6.3 Steps in a Successful Marketing Research Plan

Learning outcomes.

By the end of this section, you will be able to:

- 1 Identify and describe the steps in a marketing research plan.

- 2 Discuss the different types of data research.

- 3 Explain how data is analyzed.

- 4 Discuss the importance of effective research reports.

Define the Problem

There are seven steps to a successful marketing research project (see Figure 6.3 ). Each step will be explained as we investigate how a marketing research project is conducted.

The first step, defining the problem, is often a realization that more information is needed in order to make a data-driven decision. Problem definition is the realization that there is an issue that needs to be addressed. An entrepreneur may be interested in opening a small business but must first define the problem that is to be investigated. A marketing research problem in this example is to discover the needs of the community and also to identify a potentially successful business venture.

Many times, researchers define a research question or objectives in this first step. Objectives of this research study could include: identify a new business that would be successful in the community in question, determine the size and composition of a target market for the business venture, and collect any relevant primary and secondary data that would support such a venture. At this point, the definition of the problem may be “Why are cat owners not buying our new cat toy subscription service?”

Additionally, during this first step we would want to investigate our target population for research. This is similar to a target market, as it is the group that comprises the population of interest for the study. In order to have a successful research outcome, the researcher should start with an understanding of the problem in the current situational environment.

Develop the Research Plan

Step two is to develop the research plan. What type of research is necessary to meet the established objectives of the first step? How will this data be collected? Additionally, what is the time frame of the research and budget to consider? If you must have information in the next week, a different plan would be implemented than in a situation where several months were allowed. These are issues that a researcher should address in order to meet the needs identified.

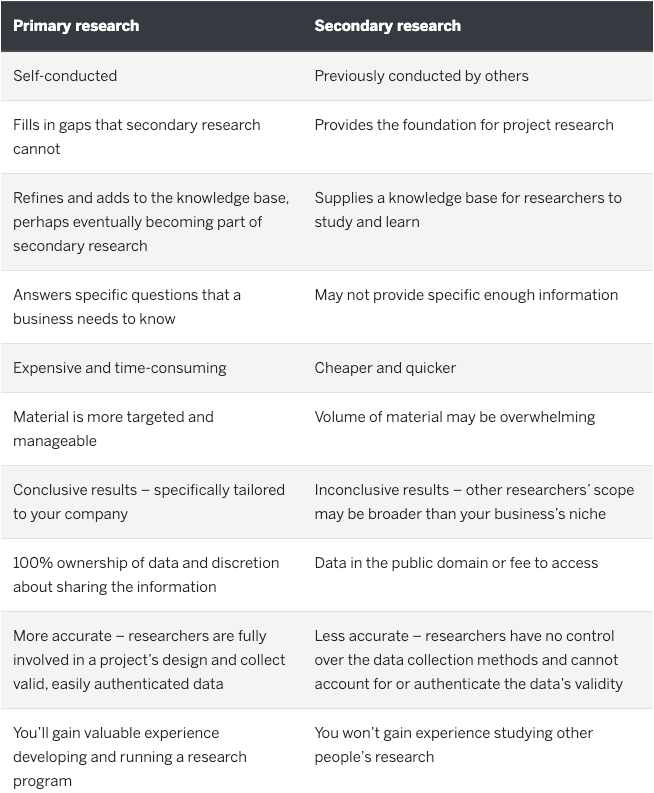

Research is often classified as coming from one of two types of data: primary and secondary. Primary data is unique information that is collected by the specific researcher with the current project in mind. This type of research doesn’t currently exist until it is pulled together for the project. Examples of primary data collection include survey, observation, experiment, or focus group data that is gathered for the current project.

Secondary data is any research that was completed for another purpose but can be used to help inform the research process. Secondary data comes in many forms and includes census data, journal articles, previously collected survey or focus group data of related topics, and compiled company data. Secondary data may be internal, such as the company’s sales records for a previous quarter, or external, such as an industry report of all related product sales. Syndicated data , a type of external secondary data, is available through subscription services and is utilized by many marketers. As you can see in Table 6.1 , primary and secondary data features are often opposite—the positive aspects of primary data are the negative side of secondary data.

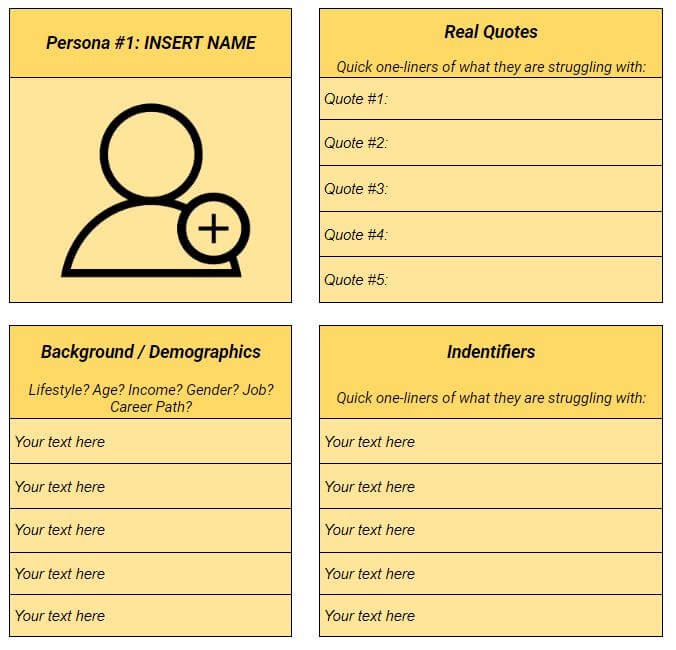

There are four research types that can be used: exploratory, descriptive, experimental, and ethnographic research designs (see Figure 6.4 ). Each type has specific formats of data that can be collected. Qualitative research can be shared through words, descriptions, and open-ended comments. Qualitative data gives context but cannot be reduced to a statistic. Qualitative data examples are categorical and include case studies, diary accounts, interviews, focus groups, and open-ended surveys. By comparison, quantitative data is data that can be reduced to number of responses. The number of responses to each answer on a multiple-choice question is quantitative data. Quantitative data is numerical and includes things like age, income, group size, and height.

Exploratory research is usually used when additional general information in desired about a topic. When in the initial steps of a new project, understanding the landscape is essential, so exploratory research helps the researcher to learn more about the general nature of the industry. Exploratory research can be collected through focus groups, interviews, and review of secondary data. When examining an exploratory research design, the best use is when your company hopes to collect data that is generally qualitative in nature. 7

For instance, if a company is considering a new service for registered users but is not quite sure how well the new service will be received or wants to gain clarity of exactly how customers may use a future service, the company can host a focus group. Focus groups and interviews will be examined later in the chapter. The insights collected during the focus group can assist the company when designing the service, help to inform promotional campaign options, and verify that the service is going to be a viable option for the company.

Descriptive research design takes a bigger step into collection of data through primary research complemented by secondary data. Descriptive research helps explain the market situation and define an “opinion, attitude, or behavior” of a group of consumers, employees, or other interested groups. 8 The most common method of deploying a descriptive research design is through the use of a survey. Several types of surveys will be defined later in this chapter. Descriptive data is quantitative in nature, meaning the data can be distilled into a statistic, such as in a table or chart.

Again, descriptive data is helpful in explaining the current situation. In the opening example of LEGO , the company wanted to describe the situation regarding children’s use of its product. In order to gather a large group of opinions, a survey was created. The data that was collected through this survey allowed the company to measure the existing perceptions of parents so that alterations could be made to future plans for the company.

