Need a consultation? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- E1 Treaty Trader Visa

- E2 Treaty Investor Visa

- Innovator Founder Visa

- UK Start-Up Visa

- UK Expansion Worker Visa

- Manitoba MPNP Visa

- Start-Up Visa

- Nova Scotia NSNP Visa

- British Columbia BC PNP Visa

- Self-Employed Visa

- OINP Entrepreneur Stream

- LMIA Owner Operator

- ICT Work Permit

- LMIA Mobility Program – C11 Entrepreneur

- USMCA (ex-NAFTA)

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Online Boutique

- Mobile Application

- Food Delivery

- Real Estate

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- Business Valuation

- How it works

- Business Plan Templates

Medical Device Business Plan

Published Nov.06, 2023

Updated Sep.14, 2024

By: Brandi Marcene

Average rating 5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

Table of Content

Medical Device Business Plan Sample

A medical device business plan is a document that outlines how to start and run a successful company that produces and sells products that diagnose, treat, or prevent diseases or injuries. Navigating the vast and expanding medical device sector presents thrilling opportunities alongside complex hurdles. A well-crafted business plan illuminates the route to success. Articulate your vision, milestones, tactics, and budgetary forecasts.

A business plan should also demonstrate how you will stand out from the crowd, satisfy users, adhere to regulations, and uphold ethical standards. A medical billing business plan is a specific type of medical device business plan that focuses on how to provide billing and coding services for healthcare providers.

In this article, we will provide you with a medical device business plan sample that you can use as a template or a reference for your business plan. We will cover the following sections:

- Executive Summary

- Company Overview

- Industry Analysis

- Customer Analysis

- Competitive Analysis

- Marketing Plan

- Operations Plan

Management Team

- Financial Plan

Executive Summary Section of Our Medical Device Business Plan

Business overview.

Medix is a medical device company that develops and sells innovative and affordable devices for diabetes management. We aim to enhance the well-being and health results of those managing diabetes. We aim to offer user-friendly and dependable products that assist in tracking and regulating blood sugar levels.

Products and Services

Medix offers two main products:

- Medix Glucometer – A smart glucose meter that connects to a mobile app via Bluetooth and provides accurate and instant readings of blood glucose levels.

- Medix Patch – A wearable patch that continuously measures blood glucose levels through the skin without needing finger pricks or test strips.

Customer Focus

Medix focuses on serving people with diabetes, seeking convenient and affordable solutions to manage their condition. According to the IDF Diabetes Atlas 10th edition report , 537 million adults (20-79 years) live with diabetes – 1 in 10. Experts predict that this number will rise to 643 million by 2030 and 783 million by 2045. Therefore, there is a huge demand for effective and accessible diabetes care products.

Leo Clark and Aria Bennett, two experienced entrepreneurs with biomedical engineering and business administration backgrounds, founded Medix. Leo is the CEO and head of product development, while Aria is the COO and head of marketing and sales. A team of qualified engineers, designers, developers, marketers, salespeople, and advisors supports them.

Success Factors

Medix has several competitive advantages that will enable it to succeed in the medical device industry:

- Innovation with cutting-edge technology to create novel devices

- High standards of quality and safety in every aspect of devices

- Customer satisfaction by providing user-friendly devices

- Social impact by addressing a major health problem globally

Financial Highlights

Medix seeks $5 million in seed funding to launch its products and scale its operations. The company projects to generate $1.2 million in revenue in the first year, $3.6 million in the second year, and $10.8 million in the third year, with a gross margin of 60% and a net profit margin of 20%. The company expects to break even in the second year and reach a valuation of $50 million by the end of the third year.

Company Overview Section of Our Medical Device Sales Business Plan

Who is Medix Medical Supply?

Medix dedicates itself to developing and selling innovative, affordable, and reliable devices for diabetes management. Our products help people with diabetes to monitor and control their blood glucose levels with ease and effectiveness, leading to better health outcomes and an improved quality of life.

Medix Medical Supply History

Medix is a company that provides innovative solutions for diabetes care. It was founded by Leo Clark and Aria Bennett in 2023, who both personally experienced the challenges and frustrations of living with diabetes. These challenges included frequent finger pricks, expensive test strips, inaccurate readings, and complicated insulin injections.

They started Medix with their personal funds and an incubator grant to address these issues. Medix developed two products – the Medix Glucometer and the Medix Patch – to make diabetes monitoring and treatment easier, more accurate, and more affordable.

The Medix products have received regulatory approvals from the Food and Drug Administration (FDA) and the European Medicines Agency (EMA). They are now ready for launch in the US and European markets. For more information, please refer to our dentistry business plan .

Legal Structure

Medix, an LLC registered in Delaware, USA, has obtained ownership by Leo Clark (60%) and Aria Bennett (40%). Additionally, the company has applied for a patent for its products in the US Patent and Trademark Office (USPTO).

Industry Analysis Section of Our Medical Device Business Plan

The medical device industry is one of the world’s most innovative and dynamic sectors. Fortune Business Insights reported that the global medical device market was valued at $512.29 billion in 2022 and can grow from $536.12 billion in 2023 to $799.67 billion by 2030, at a CAGR of 5.9%.

The medical device industry is driven by several factors, such as:

- The increasing prevalence of diseases and the aging population

- The rising demand for minimally invasive and personalized treatments

- The advancement of technology and digitalization

- The emergence of new markets and segments

Customer Analysis Section of Our Medical Supply Business Plan

Demographic profile of target market.

Medix’s target market is the US market, which ranks third for the highest number of people with diabetes. We target diabetic people looking for convenient, affordable solutions to manage their condition.

According to the National Diabetes Statistics Report by CDC, here are some interesting stats about why the US market is best for Medix:

- 37.3 million people have diabetes (11.3% of the US population)

- 28.7 million people are diagnosed, including 28.5 million adults

- 8.5 million people are undiagnosed (23.0% of adults)

- 96 million people aged 18 years or older have prediabetes (38.0% of the adult US population)

- 26.4 million people aged 65 years or older (48.8%) have prediabetes

The demographic profile of our target market is as follows:

- Age – We target all ages, mainly the young and middle-aged, who are tech-savvy and have more money to spend. A CDC report says 34.1 million adults aged 18 years or older—or 13.0% of all US adults—have diabetes.

- Gender – We target both males and females, as diabetes does not discriminate by gender. A NIDDK (NIH) report says a higher percentage of men (41%) than women (32%) have prediabetes.

- Income – We target all income levels, mainly the low and middle-income who need better healthcare solutions. An NCBI (NIH) report says 80% of the adults worldwide with diabetes live in low- and middle-income countries (LMICs).

Customer Segmentation

Based on our market research and customer feedback, we have identified four main customer segments for our products:

- Segment A – Tech-savvy innovators who value quality, performance, and convenience. They share their views online.

- Segment B – Cost-conscious buyers who seek affordable and effective products. They trust their peers’ recommendations.

- Segment C – Health-conscious improvers who want products that motivate and support them. They join online health communities.

- Segment D – Compliance-driven users need products that ensure safety, security, and simplicity. They depend on their health providers and caregivers.

