How to Make Risk Management Presentations Engaging and Actionable Across Your Organization

Life is full of risk. We face risks from the moment we wake up in the morning until we fall asleep at night. Will the alarm fail to sound? Will I get into a car accident on my way to work? Will I catch a virus when I go to dinner? Heck, there’s a risk— no matter how small— that we will die in our sleep during each night.

Risk is simply an inherent element of everything we do, and business is no exception. Will a vital employee quit, or will there be a labor shortage? What will happen in the stock market, and how will it impact the economy? What if there is an accident or a lawsuit involving the company? What happens if a new product fails? What actions will be taken in the event of a security breach or equipment failure?

We might not be able to prevent risk, but we can manage it. Managing business risk requires identifying and understanding risks while seeking ways to reduce risk in a way that also supports other business goals.

Companies heavily invest every year in ways to mitigate and respond to risk. But how do they make sure everyone is on board?

There might be a variety of ways to communicate a risk management plan to all the relevant players, but a visual presentation can be effective in not only presenting the risk management plan, but also ensuring that it is engaging and actionable across your organization.

What to include when you prepare a risk management plan:

A written risk management plan for business should not only include a listing of possible risks, but it also should feature plans to manage risk and respond to incidents.

- Identify risks

Risk management refers to a variety of business aspects, both internal weaknesses, and external threats. Like much in life, knowing is half the battle, and therefore identifying risks is key in addressing them.

Risk management should be considered before embarking on any new task or project, and everyone connected to a business should be encouraged to identify additional risks. Not only should the risk itself be considered, but companies also should identify possible consequences to better prepare to address each one.

- Minimize risks

A variety of strategies are available to manage and minimize risks once they are identified. One popular method of mitigating risk involves the 4Ts:

- Transfer risk by assigning a responsible team or party to each identified risk.

- Tolerate risk by monitoring it before taking further action.

- Treat risk by taking actions that reduce the likelihood that it will occur.

- Terminate risk by adopting or amending processes that eliminate it.

- Assign roles

Staff members should be assigned to each potential risk or risk category. These individuals will be responsible for mitigating their assigned risks, as well as reporting and responding to applicable incidents. A list of these roles should be included in the risk management plan.

- Plan recovery

Each risk included in the management plan must be followed by a strategy for preventing and addressing issues. An effective risk management plan will include a compilation of business projects, the risk applicable to each and an operational plan to respond and recover from incidents. Part of that plan also should include updating mitigation efforts following an incident to prevent it from repeating.

- Communicate plan

A risk management plan can’t be effective unless everyone within a company is on board. In addition to presenting the plan to principle players, be sure that it is also published somewhere that the full risk management plan can be accessed and understood by anyone within the company at any time.

- Rinse and repeat

The most effective risk management plans are living documents, continually updated with new or changed risks and new strategies to address them. Each risk outlined in the plan should be periodically reevaluated and new risks identified. The plan also should be monitored along with staff turnover to ensure no tasks fall through the cracks.

Tips to make risk management presentations engaging and actionable across your organization:

Audience engagement is vital to a successful risk management training presentation. After all, if staff and executives are asleep they will hardly become familiar with the plan and their assigned roles.

- Include visual assets

About 90 percent of human thought is visually-based. Therefore, it’s no shocker that including visual assets within a presentation is one of the most effective strategies for engaging all types of audiences .

Releasing the risk management plan through a visual presentation is a great start, but the content within the slide deck is just as important. After all, the average PowerPoint slide includes 40 words , which is entirely too many. Instead, include more images, videos and animations within a financial risk management presentation or any other risk management training presentations.

- Illustrate data

Data is one of the most convincing sorts of content that can be presented to an audience. As anyone can attest— at least in most cases— numbers don’t lie. In fact, they can tell their own stories. A crowded slide full of stats and figures is a quick way to send your audience off to Dreamland.

Instead, illustrate your data through infographics. Beautiful.ai offers a host of various infographics through our smart slide templates. Just input your data and watch our artificial intelligence-powered presentation software design the infographic accordingly. Choose from infographics like scattergraphs , process diagrams , pie charts and bar graphs to tell the story of different risks and strategies to address them.

- Tell a story

According to the 2018 State of Attention survey, almost 90 percent of respondents said a strong narrative or story backing a presentation is critical in maintaining audience engagement. Sure, facts and data can persuade audiences and get them on board, but only if people are paying attention.

Stories have kept audiences engaged since before recorded history. Tell the story of your risk management plan by including real-life examples or by creating a character for hypothetical scenarios. Those unsure how to incorporate a story into the structure of their presentation can look to Beautiful.ai’s various presentation templates for inspiration.

- Include your audience

If you really want to keep your audience engaged with your risk management presentation slides, be sure you talk with people, not at them. Include your audience in your presentation by asking questions, taking surveys or presenting group activities. Of course, the first step is identifying who makes up that audience. You won’t necessarily present the same content to an executive board as to a room full of new hires.

One effective way to engage an audience with a risk management plan presentation from the very start is through a pre-presentation quiz or survey that gauges how much participants already know about risk management, like this example from the U.S. Small Business Association. Not only will the activity engage the audience, but it will alert participants to what they don’t know from the very start. Other engagement tools include Q&A sessions, humor and gamification.

As mentioned, the average PowerPoint slide consists of 40 words… way too many to keep audiences engaged. Remember, your presentation should be based on an outline of your plan, not a verbatim recitation of it.

Not only are uncluttered slides more effective, but shorter presentations also are more effective than longer ones, based on both audience attention and respect for time. Especially when delivering a risk management board presentation, it’s vital to respect your audience’s time. Beautiful.ai’s library of presentation templates can serve as a guideline to effective presentation lengths for a variety of topics.

Samantha Pratt Lile

Samantha is an independent journalist, editor, blogger and content manager. Examples of her published work can be found at sites including the Huffington Post, Thrive Global, and Buzzfeed.

Recommended Articles

How to craft a thought leadership marketing strategy to become a subject matter expert, what is high ticket affiliate marketing, and does it work for your brand, the leadership guide to sales prospecting, the top 6 ai presentation makers.

Risk Management 101

May 03, 2013

630 likes | 1.43k Views

Risk Management 101. An Introductory Guide to Risk Management and Managing Risks. Definition of Risk. danger possibility peril chance exposure jeopardy consequence hazard menace threat gamble

Share Presentation

- financial risk

- worst case scenarios

- your vendors

- idl ndi ui program

- risk management authority csurma

- evaluate loss

Presentation Transcript

Risk Management 101 An Introductory Guide to Risk Management and Managing Risks

Definition of Risk danger possibility peril chance exposure jeopardy consequence hazard menace threatgamble We are concerned with the potential loss, including economic loss, human suffering, or that which may prevent the organization from being able to achieve its goals.

WHAT IS RISK MANAGEMENT? • A conscious effort of planning,organizing, directing, and controlling resources and activities. • To minimize the adverse effects of accidental loss at the LEAST POSSIBLE ACCEPTABLE COST.

Risk Management Decision Process Monitor results/ Modify methods Identify exposures Implement selected method Evaluate loss potential Select method

Types of Risk and Loss • General Liability • Workers’ Compensation • Property Loss – building & contents • Athletic Injury • Business Interruption • Institutional Reputation and Image Loss • Contractual Activities • Vehicle

Types of Risk and Loss continued • Financial Risk • Legal Liability • Environmental Health & Safety • Information Management • Intellectual Property • Student Activities • Auxiliary Enterprises

California State University Risk Management Authority CSURMA • Joint powers authority (JPA) formed under CA Gov’t Code section 6500 et seq.; ultimately allows CSURMA to provide insurance programs, self-insurance programs, and related services to the 23 campuses, Chancellor’s Office, and auxiliaries. • Separate legal entity from the CSU. • Subject to open meetings (Bagley-Keene Meeting Act).

Programs in the CSURMA • General Liability Program • Workers’ Compensation Program • Master Property Program • IDL/NDI/UI Program • Athletic Injury Medical Expense Program (AIME)

Programs in the CSURMA continued • Property – Inland Marine Program • AGPIP – Auxiliary Group Purchase Insurance Program – create market clout among the CSU Auxiliary Organizations to drive premium costs down through group purchase of insurance. • Student Health Insurance Program (CSUSHI) • Foreign Travel Liability Program

Campus Risk Exposures • On the Job Safety (internal & external) • EPL • Vehicle Accidents • Vendors (contracts & product) • Building Maintenance (repairs, IAQ, general maintenance, etc.) • Facilities Use (internal & external) • Reputation (internal & external)

Headlines: Eight killed in Utah State University Van Rollover By Paul Foy ASSOCIATED PRESS 10:09 p.m. September 26, 2005 TREMONTON, Utah – A Utah State University van returning to campus from a field trip blew a tire on Interstate 84 and rolled over, killing seven agriculture students and an instructor. Three other students were hospitalized. The van overturned Monday on the freeway near Tremonton, about 65 miles northwest of Salt Lake City. All 11 occupants were thrown from the van. The students were underclassmen, mostly freshmen. "Some have only been on campus a couple of weeks," university President Stan Albrecht said, calling the deaths an "incredible tragedy." No one in the 16-passenger van, driven by the instructor, was wearing a seatbelt, the Utah Highway Patrol said. Six men were pronounced dead at the scene. Two others died at hospitals. Two of the survivors were in critical condition at McKay-Dee Hospital in Ogden, hospital supervisor Robert Miller said. A third was taken to Ogden Regional Medical Center. .... The single-vehicle crash occurred at about 4:30 p.m. It appeared the left rear tire on the eastbound van had blown as it tried to pass another vehicle, said patrol Lt. Ed Michaud. The Dodge van rolled four times, coming to rest on its wheels about six feet from a 50-foot-deep ravine, troopers said. The van's roof was collapsed to the windows. Parts of the vehicle and personal belongings littered the area near the freeway. "It was a horrific, nasty accident," said Trooper Jason Jensen. "It was one of those things you don't want to drive up on." Albrecht said the students had been on a field trip to look at harvest equipment near Tremonton, west of the Logan campus. Utah State University has about 21,000 students. .....A similar rollover shocked the school in April 2001. Six members of the men's volleyball club were injured when their Dodge van flipped over near Laramie, Wyoming. The crash prompted a government safety warning for large-sized vans.

