EdrawMind – Quick Mind Map

Easier, faster, and smarter

Best 10 BCG Matrix Examples for Students

Discover more helpful information.

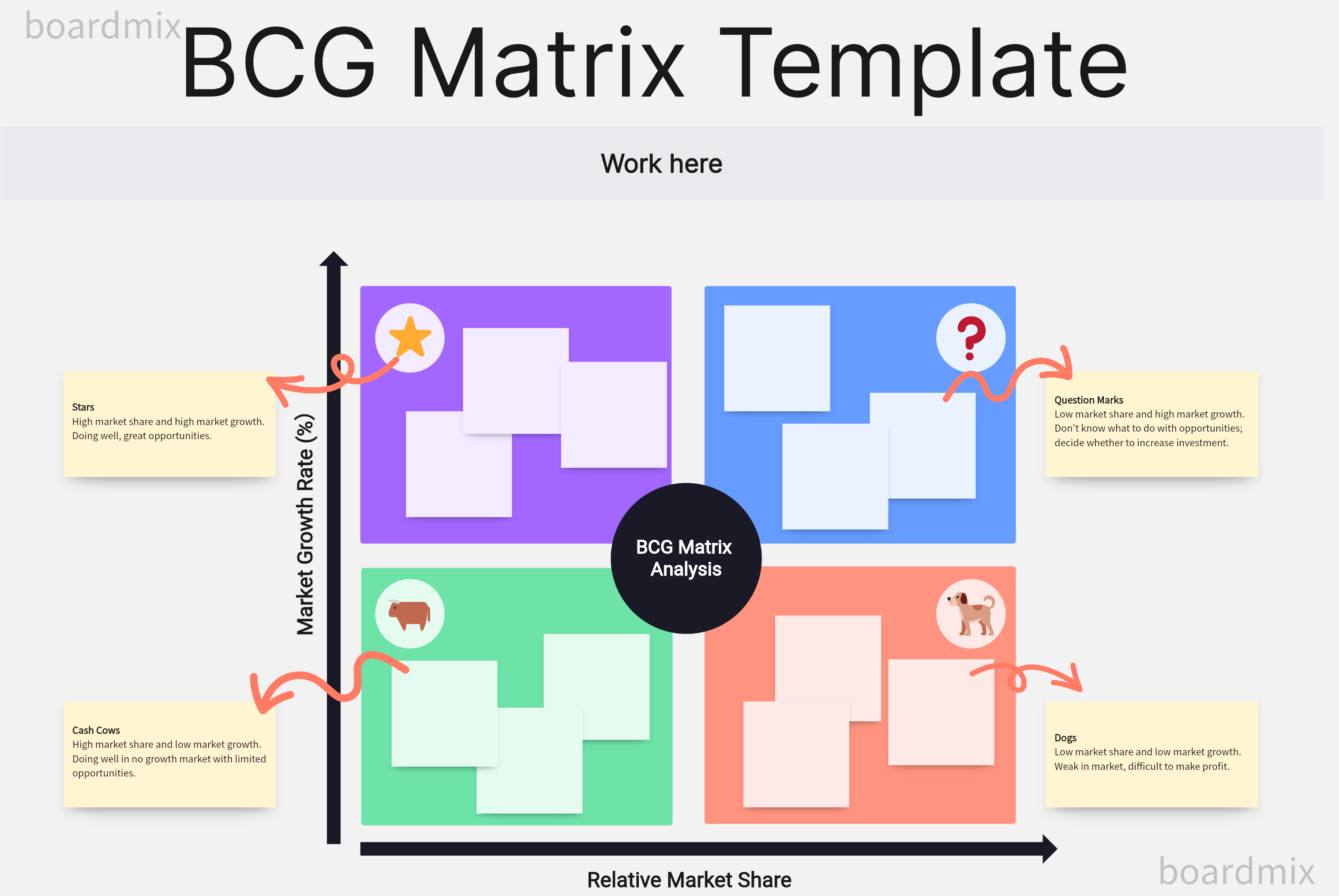

BCG Matrix is an apparatus utilized to incorporate methodology to break down specialty units or product offerings dependent on two factors: relative piece of the overall industry and the market development rate. By joining these two factors into a matrix, an organization can plot their specialty units as needs are and figure out where to dispense extra (financial) assets, where to money out, and where to strip.

The primary reason for the BCG Matrix is accordingly to settle on speculation choices on a corporate level. Contingent upon how well the unit and the business are doing, four different classification names can be credited to every group:

- Question Marks

This article covers every classification and how to utilize the BCG Matrix appropriately.

10 Examples of BCG Matrix (of famous companies)

The BCG Model depends on items as opposed to administrations, be that as it may, it applies to both. You could utilize this if checking on a scope of items, particularly before growing new ones. Here are the example list:

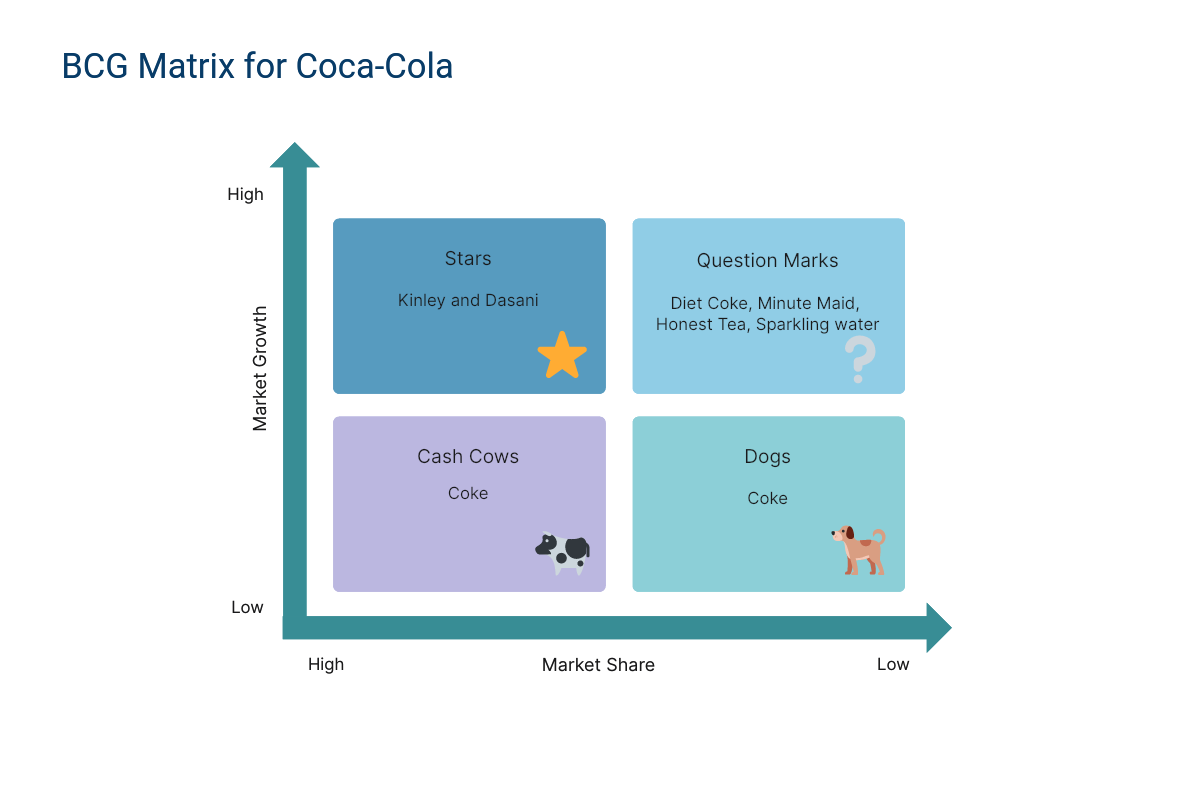

1. BCG Matrix of Coca-Cola

A world-driving ready-to-drink refreshment company, Coca-Cola Company has more than 500 soda pop brands, from Fuse Tea to Oasis to Lilt to Powerade. Yet, none of them is anyplace near the coke brand in terms of mindfulness, income, and benefit.

Stage 1. Choose the Product/Firm/Brand

We pick the firm Coca-Cola for investigation. Also, you need to identify the market, as the picked market is beverages, diet cokes, and mineral water.

Stage 2. Calculate Relative Market Share & Find out the Market Growth Rate

By and tremendous Growth rate in Coke is that it is no: in more than 200 countries.

Stage 3. Draw the Circles on a Matrix

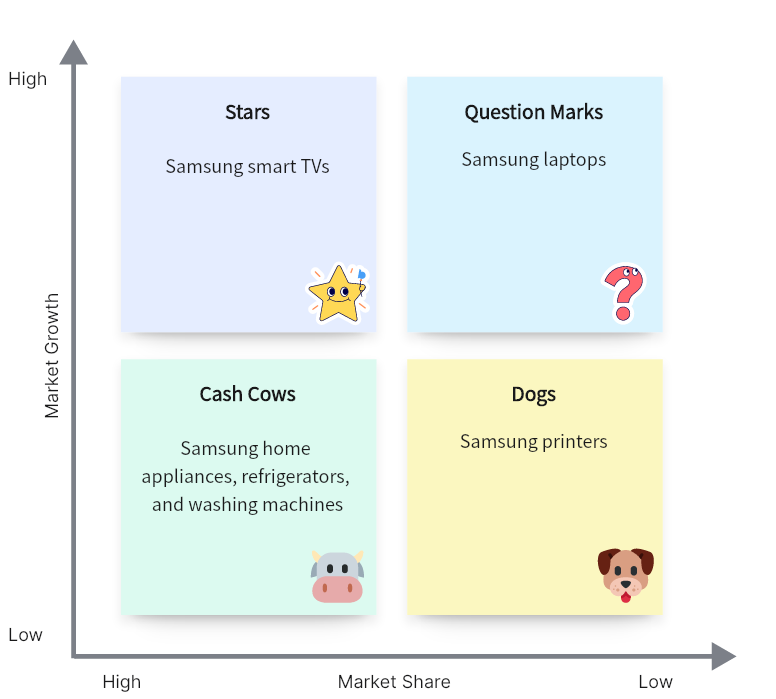

2. BCG Matrix of Samsung

Stage 1. choose the product/firm/brand.

We pick the firm Samsung for investigation.

The picked market is the consumer electronics industry which incorporates smartphones, computers, tablets, etc.

Stage 3. Calculate Relative Market Share

By and tremendous Growth rate in Samsung home appliances by making 60% of the sales.

Stage 4. Draw the circles on a matrix

3. BCG Matrix of L'Oréal

We pick the firm L'Oréal for investigation.

Stage 2. Identify Market

The picked market is the Cosmetics Industry, which essentially incorporates Skincare, Makeup, Haircare, Hair shading, and Fragrances.

Stage 4. Find out the Market Growth rate

By and tremendous Growth rate in Cosmetics Industry (starting at 2018) = 4.8%

Stage 5. Draw the circles on a matrix

Note: Just follow the above pattern with every example and BCG matrix you will be making for your class.

