- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

Business Plan Section 8: Funding Request

These guidelines will help you prepare a funding request to present to a potential lender alongside your loan application.

We’ve talked before about the benefits of having a business plan for every business, but the truth is, most companies don’t put one together until they want to apply for funding, whether from a bank or investor. Sometimes, even if you don’t need a full business plan when applying for a loan, you will be asked for a funding request. You can also follow the guidelines below to prepare a stand-alone proposal to present to a potential lender with your application.

If the purpose of your business plan is NOT to get funding, feel free to skip this section.

As we’ve said before about writing a business plan, it’s important to keep your audience in mind. You can certainly prepare different versions of your funding request depending on whether you’re applying for a loan or approaching an investor. The terms of each would be different, and you might be looking for different amounts of money or types of funding, especially if you’re approaching several potential partners.

Be clear about whom you’re directing the request to, and think about the questions they might have and what they would want to see. Make sure you’ve done your homework regarding the costs involved with your plans. This is where the financial section of your plan will work hand in hand with this one. Be consistent with your numbers, and ask for enough to cover your needs fully so you don’t fall short and remain unable to complete your goals. At the same time, don’t ask for more than you need.

What to Include in Your Funding Request

1. a summary of the business.

If the request is part of your business plan, you will have already put together all the information found in a business summary. If you’re creating a funding request as a stand-alone document, explain what the company is, where you’re located, what you sell or what services you offer, and who your customers are. Mention whether you’re incorporated, and if so, what type of corporation it is, along with who the owners and key staff members are. Briefly list your business successes and accomplishment thus far.

2. How much money you’re requesting

How much cash are you looking for now, and if you anticipate this being the first part of an ongoing growth plan, how much more money do you plan to request over time? What would the specific timeline look like? The Small Business Administration suggests thinking as far as five years down the road when putting your funding request together. Also spell out what type of funding you’re looking for, whether a loan or investment, and the terms you’re asking for. (As we suggested above, you can put together different versions of the request for different types of funding.)

3. What you will use the money for

Do you need some extra funds for working capital to buy more inventory? Are you paying off a high-interest loan? Buying a building, new equipment, or another company? Expanding your advertising campaign, or hiring more staff? Whatever it is, explain how much each aspect will cost.

4. Financial information

This will be the heart of the financial information section of your business plan , but you need to include it here if you’re putting together a stand-alone funding request.

You’ll need historical data on the company (if it’s an established business), like income statements, balance sheets, and cash flow statements for the last three to five years. If the funding request is for a loan that requires collateral, document what you have to offer. If you’ve invested your own money in the company or there are other investors, state that along with how much.

Offer realistic projections for the future, and explain how this new funding would help you reach those goals. Prepare yearly forecasts for income, balance sheets, cash flow and capital expenditure budgets for the next five years. Be even more specific for the first year, with projections for each month or quarter.

You also need to cover how you plan to pay off the debt, or what kind of return on investment you can offer a potential investor. Potential funders will pay particular attention to this, wanting to maximize their gains and minimize their risk as much as possible. If the plan is targeted to investors, what would their exit plan be? Can they cash out in a specific number of years? Do you plan to go public and offer stock?

Finally, address anything that might affect your ability to repay, whether positively or negatively, such as being acquired, buying out another business, relocating, etc.

Getting money to fund your business may very well be the point of creating your entire business plan, so take the time to carefully prepare your funding request, making sure to include all the information a decision-maker will need.

Financial Strategies for Your Funding Request

When it comes to your finances, you want clear guidance and easy-to-implement tools based on your unique needs. Visit Learn with AOF to get started strengthening your financial management and meeting your goals.

Experience a different kind of financial education. Learn with AOF has flexible, on-demand courses developed by small business owners, for small business owners. Learn on your schedule, with no time commitment or limit. Save your progress any time to fit courses into your busy schedule.

