Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Corporate Development Recruiting: The Definitive Guide

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

- A lot of confused questions and contradictory answers.

- Disagreements about what to expect in interviews, case studies, and even the process itself.

- And debates about exit opportunities and how they compare with the ones offered by investment banking.

We’ve published quite a few interviews from readers who broke into corporate development from all backgrounds: straight out of undergrad , Master’s in Finance degrees , consulting , investment banking , corporate finance , valuation , and yes, even data science .

This article will summarize the key points from those stories and give you an idea of what to expect in the recruiting process – no matter your background and the types of companies you’re applying to:

Corporate Development Definition: What Is It?

Corporate development teams at companies focus on acquisitions and divestitures, including deal sourcing and execution, as well as on joint venture (JV) deals and partnerships.

They also spend time doing competitive research, creating “market maps” of companies in different sectors, and determining which markets their companies should enter.

Much of it is similar to the work you do on buy-side M&A deals at an investment bank , but the key difference is that you work at one single company and contribute to that company’s growth over the long term.

You do not represent clients, but instead complete acquisitions and other deals that help your company grow.

Also, you may spend more time on integration following the close of deals, though that varies by firm and team.

Many other groups have “corporate” or “development” in their names, so here’s a full comparison:

- Business Development: You focus on sales, marketing, and partnerships rather than M&A. The goal is to boost the company’s growth via organic means.

- Corporate Strategy : This is like management consulting, but internal to the company. You plan the company’s big-picture strategy, solve specific operational problems, and complete competitive analysis.

- Corporate Finance : You plan the company’s budget, work with auditors, complete monthly reports, and manage cash and cash flow. This role is more about day-to-day and month-to-month tasks and has nothing to do with JV or M&A deals.

- Corporate Banking : This one is completely different because it only exists at banks. Corporate bankers are like the “hub in the wheel” for clients who need to access the bank’s products and services, and they provide credit, cash management, trade finance, liquidity management, and other services.

If you are in corporate development at a large company (e.g., a Fortune 100 firm), then you will focus on M&A deals and you won’t need to do much sourcing since you’ll get so much deal flow from bankers and other parties.

If you’re at a smaller company or a startup, the role will often be more “random,” and you’ll spend more time on sourcing and tasks that might fall under the business development or corporate strategy categories at larger firms.

Why Corporate Development?

Corporate development is a good option if:

- You want to work on transactions, primarily M&A deals and joint ventures;

- You don’t mind the fact that, as in PE and other buy-side roles, most of the deals will go nowhere;

- You want to stick with one company over the long term and help it grow;

- You want a better lifestyle and hours than you would get in investment banking or private equity; and

- You don’t mind significantly lower compensation and slower advancement.

Obviously, you should not mention points #2, #4, or #5 in response to the “Why corporate development?” question in interviews – you should focus on #1 and #3.

Corporate Development Recruiting: Who Wins Interviews and Offers?

Corporate development (CD) teams want candidates who:

- Have deal experience working on joint ventures, acquisitions, and other deals;

- Know the industry and the specific company in-depth so they can come up with meaningful ideas; and

- Can run deals by themselves.

In practice, this means that CD teams prefer to hire investment bankers who have worked in matching industry groups .

They do also hire consultants, especially for roles that are less M&A-focused, as well as professionals from strategy teams and Big 4 valuation and transaction advisory teams.

Unlike many private equity and hedge fund roles, corporate development is open to more than just elite boutique and bulge bracket bankers .

You could easily work at a boutique or middle market firm and still get into corporate development; in fact, that’s often one of the top exit opportunities from such banks .

Another difference is that it’s more feasible for post-MBA bankers and consultants to get in – the “exit opportunity window” doesn’t close as much as it does for PE/HF roles .

You could also potentially get into corporate development coming from a job in private equity, such as Private Equity Analyst .

You do not have a great shot at corporate development roles if you’ve worked in a “public markets” group/firm like equity research or asset management since you won’t have deal experience.

Corporate development teams sometimes hire internal candidates, such as ones who are in corporate finance rotational or data science roles .

These candidates often know the industry and company well, but lack formal deal experience – but since they’re internal hires, that may not be a deal breaker.

It is very rare for students to get into corporate development straight out of undergrad .

It’s even rarer than winning a PE or HF role out of undergrad – with those, some firms increasingly recruit undergrads who want to skip banking.

But in corporate development recruiting, teams rarely do this because professionals need more of a “real-world” skill set, including the ability to wrangle information out of bureaucratic organizations and win agreement from different departments.

By contrast, you could do well at a hedge fund if you can sit in a room, do a ton of research and analysis, and come up with insights.

If you want to start in corporate development, you should target smaller, higher-growth firms, such as startups with a few hundred people (but not, say, a few thousand).

These types of companies sometimes hire recent grads for their “fresh mindsets” and unbiased views, and they might view internships as providing sufficient industry knowledge.

Finally, keep in mind that there are far fewer corporate development jobs than there are IB/PE/HF jobs.

To have a corporate development division, the company must already be fairly large – 10-person startups don’t have teams dedicated to M&A.

So, while a wider variety of candidates have access to corporate development recruiting, it can be challenging to find positions or companies that are hiring.

The Corporate Development Recruiting Process

If the private equity recruiting process in North America is early, highly structured, and driven by headhunters, then corporate development recruiting is more like off-cycle private equity recruiting :

- The timing is very random, and firms do not fill roles 1-2 years in advance as PE firms do. There might be a lead time of several months.

- Initial interviews often come from referrals and your own networking rather than headhunters.

- There is some structure, but nothing like PE interviews where all the big firms send modeling tests to candidates, interview them, and make decisions in a single weekend.

Headhunters have less power than they do in PE recruiting because large companies have plenty of ways to find candidates on their own; it’s easy when you can ask 10,000 employees for recommendations.

Some PE-owned companies may still use headhunters if they need to hire someone ASAP, but most CD teams skip headhunters and rely on referrals and internal candidates.

If you win a referral to a CD team that is hiring, you’ll usually go through a phone screen, complete a few phone interviews, and then meet everyone in the group for in-person interviews.

If it’s a bigger company with over a dozen people in the group, then you may not meet everyone – just those with hiring power.

If you’re in investment banking or consulting right now and you want to move into corporate development, you should start by asking for referrals from the senior staff in your group – assuming it’s the type of culture where junior employees are expected to leave after 2-3 years.

Keep your requests open-ended because your MD probably can’t help if you want “corporate development roles at fin-tech companies in the crowdfunding space in London with over 1,000 employees.”

Again, it’s the opposite of how you deal with PE/HF headhunters , where specificity is key.

If you cannot win referrals from the senior staff, then the next best option is to find companies that have posted corporate development positions on job sites.

Then, look up those companies on LinkedIn, find professionals in the CD team, and email them to introduce yourself and ask about opportunities at the firm.

Because of the relative scarcity of CD roles, you should not be too picky.

Yes, you should go for companies that match your current industry, but you don’t want to be as specific as the example above.

Corporate Development Interview Questions and Answers

The main interview topics in corporate development recruiting include:

- Your deal experience.

- Technical questions similar to the ones in IB interviews.

- “Fit” questions similar to the ones in IB interviews.

- “Why corporate development?” and similar questions about the job.

- Industry knowledge and ideas for acquisitions and JVs.

- Case studies and modeling tests.

The questions vary significantly because CD professionals have very different backgrounds, and so do the candidates.

For example, a single team could have former bankers, former Big 4 professionals, a former software engineer or biochemist, a former data scientist, and a former integration consultant.

Each person has different concerns and looks for different qualities.

In many teams, the most important qualities are industry background and fit – especially if it is something specialized or technical, such as pharmaceuticals or biotech.

You would have a huge advantage at that type of company if, in addition to deal experience, you also knew about the drug lifecycle, the government approval process, clinical trials, the business models of generics vs. branded drugs, and so on.

If the company is in an unusual location (e.g., far outside major cities or in an emerging market), then local connections to the area can be quite important because they want to see that you’re committed for the long term.

Here’s what to expect in each question category above:

Your Deal Experience

We covered the key points about your deal experience in the article on investment banking deal sheets , and everything there applies to corporate development recruiting as well.

The main differences are:

- You must be much more critical about each deal because corporate development is, effectively, a buy-side role. So, in addition to your key contributions and the transaction rationale, you should develop your own view of each deal as well (i.e., should the buyer have done it or not done it, and why).

There’s a good example of how to do that in this article on middle-market private equity recruiting .

- If you do not have M&A deal experience, you must spin whatever you do have into sounding like deal experience. For example, if you held a corporate finance role before this, you could point out how a major project required collaboration across the entire company, which is similar to deal processes since you need to coordinate large groups in both.

There’s an example of this strategy in the data science to corporate development article .