The table below summarizes our findings:

Based on the table, we have decided to target segments A and B as our primary segments, and segments C and D as our secondary segments.

Competitive Analysis Section of Our Medical Equipment Producer Business Plan

Direct and indirect competitors.

Our direct competitors are other medical device companies that offer similar or substitute surgical medical equipment for diabetes management. Some of the major players in this category are:

1. Abbott – A global healthcare company that offers a range of products for diabetes care with mobile apps for real-time data and insights.

- Strong brand recognition

- Global presence

- Innovation capabilities

- Customer loyalty

Weaknesses:

- Limited availability

- Technical issues

2. Dexcom – A medical device company specializing in CGMs for diabetes management. These devices use sensors to record and transmit data to a receiver or a smartphone.

- High accuracy

- Reliability

- Convenience

- Customer satisfaction

- Short sensor lifespan

- Skin irritation

3. Medtronic – A medical technology company that offers a range of durable medical equipment for diabetes care, such as insulin pumps, CGMs, and APSs. The system connects to a mobile app to monitor and control settings.

- Leadership position

- Advanced technology

- Clinical evidence

- Customer support

- Safety concerns

- Regulatory hurdles

- Competition

Our indirect competitors are other healthcare providers or solutions that offer alternative or complementary ways to manage diabetes, such as medications, diet plans, exercise programs, coaching services, etc. Refer to our hospital business plan to learn more.

Competitive Advantage

Medix’s unique value proposition and competitive advantage over its competitors are:

- Medix is more innovative

- Medix is more convenient

- Medix is more versatile

- Medix is more affordable

- Medix is more user-friendly

Marketing Plan Section of Our Medical Device Business Plan

Promotions strategy.

We will promote our products using online and offline channels to attract and retain customers. Our promotional mix consists of:

- Advertising – Online platforms (e.g., Google Ads, Facebook Ads) and offline media (e.g., newspapers, billboards) to deliver relevant and engaging messages.

- Public Relations – Press releases, media interviews, podcasts, webinars, etc., to generate positive publicity and exposure. Social media platforms (e.g., Facebook, Twitter) to interact and communicate with customers and stakeholders.

- Sales Promotion – Discounts, coupons, free samples, free trials, referrals, loyalty programs, etc., to stimulate sales and repeat purchases. Contests, sweepstakes, giveaways, etc., to create excitement and buzz.

- Personal Selling – Direct sales, telemarketing, email marketing, etc., to contact and persuade customers to buy our products. Online platforms (e.g., Amazon, eBay, Shopify) to sell our products directly.

We will use a value-based pricing strategy that reflects the value and benefits of our products and our competitive advantage. We will also offer competitive pricing that matches or undercuts our competitors’ prices.

We will charge $100 for each Medix Glucometer and $50 for each Medix Patch. We will also generate recurring revenue from the sales of test strips ($0.5 each) and insulin cartridges ($10 each). We estimate that each customer will use an average of 100 test strips and 12 insulin cartridges per year.

Operations Plan Section of Our Medical Device Business Plan

Operation functions.

We do these core activities to offer our products and services to our customers:

- Product Development – We research, design, test, and improve our products using agile methods, customer feedback, market trends, and tools like GitHub, Jira, Figma, etc.

- Manufacturing – We produce our products on a large scale and high quality by outsourcing to a reliable contract manufacturer.

- Distribution – We deliver our products to our customers quickly and cheaply using direct and indirect channels in different regions or countries.

- Customer Service – We support and assist our customers before, during, and after their purchase using various channels and methods.

Milestones and Timeline

We have these specific goals and objectives to track our progress and success in our operation functions:

- June 2024: Complete R&D, testing, prototyping of products

- September 2024: Obtain regulatory approvals and certifications

- December 2024: Launch marketing campaign and product launch in the US

- March 2025: Market research for Europe entry

- December 2025: Launch Europe marketing, market entry

- March 2026: Invest in production capacity

- June 2026: Expand manufacturing workforce

- December 2026: Evaluate production, increase to 100k units/month

Management Team Section of Our Medical Device Business Plan

Founders and co-founders.

Leo Clark, a biomedical engineer with type 1 diabetes, and Aria Bennett, the daughter of a type 2 diabetic and a business administrator, founded Medix. Leo is responsible for the product development function, while Aria leads the marketing and sales function. Both have several years of experience working in their respective fields and personal and professional experience with diabetes.

Other Key Team Members

- Alice Lee – Our chief engineer

- Bob Chen – Our chief developer

- Carol Wang – Our chief designer

- Dave Jones – Our chief marketer

- Emma Smith – Our chief salesperson

Financial Plan Section of Our Medical Device Business Plan

Key revenue and costs.

Medix’s main sources of revenue, along with pricing, are:

- Medix Glucometer – $100 for each Glucometer

- Medix Patch – $50 for each Patch

- Test Strips – $0.5 for each test strip

- Insulin Cartridge – $10 for each cartridge

We estimate that each customer will use an average of 100 test strips and 12 insulin cartridges per year.

Medix’s main categories of expenses are:

- Cost of Goods Sold (COGS) – Our main cost of goods sold is the cost of materials, components, parts, and additional supplies. We estimate that the COGS per unit is $40 for the Medix Glucometer, $20 for the Medix Patch, $0.1 for the test strip, and $2 for the insulin cartridge.

- Operating Expenses (OPEX) – Our main operating expenses are the costs we incur for running and operating our business, such as salaries, rent, utilities, marketing, advertising, R&D, etc. Our OPEX will be 40% of our revenue in the first year, 35% in the second year, and 30% in the third year.

Funding Requirements and Use of Funds

Funding Requirements – We seek $5 million in seed funding to launch our products and scale our operations. We have already raised $500,000 from our savings and a small grant from a local incubator. We need an additional $4.5 million to cover our expenses for the next 18 months until we reach the break-even point.

Use of Funds – We will use the funds for the following purposes as highlighted in the below chart:

Key Assumptions

- Market size for our products is 10% of the total number of people with diabetes in the US and Europe

- Market share is projected to grow from 107,000 customers in 2024 to 444,000 customers in 2026

- Sales volume is projected to grow from 321,000 units in 2024 to 1.33 million units in 2026

- Gross margin is projected to be 60% in all three years

- Net margin is projected to grow from 20% in 2024 to 30% in 2026

Financial Projections

Based on the above assumptions, we have prepared the following financial projections for the next three years:

Income Statement

OGSCapital – Your Partner for Medical Device Startup Success

With over a decade of experience, at OGSCapital, we have helped various entrepreneurs craft winning business plans. Our consultants provide end-to-end support – from market research and competitor analysis to realistic profitability forecasts. We understand the medical device industry inside-out, including regulations, manufacturing, and distribution.

Whether you need help with your hospital feasibility study , medical equipment manufacturing business plan, or medical supply store business plan, we tailor our approach to your specific product and goals. Partner with us to launch your startup on the path to profitability and rapid growth.

Frequently Asked Questions

How to start a medical device business.

A strategic business plan is a key ingredient in a startup medical device company. But that alone won’t cut it – the company also requires a talented group of professionals, structured product development procedures, a plan for meeting regulatory guidelines, and effective marketing tactics. A distributor or a medical equipment supplier can help distribute the devices.

