Marketing Reporting Examples: How to Build and Analyze Marketing Reports

Run marketing reports that better inform your decisions, bolster your marketing resources, and help your organization grow better.

MONTHLY MARKETING REPORTING TEMPLATES

Excel, PowerPoint, and Google Drive Templates to Make Your Monthly Reporting Faster and Easier

Published: 11/03/23

As a marketer, I make crucial daily decisions that can impact the company I work for. Using my best judgment, I track important metrics like traffic, leads, and customers — and I provide a marketing report to back up my decisions.

While the above metrics are crucial to my marketing funnel and flywheel , a marketing report helps me further explore my findings and properly analyze the data to make the best decisions I can for my team and company.

Marketing reports aren‘t just vital for my work, they’re key to any marketer looking to do what‘s right for their organization. In this article, we’ll explore what a marketing report is and how to build one, and we'll spotlight some examples.

![reporting research findings marketing → Free Download: Free Marketing Reporting Templates [Access Now]](https://no-cache.hubspot.com/cta/default/53/0d883e85-c2e5-49bb-bef2-bfddb500d84b.png)

Marketing Reporting

Marketing reporting examples, how to create a marketing report, create your marketing report today.

Marketing reporting is the process of gathering and analyzing marketing metrics to inform future marketing decisions, strategies, and performance. Marketing reports uncover meaningful, actionable data that help you draw important conclusions and meet organization-wide goals.

Marketing reports vary depending on what data you’re reviewing and the purpose of each report. They can assess where your traffic and leads are coming from, what content they interacted with, if and when they converted, and how long it took to become a customer.

Take our free, 20-minute HubSpot Academy course on marketing reporting to measure success and optimize your efforts.

To reiterate: Marketing reports inform decisions .

You wouldn’t run a marketing report to review data performance or check on an ongoing goal — for these purposes, you’d glance at your marketing dashboards.

Look at it this way. Compiling a marketing report for knowledge’s sake is synonymous with scheduling a meeting to review a project. Who wants to attend a 30-minute session to review what could've been shared via email? Not me.

The same goes for marketing reporting. Reports should help you decide or come to an important conclusion — similar to how a meeting would help your team deliberate about a project or choose between project resources.

In short, marketing reporting is a precious process if used and crafted correctly.

Marketing Reporting Templates

- Track leads.

- Measure CVR.

- Track channel performance.

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

There are hundreds of reports that you can run to dig into your marketing efforts. At this point, however, you’re likely asking, “Where should I start?“ and ”What are those basic marketing reports I can run to get more comfortable with all the data I’ve been tracking?”.

We’ve pulled together these five marketing reporting examples to get started.

You will need some marketing software (like HubSpot Marketing Hub) to do this. You should also ensure your software allows you to export the data from your software and manipulate it in Excel using pivot tables and other functions.

This free guide and video will teach you how to create an Excel graph, make pivot tables, and use VLOOKUPS and IF functions.

Since we use HubSpot for our reporting needs, I'll show you how to compile these reports using the Marketing Hub tool. (The data below is sample data only and does not represent actual HubSpot marketing data.)

1. Multi-Touch Revenue Marketing Report

As a marketer, you’re a big part of your company’s growth. But unless you can directly tie your impact to revenue, you’ll be forever underappreciated and under-resourced. Multi-touch revenue attribution connects closed gain to every marketing interaction — from the first page view to the final nurturing email.

That way, marketers get the credit they deserve, and marketing execs make more innovative investments rooted in business value instead of vanity metrics. As a bonus, multi-touch revenue attribution can help you stay aligned with your sales team.

HubSpot customers can create multi-touch attribution reports quickly; HubSpot’s attribution tool is built for real people, not data scientists. (It also connects every customer interaction to revenue automatically.)

Navigate to your dashboard and click Add Report > Attribution Report . Select from the set of pre-baked best-practice templates, or create your own custom report.

How to Analyze Revenue Reporting

To analyze revenue reporting, determine what’s working and double down on it. Look at the revenue results from different channels and see where you most succeeded. Use this information to decide what marketing efforts to invest in moving forward.

For example, if you notice that your Facebook campaigns drove a ton of revenue, run more Facebook campaigns!

Multi-touch attribution reports should be run monthly to understand the broader business impact of your marketing channels. While revenue is necessary, you should dig into some of your other metrics for a more complete picture.

2. Channel-Specific Traffic Marketing Report

Understanding where your traffic comes from will help you make strategic decisions as you invest in different marketing channels. You should invest more resources if you see strong performance from one source.

On the other hand, you can invest in some of the weaker channels to get them on pace with some of your other channels. Whatever you decide, source data will help you figure that out.

HubSpot customers can use the Traffic Analytics report (under Reports > Analytics tools in your navigation) to break down traffic by source.

Want to get an even deeper understanding of your traffic patterns? Break down your traffic by geography. (Example: Which sources bring in the most traffic in Brazil?) You can also examine subsets of your website (like your blog vs. your product pages).

Don't forget to share this post!

Related articles.

Did Companies See Summer Slumps in 2021? We Analyzed 103,000 Businesses to Find Out

19 Top Marketing Attribution Software Tools for 2024

What Is Marketing Attribution & How Do You Report on It?

Heat Maps: Everything Marketers Need to Know

The Ultimate Guide to Google Data Studio in 2024

KPI Dashboards & How to Use Them in Your Marketing

![reporting research findings marketing How to Calculate Marketing ROI [+Free Excel Templates]](https://www.hubspot.com/hubfs/Marketer%20calculating%20ROI%20in%20marketing%20from%20free%20Excel%20templates.jpg)

How to Calculate Marketing ROI [+Free Excel Templates]

Waterfall Charts: The Marketing Graph You Need to Hit Your Goals

![reporting research findings marketing How to Create a Funnel Report [Quick Guide]](https://www.hubspot.com/hubfs/funnel-reporting_1.webp)

How to Create a Funnel Report [Quick Guide]

Tired of Waiting for IT to Generate Your Reports? Try Ad Hoc Analysis

Templates to Make Your Monthly Reporting Faster and Easier

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Marketing Reporting: The KPIs, Reports, & Dashboard Templates You Need to Get Started

Table of contents

To see what Databox can do for you, including how it helps you track and visualize your performance data in real-time, check out our home page. Click here .

Reporting on marketing performance is a critical skill that any marketer––from leadership to individual contributors––needs in order to convey the value of their work. In fact, according to Databox’s state of business reporting , marketing is the most monitored and reported operation.

Driving traffic and leads is important. But, understanding where they came from, how they engage with your website, and ultimately what led to a conversion or purchase (amongst many other insights) is necessary for building a repeatable and sustainable marketing program.

The challenge? As marketing technology has exploded, digital marketing reporting has gotten more complicated.

In this guide, we’ll cover everything you need to know about marketing reporting, including:

What is Marketing Reporting?

What is a marketing report.

- The Types of Marketing Reports

- What Should A Marketing Report Include?

- How to Create a Marketing Report?

- Marketing KPIs and Metrics

Marketing Reporting Dashboards and Templates

- Reporting on Output vs. Outcome Metrics

- Bonus: White-Labeled Marketing Reports

Marketing reporting is an exercise that involves regularly sharing updates on key performance indicators (KPIs) , progress toward goals, as well as next steps with your team in order to identify priorities and make adjustments.

Reporting is typically done through regular marketing meetings , most commonly weekly and monthly. A marketing reporting meeting typically involves sharing numerous marketing reports in order to present a comprehensive view of the strategy and how it is performing.