What we think…. The usual reality.. Field Trips

Obligations • Know where the students are going. • Prepare them for an emergency. • Know in advance if there are health issues that may have to be dealt with. • Review acceptable actions and unacceptable actions.

Student Travel • Approval = Acknowledged benefit • Prepare the students for the travel – risks, expectations, contacts • Waivers versus Informed Consents • Know who is where • Options for those with disabilities

The Accident • Have your contact information handy. • Report the accident to the campus (your supervisor or the Police) as soon as you can. • Do Not Admit Fault. • Do Not make promises.

The Claim • Their’s Victim’s Compensation & Government Claims • Your’s Victim’s Compensation & Government Claims • Our’s CSU Risk Management – Program Administrators

Government Claim Booklet • State of California Victim’s Compensation & Government Claims Program • Includes Instructions & Claim Form http://www.governmentclaims.ca.gov/

METHODS OF CONTROLLING RISK • Avoidance • Transfer of Risk • Retention of Risk • Reduce Risk through Loss Reduction Efforts • Finance Retained Risk • Define Meaningful Standards and Expectations

EVALUTE LOSS POTENTIAL • Evaluation Techniques • Frequency/Severity of Claims • Publications/Periodicals/Other Universities • Political/Litigation Climate • Anticipate

The Challenges We Face • Internal • “We’ve never had that kind of loss” • “What, change my procedure, I’ve always done it this way!” • “I’ve taught this class for 20 years without a problem!” • “All Risk Management has is: bad news with higher price tags!” • No communication!

The Challenges We All Face • External: • The Insurance Market • Your vendors • Your constituents • Unions • Auxiliary Organizations • Foundations • Athletic Corporations • Bookstores • Food Services • Health Centers

OTHER RISKS TO CAUSE YOU WORRY • Liability • General, a wide variety of exposures, including civil liability arising out of accidents resulting from the premises or operations of a public university • Employment- the trifecta of risk • Expensive to defend • Awarding of compensatory, special damages • Awarding of plaintiff’s attorney fees • Automobile • Public Officials’ Errors and Omissions

Risk Management’s Role • Manages insurance and claims • Looks for process improvement through feedback • Consults • Reviews • Forecasts • Play “what ifs” • Thinks worst case scenarios • Recommends

Let’s Team Up! RM&S Takes an Active Role: • G.O. • Observe • Inquire • Alert • Collaborate

Most Risks Do Have a Reward! Be prepared in order to enjoy.

- More by User

Risk Management

Youth Sports Programs. Charitable Organizations. Common Transfer Options. file://localhost ... by federal, state or local organizations such as schools and city ...

937 views • 24 slides

Insurance & Risk Management 101

Insurance & Risk Management 101. Insurance & Risk Management 101. Presenters: Kymberlee Keefe, National Director of Elder Services, Aon Risk Services Judy Cangealose, Atlanta Healthcare Practice Leader, Aon Risk Services

742 views • 33 slides

Risk Management. F29SO1 Software Engineering. Monica Farrow EM G30 [email protected] www.vision.hw.ac.uk. Risk Management. Risk concerns future happenings For today and yesterday, we are reaping what we sowed by our past actions/inactions

913 views • 29 slides

risk management

2. ????? ??????? ?????? ????? ???? ??????? ?? ????? ??? ?? ??? ?????? ???? ??? ? ???? ?? ???? ?????? : . ????? ?????? ???? risk management ????? ???? ?? ??? ??????? uncertainty ?? ?????? ????? chance of loss????? ???? ???? pure risk ?? ???? ??? ? ???? speculative risk????? ??????? ??????? ???

961 views • 62 slides

RISK MANAGEMENT

2. What is Risk Management ?. A system designed to protect the organization, its employees, patients and visitors from injury, lost work, and loss of tangible and intangible assets. 3. Clinical Risk Management. Program ResponsibilitiesProvide quality oversight for the components of the Risk Man

929 views • 64 slides

Clinical Risk Management: 101

1.36k views • 108 slides

Risk Management “101” Terminology

Risk Management “101” Terminology. Presented for Wisconsin 4-H Youth Development Staff. Youth Emphasis April 2005. Potential Liability Risks. Negligence

235 views • 8 slides

Risk Management 101. Presented at:. Illinois ASBO 61 st Annual Conference May 16, 2012. Presented by:. Michael McHugh Area Executive Vice President Arthur J. Gallagher Risk Management Services, Inc. Introductions. 31+ Years Insurance and Brokerage Experience

638 views • 33 slides

“Management 101”

“Management 101”. Tim Smith President, Gwinnett Cemeteries. I. The Most Important Aspect of Managing People Is …CONSISTENCY!. Examples: GOD PARENTS COACHES TEACHERS

327 views • 20 slides

Risk management

177 views • 4 slides

Risk Management. Mrs. Smith 2/10/2014. Recession. A Period of temporary economic decline. Trade and Industrial activity are reduced During recessions jobs are scarce and companies are doing everything they can to protect their reputations. Inflation Warranty Guarantee. What is Risk?.

250 views • 7 slides

Risk Management. John Watt. Overview. An introduction to risk management standards and frameworks.

423 views • 16 slides

Risk Management. Speculative risk Pure risk Everyday life Business risk Occupational safety and health is ONE business risk. Risk Management for OSH Hazard Risk Control. Identify the hazard Assess the risk Control the risk Avoid Retain and / or Reduce Transfer. Likelihood.

525 views • 8 slides

Risk Assessment 101

Risk Assessment 101. Anna Tomassacci , Kendal McGillycuddy and Teddi Wilcox. objectives. Perform a basic risk assessment Design a system of internal controls. agenda. Risk Assessment Bazinga Internal Controls Overview Group Exercise:

429 views • 17 slides

risk management 101 measuring, managing & monitoring risk: a km approach kmworld09

risk management 101 measuring, managing & monitoring risk: a km approach kmworld09. [email protected]. why should km care about risk?. “The purpose of knowledge management is to provide support throughout the organization for improved:

342 views • 17 slides

Risk Management. Proactive strategies for minimizing the effects of bad things. Software Risk Management: Principles and Practices. Barry Boehm IEEE Software, Jan1991 text pp443-452. Survey. 35% of 600 firms “had at least one runaway software project”

221 views • 12 slides

ERM 101 Risk Management and the Actuarial Profession

ERM 101 Risk Management and the Actuarial Profession. Management of Risks Actuaries (and others) have been managing specific risks as part of business as long as there have been businesses Risks have often been managed risk-by-risk, in silos Management by profession or occupation

254 views • 22 slides

Risk Management. Introduction Risk identification Risk projection (estimation) Risk mitigation, monitoring, and management. (Source: Pressman, R. Software Engineering: A Practitioner’s Approach . McGraw-Hill, 2005). Introduction. Definition of Risk.

904 views • 29 slides

Risk Management. Instructor: Vassilis Athitsos. This presentation was derived from the textbook used for this class, McConnell, Steve, Rapid Development , Chapter 5. The presentation was prepared by Mr. Mike O'Dell and modified by Vassilis Athitsos. Systems Design Project Are Risky.

658 views • 18 slides

Risk management theory and practice

587 views • 7 slides

Enterprise Risk Management 101: Programs, Frameworks, and Advice From Experts

By Andy Marker | June 26, 2017 (updated December 4, 2021)

- Share on Facebook

- Share on LinkedIn

Link copied

Nothing in life is risk-free, and that includes the corporate world. Enterprises in every industry face risks that are both specific to their industries, as well as universal, including cyber-threats, the impact of natural disasters, and employee error. The growing field of enterprise risk management can help enterprises identify, monitor, and address risks to minimize the negative impact. In this article, we will outline enterprise risk management and discuss how a framework and roadmap can help an enterprise visualize and address risks. We will also hear from the field’s top experts on best practices in several areas of the current landscape and the types of risk that may lie ahead for enterprises.

What Is Enterprise Risk Management?

