Business Plan Evaluation

What’s a rich text element, static and dynamic content editing.

para link here

What is Business Plan Evaluation?

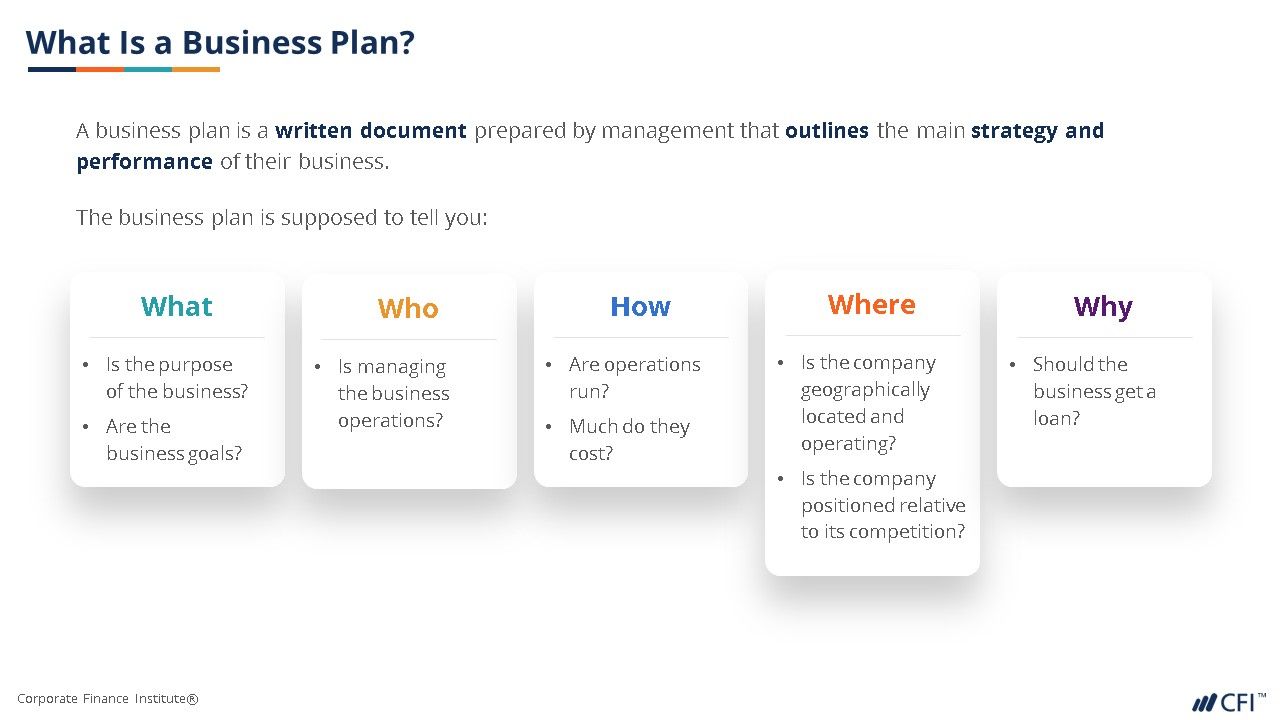

A business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business. The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team.

The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives. The evaluation process also helps identify areas where improvements can be made to enhance the chances of success. This process is particularly important for solopreneurs who are solely responsible for the success or failure of their business.

Importance of Business Plan Evaluation

The evaluation of a business plan is an essential step in the business planning process. It provides an opportunity for the entrepreneur to critically examine their business idea and identify potential challenges and opportunities . The evaluation process also provides valuable insights that can help improve the business plan and increase the chances of success.

For investors, a business plan evaluation is a crucial tool for risk assessment. It allows them to assess the viability of the business idea, the competence of the management team, and the potential for return on investment. This information is vital in making investment decisions.

For Solopreneurs

For solopreneurs, the evaluation of a business plan is particularly important. As they are solely responsible for the success or failure of their business, it is crucial that they thoroughly evaluate their business plan to ensure that it is feasible, viable, and has the potential to be profitable.

The evaluation process can help solopreneurs identify potential challenges and opportunities, assess the feasibility of their business idea, and determine the likelihood of achieving their business objectives. This information can be invaluable in helping them make informed decisions about their business.

For Investors

Investors use the evaluation process to determine whether or not to invest in a business. They look at various aspects of the business plan, including the business model, market analysis, financial projections, and management team, to assess the potential for success. If the evaluation reveals that the business plan is solid and has a high potential for success, the investor may decide to invest in the business.

Components of a Business Plan Evaluation

A business plan evaluation involves the analysis of various components of the business plan. These components include the executive summary, business description, market analysis, organization and management, product line or service, marketing and sales, and financial projections.

Each of these components plays a crucial role in the overall success of the business, and therefore, they must be thoroughly evaluated to ensure that they are realistic, achievable, and aligned with the business objectives.

Executive Summary

The executive summary is the first section of a business plan and provides a brief overview of the business. It includes information about the business concept, the business model, the target market, the competitive advantage, and the financial projections. The executive summary is often the first thing that investors read, and therefore, it must be compelling and persuasive.

In the evaluation process, the executive summary is assessed to determine whether it clearly and concisely presents the business idea and the plan for achieving the business objectives. The evaluator also assesses whether the executive summary is compelling and persuasive enough to attract the attention of investors.

Business Description

The business description provides detailed information about the business. It includes information about the nature of the business, the industry, the business model, the products or services, and the target market. The business description also provides information about the business's competitive advantage and how it plans to achieve its objectives.

In the evaluation process, the business description is assessed to determine whether it provides a clear and comprehensive description of the business. The evaluator also assesses whether the business description clearly outlines the business's competitive advantage and how it plans to achieve its objectives.