What should be included in your marketing reports? We cover that, and more, below.

Related article: 17 Marketing Report Examples for Sharing Performance With Your Team.

A marketing report is a visual representation, usually presented in a dashboard or slide deck, of your marketing metrics and KPIs and their progress over a specific time period.

One reporting meeting may contain several marketing reports. In fact, it should.

For example, you might present separate marketing reports for your content marketing, paid advertising, and social media efforts. Each report would display marketing KPIs specific to that function.

This will help you uncover meaningful, actionable insights that will help your team identify opportunities and make adjustments.

Below is a marketing dashboard example that helps to communicate current performance, progress toward goals, and month-over-month comparisons to help inform and prioritize next steps.

Types of Marketing Reports

While there are any number of ways you could organize your digital marketing reports, we think it makes the most sense to organize them according to how frequently they would be shared.

There are, of course, situations when you need to create a specific KPI report for a particular purpose.

But, for the most part, here are the most common marketing report types as well as the specific reports you would share during a specified time range.

- Monthly marketing reports

- Weekly marketing reports

- Daily marketing reports

- Annual marketing reports

PRO TIP: How Are Users Engaging on My Site? Which Content Drives the Most Online Activity?

If you want to discover how visitors engage with your website, and which content drives the most engagement and conversions, there are several on-page events and metrics you can track from Google Analytics 4 that will get you started:

- Sessions by channel. Which channels are driving the most traffic to your website?

- Average session duration. How long do visitors spend on your website on average?

- Pageviews and pageviews by page . Which pages on your website are viewed the most?

- Total number of users . How many users engaged with your website?

- Engagement rate . Which percentage of your website visitors have interacted with a piece of content and spent a significant amount of time on the site?

- Sessions conversion rate . How many of your website visitors have completed the desired or expected action(s) and what percentage of them completed the goals you’ve set in Google Analytics 4?

And more…

Now you can benefit from the experience of our Google Analytics 4 experts, who have put together a plug-and-play Databox template showing the most important KPIs for monitoring visitor engagement on your website. It’s simple to implement and start using as a standalone dashboard or in marketing reports, and best of all, it’s free!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Google Analytics account with Databox.

Step 3: Watch your dashboard populate in seconds.

Monthly Marketing Reports

Monthly marketing reports are a management tool used by most marketers and agencies to demonstrate relevant marketing results on a monthly basis. In a monthly marketing report , we usually find metrics focused on web analytics and campaign performance.

Web Analytics Report

A web analytics report displays the data derived from the monitoring of your website performance. In this context of KPIs vs metrics, you will typically encounter the following metrics and key performance indicators (KPIs) – online conversions, bounce rates, page views, referral traffic, etc. You can see some examples of web analytics dashboards here.

Digital Marketing Performance Report

A digital marketing performance report provides you with a complete overview of all your paid advertisement campaigns’ performance. It helps you discover the amount you have spent and if you were able to stay within a planned budget while still reaching your pre-set goals. It should also include the CPA metric so that you know how much you spent to get each new customer. You can see some examples of performance dashboards here.

Weekly Marketing Reports

You can view weekly marketing reports as a status check for your goals and campaigns. They are used to generate actionable marketing insights on a medium-term and weekly basis. In the case of weekly marketing reports, the main metrics to watch are traffic and engagements.

Website Traffic Report

A Website Traffic Report provides you with data on the number of people that have visited your site. Monitoring your website traffic can help you discover where your traffic is coming from and how it’s engaging with your site. You can find this and other useful data in your reports. You can see more examples of SEO dashboards here.

Blog Traffic Report

A Blog Traffic Report should be a weekly event, as your blog traffic tends to fall after the first week, after the promotions and boosts end. But continual monitoring of the blog traffic via blog traffic reports can show you what is your optimal number of visits over the course of a month, and longer. Check out some examples of content marketing dashboards here.

Social Media Report

A monthly Social Media Engagement Report is a great way to keep track of your growth and improve your social strategy accordingly. Understanding how your content performs through tracking account metrics and insights over time is key to building a successful social media strategy for your business. See examples of social media dashboards here.

Online Advertising Performance

An Online Advertising Performance Report provides you data on how your online ads are fairing. By analyzing it on a weekly level you will ensure that your ad investments are stable or adjust them timely if they need more optimization to deliver specified targets. See examples of PPC dashboards , including paid ads templates and paid search templates , here.

Daily Marketing Reports

In most cases, daily marketing reports are used for internal company purposes. Their main goal is to spot changes or threats as they appear and react immediately. A daily marketing report should include some of the following:

Average Session Duration Report

Average session duration provides you data regarding user engagement from different sources and how useful your content is for each user.

SEO Overview Report

SEO Overview, when reported on a daily level, shows you the increase and decrease of your site metrics, which can help you see, on a daily level, what has a positive or negative impact on your SEO efforts.

Keyword Rankings Report

Keyword Rankings should be reported daily as they fluctuate every single day. If this is something relevant for your company and your clients daily reports are crucial.

Annual Reports

The Annual Marketing Report is meant to deliver the milestones and KPIs (key performance indicators) that you and your clients need to know. It helps you define the key successes, to evaluate what could be improved, and to communicate all that with your team and your clients.

Marketing CMO Report

A CMO usually reports to the CEO. These reports should represent everything the marketing team has accomplished over a course of a year. Whether they have hit all the set goals and what were the possible shortcomings. It is there to inform the company management of the overall success of the in-house marketing team. See specific examples of executive dashboards here. This can be built using an executive dashboard software .

Marketing KPI Report

With the annual Marketing KPI Report, you can see the performance of your online marketing campaigns and monitor trends over the course of the previous year.

What Should a Marketing Report Include?

Marketing reporting software provides you with actionable reports and easy-to-read snapshots of your campaigns. What to include in your marketing reports depends on your goals and what you are looking to achieve with your marketing efforts.

But, generally speaking, a good marketing report should cover the following:

- Output Metrics: Output metrics measure your activities. They are direct measurements of the work you’re doing on a daily or weekly basis. Examples would be things like the number of sales calls, number of blog posts published, etc.

- Outcome Metrics: Outcome metrics are typically the metrics that companies obsess over. These metrics are the ones that are shared with stakeholders like bosses, clients, and investors. Metrics like traffic, leads, and sales would be considered “outcome metrics.”

- Quality Metrics: Quality metrics are things like visit-to-signup conversion rates or other metrics that measure the overall quality of an outcome metric like Sessions.

- Progress Toward Goals: No marketing report is complete without a visualization of your progress toward your goals. Are you on or off track? That should be clearly represented so the team can adjust accordingly.

- Comparisons: Are you growing month-over-month? Comparing current performance to last month, quarter, or year is an easy way of measuring progress and growth.

Related article: 34 Marketing Metrics to Include in Every Marketing Report

How Often Should You Share a Marketing Report?

This depends on the type of report and the preset agreement you have with your team or your clients.

- Monthly reporting allows you to gather enough data to see how changes have affected marketing results while ensuring that underperforming campaigns don’t run for too long. They are ideal for showing your clients the progress you made without overwhelming them.

- Weekly reporting is great for your team, and you can see the current changes and adjust strategies accordingly.

- Real-time reporting is essential for retail as companies must be able to analyze real-time data to make more informed, accurate decisions.

Why is Marketing Reporting Important?

Marketing reports are the outcome of your data-driven marketing. Their main purpose is to help interpret all the data you have collected through easily understandable visualizations. Marketing reporting helps you build context around your data and present your efforts and successes to your clients in a manner that will be clear to them.

