The Business Planning Process: 6 Steps To Creating a New Plan

In this article, we will define and explain the basic business planning process to help your business move in the right direction.

What is Business Planning?

Business planning is the process whereby an organization’s leaders figure out the best roadmap for growth and document their plan for success.

The business planning process includes diagnosing the company’s internal strengths and weaknesses, improving its efficiency, working out how it will compete against rival firms in the future, and setting milestones for progress so they can be measured.

The process includes writing a new business plan. What is a business plan? It is a written document that provides an outline and resources needed to achieve success. Whether you are writing your plan from scratch, from a simple business plan template , or working with an experienced business plan consultant or writer, business planning for startups, small businesses, and existing companies is the same.

Finish Your Business Plan Today!

The best business planning process is to use our business plan template to streamline the creation of your plan: Download Growthink’s Ultimate Business Plan Template and finish your business plan & financial model in hours.

The Better Business Planning Process

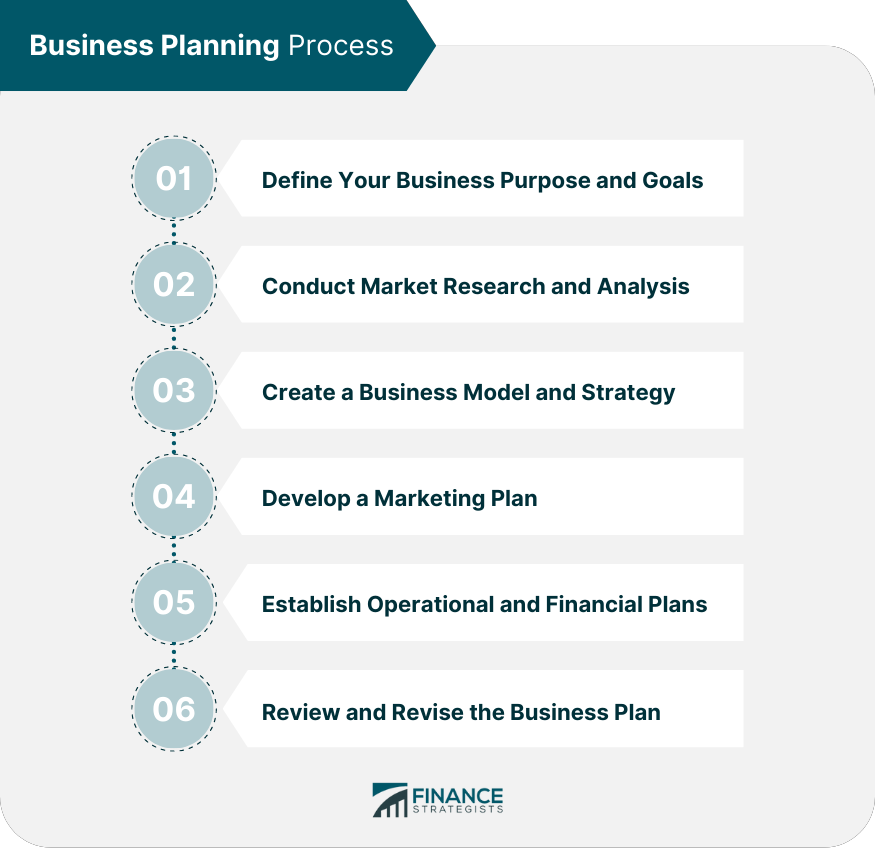

The business plan process includes 6 steps as follows:

- Do Your Research

- Calculate Your Financial Forecast

- Draft Your Plan

- Revise & Proofread

- Nail the Business Plan Presentation

We’ve provided more detail for each of these key business plan steps below.

1. Do Your Research

Conduct detailed research into the industry, target market, existing customer base, competitors, and costs of the business begins the process. Consider each new step a new project that requires project planning and execution. You may ask yourself the following questions:

- What are your business goals?

- What is the current state of your business?

- What are the current industry trends?

- What is your competition doing?

There are a variety of resources needed, ranging from databases and articles to direct interviews with other entrepreneurs, potential customers, or industry experts. The information gathered during this process should be documented and organized carefully, including the source as there is a need to cite sources within your business plan.

You may also want to complete a SWOT Analysis for your own business to identify your strengths, weaknesses, opportunities, and potential risks as this will help you develop your strategies to highlight your competitive advantage.

2. Strategize

Now, you will use the research to determine the best strategy for your business. You may choose to develop new strategies or refine existing strategies that have demonstrated success in the industry. Pulling the best practices of the industry provides a foundation, but then you should expand on the different activities that focus on your competitive advantage.

This step of the planning process may include formulating a vision for the company’s future, which can be done by conducting intensive customer interviews and understanding their motivations for purchasing goods and services of interest. Dig deeper into decisions on an appropriate marketing plan, operational processes to execute your plan, and human resources required for the first five years of the company’s life.

3. Calculate Your Financial Forecast

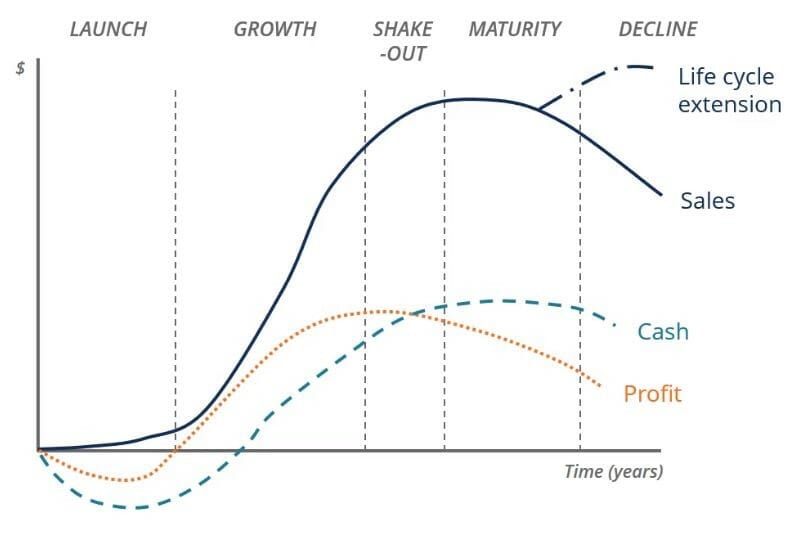

All of the activities you choose for your strategy come at some cost and, hopefully, lead to some revenues. Sketch out the financial situation by looking at whether you can expect revenues to cover all costs and leave room for profit in the long run.

Begin to insert your financial assumptions and startup costs into a financial model which can produce a first-year cash flow statement for you, giving you the best sense of the cash you will need on hand to fund your early operations.

A full set of financial statements provides the details about the company’s operations and performance, including its expenses and profits by accounting period (quarterly or year-to-date). Financial statements also provide a snapshot of the company’s current financial position, including its assets and liabilities.

This is one of the most valued aspects of any business plan as it provides a straightforward summary of what a company does with its money, or how it grows from initial investment to become profitable.

