- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Interview Questions

Equity Research Interview Questions and Answers (40 Samples)

40 common equity research interview questions. Examples include technical, transactional, behavioral, and logical tests with sample answers

Prior to becoming a Founder for Curiocity, Hassan worked for Houlihan Lokey as an Investment Banking Analyst focusing on sellside and buyside M&A , restructurings, financings and strategic advisory engagements across industry groups.

Hassan holds a BS from the University of Pennsylvania in Economics.

Mr. Arora is an experienced private equity investment professional, with experience working across multiple markets. Rohan has a focus in particular on consumer and business services transactions and operational growth. Rohan has also worked at Evercore, where he also spent time in private equity advisory.

Rohan holds a BA (Hons., Scholar) in Economics and Management from Oxford University.

Common First Equity Research Interview Questions

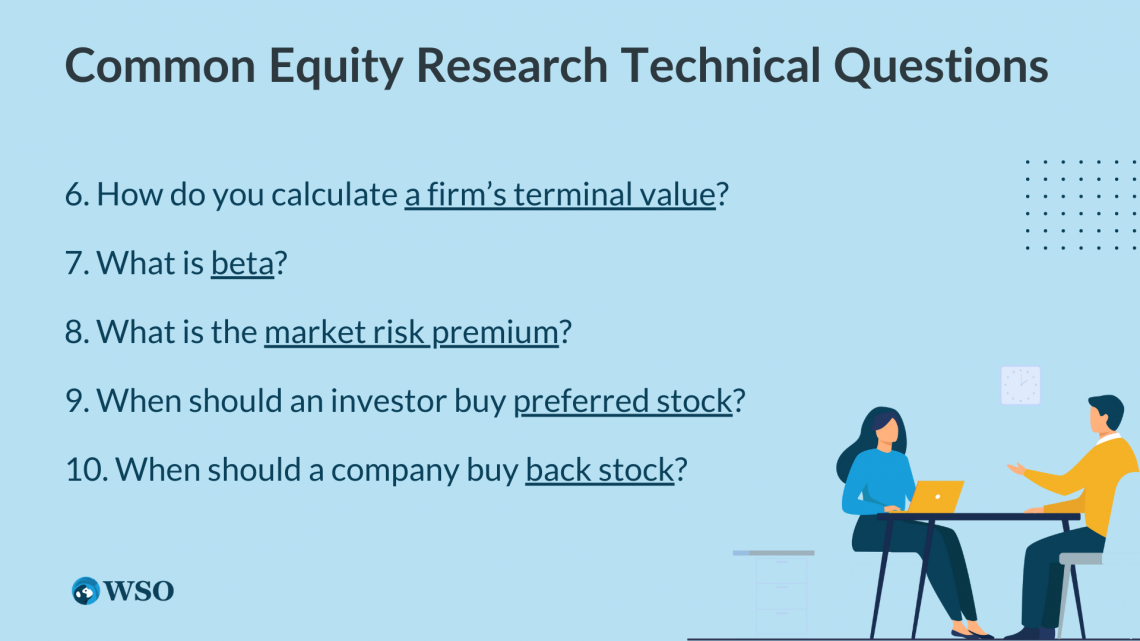

15 common equity research technical questions.

- WSO Bonus Technical Question

8 Fund-Specific Hard Technical Questions

- 5 Most Common Equity Research Behavioral/Fit Questions

5 Firm-Specific Behavioral/Fit Questions

5 logical puzzles - interview brain teasers, full wso hedge fund prep guide & additional resources, list of hedge funds.

Equity Research (ER) attracts seasoned professionals and new hires with a variety of talents and diversified skill sets across the world for a fulfilling career. New hires starting right out of school will start as research associates and move up the chain to becoming research analysts after gaining experience in the industry.

Given the limited number of positions for a tremendous amount of applicants, it is no surprise that the interview process is designed to be incredibly competitive .

Consequently, answering the technical and behavioral questions confidently and consistently is key to converting an interview into an offer . Therefore, the best way to prepare for these interviews is to follow the markers, learn to answer the common questions asked (covered below!), and practice tirelessly.

The following free WSO ER interview guide is a comprehensive tool designed to cover every single aspect of the ER interview process, walking you through step by step from the beginning to the end of the interview. This interview guide will drastically improve your chances of securing an offer with your dream job.

Our guide covers a total of 40 of the most common behavioral, technical, and logical questions, along with proven sample answers , that are asked by hedge funds professionals to candidates during the hiring process.

We strongly believe it’s a great place to start your preparation before investing in our more comprehensive Hedge Fund Interview Course .

This resource features 13 firm-specific questions from leading hedge funds ( Citadel , Bridgewater Associates , etc.) and proven sample answers to them.

Successful professionals within the equity research industry can present themselves as the ideal candidate for the position by highlighting their genuine interest in finance and strong work ethic. A candidate’s presentation of themself occurs at the beginning of the interview, often through these two questions. Regardless of the firm, the position, or the location, we can guarantee that these industry standard questions will be asked.

Anticipating both of these questions before walking into the interview, being well-practiced in crafting a compelling narrative around them, and selling yourself will make you stand out from amongst the pool of potential candidates.

Walk me through your background/resume

We recommend you dial in a cohesive 90-second resume walkthrough that highlights as well as explains all the on the positive and motivating factors behind every transition on your resume (school to job, job to better job, most recent position to grad school).

A good example highlighting this is as follows,

I initially went to school to learn how to design cars, but after my first internship in the field, I realized that I loved interacting with clients directly and decided to pursue full-time roles in B2B sales. In these sales roles, I learned and developed solid selling skills as well as gained direct exposure to A, B, and C. Since I wanted to continue refining that skill set and branch out to focus on X, Y, and Z, I am looking for a new role/promotion which provides that opportunity…

Be deliberate with your delivery. Every decision you made should have a purpose (preferably that you initiated). Don't be negative with your answers. It's important to never say you left because you were bored or "wanted to try something new."

Moving on from there, have a few backup stories prepared. These stories should effectively portray you as a good ER candidate involve highlighting your abilities as a go-getter with a genuine interest in financial markets. Have these stories prepped and use them to answer whatever the interviewer is asking you. Tell these stories with confidence, clarity, and relevance, and you’ll be putting yourself in good territory. Again, it is key to ensure your resume lines up and supports your stories.