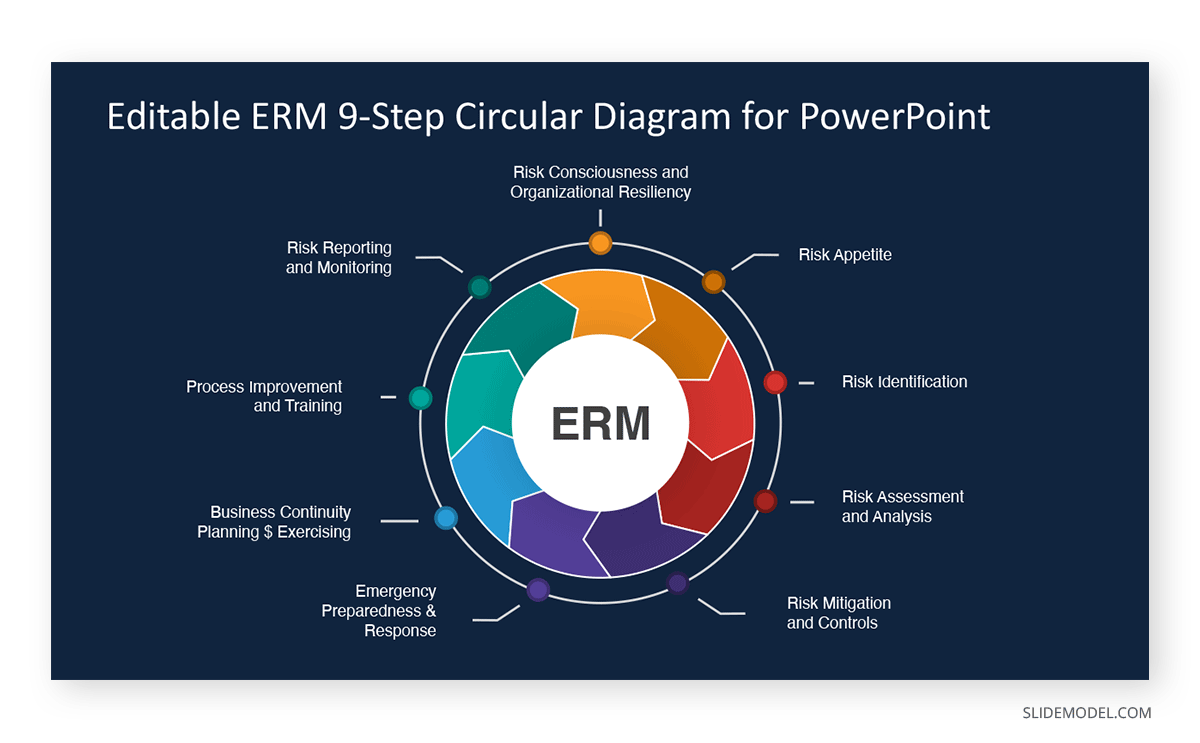

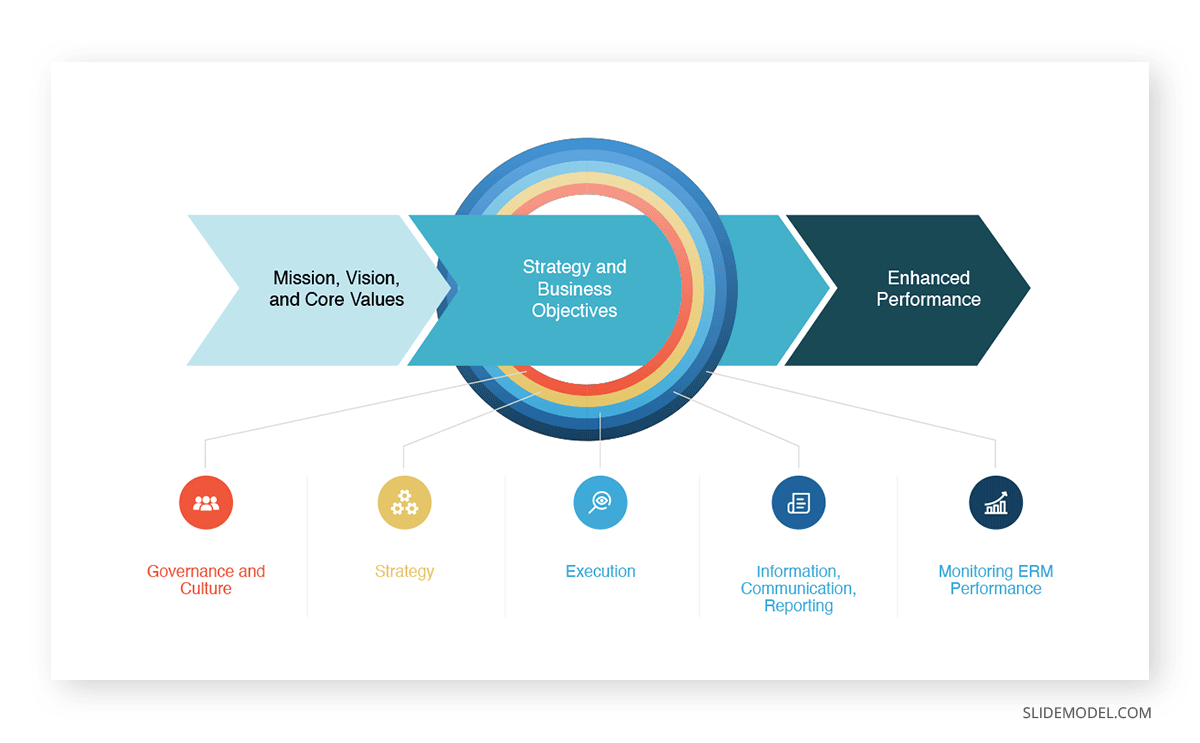

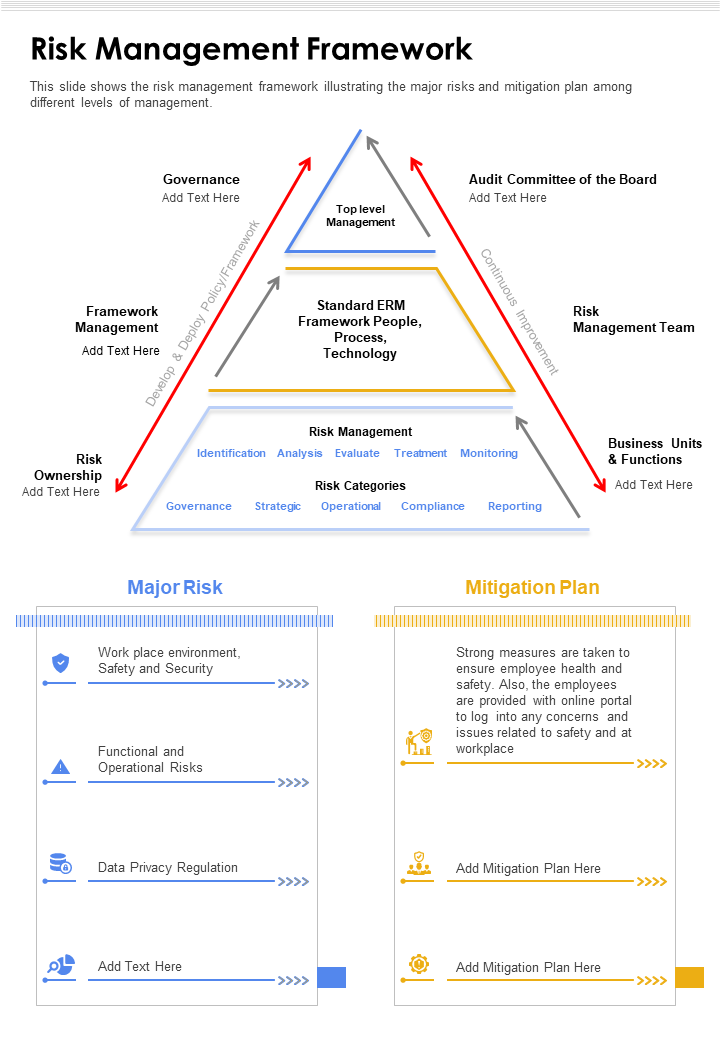

Enterprise risk management (ERM) is a constantly evolving field, but remains focused on identifying and minimizing risks that companies face. These risks might be specific to an industry (for example, HIPAA compliance in the healthcare field) or those faced by virtually every organization in the 21st century, such as cyber threats. An enterprise risk management framework is a tool that can help a company identify, list, and rank potential risks to specific parts of the organization. See below for more information and an example.

Why do enterprises need risk management? To succeed financially and otherwise, an enterprise needs to be aware of potential risks that could affect security, reputation, profits, operations, and more. An enterprise that ignores risks and the ways to mitigate them could potentially face catastrophic consequences.