4. Draft Your Plan

With financials more or less settled and a strategy decided, it is time to draft through the narrative of each component of your business plan . With the background work you have completed, the drafting itself should be a relatively painless process.

If you have trouble writing convincing prose, this is a time to seek the help of an experienced business plan writer who can put together the plan from this point.

5. Revise & Proofread

Revisit the entire plan to look for any ideas or wording that may be confusing, redundant, or irrelevant to the points you are making within the plan. You may want to work with other management team members in your business who are familiar with the company’s operations or marketing plan in order to fine-tune the plan.

Finally, proofread thoroughly for spelling, grammar, and formatting, enlisting the help of others to act as additional sets of eyes. You may begin to experience burnout from working on the plan for so long and have a need to set it aside for a bit to look at it again with fresh eyes.

6. Nail the Business Plan Presentation

The presentation of the business plan should succinctly highlight the key points outlined above and include additional material that would be helpful to potential investors such as financial information, resumes of key employees, or samples of marketing materials. It can also be beneficial to provide a report on past sales or financial performance and what the business has done to bring it back into positive territory.

Business Planning Process Conclusion

Every entrepreneur dreams of the day their business becomes wildly successful.

But what does that really mean? How do you know whether your idea is worth pursuing?

And how do you stay motivated when things are not going as planned? The answers to these questions can be found in your business plan. This document helps entrepreneurs make better decisions and avoid common pitfalls along the way.

Business plans are dynamic documents that can be revised and presented to different audiences throughout the course of a company’s life. For example, a business may have one plan for its initial investment proposal, another which focuses more on milestones and objectives for the first several years in existence, and yet one more which is used specifically when raising funds.

Business plans are a critical first step for any company looking to attract investors or receive grant money, as they allow a new organization to better convey its potential and business goals to those able to provide financial resources.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink business plan consultants can create your business plan for you.

