- Business plans

Handyman Business Plan Template

Used 4,872 times

Start a new handyman business using a well-researched handyman business plan template to meet your goals faster.

e-Sign with PandaDoc

Created by:

[Sender.FirstName] [Sender.LastName]

[Sender.Company]

Prepared for:

[Recipient.FirstName] [Recipient.LastName]

[Recipient.Company]

Executive Summary

[Sender.Company] is a new handyman business located in [Sender.StreetAddress] [Sender.City] [Sender.State] [Sender.PostalCode] (Enter business location).

The company offers various residential handyman services, including plumbing, drywall service, carpentry, and door and window repair.

[Sender.City] will provide local residents and homeowners with a variety of services to help keep their homes in perfect condition. Some of these services include:

Door and window repair

(Add service)

[Sender.Company] will primarily serve the residents and homeowners of (Enter business location) and the surrounding area. The demographics of these customers are as follows:

85,235 residents

45% married

25% with children under 18

75% homeowners

Median age of 33

These demographics serve our company well. With such a large population of homeowners, many residents will need a local handyman to keep their homes in perfect condition.

Business Description

[Sender.Company] strives to be the best handyman service in the area that residents can trust for all of their home projects.

[Sender.Company] is led by [Sender.FirstName] [Sender.LastName] , who has been a handyman for (Enter number) years.

Since incorporation, the company has achieved the following milestones:

Found a commercial space and signed a Letter of Intent to lease it.

Developed the company’s name, logo, and website located at (website).

Planned the suite of services to be offered.

Determined equipment, supplies, and materials needed.

Begun recruiting key employees and experienced handymen

Mission Statement

The following are a series of steps that lead to our vision of long-term success. [Sender.Company] expects to achieve the following milestones in the following (Enter number) months:

Date | Milestone |

|---|---|

(MM/DD/YY) | Finalize lease agreement |

(MM/DD/YY) | Design and build out [Sender.Company] office |

(MM/DD/YY) | Hire and train initial staff |

(MM/DD/YY) | Kickoff of the promotional campaign |

(MM/DD/YY) | Reach break-even |

(List the strengths that make your business unique)

[Sender.Company] will provide local residents and homeowners with a variety of services to help keep their homes in perfect condition. Some of these services include:

Floor repair

Drywall installation and repair

Marketing Plan

[Sender.Company] seeks to position itself as a high-quality, friendly, and convenient handyman business.

The [Sender.Company] Brand

The [Sender.Company] brand will focus on the company’s unique value proposition:

Client-focused installation and repair services, where the company’s interests are aligned with the customer.

Service is built on long-term relationships and personal attention.

Promotions Strategy

[Sender.Company] expects its target market to be individuals within a 10-mile radius of its location. [Sender.Company] ’s promotion strategy to reach these potential customers includes:

Website/SEO

Social Media

Publications

Direct Mail

Pricing Strategy

The pricing will be determined by the materials needed and the amount of labor required to finish the job. Pricing will be moderate and less expensive than our competitors but more expensive than lower-quality, efficiency-driven handyman and repair businesses.

Operations Plan

Functional roles.

[Sender.Company] will need to fulfill the following functional roles to execute its business plan and ensure the company’s success:

Service Functions

Installation services

Repair services

Customer service

(Add function)

Administrative Functions

Social media management

Website management

Management Organization

[Sender.Company] is led by [Sender.FirstName] [Sender.LastName] , who has been a handyman for (Enter number) years. Throughout this time, he has worked on a variety of installation and repair services, both while employed by local handyman businesses and while operating alone.

Hiring Plan

[Sender.FirstName] [Sender.LastName] will serve as the Owner and Manager of [Sender.Company] . In order to launch, he needs to hire the following personnel:

Assistant Managers (1 to start)

Administrative Staff (1 to start)

Handymen (2 to start)

Financial Plan

Annual income / profit/loss statement.

Income Statement / Profit/Loss Statement | |||||

|---|---|---|---|---|---|

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

Total revenue: | | | | | |

Cost of services sold: | | | | | |

Gross profit: | | | | | |

Operating income: Interest expense | | | | | |

Pretax income: Taxes: | | | | | |

Net income: | | | | | |

Cash Flow Statement

Cash Flow Statement | |||

|---|---|---|---|

| Jan ‘23 | Feb ‘23 | Mar ‘23 |

Starting cash balance: | | | |

Cash received: Cash from operations: Cash from sales: | | | |

Subtotal cash received: | | | |

Additional cash received: (List sources) | | | |

Subtotal additional cash received: | | | |

Total cash received: | | | |

Expenditures: (List all expenditures) | | | |

Total cash spent: | | | |

| | | |

Net cash flow: | | | |

Ending cash balance: | | | |

Balance Sheet

Assets and Liabilities | |||||

|---|---|---|---|---|---|

Current Assets: | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

Cash | | | | | |

Accounts receivable | | | | | |

Inventory | | | | | |

Prepaid expenses | | | | | |

| | | | | |

Fixed Assets: | | | | | |

(List all) | | | | | |

| | | | | |

| | | | | |

Total Assets: | | | | | |

| | | | | |

Liabilities | | | | | |

(List all) | | | | | |

| | | | | |

| | | | | |

Total Liabilities: | | | | | |

| | | | | |

Equity | | | | | |

(List all) | | | | | |

| | | | | |

| | | | | |

Total Equity: | | | | | |

Funding Requirements

Funding Requirements | |

|---|---|

Required for: | Value: |

| |

| |

| |

Confidentiality Statement

The confidential information and trade secrets described above shall remain the exclusive property of the Company and shall not be shared or removed from the premises of the Company under any circumstances whatsoever without the express prior written consent of the handyman business.

Please find listed below any additional addendums related to [Sender.Company] :

(Add any relevant addendums)

[Recipient.FirstName] [Recipient.LastName]

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured Templates

- Sales Proposals

- NDA Agreements

- Operating Agreements

- Service Agreements

- Sales Documents

- Marketing Proposals

- Rental and Lease Agreements

- Quote Templates

- Business Proposals

- Agreement Templates

- Purchase Agreements

- Contract Templates

Handyman Business Plan [How to Write + Template]

- Last Updated: Aug 25, 2022

A handyman business plan is essential whether you’re a first-time business owner or an established handyman trying to expand your handyman business.