You’re most likely to get a lot of questions in this category if you’ve had 2+ years of experience working on deals.

Technical Questions

You should take a look at the article on investment banking interview questions and answers because all the technical questions there apply here as well.

Unlike in corporate finance, where questions beyond accounting are unlikely, anything could come up in corporate development recruiting since you value companies and model transactions.

Even LBO models are fair game because you’ll often compete with financial sponsors to win deals, so you need to understand how they think about potential targets’ values as well. If you don’t already know how they work, check out our simple LBO model tutorial.

“Fit” Questions

In corporate development recruiting, these should be quite similar to the fit questions in investment banking interviews , so refer to that previous article.

The main difference is that CD professionals are less likely to play “bad cop” and probe you on points that might be deal breakers in IB – such as being too old, not going to a target school, or having a GPA that’s below their cutoff.

Those topics could come up, but interviewers are not going to spend 30 minutes grilling you about a bad grade in a 1 st year accounting class, whereas a banker going through a mid-life crisis could easily do that.

Why Corporate Development? Questions

Especially if you’re moving in from investment banking, you’re likely to get a lot of questions about your knowledge of the group; they want to make sure that corporate development recruiting is not just your “Plan B” or “Plan C” after private equity did not work out.

Questions in this category might include:

“Why corporate development?”

Focus on the long-term nature of the job and how you want to stay with one company to grow its business year after year rather than switching between different companies/clients.

“What are the key challenges in corporate development compared with the ones in investment banking?”

Winning buy-in from all the relevant parties is much harder in corporate development because certain departments are averse to deals; the challenge isn’t connecting a buyer and seller, but getting everyone on your side to agree. Integration also tends to be more difficult than execution, which is something you’re not exposed to in IB.

“How much do you know about the deal process here?”

Take a look at the articles on M&A deals and CIMs to get some ideas.

“How are JVs or partnership deals different from M&A deals?”

The main difference is that there’s less due diligence and more deal analysis since you’re not acquiring another company – but the details of a JV deal can be very complicated, much more so than the average M&A deal.

For example, there might be an upfront payment, commissions for back-end or subscription sales, bonus incentives if certain goals are met, penalties for underperformance, and so on.

Industry Knowledge and Acquisition/JV Ideas

There isn’t a fast or efficient preparation method for these questions in corporate development recruiting because you need to take the time to learn the industry and figure out the company’s goals.

A few tips to prepare:

- Start with our article on How to Learn an Industry and follow the suggestions there on doing rather than passively reading.

- If the company is public, read its past few earnings call transcripts and look at what the CEO, CFO, and other executives are saying. Also, review transcripts from its closest competitors.

- Look up the company’s past acquisitions and avoid any industries in which it has recorded write-downs and impairments from these past deals.

- If you’re interviewing with a PE-owned company, you should research the sponsor to understand their deals and portfolio companies.

Once you have some ideas, pitching an acquisition or JV is similar to pitching a stock , but with a different focus because of the long-term nature of corporate development.

For example, you could point out why a target company is undervalued, but it would be better to point out how the acquisition would boost your company’s metrics and make it more valuable over time (e.g., a “value creation analysis”).

Also, in many cases, you cannot do much to mitigate the risk factors with 100% acquisitions.

There are some options, such as earn-outs for private companies , but if it’s a large, public company, your choices are more limited.

So, most of these pitches will take the form:

“We could acquire XYZ Company for Price A, which is a good deal, and it would boost our business by improving metrics C, D, and E; furthermore, there’s a strong team/cultural fit, and XYZ Company would allow us to move us into higher-growth markets.”

The Corporate Development Interview Case Study: What to Expect

There are four main types of case studies you can expect in corporate development recruiting, ranked below from most common to least common:

- Most Common: An on-site, 30-60-minute test where they give you a potential acquisition target and ask you to recommend for or against the deal and if you’re in favor of the deal, the price you would pay. You may also have to present your findings and answer questions from the team afterward.

- Less Common: A take-home case study where you have a few days up to a week to analyze a target company’s financial statements, value it, and explain how much it might be worth to the company you’re interviewing with.

- Even Less Common: No case study or modeling test at all – they’ll just ask for work samples, presentations, and deal documents you’ve worked on, with sensitive information deleted.

- Least Common: A partnership or JV model that includes upfront payments, incentive fees above certain performance goals, and other terms. For example, one company in the JV might be penalized if the other company’s sales fall, but it might receive a bonus if combined sales volume rises by a certain percentage.

With the on-site, 30-60-minute tests, avoid over-complicating the case study and get to a quick answer.

For example, project the company’s cash flows, calculate the IRR at different purchases prices, and build a simple DCF.

You could look at something like our Uber valuation and simplify that to get an idea of what to expect (as it’s far more complicated than what you’d be expected to complete in a short, on-site test).

You don’t need an LBO model, full 3-statement projections, or anything fancy if you have only 30-60 minutes.

With take-home case studies, you still want to keep the models relatively simple, but you should go above and beyond with your market research.

For example, instead of stopping at a deal recommendation, research the market and present another few acquisitions that might make more sense than the original idea and give rough valuation ranges.

And with JV/partnership models, the key is to enter the Excel formulas competently and efficiently and use functions like MIN/MAX and INDEX/MATCH correctly.

This one is more of an Excel practice test than a financial modeling or investment analysis test because you’re simply trying to calculate the correct numbers.

If you want to practice these types of case studies, we include 17 examples with full solutions in the IB Interview Guide (plus, technical questions, fit questions, deal discussions, and more).

And if you want to learn the fundamentals from the ground up, including the key Excel functions and shortcuts and the concepts behind all the models, check out the Core Financial Modeling course:

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

When Will You Hear Back in the Corporate Development Recruiting Process?

As usual, if you hear back quickly – within a day or two – then it’s almost always good news.

If not, however, you can’t necessarily conclude that the interview went poorly because CD teams tend to be small and resource-constrained.

As a result, they sometimes get busy with deals and have to put interview processes on hold for 1-2 months.

So, follow up every week or two until you’ve heard back, and understand that since the process is more random, you may not get an answer right away.

Corporate Development: What Next?

That’s it for our overview of corporate development recruiting.

Coming up next, we’ll delve into what to expect on the job, including daily tasks, compensation, exit opportunities, and more.

Corporate Development Series:

- Part 1 – Corporate Development Recruiting

- Part 2 – Corporate Development Careers

Further Reading

You might be interested in:

- Wealth Management vs. Investment Banking: Career Deathmatch

- Capital Markets vs. Investment Banking: Deals, Careers, Recruiting, Exits, and Offer Decisions

- The Investment Banking Career Path: The Complete Guide

- Corporate Finance vs Corporate Strategy: The Never-Ending Debate?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

31 thoughts on “ Corporate Development Recruiting: The Definitive Guide ”

Hi Brian – I’m curious about MBA-level corporate development recruiting (for internships). Do you know how this process works (i.e., structure, process, timing, etc.) – is it similar to the recruiting timeline for investment banking MBA internships?

Sorry, I have no information on this. I would imagine it is slower and less competitive than IB recruiting because CD roles pay less and have worse exit opportunities, and they’re not open to as many candidates. It is also probably a bit less structured. But no direct information on this topic one way or another.

Hello Brian,

Thanks for the awesome article. Would someone working in IB Leveraged Finance be able to exit into Corporate Development?

Asking because, from my understanding, corporate development seems closely tied to M&A and strong industry groups. Thank you.

Thanks. Yes, you could probably exit from LevFin into Corp Dev, though you are correct that your chances are probably higher coming from a strong industry group. Any industry that uses significant debt could still be a good target coming from LevFin.

Hi Brian, Great article as always. I notice that the “data science to corporate development” article seems to have been taken down? Where can I find the content? Thanks!

Thanks. Yes, we deleted that article because it didn’t generate much traffic, and pretty much everything in it was covered and summarized in this overview article instead.

With a lot of the interviews on this site, people say pretty much the same things over and over, so we prefer to consolidate the insights and takeaways into single articles covering one specific career or recruiting process.

Got it that makes sense. I am particularly interested in how the data science interviewee spin his/her experience into sounding like deal experience and broke into CD, but this article skips over the details. Would you mind sharing more details about that example? Thanks a lot.

Relevant parts of the interview:

“Q: But how did you meet those criteria [deal experience, know the industry and company in-depth, and can run deals by themselves]?

You had no deal experience, and you had never run a deal by yourself.

A: No, but I had run projects across the entire company before.

Data science ties into all the other departments, so I said, “While I may not have run M&A deals before, I’ve done something similar with Projects X, Y, and Z, where I had to disseminate information, work with senior executives, and speak with all departments at the company to win project approval.”

I argued that “deals” were similar to the “projects” I had been working on; in both, you act as the central communicator.

