Importance of Business Plan to an Entrepreneur: Guide to Implement

Importance of Business Plan to an Entrepreneur – A business plan is an essential road map that entrepreneurs use to navigate the difficult process of starting and expanding a profitable firm. It performs as a strategic instrument for outlining the goals. Also, serve as a financial prediction of a company.

Importance of a Business Plan to an Entrepreneurs

A strong business plan’s importance cannot be overstated since it provides entrepreneurs with a comprehensive framework for making decisions, attracting investors , securing funding, and navigating the dynamic business world. This article will cover the significance of a business plan. Also, offer practical guidance on how entrepreneurs can utilize it to advance their ventures. Let’s discuss what are the importance of a business plan to an entrepreneur.

A Business Plan Provides a Roadmap for a Business

Picture you are going on a road trip to a dream destination. Before setting off, you would carefully plan your route, mark critical milestones, estimate travel time, and consider alternative paths in case of detours. Similarly, a business plan helps entrepreneurs chart their course by defining their vision, identifying target markets, assessing competition, setting financial goals, and mapping out strategies to overcome challenges.

Read – Can Anyone Be an Entrepreneur

Helps Entrepreneurs to Define Their Objectives

Imagine that an entrepreneur wishes to launch a sustainable clothing line. They would specify their goals through the business planning process, such as advancing ethical fashion, minimizing environmental effects, and making a good social impact. The business plan would outline these objectives and establish strategies and action steps to align the business activities with these goals.

Defined objectives in a business plan help entrepreneurs think critically, establish purpose, and guide decision-making. By setting SMART objectives, entrepreneurs can track performance, evaluate strategies, and make necessary adjustments to achieve desired outcomes. For example, an e-commerce business can increase online sales by 50% within a year, allowing regular monitoring, analysis, and adjustments to achieve its target.

Importance of Entrepreneurs to Identifying Their Target Market

When determining the target market for their goods or services, businesses place a lot of weight on their business plans. A business plan aids entrepreneurs in comprehending their potential clients, their demands, and their preferences by doing in-depth market research and analysis. This knowledge is essential for creating efficient marketing plans and modifying the company’s product offerings to satisfy the needs of the target market.

Let’s use the example of an entrepreneur who wants to launch a line of fitness clothes to demonstrate the significance of this. They would do market research as part of the process of writing a business plan to pinpoint their target consumers, such as fitness fanatics, gym visitors, or athletes. The business plan would include insightful information on the target market’s demographics, hobbies, and purchase patterns. With this knowledge, the business owner may carefully coordinate their product offering, price, and marketing messaging to appeal to the determined target demographic.

Entrepreneurs may focus on the appropriate audience, avoid one-size-fits-all techniques, and customize their products, services, and marketing strategies to their consumers’ needs by determining their target market. This aids in comprehending the competitive landscape, spotting gaps, and creating distinctive value propositions that appeal to the target market.

Helps Entrepreneurs to Assesses Competition

A business plan is a valuable tool that helps entrepreneurs assess their competition and gain a deeper understanding of the market landscape in which they operate. By following a structured approach, a business plan guides entrepreneurs on how to effectively analyze and evaluate their competitors.

A business plan helps entrepreneurs identify their key competitors by conducting research and gathering information about their products or services, pricing strategies, target market, marketing tactics, distribution channels, and customer reviews. This helps entrepreneurs understand their unique selling points and position themselves in the market. Entrepreneurs can compare their strengths and weaknesses to those of their competitors, identifying areas for differentiation. They also analyze market demand and customer preferences to identify gaps or underserved segments, tailoring their products or services to cater to these needs. A business plan guides entrepreneurs in positioning themselves against their competition, developing a unique value proposition that resonates with the target market. This roadmap helps entrepreneurs stay agile and adapt their strategies accordingly.