Here are just some of the things marketing reporting enables you to do:

1. Track progress towards marketing goals

Regular marketing reporting helps you obtain data that shows how close you are to reaching your pre-set marketing goals. Based on that data, you can make the necessary changes to ensure that all the goals are met in time.

2. Have a clear view of all the outputs and outcomes

Marketing outputs, in the end, enable marketing outcomes. Marketing Reporting lets you track both and see when and if there is a need for adjustment so that you can reach the desired target.

3. Identify emerging trends and be able to react to them quickly

Marketing Reporting enables you to keep a close eye on the current and emerging trends and to act on them in real-time. Thus improving your chances of reaching the pre-set marketing goals.

4. Identify the best performing content (and vice versa)

We want to know what works and what doesn’t so that we can replicate successful tactics. By analyzing what was successful through Marketing Reporting, we can build a far more stable marketing strategy for the future.

5. Better marketing forecasting

When we have the right data, we can make educated predictions regarding some of our desired marketing outcomes. Marketing growth forecasting includes marketing reports that pay special attention to the following – sources of traffic, target audience, click-through rate (CT), conversion rate, number of transactions, the value per transaction, cost per transaction, and return on ad spend.

How to Create a Marketing Report

An effective marketing report needs to be both accessible and actionable. This means that in addition to the numerical figures themselves, it’s helpful to have a data visualization to go along with each metric in your marketing report.

While most marketing technology tools boast their own analytics, this requires you to log into dozens of separate tools in order to get a comprehensive view of performance.

This is why dashboard software like Databox (Okay, we’re biased. But, it’s free.) are helpful in that they allow you to collate marketing metrics from multiple sources into one place.

To build your marketing report, you first should understand some of the most common sections.

Every report should include Outcome Metrics of some kind. Things like Sessions and Signups.

Then, you should also include drill-down metrics that allow viewers to better understand the performance of a specific metric. For example, instead of simply tracking Sessions, you should include a drill-down metric that measures Sessions by channel source in order to see which channels are paying off.

Next, you should also include a quality metric of some kind––a metric that allows you to measure to overall quality of an outcome metric like Sessions. For Sessions, we’d recommend something like visit-to-conversion rate.

Finally, you should also track Output Metrics that show the activities your team has executed on. This allows you to draw correlation between activities and results. This way, you can ensure that your team is only spending time on high leverage marketing activities.

In the example below, you can see “Total blog posts published” as the Output Metric.

Or, you could even add a visualization that measures the volume of each content type your team has published. This way, you can draw correlation between results and the specific types of content your team publishes.

Which Marketing KPIs and Metrics Should I Report On?

Marketing metrics are specific measurements of the actions or behaviors exhibited on your website. This would include metrics like sessions, bounce rate, average session duration, etc.

Marketing KPIs are an agreed-upon set of metrics that have been determined to be of importance to your company’s goals and overall business. This could also include metrics like sessions, but more commonly KPIs are reserved for Outcome and Output Metrics that have proven to have an impact on a company’s revenue growth.

In short, while all KPIs are metrics, not all metrics at KPIs.

Below, we’ve included some of the more common marketing KPIs and metrics that teams track and report on.

- Web analytics metrics

- Performance metrics

Website traffic metrics

Blog traffic metrics.

- Social media metrics

- Content quality control metrics

Web Analytics Metrics

Simply put Website Analytics Metrics tell you whether your website is getting results for your business. Website Analytics includes the collection, reporting, and analysis of website data. You can then go on and use that website data to determine the success or failure of your pre-set goals and to drive strategy and improve user experience.

- Sessions – a group of user interactions with your website that takes place within a designated time frame. It underlines usage data and the key to retention and serves to identify the steps a user takes while interacting with your website.

- Visits – the full-time span that a Visitor spends on your website. This metric serves to measure website traffic volume over a time period.

- Avg. Session Duration – the sum of the duration of each session during the date range you specify divided by the total number of sessions. This metric is a great starting point for better understanding and improving your customer journey.

- Pages per Session – show you how many pieces of content (Web pages) a single visitor or a group of visitors views on your website. A high number means that you offer great content that inspires visitors to stay and continue exploring your website while a low one can mean that either your content is lacking or your website’s design is preventing visitors from navigating around it with ease.

- Pageviews – the total number of pages viewed. It can provide an indication of how popular a page or post is. Page Views is best used in combination with other metrics for a more definitive insight.

- Goal Completions – show the number of completed goals. This metric helps you track how successful your marketing efforts are based on the goals to set and complete over the predefined time period.

- Traffic Sources – the origin or source of a visit to your website. By tracking Traffic Sources metrics you can determine where most of your traffic is coming from and which sources are driving the least traffic to your website.

- Bounce Rate – the number of single-page sessions (bounces) divided by the total number of sessions. It is important to keep the Bounce Rate as low as possible, which can be done by improved page content and design.

Marketing performance metrics

Marketing performance metrics or key performance indicators (KPIs) represent a source of useful data for not just marketing professionals but also the company CEO, sales department, and the senior management team. They can all use marketing KPIs in order to get a clear insight into how marketing activities and spending impact the company’s bottom line.

This is especially important since more and more marketers are required to show a return on investment (ROI) on their activities. And performance metrics are here to help you understand the extent of how much marketing spending contributes to profits. Monitoring marketing’s progress towards its annual goals

By carefully and accurately establishing marketing performance metrics marketers can help companies achieve customer satisfaction and monitor the progress towards the pre-set goals.

- CPA by Campaign – measures the aggregate cost to acquire a single paying customer during a campaign. It provides you with data regarding how much your new customers are costing you. Based on that data, you can then decide what actions you can take to lower the CPA.

- CPC by Campaign – the price an advertiser pays a publisher for each click on a link during the duration of a campaign. Tracking this metric is important because the costs can add up quickly, and if you are not careful, you might not see any ROPI from a campaign.

- Acquisition by Campaign – the number of acquired new prospects by your campaign. A high Acquisition by Campaign lets you know how successful your campaign has been when it comes to attracting new prospects.

- Clicks – the number of times a user clicked on something like your ad. All clicks are counted regardless if they end up at the preset destination. Clicks help you gain insight into how well your ad or page is appealing to people who see it.

- Impressions – the number of times your content is displayed, regardless of the fact if it was clicked or not. Impressions provide a simple representation of how many people see your ads within a particular channel.

We can define Website Traffic as the number of visitors your site gets in a set timeframe. However. there is a lot more to it. A website traffic metric is viewed as a quantifiable indicator of an aspect of your website’s popularity. There are a lot of different website traffic metrics that you could be tracking , as different metrics tend to answer different questions you might have about the efficiency of your website.

- Users – visitors who have initiated one session with your website or app within a specified period of time. It is important to distinguish between new and returning users. Returning users have a higher conversion rate and new users tend to stay way shorter on your website.

- Pages per Session – the average number of pages viewed by a visitor during a single session. This metric helps you see how compelling your content is to visitors and if it needs significant improvement.

- % New Sessions – the percentage of first-time visits to your site. It can be viewed as an indirect engagement metric and depending on your goals and business you can decide which course of action you will need to take to steer this in the right direction.

- Top Organic Keywords – the highest-ranked organic keywords used to attract free traffic through search engine optimization. Knowing which Top Organic Keywords to optimize for can significantly improve your SEO efforts.

- Sessions by Source – the number of sessions displayed by source. This metric can help you see which source drives the most traffic to your website so that you can adjust your marketing efforts accordingly.

- Traffic by Channel – shows you where most of your website traffic comes from. By tracking Traffic by Channel, you will be able to gain insights into what are the most effective methods to acquire visitors.