Based on an analysis , researchers have concluded that business planning aids company founders in making better decisions, balancing resource supply and demand, and concretizing otherwise intangible goals into actionable ones.

You may increase the likelihood of success for your handyman business by writing a handyman business plan and using it to secure financing, if necessary.

As your handyman business evolves and develops over time, it is important to revise and update your handyman business plan every year. In this blog, we’re giving you every detail about how to put together a comprehensive business strategy for your handyman services.

Table of Content

- How to Write Business Plan for Handyman Business

Handyman Business Plan Template

How to write business plan for handyman business .

The following are the key components that explain how to write a handyman business plan :-

1. Executive Summary

Although it serves as an introduction to the rest of your handyman business plan, the executive summary is typically written last because it summarises each important part. One of the main purposes of an executive summary is to catch the reader’s attention right away.

Inform them of the nature and progress of your handyman business. For instance, do you own a new business, handyman services that you intend to expand, or a handyman service franchise?

The following are the key components of your home repair business plan :-

- How is the current handyman industry? Describe in a high-level summary.

- What is the type of your handyman services? Will it be technical services, repair services, or maintenance services?

- Who is your target audience?

- Who are your key competitors?

- Describe your marketing strategy in brief.

- A brief of your financial strategy

2. Company Description

Your company summary is where you get to really sell yourself and explain just what kind of handyman services you offer. There are different kinds of handyman services offered by a handyman business .

These include services related to plumbing, drywall, painting, fixtures, tiles and stones, and waterproofing.

Describe in detail what kind of handyman services you offer and the details of your company to the reader. For example, the key dates of your company like the date of establishment, your accomplishments, sales goals, and your company’s legal details.

3. Market Research

To complete your market or handyman industry research, you must give a brief summary of the handyman business. It’s a useful tool for learning about the industry in which you’ll be competing.

Additionally, if you analyze the data and find market trends, market research can help you develop a more effective marketing strategy. You should include details such as:-

- Total Revenue generated by your handyman business

- The leaders in the handyman business

- The handyman industry growth over the next 10 years

- The market size

4. Customer Analysis

This section of your handyman business plan should include information about who you’ve served in the past and who you hope to serve in the future. Anyone from people to large businesses to families and even educational institutions could make up your target market.

The industry you run a business in depends entirely on the niche you pick. Individuals’ reactions to advertising efforts won’t necessarily mirror those of your business.

You should segment your potential buyers by their demographic and psychographic characteristics. In terms of the sex, age range, geographic spread, and income of the target audience for your business.

Client desires and expectations can be described in detail using psychographic profiles. The more you can detect and describe these needs, the better you will do in attracting and retaining your potential clients.

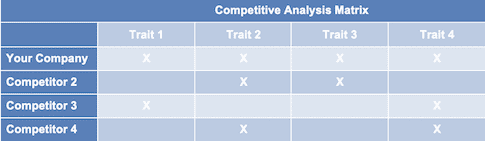

5. Competitive Analysis

Identify who the competitors of your handyman business are and find their specific details. Describe each competitor’s business and list their advantages and disadvantages in the competitive analysis section. The following are the key details you must find about them:-

- Who exactly does this business cater to?

- What are their key handyman services?

- How do they price their handyman services ?

- What are their major selling points?

- What do they lack?

Further on, you’ll have to detail how you stand out from the competition.

- How is your handyman business better for the customers?

- What special features or advantages over the competition do you want to boast?

- Will there be competitive prices?

- What will be your unique marketing approach?

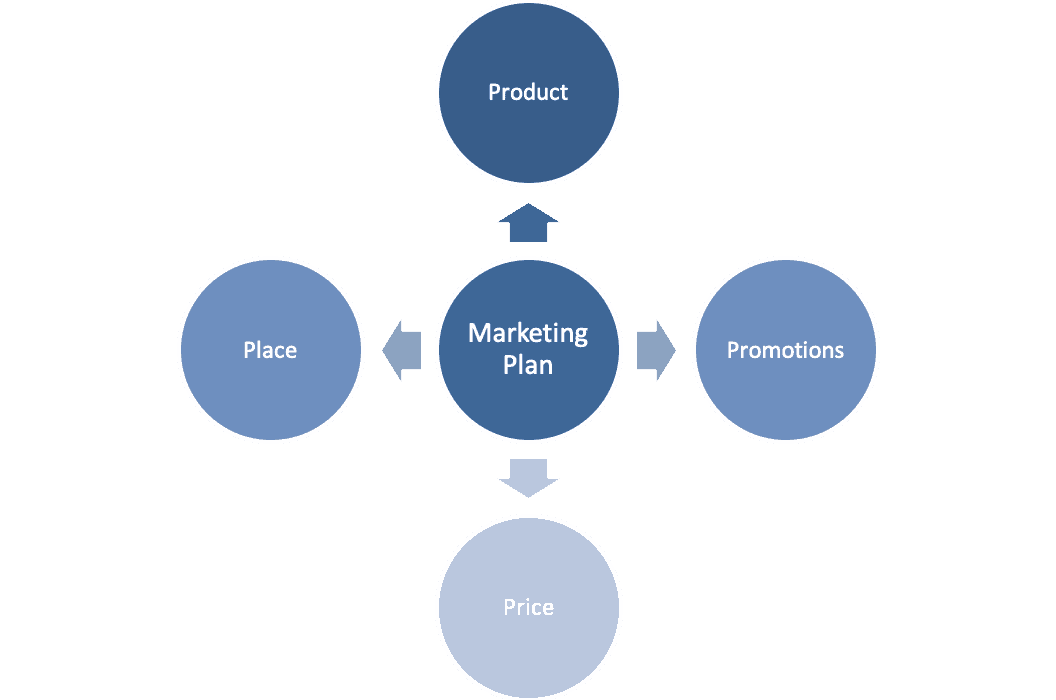

6. Marketing Strategy

The following are the key pointers that need to be included in the handyman advertising strategies of your handyman business plan:-

- Specify handyman services that you’re planning to offer to your target market. Will you help with things like plumbing, wiring, painting, drywall, or more?

