- High School

- You don't have any recent items yet.

- You don't have any courses yet.

- You don't have any books yet.

- You don't have any Studylists yet.

- Information

Managerial Economics Assignment

Managerial economics (gmb5163), national university of science and technology.

Students also viewed

- EE-232 Lab Manual Signals and Systems

- Agribusiness Marketing Management Exam 2017

- Foreign Policy of Pakistan

- ADAM Smith'S Canons OF Taxation

- Output stages and power amplifiers

- European history

Related documents

- Solution of PDE

- C constants - HELPFUL

- Design 2023 - HELPFUL

- Hypothesis-testing-sheet

- inoculation techniques

- Agricultural surveying Gadpt 03

Related Studylists

Preview text, faculty of commerce, graduate school of business, general master of business administration, managerial economics.

Your company is operating in a country where the economic environment is said to be risky and uncertain. You have recently been appointed the Chief Executive Officer of the company and wish to improve its performance.

Critically analyze the techniques you will apply for decision making to improve the performance of the company.

Introduction

This essay is a critical analysis of the techniques are used for decision making under risky and uncertainty conditions in order to improve company performance. It will examine the different techniques using practical examples at the same time looking at the merits and demerits of each of the techniques. There are several techniques used to make decisions under risk conditions, expected monetary value and decision trees. This essay will exhaustively examine the expected monetary value and decision trees. It will further analyse the maxmin criterion, mini regret, maximax and the Hurwicz criterion as decision making techniques in uncertainty conditions.

Uncertainty

Uncertainty is present when there is more than one possible outcome for a decision, the greater the dispersion of possible outcomes, the higher the degree of uncertainty. The key to sound decision making under uncertainty is to recognize the range of possible outcomes and assess the likelihood of their occurrence (Samuelson and Marks 2012). Thus, Uncertainty may have more than one outcome and the decision maker does not know the precise outcome, nor can be objectively assign a probability of each occurring. As a result of imperfect information, techniques for coping with risk have been developed. Uncertainty deals with possible outcomes that are unknown.

A situation where a decision maker is aware of all possible outcomes and the probability of each one occurring, but a decision may have more than one possible outcome. Karhude and Wankade (2015) are of the view that risk is the probability of deciding the method or the opportunities for the better output. Risk is a certain type of uncertainty that involves the real possibility of loss. Risks can be more comprehensively accounted for than uncertainty. The quantity of risk is equal to the sum of the probabilities of a risky outcome (or various outcomes) multiplied by the anticipated loss as a result of the outcome. Risk implies a degree of uncertainty and an inability to fully control the outcomes of such an action.

Decision making

Decision making is the process of a manager or organisation choosing a course of action. Managers and Organisations have the resources to develop and adopt structured processes for decision making to achieve a desired outcome, such as welfare or profit maximisation. These decision-making processes are complicated substantially by elements of risk and uncertainty. A chief Executive officer has to take decisions in the context of imperfect information with attended risk and uncertainty. The analysis of risk and uncertainty helps Business Leaders to make rational decisions. Decision making under conditions of risk should seek to identify, quantify and absorb risk wherever possible. A firm’s ability to absorb, transfer and manage risk will often define managements’ risk appetite once risks are identified and quantified, decisions may be made as to what extent risky outcomes may be tolerated.

Advantages of EMV

Simple to understand and calculate Represents whole distribution by a single figure. Arithmetically takes account of the expected variables of all outcomes. The decision maker knows possible outcomes that may result from a decision and can assign probabilities to each of those outcomes. Makes the assumption that the decision maker is risk neutral Monetary values can be substituted for certain values in choosing alternative courses of action. By representing the whole distribution with a single figure, it ignores other characteristics of the distribution e. skewness.

Disadvantages of EMV

If expected monetary values are used decision criterion, a rational decision maker deciding between two alternatives will choose a course of action that yields the highest EMV. However a number of examples show that its application can lead to a number of quite clearly nonsensical conclusions.

No situation has perfect information. Calculating probabilities may be a hurdle-dependent on probabilities. Relies upon the decision maker’s ability to answer hypothetical questions in the same way they would answer real one.

This technique is hinged on the Neo-Classical model where profit maximisation is at the core. This is imperative for any new Chief Executive Officer to take in account. For example, The CEO of a Soap manufacturing company might operate in an environment where Labour unrest, Cost of materials and market demand are key project risks and may want to determine the extent of losses coupled with each risk.

Project Risks 1 – Labour unrest: There is a 15 percent chance of workers going on strike due to salaries that are eroded by the current hyperinflation. This is due to cost the project $50000.

Project Risks 2 - Cost of raw Material: There is a 20 percent probability of the price of material material dropping, which will save the project $10,000.

Project Risks 3 – Market Demand: There is an 8 percent increase probability of market demand due to earn the company $15000.

In this Expected Monetary Value example, we have two negative project risks (Weather and Labour Turmoil) and a positive project risks (Cost of Construction Material). The Expected Monetary Value for the project risks:

Labour Unrest: 15/100 * (-$50,000) = -$

Cost of raw Material: 20/100 * (-$10,000) = -$

Market Demand: 8/100 * ($15,000) = $

Note: Though the highest impact is caused by the Labour Unrest project risk, the Expected Monetary Value is the lowest. This is because the probability of it occurring is very low.

This means that if the:

Labour unrest negative project risks occurs, the project loses -$7500,

Cost of raw Materials negative project risks occurs, the project losses -$2000, and Market

demand has positive risks occurs the project gains $

The project’s Expected Monetary Value based on these project risks is:

-(7500) + ($3000) – ($2000) = - $6,

Therefore, if all risks occur in the project, the project would lose $6,500. In this scenario, the project manager can add $6,500 to the budget to compensate for this.

- Decision Trees (DTs)

Provides an evaluation framework - The value and likelihood of outcomes and the probability of achieving them can be quantified directly on the tree chart. Robust - They easily accommodate new assumptions with probabilities when facts are not readily available thus allowing the user to analyse fully the possible consequences of a decision. Enables valuation of information - Decision trees enable a calculation of the value of perfect information or the value of knowing what will happen in the future. This can help determine how much to spend on additional research to improve assumptions. Easily combined with other techniques - Other decision making techniques can be used to evaluate specific options through the tree. Net Present Value (NPV) and Project Evaluation Review Technique (PERT) analysis are common examples. Well suited for computers - The logical "if ... then ... else ..." structure and easy computation of a decision tree has made it a good target for use in computer decision tools and simulations.

Limitations

Tree diagrams continue to grow as you move from the beginning node to final outcomes. This will limit tree size for those drawn manually. As tree size increases you can begin to lose transparency as it becomes more difficult to fully understand all the attributes and relationships embedded in the diagram. The goals and/or success factors are distributed across the tree structure making is possible to lose track of what is most important. Evaluation of the path through the tree may require use of a common metric for utility, typically monetary units. This may be difficult to achieve, particularly for intangibles such as core values. Decision trees are better matched to attributes with a finite set of fixed possibilities

Techniques for coping with uncertainty

Decision making under uncertainty is a disciplined methodical approach to decision making with probalistic analysis at the heart of its logical reasoning.

A number of techniques can be used when making decisions in situations associated with uncertainty and these are:-

The maximin criterion

The minimax regret criterion

The maximaxi criterion

The Harwicz “alpha” criterion.