If you want to know how much traffic your blog is attracting, you need certain sets of data to do the calculations. This is where tracking Blog Traffic Metrics comes in, you could bet measuring just traffic to your blog, and in that case, a blog post with 100,000 visits looks like a dream come true. But what if everyone who visited your post left within 15 seconds of the page loading? That is why more metrics need to be included for you to get more precise data.

- Traffic by Blog Post – how many visitors is a single blog post attracting. Tracking this metric lets you evaluate which blog posts perform better and attract more visitors. Based on that you can construct a strategy of updating old blog posts so that they bring in more traffic.

- Time on Page – the average amount of time users spent viewing a specific page or set of pages. It helps you determine which pages are keeping visitors’ attention. This is especially helpful with blog pages as you can see which topics the visitors find insightful and engaging.

- Signups – show the number of new visitors that sign up for your blog newsletter or a paid subscription. It can show you which CTAs are effective and it is an important piece of information when it comes to tracking your blog’s conversions.

- Top Blog Posts by Session – show you on which blog posts visitors spend the most time during their sessions on your website. This can help you gain insight into where most of your visitors spend their time after they come to your website.

- Top Blog Posts by Signups – show you which blog posts on your blog are generating the most signups. This can help you gain insight into which blog posts are the most effective when it comes to converting your visitors into subscribers.

Social Media Metrics

According to marketing consultant Mike Sonders , social drives an average of only 2.2% of traffic to the top 50 public SaaS companies. There is no doubt about the importance of social media metrics now more than ever. But it is equally important to know which ones you should be tracking.

- Likes – the number of “votes” your social media page, post, or ad gets. By tracking specific likes, you can see how well your page, post, or ad is performing.

- Followers – a follower on social media is a user who chooses to see all of another user’s posts in their content feed. Having a significant number of followers means that you have an established brand presence on social media.

- Comments – a way for your followers on social media to interact with your brand. They help you interact with your flowers, answer questions, and see how engaging your content is, depending on how much commenting it inspires.

- Reach – the total number of people who see your content. If you consider that Reach is directly related to the number of unique users that are seeing your content, using Reach to optimize your paid campaigns is a great option.

- Page Views – the number of times a page’s profile has been viewed by people, including people who are logged into that particular social media platform and the ones who aren’t. This metric helps you see what your audience is interested in and if your page content fares well with social media users.

- Sessions from Social Media – the number of times users were directed to your website through social media. Tracking the Sessions from Social Media is very important if you want to know whether your social media efforts are leading to website visits.

Thankfully, you can easily track these metrics daily with the help of this social media dashboard software .

Content Quality Control Metrics

By tracking Content Quality Control Metrics you will be able to see how well your content is performing and contributing to downstream metrics like conversions, opportunities, and sales. Some of the content metrics you should consider tracking are as follows:

- Google Keyword Ranking – the position that your website is listed in Google when someone searches that particular phrase or keyword. A ranking of one to ten means that you are on the first page of google search, 10 to 20 on the second, and so on, as search pages have ten hits. Of course, the goal is to be on the first page in the first three hits. Tracking Keyword Rankings can help you better optimize your pages so that they get pushed to some of the more relevant Google search pages. Even a small update means getting from the second to the first page in Google.

- Visibility – a metric showing how often your website is found on the Internet. Based on your Visibility metric, which should be as high as possible, you should make adjustments to your content, specifically Keyword Rankings so that it increases in time.

- Domain Authority – According to MOZ , Domain Authority (DA) is a search engine ranking score developed by Moz that predicts how likely a website is to rank on search engine result pages (SERPs). Knowing your site’s DA is very important simply because higher DA sites perform better than lower DA sites. This means that there’s a direct correlation between high DA scores and higher rankings. And we all want high rankings.

- Goal Competitions – the total number of visitors who have completed all elements defined for a particular goal. If you have adequately configured goals, Google Analytics can provide you with critical information, like the number of conversions and your site or app’s conversion rate.

Building and sharing marketing reporting dashboards is the essence of modern marketing reporting. If you are just starting, using plug-and-play marketing report templates is the best option. Databox has a great selection of Marketing reporting templates for you to choose from, depending on what you want to include in your marketing reporting.

Marketing Automation Dashboard Templates

Ecommerce dashboard templates, crm & sales dashboard templates, project management dashboard templates, analytics dashboard templates, help desk dashboard templates, social media dashboard templates, connectors & development dashboard templates, paid search dashboard templates, paid social dashboard templates, accounting & payments dashboard templates, website marketing & sales dashboard templates, app stores dashboard templates, email marketing dashboard templates, video dashboard templates.

Marketing automation is defined as the process of utilizing technology to streamline marketing efforts and make them more effective. The current Marketing Automation Databox Templates include:

- HubSpot Marketing Dashboard Template

- Google Analytics: Website Engagement Dashboard Template

- CallRail Overview Dashboard Template

- Marketo Email Marketing Dashboard Template

And many more…

Browse all marketing automation dashboards here.

An eCommerce dashboard can be defined as a hub for important business and performance data. It enables you to get a snapshot view of your business and dive into your most important data. Databox offers a wide range of Ecommerce Templates, here are just some that you can get right now:

- Google Analytics (Ecommerce overview) Dashboard Template

- Shopify Dashboard

- eCommerce Full Funnel Dashboard Template

- WooCommerce (shop overview) Dashboard Template

- Shopify + Fb + GA: Online Sales Dashboard Template

And many more…

Browse all ecommerce dashboards here.

CRM, or Customer Relationship Management, is an important tool to help you turn a lead into a paying customer. A well designed CRM & Sales Dashboard will help you see where every individual lead is within your sales pipeline. The selection of Databox CRM & Sales Templates definitely has what you are looking for.

- HubSpot CRM Dashboard Template

- Stripe (MRR & Churn) Dashboard Template

- Closed Won Totals (Sales Rep View) Dashboard Template

- CallRail Source & Keyword Performance Dashboard Template

- QuickBooks + HubSpot CRM: Financial Performance Dashboard Template

Browse all sales dashboards here.

A simple definition of a project management dashboard is that it is a data Dashboard containing key performance indicators related to specific projects. There is a great selection of Databox Project Management Templates to choose from.

- Harvest: Time report Dashboard Template

- Asana (Team overview) Dashboard Template

- Jira Dashboard Template

Browse all project management dashboards here.

A great Analytics Dashboard needs to contain all your key indicators of acquisition, retention, and referrals in one place. With Analytics Databox Templates you are bound to find the perfect fit. Here are just some of the options:

- Google Analytics 4 (Website traffic) Dashboard Template

- Targeting, Engagement, Revenue Dashboard Template

- YouTube Watch Time Performance Dashboard Template

- Credo’s Marketing KPIs Dashboard Templates

And many more…

Help Desk Dashboards are a great option in case you are having trouble understanding Help Scout or Drift. Here are just some of the Help Desk Databox Templates:

- Help Scout Mailbox Dashboard Template

- Customer Success Dashboard Template

- HelpScout Docs Report Dashboard Template

- HelpScout for Customer Support Dashboard Template

- HubSpot Service (Tickets Overview) Dashboard Template

Browse all help desk dashboards here.

Social Media Dashboards are a great way to showcase your social media efforts to your team or your clients. They are easy to follow and can track your most relevant metrics. Social Media Databox Templates include some very useful Dashboards that you might be interested in.