Learn More with Financial Education

When it comes to your finances, you want clear guidance and easy to implement tools based on your unique needs. Visit Learn with AOF to get started strengthening your financial management and meeting your goals.

Experience a different kind of financial education. Learn with AOF has flexible, on-demand courses developed by small business owners, for small business owners. Learn on your schedule, with no time commitment or limit. Save your progress any time to fit courses into your busy schedule.

NEXT ARTICLE > BUSINESS PLAN SECTION 9: APPENDIX

Apply for a loan, get started.

Loans from $5,000 - $100,000 with transparent terms and no prepayment penalty. Tell us a little about yourself, your business and receive your quote in minutes without impacting your credit score.

Thanks for applying!

Loans are originated and funded through our lending arm, Accion Opportunity Fund Community Development. By clicking “Continue to Application,” you consent to, Accion Opportunity Fund Community Development’s Terms of Use and Privacy Policy ; and to receive emails, calls and texts , potentially for marketing purposes, including autodialed or pre-recorded calls. You may opt out of receiving certain communications as provided in our Privacy Policy .

Trending Courses

Course Categories

Certification Programs

Free Courses

Private Equity Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

ALL COURSES @ADDITIONAL 50% OFF

Funding Request

Last Updated :

Blog Author :

Aswathi Jayachandran

Edited by :

Shreya Bansal

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

AI Research Assist Your go-to AI-powered research assistant

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Plan Writing & Consulting We create a business plan for you

Business Plan Review Get constructive feedback on your plan

Financial Forecasting We create financial projections for you

SBA Lending Assistance We help secure SBA loans for your business

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Customer Success Stories Read our customer success stories

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Write the Funding Request for Your Business Plan?

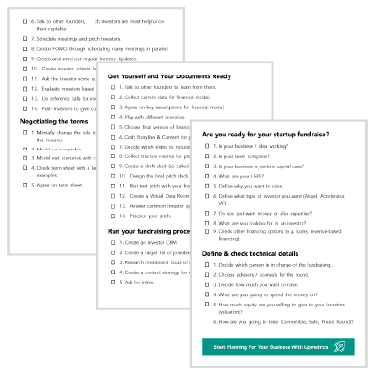

Startup Fundraising Checklist

- May 7, 2024

Funding requests are one aspect where the “under promise and over deliver” phenomenon might not work.

Set your business valuation too high, and investors might not invest. In contrast, value it too low, and you might end up receiving way less than what you’re truly worth.

Moreover, if I were to invest in your business, I would want to know why you are raising funds and how they will be used.

In short, a well-planned funding request with the purpose of fund-raise and a realistic ask is key to securing funds. You cannot mess up.

Need help writing the funding request for your business plan ? Here’s our quick guide on writing a compelling and realistic funding request to ensure you don’t miss out.

Let’s dive right in.

What is the funding request?

The funding request section of a business plan is an official section for the organizations to ask for new funding. It outlines the amount of funding needed, the purpose of the funds, how they will be used, and in what timeline they will be used (generally for 5 years).

The main goal of a funding request is to secure the necessary capital to start or expand a business, fund a project, or achieve a specific objective.

How to write your business plan funding request

How you write your funding request heavily depends on why you’re raising funds—the purpose. So, before you start writing, be clear about your requirements and the purpose of fundraising.

Your purpose can be hiring new staff, getting the latest equipment, launching a new product, or starting or expanding a business.

Once you do that, you may start working on your funding request; follow these steps:

1. Provide business information

Start by providing a brief overview of your business. I know—you’ve already included all the information in the prior sections, but adding it here would be an opportunity for you to give your investors a little recap.

No, it does not get redundant—It doesn’t have to be. So don’t worry.

Moreover, sometimes, you only need to send the funding request, not the entire business plan. In such cases, such information makes sense and comes in handy.