WSO has published its very own Equity Research sample resume template and provides guidelines on crafting a successful ER resume. Check it out at WSO’s official Equity Research Resume Guidelines page.

Why equity research?

Given the wide variety of professional backgrounds that candidates come from, WSO has created a dedicated page to answer this question. WSO’s “Why Equity Research?” page covers a variety of sample answers tailored for students and professionals looking to break into equity research.

Free Interview Training

Sign up to our FREE 5-Day Interview Training to kickstart your interview prep.

Technical questions are a cruical component of almost every equity research recruiting process. Therefore, your interviewers will expect accurate and detailed responses to commonly asked technical questions. It's important that and your answers must demonstrate in-depth knowledge and expertise of the topics at hand. The following section features 15 common ER interview questions , and sample answers have been provided for every question.

At the end of these 15 questions, we have also provided you with eight exclusive firm-specific technical questions to jumpstart your mock interview training.

The 15 technical questions covered below are exclusive to the equity research industry. However, equity research interviews often overlap with investment banking and hedge fund interviews as general finance/accounting questions can also be asked. To check out an additional 45 technical questions with sample answers, check out WSO’s free 101 Investment Banking Interview Questions and Answers and Hedge Fund Interview Questions pages.

1. What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization . It is a general metric for evaluating a company’s cash profitability. In addition, it is sometimes used as a proxy for free cash flow because it will allow you to gauge how much cash is available from operations to pay financing costs like interest, capital expenditures, etc. This is one of the most important single items someone will look at in evaluating a Company.

EBITDA = Revenues - Expenses (excluding non-cash and non-operational items like interest, taxes, depreciation, and amortization)

Sample Answer:

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s an excellent high-level indicator of a company’s financial performance .

Since it removes the effects of financing and accounting decisions such as interest and depreciation, it is a much better metric than revenue or net profit for comparing different companies. As a result, it serves as a rough estimate of free cash flow and is used in the EV/EBITDA multiple to establish a company’s high-level valuation quickly .

2. What is enterprise value?

Enterprise Value is the value of an entire firm. It accounts for the debt and equity in a business and is calculated using the equation below. This is the price that would be paid for a company in the event of an acquisition, where the acquirer takes on all the debt and equity of the acquiree .

Simplified Enterprise Value Formula :

Enterprise Value = Market Value of Equity + Debt + Preferred Stock + Minority Interest - Cash

Enterprise Value is the value of a firm as a whole from the perspective of its owners, including both debt and equity holders. In its simplest form, you calculate an Enterprise Value by taking the market value of equity (aka the company’s market cap ), adding the debt and the value of the outstanding preferred stock. Then you add the value of any minority interests the company owns and then subtract the cash the company currently holds.

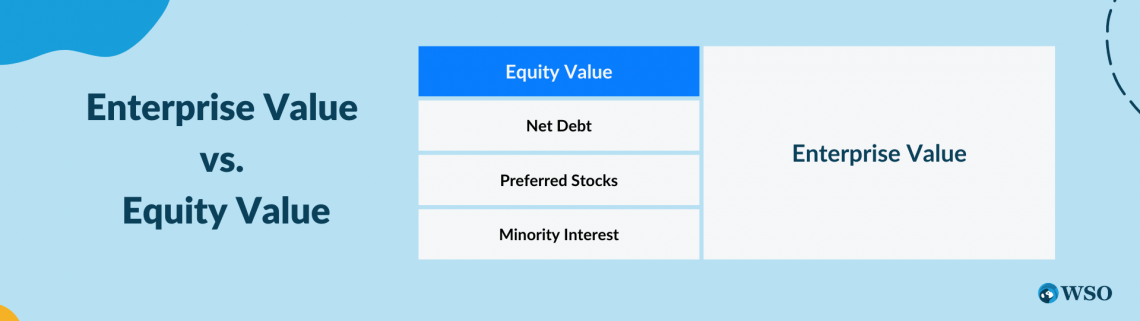

3. What is the difference between enterprise value and equity value?

Equity Value represents residual value for common shareholders after the company satisfies its outstanding obligations (net debt, preferred stock, which is senior to common equity). In contrast, enterprise value represents the value available to both equity and debt holders.

4. How do you value a private company?

- You cannot use a straight market valuation since the company is not publicly traded.

- A DCF can be complicated by the absence of an equity beta, making calculating WACC difficult. In this case, you have to use the equity beta of a close comp in your WACC calculation.

- Financial information for private companies is more difficult to find because they are not required to make public online filings.

- An analyst may apply a discount on a comparable company’s valuation if the comps are publicly held because a public company will demand a 10-15% premium for the liquidity an investor enjoys when investing in a public company.

5. Why might there be multiple valuations of a single company?

Each valuation method will generate a different value because it is based on various assumptions, multiples, or comparable companies and/or transactions.

Typically, the precedent transaction methodology and discounted cash flow method result in a higher valuation than the result of a comparable companies' analysis or market valuation. In addition, the precedent transaction result may be higher because the approach usually includes a “ control premium ” while calculating the company’s market value. This premium exists to entice shareholders to sell and will account for the “synergies” that are expected from the merger .

The DCF approach typically produces higher valuations because analysts’ projections and assumptions are usually somewhat optimistic.

You can value a private company with many of the same techniques one may use for a public company valuation. However, there are a few differences. There will be difficulty in obtaining the right inputs as financial information will likely be harder to find, potentially less complete, and less reliable. Further, you can’t simply use a straight market valuation for a company that isn’t publicly traded. On top of this, a DCF can be problematic because a private company will not have an equity beta to use in the usual WACC calculation. Finally, if you are doing a comps analysis using publicly traded companies, a 10-15% discount may be required in the calculations as a 10-15% premium is typically paid for the public company’s relative liquidity.