Methods of Business Plan Evaluation

There are several methods that can be used to evaluate a business plan. These methods include the SWOT analysis, the feasibility analysis, the competitive analysis, and the financial analysis. Each of these methods provides a different perspective on the business plan and can provide valuable insights into the potential for success.

It's important to note that no single method can provide a complete evaluation of a business plan. Therefore, it's recommended to use a combination of these methods to get a comprehensive understanding of the business plan.

SWOT Analysis

SWOT analysis is a strategic planning tool that is used to identify the strengths, weaknesses, opportunities, and threats related to a business. This method involves examining the internal and external factors that can affect the success of the business.

In the evaluation process, a SWOT analysis can provide valuable insights into the potential for success of the business. It can help identify the strengths and weaknesses of the business plan, as well as the opportunities and threats in the market.

Feasibility Analysis

A feasibility analysis is a process that is used to determine whether a business idea is viable. This method involves assessing the practicality of the business idea and whether it can be successfully implemented.

In the evaluation process, a feasibility analysis can provide valuable insights into the feasibility of the business plan. It can help determine whether the business idea is practical and whether it can be successfully implemented.

In conclusion, a business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business.

The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team. The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives.

Whenever you're ready, there are 4 ways I can help you:

1. The Creator MBA : Join 4,500+ entrepreneurs in my flagship course. The Creator MBA teaches you exactly how to build a lean, focused, and profitable Internet business. You'll get 5 years of online business expertise, proven frameworks, and actionable strategies across 111 in-depth lessons.

2. The LinkedIn Operating System : Join 25,000 students and 60 LinkedIn Top Voices inside of The LinkedIn Operating System. This comprehensive course will teach you the system I used to grow from 2K to 600K+ followers, be named The #1 Global LinkedIn Influencer 5x in a row, and earn $8.3M+ in income.

3. The Content Operating System : Join 11,000 students in my multi-step content creation system. Learn to create a high-quality newsletter and 6-12 pieces of high-performance social media content each week.

4. Promote yourself to 215,000+ subscribers by sponsoring my newsletter.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Measure Your Business Strategy's Success

- 04 Jan 2024

Measuring your business strategy’s success is vital to strategy execution .

Despite its importance, research by SurveyMonkey shows that only 35 percent of business owners set benchmarks or goals. Among those who set them, 90 percent consider themselves successful. Of those who don't, only 71 percent report the same.

If you want to achieve organizational objectives and avoid common strategic planning pitfalls , here’s why it’s important to evaluate your strategy.

Access your free e-book today.

Why Is It Important to Evaluate Your Strategy?

Evaluating your strategy can help your organization achieve its goals and objectives while highlighting necessary adjustments for long-term success.

Its benefits include:

- Ensuring organizational alignment

- Establishing accountability

- Optimizing operations

Assessing your business strategy is an ongoing process. To ensure it’s set up to succeed, you must evaluate it pre-, during, and post-implementation. Here’s how to do so.

How to Measure Your Strategy’s Success

1. revisit goals and objectives.

Every business strategy needs clearly defined performance goals. Without them, it can be difficult to identify harmful deviations, streamline the execution process, and recognize achievements.

After establishing goals and objectives, plan to revisit them during and after implementing your strategy. According to Harvard Business School Professor Robert Simons in the online course Strategy Execution , the best way to do so is by comparing them to critical performance variables —the factors you must achieve or implement to make your strategy succeed.

For example, if your company’s value comes from customer loyalty, one of your critical performance variables could be customer satisfaction. When customers no longer receive value from your products or services, that could impact your company’s bottom line.

The best way to verify critical performance variables is by analyzing them against your strategy map —a visual tool outlining the cause-and-effect relationships underpinning your strategy. Those variables should also receive high importance on your balanced scorecard , which translates your strategy into goals and objectives.

By taking these steps, you can identify performance measures worth reviewing.

2. Review Measures

Evaluating business performance requires measures —quantitative values you can scale and use for comparison—and they must tell the right story.

According to Strategy Execution , you should ask three questions when reviewing measures:

- Do they align with my strategy?

- Are they objective, complete, and responsive?

- Do they link to economic value?

For example, if you want to improve your company’s brand loyalty, metrics worth monitoring include the number of new customers, average purchases per customer, and the number of social media followers.

A balanced scorecard can provide a holistic view of your business performance measures—ensuring all your employees are on the same page.

“You can have the best strategy in the world,” Simons says in Strategy Execution . “But at the end of the day, what everyone pays attention to is what they're measured on. So, you need to be sure that measures throughout the business reflect your strategy, so that every employee will devote their efforts to implementing that strategy.”

3. Supervise Monitoring Systems

While balanced scorecards are powerful diagnostic control systems —formal information systems used to monitor organizational outcomes—they don’t provide visibility into all measures of success. That’s why you need additional systems to streamline strategic plans’ evaluation.

For example, you can use customer relationship management systems’ analytics tools to generate reports that align with business goals and objectives. To boost customer loyalty, you can automate reports on:

- Purchasing patterns

- Purchase frequency

- Customer survey scores

“But to ensure that these systems are effective, you need to invest considerable time and attention in their design,” Simons says in Strategy Execution . “You must not only spend time negotiating and setting goals—as we've discussed—you must also design measures for these goals and then align performance incentives.”

4. Talk to Employees

Employee feedback and buy-in are other useful tools for measuring success.

For example, creative software company Adobe is known for its loyal employee base. That was put to the test when the company shifted to a subscription-based model, launching Adobe Creative Cloud .