Experimental research , also known as causal research , helps to define a cause-and-effect relationship between two or more factors. This type of research goes beyond a correlation to determine which feature caused the reaction. Researchers generally use some type of experimental design to determine a causal relationship. An example is A/B testing, a situation where one group of research participants, group A, is exposed to one treatment and then compared to the group B participants, who experience a different situation. An example might be showing two different television commercials to a panel of consumers and then measuring the difference in perception of the product. Another example would be to have two separate packaging options available in different markets. This research would answer the question “Does one design sell better than the other?” Comparing that to the sales in each market would be part of a causal research study. 9

The final method of collecting data is through an ethnographic design. Ethnographic research is conducted in the field by watching people interact in their natural environment. For marketing research, ethnographic designs help to identify how a product is used, what actions are included in a selection, or how the consumer interacts with the product. 10

Examples of ethnographic research would be to observe how a consumer uses a particular product, such as baking soda. Although many people buy baking soda, its uses are vast. So are they using it as a refrigerator deodorizer, a toothpaste, to polish a belt buckle, or to use in baking a cake?

Select the Data Collection Method

Data collection is the systematic gathering of information that addresses the identified problem. What is the best method to do that? Picking the right method of collecting data requires that the researcher understand the target population and the design picked in the previous step. There is no perfect method; each method has both advantages and disadvantages, so it’s essential that the researcher understand the target population of the research and the research objectives in order to pick the best option.

Sometimes the data desired is best collected by watching the actions of consumers. For instance, how many cars pass a specific billboard in a day? What website led a potential customer to the company’s website? When are consumers most likely to use the snack vending machines at work? What time of day has the highest traffic on a social media post? What is the most streamed television program this week? Observational research is the collecting of data based on actions taken by those observed. Many data observations do not require the researched individuals to participate in the data collection effort to be highly valuable. Some observation requires an individual to watch and record the activities of the target population through personal observations .

Unobtrusive observation happens when those being observed aren’t aware that they are being watched. An example of an unobtrusive observation would be to watch how shoppers interact with a new stuffed animal display by using a one-way mirror. Marketers can identify which products were handled more often while also determining which were ignored.

Other methods can use technology to collect the data instead. Instances of mechanical observation include the use of vehicle recorders, which count the number of vehicles that pass a specific location. Computers can also assess the number of shoppers who enter a store, the most popular entry point for train station commuters, or the peak time for cars to park in a parking garage.

When you want to get a more in-depth response from research participants, one method is to complete a one-on-one interview . One-on-one interviews allow the researcher to ask specific questions that match the respondent’s unique perspective as well as follow-up questions that piggyback on responses already completed. An interview allows the researcher to have a deeper understanding of the needs of the respondent, which is another strength of this type of data collection. The downside of personal interviews it that a discussion can be very time-consuming and results in only one respondent’s answers. Therefore, in order to get a large sample of respondents, the interview method may not be the most efficient method.

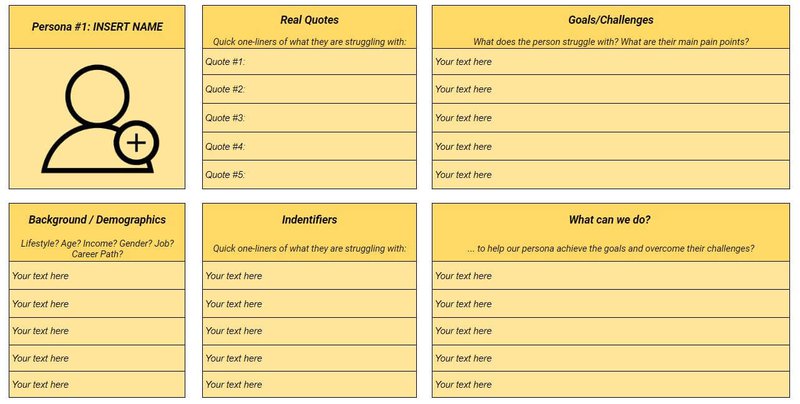

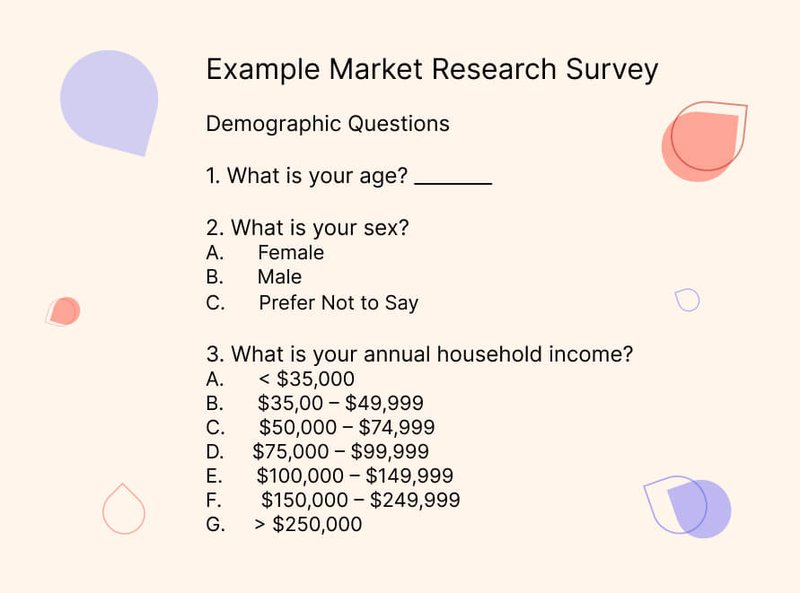

Taking the benefits of an interview and applying them to a small group of people is the design of a focus group . A focus group is a small number of people, usually 8 to 12, who meet the sample requirements. These individuals together are asked a series of questions where they are encouraged to build upon each other’s responses, either by agreeing or disagreeing with the other group members. Focus groups are similar to interviews in that they allow the researcher, through a moderator, to get more detailed information from a small group of potential customers (see Figure 6.5 ).

Link to Learning

Focus groups.

Focus groups are a common method for gathering insights into consumer thinking and habits. Companies will use this information to develop or shift their initiatives. The best way to understand a focus group is to watch a few examples or explanations. TED-Ed has this video that explains how focus groups work.

You might be asking when it is best to use a focus group or a survey. Learn the differences, the pros and cons of each, and the specific types of questions you ask in both situations in this article .

Preparing for a focus group is critical to success. It requires knowing the material and questions while also managing the group of people. Watch this video to learn more about how to prepare for a focus group and the types of things to be aware of.

One of the benefits of a focus group over individual interviews is that synergy can be generated when a participant builds on another’s ideas. Additionally, for the same amount of time, a researcher can hear from multiple respondents instead of just one. 11 Of course, as with every method of data collection, there are downsides to a focus group as well. Focus groups have the potential to be overwhelmed by one or two aggressive personalities, and the format can discourage more reserved individuals from speaking up. Finally, like interviews, the responses in a focus group are qualitative in nature and are difficult to distill into an easy statistic or two.

Combining a variety of questions on one instrument is called a survey or questionnaire . Collecting primary data is commonly done through surveys due to their versatility. A survey allows the researcher to ask the same set of questions of a large group of respondents. Response rates of surveys are calculated by dividing the number of surveys completed by the total number attempted. Surveys are flexible and can collect a variety of quantitative and qualitative data. Questions can include simplified yes or no questions, select all that apply, questions that are on a scale, or a variety of open-ended types of questions. There are four types of surveys (see Table 6.2 ) we will cover, each with strengths and weaknesses defined.

Let’s start off with mailed surveys —surveys that are sent to potential respondents through a mail service. Mailed surveys used to be more commonly used due to the ability to reach every household. In some instances, a mailed survey is still the best way to collect data. For example, every 10 years the United States conducts a census of its population (see Figure 6.6 ). The first step in that data collection is to send every household a survey through the US Postal Service (USPS). The benefit is that respondents can complete and return the survey at their convenience. The downside of mailed surveys are expense and timeliness of responses. A mailed survey requires postage, both when it is sent to the recipient and when it is returned. That, along with the cost of printing, paper, and both sending and return envelopes, adds up quickly. Additionally, physically mailing surveys takes time. One method of reducing cost is to send with bulk-rate postage, but that slows down the delivery of the survey. Also, because of the convenience to the respondent, completed surveys may be returned several weeks after being sent. Finally, some mailed survey data must be manually entered into the analysis software, which can cause delays or issues due to entry errors.

