Free! The $1 Challenge - Make Your First Shopify Sale in Just 5 Days!

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

7 Steps to Finding Your Brand Tone of Voice

5 Ways to Leverage Customer Reviews to Increase Sales

Brand Authenticity: How User-Generated Content Can Give You a Much-Needed Boost

5 Ways Personalization in eCommerce Can Enhance Customer Experience

Engaging Your Audience with Social Media Quizzes and Polls

Email Marketing Automation: Tools and Strategies for 2024

How to Find Influencers: 6 Ways to Discover Your Perfect Brand Advocate

How to Create a Marketing Plan In 2024 (Template + Examples)

What Is UGC and Why It’s a Must-Have for Your Brand

Ad Expert Phoenix Ha on How to Make Creative Ads without Breaking Your Budget

14 Punchy TikTok Marketing Strategies to Amplify Your Growth

How to Grow Your YouTube Channel and Gain Subscribers Quickly

How to Get More Views on Snapchat with These 12 Tactics

12 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

Create Viral Infographics That Boost Your Organic Traffic

Accelerate Your Ecommerce Journey for Just $1

Step-by-Step Guidance from World-Class Entrepreneurs to Build, Grow, and Scale Your Ecommerce Brand

Don't Miss Out! Register Free For The 5-Day Challenge.

- 5 Days. 7-Figure Founders LIVE.

- Walk Away With A Winning Idea.

How to do Market Analysis in 6 Easy Steps

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Knowing how to do market analysis is pivotal for many roles, benefiting any organization, regardless of its size, scope, or sector.

Regular market analysis levels up your individual ability to spot potential opportunities, stay on top of current trends, and gives you insights into the competitive landscape .

This article will cover why you need to analyze a market frequently and shows you how to do a basic market analysis in 6 straightforward steps.

What is a market analysis?

Market analysis is the process of gathering data about a target market . It examines the competitive landscape, consumers, and conditions that impact the marketplace.

The benefits of market analysis

Here are eight reasons why a regular market analysis is beneficial:

- Understand the competitive landscape

- Spot trends in your market

- Uncover opportunities for growth or diversification

- Reduce either risk or cost for launching new products or services

- Develop a deeper understanding of a target audience

- Enhance marketing efforts or discover ways to change

- Analyze business performance within a market

- Identify new segments of a market to target

Why you should conduct a market analysis

Aside from the benefits we’ve already listed, reviewing and redoing your market analysis regularly is important . Here’s why.

- Markets shift

- Consumer behaviors change

- New players enter existing markets

- Disruptive technologies and enhancements to rival offerings can shift the landscape

- External events impact market conditions that drive changes

If you already know how to do market analysis, ask yourself how frequently you undertake the task: is it annually or quarterly? And consider the time it takes and the tools you used to obtain your information.

With this in mind, we’ll walk you through the most effective market analysis methods. Showing you the steps to take, with market analysis examples, to bring these steps to life.

How to conduct a market analysis

These six steps break down how to analyze a market into easy-to-follow, digestible stages.

Before you start: Use a framework to record your findings. There are plenty of visualization tools, but a basic excel sheet will be fine if you want to keep it simple. Why? Because when you return to review this analysis and repeat this exercise, you’ll want to have everything recorded in a single place. It will save you time and make any future comparisons easier.

Step 1 – Market segmentation

What: Whether you want to enter a new market , launch a new product, or simply assess opportunities for an existing business, this first step in the market analysis process is crucial yet often overlooked.

Why: Market segmentation helps you identify the core segments of a market to target. By identifying the portion of a market your products will be suitable for, you can accurately define the market size and better understand your potential customers’ specific needs and preferences.

How: There are multiple ways you can segment a market, and the right approach will depend on your product, its customers, and its target profiles.

Here, we can see how a segment is built using Similarweb’s website segment feature. I specifically want to view the credit card sector in the US, a market made up of pure players (think Amex or Visa ) and individual players with credit card lines as one of their segments (think Wells Fargo or USAA ). By splitting up a market like this, I can analyze the areas of business I care about more for my market analysis.