Company leaders briefed employees on strategic changes and how they provided value to customers. They also encouraged employees to contribute ideas and feedback throughout the transition. With minimal internal pushback and a boost in collaboration, Adobe knew its strategy would succeed and ensure relevance in a constantly evolving market.

“The best businesses motivate their employees to be creative, entrepreneurial, and willing to work with others to find customer solutions,” Simons says in Strategy Execution .

Related: How to Create a Culture of Strategy Execution

5. Reach Out to Customers

Customer feedback is a key measure of your strategy’s success. According to a recent report by Zendesk , 73 percent of business leaders believe customer service directly links with business performance—with 64 percent attributing customer service to positive business growth.

Feedback can also reflect how well initiatives align with customer needs and expectations when it comes to value creation , making it important to consistently seek out ways to monitor attitudes toward your company and its strategy.

In Strategy Execution , Tom Siebel, CEO of C3 AI, shares his thoughts on customer satisfaction when measuring success.

“Everything that's important to the business, we have a KPI and we measure it,” Siebel says. “And what could be more important than customer satisfaction?”

Unlike your company’s reputation, measuring customer satisfaction has a more personal touch in identifying what they love and how to capitalize on it.

“We do anonymous customer satisfaction surveys every quarter to see how we're measuring up to our customer expectations,” Siebel says in the course.

Your customer satisfaction measures should reflect your desired market position and focus on creating additional value. When customers are happy, profit margins tend to rise, highlighting why this should be the final step in measuring your strategy’s success.

Success Is within Reach

Measuring your strategy’s success is a continuous process that requires understanding your company’s goals and objectives.

By taking an online strategy course , you can develop strategy execution skills to measure performance effectively. Strategy Execution provides an interactive learning experience featuring organizational leaders who share their successes and failures to help you apply course concepts and excel in your career.

Want to learn how to measure your strategy’s success? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to begin your journey toward implementing strategy successfully.

About the Author

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How Should You Review Your Business Plan?

Ultimate Guide On Writing A Business Plan

- May 25, 2024

When was the last time you reviewed your business plan?

If you can’t recall, it’s possibly long enough, and by now your plan might not even offer a realistic blueprint for your business.

You see, writing a business plan is not enough. It’s much more important to review and update it time and again to keep it relevant and useful.

Now, the question is how and how often should the business plan be reviewed. Well, we will cover all that in this blog post but before that, let’s understand what exactly is a business plan review .

What is a business plan review?

A business plan review is a structured evaluation of your business plan to identify its strengths and weaknesses so that you can take remedial steps to improve its effectiveness.

A business plan review process evaluates the feasibility and assumptions of the plan and enhances its overall clarity to help make it more presentable to potential investors.

Why should you regularly review your business plan?

Whether you have just written your business plan or yours is sitting on the shelf collecting dust—it is important to revisit it regularly to ensure that it remains useful and relevant.

Many businesses review their business plans regularly, and if you don’t, here are all the reasons why you should.

- A rigorous review ensures that your plan includes all the relevant and essential information for stakeholders. It identifies gaps in your plan and removes inessential fluff to make it crisp and qualitative.

- Regular review realigns your business strategies with the changing market conditions. This will ensure that your plan remains relevant, effective, and in line with your long-term objectives.

- The review analyzes resource allocation and helps you make essential changes to ensure that none of the resources get over or underutilized.

- Critiquing your plan allows you to see your business objectively. You can see the faults that are otherwise invisible and make essential changes to strengthen your business’s position.

- Reviewing your plan pushes you to reevaluate your financials, making sure they aren’t impractical or unrealistic.

Plan review is therefore essential for everyone— a new business as well as an established one to drive a business in a forward direction.

How to review your business plan?

Reviewing a business plan requires an eye for detail. While we are not suggesting a microanalysis of the plan, thorough reviewing should ensure that every aspect of the plan is properly covered and presented, the facts quoted are corrected, and there is negligible scope for confusion.

Here is a quick step-by-step guide to reviewing business plans:

1. Read the business plan

After you write a business plan , read it at least twice to find critical errors, gaps in information, lack of depth, and irrelevant information. Start making notes wherever you find room for improvement.

2. Put yourself in the investors’ shoes

As you review your plan, think from an investor’s perspective. Evaluate if the plan has sufficient information about a business model and financial aspects to aid decision-making. If not, rework and focus on aspects that show the business’s potential to make money.

3. Assess your business strategy

While reviewing, reassess your market research and analysis. Ensure that the target market and competitors’ edge are explicitly explained.

Think from the customers’ perspective while analyzing your products and service section . Do you see the benefits or USPs that would make the target customers want your products and services? If not, rework the section and present your offerings in a stronger light.

Also, check your marketing and sales strategies to see that they are clearly laid out.

4. Evaluate the management team

Assess the management section to see if it strongly reflects the potential of your people to execute business strategies. If not, the section needs rework. Focus on highlighting their achievements, skills, and expertise.

As a new business, you might still be building your team. However, the section must acknowledge the gaps in your talent team and offer strategic ways to overcome them.

5. Reassess your financial projections

Scrutinize your financial and profit projections to identify missed costs and overly optimistic profits and revenue. Ensure that you offer a logical and easy-to-follow explanation to help prospective investors assess the practicality of your projections.

Following these steps will ensure that the business plan is effectively critiqued.

How often should a business plan be reviewed?

A business plan is a living document that needs regular reviewing and a thorough update every now and then. However, the question is how often?

Ideally, a business plan should be reviewed at least once every year to keep it relevant and useful. However, most successful businesses follow a review cycle of 45 days to 6 months to increase their adaptability to market changes, emerging trends, consumer shifts, and government regulations.

It’s okay if you cannot conduct a regular review of your business plan, month after month. However, if there are major industrial or market changes in your business landscape, you should reassess the plan and make essential changes immediately.