- Detail the planned rates of your handyman business and how they stack up against the competition in marketing. The items and prices portions of your handyman business plan are where you’ll detail what you sell and at what cost.

- Include a description of your handyman business’s location and how it will affect its success. Where exactly are you setting up shop as a handyman? Talk about why your location would be perfect for the target audience.

- The methods of promotions that you will be using to attract target clients will be in this section of your handyman business plan. What is your preferred marketing channel? Will it be traditional advertising, online advertising, or both?

7. Operations Strategy

While the introduction and body of your handyman business plan focus on explaining your goals, your operations, and your sales strategy detail how those objectives will be attained. There should be two main parts to your operations strategy:-

- How will be the operations of your handyman business? How will you be attending to customers, and managing invoices? It’s best to manage everything digitally with the help of service scheduling software like FieldCamp.

- What are your short-term and long-term goals in terms of customers and revenue generation? Are you planning on expanding your business and what is your sales strategy?

8. Personnel in Charge

In order to prove the viability of your handyman business, you need a capable business management team. Bring attention to the experience and qualifications of your key individuals, particularly as they relate to the expansion of your organization.

You and/or your team members should ideally have previous expertise in leading handyman operations. In that case, you should emphasize your knowledge and experience in the field. However, don’t forget to mention any relevant experience you may have that could be useful to your company.

Building an advisory board might help fill any gaps in your team. There should be between two and eight people on your advisory board, all of whom would be willing to offer advice and guidance to your company.

As a result, they would be able to answer queries and offer strategic advice. Seek out board members, if necessary, who have worked in management roles at handyman services.

9. Budgeting Strategy

Consider including a financial statement for the next 5 years in your financial plan, breaking down the first year into monthly or quarterly projections and the subsequent 4 years into yearly projections.

Your income statement, balance sheet, and cash flow statement are the three main components of your financial statements in the financial plan.

10. Income Statement

Add a Profit and Loss (P&L) statement to your handyman business plan. It shows your revenue and then subtracts your costs to demonstrate whether you generated a profit or not.

What will be your income strategy? Will you offer referral discounts? What will the sales growth rate? The financial projections of your company are highly sensitive to the assumptions you make.

Try to ground your assumptions in reality as much as possible through study in your handyman business plan.

11. Income and Expense Statements

The assets and debts of a company are detailed in a balance sheet in your handyman business plan. While balance sheets might be lengthy, it is important to distill the essential information down to the most crucial aspects.

12. Record of Transactions

In order to ensure that your organization never runs out of money, a cash flow statement is essential in your handyman business plan. Most business owners and entrepreneurs don’t understand that it’s possible to make a profit while yet going bankrupt due to a lack of capital.

To ensure the accuracy of your income and balance sheets, it’s important to account for all of the following essential expenses associated with running and expanding your handyman business:

- Total expense for machinery and supplies

- Wages and salaries paid to employees

- Insuring a company financially

- Legal fees, permits, software, and hardware are just some of the other costs associated with starting a handyman business .

TRY HANDYMAN SOFTWARE FOR FREE

Schedule and dispatch jobs, Create invoices, Get paid, Generate service reports with our All-in-one Handyman Business Software.

Here’s the link to the handyman business plan template that will help businesses understand how to create a handyman business plan

Free PDF Template of Handyman Service Business Plan

When you write a business plan for your handyman service, you must remember to make it concise and easy to read, typically not exceeding 15 to 20 pages in length.

If you do have other documents that you believe may be useful to your audience and the goals you want to accomplish, you might want to think about including them as appendices. It’s best to check handyman business plan templates to have a clear idea.

Getting your handyman business off the ground is simple when you follow these 13 steps:

- Think about a good name for your handyman company

- Develop a strategy for your handyman enterprise

- Think about the best legal structure for your handyman business

- How to get start-up money for Your handyman business (If Needed)

- The first step in starting a handyman business is finding a suitable site and registering with the IRS

- You should open a business bank account immediately

- Make sure your business has a credit card

- Get your company the required permits and business license

- The owner of a handyman business might be wise to purchase professional liability insurance

- Get the right tools for your handyman business by buying or renting them

- You should advertise your handyman services, so prepare some promotional materials

- Get the programs you need to run your handyman business and set them up

- Prepare your company for clients

If you’re starting a handyman service, it’s a good idea to put together a handyman business plan. Following the aforementioned outline will make you an expert in no time.

When you finish this handyman business plan, you will have a solid grasp of the fundamentals of marketing and the steps necessary to begin and grow a profitable handyman business.

For those starting a new handyman business or those who wish to grow their current business exponentially, it’s best to have your operations optimized.

FieldCamp is a service scheduling software that manages all the tedious tasks such as workforce management, managing invoices, tracking the growth, and more for your business. Get in touch with us if you wish to know more or avail a free 7-day trial to check the difference yourself.

Gaurang Bhatt

Sign up for weekly updates from Fieldcamp.

Related Blog

How to Price a Roofing Job in 6 Simple Ways

How to Write Cleaning Services Business Plan

6 Failsafe HVAC Marketing Ideas to Grow Your Business

Field Service Technician Job Description – Everything You Need to Know

Home Depot Desk vs. Lowe’s Desk: A Comparison Guide

What is Field Service Automation? What are the Advantages of It?

Schedule and Dispatch Jobs with FieldCamp

Automate Your Field Service Business Operations with Easy-to-Use Field Service Management Software.

Automate 90% of Daily Operations

Save up to 95% of Time on Scheduling and Reports

Track Technicians and Crews

No credit card details required

https://www.fieldcamp.com/blog/handyman-business-plan/

Handyman Business Plan Template

Written by Dave Lavinsky

Handyman Business Plan

You’ve come to the right place to create your Handyman business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Handyman businesses.

Below is a template to help you create each section of your Handyman business plan.

Executive Summary

Business overview.

