefer different styles, the key here is to remain consistent with your audience and business.

Writing Your Business Plan: A Section-By-Section Breakdown

We devoted an entire article carefully breaking down the key components of a business plan which takes a comprehensive look of what each section entails and why.

If you haven't already, you should check that out, as it will act as the perfect companion piece to what we're about to dive into in a moment.

For our purposes here, we're going to look at a few real world business plan examples (as well as one of our own self-penned “dummy” plans) to give you an inside look at how to position key information on a section-by-section basis.

1. Executive Summary

Quick overview.

After your Title Page — which includes your company name, slogan (if applicable), and contact information — and your Table of Contents, the Executive Summary will be the first section of actual content about your business.

The primary goal of your Executive Summary is to provide your readers with a high level overview of your business plan as a whole by summarizing the most important aspects in a few short sentences. Think of your Executive Summary as a kind of “teaser” for your business concept and the information to follow — information which you will explain in greater detail throughout your plan. This isn't the place for your a deep dive on your competitive advantages, or cash flow statement. It is an appropriate place to share your mission statement and value proposition.

Executive Summary Example

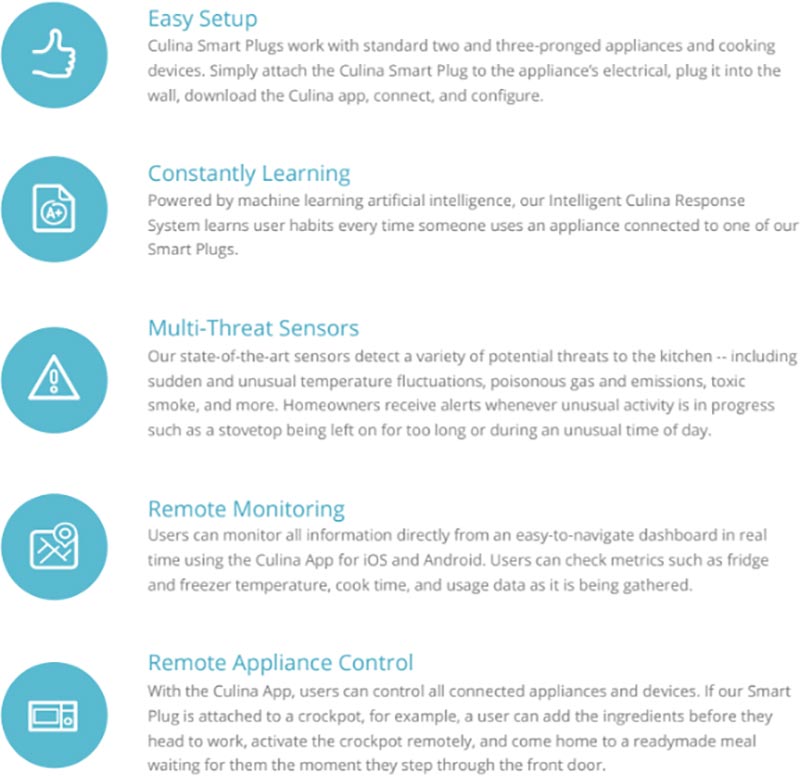

Here's an example of an Executive Summary taken from a sample business plan written by the Startups.com team for a fictional company called Culina. Here, we'll see how the Executive Summary offers brief overviews of the Product , Market Opportunity , Traction , and Next Steps .

Culina Tech specializes in home automation and IoT technology products designed to create the ultimate smart kitchen for modern homeowners.

Our flagship product, the Culina Smart Plug, enables users to make any kitchen appliance or cooking device intelligent. Compatible with all existing brands that plug into standard two or three-prong wall outlets, Culina creates an entire network of Wi-Fi-connected kitchen devices that can be controlled and monitored remotely right from your smartphone.

The majority of US households now spend roughly 35% of their energy consumption on appliances, electronics, and lighting. With the ability to set energy usage caps on a daily, weekly or monthly basis, Culina helps homeowners stay within their monthly utility budget through more efficient use of the dishwasher, refrigerator, freezer, stove, and other common kitchen appliances.

Additionally, 50.8% of house fires are caused in the kitchen — more than any other room in the home — translating to over $5 billion in property damage costs per year. Culina provides the preventative intelligence necessary to dramatically reduce kitchen-related disasters and their associated costs and risk of personal harm.