How profitable are medical devices?

The medical equipment industry is booming with high growth potential. The average operating margin for medical equipment and supplies companies averages 2.87%. The medical device market will grow at a CAGR of 5.5% to 5.9% from 2022 to 2030.

How do I market my medical device?

As highlighted in our Medical Clinic Business Plan , some popular marketing channels to market a medical device include online platforms, social media, trade shows, conferences, webinars, publications, referrals, and testimonials. A medical equipment rental company can also help market the device.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rated document, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Medical Device Business Plan Template

Written by Dave Lavinsky

Medical Device Business Plan

You’ve come to the right place to create your Medical Device business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Medical Device businesses.

Below is a template to help you create each section of your Medical Device business plan.

Executive Summary

Business overview.

MediTech LLC is a medical device company that sells Class I medical devices to hospitals, clinics, and other establishments in the medical industry. We manufacture a long list of devices including surgical instruments, syringes, and bandages. We know that patients can’t receive quality care if medical professionals don’t have good tools. Therefore, our mission is to provide the best medical devices in the industry so that all hospitals and clinics can provide the best care possible.

MediTech LLC is founded by Sarah Nelson. Sarah has considerable experience as a surgeon and used hundreds of medical devices throughout her career. She knows exactly what it takes to make high quality medical products and has made it her mission to create the best medical devices in the industry. Her expertise and knowledge of the industry will give us a considerable advantage over the competition.

Product Offering

MediTech LLC sells a long list of Class I medical devices. Class I medical devices are low risk devices and are unlikely to cause any harm to users. These include bandages, surgical tools, bedpans, gloves, and surgical masks. Our product list will grow and change depending on which devices are in high demand.

Customer Focus

MediTech LLC will primarily serve hospitals, clinics, and other medical organizations. Some products will be sold in stores to the public, including bandages, gloves, and face masks.

Management Team

MediTech LLC was founded by Sarah Nelson, a licensed and experienced surgeon. While working in the medical industry, she was frustrated by the quality of the medical devices she used. Her hospital routinely purchases low quality devices to save costs and this would affect the quality of her care. She researched what it would take to make higher quality versions of these products and decided to start a company that provides better quality devices for an affordable cost.

Success Factors

MediTech LLC will be able to achieve success by offering the following competitive advantages:

- We will provide the best quality medical devices in the industry. Our devices will help improve the quality of care that our clients give their patients.

- MediTech will price all of its products moderately so all of our clients and customers can afford them.

- Our founder has years of experience as a surgeon in the medical industry, bringing a vast amount of medical knowledge to the table. This will help us create perfect medical devices and products that all medical professionals will be eager to use.

Financial Highlights

MediTech LLC is currently seeking $1,400,000 to launch. The funding will be dedicated to the facility build out, purchase of initial equipment, working capital, marketing costs, and startup overhead expenses. The breakout of the funding is below:

- Facility design/build: $500,000

- Equipment: $200,000

- Six months of overhead expenses (payroll, rent, utilities): $400,00

- Initial supplies and inventory: $100,000

- Marketing and advertising: $100,000

- Working capital: $100,000

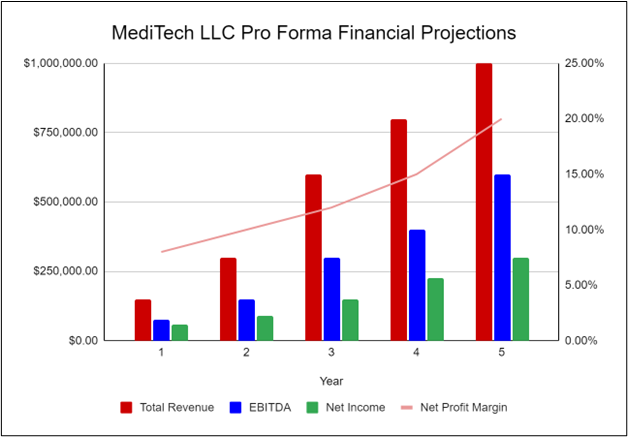

The following graph below outlines the pro forma financial projections for MediTech LLC.

Company Overview

Who is meditech llc.

MediTech LLC sells high-quality Class I medical devices to the medical industry. Our management team knows from experience that patients can’t receive the best care possible if physicians aren’t using the best tools. However, many medical organizations order lower quality devices in order to save on costs. At MediTech LLC, we are committed to making the best medical devices in the industry that are more affordable than the competition.

MediTech LLC produces a long list of medical devices for the medical industry. These include bandages, surgical masks, gloves, surgical instruments, and bedpans. All of our products are Class I devices, meaning they present a low risk to the user.

MediTech LLC is founded by Sarah Nelson. Sarah has considerable experience as a surgeon and used hundreds of medical devices throughout her career. She knows exactly what it takes to make high quality medical products and has made it her mission to create the best medical devices in the industry. Her expertise and connections in the industry will ensure that MediTech LLC achieves its mission.

MediTech LLC History

Sarah Nelson founded and incorporated MediTech LLC as an LLC in June 2023. Though the company is currently running out of a small rented office, it will move to a large warehouse once the lease is finalized.

Since incorporation, MediTech LLC has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined equipment and fixture requirements

- Identified and established relationships with potential clients and suppliers

- Begun recruiting key employees

MediTech LLC Services

MediTech LLC manufactures and sells Class I medical devices. These include (but are not limited to) the following:

- Surgical instruments

- Non-electric wheelchairs

- Stethoscopes

- Surgical masks

Industry Analysis

The medical industry is dependent on the access to high-quality medical devices and products. From gloves and masks to EKG machines, every device used in the care of patients needs to be high quality and always in working order. Devices that are poor quality or don’t work properly can cause significant problems when being used to care for patients.

Medical devices are categorized into three classes. Class I devices are devices that pose very little risk to the user. These items include bandages, surgical instruments, and gloves. Class II devices are intermediate risk devices. These include intravenous pumps and CT machines. Class III devices are high risk and require a great amount of regulation. These devices are also critical to sustaining life. These include pacemakers and brain stimulators.

According to Fortune Business Insights, the medical device industry is valued at $539 billion and is expected to grow at a CAGR of 5.9%. Medical devices are constantly in high demand and are essential for the success of the medical industry. Therefore, now is a great time to start a new medical device company.

Customer Analysis

Demographic profile of target market, customer segmentation.

The company will primarily target the following customer segments:

- Medical clinics

Competitive Analysis

Direct and indirect competitors.

MediTech LLC will face competition from other companies with similar business profiles. A description of each competitor company is below.

Smith & Smith

Smith & Smith is a large corporation that sells thousands of products, including cosmetics, hygiene products, and certain medical devices. The medical devices they primarily produce include bandages, ointments, and low risk surgical and physician instruments. They sell many of their products to the general public (such as simple wound care devices) but also sell some devices to the medical industry. They will be a major competitor since they sell primarily Class I devices. However, they currently do not produce as many medical devices as MediTech LLC plans to produce, which gives us an advantage in the market.