So, instead of viewing data that encompasses the other lines of business the likes of Wells Fargo and the USAA handle, such as loans, I get to hone in on their credit card segments only.

This is just one example of market segmentation. You can also segment a market based on consumer needs, ideal consumer profiles, regions, and other demographic data.

Step 2 – Market sizing

What: Market sizing determines your target market’s potential volume or sales revenue. It’s an essential component of market analysis that uses either secondary or primary research to explore the actual size of the market you are in or wish to enter.

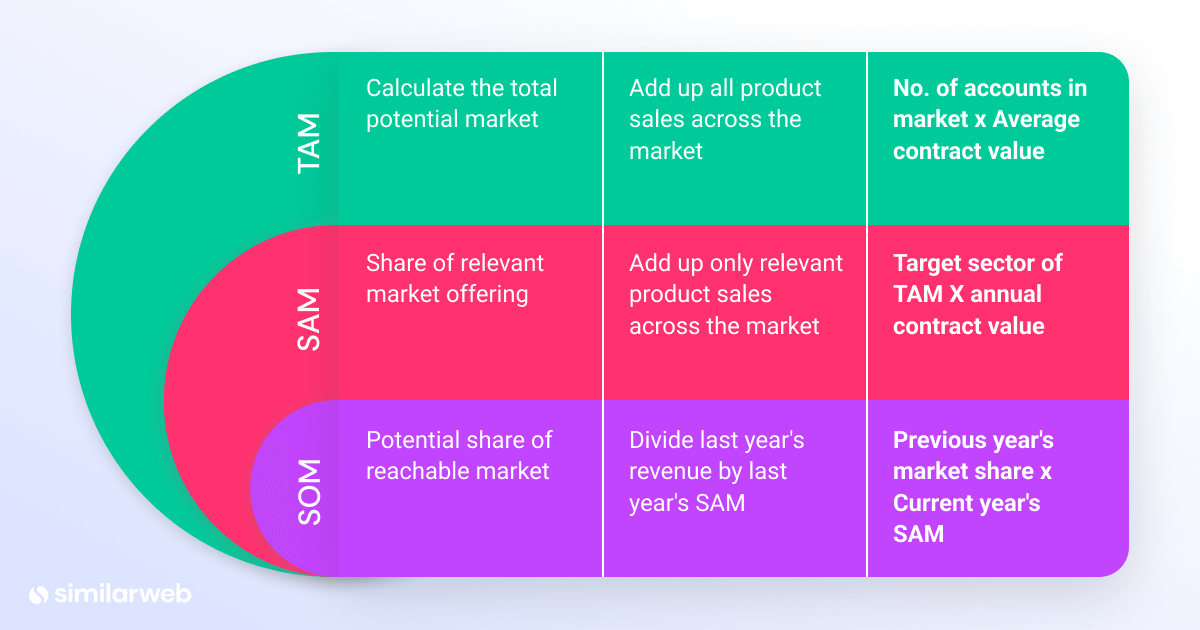

Total Addressable Market (TAM) – This gives you the complete value of the overall market and the first step in the market sizing process . Let’s say we want to analyze the US credit card market, the TAM would account for the whole of this market. Service Addressable Market (SAM) looks at potential audience volumes for a product or service in a target region. Sticking with the credit card sector example, this could be the total value of the credit card business that specifically targets the ‘poor credit rating’ segment of this market. Share of Market (SOM) – Also known as ‘service addressable market,’ it represents the proportion of your SAM that you are likely to achieve. SOM is always lower than SAM, taking a range of estimates based on the previous year’s performance or current market share + project growth to arrive at this figure.

Why: Market sizing helps businesses understand the size of their opportunity. By understanding the size and scope of a market, companies can better assess the potential profitability of the market. Tracking market share over time can also show who wins or loses at any given time.