Our team has already completed the product development and design phase, and we are now ready to begin mass manufacturing. We've also gained a major foothold among consumers and investors alike, with 10,000 pre-ordered units sold and $5 million in investment capital secured to date.

We're currently seeking a $15M Series B capital investment that will give us the financial flexibility to ramp up hardware manufacturing, improve software UX and UI, expand our sales and marketing efforts, and fulfill pre-orders in time for the 2018 holiday season.

2. Company Synopsis

Your Company Synopsis section answers two critically important questions for your readers: What painful PROBLEM are you solving for your customers? And what is your elegant SOLUTION to that problem? The combination of these two components form your value proposition.

Company Synopsis Example

Let's look at a real-life company description example from HolliBlu * — a mobile app that connects healthcare facilities with local skilled nurses — to see how they successfully address both of these key aspects. *Note: Full disclosure; Our team worked directly with this company on their business plan via Fundable.

Notice how we get a crystal clear understanding of why the company exists to begin with when they set up the problem — that traditional nurse recruitment methods are costly, inconvenient, and time-consuming, creating significant barriers to providing quality nursing to patients in need.

Once we understand the painful problem that HolliBlu's customers face, we're then directly told how their solution links back directly to that problem — by creating an entire community of qualified nurses and directly connecting them with local employers more cost-effectively and more efficiently than traditional methods.

3. Market Overview

Your Market Overview provides color around the industry that you will be competing in as it relates to your product/service.

This will include statistics about industry size, [growth](https://www.startups.com/library/expert-advice/the-case-for-growing-slowly) rate, trends, and overall outlook. If this part of your business plan can be summed up in one word, it's research .

The idea is to gather as much raw data as you can to make the case for your readers that:

This is a market big enough to get excited about.

You can capture a big enough share of this market to get excited about.

Target Market Overview Example

Here's an example from HolliBlu's business plan:

HolliBlu's Market Overview hits all of the marks — clearly laying out the industry size ($74.8 billion), the Total Addressable Market or TAM (3 million registered nurses), industry growth rate (581,500 new RN jobs through 2018; $355 billion by 2020), and industry trends (movement toward federally-mandated compliance with nurse/patient ratios, companies offering sign-on bonuses to secure qualified nurses, increasing popularity of home-based healthcare).

4. Product (How it Works)

Where your Company Synopsis is meant to shed light on why the company exists by demonstrating the problem you're setting out to solve and then bolstering that with an impactful solution, your Product or How it Works section allows you to get into the nitty gritty of how it actually delivers that value, and any competitive advantage it provides you.

Product (How it Works) Example

In the below example from our team's Culina sample plan, we've divided the section up using subheadings to call attention to product's key features and how it actually works from a user perspective.

This approach is particularly effective if your product or service has several unique features that you want to highlight.

5. Revenue Model

Quite simply, your Revenue Model gives your readers a framework for how you plan on making money. It identifies which revenue channels you're leveraging, how you're pricing your product or service, and why.

Revenue Model Example

Let's take a look at another real world business plan example with brewpub startup Magic Waters Brewpub .*

It can be easy to get hung up on the financial aspect here, especially if you haven't fully developed your product yet. And that's okay. *Note: Full disclosure; Our team worked directly with this company on their business plan via Fundable.

The thing to remember is that investors will want to see that you've at least made some basic assumptions about your monetization strategy.

6. Operating Model

Your Operating Model quite simply refers to how your company actually runs itself. It's the detailed breakdown of the processes, technologies, and physical requirements (assets) that allow you to deliver the value to your customers that your product or service promises.

Operating Model Example

Let's say you were opening up a local coffee shop, for example. Your Operating Model might detail the following:

Information about your facility (location, indoor and outdoor space features, lease amount, utility costs, etc.)

The equipment you need to purchase (coffee and espresso machines, appliances, shelving and storage, etc.) and their respective costs.

The inventory you plan to order regularly (product, supplies, etc.), how you plan to order it (an online supplier) and how often it gets delivered (Mon-Fri).

Your staffing requirements (including how many part or full time employees you'll need, at what wages, their job descriptions, etc.)

In addition, you can also use your Operating Model to lay out the ways you intend to manage the costs and efficiencies associated with your business, including:

The Critical Costs that make or break your business. In the case of our coffee shop example, you might say something like,

“We're estimating the marketing cost to acquire a customer is going to be $25. Our average sale is $45. So long as we can keep our customer acquisition costs below $25 we will have enough margin to grow with.”