Other Helpful Business Plan Articles & Templates

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

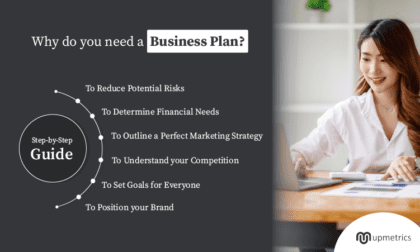

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

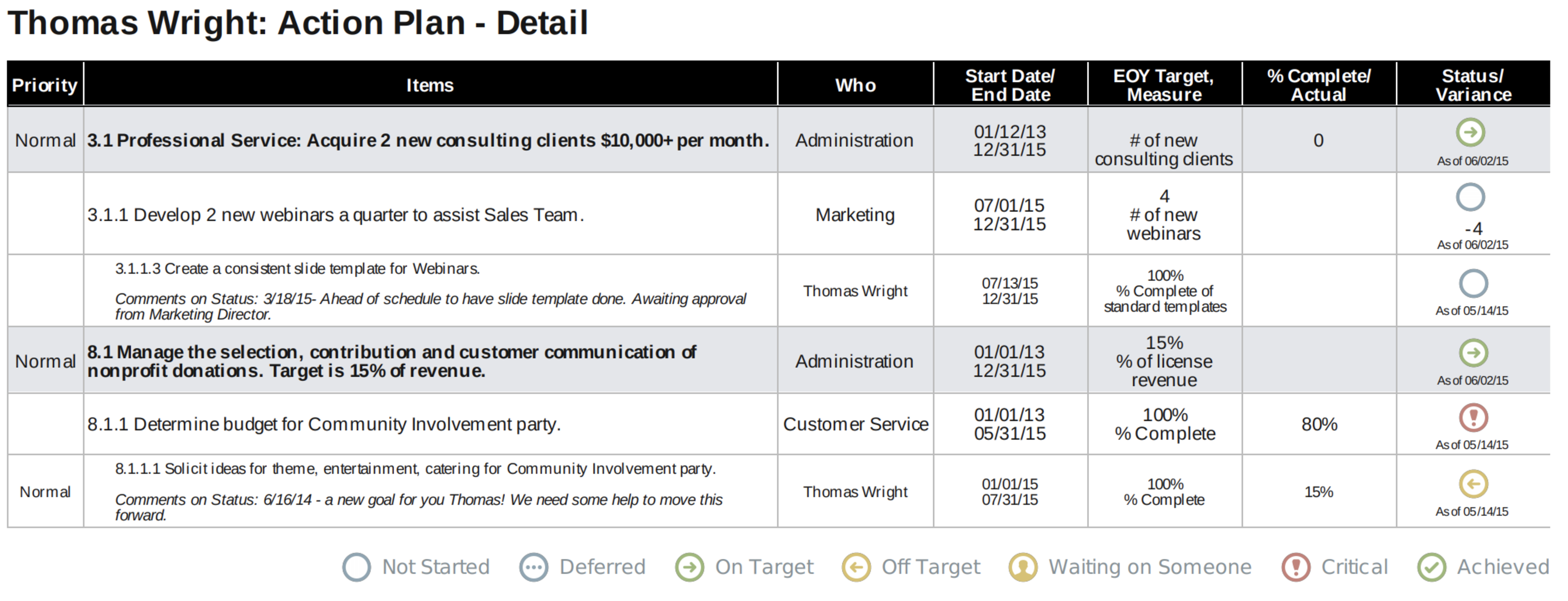

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

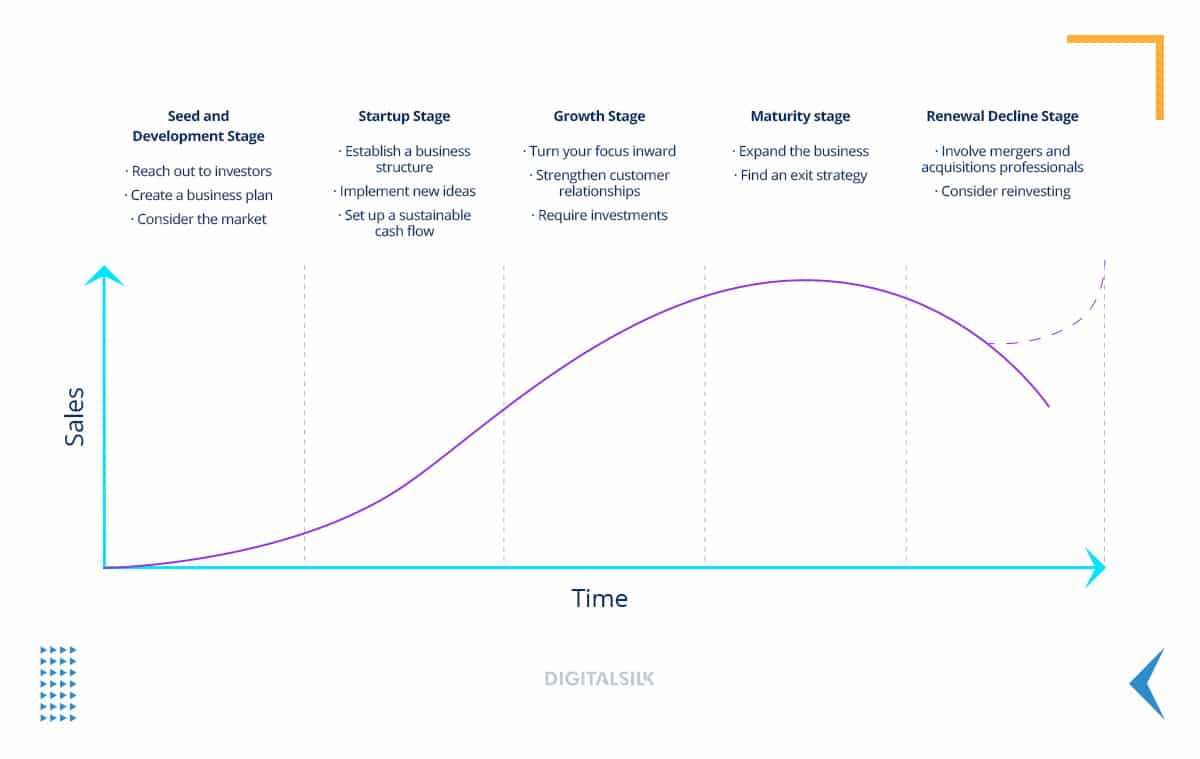

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

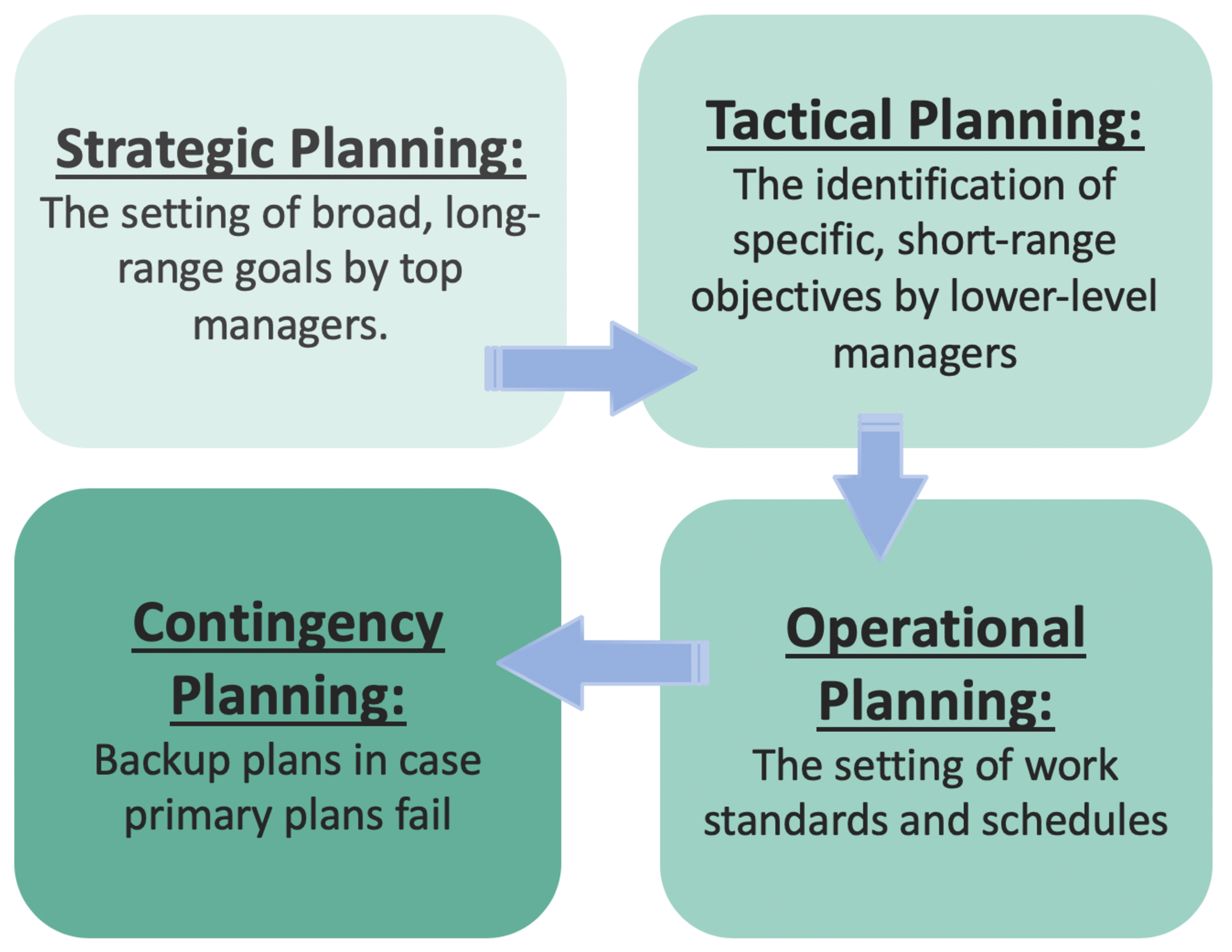

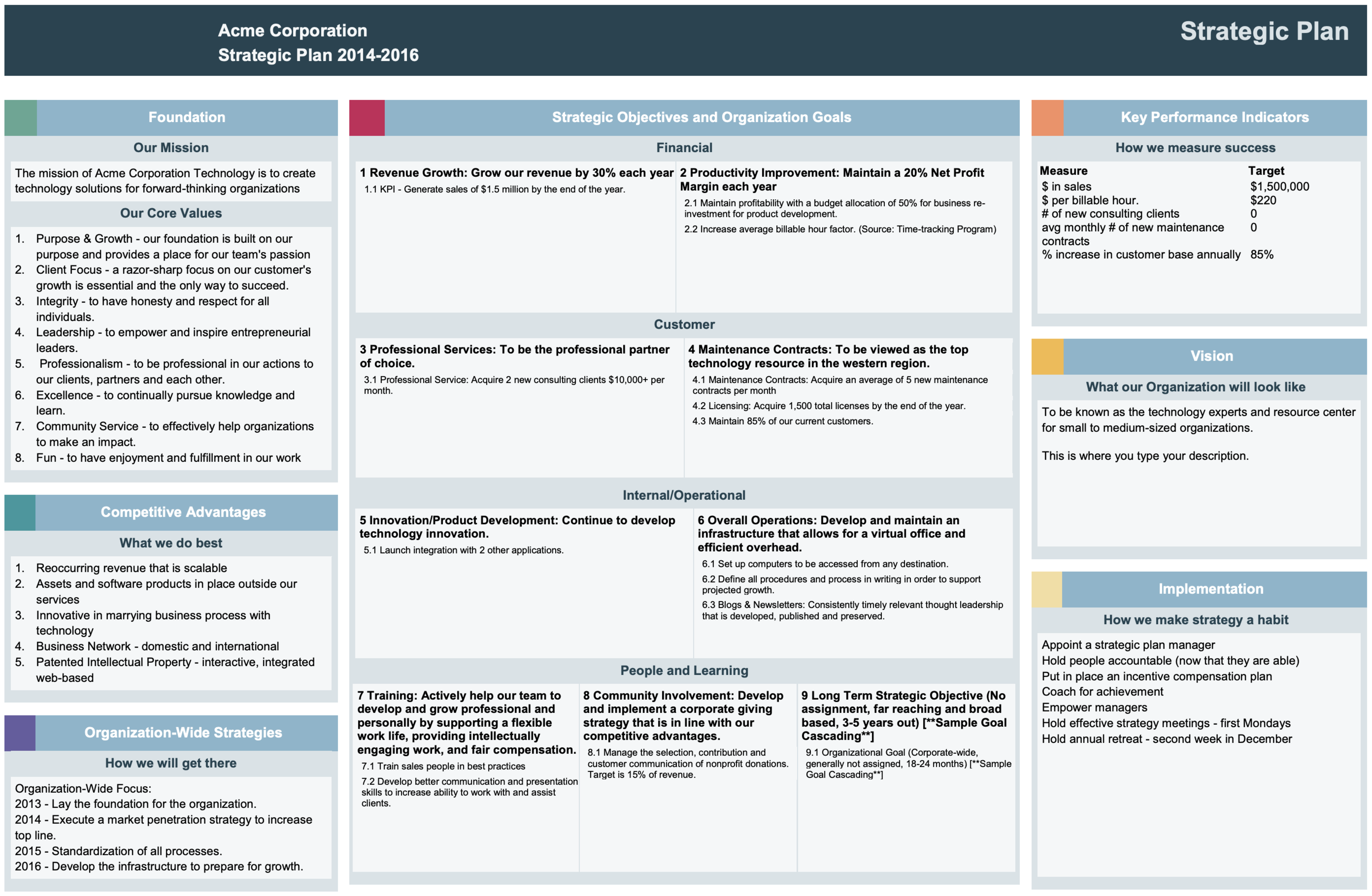

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

The 7 Steps of the Business Planning Process: A Complete Guide

In this article, we'll provide a comprehensive guide to the seven steps of the business planning process, and discuss the role of Strikingly website builder in creating a professional business plan.

Step 1: Conducting a SWOT Analysis

The first step in the business planning process is to conduct a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. This analysis will help you understand your business's internal and external environment, and it can help you identify areas of improvement and growth.

Strengths and weaknesses refer to internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

You can conduct a SWOT analysis by gathering information from various sources such as market research, financial statements, and feedback from customers and employees. You can also use tools such as a SWOT matrix to visualize your analysis.

What is a SWOT Analysis?

A SWOT analysis is a framework for analyzing a business's internal and external environment. The acronym SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Strengths and weaknesses include internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

A SWOT analysis can help businesses identify areas of improvement and growth, assess their competitive position, and make informed decisions. It can be used for various purposes, such as business planning, product development, marketing strategy, and risk management.

Importance of Conducting a SWOT Analysis

Conducting a SWOT analysis is crucial for businesses to develop a clear understanding of their internal and external environment. It can help businesses identify their strengths and weaknesses and uncover new opportunities and potential threats. By doing so, businesses can make informed decisions about their strategies, resource allocation, and risk management.

A SWOT analysis can also help businesses identify their competitive position in the market and compare themselves to their competitors. This can help businesses differentiate themselves from their competitors and develop a unique value proposition.

Example of a SWOT Analysis

Here is an example of a SWOT analysis for a fictional business that sells handmade jewelry:

- Unique and high-quality products

- Skilled and experienced craftsmen

- Strong brand reputation and customer loyalty

- Strategic partnerships with local boutiques

- Limited production capacity

- High production costs

- Limited online presence

- Limited product variety

Opportunities

- Growing demand for handmade products

- Growing interest in sustainable and eco-friendly products

- Opportunities to expand online presence and reach new customers

- Opportunities to expand product lines

- Increasing competition from online and brick-and-mortar retailers

- Fluctuating consumer trends and preferences

- Economic downturns and uncertainty

- Increased regulations and compliance requirements

This SWOT analysis can help the business identify areas for improvement and growth. For example, the business can invest in expanding its online presence, improving its production efficiency, and diversifying its product lines. The business can also leverage its strengths, such as its skilled craftsmen and strategic partnerships, to differentiate itself from its competitors and attract more customers.

Step 2: Defining Your Business Objectives

