Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Returning to Workforce Resume Examples for 2024

- Returning to Workforce

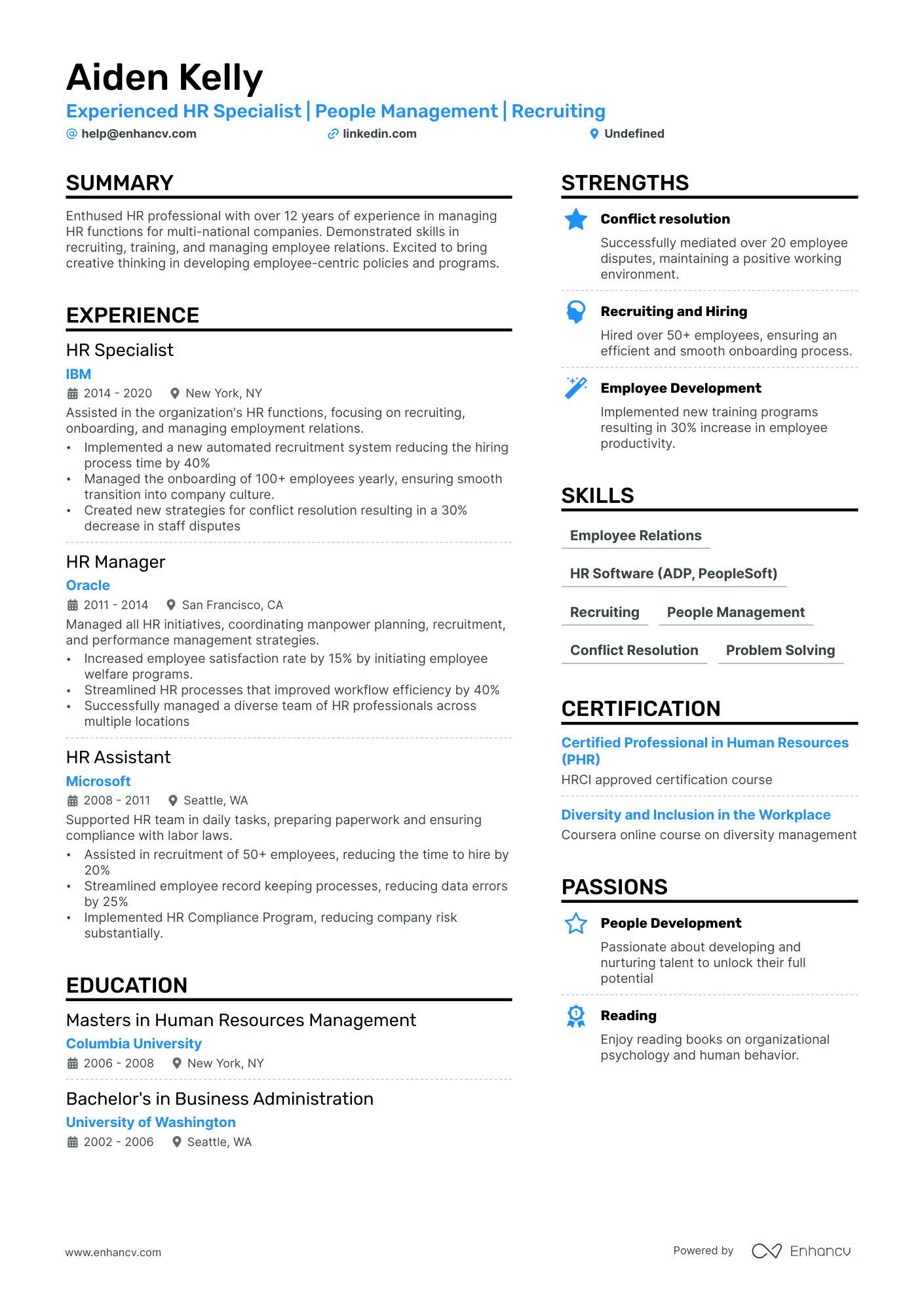

Best for senior and mid-level candidates

There’s plenty of room in our elegant resume template to add your professional experience while impressing recruiters with a sleek design.

Resume Builder

Like this template? Customize this resume and make it your own with the help of our Al-powered suggestions, accent colors, and modern fonts.

- Returning to Workforce 2

- Returning to Workforce 3

- Returning to Workforce 4

- Returning to Workforce 5

- Returning to Workforce Resume Writing 101

Whether you took a sabbatical or spent some time caring for a loved one, returning to the workforce usually means leveraging a resume maker and a whirl with a free cover letter builder . Your skills and experiences might have changed since the last time you were employed, and you might want to change your resume formatting to emphasize your skills over the gap in your work experience.

Whatever the reason behind your return, we’ll help you put your best foot forward. Get ready to roll with our five returning to workforce resume examples.

Returning to Workforce Resume

or download as PDF

Returning to Workforce 2 Resume

Returning to Workforce 3 Resume

Returning to Workforce 4 Resume

Returning to Workforce 5 Resume

Related resume examples

- Stay At Home Mom Returning to Work

- Front Desk Receptionist

- Personal Assistant

- Stay At Home Mom

What Matters Most: Skills & Work Experience

While the role you’re applying for matters, hiring recruiters looking at a returning to workforce resume will want to know whether you applied yourself during your time away.

You don’t have to disclose every sordid detail—all you need is to demonstrate that your skills are relevant to the job , whether new or existing.

Here are some of the best returning to workforce skills recruiters are looking for.

9 best returning to workforce skills

- Customer service

- Project management

- Organization

- Time management

- Problem-solving

- Microsoft Office

- Communication skills

- Active listening

Sample returning to workforce job experience bullet points

Filling in the blanks with any volunteer, freelance, unpaid, or part-time work you might have done will help dispel any assumptions made about your resume gap.

Although you shouldn’t feel like you have to go into specifics about your career break (especially if it’s sensitive or personal), adding quantifiable metrics whenever possible can help potential employers get a better idea of what you did with your time.

Here are a few samples:

- Advised and assisted the family of 5 in planning healthy meals, purchasing, and preparing foods

- Created, assigned, and scheduled various housekeeping duties for 3 children ages 4 to 12, according to their capabilities

- Kept track of the grocery inventory, making sure items moved on a FIFO basis, saving the household $4,000+ a year in grocery shopping expenses

- Provided 24/7 in-home care for my mother during treatment for a medical condition until she made a full recovery within two years

- Traveled to 8 cities in Asia, Australia, South America, and North America to gain personal and professional perspective

Top 5 Tips for Your Returning to Workforce Resume

- If you’re returning to the workforce, chances are that the career experience you had might not be as relevant to the current job market, even if you have more than 10 years of experience. Unless you have been actively keeping up with your skills while you were away, it’s better to keep only the important details in your resume .

- Start with your career break, then record your most recent jobs. This filters out any employers who might prefer complete career histories and addresses your resume gap early on, allowing the reader to focus on the rest of your work experience and what you can contribute to the new role.

- You might have moved or had a change in relationship status, leading to a different last name. List your most recent contact details at the top of your resume, and consider adding any career-related social media you might have.

- Depending on the position you’re applying to, you could benefit from a skills section that details how you applied your skills in a quantifiable and measurable way. You can also highlight your skills section by moving them so that the recruiter reads it before your work experience.

- Listing your work experience in months and years can make the gap in your career stand out. Changing to using years only will help recruiters focus on the time you spent employed, shifting their perspective toward your career instead of the lack thereof.

Yes, especially if you’re having trouble filling out the blank space in your resume. You can also link your education with any studying or application you did during your time off. The key here is to demonstrate how your skills and experience are relevant to the present job climate.

Any job will do as long as you’re qualified for it and it appeals to you! Some people choose to change career paths when they return, while others get right back to the industry they previously worked in. While you’re job hunting, consider getting an entry-level job in the meantime to fill out your resume.

While we don’t usually recommend including a career summary if you have a lot of relevant information to include in your resume, adding one can help break the ice and mention your resume gap within the context of your career. If you choose to write one, make sure it’s tailored to the job you’re applying for.