Cost Maturation & Milestones that show how your Critical Costs might fluctuate over time.

“If we sell 50 coffees a day, our average unit cost will be $8 on a sale of $10. At that point we're barely breaking even. However as we scale up to 200 coffees a day, our unit costs drop significantly to $4, creating a 100% increase in net income.”

Investment Costs that highlight strategic uses of capital that will have a big Return on Investment (ROI) later.

“We're investing $100,000 into a revolutionary new coffee brewing system that will allow us to brew twice the amount our current output with the same amount of space and staff.”

Operating Efficiencies explaining your capability of delivering your product or service in the most cost effective manner possible while maintaining the highest standards of quality.

“By using energy efficient Ecoboilers, we're able to keep our water hot while minimizing the amount of energy required. Our machines also feature an energy saving mode. Both of these allow us to dramatically cut energy costs.”

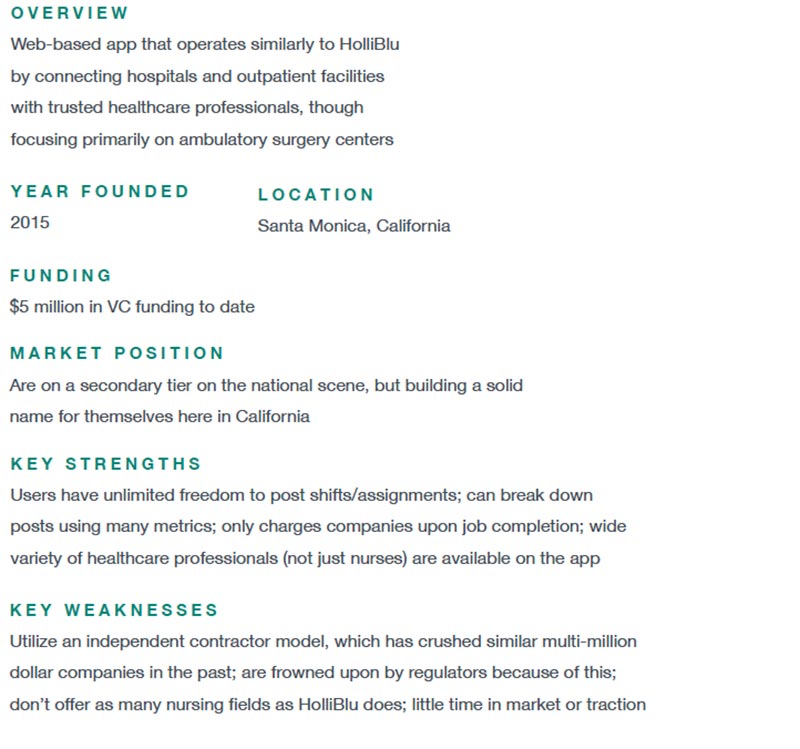

7. Competitive Analysis

Like the Market Overview section, you want to show your readers that you've done your homework and have a crazy high level of awareness about your current competitors or any potential competitors that may crop up down the line for your given business model.

When writing your Competitive Analysis, your overview should cover who your closest competitors are, the chief strengths they bring to the table, and their biggest weaknesses .

You'll want to identify at least 3 competitors — either direct, indirect, or a combination of the two. It's an extremely important aspect of the business planning process.

Competition Analysis Example

Here's an example of how HolliBlu lays out their Competitive Analysis section for just one of their competitors, implementing each of the criteria noted above:

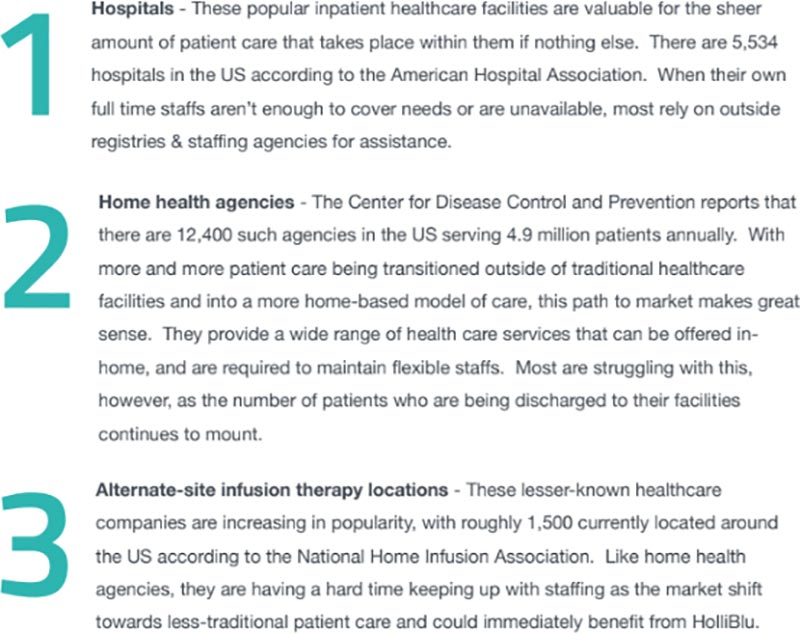

8. Customer Definition

Your Customer Definition section allows you to note which customer segment(s) you're going after, what characteristics and habits each customer segment embodies, how each segment uniquely benefits from your product or service, and how all of this ties together to create the ideal portrait of an actual paying customer, and how you'll cultivate and manage customer relationships.

Customer Definition Example

HolliBlu's Customer Definition section is effective for several reasons. Let's deconstruct their first target market segment, hospitals.

What's particularly successful here is that we are explained why hospitals are optimal buyers.

They accomplish this by harkening back to the central problem at the core of the opportunity (when hospitals can't supply enough staff to meet patient demands, they have to resort on costly staffing agencies).

On top of that, we are also told how big of an opportunity going after this customer segment represents (5,534 hospitals in the US).

This template is followed for each of the company's 3 core customer segments. This provides consistency, but more than that, it emphasizes how diligent research reinforces their assumptions about who their customers are and why they'd open their wallets. Keep all of this in mind when you are write your own business plan.

9. Customer Acquisition

Now that you've defined who your customers are for your readers, your Customer Acquisition section will tell them what marketing and sales strategy and tactics you plan to leverage to actually reach the target market (or target markets) and ultimately convert them into paying customers.

marketing Strategy Example

Similar to the exercise you will go through with your Revenue Model, in addition to identifying which channels you're pursuing, you'll also want to detail all of relevant costs associated with your customer acquisition channels.

Let's say you spent $100 on your marketing plan to acquire 100 customers during 2018. To get your CAC, you simply divide the number of customers acquired by your spend, giving you a $1.00 CAC.

10. Traction

This one's huge. Traction tells investors one important thing: that you're business has momentum. It's evidence that you're making forward progress and hitting milestones. That things are happening. It's one of the most critical components of a successful business plan.

Why is this so important? Financial projections are great and all, but if you can prove to investors that your company's got legs before they've even put a dime into it, then it will get them thinking about all the great things you'll be able to accomplish when they do bankroll you.

Traction Example

In our Culina Traction section, we've called attention to several forms of traction, touching on some of the biggest ones that you'll want to consider when writing your own plan.

Have I built or launched my product or service yet?

Have I reached any customers yet?

Have I generated any revenue yet?

Have I forged any strategic industry relationships that will be instrumental in driving growth?

The key takeaway here: the more traction you can show, the more credibility you build with investors. After all, you can't leave it all on market analysis alone.