Once you have conducted a SWOT analysis, the next step is to define your business objectives. Business objectives are specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your business's mission and vision.

Your business objectives can vary depending on your industry, target audience, and resources. Examples of business objectives include increasing sales revenue, expanding into new markets, improving customer satisfaction, and reducing costs.

You can use tools such as a goal-setting worksheet or a strategic planning framework to define your business objectives. You can also seek input from your employees and stakeholders to ensure your objectives are realistic and achievable.

What is Market Research?

Market research is an integral part of the business planning process. It gathers information about a target market or industry to make informed decisions. It involves collecting and analyzing data on consumer behavior, preferences, and buying habits, as well as competitors, industry trends, and market conditions.

Market research can help businesses identify potential customers, understand their needs and preferences, and develop effective marketing strategies. It can also help businesses identify market opportunities, assess their competitive position, and make informed product development, pricing, and distribution decisions.

Importance of Market Research in Business Planning

Market research is a crucial component of the business planning process. It can help businesses identify market trends and opportunities, assess their competitive position, and make informed decisions about their marketing strategies, product development, and business operations.

By conducting market research, businesses can gain insights into their target audience's behavior and preferences, such as their purchasing habits, brand loyalty, and decision-making process. This can help businesses develop targeted marketing campaigns and create products that meet their customers' needs.

Market research can also help businesses assess their competitive position and identify gaps in the market. Businesses can differentiate themselves by analyzing their competitors' strengths and weaknesses and developing a unique value proposition.

Different Types of Market Research Methods

Businesses can use various types of market research methods, depending on their research objectives, budget, and time frame. Here are some of the most common market research methods:

Surveys are a common market research method that involves asking questions to a sample of people about their preferences, opinions, and behaviors. Surveys can be conducted through various channels like online, phone, or in-person surveys.

- Focus Groups

Focus groups are a qualitative market research method involving a small group to discuss a specific topic or product. Focus groups can provide in-depth insights into customers' attitudes and perceptions and can help businesses understand the reasoning behind their preferences and behaviors.

Interviews are a qualitative market research method that involves one-on-one conversations between a researcher and a participant. Interviews can be conducted in person, over the phone, or through video conferencing and can provide detailed insights into a participant's experiences, perceptions, and preferences.

- Observation

Observation is a market research method that involves observing customers' behavior and interactions in a natural setting such as a store or a website. Observation can provide insights into customers' decision-making processes and behavior that may not be captured through surveys or interviews.

- Secondary Research

Secondary research involves collecting data from existing sources, like industry reports, government publications, or academic journals. Secondary research can provide a broad overview of the market and industry trends and help businesses identify potential opportunities and threats.