The History of Enterprise Risk Management

Companies have faced risks since commerce began. Theft, natural disasters, and numerous other external factors posed threats to early businesses and continue to present risks today. By the 20th century, however, risks to enterprise organizations became more sophisticated and the results potentially more dire. According to Gerry Dickinson in his series in the Financial Times and in his book Enterprise Risk Management: The Way Ahead for DRDC Within the DND Enterprise , enterprise risk management as we know it began after WWII, when professionals identified certain risks, like natural disasters, that insurance companies would address and cover. In 1963, Robert I. Mehr and Bob Hedges wrote Risk Management in the Business Enterprise . This book articulated the idea that businesses should not only insure the risks they face, but also identify and manage them across the enterprise, with visibility from the C-suite down. Dickinson writes that the 1970s saw a rise of financial risks (a result of the growing popularity of derivatives and hedge funds), and major companies realized that they should manage both insurance risks and financial risks. Moreover, as industries evolved — and entirely new industries were created — business leaders began to encounter compliance and regulatory issues, which posed general and industry-specific risks. All of these risks could affect a company’s reputation, performance, and profitability. Thus was born the modern concept of enterprise risk management.

Why Enterprise Risk Management Is Important: The Risks Faced by Enterprises

Today’s business environment is complex and ever-changing. Many companies operate around the world, where different laws and regulations may apply. As more companies conduct their business over the internet, cybersecurity has become a threat to virtually every organization. Here are some types of risks that individual industries may face:

- Financial: Nearly every type of risk can affect a company’s bottom line. Failure to respond to a natural disaster, theft from within, and reputational issues affect not just those specific operations, but potentially the financial health of the overall company.

- Interest Rate: The fluctuation in interest rates can impact all manner of industries, including banking and lending, the stock market, real estate, and others.

- Legal Issues: Companies may face legal penalties if they fail to comply with the letter or spirit of the law, whether they be local, national, or even international regulations. They could also face civil suits as a result of perceived negligence, discrimination, etc.

- Hacking and Cyberattacks: Any company that does any of its business online can face enormous risks to the security of its data, its financial accounts, and more. See more details below.

- Theft: One of the biggest risks companies deal with is theft from suppliers, vendors, and employees. This can range from taking home burgers at the end of a fast-food shift to embezzling millions of dollars.

- Uncertain Financial Markets: Global and national financial market instability is a risk to any enterprise. A company’s stock may suddenly plunge due to no fault of the company itself.

- Natural Disasters: Disasters like earthquakes and hurricanes can devastate regions to the point where they affect supplier delivery and order fulfillment, sometimes for long periods.

- Government and Regulatory: Compliance in several industries, especially finance and health care, is a business-critical factor for risk. Compliance and regulations are constantly evolving, so it’s incumbent upon businesses to be aware of and in alignment with all relevant regulations.

- Accidents: An accident, with a shipment of goods, for example, could put a company at risk. So could an accident involving an employee, if the legal system determines that the company is responsible.

- Global and Political Instability: The uncertainty of the geopolitical arena influences international trade and the companies that engage with it.

The Goals of Enterprise Risk Management Programs

An enterprise risk management system typically has five goals, all of which are important for a solution to be successful. Any program that doesn’t include all of these may not be thorough and effective. The five goals include:

- Identifying, monitoring, and mitigating risks

- Being as proactive as possible in risk prevention

- Providing clear steps for remedying potential adversity

- Creating transparency and accountability to increase the faith and confidence of shareholders

- Conforming to industry-specific compliance and regulatory rules

Ray Monteith is the Senior Vice President and Risk Control Services Leader in the British Columbia offices of HUB International , a risk-management consultancy. He would add a sixth goal to this list: constantly reevaluating the first goal.

“It is so important for businesses to keep working to identify new, potential risks. New risks can emerge in any industry, so it’s critical to be constantly evaluating the landscape .” — Ray Monteith, Senior Vice President and Risk Control Services Leader, HUB International, British Columbia, Canada

How Enterprise Risk Management Addresses the Risks Faced by the Financial Sector

Some industries face more risks than others, especially the financial sector. Investment banking, money management, the mortgage industry, and other types of financial services face several potentially harmful risks. These include the following:

- Investment Risks: No investment is completely risk-free, and financial institutions, mutual funds, etc., can face severe losses if investments don’t pay off.

- Security: Financial institutions must protect not only their own money and profits, but their investors’ and customers’ as well. Customers need to know their deposits and transactions are secure and protected.

- Breaks in Business Continuity: When enterprises merge, close, or have breaks in operations, financial sector businesses may suffer, either directly or indirectly.

Moreover, because of the risks faced by this sector, the Basel II Accord of 2004 international regulation requires financial services companies to use risk management software. This regulation also requires that banks have enough cash reserves to cover the cost of any problems that occur, including fraud and IT-related events. In addition, the primary integrated financial trading systems, such as Misys , Calypso , and Murex , have built in risk management and compliance. Misys is a London-based financial conglomerate. San Francisco-based Calypso provides solutions to trading companies the world over. Murex, based in Paris, offers software IT products and solutions to the financial sector. Because of the nature of these companies’ customers, they all must conform to regulatory stipulations, as must the companies that do business with them.

IT and Cyber Risk Management

In the past several years, enterprise risks involving IT and the internet have increased exponentially. There are essentially two types of IT risk issues. The first concerns the tech and IT industries, where perpetrators can infiltrate a company’s proprietary software or email servers. The second involves virtually all companies, since nearly every enterprise has a significant internet presence and uses email to conduct transactions and communicate. Every organization is vulnerable to cyber risks, particularly as hackers and malware grow ever more sophisticated. Compromised companies can suffer harm to their products, their reputation, their customer service, their growth, their employees, and other areas. Companies that experience hacking or data breaches need to act as quickly and transparently as possible, contacting customers to announce how they plan to remedy the situation. Also, the highest-level executives need visibility into all cyber threats to their organization. An IT department cannot combat these sophisticated attackers on its own. The powerful, pervasive nature of cyber threats underscores the need for an enterprise-wide enterprise risk management system. Every company, regardless of industry, should cultivate and maintain strong relationships between IT risks, assets, processes, and controls by defining them according to description, category, hierarchy, ownership, and visibility. Companies should empower IT departments to assess, quantify, monitor, and manage IT risks. There should be issue management and remediation policies, including investigation protocols and root cause analyses. Lastly, there should be risk monitoring and metrics available to IT and other business leaders, so they can quickly identify risks and take action if needed.

One of the Biggest Risks in Enterprise Risk Management: Employee Theft

The leading risk factor faced by the retail world, especially fast-food restaurants, is theft by employees, says Mike Compton, President of DIGIOP, a loss- prevention company based in Indianapolis.

“ U.S. companies lose $40 billion a year in employee theft, according to the U.S. Chamber of Commerce, and retailers are among the hardest hit. Our goal is to help make that a thing of the past.”— Mike Compton, CEO, DIGIOP

“Loss can come from employees taking cash and then voiding a sale or helping themselves to merchandise and food, etc. Because there can be a high turnover in these businesses, employers and companies often can’t catch up or are just resigned to this loss as a ‘cost of doing business,’” Compton points out. “We try to help our clients be more strategic and stop that loss where it happens,” he continues. That includes his company’s solution, which integrates video monitoring with accounting and combines them in a dashboard.

Risks Faced in Other Industries

As mentioned, virtually every industry faces its own types of risks. Savvy CEOs and other business leaders have their eyes open about potential risks and oversee the implementation of the right risk management solution for their industry. Here are some of the risks faced by industries other than retail:

- Insurance: Insurance companies face a constantly evolving landscape of risk, measuring ever-shifting changes in population, geography, etc.

- Healthcare and Health Insurance: Healthcare providers are bound by strict protocols, including HIPAA, and can face risk regarding how a doctor diagnoses or treats a patient. Now, health insurance companies must comply with the U.S. Affordable Care Act, in addition to following insurance industry regulations.

- Manufacturing: Manufacturing companies face risks in their supply chains, in the actions or inactions of their vendors , in their plants (safety issues), and in other areas.

- Transportation: Numerous factors affect transportation companies, including the price of gasoline, supply and demand, and potential supply chain and manufacturing risks.

- Entertainment: Even the entertainment industry isn’t free of risk, as people steal artists’ work or sample it without permission.Moreover, companies may assess artists’ royalties incorrectly, etc.

- Nonprofits: NGOs, educational facilities, and nonprofit organizations also face risks in their interactions with the communities around them, in adherence to regulations, and in auditing.

Incorporating Compliance and Governance into Enterprise Risk Management

Industries face unique risks regarding compliance and governance issues. As the government imposes more regulations to help consumers, companies must quickly adapt to the increasing number and types of compliance regulations. These can include the following:

- Government Regulations: The city, state, and federal governments can all have their own regulations with which companies must comply. For example, manufacturing and transportation companies typically must limit their carbon emissions according to local, state, and federal laws. Noncompliance exposes these companies to major risks concerning their operations and reputations.

- International Regulations: Industries that do business globally face additional types of risks and challenges. Some transactions are governed by international agreements, while others are subject to requirements and regulations in the individual countries where a company does business. These restrictions may include language and cultural issues, and noncompliance can pose a huge risk for a company.

- HIPAA: The Health Insurance Portability and Accountability Act of 1996 applies to the security of all health information related to individuals. Breaches of protected health information pose an enormous risk to healthcare companies, as well as individual providers. Compliance protocols must be followed to the letter. If they are not, the government can penalize the entire institution.

- Financial Regulations: After the recession of 2007-09, Congress enacted many laws intended to prevent a similar financial crisis. These include regulations governing sub-prime mortgages and other risky practices.