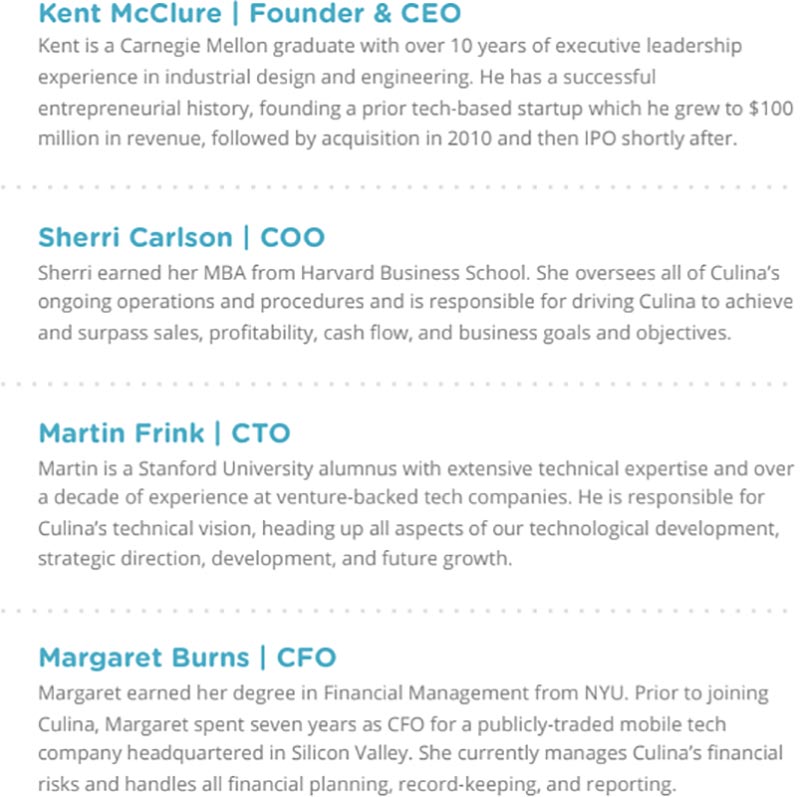

11. Management Team

Here's what your Management Team section isn't: it's not an exhaustive rundown of each and every position your team members have held over the course of their lives.

Instead, you should tell investors which aspects of your team's experience and expertise directly translates to the success of this company and this industry.

In other words, what applicable, relevant background do they bring to the table?

Management Team Example

Let's be real. The vast majority of startup teams probably aren't stacked with Harvard and Stanford grads. But the thing to home in on is how the prior experience listed speaks directly to how it qualifies that team member's current position.

The word of the day here is relevancy. If it's not relevant, you probably don't need to include it in your typical business plan.

12. Funding

Funding overview.

The ask! This is where you come out and, you guessed it, ask your investors point blank how much money you need to move your business forward, what specific milestones their investment will allow you to reach, how you'll allocate the capital you secure, and what the investor will get in exchange for their investment.

You can also include information about your exit strategy (IPO, acquisition, merger?).

Funding Example

While we've preached against redundancy in your business plan, an exception to the rule is using the Funding section to offer up a very brief recap that essentially says, “here are the biggest reasons you should invest in my company and why it will ultimately benefit you.”

13. Financials

Spreadsheets and numbers and charts, oh my! Yes, it's everybody's “favorite” business plan section: Financials.

Your Financials section will come last and contain all of the forecasted numbers that say to investors that this is a sound investment. This will include things like your sales forecast, expense budget, and break-even analysis. A lot of this will be assumptions, or estimates.

The key here is keeping those estimates as realistic as humanly possible by breaking your figures into components and looking at each one individually.

Financials Example

The balance sheet above illustrates the business' estimated net worth over a three-year period by summarizing its assets (tangible objects owned by the company), liabilities (debt owed to a creditor of the company), and shareholders' equity (source of financing used to fund the assets).

In plain words, the balance sheet is basically a snapshot of your business' financial status by laying out what you own and owe, helping investors determine the level of risk involved and giving them a good understanding of the financial health of the business.

If you're looking to up your game from those outdated Excel-style spreadsheets, our business planning software will help you create clean, sleek, modern financial reports the modern way. Plus, it's as easy to use as it is attractive to look at. You might even find yourself enjoying financial projections, building a cash flow statement, and business planning overall.

You've Got This!

You've committed to writing your business plan and now you've got some tricks of the trade to help you out along the way. Whether you're applying for a business loan or seeking investors, your well-crafted business plan will act as your Holy Grail in helping take your business goals to the next plateau.

This is a ton of work. It's not a few hours and a free business plan template. It's not just a business plan software. We've been there before. Writing your [business plan](https://www.startups.com/library/expert-advice/top-4-business-plan-examples) is just one small step in startup journey. There's a whole long road ahead of you filled with a marketing plan, investor outreach, chasing venture capitalists, actually getting funded, and growing your business into a successful company.

And guess what? We've got helpful information on all of it — and all at your disposal! We hope this guides you confidently on how to write a business plan worth bragging about.

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

COMMENTS

A good business plan guides you through each stage of starting and managing your business. You’ll use your business plan as a roadmap for how to structure, run, and grow your new business. It’s a way to think through the key elements of your business.

Read our simple guide to learn how to write a business plan quickly and easily. A solid business plan is essential for any new business.

What Is a Business Plan? A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and...

Quite simply, a business plan is a detailed roadmap of your business — a written document that communicates to readers and potential investors what your business goals are and the steps that you plan on taking to achieve them.

A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors.

A comprehensive, step-by-step guide - complete with real examples - on writing business plans with just the right amount of panache to catch an investor's attention and serve as a guiding star for your business.