MedMonitor is a medical device company that manufactures Class III medical devices. Some of their products include breast implants, pacemakers, implanted prosthetics, and defibrillators. They do sell some Class I and Class II products, such as gloves, wound care items, and surgical masks, but they are not a major manufacturer of these products. As such, we expect that MedMonitor will only be a minor competitor in the market.

MedSource is the source for most of the medical industry’s Class II medical devices. They produce a long list of devices including syringes, testing kits, contact lenses, and blood pressure cuffs. They do produce some products that can be categorized as Class I devices, but their product list does not overlap too much with ours. As such, we expect that MedSource will only be a minor competitor.

Competitive Advantage

MediTech LLC enjoys several advantages over its competitors. These advantages include the following:

- Management : Sarah Nelson has been extremely successful working in the medical industry and will be able to use her previous experience to design and manufacture the best medical devices in the industry.

- Relationships : Sarah knows many of the local leaders, business managers, and other influencers in the medical industry. These relationships will help her have access to quality materials and create an initial clientbase.

- Affordability : Thanks to Sarah’s connections within the industry, we are able to access high-quality materials for our products for an affordable cost. As a result, we can price all our products more moderately than the competition.

Marketing Plan

Brand & value proposition.

The MediTech LLC brand will focus on the company’s unique value proposition:

- High quality medical devices

- Affordable pricing

- Client-focused service

Promotions Strategy

The promotions strategy for MediTech LLC is as follows:

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. MediTech LLC will use social media to develop engaging content in terms of the company’s product offerings. Engaging with prospective consumers and businesses on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand changing customer needs.

Website/SEO

MediTech LLC will invest in developing a professional website that displays all of the products offered by the company. It will also invest in SEO so that the company’s website will appear at the top of search engine results.

Direct Mail

MediTech LLC will blanket businesses with direct mail pieces. These pieces will provide general information on MediTech LLC, offer discounts, and/or provide other incentives for companies to buy our products.

Advertisement

Advertisements in print publications like newspapers, magazines, etc., are an excellent way for businesses to connect with their audience. MediTech LLC will advertise its products in popular magazines and news dailies. Obtaining relevant placements in industry magazines and journals will also help in increasing brand visibility.

MediTech LLC’s pricing will be moderate, so clients feel they receive great value when purchasing our products.

Operations Plan

The following will be the operations plan for MediTech LLC. Operation Functions:

- Sarah Nelson will be the CEO of MediTech LLC. She will oversee the general operations and executive aspects of the business.

- Sarah is joined by Rebecca Smith who will act as the warehouse manager. She will train and manage the staff as well as oversee general production of our products.

- Sarah will hire an Administrative Assistant, Marketing Manager, and Accountant, to handle the administrative, marketing, and bookkeeping functions of the company.

- Sarah will also hire several employees to manufacture our products and maintain the equipment and machinery.

Milestones:

MediTech LLC will have the following milestones completed in the next six months.

- 02/202X Finalize lease agreement

- 03/202X Design and build out MediTech LLC

- 04/202X Hire and train initial staff

- 05/202X Kickoff of promotional campaign

- 06/202X Launch MediTech LLC

- 07/202X Reach break-even

Sarah Nelson is a former surgeon who is familiar with the most popular medical devices in the industry. She knows better than anyone that low quality products means low quality care for patients. As a surgeon, she was often disappointed with the quality of the medical devices she used. Her hospital would routinely choose the cheapest options to save costs. This resulted in more problems and low quality care being delivered to her patients. She is now passionate about starting her own company that provides high quality medical devices for an affordable cost.

Though Sarah has never run a business of her own, she has worked in the medical industry long enough to gain an in-depth knowledge of the operations (e.g., running day-to-day operations) and the business (e.g., staffing, marketing, etc.) sides of the industry. She will also hire several professionals to help her run other aspects of the business she is unfamiliar with.

Financial Plan

Key revenue & costs.

The key revenues for MediTech LLC will come from the sale of our medical devices and products.

The major cost drivers for the company will include manufacturing costs, overhead expenses, labor expenses, and marketing costs.

Funding Requirements and Use of Funds

- Six months of overhead expenses (payroll, rent, utilities): $400,000

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of wholesale contracts:

- Year 5: 100

- Average order value: $5,000

Financial Projections

Income statement, balance sheet, cash flow statement, medical device business plan faqs, what is a medical device business plan.

A medical device business plan is a plan to start and/or grow your medical device business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Medical Device business plan using our Medical Device Business Plan Template here .

What are the Main Types of Medical Device Businesses?

There are a number of different kinds of medical device businesses , some examples include: Class 1 medical device, Class 2 medical device, and Class 3 medical device.

How Do You Get Funding for Your Medical Device Business Plan?

Medical Device businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Medical Device Business?

Starting a medical device business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Medical Device Business Plan - The first step in starting a business is to create a detailed medical device business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your medical device business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your medical device business is in compliance with local laws.

3. Register Your Medical Device Business - Once you have chosen a legal structure, the next step is to register your medical device business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your medical device business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Medical Device Equipment & Supplies - In order to start your medical device business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your medical device business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful medical device business:

- How to Start a Medical Device Company

Medical Device Business Plan Template [Updated 2024]

Medical Device Business Plan Template

If you want to start a medical device business or expand your current medical device business, you need a business plan.

The following Medical Device business plan template gives you the key elements to include in a winning Medical Device business plan.

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

Medical Device Business Plan Example

I. executive summary, business overview.

[Company Name] is a brand new medical device designer and manufacturer, established in 2022 as a C corporation by two college friends. The friends, [Founder’s Name] and [Founder’s Name], developed a cutting edge device during graduate school that has since been improved and FDA approved.

This technology helps solve medication compliance challenges observed and experienced by [Founder’s Name] and [Founder’s Name]. It works by automating the dispensing and refill of medications, as well as providing automatic reminders when it is time for a dose. The device will be available in three versions, intended for the consumer, elder care, and travel markets. Products are customized to meet the needs of each of the three markets.

Helping patients with medication compliance is the bottom line goal of [Founder’s Name] and [Founder’s Name] at [Company Name].

Products Offered

[Company Name] produces three versions of its medication dispenser. These devices have various features specific to their respective markets, and all dispensers feature smart connections. These devices have been approved by the U.S. Food and Drug Administration.

Customer Focus

[Company Name] serves consumers of all ages. The demographics of current and potential clients and customers of our clients are as follows:

- 131 million people in the U.S. use prescription drugs

- 53% of all Americans aged 18 to 34

- 62% of those aged 35 to 49

- 75% of those aged 50 to 64

- 87% of those aged 65 to 79

- 91% of Americans aged 80 or older

[Company Name] recently entered into a contract to supply a 25-location regional pharmacy chain.

Management Team

[Founder’s Name] and [Founder’s Name] comprise the management team of [Company Name], and are in the process of securing additional management and staff personnel.

[Founder’s Name] holds a graduate degree from Florida State University in engineering. She is the CEO of the C corporation and her primary occupation is to present the vision of [Company Name], while encouraging major corporate relationships with retail pharmacies across the United States. She is a former regional sales manager for a major medical device corporation, with a track record of 10 years in that role, garnering over 25M in sales.

