- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Financial Services Associate Resume Examples

Writing a resume as a Financial Services Associate can be a challenge as the position involves a wide breadth of skills and knowledge. It is important to present your expertise in a manner that shows potential employers how your experience and abilities can be beneficial to their organizations. This guide provides information on how to write a Financial Services Associate resume, including advice on structure, content, and formatting. Additionally, examples of resumes from successful Financial Services Associates are included to provide inspiration and best practices. By using this guide, you will be able to craft a resume that catches the attention of employers and sets you apart from other applicants.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

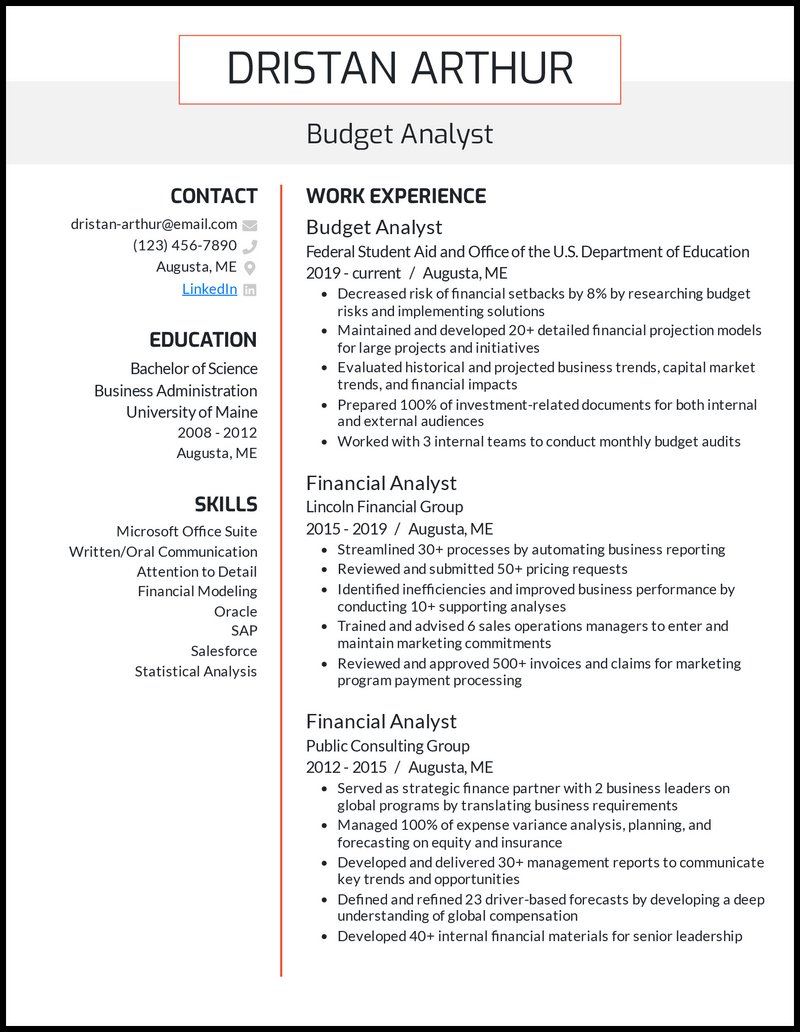

Financial Services Associate

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

Highly motivated and experienced Financial Services Associate with five years of experience in the industry. Possess a B.S. in Business and Economics from ABC University and a solid understanding of financial services and products. Have a proven track record of providing excellent customer service and helping clients understand their financial options. Possess excellent communication and customer service skills, as well as the ability to develop and maintain relationships with clients.

Core Skills :

- Financial Product Knowledge

- Customer Service

- Relationship Building

- Problem Solving

- Communication

- Computer Proficiency

- Organization

Professional Experience : ABC Financial Services, City, State Financial Services Associate, 2015- 2020

- Worked with clients to assist them in understanding their financial services and to answer their questions and concerns.

- Developed and maintained customer relationships, resulting in increased customer loyalty and satisfaction.

- Evaluated clients’ financial information and needs, and provided advice and recommendations on the most suitable products and services.

- Developed and implemented customer service strategies that consistently exceeded customer expectations.

- Provided outstanding customer service to ensure clients’ satisfaction with their financial services.

Education : ABC University, City, State B.S. in Business and Economics, 2015

Create My Resume

Build a professional resume in just minutes for free.

Financial Services Associate Resume with No Experience

Recent college graduate with a degree in finance, looking to gain experience as a Financial Services Associate. Possess strong analytical and communication skills, as well as a proven ability to work collaboratively and efficiently.

- Financial analysis

- Data processing

- Financial reporting

- Account management

- Financial modeling

- Financial planning

- Risk management

- Problem solving

- Account reconciliation

Responsibilities :

- Conduct research to provide clients with accurate information and financial reports

- Manage customer accounts to ensure that all financial documents are up to date and accurate

- Analyze financial data to identify trends and make recommendations for improvement

- Develop and implement budgeting and forecasting models to track financial performance

- Assist clients in selecting appropriate financial products and services

- Process and reconcile financial transactions

- Provide customer service and guidance to clients on financial matters

- Stay current on industry trends and applicable regulations

Experience 0 Years

Level Junior

Education Bachelor’s

Financial Services Associate Resume with 2 Years of Experience

Highly motivated and detail- oriented Financial Services Associate with 2+ years of experience. Experienced in providing exceptional customer service, executing financial transactions, and developing strategic plans and solutions. Adept in analyzing and interpreting data, resolving customer inquiries and complaints, and utilizing financial software. Highly skilled in balancing multiple tasks, managing projects and deadlines, and adapting to changing work environments.

- Financial Analysis

- Financial Modeling

- Data Analysis

- Account Reconciliation

- Problem- Solving

- Project Management

- Regulatory Compliance

- Risk Management

- Performed complex financial analysis and developed financial models to assess financial performance and measure financial risk.

- Conducted data analysis and account reconciliation to ensure accuracy and completeness of financial transactions.

- Developed solutions and strategic plans to meet customer needs, resolve customer inquiries, and address customer complaints.

- Managed multiple projects and deadlines through advanced planning and organizational skills.

- Ensured compliance with regulatory guidelines and risk management protocols.

- Provided exceptional customer service to retain existing clients and promote new business.

Experience 2+ Years

Financial Services Associate Resume with 5 Years of Experience

A highly qualified and motivated Financial Services Associate with 5 years of experience in providing comprehensive financial services, including financial counseling, portfolio management, asset management, and budgeting. Possesses excellent communication and customer service skills, adept at developing and maintaining relationships with clients. Accumulated a great deal of knowledge in risk assessment, portfolio planning and management, and compliance regulations. Highly organized, reliable and efficient in completing tasks with accuracy and paying close attention to detail.

- Financial Counseling

- Risk Assessment

- Portfolio Planning and Management

- Compliance Regulations

- Asset Management

- Provided financial counseling to clients on managing their finances and investments.

- Assisted clients with understanding and evaluating various financial instruments.

- Monitored stock, bond, and mutual fund performance and kept clients informed of changes.

- Developed and managed risk assessment and portfolio planning models.

- Complied with all regulations regarding investment management.

- Identified and reported any suspicious activities to the proper authorities.

- Provided customer service to address client inquiries and complaints.

- Prepared and presented financial summaries and reports to clients.

- Created and maintained financial budgets and accounts.

Experience 5+ Years

Level Senior

Financial Services Associate Resume with 7 Years of Experience

Dynamic and detail- oriented Financial Services Associate with 7 years of experience in the finance industry. Adept at analyzing financial data, creating reports and presenting complex financial information in an understandable format. Hands- on experience in assisting clients with various financial services, such as investments, banking, insurance, retirement planning and tax preparation. Committed to providing the highest quality of customer service and delivering excellent results.

- Financial presentations

- Investment planning

- Banking services

- Insurance services

- Tax preparation

- Retirement planning

- Customer service

- Regulatory compliance

- Problem- solving

- Reviewed and analyzed financial data and documents to provide accurate and timely financial services to clients.

- Prepared financial reports and presentations for clients to present to potential investors.

- Assisted clients with investment planning, banking services, insurance services, retirement planning and tax preparation.

- Provided accurate and up to date information on financial trends in order to ensure the best possible financial services.

- Maintained effective communication with clients to ensure the highest level of customer service.

- Ensured compliance with all applicable regulations when providing financial services.

- Resolved any financial related customer issues quickly and efficiently.

- Entered financial data into the system accurately and efficiently.

Experience 7+ Years

Financial Services Associate Resume with 10 Years of Experience

Hardworking Financial Services Associate with 10 years of experience in the banking industry. Skilled in developing and maintaining client relationships, managing accounts, and utilizing financial software to ensure accuracy. A creative problem solver with a passion for improving processes and serving customers.

Core Skills

- Client Relationship Management

- Financial Software Utilization

- Account Management

- Process Improvement

Responsibilities

- Responded to customer inquiries and requests in a timely and accurate manner.

- Analyzed and managed customer accounts with a focus on accuracy and compliance.

- Built and maintained positive relationships with customers and other stakeholders.

- Utilized financial software to track and monitor account activity.

- Assisted banking staff with processing and auditing financial documents and data.

- Developed and implemented process improvements to optimize customer service and efficiency.

- Investigated and resolved customer complaints in a professional manner.

- Generated and presented reports to senior staff on customer accounts.

- Trained new staff on customer service and banking procedures.

Experience 10+ Years

Level Senior Manager

Education Master’s

Financial Services Associate Resume with 15 Years of Experience

Financial Services Associate with 15 years of experience providing comprehensive financial services for a variety of clients. Skilled in financial analysis, client relations, trust management, portfolio administration, and transaction management. Proven ability to satisfy complex client needs, balance multiple tasks, and ensure compliance with regulations.

- Client Relations

- Trust Management

- Portfolio Administration

- Transaction Management

- Data Management

- Gathered and interpreted financial data to provide sound financial advice to clients.

- Managed client portfolios and trust accounts, ensuring accurate and timely reporting.

- Conducted extensive financial analysis to assess and recommend appropriate courses of action.

- Monitored market activities and provided recommendations for portfolio adjustments.

- Developed and maintained positive relationships with clients, responding promptly to inquiries and resolving any issues.

- Analyzed financial records and ensured regulatory compliance.

- Managed data and maintained accurate records of client accounts.

- Prepared and delivered presentations on portfolio performance and risk management strategies.

Experience 15+ Years

Level Director

In addition to this, be sure to check out our resume templates , resume formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

What should be included in a Financial Services Associate resume?

A Financial Services Associate resume should showcase the skills and experience needed to work in a financial services environment. It should also convey your ability to manage client relationships, provide financial services, and help customers reach their financial goals.

When crafting a Financial Services Associate resume, here are some of the key qualities and skills you should include:

- Strong knowledge of financial services products, regulations, and procedures.

- Excellent customer service skills, including the ability to respond to inquiries and resolve customer problems.

- Proficiency in various financial software products and applications.

- Experience in building and maintaining client relationships.

- Ability to analyze financial data and make recommendations.

- Strong communication and interpersonal skills.

- Detail-oriented and organized approach to work.

- Strong problem-solving and decision-making skills.

- Ability to work independently and as part of a team.

- Ability to meet deadlines and work under pressure.

In addition to highlighting these skills, your Financial Services Associate resume should include educational qualifications and relevant work experience, as well as any professional certifications or licenses you may possess. It should also include a summary of your professional accomplishments, such as awards you have won or projects you have completed. Finally, you should include references from past employers and colleagues who can speak to your qualifications and performance.

Writing an effective Financial Services Associate resume is a key part of the job search process, and by including the right skills and qualifications, you can increase your chances of landing the job you want.

What is a good summary for a Financial Services Associate resume?

A Financial Services Associate is responsible for providing customer service and support to clients related to their financial investments and products. The resume of a Financial Services Associate should showcase their qualifications and experience in the financial services industry as well as their strong communication and client relationship skills.

A good summary for a Financial Services Associate resume should highlight the candidate’s education and experience in the financial services industry, as well as their interpersonal skills and ability to work with a wide range of clients. Additionally, the summary should emphasize the candidate’s ability to assess clients’ needs, provide suitable solutions, and achieve customer satisfaction. The summary should also provide evidence of the candidate’s ability to effectively manage client accounts and their financial portfolios. Finally, the summary should mention the candidate’s strong problem-solving skills, as well as their commitment to providing the highest quality of service to customers.

What is a good objective for a Financial Services Associate resume?

A financial services associate is responsible for providing customer service to clients and implementing banking guidelines, making it a career with a wide range of responsibilities. A good objective on a financial services associate resume should reflect this diversity and highlight the applicant’s strongest skill set.

When crafting a financial services associate resume objective, include the following:

- Demonstrate strong knowledge of banking regulations, customer service standards, and financial strategies

- Excellent written and verbal communication skills with customers and co-workers

- Maintain accurate records and customer records

- Identify and resolve customer issues and inquiries quickly and effectively

- Remain flexible and adaptive in a fast-paced environment

- Develop customer relations and foster customer loyalty

- Adhere to banking guidelines and protocols

- Follow policies and procedures to ensure compliance

- Utilize problem-solving skills to address customer concerns and inquiries

- Prioritize customer service and customer satisfaction

By incorporating these qualities and skills into your resume objective, you will be able to showcase your qualifications and demonstrate your value to prospective employers.

How do you list Financial Services Associate skills on a resume?

When crafting your resume as a Financial Services Associate, it’s important to include the right skills and experiences to showcase your expertise. Here are some tips on how to list your skills to demonstrate your background and capabilities in the financial services industry.

- Start by providing an overview of who you are and your experience in the financial services industry. This is a good place to list any certifications you may have, such as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Next, provide a list of specific skills that are relevant to the role of Financial Services Associate. These should include technical skills such as budgeting, investing, financial analysis, and financial planning. It is also important to include soft skills such as communication, problem-solving, and customer service.

- Finally, list any experience you may have working in the financial services industry, as well as any relevant education or courses you may have taken. This could include internships, volunteering, or other professional experiences.

By following these tips, you can make sure that your resume accurately reflects your experience and expertise in the financial services industry. With the right skills and experiences highlighted, you can demonstrate to employers that you are the ideal candidate for the job.

What skills should I put on my resume for Financial Services Associate?

Financial services associates are a key role in the financial sector, providing support to customers and helping them manage their finances. To maximize your career success as a financial services associate, it is important to have a comprehensive resume that clearly outlines your relevant qualifications and experience.

When drafting your resume, it is important to include the skills and qualifications that make you the best candidate for the job. Here are some of the key skills you should include on your resume when applying for a financial services associate position:

- Strong Math Skills: Financial services associates must be proficient in basic math in order to understand and process financial transactions, as well as work with customers to make educated decisions about their finances.

- Knowledge of Financial Products: To be successful in a financial services associate role, it is important to have a working knowledge of the various financial products and banking products available on the market.

- Analytical Thinking: Financial services associates must be able to assess customer financial needs and make informed recommendations. Having strong analytical skills is essential in order to make sound decisions about customers’ money.

- Technical Proficiency: Financial services associates must be proficient with technology and banking software in order to process customer transactions and provide the best customer experience.

- Customer Service: Financial services associates must have excellent customer service skills in order to effectively build relationships with customers and provide customer support.

- Time Management: Financial services associates must be able to juggle multiple tasks while still meeting customer deadlines. Strong time management skills are essential in order to provide a customer-focused experience.

By including these key skills on your resume, you can demonstrate to employers that you are the right candidate for the job. With the right qualifications and experience, you can be successful in a financial services associate role.

Key takeaways for an Financial Services Associate resume

A Financial Services Associate resume must include a number of key elements to effectively showcase your skills and experience to potential employers. Here are some key takeaways to keep in mind when crafting your resume:

- Highlight Your Relevant Skills: Your resume should emphasize the skills and experiences that make you a strong candidate for the Financial Services Associate role. This could include proficiency in financial software, investment research, customer service, and data analysis.

- Showcase Your Professional Accomplishments: Be sure to include any relevant awards, certifications, or accomplishments you have achieved in the Financial Services industry. This will demonstrate your commitment to the profession and give potential employers confidence in your ability to excel in the role.

- Demonstrate Your Financial Acumen: Your resume should include details on any relevant financial projects you have worked on, or any financial-related courses you have taken. This will demonstrate your commitment to the field and your understanding of the complexities of the role.

- Outline Your Education: If you have any academic credentials related to Financial Services, be sure to include this information on your resume. This could include a degree in a financial-related field, or any courses related to the profession.

- Include Your Professional Experience: Include detailed information on any experience that you have in the Financial Services industry. This could include internships, job roles, or volunteer work.

By including all of these elements on your Financial Services Associate resume, you can effectively showcase your qualifications and experience to potential employers. This will ensure that you are considered for the role and will increase the chances of being called for an interview.

Let us help you build your Resume!

Make your resume more organized and attractive with our Resume Builder

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

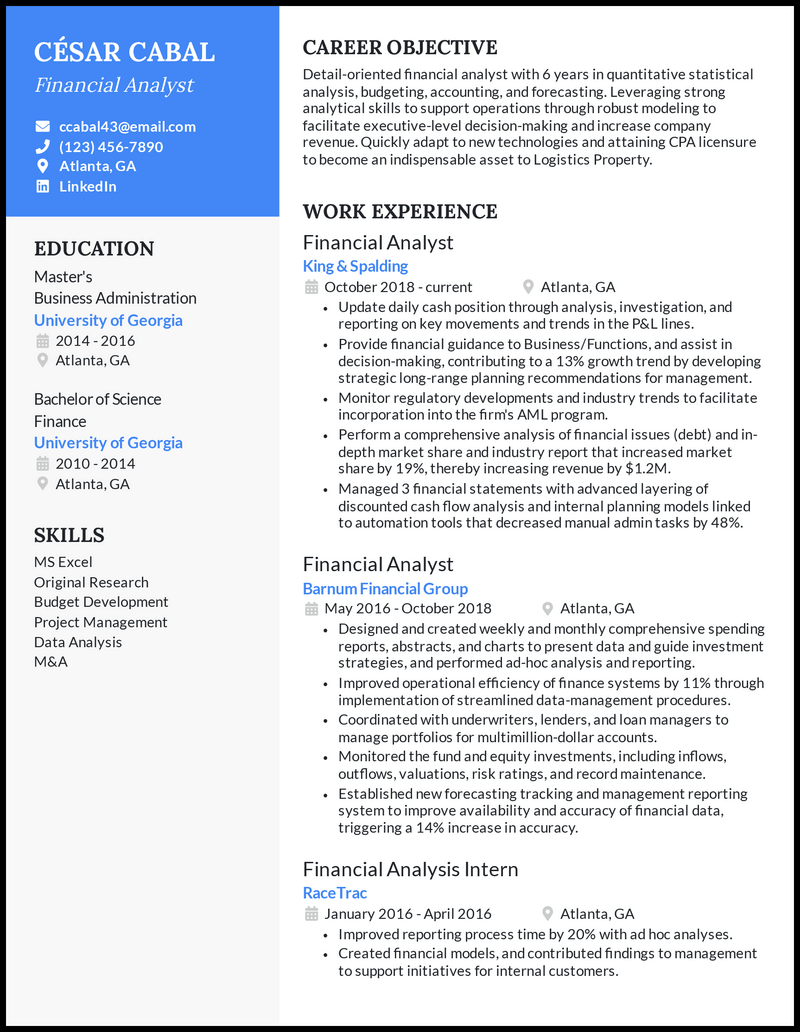

13 Real Financial Analyst Resume Examples That Worked in 2024

- Financial Analyst Resume

- Financial Analyst Resumes by Experience

- Financial Analyst Resumes by Role

Writing Your Financial Analyst Resume

Financial analysts have different duties and responsibilities based on seniority level and business sector, making it hard to decide what to include on your financial analyst resume when applying for that dream finance job.

You must also know how to format your resume , what information to include, and what projects to highlight to attract the attention of a hiring manager or recruiter.

We’ve meticulously researched and analyzed countless financial analyst resume samples from all career stages in different industries, resulting in the creation of 13 resume samples to help you create a resume and land more interviews in 2024 . Plus, our writing guide will give you plenty of resume tips so you hit the right note every time!

Financial Analyst Resume Example

or download as PDF

Why this resume works

- Run your resume through a resume checker to ensure you include enough stats and don’t have grammar or punctuation errors, but don’t forget to check it yourself!

- Don’t forget to include your projections and forecasts! Focus your financial analyst resume experience on how close your projections and forecasts were for the company and “how” those accurate projections and forecasts helped the business.

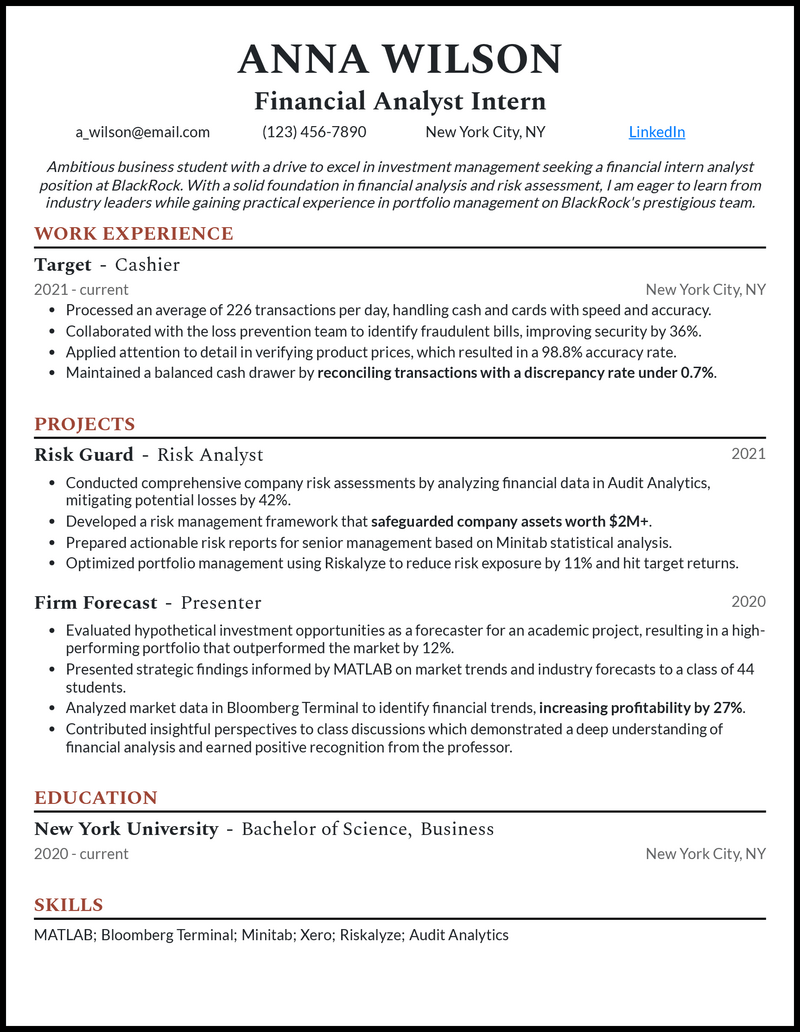

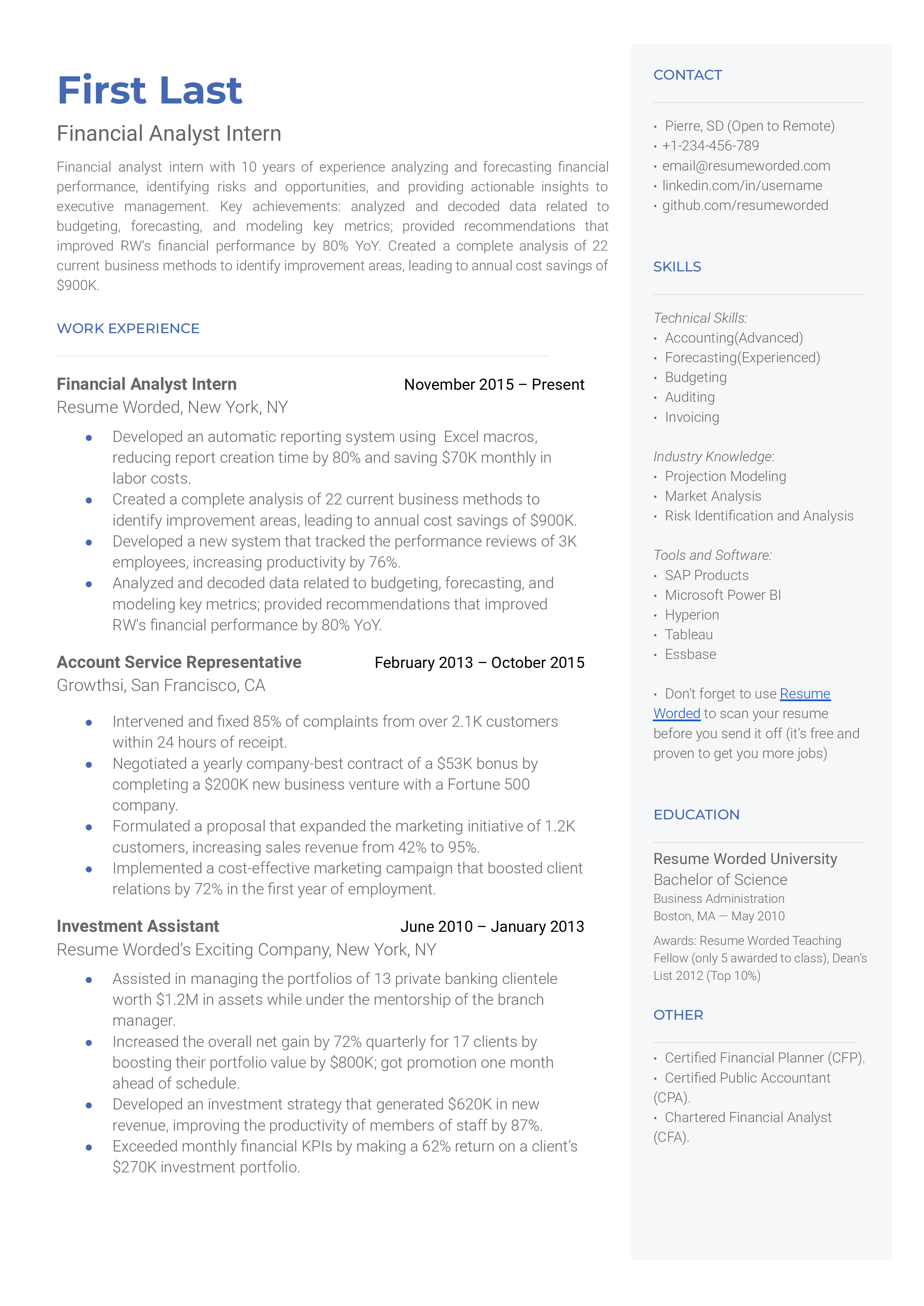

Financial Analyst Intern Resume

- Detail your academic projects in risk analysis and forecasting to demonstrate well-rounded experience on your financial analyst intern resume.

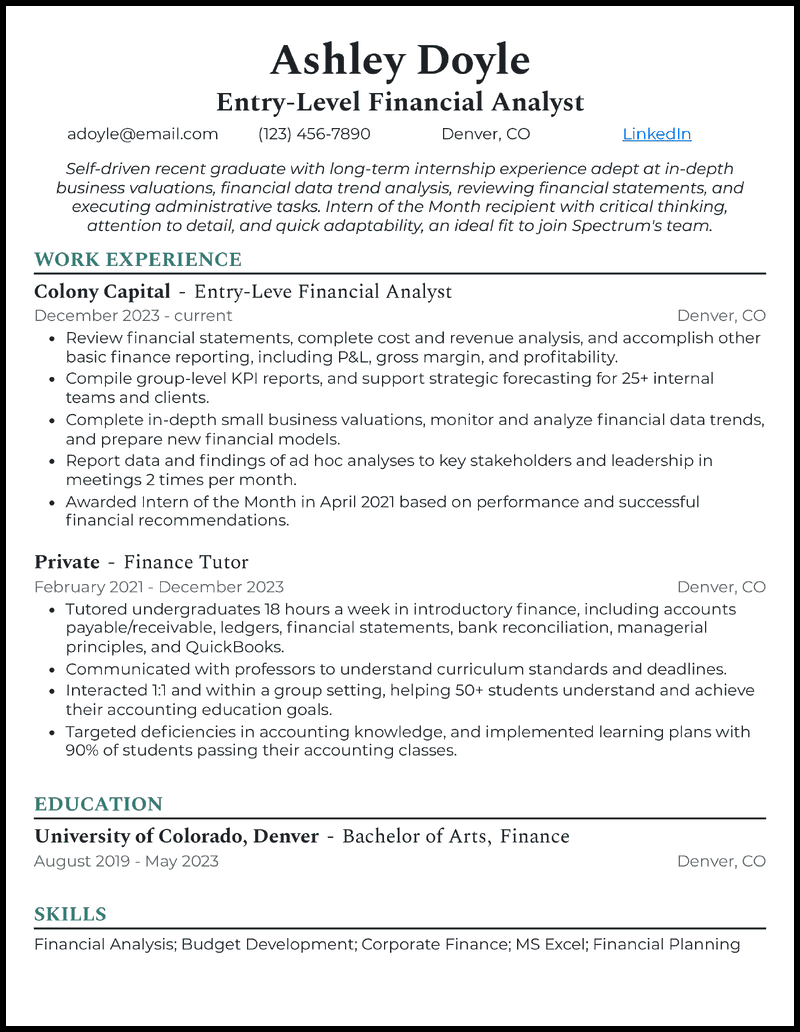

Entry-Level Financial Analyst Resume

- Even if you don’t have the technical skills required, skills like communication, data reporting, and scheduling show employers you’re organized, detail-oriented, and able to work together in a team.

- Be proud of your experience; hiring managers understand (and want to see) that we all started someplace.

- Always tailor this section to each job to which you apply. Include the name of the company, the job title you’re applying for, and skills mentioned in the job description.

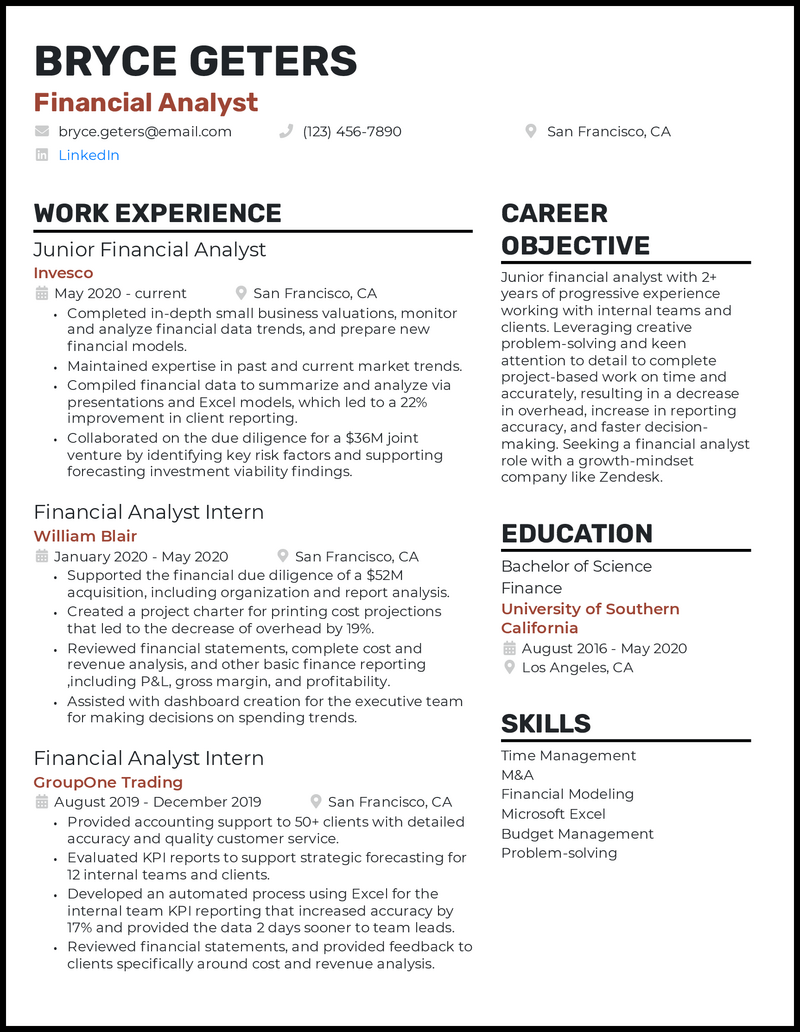

Junior Financial Analyst Resume

- Yes, yes, we know it’s tedious, but it’s vital. You don’t have to spend hours on it, either; simply do some research on the company and scan the financial analyst job description , then include relevant keywords on your junior financial analyst resume.

- Be sure to include the type of reports you created and the impact of your work (that’s where you can include metrics).

Senior Financial Analyst Resume

- Don’t be afraid to brag about your team’s size, your project’s budget, the number of projects you completed on time.

- And if you can, list how those projects have directly impacted the team, the company, and its clients.

- Skills like “financial modeling,” “budget management,” and “SQL,” are all fantastic additions to your resume!

International Financial Analyst Resume

- Your most recent (job-relevant) role, provided it’s related, should top your resume’s work experience section. From there, let other positions line up behind it like well-behaved ducks, in a descending order. The end goal? To accentuate your most relevant skills and experience and demonstrate a clear path of your career trajectory.

Financial Reporting Analyst Resume

- To steal the spotlight, you need the perfect resume format. How about fonts that don’t require a magnifying glass to read and look modern—think Arial or Calibri? And don’t forget about some breathing room on your page (a.k.a. white space) and short, easy-to-parse section headings that actually tell something useful.

Chartered Financial Analyst Resume

- Reiterate your professional value on your chartered financial analyst resume by going beyond your best investments and drawing attention to your track record with clients.

- Try employing story-telling techniques in your financial analyst cover letter to demonstrate your success with clients.

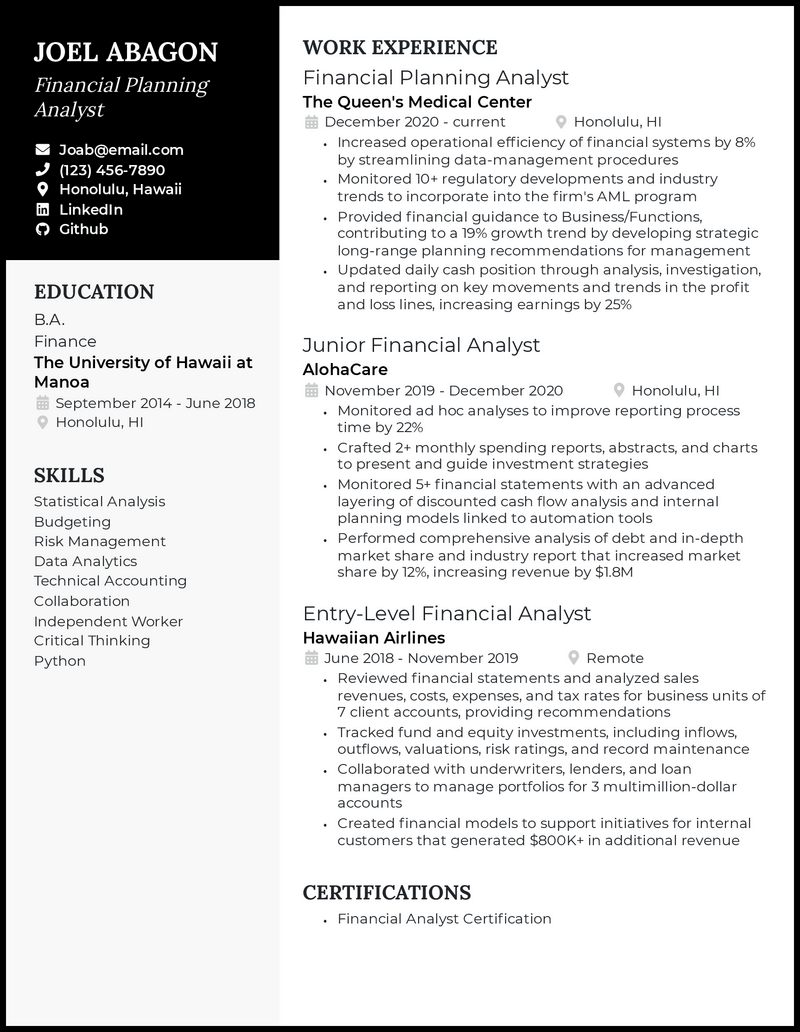

Financial Planning Analyst Resume Example

- It may be difficult to include specific bullet points for all your areas of aptitude, so pick and choose your skills based on the job description.

- This format lets hiring managers see your most recent (and probably most relevant) work experience first.

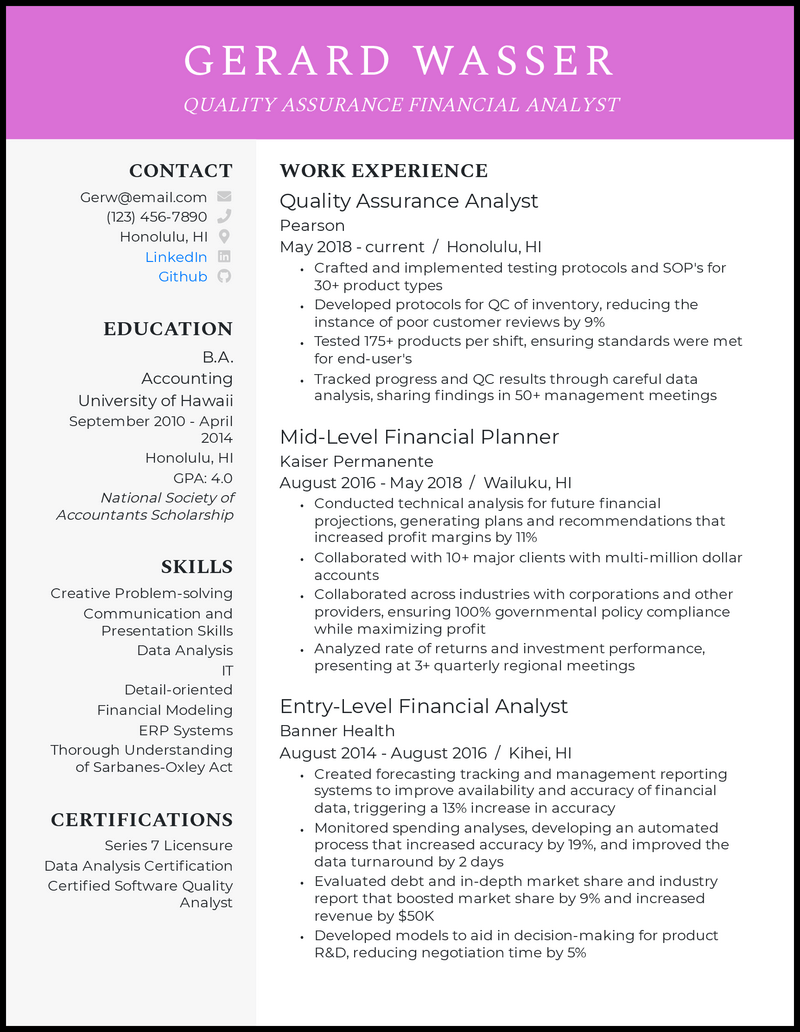

Quality Assurance Financial Analyst Resume

- If you don’t have certifications, you can add awards instead. If the certificate or award isn’t well known, you should add the organization that issues the certification.

- Each templates come with their own pros and cons, especially when it comes to length. Some formats allow for longer content while others focus more on other sections, so try out a couple to see what works.

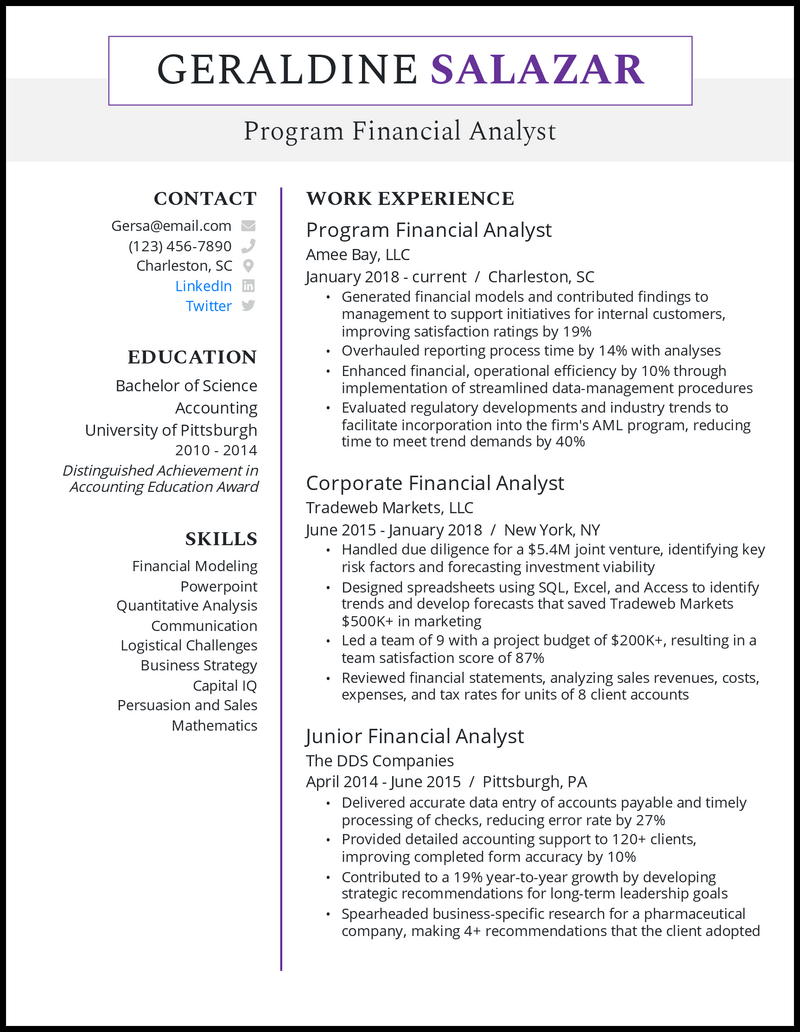

Program Financial Analyst Resume

- If you target your bullet points for each job to which you apply, hiring managers are more likely to give you an interview over a generalist resume.

- When it comes to tailoring, look at the financial analyst job description ; does it focus on data analysis, modeling, and presentations, or is there more emphasis on team leadership, ROI, and accounts payable?

- You can categorize your bullet points by necessary skills so when the job application focuses more on one skill over another, you’re ready!

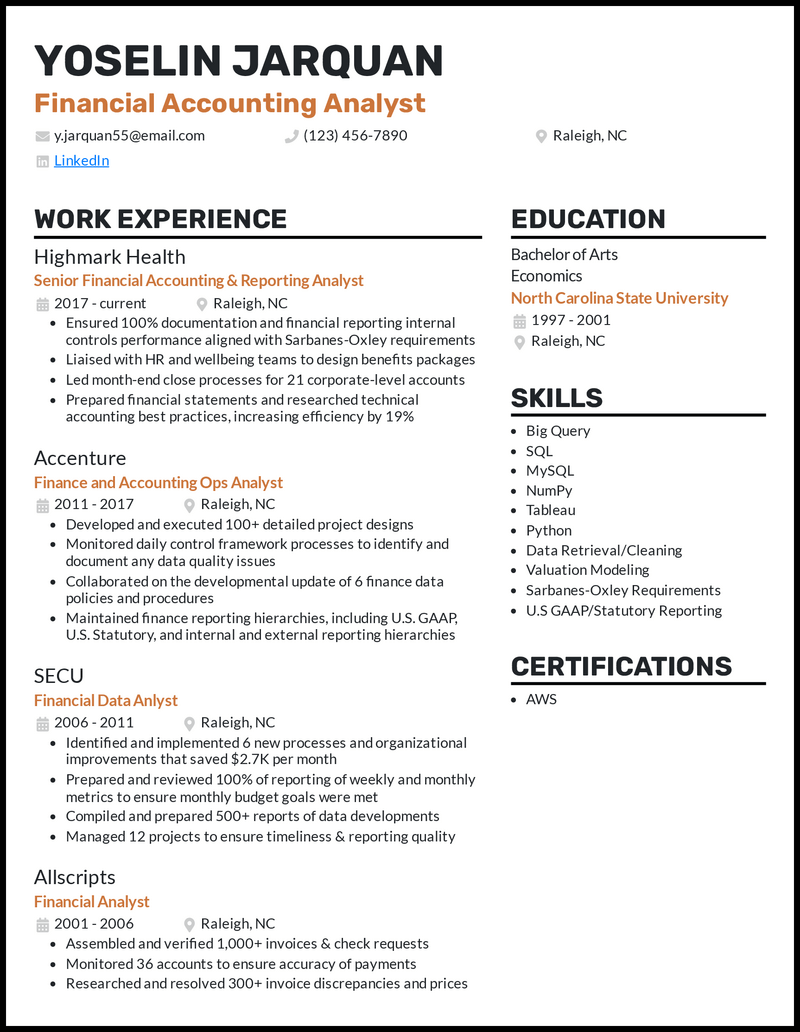

Financial Accounting Analyst Resume

- Since financial accounting analysts use their expertise to assess current situations and give financial advice, use clear metrics like project and initiative quantities, improvement percentages, and company savings.

- Even using a simple pop of color in some of your headers can make your resume more memorable (and easier to read, too).

Budget Analyst Resume

- Limiting your work experience roles lets you include details like the number and type of projects that you handled like a champ.

- Don’t worry if you have too many jobs to list on your budget analyst resume . You only need to show three to four of your most relevant roles.

- When you provide quantifiable achievements in your experience section, think of which programs or skills you used and highlight those.

Related resume guides

- Investment Banking

You might be tempted to think that the only thing that matters on your resume is the content, but proper resume formatting is almost as important. Even if you have decades of impressive financial analyst experience, it’ll be hard for a hiring manager to look past poor formatting. A well-formatted resume will be readable for ATS and logical for hiring managers who only have a few moments in their day to look at your resume.

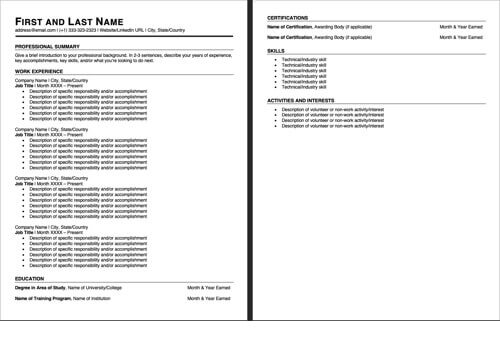

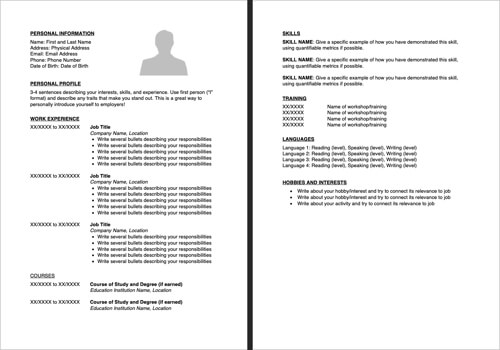

Let’s review some of the most important aspects of resume formatting, including:

- Resume formatting choices

How to include your contact information

Outwit the ats, resume format choices.

Each of the following formats performs a particular function, highlighting your work experience, skills, or both.

Three resume format favorites among successful job applicants in 2024.

- Reverse-chronological format: This format is exactly what you think: it orders your work experience starting from the most recent. This format will help hiring managers see your most relevant (and likely most impressive job title) first.

- Functional format: Unlike the reverse-chronological format, the functional formats place the most emphasis on skills. If you have employment gaps, you may want to consider this format, but be aware that hiring managers may be confused or wonder if you’re being forthcoming.

- Combination/hybrid format: This format weights work experience and skills equally by combining functional and reverse-chronological formats.

For financial analysts, we almost always recommend reverse-chronological formatting. Hiring managers love that it’s easy to read and skim, and you’ll love that it showcases your most senior position.

When a hiring manager wants to reach out for an interview, it’s important to make your name, phone number, and email easy for them to find. Ensure your contact information is highly visible by placing it at the very top of your financial analyst resume.

Use a large font for your name and a large (but slightly smaller) font for your job title. Both your name and your job title should be centered in the header.

If you want to try using color in your resume we suggest using the color as the backdrop for your contact information header. Professional colors for financial analysts include navy, amber, or dark green.

Below your header, you’ll need to include contact information, which should include:

- Phone number

- Your city and state (optional but recommended if it’s a local business)

- Professional links, such as LinkedIn (optional)

Like the example below, you can do a lot with your header to showcase your creativity while remaining professional.

If you’re applying to an online job posting, the chances are high that the hiring manager is using applicant tracking system software (ATS) to pre-filter applicants.

The ATS works by picking up on words used throughout your resume and matching them to keywords selected by recruiters (usually keywords in the financial analyst job description ). If you don’t have enough keyword matches, your resume may be thrown out before anyone can read it. That’s why your resume must be ATS-friendly.

Be careful to adhere to the following formatting guidelines:

- Margins: Use standard one inch margins, or at the very least half an inch, if needed to save space.

- Font type: Keep it basic by using Times New Roman, Arial, Cambria, or Garamond.

- Font sizes: The body of your resume should be a 12-14-point font, but you can make it slightly smaller (but only slightly) if needed. Your job title should be larger, around 20-point font, and your name should be about 24-point font.

- Header names: Use colors, bolding, or complementary fonts to help your subheaders stand out throughout your resume. Just make sure your font is readable.

- Skills: Customize your skills section for every job to which you apply. Carefully read the job descriptions to determine what keywords the recruiters will be scanning for while avoiding plagiarizing their job posting!

- Logical order: As we mentioned earlier, reverse-chronological order is the best for your financial analyst resume, and ATS operates under the assumption that your resume is formatted this way.

- Page count: Do everything you can (adjust font and margin, within reason) to fit the page perfectly. Your resume will look unprofessional and burdensome to read if it’s over a page. If your resume is a little short, recruiters will wonder if you’re inexperienced.

Formatting your resume isn’t easy at first, but once you’ve used an AI resume maker for the first time, all you need to do is minor tweaks for each job application.

Write your financial analyst resume

Writing your perfect financial analyst resume can be difficult especially with a job at stake. We know that writing an effective resume may feel overwhelming, but if you take it one section at a time, the process shouldn’t be too stressful.

Without further ado, let’s dig into the content of your financial analyst resume. Here’s what we’ll cover:

- Using a resume objective or summary statement

- Writing about your work history

- Key skills for financial analysts

- Education and optional sections

- Customizations

- Flawless editing

Understand the elusive objective/summary statement

Objectives and summaries are some of the most commonly misunderstood sections on a resume, but they can be useful. However, choosing between a resume objective or a resume summary is difficult because there are only a few circumstances in which you’ll use either one.

Both are highly job-specific, two to three-sentence paragraphs used near the top of your resume (often under your job title). An objective is for entry-level candidates or job seekers who have recently changed fields. An objective will tell hiring managers why you want the job.

On the other hand, a summary is for professionals with over 10 years of experience in a specific field. It highlights skills you’ve developed and biggest achievements.

Neither the objective nor the summary is a mandatory inclusion on your resume, but these statements can enhance your resume and boost your chances of getting hired. Let’s go over a few examples:

Example 1: Young professional seeking a job at your office to continue advancing my career in finance.

What could be improved: This is a poorly written resume objective. You should mention the specific job title you’re applying to, the company name, and one to three highly-specific skills you possess that will improve or contribute to the company’s operations.

Example 2: Working in finance with experience in organizing and communicating.

What could be improved: This summary is too bare-bones. It contains no meaningful information and just takes up space.