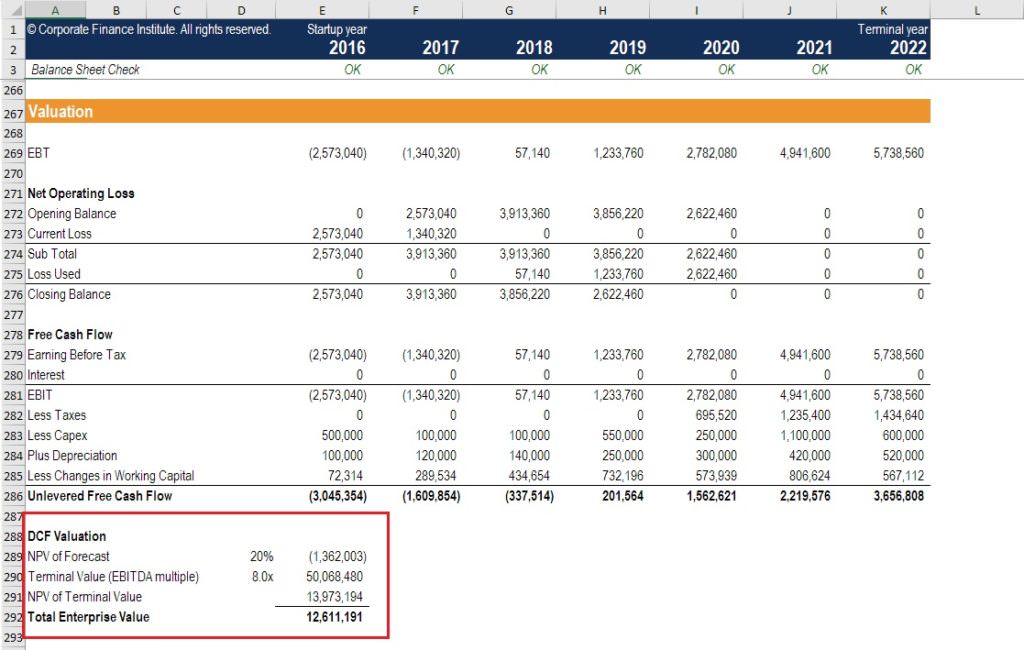

6. How do you calculate a firm’s terminal value?

Terminal Value = ( FCF t (1+g)) / (WACC - g)

- To establish a terminal value, you can either use the formula above, which is the perpetual growth methodology, or the multiples method.

- In the multiples method, you assign a valuation multiple (such as EV/EBITDA) to the final year’s projection and use that as the “terminal value” of the firm.

- In either case, you must remember to discount this “cash flow” back to year zero as you have with all other cash flows in the DCF model .

There are two ways to calculate terminal values. The first is the multiples method. In order to use this method, you choose an operation metric (most commonly EBITDA) and apply a comparable company’s multiple to that number from the final year of projections.

The second method is the perpetual growth method, where you select a modest growth rate, typically just a little bit higher than the inflation rate and lower than the GDP growth rate, and assume that the company can grow at this rate infinitely. Then you multiply the FCF from the final year by 1 plus the growth rate and divide that number by the discount rate (WACC) minus the assumed growth rate.

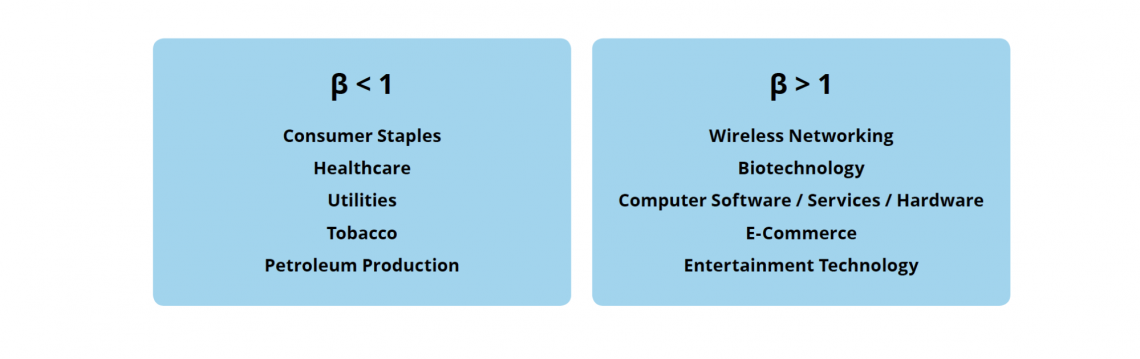

7. What is beta?

- It represents the relative volatility or risk of a given investment with respect to the market.

- Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of 1, while investments that are more volatile than the market have a beta greater than 1, and those that are less volatile have a beta less than 1.

- β < 1 means less volatile than the market (lower risk, lower reward).

- β > 1 means more volatile than the market (higher risk, higher reward).

- A beta of 1.2 means that an investment theoretically will be 20% more volatile than the market. For example, if the market goes up 10%, that investment should increase by 12%.

8. What is the market risk premium?

The market risk premium is the excess return that investors require for choosing to purchase stocks over “risk-free” securities. It is calculated as the average return on the market (usually the S&P 500, typically around 10-12%) minus the risk-free rate (current yield on a 10-year Treasury).

9. When should an investor buy preferred stock?

- Preferred stock could be looked at as a cross between debt and equity. It will generally provide investors with a fixed dividend rate (like a bond), but also allow for some capital appreciation (like a stock). Preferred stock may also have a conversion feature that allows shareholders to convert their preferred stock into common stock .

- It typically does not have voting rights like those of common stock.

- It is senior to common stock within the company’s capital structure .

An investor should buy preferred stock for the upside potential of equity while limiting risk and assuring stability of current income in the form of a dividend. In addition, preferred stock’s dividends are more secure than those from common stock. Owners of preferred stock also enjoy a superior right to the company’s assets, though inferior to those of debt holders, should the company go bankrupt.

10. When should a company buy back stock?

A company should buy back its own stock if it believes the stock is undervalued when it has extra cash. However, if it believes it can make money by investing in its own operations, or if it wants to increase its stock price by increasing its EPS by reducing shares outstanding or sending a positive signal to the market. Also, a stock buyback is the best way to return money to shareholders, as they are tax-efficient when compared to dividends.