[Founder’s Name] holds an MBA degree from University of Alabama, with a focus on corporate strategic management. He is a former sales representative for a major medical device corporation, with a track record of 15 years in that role, garnering over 20M in sales.

Success Factors

[Company Name] is positioned in several ways to become a well-established corporation for the following reasons:

- Founders are highly-experienced in the medical device industry

- Founders have a contract to supply 25 retail pharmacies, which have a combined total of more than 100K customers

- Founders have patented these medical devices

- [Company Name] has a track record of continuous improvement to the original product, as technology progresses

- Founders have staff with experience in medical device manufacturing

Financial Highlights

[Company Name] is currently seeking $430,000 to launch. Specifically, these funds will be used to build on property, pay salaries, market services, and pay for research and development, including prototyping and concept modeling, as follows:

- Manufacturing center design/build: $150,000

- Working capital: $120,000 to pay for salaries, and overhead costs until [Company Name] reaches break-even

- Concept modeling, prototyping, and CAD-drawn sampling: $80,000

- Patenting and Trademarking: $50,000

- Marketing, advertising, customer presentations: $30,000

Top line projections over the next five years are as follows:

II. Company Overview

Who is [company name].

[Company Name] is a brand new medical device designer and manufacturer, registered in 2022 as a C corporation by two college friends. The friends, [Founder’s Name] and [Founder’s Name], developed a cutting edge device during graduate school that has since been improved and FDA approved. The device uses technology that helps solve medication compliance challenges.

In an informal survey of physicians within the greater Los Angeles area, [Founder’s Name] and [Founder’s Name] found that 56% of patients report some issue with medication compliance. In most cases, these patients rely on their memory to take medications as prescribed. Because memories can be faulty, physicians are eager to find a solution which will easily increase medication compliance.

Both [Founder’s Name] and [Founder’s Name] have personally experienced problems with medication compliance. Both have taken prescription medications since college, and quickly learned how easy it is to forget a dose or two. They soon discovered that this is a common experience, and the two of them embarked on a solution-finding mission: that of creating a device which minimized or entirely eliminated medication non-compliance.

The search led to an array of potential solutions, and with the help of their college professors and mentors, they prototyped several until they arrived at the first iteration of the device they build today. While they were still in school, the pair were awarded a patent for the device. Some years later, when their dreams began to coalesce into a solid plan, the founders took steps to ensure the device was approved by the FDA.

[Company Name]’s History

[Company Name] was formed as a C corporation. The history of the device is substantial. Extensive experience within the medical device industry provides the backbone of this corporation’s history, with high projections for profitability and multi-stage growth in the years to come.

[Company Name]’s Products

The devices produced by [Company Name] are designed to dispense, refill, and remind patients to take their prescription medications. This device offers a simple solution to medication compliance issues.

Significant advances in the process of concept and discovery, prototyping and production will be patented and trademarked as appropriate. The patents and/or trademarks will add to the value of the medical devices produced.

III. Industry Analysis

The U.S. medical device industry is projected to grow a healthy 3.3% over the next five years, with an increasing demand as time continues. The industry is in a growth cycle, and exhibits high profitability. An aging population and rising community expectations will drive demand for medical devices over the coming years. With the rise of chronic conditions such as diabetes, heart disease, cancer, AIDS, and hepatitis, prescription sales increased an estimated six times faster than population growth, resulting in a dramatic increase in the average number of retail prescriptions per capita. This represents a significant opportunity for [company name].

IV. Customer Analysis

Demographic profile of target market.

[Company Name] will serve the entire United States, targeting several customer segments within that market.

The largest market is retail pharmacies. There are 828,738 pharmacies in the U.S., as of 2022. Pharmacy and drug store staff members typically assist in recommending products to potential customers, as well.

The end consumers are the patients who take prescription medications. They include patients who take medication for chronic conditions, as well as those with acute conditions.

Customer Segmentation

The customers of [Company Name] can be segmented into primary and secondary segments.

Primary Customers:

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Online Medical Product Retailers

Secondary Customers:

- End Consumers

- Home Health Care Providers

- Families of Elderly and Disabled Patients

V. Competitive Analysis

Direct & indirect competitors.

MedTime – direct competitor Established in 2018, MedTime is a privately held business that has developed the first and only in-home medication manager that intuitively sorts and dispenses medication. The MedTime device has audible and digital reminders; automates refills; and provides real-time as well as historical adherence data. MedTime operates on a subscription fee and offers a free 90 Days Risk-Free trial. Each subscription comes with a MedTime smart dispenser. Additionally, the subscription gives access to a medication management app that gives pill-time reminders and missed-dose alerts, tracks what was taken and when, and gives remote caregiver monitoring for safety and medication schedule management with HIPAA-compliant security. The subscription also has automatic refills with free delivery and access to a 24/7 live support.

MedMonitor – direct competitor MedMonitor is a privately held business that provides services that simplify medication management and improve medication adherence. MedMonitor offers an automatic pill dispenser that reminds users when it is time to take their medication through flashes, beeps, text messages, and phone calls. The dispenser also provides the user’s caregivers, family members, or pharmacists with notifications about dosage activity, which can be monitored remotely through a patient profile’s on MedMonitor’s website. The subscription comes with a dispense device that is filled for several weeks, depending on the number of dosages per day, optional Locking, refill trays, an optional Medical Alert that has a two-way voice channel with the medical alert professionals, and an interactive screen that can be personalized. Additionally, the subscription comes with access to a secure website, where users and caregivers can easily program their unit’s medication schedule remotely, set up preferred notifications and review reports.

MediBox – direct competitor MediBox is a privately held business that developed a medication dispenser designed for people who have a hard time remembering to take their medicine. It reminds patients to take their medications, automatically dispenses a 90-day supply of up to 16 different medications, and sends messages to family and caregivers if they miss a dose. The MediBox is easy to setup, provides refill alerts and fast refills, provides a picture of the pills for each dose given, has a tilt sensor alerts for possible tampering or incorrect dosing/spillage, is lockable, and is the only medication dispenser tested to significantly improve adherence in an FDA approved clinical trial.

Competitive Advantage

[Company Name] has several competitive advantages over competitors, listed as follows:

- Founders have experience and in-depth understanding of the target markets, as well as direct contact with over 200 decision-makers in this industry

- Founders have several years of experience in sales and marketing of medical devices throughout the U.S.

- Patented and trademarked medical devices will increase value of the corporation

VI. Marketing Plan

The [company name] brand.

There are many medical device providers within the U.S. industry; there is only one, [Company Name], which delivers an affordable device proven to increase medication compliance.

Promotions Strategy

[Company Name] will promote its devices via the following methods:

Public Relations [Company Name] will make a series of press releases as the company continues in phase one of growth. Each announcement will present current notes of interest, such as medical device innovations, key company personnel additions, patents received, or trademarks confirmed. Each press release will contain forward-looking statements. Press releases will be sent to newspapers, industry newsletters and social media outlets.

Social Media [Company Name] will build activity on Instagram, Facebook, and, in particular, LinkedIn. These media markets will help drive traffic to the website and serve as a source for new hires and competitor information.