Example 3: Financial analyst with 7+ years of experience specializing in informative and persuasive professional presentations, seeking a role to utilize my depth of ROI and client relations skills as a team player at Spectrum.

What we like: This objective and the example below mention a specific job title, the company name, and the skills they bring to the table. It’s short and effective.

Example 4: Data-driven financial analyst with 23 years of business valuation and trend analysis under 3 major Fortune 500 corporations. With skills across many areas of data analysis and presentation, trend forecasting, and financial advisement, I provide a wealth of knowledge and business know-how to companies with which I’ve worked. I am eager for an opportunity to improve ROI in several key areas to optimize growth at BetterMent.

What we like: This summary (and the example below) are specific and contain information that makes this candidate an obvious choice. The applicant above also points directly to an area they know they can improve business operations. You want a hiring manager to read your summary and think, “we need this person.”

How to include your financial analyst work history

It should come as no surprise to you that the most important section of your financial analyst resume is your work history. It can be tempting to cram every job title you’ve held onto the page, but hiring managers prefer applicants who focus on the most relevant and recent work experience they’ve had. You can share information about older jobs and internships during your interview! You’ll want to include two to four job experiences.

Write descriptive bullet points

Your work experience should be broken down into bullet points, which make your resume look more organized and easier for hiring managers to read.

- Throughout your bullet points, you’ll want to avoid passive voice, which can make text boring to read and unengaging. Instead, use active voice, which exudes confidence and ownership of your work. Adding action words to start each bullet point, like “operated,” “spearheaded,” and “orchestrated,” will further engage readers and break up your text.

- You’ll also want to be careful to avoid personal pronouns, like “I” or “my.” Employers already know you’re writing about yourself, and personal pronouns sound unprofessional.

- You can choose to end all of your bullet points with or without periods. Consistency is key.

- Finally, you’ll want to consider verb tense. You can leave your current work experience in the present or past tense, but all of your former work experience must be in the past tense.

Here are a few examples of good bullet points that incorporate these tips:

- Oversaw the financial due diligence of a $52M acquisition, including organization and report analysis

- Developed an automated process using Excel for the internal team KPI reporting that increased accuracy by 17% and provided data 2 days faster to team leads

- Monitored 10+ regulatory developments and industry trends to incorporate into the firm’s AML program

These bullet points are perfect for a financial analyst resume. They’re written in active voice, using action verbs, avoiding personal pronouns; they’re all written in the past tense, with consistent punctuation.

Leverage numbers

Numbers demonstrate your value to the company, unlike words alone. We’ve interviewed countless hiring managers to ask them what they consider the most important element of a successful resume; almost unanimously, they’ve reported that metrics made applicants much more likely to get interviews. For the best results, aim to include quantifiable metrics on at least 50 percent of your bullet points.

Here are a few ways you might consider adding metrics about your past roles in financial analysis:

- Hard numbers: Discuss the details of your work. What percentage have you increased ROI? What percent have gross earnings increased for the company during your time of employment?

- Sales: Discuss the rate of potential clients converted from your presentations, the number of presentations you provided, and the success of your sales strategies.

- Reports: Have you successfully forecasted trends? Have your abstracts and internal presentations resulted in financial gain for the company?

- Collaboration: Financial analysts need to collaborate across departments frequently. Let employers know you collaborate well with others by detailing the number of people or departments with which you’ve worked.

If you’re having trouble visualizing how you’d use these questions to come up with numbers, don’t worry. Here are a few examples:

- Provided financial guidance to Business/Functions, contributing to a 19% growth trend by developing strategic long-range planning recommendations for management

- Collaborated with 10+ major clients with multi-million dollar accounts

- Created forecasting tracking and management reporting systems to improve the availability and accuracy of financial data, triggering a 13% increase in accuracy

- Evaluated regulatory developments and industry trends to facilitate incorporation into the firm’s AML program, reducing time to meet trend demands by 40%

Financial analyst skills to include in your resume

The skills section is an important place to demonstrate your value to potential employers, not to mention it’s one of the best places to include keywords for ATS. Unfortunately, many hopeful applicants don’t emphasize the right skills. The right skills for your financial analyst resume will depend on the specific job to which you’re applying.

Generally, we recommend including a mix of soft and hard skills, with the majority being hard skills because they’re easier to measure and more job-specific. Aim to include six to ten highly relevant skills on your resume.

Use the following financial analyst skills as examples to get you started:

- Financial Modeling

- Cash Flow Management

- Financial Reporting

- Quantitative Finance on Python

- Electronic Trading Systems Development

- Data Consolidation

- Predictive Analysis

Why are these resume skills appropriate? We’ve included a mix of hard and soft skills specific, measurable, and highly desired by most employers. When looking for your next financial analyst job, be sure to read the job description carefully. Often, you’ll be able to pick up on which skills are the most important to your hopeful employers.

But, a word of caution: avoid overselling your skills. If you don’t know how to do something or are inexperienced, leave it off your resume. Hiring managers want honesty above all.

Education + optional resume sections

ou probably already know that the financial analyst world can be a tough place in which to get your career started. Though there are no formal educational requirements, most employers will seek applicants with at least a bachelor’s degree in a relevant field.

Include the highest education level on your resume, but avoid including too much detail unless you’re a recent graduate with limited work experience. If you have minimal experience, you can utilize your education to demonstrate your working potential. Still, if you’re a more experienced applicant, you only need to provide your school name, graduation year, and degree.

There aren’t any formal requirements for certifications for financial analysts, but you should mention any specialized training you’ve received, such as a Financial Analyst Certification, Data Analysis Certification, or Certified Software Quality Analyst.

Finally, you may be wondering whether you should include any interests and hobbies to your resume . Generally, we don’t recommend including them, but there are a few instances where they’re appropriate additions to your resume:

- If you don’t have a great deal of work experience, it may be helpful to highlight some interesting hobbies or volunteer activities in which you’ve taken part. These can be great talking points during interviews if used appropriately!

- If you’re a recent graduate seeking your first finance job, you likely lack a lengthy work history to share on your resume. In this case, you can use interests and hobbies to convey to employers that you’re a hard worker and someone who thrives under pressure.

Tailor your financial analyst resume to the job ad

We’ve mentioned it a few times, but it’s important enough to reiterate. You need to tailor your financial analyst resume for every job to which you apply. Specifically, if used, your resume objective or summary statement needs to be customized with specific job titles and company names. Your skills section should be tailor-made to the job, too. You can do this by referencing skills mentioned in the job description (without ever copying anything from the job posting verbatim). Finally, your bullet points should be tailored to fit the specific needs of each company.

Don’t submit a sloppy financial analyst resume

We know it’s difficult to take a step back after you’ve finished working on your financial analyst resume. However, we strongly recommend that financial analysts, and all job seekers, take a step back. Put your resume away for a day or two, and then look it over again for typos. Have friends or family proofread it, and take advantage of our free resume checker .

One step closer to your next job

Congratulations! The first step to writing your professional financial analyst resume is research. If your resume is complete, you can upload it to see what AI-powered tips our resume checker has for you before making a cover letter .

If you haven’t started yet, or if you want to start your resume from scratch, use our resume builder . Both our resume checker and builder will analyze your resume and provide specific tips on how you can make improvements.

- Finance objectives and summaries

Finance Objectives & summaries

112 Finance objectives and summaries found

A well-written objective or summary on your resume can be the difference between getting rejected, or getting invited for an interview. Copy any of these Finance objective or summary examples, and use it as inspiration for your own resume. All examples are written by certified resume experts, and free for personal use.

Learn more about: objective vs. summary

Summary examples

Personable and enthusiastic professional with experience in sales and customer relations positions. Adept at managing high-profile client accounts and establishing strong business relationships which result in an overall increase in revenue and the attainment of defined corporate goals.

Bank teller

Methodical and customer-oriented professional, with 2 years’ experience in customer facing positions in high-pressure and fast-paced work environments within the retail sales industry. Offering practiced communication and critical thinking skills to resolve client issues and address complaints.

Personal banker

Customer-focused professional offering successful sales experience within the retail industry, with established expertise in managing and building long-term relationships with individual and corporate clients. Looking to transition my skills into a personal banker positon and help provide value to the bank and its customers.

Objective examples

Resourceful Banking professional, well versed in the workings of the financial market and customer care to successfully manage a portfolio of consisting of high income clients. Seeking a challenging position at a reputable financial institution that allows for further career growth.

Experienced bank teller, skilled at supporting daily branch operations and providing premium customer service to each customer. Seeking a challenging position within a visionary financial institution that offers the opportunity for further career growth and exposure.

Organized and analytical personal banker adept at facilitating banking processes and managing clients’ accounts within fast paced environments. Looking to leverage problem-solving and relations expertise to handle customer accounts and facilitate revenue goals for a reputable bank.

Financial analyst

Accomplished Senior Financial Analyst, offering in-depth knowledge and extensive experience in directing and advising on all aspects of complex financial and accounting processes. Effectively utilizes various financial techniques to analyze financial data, recommend tools, systems, and accounting measures to drive profitable performance. Offers leadership experience with the interpersonal skills needed to build strong relationships. Thrives in fast-paced environments requiring the ability to prioritize and manage multiple projects within time limits.

Private equity analyst

Tenacious finance college graduate offering recognized analytical skills. Commended by professors for dedication to accuracy and consistently turning in projects before deadlines. Eager to learn and develop practical experience at a reputable financial institution.

Credit analyst

Accomplished in maximizing cash flow and retrieving millions of dollars in unsecured debt while minimizing aged receivables and uncollectible expenses. Remarkably successful in navigating the complex process of collecting on delinquent accounts. Proven history of maintaining full compliance with laws, regulations, and contractual agreements. Paired time-tested collection methods with industry-leading technologies to recover money as quickly as possible. Leverages active listening, crafting alternative solutions, and assertiveness to elicit quick, favorable responses from debtors.

A highly astute, energetic, and team-spirited financial analyst graduate seeking a position to meet and exceed an organization’s goals and objectives. Adept at working as part of a cross-functional team or independently. Communicates effectively with all levels of an organization.

Dynamic financial expert and private equity analyst adept at efficiently managing diverse portfolios to increase investments. Looking to leverage excellent relations expertise to manage high-profile clients and develop strategic financial plans that help them attain and exceed their financial goals.

Credit Evaluation expert with six years of extensive experience in credit structures, financial collections, and all related credit-based system procedures. Seeks an opportunity within the capacity of a credit analyst by maintaining the highest standards in the best interests of all parties.

Finance manager

Methodical finance manager with 6+ years’ professional experience in successfully growing clients’ revenue streams through strategic financial plans and project management. Offering expertise in evaluating business performance, developing detailed financial reports and competition analysis, and cash flow management in support of corporate and individual clients.

Finance director

Result-driven, conscientious, and task-oriented financial professional experienced in directing activities for accounting, financial planning, revenue generation, cost reduction and budget management. Adept in assisting staff through training, open negotiation, and counseling to develop and enhance their efficiency at work. Expertise in achieving team-driven process improvements to increase operational effectiveness, profitability, and consumer retention while certifying reliability and compliance.

Driven Finance Manager with extensive experience in assessing risks, creating alternative solutions and contingency plans to achieve financial and business goals. Champions productivity across the organization through the identification of possible opportunities and advocates productivity changes to financial and non-financial processes. Manages Treasury, Tax and Commercial, and Corporate Finance with the pace and agility as per business and market demands. Demonstrates self-confidence, decisiveness, and calculated risk-taking abilities.

Analytical and results oriented finance manager, adept at streamlining daily financial operations whilst translating complex data into actionable information to achieve strategic organizational goals. Looking to join an advanced organization that allows for further career growth and exposure.

Analytical and self-motivated professional seeking the position of Finance Director with 6+ years of work experience assembling, interpreting, and evaluating financial data; forecasting upcoming economic trends and emerging workable strategies to take advantage of market opportunities.

Accomplished finance manager with over 6 years’ experience in managing, evaluating and redefining team structures to meet strategic operational goals whilst providing financial guidance to organizations. Eager to leverage my leadership skills to drive business goals through strategic financial development initiatives.

Insurance agent

Customer oriented and analytical insurance agent, recognized for skills in sourcing and singing up new clients for policies. Leveraging previous sales and customer service expertise to evaluate each prospective clients’ need and recommend policies suited to them whilst providing them with ample information on insurance premiums, coverages, and claims information.

Claims adjuster

Dedicated to accurately and ethically determining liability in insurance claims. Committed to avoiding litigation by ensuring fair settlements with claimants. Talented problem-solver with high levels of social competence and a passion for helping people in crisis. Knowledgeable of Texas state regulations.

Certified Actuarial Analyst (CAA) with comprehensive foundation in actuarial valuations, budgeting, and forecasting. Outstanding accuracy in quantitative/ qualitative research and statistical analysis, financial modeling, risk, and probability analysis. Highly systematic and diligent professional with exceptional supervisory, managerial, and operations skills. Proficient in overall accounting cycle, from data-entry to creating financial reports.

Goal-focused insurance agent, recognized for leveraging previous sales and customer service expertise to consistently surpass set sales goals. Looking to build a successful career within an ambitious organization, whilst honing new skills to better execute duties and bring value to clients.

Well-rounded and result-driven professional eager to gain the position of Claims Adjuster. Enthusiastic about utilizing 6+ years of experience in claims risk assessment, policy interpretation, documentation and claim settlements to reach the best claim decisions for the organization.

A dynamic and performance-driven Actuary with 6 years of experience in statistic and financial data analysis. Seeks an opportunity to utilize excellently honed analytical and statistical techniques to evaluate and minimalize risk within a dynamic actuary position.

Financial advisor

Client-focused financial and banking professional, offering 12+ years of verifiable experience in financial services and client services operations with leading banking institutions. Equipped with both entrepreneurial and intrapreneurial leadership to drive top/ bottom-line growth. Utilizes excellent communication skills to develop a relationship with cross-functional business partners and key internal and external stakeholders. Implements cutting-edge solutions that foster improved processes, sound credit policies, and profitability.

Financial consultant

Savvy and expert financial consultant with six years of significant investment expertise. Maintained a successful record of providing tailored financial strategies that fit with client requirements. Managed various portfolios with due diligence and continual analysis of economic trends to ensure optimal asset allocation. Highly competent in appraising business and investment prospects, clear understanding corporates and their market trends. Consistent high performing specialist in corporate expansion, growth, and diversification.

Seasoned business leader and financial consultant, offering entrepreneurial leadership by creating and delivering financial planning and retirement solutions. Excellent ability to understand customer needs from multiple perspectives, as well as the ability to envision, create, and execute solutions to personal and business challenges. Skilled at contributing to strategic development planning and guidance to achieve a quality of life and financial sustainability. Demonstrates the highest level of integrity and fully commitment to excellence.

Dynamic Financial Advisor, adept at efficiently evaluating clients’ assets whilst educating them on different financial and investment products to develop comprehensive financial plans that facilitate the attainment of their financial goals. Looking to join an ambitious financial institution to raise client satisfaction and facilitate strategic financial plans.

Highly impactful financial consultant with exceptional six years’ experience identifying initiatives and implementing action-driven plans to support organizational growth and objectives. Seeks a position to utilize comprehensive investment expertise in beneficial to an organization.

Strategic financial advisor with a master’s in finance and business management. Offering over 6 years’ experience in financial reporting and analysis to support process improvement initiatives. Looking to drive organizational growth through strategic financial planning at a fast-paced organization.

- Easy step-by-step builder

- Professional templates

- Try for free!

Professional resume templates

Make a resume that wins you interviews! Choose one of these professionally-designed resume templates and follow 3 easy steps to complete.

Create a perfect resume in a few minutes

- Field-tested resume templates created by experts

- Powered by Resume.io

- Try now for free!

Free resume templates

- Free for personal use

- Direct download as a Microsoft Word document

- Created by a CPRW certified resume expert

- Optimized for applicant tracking system (ATS) screening

Choosing a correct resume format and template

Resume template

Download our American style resume template. Chronological resume format. Download a functional resume template .

Learn more about the differences between a resume and a CV .

CV template

Download our British/European style cv template. Similar to a resume but more commonly used in Europe, Asia and Africa.

Download cv-template.docx 29.34 KB

Resume Worded | Proven Resume Examples

- Resume Examples

50+ Finance Resume Examples - Here's What Works In 2024

To break into finance, you need a strong resume that highlights your experience in the industry. if you need inspiration, look no further — we've provided a ton of downloadable resume samples that you can use as a starting point for your own finance resume..

Choose a category to browse Finance resumes

We've put together a number of free Finance resume templates that you can use. Choose a category depending on your field, or just scroll down to see all templates.

Bookkeeper Resumes

The bookkeeping field is wide open for those with a knack for numbers and a desire to help companies keep an accurate perspective of their finances. Learn how to make your bookkeeper resume stand out as we review four templates for bookkeepers from a variety of backgrounds and delve into key tips to keep in mind.

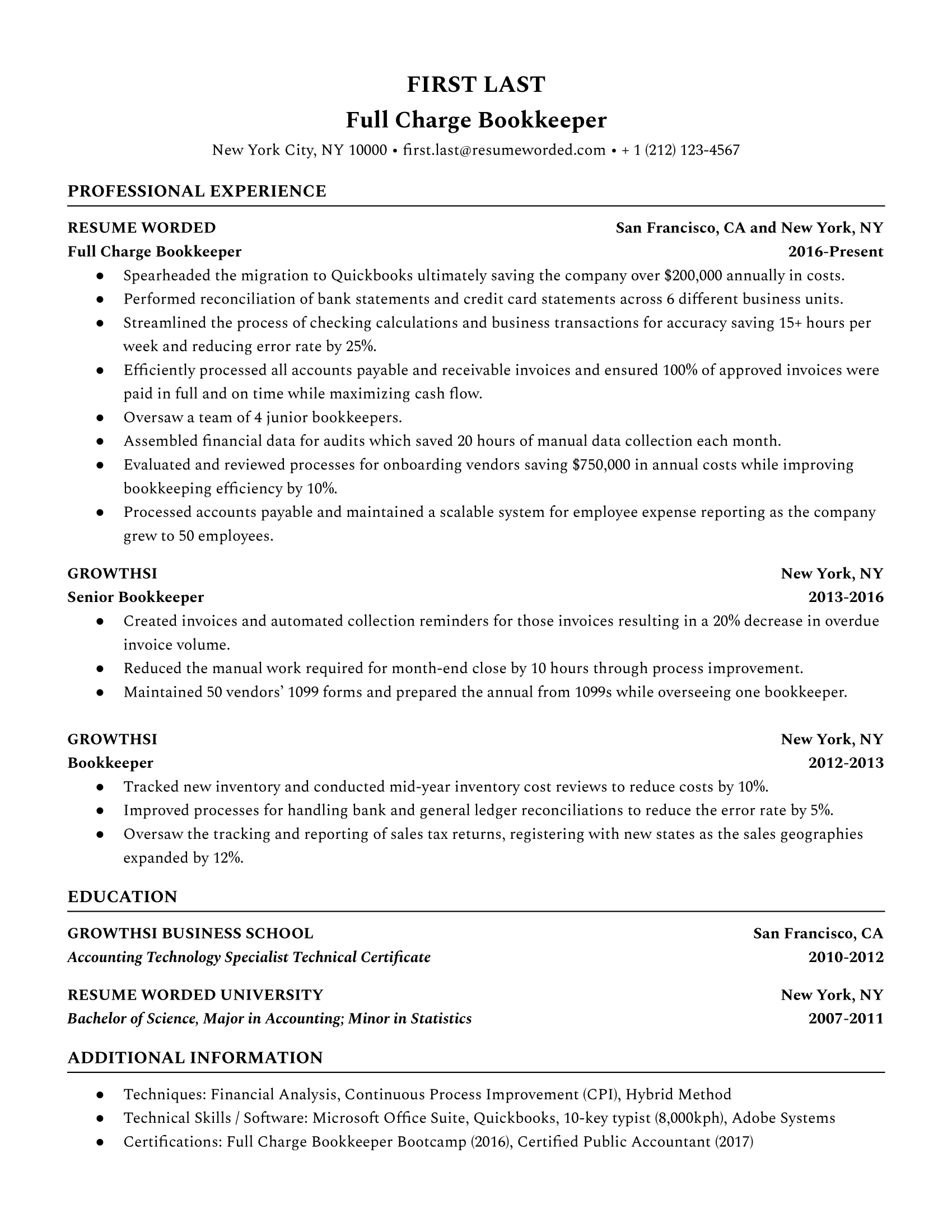

Full Charge Bookkeeper

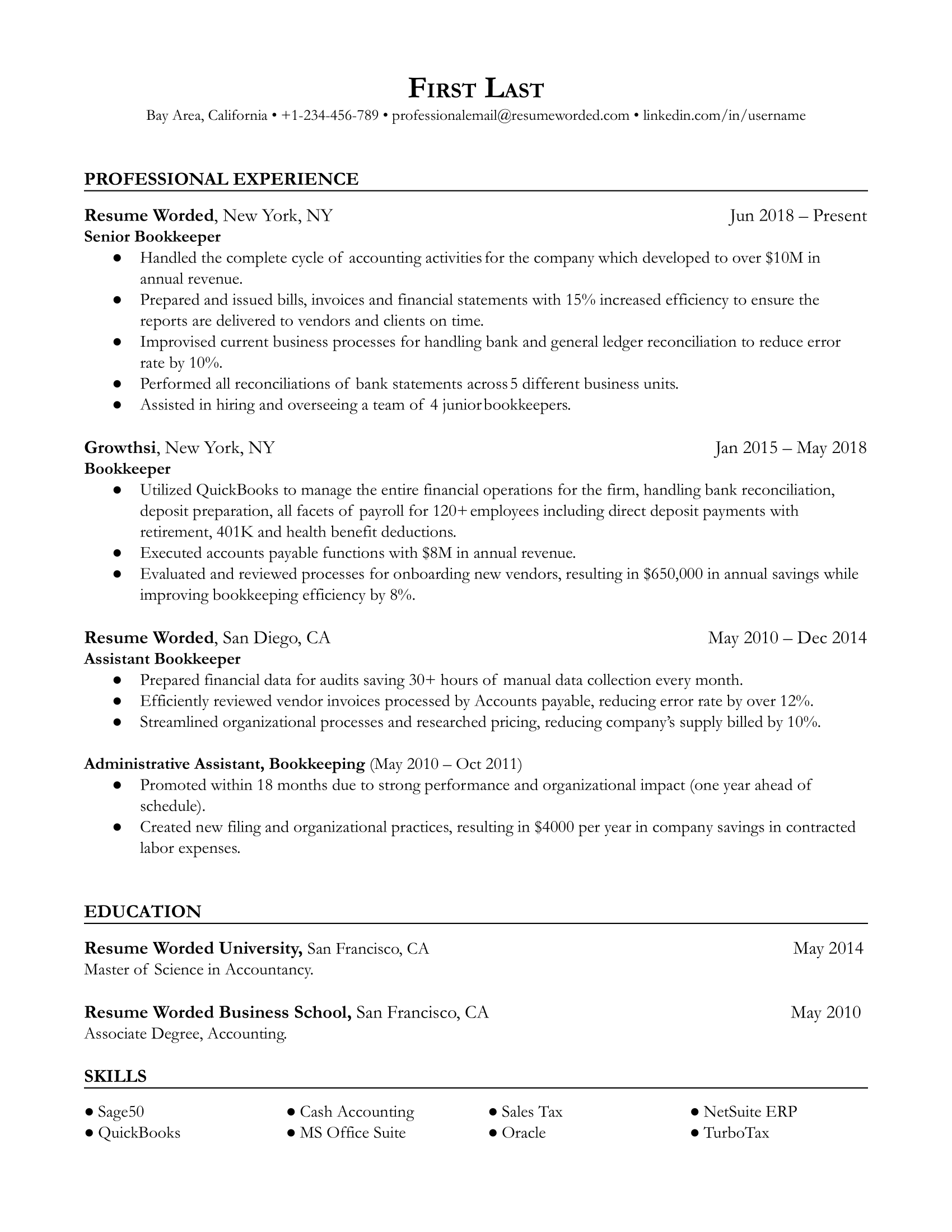

Senior Bookkeeper

Entry Level Bookkeeper

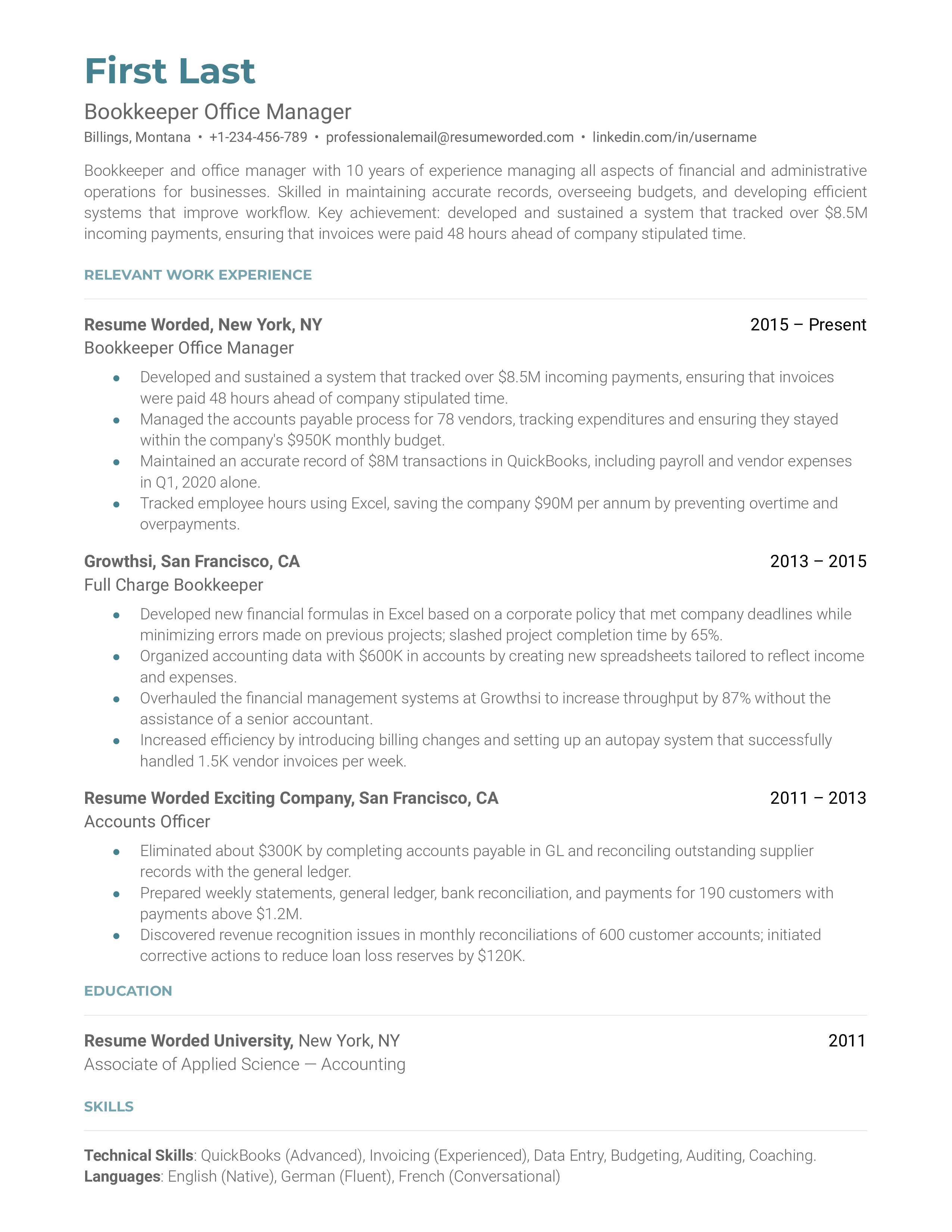

Bookkeeper Office Manager

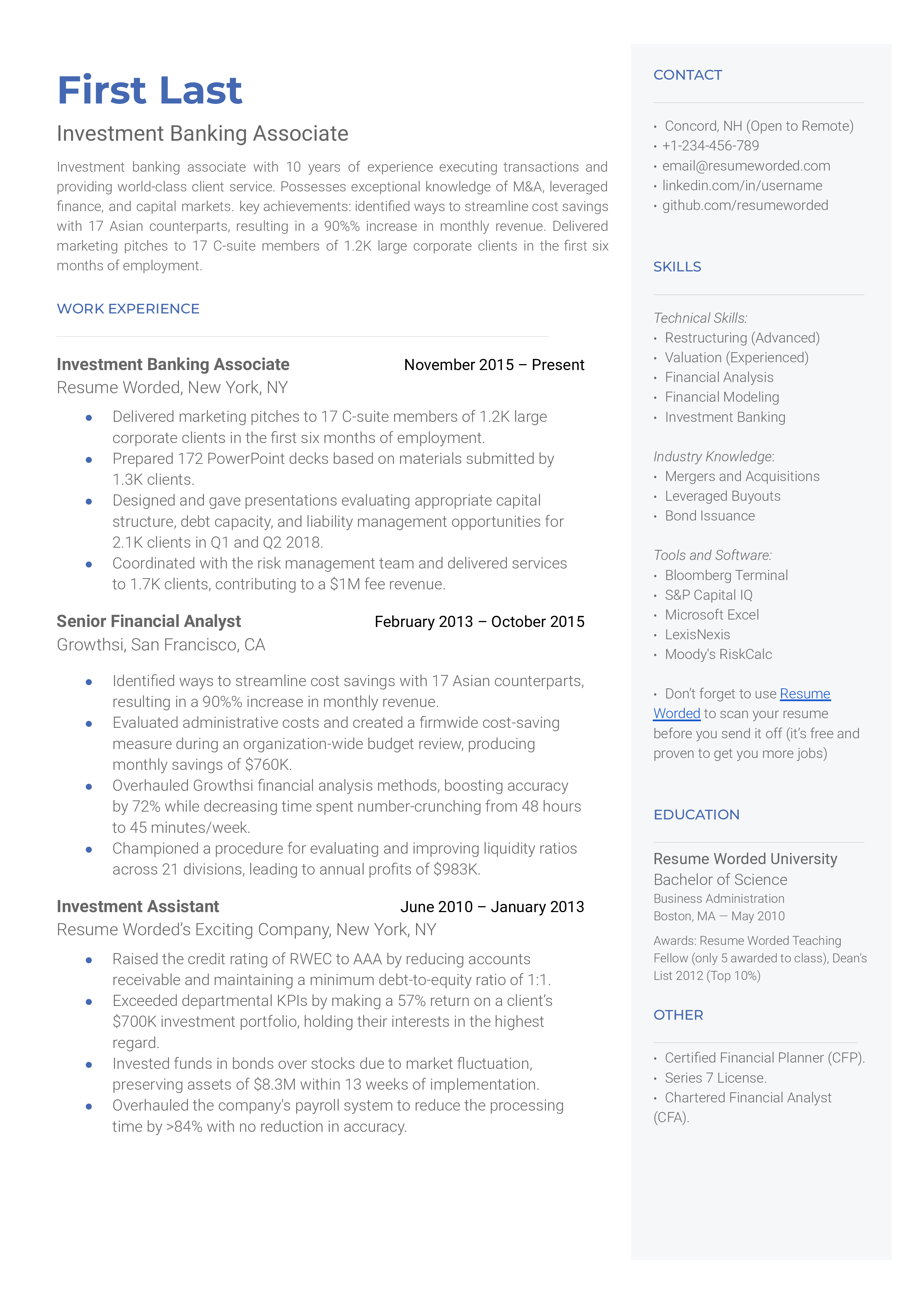

Investment Banking Resumes

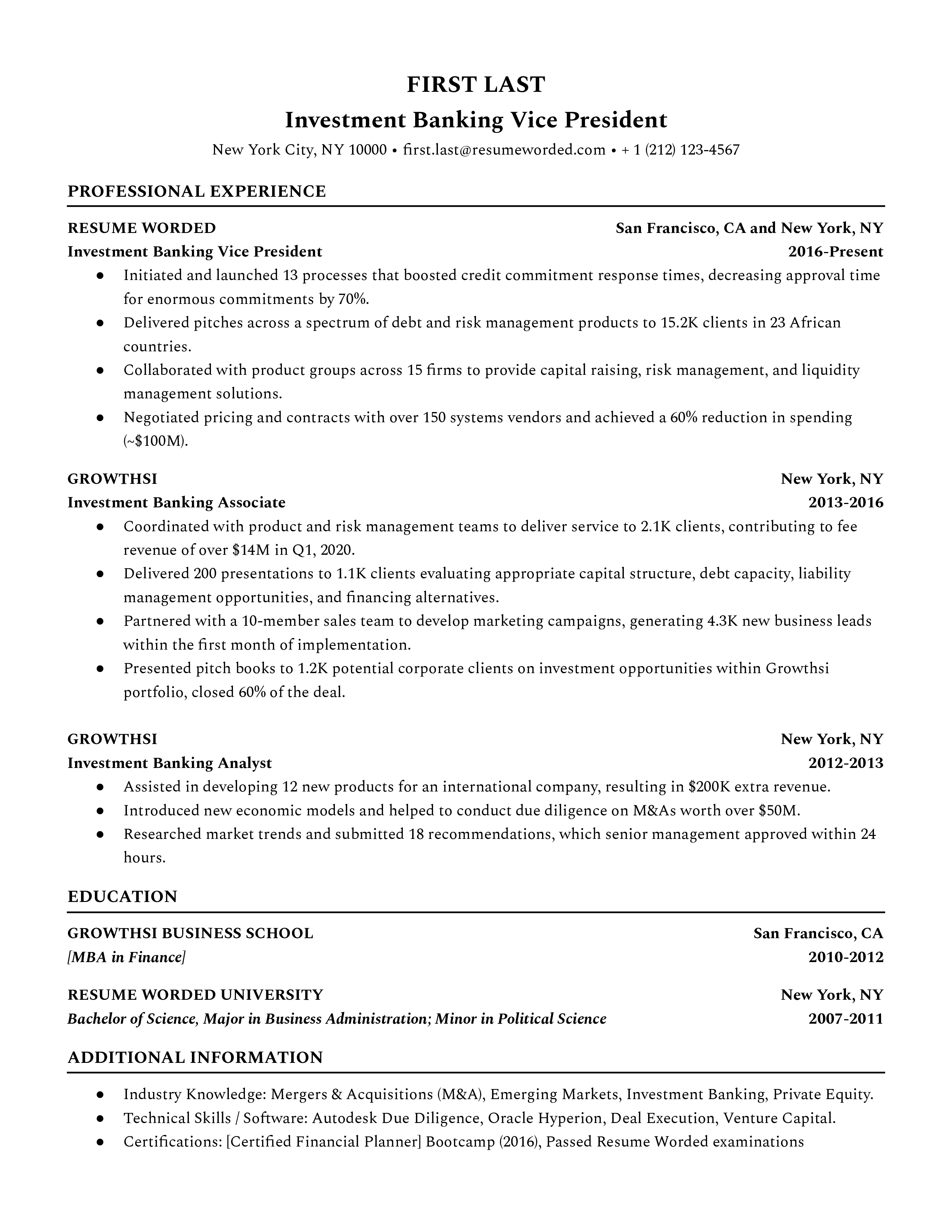

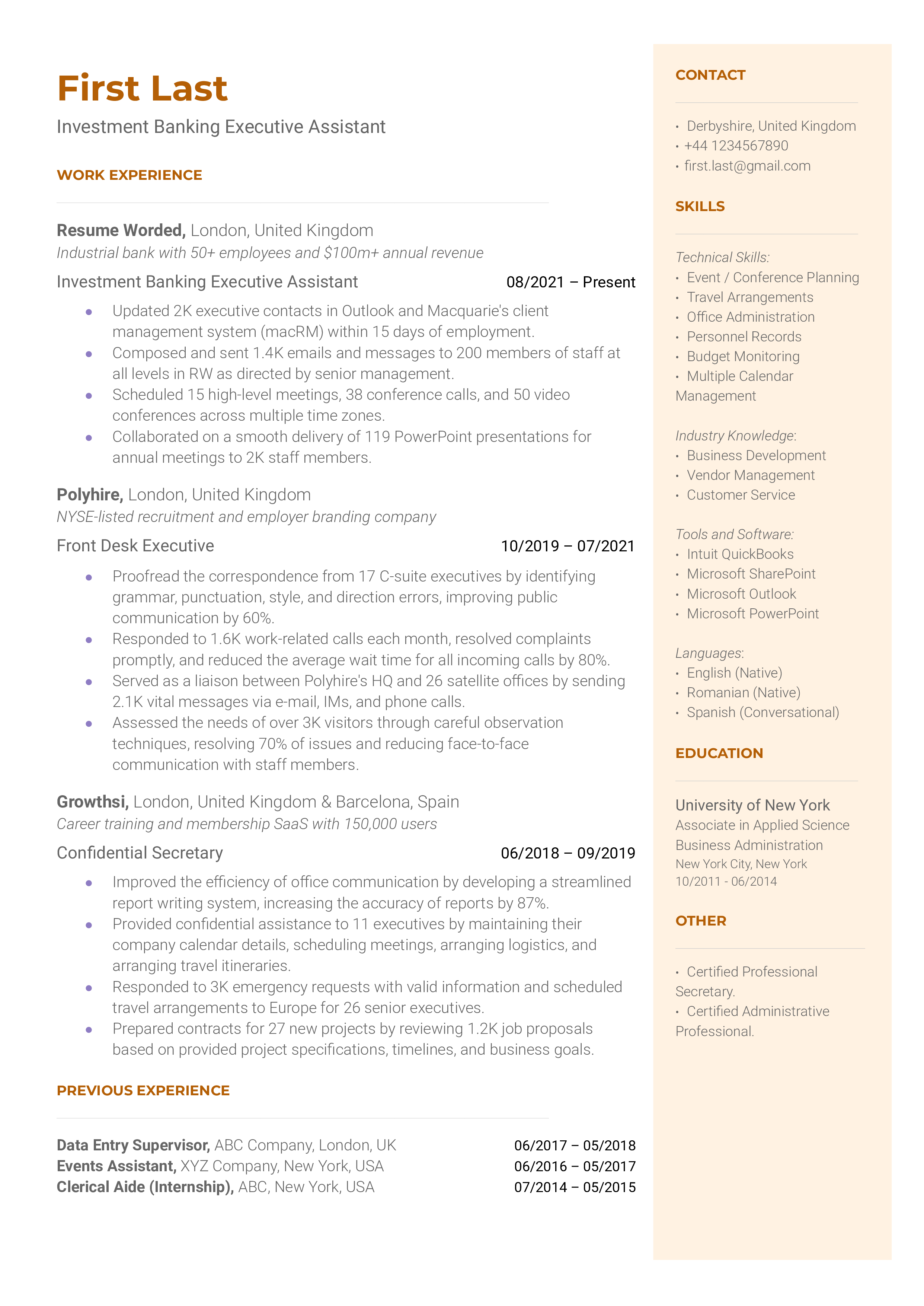

Investment banking can be a lucrative but also very demanding career where only the best of the best succeed. This guide has been created to help you create a resume that will stand out among the sea of impressive resumes recruiters see every day. We will define 5 investment banking positions, show you a strong resume sample for each, and give you pointers to help you elevate your resume and secure that interview.

Investment Banking Associate

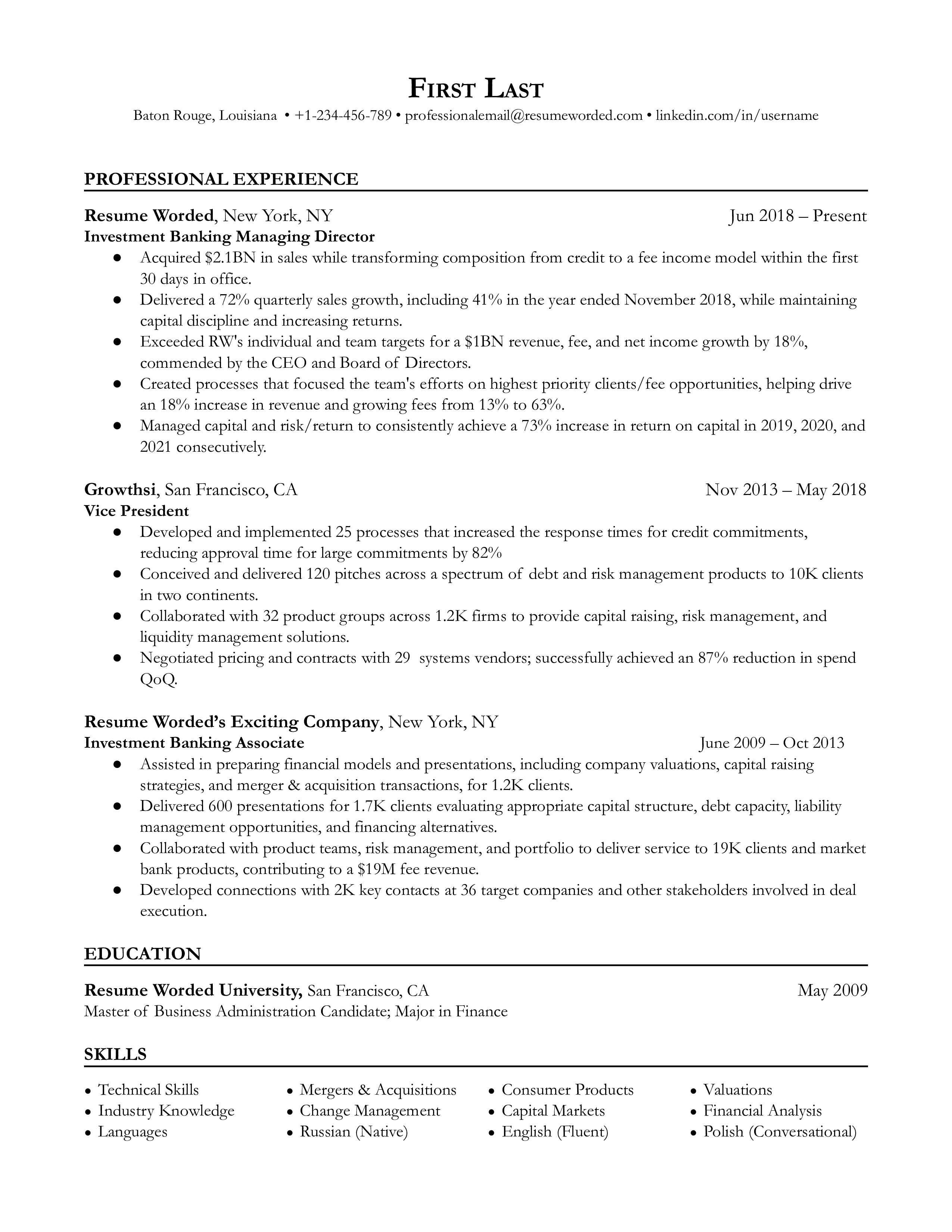

Investment Banking Managing Director

Investment Banking Vice President

Investment Banking Executive Assistant

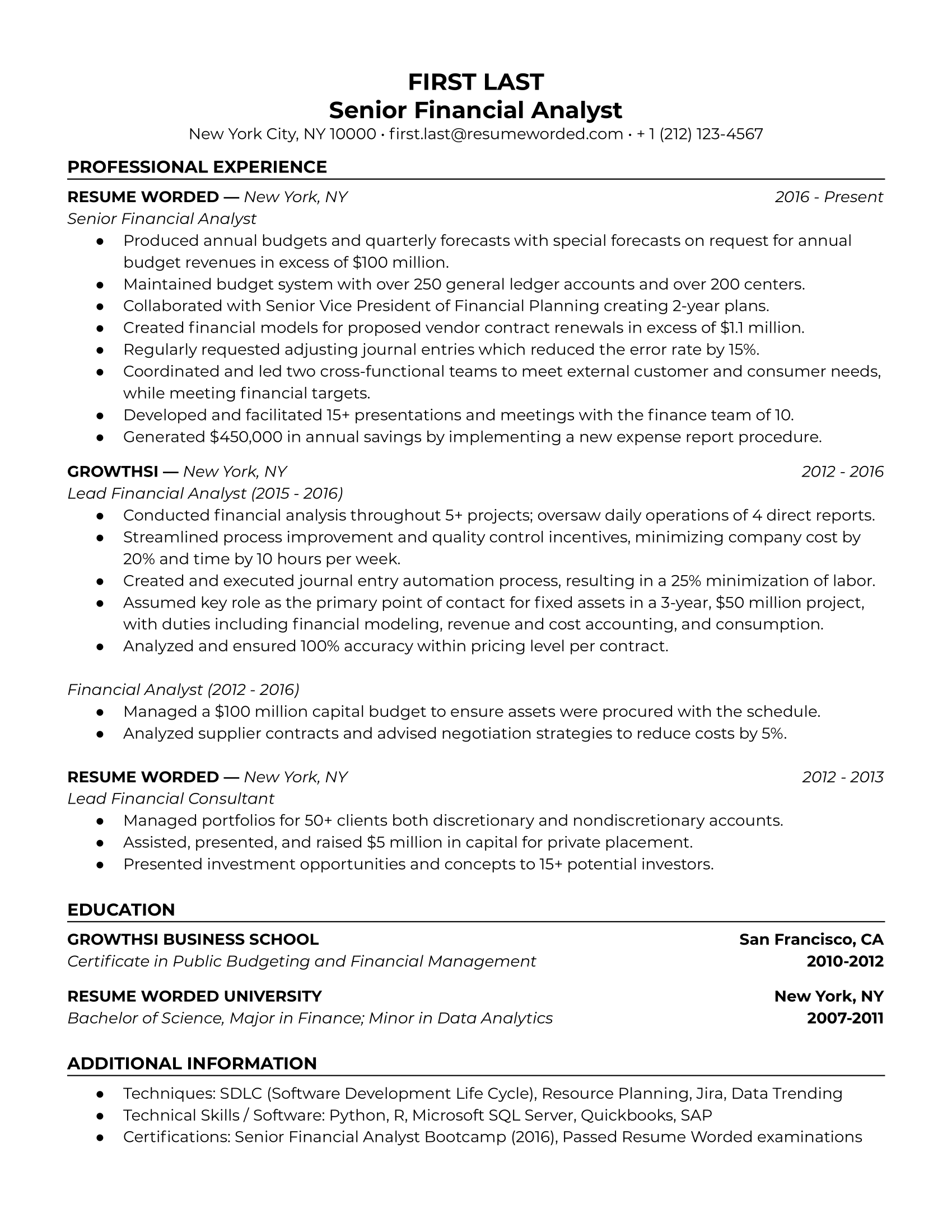

Financial Analyst Resumes

Great financial analysts can help companies thrive. We’ve got six sample resumes here to help you snag a job in 2023 (Google Docs and PDFs attached).