Fix-It Pro Services is a startup company located in Augusta, Maine. The company is founded by Jimmy Larkin, who has experience in multiple areas of home repair and services Now, with the expertise of knowledge and business acumen, he has determined he can confidently start and effectively grow a successful Fix-It Pro Services company. Jimmy believes his experience of strategic growth, marketing skills, financial capabilities, and wide and deep knowledge of home repair and home service practices will provide everything needed for long-term growth and profitability.

Fix-It Pro Services will provide a comprehensive array of products and services for a wide variety of clients. Fix-It Pro Services will be a one-stop shop, providing for the specific needs of each client while supporting the strategic goals of the company. Fix-It Pro Services will be the ultimate choice in Augusta for clients to ensure that every need of the customers is fully and completely met.

Product Offering

The following are the services that Fix-It Pro Services will provide:

- General repairs and maintenance

- Plumbing and electrical work

- Carpentry and woodworking

- Painting and drywall repair

- Unique services in wallpapering and wall treatments

- Day to day software management system of all projects, guaranteeing on-time completion of projects

Customer Focus

Fix-It Pro Services will target all residents within the greater Augusta region. They will target owners of office buildings, apartment complexes, and commercial buildings, in addition. They will also target those individuals who have residential properties that are rentals and often need repair or painting to prepare for new renters who will occupy the homes. No matter the client, Fix-It Pro Services will deliver the best service and timely completion of projects.

Management Team

Fix-It Pro Services will be owned and operated by Jimmy Hawkins. He recruited his brother and former handyman assistant, Tommy Hawkins, to be his assistant manager of operations and help oversee the handyman projects overall.

Jimmy Hawkins is a professional handyman with over twenty years of experience in residential and commercial properties. Whether repair or maintenance work is required, Jimmy has the expertise and capability to fix or replace items and building components with professionalism and excellent references from former clients.

Tommy Hawkins has served as the assistant to Jimmy Hawkins in his former position and has been in that position for ten years. He graduated from Augusta Community College with an Associates Degree in Electrical Repair. Tommy has concentrated on electrical repair services since his graduation and has completed over one hundred repair contracts for residential and commercial clients during the past ten years. He will take on the role of assistant manager of operations in the new company.

Success Factors

Fix-It Pro Services will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of Fix-It Pro Services

- Comprehensive menu of services and a full slate of capabilities within the professional handyman arena. Such services include:

- HVAC maintenance

- Appliance installation and repair

- On occasion, landscaping and outdoor maintenance service are offered

- Unique wallpaper and wall treatment services are provided upon request

- Fix-It Pro Services offers the best pricing in town. Their pricing structure is the most cost effective compared to the competition.

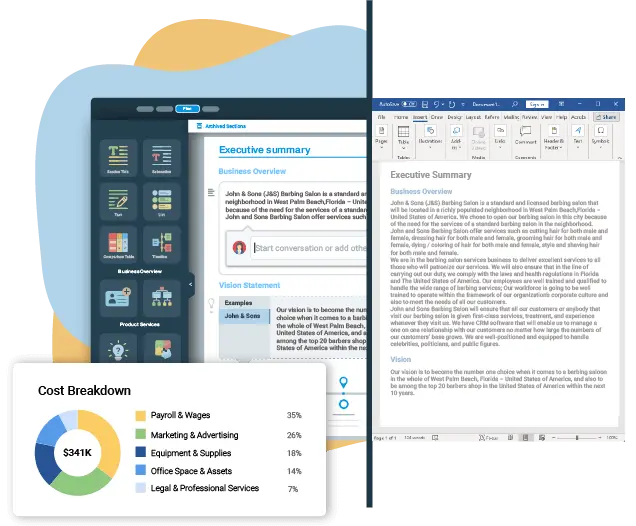

Financial Highlights

Fix-It Pro Services is seeking $200,000 in debt financing to launch its professional handyman company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

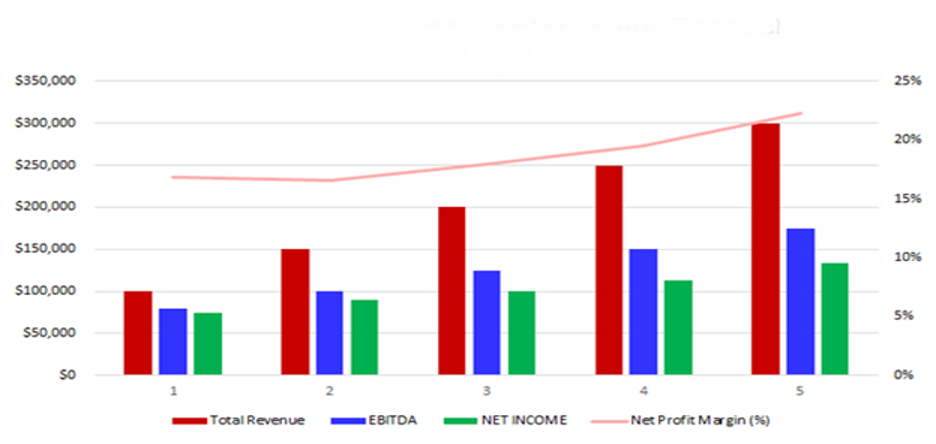

The following graph outlines the financial projections for Fix-It Pro Services.

Company Overview

Who is fix-it pro services.

Fix-It Pro Services is a newly established, full-service professional handyman company in Augusta, Maine. Fix-It Pro Services will be the most reliable, cost-effective, and efficient choice for residential and commercial clients in Augusta and the surrounding communities. Fix-It Pro Services will provide a comprehensive menu of products and services for any client to utilize. Their full-service approach includes a comprehensive wallpaper and wall treatment special application and repair service.

Fix-It Pro Services will be able to quickly and efficiently provide services for all clients. The team of professionals are highly qualified and experienced in handyman projects and maintenance. Fix-It Pro Services removes all headaches and issues of property maintenance and repair and ensures all issues are taken care of expeditiously while delivering the best customer service.