And since I had performed well at the company already, the corporate development team had more faith in my technical skills than banks.

Q: OK. What about the process itself?

A: I spoke with two Associates, three VPs, and one MD, all on the same day. It took about 3-4 hours total.

We have a pretty big deal team – over 15 people – since this is a Fortune 100 company. So, I spoke with ~1/3 of the team during interviews.

They asked me:

-Technical questions similar to the ones you might receive in IB interviews – depending on the interviewer.

-Pitches for acquisition or joint-venture ideas for the company, which took a lot of time to research.

-Questions about why I wanted to move into corporate development and how much I knew about the deal process.

They also gave me a 30-minute written test at the end, but it was pretty simple: They showed me a potential acquisition target, presented the revenue and cost synergies, and asked how much I would recommend paying for the company.

If you’ve ever built a merger model or valuation, it was not difficult to answer.”

Thank you Brian!

From my group, I have the option to enter into either Corporate Development (F100), MM Infrastructure PE Fund, Real Estate PE, however i am not sure which option to choose. I have networked extensively in these fields to try find what my interests lie more towards, however am still having a very hard time trying to decide.

I feel as though because both are equally “good” options for me, i should just take the one that has higher pay? Would you agree with this? If so, which career overall do you think pays better? (Though also understand that it depends on many things, but would be great to get your opinion in general)

The PE options will tend to pay more than corporate development. If you want to earn more but have a worse lifestyle, infra PE or RE PE are better. You will also be more specialized in both of those. If you want more of a relaxed lifestyle but at the expense of lower pay, and you want to be more of a generalist, the CD offer is better.

Hey Brian – just submitted a case study for a corp dev position where they asked me to put a brief together for a strategic partnership (so not necessarily M&A e.g. could also be a product development between 2 companies which is what I did). I did the above but did not include a sensitivity table in the deck due to hitting their required page limit – instead I wrote a bullet in the “proposed next steps” page that I would run sensitivity analysis sensitizing X assumptions by Y reasons. Do you think not including an actual sensitivity table would ding me even though I acknowledged what I would do if I were to run a sensitivity? Or I guess more broadly, what is it that the case studies are usually judged on / how important critical are they to getting the job e.g. if one sensitivity is not included but the rest of the case is ok, would you get dinged.

I don’t think the lack of a sensitivity table will hurt you, especially if you mentioned that you would also create one with more time/space. They mostly want to see if you can think logically and present coherent arguments for or against a deal.

Thank you for all of the great content, huge fan of M&I. I have landed a corporate development role and was curious about potential exit opportunities. My team is a bit unique in that in addition to M&A i have made seed – series A investments within an internal “fund”. Curious to how this type of deal experience would lend itself to IB, PE, VC, or other CD roles given the early stage investment deal experience. Deliberately being somewhat vague, but i am pre-MBA and lack deep M&A experience.

I think it would work well for VC roles, but it would be tough to use that experience to get into PE because they normally want to see more traditional M&A experience. You might be able to use it to get into IB because bankers sometimes don’t go into a ton of detail on what you did, exactly, in each deal.

Hi Brian – great article, thank you.

Within the interview case study section, you said: “For example, project the company’s cash flows, calculate the IRR at different purchases prices, and build a simple DCF.”

What would the “investor proceed” metric be within each year of the IRR formula? For example, year 0 would contain the company’s market cap (the purchase price we’ll likely sensitize, also assuming it was a 100% stake purchase).

In the final year (eg. year 10) of the IRR, assuming it’s a strategic buyer, would we assume a theoretical “exit” multiple (even though strategics would probably hold for a much longer time period than the projected period) or Terminal Value via multiples method (I guess technically the same thing), both ending up as an “exit” market cap via the EV to EqV Bridge?

What about investor proceeds within years 1 through 9? Would you treat these period’s investor proceeds like you did in the 7 Days Inn case study, make them all 0? Would these periods contain their respective cash flows you just calculated: maybe take the unlevered FCF you calculated for the DCF, factor in interest payments and mandatory debt repayments by creating a debt schedule and arriving at levered FCF for each of the periods (so your using apples to apples with market cap purchase and exit values?) Maybe have levered FCF in the final year too instead of/with the theoretical exit market cap talked about above?

Maybe these “in between” periods only contain dividends that would be issued due to a high cash balance remaining after debt servicing would make up the investor proceeds (also requiring a debt and cash schedule with a minimum balance?)

Maybe it should be as simple as Atlassian’s Growth Equity IRR analysis, only purchase and exit market caps?

Apologies for the information dump! Looking forward to your response.

We cannot answer technical questions of this level on this free site. If you are a coaching client or have a BIWS account, please leave a comment with your questions on the site or contact us via email for answers to these questions.

A full 3 way model wasnt required for this either so definitely agree with you on the unlikelyhood of a full merger model. The reviewer was just trying to see where my knowledge was at and how well i could lay out a model that was logical to follow. Doing your courses was definitely a big help

Thanks, glad to hear it and thanks for sharing. Good luck!

I appreciate the article. I have been interested in CD for a while. It seems much better to me than the investment banking road. I’m willing to trade the prestige of having an IB job & pay for better hours and still have the opportunity to work on deals/due diligence.

My question is for those of us without IB experience (I am an auditor with a CPA), do you think it’d be better to go to a company in say their FP&A department and look to transfer to CD within the company later on or would I be better off going to like a Big 4 valuation position and wait 1-2 years?

Either one could work, it just depends on where you have the easiest transition. If you can move into the valuation group at your current firm more easily, that’s probably a better option because you will then do work that is more relevant. But if it’s difficult or they don’t accept many transfers, then it probably makes more sense to go for a corporate finance role and move in like that.

Thanks for this Brian. Could you provide some information in regards to: -Top Companies for CD -Career Progression and salary at each stage

Oops did not read the last paragraph my bad.

Yes, we are covering these topics in the next article in this series, but it’s hard to say what the “top companies” are because it depends on how you’re using the role. If you’re using it to potentially move into IB, the biggest companies (Fortune 100) are best because you’ll do more relevant work and get a better brand name. But if you’re using Corp Dev as your path into the industry and a first job, then it’s better to aim for smaller companies that are more open to hiring you without a lot of deal experience.

All-in compensation starts at around $120-$160K for Associates and ranges up to $350K – $400K at the Director level. Figures will be lower than that outside of major financial centers and at smaller companies. And it takes a long time to make it to the Director level, longer than the equivalent role/title in IB, because turnover in CD is quite low compared to banking.

Thank you for the explanation, Brian.

Many thanks for this article, very insightful as always. I am currently in the process for a CD internship next year within a very large Financial Institution (BB), and have made it successfully to the last round, where I will meet the head of the CD Team. It seems to me more like a “confirm the hire by the top guy” type interview since I already had interviews with 4 team members and a case study, but in your experience what should I expect from this interview? I suppose it will revolve around my knowledge of the team/role and usual fit questions, but I would very much value your input.

Best and thank you for this amazing website

Thanks. Yes, it sounds like they just want to confirm your hiring, so I would expect a fit-focused interview where it’s more about your background and how well you’ll do in the team rather than specific technical knowledge. Senior interviewers tend to care more about that and usually leave technical questions to the junior interviewers.

Hi, thanks for the write up.

I have a 2 hour case modelling test soon for Corp dev in a private company. Just wondering on the likelihood of having to build a merger model? Or would that be too little time? Since it is longer than 30-60 minutes just wondering what else to expect.

It’s very unlikely that you will have to build a full merger model. At most, maybe something where you combine just the IS and simplified CFS. And a valuation case study is still more likely in most cases. There might just be more information to review (or more questions at the end), but the actual model will not necessarily be more complex just because it’s 2 hours.

Just wanted to give you all an update on this, but for my modelling test I received an LBO test which took me a bit by surprise

Thanks for the update. An LBO test isn’t too surprising since it’s really just a variation of a 3-statement model, and those are common in all case studies. But yes, LBOs and LBO models are definitely fair game. I still think a full 3-statement merger model would be unlikely due to time constraints.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Got an Investment Banking Interview?

The BIWS Interview Guide has 578+ pages of technical and fit questions & answers, personal pitch templates, 17 practice case studies, and more.

47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Digital transformation case with ex-Bain consultant

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

13. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

Practice with experts

Using case interview examples is a key part of your interview preparation, but it isn’t enough.

At some point you’ll want to practise with friends or family who can give some useful feedback. However, if you really want the best possible preparation for your case interview, you'll also want to work with ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock case interviews 1-on-1 with ex-interviewers from MBB firms . Start scheduling sessions today!

The IGotAnOffer team

- Career Advice

- Job Search & Interview

- Productivity

- Public Speaking and Presentation

- Social & Interpersonal Skills

- Professional Development

- Remote Work

Eggcellent Work

How to ace your next corporate development interview: questions and answers .