Importance to Evaluate Feasibility

Read – Benefits of Being an Entrepreneur

Importance of Entrepreneurs to Attract Investors

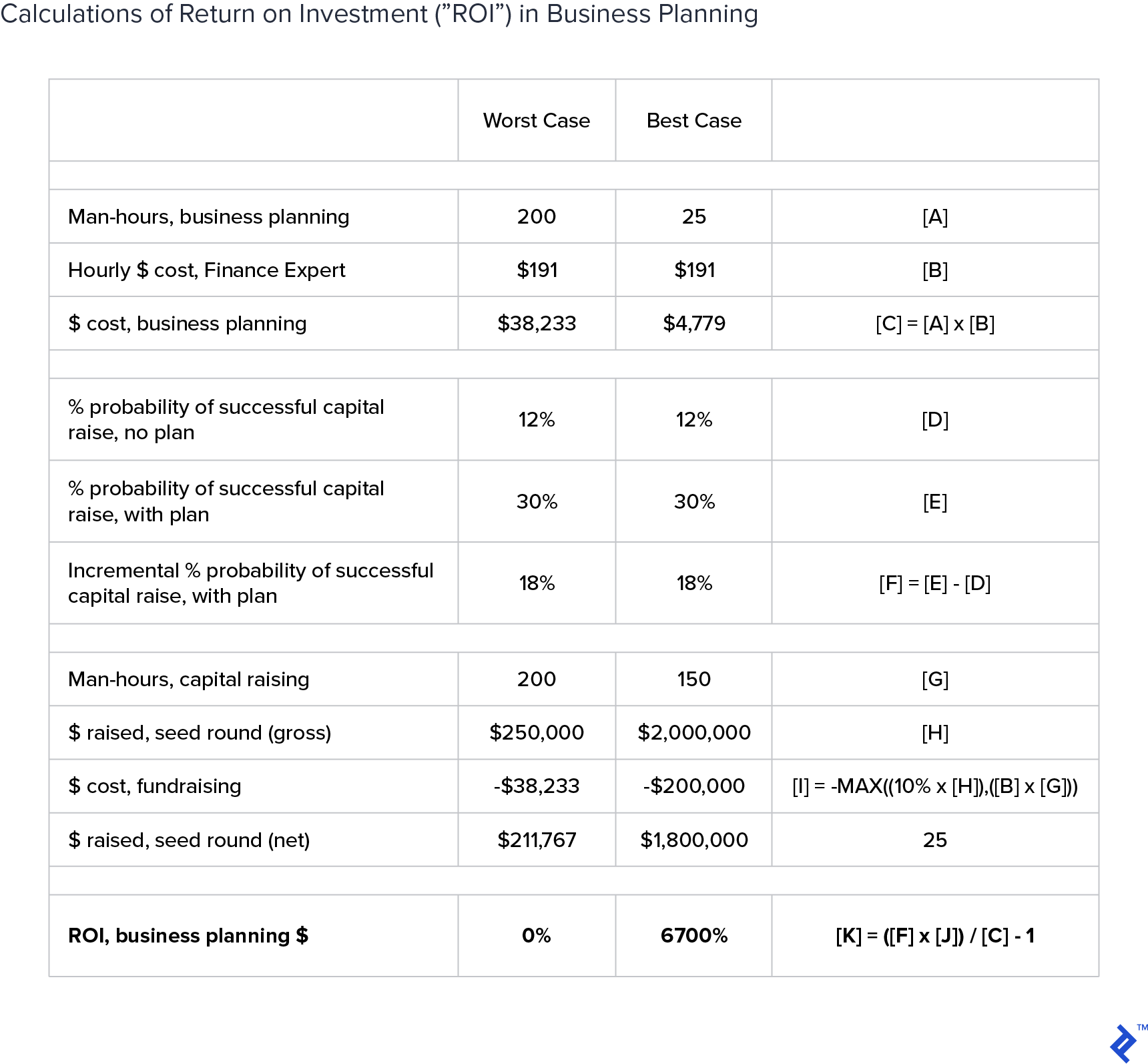

A business plan holds immense importance for entrepreneurs when it comes to attracting investors to support their venture. A well-crafted business plan serves as a persuasive tool that demonstrates the potential of the business and convinces investors to provide financial backing.