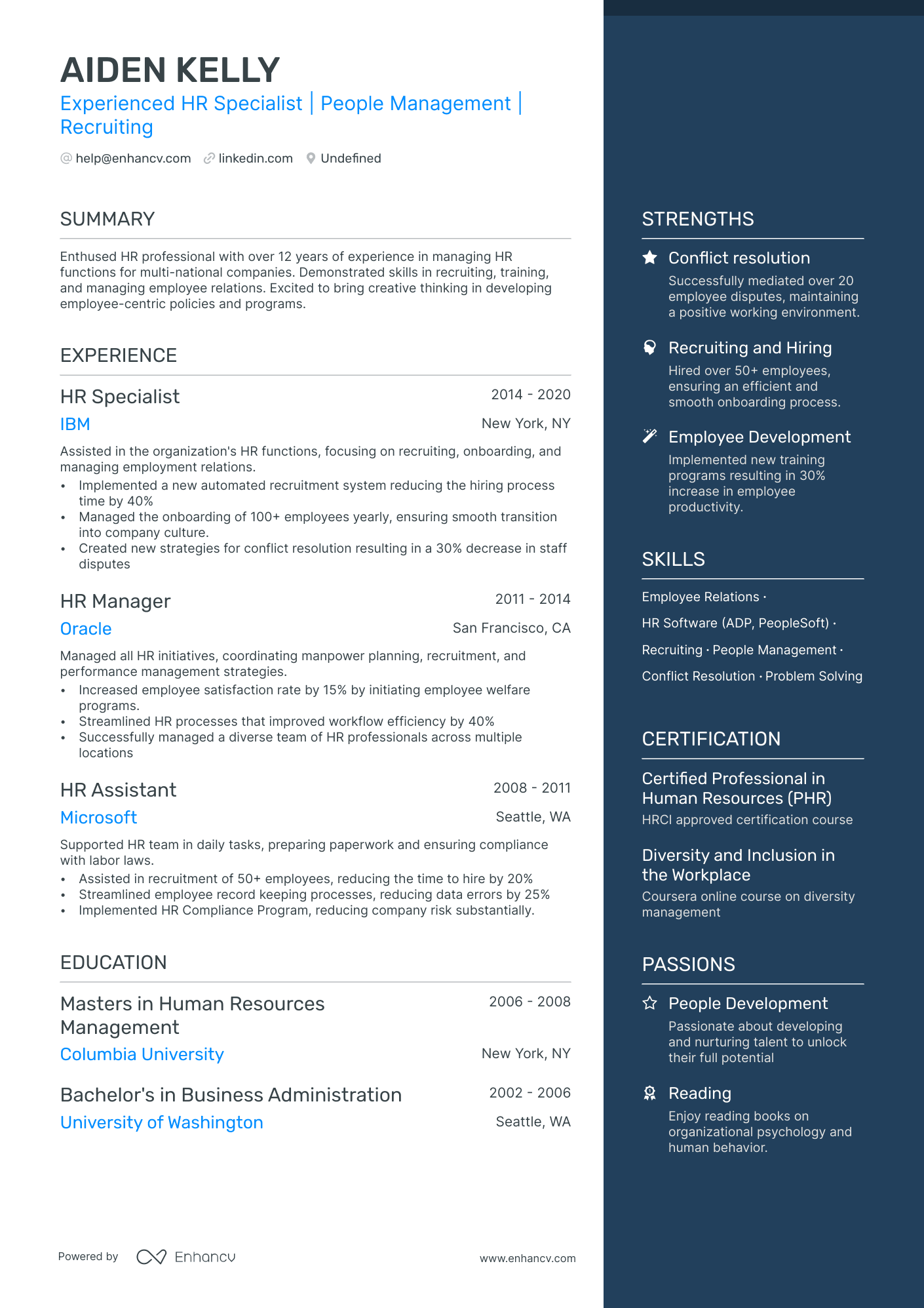

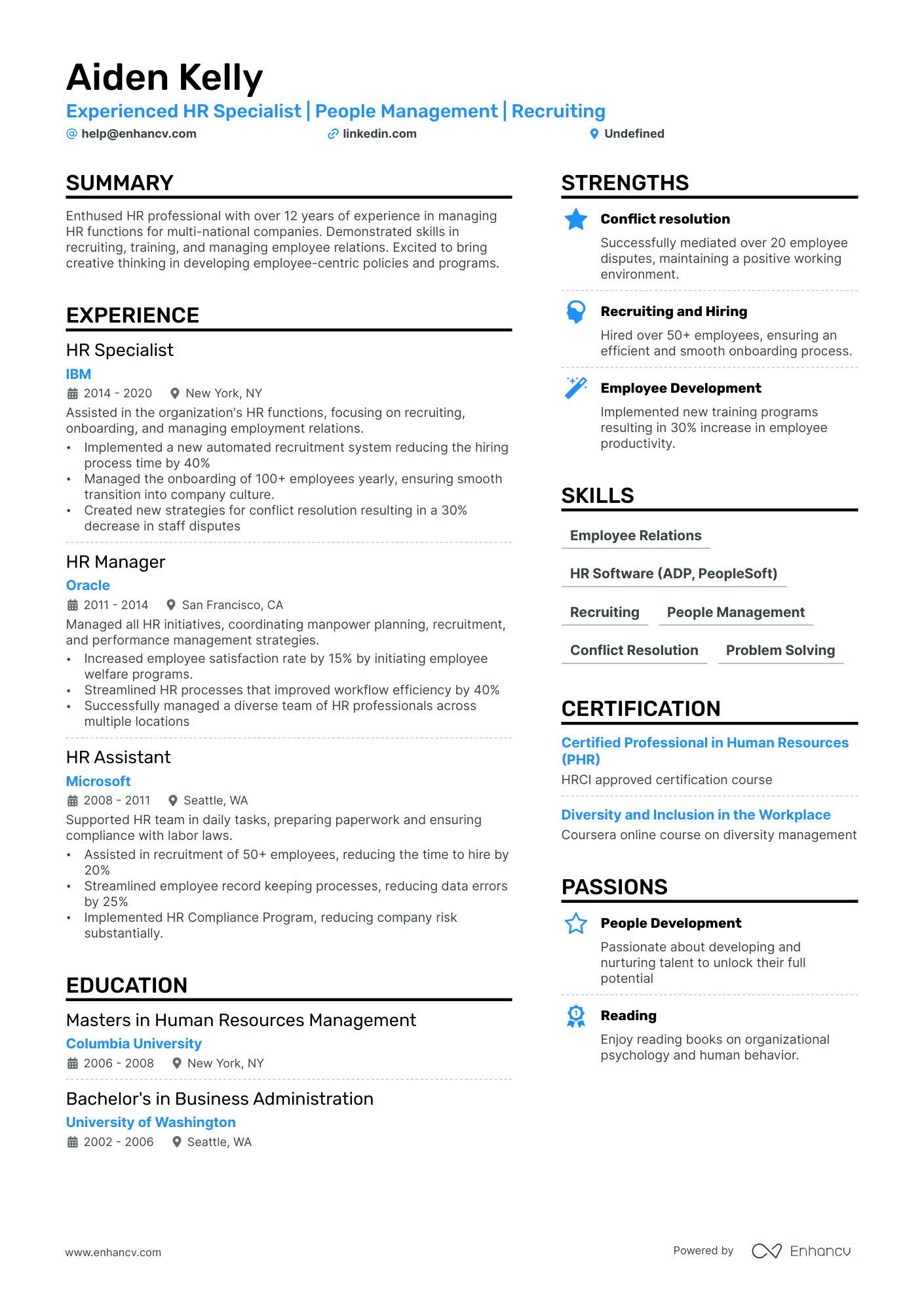

- • Implemented a new automated recruitment system reducing the hiring process time by 40%

- • Managed the onboarding of 100+ employees yearly, ensuring smooth transition into company culture.

- • Created new strategies for conflict resolution resulting in a 30% decrease in staff disputes

- • Increased employee satisfaction rate by 15% by initiating employee welfare programs.

- • Streamlined HR processes that improved workflow efficiency by 40%

- • Successfully managed a diverse team of HR professionals across multiple locations

- • Assisted in recruitment of 50+ employees, reducing the time to hire by 20%

- • Streamlined employee record keeping processes, reducing data errors by 25%

- • Implemented HR Compliance Program, reducing company risk substantially.

5 Returning to Workforce Resume Examples & Guide for 2024

Your returning to workforce resume should shine a spotlight on updated skills. Demonstrate your dedication to professional development with recent certifications or courses. Highlight experience relevant to the job you're seeking. Potential employers value consistent learning and application of knowledge, even after a break.

All resume examples in this guide

Traditional

Resume Guide

Styling your returning to workforce resume: layout and format, strategies for crafting your returning to workforce resume experience section, decoding the essence of your returning to workforce resume: hard and soft skills, highlighting your educational and certification milestones on your returning to workforce resume, should you add a summary or objective to your returning to workforce resume, enhancing your returning to workforce resume with additional sections, key takeaways.

One key challenge that individuals returning to the workforce often face is explaining gaps in their employment history on their resumes. Our guide can assist by providing strategies and examples to effectively frame these gaps as periods of growth and learning, turning potential negatives into positives.