4. BCG Matrix of PepsiCo

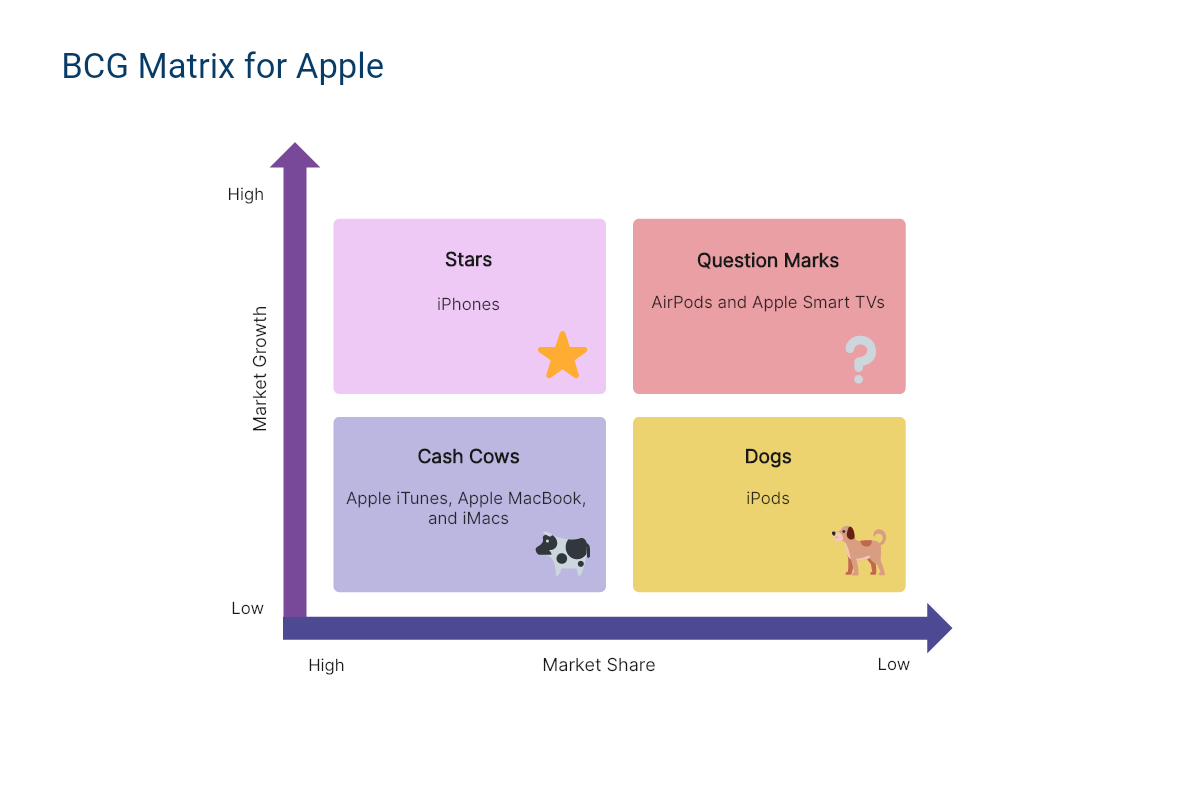

5. BCG Matrix of Apple

6. BCG Matrix of Nestle

7. BCG Matrix of Unilever

8. BCG Matrix of McDonalds

9. BCG Matrix of KFC

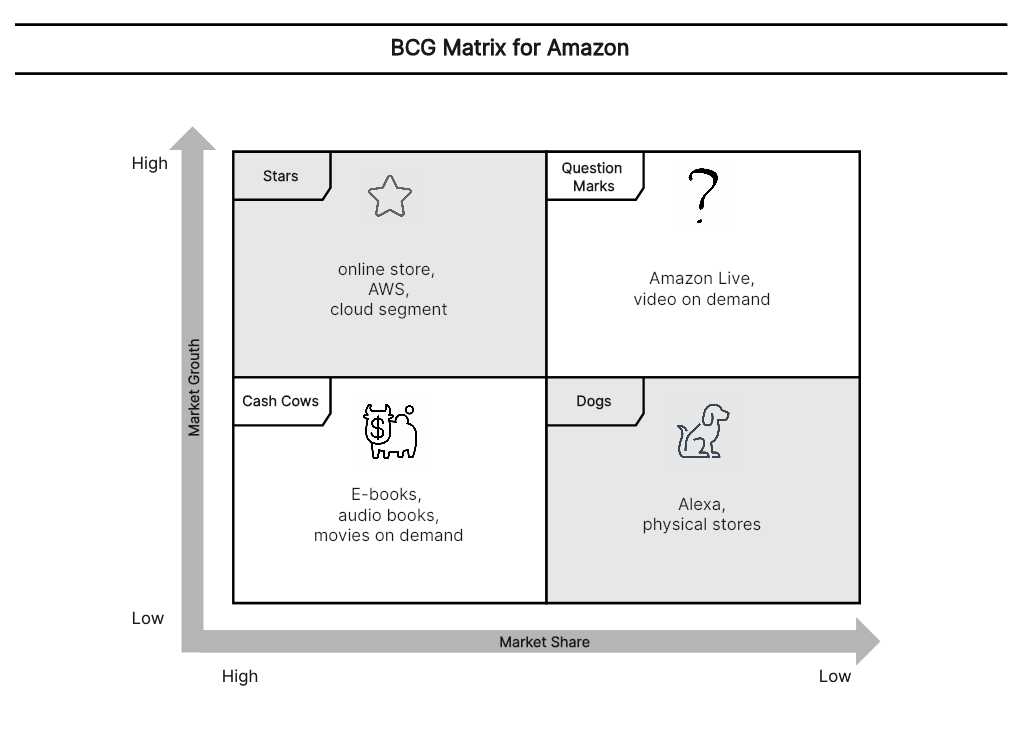

10. BCG Matrix of Amazon

What is BCG Matrix?

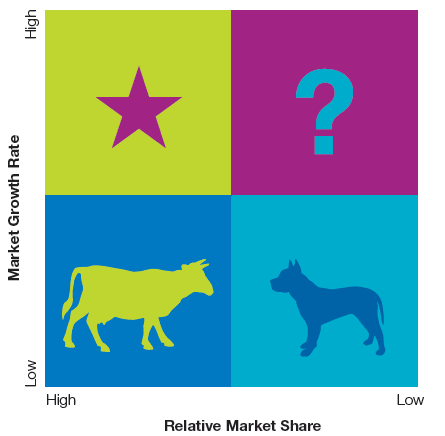

The Boston Consulting Group's item portfolio matrix ( BCG matrix ), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business to consider development openings by inspecting its arrangement of items to choose where to contribute to suspend or create things. It's otherwise called the Growth/Share Matrix. The Matrix is separated into four quadrants dependent on an investigation of market development and the relative peace of the overall industry.

It depends on the mix of market development and the overall industry comparative with the following best contender.

High Growth, High Market Share

Star units are pioneers in the classification. Items situated in this quadrant are appealing as they are located in a hearty class, and these items are exceptionally serious in the classification.

2. Question Marks

High Growth, Low Market Share

Like the name proposes, the future capability of these items is dubious. Since the development rate is high here, with the correct systems and ventures, they can become Cash cows and, at last, Stars if they have a flat piece of the overall industry so that off-base ventures can downsize them to Dogs significantly after loads of speculation.

3. Cash Cows

Low Growth, High Market Share

In the long run, if you are working for quite a while working in the business, advertising development may decay, and incomes deteriorate. At this stage, your Stars are probably going to change into Cash Cows. Since they despise everything that has a substantial relative piece of the overall industry in a deteriorating (developed) market, benefits and cash streams are relied upon to be high. As a result of the lower development rate, ventures required ought to likewise below. Along these lines, cash cows ordinarily produce cash in an overabundance of the measure of money expected to keep up the business. This 'overabundance cash' should be 'drained' from the Cash Cow for interests in different specialty units (Stars and Question Marks). Cash Cows eventually carry parity and security to a portfolio.

Low Growth, Low Market Share

Dogs hold a flat piece of the overall industry contrasted with contenders. Neither do they create cash, nor do they require huge cash. As a rule, the resources are not worth putting into because they create low or negative cash returns and may need enormous entireties of money to help. Because of the flat piece of the pie, these items face cost inconveniences.

How to Make a BCG Matrix Diagram?

So far, we realize products are ordered in four sorts. Presently we will see on what premise and how that order is done. We will comprehend the five procedures of improving a BCG matrix by making one for L'Oréal in the areas to follow.

Stage 1. Choose the Product

BCG matrix can be utilized to operate Business Units, separate brands, products, or firms as a unit itself. The decision of the group impacts the entire investigation. Along these lines, characterizing the unit is essential.

Stage 2. Define the Market

A mistakenly characterized market can prompt a weak characterization of products. For instance, if we investigate Daimler's Mercedes-Benz vehicle brand in the traveler vehicle market, it would wind up as a dog (it holds under 20% relative market share). However, it would be a cash cow in the extravagant vehicle market. Characterizing the market is a significant pre-imperative for a better understanding of the portfolio position.

Stage 3. Calculate the Relative Market Share

Market share is the level of the entire market taken into account by your company, estimated either in income terms or unit volume terms.

We utilize Relative Market Share in a BCG matrix, contrasting our product deals and the main adversary's sales for a similar product.

Relative Market Share = Product's business this year/Leading opponent's business this year

For instance, if your rival's market share in the vehicle business was 25% and your association's image market share was 10% around the same time, your relative market share would be just 0.4. The relative market share is given on the x-axis.

Stage 4. Find out the Market Development Rate

The business development rate can be effortlessly found through free online sources. It can likewise be determined by deciding the healthy income development of the leading firms. The market development rate is estimated in rate terms.

Market development rate was typically given side-effects (business this year – Product's business a year ago)/Product's business a year ago.

Markets with high development are ones where the total market share accessible is growing, so there are a lot of chances for all organizations to bring in cash.

Stage 5. Draw the Circles on a Matrix

Having determined the above measures, you have to plot the brands on the Matrix simply on EdrawMind desktop version. It has the premade templates for BCG. All you have to do is put up the data just like we did with every example.

The x-axis shows the relative market share, and the they-pivot shows the business development rate. You can plan a hover for every unit/brand/product, the size of which ought to relate to the extent of income created by it in a perfect world.

Taken these variables together, you can attract the perfect way to follow the BCG Matrix, from start-up to market pioneer. Question Marks and Stars should be financed with ventures produced with Cash Cows. What's more, Dogs should be stripped or exchanged to let loose cash with minimal potential and use it somewhere else. At long last, you will require a reasonable arrangement of Question Marks, Stars, and Cash Cows to guarantee positive cash streams later on.

Porter's Five Forces Analysis Definition and Examples

5 Whys Template

Several Mental Health Mind Maps to Improve Mental Wellbeing

Explain Acid Rain with Mind Maps - Causes & Effects

Solar System Planets - Everything in a Mind Map

BCG Matrix: Portfolio Analysis in Corporate Strategy

BCG Matrix (also known as the Boston Consulting Group analysis, the Growth-Share matrix, the Boston Box or Product Portfolio matrix) is a tool used in corporate strategy to analyse business units or product lines based on two variables: relative market share and the market growth rate. By combining these two variables into a matrix, a corporation can plot their business units accordingly and determine where to allocate extra (financial) resources, where to cash out and where to divest. The main purpose of the BCG Matrix is therefore to make investment decisions on a corporate level. Depending on how well the unit and the industry is doing, four different category labels can be attributed to each unit: Dogs, Question Marks, Cash Cows and Stars. This article will cover each of these categories and how to properly use the BCG Matrix yourself.

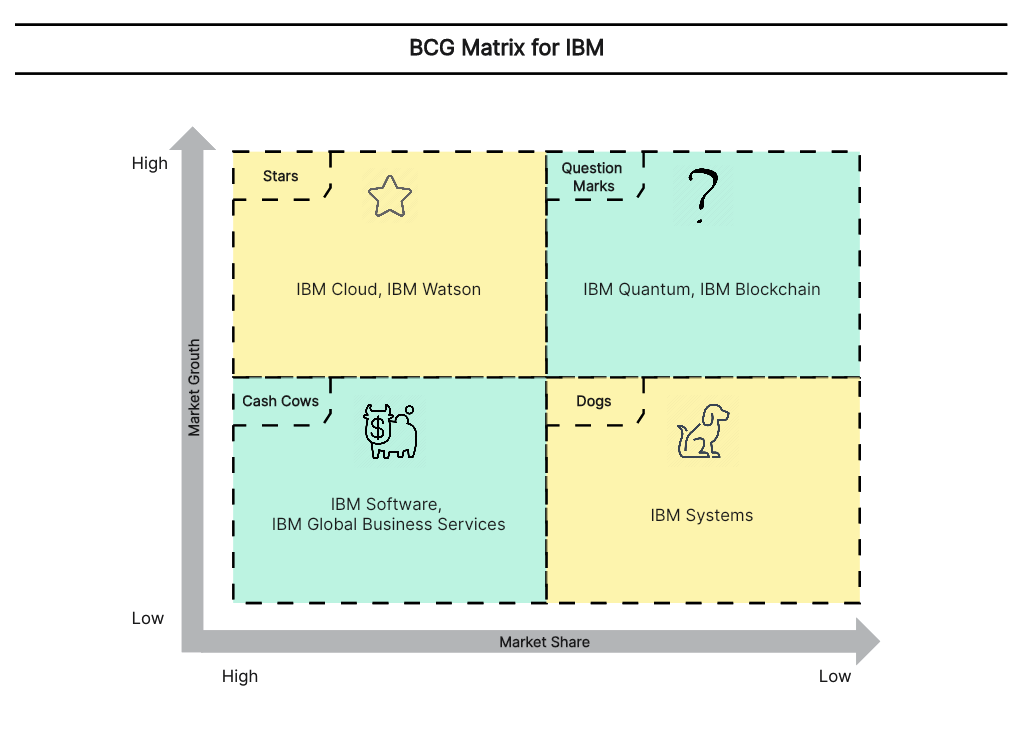

Figure 1: BCG Matrix

BCG Matrix Example: Samsung’s Product Portfolio

Samsung is a conglomerate consisting of multiple strategic business units (SBUs) with a diverse set of products. Samsung sells phones, cameras, TVs, microwaves, refrigerators, laundry machines, and even chemicals and insurances. This is a smart corporate strategy to have because it spreads risk among a large variety of business units. In case something might happen to the camera industry for instance, Samsung is still likely to have positive cash flows from other business units in other product categories. This helps Samsung to cope with the financial setback elsewhere. However even in a well balanced product portfolio, corporate strategists will have to make decisions on allocating money to and distributing money across all of those business units. Where do you put most of the money and where should you perhaps divest? The BCG Matrix uses Relative Market Share and the Market Growth Rate to determine that.