This is the situation where a firm considers the worst outcome and it is therefore a pessimistic conservative or high-risk averse strategy. All outcomes are ignored except the worst in each given set of alternative outcomes implying a very high opportunity cost at time. The decision maker examines the worst pay off for each action and chooses the action for which the worst payoff is greatest. This decision criterion is a decision-making approach in the presence of complete ignorance that involves the selection of the largest payoff among the best possible payoffs (Webster, 2003). It is an extremely optimistic approach to decision making. According to Wilkinson, “Managers who use this approach will select as optimal that strategy that promises the best of the best of all possible outcomes.” It is an aggressive decision-making criterion. Maximax theory states that the decision maker should select the course of action whose best (maximum) gain is better than the best gain of all other courses of action possible in given circumstances.

The Maximax Criterion indicates that managers are extreme risk takers who are willing to sacrifice the firm’s assets in the hope of gaining a big payoff. As a result, it appeals to adventurous decision makers who are attracted by the high payoffs. It may also appeal to a decision maker who likes to gamble and is in a position to withstand any losses without substantial inconvenience. It is very unlikely that mangers will adopt this approach to decision

Savage minimax Regret criterion is a decision-making approach in purely uncertain condition that focused on avoiding regrets that may result from making non optimal decisions. Although regret is a subjective emotional state, the assumption is that it is quantifiable in direct linear to the rewards of the payoff matrix (Pazek and Rozman 2004).

The Savage decision criterion is used to determine the strategy that results in the minimum of all maximum opportunity costs associated with the selection of an incorrect strategy. It examines the regret opportunity costs or loss resulting when a particular situation occurs and the payoff of the selected alternative is smaller than the payoff that could have been attained with the situation(Webster 2003). The Savage decision criterion, which is sometimes referred to as the minimax regret criterion, is based on the opportunity cost (or regret) of selecting an incorrect strategy.

This regret matrix should always be constructed to determine clearly the maximum regret. This strategy is therefore a cautious principle and ensure that if the worst happens, we make the best job. Furthermore, this criterion is criticized for making use of very limited information that is available and ignoring everything else. Actions which are rejected may have much smaller regrets than the one which is chosen, apart from their largest regrets.

It is also possible that use of this approach could lead to inconsistent decisions in that if an action is chosen from a group of alternatives and then one of the rejected actions is deleted from the options, a different action may now be chosen, despite the fact that the original best option is still available.

Minimax Regret is a better decision criterion than Maximax or Maximin and, arguably, Hurwicz as well because. It employs the far-from-robust minimax logic, the values over which it operates (opportunity losses) contain more problem information (actual monetary losses plus unrealized potential profits), leading to a more informed decision than was possible with any of the three previous models

This criterion appeals to a cautious decision maker who wants to ensure that the selected alternative does well when compared to the other alternatives regardless of the situation arising. It is particularly attractive to a decision maker who knows that several competitors face identical or similar circumstances and who is aware that the decision maker’s performance will be evaluated in relation to the competitor.

Minimax Regret fails to employ all of the available problem information and is therefore not a rationally acceptable criterion. Minimax Regret is a conservative criterion, as is Maximin/Minimax. However, it is not as extreme in its pessimism. It is not necessary that equal difference in profit would always correspond to equal amounts of regret

- The Harwicz ‘alpha’ Criterion

It is an attempt to make a trade-off between complete risk indifference (as in the Maximax rule), and total risk aversion (as in the Maximin rule)which selects the maximum and minimum payoffs to each given action while attempting to find a middle ground between extremes posed by pessimist and optimist criterion (Webster 2003). With this procedure, the decision maker will decide how much emphasis to put on each extreme, alpha or coefficient of optimism. This is an approach that takes the management attitude towards risk into consideration.

The Harwicz approach is an attempt to use more the information available by constructing an index(alpha) for each action , which taken into account both of the best and worst outcomes and the extent to which the decision maker wishes to adopt a pessimistic or optimistic posture. The criterion is a weighted average of the best and worst pay offs of each action. This is considered more realistic than maximin, maxi maxi and minimax strategies which are based solely on extreme pay offs.

There is a possible negative impact on the company should the management sense of optimism proved to be misplaced

- Tsinani A et al, 2005, “Decision making process under risk and uncertainty, Role of Managerial optimism: A theoretical Approach”

- Webster T J, (2003), “Managerial Economics Theory and Practice”, Lubin School of Business, Pace University, Academic Press, New York,

- Wilkinson, N, (2005), “Managerial Economics: A Problem-Solving Approach”, Cambridge University Press, United Kingdom

- Samuelson W, Marks SG, (2012) “Managerial Economics 7th edition”, John Wiley, Boston Univesity.

- Pazek K and Rozman, (2004): “Decision making under conditions of uncertainty in Agriculture: A case study of oil crops.”

- Kurhade, M and Wankade, R (2015) “An Overview on Decision Making Under Risk and Uncertainty” International Journal of Science and Research (IJSR)

You are the CEO of a company which is operating in an oligopoly market structure. You wish to improve its performance.

Discuss how you could use the game theory in decision making to improve the performance of your company.

The essential factors of a firm operating in an oligopolistic market are interdependence and a good understanding and utilization of game theory. An oligopoly market structure is one that where there are few firms which dominate the market. Example of an oligopoly market is telecommunications industry in Zimbabwe, which is dominated by only three players. In such cases, where the market is being shared between few firms, the market is said to be highly concentrated and there are high barriers of entry. Firms in an oligopolistic market structure are interdependent. Thus, not only are they affected by their own decisions but by the decisions of other firms in the market as well. An understanding and utilization of game theory by the Business leaders in this market structure is there for not only essential but of paramount importance for the success of the business/firm, as game theory offers a useful framework of taking into consideration other firms’ decisions in the context of this interdependency.

Game theory

Since CEOs are the drivers of firms as they make decisions that are economically relevant and affect not only their utility but the utility of many stakeholders inside and outside the firm, they therefore need a thorough understanding of game theory, as they need to anticipate the decisions of other firms in the market. In game theory, we study strategic situation whereby firms choose various actions to maximize their benefits using quantitative methods. Game theory, therefore explores the possible outcomes of a situation in which two or more businesses/firms look for a course of action that best benefits them, leaving no variables to chance. Hence, game theory analyses strategic interactions of which the outcome of one firm’s choice, depends on the other firm’s choices or possible actions. It allows the players to think strategically about their best action to take while considering the possible actions of their competitors.

Game theory in business

In business, all firms in the market want to be successful, while maximizing their profits and utility. Thus, if a firm in an oligopolistic market does not take into consideration the action of other firms in the market when deciding, they may as well arrive at a strategy that is not optimal. An example of this is when a firm reduces their price to increase sales, therefore increasing profit, they may lose a lot of money if the other firms in the market respond by price cuts. In

Identification of critical factors, for example first mover advantage as seen in the case of Econet, entry and exit costs, Models to adopt, e. simultaneous games which take into considerations Nash equilibrium or decision trees. Development of intuition resulting from using the model Formulation of a strategy that covers all scenarios.