So, here’s what you will have to explain in the funding request section of your business plan:

- Target Market

- Your business structure like LTD, LLC, or more

- Brief about your product/service

- Partners involved

- Business heir, if there exists.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

2. Present the current financial situation

You might have provided some financial information in the financial section. But, you have to add some figures here anyway. Not only will it be contextual but easier to have a clear picture in one place.

Here are some financial details that you will have to include in this section:

- Quarterly as well as yearly cash inflow and outflow

- Balance sheets

- P&L statement

- Expected financial condition in the upcoming quarter and year

- Include the list of assets and their ownership details if you are asking loan from the bank or applying for any grant

- Break-even point

- If your business is in debt, explain the situation in detail and brief plan for paying it

- Mention how much return on investment can they expect

- In the end, mention how will you pay off the loan or transfer the ownership of the business

3. Announce how much funds you need

When you explain the situation in brief and have all the facts and figures put aside, narrow it down to your requirements. Mention how much money you need.

For that, you will need to calculate your startup costs or the total costs of the activity for which you need funding.

Finally, justify your funding request by explaining how the investment will benefit your organization and contribute to its growth and success.

4. Discuss how you will use the money

Here, you have to narrow down what you need the money for and how you are going to use it. Just list down the details and put the figure for it—so much like how you do your billing. If you are taking the money for multiple things, highlight every detail.

Some examples of various areas where you might use the funding are:

- Product development

- Marketing and advertising

- Operational expenses

- Technological integration

5. Explain current and future financial planning

You must have explained a little about the inflow and outflow in the financial section of a business plan . But over here, you have to get into the details like:

- If you are getting a loan, outline your timelines for payments.

- If you are looking forward to selling, mention how it will affect the investors.

- And then, finally, mention the exit strategy. Your exit strategy includes how you will transfer the business ownership.

Key points to remember

As we now know what to include in the funding request, let’s see certain points that you need to keep in mind while writing it:

Target audience’s perspective . Applying for a loan is different from approaching an investor. Each of these situations involves different contract terms, types of funding, or amounts of money.

Clarity . Clearly explain with numbers how much funding is required, why you need it, and where you will use it. Also, keep your language for funding requests simple so that everyone can understand.

Realistic financial projections . Provide realistic financial projections so investors can feel confident about your business and trust you with an investment.

Call-to-action . Include a clear call-to-action that encourages investors to take the next steps, whether that’s scheduling a meeting or making an investment.

These may seem like simple tips, but they can help you write a strong funding request that gets investors interested in your business.

As a wrap-up, writing a compelling funding request requires a strategic approach and attention to detail. So, being carefully and include realistic projections.

If you are still confused about writing a funding request, you can leverage business planning software and make your business plan investment-ready.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

Do i need a business plan to get funding.

Yes, a business plan is necessary for securing funding for a business. It allows investors and lenders to grasp the company’s vision and mission. A well-thought-out business plan increases your chances of securing funding.

How do I determine the amount of funding to request?

To determine the amount of funding, you will need to assess your organization’s startup costs, forecast cash flow, and consider growth plans.

Taking the help of an AI business plan generator or a financial advisor can help you determine a realistic funding amount based on your business’s needs and goals.

Do I need financial projections in my funding request?

Yes, including financial projections in a funding request is important. It provides potential investors or lenders with a clearer understanding of your finances. Usually, you should add a crux of your finances for at least three years.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Get started with Upmetrics Al

- 400+ sample business plans

- Al-powered financial planning

- Collaborative workspace

Reach Your Goals with Accurate Planning

How to Write a Funding Request

- Fundrising Ready

- MAC & PC Compatible

- Immediate Download

Related Blogs

- How to Get Angel Investment for Your Business

- Invest in Accounting Software and Enjoy the Benefits

- Crafting an Effective Business Plan for Franchises

- Creating a budget that will help you achieve success

- Key Considerations for Starting a Business

Writing a funding request can be a pivotal step in securing the financial support your project needs. Understanding the key elements, such as a clear overview of your initiative, a detailed budget breakdown , and a compelling narrative, is essential to capture the attention of potential funders. With the right approach, you can effectively communicate your vision and demonstrate the impact of your work, increasing your chances of success.