Other industries belong to their own relevant trade associations, which include voluntary compliance to any related regulations. One example is the Motion Picture Association of America, which rates Hollywood films distributed to wide audiences.

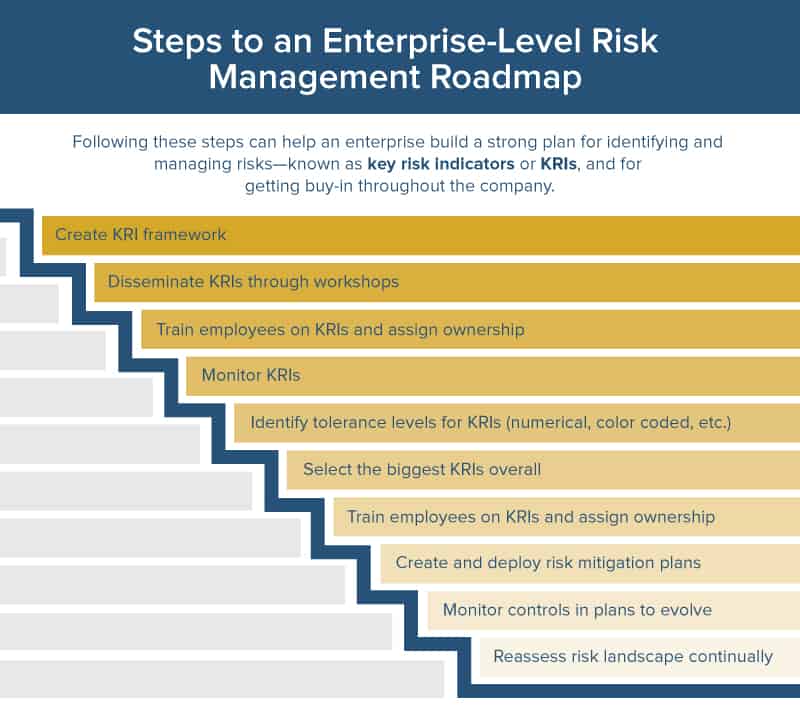

Enterprise Risk Management Policy: The Best Practices of Implementing a Policy and Identifying KRIs

A comprehensive ERM policy statement supplies a high-level overview of an organization’s ERM program and guides its members to effective risk management. The board of directors usually approves it, and the statement contains the chief tenets of the organization’s ERM program. “The transparency and buy-in from the entire company is essential,” emphasizes Monteith. “It’s so important to have a risk strategy, not just a policy,” he says. “This will help the organization understand where all the risks reside and how to assign ownership of monitoring and addressing those risks.” Monteith’s company helps clients transfer the risks they can out of the organization and into insurance policies. For those risks that remain, “We help the client evaluate how to manage them and align them with the company’s overall mission and vision. It’s also important that at the most senior level, the risk appetite of the company is understood,” Monteith notes. An ERM policy is broad and detailed, covering the known key risk indicators (KRIs). These could include the failure to meet sales projections, workforce availability, the strength or weakness of the dollar, etc. “The key to an ERM policy that works in the current environment,” Monteith explains, “is that it must be a continuing conversation. The company should be in a continual state of implementing, monitoring, addressing, and re-adjusting.” A KRI roadmap can be a strong guide in this process.

“Having a strategic risk management policy also helps companies think ahead and be agile,” Monteith addes. “We hear people say, ‘But something like that has never happened before. Why should we prepare for it?’ And we say, ‘because there is always the risk of events that can be transformational.’” Companies whose risk management policies foster this kind of agility and questioning may be best armed for the unexpected risks they could face. An ERM framework is different from a policy. The policy comes first, and the framework is built to support it. The policy states the overarching goals of risk reduction in an organization. The framework can be as granular as needed so that those throughout the company can have all the guidance they require to reduce risk. “Companies should also be increasingly evaluating their own risk culture ,” recommends Alasdair Wood, Director, Human Capital and Benefits, Willis Towers Watson, in London. “In short, this involves a company’s defining what are acceptable, even necessary, risks its employees can take and what are unacceptable. It comes down to empowering employees to take the right risks in an informed manner. No more, no less,” concludes Wood.

Enterprise Risk Management Frameworks and How to Use Them

An ERM framework is a useful tool in helping teams visualize the risks and ownership, as well as the responsibility for monitoring and addressing those risks. To learn more about different frameworks, including how to create a custom ERM framework, see "Guide to Enterprise Risk Management Frameworks" (this article link).

Enterprise Risk Management Maturity Models

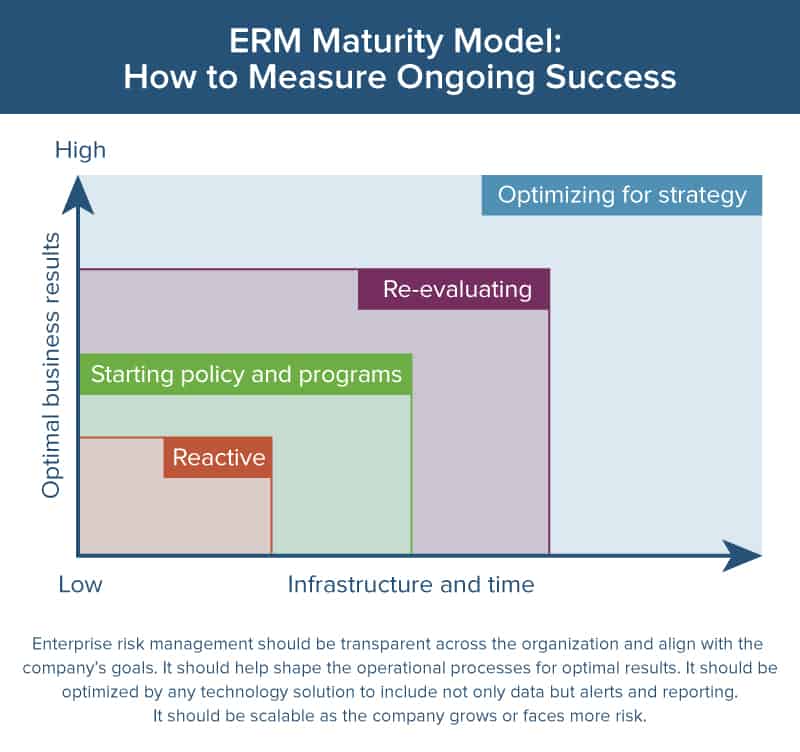

An enterprise risk management maturity model consists of two axis of desired business outcomes measured against investments and a timeline. Ideally, a strategic organization working on enterprise risk management will see its progress go up and to the right over time. As a company matures, so should its strategic implementation of risk management.

Source: IDC Financial Insights The nonprofit Risk Management Society, known as RIMS, is another useful resource. The organization offers a free tool online to create your own risk maturity model. You can adapt it to any enterprise in any industry. To learn more about the RIMS risk maturity model, see "Guide to Enterprise Risk Management Frameworks".

Enterprise Risk Management: The Experts’ View

Experts who work with enterprises see a rapidly changing terrain of newer potential risks. “The companies that are agile and continually revisiting their risk policy and plan are the ones most likely to respond quickly and well if something happens,” Monteith says. The current risks, though, are likely to remain risks for the foreseeable future. They include employee theft and human error. “Being able to monitor an employee’s actions at the cash register, or throughout the store, is a huge opportunity for retailers and others doing transactions and selling goods and services,” says Compton. Making even a small dent in that $40 million loss related to employee theft could save companies significant amounts of money. Monteith believes that where there are catastrophic failures in business, it’s clear that human error was a factor. “Lehman Brothers, the failure of which led to the financial crisis, clearly misidentified and recklessly managed enterprise risks,” he stresses. Another tragic example of mismanaged risk is the 2013 derailment of a train carrying fuel oil through the Québec town of Lac-Mégantic. “The train was unstaffed. There were no brakes, and on and on, resulting in a catastrophic loss of life,” Monteith says. Thirteen people were killed and many more injured. In the investigation that followed, authorities cited 18 different factors as reasons for the crash. According to CNN , those included a "weak safety culture" in the railroad that carried the oil, a law requiring, but rarely enforcing, safety plans from the industry, and a train composed almost entirely of substandard tanker cars. “There was a clear disconnect between the organization’s goals and risk management on an operational level,” Monteith remarks. Some companies have done a good job in mitigating risk when dealing with threats. Tylenol faced a crisis in 1982 when an unknown person laced several Chicago-area bottles of the drug with potassium cyanide, resulting in at least seven deaths . The company immediately pulled all its products from retail shelves, restocking them only after creating the now-ubiquitous seal under the lid. Home Depot and Target immediately reached out to customers and the media when they learned credit-card data had been hacked and stolen.

The Benefits of Using Enterprise Risk Management Software

Most large enterprises use risk management software or systems to help identify, monitor, and communicate risks associated with a given set of assets. Typically, the solutions collect data from throughout the business to indicate where risks may lie and then display results on a dashboard. These systems also notify businesses (or, specifically, the owner of the particular risk issue) of these occurrences, including security breaches. In this era of doing business at internet speed, the benefits of using risk management software are substantial. Some benefits to organizations include:

- Increased Shareholder Value: Mitigating risk efficiently results in a better brand and reputation, boosting stock prices.

