Free Simple Business Plan Template

Our experts

Written and reviewed by:.

Our independent reviews are funded in part by affiliate commissions, at no extra cost to our readers.

Your business plan is the document that adds structure to your proposal and helps you focus your objectives on an achievable and realistic target. It should cover every aspect of what your business journey will look like, from licensing and revenue, to competitor and sector analysis.

Writing a business plan doesn’t need to be a difficult process, but it should take at least a month to be done properly.

In today’s capricious business climate there’s a lot to consider, such as the impact of political challenges like Brexit. These details are especially important in today’s bad economy. Investors are looking for entrepreneurs who are aware of the challenges ahead and how to properly plan for them.

Below, you’ll find everything you need to create a concise, specific and authoritative business plan. So let’s get started turning your idea into a reality!

Click here to download your free Business Plan template PDF – you can fill in your own details and those of your business, its target market, your customers, competitors and your vision for growth.

Our below guide will give you detailed advice on how to write a quality business plan, and our PDF download above can give you a clear template to work through.

But, creating an effective business plan needs….planning! That’s where a high quality planning tool can help.

We recommend creating an account with monday to use this tool – there’s even a free trial . Doing so means you can start your entrepreneurial journey on the right foot.

Get the latest startup news, straight to your inbox

Stay informed on the top business stories with Startups.co.uk’s weekly newsletter

By signing up to receive our newsletter, you agree to our Privacy Policy . You can unsubscribe at any time.

What to include in your business plan template

There’s a lot of information online about how to write a business plan – making it a confusing task to work out what is and isn’t good advice.

We’re here to cut through the noise by telling you exactly what you need to include for a business plan that will satisfy stakeholders and help develop a key identity for your brand. By the end, you’ll have a plan to make even Alan Sugar proud and can get started with the most exciting part – running your business.

Throughout this guide, we’ve featured an example business plan template for a new restaurant opening in Birmingham called ‘The Plew’. In each section, you’ll be able to see what the contents we’re describing would look like in a ‘real-life’ document.

What to include in your business plan:

- Executive Summary

- Personal summary

- Business idea

- Your product or service

- Market analysis

- Competitor analysis

- Cash forecast

- Operations and logistics

- Backup plan

- Top tips for writing a business plan

- Business plan template UK FAQs

1. Executive summary

This section is a summary of your entire business plan. Because of this, it is a good idea to write it at the end of your plan, not the beginning.

Just as with the overall business plan, the executive summary should be clearly written and powerfully persuasive, yet it should balance sales talk with realism in order to be convincing. It should be no more than 1,000 words.

It should cover:

- Mission statement – what is your company’s purpose?

- Business idea and opportunity – what unique selling point (USP) will you provide?

- Business model – how will your business operate?

- Business objectives – what are you aiming to achieve?

- Target market – who is your customer base?

- Management team – who are the owners/senior staff?

- Competition – who are you competing against?

- Financial summary – can you prove the business will be profitable?

- Marketing strategy – what is your marketing plan and associated costs?

- Timeline – how long will it take to launch/grow your new business?

It sounds like a lot – but don’t feel you have to spend hours putting this together. Here’s what the above information for an executive summary might look like when put into our example business plan template for ‘The Plew’:

Startups’ business plan template example: executive summary

2. Personal summary

Investors want to know who they’re investing in, as much as what. This is where you tell people who you are, and why you’re starting your business.

Outline your general contact details first, giving your telephone number, email address, website or portfolio, and any professional social media profiles you might have.

Run through this checklist to tell the reader more about yourself, and put your business ambitions into context.

- What skills/qualifications do you have?

- What are you passionate about?

- What is/are your area(s) of industry expertise?

- Why do you want to run your own business?

Here’s what our two fictional co-founders of ‘The Plew’ might write in their personal summaries for our example business plan. CEO Gabrielle Shelby, has highlighted her expertise in the restaurant industry, while CFO Freya Moore outlines her accounting and finance knowledge.

Startups’ business plan template example: personal summary

Richard Osborne, founder and CEO of UK Business Forums, says personality is important in a business plan.

“Having a strong, personal reason at the heart of your business model will help keep you going and give you the motivation to carry on,” he affirms.

3. Business idea

This section is essentially to offer a general outline of what your business idea is, and why it brings something new to the market.

Here, you should include your general company details, such as your business name and a one-line summary of your business idea known as an elevator pitch. This section should also list a few key business objectives to show how you plan to scale over the next 1-3 years.

We also recommend carrying out a SWOT analysis to tell investors what the strengths, weaknesses, opportunities, and threats are for your business idea. Think about:

- Strengths: ie. why is this a good time to enter the sector?

- Weaknesses: ie. what market challenges might you encounter?

- Opportunities: ie. what demand is your product/service meeting in today’s market?

- Threats: ie. how will the business be financed to maintain liquidity?

In the template below, you can see a breakdown of the above information for ‘The Plew’. At the top is its mission statement: “to craft an unforgettable dining experience in a chic atmosphere.”

Startups’ business plan template example: business idea

Need a business idea? We’ve crunched the numbers and come up with a list of the best business ideas for startup success in 2023 based on today’s most popular and growing industries.

4. Your products or services

Now it’s time to explain what you are selling to customers and how will you produce your sales offering.

Use this section to answer all of the below questions and explain what you plan to sell and how. Just like your business idea outline, your answers should be concise and declarative.

- What product(s) or service(s) will you sell?

- Do you plan to offer new products or services in the future?

- How much does the product or service cost to produce/deliver?

- What is your pricing strategy ?

- What sales channels will you use?

- Are there legal requirements to start this business?

- What about insurance requirements?

- What is the growth potential for the product or service?

- What are the challenges? eg. if you’re looking to sell abroad, acknowledge the potential delays caused by post-Brexit regulations.

What insurance and licensing requirements do you need to consider?

Depending on what your business offers, you might need to invest in insurance or licensing. Our How To Start guides have more details about sector-specific insurance or licensing.

Public Liability, Professional Indemnity, and Employers’ Liability are the most well-known types of business insurance. We’ve listed some other common other licensing and insurance requirements below:

In our example product/service page for ‘The Plew”s business plan, the founders choose to separate this information into multiple pages. Below, they outline their cost and pricing, as well as sales strategy. But they also include an example menu, to offer something a bit more unique and tantalising to the reader:

Startups’ business plan template example: product list and pricing strategy

5. Market analysis

This section demonstrates your understanding of the market you are entering, and any challenges you will likely face when trying to establish your company.

This section pulls all of your target market and customer research together to indicate to stakeholders that you are knowledgable about the sector and how to succeed in it.

- Who is your typical customer and where are they are based? Describe the profile of your expected customers eg. average age, location, budget, interests, etc.

- How many customers will your business reach? Outline the size of your market, and the share of the market that your business can reach.

- Have you sold any products/services to customers already? If yes, describe these sales. If no, have people expressed interest in buying your products or services?

- What have you learned about the market from desk-based research? What are the industry’s current challenges, and how has it been affected by the economic downturn?

- What have you learned about the market from field research? (eg. feedback from market testing like customer questionnaires or focus group feedback).

What is your marketing strategy?