Fix-It Pro Services History

Fix-It Pro Services is owned and operated by Jimmy Hawkins, a former handyman who worked for a national handyman company as a manager of residential and commercial services for fifteen years. Jimmy built a large portfolio of properties that were entrusted to his care by clients who experienced Jimmy’s very high degree of professionalism and valuable repair and overall property services. Jimmy has requested that his brother, Tommy, join him in the company, creating a professional duo with over twenty years of experience behind them and a full portfolio of customers waiting to join them in their new company.

Since incorporation, Fix-It Pro Services has achieved the following milestones:

- Registered Fix-It Pro Services, LLC to transact business in the state of Maine.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to include Fix-It Pro Services.

- Began recruiting a staff of two and office personnel to work at Fix-It Pro Services.

Fix-It Pro Services

The following will be the services Fix-It Pro Services will provide:

Industry Analysis

The handyman industry is expected to grow over the next five years to over $315 billion. The growth will be driven by an increase in homeownership as the population grows. In addition, the handyman industry will grow as commercial properties are utilized for expanding technology and commercial concerns. Costs will likely be reduced as repairs or replacement of items will be conducted via software management applications and technology not yet utilized. The costs will also be reduced by an increase in self-employed repair services as individuals move into positions that offer work-life balance.

Customer Analysis

Demographic profile of target market.

The precise demographics for Fix-It Pro Services are:

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

Fix-It Pro Services will primarily target the following customer profiles:

- Residents within the greater Augusta region

- Owners and managers of commercial buildings

- Owners of apartment buildings

- Owners of residential properties

Competitive Analysis

Direct and indirect competitors.

Fix-It Pro Services will face competition from other companies with similar business profiles. A description of each competitor company is below.

Handyman-in-a-Hurry

Handyman-in-a-Hurry is a national chain of handyman franchises with franchisees who own and operate businesses within various geographic locations. The franchisee, Taylor Tomkin, operates the Augusta location business; however, the national franchisor company oversees the products used, repair services offered, and marketing and brand messaging. Taylor Tomkin started the company in 1998 and has continued in the franchisor/franchisee relationship during the past several years. The company has a solid following of clients who trust Taylor and Handyman-in-a-Hurry, in part due to the national franchise connection and national, on-going marketing efforts.

Handyman-in-a-Hurry does not repair or maintain outdoor landscaping or irrigation, nor does Handyman-in-a-Hurry offer services for wallpapering or wall treatments. The roster of services includes general repair and electrical services, as needed.

The Service Station

Pinky and Charlie Staton started The Service Station ten years ago while the housing industry was booming in the Augusta region. Their company grew quickly as they serviced new residential homes with moving in services, electrical hookups, and set-up of appliances. As the housing industry slowed during recent years, The Service Station has focused more on general repairs and residential painting.

Pinky and Charlie Staton were experienced handyman service providers prior to opening their company. Together, they managed a large residential complex for a nationally-known celebrity homeowner. The multiple-acreage property with several residences and outbuildings required constant repairs and upkeep. Exterior landscaping and maintenance included the twenty-acre complex and, as a result, Pinky and Charlie brought a high level of expertise to the handyman industry.

The Service Station is housed in a former gas station, which lends itself to the name of the company and the owners offer the unique advantage of attracting current and new customers by serving coffee and snacks in one of the converted repair bays of the station on a weekly basis. Homeowner courses in repair and maintenance are offered by Pinky and Charlie at each gathering.

Handyman Haven

Handyman Haven was started in Augusta, Maine in 2018 by Darren Woods. Darren, a former property manager for a large Augusta company, oversees the maintenance and repair of residential home rental properties in the region. Services include move-in/move-out cleaning, painting, wall repairs, electrical installation and other general repair or improvement services for rental properties.

Handyman Haven has produced a business strategy that operates with yearly contracts between rental owners and Handyman Haven. The strategy provides for monthly payments irrespective of general repairs needed and effectively spreads the cost of the residential upkeep over twelve months during each contracted period. Yearly contracts are updated each January and are reflective of the age and condition of each residence. Rental owners may contact Handyman Haven as needed for repairs, painting or other services without incurring additional costs.

Competitive Advantage

Fix-It Pro Services will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Fix-It Pro Services will offer the unique value proposition to its clientele:

- Highly-skilled management with extensive handyman expertise.

- Software management that tracks and schedules appointments, offering customers the ease of online appointments and cancellations, as well as up-to-the-minute tracking of repair and service personnel.

- Unbeatable pricing to their clients; they will offer the lowest pricing in the city.

Promotions Strategy

The promotions strategy for Fix-It Pro Services is as follows:

Word of Mouth/Referrals

Fix-It Pro Services has built up an extensive list of contacts over the years by providing exceptional service and expertise to their clients. The contacts and clients will follow them to their new company and help spread the word of Fix-It Pro Services.

Professional Associations and Networking

Jimmy Hawkins will build on existing client relationships to create new opportunities within associations and trade groups of the handyman industry. He will enter into leadership roles in these groups and encourage new business from these relationships.

Print Advertising

Fix-It Pro Services will offer via a direct mail piece a “first month” discount for all new clients. The piece will be mailed two weeks before the opening of the company and will cover the entire Augusta region. In addition, clients who choose to sign contracts for extended coverage of services (12-18 months), will receive a sizable discount on services if they choose the coverage within the first two months of the company opening.

Website/SEO Marketing

Fix-It Pro Services will fully utilize their website. The website will be well organized, informative, and list all the services that Fix-It Pro Services provides. The website will also list their contact information and highlight their unique wallpapering and wall treatment services . The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “handyman company” or “handyman near me,” Fix-It Pro Services will be listed at the top of the search results.

The pricing of Fix-It Pro Services will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for Fix-It Pro Services. Operation Functions:

- Jimmy Hawkins will be the owner and president of the company. He will oversee all staff and manage client relations. Jimmy has spent the past year recruiting the following staff:

- Tommy Hawkins has served as the assistant to Jimmy Hawkins in his former position for ten years. He graduated from Augusta Community College with an Associates Degree in Electrical Repair. He will take on the role of assistant manager of operations in the new company.

- Sue Rodgers will take on the role of Marketing Manager and will provide all marketing for Fix-It Pro Services.