- LinkedIn Company pages Dashboard Template

- HubSpot (Social Media Tracking) Dashboard Template

- Instagram Business (account overview) Dashboard Template

- Facebook Pages & Facebook Ads: Engagement Summary Dashboard Template

Connectors & Development Dashboard will help you have a better overview when it comes to how successful you and your team are at hitting sprint targets and responsiveness to user demands. There are several Connectors & Development Databox Templates to choose from.

- Bitbucket Dashboard Template

- GitHub Dashboard Template

Browse all software development dashboards here.

A Paid Search Dashboard is a great way to pull and visualize paid search data so that you can analyze trends and optimize performance. You have a great selection of Paid Search Databox Templates to choose from depending on the data you want to show.

- AdSense Dashboard Template

- AdMob Dashboard Template

- Microsoft Advertising Overview Dashboard Template

- HubSpot + Google Ads Top of Funnel Dashboard Template

Simply put, Paid Social Dashboard is best used to summarize ad engagement and conversion behavior driven by paid social platforms. Depending on the social platform you are using, there is a whole selection of Paid Social Databox Templates at your disposal.

- Facebook Ads Purchase & Leads Breakdown Dashboard Template

- LinkedIn Ads: Ads Performance Dashboard Template

- Twitter Ads: Campaign Summary Dashboard Template

Accounting & Payments Dashboards are here to help visualize key accounting KPIs and provide a more comprehensive view of business performance. By doing so they are saving time, offering clarity, and improving your decision-making capabilities. You can check out some of the available Accounting & Payments Databox Templates to see whether they suit your business needs.

- Stripe Dashboard Template

- Xero Dashboard Template

- Quickbooks: Profit and Loss Overview Dashboard Template

- ProfitWell (Churn Overview) Dashboard Template

- PayPal (Account Overview) Dashboard Template

Browse all financial dashboards here.

Website Marketing & Sales Dashboards help your team react better in real-time. They pull data from various locations and provide you key data that reveals product sales, customer engagement, and more. Depending on your team’s needs you can select from many Website Marketing & Sales Databox Templates.

- Intercom (account overview) Dashboard Template

- Drift Dashboard Template

- Blog Post Performance After SEO Update Dashboard Template

- Google My Business Insights Dashboard Template

An App Store Dashboard is here to enable you to gain insights into your sales trends and easily download data for your organization’s apps to analyze it more efficiently. Here are just some examples of App Stores Databox Templates:

- Play Store Metrics Dashboard Template

Browse all app store dashboards here.

Your Email Dashboard should contain key metrics to demonstrate the performance and ROI of your email campaigns. There are several options to select from when it comes to Email Databox Templates.

- Seventh Sense- Overview Dashboard Template

- Mailchimp Dashboard Template

- HubSpot Advanced Email Metrics Dashboard Template

- Email Marketing Performance Dashboard Template

Browse all email marketing dashboards here.

Your Video Dashboard should contain all the relevant metrics related to the performance of your videos. Some of the options offered are the following Video Databox Templates:

- Wistia Essentials – Getting Started with Video Dashboard Template

- YouTube Overview Dashboard Template

- Vimeo OTT (video overview) Dashboard Template

Browse all video marketing dashboards here.

Database Dashboard Templates

The main purpose of a Database Dashboard is to combine the use of metrics and KPIs to produce a visually appealing design that is easily interpreted. Here are just some of the Database Databox Templates:

- MySQL Dashboard Template

- Microsoft SQL Server Dashboard Template

Browse all database dashboards here.

SEO & SEM Dashboard Templates

By using SEO & SEM Dashboards, you can easily track your efforts when it comes to SEO, Advertising Campaigns, Revenue, Goal Completions, Locations, Channel Groupings, and numerous other relevant data. SEO & SEM Databox Templates have a lot to offer when it comes to visualizing these particular data sets.

- SEMrush (Keywords & Audits) Dashboard Template

- MOZ Basics Dashboard Template

- AccuRanker Domain Overview Dashboard Template

- Ahrefs: Project Overview Dashboard Template

- Google Analytics SEO Dashboard Template

Editor’s note: Did you know that any Databox dashboard can be displayed on your smart TV? Broadcast your TV Dashboards for free now.

Reporting On Output vs. Outcome Metrics in Your Marketing Meetings

Marketers tend to judge their performance based on their outputs, but it isn’t possible to have a full picture without calculating the outcomes. On the other hand, tracking only the outcomes means your team lacks visibility into the specific activities that actually drive those outcomes. Understanding business analysis better can be beneficial when it comes to improving your overall business performance.

But, first, let’s understand the terminology a bit better –

Outcomes represent what your business wants or needs to achieve. While outputs represent actions or items that contribute to achieving an outcome that you have set.

Difference between Output and Outcome Metrics

Much like there is a clear difference between outcomes and outputs, there is a distinction between the metrics that we use to measure them.

Output metrics

Output metrics measure your marketing activities. They are direct measurements of the work you’re doing on a daily or weekly basis. An additional benefit of output metrics is that they let you prioritize your daily activities by keeping you focused on things you can control right now.

Outcome metrics

When it comes to outcomes metrics, they need to help you collect specific data to get insights into the extent to which expected outcomes, like changes in user behavior or knowledge, have been achieved. Simply put, they measure the impact of your outputs.

There is a distinction between leading and lagging outcomes. Unlike with outputs where you can control your activities, outcomes often depend on people outside of your organization taking action. We don’t have control over outcomes, but some provide faster feedback than others.

A leading outcome would be a web traffic spike to your website after content sharing, while a lagging one is determining the success of a single blog post.

Finding the right Output and Outcome metrics

To truly determine the impact of your marketing efforts, it is important to look at both output and outcome metrics side by side. Sure, we can say that the ultimate outcome for a business is – growth, while the ultimate output goal is facilitating that growth. But how do we get there? We start by measuring outputs and outcomes.

Measuring outputs vs. outcomes

Measuring outputs is done by activity-based metrics that are easily quantifiable, for example:

- Number of emails sent during an email campaign

- Number of Events Managed in a month

- Number of tweets sent out a day

Measuring outcomes is not as direct, it depends on the desired outcome. By knowing the outcome you want to achieve, you are able to determine the activities that need to be completed and how integral each of these activities is to success.

Setting goals

Having clear objectives that you want to achieve through your marketing efforts is essential for tracking marketing success. This is why setting goals is relevant to all marketers.

What are Marketing Goals?

Marketing Goals are defined as a set of specific objectives you describe in your marketing plan. Goals vary depending on your marketing strategy, They can be tasks, quotas, improvements in KPIs, or various other standards based on which you have decided to measure your marketing success. That being said, it is important to note that marketers often opt for the SMART mnemonic when defining key goals. This helps present a far clearer picture of their intended outcome. So what does SMART stand for?

- Specific — Make sure your goals are defined as precisely as possible and set real numbers and real deadlines to hold yourself accountable.

- Measurable — goals that you set need to be both easily trackable and measurable.

- Attainable — Setting realistic goals is essential. Base your goals on the resources currently at your disposal when it comes to budget, team members, and time constraints. Don’t set them too low, you do want to experience growth in time.

- Relevant — your chosen goals need to be closely related to your entire marketing plan, setting random goals is never helpful.

- Time-Bound — set clear deadlines for achieving your goals. Without set dates, your goals will end up being nothing more than wishful thinking.

How to Position your Goals to:

- Teammates – setting goals for a team requires you to find a balance between maximizing the individual skill sets of each team member and finding the best way to achieve the desired outcome. Set weekly Marketing Reports for your team so that you can see where you are when it comes to hitting your pre-set targets for each time period.