BCG Matrix Video Tutorial

Relative Market Share

The creator of the BCG Matrix used this variable to actually measure a company’s competitiveness . The exact measure for Relative Market Share is the focal company’s share relative to its largest competitor. So if Samsung has a 20 percent market share in the mobile phone industry and Apple (its largest competitor) has 60 percent so to speak, the ratio would be 1:3 (0.33) implying that Samsung has a relatively weak position. If Apple only had a share of 10 percent, the ratio would be 2:1 (2.0), implying that Samsung is in a relatively strong position, which might be reflected in above average profits and cash flows. The cut-off point here is 1.0, meaning that the focal company should at least have a similar market share as its largest competitor in order to have a high relative market share. The assumption in this framework is that an increase in relative market share will result in an increase in the generation of cash , since the focal company benefits from economies of scales and thus gains a cost advantage relative to its competitors.

Market Growth Rate

The second variable is the Market Growth Rate , which is used to measure the market attractiveness . Rapidly growing markets are what organizations usually strive for, since they are promising for interesting returns on investments in the long term. The drawback however is that companies in growing markets are likely to be in need for investments in order to make growth possible. The investments are for example needed to fund marketing campaigns or to increase capacity. High or low growth rates can vary from industry to industry, but the cut-off point in general is usually chosen around 10 percent per annum. This means that if Samsung would be operating in an industry where the market is growing 12 percent a year on average, the market growth rate would be considered high.

Question Marks

Ventures or start-ups usually start off as Question Marks . Question Marks (or Problem Children) are businesses operating with a low market share in a high growth market. They have the potential to gain market share and become Stars (market leaders) eventually. If managed well, Question Marks will grow rapidly and thus consume a large amount of cash investments. If Question Marks do not succeed in becoming a market leader, they might degenerate into Dogs when market growth declines after years of cash consumption. Question marks must therefore be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

Stars are business units with a high market share (potentially market leaders) in a fast-growing industry. Stars generate large amounts of cash due to their high relative market share but also require large investments to fight competitors and maintain their growth rate. Successfully diversified companies should always have some Stars in their portfolio in order to ensure future cash flows in the long term. Apart from the assurance that Stars give for the future, they are also very good to have for your corporate’s image.

Eventually after years of operating in the industry, market growth might decline and revenues stagnate. At this stage, your Stars are likely to transform into Cash Cows . Because they still have a large relative market share in a stagnating (mature) market, profits and cash flows are expected to be high. Because of the lower growth rate, investments needed should also be low. Cash cows therefore typically generate cash in excess of the amount of cash needed to maintain the business. This ‘excess cash’ is supposed to be ‘milked’ from the Cash Cow for investments in other business units (Stars and Question Marks). Cash Cows ultimately bring balance and stability to a portfolio.

Business units in a slow-growth or declining market with a small relative market share are considered Dogs. These units typically break even (they neither create nor consume a large amount of cash) and generate barely enough cash to maintain the business’s market share. These businesses are therefore not so interesting for investors. Since there is still money involved in these business units that could be used in units with more potential, Dogs are likely to be divested or liquidated.

Figure 2: Cash Flows and Desired Movement in BCG Matrix

BCG Matrix and the Product Life Cycle

The BCG matrix has a strong connection with the Product Life Cycle . The Question Marks represent products or SBU’s that are in the introduction phase. This is when new products are being launched in the market. Stars are SBU’s or products in their growth phase. This is when sales are increasing at their fastest rate. Cash Cows are in the maturity phase: when sales are near their highest, but the rate of growth is slowing down due to saturation in the market. And Dogs are in the decline phase: the final stage of the cycle, when sales begin to fall.

Figure 3: BCG Matrix and Product Life Cycle

BCG Matrix In Sum

Taken all of these factors together, you can draw the ideal path to follow in the BCG Matrix, from start-up to market leader. Question Marks and Stars are supposed to be funded with investments generated by Cash Cows. And Dogs need to be divested or liquidated to free up cash with little potential and use it elsewhere. In the end, you will need a balanced portfolio of Question Marks, Stars and Cash Cows to assure positive cash flows in the future. If you want to know more about HOW to spend these investments in order to grow a business unit, you might want to read more about the Ansoff Matrix . Besides the BCG Matrix, there are other portfolio management frameworks you might want to have a look at such as the GE McKinsey Nine Box Matrix .

Further Reading:

- Henderson, B. (1970). Growth-Share Matrix. BCG Perspectives.

- https://www.bcgperspectives.com/content/articles/corporate_strategy_portfolio_management_strategic_planning_growth_share_matrix_bcg_classics_revisited/

- https://www.bcg.com/publications/1970/strategy-the-product-portfolio.aspx

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on X (Opens in new window)

- Marketing Funnel: Visualizing the Customer Journey

- Value Chain Analysis: An Internal Assessment of Competitive Advantage

10 thoughts on “ BCG Matrix: Portfolio Analysis in Corporate Strategy ”

Simple, easy to follow and moreover Clear and Perfect presentation Sir.

impressing thank you so much……well articulated easily understandable tutorial/lecture.

Thank you, all the videos have helped me with my studies and progress in my MBA

Great videos, really helps

Great video it was really easy to follow!!

From ILOVEADIAN

This is a great video. Explained BCG matrix succinctly

Fantastic breakdown of the BCG matrix. greatly simplified!

What a powerful presantation of the BCG Matrix. You are simply the best.

Great website. It helps to add further clarity and more context to my textbook.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Best 15 BCG Matrix Examples for Students

Mackenzie Carter

Published on Sep 24, 2024, updated on Sep 24, 2024

What is the BCG matrix?

The Boston Consulting Group Matrix (BCG Matrix) is also called Growth/Share Matrix. As the name suggests, it is a framework for portfolio management used to prioritize different products. It was developed by the Boston Consulting Group in the 1970s and is widely used for strategic planning and decision-making regarding investment in competitiveness and market attractiveness.

The BCG matrix categorizes products or business units into four quadrants based on their market growth and relative market share. These quadrants are: Stars, Cash Cows, Question Marks (or Problem Children), and Dogs.

1) Stars -- High Growth, High Market Share

Stars units are leaders in the category. They have the potential to generate substantial returns and are considered strategic assets for the organization.

2) Cash Cows -- Low Growth, High Market Share

While Cash Cows operates in a matured market and may not have significant growth prospects, they generate stable and positive cash flow, contributing to the financial stability of the organization. Usually, these products finance other activities in progress (including stars and question marks).

3) Question Marks (or Problem Children) -- High Growth, Low Market Share

Since the development rate is high here, with the correct strategies and ventures, they can turn into Cash Cows and even Stars in the end. However, the low market share means that wrong investments can downsize them to Dogs significantly after loads of speculation.

4) Dogs -- Low Growth, Low Market Share

Dogs do not have strong prospects for growth or profitability and may drain resources from the organization. Businesses may consider divesting or discontinuing dogs if they are not strategically valuable.

How to Make a BCG Matrix Diagram?

The following shows the six basic processes of creating a BCG matrix diagram:

Step 1: Identify your products or business units

BCG matrix can be used to analyze Business Units, separate brands, products, or a firm as a unit itself. The choice of the unit impacts the whole analysis. So be careful to determine the products or business units that you want to analyze and classify.

Step 2: Define the market

An incorrectly defined market can lead to a poor classification of products. For example, Daimler’s Mercedes-Benz car brand would be considered a Dog if analyzed in the passenger vehicle market, but it would be a cash cow in the luxury car market.

Step 3: Calculate the relative market share

This can be calculated by dividing the company’s market share by the market share of the largest competitor in that particular market. Categorize them as high, medium, or low market share.

Relative Market Share = Product’s sales this year/Leading rival’s sales this year

Step 4: Find out the market growth rate

This can be done by analyzing industry data, market research, or internal sales data. It can also be calculated by determining the average revenue growth of the leading firms. The market growth rate is usually given by:

(Product sales this year – Product sales last year)/Product sales last year

Step 5: Draw the circles on a matrix

Having calculated the above measures, now you need to just plot the brands on the matrix. The x-axis shows the relative market share, and the y-axis shows the industry growth rate. You can plot a circle for each unit/brand/product, the size of which should ideally correspond to the proportion of revenue generated by it.

Step 6: Analyze and regularly update

Analyze the positioning of each product or business unit on the matrix. Develop appropriate strategies for each quadrant. Also, remember to regularly update and review the matrix to reflect changes in market conditions, performance, and strategies.

15 BCG Matrix Examples

Bcg matrix for coca-cola.

1) Stars: Kinley and Dasani

Bottled water brands Kinley and Dasani are Stars because they dominate the market in Europe and the US and show no signs of slowing down.

2) Question marks: Diet Coke, Minute Maid, Honest Tea, Sparkling water

With an aim to cater to the changing needs of consumers for zero calories and no-sugar drinks, the Coca-cola company has launched a number of products/brands to cater to the same. However, some products/brands are still in the initial/development phase of the product lifecycle and have a huge potential to grow. Diet Coke, Minute Maid, Honest Tea, and Sparkling Water are the few Question Mark products, as they appeal to a modest audience but still have room for growth.

3) Cash Cows: Coke

Coke for years has been a market leader in the carbonated soft drink segment and a major cash generator for the company. However, demand for carbonated soft drinks is declining, fueling a growing demand for healthier options or low-calorie drinks like Diet Coke.

4) Dogs: Coke

BCG Matrix for Apple

1) Stars: iPhones

Apple’s iPhones continue to generate excess profits, and the company dominates the growing smartphone market. Apple iPhones have a high stature because of their unique design and advanced technology. Also, the iPhone enjoys a loyal customer base that makes it beat all the competition in the booming mobile phone market.

2) Question marks: AirPods and Apple Smart TVs

Apple’s AirPods are growing extremely quickly but have yet to dominate the market. Likewise, Apple Smart TVs makes a little money but is still far from its true potential, and it can become a star if Apple can fix a few ecosystem issues.

3) Cash Cows: Apple iTunes, Apple MacBook, and iMacs

Once an innovative product, some products like Apple’s laptops are no longer in a fast-growing industry but generate healthy profits for the company. Over the years, these products have retained their market share and have increased cash flows for the company. Apple has a strong, loyal customer base that prefers Apple products exclusively.

4) Dogs: iPods

Apple’s iPods are considered dogs because they have lost their attraction due to high competition and low customer demand. They have now been cannibalized by its iPhones and should no longer receive further heavy investment.

BCG Matrix for Amazon

1) Stars: online store, AWS, and cloud segment

Amazon’s claim to fame is definitely its online store called Amazon.com. It continues to generate great ROI with a high growth rate. Amazon’s AWS and cloud segment is also showing growth potential, and the market is also becoming attractive.

2) Question marks: Amazon Live and video on demand

In the Amazon BCG matrix, video on demand and Amazon Live can become a question mark because of limited growth. However, they still have promising growth potential.