Corporate Development, also known as Corp Dev, refers to the group within an organization that is responsible for strategic decisions to expand and restructure the business.

You have decided you are ready to join a Corporate Development team so you can identify and execute opportunities for the company. These include helping with initiatives such as mergers and acquisitions and divestitures. You understand that your role is critical to key business objectives of:

- Improving the enterprise’s financial and operating performance.

- Outperforming company competitors.

As a unit of the enterprise intended to create and execute innovative strategies to leverage competitive advantages, Corporate Development also focuses on establishing strategic partnerships and looks for opportunities for the corporation to achieve organizational excellence.

You want to know what to expect when it comes to being chosen to join a Corporate Development group, including the types of corporate development interview questions you can expect and how best to answer them. These issues and more are discussed here.

Table of Contents

What does a Corporate Development do?

Corporate Development operates on two levels simultaneously: internally and externally.

Internally, Corporate Development is essential to the enterprise, identifying gaps in geographic market reach and in the company’s product portfolio.

Externally, Corporate Development’s role is essential for the organization, helping to create partnerships and deals that will help the enterprise monetize and increase valuable assets. In this function, Corporate Development works to help innovate and create business partnerships and deals that can bring value to the enterprise.

While Corporate Development is most commonly known for its role in assisting with mergers and acquisitions (M&A), there is more to Corporate Development. In fact, M&As is one of the riskier tasks that Corporate Development teams handle. According to the Harvard Business Review, more than 70% of acquisitions fail .

That increases the importance of other tasks that Corporate Development teams participate in that serve the enterprise’s business objectives, including:

- Analyzing and investing in new strategic initiatives, which are not just mergers and acquisitions, but also include strategic divestitures.

- Assisting with the creation of forecast models and budgets that will determine the enterprise’s allocation of assets and maintain oversight of the company’s performance.

- Serving as the enterprise’s liaison with government and industry regulators.

- Monitoring and ensuring capital adequacy.

- Helping the enterprise achieve operational excellence.

- Taking responsibility for identifying and managing assets that are not core business assets.

- Improving the client and customer experience.

- Striving to optimize firm productivity and agility.

- Serving as a company representative in financial conferences, investor gatherings and shareholder meetings.

- Helping the company communicate its strategy to shareholders after earnings releases.

- Participating in product development, market analysis and market penetration.

- Managing the enterprise’s portfolio.

- Comprehending the main drivers of the enterprise’s revenues and expenses

- Identifying critical Key Performance Indicators (KPIs) to evaluate and measure the company’s performance.

What can I expect from a corporate development interview?

In addition to some fairly common corporate development interview questions, you can expect a discussion of your professional background as it relates to corporate development, financing, valuation, consulting and financial modeling.

Depending on whether your interviewer has a consulting or banking background, you may be asked to consider case studies or you may be asked your opinion about particular investments in business units.

Corporate Development groups seek candidates with experience working on acquisitions, joint ventures and deals. You may be asked about the size of deals you have participated in and to describe your role and experience in those deals.

Corporate Development teams also seek independent workers who can handle deals by themselves.

How do I prepare for a corporate development interview?

You can expect corporate development interview questions to include a request to detail your work experience, including projects you led or participated in previously.

Your answer should offer a brief discussion of that experience, but it also should be crafted in a way that shows you understand the industry in which the enterprise operates.

This is particularly important if you do not have prior experience in the industry or did not cover the industry if you previously served as a consultant or analyst.

The importance of modeling

Some corporate development interview questions also focus on modeling, according to Corporate Development team members who shared their experiences on the Wall Street Oasis (WSO) forums.

This is usually brought up with candidates who have advanced beyond the initial round of interviews. In some cases, you may receive a case study where you are asked to develop a financial model and a formal presentation.

When it comes to M&A cases, you may be asked to walk through how you would expect the process to unfold, from identifying merger or acquisition targets to the expected closing of the transaction. In some cases, interviewers may ask you to comment on the possibility of the enterprise acquiring a specific company.

While you should not feel as if you need to offer advice on such a transaction, be prepared to discuss hard valuation methods, particular synergies (i.e. market share and talent and cost reduction), and integration issues that may surface.

You will likely be asked by some interviewers to perform an M&A modeling test, particularly if, as a consultant, you did not appear to have a significant amount of experience with this exercise.

Do not ignore the basic decision that many corporations must ask themselves when considering M&A: Is this something that should be built or something that should be bought?

The enterprise clearly has an interest in expanding its operations and market share, but should this be done through acquisition or through internal development?

Your answer can discuss the pros and cons of these options, or at least how you would calculate these when considering the options.

Know the company and the industry

As you discuss your thinking and methodologies related to these factors, take this opportunity to show your knowledge of the industry and the company that is considering you for the position. As investor Mark Cuban says, “Know your business and industry better than anyone else in the world.”

Your answer should begin with a 30,000-foot overview of the industry and the company’s place in that industry. You can note your understanding of why the company is in the position to consider M&A in this context. Then offer some insight into how you think the target company fits into this dynamic.

More than anything, your answer relating to potential M&A must include a solid understanding of the company and its position in the market relative to top competitors. You can likely argue the case either way for or against M&A. This is because the top driver of any M&A is corporate strategy.

Any discussion about options must include a strong understanding of the corporate strategy and how M&A fits into that.

Buy or Build

Discuss the question you would pose if buying, such as, how does this purchase represent the best use of capital? Is there an argument to reinvest in the existing business?

For example, if the enterprise’s core business represents low growth and low profitability, buying a smaller competitor that is seeking to disrupt your business might make sense in that case.

You can also note some of the negatives that stem from corporate M&As, such as the potential adverse impact on shareholder value and possible conflict with ongoing integration from previous acquisitions.

It is also possible that the enterprise’s disappointing history with M&As and recently announced deals by key competitors can affect the enterprise’s decision. There are instances when M&A should not be considered, so your answer should indicate that you appreciate there are situations where that is a factor.

Know the interviewer

In addition to Corporate Development Interview Questions, you should know something about the people who are interviewing you. What is their background, consulting or banking?

If they were consultants at one point, chances are they would focus more on a case study during the interview process. They may ask for your opinion about particular investments within business units and they could ask you to develop an investment thesis around them. This is a good time to offer insights about the potential for products in the market.

If they have an investment banking background, expect more discussion about financing. That’s particularly true if you also come from an investment banking background.

Expect questions that test your knowledge of Corporate Development. For example, you could be asked, why Corporate Development? Your answer can emphasize the long-term nature of helping a company grow its business versus bouncing from client to client in investment banking.

You also may be asked about the differences between Corporate Development and investment banking when it comes to key challenges.

You can highlight the importance of aligning interests within your organization when it comes to making deals in Corporate Development, as opposed to connecting a buyer and a seller in investment banking.

You can also discuss the difficulties that integration can pose, which is a challenge you didn’t experience in investment banking.

- Work Assignments During The Job Interview Process: Here’s How To Handle This Request

- Best C-Suite Interview Questions And How To Answer Them With Ease

- What To Expect During an Interview With a Japanese Employer (And How To Crush It!)

- How To Spots Companies That Interview With No Intention Of Hiring You

- How To Become A Corporate Raider – Here’s All You Need To Know

- Applying For A Job At A Client Company: 4 Things To Consider

Jenny Palmer

Founder of Eggcellentwork.com. With over 20 years of experience in HR and various roles in corporate world, Jenny shares tips and advice to help professionals advance in their careers. Her blog is a go-to resource for anyone looking to improve their skills, land their dream job, or make a career change.

Further Reading...

When Is the Best Time to Look for a Job in Singapore?

How To Reply To An Interview Email (With Examples)

What To Do While Waiting On A Background Check After A Job Offer

No comments, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

How To Handle Interview Question "Tell Me A Joke" (And How Not To Overdo It)

How to identify a false or unfair performance improvement plan (and how to respond) .

The Ultimate Guide to the Consulting Case Interview – With Examples

This guide, written by a former McKinsey consultant and Wharton MBA, breaks down the management consulting case interview into comprehensible parts with relevant, realistic examples at every turn.

By Tracy V.

Posted March 12, 2024

Featuring Alex S.

De-Mystifying the McKinsey Interview

Wednesday, may 15.

10:00 PM UTC · 45 minutes

Table of Contents

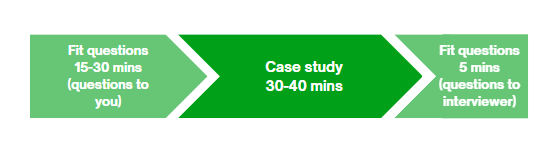

While the consulting case study interview may seem daunting at first, most cases follow a typical song-and-dance. Once you get a hang of it, prepping feels much more manageable. The first part of this guide will give a broad overview of the case interview. The second part will break out the typical structure of an interviewee-led case. The last part will dive into each component, with tips and suggestions for preparing. Note that some firms may have their own specific case interview style. Be sure to familiarize yourself with your target firms’ interview processes before the time comes to recruit.