Website The website for [Company Name] will be primarily an introduction to the corporation, with successive pages demonstrating pictorial examples of its device improvements, concept models and CAD-drawn samples. A “From the Bench” article written by one of the founders shall be dropped monthly to add to reader interest.

Partnerships [Company Name] will partner with various philanthropic organizations in giving to charitable causes, including those that support the medical device industry. This effort will create potential target markets, as well as serve as a way of giving back to the customers served.

Medical Device Trade Shows [Company Name] shall be represented at booths at national industry trade shows, where the company will be highlighted via video presentations and examples of its devices.

Medical Conferences [Founder’s Name] and [Founder’s Name] shall both serve as company representatives on expert panels or in seminars. They will represent [Company Name] as industry leaders and as experts within the medical device industry.

Pricing Strategy

The pricing strategy for [Company Name] will be based on models that conform to the pharmacies, physicians’ offices, caregivers and patients who purchase the devices.

VII. Operations Plan

Functional roles.

[Company Name] contains the following functional roles:

Research & Development Role

- Direct responsibility for technological advances relating to the device

- Responsible for production of prototyping, 3D printing, and CAD-drawn samples

- Oversight of staff members who work with every phase of production

FDA Administration Role

- Direct responsibility for timely FDA review and approval process

- Oversight of timelines for customization process; in tandem with R & D

Administrative & Human Resources Role

- Direct responsibility for all office functions and administrative procedures, including financial accounting and tax processes

- Customer relations responsibility

- HR responsibility (until future HR Director hired)

- Oversight of maintenance staff and inventory, stock, and supplies

- Marketing & Sales Manager

- Responsible for all marketing and sales promotions and presentations

- Responsible for representation of the company at trade shows and in seminars or other industry events

- Oversight of sales representatives

VIII. Management Team

Management team members.

[Company Name] was founded by [Founder’s Name] and [Founder’s Name]. The corporation shall be under the direction of the founders who share equal shares of the corporation. Each founder will be responsible for a portion of the functional roles within the corporation and those who operate it.

Given the history of the founders within the medical device industry, building a staff of teams will be done with purposeful and serious thought and with an understanding of which team member will perform best in each role.

Hiring Plan

[Company Name] will hire the following personnel as soon as possible in phase one of growth:

- Research & Development Director

- FDA Administrative Officer

- Administrative & Human Resources Director

- Administrative staff members (2)

IX. Financial Plan

Revenue and cost drivers.

The revenue for [Company Name] will be generated by sales of medical devices offered to pharmacies, physicians, caregivers, and patients.

[Company Name] will produce the three current versions of its medication dispenser, as well as developing continuous improvements to the devices offered by [Company Name].

The major costs for [Company Name] will include overhead (including employees, building and material costs), costs for research and development, prototyping, 3D printing, and costs related to FDA approval processes.

Capital Requirements and Use of Funds

[Company Name] is currently seeking $430,000 to launch and take the company through phase one of the growth cycle. Specifically, these funds will be used to build on property, pay salaries, market products, and for research and development, including prototyping and concept modeling, as follows:

Key Assumptions

5 Year Annual Income Statement

Comments are closed.

Medical and Health Business Plans and Resources

Written by Dave Lavinsky

In the medical and healthcare industry, where the balance between patient care and operational efficiency is paramount, a comprehensive business plan stands as a critical element for success. It serves as a strategic guide, vital for navigating the sector’s regulatory complexities, technological advancements, and evolving patient needs.

Below you will find an extensive array of business plan examples for a variety of medical and healthcare businesses, including private clinics, medical device startups, telemedicine services, and healthcare consulting firms. Each plan is meticulously crafted to address crucial aspects such as market research, compliance with healthcare regulations, service delivery models, and financial management. These plans are invaluable for professionals and entrepreneurs in the healthcare sector, providing a structured approach to developing services that are not only medically effective but also financially viable and operationally sustainable. They underscore the importance of strategic planning in creating a healthcare business capable of delivering high-quality patient care while navigating the challenges of this highly regulated and competitive industry.

Medical Practice Business Plans and Resources

Acupuncture Business Plan PDF Chiropractic Business Plan Template Chiropractic Business Plan PDF Counseling Private Practice Business Plan Template How to Open a Counseling Private Practice Business Dental Business Plan Template Medical Practice Business Plan Template Sample Medical Practice Business Plan How to Open a Medical Practice Business Medical Clinic Business Plan PDF Mental Health Private Practice Business Plan Template Mental Health Private Practice Business Plan PDF Mobile Health Clinic Business Plan Template Optometrist Business Plan Template

Nursing Home, Elderly Care and Home Health Business Plans and Resources

Assisted Living Business Plan Template Sample Assisted Living Business Plan How to Start an Assisted Living Business Assisted Living Business Profit Margins Monthly Expenses of Assisted Living Business How Much Does an Assisted Living Business Makes Assisted Living Business Startup Costs Assisted Living Business Plan PDF Elderly Daycare Business Plan Template Group Home Business Plan Template Group Home Business Plan PDF Home Health Care Business Plan Template How to Start a Home Health Care Business Home Health Care Business Plan PDF Non Medical Home Care Business Plan Template How to Start a Non Medical Home Care Business Non Medical Home Care Business Plan PDF Nursing Home Business Plan Template How to Start a Nursing Home Business

Other Medical and Health Business Plans and Resources

Apothecary Business Plan Template Drug Rehabilitation Business Plan Template Health Coaching Business Plan Template IV Hydration Business Plan Template How to Start an IV Hydration Business IV Hydration Business Plan PDF Medical Billing Business Plan Template How to Start a Medical Billing Business Medical Device Business Plan Template How to Start a Medical Device Company Medical Device Business Plan PDF Non Emergency Medical Transportation Business Plan Template Mobile Phlebotomy Business Plan Template Pharmaceutical Business Plan Template Pharmacy Business Plan Template Sample Pharmacy Business Plan How to Start a Pharmacy Pharmacy Business Plan PDF Physical Therapy Business Plan Template Physical Therapy Business Plan PDF Sober Living Business Plan Template Transitional Housing Business Plan Template How to Start a Transitional Housing Business Urgent Care Business Plan Template Medical Transportation Business Plan Template Medical Lab Business Plan Template

Medical Business Plan

You cannot start and run a successful medical business without writing and implementing a comprehensive business plan. A business plan gives you a complete framework for researching and analyzing the market, identifying possible opportunities, financing the project, and scaling it all together. Here are some of the best examples of medical business plans worth having a look.

Medical Practice Business Plan Template

- Google Docs

Size: A4, US

Medical Laboratory Business Plan Template

Dispensary Business Plan Template

Fertility Clinic Business Plan Template

Fertility Clinic Marketing Plan Template

Pharma or Drug Sales Plan Template

Medical Clinic Sales Plan Template

Medical Device Sales Plan Template

Executive Medical Reimbursement Plan Template

Best Medical Business Plan Examples & Templates

medical business plan example.