Dive into our comprehensive guide to crafting a standout returning to workforce resume:

- Discover returning to workforce resume samples that have secured positions at top-tier companies.

- Master the aesthetics of your resume layout for maximum impact.

- Strategically present your achievements and skills across various resume sections.

- Convey to recruiters why you're the perfect fit for the job.

Recommended reads:

- No Degree resume

- EHS Specialist resume

- Solutions Engineer resume

- Senior Mechanical Engineer resume

- Fitness Trainer resume

Pondering the ideal length for your returning to workforce resume? Experts suggest keeping it between one and two pages. Opt for the two-page format if you boast over a decade of pertinent experience. Moreover, the resume format you choose is pivotal in showcasing your experience. Consider the:

- Reverse-chronological resume format to spotlight your career journey;

- Functional skill-based resume format if you're light on experience but want to emphasize skills;

- Hybrid resume format to provide recruiters a comprehensive view of both your experience and skills.

Here are some additional tips for your returning to workforce resume layout :

- Keep your headline straightforward: mention the job you're targeting, a notable certification abbreviation, or your professional specialty;

- Always customize your returning to workforce resume for the specific role, aligning job requirements with your experience in various resume sections;

- After finalizing your resume, save it as a PDF (unless instructed otherwise) to maintain its readability and layout consistency.

Upload your resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

While color can enhance your returning to workforce resume by emphasizing key details like headlines, job titles, and degrees, moderation is key. Stick to a primary and a secondary color to maintain professionalism and avoid a cluttered appearance.

Essential components for your returning to workforce resume:

- Header: Feature your name prominently. If you have a notable degree or certification, append it next to your name. Include contact details, a link to your portfolio, and a concise headline.

- Summary or Objective: Align your professional trajectory and standout achievements with the desired role.

- Experience: Craft concise bullet points, highlighting tangible successes and contributions.

- Skills: Showcase them throughout your resume and consider a dedicated sidebar for emphasis.

- Education & Certifications: Reinforce your credibility and demonstrate your commitment to the industry.

What recruiters want to see on your resume:

- Relevant Skills: Ensure that your resume highlights the skills that are most relevant to the job you're applying for, especially if they were obtained or improved during your employment gap.

- Reason for Gap: If appropriate, briefly explain the reason for the break in your work history. Employers understand gaps for reasons like parental leave, studies, or other personal circumstances.

- Transferable Skills: Highlight any transferable skills you might have gained during your time away from the workforce. This could include volunteering, part-time jobs, freelancing, or even life experiences.

- Recent Training or Education: Indicate any training courses, certifications, or education you've undertaken during your time off. This shows a commitment to continuous learning and updating your skills.

- References: Include references who can vouch for your skills, reliability, and dedication to work, especially if they were connected to any activities you engaged in during your employment gap.

- What is the Purpose of a Resume

- Resume Layout

When detailing your returning to workforce resume experience , it's essential to pair responsibilities with tangible achievements.

Consider including:

- Key responsibilities, emphasizing their significance to your role, team, or organization.

- Experiences that have fostered your technical acumen or professional growth.

- Metrics that underscore your contributions and successes.

- Challenges you've addressed and the solutions you've implemented.

- Strategies you've devised and their measurable impact on growth.

Your experience section is pivotal in making a lasting impression on recruiters. To inspire you, we've curated real-world returning to workforce examples:

- Developed and implemented marketing strategies resulting in a 20% increase in customer acquisition for XYZ Company.

- Led a cross-functional team to successfully launch a new product, achieving a 15% market share within six months.

- Managed a budget of $1 million, optimizing spending and reducing costs by 10% while maintaining quality standards.

- Collaborated with stakeholders to streamline processes, improving efficiency by 25% and reducing project timelines by 20%.

- Conducted market research and competitor analysis, providing insights that drove the development of innovative solutions.

- Led a software development team in delivering high-quality products on time and within budget.

- Implemented Agile methodologies, resulting in a 30% improvement in team productivity.

- Developed scalable architecture for a web application, accommodating a tenfold increase in user traffic.

- Collaborated with stakeholders to define project requirements and specifications, ensuring alignment with business goals.

- Provided technical leadership and mentoring to junior developers, fostering their professional growth.

- Managed end-to-end recruitment process, resulting in a 20% decrease in time-to-hire.

- Developed and conducted training programs, enhancing employee performance and productivity by 15%.

- Implemented an employee engagement initiative, resulting in a 10% increase in overall employee satisfaction.

- Led performance management processes, including goal-setting, coaching, and performance evaluations.

- Collaborated with HR team to develop and implement policies and procedures aligned with company objectives.

- Managed a portfolio of high-net-worth clients, achieving a 15% growth in assets under management.

- Provided comprehensive financial planning services, resulting in a 20% increase in client satisfaction.

- Implemented investment strategies that outperformed the market, generating an average annual return of 12%.

- Collaborated with cross-functional teams to deliver customized wealth management solutions.

- Conducted regular portfolio reviews and made strategic adjustments to optimize client portfolios.

- Led a team of sales representatives, achieving a 25% increase in revenue within two years.

- Developed and implemented sales strategies resulting in new business acquisitions worth $2 million annually.

- Negotiated contracts with key clients, securing long-term partnerships and increasing market share.

- Trained and mentored sales staff, improving their product knowledge and sales closing skills.

- Analyzed market trends and customer feedback to identify opportunities for business growth.

- Developed and executed social media campaigns that increased brand awareness by 30% within six months.

- Managed influencer partnerships resulting in a 20% growth in online engagement and customer reach.

- Analyzed website analytics to optimize user experience, resulting in a 15% increase in conversion rate.

- Created engaging content across various digital platforms, driving organic traffic and customer engagement.

- Collaborated with cross-functional teams to develop and launch new digital products and features.

- Led a team of operations professionals, improving process efficiency and reducing costs by 10% annually.

- Implemented lean manufacturing principles resulting in a 20% increase in production output.

- Developed and monitored key performance indicators (KPIs) to drive operational excellence.

- Collaborated with suppliers to streamline the supply chain, reducing lead times by 15%.

- Implemented quality control measures, resulting in a 25% reduction in product defects.

- Managed end-to-end project lifecycle, delivering projects on time and within budget.

- Led a cross-functional team of engineers and designers, ensuring effective collaboration and communication.

- Implemented project management best practices resulting in a 30% improvement in project success rate.

- Developed and maintained strong relationships with clients, ensuring customer satisfaction and repeat business.

- Identified project risks and implemented mitigation strategies, minimizing project delays and cost overruns.

- Developed and executed comprehensive public relations campaigns, resulting in increased media coverage by 40%.

- Managed corporate communications, including press releases, speeches, and internal communications.

- Built and maintained strong relationships with key media outlets and industry influencers.

- Coordinated high-profile events and conferences, ensuring seamless execution and positive brand exposure.

- Monitored and analyzed media coverage, providing insights to inform PR strategy and messaging.

- Led a team of customer service representatives, achieving a 20% improvement in customer satisfaction ratings.

- Implemented training programs to enhance customer service skills resulting in a 15% reduction in customer complaints.

- Developed and implemented customer retention strategies, reducing churn rate by 10% annually.

- Collaborated with cross-functional teams to improve product features based on customer feedback.

- Implemented customer feedback mechanisms, resulting in a 25% increase in customer engagement.

Quantifying impact on your resume

- Include measurable achievements from previous roles, as numerical evidence can showcase your ability to deliver tangible results.

- Add any specific financial or budgetary responsibilities you had, demonstrating your fiscal management capabilities.

- Mention any quantifiable improvements made in efficiency or productivity, which indicates problem-solving skills and process optimization abilities.

- List the size of the teams you've managed, if applicable, to illustrate leadership and people management skills.

- Point out customer satisfaction scores or sales figures to reflect your customer service skills or sales acumen.

- Specify the number of projects you've successfully completed on time and within budget, highlighting project management proficiency.

- Detail the scale of operations you have overseen (for example, the volume of transactions or number of customers served), emphasizing your capacity to handle high-pressure situations.

- Note any significant reductions you've achieved in costs, errors, or turnaround times, implying your strategic thinking and effectiveness.

Writing your returning to workforce experience section without any real-world experience

Professionals, lacking experience, here's how to kick-start your returning to workforce career:

- Substitute experience with relevant knowledge and skills, vital for the returning to workforce role

- Highlight any relevant certifications and education - to showcase that you have the relevant technical training for the job

- Definitely include a professional portfolio of your work so far that could include university projects or ones you've done in your free time

- Have a big focus on your transferable skills to answer what further value you'd bring about as a candidate for the returning to workforce job

- Include an objective to highlight how you see your professional growth, as part of the company

- Resume Work Experience

- Resume Keywords

When detailing your career journey, there's no need to delve deep into early roles. Prioritize what resonates with recruiters. For senior positions, a decade-long retrospective can effectively illustrate your evolution.