Power-up Your Market Analysis with Similarweb Today

Market analysis example: market sizing

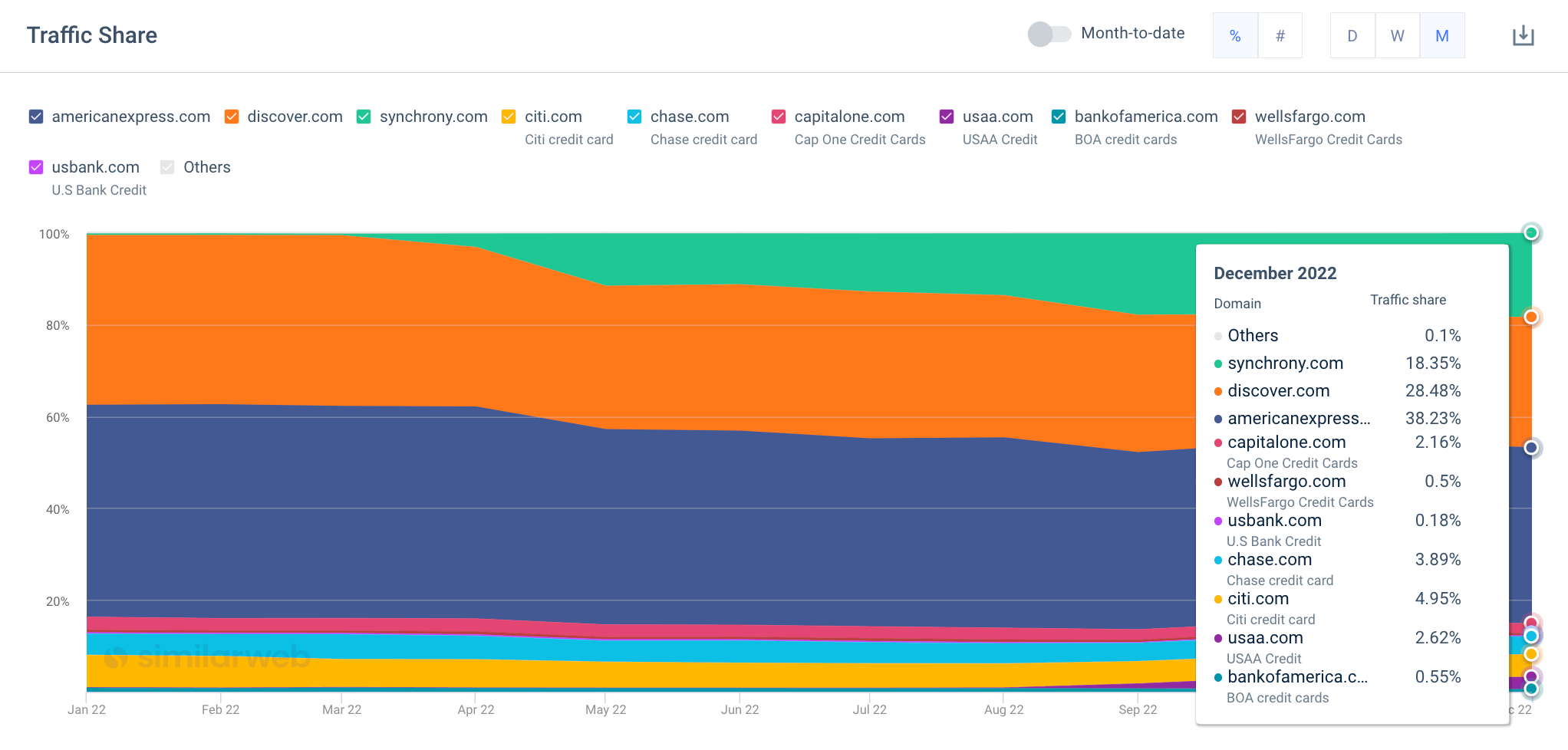

Using a metric known as traffic share , we can estimate the potential market size by showing the total reachable audience you have or could have with a product or service.

Using Similarweb Industry Analysis , I can see a real-time snapshot of my market’s performance. With it, I can see the total number of people in a market (unique visitors) and establish how much of that share I have or will target this year.

When sizing a market, it’s easy to fall into the habit of analyzing the market quarterly or annually. But often, the best insights are dynamic in nature. They appear to show shifts, sometimes unexpectedly or can indicate growth and changing behaviors as the year progresses. This is why we place a high emphasis on continuing a market analysis throughout the year.