Once you’ve highlighted who your rivals are in the market, you can provide details on how you plan to stand out from them through your marketing strategy. Outline your business’ USP, your current marketing strategy, and any associated advertising costs.

‘The Plew’ identifies its target audience as young, adventurous people in their mid-30s. Because of the restaurant’s premium service offering, its audience works in a well-paid sector like tech:

Startups’ business plan template example: customer analysis

6. Competitor analysis

This section demonstrates how well you know the key players and rivals in the industry. It should show the research you have carried out in a table format.

Begin by listing the key information about your competitors. Don’t worry about sounding too critical, or too positive. Try to prioritise accuracy above all else.

- Business size

- Product/service offering

- Sales channels

- Strengths/weaknesses

Competitors will take two forms, either direct or indirect. Direct competitors sell the same or similar products or services. Indirect competitors sell substitute or alternative products or services.

Here’s a breakdown of the strengths, weaknesses, and opportunities, and threats presented by a competitor restaurant for ‘The Plew’ called Eateria 24. At the bottom, the founders have written what learnings they can take from the chart.

Startups’ business plan template example: competitor analysis

Check out our list of the top competitor analysis templates to download free resources for your business, plus advice on what to include and how to get started.

7. Cash forecast

Outline your financial outlook including how much you expect to spend, and make, in your first year

All of your considered costs can be put into one easy-to-read document called a monthly cash forecast. Cash forecasts contain:

1. Incoming costs such as sales revenue, customer account fees, or funding.

2. Outgoing costs such as staff wages or operating expenses. The latter can cover everything from advertising costs to office supplies.

For those firms which have already started trading, include any previous year’s accounts (up to three years) as well as details of any outstanding loans or assets.

Annual cash forecast: what is it?

By conducting 12 monthly cash forecasts, you can create an annual cash forecast to work out when your company will become profitable (also known as breakeven analysis) . You will break even when total incoming costs = total outgoing costs.

In your annual cost budget, make sure to also include month opening/closing balance. This is important to monitor for accounting, particularly for year-end.

- Opening balance = the amount of cash at the beginning of the month

- Closing balance = the amount of cash at the end of the month

The opening balance of any month will always be the same as the closing balance of the previous month. If you are repeatedly opening months with a negative closing balance, you need to adjust your spending. Here’s an example of what ‘The Plew’s financials might look like in its first year of operation:

Startups’ business plan template example: cash forecast

8. Operations and logistics

Explain how your day-to-day business activities will be run, including key business partnerships around production and delivery.

A.) Production

List all of the behind the scenes information about how your business will operate. Include:

- Management team – who do you plan to hire as senior staff and why?

- Premises – where will you be based? What will be the cost?

- Materials – what materials/equipment will you need to make your product/service?

- Staffing – how many employees will you hire? How much will they cost?

- Insurance – what insurance do you need for production?

B.) Delivery

Detail how your customers will receive your product or service. Include:

- Distribution – how will you sell your product to customers?

- Transport – how will you transport the product/service to customers or partners?

- Insurance – what insurance do you need for delivery?

C.) Supplier analysis

Lastly, you should carry out a supplier analysis. Write down 2-3 suppliers you plan to use as part of your business operations and evaluate them on factors like location and pricing.

In our example business plan for ‘The Plew’, the founders have chosen to present this information in an easily-digestible chart, breaking down the leadership and employees into two different areas: product development and operations.

Startups’ business plan template example: staffing section

9. Backup plan

Explain how you will manage any surprise losses if your cash forecast does not go to plan.

In the event that your business does not go to plan, there will be costs to incur. A backup plan outlines to potential investors how you will pay back any outstanding loans or debt.

In the short-term:

If your cash-flow temporarily stalls, what steps could you take to quickly raise money or make savings? For example, by negotiating shorter payment terms with your customers.

In the long-term:

If you’ve noticed a drop in sales that seems to be persisting, what changes can you make that would improve cash flow longer term? For example, can you do more of your business online to reduce rent fees?

To placate investors even further, it’s a good idea to include details about potential support channels you can utilise (eg. a business network or contact) who might be able to help if you get caught in a sticky cash-flow situation.

Startups’ 5 top tips for writing a business plan

- Keep your predictions realistic. Your business plan should showcase your knowledge of the sector and what’s achievable. It’s not about impressing investors with big numbers or meaningless buzzwords.

- Don’t go over 15 pages. Business plans should be engaging, which means sticking to the point and avoiding a lot of long-winded sentences. Keep your executive summary to less than 1,000 words, for example.

- End with supporting documents. Use your appendix to include product diagrams or detailed research findings if these are helpful to your business case.

- Get a second pair of eyes. Everyone misses a spelling error or two – invite a trusted business contact or associate to look over your business plan before you send it anywhere.

- Leave enough time to write! It’s exciting to think about getting your business up and running – but planning is an important step that can’t be rushed over. Spend at least a month on writing to get all the details correct and laid-out.

At Startups.co.uk, we’re here to help small UK businesses to get started, grow and succeed. We have practical resources for helping new businesses get off the ground – use the tool below to get started today.

What Does Your Business Need Help With?

Designing a business plan is very important for laying the foundation of your business. Ensure you spend an appropriate amount of time filling it out, as it could save you many headaches further down the line.

Once your plan is complete, you’ll then be ready to look at other aspects of business set-up, such as registering your company. Sound daunting? Don’t worry!

Our experts have pulled together a simple, comprehensive guide on How to Start a Business in 2024, which will tell you everything you need to know to put your new plan into action.

- Can I write a business plan myself? Absolutely! There are plenty of resources available to help, but the truth is a business plan needs to reflect the owner's personal ambitions and passion - which is why entrepreneurs are best-placed to write their own.

- How long should a business plan be? We recommend your business plan is kept to a maximum of 15 pages. Keep it short and concise - your executive summary, for example, should be no more than 1,000 words.

- Is it OK to copy a business plan? While not technically illegal, copying a business plan will leave you in a poor position to attract investment. Customising your plan to your unique business idea and industry specialism is the best way to persuade stakeholders that you have a winning startup formula.

Startups.co.uk is reader-supported. If you make a purchase through the links on our site, we may earn a commission from the retailers of the products we have reviewed. This helps Startups.co.uk to provide free reviews for our readers. It has no additional cost to you, and never affects the editorial independence of our reviews.

- Essential Guides

Written by:

Leave a comment.

Save my name, email, and website in this browser for the next time I comment.

We value your comments but kindly requests all posts are on topic, constructive and respectful. Please review our commenting policy.