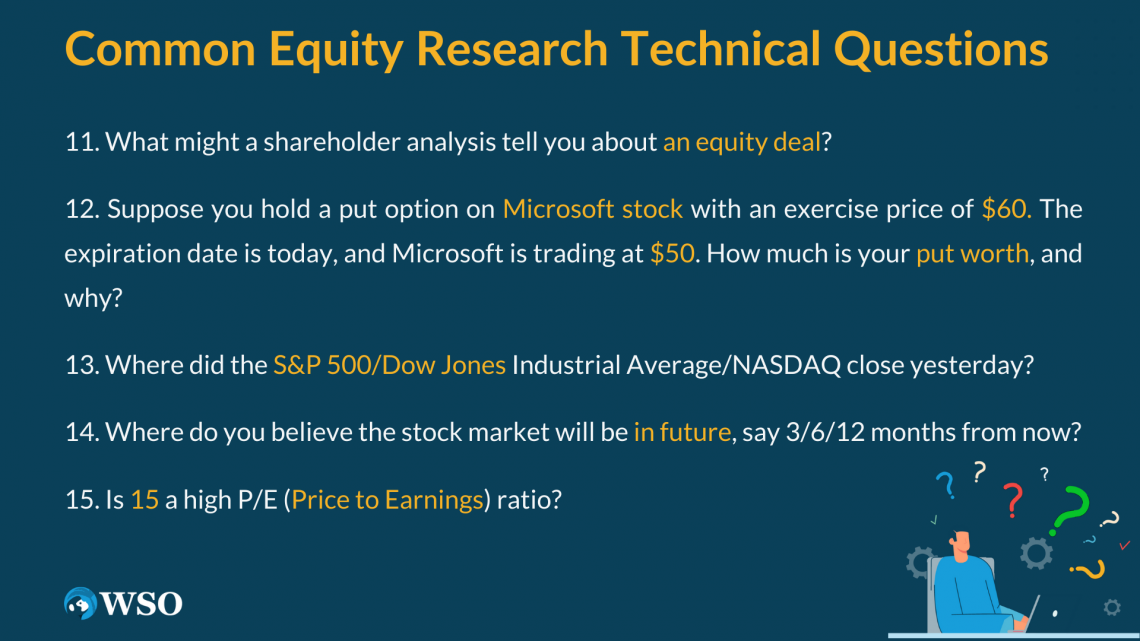

11. What might a shareholder analysis tell you about an equity deal?

- For an existing public company, a shareholder analysis compares current institutional investors to ones that the company might target in a new equity offering.

- You could also use this analysis to find institutional investors with similar industry holdings that have not yet invested in your client and target them in the offering.

12. Suppose you hold a put option on Microsoft stock with an exercise price of $60. The expiration date is today, and Microsoft is trading at $50. How much is your put worth, and why?

This put is worth $10. It gives you the option to sell your shares at $60, and you can buy them in the open market at $50. You therefore would buy shares of Microsoft at $50 per share and immediately sell them for $60, making a profit of $10 per share.

13. Where did the S&P 500/Dow Jones Industrial Average/NASDAQ close yesterday?

- This question is used to gauge your general interest in the financial markets . You probably will not be expected to know the number to the penny, but knowing the levels of the three major exchanges/indices, as well as whether they were up or down and why will show your interviewer that you keep track of what is going on in the world of finance.

- You should know how the market moved (up or down) the previous day and why it moved. You can find this information by watching CNBC , reading the WSJ, or just by using Google.

- Yesterday the XXXX closed at XXXX, up/down XXX from the open. I also noticed that it was up XXX from the day before due to …

- It would also be a good demonstration of market interest to know the overall valuation levels of the three major indices. The P/E ratios for the overall Dow, S&P 500, and Nasdaq are publicly available on major financial news publications.

14. Where do you believe the stock market will be in future, say 3/6/12 months from now?

- This question can show your interest in the markets. There’s no right/wrong answer as everyone has different opinions on where the market is going.

- You need to have an opinion and well-thought-out reasoning for that opinion.

- If you think the market will drop in the next three months, hit bottom, and then begin to bounce back, have a reason to explain why you think it is going to drop, why it is going to bottom out, and why it is going to bottom out will begin to rise.

- It is more important to display logical reasoning than to be correct.

- Do some research before your interview. Read what writers for major newspapers are predicting and saying, and then implement some of their reasons in your own explanation.

- Also, be sure to stick to your reasoning. Your interviewer may challenge your position and question your reasoning. If you have to come up with a solid theory behind your response, be confident in your position and try to explain your rationale. If your logic and thought process makes sense, don’t change your opinion just to agree with your interviewer.

15. Is 15 a high P/E (Price to Earnings) ratio?

This is not just a yes or no question. A firm’s P/E ratio is essential compared to other companies in its industry. P/E can be thought of as how many dollars an investor is willing to pay for one dollar of earnings.

A high P/E represents high anticipated growth in earnings. In high-growth industries, such as technology, a P/E ratio of 15 may be considered relatively low. This is because the company is expected to grow its earnings at a high rate and therefore deserves a higher valuation relative to its present earnings.

However, a P/E of 15 may be considered high for a large pharmaceutical company since earnings growth may be expected to be slow but steady in future years.

It depends on the industry. For example, a P/E ratio of 15 in an industry like financial institutions may be considered a bit high, but if the company is a high-growth tech company, 15 may be considered relatively low.

WSO Bonus Technical Question:

"pitch me a stock".

The stock pitch is arguably the most crucial and most common question you will be asked during the interview process. Ideally, you want to have 2-4 stocks in mind that you can pitch , i.e. large-cap, small-cap, stock to short. We advise spending 30 minutes to a couple of hours finding a stock you like and listing out the reasons why. Even if your interviewer doesn't ask you, it's always better to be prepared for these interviews. Here's a good explanation of how to answer this question.

They are trying to figure out whether you understand the underlying concept of what drives a business. Some questions to help figure this out are:

- What are the key drivers of the company (both revenue and cost)?

- Why is it a good investment?

- What are the potential opportunities available?

- What' s their competitive advantage ?

- What are the primary risks?

Here's a sample stock pitch, courtesy of [esbanker] , a private equity associate. The post has been edited and formatted.

Well, I've recently been following Copa Airlines, a Panamanian airline company, currently trading at $xx per share. Recently, the airline industry has been underperforming the markets for several reasons: compressed margins from the volatility in oil this year increased competition from low-cost carriers, and over-leverage by most airlines (think American or Air Canada). While many airline companies are in desperate need of restructuring, Copa airlines have seen their revenues - now at $1.4 billion - growing at a robust 10% compounded over the last 5 years. Copa boasts an EBITDA of approx. $350 MM, Net Income of around $240MM, which translates to roughly 18%. Margins have remained stable over the last few years and are significantly greater than other airlines. After running a basic DCF (5-year projections), Copa has an implied price per share of $xxx. In terms of comps, Copa is trading at an EV/ EBITDAR of 7 .7x, which is slightly less than the industry median of 10.3 x, and a PE ratio of 12.9 x relative to an industry median of 14.1 x. Given Copa's strategic positioning in Latin America, its strong operating and financial performance of late, and its relatively low share price, I would strongly recommend buying Copa Airlines.