Here, we’re looking at traffic share changes over time using Similarweb’s market trends. You can see the impact of Snychrony’s growth (in green) as they gain traction, along with USAA (purple). At the start of the year, these two players had no impact on the market. By the end of 2022, they’re showing gains and would be two key competitors to track when you reach step 4 of the market analysis process.

Those analyzing a market annually would miss out on key insights that show the rise of these two emerging players. At the end of the year, they’ve already grabbed a chunk of the market and, if they continue on the same trajectory, will continue to do so in 2023.

With the right tools, you get a dynamic view of the market data you need, allowing you to change tactics when markets shift.

Step 3 – Market trends

What: Reviewing current trends is key to any good market analysis. As we all know, trends can rise and fall at a moment’s notice. This is why this activity, in particular, is one you should routinely perform.

Why: Keeping a finger on the pulse can help you adapt and flex, at the right time, in the right way. Market trends give you insights into the current market situation and potential opportunities and challenges. Doing so can help you identify areas for growth, spot potential risks, and plan effective strategies. Market trends can also provide valuable information about customer preferences, competition, and economic and technological developments. By monitoring these trends, businesses can stay ahead of the curve and make informed decisions that will benefit their bottom line.

You may have heard about ChatGPT in the press ; this is an example of a highly-disruptive technology that has the potential to completely shift an entire market; many, in fact. It managed to gain over 1 million users within its first week on the market. And it’s a great example of why regular market trends analysis should occur.

How: There are lots of ways new market trends can surface. Consumer behavior , economic trends, technological advancements, and the competitive landscape can impact how markets behave. Legal and regulatory changes can also influence trends and changes too.

Staying up to date with industry news and legislation changes is useful. But it takes time, and it’s not always the most effective way to know when consumer sentiment changes.

Market research surveys are one way to understand customer attitudes and needs and how they shift over time. However, it’s not the most effective way to inform your market analysis. Particularly when you want real-time market intel.

Market analysis example: trend detection

Similarweb analyzes billions of data signals daily to deliver game-changing insights about any market, region, or individual company. So, as we look at how to do market analysis, I wanted to share a practical example of how clients use Similarweb to spot trends in a market.

Wonderbly , a global business, provides personalized books, serving over 6 million customers. To grow its business, it conducts regular market analysis. As part of this process, they analyzed seasonal trending keywords within Similarweb. Let’s look at what it found out and how it impacted the business.

Wonderbly was able to spot an emerging category (anniversaries and weddings) that was not currently catered for within its own product set. In addition to being able to capitalize on seasonal trends in its market, it achieved a 69% revenue in books purchased by a more mature demographic and a completely new audience for its business.

Read more: Wonderbly’s market analysis success story .

Step 4 – Competitive analysis

What: A competitive analysis involves collecting and reviewing data about key industry players, rivals, or emerging stars in your market. It unpacks and tracks their activities and successes, letting you see what’s working, how they go to market and the various marketing strategies they use to attract and retain customers.

Why: Regardless of your size or scope, understanding the competitive landscape is key. Your target audience knows your competitors and will likely size up the pros and cons of buying from thesm before considering whether to do business with you. A robust competitive analysis can help you refine your own offerings, make informed pricing decisions, show where you can beat out your rivals, and identify areas for improvement or diversification.

How: A tried and trusted tool for this process is the well-known SWOT analysis . It lets you map and view what and how each competitor takes its products to market. Considering things like pricing, positioning, marketing, services, and more. A competitive matrix is another tool used to visualize data about rivals in a market.

To do it, download our free competitive analysis framework . Then, pick five competitors in your market to track. Complete each section, and analyze the results to discover your biggest opportunities.

Step 5 – Develop strategies

What: Use the results of your market analysis to make data-driven decisions .

Why: When you read a post about how to do market analysis, the chances are you’ve got a goal in mind. Perhaps you want to explore a new market before deciding if it’s ripe for entry. You may want to introduce a new product or service or acquire an existing company. Whatever your goal is, ensure you put the insights and data you’ve obtained to good use.