What is a funding request and why is it important?

Definition of a funding request.

A funding request is a formal proposal that outlines the financial needs of a project or organization, seeking financial support from potential funders. It serves as a detailed document that explains the purpose of the funding, the intended use of the funds, and how the project aligns with the funder’s goals. The request can take various forms, such as a funding request letter, grant proposal, or funding proposal template, each tailored to meet specific requirements.

Purpose of a funding request in various contexts

The purpose of a funding request varies depending on the context in which it is presented. In nonprofit organizations, a funding request is often aimed at securing grants from foundations or government entities to support community initiatives. For startups, it may be a means to attract private investors to fund innovative projects. Regardless of the scenario, the funding request is crucial as it:

- Clearly articulates the project's vision and objectives.

- Demonstrates the potential impact of the project on the community or industry.

- Provides a transparent financial plan, showcasing how funds will be allocated effectively.

Importance of clarity and purpose to potential funders

Clarity and purpose are paramount in any funding request. Funders receive numerous proposals and are often pressed for time, making it essential for your request to stand out. A well-structured funding proposal will:

- Present a clear and compelling narrative that captures the funder's attention.

- Detail the specific financial needs and how they relate to the project's goals.

- Align the project’s objectives with the funder’s mission, showing a shared vision.

In this context, writing a funding proposal that is straightforward and free of jargon will enhance the likelihood of securing support. By ensuring that your funding request is both clear in its intentions and comprehensive in its details, you will significantly improve your chances of success.

- Always tailor your funding request to the specific interests and guidelines of the potential funder.

- Use a straightforward language that avoids jargon, making your proposal accessible to a broader audience.

- Highlight the unique aspects of your project that align with the funder's priorities and values.

Who is the target audience for your funding request?

Identifying potential funders.

When embarking on the journey of writing a funding request, the first step is to identify your potential funders. Funders can be categorized into several types:

- Foundations: These may include private, corporate, or community foundations that provide financial support for various initiatives.

- Government agencies: Local, state, and federal government entities often offer grants and funding opportunities for projects that align with their priorities.

- Private investors: Individuals or organizations looking to invest in innovative projects that demonstrate potential for return on investment.

Understanding who your funding sources are is crucial, as it sets the stage for crafting a tailored funding request that resonates with their specific goals and interests.

Understanding the interests and motivations of your audience

Each potential funder has unique interests that drive their funding decisions. To effectively engage them, you must delve into their motivations:

- Mission alignment: Ensure your project aligns with the funder's mission and vision. Research their previous funding initiatives to identify common themes.

- Impact focus: Many funders prioritize projects that demonstrate significant social, economic, or environmental impact. Articulate how your project meets these criteria.

- Return on investment: For private investors, outline how their investment will yield financial returns or other benefits.

By gaining insight into the interests of your funding audience, you can better position your project to meet their expectations and persuade them of its value.

Tailoring the request to meet the expectations of different funders

Once you have identified your target funders and understood their motivations, the next step is to tailor your funding request accordingly. This involves adapting your approach based on the type of funder:

- Grant applications: For foundations and government agencies, use a formal grant request format that includes clear objectives, a detailed budget breakdown, and measurable outcomes.

- Investor pitches: When approaching private investors, focus on the potential for financial returns. Use persuasive language and highlight the scalability of your project.

- Personalization: Always address funders by their name and reference their previous funding activities or interests to create a personal connection.

- Consider creating a funding proposal template that can be customized for different funders, saving time while ensuring relevance.

- Utilize insights from the funding application process to refine your request over time, learning what resonates with funders.

Tailoring your funding request not only demonstrates your commitment to the funder's goals but also increases the likelihood of securing the necessary project funding.

What key elements should be included in a funding request?

Overview of the project or initiative.