Helps Entrepreneurs to Secures Their Funding

A business plan is essential for assisting entrepreneurs in obtaining finance for their projects. It acts as a roadmap that details the company’s potential, financial estimates, and growth plans. Entrepreneurs should write a succinct executive summary, thorough business description, market and competitive analysis, financial projections, funding requirements, marketing and sales strategy, management team, risk assessment, and mitigation, and supporting documents to obtain funding through a business plan.

These elements help investors and lenders understand the business’s unique value proposition, target market, revenue potential, and funding requirements. By presenting realistic financial projections, well-supported financial projections, and a well-thought-out marketing and sales strategy, entrepreneurs can secure funding and attract investors and lenders.

Read – Common Myths about Entrepreneurs

Business Plan Guides Entrepreneurs to Resource Allocation

A business plan serves as a valuable tool that guides entrepreneurs in allocating their resources effectively. It provides a clear roadmap for resource allocation by outlining the key areas of the business that require attention and investment.

Importance to Facilitate Decision-Making

A business plan holds great importance for entrepreneurs in facilitating effective decision-making throughout their entrepreneurial journey. It provides a framework that helps entrepreneurs make informed decisions by considering various factors and evaluating potential outcomes.

To effectively use a business plan for decision-making, entrepreneurs should define goals and objectives, gather relevant information, evaluate alternatives, consider financial implications, analyze risks and mitigation strategies, seek input from experts, regularly review and update the plan, and trust intuition and vision. This balances analytical thinking with an entrepreneurial instinct, ensuring long-term sustainability and informed decisions.

Identifies Risks and Mitigation Strategies

To identify risks and develop mitigation strategies in a business plan, conduct a comprehensive risk assessment, analyze the impact and likelihood of risks, and develop specific strategies. Allocate resources, including financial, personnel, and time, to support the implementation of these strategies. Regularly monitor and update the business plan, seeking external expertise or consulting with industry professionals to gain insights. Communicate the identified risks and mitigation strategies clearly to stakeholders, including investors, lenders, and partners, to demonstrate professionalism and confidence in the business.

Importance of Entrepreneurs to Assists in Team Building

Read – Entrepreneurship Books for Students

Business Plan Supports Marketing and Sales Efforts

A business plan holds significant importance in supporting marketing and sales efforts for entrepreneurs. It provides a strategic roadmap for effectively promoting products or services and attracting customers. A business plan helps understand the target market, define the unique selling proposition (USP), develop marketing strategies, allocate budgets, monitor and measure results, and adapt and evolve.

Guides Product or Service Development

A business plan is essential for directing entrepreneurs as they create their goods or services. It offers a methodical way to determine consumer demands, specify product characteristics, and create a schedule for product development.

A business plan can guide product or service development by identifying customer needs, defining product or service features, setting development milestones, determining resource requirements, conducting testing and iteration, and integrating marketing and launch strategies. This helps entrepreneurs stay focused, track progress, and ensure the timely completion of activities. The plan should also outline the necessary funding, collaborations, and resources needed for the development process. By incorporating continuous improvement and iterative development, entrepreneurs can create a high-quality offering that meets or exceeds customer expectations.

Importance of Entrepreneurs to Manage Finances Effectively

A business plan holds great importance for entrepreneurs when it comes to managing finances effectively. It offers a thorough foundation for comprehending the financial facets of the firm and aids business owners in making defensible choices to maximize financial resources.

Business Plan Measures Progress and Success

A business plan holds significant importance for entrepreneurs in measuring their progress and success. They may compare their accomplishments to it as a standard to see if they are progressing in the correct path.

Establish Key Performance Indicators (KPIs) that are in line with the goals of the business’s plan to successfully measure the growth and success of entrepreneurs. Regularly track and monitor KPIs to assess progress and make informed decisions. Conduct periodic reviews to evaluate progress against the plan, identify areas for adjustments or course corrections, and celebrate milestones and successes. Continuously update and evolve the business plan to reflect evolving goals, strategies, and market conditions.