3) Cash Cows: E-books, audiobooks, and movies on demand

The E-books division is a lucrative cash cow for the company. Amazon has its native e-book reader called Kindle, and it has generated substantial ROI. Audiobooks and movies on demand also generate potential revenue and are in high demand from consumers.

4) Dogs: Alexa and physical stores

Amazon’s physical stores are the least competitive in terms of market share. They represent only about 0.015% of the market share, which is almost negligible. Besides, Amazon Alexa can also be categorized as a dog in the Amazon BCG matrix because its market is shrinking and showing negative market growth.

Reference: https://www.edrawmax.com/article/amazon-bcg-matrix-analysis.html

BCG Matrix for Samsung

1) Stars: Samsung smart TVs

Samsung smart TVs are quite competitive in this industry, continuing to gain traction as consumers demand more smart products. Mobile phones from Samsung also fall into this quadrant because the industry is still evolving. It is an industry developing fast with newer advancements in mobile computing devices.

2) Question marks: Samsung laptops

Samsung laptops fall in the question mark quadrant, owing to a poor reputation for unreliable battery life and basic design among their counterparts.

3) Cash Cows: Samsung home appliances, refrigerators, and washing machines

Samsung home appliances, refrigerators, and washing machines are the cash cows in its BCG matrix analysis, for they contribute to a significant share of the company’s revenue.

4) Dogs: Samsung printers

Samsung printers is a business that Samsung tried to push but has failed. The printers business was finally transferred to HP, which is a good choice because HP is one of the well-known printer brands.

Reference: https://www.financefied.com/education/bcg-matrix-example/

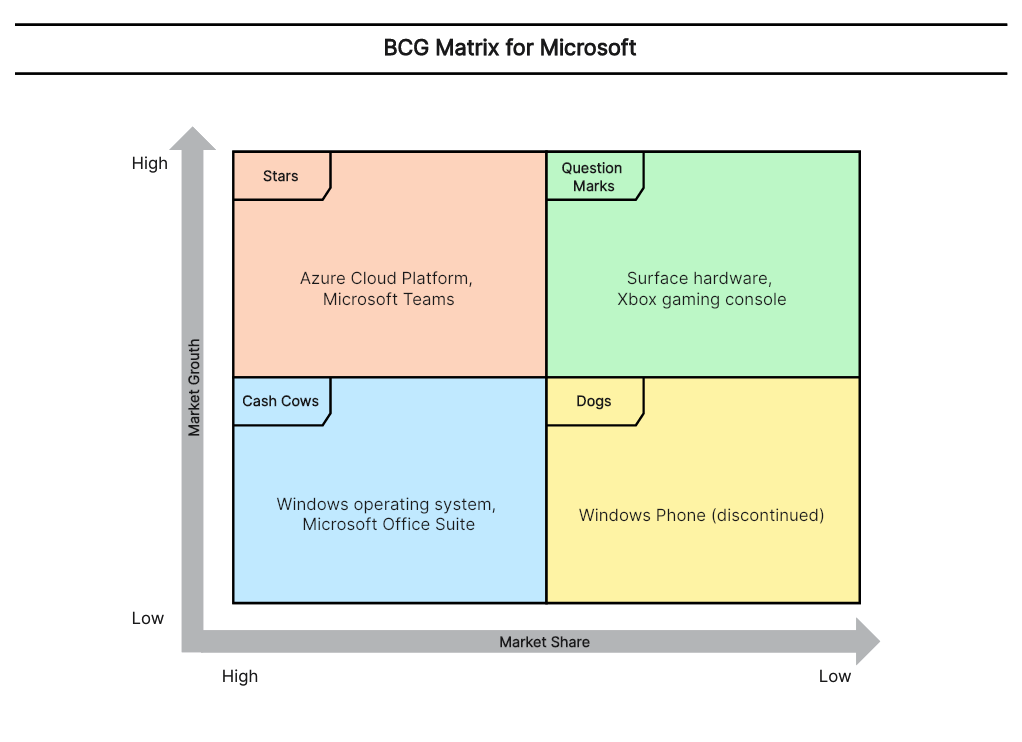

BCG Matrix for Microsoft

1) Stars: Azure Cloud Platform, Microsoft Teams

Azure is Microsoft’s cloud computing platform that offers a wide range of services, which has experienced significant growth and has a strong market position.

Microsoft Teams is a collaboration and communication platform that has gained significant traction, especially with the rise of remote work and virtual meetings. Its high growth potential has made it a central product in Microsoft’s portfolio.

2) Cash Cows: Windows operating system, Microsoft Office Suite

Windows is Microsoft’s flagship operating system that powers a vast majority of personal computers worldwide. While the growth of the PC market has slowed down, it continues to generate substantial revenue and profit as a mature and established product.

The Office Suite is widely used in business, education, and personal settings. As a dominant and well-established product, it generates steady cash flow for Microsoft.

3) Question Marks: Surface hardware, Xbox gaming console

While the Surface lineup (laptops, tablets, and hybrid devices) has gained recognition for its design and innovation, it faces strong competition in the hardware market. These products have the potential for growth but require further investment and market share expansion.

Xbox is Microsoft’s gaming console brand. Born in the highly competitive gaming console market, Xbox faces challenges from competitors such as Sony’s PlayStation, which has restricted its growth potential.

4) Dogs: Windows Phone (discontinued)

Microsoft discontinued its mobile hardware efforts, and the Windows Phone platform no longer receives active development or support.

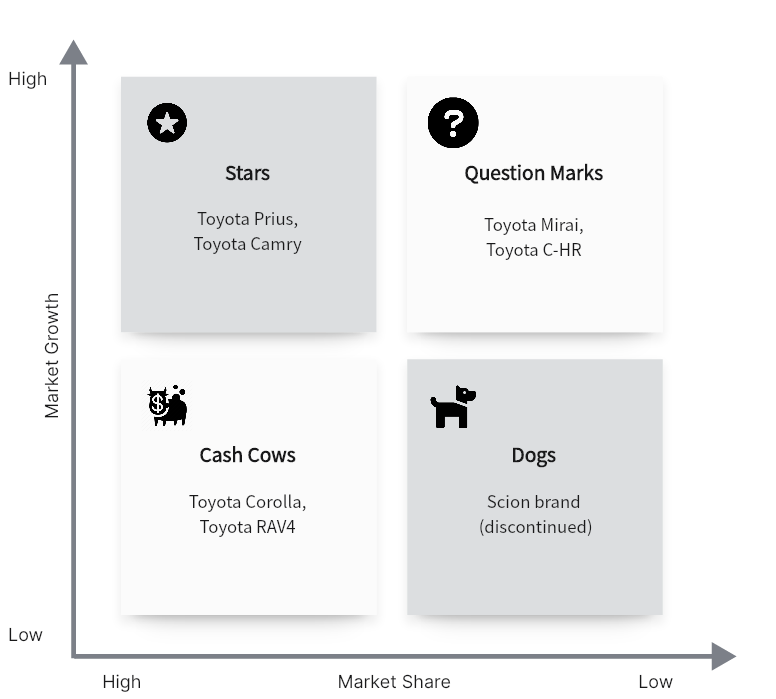

BCG Matrix for Toyota

1) Stars: Toyota Prius (hybrid cars), Toyota Camry (midsize sedans)

The Prius, known for its fuel efficiency and environmentally friendly features, has enjoyed significant market growth and has established a strong market share in the hybrid car segment. Toyota Camry, a popular midsize sedan known for its reliability, comfort, and fuel efficiency, has consistently performed well in the market.

2) Cash Cows: Toyota Corolla (compact cars), Toyota RAV4 (compact SUVs)

The Corolla is one of the best-selling compact cars globally, while Toyota RAV4 is a compact SUV that has gained popularity for its versatility, practicality, and fuel efficiency. They both enjoy a well-established market share and generate substantial cash flow for Toyota.

3) Question Marks: Toyota Mirai (hydrogen fuel cell vehicles), Toyota C-HR (compact crossover)

While Toyota Mirai is a technologically advanced and environmentally friendly option, the market for hydrogen fuel cell vehicles is still in its early stages. Besides, Toyota C-HR has shown promise with a distinctive design. Still, it is not impressive enough in the highly competitive compact crossover segment.

4) Dogs: Scion brand (discontinued)

Scion was a brand owned by Toyota that targeted younger demographics with compact and sporty vehicles. However, due to various reasons, Toyota has abolished the Scion brand. It represents a low-growth, low-market-share product that no longer exists in Toyota’s portfolio.

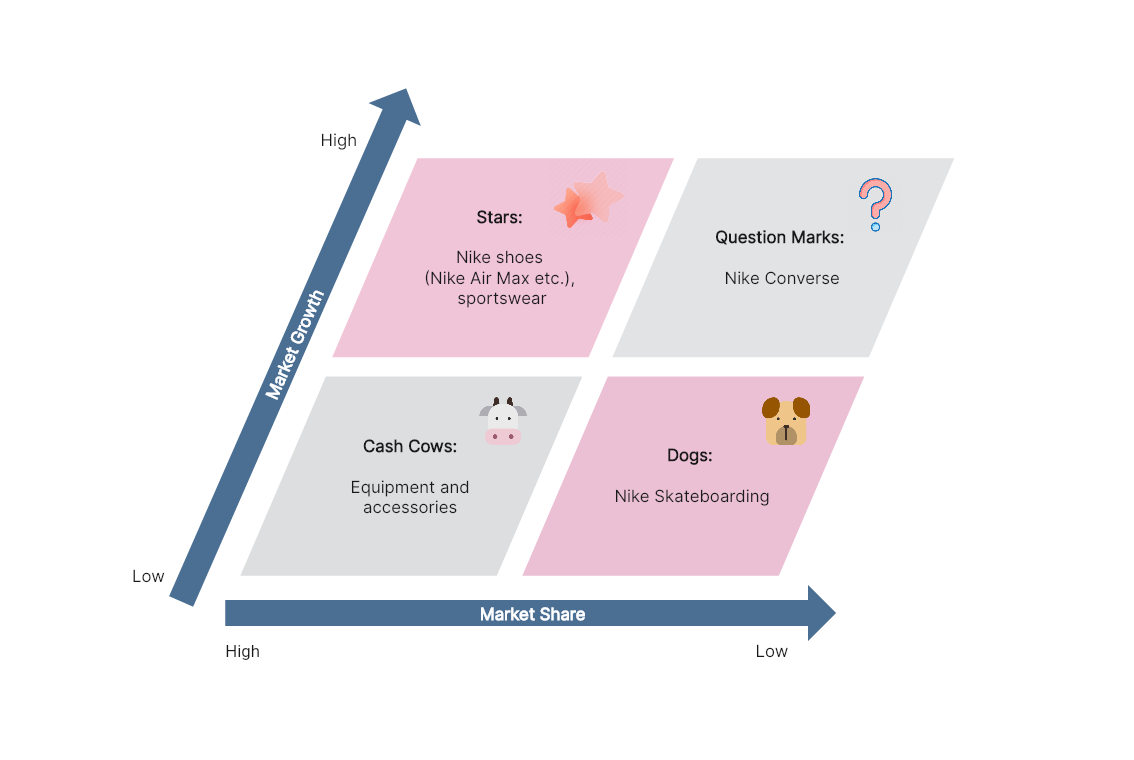

BCG Matrix for Nike

1) Stars: Nike shoes (Nike Air Max etc.), sportswear

Certainly, the leader of the Nike product portfolio is Nike shoes. However, due to the pandemic period, sportswear has become a star of the portfolio because there have been changes in the lifestyle of consumers.

2) Cash Cows: equipment and accessories

The equipment and accessories are Cash Cows for the Nike company. They generate cash to turn questioned products (dilemmas) into dairy cows.

3) Question Marks: Nike Converse

The Nike Converse product category can be found in the dilemmas. If Nike adopts effective and specific strategies, this product can be converted into a Cash Cows.

4) Dogs: Nike Skateboarding

Nike Skateboarding products fall in the dogs quadrant since these offerings are not very popular among the skateboarding community. However, the company continues to produce skateboarding shoes and clothing despite a large number of competitors.