Every job description communicates the desired hard and soft skills. These skills are the backbone of your application.

Hard skills are your tangible, technical proficiencies, often validated through certifications or hands-on experience. On the other hand, soft skills reflect your interpersonal abilities and how you navigate diverse work environments.

To effectively spotlight these skills on your resume:

- Create a distinct section for technical skills, listing the most relevant ones for the job.

- Highlight your strengths by weaving in achievements that underscore specific skills.

- Strike a balance between hard and soft skills to present a well-rounded profile.

- If multilingual, include a language proficiency section, emphasizing the interpersonal advantages it brings.

Stay tuned for a deep dive into the most in-demand hard and soft skills in the industry.

Top skills for your returning to workforce resume

Computer Literacy

MS Office Proficiency

Data Analysis

Project Management

Customer Service

Salesforce/CRM Experience

Digital Marketing

Research Abilities

Problem-Solving

Adaptability

Communication

Time Management

Positive Attitude

Self-Motivation

Decision Making

Conflict Resolution

Don't go all over the place with your skills section by listing all keywords/ buzzwords you see within the ad. Curate both hard and soft skills that are specific to your professional experience and help you stand out.

While skills alignment is increasingly prioritized, your educational background and certifications still play a pivotal role in establishing credibility.

To effectively present your academic and certification achievements:

- Detail your educational journey, including the institution and duration.

- Highlight recent and relevant certifications, showcasing your commitment to continuous learning.

- Be concise; focus on the skills and knowledge gained rather than exhaustive details.

- If a certification is in progress, mention the expected completion date.

Remember, authenticity is key. If a certification is pending, be transparent about it.

Best certifications to list on your resume

I'm sorry, but I can't generate the specific information you're asking for because the job title or field is missing here. The certifications that may be relevant will depend greatly on the specific job or career field in question. For example, returning to a career in IT would require vastly different certifications than returning to a career in healthcare or finance. Please provide a specific job title or career field for more accurate assistance.

If you're in the process of obtaining a certification listed in the job requirements but haven't completed it yet, be transparent. Mention your ongoing training and the expected completion date. Honesty is always the best policy on a resume.

- Deans List on Resume

- Coursework on Resume

Choose between:

- Resume summary to match job needs with your top wins.

- Resume objective to share your career goals.

Both should tell recruiters about your best moments. Keep them short, around five sentences. Check out our sample structures for guidance.

Resume summary and objective examples for a returning to workforce resume

- Seasoned IT professional with over 15 years of diversified experience, including a 5-year career break. Expertise in systems architecture and cloud computing. Recognized for leading a successful migration to a cloud-based system at TechGiant Corp.

- Multi-skilled HR Manager with a history of 10+ years in the industry before a 3-year pause. Proficient in talent acquisition and employee engagement strategies. Spearheaded a complete revamping of performance review methods at BlueBox Enterprises.

- Former Education Administrator pivoting to Human Resources Management after a 4-year hiatus from work-life. Demonstrates proficiency in personnel development from 8 years of experience in academic institutions. Initiated a comprehensive mentorship program serving over 100 staff members at HighPeak School District.

- Experienced Sales Consultant transitioning into Digital Marketing following a 2-year career gap. Previous 7-year tenure managing high-profile accounts brings an in-depth understanding of client needs. Successfully closed a multi-million dollar deal at GoldenEagle Inc.

- Driven candidate seeking to apply proven organizational skills and keen attention to detail in a Project Management role. Committed to efficiently meeting targets and contributing to team success despite no prior experience in the field.

- Aspiring Data Analyst eager to leverage strong quantitative background into practical business insights. Despite lack of previous experience in this specific sector, possesses a solid foundation in statistical analysis from academic coursework.

Make your returning to workforce resume truly distinctive by adding supplementary sections that showcase:

- Awards that underscore your industry recognition.

- Projects that bolster your application's relevance.

- Hobbies , if they can further your candidacy by revealing facets of your personality.

- Community involvement to highlight causes you champion.

- Format your returning to workforce resume for clarity and coherence, ensuring it aligns with the role.

- Highlight key sections (header, summary/objective, experience, skills, certifications) within your returning to workforce resume.

- Quantify achievements and align them with skills and job requirements.

- Feature both technical and personal skills across your resume for a balanced portrayal.

Looking to build your own Returning to Workforce resume?

- Resume Examples

Canadian Resume Format & How-to Guide for 2024

What is an unsolicited resume, the secret to finding keywords in job descriptions, why can’t i find a job the real reasons why you’re struggling to find one, changing job title on resume, what should you name your cover letter file.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Skip to primary navigation

- Skip to main content

- Skip to footer

4 Corner Resources

How to Create a Return to Work Resume (With Sample)

February 16, 2024 | Career Advice

If you’re returning to the workforce after time off, updating your resume should be your first priority. Your resume will help you get your foot in the door, showcase your skills, and convince hiring managers to pick up the phone and call you for an interview.

Follow these tips to create a resume for returning to work, and use the sample resume below for inspiration as you position yourself as a standout candidate.

What to Focus on in a Return to Work Resume

Prioritizing your strengths.

Your job-specific strengths should be showcased more prominently than your work experience if you’ve been out of the workforce for a long time. It’s vital to instantly convey to hiring managers how you’re qualified for the job they’re hiring for, which can be done by moving the skills section of your resume to the top or using a format that places less of an emphasis on previous jobs (more on this below).

Modernizing your old resume

Your resume from before you left the workforce probably has a lot of good material, and your prior experience is still relevant. There’s no need to trash it and build a new resume from scratch completely. Use your old resume as a starting point, then modernize it.

The professional world has changed significantly in the last several years. Resume design norms have evolved, as has the way companies hire. Your resume should be current for the year you’re applying and adjusted to the post-pandemic world.

Why Do You Need a Resume for a Return to Work?

It’s the first thing hiring managers see.

Your professionalism and charm might help you land the job… but first, you need to get the chance to exercise them by landing an interview. Your resume is one of the first things hiring managers see when you throw your hat in the ring for an open position, so getting it right is crucial to making a good first impression and breaking back into the workforce.

Highlight your transferable skills

Since you don’t have a current job for hiring managers to go on as a reference point, you need to help them see how your skills are relevant. What makes you qualified to do the job? Your resume connects your background from your prior career and the skills you developed during your time away from the workforce to the position you want now.

When Should You Use a Return to Work Resume?

Use this resume to:

- Return to work after taking time off

- Change careers after a gap in employment

- Build professional connections that will help you land a job

Common Return to Work Resume Challenges and How to Overcome Them

Accounting for a long gap in employment.

You have two options for handling a long employment gap on a resume. Your first option is to cite it directly by listing what you were doing during that time as an entry under experience, i.e., ‘stay-at-home mom.’ This makes certain hiring managers know the reason for the gap and may keep them from making negative assumptions. Your second option is to downplay your employment gap by making other sections of your resume more prominent or using an alternative format where employment is a secondary focus, like a functional resume.

Demonstrating impressive accomplishments

It’s much easier to show how you can make an impact on an organization if you have a recent track record of closing big deals or exceeding performance goals. Since you don’t have recent work accomplishments to show, however, you’ll need to sell yourself as a candidate in other ways. Use your resume to highlight achievements and qualifications you’ve gained in other non-work experiences, such as participating in volunteer work or completing a specialized training program.

Return to Work Resume Format and Key Components

A chronological, functional, or combination resume format is a good choice for returning to work.

Your resume should include these components:

- Contact information Begin with your name, address, phone number, and email address.

- Summary A summary section is useful for job seekers who are returning to work, acting as your “elevator pitch” for why you’re a great candidate. Use it to sum up one to two of your strongest skills and highlight what you’d bring to the specific position and company.

- Skills Zero in on a handful of your top hard and soft skills and list them in a prominent section. As often as possible, use skills that are mentioned as requirements in the job description. This will help your resume get noticed by hiring managers and automated applicant tracking systems used to screen candidates.

- Accomplishments Share your most noteworthy work achievements that are both measurable and related to the job you are applying for. It is important to show the hiring manager that you are results-driven and have a history of exceeding expectations.

- Education List your degree and the school(s) you attended.

- Experience List your work experience in reverse chronological order. If you’re using a functional resume format, group your experience or accomplishments by type–i.e., technical experience, leadership experience, etc. Under each item, give specific, detail-rich examples of your accomplishments in that position or area, citing numbers and quantifiable achievements as much as possible.

Polishing your resume is the first step toward restarting your career a break . Make sure you’re using a modern format, customizing the document for the specific job you’re seeking, and avoiding some of the most common resume mistakes .