Some of the numbers are out of date - this is from an early 2011 model.

Walking into the interview with an in-depth understanding of the above-covered 15 technical questions will undoubtedly make you stand out in the applicant pool. However, to achieve complete technical mastery, you must expect technical questions that are specific to different hedge funds.

The following section features eight exclusive interview questions that actual interviewers asked potential candidates at some of the world’s largest hedge funds during equity research interviews.

Did you know?

The following questions are from WSO’s company database , which is sourced from the detailed personal experiences of more than 30,000 people with hedge funds interviews. The Hedge Fund Interview Course includes access to over 800 questions across 165 hedge funds (no other resource comes close).

Point72 Technical Questions

- In order to value a company with no revenue, such as a start-up, you must project the company’s cash flows for future years and then construct a discounted cash flow model of those cash flows using an appropriate discount rate .

- Alternatively, you could also use other operating metrics to value the company. If you took a start-up website with 50,000 subscribers, but no revenue, you could look at a similar website’s value per subscriber and apply that multiple to the website you are valuing.

- Valuing a company with no revenue comes down to determining the market opportunity for a company and assigning a value per user, customer, or subscriber, and then discounting that back at an appropriate rate that accounts for the inherent execution and market risk .

A sample general approach to modeling and research could involve the following 6-step process:

- Formation of assumption/hypothesis

- Collection of relevant data

- Analysis of markets

- Creation of forecast

- Simulation/test-run

- Release and monitoring of model

- The profits generated on the Income Statement after any payment of dividends are added to shareholder ’s equity on the Balance Sheet under retained earnings .

- Debt on the Balance Sheet is used to calculate interest expense on the Income Statement .

- Property, plant, and equipment, on the Balance Sheet, are used to calculate depreciation expenses on the Income Statement.

There are many other links, but the above are some of the primary connections frequently analyzed as part of accompanying schedules in financial modeling .

There are many links between the Balance Sheet and the Income Statement. The central link is that any net income from the Income Statement, after the payment of any dividends, is added to retained earnings. In addition, debt on the Balance Sheet is used to calculate the interest expense on the Income Statement, and property, plant, and equipment (PP&E) are used to calculate any depreciation expense .

Citadel Investment Group Technical Questions

The exchange ratio is the relative number of new shares given to existing shareholders of a company that has been acquired or merged with another. It is used by companies looking to offer a full or part equity offer for an acquisition transaction.

It is best to go prepared with one long idea and one short idea. Being able to demonstrate that you understand the many nuances of shorting is a fantastic way to differentiate yourself from other possible candidates.

If you are interviewing for a specific sector/industry, then select a business from that industry to pitch . While your interviewer will likely know more about the industry and/or company, but as long as you stick to stating this, you should be in the clear.

Using a pitch structure such as the one below gives the best results:

- Industry : Why is the industry attractive? [Use a quantitative metric to show you did your homework here, such as, "ABC Industry has the ability to grow xyz% in the next 3-5 years. This is also a good place to highlight changing competitive dynamics, etc.]

- Company : Why is the company attractive? ["The business has sales of $30 in a $3,000 industry representing a 3% market share despite being recognized as the product leader and having an exceptional management team" is an example of one of the best way to address this]

- Catalyst : Why is the market wrong and how will the market realize the intrinsic value of the business? [This is the most critical part of the pitch. For example, "ABC is currently valued at 10x [insert multiple] but is being unfairly discounted because of the incompetency of the prior management team. Since the current management team has taken over [insert metric] XYZ has improved. As of right now, the market has not recognized the improvement in XYZ or the overall business, but I expect that [insert catalyst] will demonstrate ABC's true value to the market within [insert time frame]."

- Valuation : What is the intrinsic value of the business? ["If my assumptions [discuss them here] about the effect of [insert catalyst] prove true, then the market will realize ABC's intrinsic value of [insert valuation]." You can then speak about contingency valuations, etc.]

Try to keep your pitches as short as possible and as high-level as possible. This helps to minimize the chances of putting your foot in your mouth and allows the interviewer to ask more in-depth questions where they feel necessary. Of course, you also need to be prepared to answer in-depth questions about anything pertaining to your pitch. This includes topics ranging from the industry, competitors, or the company.

Note: The above extract was taken and paraphrased from WSO User @Simple As…’s post, “ The Asymmetric Risk Profile: Preparing For The Hedge Fund Interview ”

We assume that the entire Net Operating Balance ( NOL ) goes to $0 in an M&A transaction, and therefore we write down the existing Deferred Tax Asset by this NOL write -down.

Bridgewater Associates Technical Question

It could be beneficial to increase the volume of software sold and increase the price of pens, as the incremental cost of each additional software license sold is relatively low, and almost all of the additional revenue would flow directly to margins, not to mention its scalability. Increasing the price of pens has more advantages from a financial standpoint as they have a higher incremental cost (cost of producing a pen scales with quantity sold).

D.E. Shaw Group Technical Question

During the Covid-19 pandemic, the Fed lowered interest rates to accommodate the lack of demand due to the uncertainty caused by the pandemic. This led to massive inflation, the effects of which are now being realized. Looking at the treasury curve and comments by Mr. Powell (who mentioned that inflation is not transitionary), it is evident that the rates will increase by mid-2022. This is to ensure that inflation is curbed and the economy moves towards normalization post-Covid.

5 Most Common Equity Research behavioral/Fit Questions

Fit or “behavioral” questions are used to gauge whether or not you have the right work ethic, attitude, personality, and values to fit in with a Hedge Fund’s equity research department. Many Hedge Funds take this process extremely seriously because most firms typically have only a handful of investment professionals who must collaborate on projects over long hours and under tight deadlines.

For example, Bridgewater Associates is known for its intense corporate culture of radical truth and radical transparency . Therefore, its interviews consist mainly of ethical and moral questions.

The following section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The proposed strategies and sample answers are meant to be illustrative. Always remember, you need to adapt your responses to be true to yourself and your own words.

1. What do you consider to be your greatest accomplishment?

- If you want your answer to be related to your education, talk about how you worked on an assigned project that you didn’t understand at first, struggled through understanding it, and eventually received an A for your hard work.