By combining these market research methods, businesses can comprehensively understand their target market and industry and make informed decisions about their business strategy.

Step 3: Conducting Market Research

Market research should always be a part of your strategic business planning. This step gathers information about your target audience, competitors, and industry trends. This information can help you make informed decisions about your product or service offerings, pricing strategy, and marketing campaigns.

There are various market research methods, such as surveys, focus groups, and online analytics. You can also use tools like Google Trends and social media analytics to gather data about your audience's behavior and preferences.

Market research can be time-consuming and costly, but it's crucial for making informed decisions that can impact your business's success. Strikingly website builder offers built-in analytics and SEO optimization features that can help you track your website traffic and audience engagement.

Step 4: Identifying Your Target Audience

Identifying your target audience is essential in the business planning process. Your target audience is the group of people who are most likely to buy your product or service. Understanding their needs, preferences, and behaviors can help you create effective marketing campaigns and improve customer satisfaction.

You can identify your target audience by analyzing demographic, psychographic, and behavioral data. Demographic data include age, gender, income, and education level. Psychographic data includes personality traits, values, and lifestyle. Behavioral data includes buying patterns, brand loyalty, and online engagement.

Once you have identified your target audience, you can use tools such as buyer personas and customer journey maps to create a personalized and engaging customer experience. Strikingly website builder offers customizable templates and designs to help you create a visually appealing and user-friendly website for your target audience.

What is a Target Audience?

A target audience is a group most likely to be interested in and purchase a company's products or services. A target audience can be defined based on various factors such as age, gender, location, income, education, interests, and behavior.

Identifying and understanding your target audience is crucial for developing effective marketing strategies and improving customer engagement and satisfaction. By understanding your target audience's needs, preferences, and behavior, you can create products and services that meet their needs and develop targeted marketing campaigns that resonate with them.

Importance of Identifying Your Target Audience

Identifying your target audience is essential for the success of your business. By understanding your target audience's needs and preferences, you can create products and services that meet their needs and develop targeted marketing campaigns that resonate with them.

Here are reasons why identifying your target audience is important:

- Improve customer engagement. When you understand your target audience's behavior and preferences, you can create a more personalized and engaging customer experience to improve customer loyalty and satisfaction.

- Develop effective marketing strategies. Targeting your marketing efforts to your target audience creates more effective and efficient marketing campaigns that can increase brand awareness, generate leads, and drive sales.

- Improve product development. By understanding your target audience's needs and preferences, you can develop products and services that meet their specific needs and preferences, improving customer satisfaction and retention.

- Identify market opportunities. If you identify gaps in the market or untapped market segments, you can develop products and services to meet unmet needs and gain a competitive advantage.

Examples of Target Audience Segmentation

Here are some examples of target audience segmentation based on different demographic, geographic, and psychographic factors:

- Demographic segmentation. Age, gender, income, education, occupation, and marital status.

- Geographic segmentation. Location, region, climate, and population density.

- Psychographic segmentation. Personality traits, values, interests, and lifestyle.

Step 5: Developing a Marketing Plan

A marketing plan is a strategic roadmap that outlines your marketing objectives, strategies, tactics, and budget. Your marketing plan should align with your business objectives and target audience and include a mix of online and offline marketing channels.

Marketing strategies include content marketing, social media marketing, email marketing, search engine optimization (SEO), and paid advertising. Your marketing tactics can include creating blog posts, sharing social media posts, sending newsletters, optimizing your website for search engines, and running Google Ads or Facebook Ads.

To create an effective marketing plan , research your competitors, understand your target audience's behavior, and set clear objectives and metrics. You can also seek customer and employee feedback to refine your marketing strategy.

Strikingly website builder offers a variety of marketing features such as email marketing, social media integration, and SEO optimization tools. You can also use the built-in analytics dashboard to track your website's performance and monitor your marketing campaign's effectiveness.

What is a Marketing Plan?

A marketing plan is a comprehensive document that outlines a company's marketing strategy and tactics. It typically includes an analysis of the target market, a description of the product or service, an assessment of the competition, and a detailed plan for achieving marketing objectives.

A marketing plan can help businesses identify and prioritize marketing opportunities, allocate resources effectively, and measure the success of their marketing efforts. It can also provide the marketing team with a roadmap and ensure everyone is aligned with the company's marketing goals and objectives.

Importance of a Marketing Plan in Business Planning

A marketing plan is critical to business planning. It can help businesses identify their target audience, assess their competitive position, and develop effective marketing strategies and tactics.

Here are a few reasons why a marketing plan is important in business planning:

- Provides a clear direction. A marketing plan can provide a clear direction for the marketing team and ensure everyone is aligned with the company's marketing goals and objectives.

- Helps prioritize marketing opportunities. By analyzing the target market and competition, a marketing plan can help businesses identify and prioritize marketing opportunities with the highest potential for success.

- Ensures effective resource allocation. A marketing plan can help businesses allocate resources effectively and ensure that marketing efforts are focused on the most critical and impactful activities.

- Measures success. A marketing plan can provide a framework for measuring the success of marketing efforts and making adjustments as needed.

Examples of Marketing Strategies and Tactics

Here are some examples of marketing strategies and tactics that businesses can use to achieve their marketing objectives:

- Content marketing. Creating and sharing valuable and relevant content that educates and informs the target audience about the company's products or services.

- Social media marketing. Leveraging social media platforms like Facebook, Twitter, and Instagram to engage with the target audience, build brand awareness, and drive website traffic.

- Search engine optimization (SEO). Optimizing the company's website and online content to rank higher in search engine results and drive organic traffic.

- Email marketing. Sending personalized and targeted emails to the company's email list to nurture leads, promote products or services, and drive sales.

- Influencer marketing. Partnering with influencers or industry experts to promote the company's products or services and reach a wider audience.

By using a combination of these marketing strategies and tactics, businesses can develop a comprehensive and effective marketing plan that aligns with their marketing goals and objectives.

Step 6: Creating a Financial Plan

A financial plan is a detailed document that outlines your business's financial projections, budget, and cash flow. Your financial plan should include a balance sheet, income statement, and cash flow statement, and it should be based on realistic assumptions and market trends.

To create a financial plan, you should consider your revenue streams, expenses, assets, and liabilities. You should also analyze your industry's financial benchmarks and projections and seek input from financial experts or advisors.

.jpg)Image taken from Strikingly Templates

Strikingly website builder offers a variety of payment and e-commerce features, such as online payment integration and secure checkout. You can also use the built-in analytics dashboard to monitor your revenue and expenses and track your financial performance over time.

What is a Financial Plan?

A financial plan is a comprehensive document that outlines a company's financial goals and objectives and the strategies and tactics for achieving them. It typically includes a description of the company's financial situation, an analysis of revenue and expenses, and a projection of future financial performance.

A financial plan can help businesses identify potential risks and opportunities, allocate resources effectively, and measure the success of their financial efforts. It can also provide a roadmap for the finance team and ensure everyone is aligned with the company's financial goals and objectives.