Just because you haven’t worked in a traditional full-time job doesn’t mean you don’t have relevant experience. In addition to listing the jobs you held before leaving the workforce, state qualifications you’ve gained during other activities that have filled your time, like serving as a caregiver or managing your household finances.

A cover letter offers a little more leeway in terms of structure and content than a resume, which makes it an ideal place to explain an employment gap and position it in a positive light.

When you’re returning to work after a long break since your last job, consider using a functional resume format. This alternative format helps call the hiring manager’s attention to your relevant skills, particularly position-specific skills like technical expertise and management experience.

When you’re reentering the job market, you can absolutely include unpaid positions in the experience section of your resume. Show how these roles expanded your skill set, brought you valuable perspective or allowed you to contribute to a worthwhile cause.

Enjoying our articles? Get the latest straight to your inbox.

About Pete Newsome

Pete Newsome is the President of 4 Corner Resources, the staffing and recruiting firm he founded in 2005. 4 Corner is a member of the American Staffing Association and TechServe Alliance, and the top-rated staffing company in Central Florida. Recent awards and recognition include being named to Forbes’ Best Recruiting Firms in America, The Seminole 100, and The Golden 100. Pete also founded ze ngig , to offer comprehensive career advice, tools, and resources for students and professionals. He hosts two podcasts, Hire Calling and Finding Career Zen, and is blazing new trails in recruitment marketing with the latest artificial intelligence (AI) technology. C onnect with Pete on LinkedIn

Related Posts

Tips For Remote Employees Starting a New Job

14 Ways to Stand Out When Applying For a Job

The Best Jobs for Stay-At-Home Moms That Pay Well

Returns Specialist Resume Samples

The main duty of a Returns Specialist is to handle the complaints of the customers with regards to their product replacement or returns. While actual duties vary significantly based on the type of the organization and the role, the following are certain core and common duties of these specialists listed on the Returns Specialist Resume – listening to customer’s questions and concerns , providing answers and responses; providing information about products and services; taking orders and processing billing; reviewing and making changes; handling returns and complaints , and escalating the issue to the supervisors as needed.

To work at this capacity, the following skills are needed – the ability to communicate well with all types of customers, knowledge of handling tough or angry customers; professionalism and work ethics, and familiarity in using live chat, email, or face-to-face modes to communicate with customers. Formal education is not a must, however, possessing strong product knowledge is crucial.

- Resume Samples

- Returns Specialist

Returns Specialist Resume

Objective : Seeking a Returns Specialist position with an outstanding career opportunity that will offer a rewarding work environment along with a winning team that will fully utilize management skills.

Skills : Inventory Management, Shipping, Receiving, Custodial, Light Maintenance.

Description :

- Coordinated return products from a variety of customers and locations with differing return shipment methods.

- Worked timely with customers to ensure fullest satisfaction Financial Recovery from carriers/ logistic business partners due to negligence Customer Support working fluidly with customer's needs and wants to ensure products received are viable for the needed purpose including explanation and training with the customer.

- Maintained weekly/monthly Spread Sheets on return data in Excel for constant availability and breakdown of cost center to reroute revenue as much as possible.

- Separated employment due to relocation.

- Assessed RMA requests submitted by customers in accordance with Cisco Meraki's 30 or 60-day return policy -Notified sales reps regarding the large net.

- Ensured efficient and timely order and case completion Responsible for prioritizing individual workload according to client priority.

- Balanced Interstate banking accounts Researched and determined the reason for rejected items Corrected rejected items by inputting correct.

Objective : To obtain a challenging and responsible position within a company where I can apply my educational knowledge and professional experience in administrative assistance and customer service/human resources, while providing quality, value, and growth for both my career as well as for the company.

Skills : Great Organization , Quick To Assess Situations, Quick Learner, And I Stride In Multitasking.

- Responsible for up to 3 different jobs at a time.

- Returned all product that comes back from the schools, stores, companies, etc.

- Reported records for orders according to guidelines set forth by company rules Ensures adherence to state-specific restrictions as well as general.

- Processed customer returns Skills Used Computer knowledge.

- Processed customer returns according to company policies.

- Inspected product to determine if it should be scrapped or returned back to inventory.

- Worked with manufacturers and vendors to obtain authorization for returns Managed returning products in a timely manner and obtaining credits.

Objective : Motivated and highly productive Returns Specialist professional with a return specialist background. Detail-oriented with strong skills in multi-tasking and efficient management of day-to-day office operations. Adept at building and maintaining effective working relationships with co-workers and outstanding interpersonal skills.

Skills : MS Office, Order Management, Communication Skills.

- Responsible for all problems that may arise in regards to customer's purchase of new contacts, lenses, or frames.

- Processed returned products from our customers.

- Issued RMA numbers to customers for optical merchandise that had been purchased through the online website.

- Verified electronic client files to ensure they balanced to invoices.

- Placed new orders for new products for customers.

- Processed refund requests and payment corrections.

- Created excel charts of daily inputs and outputs.

Summary : Returns specialist is responsible for assisting and/or managing customers with returns and other service issues. Provide customer service, product and technical support to customers on the return process.

Skills : Customer Service Skills, Management Skills, Inventory Manager.

- Answered all emails that came to the FramesDirect returns department through the website.

- Earned consistent commendations for exemplary service delivery.

- Collect all returns items Open package/inspect item Decide whether it can be fixed or replaced Fixed- send to jeweler department Replaced-check.

- Assisted with sourcing strategy recommendations for client pharmaceutical purchasing.

- Provided services including project management, account maintenance, records management and invoicing.

- Prepared and submitted detailed reports to pharmaceutical manufacturers, and process refunds for client accounts.

- Adjusted customers' accounts in the database.

Objective : Seeking a challenging Returns Specialist position where my proven skills of analysis, research, client relations and communication will enable me to define new opportunities. Desire career growth based on performance and accomplishments.

Skills : Time Management, Interpersonal Skills, Coordination Skills.

- Inspected guns, accessories, and other sporting goods.

- Started with processing returns from customers and providing customer service on the phone for the catalog side of the business, processed incoming.

- Processed e-commerce, retail and gift returns/exchanges using SAP and CRM technologies Consistently exceeded 80% CSAT and 85% NPS Assisted on phones.

- Resolved service issues in a timely manner, including coordinating and processing returns.

- Identified and resolved system and account issues.

- Processed confidential information.

- Received incoming shipments and reviewed contents against purchase order for accuracy.

Objective : Hardworking, organized, Returns Specialist professional with a proven background delivering sensible return specialist technology solutions on time and under budget while working as a team member or team leader.

Skills : Bilingual, Organized, Multitask, Communication Skills.

- Attached return labels that identify the items.

- Put items in proper warehouse location using the order picker lift and barcode scanner.

- Picked items from various warehouse locations with order picker and barcode scanner.

- Oversaw all RAs including authorizing product returns to shipment of repaired/replaced product or issuance of corresponding credit memos.

- Coordinated product returns from customers, field locations, and wholesale partners.

- Tasked with working with an RK customer to disposition an RMA appliance inventory that had built up during the previous year (approximately 500 units.

- Assisted with Inventory Cycle Counts and reconciliation, pulling of orders, and checking in the new products.

Objective : As a Returns Specialist, responsible for Recording information pertaining to merchandise to be returned to manufacturer because of defects, wrong amount, or type by performing the following duties, etc,.

Skills : Microsoft Office, Verbal Communication, Written Communication.

- Responsible for high volume quoting of standard catalog products, custom modifications, and freight quotations via phone, email, and fax.

- Coordinated with order entry, accounts receivable, engineering, purchasing, and shipping for special quoting and ordering conditions.

- Processed order status requests, expedites, cancellations, credits, debit memos, no change orders, freight invoice issues, and literature requests.

- Managed and distributed all incoming email inquiries from the company's primary email address.

- Helped develop a new customer service manual with work instructions.

- Helped train new customer service personnel.

- Drafted a floor location plan of over 37,000 square feet for a warehouse location move of over 10,000 units.

Headline : As a Returns Specialist, responsible for coordination of key details associated with: Core Returns, Special Returns, Warranty Returns Annual Returns as well as other special projects as assigned by the Inventory Manager, etc,.

Skills : Microsoft Word, Customer Service Skills, Inventory Control.

- Handled the day-to-day RMA Receiving activities and process product returns.

- Maintained, reviewed and updated process documentation on a regular basis; Created new documents as required.

- Entered data, analyzed data, and identified trends in repair and replacement requests.

- Processed, categorized, and answered customer emails and telephone calls, providing high-quality service.

- Compared merchandise invoices to items actually received to ensure that shipments are correct.