- Clients – Present your clients with realistic goals and make sure you keep them up to speed with all the development via well-composed Marketing Reports.

- Management – Presenting goals to Management is best done on a monthly and annual level. You need to keep them informed on your progress and any possible problems. The Marketing Reports need to be clear and concise.

Output goals

An output goal is simply defined by your desired output amount. You set output goals based on your outcome desires and track them through chosen output metrics.

Outcome goals

Outcome goals are the ones that define which output metrics you are to track. Outcome goals are harder to obtain and they specify a result. So we can treat retention and/or increase revenue as marketing goals, outcome goals need to sound more like – retain 80 percent of our tier one customers resulting in X dollars revenue.

White Label Marketing Reporting

In general, white-label solutions allow companies to rebrand, developed by other companies, then sell them as their own. In this case, we are talking about Marketing Reports.

What are white-labeled reports?

White Labeled Marketing Reports are reports that let you add your own branding to a report Dashboard created by Databox so that you can present it to your clients.

Why is white-labeling important?

White Labeling of Making Reports helps your agency’s branding efforts. Even if you use an external tool to create your reports. Having the option of branding them as your own has a great positive effect on how your clients perceive your company and are great for brand reinforcement.

Most important white-labeling features

When creating your White-Labeled Marketing Reports, it is essential that you ensure that they have the following features:

Incorporating your company’s logo on a Marketing Report is a must. The best location is toward the top of each report in the upper left or right corner. The same location works for Dashboards You can use a watermark in place of the logo as well. To save space and make it more impactful, don’t include your tagline or slogan.

2. Header/Footer

Using the header or footer as additional branding opportunities on your Marketing Reports is a great idea. You can include some of the following information in them – general contact information for your agency, your physical address, main phone number, email address, and website address. Having a white label solution that supports custom headers and footers is a great plus.

Make sure that the colors you choose to match your brand’s. But at the same time that they don’t diminish the visibility of the data presented.

4. Dashboard Domain

Keep in mind that in case your company provides clients with a unique login to view their white-label reports or dashboard online, branding the Dashboard domain is a huge plus. This will make things a lot easier for your clients as all they need to do is visit a subdomain of your agency website to log in.

5. Email Domain

Since you are the one delivering the report to your clients, in most cases, this is done via email. It is important for better branding of your business that you send the report from an agency-branded account and not a solution-branded account. There is no need for your clients to know which Marketing Reporting tool you are using.

Stay on Top of Your Marketing Reporting Game

To finish off, we want to provide you with some useful advice on how you can always stay on top of your marketing game. In order not to miss a beat and ensure success one must keep a close eye on each and every part of their marketing process.

Use Project Management Tools

If you decide not to use project management tools, there is a good chance that you’re wasting a lot of time on the little things and doing more work than necessary. Keeping track of who’s working on what is not easy, and dropping the ball will lead to an inefficient collaboration among team members and teams and spread across email threads and chat software. This usually results in missed deadlines and dissatisfied clients.

Using project management tools make all the above-mentioned problems go away. You get to run a soothe marketing operation with everyone knowing what their tasks are and how they are contributing. Not to mention that it helps define a clear timeline and meet even the strictest of deadlines.

Set up Notifications/Alerts

You don’t have to check daily when which task is due. By setting up notifications and alerts from anything from team meetings to posting content, you will stay on track and not have delays.

Editor’s note: Did you know that you can get KPI performance alerts right in Slack? Connect your data and start receiving performance insights directly in Slack now.

Organize Marketing Meetings

Weekly marketing team meetings are a great way to inform everyone what is the current state of affairs. You can share RMarketing reports and metrics to demonstrate how far your team is from reaching the set goals and exchange thoughts and ideas. Communication within a team and between different teams is essential for running a successful marketing department.

Ready to Build a Free Marketing Report in Databox?

Chances are, you’re tracking a bunch of marketing metrics across a bunch of different tools.

You can visualize those metrics, alongside metrics from other tools you’re using, in one place with Databox.

More importantly, our marketing dashboard software is free. Just create your free account here , connect your data, and build your first marketing report in minutes.

- Databox Benchmarks

- Future Value Calculator

- ROI Calculator

- Return On Ads Calculator

- Percentage Growth Rate Calculator

- Report Automation

- Client Reporting

- What is a KPI?

- Google Sheets KPIs

- Sales Analysis Report

- Shopify Reports

- Data Analysis Report

- Google Sheets Dashboard

- Best Dashboard Examples

- Analysing Data

- Marketing Agency KPIs

- Automate Agency Google Ads Report

- Marketing Research Report

- Social Media Dashboard Examples

- Ecom Dashboard Examples

Does Your Performance Stack Up?

Are you maximizing your business potential? Stop guessing and start comparing with companies like yours.

A Message From Our CEO

At Databox, we’re obsessed with helping companies more easily monitor, analyze, and report their results. Whether it’s the resources we put into building and maintaining integrations with 100+ popular marketing tools, enabling customizability of charts, dashboards, and reports, or building functionality to make analysis, benchmarking, and forecasting easier, we’re constantly trying to find ways to help our customers save time and deliver better results.

Do you want an All-in-One Analytics Platform?

Hey, we’re Databox. Our mission is to help businesses save time and grow faster. Click here to see our platform in action.

Senior Marketing Strategist at Databox

Get practical strategies that drive consistent growth

12 Tips for Developing a Successful Data Analytics Strategy

What Is Data Reporting and How to Create Data Reports for Your Business

What Is KPI Reporting? KPI Report Examples, Tips, and Best Practices

Build your first dashboard in 5 minutes or less

Latest from our blog

- How to Improve Your CRM Data Management Based on Insights From 140+ Companies September 12, 2024

- How to Select the Most Effective Facebook Ad Objectives for Your Business [Insights from 130+ Experts] September 6, 2024

- Metrics & KPIs

- vs. Tableau

- vs. Looker Studio

- vs. Klipfolio

- vs. Power BI

- vs. Whatagraph

- vs. AgencyAnalytics

- Product & Engineering

- Inside Databox

- Terms of Service

- Privacy Policy

- Talent Resources

- We're Hiring!

- Help Center

- API Documentation

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

9 Key stages in your marketing research process

You can conduct your own marketing research. Follow these steps, add your own flair, knowledge and creativity, and you’ll have bespoke research to be proud of.

Marketing research is the term used to cover the concept, development, placement and evolution of your product or service, its growing customer base and its branding – starting with brand awareness , and progressing to (everyone hopes) brand equity . Like any research, it needs a robust process to be credible and useful.

Marketing research uses four essential key factors known as the ‘marketing mix’ , or the Four Ps of Marketing :

- Product (goods or service)

- Price ( how much the customer pays )

- Place (where the product is marketed)

- Promotion (such as advertising and PR)

These four factors need to work in harmony for a product or service to be successful in its marketplace.