Business Plan Importance to Enhance Credibility

To enhance entrepreneurs’ credibility, a well-presented business plan should present a professional image, conduct thorough market research, highlight the unique selling proposition, provide detailed financial projections, incorporate risk analysis and mitigation strategies, seek third-party validation, and regularly update and refine the plan. This shows credibility and commitment to continuous improvement, demonstrating the business’s ability to adapt and thrive in the ever-changing landscape.

Business Plan Provides a Basis for Partnerships

Read – Imitative Entrepreneurship

Importance of Entrepreneurs to Do Business Expansion

A business plan plays a crucial role for entrepreneurs when it comes to business expansion. It provides a strategic framework and guidance for expanding operations, entering new markets, or launching new products or services.

Guides Entrepreneurs to Succession Planning

A business plan is of significant importance when it comes to guiding entrepreneurs in succession planning, which involves preparing for the future transition of leadership and ownership within a business.

To effectively use a business plan for succession planning, assess current leadership and ownership, identify potential successors, define succession goals and timeline, develop a succession plan, communicate with stakeholders, and regularly review and update the plan. This process ensures alignment with the long-term vision and aspirations of the business and its stakeholders. Regularly assess the progress of potential successors and provide development opportunities to enhance their skills and knowledge.

Importance to Increases Self-Awareness

Entrepreneurs should consider their objectives and values, perform a SWOT analysis, create reasonable company goals, ask for criticism and mentoring, constantly evaluate their success, and change to improve their self-awareness. By identifying strengths, weaknesses, opportunities, and threats, entrepreneurs can create a clear vision and align their business plans with their values. By seeking feedback and mentoring, entrepreneurs can develop a stronger self-awareness and improve their business strategies.

An effective business plan is a crucial tool for entrepreneurs . It gives them a path to success. A successful business plan may help entrepreneurs define clear goals. Also, identify their target market, analyze the competition, determine whether their idea is feasible, draw in investors, manage funds, and track their progress. It functions as a manual to assist business owners make wise decisions, manage resources effectively, and adjust to changing conditions.

A solid business plan is crucial for entrepreneurs to navigate the complex commercial world, guiding their companies toward expansion, profitability, and long-term success. It should be evaluated and revised regularly to reflect company demands, serving as a compass for entrepreneurs.

FAQ about the Importance of Business Plans to Entrepreneurs

Why is a business plan important, when is the best time to write a business plan.

Typically, before launching a new firm. It is the ideal time to draft a business plan. Likewise, when a current firm is expected to undergo significant adjustments. Be sure you have a solid strategy in place before approaching investors, looking for finance. Especially, starting a business. Making a business plan, though, is never too late, and you can always change it as your company grows.

What is a Business Plan’s Main Objective?

A business plan’s main objective is to outline an organization’s goals, strategies, and financial predictions. It helps business owners communicate their vision, pinpoint their target market, assess the profitability of their endeavor, entice investors, and allocate their resources effectively. It serves as a compass for monitoring growth and making adjustments as needed.

What are the Typical Challenges of Writing a Business Plan?