Senior Financial Analyst

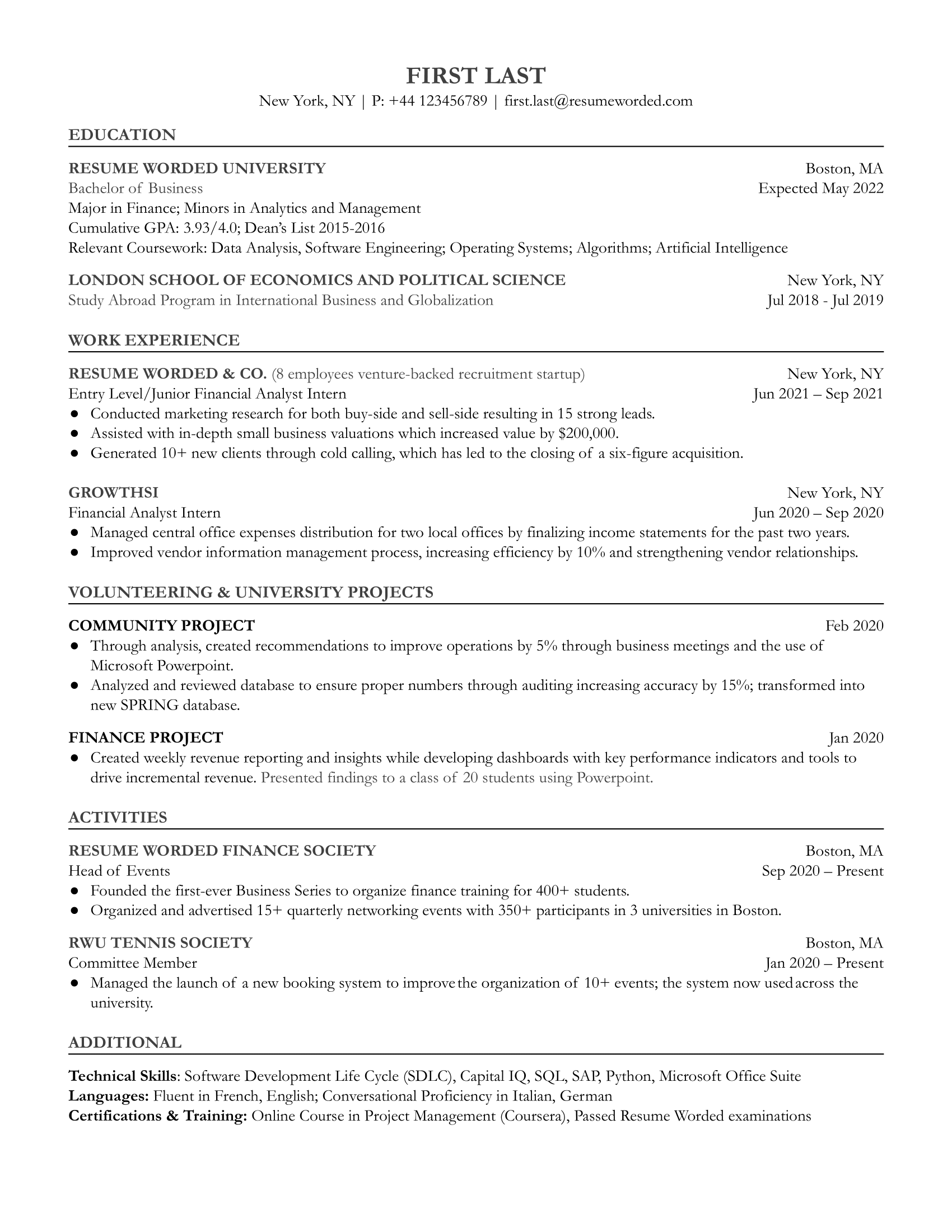

Entry Level/Junior Financial Analyst

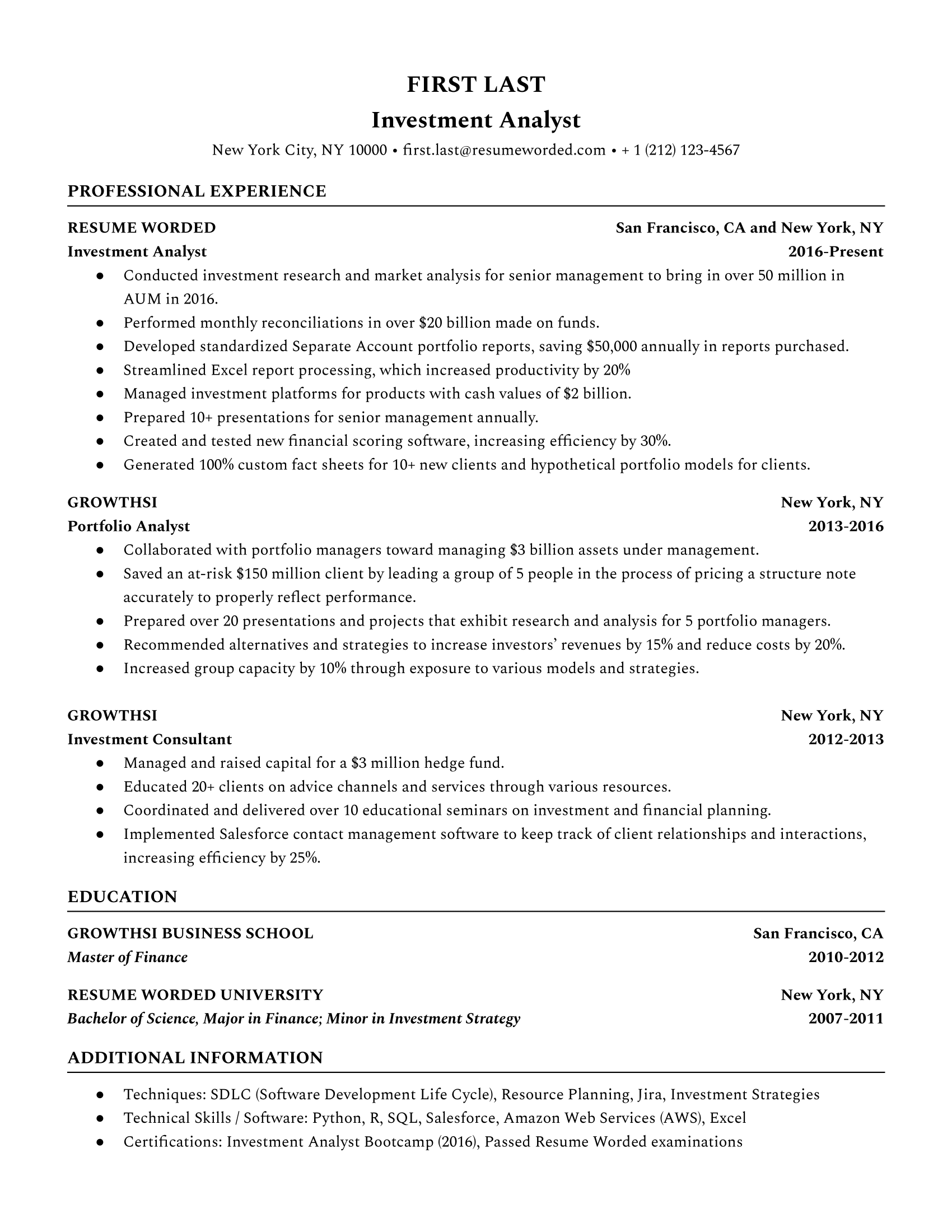

Investment Analyst

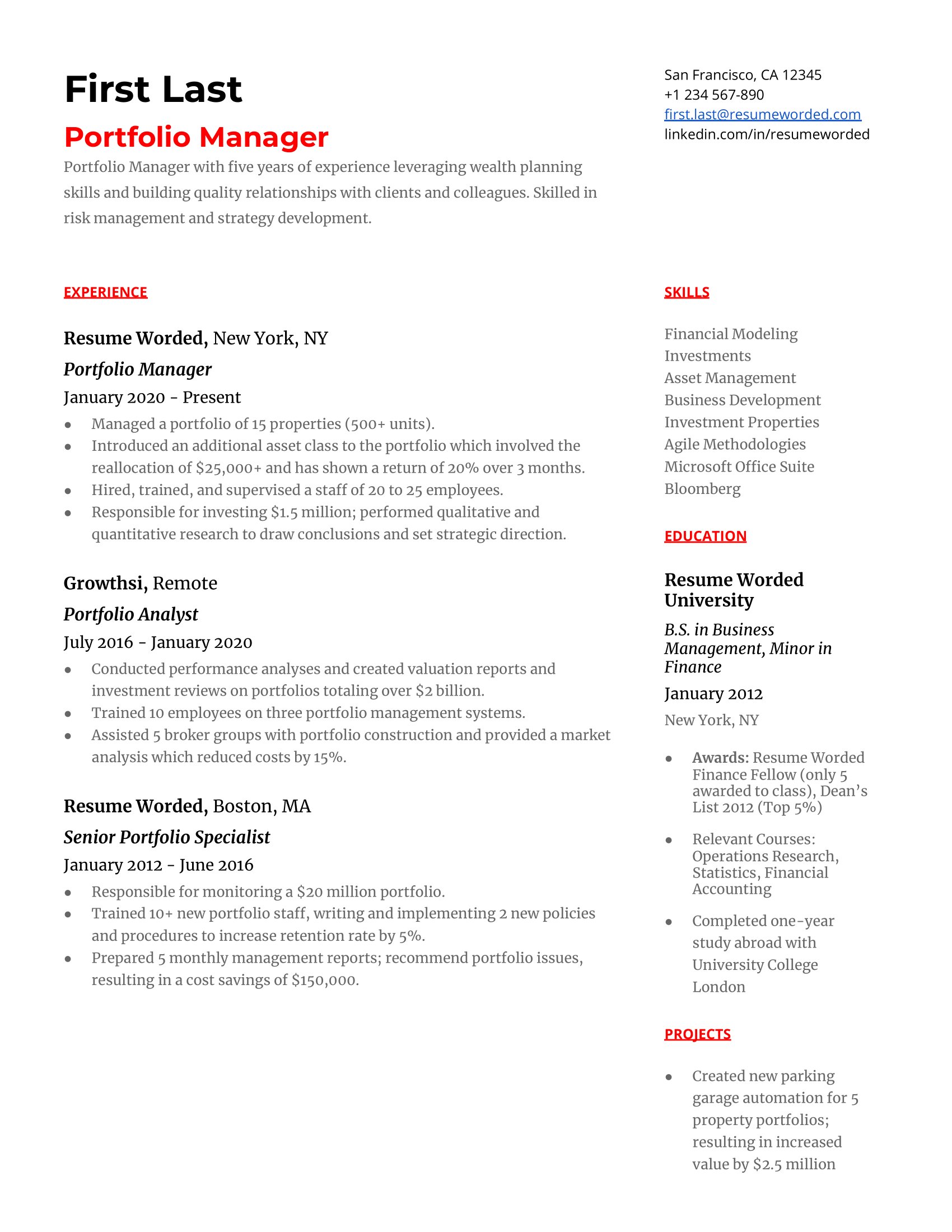

Portfolio Manager

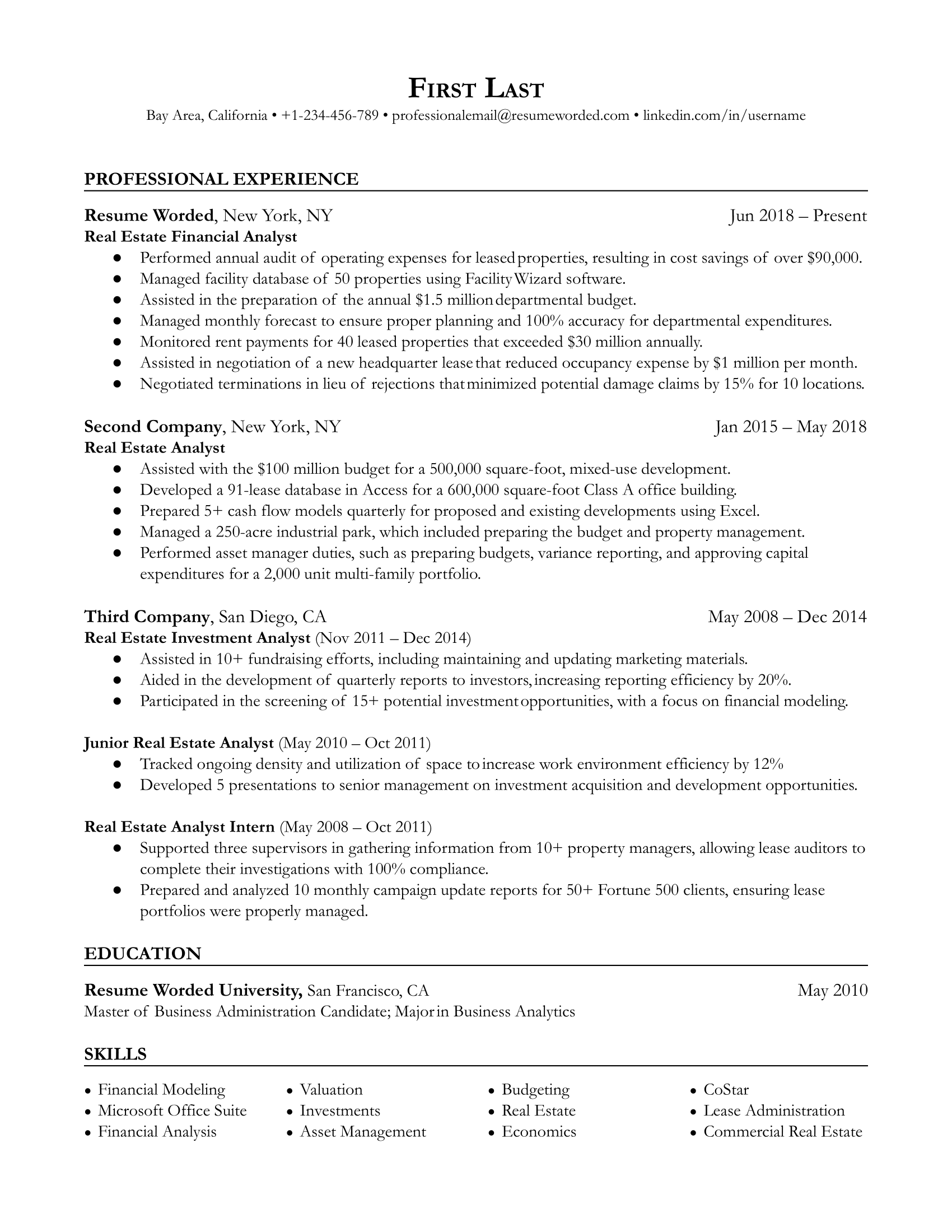

Real Estate Financial Analyst

Financial Analyst Intern

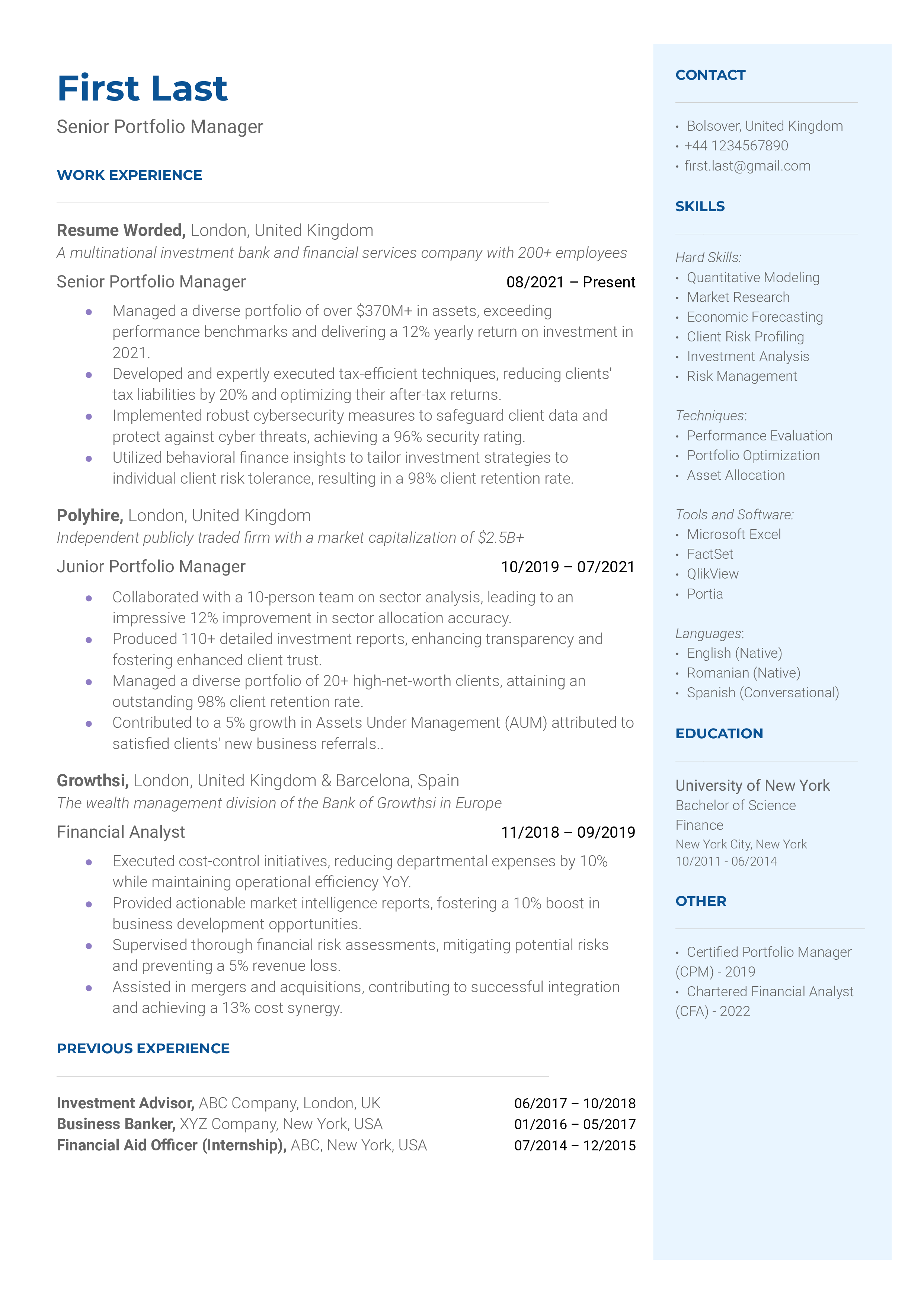

Senior Portfolio Manager

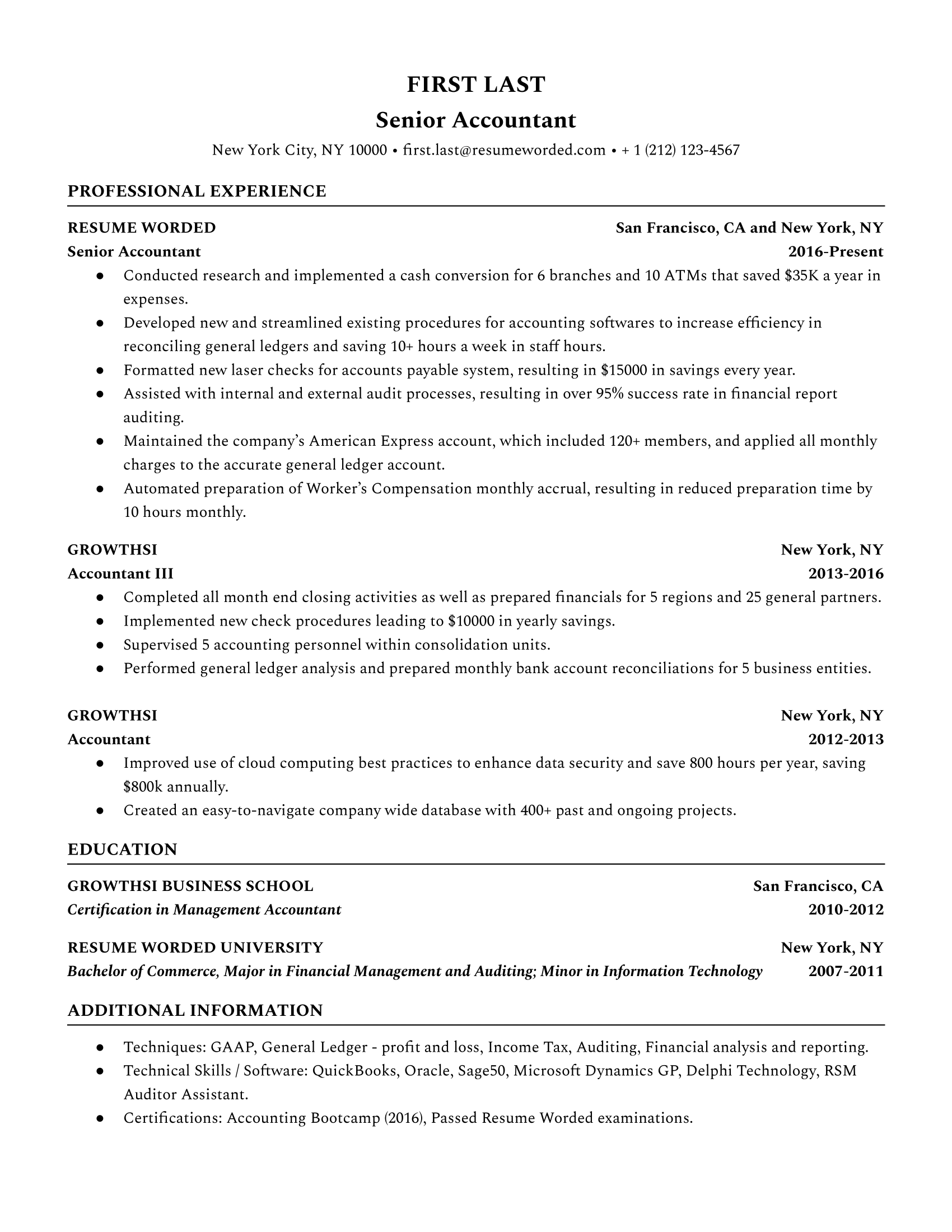

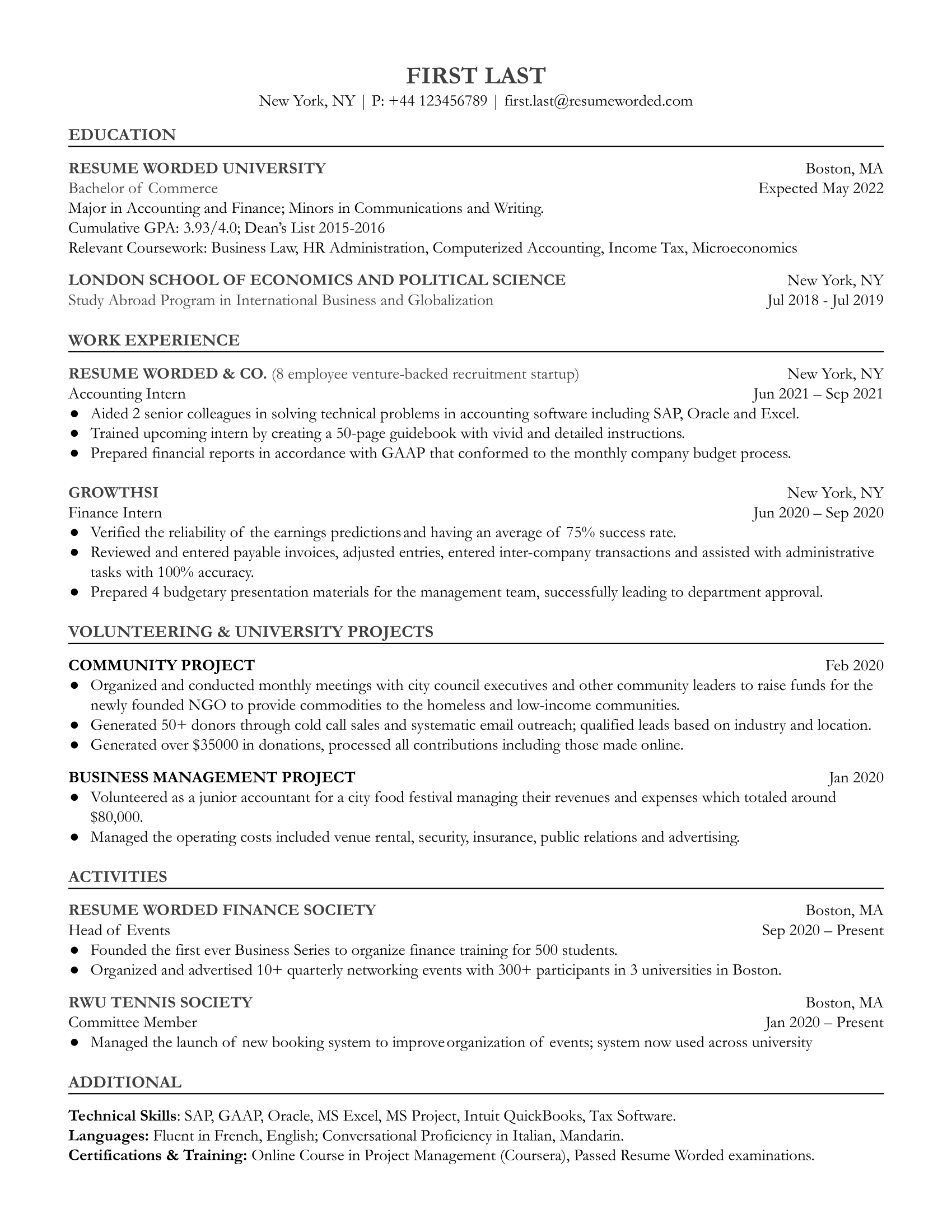

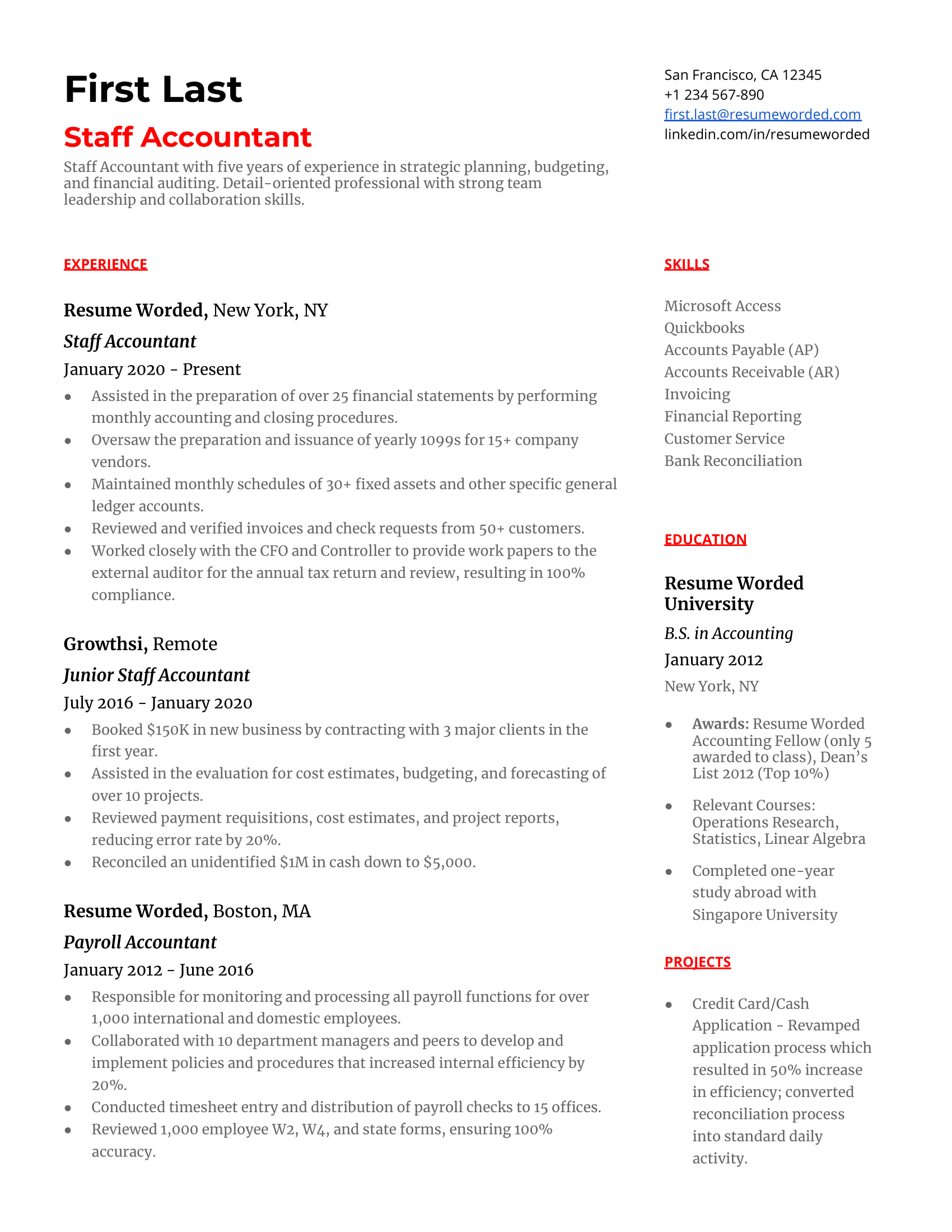

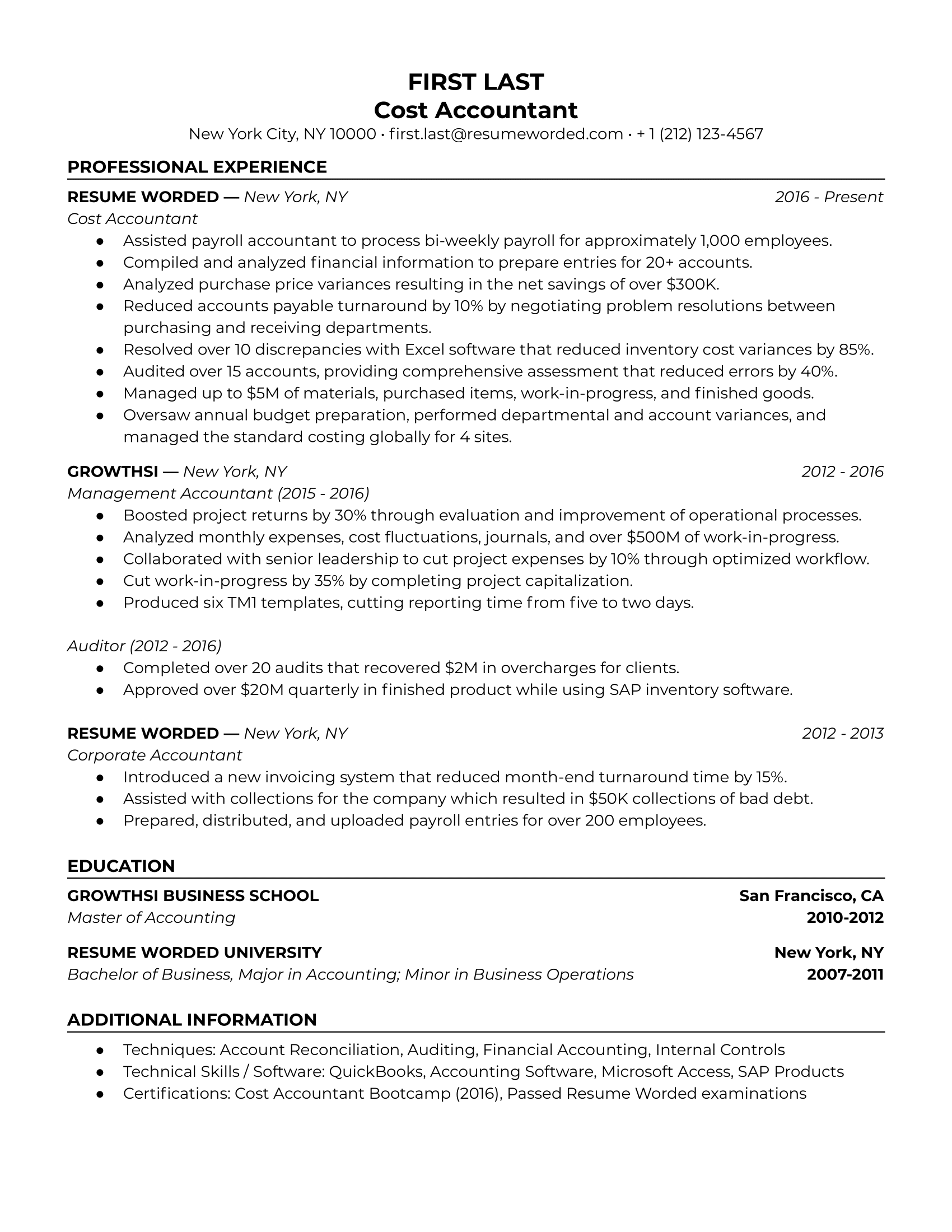

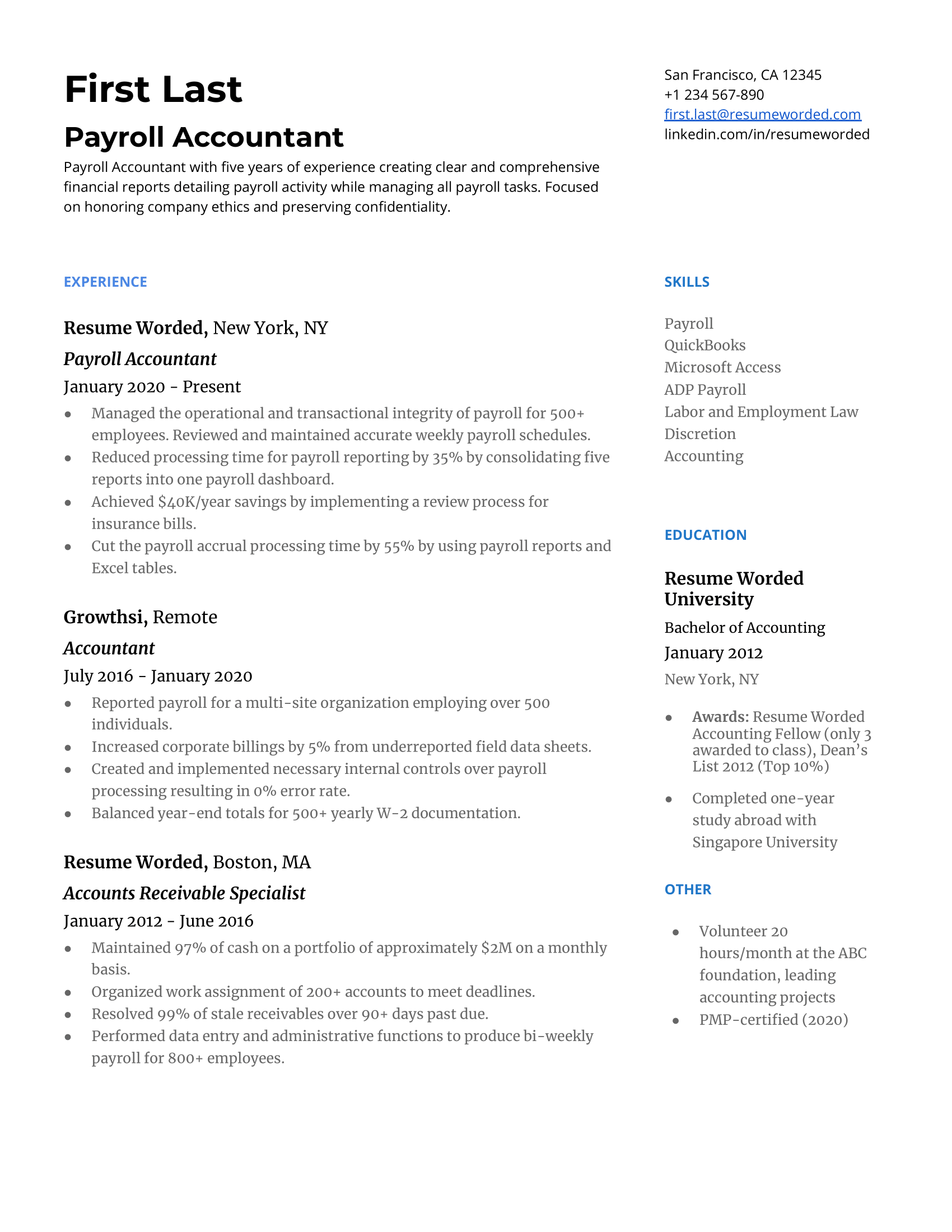

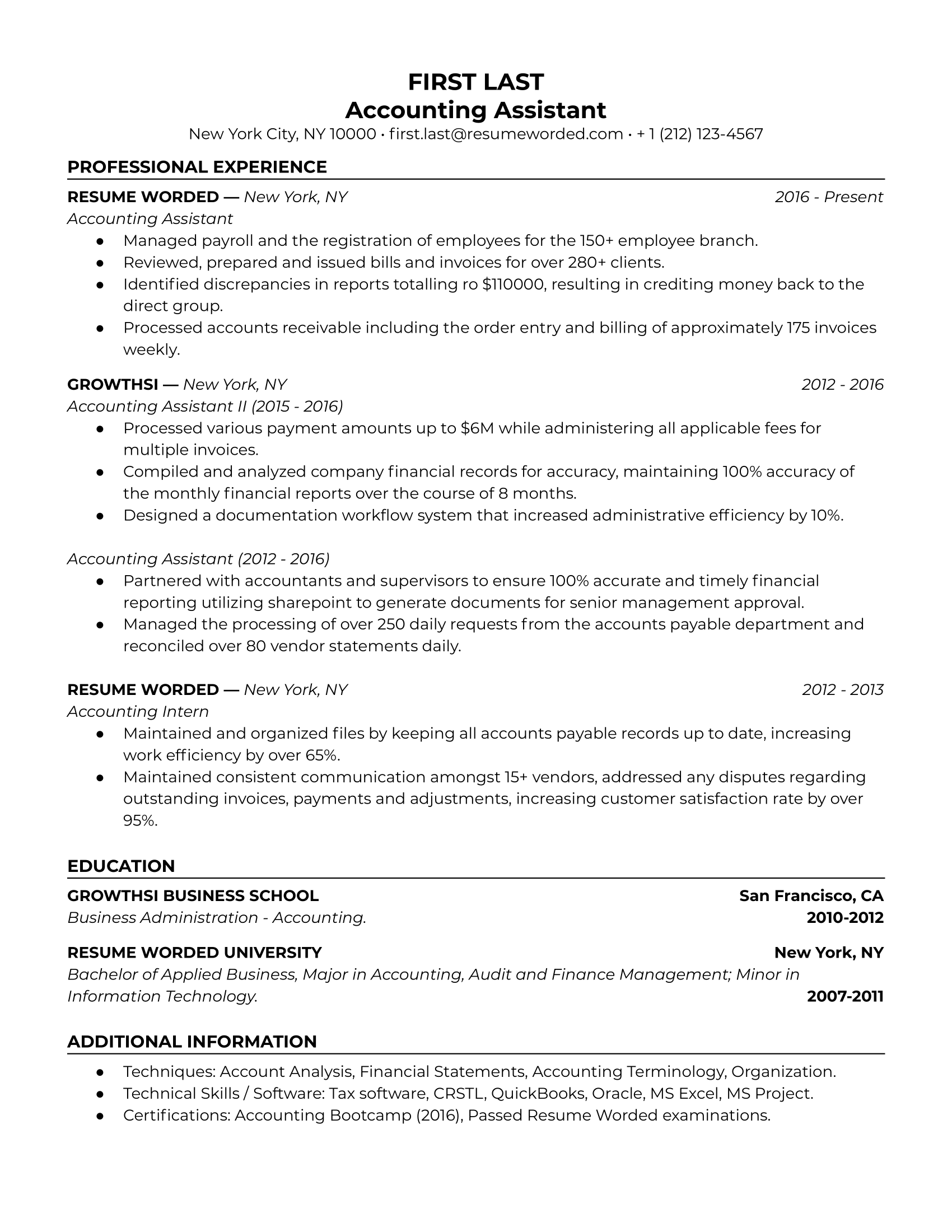

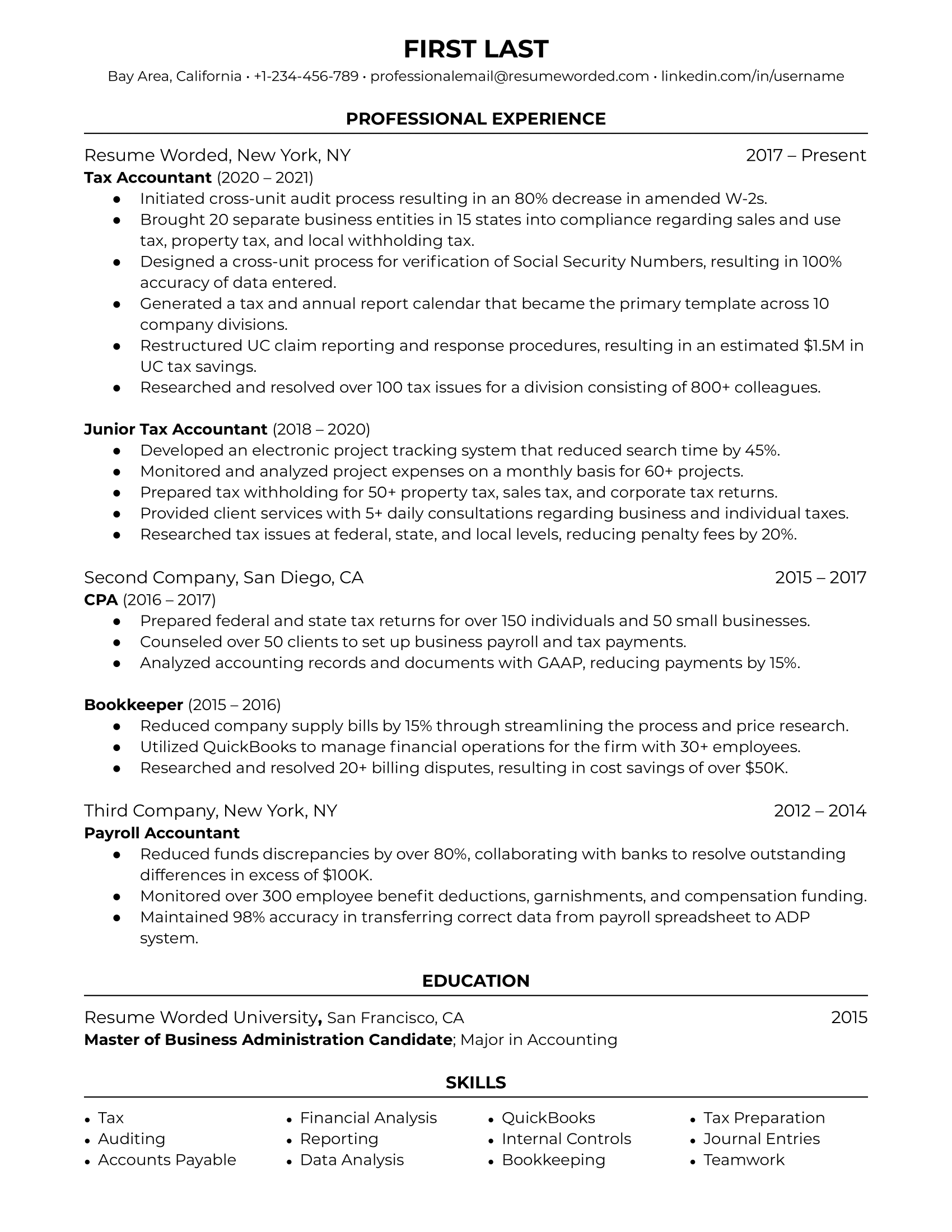

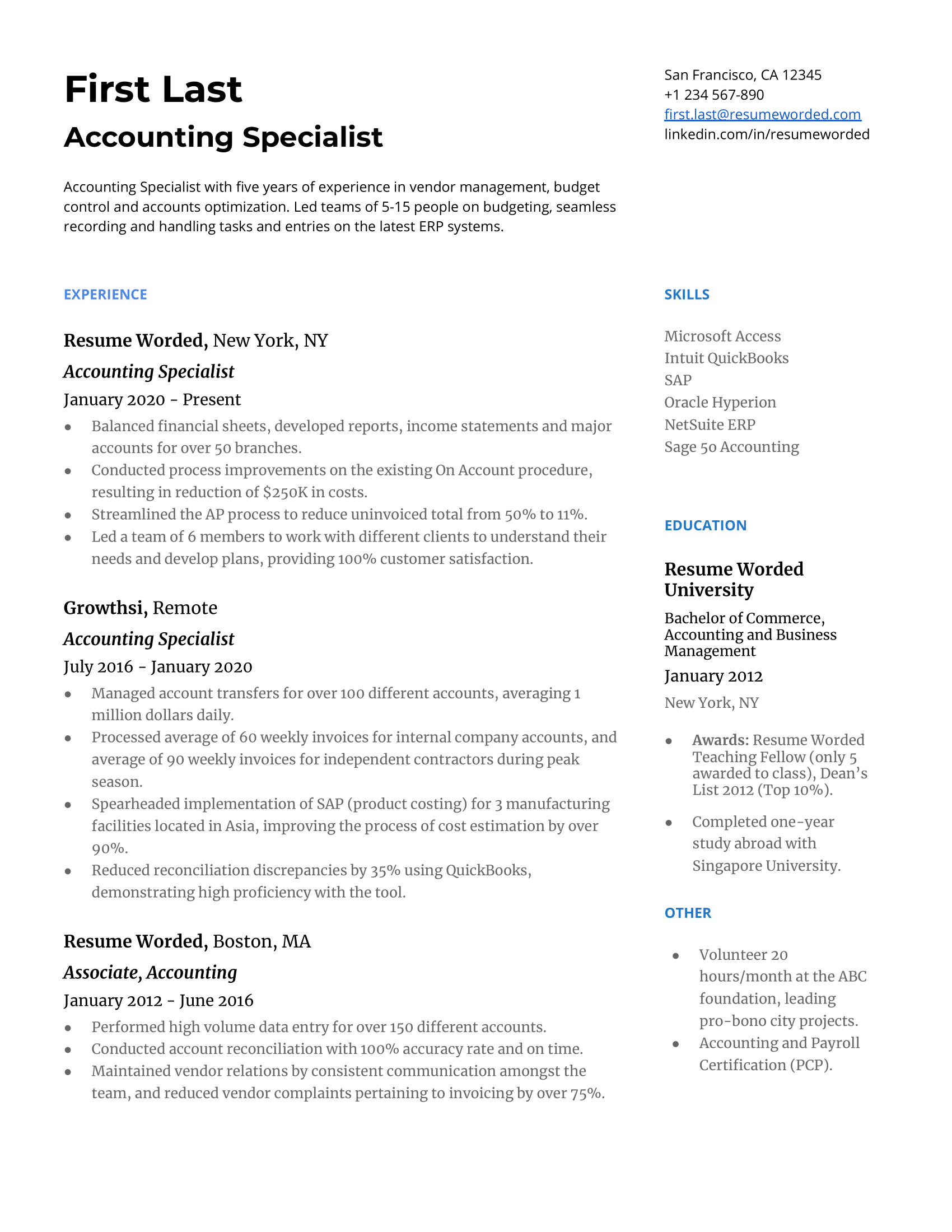

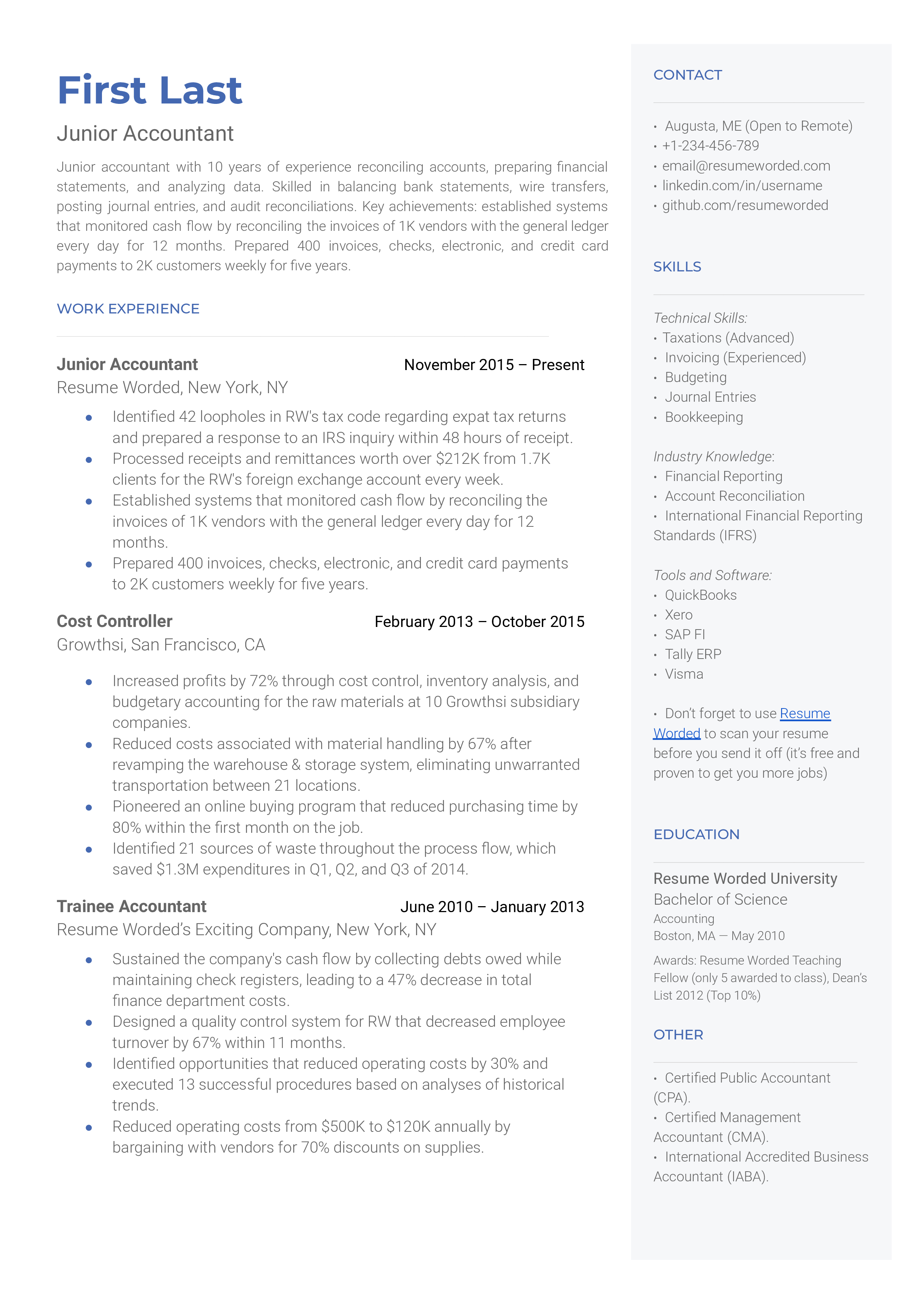

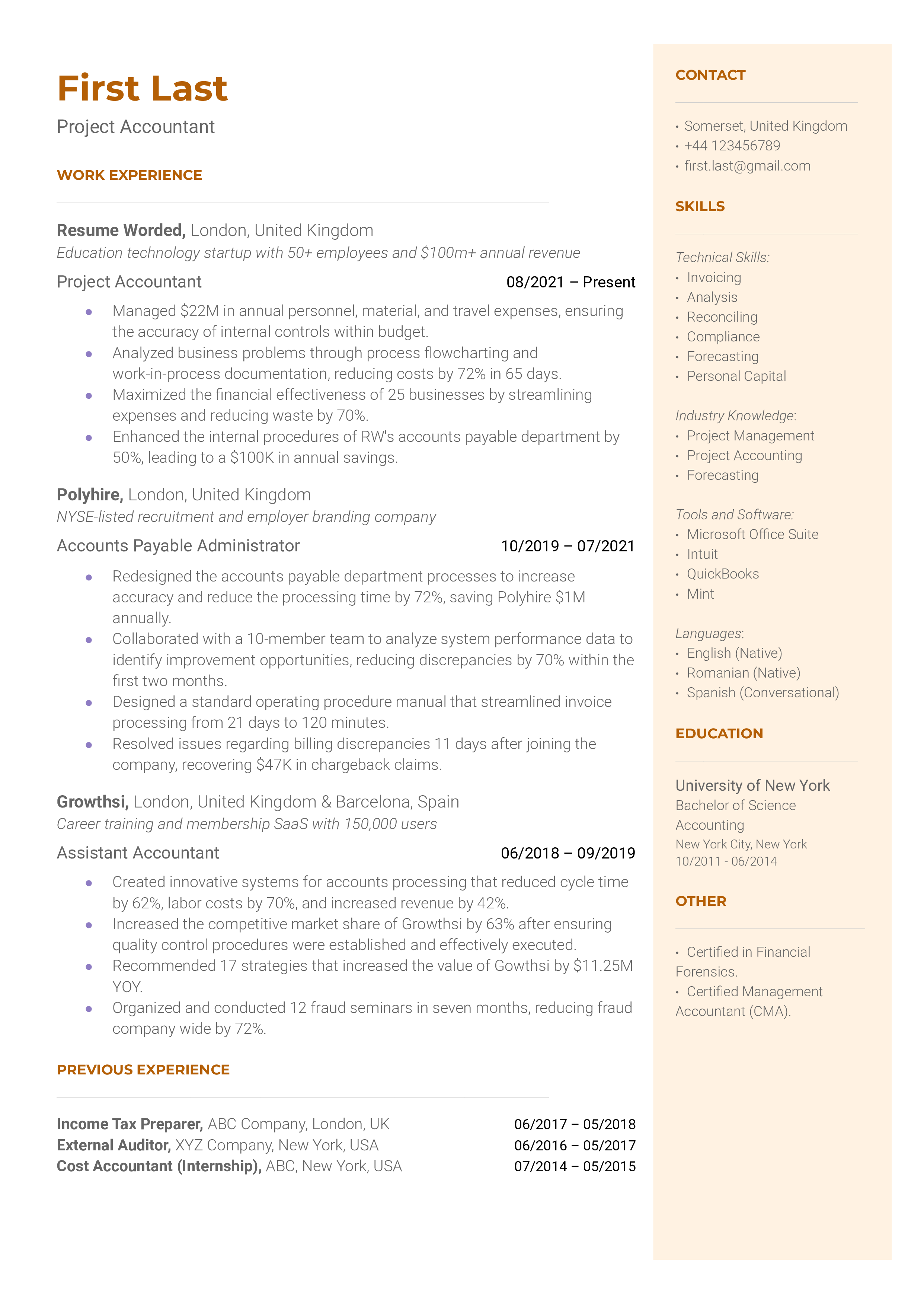

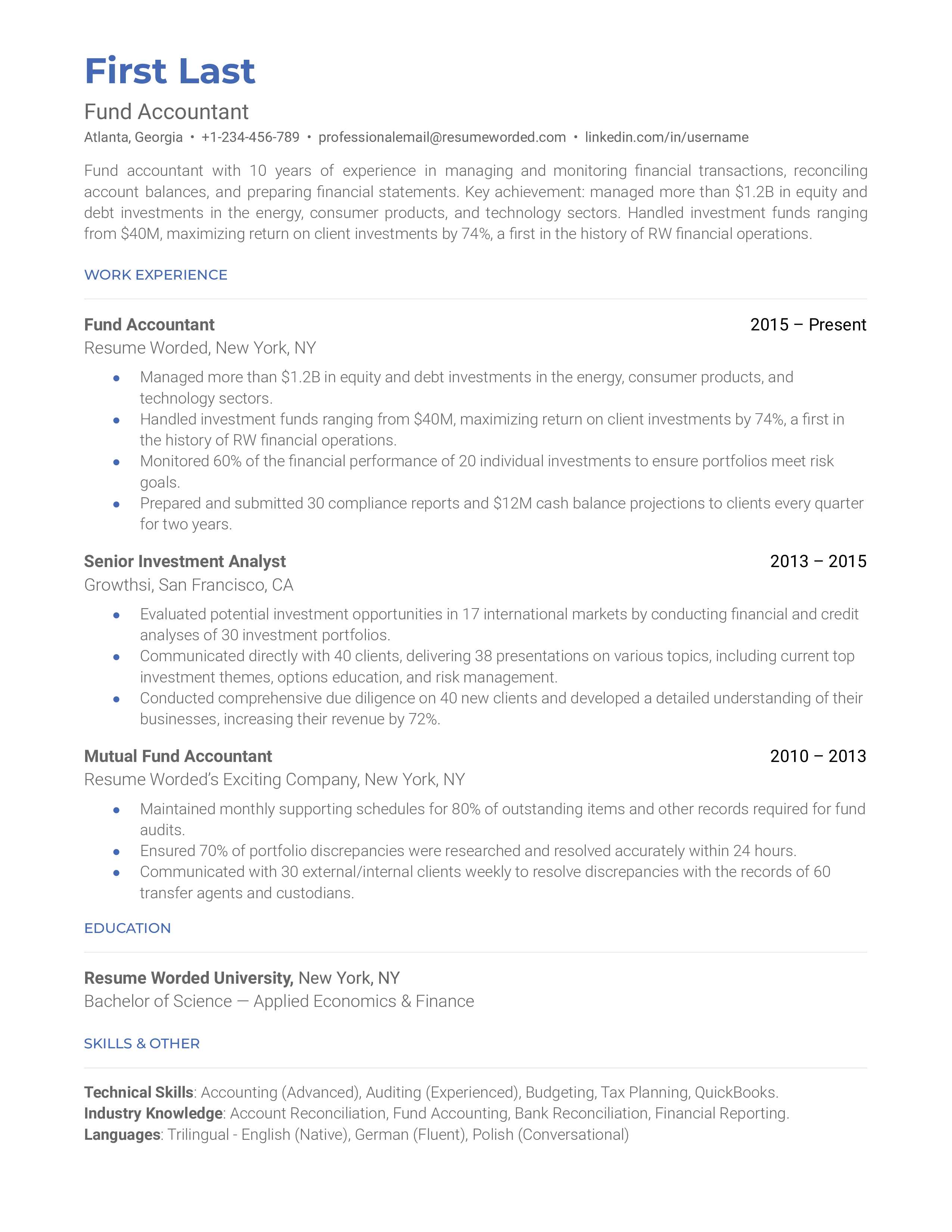

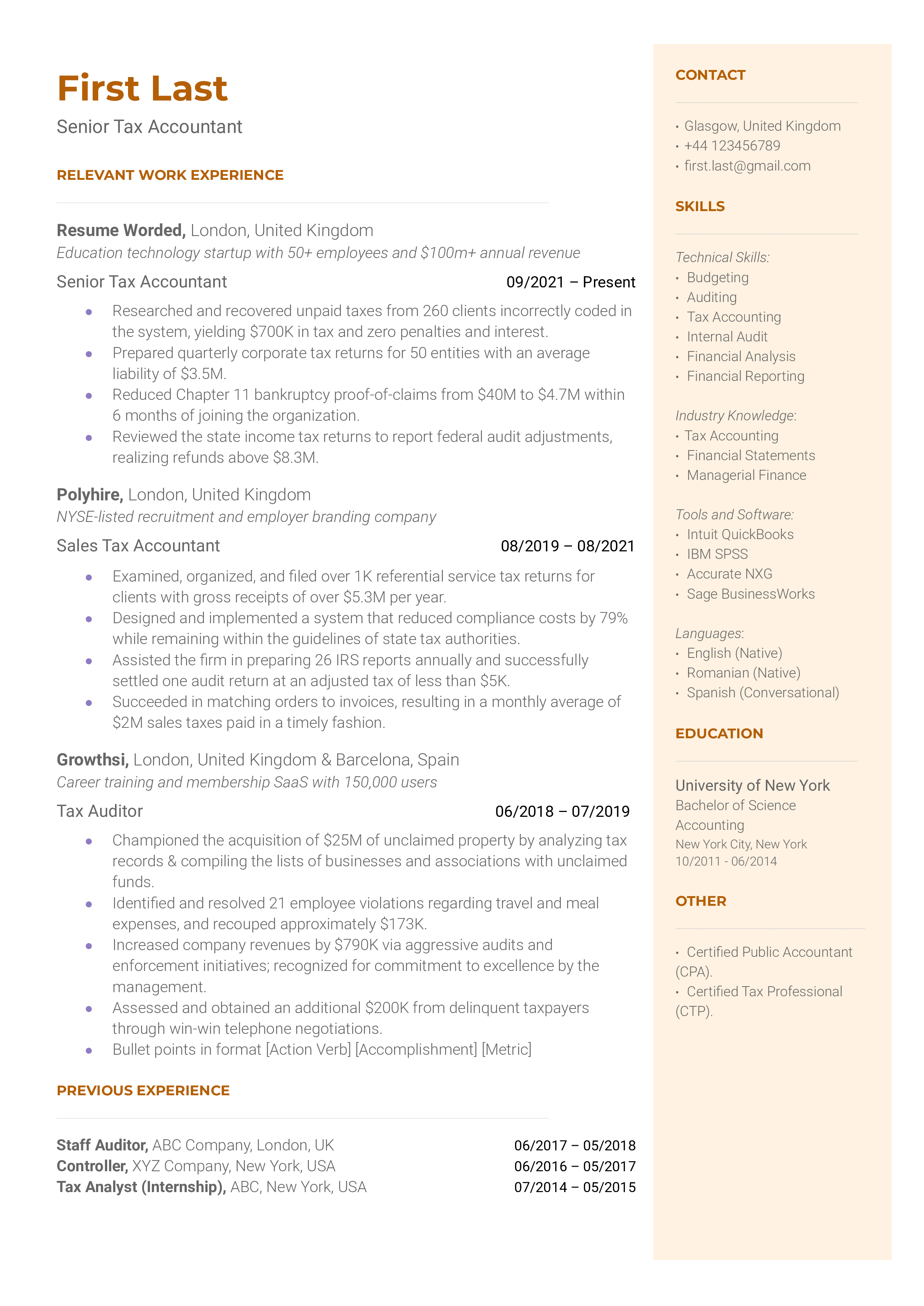

Accountant Resumes

Accountants are key players in the daily operations of most businesses. We cover what you need to know to land an accounting job in 2023 (Google Docs and PDFs attached).