Case interviews involve tackling a business issue or problem faced by a company (the client). These interviews allow consulting firms to gauge candidates’ ability to perform the job. Specifically, firms are testing whether candidates can:

- Think in a structured and creative way

- Analyze and interpret new information

- Communicate persuasively and succinctly

Most firms conduct interviewee-led cases, as outlined in the guide below. In these cases, the candidate is expected to drive the case forward by asking the interviewer for data or information relevant to forming the recommendation. A few firms, most notably McKinsey, are interviewer-led, meaning that the interviewer will be the one guiding the discussion.

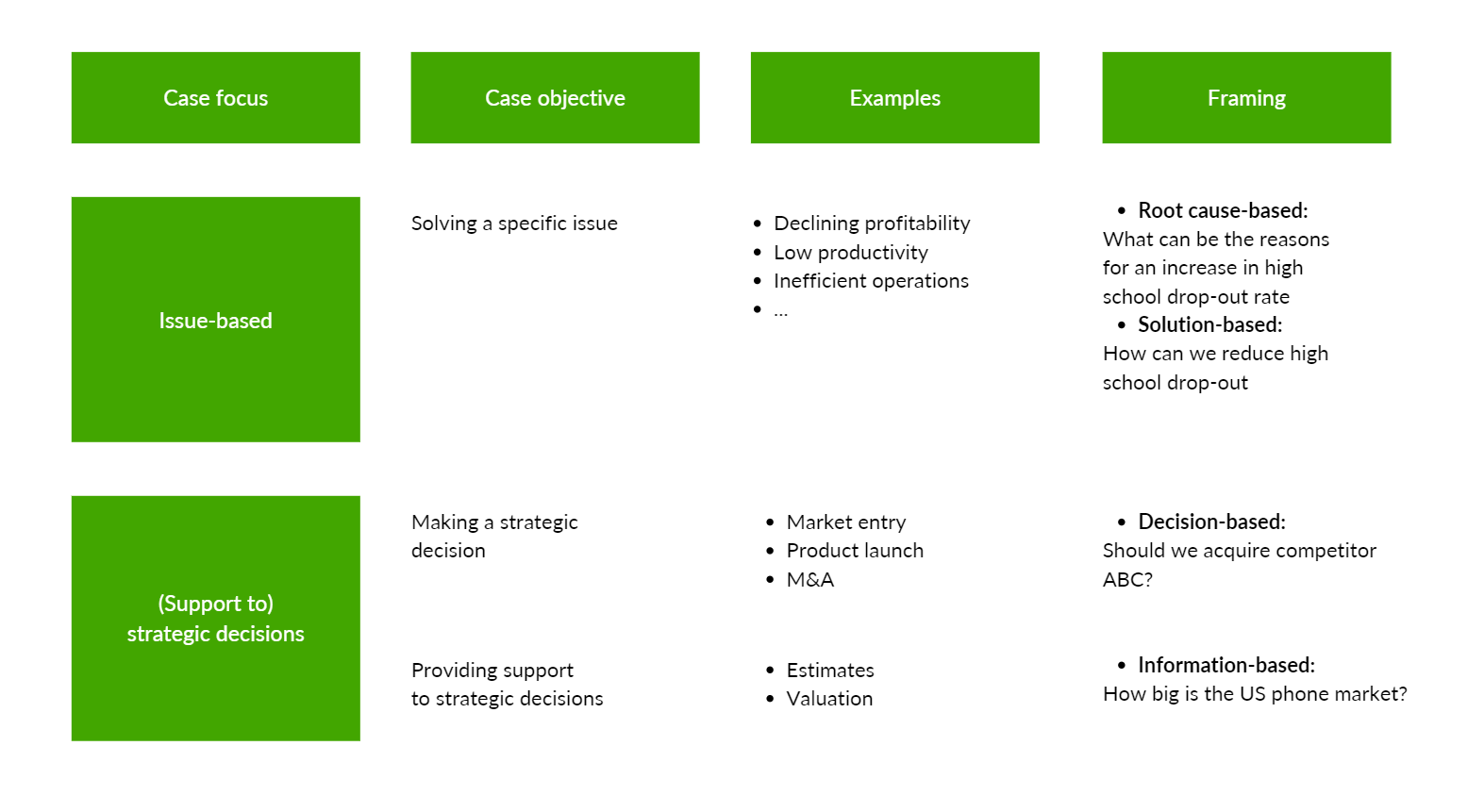

Below are a few common types of cases that you can expect to receive. Some cases can be several types all in one (lucky you!):

- Profitability - Determine cause for profit decline and / or ideas for increasing profit; you will rarely get a standalone profitability case – It will usually be rolled up in another case type

- Growth - consider strategies for company growth; could be through sales or market share

- Market Entry / New Business - Assess attractiveness of entering new geography / business / sector and method for entering

- Due Diligence / M&A - Assess attractiveness of purchasing / acquiring a company or business; client can be another company or a financial sponsor

- Competitive Response - Address a competitor’s recent action (e.g., new acquisition, change in pricing strategy)

- Non-Traditional - Similar to the other cases but the client (non-profit, NGO, education-focused entity) has different objectives than a typical corporate company