Importance of Creating a Financial Plan in Business Planning

Creating a financial plan is a critical component of the business planning process. It can help businesses identify potential financial risks and opportunities, allocate resources effectively, and measure the success of their financial efforts.

Here are some reasons why creating a financial plan is important in business planning:

- Provides a clear financial direction. A financial plan can provide a clear direction for the finance team and ensure everyone is in sync with the company's financial goals and objectives.

- Helps prioritize financial opportunities. By analyzing revenue and expenses, a financial plan can help businesses identify and prioritize financial opportunities with the highest potential for success.

- Ensures effective resource allocation. A financial plan can help businesses allocate resources effectively and ensure that financial efforts are focused on the most critical and impactful activities.

- Measures success. A financial plan can provide a framework for measuring the success of financial efforts and making adjustments as needed.

Examples of Financial Statements and Projections

Here are some examples of financial statements and projections that businesses can use in their financial plan:

- Income statement. A financial statement that shows the company's revenue and expenses over a period of time, typically monthly or annually.

- Balance sheet. A financial statement shows the company's assets, liabilities, and equity at a specific time, typically at the end of a fiscal year.

- Cash flow statement. A financial statement that shows the company's cash inflows and outflows over a period of time, typically monthly or annually.

- Financial projections. Forecasts of the company's future financial performance based on assumptions and market trends. This can include revenue, expenses, profits, and cash flow projections.

Step 7: Writing Your Business Plan

The final step in the business planning process is to write your business plan. A business plan is a comprehensive document that outlines your business's mission, vision, objectives, strategies, and financial projections.

A business plan can help you clarify your business idea, assess the feasibility of your business, and secure funding from investors or lenders. It can also provide a roadmap for your business and ensure that you stay focused on your goals and objectives.

Importance of Writing a Business Plan

Writing a business plan is an essential component of the business planning process. It can help you clarify your business idea , assess the feasibility of your business, and secure funding from investors or lenders.

Here are some reasons why writing a business plan is important:

- Clarifies your business idea. Writing a business plan can help you clarify your business idea and understand your business's goals, objectives, and strategies.

- Assesses the feasibility of your business. A business plan can help you assess the feasibility of your business and identify potential risks and opportunities.

- Secures funding. A well-written business plan can help you secure funding from investors or lenders by demonstrating the potential of your business and outlining a clear path to success.

- Provides a roadmap for your business. A business plan can provide a roadmap and ensure that you stay focused on your goals and objectives.

Tips on How to Write a Successful Business Plan

Here are some tips on how to write a business plan successfully:

- Start with an executive summary. The executive summary is a brief business plan overview and should include your business idea, target market, competitive analysis, and financial projections.

- Describe your business and industry. Provide a detailed description of your business and industry, including your products or services, target market, and competitive landscape.

- Develop a marketing strategy. Outline your marketing strategy and tactics, including your target audience, pricing strategy, promotional activities, and distribution channels.

- Provide financial projections. Provide detailed financial projections, including income statements, balance sheets, and cash flow statements, as well as assumptions and risks.

- Keep it concise and clear. Keep your business plan concise and clear, and avoid using jargon or technical terms that may confuse or intimidate readers.

Role of Strikingly Website Builder in Creating a Professional Business Plan

Strikingly website builder can play a significant role in creating a professional business plan. Strikingly provides an intuitive and user-friendly platform that allows you to create a professional-looking website and online store without coding or design skills.

Using Strikingly, you can create a visually appealing business plan and present it on your website with images, graphics, and videos to enhance the reader's experience. You can also use Strikingly's built-in templates and a drag-and-drop editor to create a customized and professional-looking business plan that reflects your brand and style.

Strikingly also provides various features and tools that can help you showcase your products or services, promote your business, and engage with your target audience. These features include e-commerce functionality, social media integration, and email marketing tools.

Let’s Sum Up!

In conclusion, the 7 steps of the business planning process are essential for starting and growing a successful business. By conducting a SWOT analysis, defining your business objectives, conducting market research, identifying your target audience, developing a marketing plan, creating a financial plan, and writing your business plan, you can set a solid foundation for your business's success.

Strikingly website builder can help you throughout the business planning process by offering a variety of features such as analytics, marketing, e-commerce , and business plan templates. With Strikingly, you can create a professional and engaging website and business plan that aligns with your business objectives and target audience.

Most Viewed

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/marketing-plan-ff4bce0e2c52493f909e631039c8f4ca.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Business Planning

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Are You Retirement Ready?

Table of contents, what is business planning.

Business planning is a crucial process that involves creating a roadmap for an organization to achieve its long-term objectives. It is the foundation of every successful business and provides a framework for decision-making, resource allocation, and measuring progress towards goals.

Business planning involves identifying the current state of the organization, determining where it wants to go, and developing a strategy to get there.

It includes analyzing the market, identifying target customers, determining a competitive advantage, setting financial goals, and establishing operational plans.

The business plan serves as a reference point for all stakeholders , including investors, employees, and partners, and helps to ensure that everyone is aligned and working towards the same objectives.

Importance of Business Planning

Business planning plays a critical role in the success of any organization, as it helps to establish a clear direction and purpose for the business. It allows the organization to identify its goals and objectives, develop strategies and tactics to achieve them, and establish a framework of necessary resources and operational procedures to ensure success.

Additionally, a well-crafted business plan can serve as a reference point for decision-making, ensuring that all actions taken by the organization are aligned with its long-term objectives.

It can also facilitate communication and collaboration among team members, ensuring that everyone is working towards a common goal.

Furthermore, a business plan is often required when seeking funding or investment from external sources, as it demonstrates the organization's potential for growth and profitability. Overall, business planning is essential for any organization looking to succeed and thrive in a competitive market.