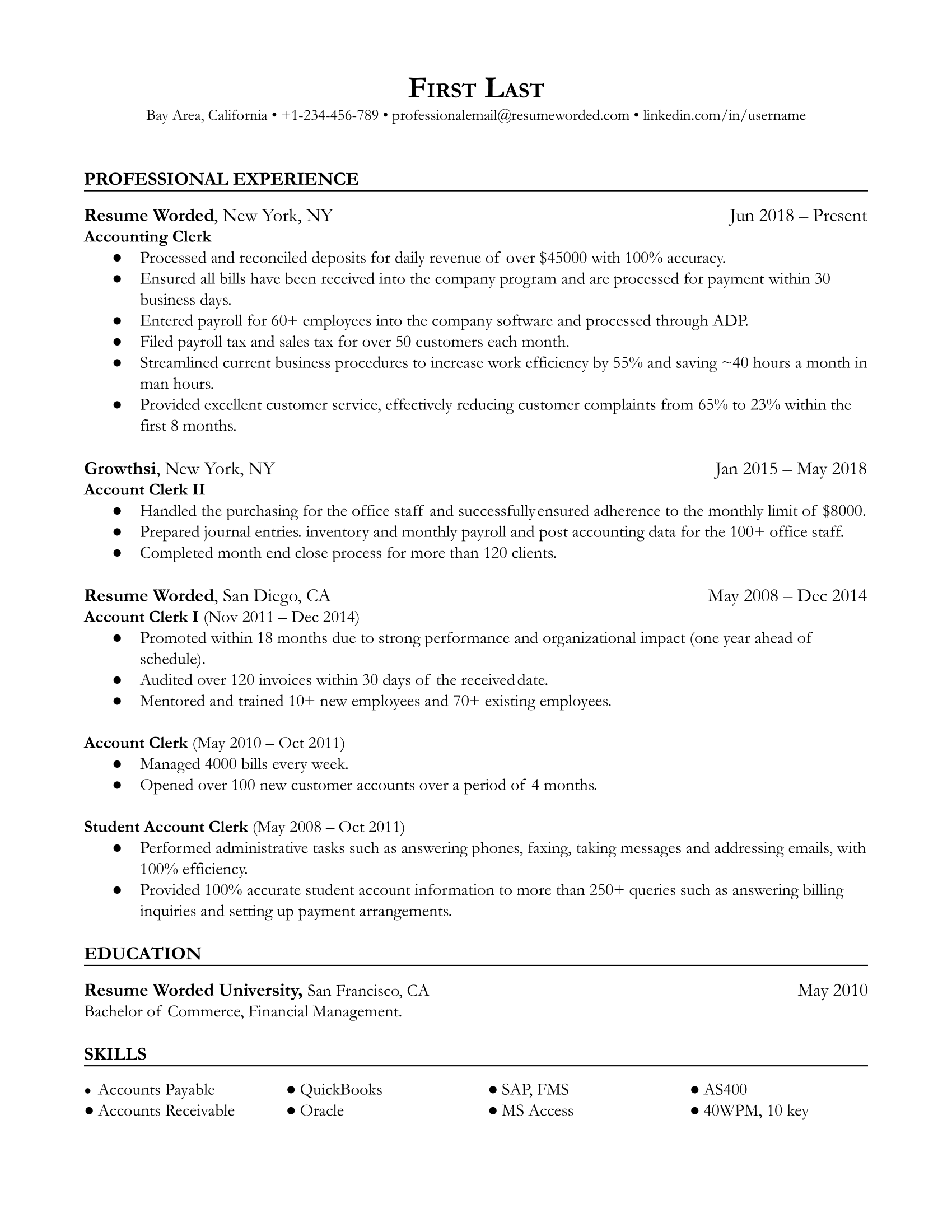

Accounting Clerk

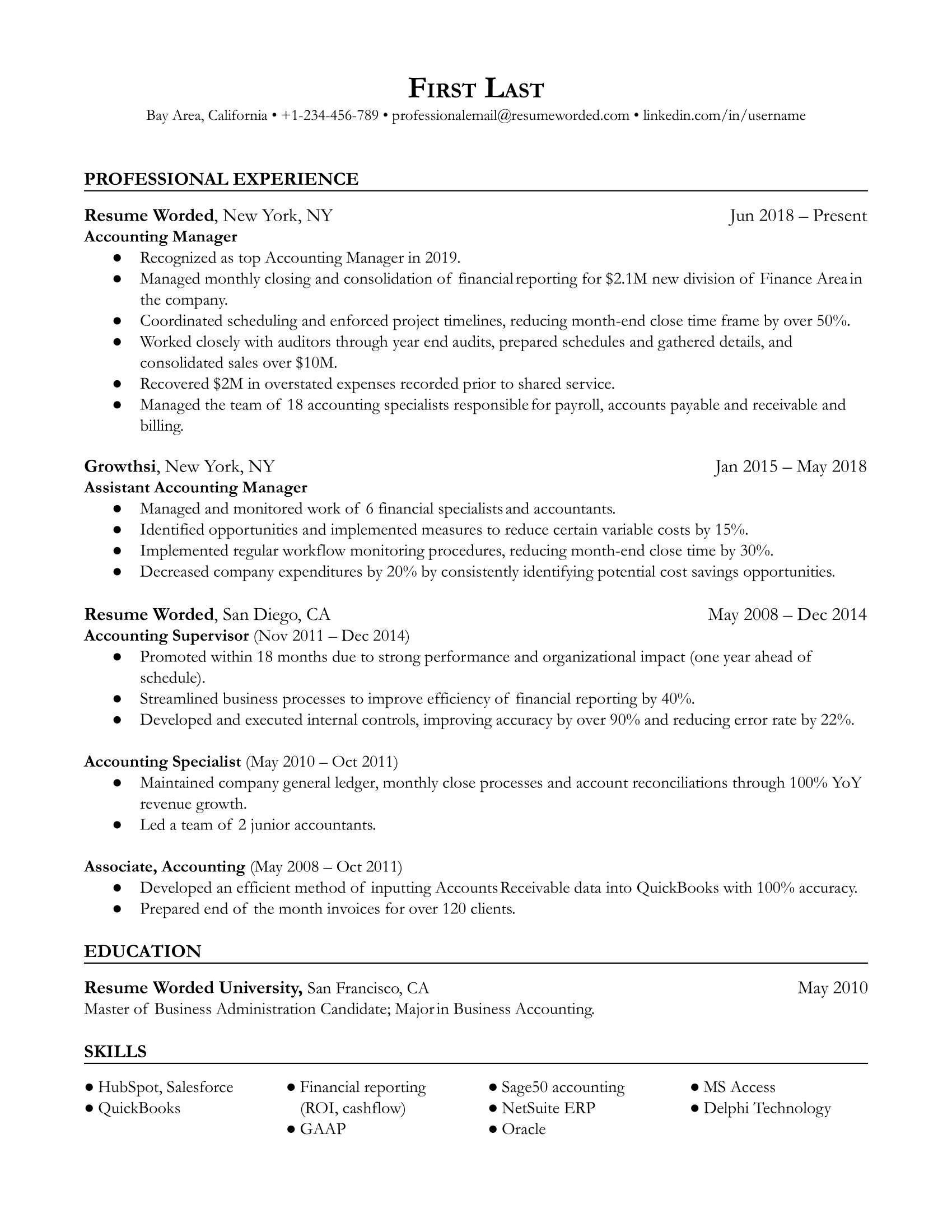

Accounting Manager

Senior Accountant / Accounting Executive

Entry Level Accountant

Staff Accountant

Cost Accountant

Payroll Accountant

Accounting Assistant

Tax Accountant

Accounting Specialist

Junior Accountant

Project Accountant

Public Accountant

Fund Accountant

Senior Tax Accountant

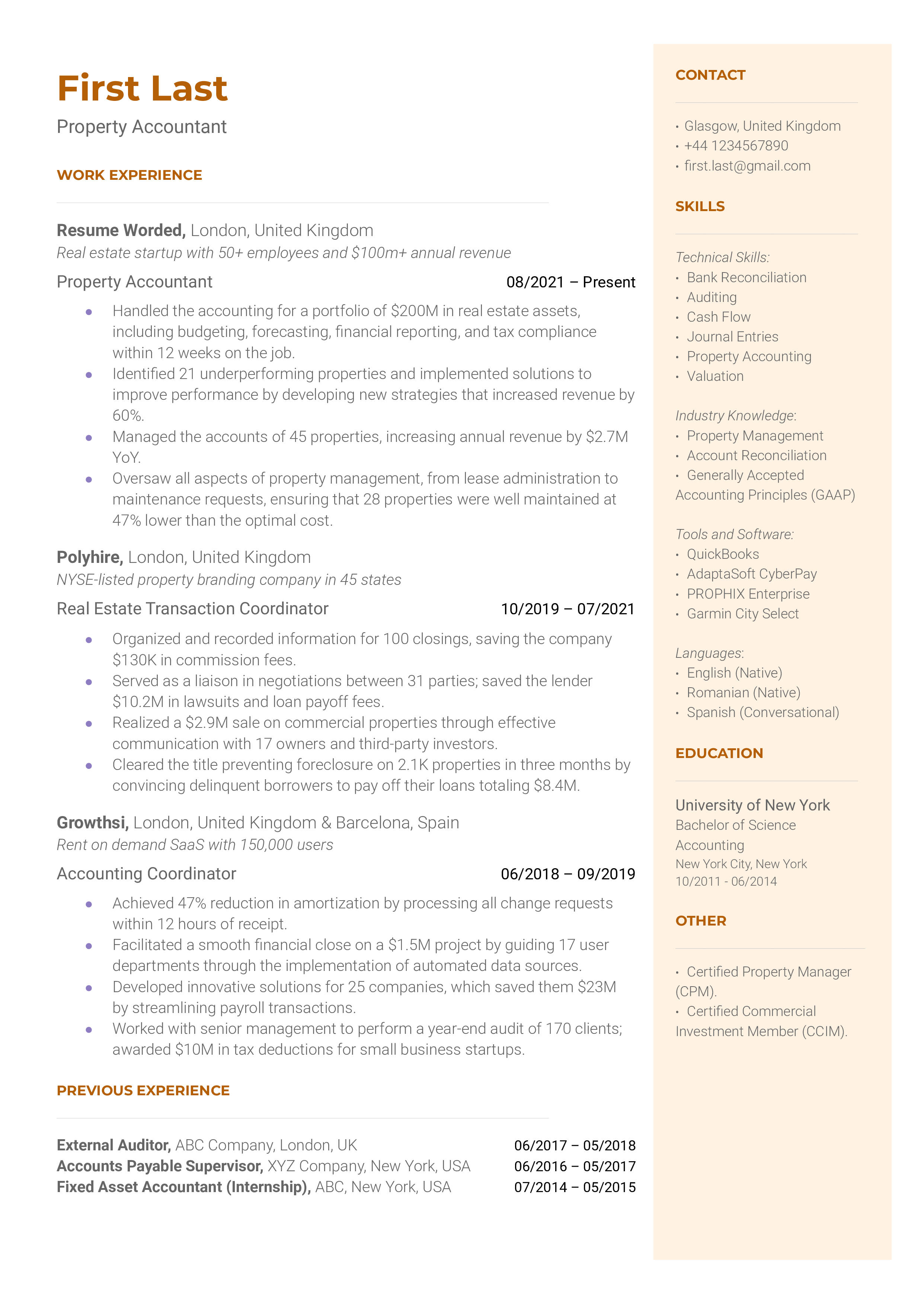

Property Accountant

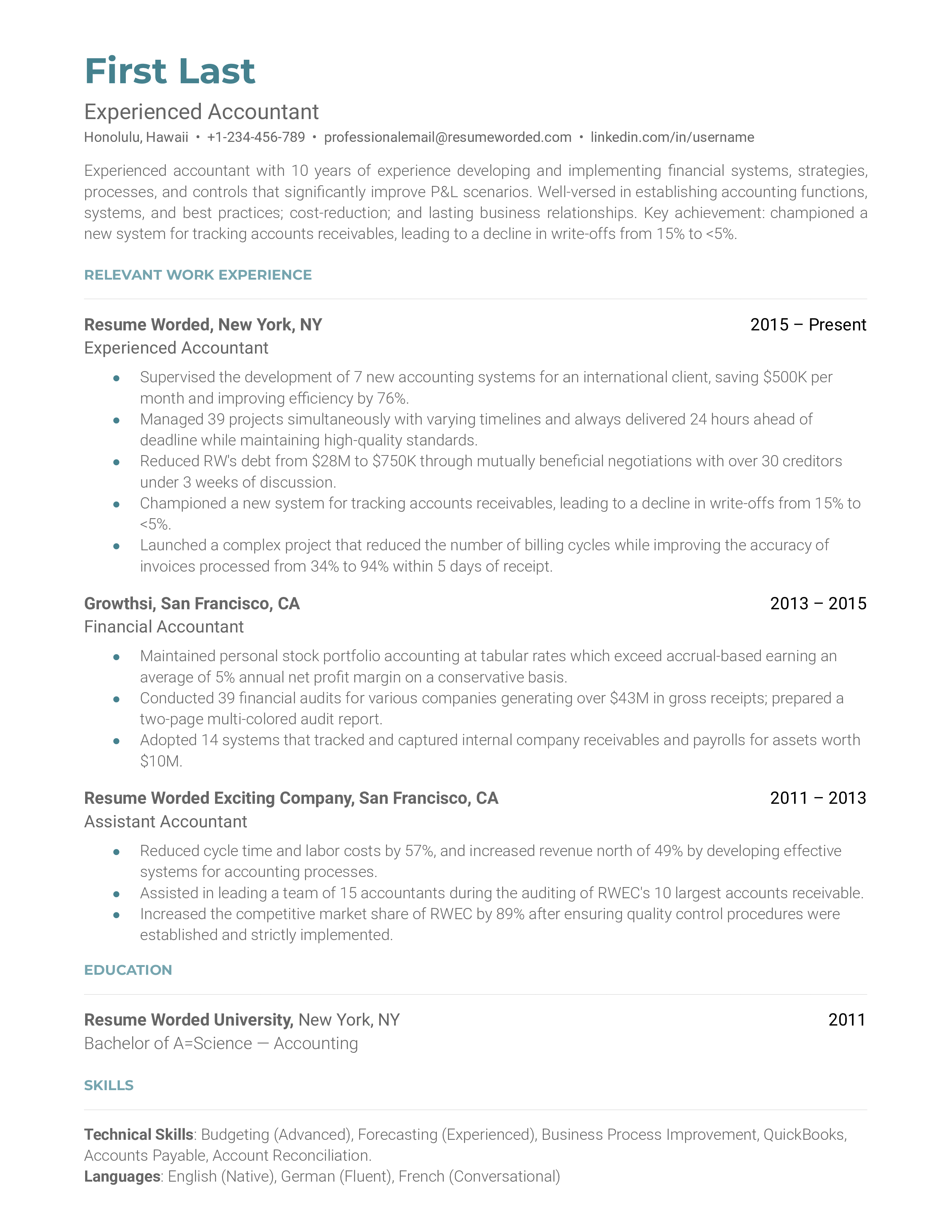

Experienced Accountant

Construction Accountant

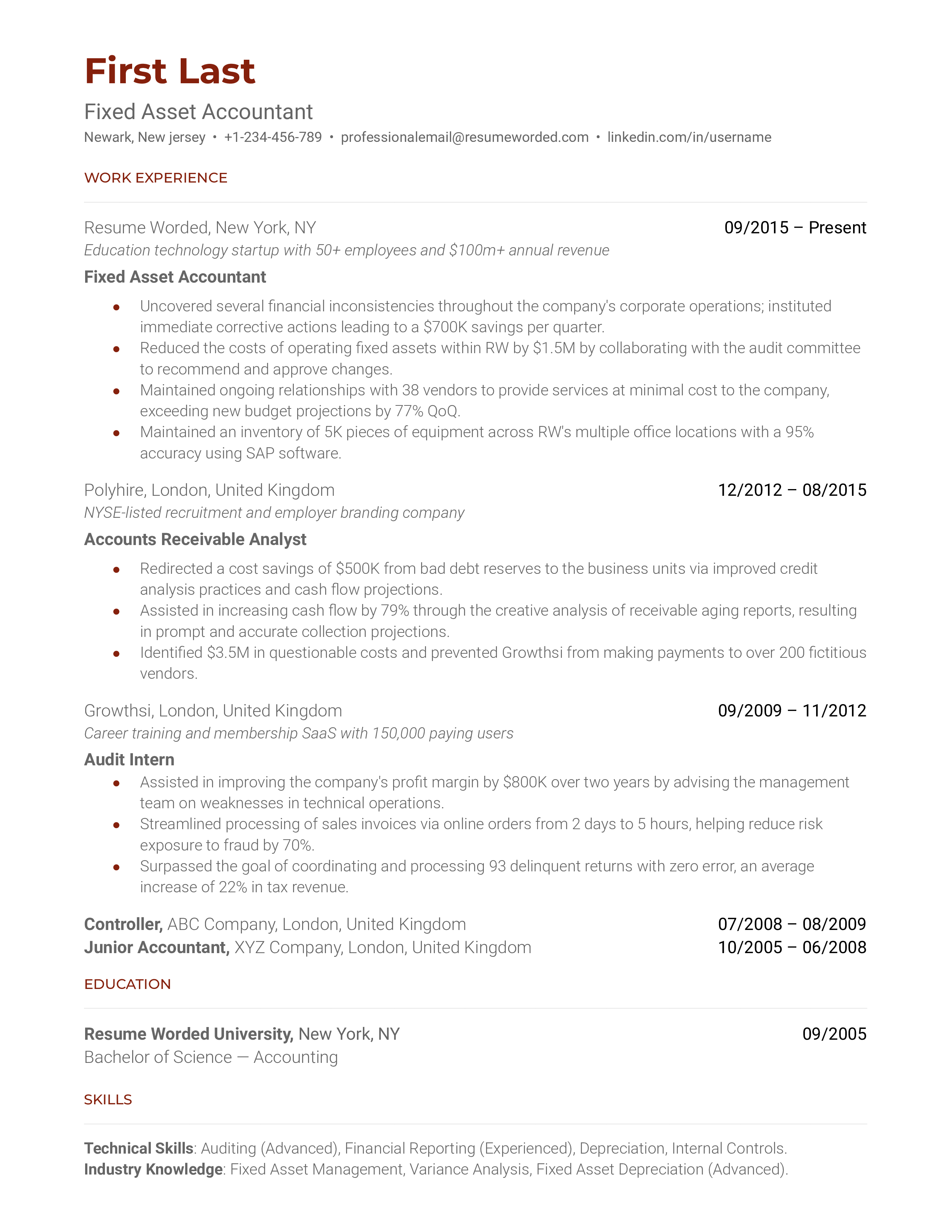

Fixed Asset Accountant

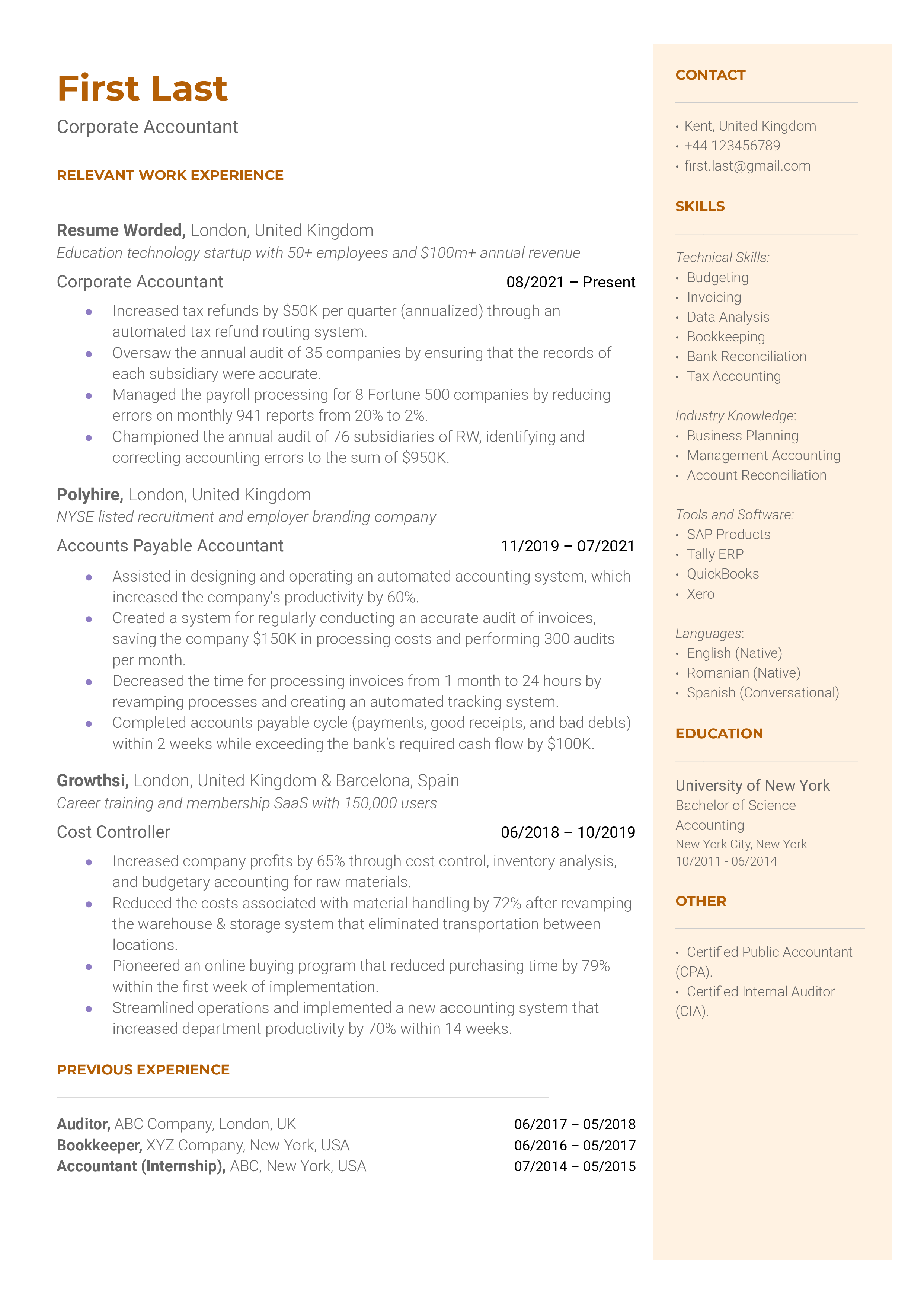

Corporate Accountant

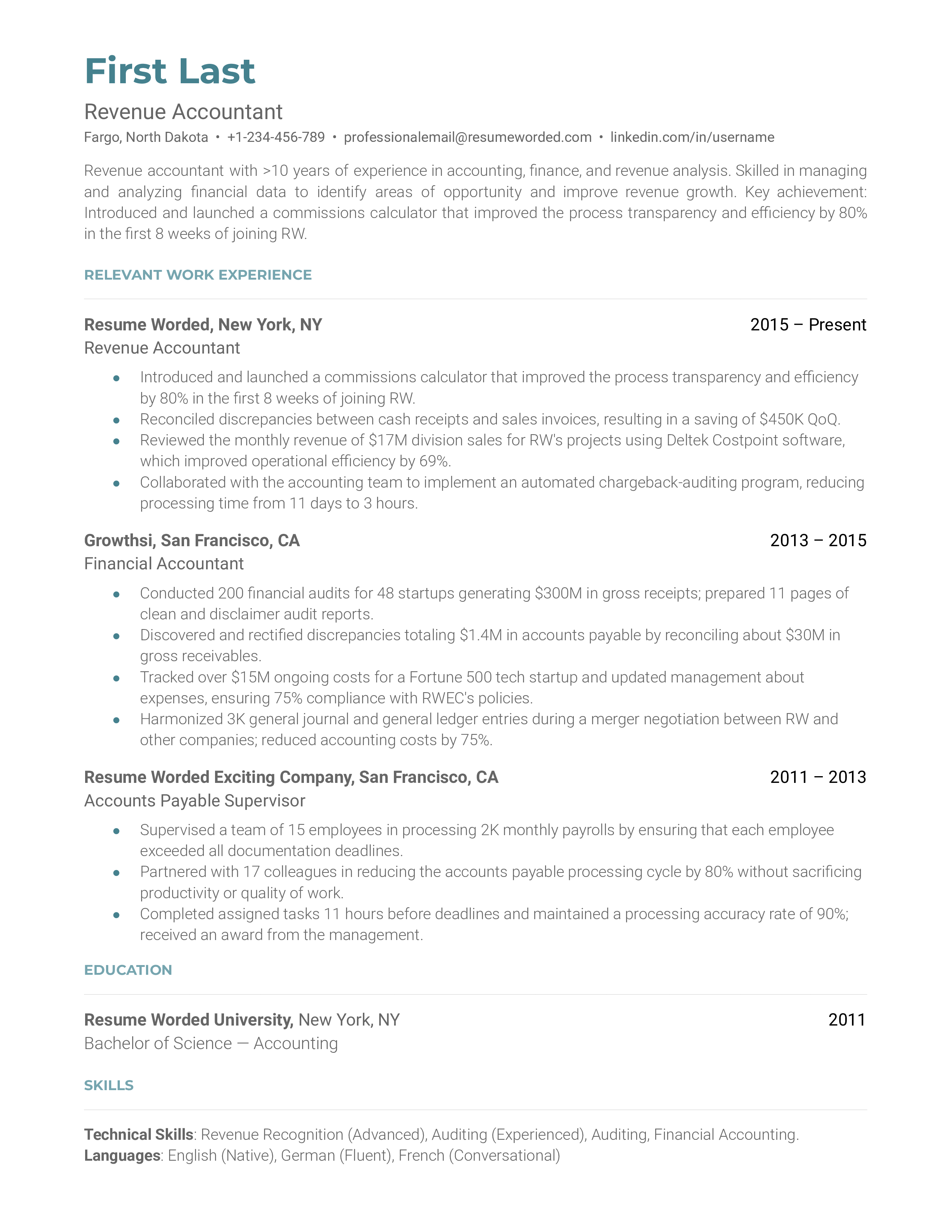

Revenue Accountant

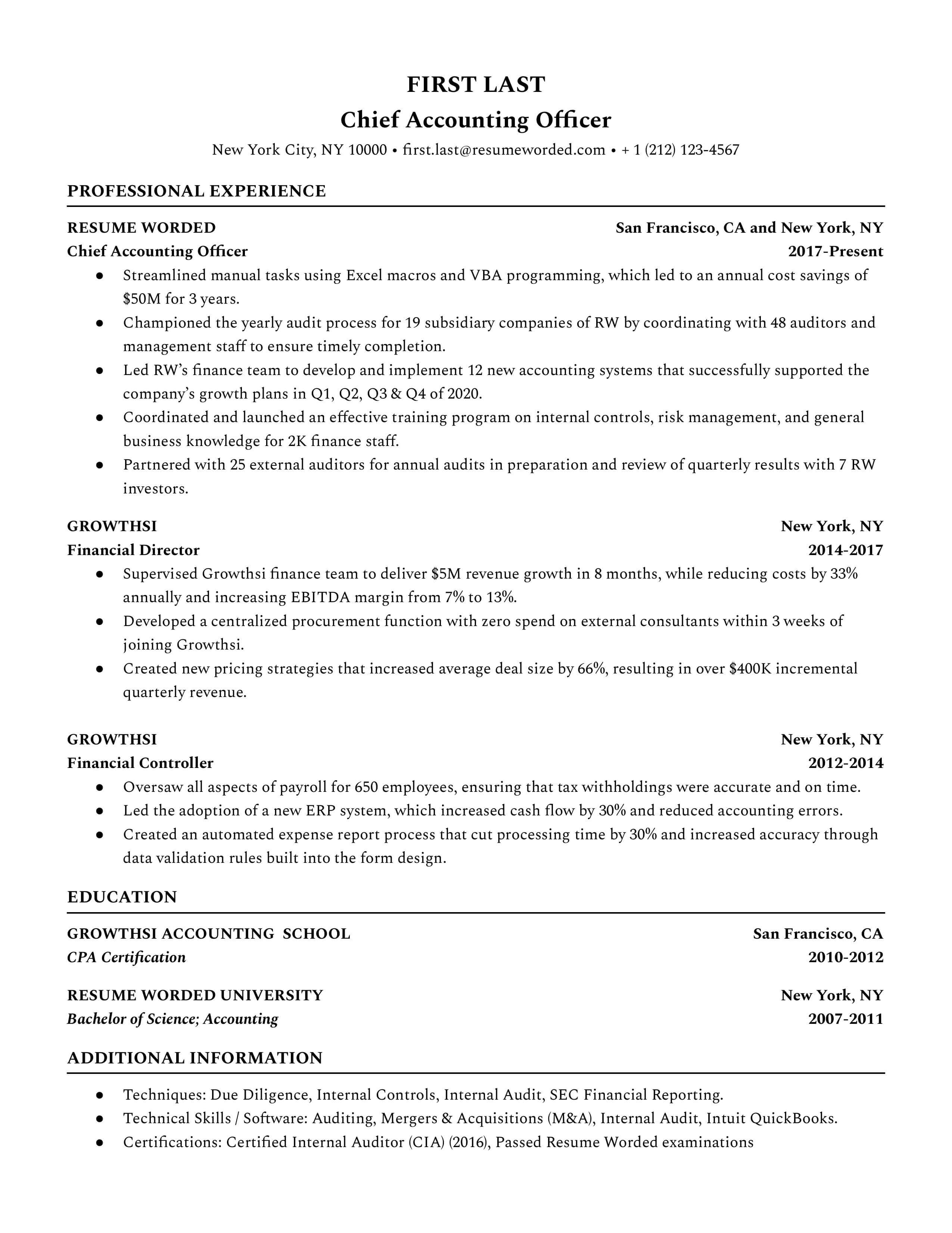

Chief Accounting Officer

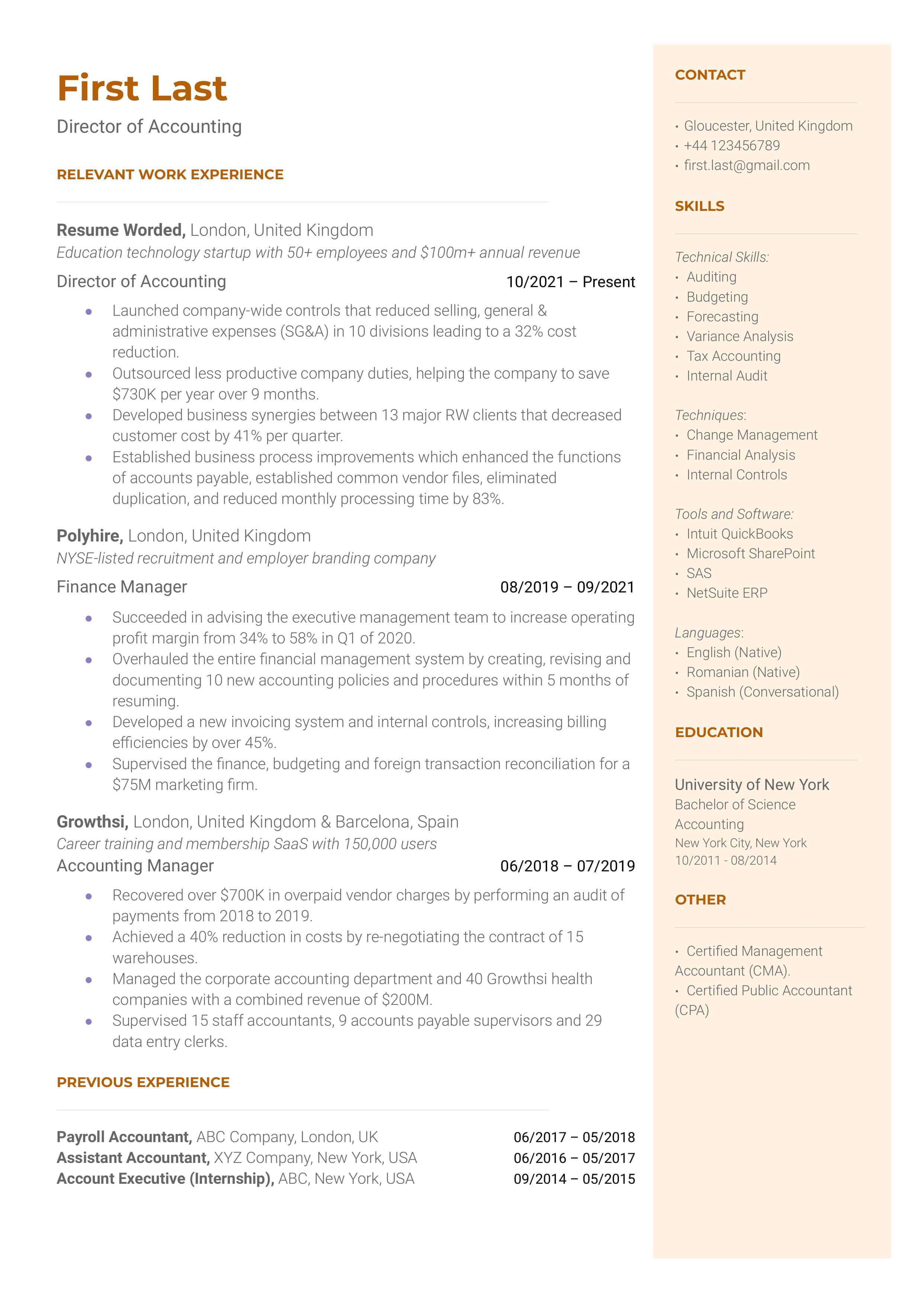

Director of Accounting

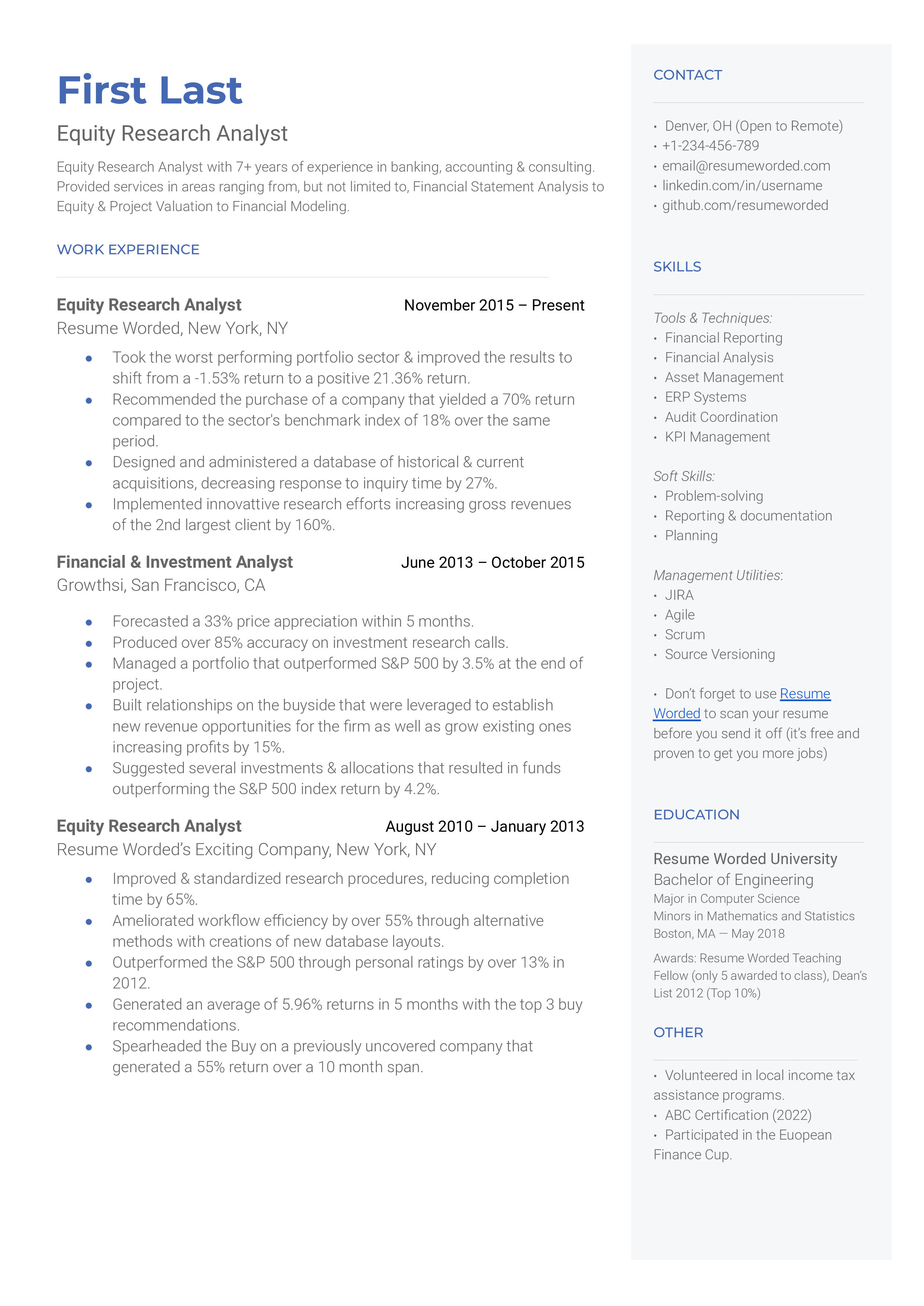

Equity Research Resumes

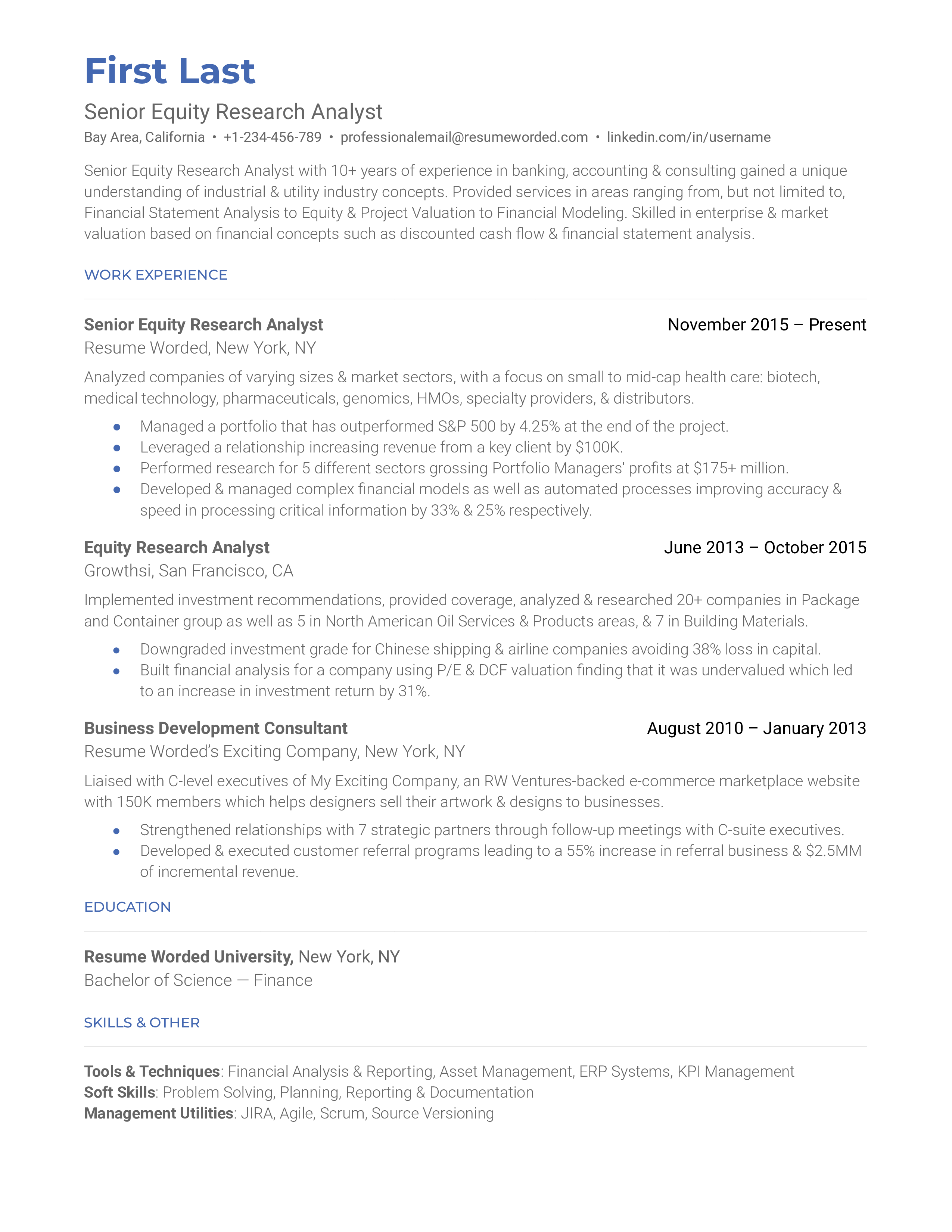

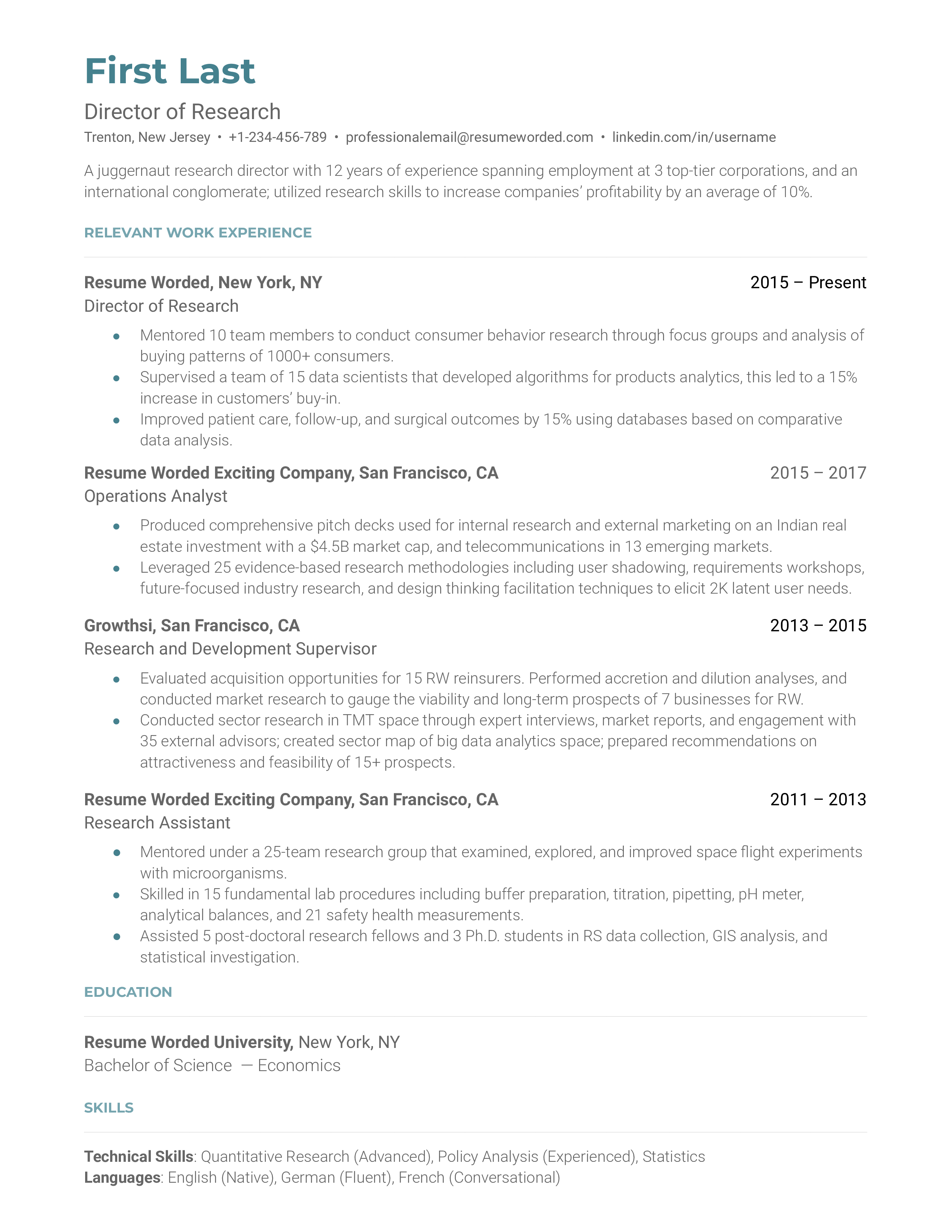

Equity researcher analysts are the advisers of the securities industry. They make sure decision-makers have the best information to make the best decisions. This guide will show you how to craft a resume that will impress recruiters.