Now, you and your partners can determine the review cycle for these living documents. However, as long as your plan represents the current situation of the business landscape, the review can be carried out on an annual basis.

Things to consider when reviewing a business plan

Now, here’s a list of things you should keep in mind or bear as a checklist while reviewing your small-business business plan.

- Ensure that the business plan covers information about all the essential business plan components . This includes sections for executive summary, company overview, market analysis, products and service offerings, sales and marketing plan, operations plan, management team, and financial plan.

- Ensure that there is a verifiable source for every data you present or the claim you make.

- Remove all extra information that is irrelevant to the context. Focus on simple, concise language with no complicated jargon.

- Reassess your competitors’ section and check if it highlights your competitive advantage.

- Ensure that the plan offers a clear understanding of your target market and the market share.

- Check your financial projections to make sure they aren’t conservative or overly optimistic.

- Add a table of contents if the plan is extremely detailed.

- Evaluate the business strategies and ensure they are in line with your business goals.

- Reassess the plan from your audience’s point of view.

- Recheck for any factual, grammatical, or content errors.

Mark this checklist as you review your business plan to ensure full assessment.

Review your Business Plan with Upmetrics

When was the last time you checked your plan? If you can’t remember this is probably the time to review it and make necessary updates so that it continues to serve as a realistic guide for your business.

No excuses about how tiring or exhausting updating your business plan can be. With the right Business planning software , you can review and update your plan in no time.

Its AI business plan writing feature allows you to quickly draft/rewrite sections of your business plan and reassess your financial projections to ensure that no expense, costs, or revenue streams remain unaccounted for.

However, if your plan needs a complete makeover, consider rewriting it using our AI business plan creator . All it takes is 15 minutes for this tool to create a plan based on the details and answers you offer.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

Who should review my business plan.

Since no one understands your business better than you, you should be the one reviewing your business plan. However, if you find someone more experienced from your industry to help you review your plan, an external unhinged opinion can be of great help.

Business plans should be reviewed at least once a year to keep them relevant. However, you should be reviewing your operational, financial, and strategic plans every few months to keep up with the changing trends and industrial shifts.

What should I do after a business plan review?

After reviewing your business plan, focus on implementation. Communicate the changes in strategies to your internal team, adjust your financial projections, and test your strategies in the actual world.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Reach Your Goals with Accurate Planning

Effective Business Evaluation: A Comprehensive Guide

At its core, business evaluation involves a systematic assessment of various aspects of a company’s operations, financial health, and market presence. It encompasses the collection and analysis of data from multiple sources, enabling decision-makers to gain a comprehensive view of their organization. The benefits of business evaluation are multi-fold, ranging from enhanced operational efficiency and optimized resource allocation to the identification of potential risks and the formulation of effective growth strategies. By harnessing the insights derived from business evaluation, companies can position themselves for long-term success in an ever-evolving business landscape.

Business evaluation stands as a pivotal practice that enables companies to navigate the complex challenges of today’s business world. It provides a structured framework for critically analyzing a company’s performance and making well-informed decisions based on tangible data and insights. As markets evolve, consumer behaviors shift, and technologies advance, businesses must adapt and evolve to remain competitive. Business evaluation equips leaders with the tools they need to understand their current position, identify areas for improvement, and capitalize on emerging opportunities.

Essential Data Collection and Analysis

Importance of accurate data for evaluation.

Accurate and reliable data serve as the bedrock upon which informed decisions are built. Whether it’s assessing financial performance, gauging operational efficiency, or identifying market trends, the quality of data directly impacts the validity of evaluation outcomes. Inaccurate or outdated data can lead to flawed conclusions and misguided strategies, potentially hindering a company’s growth trajectory. Therefore, meticulous attention to data accuracy, validity, and relevance is paramount in ensuring the effectiveness of the evaluation process.

Types of Data: Financial, Operational, Market

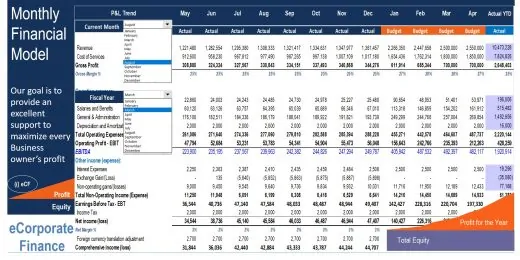

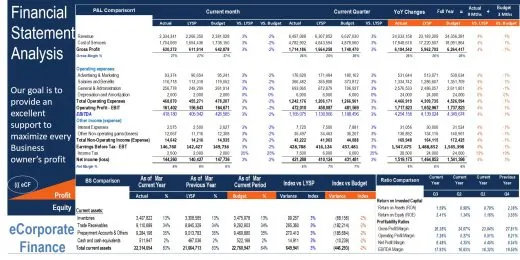

Successful business evaluation necessitates the collection and analysis of a diverse range of data. Financial data, including income statements, balance sheets, and cash flow statements, offer insights into a company’s fiscal health and profitability. Operational data delves into the efficiency and effectiveness of internal processes, shedding light on potential bottlenecks and areas for improvement. Market data, encompassing customer behavior, competitive landscape, and industry trends, provides a holistic view of the external forces shaping a business’s environment. By combining these different data streams, decision-makers can develop a comprehensive understanding of their organization’s strengths and vulnerabilities.

Analyzing Financial Health

The financial health of a business serves as a critical barometer of its overall well-being and potential for growth. This section delves into the key concepts and methods involved in assessing a company’s financial performance, equipping you with the tools to dissect financial statements, interpret key ratios, and draw meaningful conclusions.