Case Interview Components

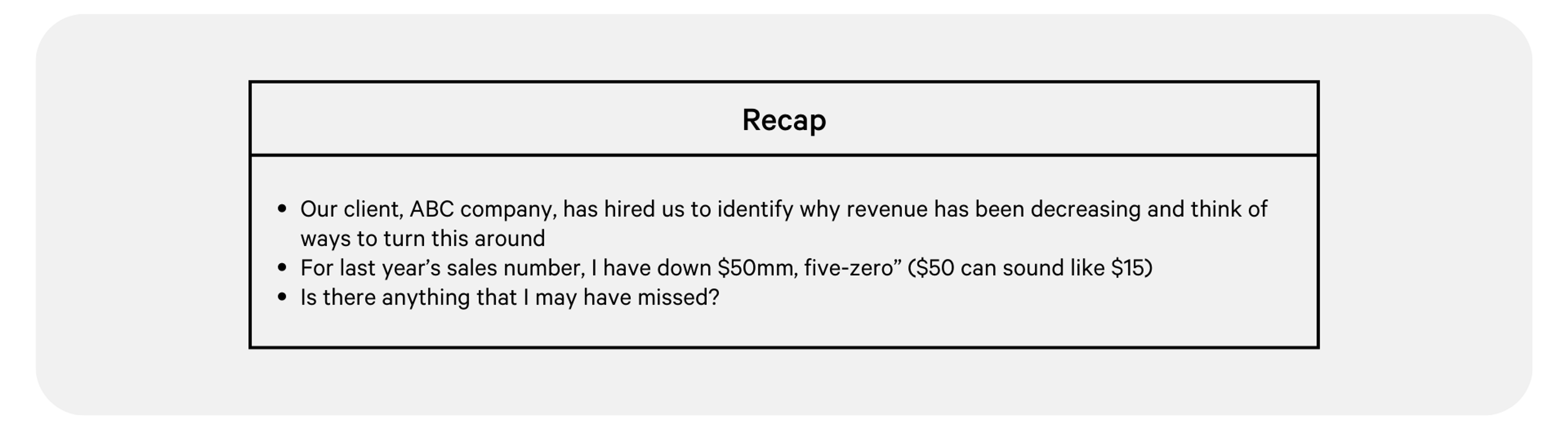

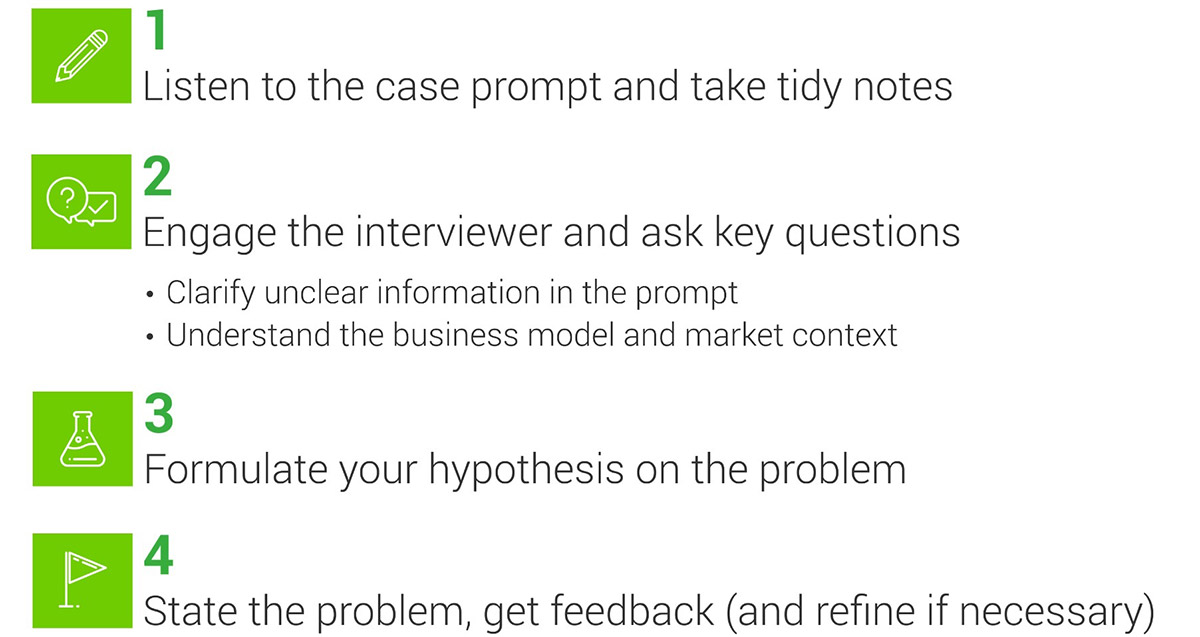

- Prompt: Interviewer reads aloud the case while the interviewee takes notes

- Recap: Interviewee provides a high-level summary of the case and confirms accuracy of information written

- Clarifying Questions: Interviewee asks 2-3 high-level questions

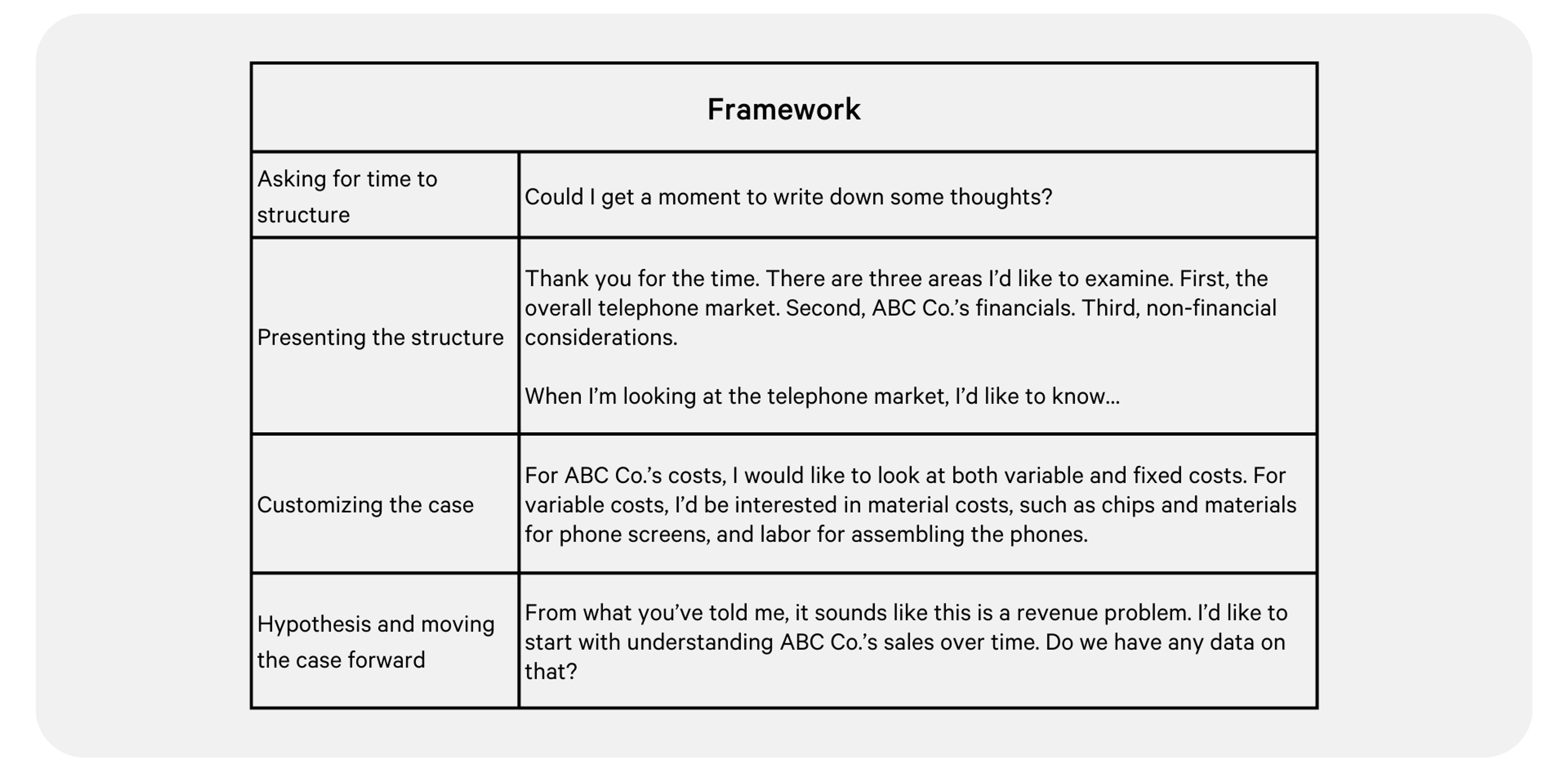

- Structuring (<2 minutes): Interviewee takes a few minutes create a roadmap for approaching the case

- Framework Presentation (2-3 minutes): Interviewee reviews the structure with the interviewer, who may have follow-up questions. Interviewee then moves the case forward by asking for additional information

- Brainstorming: Interviewee is expected to list out several solutions or ideas (e.g., cost drivers for an industry, ways to increase sales)

- Exhibits: Interviewee will be given data in forms such as graphs or charts and expected to provide high-level insights

- Math: Interviewee will be asked to perform a calculation with the new information or using data from the exhibits. Oftentimes, interviewee is not given enough information and must ask for the relevant data

- Synthesis and Recommendation (2-3 minutes) : Interviewee provides the answer first, then supporting facts from the case, and finally risks and next steps

Setup (2-3 minutes)

Prompt : The interviewer may be giving you A LOT of information - don’t write down everything verbatim. Jot down facts and figures, the client name, and the objective(s). If you miss something or don’t remember what a number means, you can ask after your recap.

- Prep: Have a friend read you several different case interview prompts and practice taking down notes. Create your own shorthand and learn how to recognize extraneous pieces of information

Recap : I always reference the client by name and start my recap with the objective(s) first, since this is the most important part of the case. The recap should be summarized, not verbatim, and you should be checking that the figures you wrote down are correct.

- Prep: Practice summarizing your notes out loud instead of repeating the case verbatim. Time yourself to make sure it’s <1 minute.

Clarifying Questions : Very detailed questions should be saved for the case. Clarifying questions are meant to help you with your structure or alleviate any confusion. Keep these at 2-3 questions. I usually ask questions pertaining to:

- Language/terminology - The interviewer won’t expect you to know the nuances of every industry or practice area. It is better you start off the case on the right footing by asking for clarifying definitions

- Goals/objectives - I always ask if there are other goals the company has in mind and, if relevant, specific financial targets or timeframe. Sometimes, the objective given is vague, so I will ask the interviewer to be more specific.

- Business model or geography - Very helpful for cases in niche industries; understanding geography can also prompt you to think about factors like labor cost or global competition

- Scope - To save you time from considering every possibility, you can ask whether the company is leaning towards one option or excluding a set of options completely

- Prep: Have a friend read you case prompts and then practice asking 2-3 clarifying questions on the fly. Try to think of them as you’re taking down notes and giving the recap. Are they helping you with your structuring or are you asking the first thing that pops into your head? Are they broad enough or overly detailed? Are there types of questions you should be asking but keep forgetting?

Framework (4-5 minutes)

Structuring (<2 minutes) : Do not use the word “framework” during the interview. I ask if I could have time to “gather my thoughts” when I am structuring. In your structure, you should have at least three but no more than five “buckets.” These are areas that you want to explore in order to solve the case. In each bucket, there should be at least three sub-bullets. Make sure there is no overlap between the buckets.

- Prep: Time yourself structuring your roadmaps. Be comfortable with recalling the different buckets you should be considering for each type of case and brainstorming sub-bullets for those buckets. It’s okay to go over two minutes when you first start, but as you get comfortable, make sure you are becoming more efficient. For example, as you become more familiar with the buckets, you don’t need to write down every example for the sub-bullets, they will become muscle memory as you recite them out loud. Review the suggested frameworks for the case and take note of whether there are vital topics you keep forgetting or whether there are unnecessary buckets you keep adding. There is no one “right” answer, but your roadmap should enable you to uncover the necessary information to make your recommendation.