GAME THEORY TECHNIQUES

SIMULTANEOUS GAMES - PRISONERS’ DILEMMA

Because decision interdependence is a prime characteristic of oligopoly markets, game theory concepts have a wide variety of applications in the study of oligopoly. A game theory strategy is a decision rule that describes the action taken by a decision maker at any point in time. A simple introduction to game theory strategy is provided by perhaps the most famous of all simultaneous- move one-shot games: The so-called Prisoner’s Dilemma. The prisoner's dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so. It was originally framed by Merrill Flood and Melvin Dresher working at RAND in 1950. In the Prisoners’ Dilemma the players are required to move simultaneously. Simultaneous-move games are sometimes referred to as static games. In a simultaneous-move game, each decision maker makes choices without specific knowledge of competitor counter moves. This is seen in a very popular example of two prisoners arrested for a crime for which there is no firm evidence, and they are being interrogated in separate rooms. Each prisoner could either cooperate with the other and not confess their crime or defect and confess the crime. In this game no matter what the other player does, each player would like to choose the best possible outcome for themselves, which is to defect and confess their crime. This yield (1,1). However, if they both cooperated and not confessed their crime, each would get a better payoff.

This bargaining problem is seen more often in an oligopolistic market structure. An example of this problem can be demonstrated by coca cola and Pepsi.

If neither firm advertises, Coca-Cola and Pepsi both earn profits of $750 million per year If both firms advertise, Coca-Cola and Pepsi both earn profits of $500 million per year. If Coca-Cola advertises and Pepsi doesn’t, Coca-Cola earns profits of $900 million and Pepsi earns profits of $400 million. If Pepsi advertises and Coca-Cola doesn’t, Pepsi earns profits of $900 million and Coca- Cola earns profits of $400 million

Since both companies want to maximise their profits, they will most like choose to advertise and hope that the other does not advertise, since not advertising can most likely earn them $400million, instead of either 500million or 900million. Hence, here advertising is the dominant strategy. Both Pepsi and Coca-Cola will opt to advertise.

Sequential Game

In a sequential game, decision makers make their move after observing competitor moves. If two firms set prices without knowledge of each other’s decisions, it is a simultaneous game. If one firm sets its price only after observing its rival’s price, the firm is said to be involved in a sequential game. The example above can used in a sequential game.

Mixed Game strategy This is when each player optimises their expected game by determining the percentage of time to use each strategy.

Conclusion Thus, from the above, we note that game theory is often used by business managers and CEOs to figure out what their collaborators and competitors are thinking. It has over time become a powerful tool for predicting the outcomes or results of interaction or transactions or transactions among a group of players or competitors. CEOs and managers are always faced with decisions on what to produce, what to procure, and what to sell, followed by decisions on how much they should spend in producing or procuring, what price they should set when they sell. Game theory can be used as tool for decision making, to obtain insights regarding the competition, to improve internal decision-making processes as well as it reduces business risk.

Bibliography

cleverism/applied-game-theory-day-day-business-operations/ accessed 9/6/

Carmichael, F, (2005), “A guide to game theory”, Pearson Education,

Baye, M., (2010), “Managerial Economics and Business Strategy”, Worth Publishers

Colsbee, A., Levitt, S. and Syverson, C., (2013), “Microeconomics”, New York, Worth Publishers

Boshkoska, M. & Hristoski, I, (2019), “The application of the game theory in the process of Managerial Decision Making”, Researchgate

courses.lumenlearning/boundless-economics/chapter/oligopoly-in-practic e/ accessed 31/8/

- Multiple Choice

Course : Managerial Economics (GMB5163)

University : national university of science and technology.

- Discover more from: Managerial Economics GMB5163 National University of Science and Technology 4 Documents Go to course

- More from: Managerial Economics GMB5163 National University of Science and Technology 4 Documents Go to course

- More from: Dev by Gracious sukoluhle Nkomo 8 8 documents Go to Studylist

Trending Courses

Course Categories

Certification Programs

Free Courses

Economics Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

ALL COURSES @ADDITIONAL 50% OFF

Managerial Economics

Last Updated :

Blog Author :

Priya Choubey

Edited by :

Collins Enosh

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

- myPNW Login

- Brightspace Login

- PNW Calendar

- Scholarships

ECON 41900: Managerial Economics

Instructor: Dr. Amlan Mitra Online Meeting: Blackboard (August 22, 2016 – December 17, 2016) Office: Classroom Office Building, CLO 248 Office Hours: Mon/Wed: Noon-1:50 P.M.; and by appointment Telephone: (219)989-2313 E-mail: [email protected]

University Catalog Description

A comprehensive treatment of economic theory and analysis applied to business decisions. Both qualitative techniques are applied to managerial decision making situations. Emphasis is placed on applications of economic concepts and processes to practical business situations.

Prerequisite: ECON 251, MGMT 225.

Course Description and Overall Goal

This is a distance learning course in Managerial Economics. It is designed to provide a solid foundation of economic understanding for use in managerial decision-making. The overall goal of this course is to guide students on the use of managerial economics tools and techniques in specific business settings. The course will offer a comprehensive treatment of economic theory and analysis, using both qualitative and quantitative tools and techniques (e.g. forecasting and estimation techniques) associated with the theory. Examples and problems discussed in the class will illustrate the application of economic thinking to a wide variety of practical situations. Students are recommended to actively participate in all assignments.

Expected Background

You are expected to be familiar with the basic concepts of microeconomics, basic algebra, differential calculus, and business statistics. While we will review almost all basic concepts in class, you may want to jump on any background topics that you may have found difficult to understand in the past. From differential calculus, you must be able to do simple derivatives. Look for review materials and exercises in the “Lecture Materials” of the Course Homepage.

Required Textbook

Loose-Leaf Managerial Economics and Business Strategy With CONNECT (The Mcgraw-Hill Series Economics) 8th Edition. By Michael Baye (Author), Jeff Prince (Author)

Publisher: McGraw-Hill Education; 8 th Edition, 2014

ISBN: 9780077413859

Connect and LearnSmart

Use the access code to register for CONNECT by visiting the following link:

http://connect.mheducation.com/class/a – mitra – smartstart – course_2

You should have full access to the following materials.

LearnSmart (SmartBook w/ Learning Resources: Mobile access to study tools like key terms, math review, self quizzes, and chapter summaries. Mobile access to chapter resources such as web buttons, student PowerPoint slides, and worked problems).

Recommended Readings

Wall Street Journal, Fortune, Business Week, Economist, Financial World, & similar publications.

Learning Objectives

ASSESSMENT OF LEARNING OBJECTIVES:

Completing assigned readings, quizzes, lab exercises, case studies, group presentations, term project, and a comprehensive final exam are the basic requirements to meet the five learning objectives. Each of these five learning objectives will be assessed in the following way:

Learning Modules

Student Evaluation :

Completing assigned readings, scheduled quizzes, lab exercises, case studies, and a term paper are the basic requirements to meet our course objectives. Grading procedure: Plus minus grading system will be used for the course based on your overall points.

Course Participation Grade up to 50 points is possible for completing all online assignments (including homework and discussion board assignments) according to the following criteria:

All satisfactory (S) assignments: 50 points. For each unsatisfactory (U) assignment 5 points will be deducted. So, if you receive 2 U’s you will get 40 points. If you receive 10 U’s you will receive a “zero” in course participation.

EXCEL SPREADSHEET ASSIGNMENTS

There will be five Excel Spreadsheet Assignments from the five learning modules. These assignments will be on solving managerial problems using the managerial economics concepts and quantitative business tools. The purpose of these assignments is to prepare you for the quizzes.

There will be five quizzes from the five learning modules. Each Excel Spreadsheet Assignment will be followed by a quiz.

Case Studies

There will be five case studies of involving managerial decision making in business firms and industries. You will be asked to examine each case study to identify and analyze the major managerial decision problems.