The marketing research process – an overview

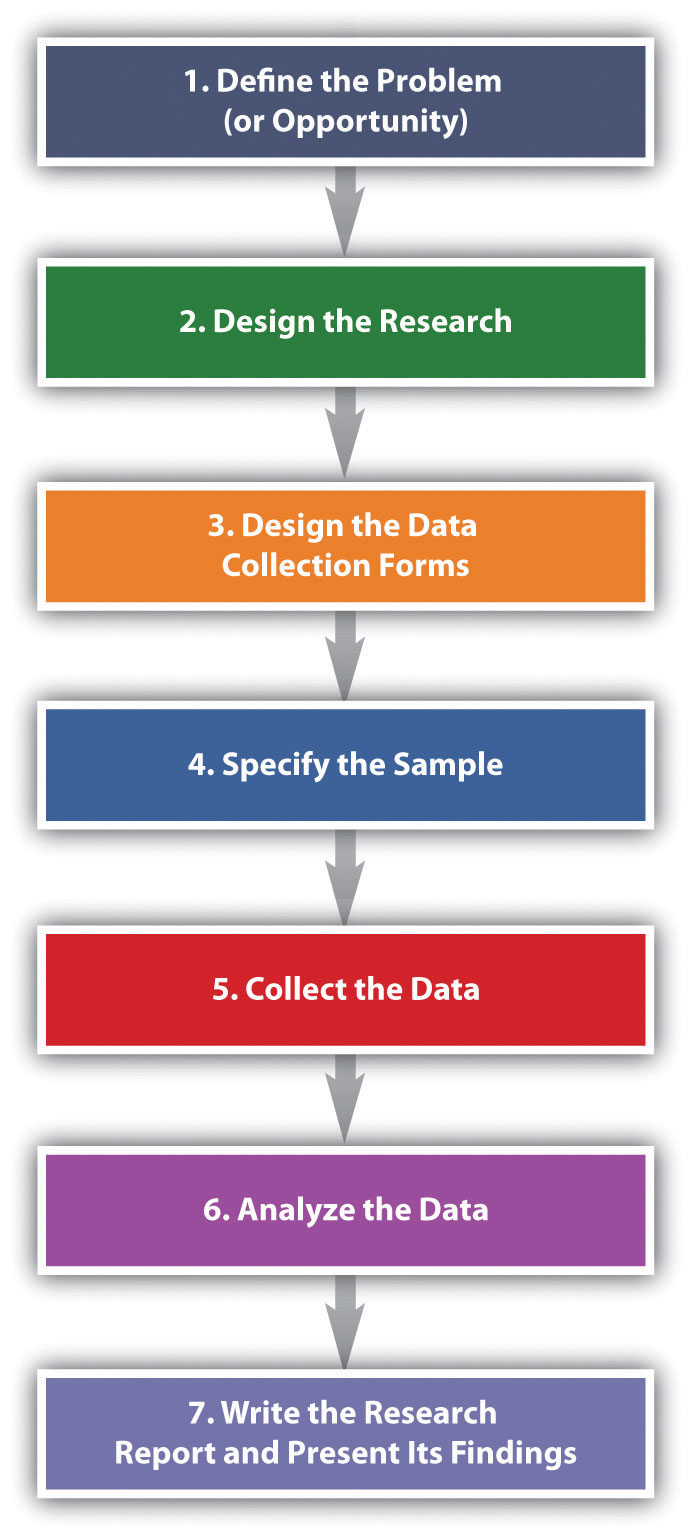

A typical marketing research process is as follows:

- Identify an issue, discuss alternatives and set out research objectives

- Develop a research program

- Choose a sample

- Gather information

- Gather data

- Organize and analyze information and data

- Present findings

- Make research-based decisions

- Take action based on insights

Step 1: Defining the marketing research problem

Defining a problem is the first step in the research process. In many ways, research starts with a problem facing management. This problem needs to be understood, the cause diagnosed, and solutions developed.

However, most management problems are not always easy to research, so they must first be translated into research problems. Once you approach the problem from a research angle, you can find a solution. For example, “sales are not growing” is a management problem, but translated into a research problem, it becomes “ why are sales not growing?” We can look at the expectations and experiences of several groups : potential customers, first-time buyers, and repeat purchasers. We can question whether the lack of sales is due to:

- Poor expectations that lead to a general lack of desire to buy, or

- Poor performance experience and a lack of desire to repurchase.

This, then, is the difference between a management problem and a research problem. Solving management problems focuses on actions: Do we advertise more? Do we change our advertising message? Do we change an under-performing product configuration? And if so, how?

Defining research problems, on the other hand, focus on the whys and hows, providing the insights you need to solve your management problem.

Step 2: Developing a research program: method of inquiry

The scientific method is the standard for investigation. It provides an opportunity for you to use existing knowledge as a starting point, and proceed impartially.

The scientific method includes the following steps:

- Define a problem

- Develop a hypothesis

- Make predictions based on the hypothesis

- Devise a test of the hypothesis

- Conduct the test

- Analyze the results

This terminology is similar to the stages in the research process. However, there are subtle differences in the way the steps are performed:

- the scientific research method is objective and fact-based, using quantitative research and impartial analysis

- the marketing research process can be subjective, using opinion and qualitative research, as well as personal judgment as you collect and analyze data

Step 3: Developing a research program: research method

As well as selecting a method of inquiry (objective or subjective), you must select a research method . There are two primary methodologies that can be used to answer any research question:

- Experimental research : gives you the advantage of controlling extraneous variables and manipulating one or more variables that influence the process being implemented.

- Non-experimental research : allows observation but not intervention – all you do is observe and report on your findings.

Step 4: Developing a research program: research design

Research design is a plan or framework for conducting marketing research and collecting data. It is defined as the specific methods and procedures you use to get the information you need.

There are three core types of marketing research designs: exploratory, descriptive, and causal . A thorough marketing research process incorporates elements of all of them.

Exploratory marketing research

This is a starting point for research. It’s used to reveal facts and opinions about a particular topic, and gain insight into the main points of an issue. Exploratory research is too much of a blunt instrument to base conclusive business decisions on, but it gives the foundation for more targeted study. You can use secondary research materials such as trade publications, books, journals and magazines and primary research using qualitative metrics, that can include open text surveys, interviews and focus groups.

Descriptive marketing research

This helps define the business problem or issue so that companies can make decisions, take action and monitor progress. Descriptive research is naturally quantitative – it needs to be measured and analyzed statistically , using more targeted surveys and questionnaires. You can use it to capture demographic information , evaluate a product or service for market, and monitor a target audience’s opinion and behaviors. Insights from descriptive research can inform conclusions about the market landscape and the product’s place in it.

Causal marketing research

This is useful to explore the cause and effect relationship between two or more variables. Like descriptive research , it uses quantitative methods, but it doesn’t merely report findings; it uses experiments to predict and test theories about a product or market. For example, researchers may change product packaging design or material, and measure what happens to sales as a result.

Step 5: Choose your sample

Your marketing research project will rarely examine an entire population. It’s more practical to use a sample - a smaller but accurate representation of the greater population. To design your sample, you’ll need to answer these questions:

- Which base population is the sample to be selected from? Once you’ve established who your relevant population is (your research design process will have revealed this), you have a base for your sample. This will allow you to make inferences about a larger population.

- What is the method (process) for sample selection? There are two methods of selecting a sample from a population:

1. Probability sampling : This relies on a random sampling of everyone within the larger population.

2. Non-probability sampling : This is based in part on the investigator’s judgment, and often uses convenience samples, or by other sampling methods that do not rely on probability.

- What is your sample size? This important step involves cost and accuracy decisions. Larger samples generally reduce sampling error and increase accuracy, but also increase costs. Find out your perfect sample size with our calculator .

Step 6: Gather data

Your research design will develop as you select techniques to use. There are many channels for collecting data, and it’s helpful to differentiate it into O-data (Operational) and X-data (Experience):

- O-data is your business’s hard numbers like costs, accounting, and sales. It tells you what has happened, but not why.

- X-data gives you insights into the thoughts and emotions of the people involved: employees, customers, brand advocates.