Related Articles

Free business plan template

- Download business plan template

- Try Xero for free

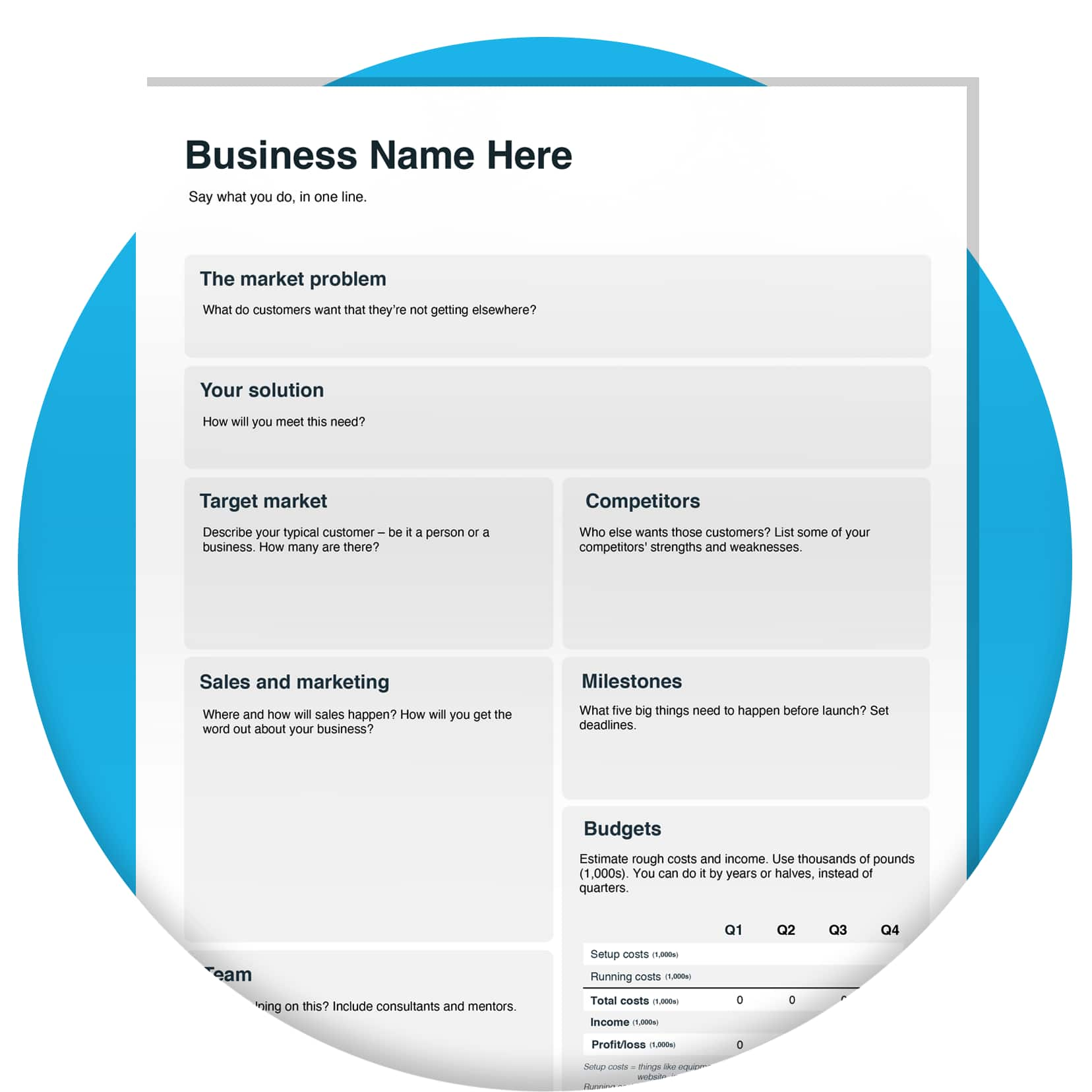

Download a business plan template and start bringing your ideas to life. Choose a one-pager, or multi-pager. Or try Xero accounting software for free.

Download the business plan template

Fill in the form to get a free business plan template as an editable PDF. We’ll send a one-pager and a multi-pager to choose from.

Privacy notice .

Getting started with the business plan template

We’ll send you two types of business plan template – a one-pager and a multi-pager. Choose the one that’s right for you. They come with instructions to help fill them out.

Doing a business plan will improve your idea. It helps you think about your business from different points of view. The process will flag up unseen risks, but also new opportunities. Aside from helping refine your idea, a business plan will move it forward. It’ll give you a concrete set of steps to go from ‘I should’ to ‘I did’.

One-page business plan template

Great for making a start

Helps you pin down the main idea

Easy to update as things evolve

Multi-page business plan template

Ideal for nailing down the details

Required by most investors and lenders

Good if you face big startup costs

Tips to help with your business plan

Don’t obsess over every detail to start with. That will make the plan long and hard to change. Keep it short and concise initially.

Financing your business

Need cash to get going? Check out our finance guide.

How to finance your business

Starting a business

Check out our guide for information about getting started.

How to start a business

Find a bookkeeper or accountant

Accoutnants and bookkeepers can help build financial resilience into your business budgets.

Find a financial advisor near you

Plan on making business fun

Are you looking forward to the bookkeeping and accounting that comes with a new business? Na, we didn’t think so. Xero can automate a lot of that stuff away for you.

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

HELPING SMALL BUSINESSES SUCCEED

MORE DONUTS:

What do you need to know about starting a business?

- Start up business ideas

- Set up a business

- Skills and wellbeing

- Business planning

- Financing a business

- Tax and National Insurance

- Business law

- Sales and marketing

- Business premises

- Business IT

- Grow your business

- Types of business

- Testing business ideas

- Product development

- Is running a business really for you?

- Start up stories

- Registering as a sole trader

- Setting up a limited company

- Business names

- Buy a franchise

- Buying a business

- Starting an online business

- Setting up a social enterprise

- Small business support

Protect your wellbeing from the pressures of starting and running a business and develop key business skills.

- Dealing with stress

- Manage your time

- Self-confidence

- Write a business plan

- Business strategy

- Start up costs

- Start up funding

- Setting prices

- How to work out tax and NI

- Accounting and bookkeeping

- Licences and registration

- Protecting intellectual property

- Insurance for business

- Workplace health, safety and environmental rules

- Looking after your customers

- Promote your business

- Your marketing strategy

- Sales techniques

- Research your market

- Creating and optimising a website

- Commercial premises

- Premises security

- People management

- Recruitment, contracts, discipline and grievance

- Employment rights

- Hiring employees

- Buying IT for your new business

- Basic IT security

- Preparing for business growth

- How to scale up your business

- Funding business growth

- Start exporting

- Personal development

Business plan template

A well-written business plan is an essential tool for any business. Not only can it help you attract funding, it can also help you test your business idea.

What should I include in a business plan?

Most business plans cover the next 12-36 months and include the following:

- Outline the aims and goals for the business and how the business owner plans to achieve those goals.

- The background of the business

- Introduce the business' management team.

- profit and loss forecasts,

- a breakdown of how much money will be required to set up and run the business,

- sales forecasts,

- pricing strategy.

- Overview of the market the business operates within, the customers the business plans to target and what marketing methods will be used.

- Assessment of comparative strengths, weaknesses, opportunities and threats posed by rivals within that market.

- The last thing to be written is usually the executive summary - which should appear at the front of the business plan. It rounds up all the detailed information contained in the main body of the business plan.

A business plan does not need to be a lengthy document but should provide these key elements.

Business plan templates

These simple and professional business plan templates from Templates.net can help you set out your business idea, plan the road map for your business formation and help you attract funding.

Available in several file formats and easily customizable, these files are a great addition to your template library.

Download the business plan templates (charge applicable).

- Start up business plan

- Simple business plan

- One-page business plan

- Sample business plan

- Business plan outline

Browse topics: Business planning

What does the * mean?