Reference: https://awware.co/blog/bcg-matrix/

https://www.researchgate.net/figure/BCG-Matrix-for-Nikes-Portfolio_fig2_351123152

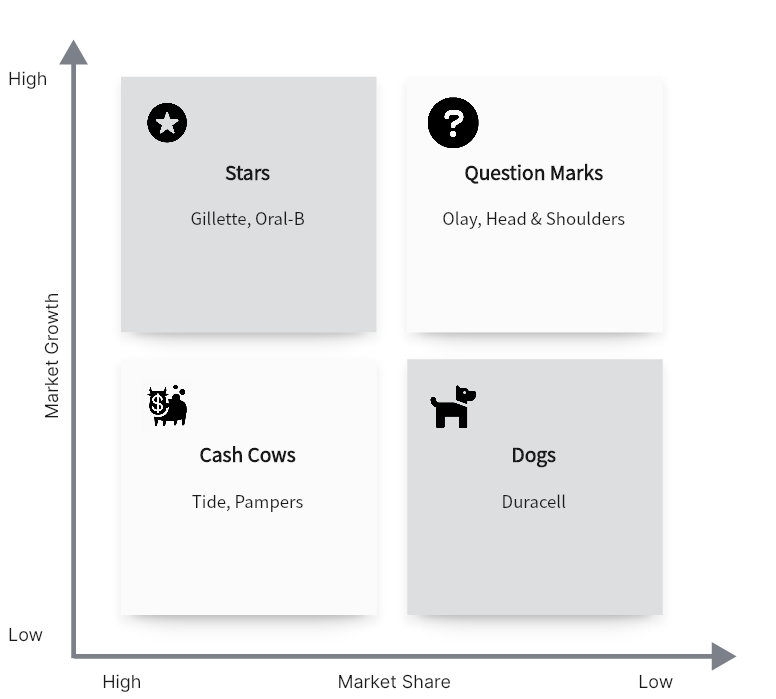

BCG Matrix for Procter & Gamble (P&G)

1) Stars: Gillette, Oral-B

Gillette is a well-established brand known for its shaving products, while Oral-B is a leading brand in the oral care market, specializing in toothbrushes and other dental products. They have experienced strong growth and have a significant market share.

2) Cash Cows: Tide, Pampers

Tide is one of P&G’s most successful brands, offering a wide range of laundry detergent products. Pampers is a leading brand in the baby care market, particularly known for its diapers. They enjoy a well-established market share and generate consistent cash flow for P&G.

3) Question Marks: Olay, Head & Shoulders

Olay is a skincare brand offering a variety of products, and Head & Shoulders is a popular brand in the hair care industry. While they have a strong presence, they face challenges in a competitive market.

4) Dogs: Duracell

Duracell is a battery brand that has a relatively low growth rate and market share compared to P&G’s other brands.

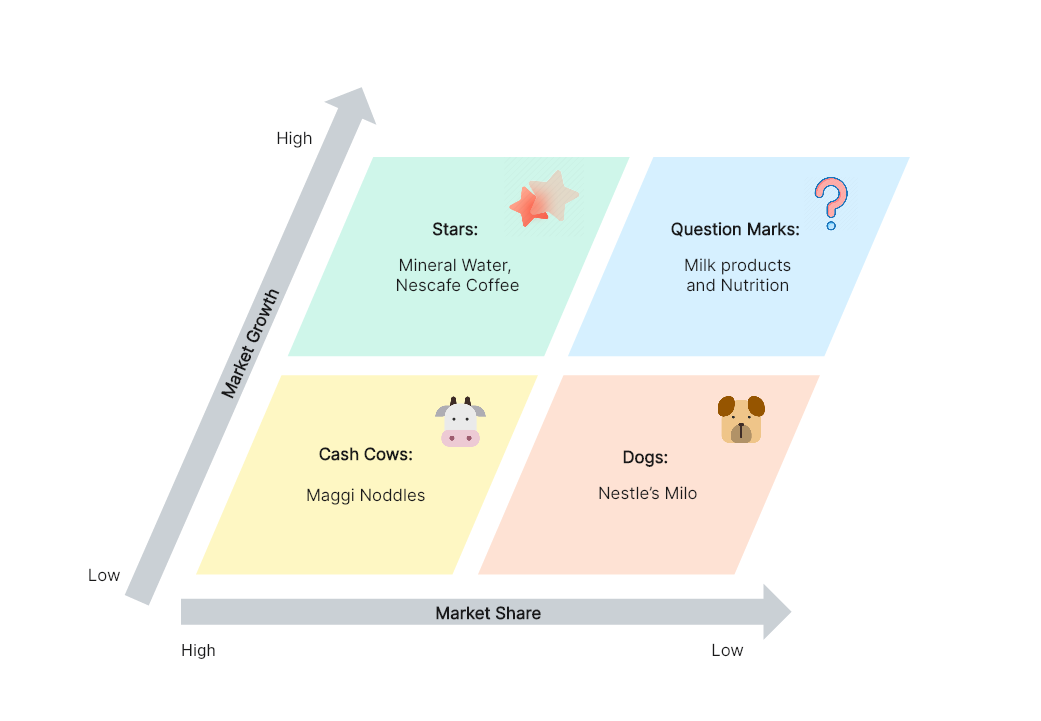

BCG Matrix for Nestlé

1) Stars: Mineral Water, Nescafe Coffee

Nestle’s Mineral Water and Nescafe Coffee (like Nescafe Latte) fall in the Star quadrant of the BCG Matrix of Nestle. With the growing number of health-conscious customers, these products have the potential to produce greater ROI later. Even though it might take heavy investment to make Nestle brand visible in that market, they may turn to cash cows in the short run.

2) Cash Cows: Nestle’s Maggi Noddles

With a market share of 80-85 %, Maggi Noddles holds a very strong hold in the market and have high customer loyalty. This product requires very less investment to maintain its market share and fight off any competition.

3) Question Marks: Milk products and Nutrition

Nestle Everyday, Nestlé Slim, and Nestlé Milk Maid are some of the milk and milk-based products from the house of Nestlé. Being in the phase of development, this domain needs a higher investment. And there is a high-risk decision to invest in them too.

4) Dogs: Nestle’s Milo

Nestle’s Milo was launched as chocolate and malt powder for milk and water; however, the product failed to create any significant impact on the business.

References: https://heartofcodes.com/bcg-matrix-of-nestle/

https://www.superheuristics.com/bcg-matrix-of-nestle-detailed/

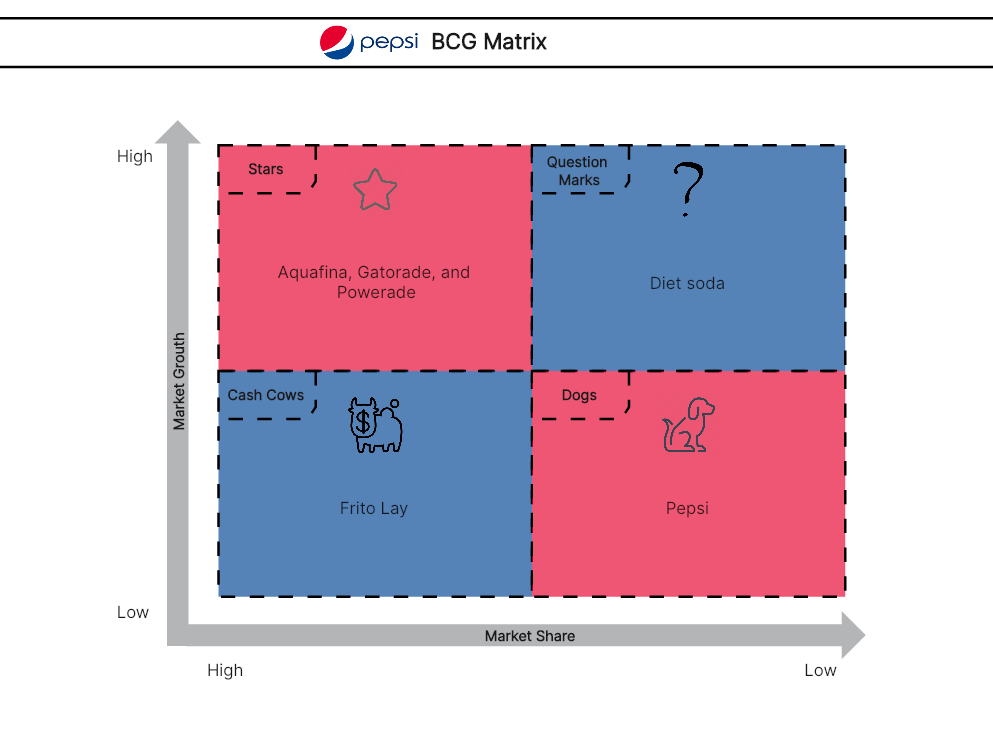

BCG Matrix for PepsiCo

1) Stars: Aquafina, Gatorade, and Powerade

Aquafina holds 15% of the bottled water market share and is second to Bisleri. The trend for carbonated drinks has decreased significantly as consumers move away from sugar-laden sodas. Gatorade is now the market leader in sports drinks, with 77% share of the market, up from 63% a year ago. Powerade has a 20% share of the market. With rising health trends and emerging markets, the brand is investing huge amounts of money into healthier foods and beverages, making a bigger dent in the soft drink category.

2) Cash Cows: Frito Lay

Frito-Lay has a dominant 72.4% market share in the chip segment, but its main competitors are Doritos with 7% and Tostitos with 8.7%. The product requires a little investment to maintain its market share, as its sales don’t fluctuate significantly with new products.

3) Question Marks: Diet soda

Not many people associate the term “Diet soda” with PepsiCo. The company launched Diet Pepsi to take back a portion of the market share it had lost to Coca-Cola and recapture the consumers’ attention. In its initial launch, Diet Pepsi captured just 5 percent of the market, but soon after, it began losing market share to Coca-Cola’s diet version.

4) Dogs: Pepsi

The present and future trends suggest that Pepsi will shift from Star to the Dog quadrant. The segment share of Pepsi has dropped from 10.3% to 8.4% due to increasing demand for low-calorie and healthy beverages and snacks.

Reference: https://www.edrawmax.com/article/pepsi-bgc-matrix.html

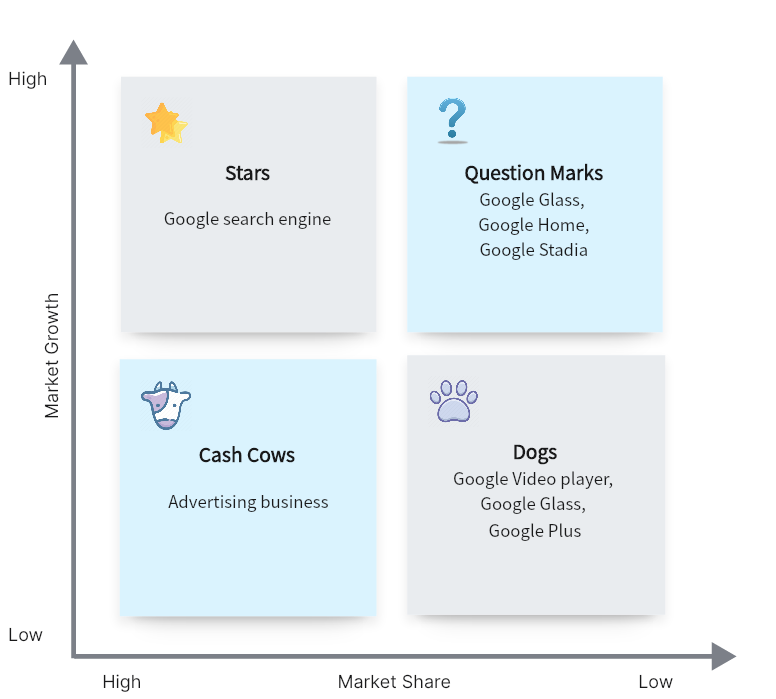

BCG Matrix for Google

1) Stars: Google search engine

For Google, its star product would be its search engine, which is the company’s flagship product and has a dominant market position in the search engine industry.

2) Cash Cows: Advertising business

For Google, its cash cow product would be its advertising business, which is a major source of revenue for the company. The advertising business generates high revenue for the company but does not require much investment to maintain its market position.

3) Question Marks: Google Glass, Google Home, and Google Stadia

The newer ventures such as Google Glass, Google Home, and Google Stadia may be counted as Google’s question mark products. They are new products and services that require significant investment to improve their market position but have the potential to become stars or cash cows for the company in the future.