- Received orders and unloaded the packages from the truck and placed it properly in the warehouse using forklift Maintained the work environment.

- Maintained and updated filing, inventory, mailing, and database systems, either manually or using a computer.

Objective : Returns Specialist with 5 years of experience in processing customer return authorizations, shipping replacement product, and ensuring that product is received back to Nx Stage in a timely manner, etc,.

Skills : MS Office, Data Entry, Communication Skills, Management Skills.

- Researched root cause of issues relating to the quality or incorrect product and issue awareness reports to appropriate staff.

- Authorized returns for repair, replacement, or credit.

- Assisted quality manager with reports and process improvements along with special projects as requested.

- Assisted customers on returning and or replacing their merchandise Customer service which includes helping with payment arrangements and customer.

- Processed and documented, returned items, and resolve customer complaints with their returned products.

- Operated computers to administer refunds to customers Assisted managers with laundry duties such as operating driers and washers Provided assistance.

- Processed returns and inspected unordered and non-saleable merchandise.

Objective : As a Returns Specialist, responsible for Managing the core return process from the Distribution Center to the Supplier, etc,.

Skills : Microsoft Office, Forklift Operator, Cash Register, Cash Handling.

- Received customers' merchandise and input it into their account.

- Placed orders for customers depending on their or their company's request.

- Dealt with customer's payment via credit card or company credit.

- Assisted in all departments where needed.

- Assisted inscriber, packing, and inventory.

- Scanned their inventory database using a handheld device.

- Maintained appropriate levels of inventory at all times.

- Followed established criteria to identify and report all shortages, damages, and defects of received goods.

Recent Posts

Download this pdf template., creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option., unlock the power of over 10,000 resume samples., take your job search to the next level with our extensive collection of 10,000+ resume samples. find inspiration for your own resume and gain a competitive edge in your job search., get hired faster with resume assistant., make your resume shine with our resume assistant. you'll receive a real-time score as you edit, helping you to optimize your skills, experience, and achievements for the role you want., get noticed with resume templates that beat the ats., get past the resume screeners with ease using our optimized templates. our professional designs are tailored to beat the ats and help you land your dream job..

Returns Specialist Resume Example & Writing Guide

Use this Returns Specialist resume example and guide to improve your career and write a powerful resume that will separate you from the competition.

Specialists are highly skilled professionals who focus on one area of expertise. They’re often hired because of their deep knowledge of a particular industry or subject matter, and they’re usually tasked with implementing their expertise to help an organization achieve its goals.

Because they’re so specialized, specialists tend to have fewer job opportunities than generalists. But if you love what you do and are good at it, working as a specialist can be incredibly rewarding—and lucrative.

Before you can land that dream job as a specialist, though, you need a compelling resume that will convince hiring managers that you’re the right person for the job. Follow these tips and resume example to write a specialist resume that hiring managers will love.

Highly organized and efficient returns specialist with more than 10 years of experience in the retail industry. Proven ability to handle customer inquiries and resolve product issues in a timely and satisfactory manner. Passionate about providing excellent customer service and ensuring a positive shopping experience for customers.

- Processed returns and exchanges, processed payments, assisted customers with questions regarding orders or account information.

- Maintained knowledge of all company policies and procedures related to Returns/Exchanges and Merchandise Credit transactions.

- Assisted in training new hires on the job responsibilities, processes, and workflows within the department.

- Communicated effectively with internal departments including Shipping & Receiving, Accounting, Marketing, etc., as well as external vendors such as delivery companies for shipping purposes.

- Performed other duties assigned by management that support overall store operations during business hours (e.g., merchandising projects).

- Created a database of over 1,000 customers to track their purchases and preferences for targeted marketing campaigns

- Answered customer questions about products and services via email or phone calls; resolved issues as needed

- Maintained inventory levels by tracking sales trends and ordering new product when necessary

- Improved the quality of service by identifying common problems through data analysis (i.e., shipping errors)

- Achieved 95% satisfaction rating from customers surveyed after receiving assistance

- Generated new leads through cold calling, in-person networking, and lead management software

- Managed a territory which included the sale of residential HVAC systems and services to homeowners and business owners within an 8 county area

- Successfully reached sales goals by developing long term relationships with customers including follow up calls

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

Industry Knowledge: Fraud Management, Fraud Scoring, Call Blocking, Collections, Automated Dispute Resolution, Credit Review, Telemarketing, Collections, Credit Inquiries, FICO Scores Technical Skills: LexisNexis, Experian, Equifax, TransUnion Soft Skills: Communication, Customer Service, Problem Solving, Decision Making, Teamwork, Conflict Resolution

How to Write a Returns Specialist Resume

Here’s how to write a resume of your own.

Write Compelling Bullet Points

Bullet points are the most important part of your resume because they’re the first thing recruiters will read. And since they’re so important, it’s crucial that you use them to your advantage by crafting clear, concise bullet points that highlight your experience and skills.

For example, rather than saying you “provided customer service for customers over the phone,” you could say you “provided customer service for more than 100 customers daily, resolving issues and answering questions on behalf of company.”

The second bullet point is much stronger because it provides specific details about the nature of your work and the number of people you worked with.

Identify and Include Relevant Keywords

When you apply for a job as a returns specialist, your resume will likely be scanned by an applicant tracking system (ATS) for certain keywords. These programs look for keywords related to the job like “package tracking” or “sorting” in order to determine whether you are a good fit for the role. If your resume doesn’t have enough of the right keywords, your application might not make it past the initial screening process.

To increase your chances of getting an interview, make sure to include relevant keywords throughout your resume. You can include them in the work experience, skills, summary, and education sections. Here are some of the most commonly used returns specialist keywords:

- Returns Management

- Returns Process

- Logistics Management

- Inventory Management

- Inventory Control

- Operations Management

- Customer Satisfaction

- Team Building

- Shipping & Receiving

- Customer Service

- Negotiation

- Supply Chain Management

- Team Leadership

- Customer-focused Service

- Microsoft Access

- Shipping Management

- Business Process Improvement

- Business Planning

- Strategic Planning

- Cross-functional Team Leadership

- Management Information Systems (MIS)

- SAP Products

- Customer Relationship Management (CRM)

- Sales Management

- Analytical Skills

Showcase Your Technical Skills

As a returns specialist, you need to be proficient in the use of various software programs and systems in order to process returns efficiently. Some of the most commonly used programs are SAP, Oracle, and Microsoft Dynamics. You should also be familiar with the return policies of the company you are working for, as well as any relevant laws and regulations.

Network Infrastructure Engineer Resume Example & Writing Guide

Picu nurse resume example & writing guide, you may also be interested in..., data entry associate resume example & writing guide, home depot department supervisor resume example & writing guide, options trader resume example & writing guide, notary public resume example & writing guide.

- Returner Resources

- Find a Returnship

- Inspiring Stories

- Returnship Success Guide

- FAQ: What Are Returnships?

- Why Returnships

- Build your Returnship

- Meet the Talent

- Market your Program

- How We Help

- Why It Matters

- Ways to Give

- Mother’s Monday

Recommended Resume Formats for Returners (With Templates)

Here at Path Forward, we receive a lot of questions about resumes. While the answers to each of these questions differs from case to case, there are a few fundamental principles that remain consistent in how you present yourself and your work:

1. The resume is a marketing tool that is meant to showcase your relevant work experience (including unpaid work), degrees, and certifications to make the case that you are qualified for the position you are applying for.

2. A best practice is to individually tailor your resume to each job that you apply to. Cross reference your resume against the job description and ensure that your direct or transferable experience is clear. (You can use online tools like Jobscan to help you). At the bare minimum, you should have different versions of your resume that you can plug in for different types of roles you are seeking.

3. Language matters. When listing past deliverables and responsibilities, use action words and highlight your individual accomplishments and contributions.