If a link has a * this means it is an affiliate link. To find out more, see our FAQs .

You are using an outdated browser. Please upgrade your browser .

4 Free Business Plan Templates: Where to find them and what you get

While some people argue about whether you need a business plan to be successful, you almost certainly will need one when opening bank accounts and seeking funding. Fortunately there are some good free business plan templates and advice online. Here we will review 4 of the best covering what you get and where to find them.

1) Gov.uk – The ‘write a business plan’ page of the UK government’s website includes advice and a selection of different business plan templates so you can select which one is best for your business.

2) The Prince’s Trust – Although The Prince’s Trust specialise in supporting young people their business plan template is available to anyone. At 16 pages it is substantially shorter than the one from Business Link and is less formal in tone. The Prince’s Trust plan also goes into more depth on the logistics of how the company is going to work and the reasons for starting it up.

3) Microsoft Word – Microsoft have a start-up business template which you can download. When you open it up in word it runs to 28 pages and is full of questions, advice and points to consider. Compared to The Princes Trust and Business Link plans it is a lot more text heavy and takes some reading. It is also a lot more focussed on the financials of the company than the other two plans, concentrating on accounts payable, pricing and other financial planning considerations.

4) Your Bank – One of the main reasons people do a business plan is because their bank asks them to. If this is your motivation then it makes sense to use a template your bank will like. Our business banking partners HSBC have a business plan tool, Natwest have an online form and Barclay’s offer plenty of advice . Many of the other main UK banks also have templates or advice online. Using the bank’s own forms should mean that you tick all of the boxes and answer all of the questions they are likely to be looking at which can only help make your meeting go more smoothly.

Whichever template you choose it is important that you invest the time to get your plan right before you try to use it. Most of these plans require you to do a considerable amount of research into your target market, customers and competitors. Don’t leave it until the night before your bank meeting to get it done!

One comment on “ 4 Free Business Plan Templates: Where to find them and what you get ”

pls help me for free business plan

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

You may use these HTML tags and attributes: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>

Save my name, email, and website in this browser for the next time I comment.

- Accessibility statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

- Private Banking

- International Banking

- Lloyds Bank Logo

Help and support

Supporting your banking needs

View all help & support

Making payments

- Cancel a Direct Debit

- Set up a standing order

Make a payment

Online banking

- Log on to Online for Business

- I’ve locked or forgotten my PIN

- Online for Business card reader

Account management

- Manage account access

- Close an account

- Change your business address

Taking payments

- Terminal problems

- PCI and security

- Upgrade your terminal

- Apply for a Business Debit Card

- View your Business Debit Card PIN

- Order a replacement debit card

Security and fraud

- Lost or stolen Business Card

- Lost or stolen Corporate Card

- Report fraud on a business account

Popular help queries

- Change who can access your account

- Find your IBAN and BIC

- Report fraud on online banking

More support

- Accessibility and disability

- Support through financial difficulty

- Help with bereavement

Our online services

View all online banking

- Online for Business

- How to register

- Mobile banking

- What you can do online

- Online payment control

Other online services

- Commercial Banking Online

Accounting software

- Invoice Finance Online

- Lloyds Online Trade Services (LOTS)

- Cardnet reporting tools

Find out more

- Other ways to bank

- How to log on to Online for Business

- Manage access to Online for Business

Accounts and savings

Everyday banking and payments

Business accounts

- Apply for a Business Account

- Switch to Lloyds Bank

- Treasurer’s account

- Client account

- School account

- Credit Union account

- Foreign Currency Account

- Instant Access Account

- Fixed Term Deposit

- Notice Accounts

- International payments

- Bulk payments

- Bacs payments

- Faster payments

- Embedded Payments

- CHAPS Payments

- Business Finance Assistant

View all products and services

Business account holders

- Manage your account

- Product terms and conditions

Savings Strategy Tool

Loans, cards and finance

Business loans

- Small business loans

- Commercial Mortgages

- Government-backed loans

- Credit Card

- Charge Card

- Card solutions (£3m+ turnover)

Asset Finance

- Business Hire Purchase

- Business Car Finance

Invoice Finance

- Selective Invoice Finance

- Invoice Factoring

- Invoice Discounting

International trade lending

View all borrowing options

- How to get a business loan

- Lending support and standards

- Lending appeals

Invoice Finance customers

- Existing customer login

- Debtor protection

- Asset Based Lending

Take payments

Card readers and online

Take payments with Cardnet®

Card readers

- Mobile card readers

- Portable card machines

- Countertop card machines

- Clover card machines

Online payments

- Hosted payments page

- Integrated payment page

- Pay by link

Over-the-phone payments

Omnichannel payments

Additional services

- Merchant Cash Advance

- Digital ordering solutions

- PCI DSS compliance

- Dynamic Currency Conversion

Existing customers

Cardnet existing customers

- Log on to your reporting tool

- Cardnet guides & resources

- Cardnet help & support

Accept card payments with our wide range of face-to-face solutions.

- International trade

Business at home and abroad

International & domestic trade

- Bonds & Guarantees

- Documentary Collections

- Letters of Credit

- Trade Finance

- Receivables Purchase

International cash management

- International Payments

- Foreign Exchange

- Currency Accounts

Existing trade customers

- International Trade Portal

- International rates and charges

- Login to LOTS

- Open Account Platform

- Trade Tracker

Find the right cover

Business Insurance

Public Liability Insurance

- Landlord Insurance

- Professional Indemnity Insurance

- Shop Insurance

- Office Insurance

- Cyber Insurance

- Café Insurance

- Salon Insurance

- Surgery Insurance

- Working from Home Insurance

- Fleet Insurance

- Pubs and Restaurants Insurance

- Business Insurance guides

- Retrieve an insurance quote

Help protect your business from legal fees and compensation costs if a customer, client or other third party makes a claim against you.

Business guidance

Start-up, manage and grow

Start your business

- Financing a startup

How to write your business plan

- Ways to improve cash flow

- Name and set up your business

- Steps to starting a business

Manage your business

- Employment law

- Mental health in the workplace

- Disability in the workplace

- Payroll systems

- Business continuity planning

Grow your business

- International Commercial Terms

- Making international payments

- Finding the right property

- Building customer relationships

- Business sectors

- Agriculture

- Charities & not-for-profits

- Manufacturing

- Real Estate & Housing

- Legal Services

Useful resources

Insights and resources

- Sustainability

- Supporting Black-owned business

- Women-owned businesses

- Managing business costs

- Latest insights

- Business guides

- Recent case studies

Good things are happening in British business

Find out how some of our customers have evolved their businesses in innovative ways.

Corporate solutions

For corporates & institutions

View all corporate solutions

- Card solutions

- Working capital

- Liquidity and accounts

- Risk management

Corporate sectors

- Consumer & Technology

- Infrastructure, Energy & Industrials

- Real Estate and Housing

- Higher Education

- Services & Public sector

- Sponsors, Debt & Structured Finance

- Sustainability & ESG Financing

- Financial Services

Online services

- Online Trade Services

Insights for corporates and institutions

Find the latest insights, reports, expert commentary and client case studies.