Phone surveys are completed during a phone conversation with the respondent. Although the traditional phone survey requires a data collector to talk with the participant, current technology allows for computer-assisted voice surveys or surveys to be completed by asking the respondent to push a specific button for each potential answer. Phone surveys are time intensive but allow the respondent to ask questions and the surveyor to request additional information or clarification on a question if warranted. Phone surveys require the respondent to complete the survey simultaneously with the collector, which is a limitation as there are restrictions for when phone calls are allowed. According to Telephone Consumer Protection Act , approved by Congress in 1991, no calls can be made prior to 8:00 a.m. or after 9:00 p.m. in the recipient’s time zone. 12 Many restrictions are outlined in this original legislation and have been added to since due to ever-changing technology.

In-person surveys are when the respondent and data collector are physically in the same location. In-person surveys allow the respondent to share specific information, ask questions of the surveyor, and follow up on previous answers. Surveys collected through this method can take place in a variety of ways: through door-to-door collection, in a public location, or at a person’s workplace. Although in-person surveys are time intensive and require more labor to collect data than some other methods, in some cases it’s the best way to collect the required data. In-person surveys conducted through a door-to-door method is the follow-up used for the census if respondents do not complete the mailed survey. One of the downsides of in-person surveys is the reluctance of potential respondents to stop their current activity and answer questions. Furthermore, people may not feel comfortable sharing private or personal information during a face-to-face conversation.

Electronic surveys are sent or collected through digital means and is an opportunity that can be added to any of the above methods as well as some new delivery options. Surveys can be sent through email, and respondents can either reply to the email or open a hyperlink to an online survey (see Figure 6.7 ). Additionally, a letter can be mailed that asks members of the survey sample to log in to a website rather than to return a mailed response. Many marketers now use links, QR codes, or electronic devices to easily connect to a survey. Digitally collected data has the benefit of being less time intensive and is often a more economical way to gather and input responses than more manual methods. A survey that could take months to collect through the mail can be completed within a week through digital means.

Design the Sample

Although you might want to include every possible person who matches your target market in your research, it’s often not a feasible option, nor is it of value. If you did decide to include everyone, you would be completing a census of the population. Getting everyone to participate would be time-consuming and highly expensive, so instead marketers use a sample , whereby a portion of the whole is included in the research. It’s similar to the samples you might receive at the grocery store or ice cream shop; it isn’t a full serving, but it does give you a good taste of what the whole would be like.

So how do you know who should be included in the sample? Researchers identify parameters for their studies, called sample frames . A sample frame for one study may be college students who live on campus; for another study, it may be retired people in Dallas, Texas, or small-business owners who have fewer than 10 employees. The individual entities within the sampling frame would be considered a sampling unit . A sampling unit is each individual respondent that would be considered as matching the sample frame established by the research. If a researcher wants businesses to participate in a study, then businesses would be the sampling unit in that case.

The number of sampling units included in the research is the sample size . Many calculations can be conducted to indicate what the correct size of the sample should be. Issues to consider are the size of the population, the confidence level that the data represents the entire population, the ease of accessing the units in the frame, and the budget allocated for the research.

There are two main categories of samples: probability and nonprobability (see Figure 6.8 ). Probability samples are those in which every member of the sample has an identified likelihood of being selected. Several probability sample methods can be utilized. One probability sampling technique is called a simple random sample , where not only does every person have an identified likelihood of being selected to be in the sample, but every person also has an equal chance of exclusion. An example of a simple random sample would be to put the names of all members of a group into a hat and simply draw out a specific number to be included. You could say a raffle would be a good example of a simple random sample.

Another probability sample type is a stratified random sample , where the population is divided into groups by category and then a random sample of each category is selected to participate. For instance, if you were conducting a study of college students from your school and wanted to make sure you had all grade levels included, you might take the names of all students and split them into different groups by grade level—freshman, sophomore, junior, and senior. Then, from those categories, you would draw names out of each of the pools, or strata.

A nonprobability sample is a situation in which each potential member of the sample has an unknown likelihood of being selected in the sample. Research findings that are from a nonprobability sample cannot be applied beyond the sample. Several examples of nonprobability sampling are available to researchers and include two that we will look at more closely: convenience sampling and judgment sampling.

The first nonprobability sampling technique is a convenience sample . Just like it sounds, a convenience sample is when the researcher finds a group through a nonscientific method by picking potential research participants in a convenient manner. An example might be to ask other students in a class you are taking to complete a survey that you are doing for a class assignment or passing out surveys at a basketball game or theater performance.

A judgment sample is a type of nonprobability sample that allows the researcher to determine if they believe the individual meets the criteria set for the sample frame to complete the research. For instance, you may be interested in researching mothers, so you sit outside a toy store and ask an individual who is carrying a baby to participate.

Collect the Data

Now that all the plans have been established, the instrument has been created, and the group of participants has been identified, it is time to start collecting data. As explained earlier in this chapter, data collection is the process of gathering information from a variety of sources that will satisfy the research objectives defined in step one. Data collection can be as simple as sending out an email with a survey link enclosed or as complex as an experiment with hundreds of consumers. The method of collection directly influences the length of this process. Conducting personal interviews or completing an experiment, as previously mentioned, can add weeks or months to the research process, whereas sending out an electronic survey may allow a researcher to collect the necessary data in a few days. 13

Analyze and Interpret the Data

Once the data has been collected, the process of analyzing it may begin. Data analysis is the distillation of the information into a more understandable and actionable format. The analysis itself can take many forms, from the use of basic statistics to a more comprehensive data visualization process. First, let’s discuss some basic statistics that can be used to represent data.

The first is the mean of quantitative data. A mean is often defined as the arithmetic average of values. The formula is:

A common use of the mean calculation is with exam scores. Say, for example, you have earned the following scores on your marketing exams: 72, 85, 68, and 77. To find the mean, you would add up the four scores for a total of 302. Then, in order to generate a mean, that number needs to be divided by the number of exam scores included, which is 4. The mean would be 302 divided by 4, for a mean test score of 75.5. Understanding the mean can help to determine, with one number, the weight of a particular value.

Another commonly used statistic is median. The median is often referred to as the middle number. To generate a median, all the numeric answers are placed in order, and the middle number is the median. Median is a common statistic when identifying the income level of a specific geographic region. 14 For instance, the median household income for Albuquerque, New Mexico, between 2015 and 2019 was $52,911. 15 In this case, there are just as many people with an income above the amount as there are below.

Mode is another statistic that is used to represent data of all types, as it can be used with quantitative or qualitative data and represents the most frequent answer. Eye color, hair color, and vehicle color can all be presented with a mode statistic. Additionally, some researchers expand on the concept of mode and present the frequency of all responses, not just identifying the most common response. Data such as this can easily be presented in a frequency graph, 16 such as the one in Figure 6.9 .

Additionally, researchers use other analyses to represent the data rather than to present the entirety of each response. For example, maybe the relationship between two values is important to understand. In this case, the researcher may share the data as a cross tabulation (see Figure 6.10 ). Below is the same data as above regarding social media use cross tabulated with gender—as you can see, the data is more descriptive when you can distinguish between the gender identifiers and how much time is spent per day on social media.

Not all data can be presented in a graphical format due to the nature of the information. Sometimes with qualitative methods of data collection, the responses cannot be distilled into a simple statistic or graph. In that case, the use of quotations, otherwise known as verbatims , can be used. These are direct statements presented by the respondents. Often you will see a verbatim statement when reading a movie or book review. The critic’s statements are used in part or in whole to represent their feelings about the newly released item.