A Note on Academic Honesty

Honesty and integrity in academic and personal pursuits are hallmarks of higher education. By acting honestly and with integrity, students maintain and uphold their own reputations, and the reputation of both the School of Management and the University. The Students Handbook states that “the commitment of the acts of cheating, lying, stealing and deceit in any of their diverse forms (such as the use of ghost-written papers, use of substitutes for taking examinations, the use of illegal cribs, plagiarism, and copying during exams) is dishonest.” Also, aiding and abetting in committing dishonest acts is in itself dishonest. The penalty for any student(s) involved in any of such acts will range from an outright zero in the specific assignment the act was committed to a grade of “F” in the course.

Students with Disabilities

In compliance with the Americans with Disabilities Act (ADA), all qualified students enrolled in this course are entitled to reasonable accommodations. It is the student’s responsibility to inform the instructor of any special needs before the end of the second week of class.

EMERGENCY PROCEDURE GUIDE : Please read the university emergency procedure guide.

CLASS MEETING SCHEDULE (SUBJECT TO CHANGE):

Managerial Economics

Managerial economics is the application of economic theory and methodology to decision making problems faced by public, private and not for profit institutions. Read this article to learn about the Definitions, Meaning, Concept, Scope and Theories of Managerial Economies.

The study of managerial economics offers major benefits for students and practicing managers. It enables one to learn practical applications of concepts studied in micro and macroeconomic theory.

1. Definitions of Managerial Economics :

1. “We define managerial economics as the integration of economic theory and methodology with analytical tools for applications to decision making about the allocation of scarce resource in public and private institution.” K. K. Seo & B.J. Winger

2. “Managerial economics is the application of economic theory and methodology to business administration practice. More specifically, managerial economics is the use of the tools and techniques of economic analysis to analyse and solve management problems.” J. L. Pappas & E. F. Brigham

ADVERTISEMENTS:

3. “Managerial economics is the application of economic theory and methodology to decision making problems faced by public, private and not for profit institutions. In managerial economics, one attempts to extract from economic theory (particularly micro-economics) those concepts and techniques that enable the decision-maker to efficiently allocate the resources of the organization.” J. R. McGuigan & R. C. Moyer

4. “It (managerial economics) is the study of why some businesses prosper and grow, why some simply survive and why others fail at the market place and go under.” T. J. Coyne

5. “Managerial economics is concerned with the application of economic principles and methodologies to the decision making process within the firm or organisation. It seeks to establish rules and principles to facilitate the attainment of the desired economic goals of management.” Evan J. Douglas

6. “Managerial economics is the study of allocation of the limited resources available to a firm or other unit of management among the various possible activities of that unit.” W. R. Henry & W. W. Haynes

2. Meaning of Managerial Economics:

Economics is concerned with the allocation of scarce resources, having alternative uses, among competing goals (or unlimited ends). Managerial economics is slightly specific in its approach. It studies the economic aspects of managerial decision making.

It provides the practicing manager with those tools and techniques which are useful in day-to-day decision making. Like traditional economics, it is concerned with choice and allocation, in a narrow sphere though, it examines how scarce resources are allocated within a firm.

Managerial economics is pragmatic. Its stress is on the real commercial world. It is concerned with those analytical tools and techniques which are useful or are likely to be so as to improve the decision making process within the firm.

Firms of different types and size arise in an economy because they have been able to organize production more efficiently than other types of institutions could. Most production takes place in business firms. In managerial economics the stress is on the process of resource allocation and decision making within the firm which is thought to be the most efficient form of organizing production.

The two terms ‘managerial’ economics and ‘business’ economics are often used interchangeably. But the scope of the former is broader than that of the latter.

While the latter deals with the decision making in profit making organizations, the former provides methods and a point of view that are also applicable in managing non-profit organizations (like hospitals) and public corporations (like the Indian Airlines Corporation).

So, in a formal sense, managerial economics is the application of economic theory and methodology to decision making problems faced by private, public and non-profit organizations. Various concepts of managerial economics can be applied to non-business or non-profit institutions.

The implementation of cost reduction programmes, the selection of more productive alternatives, the enhancement of revenues and the adoption of other measures can help to maximize the service and the social contribution of these institutions.

Governments should try to obtain the maximum benefit for tax payers in spending their revenues; government agencies can measure their efficiency through cost-benefit analysis. Hospitals often attempt to handle more patients and give better care at lower cost by applying economic techniques. Even universities can gain much by practising what they teach about managerial economics.

3. Concept of Managerial Economics:

Managerial economics is an important way of thinking about and analysing the problems that arise in both profit seeking and non-profit seeking enterprises.

Although managerial economics is an amalgam of diverse subjects, the common core is the application of the fundamental principles of economics to analyse and to help solve problems faced by organizations in a modern mixed economy.

The principles of economics and economic analysis are especially useful to managers at all levels of hierarchies in progressive business enterprises. Managerial economics emphasizes the principles of economics that underlie managerial practice. The stress is on applied economic analysis.

Immediately after the publication of Joel Dean’s first title on the subject in 1951, managerial economics has emerged as a separate discipline and been a popular subject in both under-graduate and post-graduate programmes in business administration.

Its popularity is attributable to the growing applications of economic theory in the commercial organisations as also in non-profit organizations and government companies. It seems that the subject will become more and more popular in future.

In this context one may venture to quote Joel Dean whose comment of more than four decades ago seems very important and relevant even today:

“The big gap between the problems of logic that intrigue economic theorists and the problems of policy that plague practical management needs to be bridged to give executives access to the practical contribution that economic thinking can make to top management policies.”

Before studying a particular subject two questions are likely to crop up in the minds of beginners:

1. What is the subject all about?

2. Why do we study the subject at all?

These two questions have to be answered at the outset before we proceed further. We may well start with a few definitions.

4. Relation of Managerial Economics to Other Areas of Management :

It is possible to establish link of managerial economics to other areas of management. In fact, there is a relation between managerial economics and the operation of every segment in a business, and management can make use of many of the fundamental principles or theories of economics to solve everyday business problems. We normally see application of managerial economics in the following functional areas.

i. Marketing and Sales Applications :

Marketing and sales functions largely depend on an analysis of consumer demand. Marketing managers always try to evaluate the size of the market for a new or existing product.

However, the size of the market depends on a host of economic and non- economic factors which are usually incorporated in the theoretical demand function which is represented by the demand curve and the familiar ceteris paribus (other things remaining the same) assumption.

While traditional economics provides us analytical insights into concepts such as price and income elasticity of demand, managerial economics goes a step ahead in arriving at statistical estimates of elasticity’s that can be fruitfully utilized to formulate a firm’s pricing policy and to predict the size of a future market.

In fact, through the use of regression technique, managerial economics can make a positive contribution to marketing and sales functions.

The effectiveness of the marketing and sales functions is judged by a firm’s ability to charge a premium price for its product or products. The price decisions taken by marketing managers have two major aspects: consumer resistance and market competition.

In most real-life markets a firm has to reduce the price of the product to sell more. To be more specific, the marketing manager has to weigh the advantages of increased sales volume against the advantages of lower sales price (per unit). That is to say, price reduction will have two effects, of which one is favourable to the firm and the other is unfavorable.

The net effect of these on total revenue depends on price elasticity of demand, a key economic concept introduced by Alfred Marshall in 1890. Managerial economics makes use of the concept of price elasticity of demand in order to numerically measure and quantify market sensitivity of demand, i.e., how sensitive consumers are to price varies among products and among markets.