14 Reasons Why You Need a Business Plan

10 min. read

Updated May 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

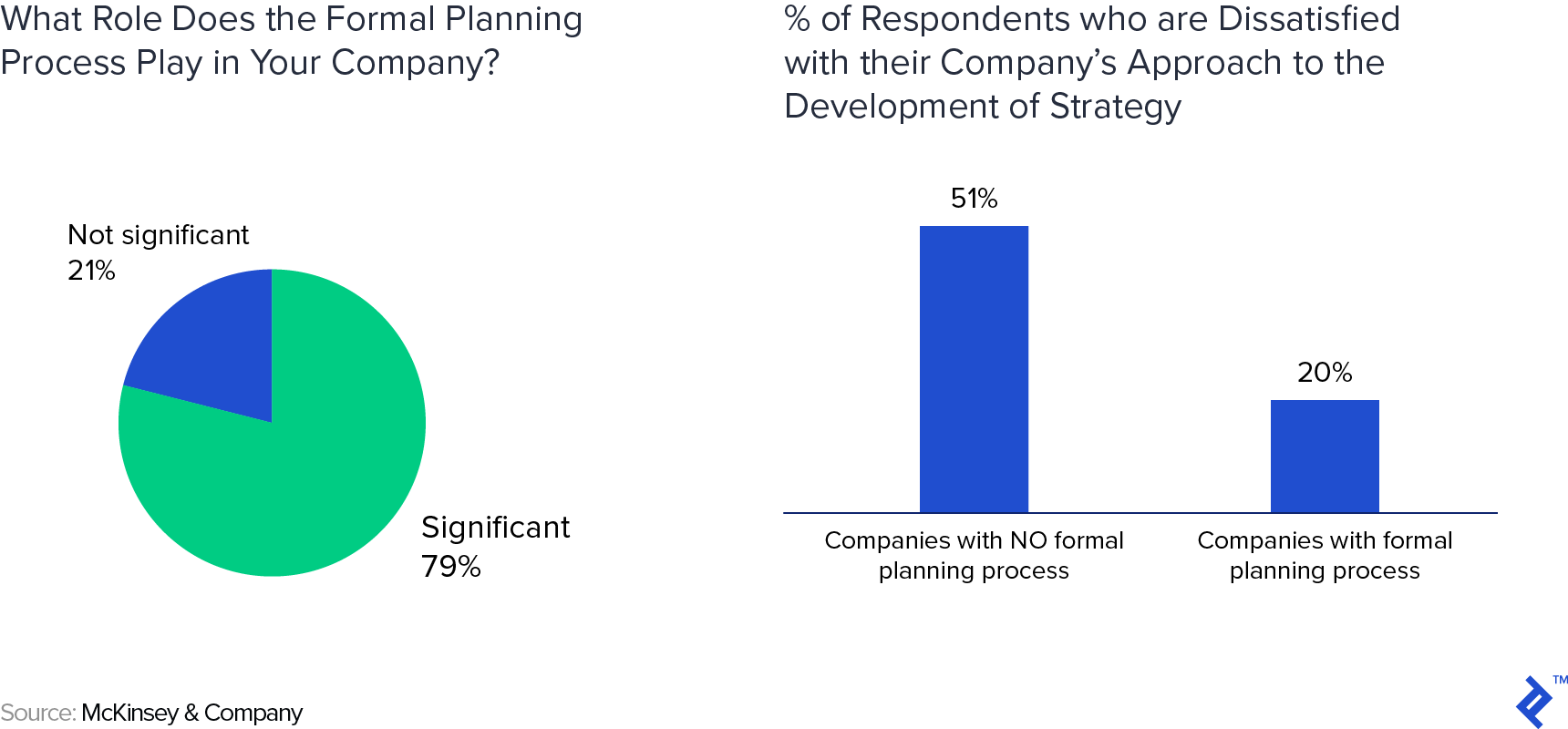

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

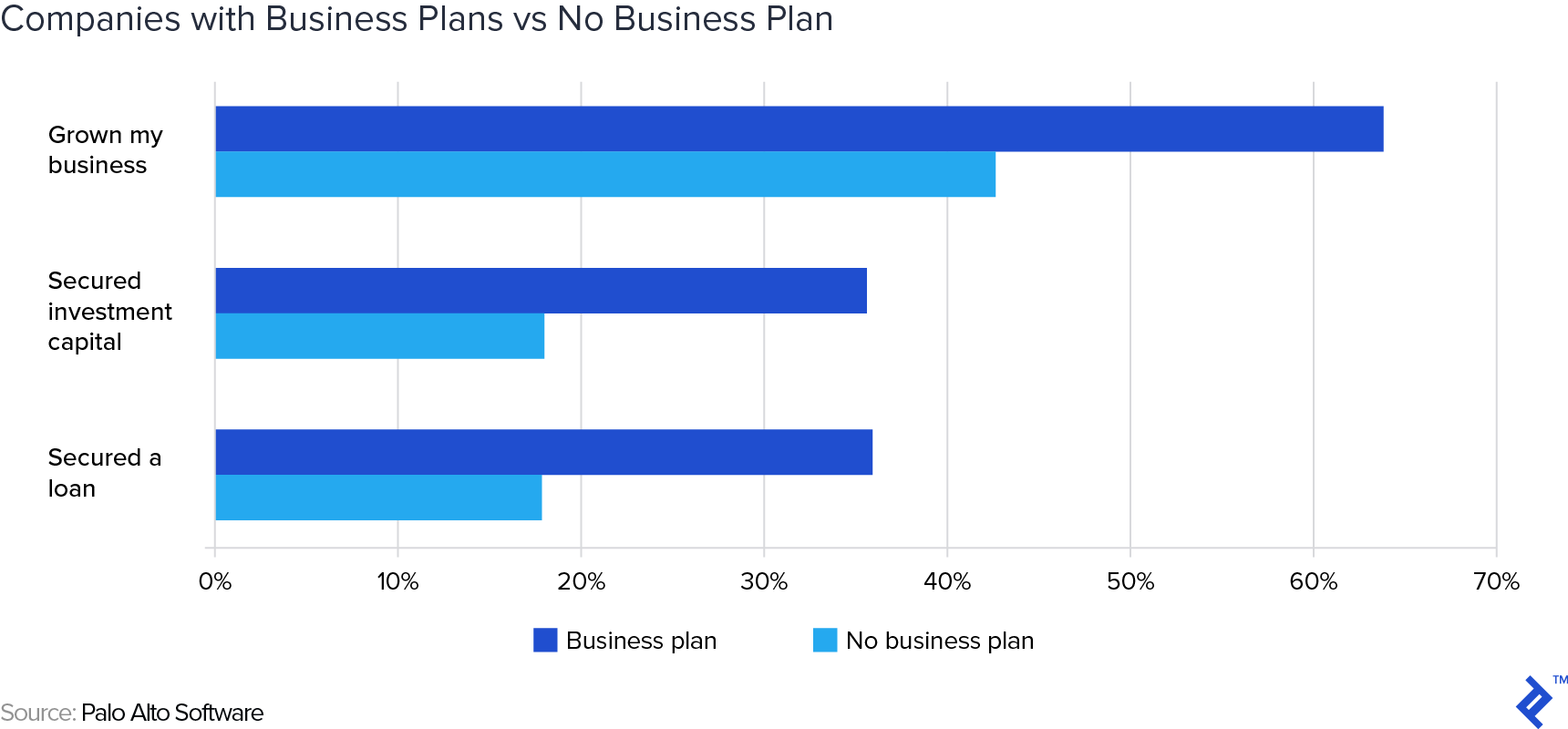

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

Further Reading: 5 fundamental principles of business planning

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

5 Min. Read