When crafting a funding request, it is crucial to begin with a comprehensive overview of the project or initiative . This section serves as the foundation for your funding proposal, providing potential funders with a clear understanding of what you are attempting to achieve. Your overview should encompass:

- A concise description of the project’s objectives and goals.

- The specific problem or need that the project addresses.

- The target audience or beneficiaries of the project.

- How the project aligns with the funder’s mission and interests.

By succinctly presenting this information, you can effectively engage funders and encourage them to delve deeper into your proposal.

Detailed budget breakdown and financial needs

The budget breakdown is one of the most critical components of your funding request. It provides a transparent view of your financial needs and demonstrates your project's viability. Here are key elements to include:

- A complete itemization of costs, including direct and indirect expenses.

- Justification for each budget item, explaining why it is necessary for the project’s success.

- Sources of funding already secured, if applicable, to showcase fiscal responsibility.

- Projected revenue streams, if relevant, to illustrate the project's sustainability.

Moreover, presenting your budget in a clear format enhances readability. Consider using a funding proposal template to maintain organization and clarity.

Timeline for project execution and milestones

Alongside the budget, a detailed timeline for project execution is essential. This timeline should outline the expected duration of the project and the key milestones that will be achieved along the way. Key components to consider include:

- The start and end date of the project.

- Specific milestones and deliverables, including their respective deadlines.

- Metrics for measuring progress and success at each stage.

This structured approach not only shows your planning capabilities but also reassures funders that you have a clear path to achieving your project goals. A well-defined timeline can significantly enhance your funding request, illustrating your commitment to effective project management.

- Ensure that your overview, budget, and timeline are interconnected. Each element should support and enhance the others for a cohesive funding request.

- Utilize visuals, such as charts and graphs, within your budget and timeline sections to make complex information more digestible.

How can you present your project effectively?

Crafting a compelling narrative to engage the reader.

When writing a funding request, it is essential to tell a story that captivates the reader. A compelling narrative helps funders understand not just what your project is about, but also why it matters. This emotional connection can significantly enhance the likelihood of securing the necessary funding. Consider the following elements when crafting your narrative:

- Start with a hook: Begin with a powerful statement or a personal anecdote that illustrates the problem your project aims to address.

- Define the problem: Clearly articulate the issue at hand, providing context and highlighting its urgency.

- Present your solution: Describe your project as a solution to the problem, outlining your objectives and the impact you anticipate.

- Include testimonials: If applicable, share quotes or stories from beneficiaries or stakeholders that reinforce the need for your project.

- Use vivid language and emotional appeals to create a connection with the reader, making your funding request more memorable.

Using data and evidence to support claims

While storytelling is vital, backing your narrative with solid data and evidence is equally important. This combination of qualitative and quantitative information adds credibility to your funding request. Here are some effective strategies to incorporate data:

- Statistics: Include relevant statistics that highlight the scope of the problem and the potential impact of your solution.

- Research findings: Reference studies or reports that support your project’s approach, demonstrating that it is grounded in proven methodologies.

- Case studies: Provide examples of similar projects that have successfully achieved their goals, showcasing the effectiveness of your proposed solution.

- Visual aids: Utilize charts, graphs, and infographics to present data in an easily digestible format, enhancing the overall appeal of your funding proposal.

- Ensure that your data is up-to-date and relevant, as outdated information can undermine your credibility.

Highlighting the impact and benefits of the project

In your funding request, it is crucial to not only outline what your project will do but also to emphasize its potential impact and benefits. Funders are often interested in how their investment will create positive change. To effectively highlight these aspects:

- Define success: Clearly articulate what success looks like for your project. Use measurable outcomes to illustrate how you will assess impact.

- Broader benefits: Discuss how your project will benefit not only the immediate target group but also the wider community or sector.

- Long-term vision: Share your long-term goals and how the project aligns with broader trends or needs, demonstrating foresight and sustainability.