- Optimized Risk/Return Outcomes: The more quickly you identify and address risk, the better the outcomes for the whole company.

- Greater Transparency: Managers and others gain the ability to tackle projects with the best risk/reward outcomes.

- Prioritization: The company can monitor and manage higher-risk initiatives more closely as needed.

- Reduced Compliance Costs: An in-house solution that integrates compliance and regulatory processes results in lower costs.

- Strengthened Operations: As a company identifies, addresses, and prevents risks according to the risk maturity model, operations become progressively more efficient and streamlined.

Enterprise Risk Management Educational Opportunities and Resources

There are plenty of educational resources, organizations, and events that enterprises can turn to for help and advice. They include:

- RIMS and the RIMS Annual Conference

- The Conference Board of Canada: ERM

- RMA’s Annual Risk Management Conference

- The Smartsheet risk management certification guide

- The North Carolina State University Enterprise Risk Management Studies program

- The University of California Office of the President Risk Summit

- The National Association of College and University Business Officers’ 2013 report on enterprise risk management

- The Protiviti FAQ Guide to Enterprise Risk Management

You can also read our How to Choose the Right risk Management Certification for You article to learn about the types of certificates available and the opportunities having one can garner.

Smartsheet: An Essential Tool for Enterprise Risk Management Professionals

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Risk management is the process of identifying, assessing and controlling financial, legal, strategic and security risks to an organization’s capital and earnings. These threats , or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters.

If an unforeseen event catches your organization unaware, the impact could be minor, such as a small impact on your overhead costs. In a worst-case scenario, though, it could be catastrophic and have serious ramifications, such as a significant financial burden or even the closure of your business.

To reduce risk, an organization needs to apply resources to minimize, monitor and control the impact of negative events while maximizing positive events. A consistent, systemic and integrated approach to risk management can help determine how best to identify, manage and mitigate significant risks.

Get insights to better manage the risk of a data breach with the latest Cost of a Data Breach report.

Register for the X-Force Threat Intelligence Index

At the broadest level, risk management is a system of people, processes and technology that enables an organization to establish objectives in line with values and risks.

A successful risk assessment program must meet legal, contractual, internal, social and ethical goals, as well as monitor new technology-related regulations. By focusing attention on risk and committing the necessary resources to control and mitigate risk, a business protects itself from uncertainty, reduce costs and increase the likelihood of business continuity and success.

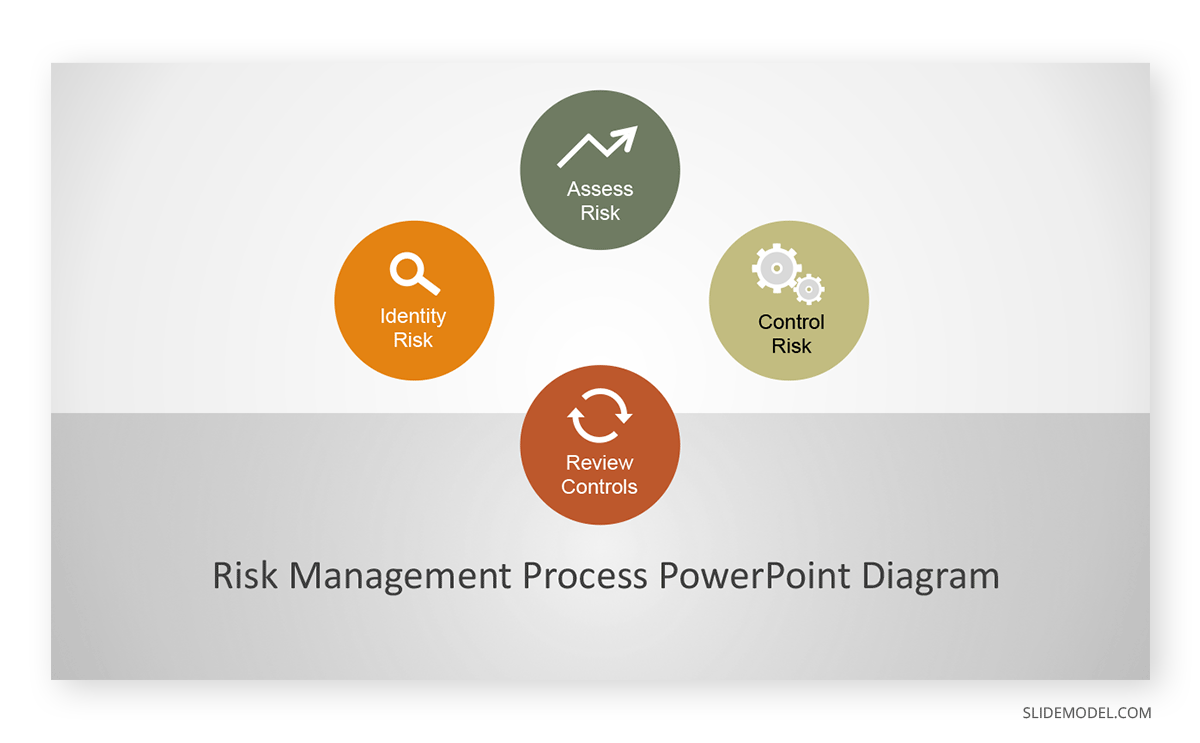

Three important steps of the risk management process are risk identification, risk analysis and assessment, and risk mitigation and monitoring.

Risk identification is the process of identifying and assessing threats to an organization, its operations and its workforce. For example, risk identification can include assessing IT security threats such as malware and ransomware, accidents, natural disasters and other potentially harmful events that could disrupt business operations.

Risk analysis involves establishing the probability that a risk event might occur and the potential outcome of each event. Risk evaluation compares the magnitude of each risk and ranks them according to prominence and consequence.

Risk mitigation refers to the process of planning and developing methods and options to reduce threats to project objectives. A project team might implement risk mitigation strategies to identify, monitor and evaluate risks and consequences inherent to completing a specific project, such as new product creation. Risk mitigation also includes the actions put into place to deal with issues and effects of those issues regarding a project.

Risk management is a nonstop process that adapts and changes over time. Repeating and continually monitoring the processes can help assure maximum coverage of known and unknown risks.

There are five commonly accepted strategies for addressing risk. The process begins with an initial consideration of risk avoidance then proceeds to 3 additional avenues of addressing risk (transfer, spreading and reduction). Ideally, these three avenues are employed in concert with one another as part of a comprehensive strategy. Some residual risk may remain.

Avoidance is a method for mitigating risk by not participating in activities that may negatively affect the organization. Not making an investment or starting a product line are examples of such activities as they avoid the risk of loss.

This method of risk management attempts to minimize the loss, rather than completely eliminate it. While accepting the risk, it stays focused on keeping the loss contained and preventing it from spreading. An example of this in health insurance is preventive care.

When risks are shared, the possibility of loss is transferred from the individual to the group. A corporation is a good example of risk sharing—several investors pool their capital and each only bears a portion of the risk that the enterprise may fail.

Contractually transferring a risk to a third-party, such as, insurance to cover possible property damage or injury shifts the risks associated with the property from the owner to the insurance company.

After all risk sharing, risk transfer and risk reduction measures have been implemented, some risk will remain since it is virtually impossible to eliminate all risk (except through risk avoidance). This is called residual risk.

Risk management standards set out a specific set of strategic processes that start with the objectives of an organization and intend to identify risks and promote the mitigation of risks through best practice.

Standards are often designed by agencies who are working together to promote common goals, to help to ensure high-quality risk management processes. For example, the ISO 31 000 standard on risk management is an international standard that provides principles and guidelines for effective risk management.

While adopting a risk management standard has its advantages, it is not without challenges. The new standard might not easily fit into what you are doing already, so you could have to introduce new ways of working. And the standards might need customizing to your industry or business.

Manage risk from changing market conditions, evolving regulations or encumbered operations while increasing effectiveness and efficiency.

Speed insights, cut infrastructure costs and increase efficiency for risk-aware decisions with IBM RegTech.

Simplify how you manage risk and regulatory compliance with a unified GRC platform fueled by AI and all your data.

Better manage your risks, compliance and governance by teaming with our security consultants.

Identify IT security vulnerabilities to help mitigate business risks.

Create a smarter security framework to manage the full threat lifecycle.

Understand your cybersecurity landscape and prioritize initiatives together with senior IBM security architects and consultants in a no-cost, virtual or in-person, 3-hour design thinking session.

Understand your cyberattack risks with a global view of the threat landscape.

Discover how a governance, risk, and compliance (GRC) framework helps an organization align its information technology with business objectives, while managing risk and meeting regulatory compliance requirements.

Find out how threat management is used by cybersecurity professionals to prevent cyber attacks, detect cyber threats and respond to security incidents.

Explore financial impacts and security measures that can help your organization avoid a data breach, or in the event of a breach, mitigate costs.

Keep up to date with the latest strategies from our expert writers.

Protect your business from potential risks and strive towards compliance with regulations as you explore the world of proper governance.

Cybersecurity threats are becoming more advanced, more persistent and are demanding more effort by security analysts to sift through countless alerts and incidents. IBM Security QRadar SIEM helps you remediate threats faster while maintaining your bottom line. QRadar SIEM prioritizes high-fidelity alerts to help you catch threats that others miss.