How to Run a Productive Monthly Business Plan Review Meeting

7 Min. Read

5 Consequences of Skipping a Business Plan

11 Min. Read

Use This Simple Business Plan Outline Example to Organize Your Plan

8 Business Plan Templates You Can Get for Free

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

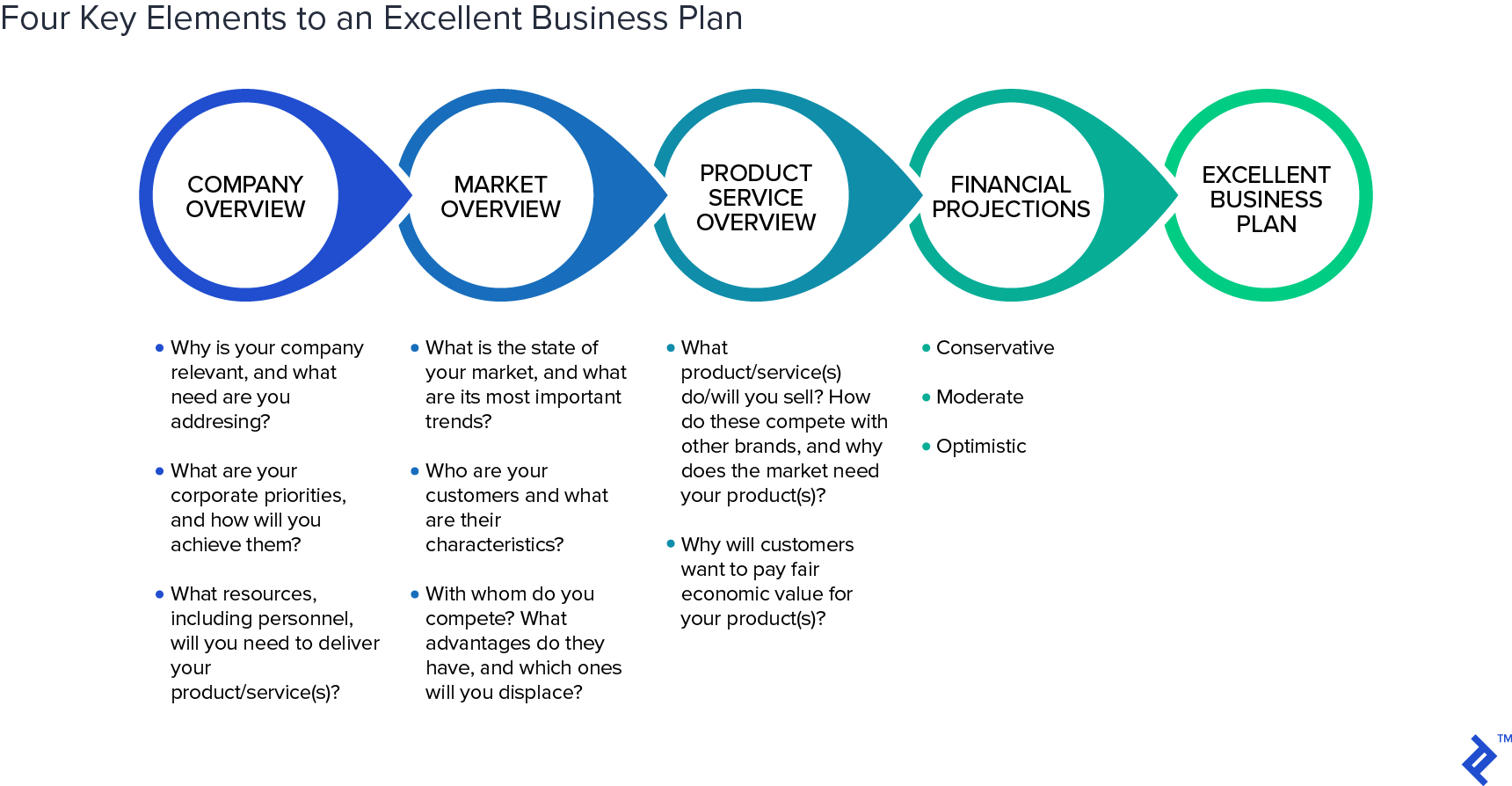

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

23 of My Favorite Free Marketing Newsletters

![important of business plan to an entrepreneur The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

![important of business plan to an entrepreneur 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![important of business plan to an entrepreneur How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

16 Best Screen Recorders to Use for Collaboration

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee + up to $50 Amazon gift card