- If you want to relate it to your personal life, talk about something you are proud of in your family life. You can even connect it to athletic success, community service, or recovery from illness.

- You can use this question to reveal the balance in your life. This can be especially useful if your resume is short on classroom excellence. Be sure to explain that you are extremely proud of your less-than-perfect GPA because it allowed you to accomplish other activities at school (as long as you have a solid list of extracurricular activities).

- Whatever approach you choose to answer this question, be sure you spin it to demonstrate how one or more of the qualities valued in finance, such as positive attitude, willingness to learn, drive, and determination lead you to success.

I consider one of my most significant accomplishments to be the work-life balance I have achieved between keeping my grades up while serving as the captain of my hockey team. As a result of this, I gained greater leadership skills as I led our varsity team through the entire season as well as structured our fall and spring workouts. This leadership role required me to polish my time management skills which were invaluable. I also wouldn’t trade the friendships and connections I made during my time on the hockey team I made for anything else in the world.

2. Coming out of this interview, what are three things about you that I should take with me?

Choose three traits you have that demonstrate your natural abilities at equity research and reveal that you are memorable and unique compared to other potential candidates.

The three things that I would like you to take from this interview are,

- To start, I want you to know that I am extremely hard working and will bust my tail every day to ensure that the job gets done

- That I have excellent communication skills and a positive attitude; and

- Your firm is my top choice, and I would be ecstatic to come to work here every day. I’ve already spoken to X, Y, and Z people and I believe that I’ll make a great fit with the other team members.

3. Describe your ideal work environment?

- The most important things about your work environment, especially in finance where people spend many hours together, are the people you work with every day.

- Talk about the fact that you want to be in a work environment with others who are all as driven, dedicated, and hard-working as you are, where everyone can rely on one another to get tasks done efficiently.

- Talk about your ideal environment as one that allows you to excel due to great teamwork and communication, one that allows you to grow intellectually and professionally, where your performance evaluations are directly correlated to your rewards.

In my mind, at least in finance, the most crucial aspect of the working environment is the people you are working with on a daily basis. Suppose you do not enjoy the company of your colleagues or teammates. In that case, the environment will be especially challenging because you’ll often be working countless hours per week, over multiple years, with these same people.

My ideal workplace is one where everyone works hard, communicates well, and trusts each other to get the job done right and on time. As a result, the team is then rewarded and evaluated based on our performance.

4. What would your last boss tell me about you?/Tell a story about a time when your boss praised you for a job you performed exceptionally well.

- highly motivated

- hard-working

- strong analytical and quantitative skills

- a good team player

- Be sure to talk about a quality your boss observed that may not be clearly listed on your resume. For example, your ability to put clients at ease upon meeting them or that you’re a great leader who sees the best in every team member.

My boss from last summer’s internship would say I worked extremely hard with maximum dedication and minimal supervision. On one occasion, he actually tell me to go home when it was getting late and I was still at my desk. He even reminded me it was just a summer internship .

Since I really strived to get the most out of my time with the internship, I guess I just didn’t want to leave any task unfinished, even if it would have been OK with my boss. At the end of the summer, my boss telling me how dedicated I was to the position was one of the biggest compliments he had to have given me.

5. What makes you think you can put up with the stress, pressure, and long hours of a career in finance?

Talk about a time in your life when you worked long hours and managed many different tasks.

The story can be from work, school, home, or a combination of all of them. For example, maybe during finals week, you had to study for two exams, finalize the school newspaper, write three papers, and still go to soccer practice.

It’s vital to ensure that you explain that while your past experience has not been as intensive as working full time as a finance professional, you are still 100% dedicated to succeeding, you feel as well prepared as anyone, and you’re willing to do whatever it takes to get the job done.

I am as prepared as anyone else coming out of college to handle the long hours of working in finance. In fact, when you add up all the time I spent doing all my extracurricular activities, my school hours were almost as long as a full-time position. Every day I was up at 7:30 for classes that ran from 8:15 until 1:00. Then, after class, I would grab lunch and then go to soccer practice, which means I didn’t get back until 5:00.

Then I would grab dinner and work in either the library or my room until I was done. This would typically go pretty late at night or into the morning. So while I know it isn’t the same time commitment and stress as working in finance, I feel my experience has left me well prepared for this career.

Knowing the culture of each hedge fund before walking into an interview is one of the secrets to connecting with the interviewer and walking out with an offer.

The following section features 5 exclusive questions that interviewers have asked in the world’s biggest hedge funds (Point72, Bridgewater Associates, Millennium Partners , etc.) during interviews. These should give you a jumpstart to help with your training for the respective hedge funds interviewing you.

- What roles are you applying for right now? What types of firms?

- What do you consider your greatest failure?

- What is your strength?

- What feedback did you receive from your last job/internship?

- What motivates you?

WSO Free Resource:

To view WSO’s sample answers and walkthroughs for the above-mentioned exclusive fund-specific behavioral questions, check out WSO’s free Hedge Fund Interview Questions page.

Logical puzzles, brainteasers , and riddles are typically used in the interview process to gauge the candidate's critical thinking abilities.

In this part of the interview, your interviewers aren’t focused on whether you can answer the riddles correctly or not. Instead, they are really focused on trying to figure out your thought process and how you arrive at your answer when solving the riddles presented before you.

Given this, it is critical to walk your interviewer through your thinking as you progress through the riddle. They may even probe you with questions to assist you or test your logic. By occasionally asking if you’re headed in the right direction and giving them a rundown of your thoughts demonstrates your ability to reflect and approach a problem with composure.

However, it is still beneficial to foresee these brainteasers in order to avoid being put in an awkward position and caught off guard in the interview. The next section has 5 commonly asked logical puzzles that you can practice beforehand to impress your interviewer.

1. How many NYSE-Listed companies have 1 letter ticker symbols?

It could be 26 as that’s how many letters are in the English alphabet, but in this case it is only 24 because I & M are already saved for Microsoft and Intel, in case they change their minds.

2. A stock is trading at 10 and 1/16. There are 1 million shares outstanding. What is the stock’s market cap?

This question is just a test of your mental math abilities.

- If a fourth is 0.25

- An eighth is 0.125

- A sixteenth is 0.0625

As a result, the stock price is 10.0625 and the Market Cap is 10 .0625 million.