Furthermore, certain fundamental principles of managerial economics can be used not only to evaluate the probable reaction of competitors to change in price, quality, service and other aspects of product, but also to quantify the effectiveness of advertising and product differentiation policies as they relate to the total demand for the product.

ii. Production and Personnel Applications :

The responsibilities of production and personnel managers differ in reality. But they have a common interest: they have the need for some reliable (though not totally perfect or accurate) estimates of the demand for the product being sold by the firm. However uncertain these sales forecasts may be, they must be translated into weekly and monthly production schedules, inventory requirements and manpower needs.

Managerial economics deals with production functions or relationships between input and output changes. Managerial economics departs from general short-term concepts of traditional economics such as law of diminishing returns and long-run concepts such as economies of scale to specific planning and budgeting issues concerning labour and material requirements.

True, a portion of this task revolves around the purely mechanical routine of estimating input-output relationships (such as the wood needed per pencil).

Another equally vital aspect of the task is to understand more subtle issues such as what happens to output and to profits per labour hour as the load factor (i.e., % utilization of existing plant capacity) increases. In the short run, the firm does not enjoy sufficient plant flexibility.

Moreover since all inputs (like labour, capital, etc.) cannot be increased proportionately in the short run, output follows the law of non-proportional return. Thus, the management has to more than double variable inputs (such as labour) in order to double output.

In some companies there is the system of productivity linked bonuses. But measurement of productivity in practice is no doubt a complex exercise, if not totally impossible. The productivity of labour and capital can be satisfactorily measured by using various techniques introduced in managerial economics. By making use of principles of managerial economics, production and personnel managers can take various decisions.

For example, they can translate average productivity, marginal productivity and production-cost functions into statistical measurement to measure efficiency of the production process and formulate wage policy and bonus plans.

Differently put, on the basis of such measurements they make resource allocation decisions. The allocation of machines and manpower among different activities or products in a multi-product firm is an obvious example of this.

The efficiency and the flexibility of the production process is perhaps the most important aspect of the performance of a firm.

For this, the managers have to understand and deal with various unknown factors such as the substitutability of capital for labour (using computers rather than part-time accountants), the tax implication of such substitution, the economic characteristics of the production process (such as diminishing return, return to scale, etc.) for pricing decisions and, of course, the cost and benefits of current inventory policies.

Managerial economics can assist the practising manager in the process.

iii. Financial Applications :

Most financial decisions such as capital equipment replacement, depreciation and capital budgeting decisions have their roots in the economics of time and uncertainty.

Although traditional micro-economic theory, as presented by Marshall, is cast in rigid time frames such as the market period, short-run and long-run, in the 1970’s a separate branch of economics, viz., the economics of time was born, thanks to the pioneering work of Sir John Hicks. Business enterprises are often faced with resources allocation decisions involving very long period of time.

For example, a firm may be faced with two alternatives — whether to invest crores of rupees in new plant and equipment (with hardly any prospect of repayment for the next 5-10 years) or to spend the same amount of money on advertising. In both the cases, the economics of time becomes an important determinant of whether resources will be allocated at present or over an extended period of time.

In a like manner, the financial manager of a large corporation has to ensure that the cash flow is such that long-term financial requirements (say for a new factory) are fulfilled by long-term financial arrangements (20-year loan) and that short- term arrangements (such as a monthly line of credit) are used to meet short-term needs (such as inventory fluctuations).

If the future were known with certainty, it would be very easy to take financial decisions. However, the real life is surrounded by a penumbra of doubt. So most business decisions have to be taken under highly uncertain conditions. This requires some sort of contingency planning.

For example, a farmer may be required to choose between a guaranteed price achievable by selling his crop at a price fixed now in the futures market (prior to harvest) and an unknown price based on supply and demand immediately after the harvest.

Now the time value of money becomes an important factor in the decision making process. Managerial economics analyses the nature of such financial trade-offs and illustrates the relevance of the economics of time and uncertainty in various resource allocation decisions.

iv. Law-Related Applications :

Managerial economics focuses on economic institutions like the structure of markets. But legal analysis focuses on illegal actions such as collusion or restrictive trade practices such as a tie-in sales or full line forcing.

For example, to understand concentration of economic power, one must understand the Lorentz curve, to understand predatory pricing, it is necessary to understand the meaning of market power and the logic of average cost (mark up) pricing. However, these terms are not necessarily accepted by courts in the same way as they are defined in traditional economics.

In practice, the growth of a large firm, its choice of the methods of production, pricing practice and so on are all influenced by the legal environment of business. In India, there is the MRTP Act. In the USA, there are anti-trust laws. The erection of artificial barriers to entry into an industry by a large firm may be prohibited by such acts.

v. Integration of Functions :

In practice, there is often conflict among these functions. Senior management has to integrate these diverse functions so as to sub serve the overall objective of the company.

If each department or division of the company operates independently, the marketing department would most certainly choose to sell that quantity that maximized revenue, production department would choose that quantity for which cost would be minimum, the financial department would choose the least costly way of raising corporate capital and the law department would seek to minimize the degree of risk taking.

However, the pursuit of each of these objectives in isolation would not lead to the fulfilment of the overall objective of the company, i.e., profit maximization.

For example, in order to derive economies of scale (i.e., advantages of large-scale production) a firm may have to use more costly equipment’s than the ones used by its competitors. Likewise, in order to achieve production efficiency, a firm may be required to utilize more capital than would be necessary if the objective was minimizing the cost of raising capital.

Thus, whereas the managers responsible for performing each of these functions have their perception of how best to proceed in their own sphere of activity, it is necessary for senior managers, to understand these interrelationships and trade-offs. The tools of managerial economics are really useful in evaluating these issues.

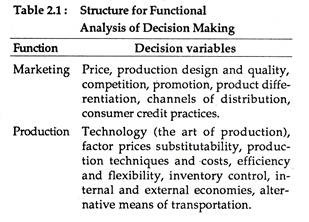

Table. 2.1 provides a broad overview of the most significant factors, internal and external, that would be taken into consideration by functional managers. Although not exhaustive, the listing does provide a convenient outline of the issues for which managerial economics can help to clarify problems facing the business organization.

5. Managerial Economics and Economic Theory (Traditional Economics) :

Economics has two major branches: microeconomics and macroeconomics. The former deals with the theory of individual choice such as decisions made by a consumer or a business firm. The latter is the study of the economic system in its totality. It studies such broad aggregates as total output (GDP), national income, employment and unemployment, the general price level as also the growth of the economy.

Since managerial economics is basically concerned with economic decision making within the firm, it is more close to microeconomics than to macroeconomics. Some writers have ventured to call it applied microeconomics or price theory in the service of business executives.

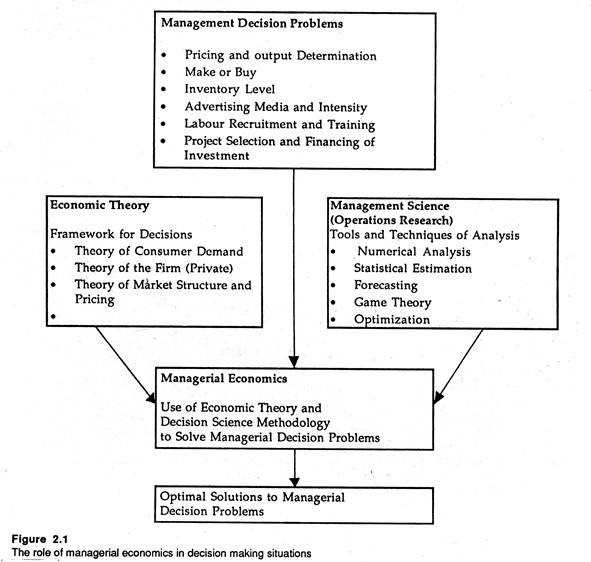

In the word of T. J. Coyne, “Managerial Economics is economics applied in decision making. It combines a broad theory with everyday practice, emphasizing the use of economic analysis in clarifying problems, in organizing and evaluating information, and in weighing alternative courses of action” . This point is illustrated in Fig. 2.1.