- Search Close Close

Internet Banking

Keep me secure

- Resource Centre

- Business Guides

Read time: 5 mins Added: 26/05/2023

A compelling and comprehensive business plan is an important asset for any business. It helps you to understand where you are now and where you want to be - then sets out how you intend to get there. If you need funding for your business, a detailed business plan can help give lenders or investors the confidence to invest.

5 things you’ll learn from this guide:

1. Why you should write a business plan

2. What to include in your plan

3. How to set SMART objectives

4. How to develop your strategy

5. The importance of financial forecasts

Why you should write a business plan

What to include in your plan.

- How to set SMART objectives

- How to develop your strategy

- The importance of financial forecasts

The process of writing a business plan forces you to explore your business idea in detail and identify what you need to do to make it happen. It will quickly show up any flaws or potential stumbling blocks, allowing you to make your mistakes on paper rather than in your actual business.

A well-thought-out business plan will:

- set a direction for the business and help you create an action plan

- help you and your staff focus on what's important

- show your commitment to banks, investors, colleagues and employees

- help you to spot problems early on and tackle them effectively

- set targets and evaluate your success

- help you attract better-qualified staff

Business planning isn't just for when you're setting up – you should keep reviewing and updating your plan regularly. A plan is always a useful asset for persuading others to invest time, money and effort in your business, and keep your plans on track.

There are some key elements of a business plan:

Executive summary While this comes first, you should write it last. It’s a concise summary of all the key information in the full plan, and is your elevator pitch on paper.

Mission statement What is the purpose of your business – what problem are you aiming to solve for customers? You need to outline what you want your business to achieve, apart from making a profit.

Objectives How do you want your business to be performing in a year, and five years? You need to define your measures of success, making sure they are SMART.

S.M.A.R.T. Objectives

Objectives should meet each of these criteria:

Specific Outline clearly what is required in a simple statement.

Measurable Include some type of metric that will enable you to monitor progress and know when the objective has been achieved.

Achievable The objective should be challenging, yet grounded in business reality.

Relevant The focus should be on achieving the outcome, not the means of doing so.

Time-Bound There should be a target date by which the objective must be achieved.

Your strategy

Your strategy outlines how you intend to achieve your objectives. It details both the environment you’re operating in, and how you operate in it.

It’s vital that you understand who your potential customers are, and what they want. Alongside that, you should research who your competitors are - not just businesses that do the same as you, but those that meet your customers needs in a different way too (indirect competitors). Our Understanding your market guide has more information.

You also need to be aware of the external opportunities and threats for your business. Economic conditions, changes in legislation and new technologies can all have an impact on your business. You should identify any which are relevant to your business and outline how you will respond to them.

Lloyds Bank business customers have access to Business KnowledgeBox as part of Internet Banking, which contains guides to setting up and running over 500 types of business and includes key market trends and issues, and trading and compliance considerations.

Our customers also have access to the Lloyds Bank International Trade Portal which provides a gateway to explore international trade opportunities and detailed market information.

You’ll also need to outline how you’ll operate including:

- Who your suppliers will be

- The staff, facilities and equipment you’ll need

- How you’ll promote your product or service

Your Budget

Financial forecasts will help you, as well as potential lenders or investors, to understand if you have a viable business. You should provide details of your financial forecasts – how much you’ll sell and what the costs will be. Outline where the start-up funds will come from, and at what point you’ll need further investment for growth.

Key figures you need to capture are:

- Sales forecasts

- Costs and overheads – staff, facility, energy

- Assets – any significant company property

- Investments, loans and grants A breakdown of costs, including tables detailing:

- Start-up costs

- Projected cash flow

- Projected profit and loss

- Projected balance sheet

You can also find more information and a range of business plan templates and examples at www.gov.uk .

We adhere to The Standards of Lending Practice which are monitored and enforced by the LSB: www.lendingstandardsboard.org.uk

Important legal information

Lloyds Bank is a trading name of Lloyds Bank plc, Bank of Scotland plc, Lloyds Bank Corporate Markets plc and Lloyds Bank Corporate Markets Wertpapierhandelsbank GmbH.

Lloyds Bank plc. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 2065. Bank of Scotland plc. Registered Office: The Mound, Edinburgh EH1 1YZ. Registered in Scotland no. SC327000. Lloyds Bank Corporate Markets plc. Registered office 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 10399850. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278, 169628 and 763256 respectively.

Lloyds Bank Corporate Markets Wertpapierhandelsbank GmbH is a wholly-owned subsidiary of Lloyds Bank Corporate Markets plc. Lloyds Bank Corporate Markets Wertpapierhandelsbank GmbH has its registered office at Thurn-und-Taxis Platz 6, 60313 Frankfurt, Germany. The company is registered with the Amtsgericht Frankfurt am Main, HRB 111650. Lloyds Bank Corporate Markets Wertpapierhandelsbank GmbH is supervised by the Bundesanstalt für Finanzdienstleistungsaufsicht.

Eligible deposits with us are protected by the Financial Services Compensation Scheme (FSCS). We are covered by the Financial Ombudsman Service (FOS). Please note that due to FSCS and FOS eligibility criteria not all business customers will be covered.

While all reasonable care has been taken to ensure that the information provided is correct, no liability is accepted by Lloyds Bank for any loss or damage caused to any person relying on any statement or omission. This is for information only and should not be relied upon as offering advice for any set of circumstances. Specific advice should always be sought in each instance.

- Footer navigation

- What are IBANs and SWIFT codes?

- I know what the debit card payment is, but there’s a problem

- Find the address, opening hours or phone number of a branch

- How do I find my sort code and account number?

- What is the cheque clearing cycle and how long does it take?

- Find Barclays

Please upgrade your browser

To have the best experience using our site, please upgrade to one of the latest browsers.

- Business insights

Writing a business plan

Your guide to a successful business plan

A good business plan defines what you want to achieve and how you intend to achieve it. Our guide could help you write yours.

Define your business

It’s important that you define what type of small business you are so that everyone you work with understands what you’re trying to achieve. A comprehensive business plan is the best way to go about defining your business.

Your plan should include:

- What your business will do

- The products or services it will provide

- How customers will access your products or services (eg in a shop, online or by phone)

- Your approach to pricing

- Your long and short-term objectives – including a series of benchmarks if possible that you can check your progress against

Know your customers

Make sure you know as much as possible about who will be buying from you. For example, if you’re marketing to consumers, here are some questions you might want to ask. Knowing the answers will help you promote your business much more effectively:

- How old are they?

- What do they do for a living?

- What are their lifestyles like?

- Do they already buy the product or service?

- Why will they buy from you and no one else?

- How will you tell them about your business?

Naming your business

The name you choose for your business should reflect the image you want to project to your market. Pick one that’s easy to pronounce and remember, but do some research first. Make sure your chosen name is not already in use, it’s available as a web address and will work on your business stationery. You may also consider looking into the name’s meaning in different countries and languages – especially if you see yourself expanding internationally in the future.

If you have the facilities, you could test various names to see how people from your proposed customer base react. There are companies that provide this service, or you could do it informally by asking friends and family.

Taking on staff

If you take on employees – even part-time – you’ll need to familiarise yourself with employment law and know how to get the best out of your staff. There are plenty of guides that will help you to understand the law and make decisions to suit your business, such as the number of employees you need, what you should offer them and if they will be contractors or permanent. Here are some key things to consider:

- What are my responsibilities and what do I need to provide them with?