Milestones:

Fix-It Pro Services will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the Fix-It Pro Services

- 6/1/202X – Finalize contracts for Fix-It Pro Services clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into Fix-It Pro Services office

- 7/1/202X – Fix-It Pro Services opens its doors for business

Tommy Hawkins has served as the assistant to Jimmy Hawkins in his former position and has been in that position for ten years. He graduated from Augusta Community College with an Associates Degree in Electrical Repair. Tommy has concentrated on electrical repair services since his graduation and has completed over five thousand repair contracts for residential and commercial clients during the past ten years. He will take on the role of assistant manager of operations in the new company.

Financial Plan

Key revenue & costs.

The revenue drivers for Fix-It Pro Services are the fees they will charge to customers for their services and products.

The cost drivers will be the overhead costs required in order to staff Fix-It Pro Services. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Customers Per Month: 80

- Average Revenue per Month: $26,000

- Office Lease per Year: $100,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Handyman Business Plan FAQs

What is a handyman business plan.

A handyman business plan is a plan to start and/or grow your handyman business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections. You can easily complete your Handyman business plan using our Handyman Business Plan Template here .

What are the Main Types of Handyman Businesses?

There are a number of different kinds of handyman businesses, some examples include: Plumbing Handyman Business, Drywall Installation Business, Fixture Replacement Business, Painting Business, and Tiling Business.

How Do You Get Funding for Your Handyman Business Plan?

Handyman businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Handyman Business?

Starting a handyman business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster. 1. Develop A Handyman Business Plan - The first step in starting a business is to create a detailed handyman business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast. 2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your handyman business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your handyman business is in compliance with local laws. 3. Register Your Handyman Business - Once you have chosen a legal structure, the next step is to register your handyman business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws. 4. Identify Financing Options - It’s likely that you’ll need some capital to start your handyman business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms. 5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations. 6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events. 7. Acquire Necessary Handyman Equipment & Supplies - In order to start your handyman business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation. 8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your handyman business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful handyman business: How to Start a Handyman Company

Handyman Business Plan Template

Written by Dave Lavinsky

Handyman Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their handyman companies.

If you’re unfamiliar with creating a handyman business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a handyman business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Handyman Business Plan?

A business plan provides a snapshot of your handyman business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Handyman Business

If you’re looking to start a handyman business or grow your existing handyman company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your handyman business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Handyman Businesses

With regards to funding, the main sources of funding for a handyman business are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for handyman companies.

Finish Your Business Plan Today!

How to write a business plan for a handyman business.

If you want to start a handyman business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your handyman business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of handyman business you are running and the status. For example, are you a startup, do you have a handyman business that you would like to grow, or are you operating a chain of handyman businesses?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the handyman industry.

- Discuss the type of handyman business you are operating.

- Detail your direct competitors. Give an overview of your target market.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of handyman business you are operating.

For example, you might specialize in one of the following types of handyman businesses:

- Plumbing Handyman Business: Specializing in light plumbing services such as fixing a water leak or replacing a garbage disposal.

- Drywall Installation Business: Specializing in installation, drywall repair services, and re-finishing drywall.

- Fixture Replacement Business: Specializing in replacing fixtures including cabinetry, ceiling fans, lighting, and kitchen and bathroom faucets.

- Painting Business: Specializing in painting and patching interior and exterior walls.

- Tiling Business: Specializing in tile installation, replacement, and waterproofing.

In addition to explaining the type of handyman business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of repeat clients, reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the handyman industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the handyman industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the handyman industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your handyman business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: homeowners, property managers, schools, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of handyman business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target market in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target market. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Handyman Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other handyman businesses.

- What types of customers do they serve?

- What type of handyman business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regard to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for your customers to acquire your product or schedule handyman service?

- Will you offer products or handyman services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways to establish a competitive edge and document them in this section of your plan.

Marketing Plan

Product : In the product section, you should reiterate the type of handyman company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide plumbing, electrical, painting, drywall, or other construction services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your handyman company. Document where your company is situated and mention how the site will impact your success. For example, is your handyman business located in a busy retail district, an industrial district, a standalone office, or purely online? Discuss how your site might be the ideal location for your target market.

Promotions : The final part of your handyman marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your handyman business, including answering calls, scheduling appointments with clients, billing clients, and collecting payments.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to book your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your handyman business to a new city.

Management Team

To demonstrate your handyman business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing handyman businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a handyman business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day? Will you offer discounts for referrals? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your handyman business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a handyman business:

- Cost of equipment and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or a list of certifications you’ve obtained.

Writing a business plan for your handyman business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the handyman industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful handyman business.

Don’t you wish there was a faster, easier way to finish your Handyman business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan writer can create your plan for you.

Other Helpful Business Plan Articles & Templates

- Sample Business Plans

- Construction, Architecture & Engineering

Handyman Business Plan

Fixing small problems around the house, tinkering with stuff, and repairing things to make them work as well as new, might seem a simple job.

But it can only be done by someone who has the skill, eye for detail, and passion for it. After all, these small things can make life terribly inconvenient if not fixed the right way.

If you are planning to start a new handyman business, the first thing you will need is a business plan. Use our sample Handyman Business Plan created using Upmetrics business plan software and write your business plan in no time.

Before you start writing your business plan, spend as much time as you can reading through some samples of Cleaning, Maintenance & Repair Business Plans .

Read on to find out more about the industry and important things to take care of before you start your business.

Industry Overview

The handyman services market stood at a global value of 281.65 billion dollars in 2018 and has continued to grow ever since due to the increase in the number of people who look for repair services online.

Handyman services are high in demand due to their multipurpose nature. Most of the services are charged either on a per-hour basis or based on how challenging the job is.

From fixing curtains, and bulbs to maintenance services, a handyman can take care of everything, making their services in demand.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Things to Consider Before Writing a Handyman Business Plan

Find out the market for your services.

As the handyman business covers a variety of services, it is a good practice to figure out what services are in demand and how they are procured. It is also advisable to see what localities need handyman services the most and can help you have a profitable business.