Equity Research Analyst

Equity Research Senior Analyst

Director of Research

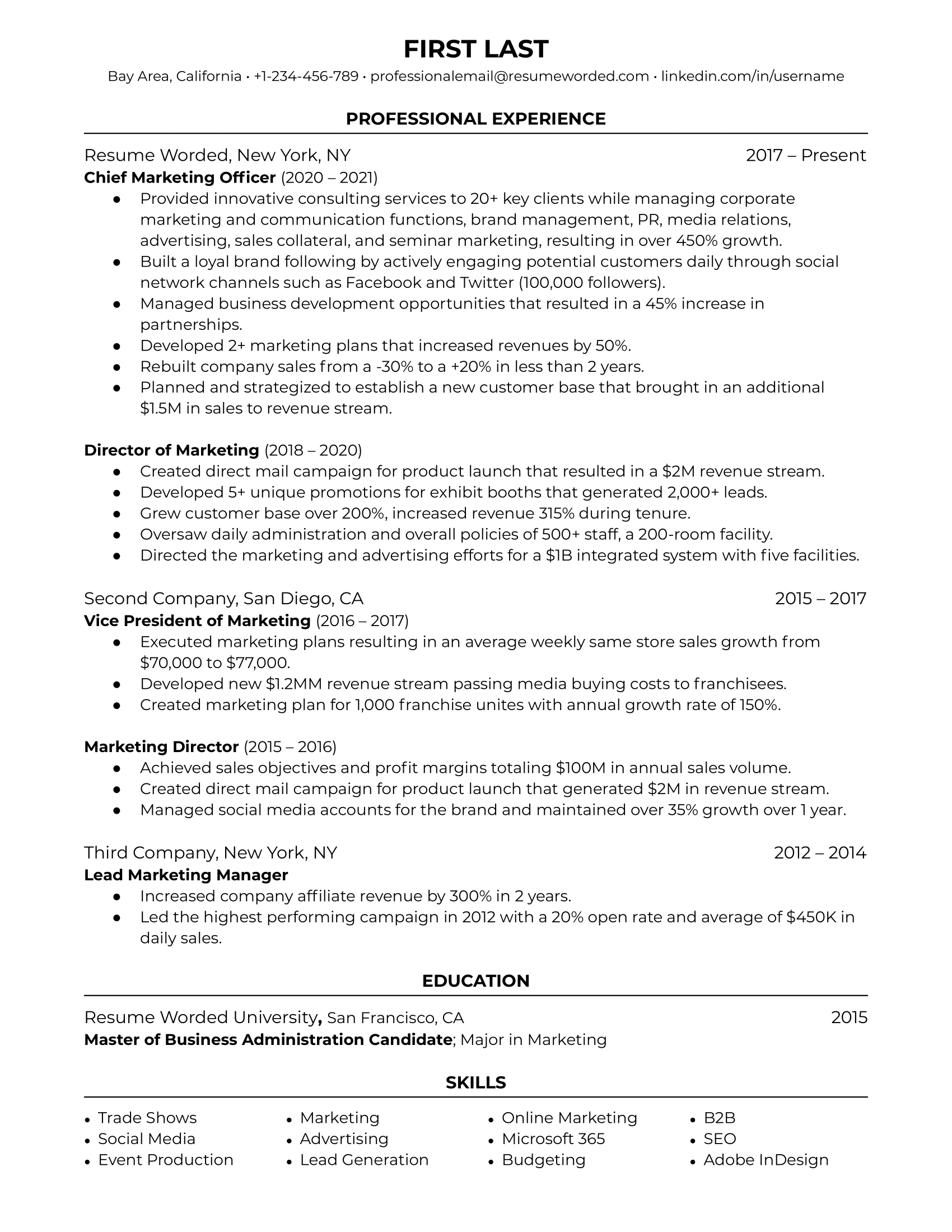

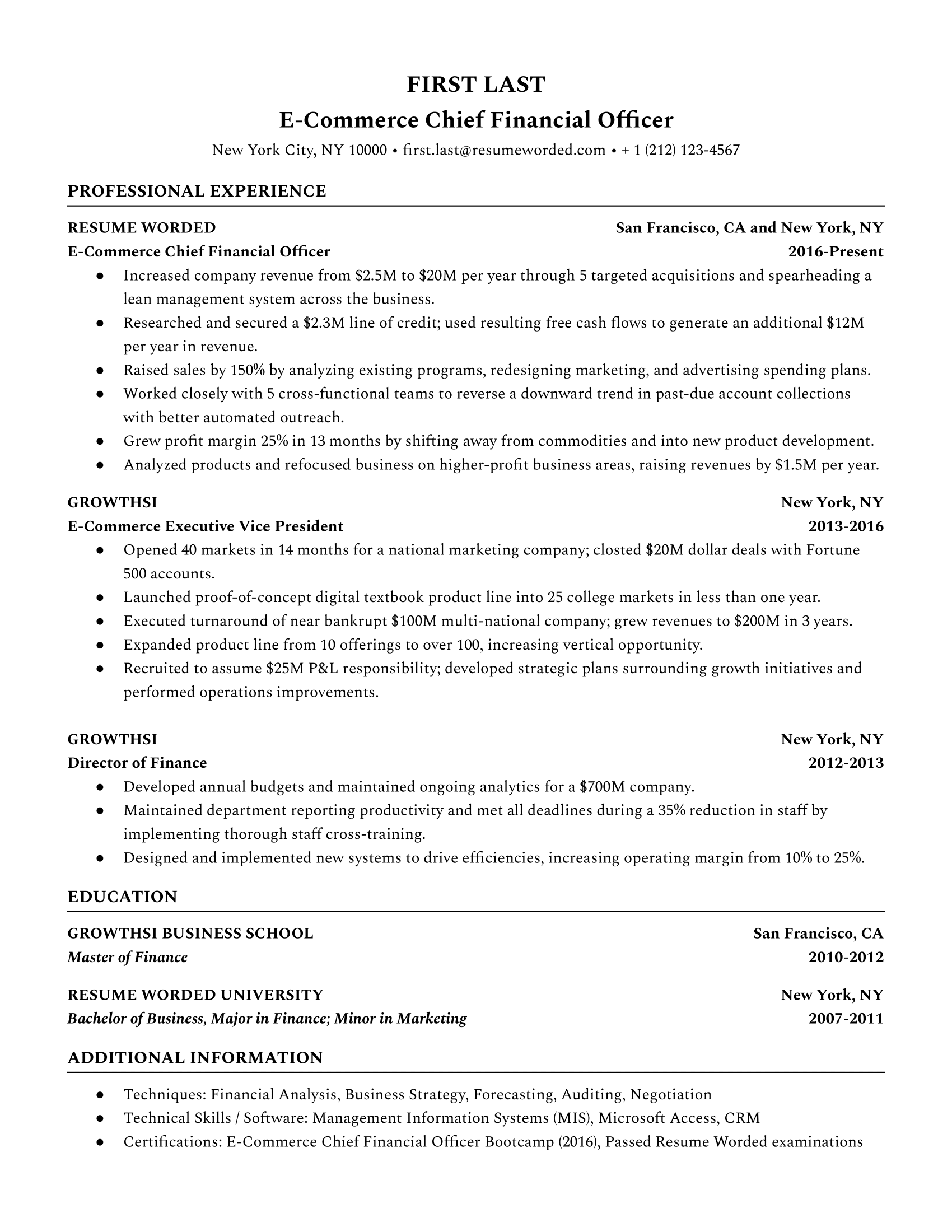

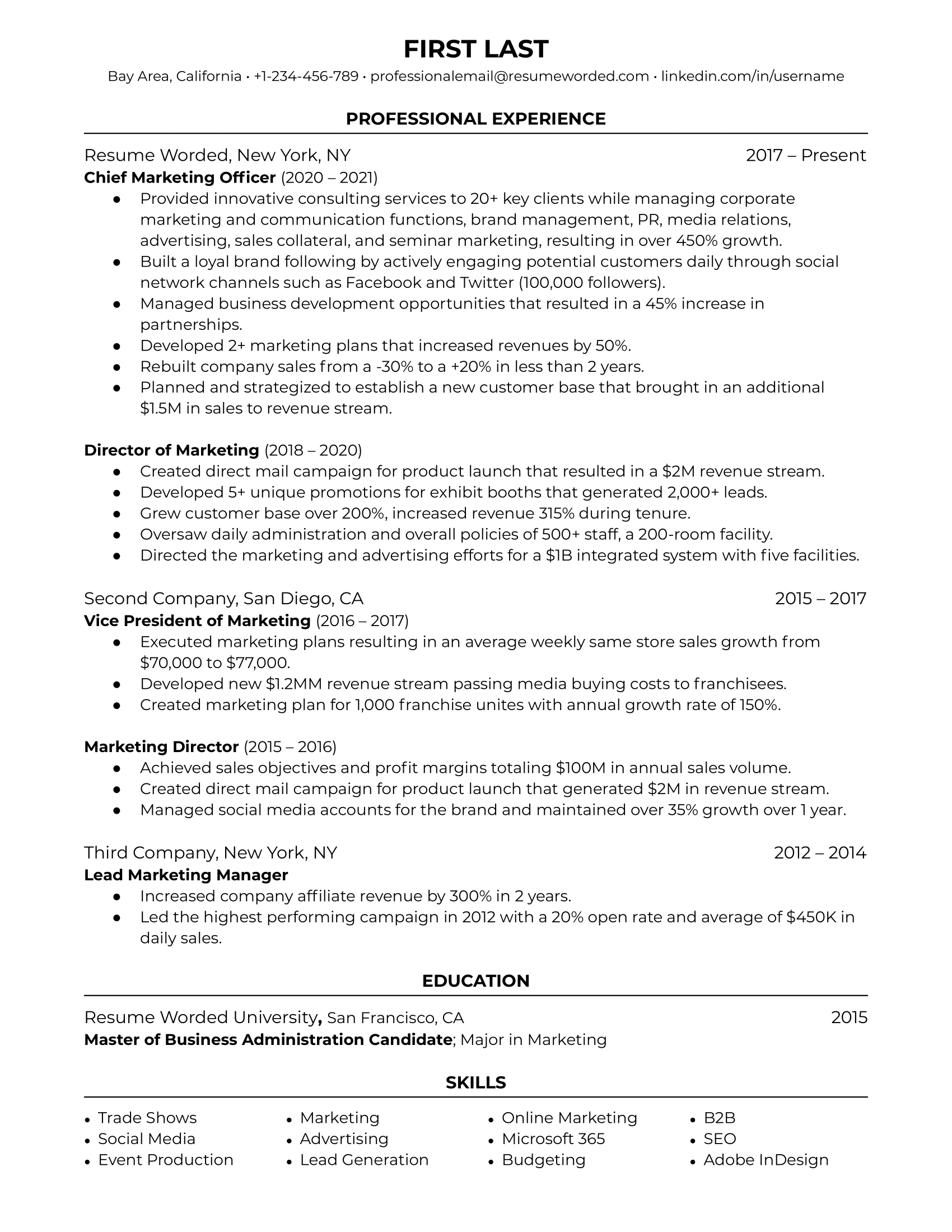

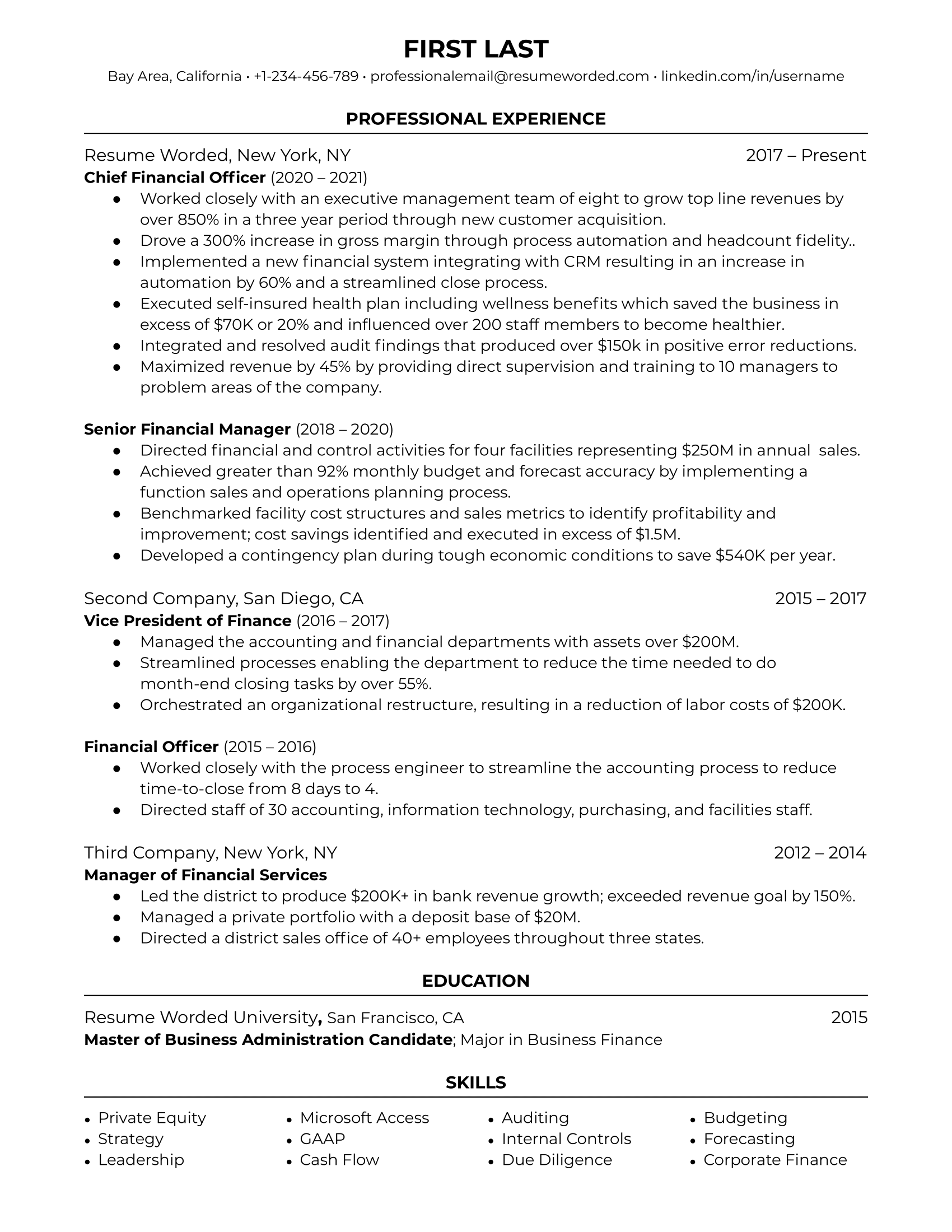

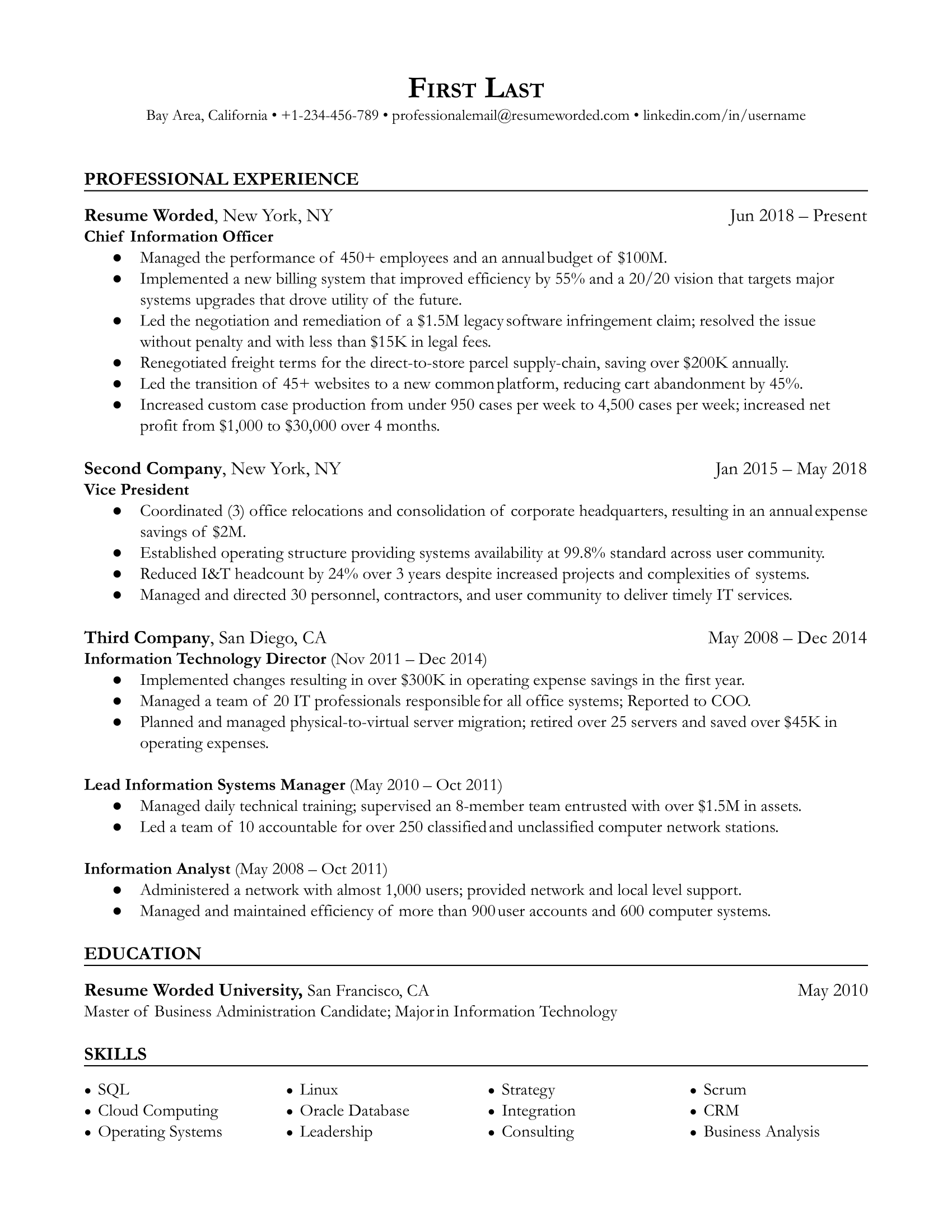

C-Level and Executive Resumes

No company can run smoothly without top C-level executives. If you’re applying for one of these demanding roles, you’ll need a resume that speaks for itself — and we can help. In this guide, you’ll find resume examples for any C-suite role as well as key industry-specific tips and insights.

Chief Marketing Officer (CMO) - 1

Chief Marketing Officer (CMO) - 2

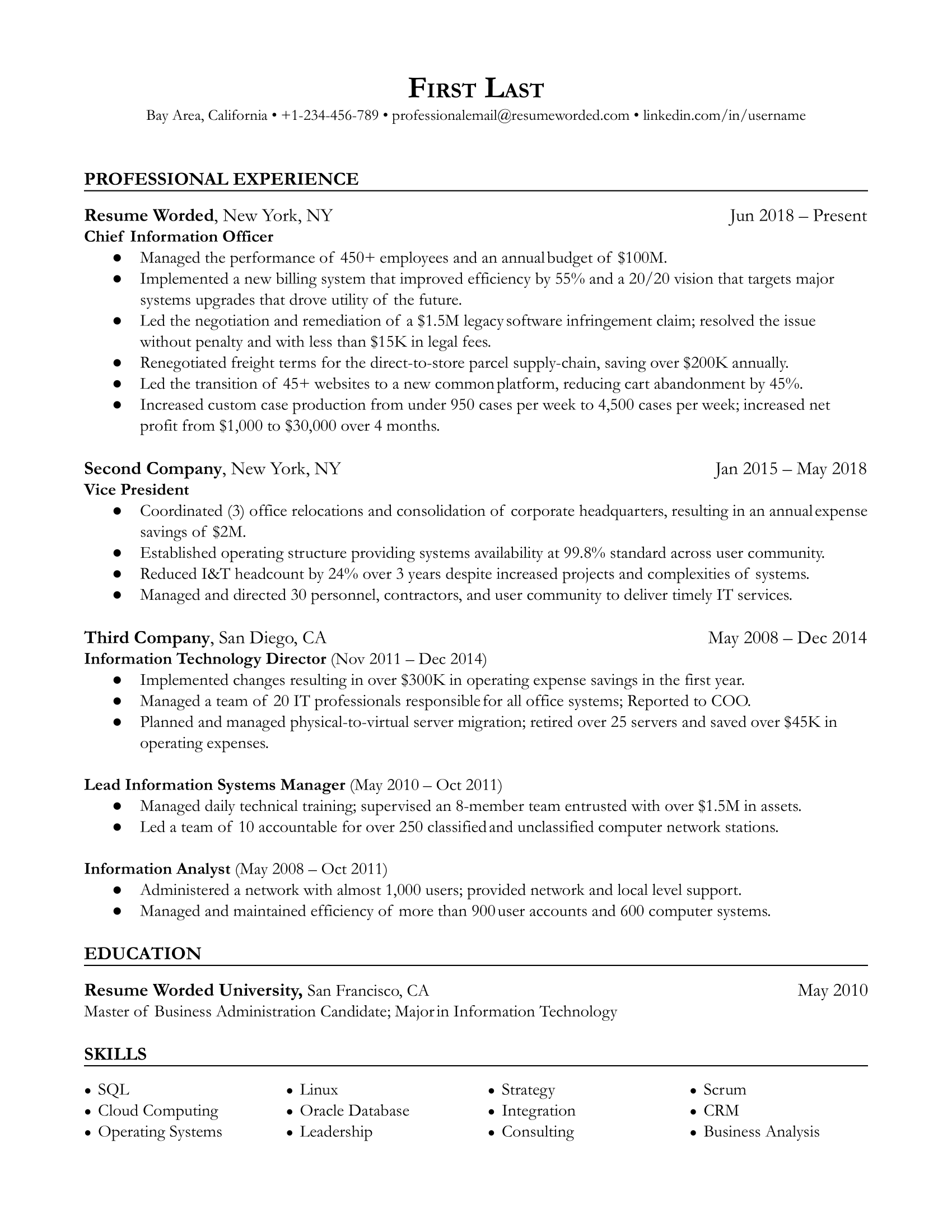

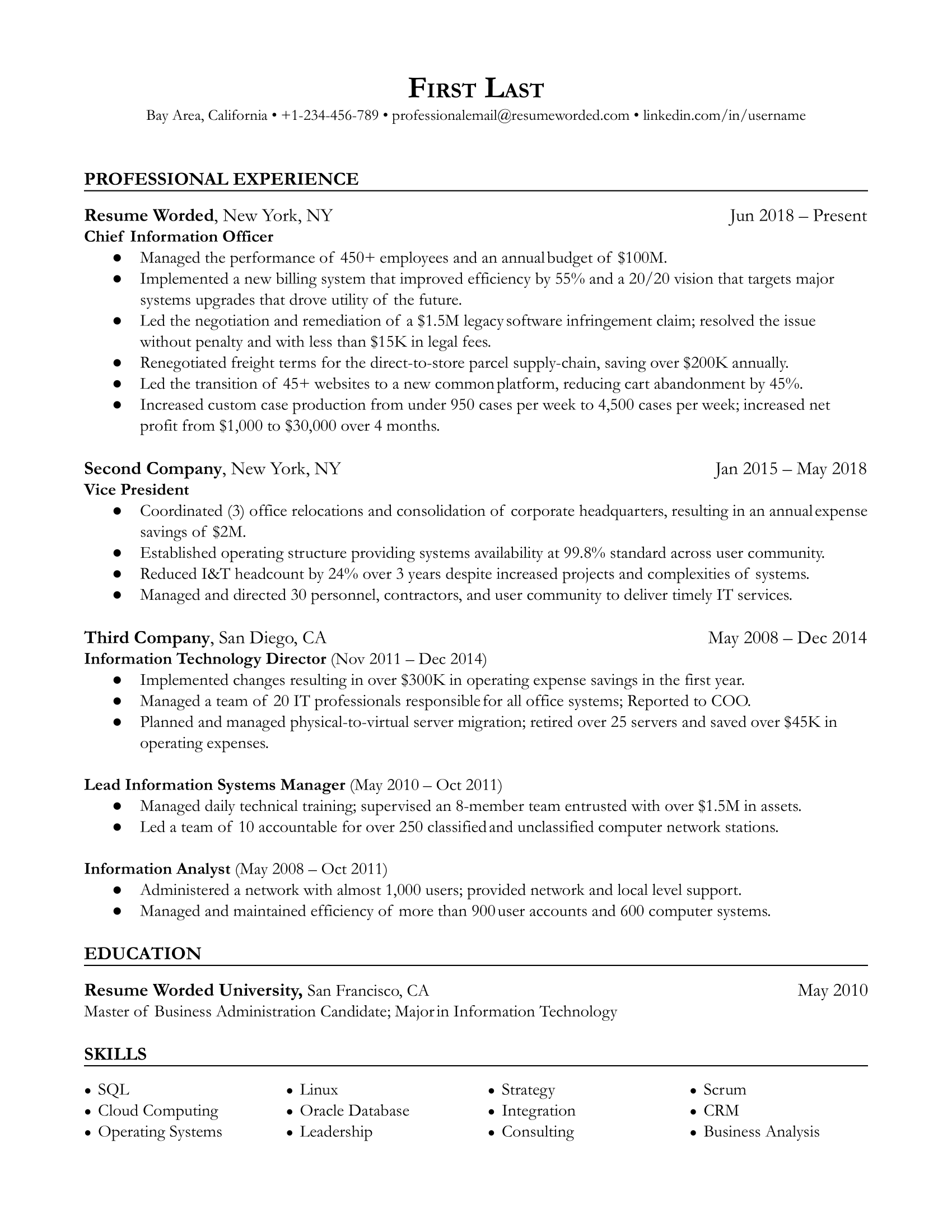

Chief Information Officer (CIO) - 1

Chief Information Officer (CIO) - 2

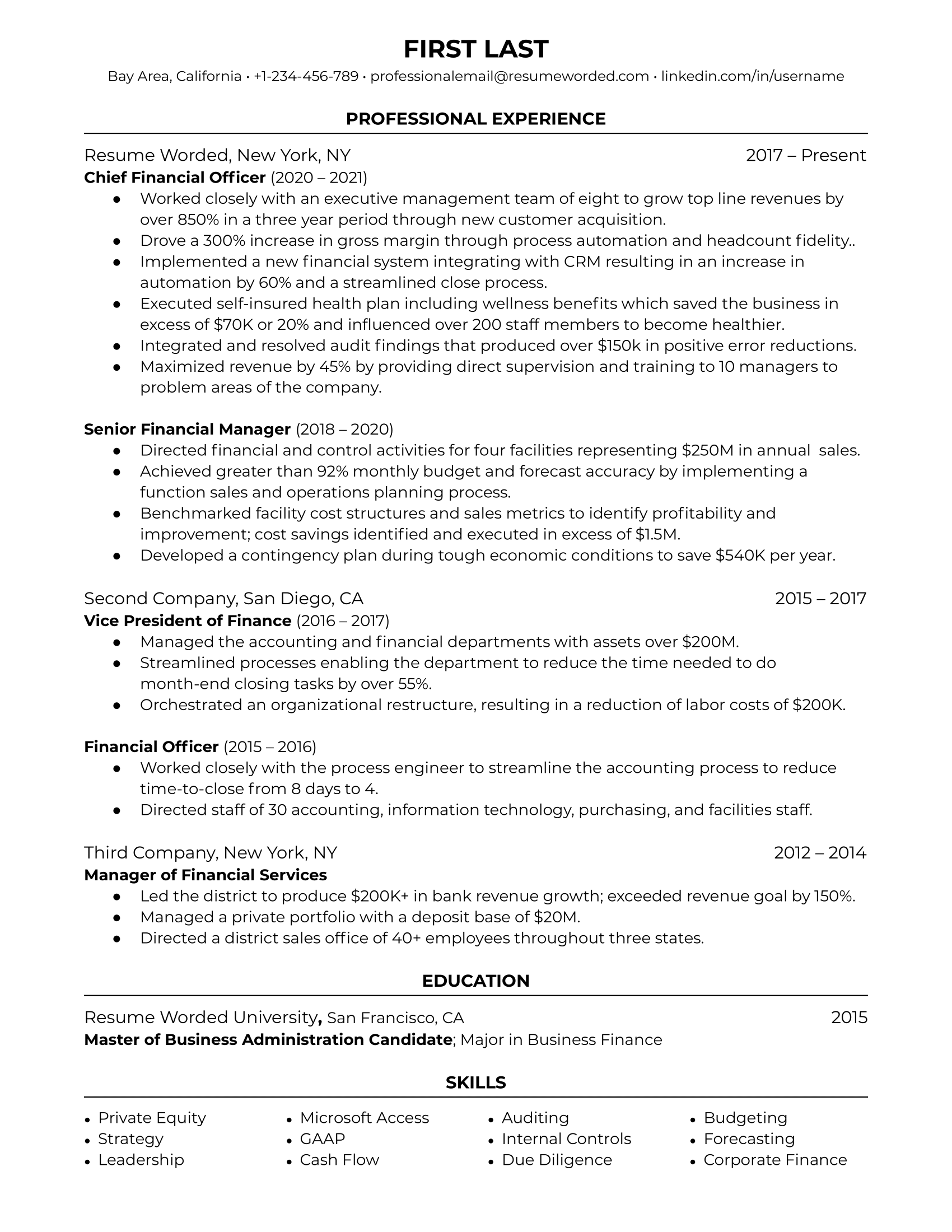

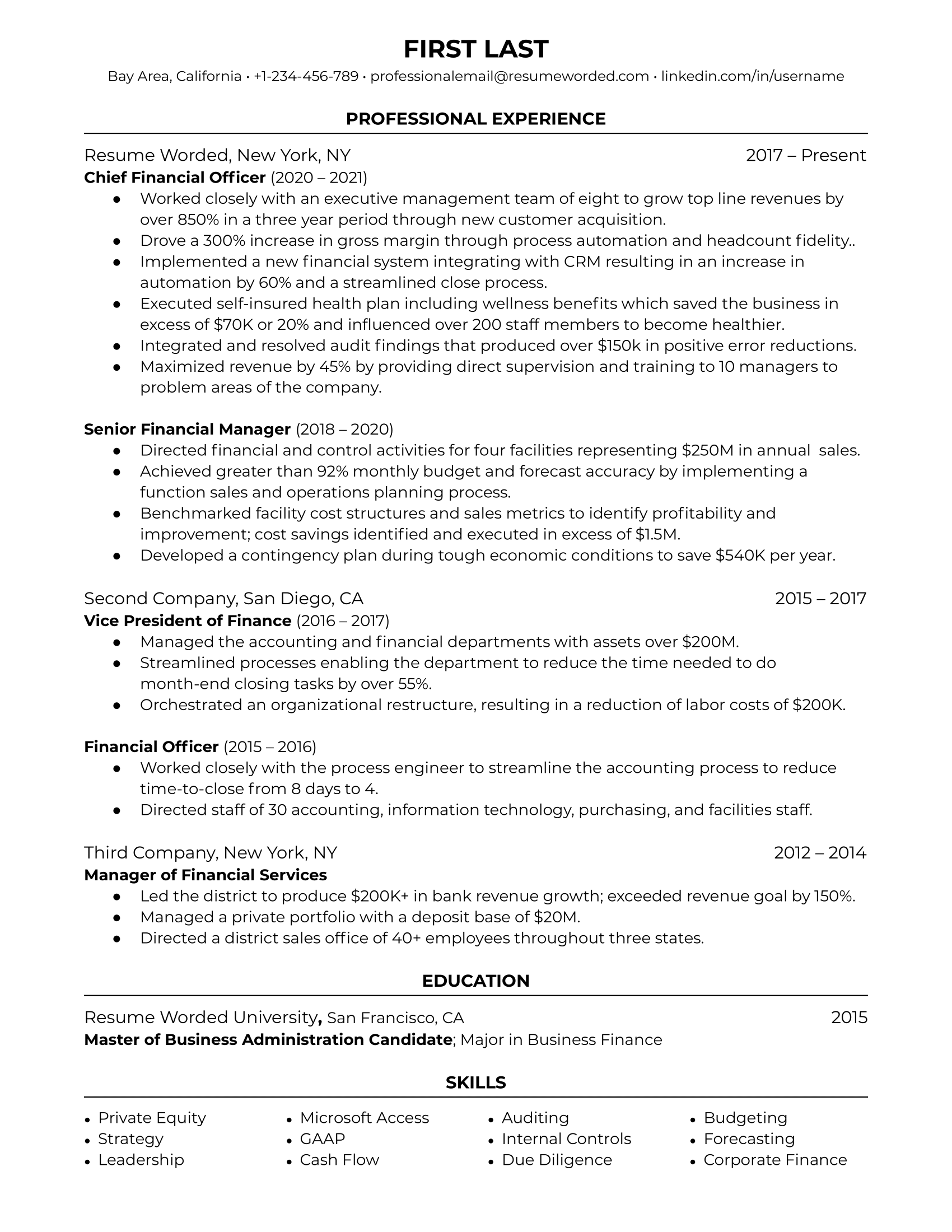

Chief Financial Officer (CFO) - 1

Chief Financial Officer (CFO) - 2

E-Commerce Chief Financial Officer

Chief Marketing Officer (CMO)

Chief Financial Officer (CFO)

Chief Information Officer (CIO)

Financial Advisor Resumes

The financial advisor career path can be both stable and rewarding, especially if you have an affinity for numbers and data entry. This guide discusses three financial advisor resume templates and provides tips on writing your resume, along with highlighting strong action verbs and skills to include.

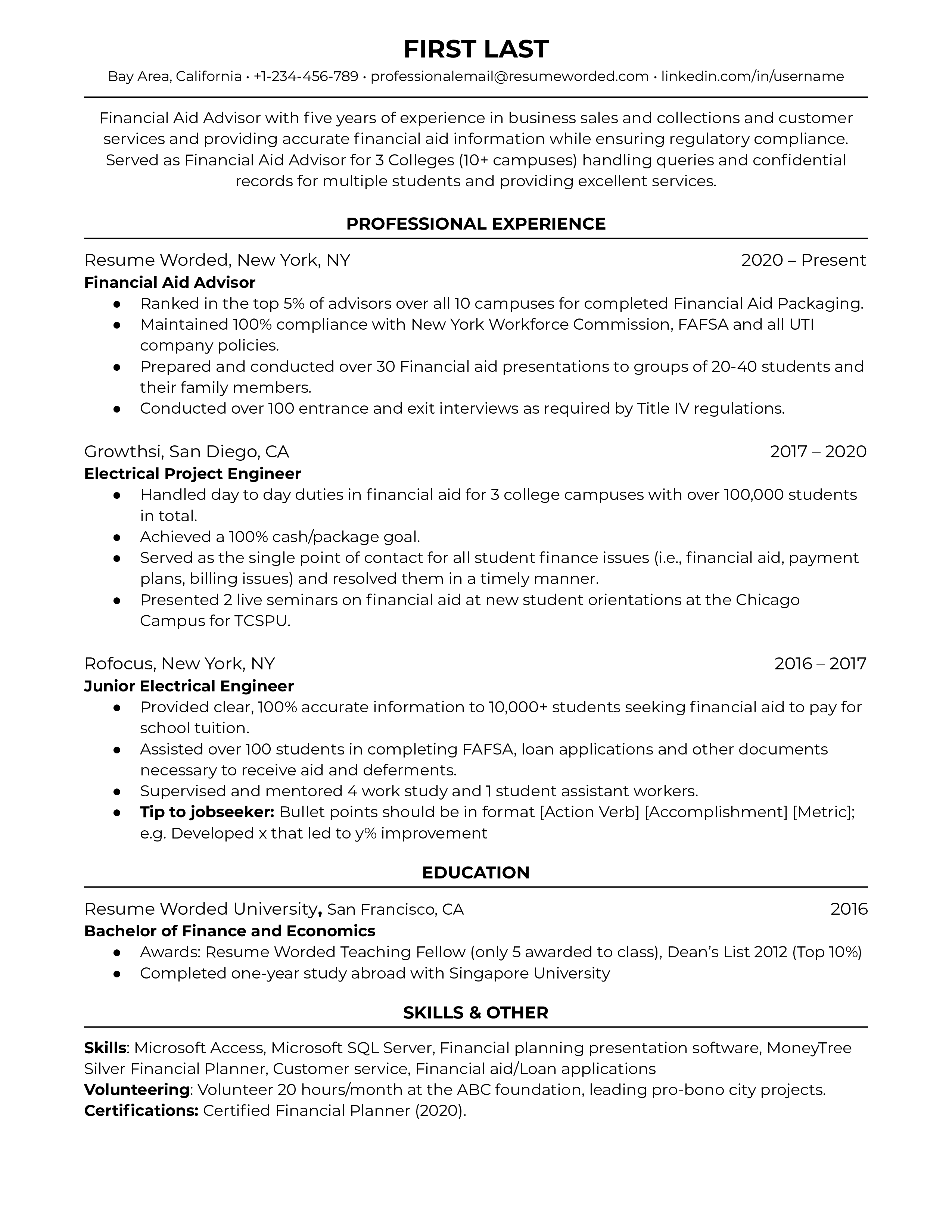

Financial Aid Advisor

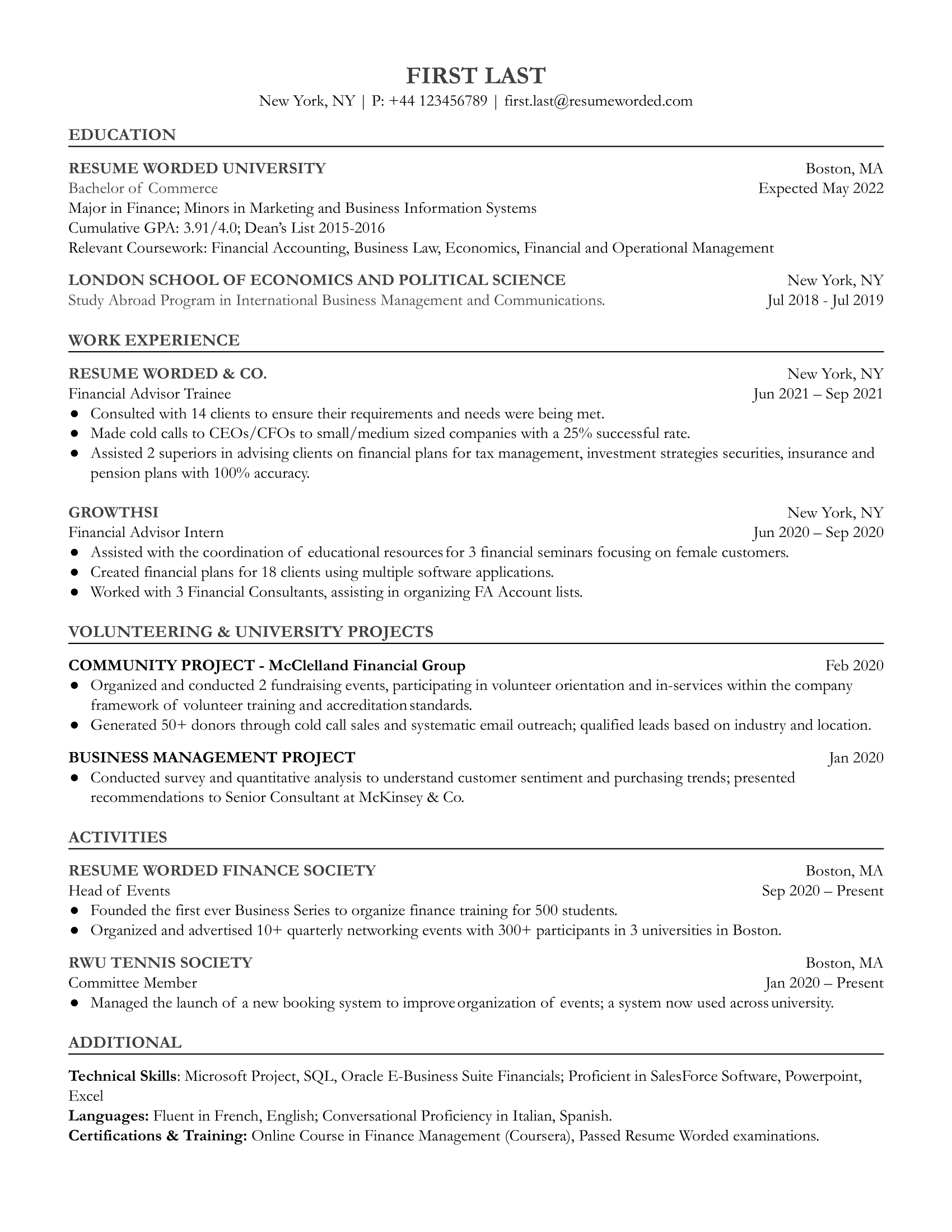

Entry Level Financial Advisor

Procurement Resumes

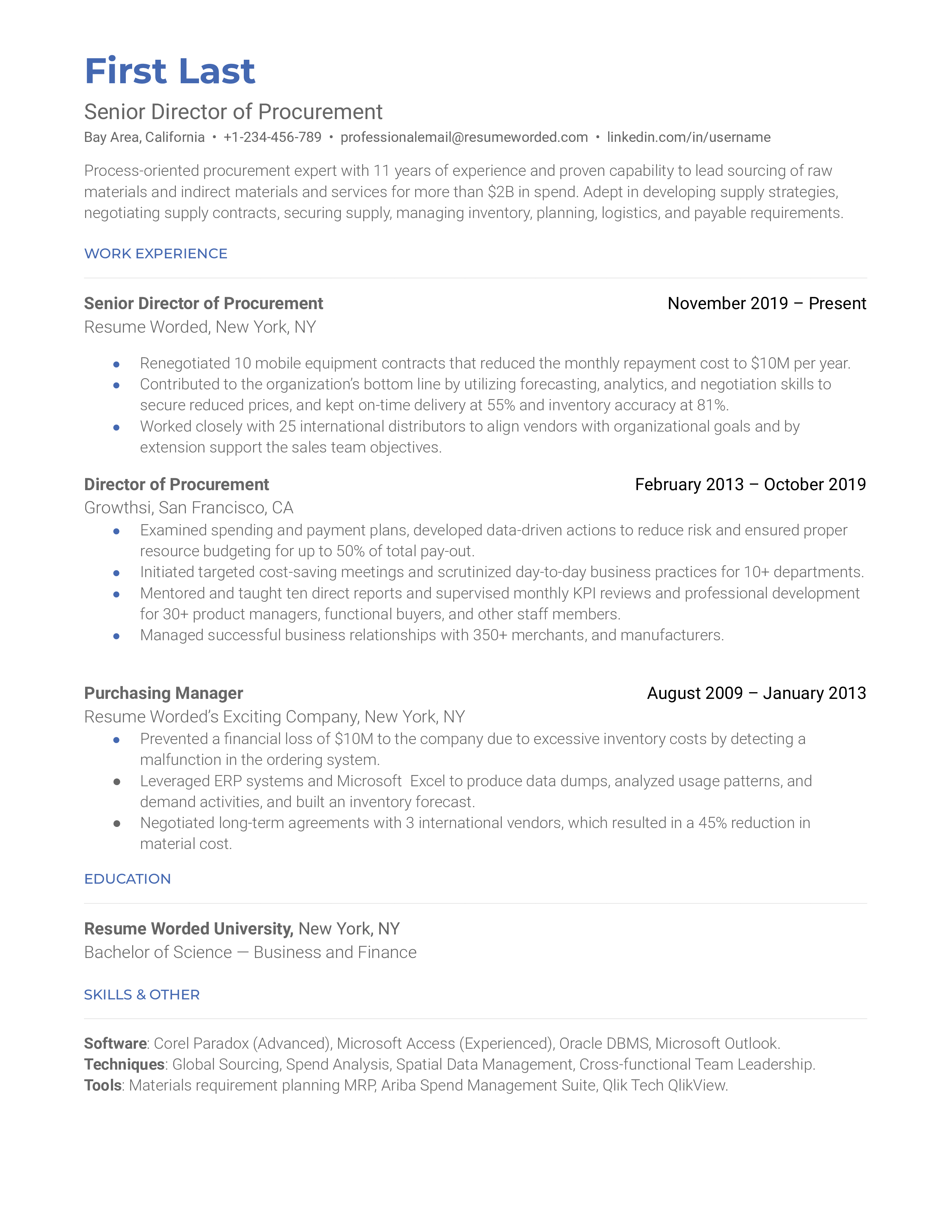

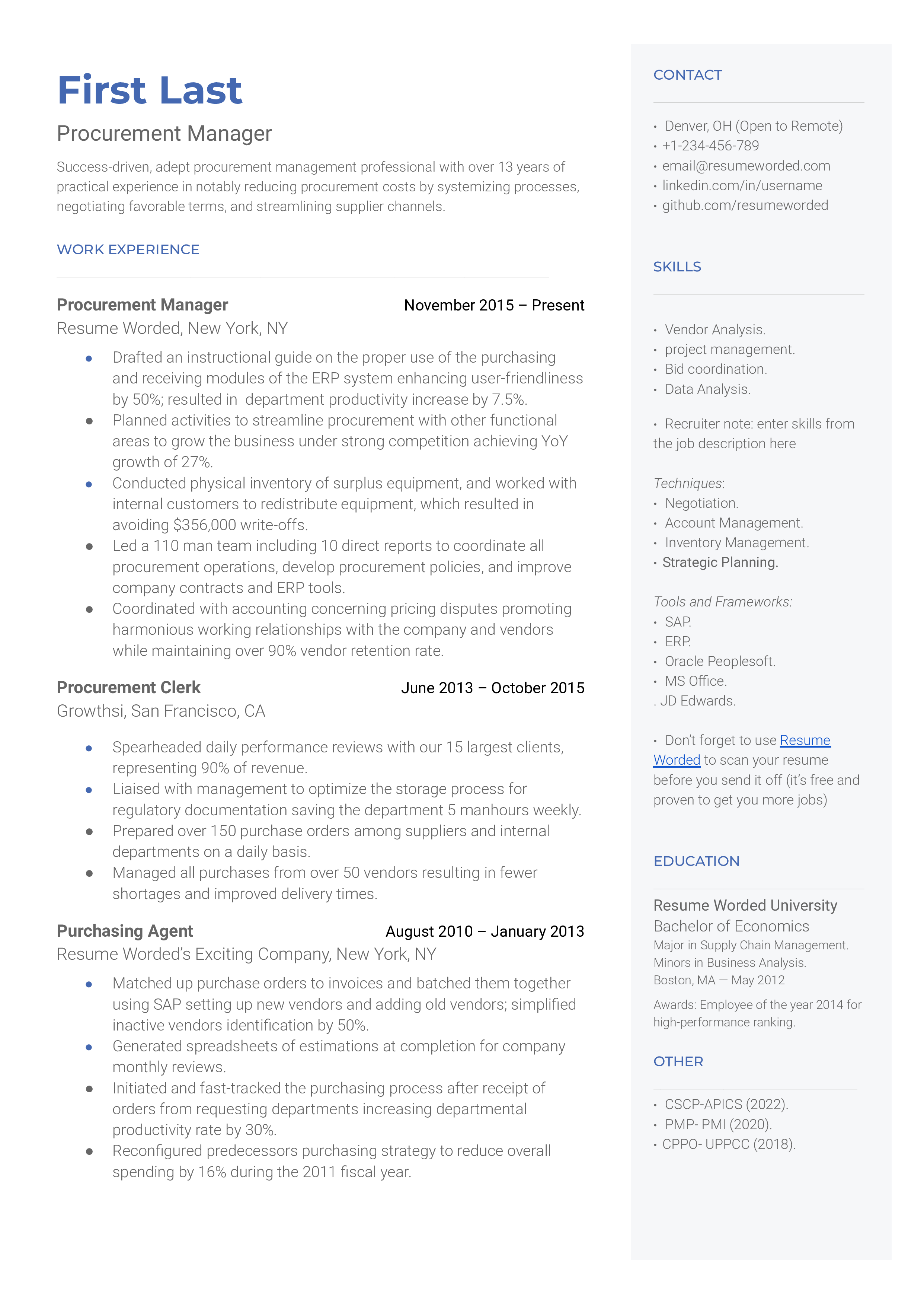

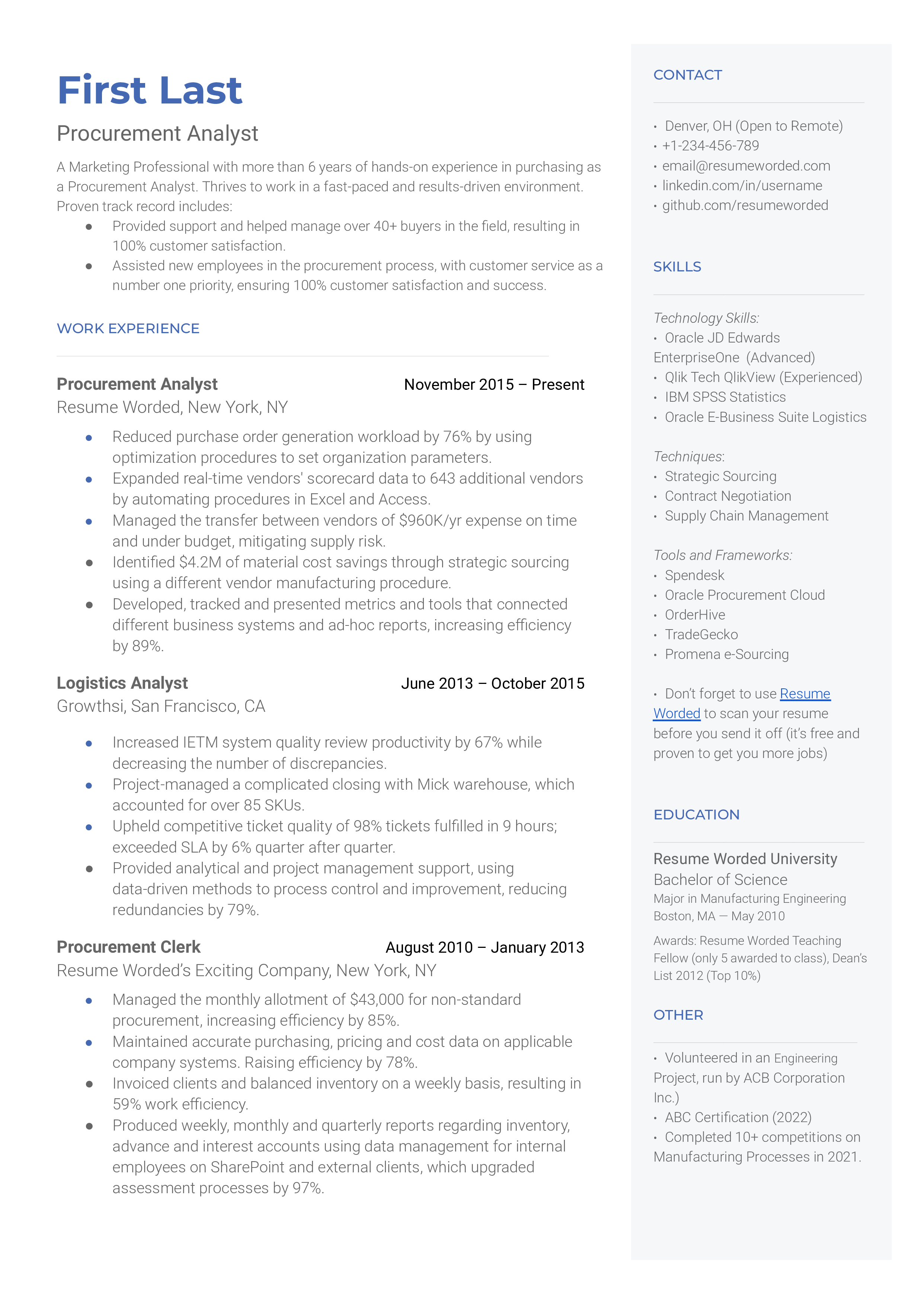

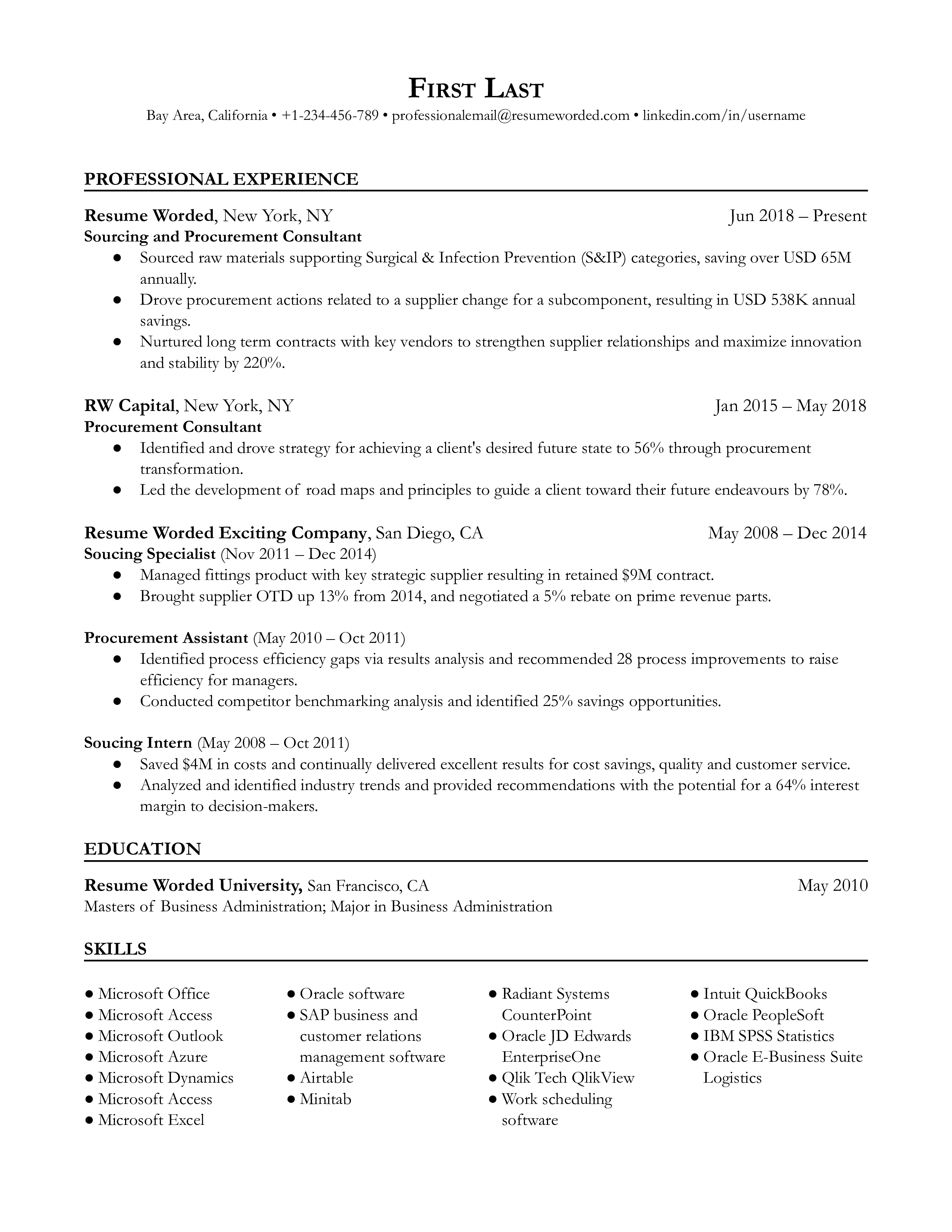

Procurement professionals are vital in an organization and need a balance of skills to thrive. They must be great communicators and negotiators and also sticklers for the budget. This guide will show you how to highlight the skills and qualifications in your resume that recruiters will most certainly be looking for.