- How will I make sure they are properly managed and trained?

- What should I pay them and does it match with the pay offered for similar roles in the area?

- Does it comply with the National Minimum Wage and National Living Wage?

- How will they benefit my business and help me to achieve my goals?

Writing it all down

When you write your business plan, remember to be clear, realistic and concise. It’s important to consider that someone reading it in the future might not be familiar with jargon or more technical terms, so writing it in plain English is advisable. You should use research and, if possible, evidence, to support your conclusions and include an action plan. Nothing needs to be set in stone, however; business plans are dynamic documents – meaning that you should adjust your plan as your business develops. See our in-depth guide to writing a business plan [PDF, 6.2MB]

You may also be interested in

11 tips on how to start a business

What you really need to know when getting your business off the ground

Read our 11-point guide on how to set up a business to help you get up and running.

Start-up business account

Banking that lets you spend more time on your business

Starting a business means there's more to think about than managing your bank account, so we give you the online tools and expertise to help you grow.

Protecting your business idea

Got a big idea? Find out how to protect it

The Intellectual Property (IP) rights of your business determine the value of your idea, so a copyright, patent or trademark is essential.

Important information

Small Business UK

Advice and Ideas for UK Small Businesses and SMEs

Example business plans

Put together your business plan with our tips.

Where can I find an example of a business plan?

If you’re preparing to write your first business plan and are looking for some useful resources and advice on what elements to include you have come to the right page.

It is essential to have a realistic, working business plan when you’re starting up a business. We have our own section devoted to business planning where there are lots of articles and links to information on writing business plans . The content can show you how to prepare a high quality plan using a number of easy-to-follow steps but also contains more specialist information to help you really fine tune your document, plus advice on presentation and targeting.

If you are specifically looking for advice as a franchisee, check out our article on the 11 things you need to include in a franchise business plan .

There are a range of other sources you may also want to use. An often overlooked source is your Bank who may well have information, examples and templates of business plans:

- Barclays template and checklist [pdf]

- Lloyds sample plan [downloadable pdf – see section 4]

The Prince’s Trust offers downloadble pdf, MS Word and Excel templates . They also offer personal advice on completing a plan through their Enterprise programme if you are selected to work with them.

Slideshare has lots of business plans uploaded, which you can browse through here . We liked this thorough 26 page example from The Business Plan Team , as well as a template created by former Deloitte Management Consultants here , and a good example of a colourful, visual plan suitable for a trendy food business here .

An interesting interactive free business plan creator is offered by LawDepot . On the website you are stepped through 7 simple steps using a well-designed graphic interface, and at the end you can output the subsequent plan ready to fill in. There are 12 industries to choose from and it has sections for company structure, product, marketing, SWOT, operations and ‘Fine Details’.

Other Web Resources: Business Plan Templates

You can find examples of business plans for different types of businesses at:

- ACCA – the Association of Chartered Certified Accountants have 3 example business plans for three different business sectors: Cafe, Import Business, UK Ltd business seeking finance.

- Bplans – owned and operated by Palo Alto Software Inc., the site has free plans to download and it also has examples for lots of different types of individual or specific market sectors.

- Expert Hub – based in South Africa, this site has 21 example business plans for different categories.

- Start Up Loans – offer a downloadable .docx template.

- Invest Northern Ireland – have a .doc business plan template to download here

- StartUps.com – have four sample plans that you can access from Google Drive (note, this is a USA site so the examples are US-based, although the formats could still work for a UK business).

- Examples.com – 20+ example downloadable .pdf plans for different sectors.

Finally, how about a video on the subject? Quite a few examples on Youtube.

How about this one from Craig Frazier?

Further reading on business plans:

- Advice and the basic tips of writing a business plan

- A check list of what should be in your business plan

Related Topics

Leave a comment.

You must be logged in to post a comment.

Related Stories

Business Ideas & Planning

The best business ideas for 2024

From going solo as a private chef or graphic designer to launching a nursery or your own food growing enterprise, we’ve got a range of ideas for everyone

Lucy Wayment

How to start a dog walking business

For those who love pooches and want to set up a dog walking business, check out this guide to learn more about how to do it

Anna Jordan

A small business guide to self employment

Being self-employed means, you are captain of your own ship. But there are key decisions to make before you quit full-time employment, unless you want your ship to run aground

Best business ideas for 2024: Vehicle leasing host

Our cars spend 96% of their time sitting on a driveway, so being a vehicle leasing host could bring in plenty of passive income.

Dom Walbanke

Best business ideas for 2024: Third culture cuisine

Anyone with even a passing interest in the UK’s culinary scene will know that most food trends rise and fall as fast as a soufflé. But third culture cuisine looks set to stay in 2024.

Henry Williams

We are aware of scams coming from email and social media where people try to impersonate us. We will never ask you for money or your bank details. Learn more about what to look out for and how to protect yourself .

- Common Scams

- Business Plan Template

Step 1: Business Plan

What is a business plan.

A Business Plan is a written document that describes your core business objectives and how you plan to achieve them over a set period of time. It is designed to help you, and others, understand how you plan to generate money and make your business sustainable. A Business Plan often includes information about your goals, strategies, marketing and sales plans and financial forecasts. Read on below for more information about the key sections of a Business Plan.

Download your copy of the Business Plan template now. The document includes a Personal Survival Budget template and a Cash Flow Forecast template, which are also required for your application:

The guide is an annotated version of the Business Plan template with notes from our Business Advisers about what type of information, examples and evidence to include in order to help us understand you and your business. While we encourage you to use this Business Plan template, it is not mandatory and you are welcome to submit your own Business Plan template provided it details similar information.

Please note, the following documents should open on any device with a document viewer and editor but for the best user experience, we recommend editing this Business Plan template on a desktop.

Why is a Business Plan important?

There are many great reasons why it is worth your time creating a Business Plan – even if you’re not quite ready to apply for a Start Up Loan. Here are just seven:

A Business Plan:

- Provides a structured way of organising your thoughts and clarifying your idea.

- Helps you set out your goals and spot any potential problems in achieving these goals.

- Gives you a clear strategy to follow when things get busy.

- Is often essential for securing external finance for your business (and is required if you’re applying for a Start Up Loan).

- Allows you to measure your progress as you go along.

- Ensures all of your team are working towards the same vision.

- Helps you plan for the future.

Key sections of a Business Plan:

A Business Plan can include whatever information you feel is required to best convey how you are planning to make your business sustainable and, when it comes to applying for a Start Up Loan, the following are the core sections we require.

Your business and key objectives: A brief description of your business and its core products or services. This section also includes a clear and concise overview of the goals your business is trying to achieve over a set period of time. Sometimes these are broken down as short, mid and long-term goals, but it helps if they’re measurable (how will you know if you have achieved this?) and realistic (can you achieve this with the money, resources and time you have?).

If you are applying for a Start Up Loan, you will of course also need to detail how you intend to use the money if you’re successful. Our Loan Assessment team will want to see that the Start Up Loan will support your overall business objectives.