Research your competitors

Carry out thorough research about who your competitors are, what services they offer, and how they reach out to their target audience. This gives you a head start on the services you should and potentially would have to offer, it helps you figure out a better marketing strategy, and also gives you a chance to do something that’ll help you stand apart from your competition.

Have handy skills to take up unexpected tasks

Handyman services are known for and sought after due to their multipurpose nature. Hence, you need to stay prepared for taking up unexpected tasks that come your way. It is necessary to have both the skill and the right equipment for such problems.

Market research and competitive analysis can help you with this too.

Get permits and insurance

Having the proper legal licenses ensures that you stay on the right side of the law. And having insurance is essential for a handyman business due to the nature of the work that brings about claims of accidents and property damage.

Insurance helps rest assured and focus on what really matters.

Write Your Business Plan

If you have the talent and skill for fixing such problems, you can make it your profession through a handyman business.

All you need to do is find a way to get customers and a handyman business plan.

Reading sample business plans will give you a good idea of what you’re aiming for and also it will show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample handyman business plan for you to get a good idea about how a perfect handyman business plan should look like and what details you will need to include in your stunning business plan.

Handyman Business Plan Outline

This is the standard Handyman business plan outline which will cover all important sections that you should include in your business plan.

- Market Validation

- Short-Term (1 -3 Years)

- Long Term (3-5 years)

- Mission statement

- Keys to success

- Fixit – 3-Year Revenue Highlights

- Company Ownership/Legal Entity

- Interior Operating Facilities

- Hours of Operation

- Startup summary

- Fixit will offer the following services

- Customer Service

- Market segmentation

- Market Trends

- Fixit Market Distribution

- Competitive Advantage

- SWOT analysis

- Marketing and Promotion Programs

- Positioning Statement

- Marketing Channels

- Pricing strategy

- Organization chart

- Management Team

- Hiring plan

- Important Assumptions

- Brake-even Analysis

- Profit Yearly

- Gross Margin Yearly

- Projected Cash Flow

- Projected Balance Sheet

- Business Ratios

After getting started with Upmetrics , you can copy this handyman plan into your business plan and modify the required information and download your handyman business plan pdf or doc file. It’s the fastest and easiest way to start writing your business plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Download a sample handyman business plan

Need help writing your business plan from scratch? Here you go; download our free handyman business plan pdf to start.

It’s a modern business plan template specifically designed for your handyman business. Use the example business plan as a guide for writing your own.

Related Posts

Dry Cleaning Business Plan

Carpet Cleaning Business Plan

Business Plan Cover Page Design Guide

Why do You Need a Business Plan

Home Improvement Business Plan

Computer Repair Business Plan

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Handyman Maintenance Business Plan

Start your own handyman maintenance business plan

HandyMan Stan

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

HandyMan Stan is a start-up organization offering residents of Duluth, Minnesota a complete handyman service. By developing the reputation as a qualified, reasonably priced and trusted service provider, HandyMan Stan will quickly generate market penetration and develop a solid foundation of repeat customers.

The Market HandyMan Stan’s target market has been segmented into: home owners and property managers. There are 24,090 potential customers in the home owner segment. This group has a 5% annual growth rate. There are 1,243 potential customers in the property manager segment. This group is growing at a 4% annual growth rate.

Services As a handyman, Stan will offer a wide range of home repair services. The services are generally fairly minor tasks, if the problem becomes major a contractor is best suited to solve the difficulty. HandyMan Stan will offer the value-added feature to pre-screen a contractor when Stan is unable to perform the repair. This will develop a trust bond with the customer so that when a more minor issue comes up the customer is more likely to call Stan due to his honesty displayed earlier. Stan offers fix-it services for: plumbing, electrical, fences, windows, decks/patios, painting, weather proofing, floors.

Competitive Edge HandyMan Stan will differentiate from the competition by offering: low price and low minimum charge. Stan is charging a reasonable $30 per hour in an effort to encourage people to hire him for tasks that they would otherwise try themselves of just ignore until it became more of a problem. The second element of the competitive edge is Stan’s low one hour minimum. This compares favorably with the other industry competitors who often have two to three hour minimums. This edge also creates an incentive for the customer to call for Stan’s assistance earlier than they would with comparable service providers.

1.1 Mission

HandyMan Stan’s mission is to provide knowledgeable, convenient, and reasonably-priced handyman service to the Duluth, Minnesota community. HandyMan Stan will provide every customer with an honest day’s work and will fix anything that is not done right.

1.2 Keys to Success

- Treat every customer as if they were the most important customer the business has.

- Honestly evaluate the needed skills for a job, passing it onto a contractor if it is too difficult as opposed to taking on a job that cannot be completed perfectly.

- Work hard, guarantee all work and promote 100% customer satisfaction, if this is done profitability will fall into place.

1.3 Objectives

- Develop the business into full-time employment within 12 months.

- Generate steady revenue per year by the end of year two.

- Create over 20% of business from repeat customers.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

HandyMan Stan has been formed as a Minnesota Limited Liability Company (LLC) by Stan Roberts. Stan will be the sole employee and owner of the company. The company will incur certain start-up costs, primarily tools, detailed in the Start-up Summary section.

2.1 Start-up Summary

HandyMan Stan will incur start-up costs associated with the beginning of the business. The following table details the start-up costs as well as indicated the needed capital for initial operations. Stan will be using his personal tools for jobs but will need to purchase the following additional equipment/tools:

- Assorted plumbing tools including: slip wrenches, snakes, teflon tape, and assorted caps, nuts, and bolts.

- Electrical tools including: electrical gauge meters, wire cutters, various wires and wire caps, and soldering iron.

- Painting material including: paint brushes, paint roller, pneumatic paint sprayer, air compressor, sand papers, spackle tools and masking tape.

- Pressure washer.

- Various general tools.

- Assorted power tools (drill, saw, sander, Dremel).

- Assorted nails, bolts, screws, and fixtures.

- Laptop with portable printer for mobile invoice printing and submission.