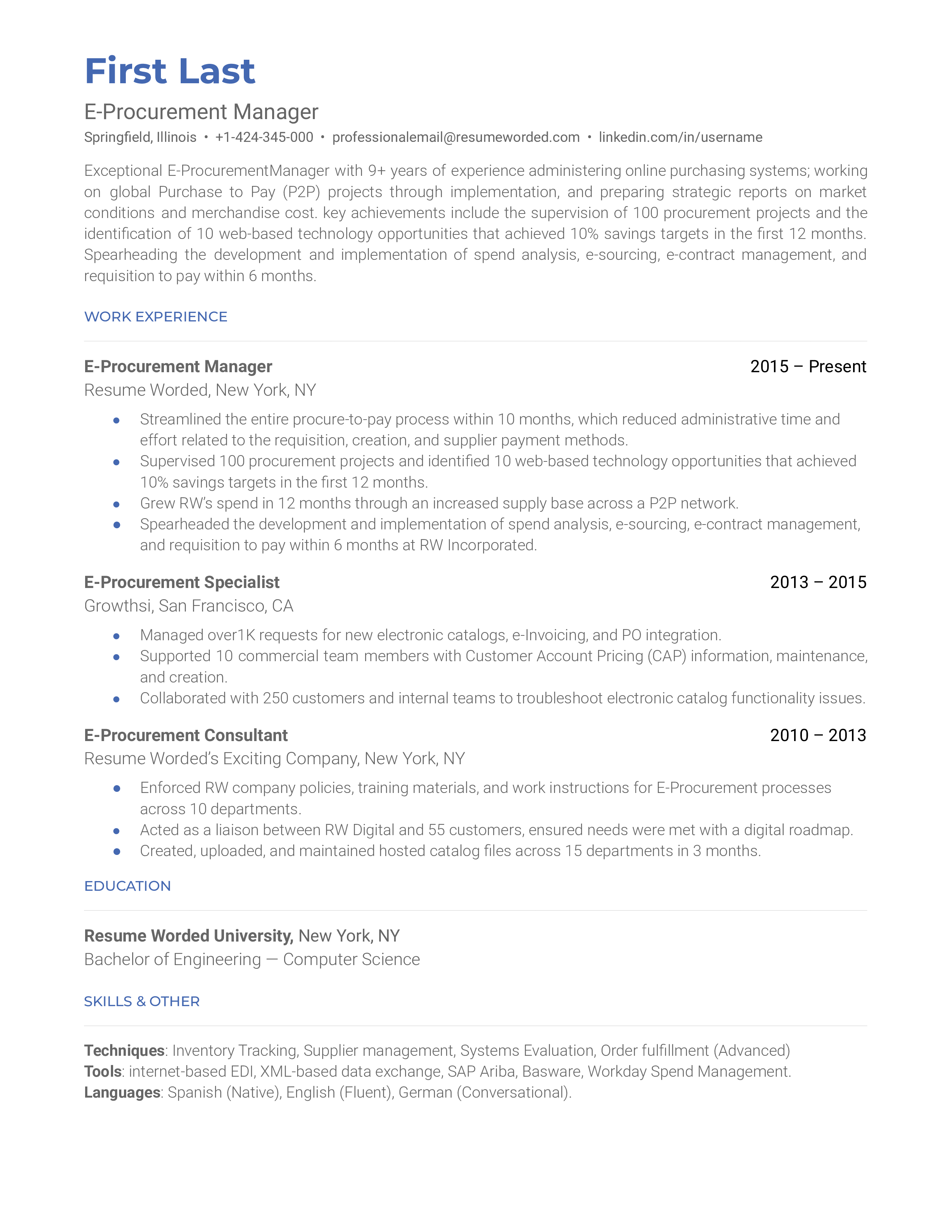

E-Procurement Manager

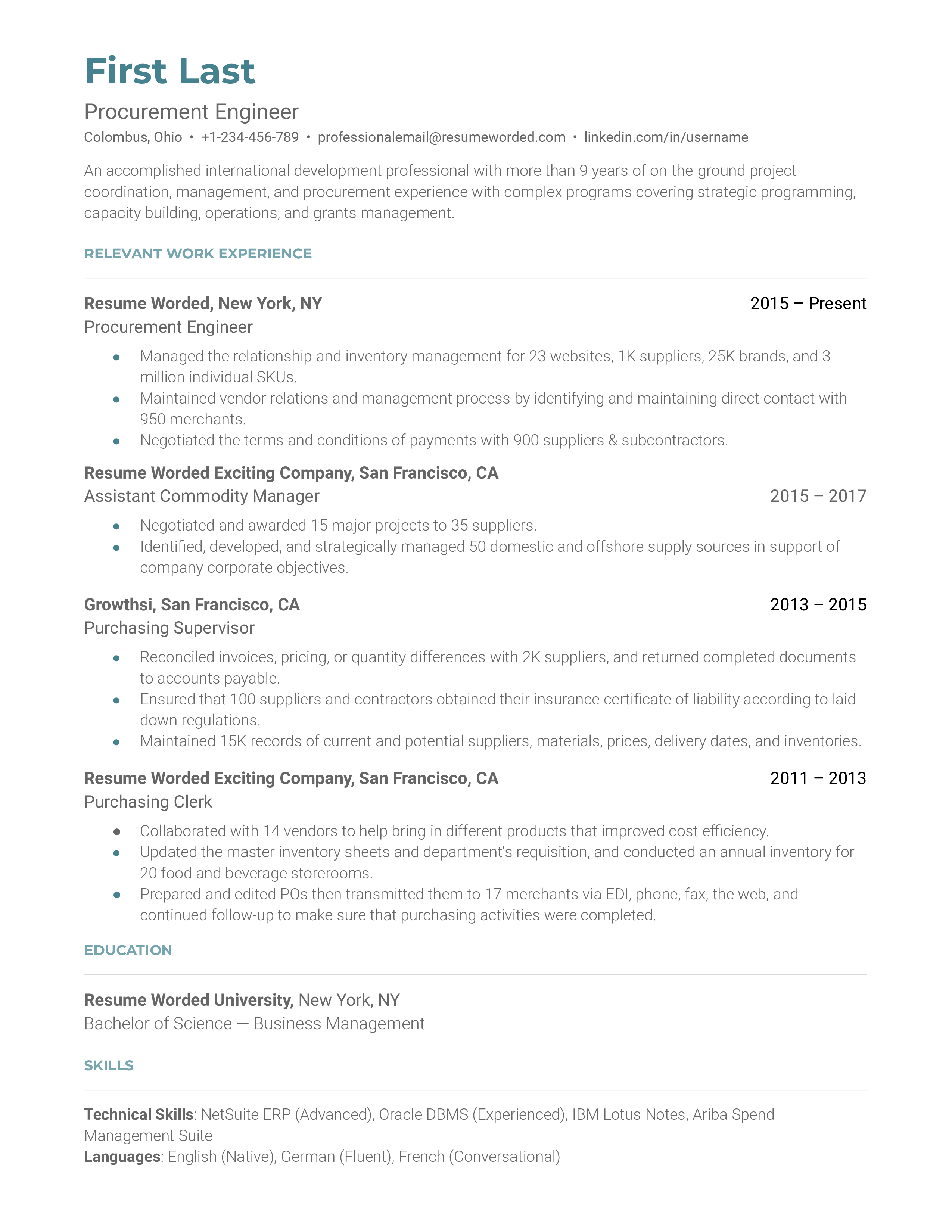

Procurement Engineer

Senior Director of Procurement

Procurement Manager

Procurement Specialist

Procurement Analyst

Sourcing and Procurement Consultant

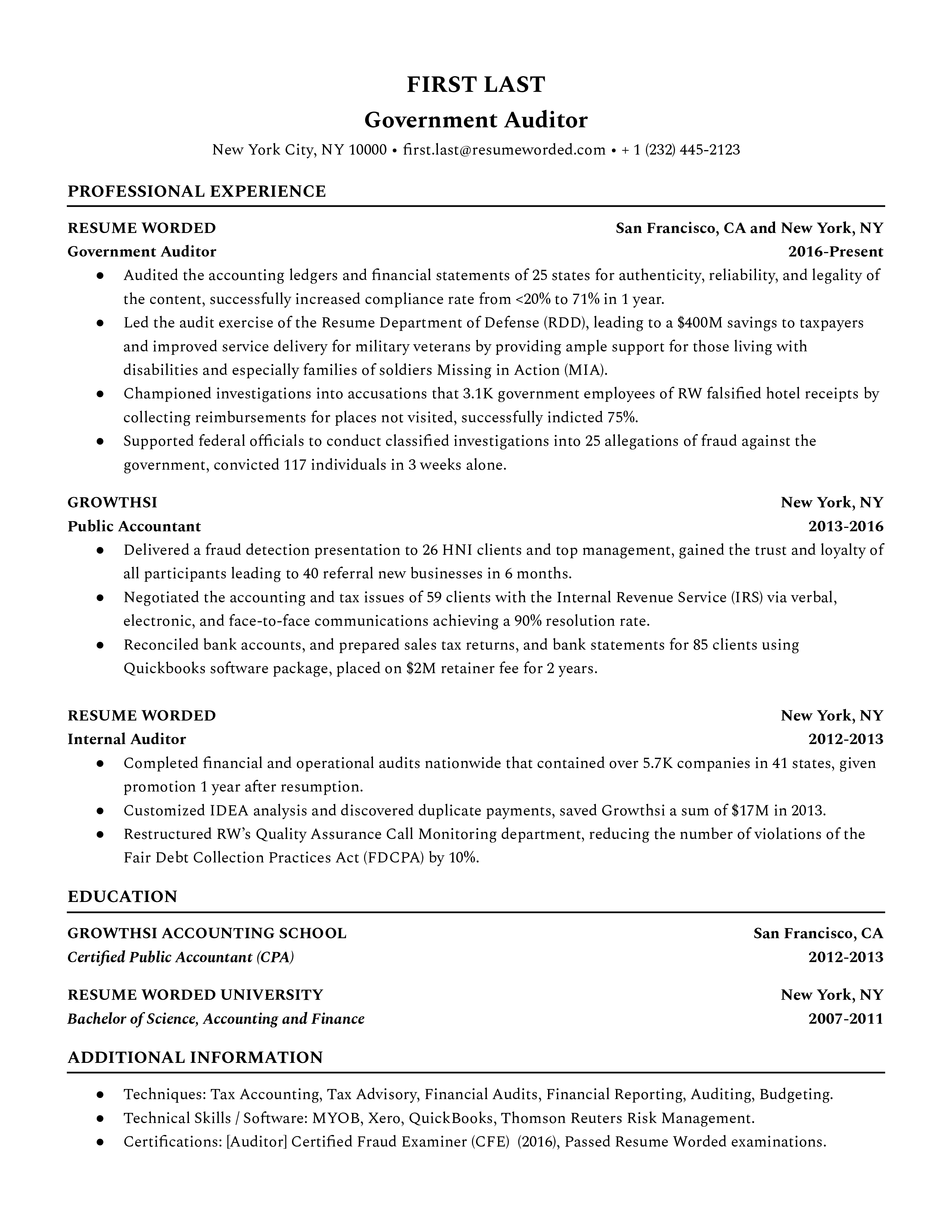

Auditor Resumes

While getting audited can sound like a terrifying ordeal, auditors’ work is actually vital for the health and long-term success of a company. Auditors will help a company cross their ts and dot their I’s when it comes to their financial documents. They ensure that everything is done correctly and that everything adds up. This guide will highlight auditor titles, give strong resume samples of each, and provide suggestions on how you can craft your own successful auditor resume. Let’s get started.

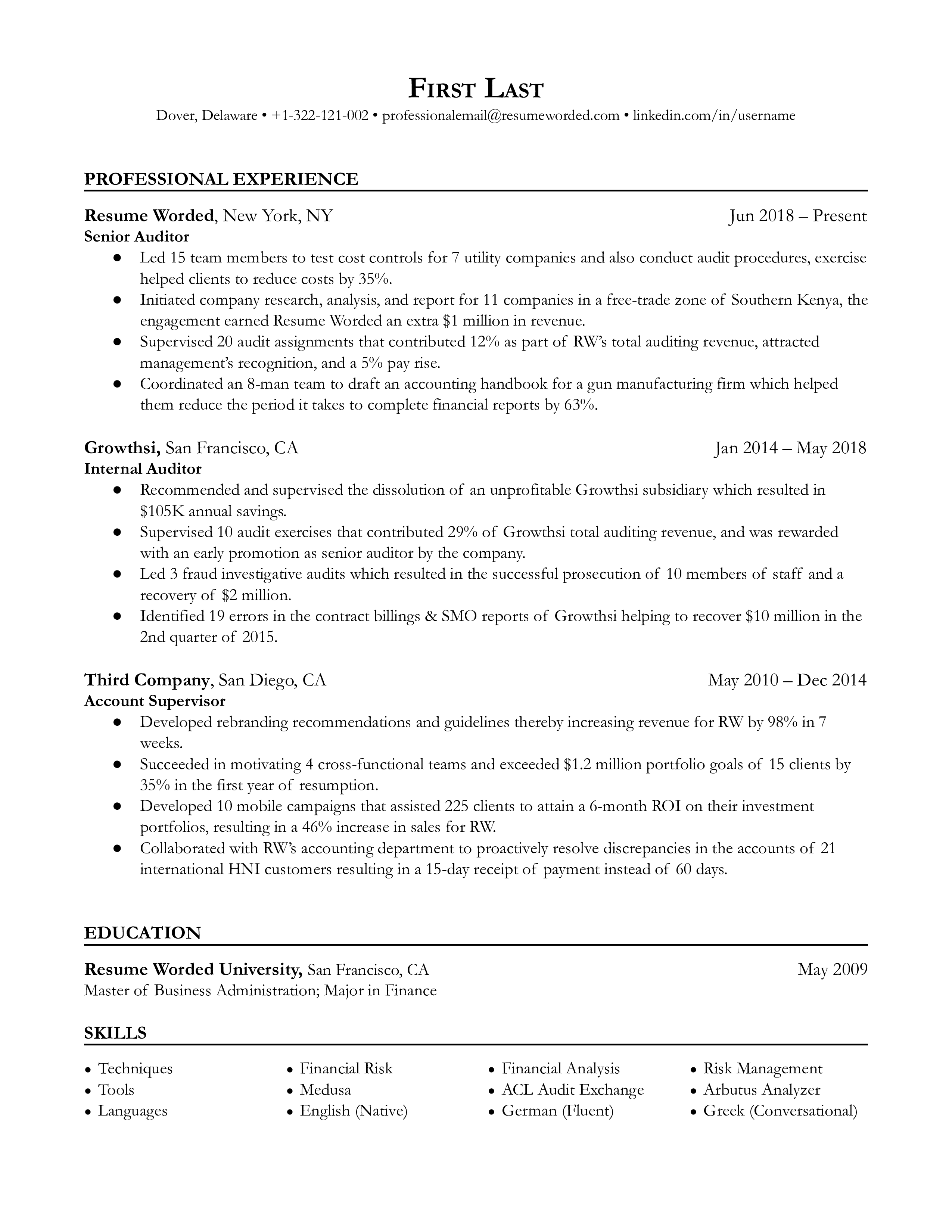

Senior Auditor

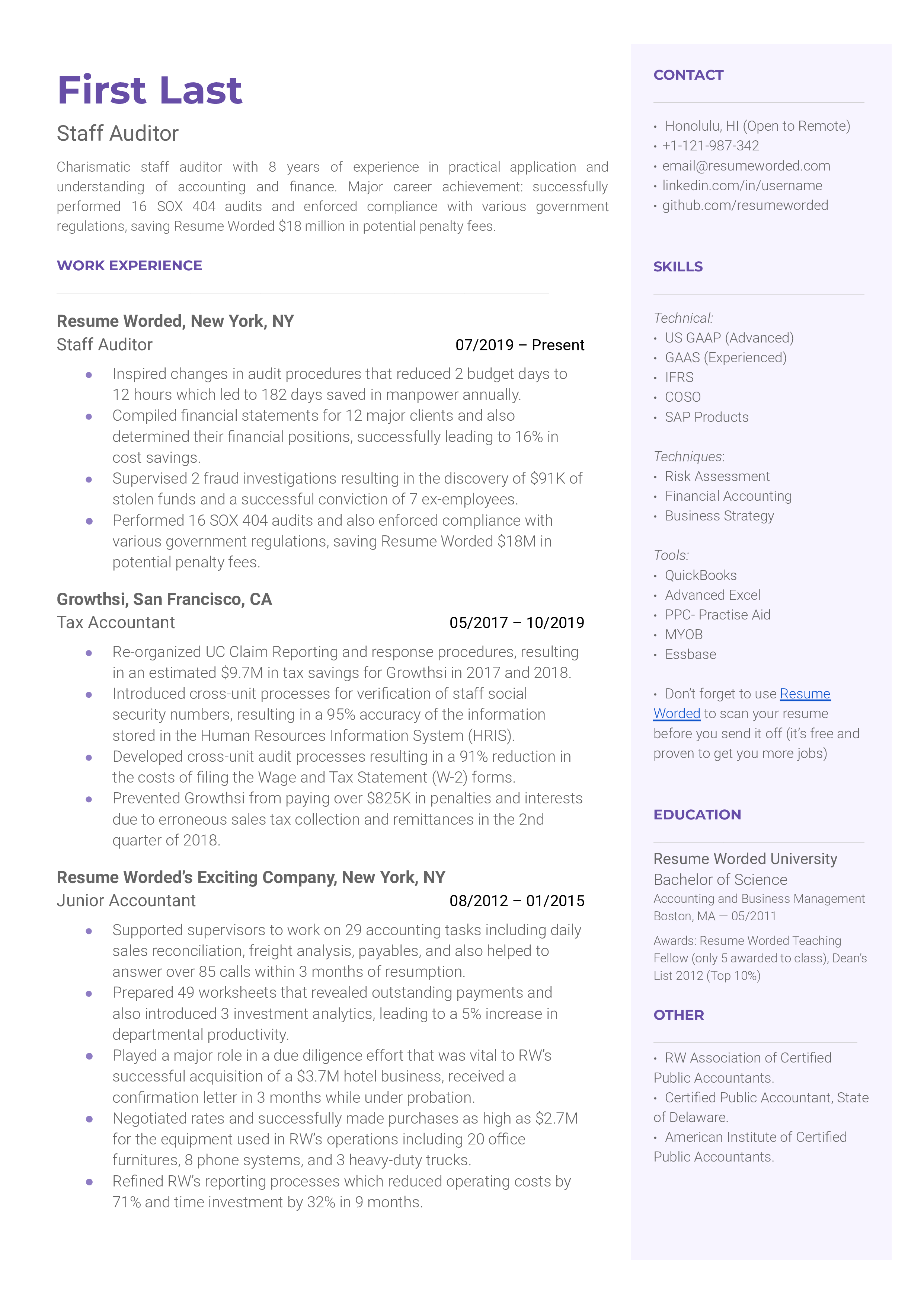

Staff Auditor

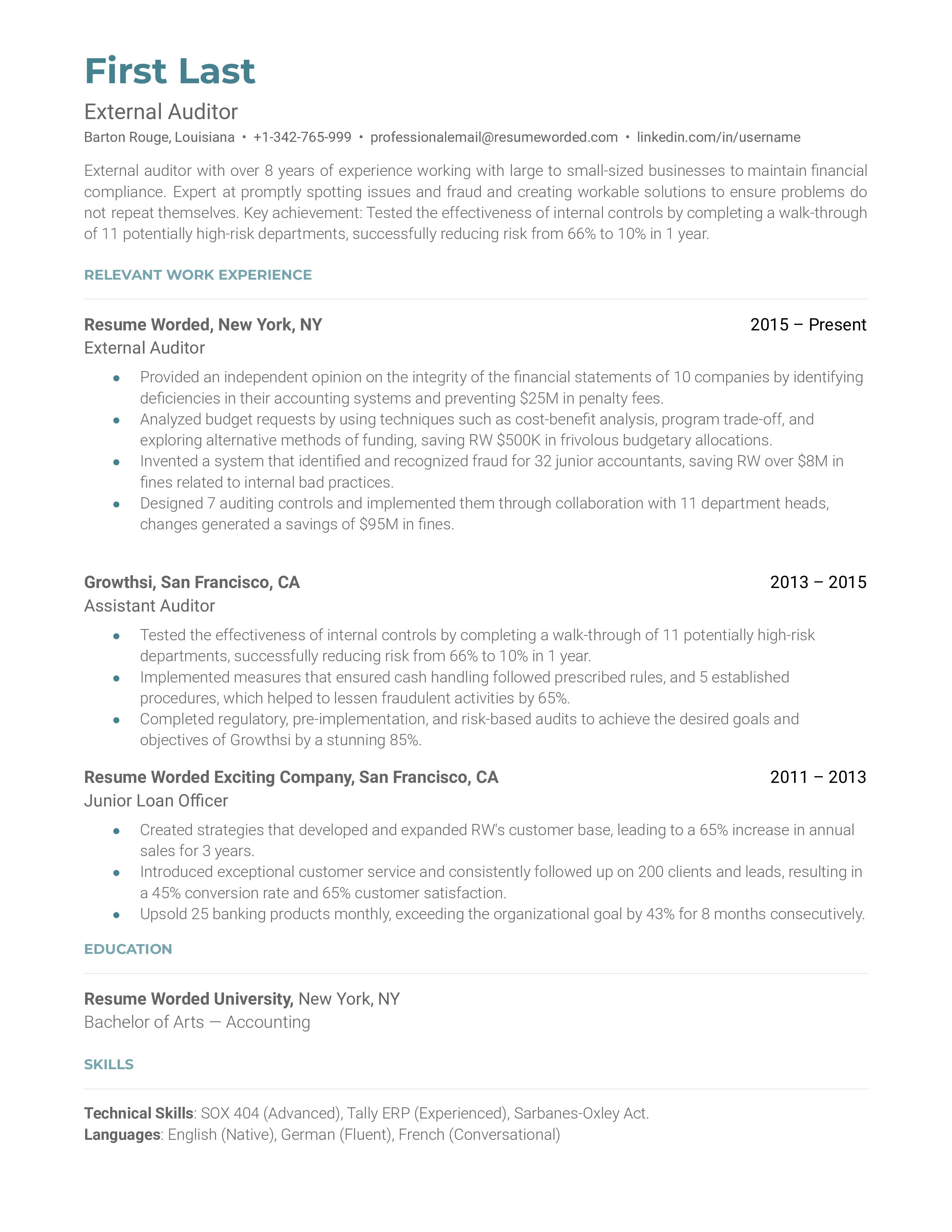

External Auditor

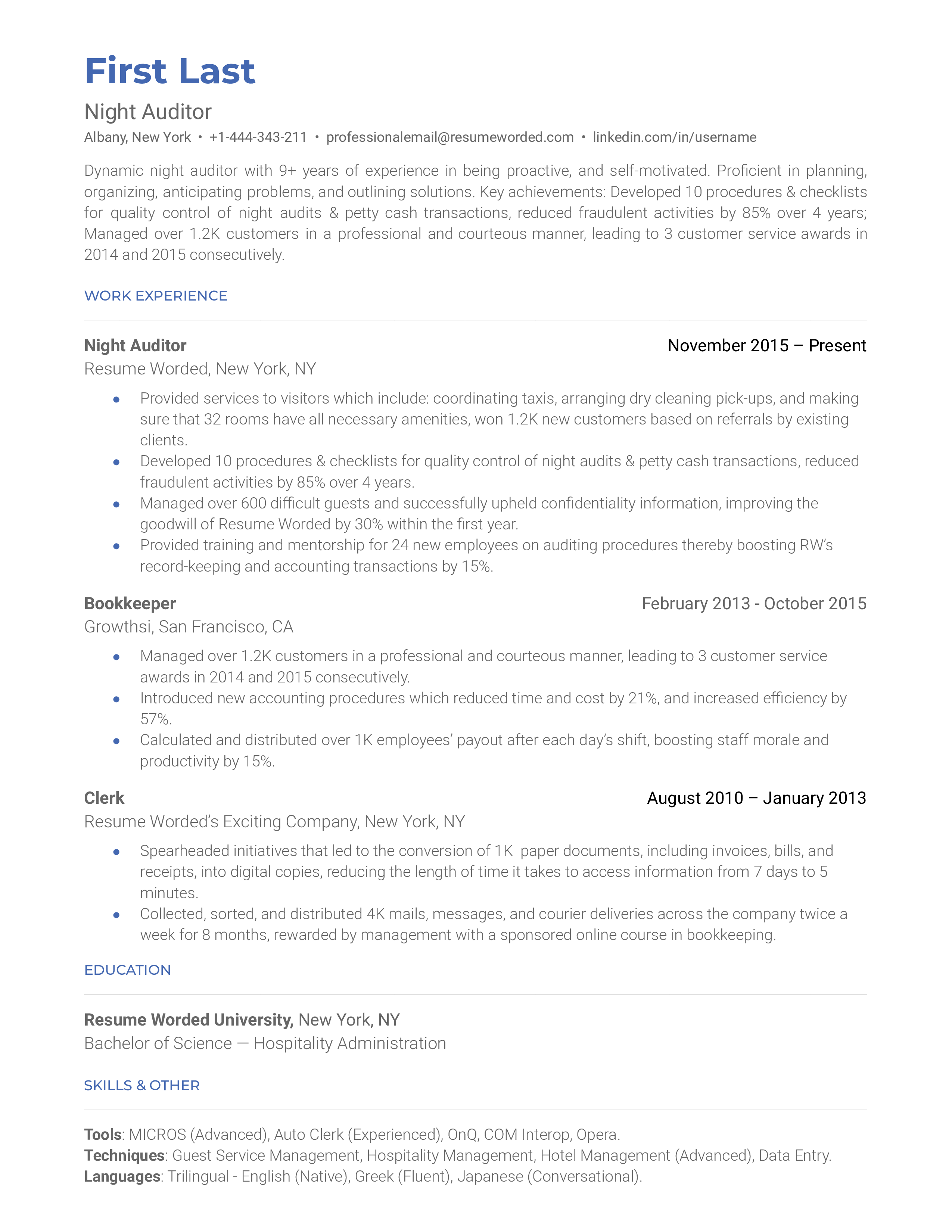

Night Auditor

Government Auditor

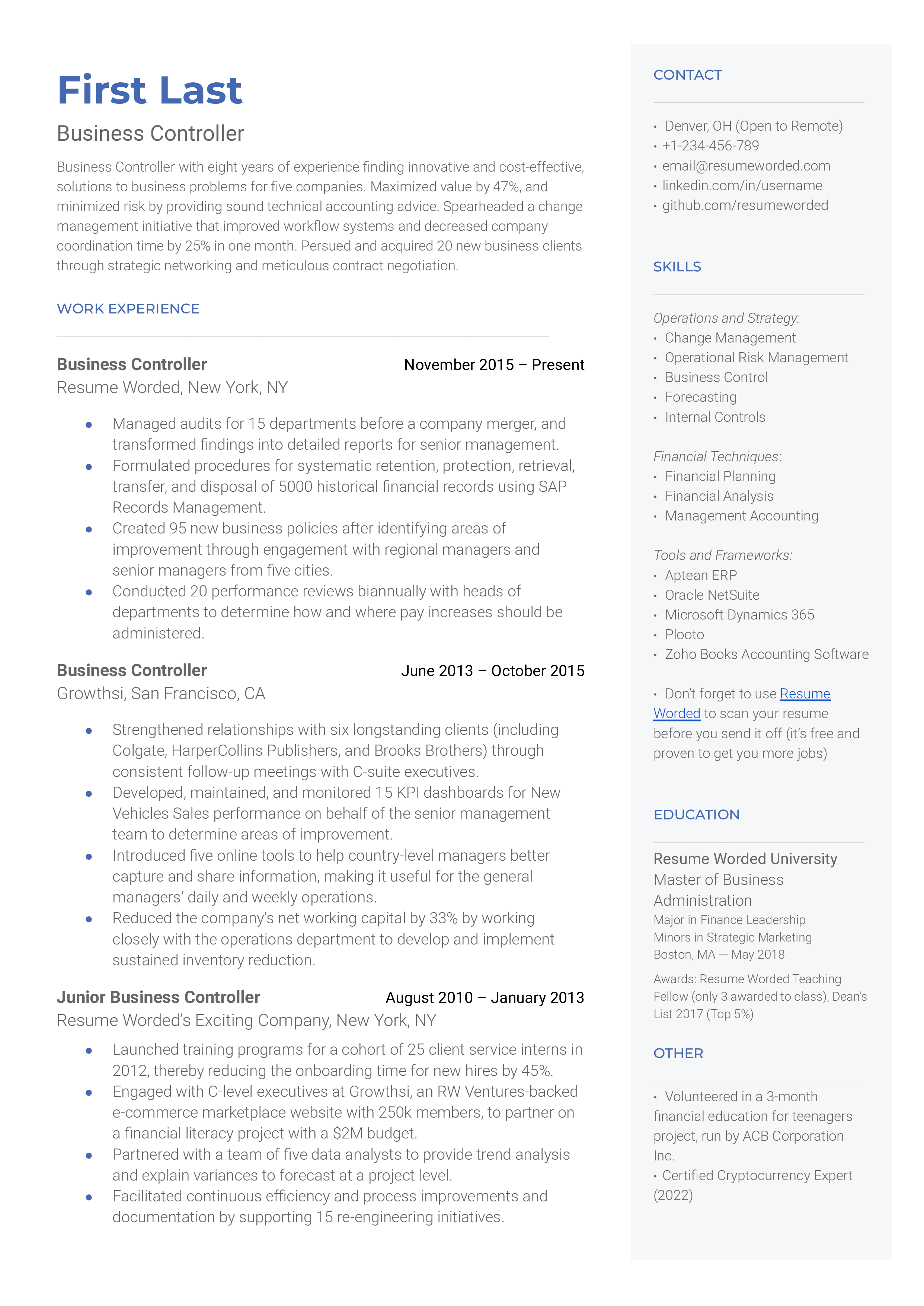

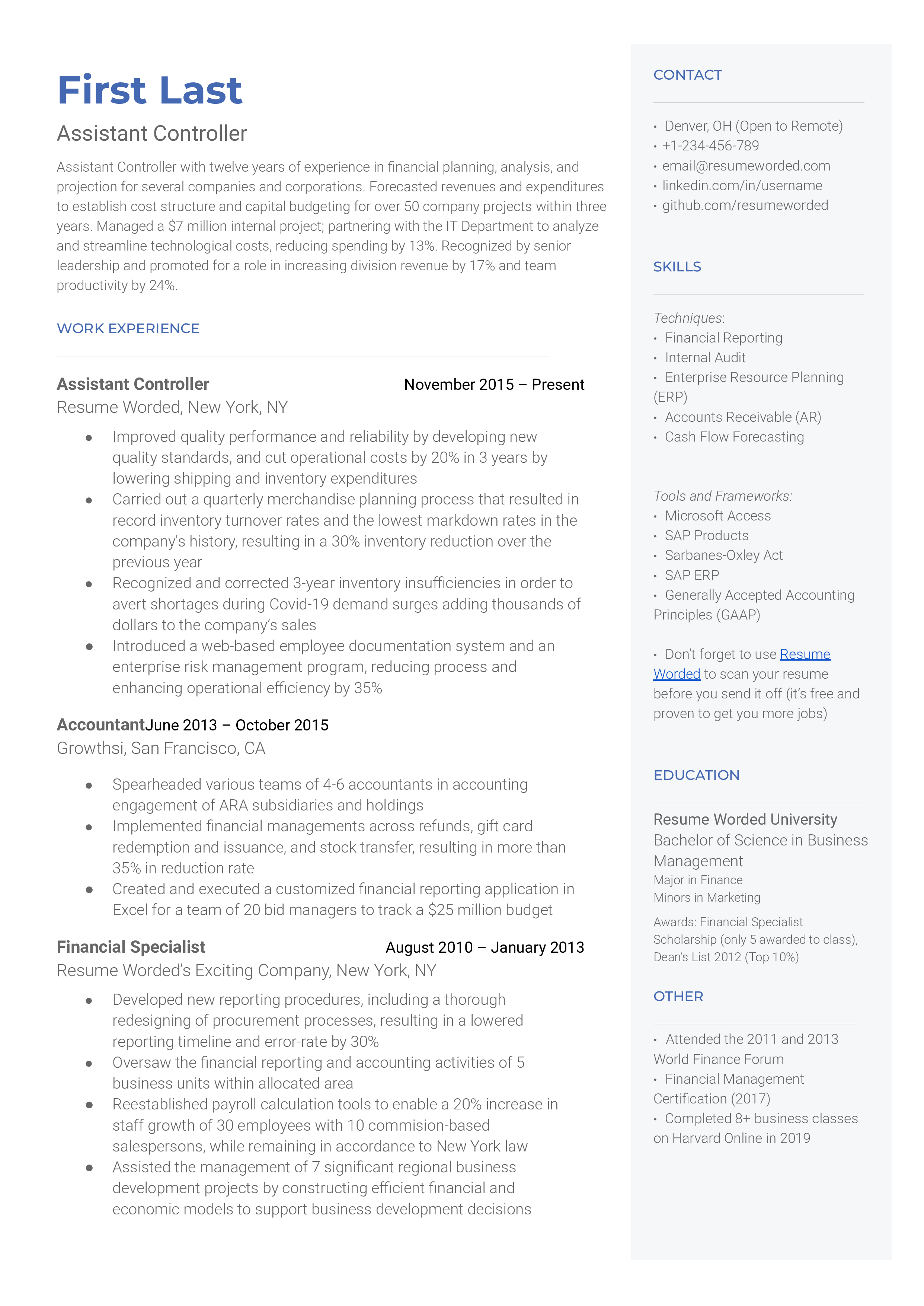

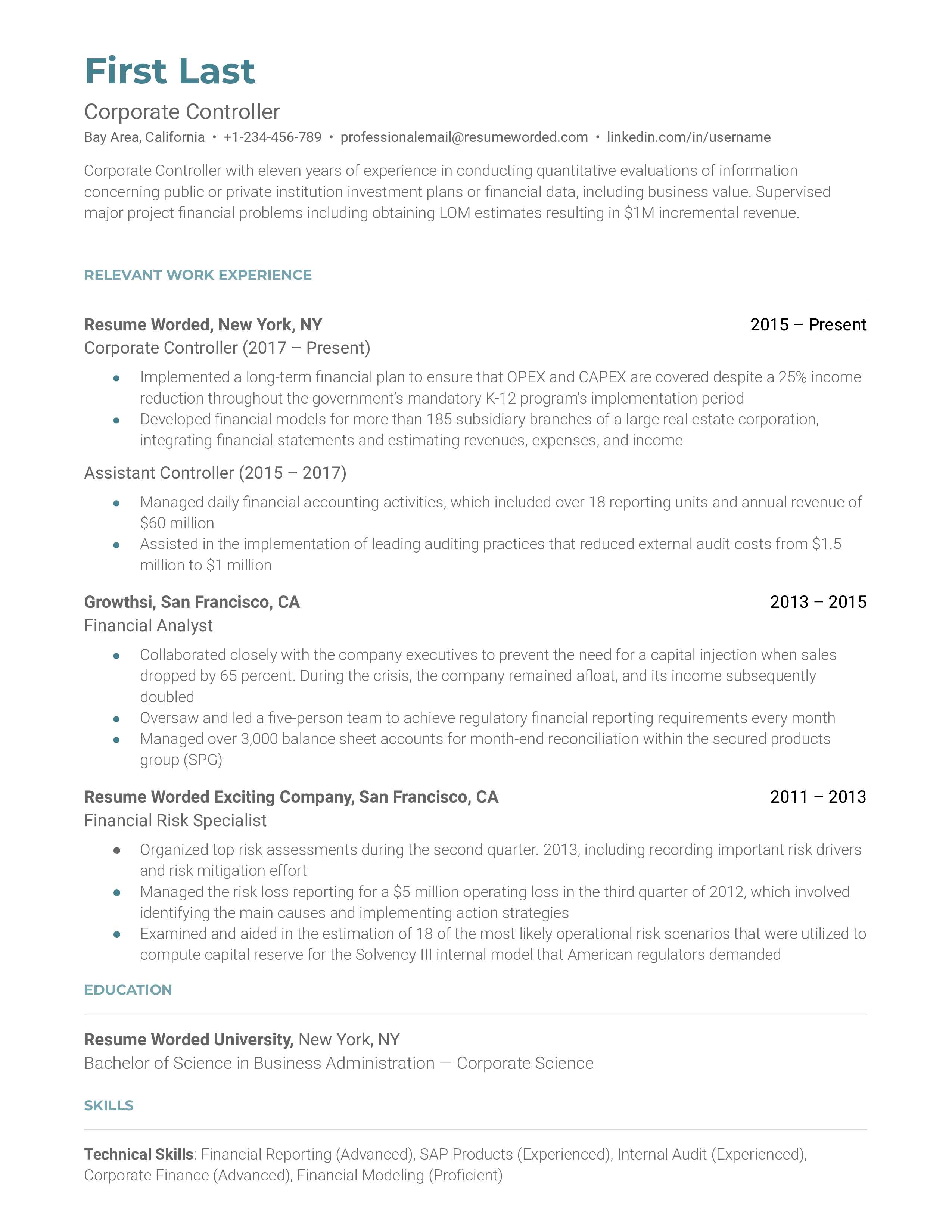

Financial Controller Resumes

Financial controllers are sometimes called company historians and are responsible for a company’s financial functions and records. This is a high-ranking position and requires high qualifications, extensive experience, and a high level of trust. This guide will specify the requirements and expectations for specific financial controller positions and give you some tips and resume samples to help you create a stellar financial controller resume.

Business Controller

Assistant Controller

Corporate Controller

Risk Management Resumes

Risk managers are the bodyguards of a company. It is their job to investigate, identify and analyze potential risks to a company and offer solutions to safeguard against any negative outcomes. Like bodyguards, they must be perceptive, resourceful, and trustworthy. In this guide, we will show you 4 resume samples for 4 risk management positions, and give you some tips to help you create an effective resume of your own.