Key Financial Ratios

Financial ratios are fundamental tools that enable decision-makers to gain insights into various aspects of a company’s financial health. Liquidity ratios, such as the current ratio and quick ratio, assess a company’s ability to meet short-term obligations. Solvency ratios, including the debt-to-equity ratio and interest coverage ratio, shed light on the company’s long-term financial stability and its capacity to manage debt. Profitability ratios, such as gross profit margin and net profit margin, provide insights into the company’s ability to generate profits from its operations. Efficiency ratios, including inventory turnover and receivables turnover, gauge the effectiveness of resource utilization.

Evaluating Liquidity, Solvency, and Profitability

Liquidity ratios help determine a company’s ability to cover its short-term liabilities, ensuring smooth day-to-day operations and financial stability. Solvency ratios, on the other hand, provide insights into the company’s capacity to manage long-term debt and meet its obligations over time. These ratios play a pivotal role in evaluating the company’s financial risk and its ability to weather economic downturns. Profitability ratios reveal how efficiently the company generates profits relative to its revenue and costs, indicating its potential for sustained growth and value creation.

Operational Efficiency

Operational efficiency is a critical driver of a company’s success and competitive advantage. This section explores the essential components of operational evaluation, guiding you through the process of identifying bottlenecks, optimizing workflows, and enhancing overall efficiency to propel your business forward.

Process Bottlenecks and Inefficiencies

Every business consists of a complex web of processes, from production and supply chain management to customer service and administrative tasks. Identifying bottlenecks and inefficiencies within these processes is key to streamlining operations and maximizing productivity. Bottlenecks, where resources are constrained and processes slow down, can hinder timely delivery and customer satisfaction. Uncovering these bottlenecks requires a thorough examination of workflows, resource allocation, and potential chokepoints.

Operational Improvements and Overall Performance

Efficiency improvements in specific operational areas have a cascading effect on the overall performance of the company. Optimizing processes not only enhances productivity but also reduces costs, shortens lead times, and improves the quality of products or services. Moreover, streamlined operations free up valuable resources that can be redirected toward innovation and growth initiatives. By connecting operational improvements to broader business goals, you create a virtuous cycle of continuous enhancement.

SWOT Analysis for Strategic Insights

A SWOT analysis stands as a powerful tool for gaining a comprehensive understanding of your business’s internal strengths, weaknesses, as well as external opportunities and threats. This section will guide you through the process of conducting a SWOT analysis, enabling you to unearth valuable insights that can shape your strategic decisions and pave the way for growth.

Exploring Internal Strengths and Weaknesses

Internal factors form the core of a SWOT analysis, encompassing the strengths and weaknesses inherent to your organization. Strengths are the attributes and capabilities that give your business a competitive edge – it could be a strong brand, a dedicated workforce, or proprietary technology. Conversely, weaknesses are areas where your business may lag – perhaps limited resources, outdated processes, or a lack of expertise. Identifying these internal factors provides a clear picture of your company’s current standing and where it can improve.

Identifying External Opportunities and Threats

External factors involve the opportunities and threats presented by the broader business environment. Opportunities are trends, market shifts, or emerging technologies that you can capitalize on to propel your business forward. Threats, on the other hand, encompass external forces like competition, regulatory changes, or economic fluctuations that could potentially hinder your progress. By identifying these external factors, you gain a holistic view of the challenges and possibilities that lie ahead.

Informed Decision-Making and Continuous Improvement

The insights derived from a comprehensive business evaluation serve as a compass that guides decision-makers through the complex landscape of choices and possibilities. When faced with critical decisions such as resource allocation, expansion strategies, or new product launches, the data-driven insights from evaluation provide a solid foundation upon which to build informed choices. By minimizing guesswork and relying on objective analysis, decision-makers can enhance the likelihood of positive outcomes and mitigate potential risks.

Business evaluation is not a one-time event, but rather an ongoing practice that fuels continuous improvement. As markets evolve, consumer preferences shift, and technologies advance, businesses that remain stagnant risk falling behind. Embracing a culture of ongoing evaluation enables companies to adapt swiftly to changing circumstances, capitalize on emerging opportunities, and address evolving challenges proactively. By regularly assessing performance, identifying areas for enhancement, and fine-tuning strategies, businesses position themselves for sustained growth and resilience.

Key TakeAway

Harnessing the power of business evaluation.

The knowledge acquired through business evaluation is not meant to reside within spreadsheets and reports; it is meant to inform action. By translating evaluation insights into strategic initiatives, you can harness your company’s strengths, address its weaknesses, and seize the opportunities that lie on the horizon. Whether it’s optimizing operations, exploring new markets, or refining customer experiences, the data-driven approach derived from evaluation serves as the bedrock of strategic success.

The business landscape is a dynamic arena, subject to shifts and transformations. To thrive in this environment, businesses must embrace the ethos of continuous improvement. Ongoing business evaluation becomes the cornerstone of this philosophy, enabling you to stay nimble, responsive, and attuned to emerging trends and challenges. Just as a ship’s captain adjusts the sails to navigate changing winds, so too must businesses adapt their strategies based on the insights garnered from constant evaluation.

Previous Post Maximizing Success with Enterprise Risk Management

Next post leveraging technology models for digital trust, related posts.

The Future of Currency

- Head Office

Emaar Square 1, Office 701-C, Downtown, Dubai – UAE

- Branch Office

Addax tower, Office 1910, Al-Reem Island, Abu Dhabi – UAE

Audit & Assurance

Mergers & Acquisitions

Risk Advisory

Legal Advisory

Strategy Transformation

Copyright © Corporate Group 2023. All Rights Reserved.