4) Dogs: Google Video Player, Google Glass, and Google Plus

The popularity of YouTube is part of the reason why Google video player failed to get income. Another example, Google Glass was a product whose “target problem” wasn’t chalked out properly. Also, Google Plus was another example of such failure that couldn’t keep up with the competition.

Reference: https://heartofcodes.com/bcg-matrix-of-google/

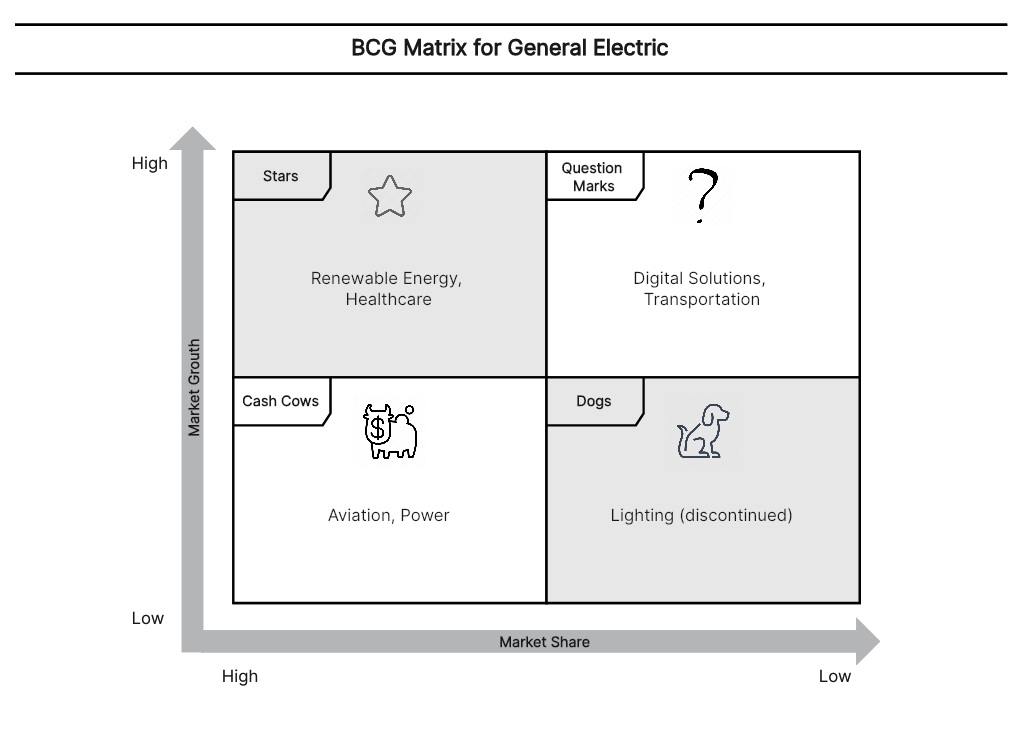

BCG Matrix for General Electric (GE)

1) Stars: Renewable Energy, Healthcare

This business unit encompasses GE’s offerings in the renewable energy sector. With the increasing focus on clean energy and sustainability, this segment has experienced significant market growth and has established a strong market share. GE’s healthcare division includes medical equipment and solutions. Likewise, this segment has seen substantial growth due to the growing demand for advanced healthcare technologies and equipment.

2) Cash Cows: Aviation, Power

GE’s aviation business is known for its jet engines and related services. The aviation industry has a consistent demand for aircraft engines and maintenance services. The power division focuses on gas turbines and related products for power generation. This segment also has a strong market position and generates substantial cash flow for the company.

3) Question Marks: Digital Solutions, Transportation

GE’s digital solutions and transportation division have the potential for growth, while at the same time, they also face challenges in the competitive market.

4) Dogs: Lighting (discontinued)

GE had a lighting division that was involved in manufacturing and selling lighting products. However, the company decided to exit this business, and it is no longer a part of GE’s portfolio.

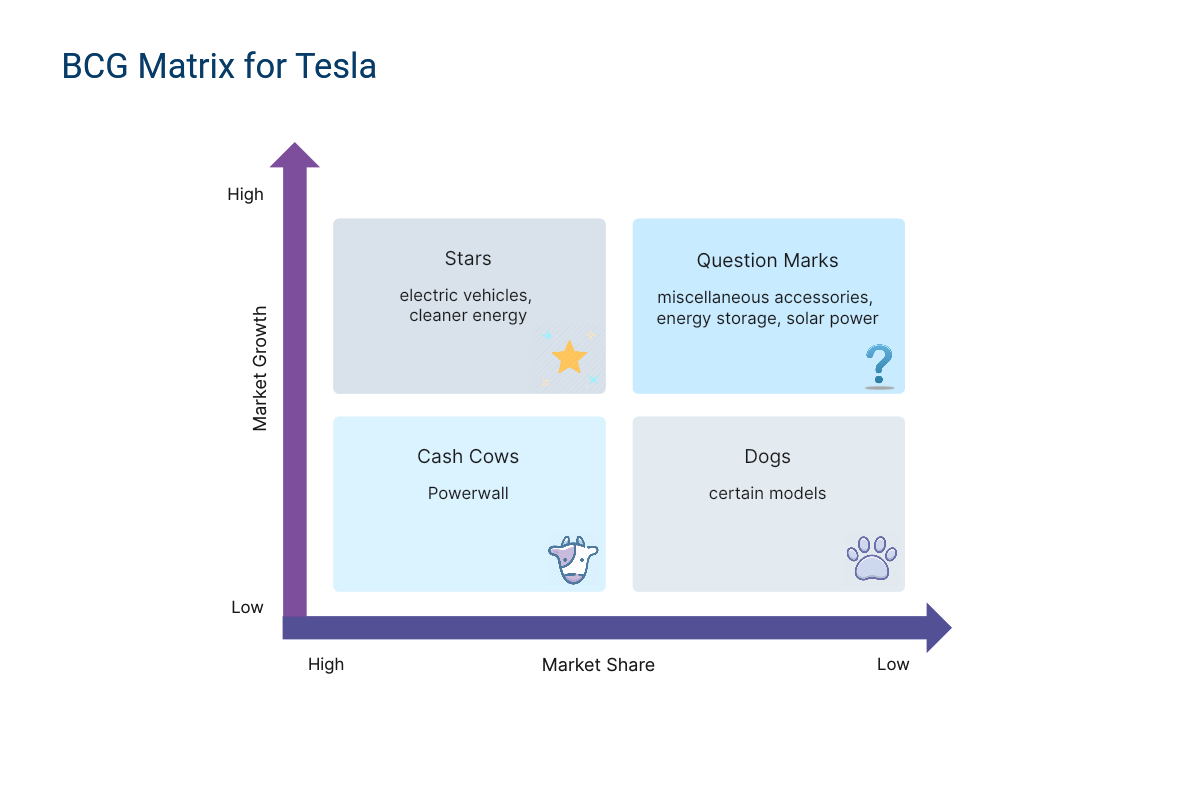

BCG Matrix for Tesla

1) Stars: electric vehicles, cleaner energy

Tesla is indeed a leader in the sustainability industry, and all of its products and services are focused on a healthier environment. The three series is the latest vehicle that has been released and has proven to be the most popular with consumers.

2) Cash Cows: Powerwall

This is the case for all other vehicle models, which require little investment. The Powerwall also falls into this category. This battery can be used in domestic settings.

3) Question Marks: miscellaneous accessories, energy storage, and solar power

The dilemmas faced by the company include miscellaneous accessories, energy storage, and solar power. Competition in these markets is very high, so it is difficult to differentiate yourself over the long term. Ecology remains a niche market in today’s world that interests more and more players. These services require larger investments to be profitable.

4) Dogs: certain models

It is possible to highlight the manufacturing complication of certain models, which can largely compromise consumer orders, especially since the competition is becoming increasingly fierce.

Reference: https://www.oboolo.com/blog/our-tips/tesla-bcg-matrix-02-03-2022.html

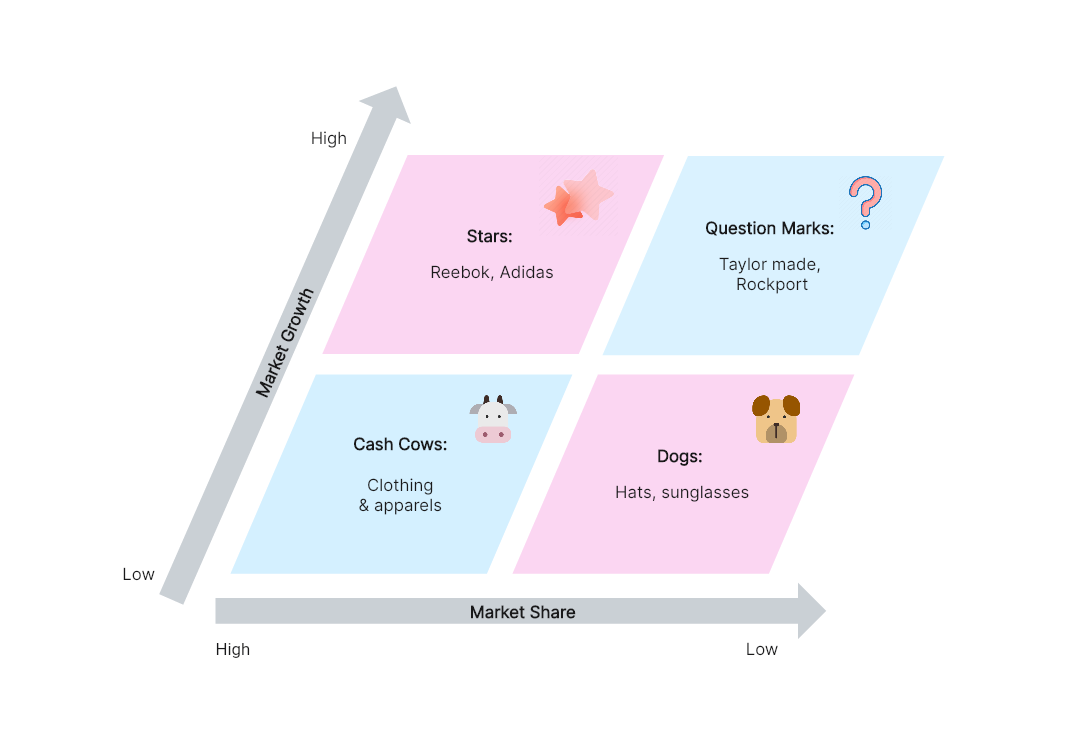

BCG Matrix for Adidas

1) Stars: Reebok, Adidas

For the Adidas group, Reebok and Adidas are the stars, as both have the stronger market share, despite of the tough competition they are facing in the fitness and sports industry, mainly its shoes.

2) Cash Cows: Clothing and apparels

For Adidas, its clothing and apparels are the cash cow items, and Adidas must consider this point, and position itself well in customers’ minds by targeting different geographic markets

3) Question Marks: Taylor Made, Rockport

Taylor Made and Rockport are the question marks for Adidas, as both have very low market shares but still possess the potential to grow more in the competitive market. Adidas needs to revise its strategies for turning potential into benefits for the strategic objective of the Group.

4) Dogs: Hats, sunglasses

The hats and sunglasses of Adidas are categorized in this quadrant because these are the least-selling items of the company, and many people are not interested in spending their money on them, as they have better options in this category.

Reference: https://bcgmatrixanalysis.com/bcg-matrix-of-adidas/

BCG Matrix for IBM

1) Stars: IBM Cloud, IBM Watson

IBM’s cloud computing services have shown significant market growth and have established a strong position in the cloud market. In addition, IBM’s Watson AI platform has demonstrated rapid growth and has become a prominent player in the field of artificial intelligence.

2) Cash Cows: IBM Software, IBM Global Business Services

IBM offers various software solutions, such as enterprise software and analytics, which generate steady cash flow for the company. Besides, IBM’s consulting services have a well-established market share and provide consistent revenue and profitability for the company.

3) Question Marks: IBM Quantum, IBM Blockchain

The company is actively involved in quantum computing research and development, representing a high-potential but uncertain market segment. Also, its blockchain technology has potential growth opportunities, although the market is still evolving, and its long-term potential is uncertain.

4) Dogs: IBM Systems

IBM’s hardware division, including servers and mainframes, represents a low-growth, low-market-share product category in comparison to their other offerings.