When you combine O-data with X-data, you’ll be able to build a more complete picture about success and failure - you’ll know why. Maybe you’ve seen a drop in sales (O-data) for a particular product. Maybe customer service was lacking, the product was out of stock, or advertisements weren’t impactful or different enough: X-data will reveal the reason why those sales dropped. So, while differentiating these two data sets is important, when they are combined, and work with each other, the insights become powerful.

With mobile technology, it has become easier than ever to collect data. Survey research has come a long way since market researchers conducted face-to-face, postal, or telephone surveys. You can run research through:

- Social media ( polls and listening )

Another way to collect data is by observation. Observing a customer’s or company’s past or present behavior can predict future purchasing decisions. Data collection techniques for predicting past behavior can include market segmentation , customer journey mapping and brand tracking .

Regardless of how you collect data, the process introduces another essential element to your research project: the importance of clear and constant communication .

And of course, to analyze information from survey or observation techniques, you must record your results . Gone are the days of spreadsheets. Feedback from surveys and listening channels can automatically feed into AI-powered analytics engines and produce results, in real-time, on dashboards.

Step 7: Analysis and interpretation

The words ‘ statistical analysis methods ’ aren’t usually guaranteed to set a room alight with excitement, but when you understand what they can do, the problems they can solve and the insights they can uncover, they seem a whole lot more compelling.

Statistical tests and data processing tools can reveal:

- Whether data trends you see are meaningful or are just chance results

- Your results in the context of other information you have

- Whether one thing affecting your business is more significant than others

- What your next research area should be

- Insights that lead to meaningful changes

There are several types of statistical analysis tools used for surveys. You should make sure that the ones you choose:

- Work on any platform - mobile, desktop, tablet etc.

- Integrate with your existing systems

- Are easy to use with user-friendly interfaces, straightforward menus, and automated data analysis

- Incorporate statistical analysis so you don’t just process and present your data, but refine it, and generate insights and predictions.

Here are some of the most common tools:

- Benchmarking : a way of taking outside factors into account so that you can adjust the parameters of your research. It ‘levels the playing field’ – so that your data and results are more meaningful in context. And gives you a more precise understanding of what’s happening.

- Regression analysis : this is used for working out the relationship between two (or more) variables. It is useful for identifying the precise impact of a change in an independent variable.

- T-test is used for comparing two data groups which have different mean values. For example, do women and men have different mean heights?

- Analysis of variance (ANOVA) Similar to the T-test, ANOVA is a way of testing the differences between three or more independent groups to see if they’re statistically significant.

- Cluster analysis : This organizes items into groups, or clusters, based on how closely associated they are.

- Factor analysis: This is a way of condensing many variables into just a few, so that your research data is less unwieldy to work with.

- Conjoint analysis : this will help you understand and predict why people make the choices they do. It asks people to make trade-offs when making decisions, just as they do in the real world, then analyzes the results to give the most popular outcome.

- Crosstab analysis : this is a quantitative market research tool used to analyze ‘categorical data’ - variables that are different and mutually exclusive, such as: ‘men’ and ‘women’, or ‘under 30’ and ‘over 30’.

- Text analysis and sentiment analysis : Analyzing human language and emotions is a rapidly-developing form of data processing, assigning positive, negative or neutral sentiment to customer messages and feedback.

Stats IQ can perform the most complicated statistical tests at the touch of a button using our online survey software , or data from other sources. Learn more about Stats iQ now .

Step 8: The marketing research results

Your marketing research process culminates in the research results. These should provide all the information the stakeholders and decision-makers need to understand the project.

The results will include:

- all your information

- a description of your research process

- the results

- conclusions

- recommended courses of action

They should also be presented in a form, language and graphics that are easy to understand, with a balance between completeness and conciseness, neither leaving important information out or allowing it to get so technical that it overwhelms the readers.

Traditionally, you would prepare two written reports:

- a technical report , discussing the methods, underlying assumptions and the detailed findings of the research project

- a summary report , that summarizes the research process and presents the findings and conclusions simply.

There are now more engaging ways to present your findings than the traditional PowerPoint presentations, graphs, and face-to-face reports:

- Live, interactive dashboards for sharing the most important information, as well as tracking a project in real time.

- Results-reports visualizations – tables or graphs with data visuals on a shareable slide deck

- Online presentation technology, such as Prezi

- Visual storytelling with infographics

- A single-page executive summary with key insights

- A single-page stat sheet with the top-line stats

You can also make these results shareable so that decision-makers have all the information at their fingertips.

Step 9 Turn your insights into action

Insights are one thing, but they’re worth very little unless they inform immediate, positive action. Here are a few examples of how you can do this:

- Stop customers leaving – negative sentiment among VIP customers gets picked up; the customer service team contacts the customers, resolves their issues, and avoids churn .

- Act on important employee concerns – you can set certain topics, such as safety, or diversity and inclusion to trigger an automated notification or Slack message to HR. They can rapidly act to rectify the issue.

- Address product issues – maybe deliveries are late, maybe too many products are faulty. When product feedback gets picked up through Smart Conversations, messages can be triggered to the delivery or product teams to jump on the problems immediately.

- Improve your marketing effectiveness - Understand how your marketing is being received by potential customers, so you can find ways to better meet their needs

- Grow your brand - Understand exactly what consumers are looking for, so you can make sure that you’re meeting their expectations

Free eBook: Quantitative and qualitative research design

Scott Smith

Scott Smith, Ph.D. is a contributor to the Qualtrics blog.

Related Articles

May 20, 2024

Best strategy & research books to read in 2024

May 13, 2024

Experience Management

X4 2024 Strategy & Research Showcase: Introducing the future of insights generation

November 7, 2023

Brand Experience

The 4 market research trends redefining insights in 2024

June 27, 2023

The fresh insights people: Scaling research at Woolworths Group

June 20, 2023

Bank less, delight more: How Bankwest built an engine room for customer obsession

April 1, 2023

Academic Experience

How to write great survey questions (with examples)

March 21, 2023

Sample size calculator

November 18, 2022

Statistical analysis software: your complete guide to getting started

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

Learn How to Write a Market Research Report: 10 Steps to Follow for Success

Dec, 2023 - by CMI

A market research report is an integral part of the coursework for many business programs. It explores the understanding of subjective views of customers towards a product or service. Still, many students struggle to create market reports that effectively address the business question. So, how do you avoid the deer-in-the-headlights reaction when presenting a market research report?

In most cases, marketers fail to create impactful research reports because they don’t know the actionable steps to follow. 10 main steps occur in a typical market research study and reporting process, from problem identification to acting on the result. Read on to get all the information you need to write a top-notch market research report.

What Is a Market Research Report?

A market research report is a document prepared to evaluate the feasibility of a new product or service to potential customers. Companies do market research reports to paint a picture of what products, services, or actions may be the most profitable to pursue. Actionable information is obtained through market research prepared in a formal report that reveals the characteristics of customers, the value of a product or service, buying habits, and a list of top competitors.

Writing a market research report helps businesses make calculated decisions about what ideas to pursue or not. It focuses on studying consumer behavior that influences spending decisions, including cultural, economic, societal, and personal factors. As a result, businesses can assimilate critical information and tips about prospective customers and target markets.

10 Steps to Write a Market Research Report That Accurately Highlights Market Opportunities

Identify the problem and objectives.

In market research, there’s a famous saying that a problem half defined is a problem half solved. So defining the potential problem, causes, or opportunities in the market is a great place to start your marketing research papers. The information will help you narrow down the parameters of the study, such as the business objective and research objectives. Whether you want to test a hypothesis about consumer opinion or how consumers will react to a new pricing model, they all require identifying a solid objective.

Develop your research strategy