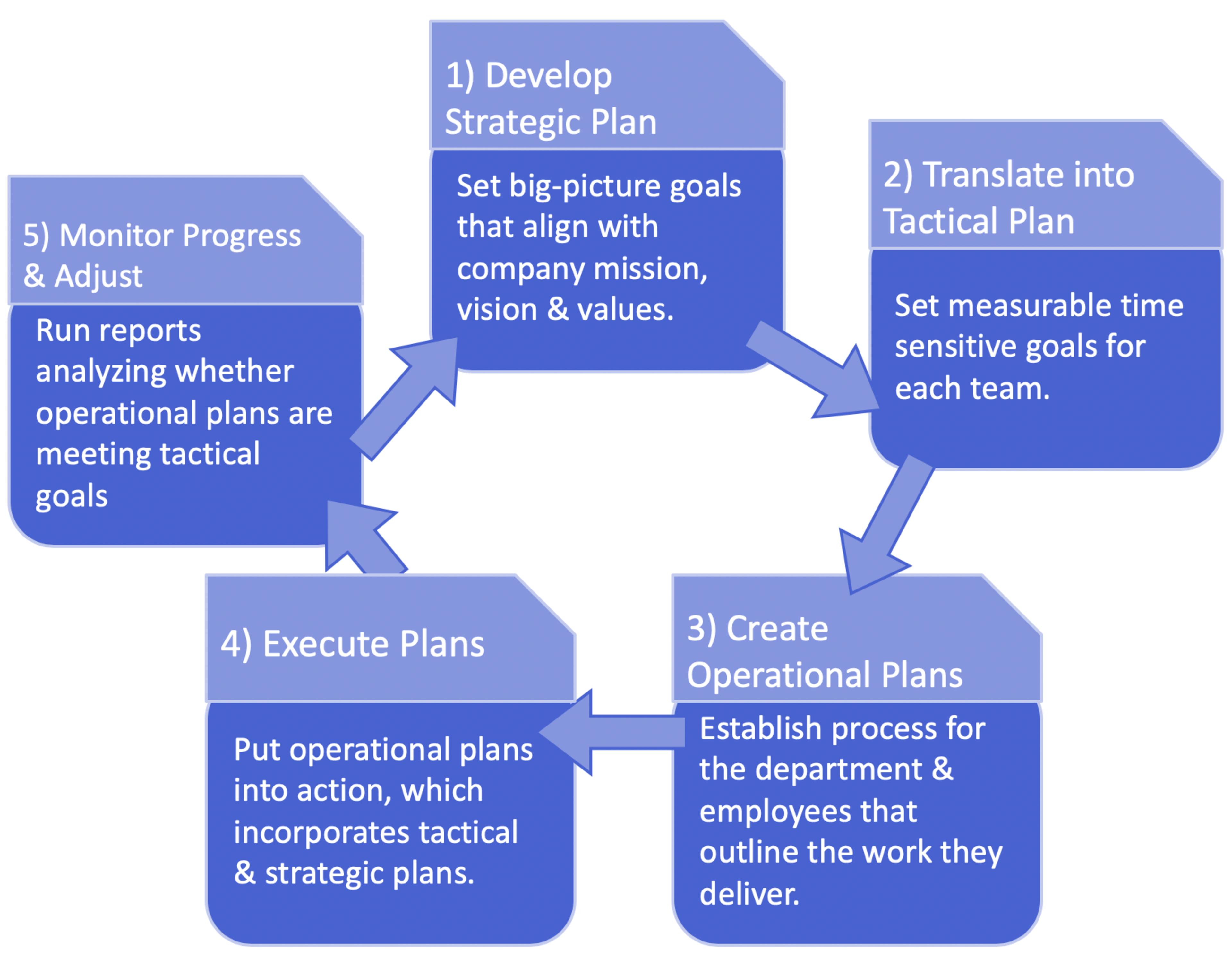

Business Planning Process

Step 1: defining your business purpose and goals.

Begin by clarifying your business's purpose, mission, and long-term goals. These elements should align with the organization's core values and guide every aspect of the planning process.

Step 2: Conducting Market Research and Analysis

Thorough market research and analysis are crucial to understanding the industry landscape, identifying target customers, and gauging the competition. This information will inform your business strategy and help you find your niche in the market.

Step 3: Creating a Business Model and Strategy

Based on the insights from your market research, develop a business model that outlines how your organization will create, deliver, and capture value. This will inform the overall business strategy, including identifying target markets, value propositions, and competitive advantages.

Step 4: Developing a Marketing Plan

A marketing plan details how your organization will promote its products or services to target customers. This includes defining marketing objectives, tactics, channels, budgets, and performance metrics to measure success.

Step 5: Establishing Operational and Financial Plans

The operational plan outlines the day-to-day activities, resources, and processes required to run your business. The financial plan projects revenue, expenses, and cash flow, providing a basis for assessing the organization's financial health and long-term viability.

Step 6: Reviewing and Revising the Business Plan

Regularly review and update your business plan to ensure it remains relevant and reflects the organization's current situation and goals. This iterative process enables proactive adjustments to strategies and tactics in response to changing market conditions and business realities.

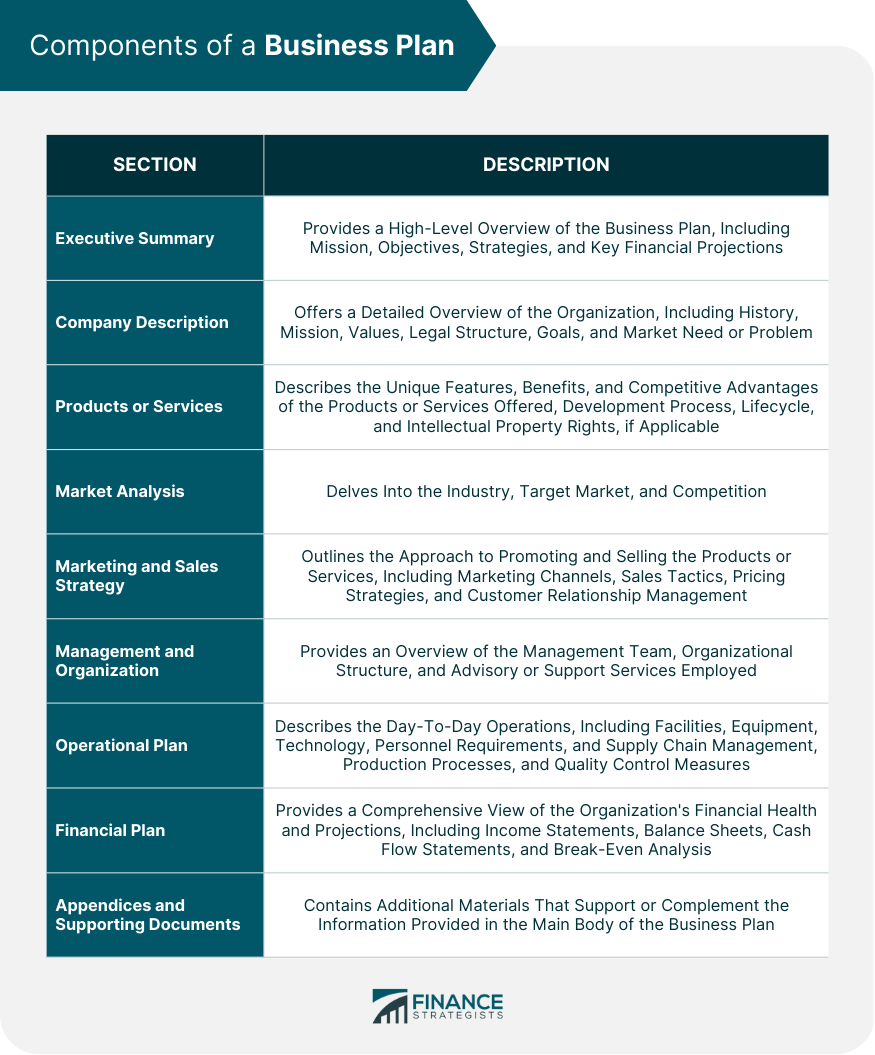

Components of a Business Plan

Executive summary.

The executive summary provides a high-level overview of your business plan, touching on the company's mission, objectives, strategies, and key financial projections.