Privacy Policy

- Statutory Audit

- Energy Audit

- Stock Audit

- Audit Remediation

- Audit Readiness

- Asset & Transaction Tracing

- Accounting Close Assistance

- Management Reporting

- Corporate Tax

- VAT Compliance

- VAT Health Check

- Tax Agency Services

- Transaction Advisory on VAT

- Assistance in FTA Audit

- VAT Refunds

- Excise Registrations

- Designated Zone Registrations

- Excise Compliance

- Assistance in Customs Health Check

- Financial Tax, Technology & Legal Due Diligence

- Transaction Valuation

- JV / Share Purchase & Subscription Agreement

- Private Equity, Debt & Equity Syndication

- Working Capital Management

- IPO & Capital Markets

- Deal Sourcing / Partner Search

- Post Merger Integration

- Internal Audit

- Standard Operating Procedures

- Investigation Fraud & Forensic Audit

- Internal Controls Over Financial Reporting (ICFR)

- Consolidation and Reporting

- Enterprise Risk Management

- Anti Money Laundering (AML)

- Anti-Bribery Compliance (ABC)

- Business Continuity Planning (BCP)

- Account Reconciliation

- Contracts Management

- Corporate Structuring

- Government Licensing

- Business Set up/ PRO-Services

- Liquidation

- Economic Substance Review & Compliance

- I/B, O/B Investments

- Corporate Secretarial Services

- Counsel Assistance

- Country by Country Reporting

- Strategic Review

- Change Management

- Organizational Transformation

- Market Entry

- Cross Border Expansion

- Feasibility Studies

- Process Improvement

- HR Strategy & Organizational Development

- Digital Transformation Strategy

- Performance Management & Training

- Information Security Audit

- Cyber Security Assessment

- SIA (NESA) & PCI DSS Compliance

- ISO 27001 Compliance

- General Data Protection Regulation (GDPR) Compliance

- Third Party Risk Management

- Robotic Process Automation

- Business Process Reengineering

- ERP & CRM Project Management

- Blogs & Insights

- Latest News

11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

| Section | Description |

|---|---|

| Company summary | Brief overview (one to two paragraphs) of the problem, solution, and potential customers |

| Customer analysis | Description of potential customers and evidence they would purchase product |

| Market analysis | Size of market, target market, and share of market |

| Product or service | Current state of product in development and evidence it is feasible |

| Intellectual property | If applicable, information on patents, licenses, or other IP items |

| Competitive differentiation | Describe the competition and your competitive advantage |

| Company founders, management team, and/or advisor | Bios of key people showcasing their expertise and relevant experience |

| Financials | Projections of revenue, profit, and cash flow for three to five years |

| Amount of investment | Funding request and how funds will be used |

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Executive Summary Component | Content |

|---|---|

The Concept | La Vida Lola is a food truck serving the best Latin American and Caribbean cuisine in the Atlanta region, particularly Puerto Rican and Cuban dishes, with a festive flair. La Vida Lola offers freshly prepared dishes from the mobile kitchen of the founding chef and namesake Lola González, a Duluth, Georgia, native who has returned home to launch her first venture after working under some of the world’s top chefs. La Vida Lola will cater to festivals, parks, offices, community and sporting events, and breweries throughout the region. |

Market Advantage | Latin food packed with flavor and flair is the main attraction of La Vida Lola. Flavors steeped in Latin American and Caribbean culture can be enjoyed from a menu featuring street foods, sandwiches, and authentic dishes from the González family’s Puerto Rican and Cuban roots. craving ethnic food experiences and are the primary customers, but anyone with a taste for delicious homemade meals in Atlanta can order. Having a native Atlanta-area resident returning to her hometown after working in restaurants around the world to share food with area communities offers a competitive advantage for La Vida Lola in the form of founding chef Lola González. |

Marketing | The venture will adopt a concentrated marketing strategy. The company’s promotion mix will comprise a mix of advertising, sales promotion, public relations, and personal selling. Much of the promotion mix will center around dual-language social media. |

Venture Team | The two founding members of the management team have almost four decades of combined experience in the restaurant and hospitality industries. Their background includes experience in food and beverage, hospitality and tourism, accounting, finance, and business creation. |

Capital Requirements | La Vida Lola is seeking startup capital of $50,000 to establish its food truck in the Atlanta area. An additional $20,000 will be raised through a donations-driven crowdfunding campaign. The venture can be up and running within six months to a year. |

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

Business Description | La Vida Lola will operate in the mobile food services industry, which is identified by SIC code 5812 Eating Places and NAICS code 722330 Mobile Food Services, which consist of establishments primarily engaged in preparing and serving meals and snacks for immediate consumption from motorized vehicles or nonmotorized carts. Ethnically inspired to serve a consumer base that craves more spiced Latin foods, La Vida Lola is an Atlanta-area food truck specializing in Latin cuisine, particularly Puerto Rican and Cuban dishes native to the roots of the founding chef and namesake, Lola González. La Vida Lola aims to spread a passion for Latin cuisine within local communities through flavorful food freshly prepared in a region that has embraced international eats. Through its mobile food kitchen, La Vida Lola plans to roll into parks, festivals, office buildings, breweries, and sporting and community events throughout the greater Atlanta metropolitan region. Future growth possibilities lie in expanding the number of food trucks, integrating food delivery on demand, and adding a food stall at an area food market. After working in noted restaurants for a decade, most recently under the famed chef José Andrés, chef Lola González returned to her hometown of Duluth, Georgia, to start her own venture. Although classically trained by top world chefs, it was González’s grandparents’ cooking of authentic Puerto Rican and Cuban dishes in their kitchen that influenced her profoundly. The freshest ingredients from the local market, the island spices, and her attention to detail were the spark that ignited Lola’s passion for cooking. To that end, she brings flavors steeped in Latin American and Caribbean culture to a flavorful menu packed full of street foods, sandwiches, and authentic dishes. Through reasonably priced menu items, La Vida Lola offers food that appeals to a wide range of customers, from millennial foodies to Latin natives and other locals with Latin roots. |