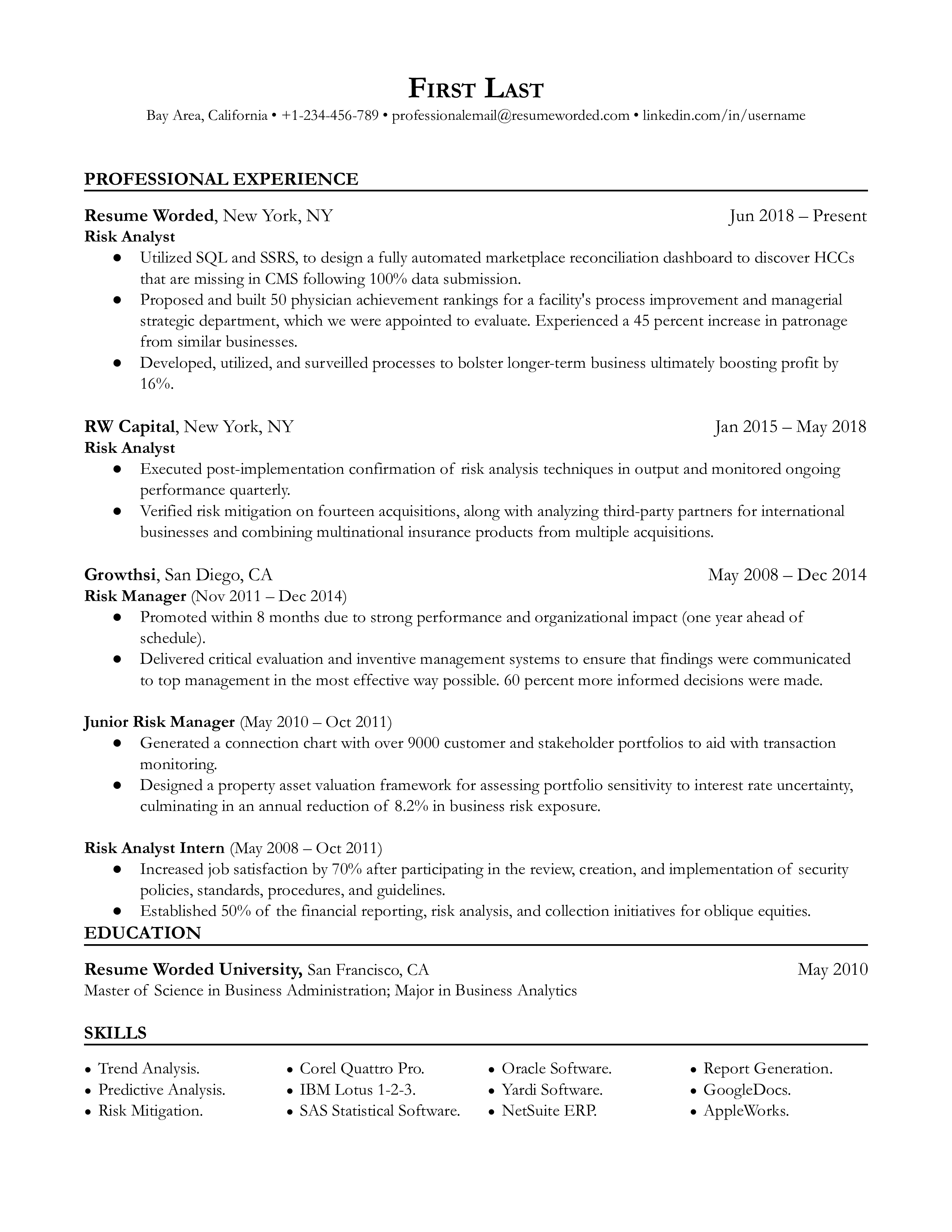

Risk Analyst

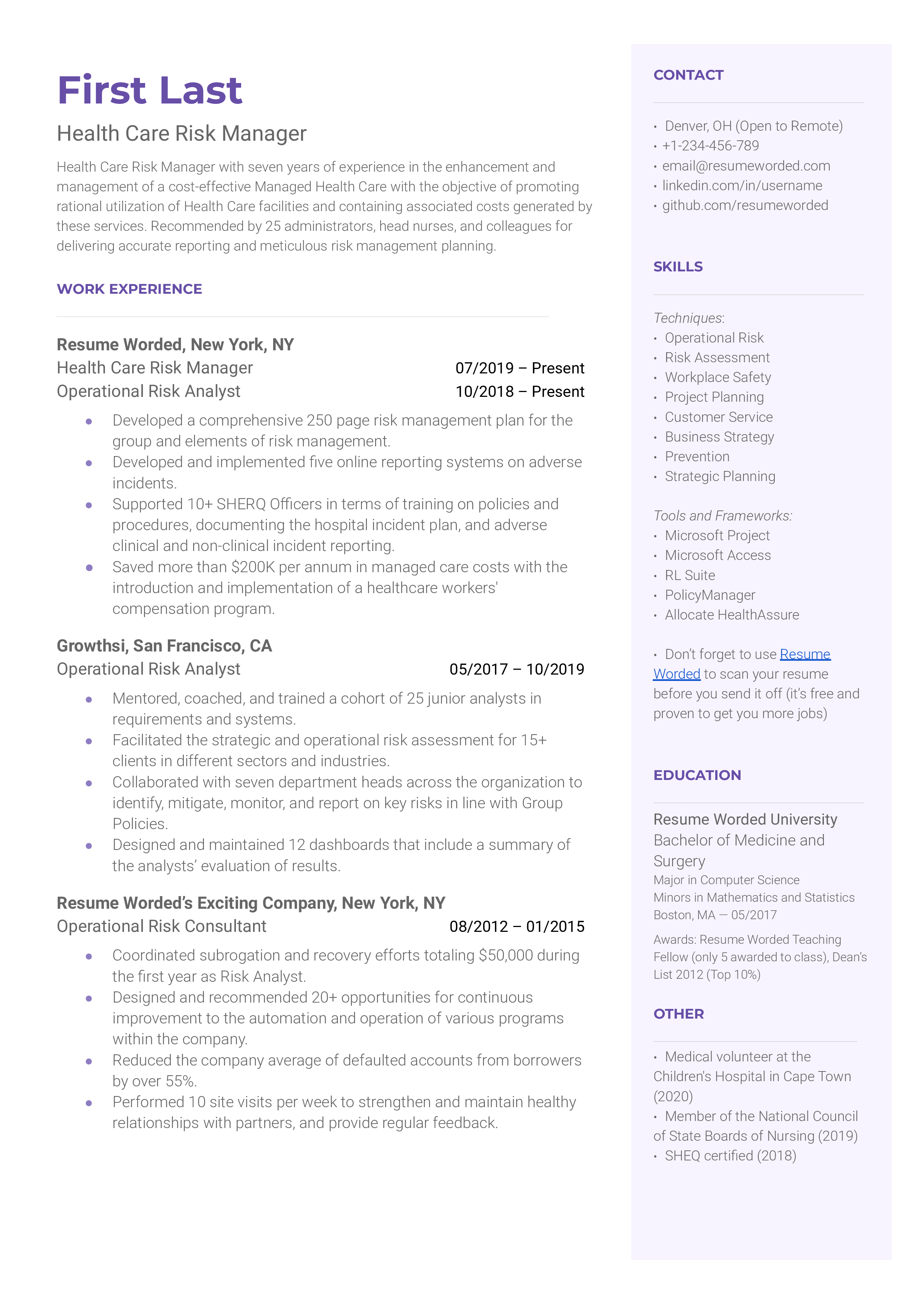

Health Care Risk Manager

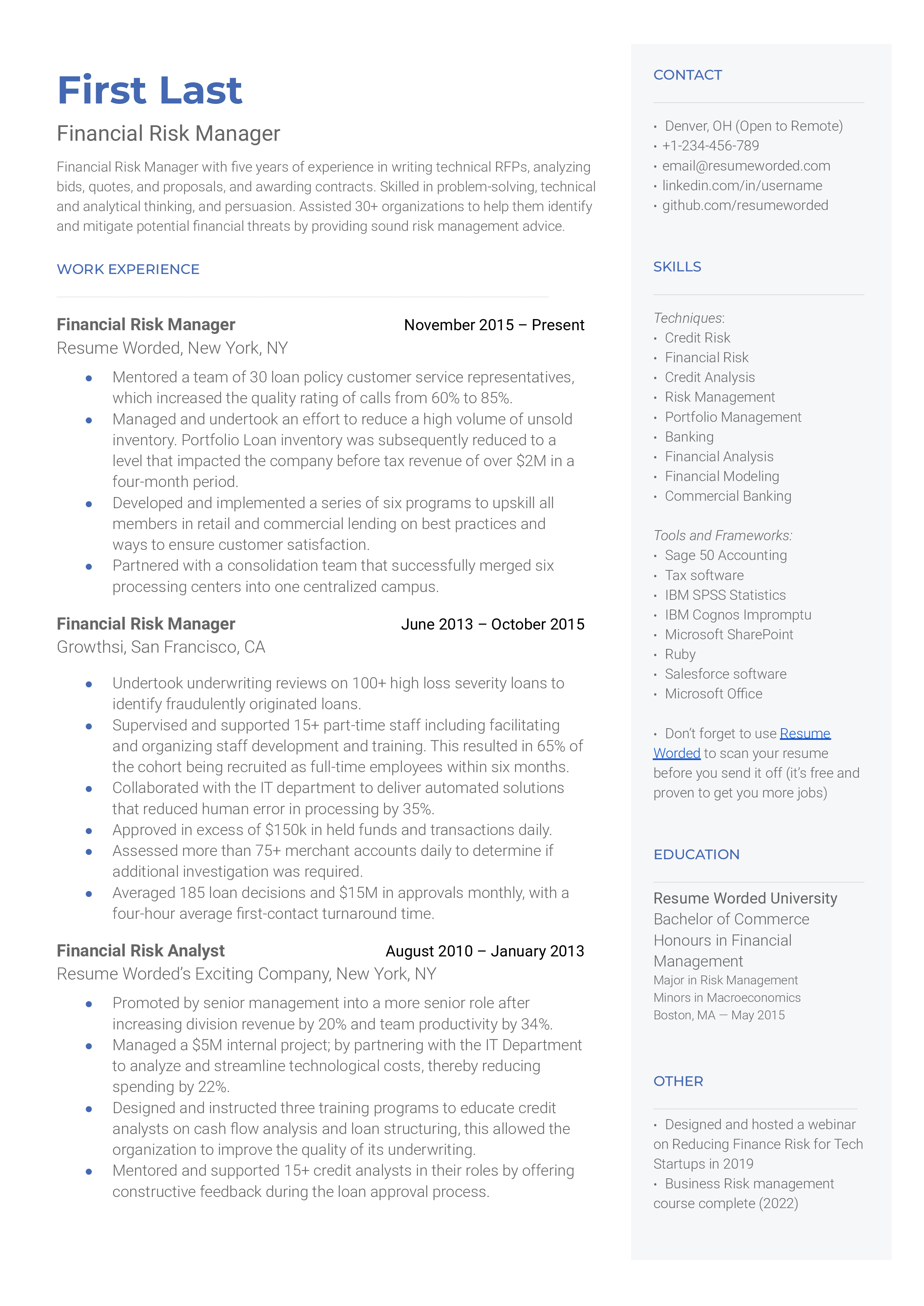

Financial Risk Manager

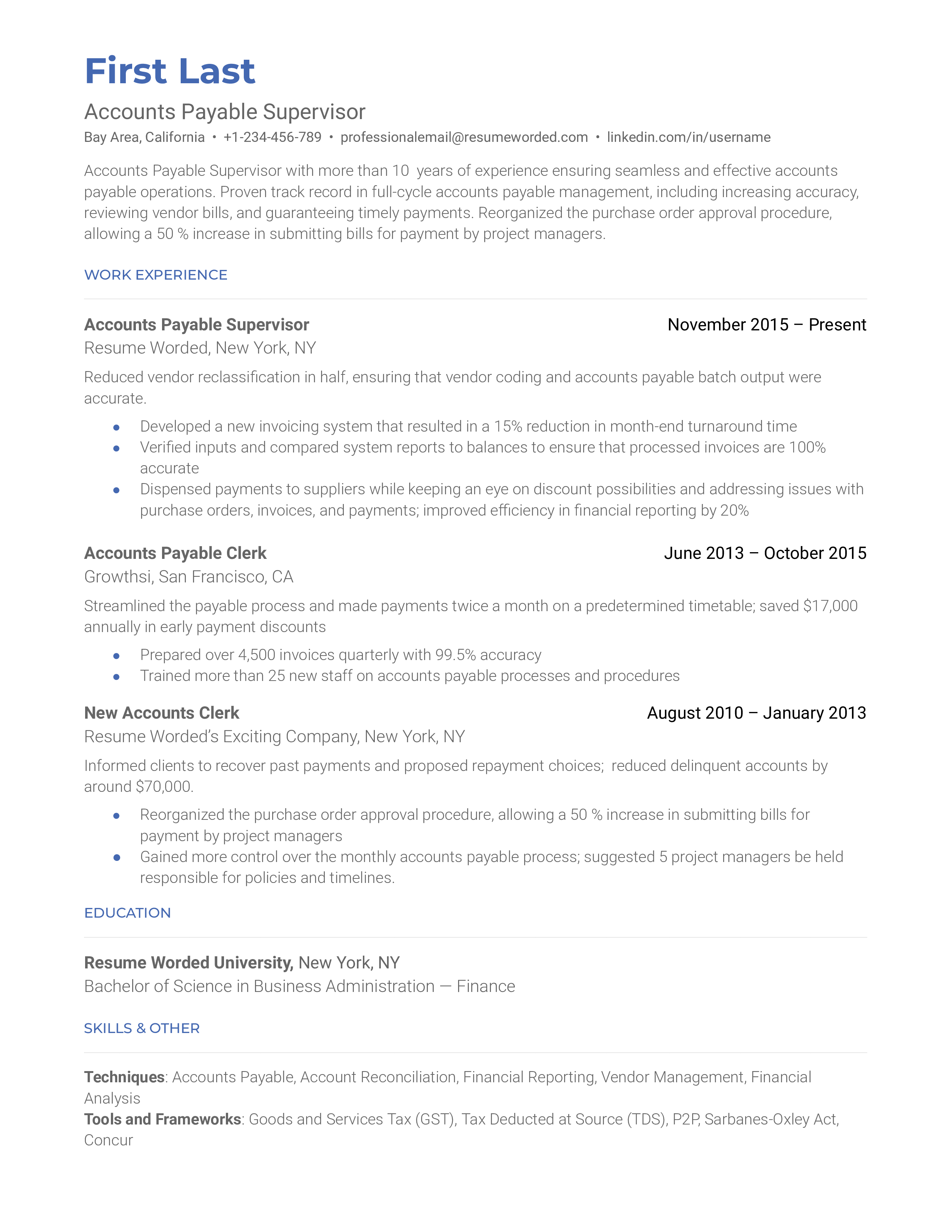

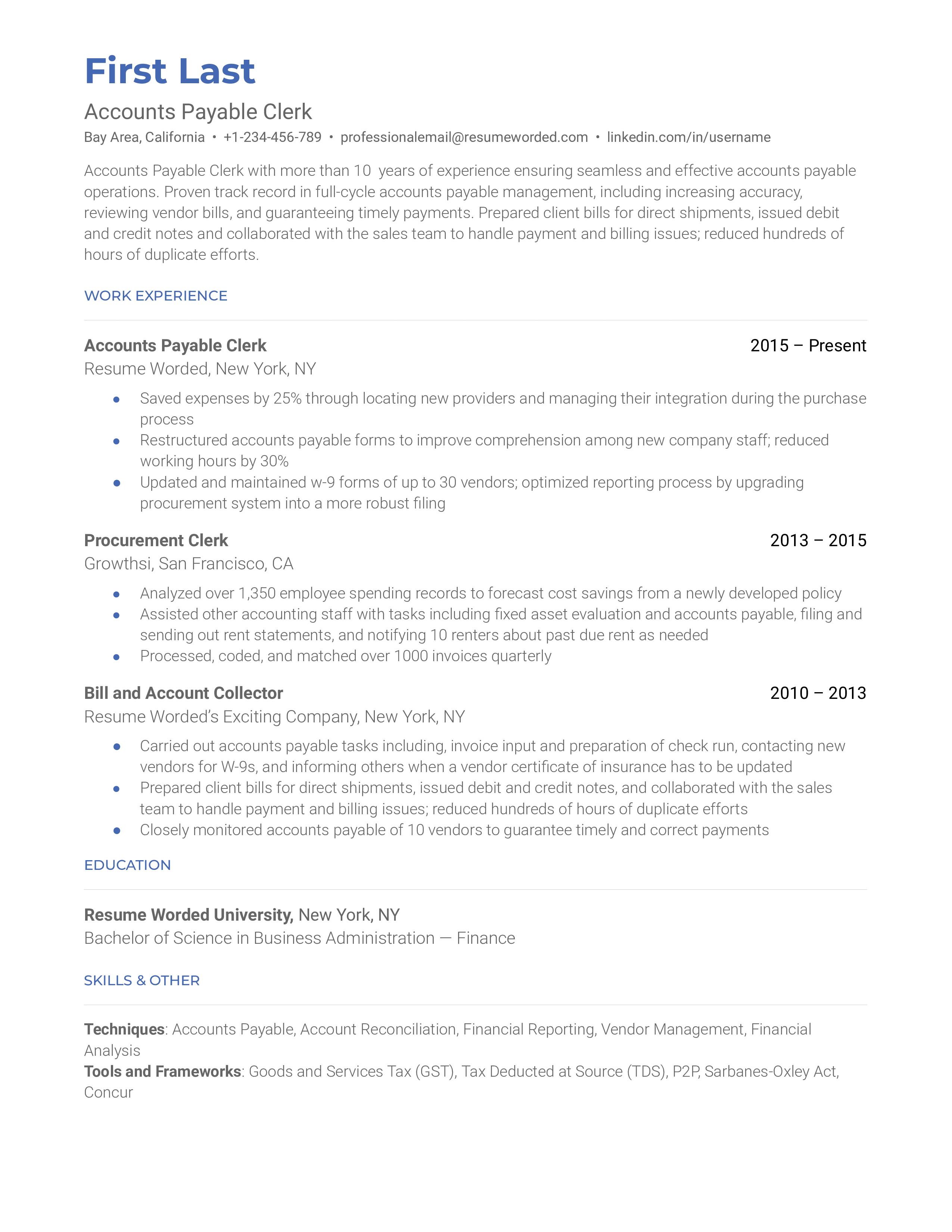

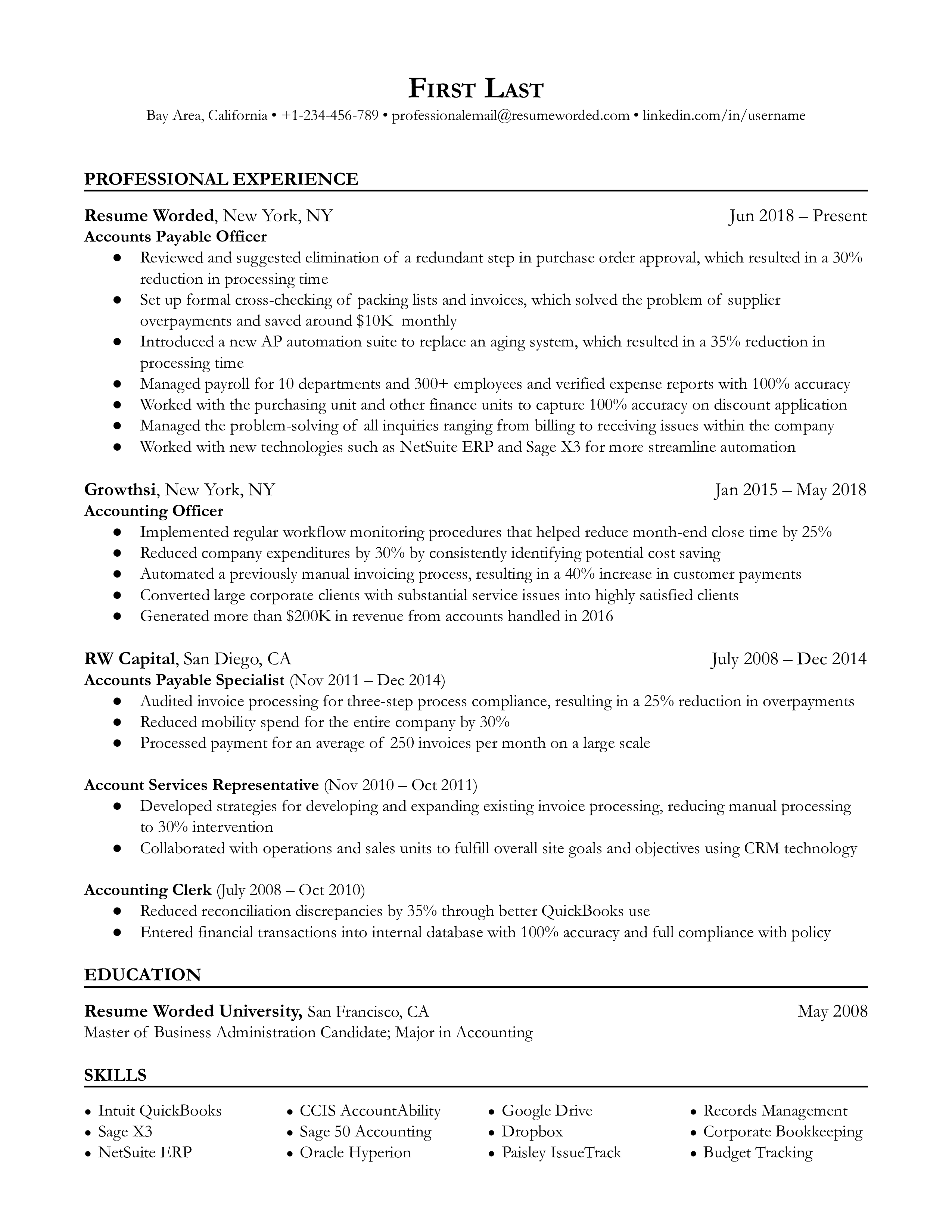

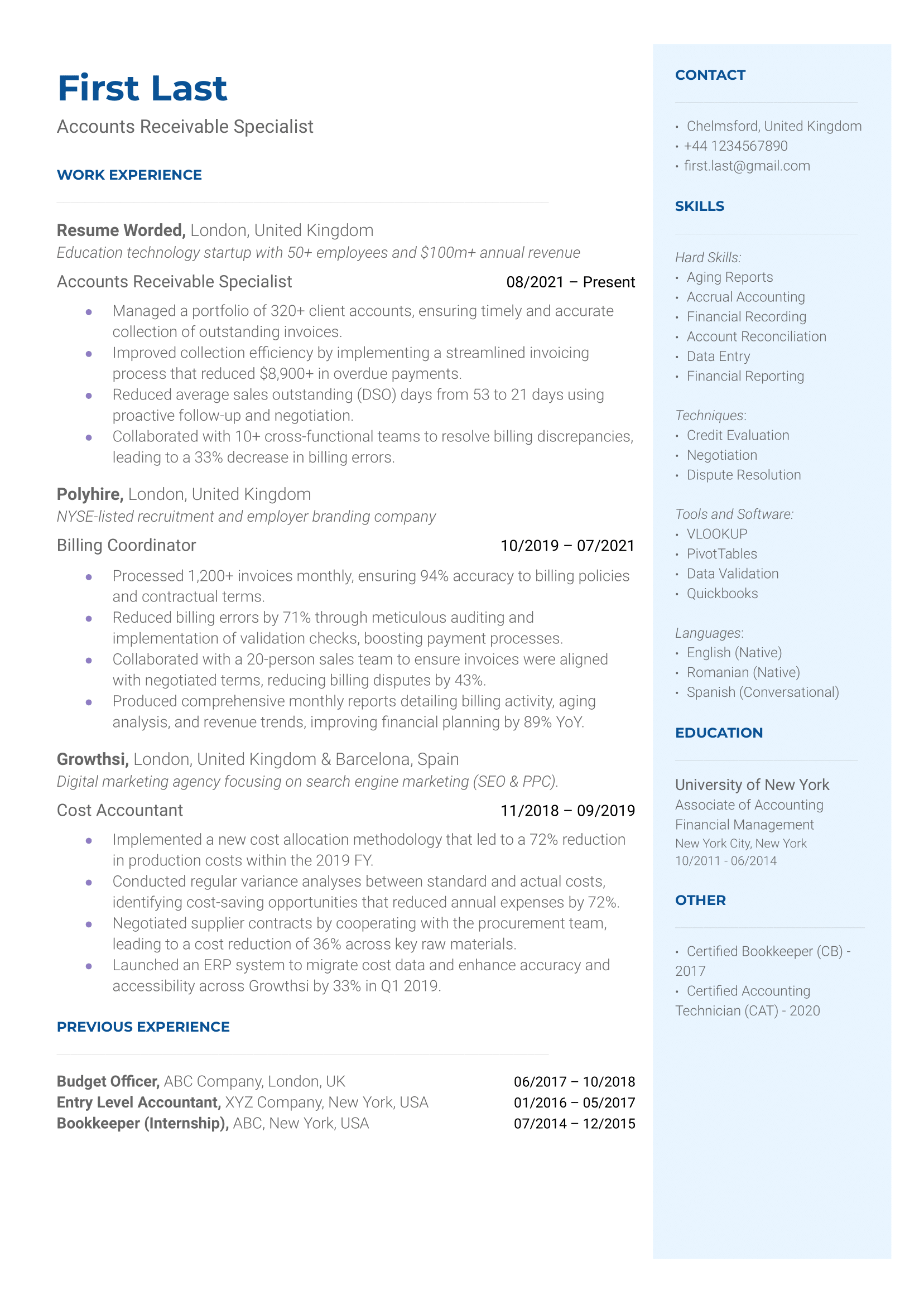

Accounts Payable Resumes

Every business has monetary transactions. They may better understand their development and improve their operations by keeping track of these transactions. To do so, they need an account-payable team! Within this guide, we created downloadable resume templates to show what a successful accounts payable resume can look like. Our tips add a professional touch to resumes, so ensure to use them!

Accounts Payable Supervisor

Accounts Payable Clerk

Accounts Payable Officer

Accounts Receivable

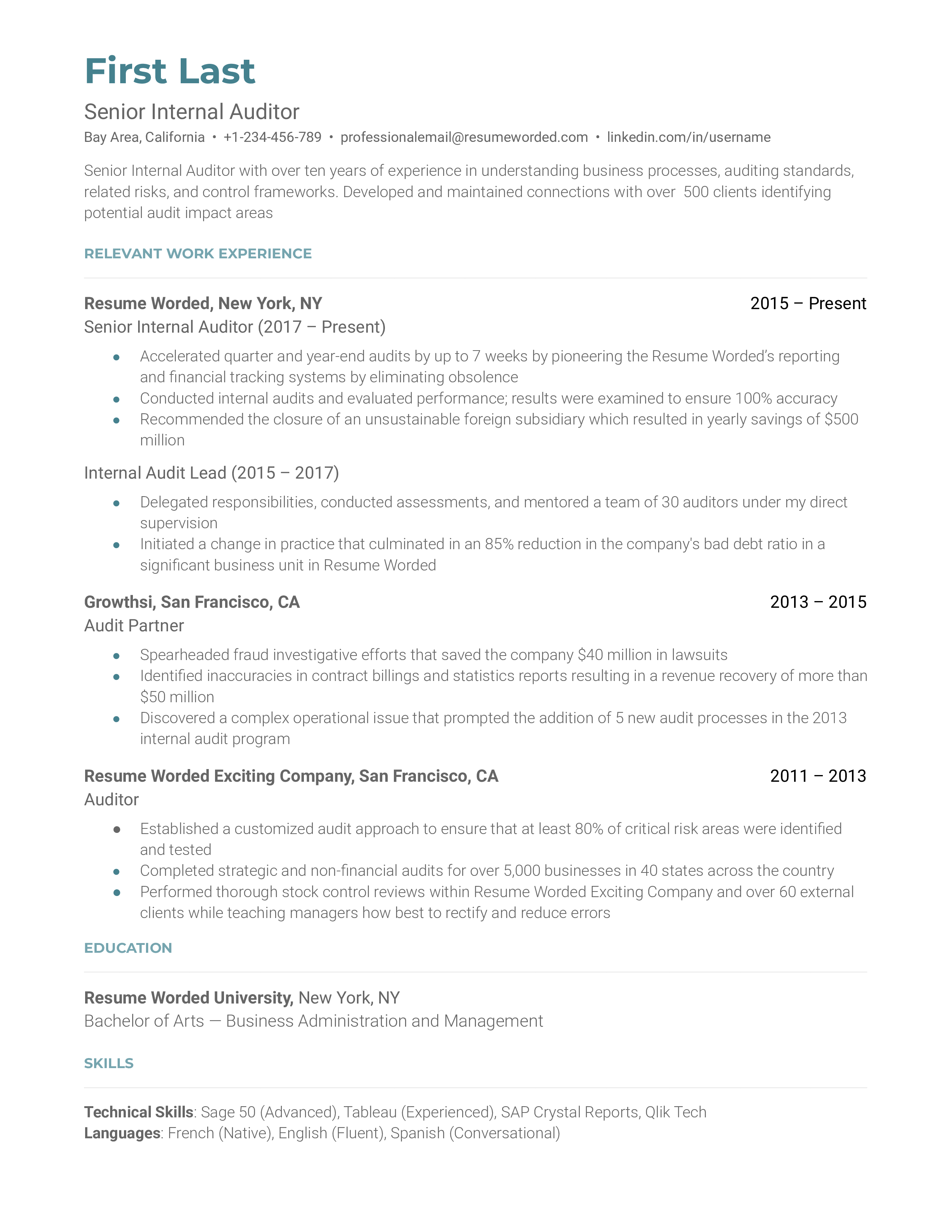

Internal Audit Resumes

Internal auditors enhance the company’s productivity by restructuring operations. Yet, one of their most important roles is to make sure the company follows legal compliance. Most organizations are visited by an external auditor once in a while. If they identify issues in the internal controls, the company may face serious legal issues. That’s why the internal auditor’s responsibility is to prevent problems in the internal controls. The demand for auditors is expected to increase by up to seven percent. That’s why building a persuasive and efficient internal audit resume is crucial. This guide will help you do just that. We’ll share some resume examples and give you tips to help you develop your internal audit resume.

Senior Internal Auditor

Purchasing Manager Resumes

Purchasing managers are the head of the purchasing team. They buy goods and materials that the company needs for reselling or developing new products. This is a senior-level job that requires a combination of education and industry experience. They must guide purchasing agents in the process of negotiating with suppliers. According to the Bureau of Labor Statistics, there are over 45,800 purchasing manager job openings every year. If you are interested in getting this role and you have the experience required, we’ve got you covered. This guide will help you create your own purchasing manager resume.

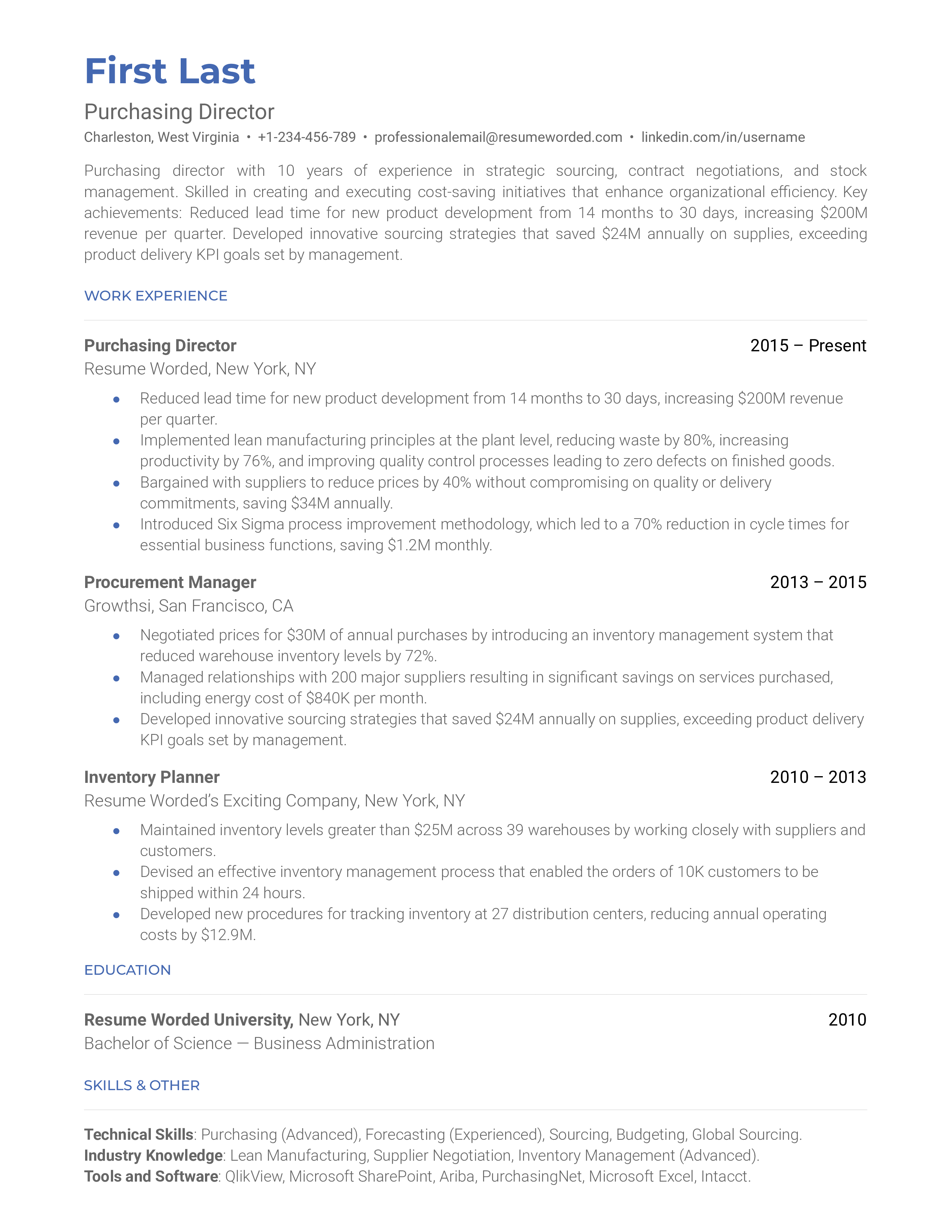

Purchasing Director

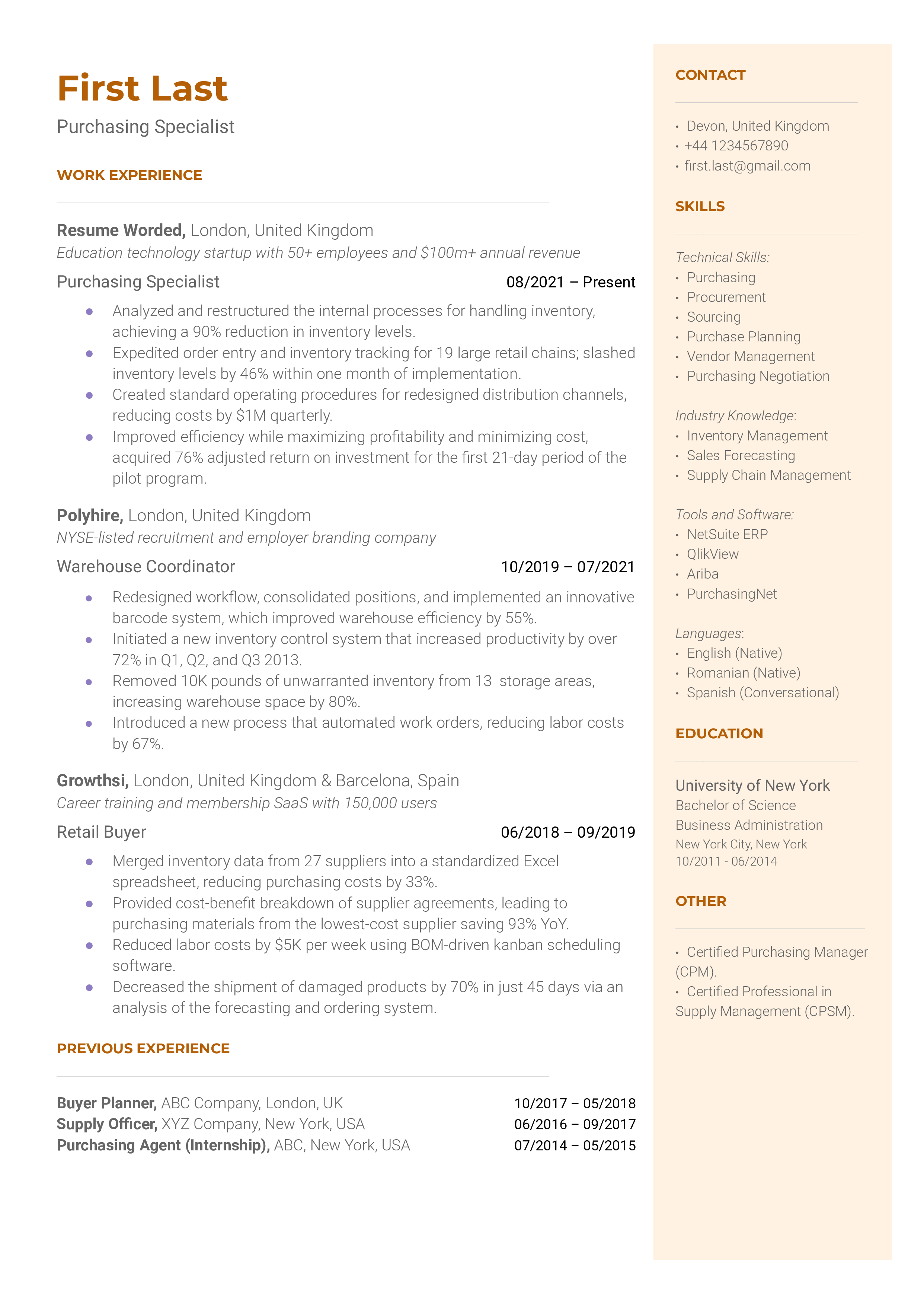

Purchasing Specialist

Strategic Sourcing Director

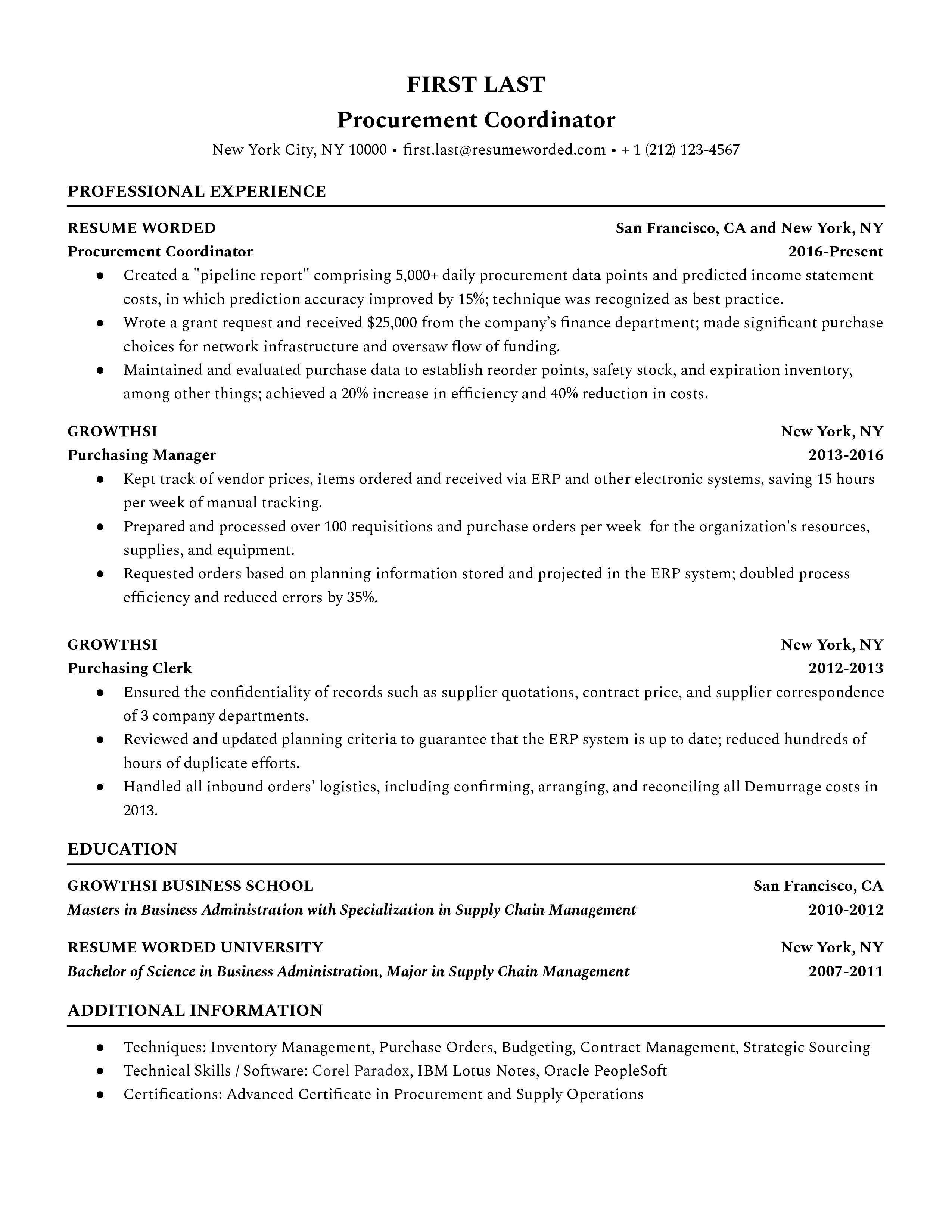

Procurement Coordinator

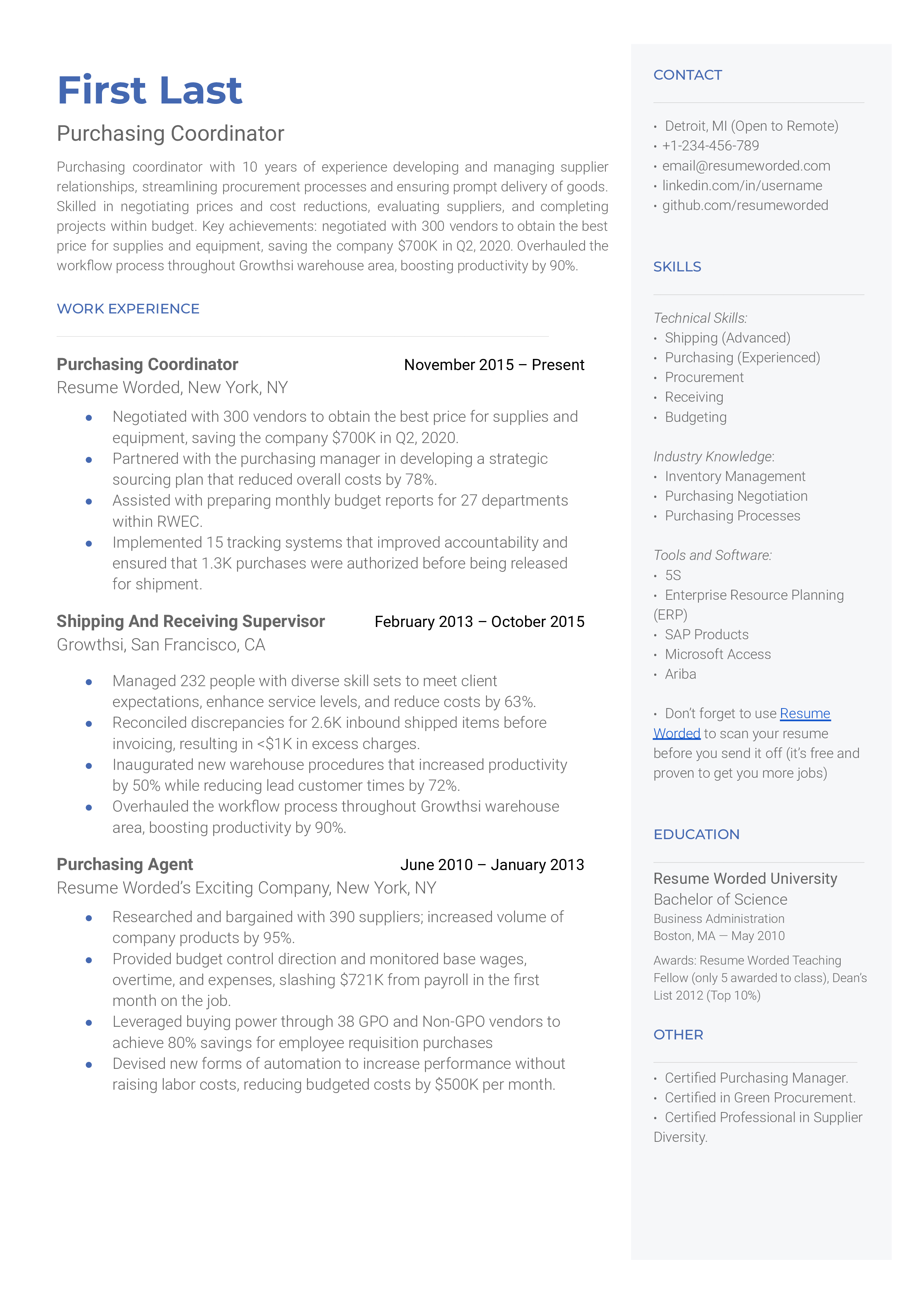

Purchasing Coordinator

Loan Processor Resumes

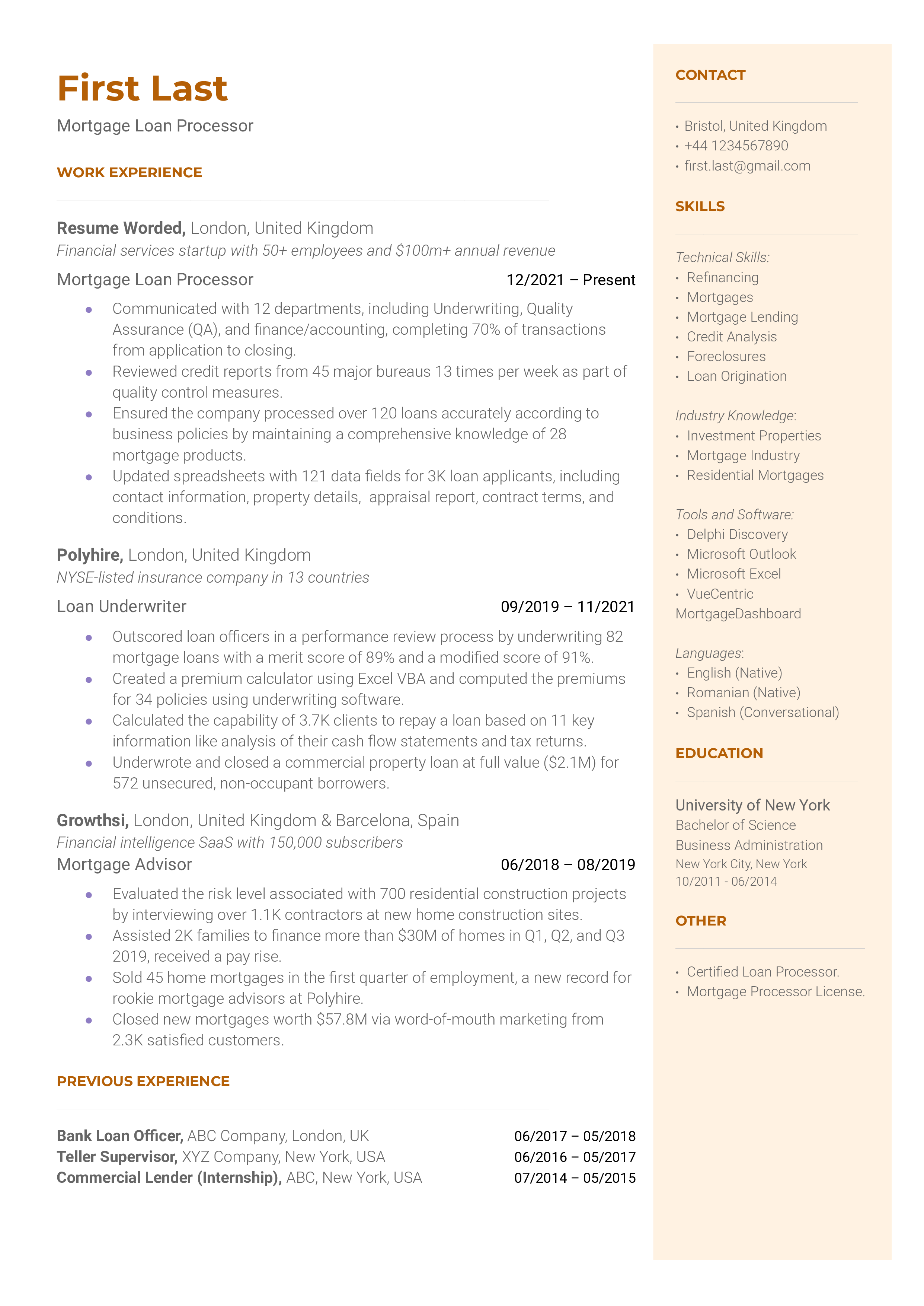

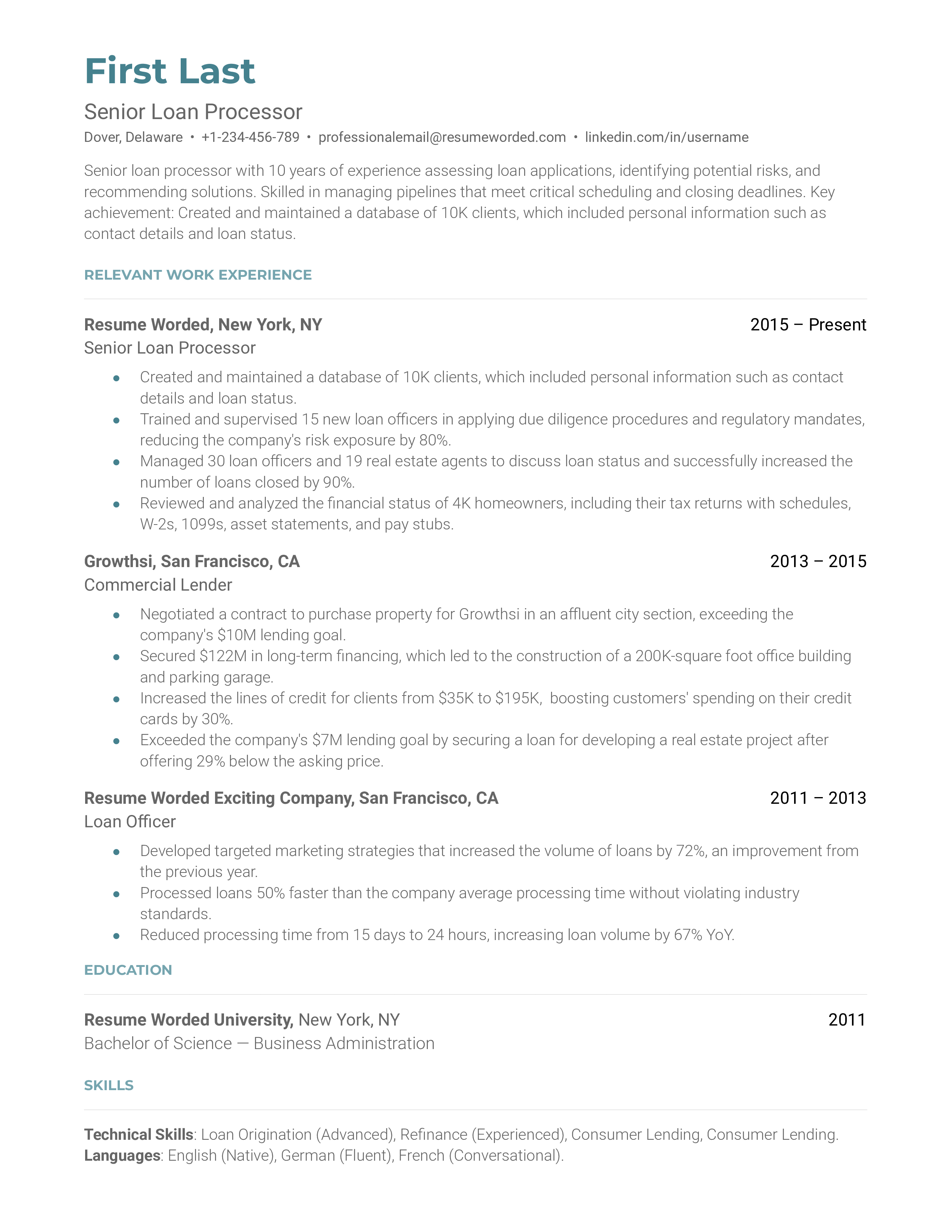

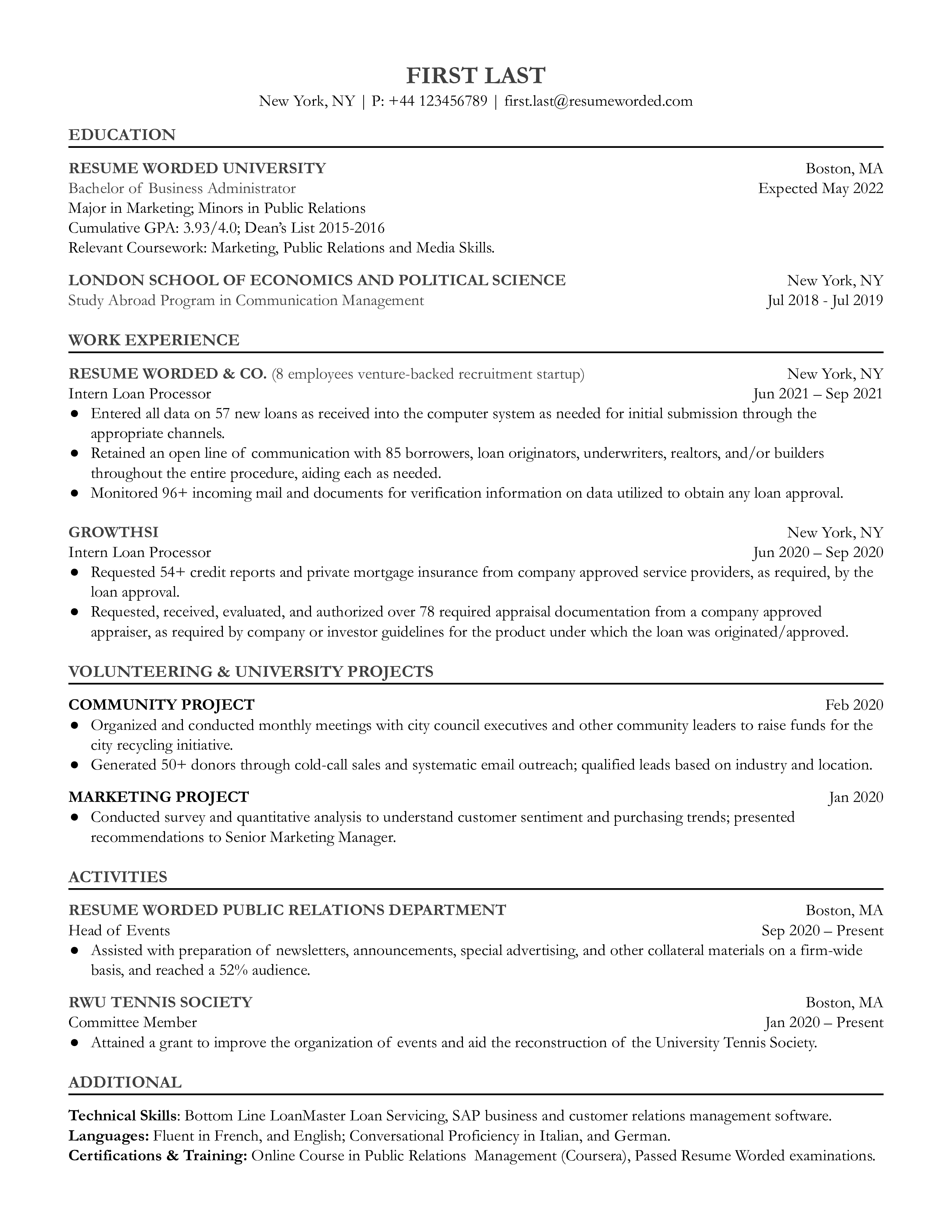

Loans are an important financial tool that most adults will use in their lifetimes. Loan processors are a vital part of the loan approval process. This guide will identify 4 loan processor positions, provide resume templates for each, and give tips on upgrading your resume and getting that dream loan processor job.

Mortgage Loan Processor

Senior Loan Processor

Entry-Level Loan Processor

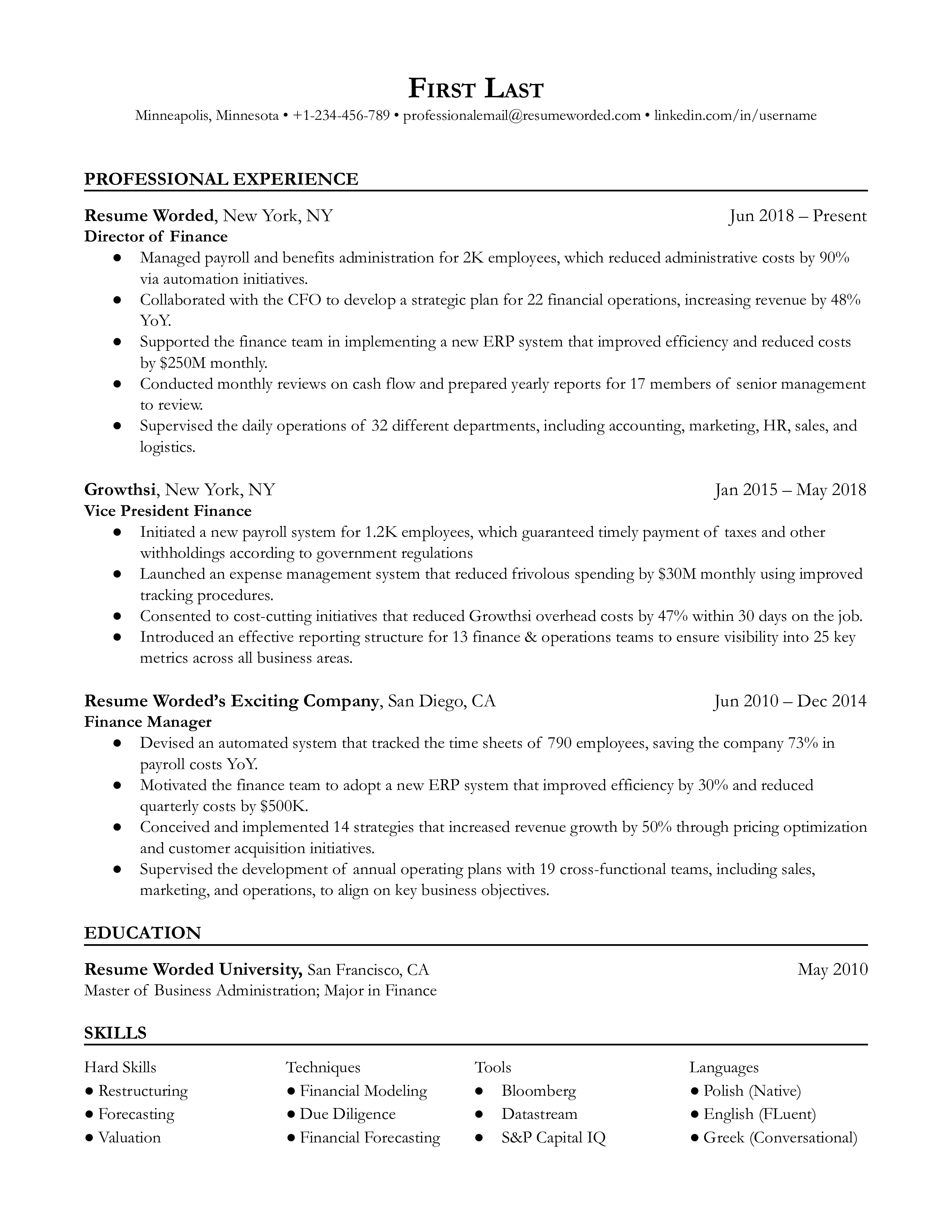

Finance Director Resumes

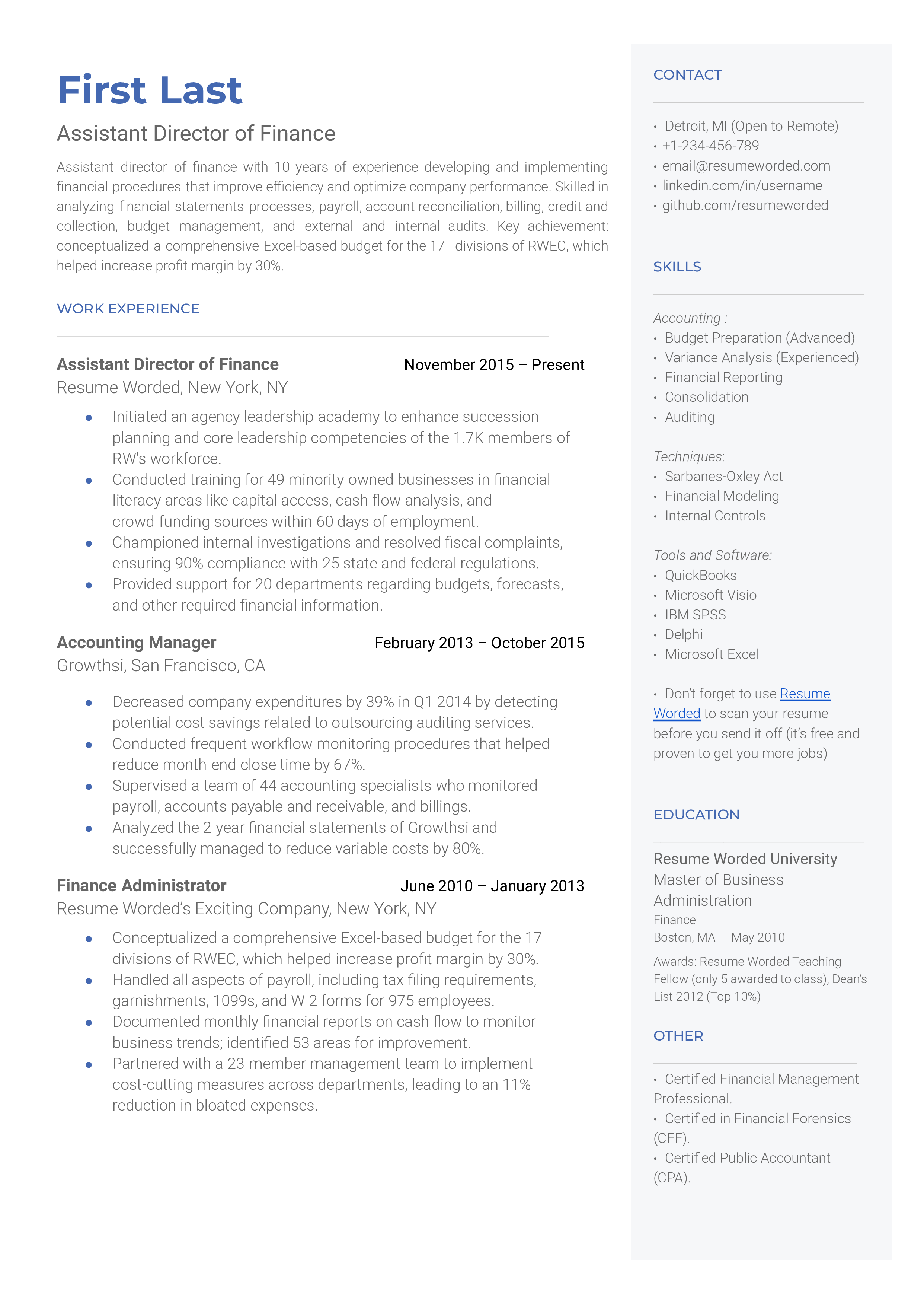

A company’s financial health is the most important thing for its survival. It is the finance director's job to know the financial health of a company at all times and to create policies and strategies to keep it healthy and thriving. This guide will help you formulate your winning finance director resume to secure your dream job.