How to Prepare for an AI Interview (Competency Test)

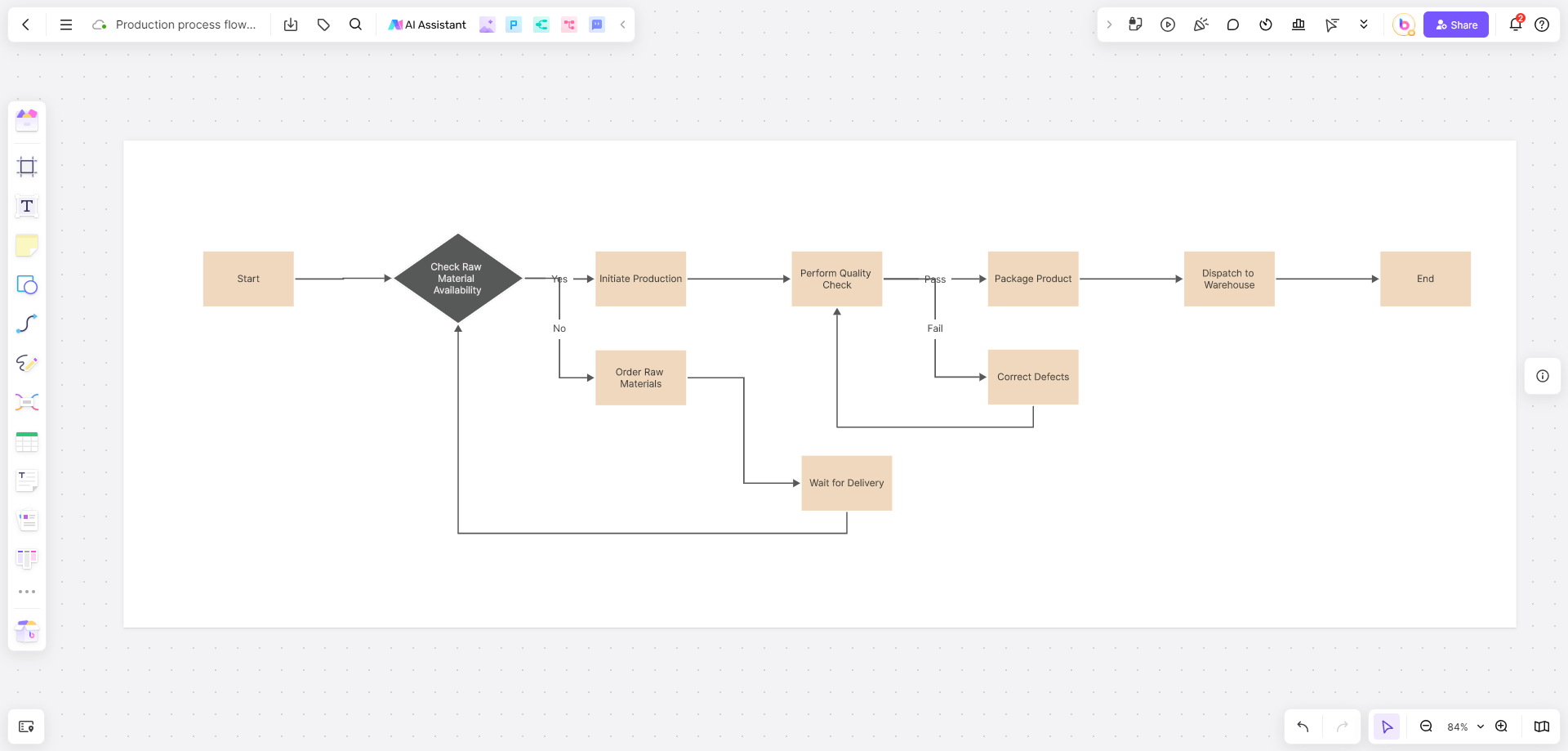

What are Production Process Flow Charts and How to Create One

How Can Interactive Digital Whiteboards Revolutionize Your Collaboration?

Text for Mobile

What is the BCG Matrix? Definition, Example, Template and Guide

How to use the bcg matrix model for your organization or business.

The ‘Boston Consulting group’s ‘abbreviation is the BCG matrix. This BCG matrix is designed to help long-term strategic planning for the benefit of the business and its growth opportunities by means of a review of its product portfolio to decide on the most suitable investment to obtain maximum Return on Investment. This also determines about discontinuing as well as developing products. It is also named the Growth Share Matrix.

How Do You Prepare a BCG Matrix?

BCG matrix is prepared by executing the following steps:

Step 1: Selection of the Product:

BCG matrix is utilised for this purpose by:

- Analysis of Business Units,

- Separation of brands, products or considering an organisation as a unit

Step 2: By defining and market study

Step 3: By comparison and by calculation of the relative market share

Step 4: a study of the market growth rate.

Step 5: Draw the circles on a matrix.

What Are the Four Categories of BCG MATRIX?

It is primarily based on planning in a portfolio-dependent study and observation. So, a company’s business units can be classified into four categories:

- Question Marks

It is necessary to conceptualise better the above four processes related to the BCG matrix by making one for L’Oréal in the following sections.

How Do You Find a BCG MATRIX?

By following the steps indicated below, you can find a BCG matrix.

Step 1: Induction of BCG Matrix.

Step 2: Reach the Ribbon > Insert > Other Charts and click Bubble Chart.

Step 3: Change X-axis values.

Step 4: Click Edit to change the source of data.

Step 5: Change series X values.

Step 6: Selection of Relative Market Share values.

Step 7: Your BCG Matrix chart is a bit changed.

How to Find Market Growth Rate?

The growth rate of industries can be easily estimated using free online resources. Alternatively, it can be calculated by counting the reputed companies’ average growth rate of revenue. Usually, the Market growth rate is represented in percentage terms.

The market growth rate is usually estimated by the formula stated below:

(Product’s sales in the current year – Product’s sales of the previous year)/Product sales last year

High growth-rated markets are the ones where the total market share gained is expanding; this results in many advantages for all companies in gaining monetary profit.

Step 5: Drawing the Circles over a Matrix

After the above calculation, it needs only to plot the brands on the matrix. The x-axis represents or shows the relative market share, and the y-axis indicates the company’s growth rate. A similar circle can be plotted for each unit, brand, and Product, and the size of which must correspond ideally to the company’s revenue.

What do the Question Marks Signify In the BCG Matrix?

The feature of question marks represents a business to have high growth prospects but a low share in the market. They consume a significant amount of cash but with little return. Ultimately, ‘question marks ‘lose money. However, as these business units increase, they have the potentiality to upgrade into stars by entering a higher growth-oriented market.

How to Use a BCG Matrix?

After defining four categories of the BCG market, we can review the strategies of the company by using each category as discussed below:

Stars: The location of the products in this quadrant is highly attractive as they are located in a robust category, and these products are highly competitive. A huge potential has been found in this category for high revenue growth. This is due to its high market share and high growth rate. It is expensive to develop but is worth investment for promotion to the long extent of its Product Life Cycle. In the event of its success, a star may be a cash cow in the event of maturity, assuming they keep the same market share unchanged.

Strategic Choices, As Indicated Below:

- Vertical Integration,

- Horizontal Integration,

- Market Penetration,

- Market Development, And

- Product Development

Question Marks: Most businesses start as question marks. Huge investments are necessary to achieve or protect market share. The question mark sector has the potential to become stars category and ultimately c ash cows but can also become dogs or exits. It requires high Investments for question marks; otherwise, this categor y may result in negative cash flow.

Like stars, the category of Question also does not always succeed; if, after a large investment, they cannot fetch profit and gain market share, they become the dog category. Therefore, careful observation and review are necessary before investing in this category.

Strategic Choices Are The Follows:

- Market Development,

- Product Development,

- Process of Investment.

Cash Cows: In this category, cash generates profits by investing as little cash as possible. It needs low-cost support and needs to be managed for continued profits & cash flow. Large corporate or SBUs are considered efficient and innovative and should have the potential to become stars. It requires maintaining a healthy market status and should defend the market share of the business house or investors. The company should take advantage of sales volume and leverage the size of its operations. It can support other businesses too.

Strategic Choices: Product Development, Diversification

Dogs: Low market share makes it a face of cost disadvantages, so they need enough cash to reach break-even, but they are rarely, if ever, worth investing. This Dog sector should be liquidated if there are fewer prospects for gaining market share. This is at a declining stage of the Product Life Cycle, requiring a minimum number of dogs in the company.

Advantages of BCG Matrix

- It is simple and easily understood.

- It can quickly and merely show the opportunities open to you,

- This can identify how corporate cash resources can be invested suitably to maximize a company’s growth and profitability.

- BCG Matrix can prepare a framework for allocating resources among different products

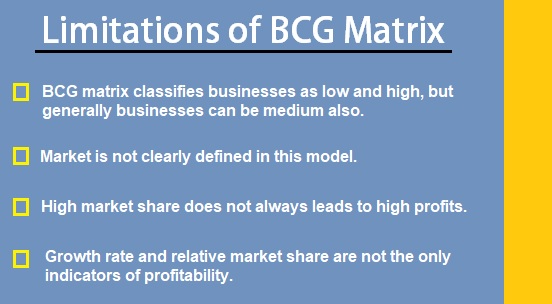

Limitations of BCG Matrix

This type of matrix has two-dimensional applications as given below:

- Relative market share and

- Market growth rate

Limitations are indicated below:

- BCG matrix is not the only indicator of the profitability of a business, attractiveness or success.

- It does not care for the effects of synergy from brand to brand.

- A company which has a minimum market share can become profitable as well.

- It has been observed that a High market share does not always produce high profits since there is also a high cost in obtaining a high market share.

- It has been observed that dogs may benefit the business or other products in achieving and gaining a competitive advantage.

- It does not care for small competitors with a fast-growing market share component.

Get Instant Help with your BCG Matrix Assignment

If you are a marketing student and given assignment writing tasks , say on (BCG) Boston matrix, then you can seek Boston matrix assignment help from the Assignment provider of Casestudyhelp.com.

Casestudyhelp.com provides 24×7 live support and online chat, as well as solves direct inquiries of the students of Business Law, Contractual Law and BCG Matrix Business case studies which help them in their BCG Matrix Assignment Help .

Why Choose Us?

We hope this writing by our Casestudyhelp.com will help students write on the BCG market and related studies. We can improve your writing skill. Our quality of work benefits us in maintaining a crowd of loyal customers. They provide us with excellent client perception.

- Our Product is 100 % Original–and is free of plagiarism. We use Free ‘Turnitin’ software for checking.

- We provide free Rework –we give all Rework and modifications free.

- 24/7 Customer Assistance–we provide round-the-clock customer assistance by our experts free of cost.

If you require any writing assignment help, please get in touch with us early.

What is a BCG matrix? Example, Advantages, Limitations

- Post last modified: 5 November 2024

- Reading time: 12 mins read

- Post category: Marketing Essentials

The Boston Consulting Group BCG Matrix is a portfolio management tool created in 1970 by Bruce Henderson. It is also referred to as the BCG growth-share matrix.

Table of Content

- 1.1 Question Marks

- 1.3 Cash Cow

- 2.3 Harvest

- 3 When to use BCG Matrix

- 4 Use of BCG in Digital Marketing

- 5 Advantages of BCG Matrix

- 6 Limitations of BCG Matrix

What is BCG matrix?

The Boston Consulting Group BCG Matrix is a simple corporate planning tool, to assess a company’s position in terms of its product range.

The purpose of the BCG Matrix (or growth-share matrix ) is to enable companies to ensure long-term revenues by balancing products requiring investment with products that should be managed for remaining profits.

The BCG matrix has two dimensions: relative market share (indicating profitability, through economies of scale) and market growth rate (indicating market attractiveness).

Four categories of BCG matrix

The BCG growth-share matrix breaks down products into four categories:

- Question marks – High Growth, Low Market Share (uncertainty)

- Dogs – Low Growth, Low Market Share (less profitable)

- Stars – High Growth, High Market Share (high competition)

- Cash cows – Low Growth, High Market Share (most profitable)

Question Marks

High Growth, Low Market Share

Question marks are products that grow rapidly and as a result, consume large amounts of cash, but because they have low market shares, they don’t generate much cash.