Presenting: Introduce the high-level buckets first before diving into each one. You will want to “customize” your framework to the specific case you’re working on. This does not mean creating a custom framework for every single case. You can use the same topics for similar types of cases (but ensure that those topics are relevant - some cases sneakily rule out an entire topic to see if you are paying attention), but you need to make sure that you are using case-specific language and examples when you present. This shows that you are thinking about the specific problem, not just recycling a generic framework. After going through the structure, pause and ask if the interviewer has any questions. Then, give your hypothesis and state which bucket you want to start with by asking for data pertaining to that bucket and why you want it.

- Prep: Present your structures out loud and note whether you are rambling or being case-specific in your language. If you find that your presentation is too long, consider cutting down on the examples or explanations. Be succinct and say enough to get your point across. Don’t just move on to the next case if your presentation falls short. Keep practicing until you feel satisfied and make mental notes for the next case.

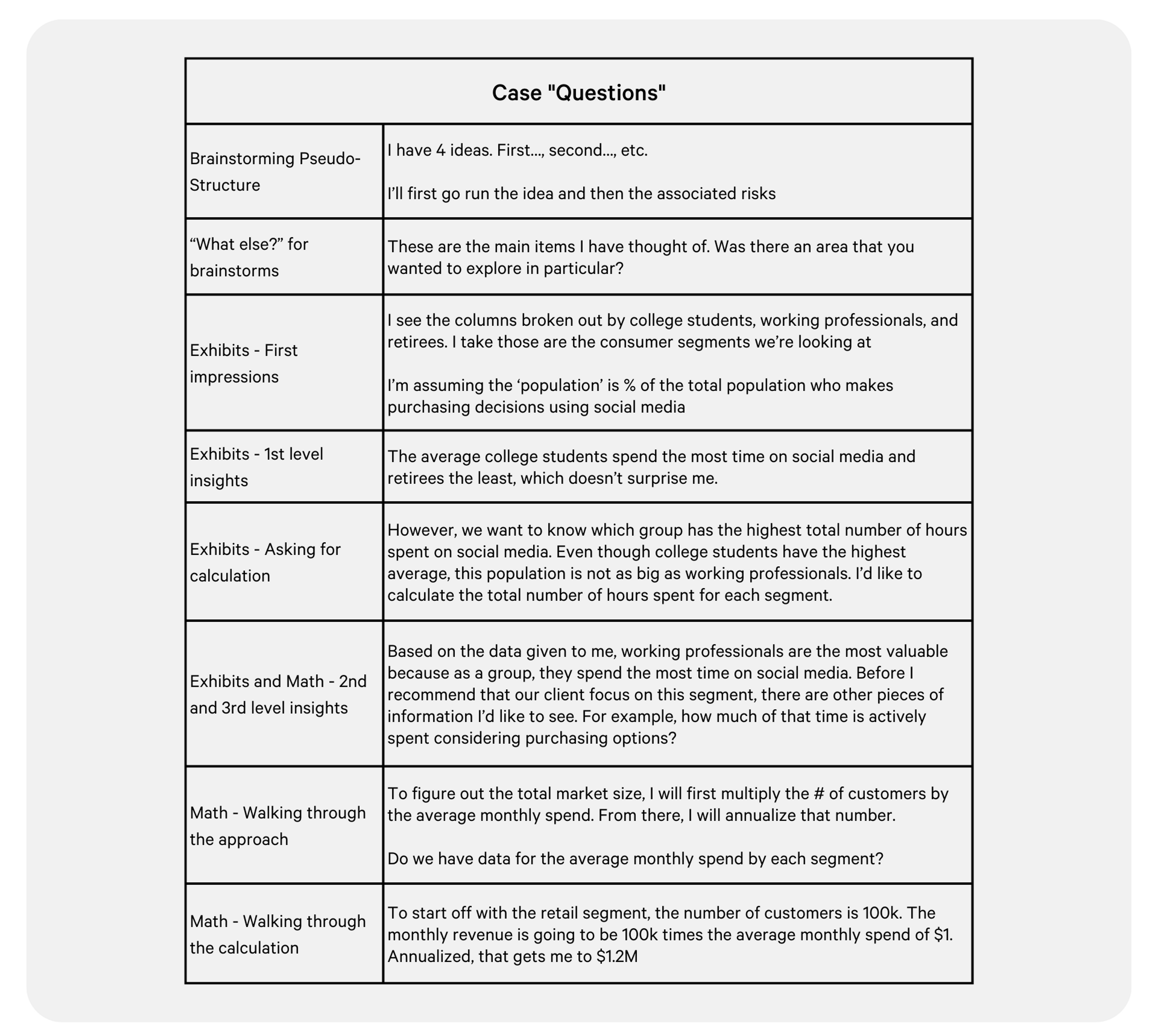

Interview “Questions” (10-20 minutes)

For each type of question, you are going to be doing the same things: answering the question, providing insights, conveying how it impacts your recommendation, and driving the case forward. Every time you have “answered” a question, you want to be thinking, “ What else do I need? What’s the logical path forward ?” The only way you can prepare for this is to run through entire cases! Remember, your framework is your friend. Refer back to it often if you don’t know where to go next.

Brainstorming : You will want to structure your ideas into MECE buckets. They can be fairly simple (financials vs. non-financials, external vs. internal, etc.). Similar to your framework, you will give a preview of the buckets first before going into the details of each and you will need to ensure that it is “custom” for your case. If a structure doesn’t naturally come to you, you can create a pseudo-structure by organizing how you will present your brainstorm. For example, you can state how many ideas you have from the onset or say that you will first go through the ideas first and then the associated risks.

This is a highly debated practice, but I always ask for a few seconds so I can think of a structure (they may say no). Don’t take more than 30 seconds because you can add to your buckets as you are presenting.

For non-technical brainstorms, be creative! For example, when interviewers asked about how to increase sales for a consumer-facing retail company, I would bring up TikTok campaigns and celebrity endorsements as a few ideas. Have fun with it!

Occasionally, interviewers will prod you with, “What else?” This does not always mean you didn’t give enough ideas. Sometimes it’s the opposite – they are looking to challenge you or see how you will react. Just roll with it - if you don’t have anything else, say so.

- Prep: Practice brainstorming for different types of prompts. Collect a bank of general ideas and solutions that can be customized for use across industries. Try to think of as many ideas as you can (four to six at the very least) and exercise that creative muscle. To help you with structuring, have a list of “easy” MECE buckets that you can pull out on the fly.

Exhibits : First, give an overview of the exhibit. As an example, for graphs say what the axes represent, tie it back to the case, and give your interpretation of those axes. This gives the interviewer a chance to course-correct if you misinterpreted the exhibit. Give some insight, even if it is low-hanging fruit, and tie it back to the case. There are three levels of insights for both exhibits and math:

- What the numbers say, patterns/trends (X is smaller than anticipated, Y is the largest driver)

- What the client should do (enter the market, cancel plans, plan for launch)

- What we should do next (reconsider something specific, research more data on X, move on to Y)

Oftentimes, exhibits will tie into a calculation. If you are given an exhibit with data that can be used to calculate more insightful information, tell the interviewer that you would like to make those calculations. The interviewer will lead you down that path regardless but it is more impressive if you call it out.

- Prep: Run through different types of exhibits and see how many insights from each level you can pull out. Practice anticipating what type of data you need next in order to move ahead in the case or whether you can/should calculate anything from the data given. Don’t be too insightful though – you only have a limited amount of time to run through the case.

Math : Before you start calculating anything, it is critical for you to confirm what you are solving for and that the information you wrote down is correct. SUPER IMPORTANT – answer the question that is being asked !! If the interviewer is asking for the incremental profit from a certain strategy, you don’t want to calculate the total profit from the strategy. Active listening is so important!

As you know by now, structure is everything. Again, I always ask for a few seconds to organize my thoughts (the worst thing they can say is no). Set up the problem before you start calculating. This allows you to identify whether there is data missing. Walk the interviewer through your method and ask for missing data. You may need to make your own assumptions or estimates – be sure you can justify them.

If your method is off, the interviewer will usually guide you back to the right path. This saves you from wasting time calculating the incorrect answer. Be sure to pay attention when the interviewer is trying to coach you.

As you are solving the problem, walk the interviewer through each calculation and use math shortcuts as much as possible. Again, if you make a math error, the interviewer can stop you before you go down the entire path. Save time by only calculating what is important for the case and understanding what you can skip.