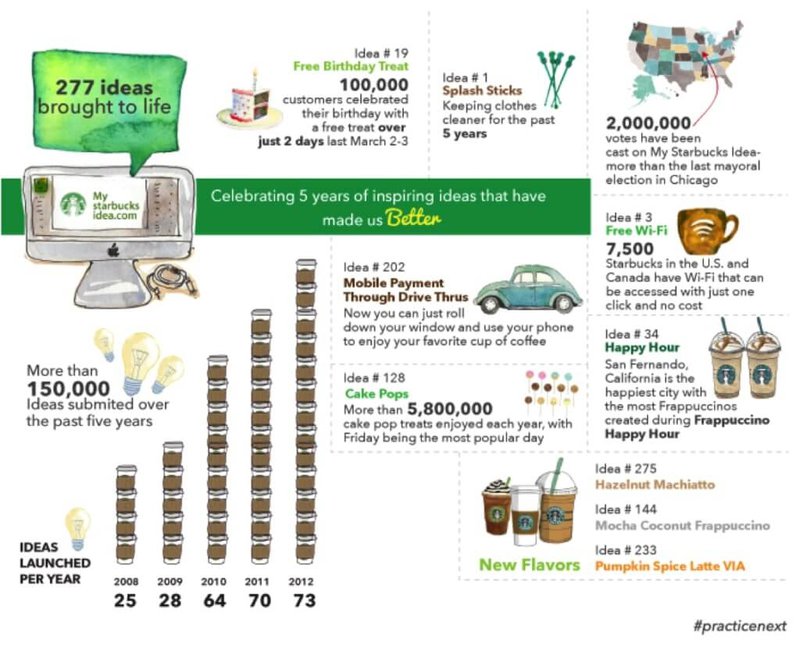

Infographics

As they say, a picture is worth a thousand words. For this reason, research results are often shown in a graphical format in which data can be taken in quickly, called an infographic .

Check out this infographic on what components make for a good infographic. As you can see, a good infographic needs four components: data, design, a story, and the ability to share it with others. Without all four pieces, it is not as valuable a resource as it could be. The ultimate infographic is represented as the intersection of all four.

Infographics are particularly advantageous online. Refer to this infographic on why they are beneficial to use online .

Prepare the Research Report

The marketing research process concludes by sharing the generated data and makes recommendations for future actions. What starts as simple data must be interpreted into an analysis. All information gathered should be conveyed in order to make decisions for future marketing actions. One item that is often part of the final step is to discuss areas that may have been missed with the current project or any area of further study identified while completing it. Without the final step of the marketing research project, the first six steps are without value. It is only after the information is shared, through a formal presentation or report, that those recommendations can be implemented and improvements made. The first six steps are used to generate information, while the last is to initiate action. During this last step is also when an evaluation of the process is conducted. If this research were to be completed again, how would we do it differently? Did the right questions get answered with the survey questions posed to the respondents? Follow-up on some of these key questions can lead to additional research, a different study, or further analysis of data collected.

Methods of Quantifying Marketing Research

One of the ways of sharing information gained through marketing research is to quantify the research . Quantifying the research means to take a variety of data and compile into a quantity that is more easily understood. This is a simple process if you want to know how many people attended a basketball game, but if you want to quantify the number of students who made a positive comment on a questionnaire, it can be a little more complicated. Researchers have a variety of methods to collect and then share these different scores. Below are some of the most common types used in business.

Is a customer aware of a product, brand, or company? What is meant by awareness? Awareness in the context of marketing research is when a consumer is familiar with the product, brand, or company. It does not assume that the consumer has tried the product or has purchased it. Consumers are just aware. That is a measure that many businesses find valuable. There are several ways to measure awareness. For instance, the first type of awareness is unaided awareness . This type of awareness is when no prompts for a product, brand, or company are given. If you were collecting information on fast-food restaurants, you might ask a respondent to list all the fast-food restaurants that serve a chicken sandwich. Aided awareness would be providing a list of products, brands, or companies and the respondent selects from the list. For instance, if you give a respondent a list of fast-food restaurants and ask them to mark all the locations with a chicken sandwich, you are collecting data through an aided method. Collecting these answers helps a company determine how the business location compares to those of its competitors. 17

Customer Satisfaction (CSAT)

Have you ever been asked to complete a survey at the end of a purchase? Many businesses complete research on buying, returning, or other customer service processes. A customer satisfaction score , also known as CSAT, is a measure of how satisfied customers are with the product, brand, or service. A CSAT score is usually on a scale of 0 to 100 percent. 18 But what constitutes a “good” CSAT score? Although what is identified as good can vary by industry, normally anything in the range from 75 to 85 would be considered good. Of course, a number higher than 85 would be considered exceptional. 19

Customer Acquisition Cost (CAC) and Customer Effort Score (CES)

Other metrics often used are a customer acquisition cost (CAC) and customer effort score (CES). How much does it cost a company to gain customers? That’s the purpose of calculating the customer acquisition cost. To calculate the customer acquisition cost , a company would need to total all expenses that were accrued to gain new customers. This would include any advertising, public relations, social media postings, etc. When a total cost is determined, it is divided by the number of new customers gained through this campaign.

The final score to discuss is the customer effort score , also known as a CES. The CES is a “survey used to measure the ease of service experience with an organization.” 20 Companies that are easy to work with have a better CES than a company that is notorious for being difficult. An example would be to ask a consumer about the ease of making a purchase online by incorporating a one-question survey after a purchase is confirmed. If a number of responses come back negative or slightly negative, the company will realize that it needs to investigate and develop a more user-friendly process.

Knowledge Check

It’s time to check your knowledge on the concepts presented in this section. Refer to the Answer Key at the end of the book for feedback.

- Defining the problem

- Developing the research plan

- Selecting a data collection method

- Designing the sample

- you are able to send it to all households in an area

- it is inexpensive

- responses are automatically loaded into the software

- the data comes in quickly

- Primary data

- Secondary data

- Secondary and primary data

- Professional data

- It shows how respondents answered two variables in relation to each other and can help determine patterns by different groups of respondents.

- By presenting the data in the form of a picture, the information is easier for the reader to understand.

- It is an easy way to see how often one answer is selected by the respondents.

- This analysis can used to present interview or focus group data.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-marketing/pages/1-unit-introduction

- Authors: Dr. Maria Gomez Albrecht, Dr. Mark Green, Linda Hoffman

- Publisher/website: OpenStax

- Book title: Principles of Marketing

- Publication date: Jan 25, 2023

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-marketing/pages/1-unit-introduction

- Section URL: https://openstax.org/books/principles-marketing/pages/6-3-steps-in-a-successful-marketing-research-plan

© Jan 9, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here .

How to Create a Market Research Plan

Before starting a business, you want to fully research your idea. A market research plan will help you understand your competition, the marketplace and more.

Table of Contents

While having a great idea is an important part of establishing a business, you’ll only get so far without laying the proper groundwork. To help your business take off, not only do you need to size up the competition, but you also need to identify who will buy your product, how much it will cost, the best approach to selling it and how many people will demand it.

To get answers to these questions, you’ll need a market research plan, which you can create yourself or pay a specialist to create for you. Market research plans define an existing problem and/or outline an opportunity. From there, the marketing strategy is broken down task by task. Your plan should include objectives and the methods that you’ll use to achieve those objectives, along with a time frame for completing the work.

What should a market research plan include?

A market research plan should provide a thorough examination of how your product or service will fare in a defined area. It should include:

- An examination of the current marketplace and an analysis of the need for your product or service: To know where you fit in the market, it’s important to have a broad understanding of your industry — covering everything from its annual revenue to the industry standards to the total number of businesses operating within it. Start by gathering statistical data from sources like the U.S. Bureau of Labor Statistics and BMI Research and consider the industry’s market size, potential customer base and how external factors such as laws, technology, world events and socioeconomic changes impact it.