3. What is the probability that the first business day of a month is a Monday?

Each day has a 1 in 7 chance of being the first day of the month. However, if the month starts on a Saturday or a Sunday, the first business day of the month will be a Monday. Therefore, the chances of the first business day being a Monday is 3 in 7 since if the month starts on Saturday, Sunday, or Monday, the first business day is a Monday.

4. You have 10 black marbles, 10 white marbles, and 2 buckets. I am going to pick one of the two buckets at random and select one marble from it at random. How would you fill the two buckets with marbles to maximize the odds that I select a white marble?

For this scenario, you want to put one white marble in one bucket and put the other 19 marbles in the other bucket. Due to this setup, the bucket with the lone white marble will be chosen nearly 50% of the time. When the alternative bucket is selected, the odds that a white marble is pulled are still nearly 50%. Setting up the situation this way makes the overall odds of a white marble selection almost 75%.

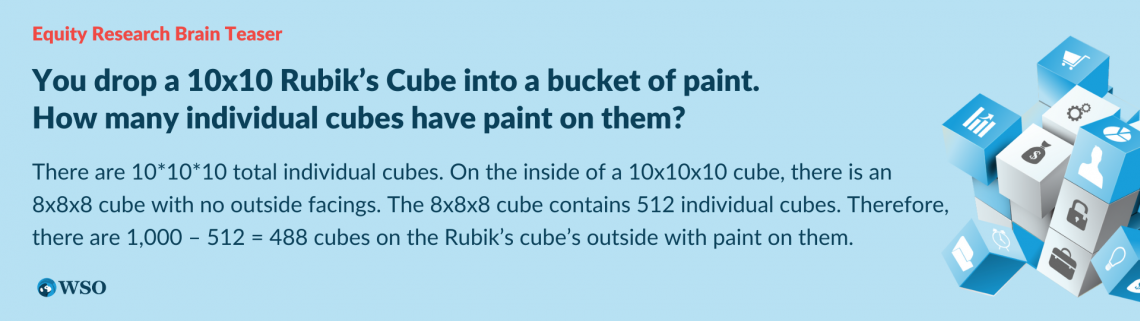

5. A 10x10 Rubik's Cube is dropped into a bucket of paint. How many of the individual cubes have paint on them?

The trick is to realize that cubes on the edge of any one of the 6 faces have a side on two faces (3 faces for corner cubes). This prevents you from simply calculating the number of cubes on a single face and multiplying by the number of faces. One of the most intuitive ways to solve this problem is to calculate the total number of individual cubes in a 10x10x10 Rubik’s cube. Once you have that you want to subtract the number of all internal cubes with no facings on the outside. There are 10x10x10 total individual cubes on this Rubik's cube. On the inside of a 10x10x10 cube, is an 8x8x8 cube with no outside facings. The 8x8x8 cube contains 512 individual cubes. Therefore, there are 1,000 - 512 = 488 cubes on the outside of the Rubik’s cube with paint on them.

The majority of questions and sample answers covered in this free guide were obtained directly from WSO’s very own Hedge Fund Interview Course , which features:

- 814 questions across 165 hedge funds

- 10+ exclusive case videos with detailed pitches

- Long, short, equity, credit, event-driven, macro+ questions

Think about it - if this page alone can set you miles ahead of the competition, imagine what our complete course can do for you. The WSO Hedge Fund Interview Prep Course will guide you through each step of the interview process and ensure you're in the strongest position to land the job at a hedge fund. Click the button below to check it out!

Everything You Need To Break into Hedge Funds

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

Additional WSO resources:

The following are additional resources as forum posts posted by WSO and WSO’s users alike over the last 15 years and are recommended by WSO for taking a look at.

- Equity Research Resume Guidelines

- Overview Of The Equity Research Industry

- Hedge Fund Careers: Getting A Hedge Fund Job Out Of Undergrad And Beyond

- Anatomy Of The 10-K

- WSO Financial Dictionary

The following are some of the biggest of the 750+ hedge funds firms WSO has data on in its company database :

Bridgewater Associates | Bridgewater Associates Overview | Bridgewater Associates Site The Tudor Group | The Tudor Group Overview | The Tudor Group Site Brandes Investment Partners | Brandes Investment Partners Overview | Brandes Investment Partners Site Renaissance Capital | Renaissance Capital Overview | Renaissance Capital Site Millennium Partners Group | Millennium Partners Overview | Millennium Partners Site Alpine Woods | Alpine Woods Overview | Alpine Woods Site Carlson Capital | Carlson Capital Overview | Carlson Capital Site 360 Global Capital | 360 Global Capital Overview | 360 Global Capital Site GSO Capital Partners | GSO Capital Partners Overview | GSO Capital Partners Site

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

- Investment Banking Interview Questions and Answers

- Private Equity Interview Questions and Answers

- Hedge Funds Interview Questions and Answers

- Finance Interview Questions and Answers

- Accounting Interview Questions and Answers

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Trending Courses

Course Categories

Certification Programs

Free Courses

Investment Banking Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

By Dheeraj Vaidya, CFA, FRM

(ex. J.P. Morgan & CLSA Equity Analyst with 20+ years of training experience)

Equity Research Interview Questions (with Answers)

Last Updated :

21 Aug, 2024

Blog Author :

Wallstreetmojo Team

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

Equity Research Interview Questions

If you are called for an equity research interview, you can be asked any question from anywhere. However, you should not take this lightly as this can change your Finance career. Equity Research interview questions are a mix of technical and tricky questions. So, you need to have a thorough knowledge of financial analysis , valuation, financial modeling, the stock market, current events, and stress interview questions.

Let's find below the top 20 Equity Research interview questions that are repeatedly asked for the positions of equity research analysts .

Table of contents

Recommended articles.

Question #1 – Do you know the difference between equity and enterprise values? How are they different?

This is a simple conceptual equity research interview question, and you need first to mention the definition of enterprise value and equity value and then tell the differences between them.

Enterprise value can be expressed as follows –

- Enterprise Value = Market Value of Common Stock + Market Value of Preferred Stock + Market Value of Debt + Minority Interest – Cash & Investments.

Whereas, the equity value formula can be expressed as follows –

- Equity Value = Market Capitalization + Stock Options + Value of equity issued from convertible securities – Proceeds from converting convertible securities.

The basic difference between enterprise value and equity value is enterprise value helps investors get a complete picture of a company's current financial affairs. In contrast, equity value helps them shape future decisions.