- Prep: Practice setting up the problem, walking the interviewer through your proposed method, and verbalizing the calculations out loud. On paper, make sure your calculations are being done neatly and not all over the place. Look for different math shortcuts and try them out. Not all of them will fit your style, but you might find new tricks. Track whether you are answering the right questions. Once again, active listening is critical to your candidacy. Once you have correctly solved the problem, make sure you are thinking about the, “So what?” Determine how that number impacts your recommendation and where you should go next.

Synthesis and Recommendation (2-3 minutes)

Again, I always ask for a few seconds to collect your thoughts (<30 secs). If the “CEO is already in the elevator,” they may say no. Have a definitive stance – start with your recommendation and then provide two to three supporting facts using data from the case.

Address risks and next steps (i.e., what is the required analysis/gameplan – this is like real life where the firm is trying to sell additional projects). Your recommendation should be <2 minutes. Frankly, the interviewer has most likely made a decision on your candidacy. Don’t ramble and try to finish strong.

The hardest part of this is pulling out the supporting data in a succinct way. Throughout the case, you should be jotting down notes. I tend to circle what I believe to be relevant supporting data. When you present it, don’t be too specific or granular. You want your recommendation to be punchy.

- Prep: Run through whole cases where you are tracking the relevant supporting data along the way. Time your recommendation and practice verbalizing the information concisely. Don’t forget the risks and next steps. I usually have a list of generic risks (e.g., competitor response, regulation, inaccurate projections) that I can “customize” on the off-chance I’m scrambling to think of some. Your next steps can be collecting additional data to support your recommendation or ways to address those risks.

Free trial!

From 100 top coaches

Access a library of videos, templates, and examples curated by Leland’s top coaches.

Example resumes.

Example Cases

Casing Drills

Mock Interviews

Final Thoughts

- Your approach is more important than the solution – The interviewer is trying to understand how you think. Some cases have data that support recommendations in either direction. The key piece is that you are able to back your stance using the facts and data uncovered during the interview.

- Deadends are okay – There will be times when you make multiple requests for data and the interviewer does not have it. That’s perfectly fine! You can’t read the interviewer’s mind and the case could go in so many directions. Just look back at your framework to see where else you can proceed.

- Be coachable – It’s not the end of the world if your method is wrong or if you misinterpreted an exhibit. The interviewer wants to see that you are actively listening and can take feedback and improve. Don’t freak out! Stay calm! Listen to what the interviewer is trying to tell you.

This guide only scratches the surface of case interviews. The best way to prepare for case interviews is to get your reps in with entire cases. That way, you can identify your areas of weakness and be more precise with the drills. I can give you feedback and additional tips and tricks so that you are performing at your best on interview day. Book a free intro call with me on my Leland profile to discuss how we can personalize your case prep plan!

Preparing for consulting recruiting and/or case interviews? Here are some additional resources to help:

- Top 3 Tactics to Ace Your Case Interview

- A Comprehensive Guide to McKinsey & Co., Bain & Co., and Boston Consulting Group

- From No Offers to Multiple Offers - How to Take Your Casing to the Next Level

- How a Disneyland Churro Helped Me Land a Job at Bain (and 5 Pitfalls to Avoid in Market Sizing Problems)

- Five Tips to Break Into Management Consulting

Browse hundreds of expert coaches

Leland coaches have helped thousands of people achieve their goals. A dedicated mentor can make all the difference.

Browse Related Articles

May 18, 2023

McKinsey Bonus Structure: Understanding the Reward System

Discover how the McKinsey bonus structure works and gain a deeper understanding of the reward system in this comprehensive guide.

Victor Cheng LOMS: Is It the Ultimate Guide to Case Interviews?

Discover the ultimate guide to acing case interviews with Victor Cheng's LOMS program.

June 8, 2023

A Comprehensive Guide to McKinsey Case Interview Preparation

Looking to ace your McKinsey case interview? Our comprehensive guide has got you covered! From understanding the interview process to mastering case frameworks, we provide expert tips and strategies to help you prepare and succeed.

January 2, 2024

The Ultimate Guide to the EY Parthenon Case Interview Process

Are you preparing for the EY Parthenon case interview process? Look no further than our ultimate guide, packed with insider tips and strategies to help you ace the interview and land your dream job.

May 11, 2023

How to Prepare for McKinsey Management Consulting Behavioral Interviews?

If you're preparing for a McKinsey management consulting behavioral interview, this article is a must-read.

How to Prepare for McKinsey Management Consulting Networking Calls?

Learn how to ace your McKinsey management consulting networking calls with these expert tips and strategies.

McKinsey First Year Salary: What to Expect and How to Negotiate

Are you curious about what your first year salary at McKinsey might be? This article provides insights on what to expect and tips on how to negotiate your salary.

Mckinsey Consulting Salary: A Comprehensive Overview

Discover everything you need to know about McKinsey consulting salaries in this comprehensive overview.

Business Analyst McKinsey: A Comprehensive Career Guide

Discover the ins and outs of a career as a Business Analyst at McKinsey with our comprehensive guide.

IQVIA Interview Process: A Comprehensive Guide for Success

Looking to ace your IQVIA interview? Our comprehensive guide covers everything you need to know to succeed, from the application process to common interview questions and tips for impressing your interviewer.

Navigating the Shift from Energy Sector to Management Consulting: An Insider's Guide

Are you considering a career shift from the energy sector to management consulting? Look no further than our insider's guide, filled with tips and insights to help you navigate this exciting transition.

Transportation to Management Consulting: An In-depth Look at How to Make the Transition

Are you considering a career change from transportation to management consulting? Look no further! Our in-depth article provides valuable insights and practical tips on how to successfully make the transition.

Are you looking for a change of job in the Finance Field? Talk to one our professionals

Corporate Development Interview Prep

We Give You BOTH Coaching and Top Quality Interview Prep Guides, Slides, Financial Models, and Case Studies for Corporate Development - Our 93% Success Rate Speaks For Itself

Corporate development has been a popular area to transition to for many finance professionals; the broad variety of factors such as mergers and acquisitions, corporate strategy and work-life balance are attractive to many. Traditionally, corporate development hired primarily investment bankers and management consultants, similar to private equity. Fortunately, demand has never been higher for corporate development as mergers and acquisitions and roll-ups are executed at a breakneck pace, and more and more firms are also hiring candidates from non-traditional backgrounds.

Corporate development interviews typically involve 3 to 4 rounds, and usually include a case study that tests your financial modeling capabilities. They also look for professionals who have strong abilities in corporate strategy and value creation, and would thrive well in a corporate environment.

We can help you prepare for the case study by walking you through similar case studies and testing you on case studies in a variety of industries. We will also build upon existing financial modeling concepts, teach you how to walk an interviewer through a model, and help you both ask and answer the right questions from our curated list of corporate development interview questions, both technical and fit.

- Build a story that aligns your experiences with the needs of corporate M&A and strategy

- Teach you the strategic elements of corporate development, such as factors to consider before entering a new market, how to account for scale, etc.

- Help you master case studies that are more focused on operational modeling

- Analyze and build upon the various valuation methods used in corporate M&A such as precedent transactions, DCFs, accretion / dilution analysis, and LBOs

- 93% of clients receive a job offer in corporate development. We are the only service completely dedicated to your success. Our philosophy is unique: a successful client is one who gets the job of their dreams, NOT one who keeps coming back!

One Hour Coaching Session

$ 199 / Hour

- Any materials we go through will be sent to you (financial models / templates, slide decks, case studies)

Bulk Package: 3 Hours (6% off)

$ 187 / Hour

- 350 questions interview guide

- 6 slide decks covering Behaviorals, Accounting, EV / Comps, DCF, M&A, and LBO

- 2 hour LBO case study

Bulk Package: 5 Hours (13% Off)

$ 174 / Hour

- DCF case study in restaurant industry

- DCF case study in software industry

- 2 M&A accretion / dilution case studies using merger model method and earnings yield method

- IB case study with advanced M&A accretion / dilution and paper LBO

- 1 corporate development / FP&A case study

Bulk Package: 8 Hours (19% Off)

$ 162 / Hour

- Complex LBO case study in software industry with quarterly modeling required and working with ownership waterfall structures like liquidation preference

- 1 long complex LBO case studies in knife sharpening industry with 50-70 slides in CIM with PPT and Excel solutions

- 1 venture capital case study

Bulk Package: 10 Hours (25% Off)

$ 149 / Hour

- Short LBO case study in restaurant industry

- Short LBO case study in software industry

- 1 long complex LBO case studies in the sporting arena industry with 50-70 slides in CIM with PPT and Excel solutions

- Complex LBO case study in the car washing industry with Excel modeling and Word memo component with solutions

- Real estate paper LBO

- Real estate private equity case study for nursing home company