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

Industry Analysis and Market Strategy | According to ’ first annual report from the San Francisco-based Off The Grid, a company that facilitates food markets nationwide, the US food truck industry alone is projected to grow by nearly 20 percent from $800 million in 2017 to $985 million in 2019. Meanwhile, an report shows the street vendors’ industry with a 4.2 percent annual growth rate to reach $3.2 billion in 2018. Food truck and street food vendors are increasingly investing in specialty, authentic ethnic, and fusion food, according to the report. Although the report projects demand to slow down over the next five years, it notes there are still opportunities for sustained growth in major metropolitan areas. The street vendors industry has been a particular bright spot within the larger food service sector. The industry is in a growth phase of its life cycle. The low overhead cost to set up a new establishment has enabled many individuals, especially specialty chefs looking to start their own businesses, to own a food truck in lieu of opening an entire restaurant. Off the Grid’s annual report indicates the average typical initial investment ranges from $55,000 to $75,000 to open a mobile food truck. The restaurant industry accounts for $800 billion in sales nationwide, according to data from the National Restaurant Association. Georgia restaurants brought in a total of $19.6 billion in 2017, according to figures from the Georgia Restaurant Association. There are approximately 12,000 restaurants in the metro Atlanta region. The Atlanta region accounts for almost 60 percent of the Georgia restaurant industry. The SAM is estimated to be approximately $360 million. The mobile food/street vendor industry can be segmented by types of customers, types of cuisine (American, desserts, Central and South American, Asian, mixed ethnicity, Greek Mediterranean, seafood), geographic location and types (mobile food stands, mobile refreshment stands, mobile snack stands, street vendors of food, mobile food concession stands). Secondary competing industries include chain restaurants, single location full-service restaurants, food service contractors, caterers, fast food restaurants, and coffee and snack shops. The top food truck competitors according to the , the daily newspaper in La Vida Lola’s market, are Bento Bus, Mix’d Up Burgers, Mac the Cheese, The Fry Guy, and The Blaxican. Bento Bus positions itself as a Japanese-inspired food truck using organic ingredients and dispensing in eco-friendly ware. The Blaxican positions itself as serving what it dubs “Mexican soul food,” a fusion mashup of Mexican food with Southern comfort food. After years of operating a food truck, The Blaxican also recently opened its first brick-and-mortar restaurant. The Fry Guy specializes in Belgian-style street fries with a variety of homemade dipping sauces. These three food trucks would be the primary competition to La Vida Lola, since they are in the “ethnic food” space, while the other two offer traditional American food. All five have established brand identities and loyal followers/customers since they are among the industry leaders as established by “best of” lists from area publications like the . Most dishes from competitors are in the $10–$13 price range for entrees. La Vida Lola dishes will range from $6 to $13. One key finding from Off the Grid’s report is that mobile food has “proven to be a powerful vehicle for catalyzing diverse entrepreneurship” as 30 percent of mobile food businesses are immigrant owned, 30 percent are women owned, and 8 percent are LGBTQ owned. In many instances, the owner-operator plays a vital role to the brand identity of the business as is the case with La Vida Lola. Atlanta has also tapped into the nationwide trend of food hall-style dining. These food halls are increasingly popular in urban centers like Atlanta. On one hand, these community-driven areas where food vendors and retailers sell products side by side are secondary competitors to food trucks. But they also offer growth opportunities for future expansion as brands solidify customer support in the region. The most popular food halls in Atlanta are Ponce City Market in Midtown, Krog Street Market along the BeltLine trail in the Inman Park area, and Sweet Auburn Municipal Market downtown Atlanta. In addition to these trends, Atlanta has long been supportive of international cuisine as Buford Highway (nicknamed “BuHi”) has a reputation for being an eclectic food corridor with an abundance of renowned Asian and Hispanic restaurants in particular. The Atlanta region is home to a thriving Hispanic and Latinx population, with nearly half of the region’s foreign-born population hailing from Latin America. There are over half a million Hispanic and Latin residents living in metro Atlanta, with a 150 percent population increase predicted through 2040. The median age of metro Atlanta Latinos is twenty-six. La Vida Lola will offer authentic cuisine that will appeal to this primary customer segment. La Vida Lola must contend with regulations from towns concerning operations of mobile food ventures and health regulations, but the Atlanta region is generally supportive of such operations. There are many parks and festivals that include food truck vendors on a weekly basis. |

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

| Operations and Management Plan Category | Content |

|---|---|

Key Management Personnel | The key management personnel consist of Lola González and Cameron Hamilton, who are longtime acquaintances since college. The management team will be responsible for funding the venture as well as securing loans to start the venture. The following is a summary of the key personnel backgrounds. Chef Lola González has worked directly in the food service industry for fifteen years. While food has been a lifelong passion learned in her grandparents’ kitchen, chef González has trained under some of the top chefs in the world, most recently having worked under the James Beard Award-winning chef José Andrés. A native of Duluth, Georgia, chef González also has an undergraduate degree in food and beverage management. Her value to the firm is serving as “the face” and company namesake, preparing the meals, creating cuisine concepts, and running the day-to-day operations of La Vida Lola. Cameron Hamilton has worked in the hospitality industry for over twenty years and is experienced in accounting and finance. He has a master of business administration degree and an undergraduate degree in hospitality and tourism management. He has opened and managed several successful business ventures in the hospitality industry. His value to the firm is in business operations, accounting, and finance. |