Director of Finance

Assistant Director of Finance

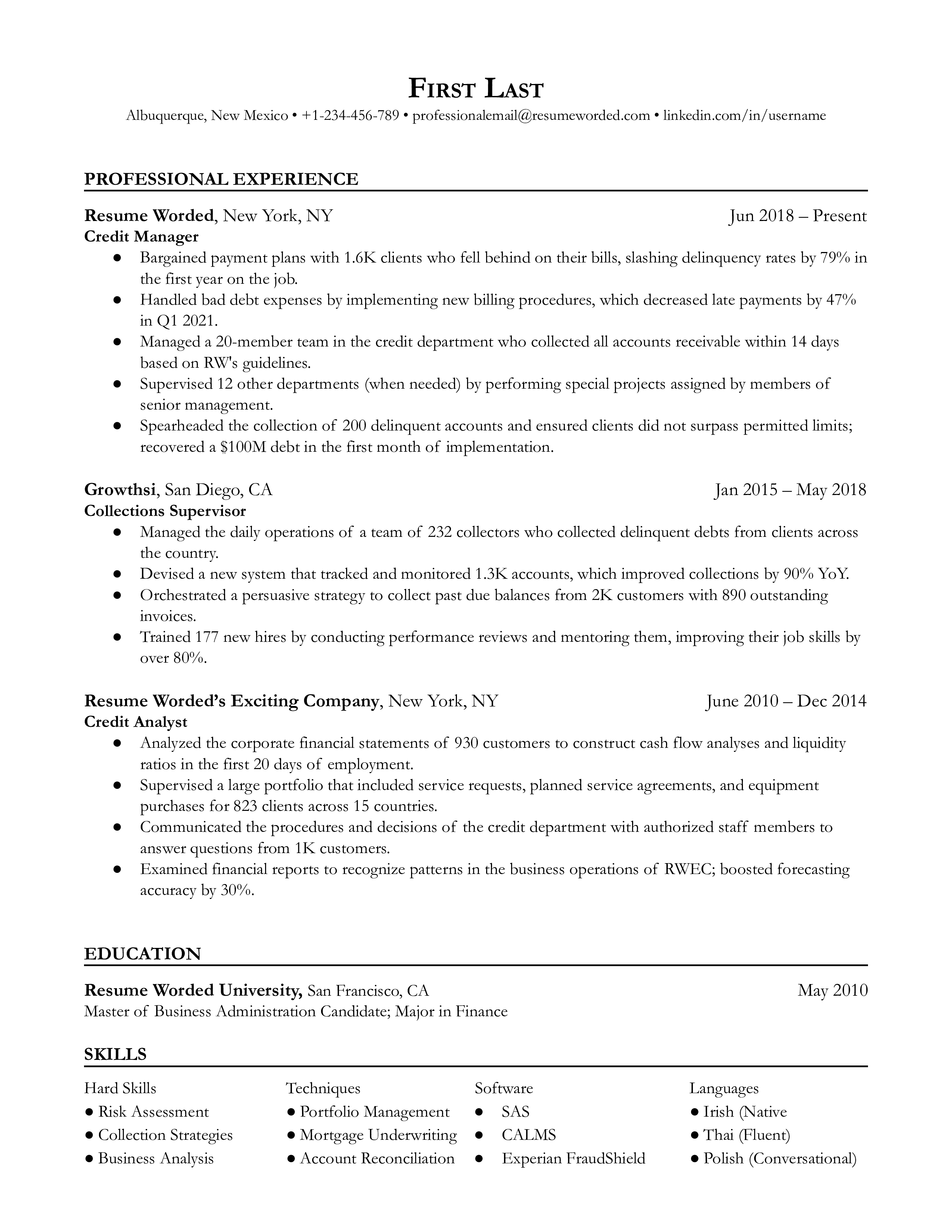

Credit Analyst Resumes

A credit analyst works in banks to determine lenders’ reliability, reduce risks, and increase revenue for the organization. This is an excellent career if you are passionate about finances, statistics, and economics. Credit analysis is also a highly in-demand profession these days. According to the Bureau of Labor Statistics (BLS), financial analysts’ demand is expected to increase by up to nine percent, which is higher than most occupations’ job outlook. If you have a background in finances and the required skills to break into credit analysis, this guide is for you. We’ll help you create an industry-relevant resume for your credit analyst career. We’ll share insightful tips and three resume templates

Credit Manager

Commercial Credit Analyst

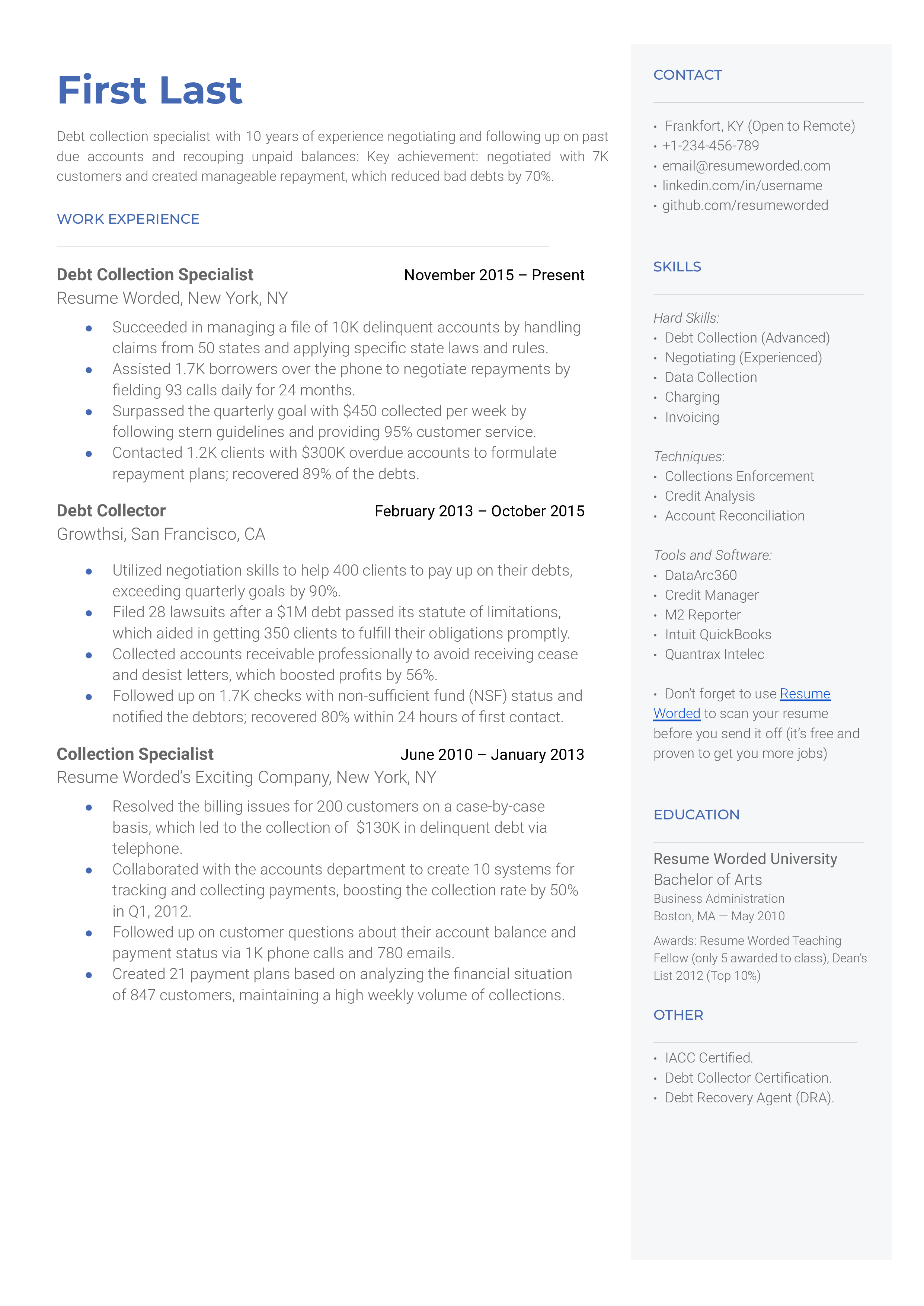

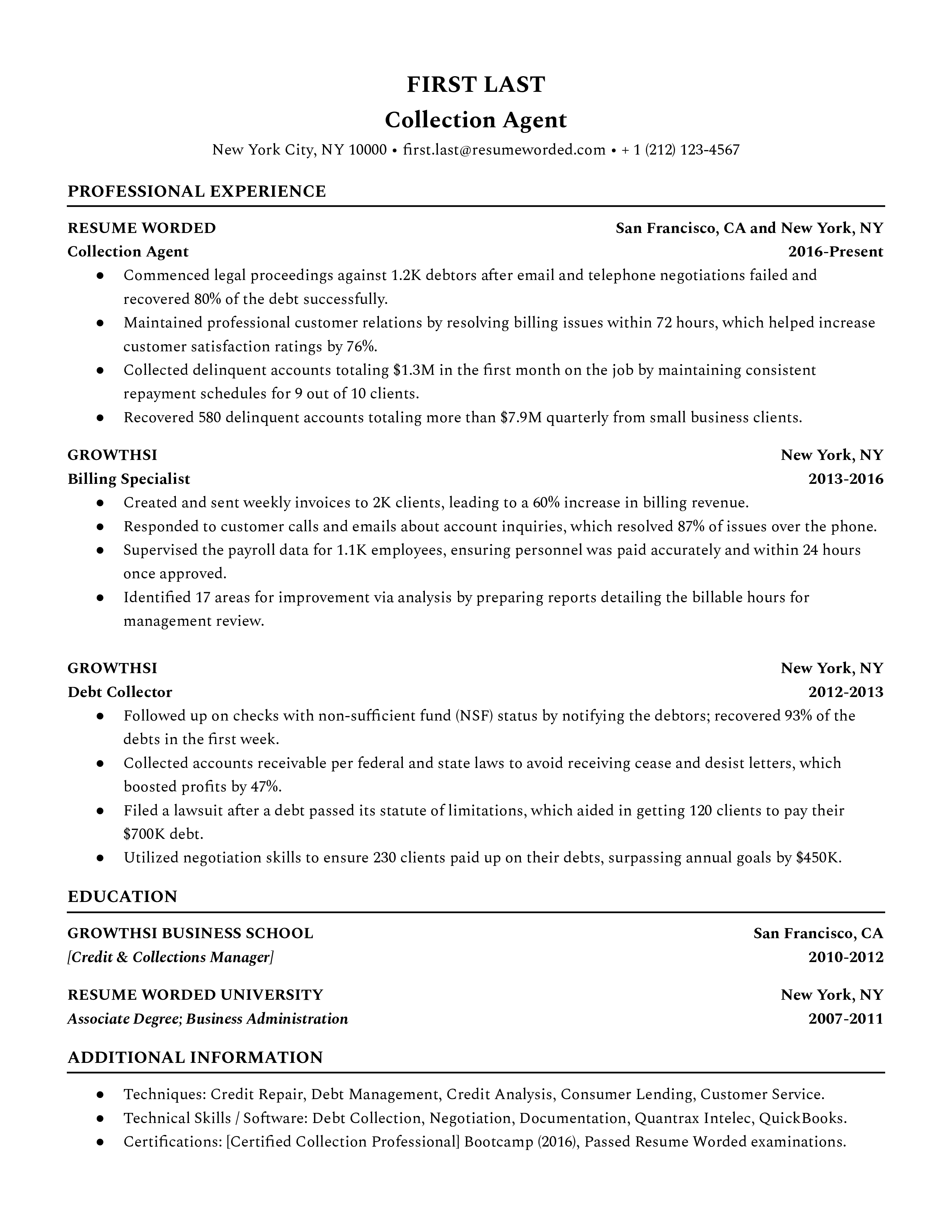

Collections Specialist Resumes

Collection specialists may get a bad rap, but they play an important role in assisting companies to recover money owed to them. This guide will show you how to create a winning collection specialist resume.

Debt Collection Specialist

Collection Agent

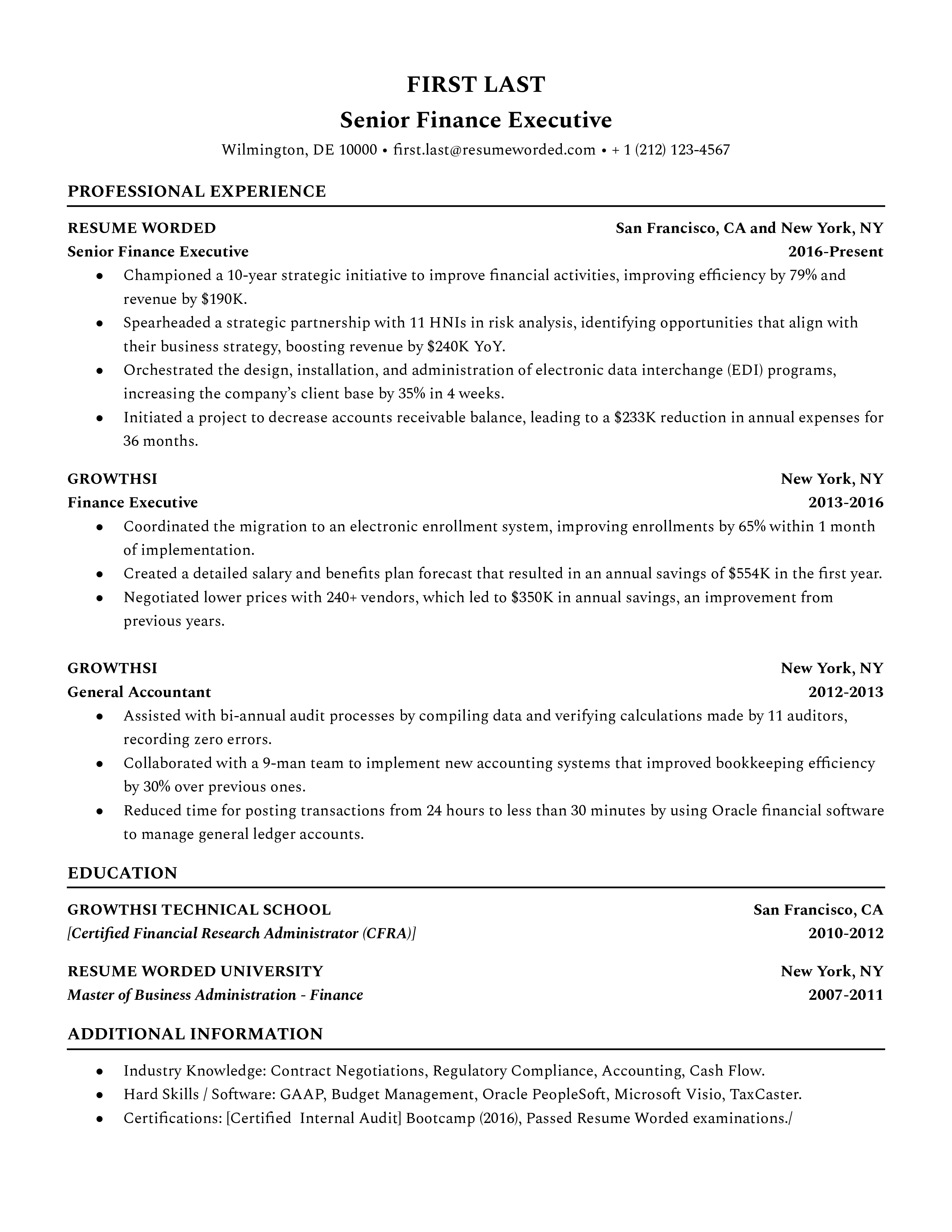

Finance Executive Resumes

Finance executives are at the head of the finance department and keep companies functioning. This resume guide has been developed to help you craft a winning finance executive resume that will get you to the top of the pile with recruiters.

Senior Finance Executive

Junior Finance Executive

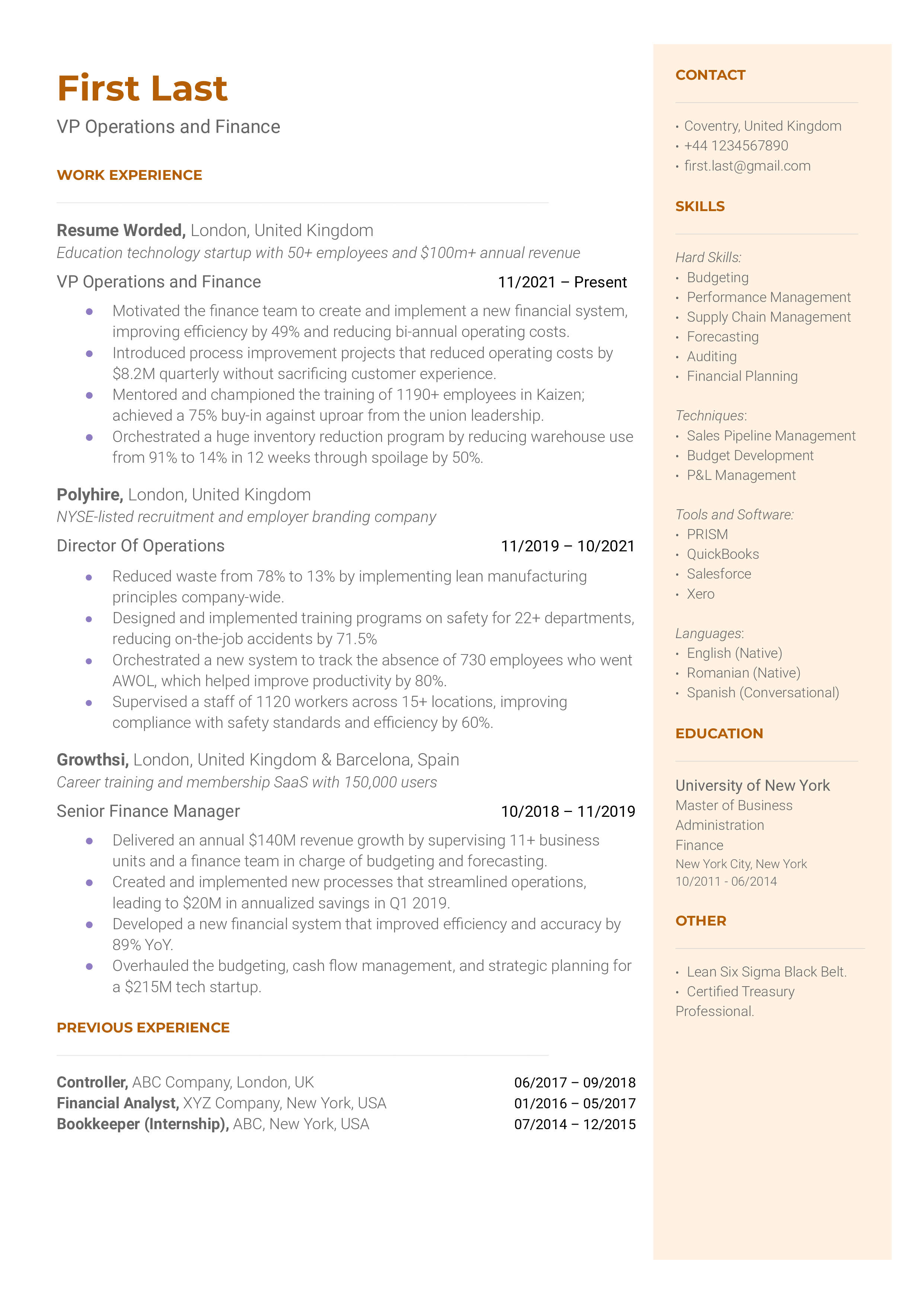

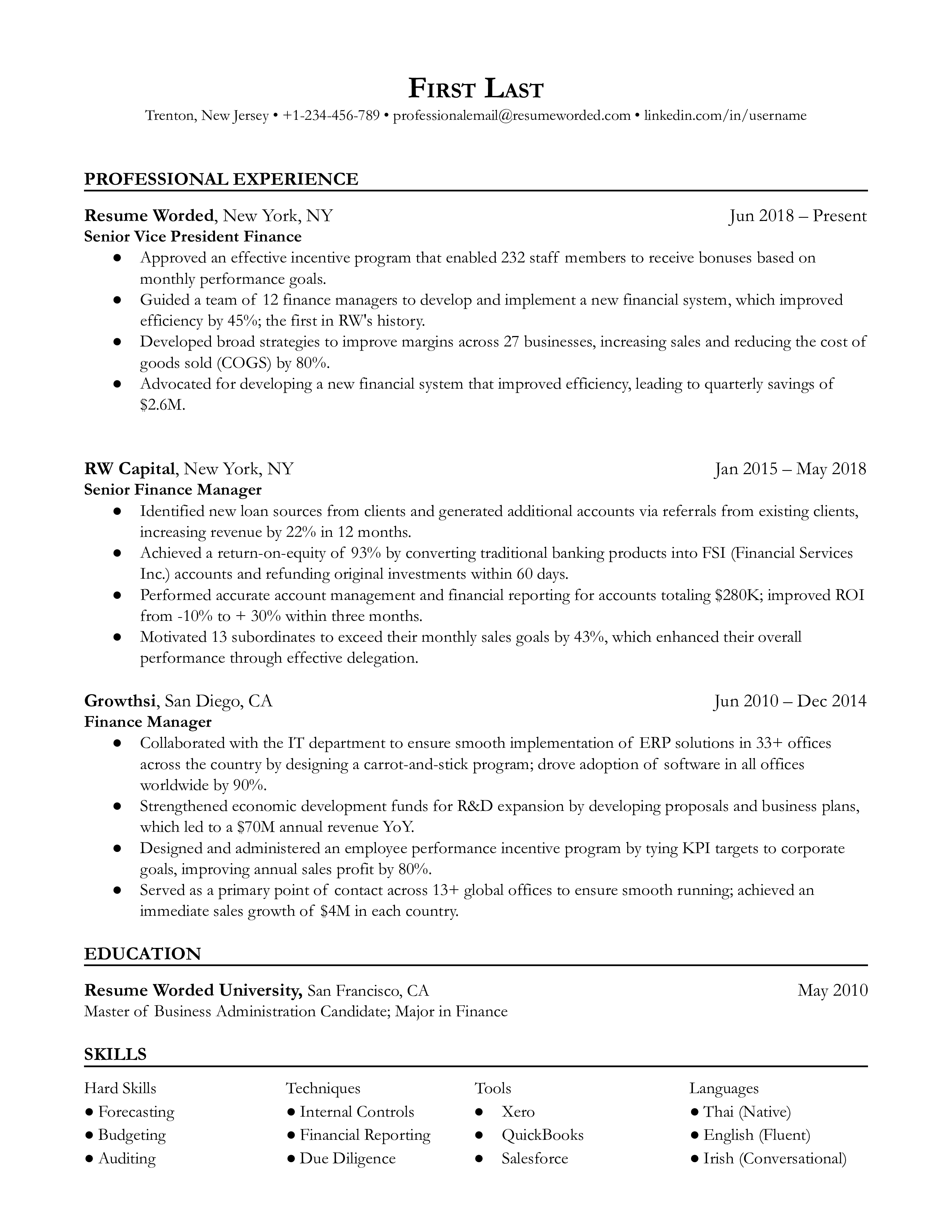

VP of Finance Resumes

With the world and economy recovering from Covid and bracing for a period of recession, a good vice president of finance who can work to maintain a company’s financial health is what all companies want. This resume guide which has been curated by top recruiters in the finance industry will show you what recruiters look for and give you specific tips to elevate your resume and secure yourself a job.

VP Operations and Finance

Senior Vice President Finance

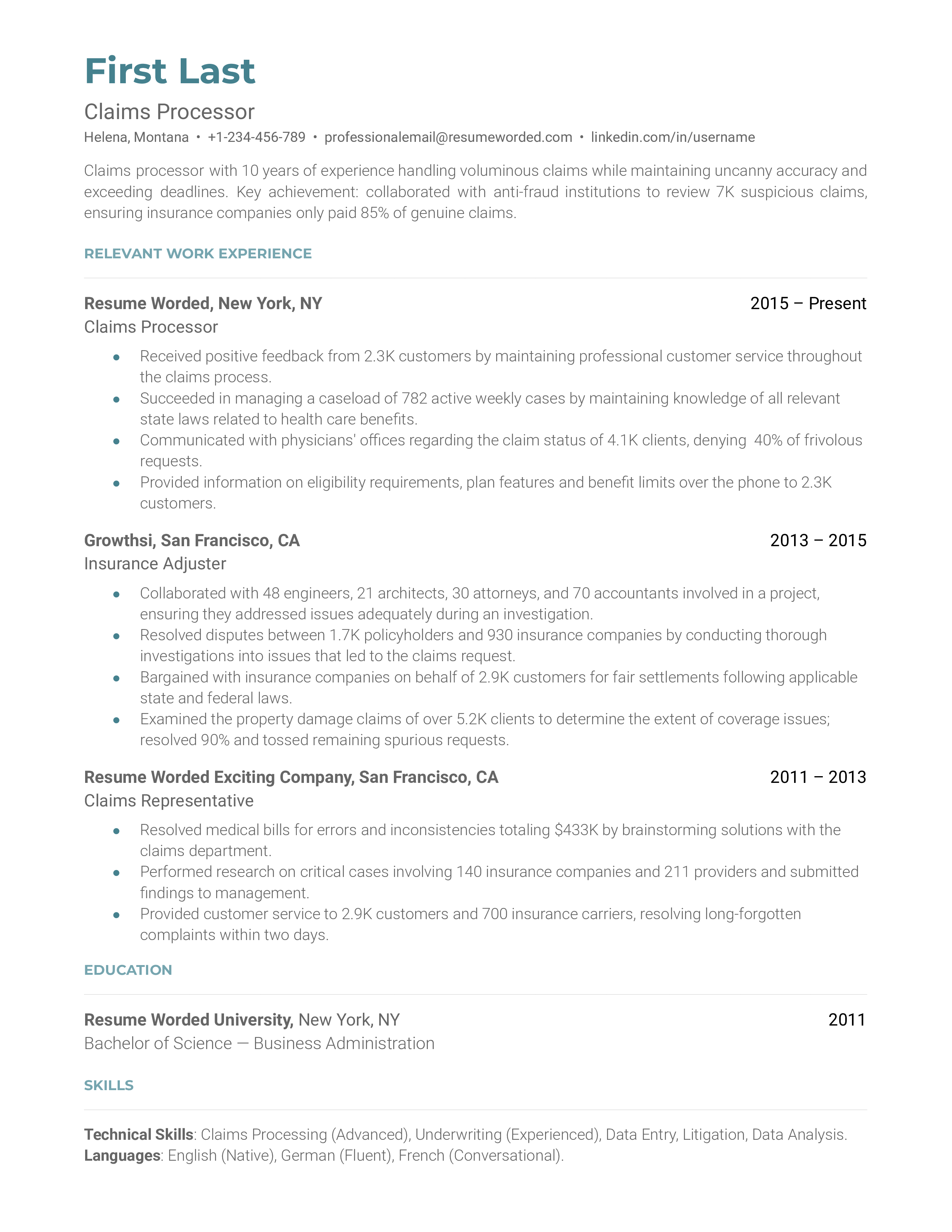

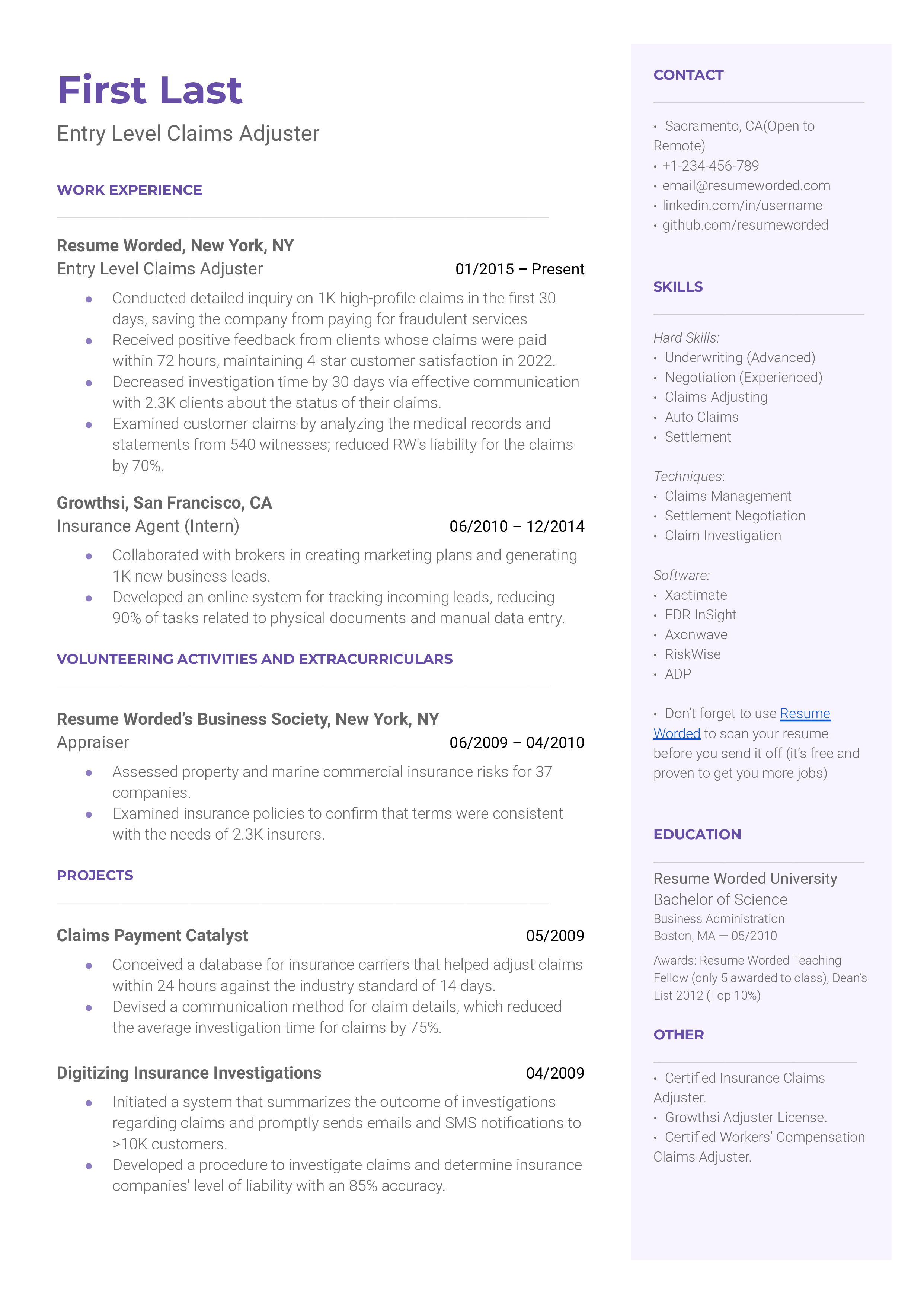

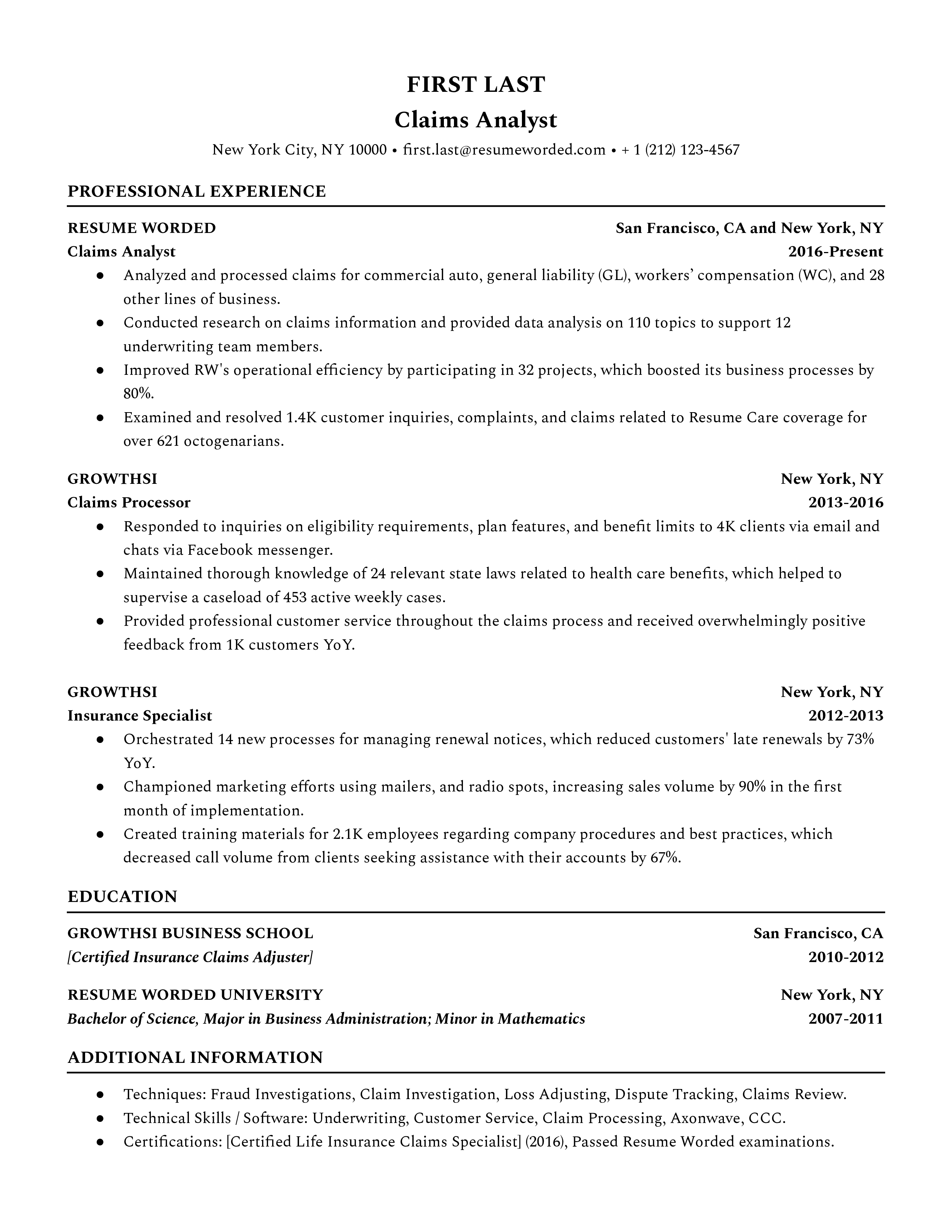

Claims Adjuster Resumes

Insurance is big business, and insurance companies go to great lengths to ensure that their insurance policies do not get taken advantage of by opportunists. Claim adjusters are part of the team that investigates claims to make sure insurance companies settle claims that are fair and warranted. This guide will help professionals create a successful resume in this field. Included are resume samples and useful recruiter tips.

Claims Processor

Entry Level Claims Adjuster

Claims Analyst

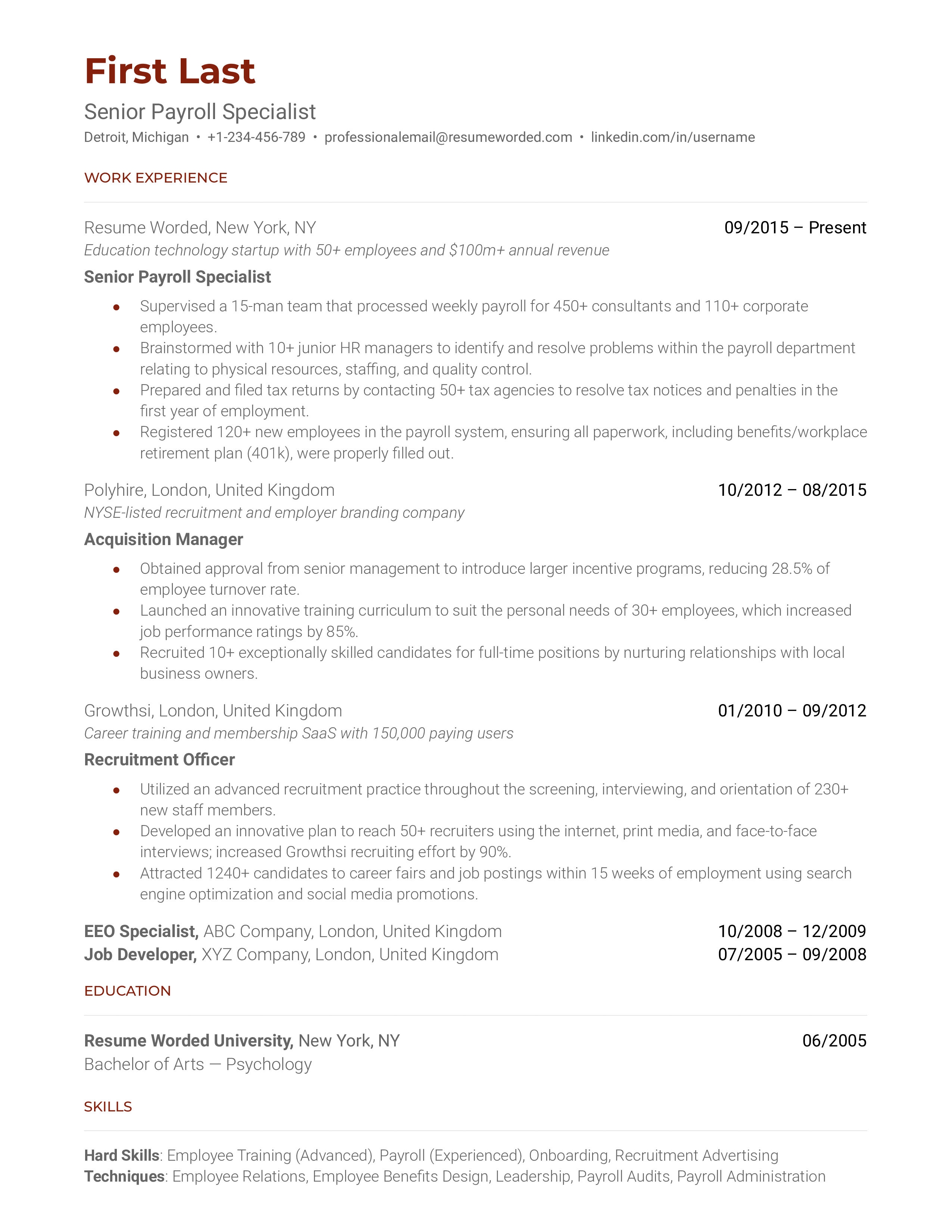

Payroll Specialist Resumes

A payroll specialist manages payment operations from start to finish. This includes calculating costs from personnel, deducting taxes, issuing payments, and reporting to upper management. This is an essential role in the accounting and HR departments. If you’re a payroll specialist trying to improve your resume, you’re in the right place. In this guide, we’ll share relevant tips that can help you demonstrate your value in the industry. Also, don’t forget to check our downloadable resume templates for payroll specialists.

Senior Payroll Specialist

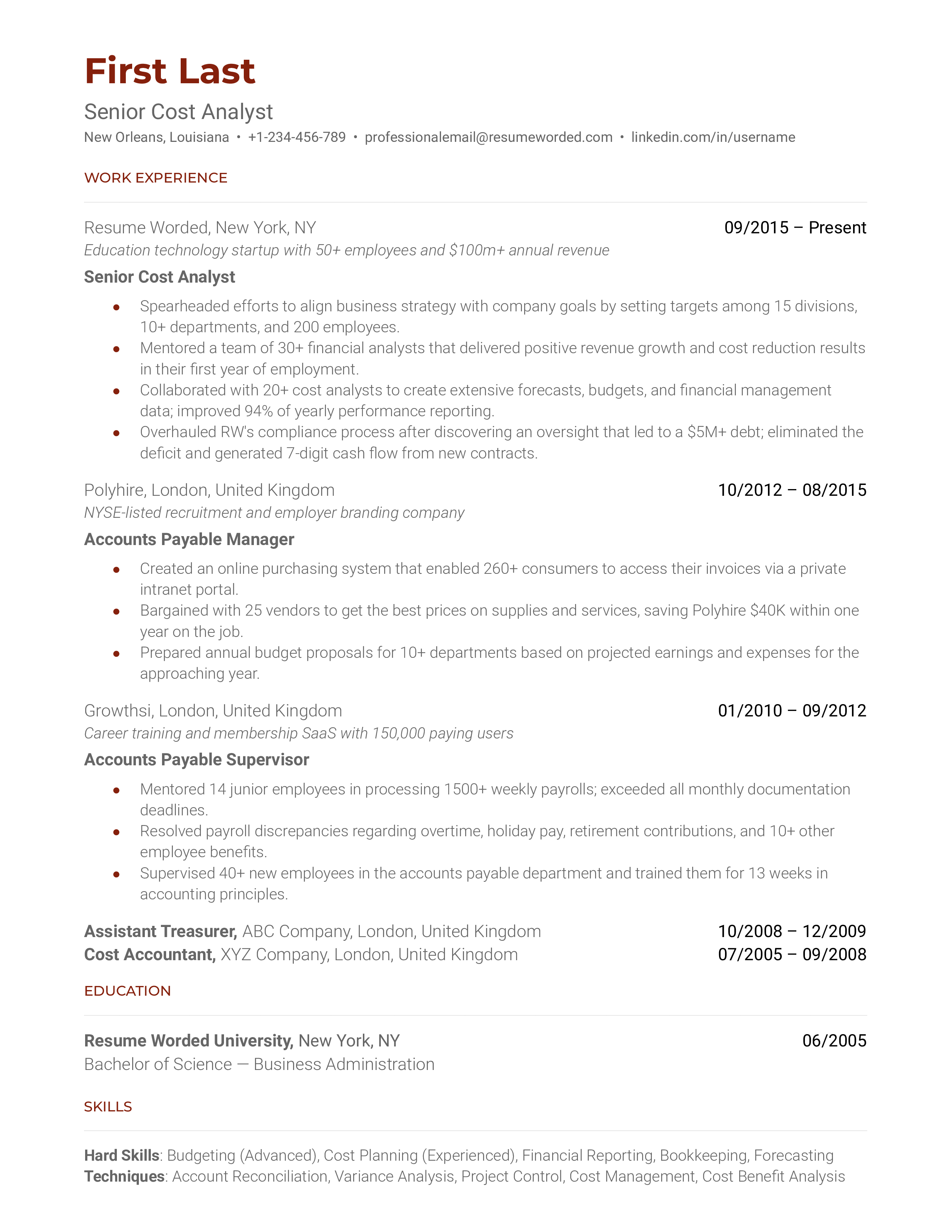

Cost Analyst Resumes

A cost analyst helps businesses make more informed decisions on their spending and budgetary plans. They are responsible for auditing a company’s expenses to identify financial issues that could affect production efficiency. If you’d like to start your job hunt as a cost analyst, we’ll help you out. This cost analyst resume guide will give you some handy tips to improve your performance and two downloadable templates.

Senior Cost Analyst

M&A Resumes

Mergers and acquisitions specialists carry out the necessary operations to coordinate a merger or company acquisition. They are responsible for analyzing risks, determining the benefits of that transaction, and negotiating with both parties. To become an M&A specialist or analyst you should have a background in accounting or finances. If you are an M&A specialist in the job hunt, this guide is for you. We’ll help you craft the best resume for your industry.

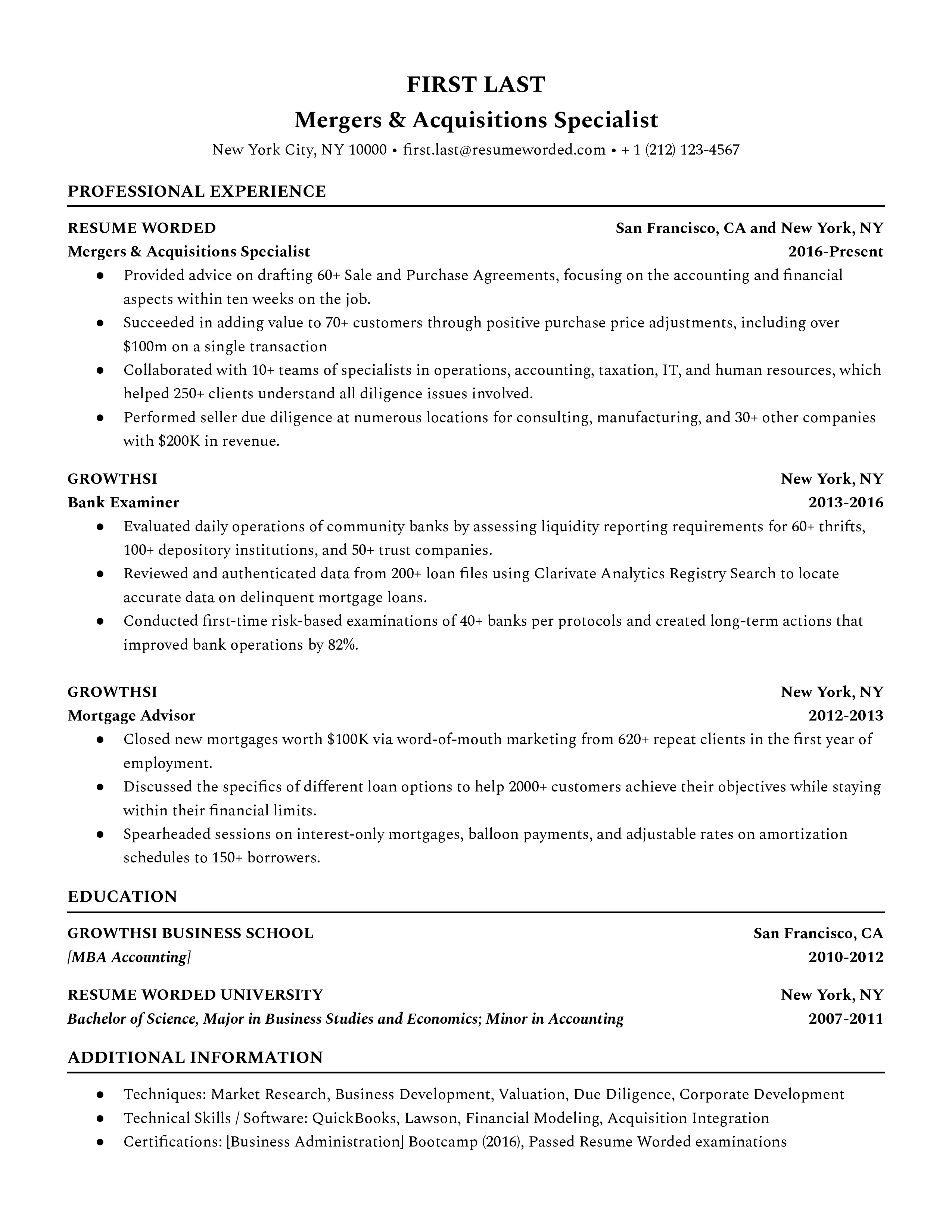

Mergers & Acquisitions Specialist

Action Verbs For Finance Resumes

- Restructured

- Implemented

How to use these action verbs?

A strong finance-based resume should show past successes in finance-related jobs, internships, or education. Always use clear resume action verbs to discuss them. You may want to showcase your industry prowess with finance-specific verbs like “modelled”, “analyzed”, or “audited”.

Finance Resume Guide

- Bookkeeper Resume Templates

- Investment Banking Resume Templates

- Financial Analyst Resume Templates

- Accountant Resume Templates

- Equity Research Resume Templates

- C-Level and Executive Resume Templates

- Financial Advisor Resume Templates

- Procurement Resume Templates

- Auditor Resume Templates

- Financial Controller Resume Templates

- Risk Management Resume Templates

- Accounts Payable Resume Templates

- Internal Audit Resume Templates

- Purchasing Manager Resume Templates

- Loan Processor Resume Templates

- Finance Director Resume Templates

- Credit Analyst Resume Templates

- Collections Specialist Resume Templates

- Finance Executive Resume Templates

- VP of Finance Resume Templates

- Claims Adjuster Resume Templates

- Payroll Specialist Resume Templates

- Cost Analyst Resume Templates

- M&A Resume Templates

- Finance Action Verbs

- All Resume Examples

Download this template for free

Download this ats-compatible resume template in word or google docs format. edit it directly in google docs., access samples from top resumes, get inspired by real resume samples that helped candidates get into top companies., get a free resume review, get actionable steps to revamp your resume and land more interviews using our free ai-powered tool..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

IMAGES

VIDEO

COMMENTS

A Financial Services Associate resume should showcase the skills and experience needed to work in a financial services environment. It should also convey your ability to manage client relationships, provide financial services, and help customers reach their financial goals.

Looking for professional Financial Services Associate resume examples? LiveCareer provides examples with the best format, template & keyword options. View now!

Looking for professional Financial Services Representative resume examples? LiveCareer provides examples with the best format, template and keyword options.

We’ve meticulously researched and analyzed countless financial analyst resume samples from all career stages in different industries, resulting in the creation of 13 resume samples to help you create a resume and land more interviews in 2024.

Resume Examples Objectives and summaries Templates Create your resume. 112 Finance objectives and summaries found. A well-written objective or summary on your resume can be the difference between getting rejected, or getting invited for an interview.

You may want to showcase your industry prowess with finance-specific verbs like “modelled”, “analyzed”, or “audited”. See examples of Finance resumes that will get you hired in 2024. Download them for free, plus learn how to update your resume for 2024 standards.