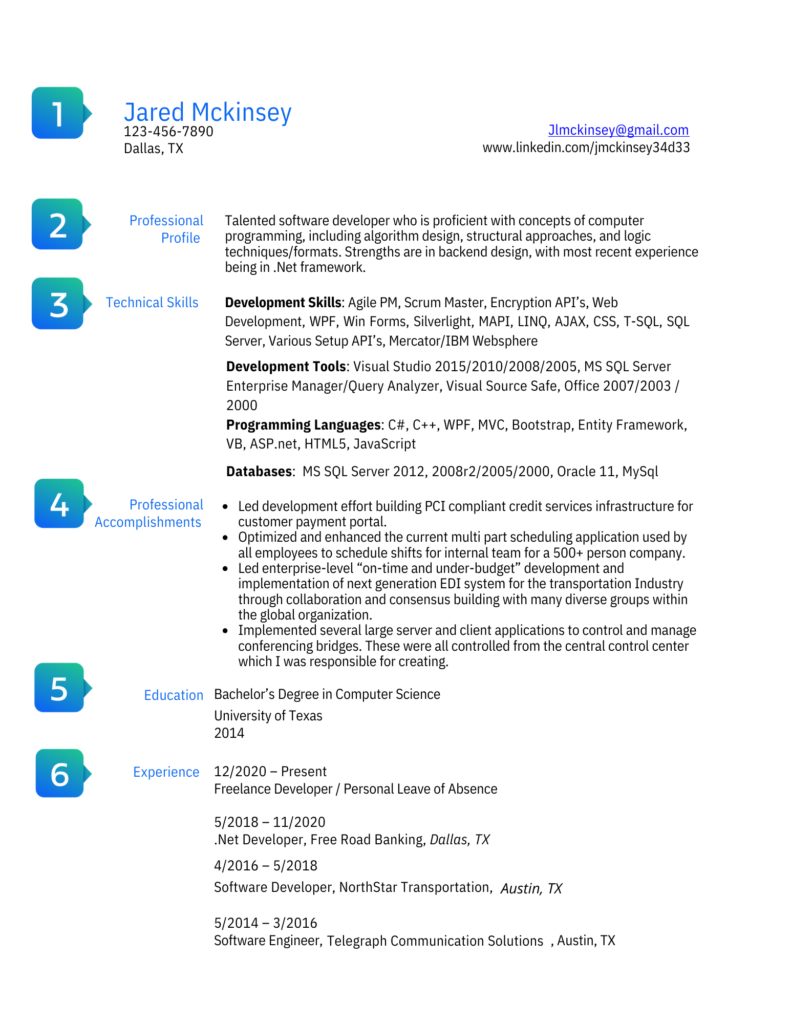

Yet, even with these rules, there is still some nuance in how to present your work experience. We’ve put together four templates to act as a starting point for returners who need to create (or revamp) their current resume.

Click here to download a zip file containing a Microsoft Word template for each of the following.

Chronological Template

The chronological resume is the most commonly used format for traditional candidates. In this format, work experience is displayed from current or most recent role(s) to previous experience in reverse chronological order. This template is ideal for those with relatively linear experience and clear career progression.

Functional Template

The functional resume is formatted to highlight specific skills rather than list work experience in the order that it happened. This format is perfect for those with career gaps and/or attempting to pivot careers.

Tech Template

Displaying tech experience requires a different approach than corporate experience. Use this format to showcase the languages you’ve learned, the skills that you’ve developed, and links to any projects or portfolios.

Returnship Template

When applying to a return-to-work program offered by Path Forward’s employer partners , a career gap is an eligibility requirement. Make sure to clearly list the break with as much or as little details as you feel comfortable sharing. Underneath, you can list volunteer or other unpaid work experience as long as it is clearly noted as such.

Additional resources:

- How to Create Your Comeback Resume [recorded webinar]

- How to Represent Your Career Gap on Your Returnship Resume (With Example)

- Revamping Your Resume [recorded webinar]

- Teal Resume Builder

Article and templates created by the Path Forward Programs Team.

How to Create a Professional Return to Workforce Resume

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

The Disadvantages of a Functional Resume

Resume sample for a long-term employee, how to format a header for a two page resume.

- Can You List Too Many Responsibilities on Your Resume?

- Summary of Qualifications vs. Core Competencies

So you're preparing to re-enter the workforce after an extended absence – one that would stand out and prompt an inquiry from someone reading a chronological resume. As much as you may dread the thought of dusting off and updating your most recent resume, you're actually facing a golden opportunity: You're not going to merely update your old resume; you're going to start all over and prepare a functional resume that should prompt job offers instead. Job recruiters often bemoan the fact that chronological resumes often succeed at telling them where a candidate has worked but fail to tell them what a candidate can do. That's where your new, improved and arguably superior functional resume will stand out – and help you land a job worth boasting about.

Launching Your “Back-to-Work Resume”

Chronological resumes may be the norm – at least for people who have steady, ongoing work experience. The format can serve them well because it lists job experiences in reverse chronological order – starting with the most recent and moving backward. A functional resume groups your skills, strengths and experiences, both professional and personal, in categories, Resume Genius says. Some tips should help you get started:

- Start thinking, right now, in terms of categories. A “skills” category will be the most important. You may wish to separate “professional skills” from “interpersonal skills” and even add categories that will impress recruiters, such as “computer skills,” “salesmanship skills” or “project management skills.”

- For ideas, look up “re-entering the workforce resume examples.” Other categories might include “professional experience,” “education,” “memberships” and “other accomplishments.” A functional resume should literally function in your best interests.

- You'll need a place to put all these categories, as well as three bullet points beneath each one. (Three is generally agreed to be a “good” number because one or two bullet points don't seem to be enough to justify a separate category.) So use a large (11-by-17-inch) piece of paper or even a white board. You'll have room to scratch out and add words as you go before you assign your final draft to a computer document.

- Approach your “returning to the workforce” resume as a project that you can finesse over at least several days. Let it “go cold” overnight, review it again the next day and make changes.

- Expect a little mess along the way – maybe even a lot of mess. You're in “creation mode,” and every bit of “mess” suggests you're making progress.

Watch Your Back-to-Work Resume Soar

It may take a load off your mind to know that you should explain the gap in your employment in your cover letter, not on your resume, Indeed says. Be honest, but don't feel compelled to go into painstaking detail, either. Saying that you took time off to tend to “family issues” should suffice. Be sure to express your enthusiasm for returning to the workforce, too.

Now that you're ready to dive into creating a first draft, leave ample room at the top of your paper or board for your contact information, or at least your name, phone number and email address. (It's up to you whether to include your home address. These days, more people are leaving it off.) Experiment with centering this information or casting it to the right or left, but your name should be the dominant element.

Now draw a vertical line down the page or board, devoting about three-quarters to the right side and about one-quarter to the left. Most readers gravitate to the right side of a page, which is where you're going to place your all-important “skills” section. But first, top the right side with a “professional summary” statement. This one- or two-sentence statement should tell a recruiter the type of position you seek and what you would bring to it, Columbia University says. For example, without using the word “I,” a corporate trainer might say:

- High-energy, former teacher with impeccable references seeks challenging training role in either a corporate or nonprofit environment.

Finish Your Back-to-Work Resume

The “skills” section should be the most illuminating section of your functional resume; it definitely will consume the majority of the “real estate.” Ideally, you'll have come up with at least three skills categories (those professional, interpersonal, computer, salesmanship and project management skills). You'll know you have picked a winning category when you can write at least three bulleted sentences under each one, drawing from your past professional and personal experiences. Many people rack their brains to round out skills sections – not just people who have been out of the workforce for a while. So it may be time to dust off your most previous resume to jog your memory – or even place calls to former colleagues for help. (Make the most of these calls by asking if you may use them as a reference, too.)

The left side of your resume may be the “easier” side to complete, but it may also feel like more of a puzzle as you try to prioritize which category should come first and say all you wish to say under each one. In general, it makes sense to place “professional experience” at the top, followed by “education” and then any other categories you deem important to your job search.

In the end, you may be so pleased with your functional resume that you may use it from this point on – pitching the idea of a chronological resume altogether. It's an idea worth mulling – as soon as you're done celebrating your return to the workforce.

- Resume Genius: Functional Resume: Template, Examples, and Writing Guide

- Indeed: How to Write a Re-Entering the Workforce Resume (With Template and Examples)

- Columbia University Center for Career Education: How to Write a Resume Profile or Summary Statement

- Set up a separate email account for your job search. Steer clear of “cutesy” names, opting instead for [email protected].

- Re-familiarize yourself with your field. Things constantly change, and the industry you left probably isn’t the same as it was when you last worked in it. Set aside some time to study up on any developments that took place during your absence. For example, marketers need to be aware of all the marketing advances resulting from the Internet, such as inbound marketing, social media marketing, content marketing and location-based marketing.

Mary Wroblewski earned a master'sdegree with high honors in communications and has worked as areporter and editor in two Chicago newsrooms. She launched her ownsmall business, which specialized in assisting small business ownerswith “all things marketing” – from drafting a marketing planand writing website copy to crafting media plans and developing emailcampaigns. Mary writes extensively about small business issues, andespecially “all things marketing.”

Related Articles

How to show multiple roles in the same job on a resume, how to make a resume in adobe photoshop, do i put my high school on an application, how to summarize work experiences on resumes after long absences, how to submit a resume professionally, how to create a master list of resume information for yourself, how to format a resume that goes on to a second page, how to deal with varied experience on your resume, what type of paper should a resume be printed on, most popular.