How: Create a list of potential opportunities, then build strategies around each. Here, you might evaluate potential ideas based on project costs or timeframes. Once you’ve clearly mapped out each opportunity, and understand the potential impact it will have, along with associated costs and timeframes, you can think strategically about which ideas to move forward with from both a short and long-term perspective.

Pro Tip: Use a framework to record, capture, and review the data you’ve collected about market segmentation, size, trends, and key competitors. You can draw inspiration from our downloadable competitive analysis frameworks. However, what’s key is that you systematically record your findings and review them regularly.

Step 6 – Monitor the market

What: Keep track of your market and its key players; monitor changes over time.

Why: We know markets shift, whether they’re impacted by consumer behaviors, external factors, or something else. So, it’s important to monitor changes over time.

How: We may be a little biased, but Similarweb gives you a real-time bird-eye view of your market. Letting you dive into the details and unpick changes and tactics whenever you need. With it, you can track key growth metrics, marketing channels, emerging players, trending topics , and much more.

Using the Industry Analysis tab in Similarweb Research Intelligence , I can identify the market leaders and rising stars quickly. Here, I immediately see a company to track, Synchrony . As an emerging player showing exponential growth (2700%), I’ll take my market analysis a step further by investigating their successes later.

Similarweb shows me key insights, such as website traffic , the marketing channels it’s getting traffic from, audience demographics , geography , organic search insights, and more. As part of any good market analysis, the ability to spot rising players and unpack their successes can be crucial, particularly when they’re showing such growth.

Analyzing a market: Conclusions

Learning how to do market analysis is the first step. Aside from analyzing the results and making key strategic decisions, the ability to track changes over time is key. Similarweb makes it easy to segment, size, and analyze a market fast. With it, you can spot opportunities, benchmark your performance, and monitor shifts and changes as they happen, not a month or quarter later.

What are the 4 types of market analysis?

The four types of market analysis are market segmentation, market sizing, market trends, and competitive analysis.

What are the five components of market analysis?

The five components of market analysis are: customer segmentation , customer needs and trends, competitors, market size and trend, and pricing.

What makes a good market analysis?

A good market analysis should include accurate, up-to-date data, clear objectives, and a thorough market and customer needs analysis.

Is market analysis the same as a SWOT analysis?

No, market analysis and SWOT analysis are not the same. While a SWOT analysis evaluates an organization’s strengths, weaknesses, opportunities, and threats, a market analysis focuses on the external environment, such as customer needs, market trends, and competitors.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

Competitive Matrix Types: Which Is Right For You?

Nail Your Market Positioning: A Go-To Guide for Standing Out

Ecommerce Market Research: Your Secret Weapon for Online Success

A Guide to Market Research Terminology For Beginners

Consumer Profiling: Targeting Your Ideal Customer

Market Opportunities: How to Identify and Analyze Them

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

In accordance with international sanctions, the Semrush platform is no longer accessible to businesses registered or based in Russia. We’re sorry for the inconvenience and if you believe there is a mistake, please send us an email to [email protected] so our team can review.

- Search Search Please fill out this field.

What Is Market Research?

- How It Works

- Primary vs. Secondary

- How to Conduct Research

The Bottom Line

- Marketing Essentials

How to Do Market Research, Types, and Example

:max_bytes(150000):strip_icc():format(webp)/dd453b82d4ef4ce8aac2e858ed00a114__alexandra_twin-5bfc262b46e0fb0026006b77.jpeg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example CURRENT ARTICLE

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Joules Garcia / Investopedia

Market research examines consumer behavior and trends in the economy to help a business develop and fine-tune its business idea and strategy. It helps a business understand its target market by gathering and analyzing data.

Market research is the process of evaluating the viability of a new service or product through research conducted directly with potential customers. It allows a company to define its target market and get opinions and other feedback from consumers about their interest in a product or service.

Research may be conducted in-house or by a third party that specializes in market research. It can be done through surveys and focus groups, among other ways. Test subjects are usually compensated with product samples or a small stipend for their time.