Managerial economics, sometimes referred to as business economics, is a relatively new area of economic analysis and has become more widespread in the past few decades. It is the application of economic theory and analysis to practices of business firms and other institutions. It deals with managerial decisions in comparing and selecting among economic alternatives.

Managerial economics is slightly broader than microeconomic theory. It also necessitates the application and integration of practices, principles, and techniques from the areas of accounting, finance, marketing, production, personnel, and other functions or disciplines associated with economics.

Because sales revenue and profits of the firm and industry are affected by the macroeconomic environment, managerial economics must relate the concept of macroeconomics to the problems of the business firm.

Because the survival, growth and prosperity of the firm are often linked to what is happening to the gross national product, the general level of employment, and the general price level, there is a need to relate the economics of the firm with the economic system.

Similarly, future sales and profits of the firm must be projected within the constraints of the growth and development of the national economy. Likewise the operations of non-profit organizations and government agencies are affected by the economic climate of a region or general business conditions of the nation.

6. Relation of Managerial Economics to Other Branches of Learning :

Managerial economics is very closely linked to microeconomic theory, macroeconomic theory, statistics, decision theory, and operations research. It draws together and relates ideas from several functional fields of business administration, including accounting, production, marketing, finance, and business policy.

i. Microeconomic Theory :

Microeconomic theory also known as the theory of firms and markets or price theory is the main source of managerial economics’ concepts and analytical tools.

Our title makes many references to such microeconomic concepts as elasticity of demand, cost, short run and long runs profits and market structures. It also makes frequent use of well- known models in price theory such as those for monopoly price, the kinked-demand theory and price discrimination.

ii. Macroeconomic Theory :

The techniques and models of forecasting are macroeconomic theory’s main contribution to managerial economics. The prospects of an individual firm often depend largely, if not entirely, on the condition of business in general. Therefore, an individual firm’s forecasts often depend heavily on general business forecasts, which make use of models derived from theory.

To actually use forecasting models in everyday business situations, close attention must be paid to details, such as inventory in the automobile industry, excess capacity in chemical manufacturing, or measurements of consumer attitudes. The manager doing the forecasting has to make a detailed demand analysis.

iii. Statistics :

Statistics is important to managerial economics in several ways:

Firstly, statistical measurements provide the basis for empirical testing of theory.

Secondly, statistical techniques provide the individual firm with methods of measuring the functional relationships vital to decision making. But statistics, vital as it is, ultimately provides only part of the input needed in decision making. Information from other sources, such as accounting and engineering, and a manager’s subjective estimates also are needed.

iv. The Theory of Decision Making:

The theory of decision making has relevance and significance to managerial economics.

Much of economic theory is based on two assumptions:

(1) Individuals and firms strive toward a single goal maximum utility for the individual and maximum profit for the firm.

(2) There is certainty or perfect knowledge in the individual’s or firm’s situation.

The decision-making theory recognizes that managers in the real world face a multiplicity of goals, and the only certainty they can count on is that each new day will bring new uncertainties.

The theoretical notion of a single optimum solution is replaced by the view that solutions must be found to balance conflicting objectives. Motivations, the relation of rewards and aspiration levels, and patterns of influence and authority all these are key factors in the theory of decision making.

The theory of decision making is concerned with how expectations are formed under conditions of uncertainty. It recognizes the costs of collecting and processing information, the problem of communication, and the need to reconcile the diverse objectives of people and organizations. It also requires that psychological and sociological influences on human behaviour be considered in the decision process.

v. Operations Research :

Operations research is closely related to managerial economics. It is concerned with model building the construction of theoretical models that aid in decision making. Economic theorists began constructing models long before the expression “model building” became fashionable. Managerial economists apply the models.

Operations research is also concerned with optimization, and economics has long dealt with the consequences of maximising profits and minimizing costs.

However, a business firm does not operate in a vacuum. It is a part of the economic system of a country. Its short-term and long-term decisions are affected by the overall (macro) environment of the country. There are certain forces such as consumer attitudes, or government policies or international competitiveness which are external to and beyond the control of an individual firm which is basically a micro-unit.

These external forces together constitute the (macro) environment of business. An individual firm can do little to affect the environment. So firms should take decisions which are consistent with the economic environment of business.

A business manager has to take both short-term and long-term decisions. In the short run he may be interested in estimating demand and cost relationships with a view to making decisions about the price to be charged for a product and the quantity of output to be produced.

Microeconomics which deals with demand theory and with the theory of cost and production is extremely helpful for making such decisions. Likewise, macroeconomics is also useful when one attempts to forecast demand for a product on the basis of the forces influencing the total economy (like GNP, aggregate consumption expenditure, aggregate investment expenditure, the rate of inflation and so on.)

A business firm has to take not only short-term decisions like production and pricing, but certain long-term decisions like investment, diversification and growth. In the long run, a business firm has to make such decisions as whether to expand production and diversification facilities, whether to develop new products and new markets, and possibly acquire other firms (mergers).

Such decisions require an act of investment or capital expenditure which will yield a return in future periods. These decisions are based on the economist’s concept of economies and diseconomies of scale and the theory of capital.

7. Normative Bias of Managerial Economics:

Traditional economics is basically descriptive in nature. But managerial economics is prescriptive. It decides whether or not a probable outcome is desirable and whether or not management should pursue courses of action leading to it.

8. Scope of Managerial Economics:

So managerial economics is concerned with the application of economic principles and methodologies to the decision-making process under uncertain conditions.

Its topics include: demand and its determinants, supply and its determinants, production functions, cost conditions, capital budgeting techniques, business and economic forecasting — short term and long-term corporate profits, and the problem of pricing in theory and practice.

Managerial economics also investigates the firm: its place in the industry, its contribution to the national economy and even its impact on international affairs.

9. Why Study Managerial E conomics?

It is helpful in making such short term and long term decisions as: which products and services to produce? How to produce them — what inputs and production techniques to employ? How much output should there be and what prices should be charged for them? When should a capital equipment be replaced? How should limited capital be allocated? What are the best sizes and locations of new plants?

Managerial economics provides management with a strategic planning tool that can be fruitfully utilised to gain a clearer perspective of the way the world at large works, and what can be done to maintain profitability in an ever-changing environment. Much of managerial economics offers decision makers a way of thinking about changes and a framework for analysing the consequences of strategic options.

Managerial economics is primarily or largely concerned with the practical application of economic principles and theories to the following types of strategic decisions made within all types of business enterprises:

1. The selection of the product or service to be offered for sale

2. The choice of production methods and optimum combination of the substitutable resources

3. The determination of the best combination of price and quantity

4. Promotional strategy and activities (determination of optimum advertising budget)

5. The selection of plant location and distribution centres from which to sell the goods or service to consumers.

Within a business enterprise, these five types of decisions are always considered by the marketing and sales departments, the production department as also the finance and accounting department.