Size: 8.86 MB

If writing a medical business plan were easy, every business aspirant would do it with ease. To be clear, a comprehensive business plan for a new healthcare facility takes time to put together. But, what if you are green in this in the first place? The best thing to do is to look at a sample plan to get a clear picture of what a comprehensive strategy for a health facility looks like. This PDF file is a unique sample of a well-written business strategy for a healthcare facility. The plan covers everything you need to know about establishing a healthcare center, from business objectives and guiding principles to demographic analysis and their access to care.

Printable Medical Business Plan

Size: 780 KB

It doesn’t make sense to start a medical business without a strategy in place. You need to identify your audience, sturdy the market, conduct a SWOT analysis , and develop a marketing technique. This calls for a comprehensive business plan and here is an example that you can download and use as a guide to writing your own strategy. This sample will help you to understand a few things. First, you’ll learn how to write a clear summary of the proposed medical business. Second, you will see what a detailed business description looks like. Third, you will dive deep into learning and understanding the competition. Then, you will learn about financial strategy, which is important for starting and running a healthcare business at scale.

Free Medical Business Plan Example

Size: 88 KB

It is important to understand that a business plan does not have to be complicated. It doesn’t have to be dozens or hundreds of pages either. In fact, you can set up and run a successful medical business with a very simple business plan . This PDF document is an example of a very simple business strategy, which a clear indication that even lean business plans can help you take a step in the right direction. This plan covers a number of sections, including an executive summary for the proposed business, proposed services, market evaluation, and marketing approach. Click the link above to download the PDF file.

Medical Practice Business Plan Example

Size: 237 KB

This PDF document is one of the most comprehensive medical business plans that you can read to understand what a professionally written business strategy looks likes. The 37-page file features a unique outline, which makes the entire document easy to scan. This file has a lot of information. From the executive summary and market sturdy to SWOT and market analysis , there is quite a lot to learn. The author uses a simple language throughout the document. So, whether you are green to writing a business proposal or you just need a simple example for reference, this is a good template to download.

Medical Startup Business Plan Example

Size: 219 KB

You cannot start and run a successful business without a plan. In fact, many businesses that begin to operate without a strategy often close within the first six months. This happens across various industries, even in medical business. Now that you have made up your mind to start a medical business, you first need to write a business plan. If you have never written one before, don’t worry. You can just download this PDF file, read the entire strategy example, and then use the same knowledge that you pick from it to write a comprehensive business plan of your own. Click the link above to download this template.

Medical Business Plan Example for Clinic

Size: 262 KB

Ask every serious entrepreneur what it takes to start and run a successful business and they’ll tell you that the first thing you need is a business plan. This tells you that a successful business depends on a comprehensive strategy . Now that you have made up your mind that it is time for you and your stakeholders to start a clinic in your locale, it’s important to write a business plan before investing money in the project. The plan will enable you to determine whether the business is feasible to pursue. By finding, connecting with, and studying the target market, it becomes easy to understand your business even before starting it. Download this medical plan for the clinic to learn more.

Private Hospital Business Plan Example

Size: 2.15 MB

Even if you have enough funding to start a private hospital, you’ll need to do in-depth research and then come up with a solid business plan that will help you set up the enterprise. At the end of the day, your goal is to run a successful business . This is something you can’t do if you start with a proper strategy. Remember, the success of your private medical startup will depend on the structure of the plan. The success of the upcoming business will depend on the structure of the plan. In other words, a business plan is a must-have.

Simple Medical Business Plan Example

Size: 141 KB

You already know that it is difficult to run a successful business without a plan. So, if you want to set up a new medical facility in your area, first start by writing a business plan for the foreseen startup. The PDF file above is a unique example of a business plan that you can use for reference. This guide is important because it focuses on the most important elements that make up a comprehensive business plan.

Comprehensive Business Plan for Medical Facility

You can use this sample template to write a comprehensive business plan for a medical facility. Some of the highlights include identifying challenges and determining their respective opportunities. This gives you a clear understanding of the market that you would like to target so that you can align your medical services to their needs once you start operation.

Short Medical Business Plan Example

Size: 264 KB

If you are the kind of a medical business enthusiast who prefers to write a short business plan, this example is suitable for you. The content of the file includes an executive summary, market analysis, business growth, marketing strategy, and financial projection.

Text prompt

- Instructive

- Professional

Create a study plan for final exams in high school

Develop a project timeline for a middle school science fair.

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Medical Equipment Developer Business Plan

Start your own medical equipment developer business plan

Medquip, Inc.

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Medquip, Inc. is a medical device development company that intends to design, patent, and market medical devices related to endoscopic surgical niche markets. Three devices have already been designed with the participation of leading physicians and surgeons in gastroenterology. Seven patents are initially incorporated. The company projects $16 million in sales in year three. The company expects to have $50 million in revenue by year five. Patent applications on its first three market entries have already been accomplished using a top patent law firm.

The market segments are clearly defined and all are subject to a high growth trend. One market is projected to exceed $160 million in the next three years. That is the endoscopic variceal ligation market. One of the founders of Medquip participated in the design of the current market leader in that field and has improved upon the product significantly. Another market addresses a well-defined and unanswered need in endoscopic surgery: the clearing of fundal pools of blood and tissue during surgical procedures. A new and innovative design has been created to answer the needs of surgeons.

This market should begin at $20 million but could expand to several hundred million as soon as approvals are obtained for many varied surgical procedures. Medquip intends to license this technology to a larger company. The company becomes mature in year three. The company is potentially profitable in year one only if a proposed licensing agreement can be closed.

The mission of Medquip, Inc. is to design, develop, and market new patented technologies in the medical device field. The technologies will fill market niches that each account for a minimum of $20 million dollars in potential sales. Each technology will fill a current need in medical procedure by improving upon an existing technology or device, or by designing a device to serve a need that is clearly defined and acknowledged by medical professionals. Each product shall be priced to appeal to a managed-care market that stresses lowest cost of total treatment parameters.

Keys to Success

The keys to success for Medquip, Inc. are as follows:

- Initial capitalization obtained.

- All patent applications filed.

- The ability to generate early revenue from non-regulated markets in Europe.

- Licensing at least one technology and application to a major medical device corporation.

- Getting low interest loans and/or grants to fully fund product development and prototype manufacture.

- Recruiting top-notch CEO prior to second round financing and market roll-out.

- Successful 510k approval from FDA to market Visi-Band in the U.S.

- Successful implementation of sales and marketing plan to U.S. managed care market to obtain a minimum 10% market share in the second full year to generate $16 million in revenue.

- Increased product development and continued market share gains to produce a $50 million revenue company by year five.

The principal objectives of Medquip, Inc. are as follows:

- To achieve a 10% market penetration in the endoscopic variceal ligation market by year three.

- To achieve $16 million in revenue by year three.

- To raise $1 million in private seed capital in the first six months.

- To win low interest loans and grants from the government of Puerto Rico totaling $1.2 million in year one.

- To license its technology for the obliteration/suction/irrigation market for $1 million dollars in year one.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Medquip, Inc. will develop and market endoscopic medical devices through multiple distribution channels both foreign and domestic. The company is currently developing its patent-applied technologies to final product and approval stage. It is also seeking to establish its corporate identity in the medical products field. Growth strategy calls for one joint venture license as well as the following objectives:

- Complete the patent process.