It is critical to make this section concise and engaging, as it is often the first section that potential investors or partners will read.

Company Description

The company description offers a detailed overview of your organization, including its history, mission, values, and legal structure. It also outlines the company's goals and objectives and explains how the business addresses a market need or problem.

Products or Services

Describe the products or services your company offers, emphasizing their unique features, benefits, and competitive advantages. Detail the development process, lifecycle, and intellectual property rights, if applicable.

Market Analysis

The market analysis section delves into the industry, target market, and competition. It should demonstrate a thorough understanding of market trends, growth potential, customer demographics, and competitive landscape.

Marketing and Sales Strategy

Outline your organization's approach to promoting and selling its products or services. This includes marketing channels, sales tactics, pricing strategies, and customer relationship management .

Management and Organization

This section provides an overview of your company's management team, including their backgrounds, roles, and responsibilities. It also outlines the organizational structure and any advisory or support services employed by the company.

Operational Plan

The operational plan describes the day-to-day operations of your business, including facilities, equipment, technology, and personnel requirements. It also covers supply chain management, production processes, and quality control measures.

Financial Plan

The financial plan is a crucial component of your business plan, providing a comprehensive view of your organization's financial health and projections.

This section should include income statements , balance sheets , cash flow statements , and break-even analysis for at least three to five years. Be sure to provide clear assumptions and justifications for your projections.

Appendices and Supporting Documents

The appendices and supporting documents section contains any additional materials that support or complement the information provided in the main body of the business plan. This may include resumes of key team members, patents , licenses, contracts, or market research data.

Benefits of Business Planning

Helps secure funding and investment.

A well-crafted business plan demonstrates to potential investors and lenders that your organization is well-organized, has a clear vision, and is financially viable. It increases your chances of securing the funding needed for growth and expansion.

Provides a Roadmap for Growth and Success

A business plan serves as a roadmap that guides your organization's growth and development. It helps you set realistic goals, identify opportunities, and anticipate challenges, enabling you to make informed decisions and allocate resources effectively.

Enables Effective Decision-Making

Having a comprehensive business plan enables you and your management team to make well-informed decisions, based on a clear understanding of the organization's goals, strategies, and financial situation.

Facilitates Communication and Collaboration

A business plan serves as a communication tool that fosters collaboration and alignment among team members, ensuring that everyone is working towards the same objectives and understands the organization's strategic direction.

Business planning should not be a one-time activity; instead, it should be an ongoing process that is continually reviewed and updated to reflect changing market conditions, business realities, and organizational goals.

This dynamic approach to planning ensures that your organization remains agile, responsive, and primed for success.

As the business landscape continues to evolve, organizations must embrace new technologies, methodologies, and tools to stay competitive.

The future of business planning will involve leveraging data-driven insights, artificial intelligence, and predictive analytics to create more accurate and adaptive plans that can quickly respond to a rapidly changing environment.

By staying ahead of the curve, businesses can not only survive but thrive in the coming years.

Business Planning FAQs

What is business planning, and why is it important.

Business planning is the process of setting goals, outlining strategies, and creating a roadmap for your company's future. It's important because it helps you identify opportunities and risks, allocate resources effectively, and stay on track to achieve your goals.

What are the key components of a business plan?

A business plan typically includes an executive summary, company description, market analysis, organization and management structure, product or service line, marketing and sales strategies, and financial projections.

How often should I update my business plan?

It is a good idea to review and update your business plan annually, or whenever there's a significant change in your industry or market conditions.

What are the benefits of business planning?

Effective business planning can help you anticipate challenges, identify opportunities for growth, improve decision-making, secure financing, and stay ahead of competitors.

Do I need a business plan if I am not seeking funding?

Yes, even if you're not seeking funding, a business plan can be a valuable tool for setting goals, developing strategies, and keeping your team aligned and focused on achieving your objectives.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Business Continuity Planning (BCP)

- Business Exit Strategies

- Buy-Sell Agreements

- Capital Planning

- Change-In-Control Agreements

- Cross-Purchase Agreements

- Decision Analysis (DA)

- Employee Retention and Compensation Planning

- Endorsement & Sponsorship Management

- Enterprise Resource Planning (ERP)

- Entity-Purchase Agreements

- Family Business Continuity

- Family Business Governance

- Family Limited Partnerships (FLPs) and Buy-Sell Agreements

- Human Resource Planning (HRP)

- Manufacturing Resource Planning (MRP II)

- Plan Restatement

Ask a Financial Professional Any Question

Our recommended advisors.

Claudia Valladares

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

IDEAL CLIENTS:

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

Taylor Kovar, CFP®

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with an advisor, submit your info below and someone will get back to you shortly..

The 4 Phases Needed to Develop a Successful Business Plan

David Gordon

- January 5, 2021

- Type Articles

As they say in the military, “The enemy has a say.” The key to winning is adjusting. In 2021, expect COVID-19 will continue to impact the first half of the year, while the second half could represent different opportunities. Further, a new presidential administration, with its new initiatives, could impact your market looking toward 2022 and 2023.

This is where business planning comes into play.

Planning is about understanding the landscape, knowing what you want to achieve and then determining how to achieve it. It requires gathering information to understand your environment; determining current deployment; resources; where you can solicit assistance and then determining what you need to do (or procure) to give your team the resources needed to achieve the goal. Then, it is all about execution – developing a plan to achieve your future goals.

The phases of developing a plan include:

1. Introspection, Research & Insights

2. idea generation, 3. aggregation & execution, 4. ongoing evaluation and refinement.

While it sounds comprehensive, and it can be, it can also be streamlined. It all depends upon your organization, style and, if you use an outside facilitator, their ability to ask the right questions, understand your business/industry and add ideas.

This first step is critical. It is about gathering information: quantitative information and qualitative insights.

This can comprise macroeconomic information, marketplace information, industry insights and data analysis. The goal is to have a sense of where the economy and market are going while understanding your strengths, weaknesses, opportunities, and threats (SWOT), which comes from information gathering.

Understand your relationship with your market, your company, your customers, and the potential of each. Data can deliver these insights. Internal business intelligence data, combined with external economic data, can be powerful tools.

Some additional areas to consider include:

- Do you “plan” expecting today’s COVID-19 environment or a different one? For how long?

- What is your expectation of the market? Future macro trends and the potential opportunities that they can create? For example, how will the new presidential administration’s likely focus on clean energy and the climate impact your markets?

- How have your processes been impacted?

- More importantly, how are customers and their customers being impacted? What are their new expectations? What is their outlook?

- What is your staff’s input?

As part of this process, “customer” insights can be beneficial. This should be 360-degree input. From end-customers/contractors, distributors (if you are a manufacturer), salespeople (and reps/RSMs), perhaps even employees or suppliers. Ask their opinion about the market, their opportunities, how “you” can improve and more. Those who contribute want you to succeed.

Next, ask departments how they can improve. How can “you/they” be easier to do business with? What additional value can each bring to their customers? What processes need to be improved? How can utilization, and productivity, increase? What is their value proposition, and the company’s, today and what could it be?