Question marks need to be analysed carefully to determine if they are worth the investment required to grow market share. New assets enter the market as Question Marks. Question mark examples : Mac Book Air of Apple, FUZE Healthy Infusions of Coca-Cola, tablet from Philips.

High Growth, High Market Share

Stars generate large sums of cash because of their strong relative market share, but also consume large amounts of cash because of their high growth rate. So, the cash being spent and brought in approximately nets out.

If a star can maintain its large market share it will become a cash cow when the market growth rate declines.

Star examples : iPhone of Apple, Vitamin Water of Coca-Cola, LED lamp from Philips

Low Growth, High Market Share

As leaders in a mature market, cash cows exhibit a return on assets that is greater than the market growth rate – so they generate more cash than they consume.

These units should be ‘milked’ extracting the profits and investing as little as possible. They provide the cash required to turn question marks into market leaders.

Cash Cow examples: iPods of Apple, Coca-Cola Classic of Coca-Cola, Philips energy-saving lamp, Procter and Gamble which manufactures Pampers nappies to Lynx deodorants.

Low Growth, Low Market Share

Dogs have a low market share and a low growth rate and neither generate nor consume a large amount of cash. However, dogs are cash traps because of the money tied up in a business that has little potential. Such businesses are candidates for divestiture.

Dog examples: New Coke of Coca-Cola, Plasma TV from Philips.

Four Strategies of BCG Matrix

After measuring market share and market growth, business units can be plotted in the matrix.

4 Strategies of BCG Matrix:

Increase market share by making further investments (for example, to maintain star status, or to turn a question mark into a star).

Maintain the status quo (do nothing).

Reduce the investment (enjoy positive cash flow and maximize profits from a star or a cash cow).

For example, get rid of the dogs, and use the capital you receive to invest in stars and question marks.

When to use BCG Matrix

The BCG matrix should be used as part of strategic portfolio management to manage cashflow (McDonald, 1999). The matrix enables you to determine which assets could produce future revenues and make investment decisions that ensure funds are allocated to the right assets.

The tool can reveal portfolio weaknesses that may threaten a company’s future cashflow. If a company is not developing many Question Marks, it needs to consider where income will come from in future.

Use of BCG in Digital Marketing

The BCG matrix will inform which products you should be selling through which methods and channels, which will influence your overall digital strategy. You can also use it to assess your digital channels themselves and understand, therefore, whether you are applying your focus effectively.

For example , Is paid search a cash cow or a dog? The value of this channel is often debated and so being able to substantiate where your channels fit on the BCG matrix is a great way to communicate how your channel strategy will be managed.

Moving SEO from a question mark to a star is a common goal of businesses that have poor natural search performance but understand the steps to make improvements.

Advantages of BCG Matrix

- It is simple to implement and easy to understand. Larger companies can use it for the seeking volume and experience effects. It predicts the future actions of a company. Hence, the company can decide its proper management strategy.

- Helpful for managers to evaluate balance in the firm’s current portfolio of Stars, Cash Cows, Question Marks, and Dogs

- The matrix indicates that the profit of the company is directly related to its market share. Therefore, a company can increase market share if it seems profitable.

- It has only four categories that make it in simple form to operate efficiently.

Limitations of BCG Matrix

The BCG Matrix produces a framework for allocating resources among different business units and makes it possible to compare many other business units. But, BCG matrix is not free from limitations.

Limitations of BCG Matrix is discussed below:

- BCG matrix classifies businesses as low and high, but generally, businesses can be medium also. Thus, the true nature of the business may not be reflected.

- The distinction between high and low is highly subjective.

- The use of BCG analysis cannot help managers take into account synergies that may possibly exist among the various SBUs within the product portfolio.

- The market is not clearly defined in this model.

- The problems of getting data on the market share and market growth.

- The framework assumes that each business unit is independent of the others.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on What is a BCG matrix ? Example, Advantages, Limitations in the comments section.

Marketing Management

( Click on Topic to Read )

- What Is Market Segmentation?

- What Is Marketing Mix?

- Marketing Concept

- Marketing Management Process

- What Is Marketing Environment?

- What Is Consumer Behaviour?

- Business Buyer Behaviour

- Demand Forecasting

- 7 Stages Of New Product Development

- Methods Of Pricing

- What Is Public Relations?

- What Is Marketing Management?

- What Is Sales Promotion?

- Types Of Sales Promotion

- Techniques Of Sales Promotion

- What Is Personal Selling?

- What Is Advertising?

- Market Entry Strategy

- What Is Marketing Planning?

- Segmentation Targeting And Positioning

- Brand Building Process

- Kotler Five Product Level Model

- Classification Of Products

- Types Of Logistics

- What Is Consumer Research?

- What Is DAGMAR?

Consumer Behaviour Models

- What Is Green Marketing?

- What Is Electronic Commerce?

- Agricultural Cooperative Marketing

- What Is Marketing Control?

- What Is Marketing Communication?

- What Is Pricing?

- Models Of Communication

Sales Management

- What is Sales Management?

- Objectives of Sales Management

- Responsibilities and Skills of Sales Manager

- Theories of Personal Selling

- What is Sales Forecasting?

- Methods of Sales Forecasting

- Purpose of Sales Budgeting

- Methods of Sales Budgeting

- Types of Sales Budgeting

- Sales Budgeting Process

- What is Sales Quotas?

- What is Selling by Objectives (SBO) ?

- What is Sales Organisation?

- Types of Sales Force Structure

- Recruiting and Selecting Sales Personnel

- Training and Development of Salesforce

- Compensating the Sales Force

- Time and Territory Management

- What Is Logistics?

- What Is Logistics System?

- Technologies in Logistics

- What Is Distribution Management?

- What Is Marketing Intermediaries?

- Conventional Distribution System

- Functions of Distribution Channels

- What is Channel Design?

- Types of Wholesalers and Retailers

- What is Vertical Marketing Systems?

Marketing Essentials

- What i s Marketing?

- What i s A BCG Matrix?

- 5 M'S Of Advertising

- What i s Direct Marketing?

- Marketing Mix For Services

- What Market Intelligence System?

- What i s Trade Union?

- What Is International Marketing?

- World Trade Organization (WTO)

- What i s International Marketing Research?

- What is Exporting?

- What is Licensing?

- What is Franchising?

- What is Joint Venture?

- What is Turnkey Projects?

- What is Management Contracts?

- What is Foreign Direct Investment?

- Factors That Influence Entry Mode Choice In Foreign Markets

- What is Price Escalations?

- What is Transfer Pricing?

- Integrated Marketing Communication (IMC)

- What is Promotion Mix?

- Factors Affecting Promotion Mix

- Functions & Role Of Advertising

- What is Database Marketing?

- What is Advertising Budget?

- What is Advertising Agency?

- What is Market Intelligence?

- What is Industrial Marketing?

- What is Customer Value

Consumer Behaviour

- What is Consumer Behaviour?

- What Is Personality?

- What Is Perception?

- What Is Learning?

- What Is Attitude?

- What Is Motivation?

- Consumer Imagery

- Consumer Attitude Formation

- What Is Culture?

- Consumer Decision Making Process

- Applications of Consumer Behaviour in Marketing

- Motivational Research

- Theoretical Approaches to Study of Consumer Behaviour

- Consumer Involvement

- Consumer Lifestyle

- Theories of Personality

- Outlet Selection

- Organizational Buying Behaviour

- Reference Groups

- Consumer Protection Act, 1986

- Diffusion of Innovation

- Opinion Leaders

Business Communication

- What is Business Communication?

- What is Communication?

- Types of Communication

- 7 C of Communication

- Barriers To Business Communication

- Oral Communication

- Types Of Non Verbal Communication

- What is Written Communication?

- What are Soft Skills?

- Interpersonal vs Intrapersonal communication

- Barriers to Communication

- Importance of Communication Skills

- Listening in Communication

- Causes of Miscommunication

- What is Johari Window?

- What is Presentation?

- Communication Styles

- Channels of Communication

- Hofstede’s Dimensions of Cultural Differences and Benett’s Stages of Intercultural Sensitivity

- Organisational Communication

- Horizontal C ommunication

- Grapevine Communication

- Downward Communication

- Verbal Communication Skills

- Upward Communication

- Flow of Communication

- What is Emotional Intelligence?

- What is Public Speaking?

- Upward vs Downward Communication

- Internal vs External Communication

- What is Group Discussion?

- What is Interview?

- What is Negotiation?

- What is Digital Communication?

- What is Letter Writing?

- Resume and Covering Letter

- What is Report Writing?

- What is Business Meeting?

- What is Public Relations?

Business Law

- What is Business Law?

- Indian Contract Act 1872

- Essential Elements of a Valid Contract

- Types of Contract

- What is Discharge of Contract?

- Performance of Contract

- Sales of Goods Act 1930

- Goods & Price: Contract of Sale

- Conditions and Warranties

- Doctrine of Caveat Emptor

- Transfer of Property

- Rights of Unpaid Seller

- Negotiable Instruments Act 1881

- Types of Negotiable Instruments

- Types of Endorsement

- What is Promissory Note?

- What is Cheque?

- What is Crossing of Cheque?

- What is Bill of Exchange?

- What is Offer?

- Limited Liability Partnership Act 2008

- Memorandum of Association

- Articles of Association

- What is Director?

- Trade Unions Act, 1926

- Industrial Disputes Act 1947

- Employee State Insurance Act 1948

- Payment of Wages Act 1936

- Payment of Bonus Act 1965

- Labour Law in India

Brand Management

- What is Brand Management?

4 Steps of Strategic Brand Management Process

- Customer Based Brand Equity

- What is Brand Equity?

You Might Also Like

Promotional mix, what is franchising advantages, disadvantages.

Marketing Mix 4ps: Definition, Example, Importance

5 M’S of Advertising | Mission, Money, Message, Media, Measurement

Creativity and advertising, database marketing, techniques of sales promotion, 10 best marketing techniques to fuel your business growth in (2024).

Business Buyer Behaviour – Type, Process, Factors, Roles

Industrial marketing, this post has one comment.

I want an answer for the importance of BCG martrix in procurement

Leave a Reply Cancel reply

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

COMMENTS

BCG Matrix is an apparatus utilized to incorporate methodology to break down specialty units or product offerings dependent on two factors: relative piece of the overall industry and the market development rate.

BCG Matrix (also known as the Boston Consulting Group analysis, the Growth-Share matrix, the Boston Box or Product Portfolio matrix) is a tool used in corporate strategy to analyse business units or product lines based on two variables: relative market share and the market growth rate.

Practical Example: Applying the BCG Matrix. Apple is a well-known example of a company that effectively utilizes the BCG Matrix to manage its product portfolio and align it with the Apple business model. Star: iPhone. The iPhone holds a high market share in the growing smartphone market, making it a star. It requires significant investment in R ...

The BCG matrix categorizes products or business units into four quadrants based on their market growth and relative market share. These quadrants are: Stars, Cash Cows, Question Marks (or Problem Children), and Dogs. 1) Stars -- High Growth, High Market Share. Stars units are leaders in the category.

BCG matrix is prepared by executing the following steps: Step 1: Selection of the Product: BCG matrix is utilised for this purpose by: Analysis of Business Units, Separation of brands, products or considering an organisation as a unit. Step 2: By defining and market study. Step 3: By comparison and by calculation of the relative market share.

Draw and explain BCG Matrix with examples. Large organizations often have many strategic business units (SBUs) and a parent company. For example,Samsung of South Korea is involved in a wide range of markets including arms, pharmaceuticals andconsumer electronics each having its distinct products.

The Boston Consulting Group BCG Matrix is a simple corporate planning tool, to assess a company’s position in terms of its product range. The purpose of the BCG Matrix (or growth-share matrix) is to enable companies to ensure long-term revenues by balancing products requiring investment with products that should be managed for remaining profits.

BCG Matrix, or Boston Consulting Group Matrix, is a strategic management tool that helps companies analyze their product portfolios. The matrix categorizes a company’s products or services into four categories: Stars, Cash Cows, Question Marks, and Dogs.

The BCG matrix was created by Bruce Henderson as a tool to assess the potential of any given company’s products and services, and then advise which ones a company should keep, sell, or invest more in.

The BCG Matrix is a powerful tool for analyzing business growth potential and allocating resources effectively. This article explores how to use the BCG Matrix to assess the strengths and weaknesses of your business units, and make informed decisions about resource allocation.