Your skills and experience: An overview of your experience as it relates to your business. If you’ve previously worked in a similar business, or have experience running another business, this will help provide confidence that you are in a good position to start up. Even if this is all brand new to you, think about any transferable skills you’ve developed, life experiences you’ve had or training you’ve completed that may be useful.

Your target customers, market and competition: A summary of key insights that demonstrate you have a strong understanding of your customers (and how to identify them), your market (and how to position yourself within it) and your competitors (and how to differentiate yourself from them on factors like price, quality, brand etc).

Your sales and marketing plans: This section is all about how you are planning to attract customers. You might include information about where you’ll distribute your products, what your branding and logo will be and what pricing you’ll apply. Additionally, you will need to demonstrate how you will spread the word about your product/services in order to generate demand, such as using social media, exhibiting at a trade conference or investing in online advertising.

Your operational plans: This will be different depending on your business model, but may include information on where you’ll trade (like a home office or external premises), the number of staff you’ll need to employ, what their roles will be and any equipment or tools you’ll need to run your business. You can also use this section to detail any processes that are important to your operations, as well as any industry, tax or legal regulations related to your business. It’s also good to think about any risks you may face, how you will overcome them and what you will do if things don’t go to plan.

Financials Many business plans include a financial section, which outlines how you’ll fund all of the activities you’ve outlined and what revenue you expect to generate. Because we ask you to complete a Cash Flow Forecast as part of your Start Up Loan application, we don’t require too much detail on this in your Business Plan. Rather, these two documents should be complementary.

Check out our Cash Flow Forecast guide and template >>

Writing a Business Plan – our top tips:

The tips below have been prepared by our Business Advisers and Loan Assessment team to help you understand some of the key things that will strengthen your application. For more in-depth advice, read our guidelines on how to write a Business Plan .

- Demonstrate that you understand your market and customer. For our Loan Assessment team to feel comfortable that your business plans are viable, they will want to see that there is a market who wants and needs your product/service, that you have thought about how you’ll set yourself apart from competitors and that you know how to attract your customers. Any market research you can do, like a simple online survey, looking up industry reports or interviews with potential customers will help.

- Use evidence and examples to back up any statements you make. It’s always more powerful when you can prove what you’re saying with hard facts, whether it’s with a strong statistic, a customer quote, examples of similar activity or other research. It doesn’t have to be detailed – sometimes it will be sufficient to include a link to further information – but it will help our loan assessment team feel more confident that your business plan is viable.

- Make sure everything ties together by linking every strategy to your core objectives. The purpose of a Business Plan is to show what your goals are and how you’re going to achieve them so remember to put your objectives at the heart of your plan. For example, if one of your goals is to generate 10 new sales per month, then in your marketing section you’ll need to think about how many sales each promotional channel needs to deliver in order to support this objective.

- Consider any risks you face and how you will overcome them. Every business has risks so don’t shy away from referencing these in your business plan. Demonstrating that you are aware of your key risks. Having a clear plan for how to reduce or overcome these is something that will set your business plan apart and give our loan assessment team confidence that you’re ready for the challenge.

- Be as clear and concise as possible and avoid waffle. Remember, we’re not looking to see every single detail about how your business will operate, rather we just need to know enough information to give us confidence that you have a clear plan in place. You might like to use bullet points, graphs, tables and subheadings to help you keep your content focused and help you avoid the temptation to go into too much detail.

- Presentation matters: proof read, review and format your document. As with most things in life, first impressions count. Use clear headings, structure your document in a clear order and check you’ve used consistent fonts throughout. Remember, you don’t have to be a writer or a designer to prepare a professional looking document. Most importantly, double check that you haven’t made any spelling or grammatical errors. It can be a good idea to have someone proof read your work for you once you’re finished to pick up anything you might have missed.

Learn new skills

Start Up Loans has partnered with the Open University to offer a range of free courses.

A Business Plan can include whatever information you feel is required to best convey how you are planning to make your business sustainable and, when it comes to applying for a Start Up Loan, the following are the core sections we require (our Business Plan template includes them).

Are you ready to kickstart your business?

- Jump to Accessibility

- Jump to Content

- Online Banking

- RBSIF FacFlow

- Resume lending

Business planning tips

On this page

Failing to plan is...well, you know the rest

To build a successful business, having a clear mission and specific goals is vital. The best way to do this is to write a thorough business plan setting out exactly how you're going to turn your dreams into reality.

Do's and don'ts when writing a plan

Do be realistic.

While it's important to show ambition, be realistic when projecting your results.

Do check for accuracy

It may be an old cliche, but you only get one chance to make a first impression. Make sure you triple check the accuracy of your content and ask a colleague or mentor to proof read it with a fresh pair of eyes.

Do your research

Make sure all research is up to date and accurate, and that any claims can be substantiated. You need to be aware of the good, the bad and the ugly!

Don't include your CV

Your business plan is about the company you intend to run, not ones you may have run in the past. A link to a completed LinkedIn profile will tell someone all they need to know about you.

Don't say you have no competition

There's always competition, the key is understanding your market and convincing your customers that your product is superior.

Don't start at the start

Start with an executive summary. This should be one page long and is your elevator pitch on paper.

6 steps to writing a business plan

Our in-depth six-step guide can help you put together a robust business plan and set you up for success or expansion.

Introduction

A business plan is a written description of your company, your aspirations and ambitions, and the methods by which you can achieve your goals.

Creating a business plan gives you a clearer understanding of what you need to do to reach your objectives. By producing a detailed business plan containing facts, figures, statistics and a summary of your skills, you will give potential investors all the information they need to buy in to your proposal.

Getting started

Once you've decided to write a business plan, the next step is deciding what needs to be included. And remember, your plan should be flexible.

An executive summary exists to summarise your ambitions and approach in a concise way. This is not always an easy task, but it's a good way to ensure you remain focussed on both the bigger picture and your core ambitions.

Your business summary should

- Describe your business - how you want it to grow, the niche you fill, why you think it can succeed

- Describe the sector it sits in - if the sector is strong, where will you fit? If it's performing poorly how will you buck the trend?

Product summary

It's worth giving your product or service a section of its own. Outline what makes it different from similar offerings and discuss the reasons that you will succeed.

Aims, objectives and audience

You should cover:

- Where do you want your idea to go and how are you going to get there?

- In a year's time what shape will your business be in?

- Will you have secured investment, or hired additional members of staff?

- Will you be able to cope if you fail to hit projected financial targets?

It's vital that all of these factors are assessed prior to launching or expanding a business. Research carried out by the Chartered Management Institute (CMI) has discovered that over half (54%) of all UK businesses that fail within the first three years of operation do so because of poor management.

Get to know your audience

You must have an understanding of your core demographic and how you are going to engage them. The more intelligence potential investors can get from reading the plan, the better.

Operations and organisation

It's good to have a solid concept, strong product and ambitious goals, but to grow a successful company, you will also need a detailed understanding of job roles, company structure and the day-to-day running of your operation.

This section of the plan is often the most detailed. Overlooking just one of the below areas could be extremely harmful when it comes to launching a company or seeking investment.

Areas to cover

- Location - where will you be based and why?

- Suppliers - who are they and what are the contract terms?

- Production - will anything be outsourced?

- Distribution - how will you deliver your product?

- Employees - how many do you need and what will they do?