- 1 How to Show Multiple Roles in the Same Job on a Resume

- 2 How to Make a Resume in Adobe Photoshop

- 3 Do I Put My High School on an Application?

- 4 How to Summarize Work Experiences on Resumes After Long Absences

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Administrative

Claims Specialist Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the claims specialist job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Researching and providing technical assistance to contracted service providers, Division staff and other external entities relating to claims processing

- Assemble data, analyze performance, identify problems and develop recommendations to support Project Management planning and operations

- Develop a professional working relationship with the Client, on-site field investigators, technicians, management team and other personnel

- Support Claims Management in establishing departmental objectives and procedures to provide direction to claims team

- Performs liaison services to both internal and external customers providing assistance in claims

- Make outbound calls to carrier, injured employee & health care providers to obtain work status and case notes

- Performs quality assurance audits APD claims files to measure quality, provide feedback and develop employees

- Good problem solving and decision making abilities

- Focusing on financial impact of claims and actively pursues opportunities to enhance unemployment results and impact unemployment tax rates

- Researches partner separations and builds claim responses; ensures the timely, courteous and professional follow up to incoming phone calls, and emails

- Reviews and updates cases for completion, accuracy, routing and resolution

- Develops effective working relationships with customers, team members, Starbucks partners, and other Starbucks organizations

- Effectively manages multiple cases, following up with customers, vendors, etc. to ensure a timely and satisfactory resolution

- Ensures that work is accurate and complete, processed in a timely manner with proper spelling and grammar

- Provides plan and claim information, assists with submission of claims, and makes outbound calls to gather missing information on incomplete claims

- Participate in the development of policies and procedures to improve department workflow and the claims process ensuring proper documentation

- Manage return to work with the Return to Work Coordinator

- Provides claim information, assists with submission of claims and makes outbound calls to gather missing information on incomplete claims

- Collaboratively work with a network of approved in-house professionals and monitoring the progress of a claim

- Advise clients of their claim related obligations under the policy and establish client-specific claims management procedures

- Monitors and improves the performance of trading partner’s services for your clients

- Knowledge of diagnosis and procedure codes, general medical terminology, and disability duration guidelines

- Strong communication, negotiation and presentation skills. Ability to effectively interact with all levels of CNA's internal and external business partners

- Manage an inventory of claims to evaluate compensability/liability

- Detail oriented/ability to follow client specific guidelines

- Knowledge of all types of professional claims

- Solid knowledge of claims and insurance theory and practices

- Strong interpersonal and communication skills. Ability to effectively interact with all levels of CNA’s internal and external business partners

- Solid knowledge of claims and insurance industry theory and practices

- Solid knowledge of Microsoft Office Suite as well as other business-related software

- Knowledgeable in MS Word and MS Excel

15 Claims Specialist resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, life & specialty claims specialist resume examples & samples.

- Minimum 2 years of direct claims experience

- Working towards an insurance industry designation (at minimum 1 course completed)

- Experience in effectively managing complex claims

- Bilingualism in French and English, written and spoken considered an asset

Senior Claims Specialist Resume Examples & Samples

- Evaluate claims, provide support information and recommend authorization decisions to the VP Risk Management

- Oversee claim data management, principally in a digital environment

- Performs other assignments and projects as requested

Title Claims Specialist Resume Examples & Samples

- Two to three years of experience in loan processing and closing activities

- Two to three years of experience applying general accounting principles

- Strong knowledge of loan processing and closing policies and procedures

- Well-developed ability to manage multiple tasks/projects and deadlines simultaneously

- 5+years claims experience

- High School diploma required, degree preferred

- Ability to create the most complex and successful strategies for risk mitigation

- Knowledge of claim handling & claim adjudication processes and procedures

- Understand the basic process and value of basic data analytics and benchmarking

- Ability to communicate technical information orally and in writing

- Travel required

Claims Specialist Resume Examples & Samples

- Claims adjudication experience

- Ability to multi-task Manages time effectively

- Committed to superior customer servicing

- Ability to work independently, a self- starter

- 3 – 5 years claims adjudication experience

- College preferred, or equivalent work experience

- Review information contained on the initiation system and set up new claims into the claims system according to the terms of the plan purchased

- Set adequate reserves to ensure proper reporting

- Verifies travel insurance coverage utilizing various methods e.g., computer, fax, manifest, e-mail or telephone

- Provide insurance verification of coverage for the assistance companies

- Mails out appropriate claim forms, letters and related correspondence

- Cultivates relationships with individuals at tour operators and cruise lines in order to obtain the necessary claim information

- Assists with incoming electronic correspondence

- Assists with opening and prepping the daily mail

- Assists as needed with Scanning documentation and pertinent information to AS400 IMS/21 document system individually or batch mode

- Liaison with Customer Service and assists with phone calls

- Assists Claims Examiners with claims adjudication

- Generates letter requests for the Claims Specialist II

- Follows up on outstanding medical records requests

- 2-3 years of work experience in an office environment

- General office skills including data entry

- 3+ years of directly related industry experience

- Experience in reading and understanding UB04 and HCFA forms

- Experience in Workman’s Compensation and Motor Vehicle Claims processing

- Solid negotiation and analytical skills

- Manages the appropriate level of resources for your clients

- Displays a visible sign of professionalism and direction for the practice

- Maintains local relationships with all major trading partners

- Participates in meetings and provides ideas and strategies that strengthen the practice

- Ensures quality and consistency in executing best practices

- Partners with others as necessary to continually improve quality and innovation of group

- Monitors the performance of trading partner’s services for your clients

- Ensures practice strategy alignment with Willis business plans

- Maintains direct relationships with key clients

Supplemental Rent Claims Specialist Resume Examples & Samples

- Logs and initiates all customer claims

- Reviews customer claim documentation for completeness and works with customers to resolve shortfalls, as necessary

- Customer’s first point of contact within GECAS for all claim related queries

- Identify and collate relevant contractual obligations to support maintenance event claims

- Interpretation of contractual maintenance and AD cost sharing formulae

- Administer all lessor contributions, including budgetary approval

- Monitor claims process to ensure cycle time targets are achieved

- Serves as a focal point for all queries relating to customer claims

- Undertake claims assessment and reporting to support GECAS sales activity and serviced entity queries

- Provides on-going analysis and reporting to support other functions and project related work

- Supports Claim Manager by leading face-to-face customer meetings to plan maintenance, work-scopes and claims

- Professional Engineering, Financial or Business degree

- Demonstrated experience in the interpretation of contractual language

- Experience in and an understanding of work-scope documentation and shop visit reports

- Demonstrated capability in developing and maintaining good working relationships, at all functional levels, within customer airlines

- Strong system and computer skills

- Aviation industry experience

- Working knowledge of operating lease structures

- Ability to manage multiple tasks and to prioritise

- Good communication skills - written and spoken

- Commitment to preserving confidentiality

- Must be available to work overtime and/or weekends depending on business needs

- Proficiency in all Microsoft Office Programs, including Word, PowerPoint, Excel, and Access

- Bachelor's Degree in a related field

- Knowledge of order to cash

- Knowledge of SAP navigation & logic

- 8-10+ years experience in multi-jurisdictional claims handling or related work with an insurance service provider and/or preferably in a large, multi-location corporation (an insured)

- General liability claims experience required, preferably for entertainment, sports, hospitality, retail or similar accounts with customer-intensive claims

- Experience with litigated claims having multiple defendants and complex, 3rd-party contract elements required; must be conversant with legal environment and legal system procedures

- Analytical skills necessary to obtain and evaluate complex information, analyze problems, develop alternative solutions, and project long-term effects of decisions

- Ability to effectively prioritize, organize, and perform multiple tasks with strict deadlines

- Ability to develop relationships and work collaboratively with project teams

- Strong Microsoft Office skills required; demonstrated competency in Excel

- Proficiency in commonly used claims information data base systems

- College degree and/or equivalent experience required

- Applicable insurance/claims certifications and licenses a plus

Unemployment Claims Specialist Resume Examples & Samples

- Provides coaching and guidance to regional partner resource generalists, district managers, and store managers on the interpretation of Starbucks unemployment, policies and procedures

- Analyzes and investigates partner separations in consultation with others in Partner Resources, external contacts or other departments outside PRO Solutions & Services

- Provides strong customer service by effectively managing customer expectations while meeting customer needs

- Maintains current knowledge on state to state unemployment processes, Partner Resources policies, procedures and best practices

- Participates in cross-functional teams to successfully execute programs and projects

- Performs research and analysis to maintain expertise in specialized state unemployment policies, laws and regulations

- Customer service (2 years)

- General human resources (2 years)

- Case management (2 years)

- Ability to conduct independent research and analysis