The major reason for studying managerial economics is that it is useful. Not only every manager but also every individual has to make economic decisions every day.

A background knowledge of the fundamental methods and principles of economic theory enables one to make wide and rational choices. Therefore, any student of managerial economics will find its study useful not only in their professional activities but also in their private lives.

Students who choose business as a career will also find economics extremely useful. It may be noted in this context that people like doctors, lawyers or other professionals are in business, too. A knowledge of economics is extremely useful in business decision making which is designed to increase the firm’s profit and enable the firm to operate more efficiently.

Moreover, economic theory is useful in helping decision makers to decide how to adopt to external changes in economic variables. For instance, increasing advertising or sales promotion expenditure or undertaking investments involve economic decisions. Therefore, a clear understanding of economic theory helps managers make the right (most profitable) decisions.

Moreover, a knowledge of economic theory is also useful to those who work for non-profit organizations like hospitals, charitable trusts, cooperative societies, etc. Certainly the goals of these organizations do not involve profit maximization, but they do involve economic efficiency.

The Ministry of Finance, for instance, may be required to allocate a fixed budget to attain the maximum benefit — in education, medical care, and so forth — permitted by the size of the budget.

Or, it may be entrusted with the responsibility of attaining a certain goal at the minimum possible cost. Managerial economics does provide the tools needed to solve these economic problems.

Economics helps not only managers of private business firms, but also managers of non-profit organizations to adapt to changes in the economic environment in the most efficient manner. So managerial economics provides efficient decision-making tools to those also who are employed in non-business operations.

i. Decision Makers’ Objectives :

In this text- we assume that executive decisions in the aggregate are directed towards achieving the organization’s primary goal. In general it is assumed that the primary goal of any organization is to maximise the benefits provided by the organisation’s operations in relation to costs. In other words, every organization attempts to make the difference between such benefits and costs as large as possible.

In non-profit organizations it is very difficult to quantify both benefits and costs. For example, we may easily count the number of graduates from a university but it is very difficult to measures the benefits they will bring to the society that subsidized the cost of their education.

In a profit-seeking organization, benefits are measured as revenue and costs expenses and money is used as the common denominator of both. Moreover, profit can be defined as the difference between benefits and costs at some given level of risk.

The difference is based on the concept of costs the economist includes opportunity cost in cost calculation and this is set against the firm’s benefits, whereas the accountant does not. But both assume that the firm attempts to maximize benefits. However, the question arises: benefits for whom? Owners or managers?

ii. Divergent Interests of Owners and Managers:

The joint stock company or the corporation is the most representative form of business organization. It is characterized by the separation of ownership from management (control).

When the ownership of a corporation is stretched over millions and millions of shareholders (who belong to diverse groups) it is unlikely that they will take an active interest in the management of the company as long as their dividends are satisfactory.

Moreover, managers may have some personal motives. Although managers enjoy discretionary power (authority) to spend the company’s funds on different projects, they are more interested in job security, large salaries, ample bonuses, stock option plans and perquisites than in maximising returns to the owners of the company.

In their path-breaking work, The Modern Corporation and Private Property (New York, Macmillan, 1932) A. Berle and G. C. Means first drew attention to the divergence of interests between owners and managers.

Later, in 1959, W.J. Baumol argued on the basis of his experience as a management consultant that maximization of sales rather than maximization of profits is a common managerial goal, and perhaps more appropriate.

Later R. M. Cyert and J. G. March argued that large corporations, or the so-called industrial giants like huge government agencies, seek to perpetuate themselves by establishing various primary and subsidiary goals that satisfy many constituents interests in the firm rather than the owners’ interest.

They identified five such goals which determine how resources are allocated within the firm, viz., sales, production, inventory, market share, and profit. With respect to the last goal, viz., profit maximization, they commented: “it makes only slightly more sense to say that the goal of a business organization is to maximize profit than to say that its goal is to maximize the salary of Sam Smith, Assistant to the Janitor. ”

Whether decision-making is directed toward maximizing wealth, sales, management perquisite, or Sam Smith’s salary, there is still a need for efficient allocation of a firm’s limited resources. And this is what managerial economics is all about.

iii. Maximization of Owners’ Wealth :

There is no denying the fact that the primary goal of a business firm is profit maximization. However, this is not the same thing as maximizing owners’ wealth unless risk is taken into consideration. This explains why profit is defined as the difference between benefits and costs at some given level of risk. If risk is assumed to remain constant, profit maximization amounts to maximizing owners’ wealth.

iv. Social Constraints :

The goal of achieving maximum profit is often tempered by the social responsibilities of the firm. In general most of these are imposed by the government, but in some cases the firm’s management assumes social responsibilities on its own initiative. For instance, the Tata group spends a huge amount of money on education and research. They also provide scholarships to students intending to study abroad.

The pertinent question here is how far a firm can be expected to go ahead with more social responsibility programme whose costs far exceed the benefits which they bring. Moreover, unless all firms participate in such socially responsible programmes, those that do will bear an inordinate share of the costs. This will undoubtedly lead to a fall of earnings and shareholder wealth, at least in the short run.

It may be noted that various institutional arrangements in a free market system (which relies on supply and demand to allocate resources and commodities) affect the various functional divisions of a business (say, the marketing and production departments).

Managerial economics is basically concerned with how individual economic units behave, make decisions, and respond to changes in the external (macro) environment of business. In other words, economic theories and models focus on the individual firm, or industry, consumer or group of consumers, but they ignore social issues of the goals or society or that of the public at large.

10. Corporate Managerial Economic Decisions :

There are at least eight different types of decisions with which business economists are likely to be associated in a typical company.

These are the following:

i. Demand Forecasting :

With the advent of large economy-wide econometric forecasting, demand forecasting has become an increasingly important function of business economists. Most large and medium-sized corporations in the USA have some sort of econometric forecasting model for predicting demand for a variety of goods and raw materials whose sales are linked to some national econometric model and data base.

In some companies, it is the task of business economists to produce such forecasts. In other companies business economists may collaborate with outside consultants who generate the demand forecasts.

Alternatively, the business economist may serve as an in-house consultant to those in the company who are actually carrying out the forecasting exercise.

ii. Pricing and Competitive Strategy:

Pricing decisions are often within the purview of company economists. However, pricing problems are merely a subject of a broader class of economic problem faced by a company: competitive analysis.

Competitive analysis not only requires anticipation of the response of competitors to the company’s pricing, advertising and marketing (product market) strategies but also an evaluation of the impact of the company’s sales turnover (or market share) on alternative marketing strategies employed by competitors.

Rational pricing and competitive marketing decisions are based on considerable knowledge of specific product markets and industry behaviour on the part of the business economist.

iii. Cost Analysis :

Information on cost is required for decision making purposes. This requires thorough cost analysis. Various cost analysis exercises are carried out by the cost accountants and industrial engineers.

However, in some situations, the production process is so complex that they necessitate the assistance of a business economist whose task it is to provide an appropriate conceptual framework for defining costs. Business economists are also expected to participate in business cost-benefit analysis. Economists also assist corporate planners in formulating realistic models of production operations.

iv. Supply Forecasting:

In a world of demising resources, supply forecasting is no less important than demand forecasting. The oil price hike of the 1970s and shortage of other raw materials have increased the importance of forecasting of factor supplies and prices.