- Engage funders: Make it clear how their support will play a crucial role in bringing about this change, fostering a sense of partnership.

- Consider using a dedicated section in your funding proposal to highlight impact, making it easy for reviewers to find this crucial information.

What common mistakes should be avoided in a funding request?

Overcomplicating the language or using jargon.

One of the most significant pitfalls in writing a funding request is the tendency to overcomplicate the language. Funders are often busy individuals who may not have the time or inclination to decipher convoluted terms or technical jargon. Using clear and concise language is essential to ensure your message is understood.

To avoid this mistake, focus on articulating your ideas in plain language. This will not only make your funding request more accessible but also help engage the reader more effectively.

- Use simple language and direct sentences to convey your message effectively.

- Define any necessary technical terms in straightforward terms.

Failing to follow the funder's guidelines and requirements

Each funding source typically has its own set of guidelines and requirements for proposals. Ignoring these can lead to automatic disqualification of your funding request. It is crucial to meticulously review the funding guidelines provided by the potential funder and tailor your proposal accordingly.

Make sure to adhere to specifics such as:

- Formatting requirements (grant request format).

- Page limits and font sizes.

- Required documentation and supplementary materials.

Following these instructions demonstrates your attention to detail and respect for the funder's process, increasing the chance of your project funding request being favorably considered.

- Create a checklist based on the funder's requirements to ensure you meet every guideline.

- Double-check your proposal against the guidelines before submission to avoid any oversights.

Lack of clarity or specificity in financial needs

Another common mistake in funding requests is a lack of clarity regarding financial needs. Funders want to know precisely how much funding you are requesting and how you plan to allocate these funds. Vague statements about needing 'some money for the project' do not instill confidence in your ability to manage funds effectively.

To strengthen your proposal, include a detailed budget breakdown that outlines:

- Specific amounts required for each aspect of the project.

- Justifications for each expense, linking them directly to project goals.

- A timeline for when the funds will be needed.

Providing a comprehensive financial needs assessment not only clarifies your request but also demonstrates your capability in planning and executing the proposed project.

- Utilize a funding proposal template to ensure all financial aspects are covered.

- Be transparent about potential risks and how you plan to mitigate them, enhancing funder confidence.

How can you strengthen your funding request with additional materials?

Importance of including a cover letter.

A well-crafted cover letter is a critical component of your funding request. It serves as the first impression you make on potential funders and can set the tone for the entire proposal. The cover letter should succinctly summarize your project, outline your funding needs, and express your enthusiasm for the opportunity to partner with the funder. It’s essential to personalize the cover letter by addressing it to the specific individual or organization to whom you are submitting the funding request.

- Keep the cover letter concise—ideally one page.

- Highlight the most compelling aspects of your project.

- Make a direct connection between your project and the funder’s goals or interests.

Providing Supplementary Documents

Supplementary documents can greatly enhance your funding request by providing additional context and credibility. These documents may include:

- Resumes of key team members: Highlight the qualifications and relevant experience of your project team to demonstrate their capability to execute the project successfully.

- Letters of support: Obtain endorsements from reputable individuals or organizations that can vouch for your project's significance and your team's competence.

- Data and research findings: Include relevant studies or statistics that support your project’s need and potential impact.

- Always check the funder’s guidelines for specific requirements regarding supplementary documents.

Utilizing Visuals to Enhance Understanding

Visual elements can significantly strengthen your funding request by making complex information more accessible and engaging. Charts, graphs, and infographics can effectively illustrate your project’s objectives, budget breakdown, and anticipated outcomes. Consider the following tips for incorporating visuals:

- Choose visuals wisely: Select visuals that clearly convey key data or concepts relevant to your funding proposal.

- Maintain clarity: Ensure that all visuals are easy to read and understand, with appropriate labels and legends.

- Integrate visuals seamlessly: Place visuals strategically within your funding request to complement the narrative rather than distract from it.

- Use high-quality images and graphics to maintain a professional appearance.