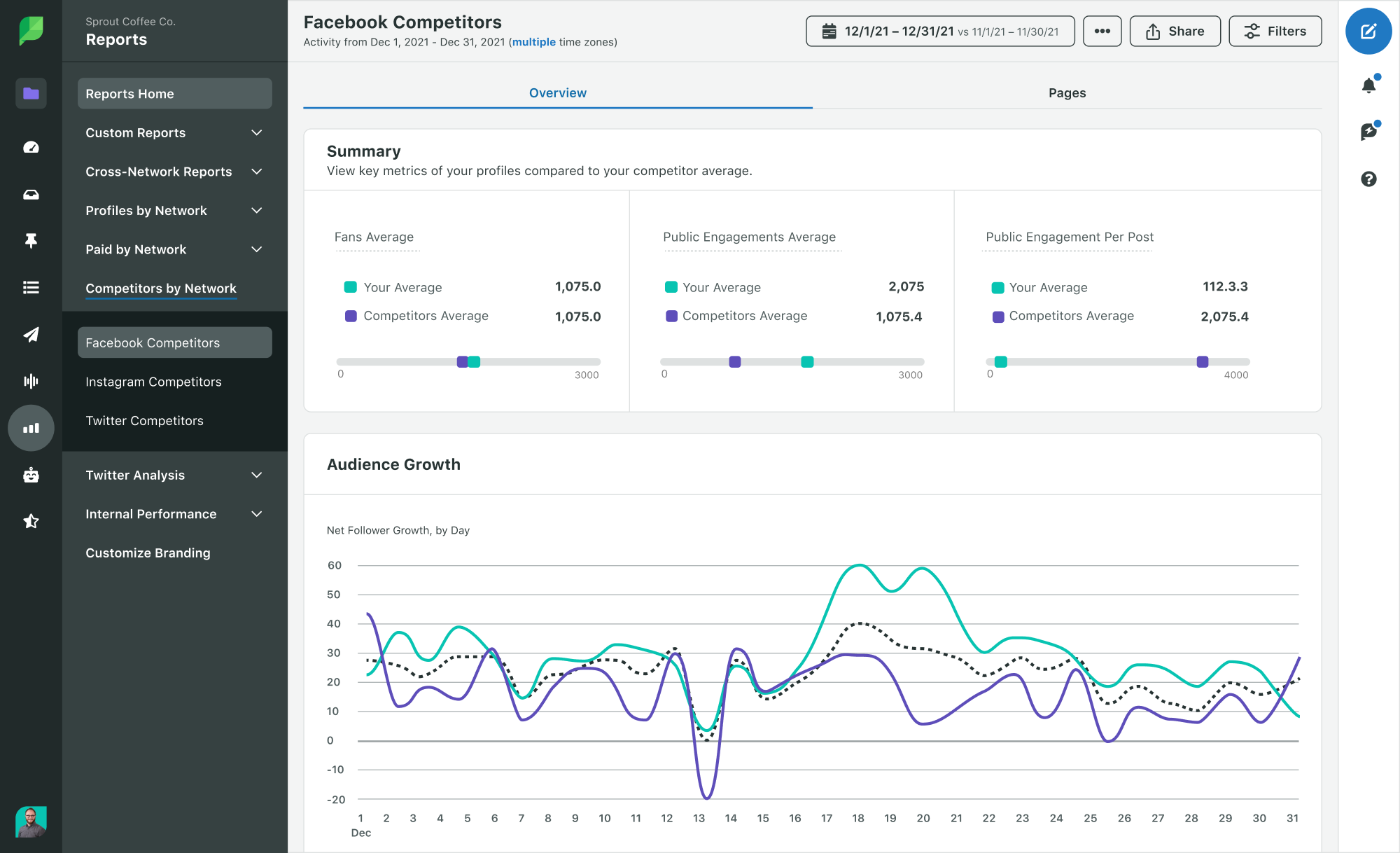

- An assessment of the competition: By analyzing your competitors, you can discover strategies to fill market gaps. This involves identifying well-known competitors and noting trends they employ successfully, scrutinizing customer feedback about businesses in your sector, such as through online reviews, and understanding competitors’ product or service offerings. This knowledge can then guide the refinement of your own products or services to differentiate them from others in the market.

- Data about customers: Identify which segment of potential customers in your industry you can effectively target, considering their demographics — such as age, ethnicity, income and location and psychographics, including beliefs, values and lifestyle. Learn about the challenges your customers face in their daily lives and determine how the features and benefits of your offerings address their needs.

- The direction for your marketing in the upcoming year: Your plan should provide a clear roadmap for your marketing strategies for the next year, focusing on approaches to distinguish your brand from competitors. Develop marketing messages that resonate with and display empathy toward your target market and find ways to address customers’ needs and demonstrate value.

- Goals to be met: Outline goals your business would like to achieve and make these goals clear to all employees on your team. Create goals that are realistic and attainable while also making a meaningful impact on the business’s growth. Consider factors including your target number of products or services, the expected number of units to sell based on market size, target market behavior, pricing for each item and the cost of production and advertising.

How to create your market research plan

Doing business without having a marketing plan is like driving without directions. You may eventually reach your destination, but there will be many costly and time-consuming mistakes made along the way.

Many entrepreneurs mistakenly believe there is a big demand for their service or product but, in reality, there may not be, your prices may be too high or too low or you may be going into a business with so many restrictions that it’s almost impossible to be successful. A market research plan will help you uncover significant issues or roadblocks.

Step 1. Conduct a comprehensive situation analysis.

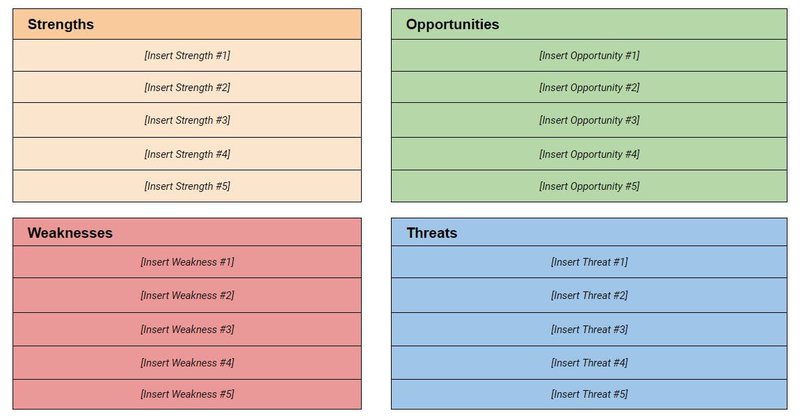

One of the first steps in constructing your marketing plan is to create a strengths, weaknesses, opportunities and threats (SWOT) analysis , which is used to identify your competition, to know how they operate and then to understand their strengths and weaknesses.

Step 2: Develop clear marketing objectives.

In this section, describe the desired outcome for your marketing plan with realistic and attainable objectives, the targets and a clear and concise time frame. The most common way to approach this is with marketing objectives, which may include the total number of customers and the retention rate, the average volume of purchases, total market share and the proportion of your potential market that makes purchases.

Step 3: Make a financial plan.

A financial plan is essentia l for creating a solid marketing plan. The financial plan answers a range of questions that are critical components of your business, such as how much you intend to sell, what will you charge, how much will it cost to deliver your services or produce your products, how much will it cost for your basic operating expenses and how much financing will you need to operate your business.

In your business plan, be sure to describe who you are, what your business will be about, your business goals and what your inspiration was to buy, begin or grow your business.

Step 4: Determine your target audience.

Once you know what makes you stand out from your competitors and how you’ll market yourself, you should decide who to target with all this information. That’s why your market research plan should delineate your target audience. What are their demographics and how will these qualities affect your plan? How do your company’s current products and services affect which consumers you can realistically make customers? Will that change in the future? All of these questions should be answered in your plan.