- Establish corporate identity, brand names, trademarks.

- Establish a medical advisory board.

- Build staff, infrastructure, and retain consultants for trial and compliance issues.

- Conduct animal trials.

- Prepare for FDA clinical trials.

- Continue R & D and product development.

- Explore options for 2nd round financing (venture capital, corporate alliance, licensing, public offering) to maximize value to shareholders.

Note: Management believes that accelerated FDA approval process will be available on the band ligation device since it involves only modifications on an existing, approved device. There is past precedent in 510k approvals (in an average of 3 months) in documented cases.

Start-up Summary

The key elements in the Start-up plan for Medquip, Inc. are:

- The legal expense for filing all patent applications.

- The establishment of Corporate Identity.

- The location and place of doing business.

- Funding of additional capital raising alternatives.

- Salary for the two key managers and founders.

- Formulation of Strategic Plan. Costs of raising capital through private placement.

$215,000 was raised from the initial two investors for these purposes. This funding came in in early 1998 and these tasks have either been completed successfully or are in the final process of completion. These are treated purely as start-up expenses by this plan. $128,000 is treated as cash-on-hand as of the start of this plan on January 1, 1998. The remainder of the start-up capital required as well as capital required for the continuation of operations in the first six months will be provided by selling the shares in the private placement. The capital obtained from these sales is expected to total an additional $850,000 and the plan calls for this cash to be infused in May and June, 1998.

Company Ownership

Medquip, Inc. is a South State “C” corporation.

Its founding shareholders are:

Eric Smith (2,545,000 shares) Timothy Jones (500,000 shares)

At the date of this plan, two additional shareholders are of record:

Arthur C. Clark (50,000 shares) Genesis Corp. (14,000 shares)

Company Locations and Facilities

Medquip, Inc. business offices are at 1234 Main Street, Anytown, U.S.A. Phone is …. Fax is …. These offices are leased month-to-month on a temporary basis. This business plan calls for the establishment of corporate offices, R&D facilities, and prototype and small-run manufacturing facilities. These facilities are to be located in Puerto Rico with 10,000 sq. ft. initially expandable to 30,000 sq.ft. Rental costs in Puerto Rico range from $1.75 to $4.00 per sq. ft. Currently available space in Puerto Rico may also be used on a joint-venture basis to be negotiated.

Medquip, Inc. will initially market three distinct products.

- The Visi-Band, a disposable device that is used in endoscopic variceal ligation procedures.

- The Visi-Gator, a partially disposable device that is used to remove blood clots during various endoscopic surgical procedures.

- The Visi-Lyser, a suction/irrigation device for laparoscopic procedures.

The technology used in these products is the subject of seven patents in the application process.

These three product areas may be more generally defined as follows:

- Endoscopy Devices–used for esophageal variceal ligation, hemorrhoidal ligation . The Visi-Band: Consisting of ligating bands with greater stretchability and grip (Super-Elastic bands incorporated into a multi-band dispensing device).

- Endoscopy Devices–used for lysis (tissue dissolving). The Visi-Gator: Consisting of a rotary cutting tool to clear fundal pools of blood in the stomach.

- Endoscopy Devices–used for suction/irrigation and tissue removal. The Visi-Lyser: Consisting of a suction/irrigation tool to remove tissue effectively.

Product Description

Multiple Ligating Band Dispenser: The Visi-Band

Application is endoscopic variceal ligation which is a rapidly growing surgical procedure quickly replacing sclerotherapy for the removal of polyps in both upper and lower gastro-intestinal exploration.

Scope: This innovation applies to the internal technology of ligating bands independent of the dispenser or delivery system. Visi-Band is a pre-loaded delivery device for applying multiple ligating bands remotely from the distal tip of an endoscope. (The leading current product in this category is the Speedband made by Boston Scientific).

Clinical Advantages: A perceived clinical advantage of these bands is ligation of a greater range of tissue sizes with a single band. These ligating bands stretch easily over the largest tissue to be ligated and yet will grip securely even the tiniest tissue to be removed. These bands can have an inner diameter near zero so that even tiny varices are gripped firmly.

Current State of the Art Technology: Market-leading bands today are molded of homogeneous rubber materials. Material properties of elasticity have limited the stretch of conventional ligating bands to a range of about seven-fold. A typical market-leading band for esophageal variceal ligation has an inner diameter of 1.8mm. This band can stretch to a maximum inner diameter of 12.4 mm to ligate a varix. This maximum size roughly corresponds to the endoscope diameter. A varix of 1.8 mm would not be ligated because the band would be loose around the tissue.

Medquip Technology: The Super-Elastic Band innovation effectively engineers the band material stresses in a way that increases the apparent stretchability of the band many times. We have created bands with proximate zero inner diameters, which can be stretched at least as large as conventional bands with large inner diameters. Bands created with this technology can also hold their elasticity for longer periods of time. The basis of our technology is an internal compressive pre-stress at the band inner diameter. This can be achieved in at least five practical ways covered in our patent documentation. The true zero inner diameter band is a result of the compressive forces creating small scale creasing or wrinkling which fill the band interior. Bands made to date exhibit an effective elasticity of 20 times and more versus the seven times stretch in the market-leading band.

Medquip ligation devices should have an unprecedented and superior range of application to meet ligation requirements. Super-Elastic Bands can mean fewer special sized devices to manufacture, purchase, specify, and stock. This fits well in a managed-care environment through lower costs with inherent clinical advantages. Medquip and the health care system could benefit from higher volumes of a smaller number of different products.

Further Clinical Advantages:

- Visi-Band is designed for multiple band ligations with a single scope insertion.

- Visi-Band delivers maximum visibility with zero “tunnel vision” during insertion and exploration, a limitation of all competitors.

- Visi-Band delivers maximum mobility by being nearly flush with the distal end of the endoscope during insertion and exploration.

- Visi-Band should be significantly faster to install to the endoscope by having many fewer assembly parts and steps than the competition.

- Visi-Band is smaller in diameter than Speedband for patient acceptance and comfort.

- Visi-Band patient entry is smoother and protected at all times from miss-fires by a smooth, transparently clear outer shield.

- Visi-Band can ligate smaller varices with the super-elastic bands as described above.

- Visi-Band can be supplied in a single configuration with multiple bands, seven or eight, at a cost similar to the competition’s three or six band unit.

Note: Today’s multiple ligating band dispensers release bands off a tube at the distal endoscope end with typically two filaments for each band. This tube is at least as long as the endoscope diameter and creates severe “tunnel vision” because the bands typically cover the outside surface of the clear plastic tube. This added length also reduces the mobility of the distal tip. Each filament must be precisely assembled and triggered for each band. Bands exposed on the outside of the tube are prone to miss-fire as evidenced by a clear shield with instruction to remove just prior to insertion into the patient. A conically tapered dispenser is typical and necessary to help bands roll off the distal end. This taper increases the diameter of the ligating unit. Installation is a complex, multiple step process often involving a separate ligating unit, handle unit, a trip wire, scope fastener, and irrigation catheter. Actuating a competitive unit can cause the distal tip to move from the tension of the trip wire.