What follow-up actions are necessary after submitting a funding request?

Establishing timelines for follow-up communication.

After submitting your funding request, it is crucial to establish a clear timeline for follow-up communication. This helps you stay organized and demonstrates professionalism to potential funders. Here are some key steps to consider:

- Review the funder's guidelines for any specified response times.

- Set a reminder to follow up approximately two to four weeks after submission.

- Be prepared to adjust your timeline based on the complexity and size of the funding source.

Preparing for potential questions or requests for additional information

Once your funding request is submitted, you may receive inquiries from funders seeking clarification or additional information. Being well-prepared can significantly enhance your chances of success. Here are some tips:

- Anticipate common questions that funders may have, such as those related to your budget or project timeline.

- Have supplementary documents, such as a financial needs assessment or resumes of key project personnel, readily available.

- Respond promptly and thoroughly to any requests for additional information to maintain the funder's interest.

Maintaining a relationship with funders regardless of the outcome

Regardless of whether your funding request is approved or denied, it is essential to maintain a positive relationship with potential funders. This can open doors for future opportunities and collaborations. Consider the following strategies:

- Send a thank-you note expressing appreciation for their time and consideration, even if your request was not successful.

- Ask for feedback on your funding request to improve future proposals.

- Keep funders updated on your project's progress and any achievements, fostering a long-term relationship.

- Be proactive in your follow-up communications and show genuine interest in the funder's feedback.

In summary, effective follow-up actions after submitting a funding request can significantly influence the outcome of your proposal. Establishing clear timelines, preparing for inquiries, and nurturing relationships with funders are all vital components of the funding application process. By implementing these strategies, you can enhance your chances of success in future funding endeavors.

- Choosing a selection results in a full page refresh.

IMAGES

VIDEO

COMMENTS

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan.

Learn how to prepare a funding request for your business plan, whether for a loan or an investor. Find out what to include, how to present it, and what financial information to provide.

A successful funding request not only presents a detailed business plan and financial projections but also highlights a compelling vision for the future and the potential impact of the investment. Funding Request Explained. A funding request is a formal proposal to obtain financial resources from an investor or lender to support a business.

The funding request section of a business plan is an official section for the organizations to ask for new funding. It outlines the amount of funding needed, the purpose of the funds, how they will be used, and in what timeline they will be used (generally for 5 years).

Key Takeaways. Purpose of a Funding Request Letter: Communicate your business needs and justify the use of funds.; Crucial Elements: Include a compelling introduction, detailed financial needs, clear repayment or return plans, and confidence in the business's potential.; Three Templates: Cover different scenarios, including a traditional bank loan request, a private investor appeal, and a ...

Funding request. If you're asking for funding, this is where you'll outline your funding requirements. Your goal is to clearly explain how much funding you'll need over the next five years and what you'll use it for. ... Example lean business plan. Before you write your business plan, read this example business plan written by a fictional ...

Sample LOI . Request for Proposal (RFP) A request for proposal or RFP is a document that solicits a proposal often through a bidding process. An organization will openly proclaim that funding is available for a specific program or project and interested companies can place bids or in the case of a grant, apply for the project or funding. How to ...

Again, if you already have written a business plan, then this funding request section is already done. Funding Request Example 5 - Solicitations for Donations Whether yours is a nonprofit organization seeking donations, or a for-profit business looking to get crowdfunding, there is an art and a science behind asking for a donation from people ...

Writing a Funding Request 1. Business Summary. A business summary is only required in cases when a funding request is being created as a standalone document. The name and nature of the company, location, owners, product or service offered, target audiences, etc., must be included. In cases of established companies, past achievements can be ...

Writing a funding request can be a pivotal step in securing the financial support your project needs. Understanding the key elements, such as a clear overview of your initiative, a detailed budget breakdown, and a compelling narrative, is essential to capture the attention of potential funders.With the right approach, you can effectively communicate your vision and demonstrate the impact of ...