Step 5: List your research methods.

Rarely does one research avenue make for a comprehensive market research plan. Instead, your plan should indicate several methods that will be used to determine the market share you can realistically obtain. This way, you get as much information as possible from as many sources as possible. The result is a more robust path toward establishing the exact footprint you desire for your company.

Step 6: Establish a timeline.

With your plan in place, you’ll need to figure out how long your market research process will take. Project management charts are often helpful in this regard as they divide tasks and personnel over a timeframe that you have set. No matter which type of project management chart you use, try to build some flexibility into your timeframe. A two-week buffer toward the home stretch comes in handy when a process scheduled for one week takes two — that buffer will keep you on deadline.

Step 7: Acknowledge ethical concerns.

Market research always presents opportunities for ethical missteps. After all, you’ll need to obtain competitor information and sensitive financial data that may not always be readily available. Your market research plan should thus encourage your team to not take any dicey steps to obtain this information. It may be better to state, “we could not obtain this competitor information,” than to spy on the competitor or pressure their current employees for knowledge. Plus, there’s nothing wrong with simply feeling better about the final state of your plan and how you got it there.

Using a market research firm

If the thought of trying to create your own market research plan seems daunting or too time-consuming, there are plenty of other people willing to do the work for you.

Pros of using a market research firm

As an objective third party, businesses can benefit from a market research firm’s impartial perspective and guidance, helping to shape impactful brand strategies and marketing campaigns. These firms, which can help businesses with everything from their marketing campaigns to brand launches, deliver precise results, drawing on their expertise and experience to provide in-depth insights and solutions tailored specifically to your company’s needs.

Even more, working with a market research firm can elevate a brand above the competition, as they provide credible and unique research that is highly valued by the media, enhancing brand credibility and potentially increasing website traffic, social media shares and online visibility.

Cons of using a market research firm

Although hiring a firm can provide businesses with tremendous results, certain downsides can lead a business toward the do-it-yourself route. Most notably, market research firms can be a costly expense that some businesses can’t afford. However, businesses that can allocate the funds will likely see a positive return on investment, as they are paying for the expertise and proficiency of seasoned professionals in the field.

Additionally, finding the right market research firm for your business’s needs can take some time — and even longer, ranging from weeks to months, for a market research firm to complete a plan. This lack of immediate results can be detrimental for businesses that don’t have the time to wait.

Market research firms can charge into the thousands of dollars for a market research plan, but there are ways to get help more affordably, including:

- Outline your plans carefully and spell out objectives.

- Examine as many sources as possible.

- Before paying for any information, check with librarians, small business development centers or market research professors to see if they can help you access market research data for free.

- You may think you’ll need to spend a hefty sum to create a market research plan, but there are plenty of free and low-cost sources available, especially through university business schools that will guide you through the process.

Miranda Fraraccio contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

Ready to level up your insights?

Get ready to streamline, scale and supercharge your research. Fill out this form to request a demo of the InsightHub platform and discover the difference insights empowerment can make. A member of our team will reach out within two working days.

Cost effective insights that scale

Quality insight doesn't need to cost the earth. Our flexible approach helps you make the most of research budgets and build an agile solution that works for you. Fill out this form to request a call back from our team to explore our pricing options.

- What is InsightHub?

- Data Collection

- Data Analysis

- Data Activation

- Research Templates

- Information Security

- Our Expert Services

- Support & Education

- Consultative Services

- Insight Delivery

- Research Methods

- Sectors We Work With

- Meet the team

- Advisory Board

- Press & Media

- Book a Demo

- Request Pricing

Embark on a new adventure. Join Camp InsightHub, our free demo platform, to discover the future of research.

Read a brief overview of the agile research platform enabling brands to inform decisions at speed in this PDF.

InsightHub on the Blog

- Surveys, Video and the Changing Face of Agile Research

- Building a Research Technology Stack for Better Insights

- The Importance of Delegation in Managing Insight Activities

- Common Insight Platform Pitfalls (and How to Avoid Them)

- Support and Education

- Insight Delivery Services

Our services drive operational and strategic success in challenging environments. Find out how.

Close Connections bring stakeholders and customers together for candid, human conversations.

Services on the Blog

- Closing the Client-Agency Divide in Market Research

- How to Speed Up Fieldwork Without Compromising Quality

- Practical Ways to Support Real-Time Decision Making

- Developing a Question Oriented, Not Answer Oriented Culture

- Meet the Team

The FlexMR credentials deck provides a brief introduction to the team, our approach to research and previous work.

We are the insights empowerment company. Our framework addresses the major pressures insight teams face.

Latest News

- Insight as Art Shortlisted for AURA Innovation Award

- FlexMR Launch Video Close Connection Programme

- VideoMR Analysis Tool Added to InsightHub

- FlexMR Makes Shortlist for Quirks Research Supplier Award

- Latest Posts

- Strategic Thinking

- Technology & Trends

- Practical Application

- Insights Empowerment

- View Full Blog Archives

Discover how to build close customer connections to better support real-time decision making.

What is a market research and insights playbook, plus discover why should your team consider building one.

Featured Posts

- Five Strategies for Turning Insight into Action

- How to Design Surveys that Ask the Right Questions

- Scaling Creative Qual for Rich Customer Insight

- How to Measure Brand Awareness: The Complete Guide

- All Resources

- Client Stories

- Whitepapers

- Events & Webinars

- The Open Ideas Panel

- InsightHub Help Centre

- FlexMR Client Network

The insights empowerment readiness calculator measures your progress in building an insight-led culture.

The MRX Lab podcast explores new and novel ideas from the insights industry in 10 minutes or less.

Featured Stories

- Specsavers Informs Key Marketing Decisions with InsightHub

- The Coventry Panel Helps Maintain Award Winning CX

- Isagenix Customer Community Steers New Product Launch

- Curo Engage Residents with InsightHub Community

- Tech & Trends /

How to Write a Market Research Plan (+ Free Template)

Chris martin, how to use synthetic data in market research.

In recent years, the rapid advancement of technology and data analytics has revolutionised working p...

Dr Katharine Johnson

- Insights Empowerment (32)

- Practical Application (175)

- Research Methods (283)

- Strategic Thinking (201)

- Survey Templates (7)

- Tech & Trends (389)

A market research plan, similar to a brief, is a vital document that details important information about your market research project. Though it is often an overlooked step of the market research process , an effective plan is often a critical factor in determining whether or not your market research efforts are successful.

Why? Because a well-thought through plan, more so than objectives alone, can be a vital instrument in focusing your investment. It ensures you know, ahead of the commencement date, the timeline, budget and desired outcomes from the project. It can even be used as a tool for receiving quicker sign-off from management when embarking on a new venture.

But it’s also important to remember that the research plan is not just for your team. To make full use of this document, it should be written in a way that can be distributed to agency partners as well – ensuring that your insight team and specialist partners are all working towards the same goal.

Tips for Crafting a Successful Plan

The first rule of writing a successful market research plan is to keep it short. The perfect length is between 1-2 pages, but as an absolute maximum try to ensure that it never exceeds 3. This will give you enough space to explain the background, scope and practicalities of the project while ensuring it is concise enough to be read in full. Throughout these few short pages, the tone of your plan should be informative. Remember that you are outlining information that you already know.

Write in a way that holistically encompasses all aspects of the project. Throughout the duration of your scripting, data collection, analysis and reporting stages of your project you should always be referring back to this document in order to remain focused. As any researcher knows, one of the biggest challenges in any research project is staying true to your original objectives.

With both exploratory and confirmatory research alike, new information is likely to arise which may spark other ideas or bring light to previously unknown issues. Remember these, but set them aside for further investigation at a later date. Travelling too far down the rabbit hole is the quickest way to overspend and under deliver on your original goal.