- Mobile phone.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $500 |

| Accountant | $500 |

| Brochures | $250 |

| Insurance | $250 |

| Total Start-up Expenses | $1,500 |

| Start-up Assets | |

| Cash Required | $20,500 |

| Other Current Assets | $0 |

| Long-term Assets | $8,000 |

| Total Assets | $28,500 |

| Total Requirements | $30,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $1,500 |

| Start-up Assets to Fund | $28,500 |

| Total Funding Required | $30,000 |

| Assets | |

| Non-cash Assets from Start-up | $8,000 |

| Cash Requirements from Start-up | $20,500 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $20,500 |

| Total Assets | $28,500 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $30,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $30,000 |

| Capital | |

| Planned Investment | |

| Investor 1 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $0 |

| Loss at Start-up (Start-up Expenses) | ($1,500) |

| Total Capital | ($1,500) |

| Total Capital and Liabilities | $28,500 |

| Total Funding | $30,000 |

2.2 Company Ownership

Stan Roberts is the founder and owner of HandyMan Stan. The company will remain a one-man operation for the foreseeable future.

HandyMan Stan offers the community of Duluth the finest home repair and maintenance for home owners and property managers. All services start at just $30 per hour plus parts. HandyMan Stan will give every customer at least one hour of work at their property.

All work is “handyman” work, for larger jobs that require a contractor, HandyMan Stan will pre-screen a service provider free for the customer.

By providing only handyman services, HandyMan Stan will always attempt to repair the problem first, replacement is only an option if the item cannot be repaired. This differs from a contractor philosophy which is generally to replace everything first.

Repairing items is far less expensive for the consumer. HandyMan Stan offers a one year guarantee for all of their work, if something goes wrong, HandyMan Stan will make it right. The goal is to not have any unsatisfied customers.

Offered services include:

| Minor plumbing | Leaky faucets, repair/replace fixtures, sprinkler repair, minor drain problems, garbage disposal install, install ice maker lines. |

| Minor electrical | Ceiling fan repair and install, electrical plugs and switches, vanity lights, motion lights, cable and phone line installation. |

| Fence repair | Metal and wood fence repair and install, electric dog fences, gate and latch install. |

| Window, wall and door repairs | Small hole repair, door installation, window maintenance and repair. |

| Decks and patios | Deck repair and maintenance, chemical cleaning, pressure washing, wood replacement, handrail installation. |

| Painting | Interior and exterior (short of an entire exterior of a house). |

| Weather proofing | Weather stripping, caulking. |

| Flooring | Carpet and hard wood repair. |

Market Analysis Summary how to do a market analysis for your business plan.">

HandyMan Stan has identified two distinct market segments, home owners and property managers. These are the most attractive customer segments as they are the customers who often have small repairs that are too small for a contractor but too complicated for the owner to perform themselves.

The handyman industry competes with the contractor industry for home repair jobs. Handymen are typically used for small items, contractors are typically called in for more extensive projects.

Customers will often call whatever service provider they are familiar with, regardless of the appropriateness. For this reason, word of mouth referrals will be very important. Potential customers will ask neighbors/friends and other property managers for recommendations on handyman service providers. HandyMan Stan will capitalize on word of mouth marketing by going the extra mile to keep customers satisfied. Exemplary service will result in new and repeat business.

4.1 Market Segmentation

The market has been segmented into two distinct customer groups:

Home owners

- The value of the homes ranges generally between $150,000 – $650,00.

- 47% of home owners attempt to make small repairs themselves, often starting the repair and realizing that they do not have the skills to complete it. The remaining 53% do not attempt to repair it, they call a professional from the start.

- 62% have owned their home for more than two years.

- 73% wait until several small problems accumulate before they call a handyman. This behavior can be explained by not wanting to incur a large upfront charge just to have someone fix one thing.

- Manage between three – 20 units.

- Typically do not have their own in-house repair man in an effort to reduce overhead expenses.

- The range of monthly rental costs of their units is $350-$675.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Home owners | 5% | 24,090 | 25,295 | 26,560 | 27,888 | 29,282 | 5.00% |

| Property managers | 4% | 1,234 | 1,283 | 1,334 | 1,387 | 1,442 | 3.97% |

| Total | 4.95% | 25,324 | 26,578 | 27,894 | 29,275 | 30,724 | 4.95% |

4.2 Target Market Segment Strategy

The two customer segments, home owners and property managers have been targeted because they are the most likely consumer of handyman services.

Unless the home owner is particularly crafty, he/she does not have the skills, time or desire to tackle most jobs. Their preference is to hire someone and have them take care of it.

The property manager are also likely consumers because they are managing a group rental property which needs periodic maintenance. Property managers with less than 20 units rarely have on-site maintenance personnel, it is less expensive to hire someone as needed.

It is rare that the property manager would have any maintenance skills themselves and those that do usually do not have the time in the day to perform the repair.

It should be noted that the majority of business will be coming from residents and rental property from within the Duluth city limits. As you venture farther out of town into the country people tend to have more free time and more fix it skills and are therefore more likely to try to repair things themselves.

4.3 Service Business Analysis

Handymen operate within the general home repair industry. This industry encompass both handymen as well as general contractors. The distinction between the two is as follows: handymen can fix most minor problems, items that are not to extensively damaged nor do they require expensive special tools.

Contractors are most useful for jobs that are very technical in nature, extensive in the repair, or require very specialized tools. A handyman is typically far more of a generalist, he can handle a wider range of repairs whereas a contractor has a smaller realm of expertise.

4.3.1 Competition and Buying Patterns

HandyMan Stan will receive competition from several sources. The most well-known competitors are detailed below:

- Jack Of All Trades: This is a handyman company that employs six different workers as handymen. This is a large company (for handymen) with a far less intimate customer experience. If a customer used this service on four different occassions, they are likely to receive four different people on the service calls.

- Fix-It-Up: This is a one man outfit that specializes in plumbing and electrical problems. Painting and patios are not serviced. In speaking with several customers regarding their experience with this service, their impressions have been mixed.

Contractors (General)

- Duluth Contractors: This is a full-service general contractor. The organization is large with 17 employees. This company does a mixture of commercial and residential work. This company has a eight hour minimum.