Key Takeaways

- Companies conduct market research before introducing new products to determine their appeal to potential customers.

- Tools include focus groups, telephone interviews, and questionnaires.

- The results of market research inform the final design of the product and determine how it will be positioned in the marketplace.

- Market research usually combines primary information, gathered directly from consumers, and secondary information, which is data available from external sources.

Market Research

How market research works.

Market research is used to determine the viability of a new product or service. The results may be used to revise the product design and fine-tune the strategy for introducing it to the public. This can include information gathered for the purpose of determining market segmentation . It also informs product differentiation , which is used to tailor advertising.

A business engages in various tasks to complete the market research process. It gathers information based on the market sector being targeted by the product. This information is then analyzed and relevant data points are interpreted to draw conclusions about how the product may be optimally designed and marketed to the market segment for which it is intended.

It is a critical component in the research and development (R&D) phase of a new product or service introduction. Market research can be conducted in many different ways, including surveys, product testing, interviews, and focus groups.

Market research is a critical tool that companies use to understand what consumers want, develop products that those consumers will use, and maintain a competitive advantage over other companies in their industry.

Primary Market Research vs. Secondary Market Research

Market research usually consists of a combination of:

- Primary research, gathered by the company or by an outside company that it hires

- Secondary research, which draws on external sources of data

Primary Market Research

Primary research generally falls into two categories: exploratory and specific research.

- Exploratory research is less structured and functions via open-ended questions. The questions may be posed in a focus group setting, telephone interviews, or questionnaires. It results in questions or issues that the company needs to address about a product that it has under development.

- Specific research delves more deeply into the problems or issues identified in exploratory research.

Secondary Market Research

All market research is informed by the findings of other researchers about the needs and wants of consumers. Today, much of this research can be found online.

Secondary research can include population information from government census data , trade association research reports , polling results, and research from other businesses operating in the same market sector.

History of Market Research

Formal market research began in Germany during the 1920s. In the United States, it soon took off with the advent of the Golden Age of Radio.

Companies that created advertisements for this new entertainment medium began to look at the demographics of the audiences who listened to each of the radio plays, music programs, and comedy skits that were presented.

They had once tried to reach the widest possible audience by placing their messages on billboards or in the most popular magazines. With radio programming, they had the chance to target rural or urban consumers, teenagers or families, and judge the results by the sales numbers that followed.

Types of Market Research

Face-to-face interviews.

From their earliest days, market research companies would interview people on the street about the newspapers and magazines that they read regularly and ask whether they recalled any of the ads or brands that were published in them. Data collected from these interviews were compared to the circulation of the publication to determine the effectiveness of those ads.

Market research and surveys were adapted from these early techniques.

To get a strong understanding of your market, it’s essential to understand demand, market size, economic indicators, location, market saturation, and pricing.

Focus Groups

A focus group is a small number of representative consumers chosen to try a product or watch an advertisement.

Afterward, the group is asked for feedback on their perceptions of the product, the company’s brand, or competing products. The company then takes that information and makes decisions about what to do with the product or service, whether that's releasing it, making changes, or abandoning it altogether.

Phone Research

The man-on-the-street interview technique soon gave way to the telephone interview. A telephone interviewer could collect information in a more efficient and cost-effective fashion.

Telephone research was a preferred tactic of market researchers for many years. It has become much more difficult in recent years as landline phone service dwindles and is replaced by less accessible mobile phones.

Survey Research

As an alternative to focus groups, surveys represent a cost-effective way to determine consumer attitudes without having to interview anyone in person. Consumers are sent surveys in the mail, usually with a coupon or voucher to incentivize participation. These surveys help determine how consumers feel about the product, brand, and price point.

Online Market Research

With people spending more time online, market research activities have shifted online as well. Data collection still uses a survey-style form. But instead of companies actively seeking participants by finding them on the street or cold calling them on the phone, people can choose to sign up, take surveys, and offer opinions when they have time.

This makes the process far less intrusive and less rushed, since people can participate on their own time and of their own volition.