The 10 Elements of the Best Research Plans

First, let me preface this with a reminder: every project is different. A long term co-creation community will have different needs and requirements to a customer feedback survey or ad testing project. However, despite this – it is important to give equal consideration to all projects, and plan each with the same high degree of meticulous care. With this in mind, these are the 10 key aspects we recommend that all research plans should include:

1. Overview

Use this first section to outline the background to the problem that you are attempting to solve. Include background information on the business to provide context, as well as the circumstances that have led to the need for research. Overviews should be limited to 200 words at most, with most of the word count dedicated to the business circumstances & challenges surrounding the research.

2. Objectives

Arguably the most important aspect of the entire document, objectives should be in bullet point format. List 3-5 of the decisions or initiatives that the research will inform – this will become the remit of the project. Below are a few examples of both well and poorly written objectives:

Well written research objectives:

- Understand the channels in which our customers are most comfortable shopping, in order to decide which should be prioritised in the 2017 Q1 budget

- Develop an active co-creation community that contributes 2 user-generated product improvements for testing to the R & D team per month

- Learn what is leading to an increase in customer churn so that a new retention strategy can be put in place within 12 weeks

Poorly written research objectives:

- Survey 1,000 potential customers to find out how our products can be improved

- Develop a panel of employees that are able to provide answers to research questions on an ad-hoc basis

- Learn how our company is perceived in comparison to competitors and how we can stand out in the marketplace

3. Deliverable outcomes

This section acts as a list what you expect to be produced at the end of the project. This can include, but is not limited to: a target number of responses you expect to receive, descriptions of how the data should be presented and the extent to which the data will be used to inform future decisions. In long term projects such as panels or communities, this may include a target for the amount of decisions that research is expected to inform and/or a pipeline for new ideas in exploratory studies.

4. Target audience

Different to sample, your target audience describes the population that you wish to research. This can be defined by a number of factors depending on the nature of your project. Some of the most common include: demographics, psychographics, life stages and company/ product interaction.

5. Sample plan

The sample plan should be used to indicate the amount of participants you wish to research, as well as a breakdown of each group. This will be affected by the choice to use qualitative, quantitative or multi-method approaches, as well as the estimated size of the target population.

6. Research Methods

List the different research methods that you plan to use in your project. This will be used by your team and agency partners to ensure that the insight you need comes from the most appropriate tools. Be sure to include any non-traditional methods you plan to use as well – it’s important that your team are aware of how data will be captured, even if it is being gathered by an experimental technique.

7. Timeline

These usually take the form of a Gantt chart, but can vary depending on the scope and length of your project. Try to break down tasks as much as possible but be wary of dependencies within your chart. Be sure to schedule enough time in case some research tasks over-run or response rates are lower than expected.

Perhaps the most dreaded aspect of any research plan, budgeting is never easy. But by providing a breakdown of costs and outlining which elements of the project require most investment, a well-planned budget can be a benefit rather than a hurdle.

9 & 10. Ethical and Further considerations

Finally, you should outline any ethical/ other considerations or issues that may arise throughout the course of your project. Whether these are as simple as a conflict of interest or a concern about supplier relationships – this is your chance to address any problems that may arise before they do.

Free Market Research Plan Template

Use this link to download our free market research plan template . The template comes complete with each of the sections outlined above, with instructions on usage and tips on how to make the most out of it. Currently available in .docx format, please email [email protected] if you have any problems with the download.

What do you believe should be included in a successful market research plan? Share your advice with us in the comments below and join the conversation.

About FlexMR

We are The Insights Empowerment Company. We help research, product and marketing teams drive informed decisions with efficient, scalable & impactful insight.

About Chris Martin

Chris is an experienced executive and marketing strategist in the insight and technology sectors. He also hosts our MRX Lab podcast.

Stay up to date

You might also like....

How to Use Synthetic Data in Market...

In recent years, the rapid advancement of technology and data analytics has revolutionised working practices in the market research industry. One significant and growing innovation to watch is the pro...

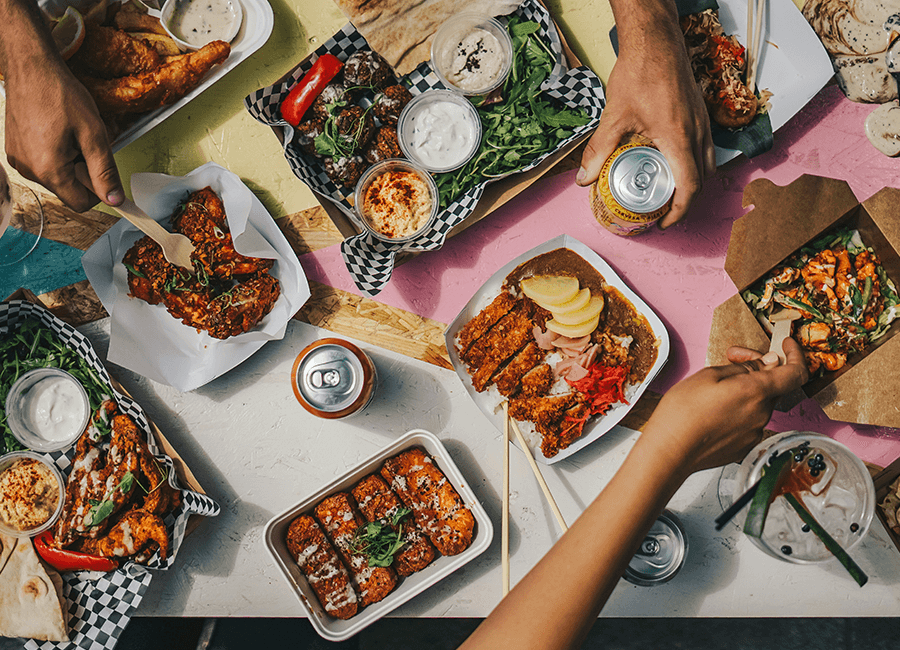

How Delivery Platforms Reshaped the...

Have you noticed how ordering food today feels like a whole new experience compared to a few years back? The restaurant and food delivery industry has been on quite a journey, and it’s amazing to see ...

Market Research Room 101: Round 2

On Thursday 9th May 2024, Team Russell and Team Hudson duelled in a panel debate modelled off the popular TV show Room 101. This mock-gameshow-style panel, hosted by Keen as Mustard Marketing's Lucy D...

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 03/30/16

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![research marketing plan → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