Home Blog Business Risk Management Techniques

Risk Management Techniques

Risk and business cannot be separated! For an entrepreneur, the possibility of a loss is as real as the possibility of profitability; what lies in between the two is risk. In simple terms, the risk is the possibility of loss for a business, with financial implications. There are risks that are avoidable and risks that need to be better managed to reduce the likelihood of negative consequences.

Basic Elements of Risk Management

Risk management is the identification, assessment, and controlling of risks. Businesses around the world plan and spend a significant amount of money in managing risks. However, risk management has implications beyond business. Risk management is applicable for businesses and disaster management and can even be used by an individual at the household level . The latter can be a form of financial management, retirement-related risks, and identification of financial shocks that can affect a household.

Risk management broadly has five basic elements, covering the structure of how it can be incorporated for anticipating and controlling risks.

1. Identify Threats

In order to anticipate and manage risks, one must first identify what might be deemed as a risk. For a business, it can include the possibility of financial loss, an injury to an employee, the possibility of a lawsuit, accidents affecting customers, etc. These risks can arise due to a number of factors, be it economic conditions of a country, competition from competitors, lack of safety measures at the workplace for employees, faulty products, and the like.

2. Assess Vulnerability of Critical Assets

The next step includes an evaluation and assessment of risks. This is to identify the vulnerability of critical assets due to the risk. For example, if there is a production process that can lead to an employee’s injury or death, there seems to be a high probability of such an accident occurring. Such a process needs to be changed or replaced.

3. Determine the Threat the Risk Poses

Different risks can pose different types of threats. An injury caused due to a hazardous production process can lead to a lawsuit by the employee, cause reputation damage, and might even lead to a decline in sales due to bad reputation.

4. Reducing Risks

There are several ways that businesses can reduce risks. If a production process has the potential to cause harm, it might be worth revising how the process is carried out or finding alternative methods for performing certain tasks to make the process safe. There might even be a need for safety equipment or machinery and regular equipment inspection and maintenance that can help manage such a risk in a better way by reducing the probability of an accident. Some risks however can be hard to reduce. This might include accounting for an economic meltdown, economic policy changes due to a change of government in a country, or viz majors like the COVID-19 pandemic or an unforeseen natural disaster.

5. Risk Reduction Measures

Risks can be categorized, (e.g., low, medium, or high). It isn’t necessary for a business to try to manage all types of risks, since the possibility of some risks might be negligible, and committing resources for them might be very expensive. Risk reduction is a process that cannot be viewed in isolation. Organizations need to perpetually monitor risks and account for course correction if and when necessary.

Managing Different Types of Risks

Risk management entails various types of strategies, such as risk reduction, risk avoidance, risk sharing, and risk retaining. We covered these strategies in detail in our previous post about risk management and risk assessment . In the section below, we will provide you with examples of different types of risks a business might face and what can be a few ways of managing such risks.

Market Risk

When it comes to imagining risks, investors usually consider the term synonymous with market risk. Market risk is the possibility of investors losing money due to a decrease in the value of their investment. The most common strategy for investors to manage market risk is by diversifying investment portfolios to avoid tying too many assets in a single business entity. Furthermore, buying at various intervals and investing in less correlated investments, such as real estate, bonds, and other commodities can be another method to avoid market risks.

Inflation Risk

Inflation can affect a business in a number of ways. The cost of inputs can suddenly rise, whereas a business engaged in export of goods can find the real value of the currency decline, leading to a loss in selling goods at a previously agreed rate. Similarly, an increase in the price of imports due to a shift in exchange rate can adversely affect the price the business can charge for its products in the local market.

There are a number of ways businesses can manage inflation-related risks, such as by localization of production parts to avoid exchange rate volatility and owing ancillary firms. Likewise, an investor might choose to invest in assets that can offer a real rate of return above inflation. This might include real estate, mineral resources, or government-issued bonds.

Liquidity Risk

You might come across a house that you intend to buy to sell later on. The location of the house might be in an area that has good market value and is likely to increase in the near future. However, how long might it take you to sell the house? Is the property too expensive for an average buyer? Will your assets get tied up for too long after purchasing the property? This is an example of how a liquidity risk can occur. Businesses can end up with assets that are tied up for too long, leading to the risk of owning assets that can be hard to cash out.

A liquidity risk can be avoided by avoiding the purchase of assets that might be difficult to cash out. Some businesses might avoid giving products on credit to local retailers or selling raw material at deferred payments to avoid a liquidity risk.

Longevity Risk

As people receive better healthcare and lifestyles, it is expected that they might live longer. While this is good news, the increase in the lifespan of such individuals means that pensions and policyholders will live longer, leading to a higher payout ratio. Longevity risk is viewed differently by different individuals. For a business, a long lifespan of policyholders or pensioners will lead to an increase in the amount of money they need to pay. Whereas people receiving such benefits will be able to live longer with the assurance of the benefits they have worked hard for.

Many organizations, be it profitable businesses or government-run organizations operating on a loss for several years, have different coping mechanisms for such a risk. Many organizations now hire employees on a contractual basis, whereas pensioners in some cases might be paid out an amount after a ‘plan termination’ by the employer. Some countries might also look to encourage people to work longer and delay social security to rationalize pension plans.

Opportunity Risk

Let’s assume you have a large sum of money placed safely in a safe at home. While the money might appear secure, it might lose value over time due to inflation. You might also run the risk of missing out on a profitable opportunity because you failed to invest in the venture. Businesses can be risk-averse , leading to a competitor taking more of the market share by investing in R&D to improve their product.

An opportunity risk, therefore, requires careful consideration. Businesses might choose to keep a sum for cost overruns, emergency needs or to avoid losing money tied up in assets hard to liquidate while investing the rest to avoid an opportunity risk.

For any business, taxes, especially an increase in them, can lead to a reduction in profitability and loss of sales due to higher prices for their commodities. There’s also the issue of sales tax compliance as the company expands to new states or countries. For an investor, it is essential to determine which portfolio to invest in, considering the rate of tax applicable in relation to the anticipated rate of return. Some investors might opt for tax-deferred accounts to cope with tax risks, whereas businesses might try to reduce tac risks by investing in offers by the government in products which are less heavily taxed.

Many countries are offering fewer taxes on electric cars to help improve the air quality of cities and reduce the negative implications of cars running on petroleum-based products. Some countries have even announced a ban on petrol and diesel-based vehicles by 2035 .

Sequence of Returns Risk

An investor might invest in a portfolio or venture that gives it a return of 5% one year and a loss of 5% the following year. To avoid negative portfolio returns, investors might spend conservatively and account for spending flexibility. An investor might also avoid selling stocks on a loss and use a reserve to fund for a buffer stock to avoid short-term losses due to a sale of stocks at a loss when the chips are down. To have smart investment strategies, start using an all-in-one investment app , which allows you to prevent risks.

Using Different Techniques for Identifying and Presenting Risks

There are a number of techniques that businesses use to identify risks. If you need to create a PowerPoint presentation about risk management, you can use a number of handy templates and techniques listed below.

Risk Matrix

A risk matrix is used during the process of assessing risks to categorize them and determine the possibility of the occurrence of the risks. The matrix can be a very handy mechanism for visually identifying high-priority risks for important management decisions.

RAIDAR Model

RAIDAR model is a risk management model used to assess risks, assumptions, issues, dependencies, action, and repairs. The model can be useful for assessing project risks and for their effective management.

PEST or PESTEL Analysis

A PEST analysis looks at the political-economic, social and technological environment for macro-environmental factors. The analysis is often extended to also include environmental and legal factors, extending the term PEST to PESTEL. This strategic management component is used for the scanning for the aforementioned factors to determine the potential for market growth, decline, and the direction that the business needs to take.

SWOT Analysis

A SWOT Analysis is a famous strategic planning technique used for identifying strengths, weaknesses, opportunities, and threats. Be it a competitor, economic uncertainty, natural disasters, market volatility, or the potential of an opportunity risk, a SWOT analysis can be a handy tool to use in identifying and mitigating risks.

Decision Tree

A decision tree is used to support decisions by placing options and anticipating possible consequences in a tree-like structure. A decision tree can be used by businesses to assess chance events, resource costs, risks, and payoffs.

Final Words

There are risks that a business can account for and manage and risks that remain perpetual. Risks that might be associated with the national economy, a natural disaster, or sudden change in government policy can be hard to account for and need constant monitoring. This is different from risks that can be managed by changing a hazardous production process to a safer alternative or diversification of portfolio to avoid losses.

Risk management is a practice that businesses would ideally do away with if it were ever possible. As distasteful as it might be, it is impossible to avoid anticipating risks for business continuity and managing them, even if it comes with a burden of heavy costs that are sometimes unavoidable.

1. Enterprise Risk Management PowerPoint Template

The Enterprise Risk Management PowerPoint Template allows you to create a visual representation that is useful for any business presentation.

Use This Template

Like this article? Please share

Business Diagrams, Business Intelligence, Business Planning, Business Presentations, Financial Risks, Risk Management Filed under Business

Related Articles

Filed under Business • May 17th, 2024

How to Make a Transition Plan Presentation

Make change procedures in your company a successful experience by implementing transition plan presentations. A detailed guide with PPT templates.