Advisory Board | During the first year of operation, the company intends to keep a lean operation and does not plan to implement an advisory board. At the end of the first year of operation, the management team will conduct a thorough review and discuss the need for an advisory board. |

Supporting Professionals | Stephen Ngo, Certified Professional Accountant (CPA), of Valdosta, Georgia, will provide accounting consulting services. Joanna Johnson, an attorney and friend of chef González, will provide recommendations regarding legal services and business formation. |

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

| Marketing Plan Category | Content |

|---|---|

Overview | La Vida Lola will adopt a concentrated marketing strategy. The company’s promotion mix will include a mix of advertising, sales promotion, public relations, and personal selling. Given the target millennial foodie audience, the majority of the promotion mix will be centered around social media platforms. Various social media content will be created in both Spanish and English. The company will also launch a crowdfunding campaign on two crowdfunding platforms for the dual purpose of promotion/publicity and fundraising. |

Advertising and Sales Promotion | As with any crowdfunding social media marketing plan, the first place to begin is with the owners’ friends and family. Utilizing primarily Facebook/Instagram and Twitter, La Vida Lola will announce the crowdfunding initiative to their personal networks and prevail upon these friends and family to share the information. Meanwhile, La Vida Lola needs to focus on building a community of backers and cultivating the emotional draw of becoming part of the La Vida Lola family. To build a crowdfunding community via social media, La Vida Lola will routinely share its location, daily if possible, on both Facebook, Instagram, and Twitter. Inviting and encouraging people to visit and sample their food can rouse interest in the cause. As the campaign is nearing its goal, it would be beneficial to offer a free food item to backers of a specific level, say $50, on one specific day. Sharing this via social media in the day or two preceding the giveaway and on the day of can encourage more backers to commit. Weekly updates of the campaign and the project as a whole are a must. Facebook and Twitter updates of the project coupled with educational information sharing helps backers feel part of the La Vida Lola community. Finally, at every location where La Vida Lola is serving its food, signage will notify the public of their social media presence and the current crowdfunding campaign. Each meal will be accompanied by an invitation from the server for the patron to visit the crowdfunding site and consider donating. Business cards listing the social media and crowdfunding information will be available in the most visible location, likely the counter. Before moving forward with launching a crowdfunding campaign, La Vida Lola will create its website. The website is a great place to establish and share the La Vida Lola brand, vision, videos, menus, staff, and events. It is also a great source of information for potential backers who are unsure about donating to the crowdfunding campaigns. The website will include these elements: . Address the following questions: Who are you? What are the guiding principles of La Vida Lola? How did the business get started? How long has La Vida Lola been in business? Include pictures of chef González. List of current offerings with prices. Will include promotional events and locations where customers can find the truck for different events. Steps will be taken to increase social media followers prior to launching the crowdfunding campaign. Unless a large social media following is already established, a business should aggressively push social media campaigns a minimum of three months prior to the crowdfunding campaign launch. Increasing social media following prior to the campaign kickoff will also allow potential donors to learn more about La Vida Lola and foster relationship building before attempting to raise funds. |

Facebook Content and Advertising | The key piece of content will be the campaign pitch video, reshared as a native Facebook upload. A link to the crowdfunding campaigns can be included in the caption. Sharing the same high-quality video published on the campaign page will entice fans to visit Kickstarter to learn more about the project and rewards available to backers. |

Crowdfunding Campaigns | Foodstart was created just for restaurants, breweries, cafés, food trucks, and other food businesses, and allows owners to raise money in small increments. It is similar to Indiegogo in that it offers both flexible and fixed funding models and charges a percentage for successful campaigns, which it claims to be the lowest of any crowdfunding platform. It uses a reward-based system rather than equity, where backers are offered rewards or perks resulting in “low-cost capital and a network of people who now have an incentive to see you succeed.” Foodstart will host La Vida Lola’s crowdfunding campaigns for the following reasons: (1) It caters to their niche market; (2) it has less competition from other projects which means that La Vida Lola will stand out more and not get lost in the shuffle; and (3) it has/is making a name/brand for itself which means that more potential backers are aware of it. La Vida Lola will run a simultaneous crowdfunding campaign on Indiegogo, which has broader mass appeal. |

Publicity | Social media can be a valuable marketing tool to draw people to the Foodstarter and Indiegogo crowdfunding pages. It provides a means to engage followers and keep funders/backers updated on current fundraising milestones. The first order of business is to increase La Vida Lola’s social media presence on Facebook, Instagram, and Twitter. Establishing and using a common hashtag such as #FundLola across all platforms will promote familiarity and searchability, especially within Instagram and Twitter. Hashtags are slowly becoming a presence on Facebook. The hashtag will be used in all print collateral. La Vida Lola will need to identify social influencers—others on social media who can assist with recruiting followers and sharing information. Existing followers, family, friends, local food providers, and noncompetitive surrounding establishments should be called upon to assist with sharing La Vida Lola’s brand, mission, and so on. Cross-promotion will further extend La Vida Lola’s social reach and engagement. Influencers can be called upon to cross promote upcoming events and specials. The crowdfunding strategy will utilize a progressive reward-based model and establish a reward schedule such as the following: In addition to the publicity generated through social media channels and the crowdfunding campaign, La Vida Lola will reach out to area online and print publications (both English- and Spanish-language outlets) for feature articles. Articles are usually teased and/or shared via social media. Reaching out to local broadcast stations (radio and television) may provide opportunities as well. La Vida Lola will recruit a social media intern to assist with developing and implementing a social media content plan. Engaging with the audience and responding to all comments and feedback is important for the success of the campaign. Some user personas from segmentation to target in the campaign: |

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action