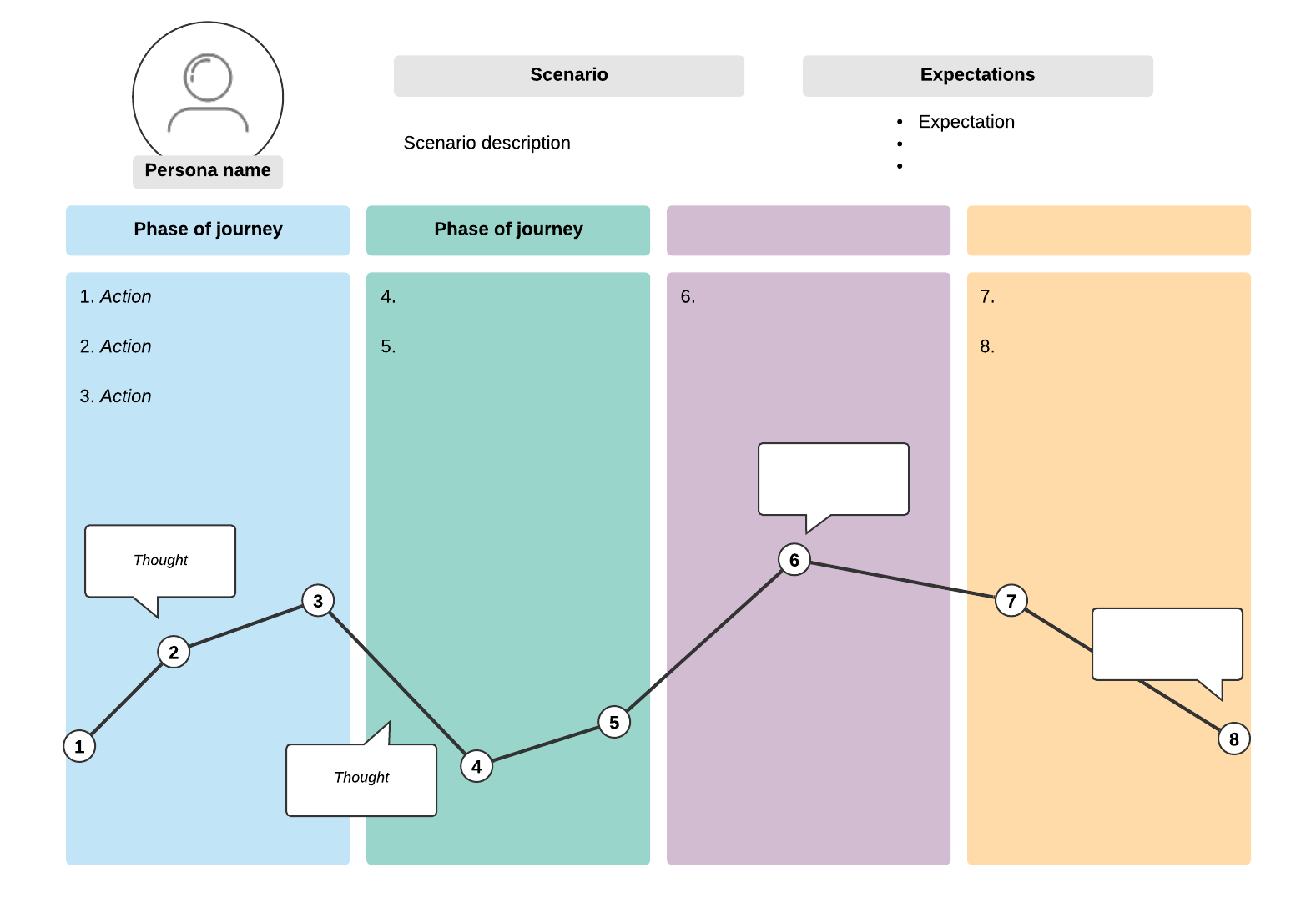

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

Identifying Content Competitors

Search engines are your best friends in this area of secondary market research.

To find the online publications with which you compete, take the overarching industry term you identified in the section above, and come up with a handful of more specific industry terms your company identifies with.

A catering business, for example, might generally be a “food service” company, but also consider itself a vendor in “event catering,” “cake catering,” or “baked goods.” Once you have this list, do the following:

- Google it. Don't underestimate the value in seeing which websites come up when you run a search on Google for the industry terms that describe your company. You might find a mix of product developers, blogs, magazines, and more.

- Compare your search results against your buyer persona. If the content the website publishes seems like the stuff your buyer persona would want to see, it's a potential competitor, and should be added to your list of competitors.

5. Summarize your findings.

Feeling overwhelmed by the notes you took? We suggest looking for common themes that will help you tell a story and create a list of action items.

To make the process easier, try using your favorite presentation software to make a report, as it will make it easy to add in quotes, diagrams, or call clips.

Feel free to add your own flair, but the following outline should help you craft a clear summary:

- Background: Your goals and why you conducted this study.

- Participants: Who you talked to. A table works well so you can break groups down by persona and customer/prospect.

- Executive Summary : What were the most interesting things you learned? What do you plan to do about it?

- Awareness: Describe the common triggers that lead someone to enter into an evaluation. (Quotes can be very powerful.)

- Consideration: Provide the main themes you uncovered, as well as the detailed sources buyers use when conducting their evaluation.

- Decision: Paint the picture of how a decision is really made by including the people at the center of influence and any product features or information that can make or break a deal.

- Action Plan: Your analysis probably uncovered a few campaigns you can run to get your brand in front of buyers earlier and/or more effectively. Provide your list of priorities, a timeline, and the impact it will have on your business.

Within a market research kit, there are a number of critical pieces of information for your business‘s success. Let’s take a look at these elements.

Pro Tip: Upon downloading HubSpot's free Market Research Kit , you'll receive editable templates for each of the given parts of the kit, instructions on how to use the kit, and a mock presentation that you can edit and customize.

What Is a Competitive Analysis — and How Do You Conduct One?

![research marketing plan The Beginner's Guide to the Competitive Matrix [+ Templates]](https://www.hubspot.com/hubfs/competitive-matrix-1-20240828-9831599.webp)

The Beginner's Guide to the Competitive Matrix [+ Templates]

![research marketing plan 9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]](https://www.hubspot.com/hubfs/marketing-research-methods-featured.png)

9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]

![research marketing plan SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

28 Tools & Resources for Conducting Market Research

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![research marketing plan How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![research marketing plan 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

Free Guide & Templates to Help Your Market Research

The weekly email to help take your career to the next level. No fluff, only first-hand expert advice & useful marketing trends.

Must enter a valid email

We're committed to your privacy. HubSpot uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time. For more information, check out our privacy policy .

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

You've been subscribed

The Ultimate Guide to Market Research [+Free Templates]

A comprehensive guide on Market Research with tools, examples of brands winning with research, and templates for surveys, focus groups + presentation template.

Rakefet is the CMO at Mayple. She manages all things marketing and leads our community of experts through live events, workshops, and expert interviews. MBA, 1 dog + 2 cats, and has an extensive collection of Chinese teas.

Learn about our

Natalie is a content writer and manager who is passionate about using her craft to empower others. She thrives on team dynamic, great coffee, and excellent content. One of these days, she might even get to her own content ideas.

Updated November 7, 2024.

![research marketing plan The Ultimate Guide to Market Research [+Free Templates] main image](https://entail.mayple.com/en-assets/mayple/62b4087370d3b5eab8bfb6b6_marketingresearch1_e2786f4e8b966e44f1401562fa23c07b_2000-1699776197229.jpg)

Before you do anything in business you have to have a good grasp of the market. What’s the market like? Who are your competitors? And what are the pain points and challenges of your ideal customer? And how can you solve them? Once you have the answers to those questions then you are ready to move forward with a marketing plan and/or hire a digital marketing agency to execute it.

In this guide we break down what market research is, the different types of market research, and provide you with some of the best templates, tools, and examples, to help you execute it on your own.

Excited to learn?

Let’s dive in.

Hire the best advertising agencies

Find a reliable partner to help you enhance your marketing efforts and promote your business the right way.

What is market research?

Market research is the process of gathering information about your target market and customers to determine the success of your product or service, make changes to your existing product, or understand the perception of your brand in the market.

“Research is formalized curiosity, it is poking and prying with a purpose.” - Zora Neale Hurston

We hear the phrase "product-market fit" all the time and that just means that a product solves a customer's need in the market. And it's very hard to get there without proper market research. Now, I know what you're going to say. Why not get actionable insights from your existing customers? Why not do some customer research?

The problem with customer research is two-fold:

- You have a very limited amount of data as your current customers don't represent the entire market.

- Customer research can introduce a lot of bias into the process.

So the real way to solve these issues is by going broader and conducting some market research.

Why do market research?

There are many benefits of doing market research for your company. Here are a few of them:

- Understand how much demand exists in the market, the market size

- Discover who your competitors are and where they are falling short.

- Better understand the needs of your target customers and the problems and pain points your product solves.

- Learn what your potential customers feel about your brand.

- Identify potential partners and new markets and opportunities.

- Determine which product features you should develop next.

- Find out what your ideal customer is thinking and feeling.

- Use these findings to improve your brand strategy and marketing campaigns.

“The goal is to transform data into information, and information into insight.” - Carly Fiorina

Market research allows you to make better business decisions at every stage of your business and helps you launch better products and services for your customers.

Primary vs secondary research