Supply forecasting is not a micro exercise, i.e., an exercise that can be carried out at the micro level. Such forecasting is to be based on national and international developments — both in economics and politics.

v. Resource Allocation :

Economics is a science of choice making. It deals with the allocation of scarce resources among competing alternatives. If there is scarcity but no alternatives, choice making is impossible and the problem is not economic in nature; if there are alternatives but no scarcity (goods or resources are free) economics is not required.

Resource allocation is important regardless of the economic and political system of a country. Products must be produced and resources must be allocated. Economics is often defined in terms of the problem: “How do we allocate scarce resources subject to a set of constraints?”

The business economist is concerned with how scarce resources are (or ought to be) allocated within an enterprise. Linear programming is a technique of ensuring optimum allocation of scarce resources within an enterprise.

vi. Government Regulation :

There are endless implications of government regulations on the business firm and at times the legal environment of business is as important as the economic environment. So, it is necessary to examine law-related applications of economic principles.

vii. Capital Investment Analysis :

Just as production decision is a short-term decision, capital investment decision is a long-term decision. Investment refers to expenditure on capital goods. Such expenditure may involve lakhs or crores of rupees.

Since resources are limited, companies have to allocate scarce resources among different activities or- branches of production. The business economist plays an important role in capital budgeting decision which is concerned with allocation of capital expenditure over time.

viii. Management of Public Sector Enterprises :

Managerial economics can also be applied to the decision making process of non-profit seeking and public sector enterprises. Economists in various government departments and public sector organizations are also concerned with project evaluation and cost-benefit analysis.

In recent years, many large firms have turned to corporate managerial economists for help in making decisions which are critical to “the running of the business”.

America’s famous magazine Business Week (Feb. 13, 1978) summed up the role of the managerial economist as follows:

“…… companies across the country are now demanding less of the old-style corporate economist who churned out sweeping economic forecasts, which often were swept into the waste basket, and are turning instead to the new-style economist who can play his skills in such fields as econometrics and industrial economics to help shape company policy. Indeed, an increasing number of them have joined the team of top-level executives who map business strategy.”

The managers of a firm are mainly responsible for making most of the economic decisions such as the type of product produced, its price, the production technology utilized, and the financing of production — which will ultimately determine the performance of the company, i.e., its profits and losses.

A study of managerial economics enables the practicing manager (or the decision maker) to learn the economic principles which are relevant to decision-making in all of the areas of firm management.

Likewise, an understanding of these principles will enable M.B.A. students or tomorrow’s managers to know which questions to ask and thus what data are needed, as well as what decision to make once the data are obtained, in order to assist the firm in maximizing profits.

Even if one does not eventually become a managerial economist, he (she) can hope that at least he will be able to communicate with economists properly and recognize when help from them can prove useful for problem solving.

In some parts of this title we shall assume that the goal of a firm is profit maximization, or making the greatest possible total profit. However, even when a firm has more complex objectives, managers benefit by knowing the difference between an efficient or profit-maximizing strategy, and one which sacrifices some efficiency or profit in order to achieve other goals.

11. The Managerial Economic Theory of the Firm :

The fundamental analytical framework for the study of managerial economics is provided by the economic theory of the firm, which consists of three basic elements.

2. Information, and

3. Decisions.

A business firm has to satisfy the goals of any one of the following groups of individuals:

1. Consumers

2. Employees

4. Shareholders

5. Managers.

In general it is assumed that in most firms share holders and managers have a common goal profit-maximization. On the contrary, if the firm’s objectives are formulated by its consumers, one possible goal might be the minimization of the cost of producing a particular collection of goods and services.

Alternatively, the consumers might be interested in increasing the firm’s output of a useful commodity while holding production costs fixed.

In large corporations shareholders are interested in profit maximization but managers (being salaried people) are more interested in their own security and well-being. So there is a conflict between profit-maximization and security maximization.

In this title we shall define the problem of the firm in terms of a decision problem for the managers of the firm. We are interested in exploring how managers should make decisions (normative economics) in order to achieve particular goals.

To the extent that these normative models correspond to the behaviour of firms in the real commercial world, attempt will be made to explain how managers of firms actually make decisions (positive economics).

A flow chart of the decision process of a firm

For the purpose of analysis we often classify the goals of managers as:

(1) Profit,

(2) Functional, and

(3) Personal.

The profit-maximization goal (hypothesis) is based on the assumption that managers either voluntarily or of necessity behave in a manner consistent with the interests of shareholders (because the amount of dividend that can be distributed by a firm depends on the amount of profit made by it).

To the extent that professional managers are motivated to relate their behaviour to the goals of shareholders, profit maximization can be treated as the operational goal of the firm. In reality, there is not only evidence of conflict of interests of managers and shareholders, but also that functional and personal goals are more important than profit-maximization.

Functional goals, on the contrary, relate to some sub-system of the firm rather than the firm in its entirety.

Three possible functional goals are:

(1) Production,

(2) Sales and marketing and

(3) Financial.

The goals of a production manager may be:

(1) Completion of delivery schedule on time,

(2) Minimization of the sum of capital investment expenditures, operating costs and in-process inventory costs and

(3) Achievement of an even distribution of work-loads among all production facilities and a target production rate.

The objective of the sales and marketing managers may be to maximize sales revenue, not profit. This point has been made by Professor W. J. Baumol. The objective of sales maximization implies committing the firm to completely unrealistic production and time orders. Moreover, the sales manager might opt for large inventories of finished goods to ensure prompt delivery and excellent services to customers.

Likewise, giving necessary financial support to other departments is the headache of the financial manager. He (she) has always to worry about whether there is enough cash to support the company’s production and marketing activities.

Finally, the Chief Executive Officer has to do the best of a bad job of balancing the conflicting goals of production, sales and financial managers. It is because the CEO has to worry about the overall profitability of an enterprise.

The personal goals would include such things as salary, job security, status, prestige, professional excellence and job satisfaction.

Yet, at the end, the fact remains that no firm would exist for long unless it makes it makes profit. So, profit maximization is the primary goal and others are subsidiary goals.

ii. Information :

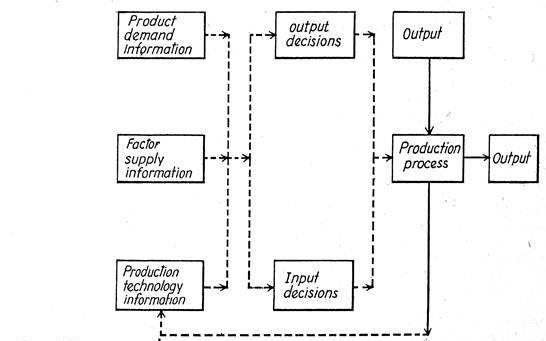

Business decision making (including forecasting) is based on three types of information: product- demand information, factor-supply information and production-technology information.

iii. Decisions :

On the basis of the above goals and information, the firm has to make two sets of decisions: output decision and input-decisions. It is because the sales plan of the business firm is followed by its purchase plan. The output decisions are concerned with which product to produce and in what quantities.

The input decisions are concerned with which factors of production to buy and hire and in what quantities. The following flow chart illustrates the major decisions of a firm. The broken lines indicate the flow (direction) of information and the solid line represents flows of factors (inputs) and final goods (end products).

Two primary tasks of managers are making decisions and processing information. In reality they are inseparable. In order to make rational decisions, managers must be able to obtain, process, and use information. It is the task of economic theory to help managers know what information should be obtained, how to process it and finally, how to use it.