Varies by State & Package

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

- How To Write An Effective Business Proposal

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

LLC Formation

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Table of Contents

How to make a business plan

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

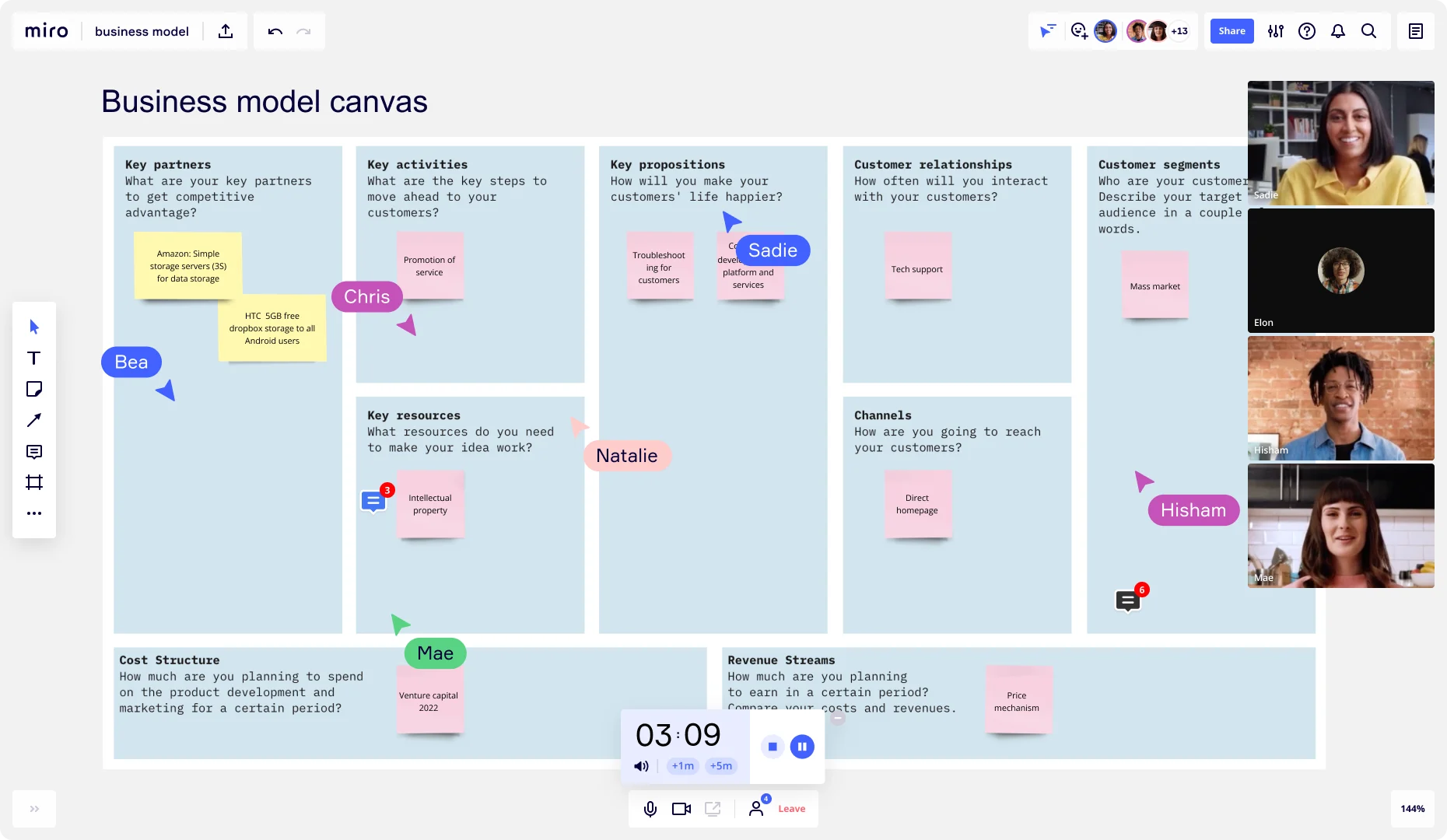

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Plans and pricing.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

What is the purpose of a business plan?

A business plan is like a map for small business owners, showing them where to go and how to get there. Its main purposes are to help you avoid risks, keep everyone on the same page, plan finances, check if your business idea is good, make operations smoother, and adapt to changes. It's a way for small business owners to plan, communicate, and stay on track toward their goals.

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.