Filed under Business • May 8th, 2024

Value Chain Analysis: A Guide for Presenters

Discover how to construct an actionable value chain analysis presentation to showcase to stakeholders with this detailed guide + templates.

Filed under Business • April 22nd, 2024

Setting SMART Goals – A Complete Guide (with Examples + Free Templates)

This guide on SMART goals introduces the concept, explains the definition and its meaning, along the main benefits of using the criteria for a business.

Leave a Reply

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Risk Management 101 An Introductory Guide to Risk Management and Managing Risks.

Published by Charlene Perry Modified over 8 years ago

Similar presentations

Presentation on theme: "Risk Management 101 An Introductory Guide to Risk Management and Managing Risks."— Presentation transcript:

Trieschmann, Hoyt & Sommer Introduction to Risk Chapter 1 ©2005, Thomson/South-Western.

Raising Entrepreneurial Capital

Museum Presentation Intermuseum Conservation Association.

Assignment Six Risk Control and Premium Auditing.

Section Objectives Explain why risk is inevitable.

Dr. James Kallman, ARM 6-1 Advanced PowerPoint Presentation ©2009 The National Underwriter Company.

Managing Risk in Academic Placement Agreements Joseph C. Risser, CPCU, ARM-P Director, Risk Management California Polytechnic State University.

“This workforce solution was funded by a grant awarded under Workforce Innovation in Regional Economic Development (WIRED) as implemented by the U.S. Department.

Lecture No. 3 Insurance and Risk.

An Introductory Guide to Risk Management and Managing Risks

WHAT IS RISK MANAGEMENT? Risk management attempts to identify and manage threats that could be the downfall of an organization.

© 2000 International Risk Control America, Inc. Risk Management Presentation — 1 International Risk Control America IRCA

Chapter 2 Insurance and Risk.

The Australian/New Zealand Standard on Risk Management

Copyright © 2008 Pearson Addison-Wesley. All rights reserved. Chapter 3 Introduction to Risk Management.

Introduction to Risk Management

PowerPoint Presentation by Charlie Cook The University of West Alabama Copyright © 2006 Thomson Business & Professional Publishing. All rights reserved.

1 Construction Engineering 221 Construction Insurance.

Identify exposures relevant to all U of I operations To protect the Students, Faculty, Staff, Board of Regents and the State Board of Education To protect.

Chapter 3: Risk Management

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

Risk Management Training Presentation

Duration: 20 minutes | format: editable ppt/pdf.

Whether we are driving to work, crossing the road, investing in financial products, or making a change in our lifestyle, risk is all around us. In an increasingly fast-paced world, the risk we have to manage is constantly evolving.

In the corporate world, risk management involves understanding and analysing risk to ensure that organisations meet their objectives.

Our free training aid is a short, interactive presentation that you can use to teach your employees all about risk management and the role they play in controlling risk across your organisation.

- What is risk?

- What is risk management?

- The types of risk

- Assessing and managing risk

- Company and employee responsibilities

Download this free training aid

Share this training aid.

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

11 templates

67 templates

21 templates

environmental science

36 templates

9 templates

holy spirit

7 steps of risk management process for business, it seems that you like this template, 7 steps of risk management process for business presentation, premium google slides theme and powerpoint template.

Download the "7 Steps Of Risk Management Process for Business" presentation for PowerPoint or Google Slides. The world of business encompasses a lot of things! From reports to customer profiles, from brainstorming sessions to sales—there's always something to do or something to analyze. This customizable design, available for Google Slides and PowerPoint, is what you were looking for all this time. Use the slides to give your presentation a more professional approach and have everything under control.

Features of this template

- 100% editable and easy to modify

- Different slides to impress your audience

- Contains easy-to-edit graphics such as graphs, maps, tables, timelines and mockups

- Includes 500+ icons and Flaticon’s extension for customizing your slides

- Designed to be used in Google Slides and Microsoft PowerPoint

- Includes information about fonts, colors, and credits of the resources used

What are the benefits of having a Premium account?

What Premium plans do you have?

What can I do to have unlimited downloads?

Don’t want to attribute Slidesgo?

Gain access to over 24500 templates & presentations with premium from 1.67€/month.

Are you already Premium? Log in

Related posts on our blog

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

How to Find Out the Best Risk Management Techniques for Your Organization? With 10 Best Designs

Nawsheen Muzamil

“ Take calculated risks. That is quite different from being rash ,” this quote from the World War II hero and commander, George S Patton reminds us of weighing our options, with care and deliberate thought, before we start any endeavor.

It wouldn’t be an overstatement to say that even the smallest task we do carries some risk. Yet, being cowed down or getting into paralysis is not the answer .

Businesses, particularly, need to tackle risks and find ways to minimize its impact.

Sometimes, however, our vulnerabilities, unpreparedness, and lack of contingency planning levies damages that can impact our lives deeply. The best response in such cases is to report early, do the necessary damage control , and, of course, learn from the unfortunate event.

Risk Management Techniques: An Overview

If your organization likes to experiment with new strategies, develop utilities, and offer competitive products and services, you are more likely to encounter risks than the rest of us. It is because apart from the resources and profits, it is your reputation that is at stake. What risk management techniques must you therefore focus on so that the damage is minimal or completely avoided? Let’s jot these down.

- Risk avoidance to prevent/ reduce loss.

- Risk financing

What is the purpose of Risk Management?

The idea behind these techniques is simple:

- Either predict the risks ahead and maneuver your way around it to prevent or minimize losses, or

- Keep an action plan ready to combat the unexpected or low priority events.

Both of these techniques prepare an organization for any similar mishap ahead wherein one would now be better equipped to handle it better than early.

It is now up to the organization on how it plans to handle risk management, while abiding by their policies, and by judicious use of resources. It is also crucial to devise a prosper risk management policy and an action framework to be used under such emergencies.

Where Do We Fit In?

Is your organization lagging in this vital responsibility of having action plans and contingencies ready? Then you need our PowerPoint Templates.

Below we have assembled the 10 best PPT Designs to enumerate most effective risk management techniques and thereby action plans. Let’s check them now!

Template 1: Risk Management Tools And Techniques PowerPoint Presentation

Here is a PPT presentation to address the details of risk management for your organization. You can enlist the common risks, identify tolerance levels, and the actionable framework to reduce or eliminate losses due to these. Employ this 30-slide PPT slideshow to create an all-in-one rulebook to counter attack vulnerabilities.

Download this template

Template 2: Risk Management Procedure PPT

This is the PowerPoint compilation to record the standard procedures to identify and combat risks. Highlight the many benefits, key objectives, and other requirements of the listed techniques for your organization. This 12-slide PPT layout can be used to create the policy and ideation behind executing different risk management techniques.

Download this template

Template 3: Investment Risk Management Strategies PowerPoint Presentation Slides

Among other areas where risk management strategies are needed, investment is the major one. With this 57-slide PPT layout, you can create an in-depth analysis of what ideal investments look for your organization. In light of this define your tolerances, and recovery plans to retain the stability of your organization. Deploy this innately infographic and vibrant presentation now!

Template 4: Enterprise Risk Management PowerPoint Presentation Slides

With this PPT Thematic, you can analyze the overall risk management system for your enterprise. Discuss its facets like management cycle, risk all-abouts, procedure for managing risks, and the tools involved in this process. Deploy this vibrant collection of 65 slides to deliver on these objectives in depth. Download now!

Template 5: Healthcare Risk Management PPT

Risks are innate to every organization whose wheels are running. Healthcare is one such sector that encounters threats and is more vulnerable since it deals with human life. As such keep your risk alleviating techniques in handy with this 12-slide PowerPoint Compilation. Use this graphical compilation to create visual insights of frameworks that can reduce damage and any harm to your reputation. Download now!

Template 6: Cybersecurity Risk Management Framework PowerPoint Presentation

Discuss your organization's risk management when it comes to ensuring cybersecurity with this PPT Slideshow. With this 63-slide PPT Compilation, walk your team through the infrastructure of the cyber network, identify vulnerabilities, previous incidents, and assess your in-place strategies. Check stats of previous techniques and suggest ways to upgrade or renew them so as to avoid a compromised digital presence. Download now!

Template 7: Risk Management Procedure And Guidelines PowerPoint Presentation Slides

Enlist and analyze your risk management policies and track their effectiveness with this 48-slide PPT Presentation. Use graphs and matrices to allot strategies to various levels of threats and make judicious use of your resources this way. Download this dynamic template collection now!

Template 8: Risk Analysis Techniques For Property Construction Project PowerPoint Presentation Slides

Do you represent a construction company that encounters human, financial, and bad reputation risks? Then it is time you keep a check on factors resulting or encouraging such vulnerabilities. Whether it is on the field or in office premises, analyze your loopholes with this thoroughly designed PPT presentation comprising 49 slides. Analyze the degree of vulnerability by examining previous projects and together with your team, develop strategies to encounter the future ones much more effectively. Explore the download link to this PPT design below.

Template 9: Effective Risk Management Strategic Mitigation Presentation Report Infographic PPT PDF Document