Financial considerations

All aspects of your business plan are essential in their own right, but it's important to make sure the financial elements are accurate and in order.

Some entrepreneurs make the mistake of believing that because they are determined to succeed, they will be able to fund business growth by reinvesting the business' profits. However this rarely works, suppliers need to be paid prior to the customer getting their hands on the goods, meaning you will need some kind of initial investment or loan to cover supply costs.

- What kind of financing you need

- How much money you require

- Whether you are willing to give away equity in the business in return for funding

- When you will be able to pay back any loan you take out

How much, what for, and from where?

Always consider these three questions when planning your finances, and always be cautious in your answers.

Measuring success and risk

No business is guaranteed to succeed. Investors understand that handing any amount of money over to a startup is a risky decision, but it's important to reassure them. Highlight that you are aware of the risks, have plans in place to avoid pitfalls, and are willing to change course or adopt different methods should you need to.

Types of business risk

- Compliance - If you fall foul of laws and regulations, your business could fail before it has a chance to properly grow.

- Operational - Operational risk can come in many forms. It could relate to employee error or a water leak that damages equipment.

- Financial - Nearly all businesses will get into debt in their opening years, but it is how that debt is managed that is important.

- Reputational - Building customer confidence in your brand and rewarding them with a quality service is an essential ingredient for all businesses.

Need a little more help?

You can find additional information and a range of business plan templates and examples on the www.gov.uk website.

Get your business idea off the ground

From the start, you’ll need to think about your approach to running your business and what support you might need to make it happen.

Something else we can help you with?

Support centre, @natwestbusiness.

Branch locator

The Road Ahead

Our analysis of the major opportunities and challenges facing the voluntary sector in 2024. Learn more

Business plan template

Use this tool to help your organisation write your business plan

Share this page

Tell a colleague

- Share on Facebook

- Share on Twitter

This page was last reviewed for accuracy on 04 July 2022

Use our step-by-step guidance to help you complete this template.

All of the headings are a guide – you should change or rearrange them to suit your organisation.

Learn how to book strategy development support from NCVO

Sign up for emails

Get regular updates on NCVO's help, support and services

IMAGES

VIDEO

COMMENTS

Download free business plan templates and find help and advice on how to write your business plan. Business plan templates Download a free business plan template on The Prince's Trust website.

Business Plan Template from Startups.co.uk. Click here to download your free Business Plan template PDF - you can fill in your own details and those of your business, its target market, your customers, competitors and your vision for growth. Download PDF (240KB) Work through your business plan, step-by-step.

A business plan is essential for reaching financial success. Download our business plan template and use it to help you achieve your goals. Whether you're starting a business or planning to expand, having a business plan can help to get you on track and get some detail behind your ideas. However, research from Barclays shows that one in four ...

Our free business plan template includes seven key elements typically found in the traditional business plan format: 1. Executive summary. This is a one-page summary of your whole plan, typically written after the rest of the plan is completed. The description section of your executive summary will also cover your management team, business ...

Create a company description. Brainstorm your business goals. Describe your services or products. Conduct market research. Create financial plans. Bottom line. Show more. Every business starts ...

Business plans and templates | Enterprise | How we can help. First name. Last name. Email address. Subscribe. Ready to craft a winning business plan? Our expert guidance covers market research, strategy, start-up funding, competitor analysis, financial forecasts and more.

SWOT stands for strengths, weaknesses, opportunities and threats. This is a very important part of your business plan, because it helps you drill down into your idea. You usually format a SWOT analysis in a grid on one page - four squares, one for each section. Then you make notes in each square.

Download the business plan template. Fill in the form to get a free business plan template as an editable PDF. We'll send a one-pager and a multi-pager to choose from. Your email address. Location. United Kingdom. One page or multi-page template. Please choose an option.

There are seven steps to creating your plan, covering all the different aspects of your business and how they interact. While some of the information is optional, most of it can be useful. The more detailed and in-depth your Business Plan is, the more helpful it'll be. 1. State the industry your business operates in.

Most business plans cover the next 12-36 months and include the following: Outline the aims and goals for the business and how the business owner plans to achieve those goals. The background of the business. Introduce the business' management team. Set of sound financial projections including:

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow. A good business plan is much more than just a document that you write once and forget about. It's also a guide that helps you outline and achieve your goals. After completing your plan, you can ...

706 templates. Create a blank Business Plan. Beige Aesthetic Modern Business Plan A4 Document. Document by Rise & Roar Design. Green Professional Strategic Business Plan Executive Summary. Document by Antler. Startup Business Plan. Document by Maea Studio. Blue White Corporate Business Plan Cover Document.

3) Microsoft Word - Microsoft have a start-up business template which you can download. When you open it up in word it runs to 28 pages and is full of questions, advice and points to consider. Compared to The Princes Trust and Business Link plans it is a lot more text heavy and takes some reading. It is also a lot more focussed on the ...

A faster way to plan. LivePlan is the #1 planning tool for over 1 million businesses. Create your business plan. Download a free business plan template in Google Doc, Microsoft Word, and PDF formats. Includes expert guidance to help fill out each section.

Template for existing businesses: pdf existing business template. Financial planning spreadsheet for startup businesses: Excel financial plan template. These free business plan templates can help you quickly write a business plan. First, you can download the templates as Adobe PDF files to your computer. Then, you can click each of the template ...

A well-thought-out business plan will: set a direction for the business and help you create an action plan. help you and your staff focus on what's important. show your commitment to banks, investors, colleagues and employees. help you to spot problems early on and tackle them effectively. set targets and evaluate your success.

A comprehensive business plan is the best way to go about defining your business. Your plan should include: What your business will do. The products or services it will provide. How customers will access your products or services (eg in a shop, online or by phone) Your approach to pricing. Your long and short-term objectives - including a ...

Other Web Resources: Business Plan Templates. You can find examples of business plans for different types of businesses at: ACCA - the Association of Chartered Certified Accountants have 3 example business plans for three different business sectors: Cafe, Import Business, UK Ltd business seeking finance. Bplans - owned and operated by Palo ...

Step 1: Business Plan. A Business Plan is like a blue print for your business - it details all your goals and how you plan to achieve them. You will be required to submit a Business Plan with your final Start Up Loan application. Check out our Business Plan template below.

Download Simple Small-Business Plan Template. Word | PDF. This template walks you through each component of a small-business plan, including the company background, the introduction of the management team, market analysis, product or service offerings, a financial plan, and more. This template also comes with a built-in table of contents to ...

Key Features. Customised business workflows, OKR & budget templates, 10+ data views, automations, 37+ integrations

A business plan is a written description of your company, your aspirations and ambitions, and the methods by which you can achieve your goals. Creating a business plan gives you a clearer understanding of what you need to do to reach your objectives. By producing a detailed business plan containing facts, figures, statistics and a summary of ...

Tell a colleague. This page was last reviewed for accuracy on 04 July 2022. Use our step-by-step guidance to help you complete this template. All of the headings are a guide - you should change or rearrange them to suit your organisation.

1. Executive Summary. This is UK Export Finance's (UKEF's) 5‑year strategic plan. It sets out how UKEF will grow the impact it delivers for the UK public, looking out to 2029.