How to Conduct Market Research

The first step to effective market research is to determine the goals of the study. Each study should seek to answer a clear, well-defined problem. For example, a company might seek to identify consumer preferences, brand recognition, or the comparative effectiveness of different types of ad campaigns.

After that, the next step is to determine who will be included in the research. Market research is an expensive process, and a company cannot waste resources collecting unnecessary data. The firm should decide in advance which types of consumers will be included in the research, and how the data will be collected. They should also account for the probability of statistical errors or sampling bias .

The next step is to collect the data and analyze the results. If the two previous steps have been completed accurately, this should be straightforward. The researchers will collect the results of their study, keeping track of the ages, gender, and other relevant data of each respondent. This is then analyzed in a marketing report that explains the results of their research.

The last step is for company executives to use their market research to make business decisions. Depending on the results of their research, they may choose to target a different group of consumers, or they may change their price point or some product features.

The results of these changes may eventually be measured in further market research, and the process will begin all over again.

Benefits of Market Research

Market research is essential for developing brand loyalty and customer satisfaction. Since it is unlikely for a product to appeal equally to every consumer, a strong market research program can help identify the key demographics and market segments that are most likely to use a given product.

Market research is also important for developing a company’s advertising efforts. For example, if a company’s market research determines that its consumers are more likely to use Facebook than X (formerly Twitter), it can then target its advertisements to one platform instead of another. Or, if they determine that their target market is value-sensitive rather than price-sensitive, they can work on improving the product rather than reducing their prices.

Market research only works when subjects are honest and open to participating.

Example of Market Research

Many companies use market research to test new products or get information from consumers about what kinds of products or services they need and don’t currently have.

For example, a company that’s considering starting a business might conduct market research to test the viability of its product or service. If the market research confirms consumer interest, the business can proceed confidently with its business plan . If not, the company can use the results of the market research to make adjustments to the product to bring it in line with customer desires.

What Are the Main Types of Market Research?

The main types of market research are primary research and secondary research. Primary research includes focus groups, polls, and surveys. Secondary research includes academic articles, infographics, and white papers.

Qualitative research gives insights into how customers feel and think. Quantitative research uses data and statistics such as website views, social media engagement, and subscriber numbers.

What Is Online Market Research?

Online market research uses the same strategies and techniques as traditional primary and secondary market research, but it is conducted on the Internet. Potential customers may be asked to participate in a survey or give feedback on a product. The responses may help the researchers create a profile of the likely customer for a new product.

What Are Paid Market Research Surveys?

Paid market research involves rewarding individuals who agree to participate in a study. They may be offered a small payment for their time or a discount coupon in return for filling out a questionnaire or participating in a focus group.

What Is a Market Study?

A market study is an analysis of consumer demand for a product or service. It looks at all of the factors that influence demand for a product or service. These include the product’s price, location, competition, and substitutes as well as general economic factors that could influence the new product’s adoption, for better or worse.

Market research is a key component of a company’s research and development (R&D) stage. It helps companies understand in advance the viability of a new product that they have in development and to see how it might perform in the real world.

Britannica Money. “ Market Research .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

:max_bytes(150000):strip_icc():format(webp)/MLM-TAERM-ADD-SOURCE-16091bd51da945f28fbd9522f5a173d6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

IMAGES

VIDEO

COMMENTS

Market analysis is a detailed assessment of your business’s target market and the competitive landscape within a specific industry. This analysis lets you project the success you can expect when you introduce your brand and its products to consumers within the market.

Market research analysis is defined as the systematic process of collecting, processing, interpreting, and evaluating data related to a specific market, industry, or business environment. Learn more about market research analysis steps, benefits, and best practices.

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more.

Follow these six easy steps to learn how to analyze the market. See market analysis examples, tips, and guidance for how to do it right, and why it matters.

Market analysis is the process of collecting and analyzing information about your specific market. It involves speaking to your customers, analyzing competitors, and identifying industry trends. The result? You’re able to: Make better business decisions. Save time (and money) Create a better experience for your customers.

Market research examines consumer behavior and trends in the economy to help a business develop and fine-tune its business idea and strategy. It helps a business understand its target market by...