Question # 2- What are the most common ratios used to analyze a company?

It can be classified as the most common equity research interview question. Here is the list of common ratios for financial analysis that can be divided into seven parts –

#1 - Solvency Ratio Analysis

- Current Ratio

- Quick Ratio

#2 - Turnover Ratios

- Receivables Turnover

- Days Receivables

- Inventory Turnover

- Days Inventory

- Accounts Payable Turnover

- Days Payable

- Cash Conversion Cycle

#3 - Operating Efficiency Ratio Analysis

- Asset Turnover Ratio

- Net Fixed Asset Turnover

- Equity Turnover

#4 - Operating Profitability Ratio Analysis

- Gross Profit Margin

- Operating Profit Margin

- Return on Total Assets

- Return on Equity

#5 - Business Risk

- Operating Leverage

- Financial Leverage

- Total Leverage

#6 - Financial Risk

- Leverage Ratio

- Debt to Equity Ratio

- Interest Coverage Ratio

- Debt Service Coverage Ratio

#7 - External Liquidity Risk

- Bid-Ask Spread Formula

Question #3 What is Financial Modeling, and how is it useful in Equity Research?

- This is again one of the most common equity research interview questions. Financial modeling is nothing but projecting the company's finances in a very organized manner. As the companies that you evaluate only provide historical financial statements, this financial model helps equity analysts understand the fundamentals of the company – ratios, debt, earnings per share , and other important valuation parameters.

- In financial modeling, you forecast the company's balance sheet, cash flows, and income statement for the future years.

- You may refer to examples like the Box IPO Financial Model and Alibaba Financial Model to understand more about Financial Modeling.

Question #4 – How do you do a Discounted Cash Flow analysis in Equity Research?

If you are new to the valuation model, please go through this Free training on Financial Modeling.

- Financial modeling starts with populating the company's historical financial statements in a standard format.

- After that, we project these three statements using a step-by-step financial modeling technique .

- The three statements are supported by other schedules like the Debt and Interest Schedule, Plant and Machinery & Depreciation Schedule, Working Capital, Shareholders Equity , Intangible and Amortization Schedules, etc.

- Once the forecast is done, you move to valuations of the firm using the DCF approach,

- Here you are required to calculate Free Cash Flow to Firm or Free Cash Flow to Equity and find the present value of these cash flows to find the fair valuation of the stock.

Question #5 – What is Free Cash Flow to a Firm ?

This is a classic equity research interview question. Free cash flow to the firm is the excess cash that is generated after considering the working capital requirements and the cost associated with maintaining and renewing the fixed assets. The firm's free cash flow goes to the debt holders and the equity holders.

Free Cash Flow to Firm or FCFF Calculation = EBIT x (1-tax rate) + Non Cash Charges + Changes in Working capital – Capital Expenditure

You can learn more about FCFF here.

Question #6 – What is Free Cash Flow to Equity?

Though this question is frequently asked in valuation interviews, this can be an expected equity research question. FCFE measures how much "cash" a firm can return to its shareholders and is calculated after taking care of the taxes, capital expenditure , and debt cash flows.

The FCFE model has certain limitations. For example, it is useful only in cases where the company's leverage is not volatile and cannot be applied to companies with changing debt leverage.

FCFE Formula = Net Income + Depreciation & Amortization + Changes in WC + Capex + Net Borrowings

You can learn more about FCFE here .

Question #7 – What's the earning season? How would you define it?

Appearing for an equity research interview? – Be sure to know this equity research interview question.

source: Bloomberg.com

In our industry, companies will announce a specific date when they declare their quarterly or annual results. These companies will also offer a dial-in number using which we can discuss the results.

- One week before that specific date, the job is to update a spreadsheet, reflecting the analyst's estimates and key metrics like EBITDA, EPS, Free Cash Flow, etc.

- On the day of the declaration, the job is to print the press release and swiftly summarize the key points.

You can refer to this article to learn more about the earning season .

Question #8 – How do you do a Sensitivity Analysis in Equity Research?

One of the technology equity research interview questions.

- Sensitivity analysis using excel is one of the most important tasks after you have calculated the fair value of the stock.

- Generally, we use the base case assumptions of growth rates, WACC, and other inputs, which result in the base valuation of the firm.

- However, to provide the clients with a better understanding of the assumptions and their impact on valuations, you must prepare a sensitivity table.

- The sensitivity table is prepared using DATA TABLES in Excel.

- Sensitivity analysis is popularly done to measure the effect of changes in WACC and the company's growth rate on Share Price.

- As we see above, in the base case assumption of a Growth rate of 3% and WACC of 9%, Alibaba's Enterprise Value is $191 billion.

- However, when we can make our assumptions to say a 5% growth rate and WACC of 8%, we get the valuation of $350 billion!

Question #9 – What is the "restricted list," and how does it affect your work?

This is a nontechnical equity research interview question. To ensure that there is no conflict of interest, a "restricted list" is being created.

When the investment banking team is working on closing a deal that our team has covered, we're not allowed to share any reports with the clients, and we will not be able to share any estimates. Our team will also be restricted from sending any models and research reports to clients. We will also not be able to comment on the merits or demerits of the deal.

Question #10 – What are the most common multiples used in valuation?

Expect this expected equity research interview question. There are a few common multiples that are frequently used in valuation –

- Price to Cash Flow

Question #11 – How do you find the Weighted Average Cost of Capital of a company?

WACC is commonly referred to as the Firm's Cost of Capital. This is because the cost to the company for borrowing the capital is dictated by the external sources in the market and not by the company's management. Its components are Debt, Common Equity, and Preferred Equity.

The formula of WACC = (Wd*Kd*(1-tax)) + (We*Ke) + (Wps*Kps).

- Wd = Weight of Debt

- Kd = Cost of Debt

- tax - Tax Rate

- We = Weight of Equity

- Ke = Cost of Equity

- Wps = Weight of Preferred Shares

- Kps = Cost of Preferred Shares

Question #12 – What is the difference between Trailing PE and Forward PE?

Trailing PE Ratio is calculated using the earnings per share of the past; however, Forward PE Ratio is calculated using the forecast earnings per share. Please see below an example of Trailing PE vs. forwarding PE Ratio.

- Trailing Price Earning Ratio formula = $234 / $10 = $23.4x

- Forward Price Earning Ratio formula = $234 / $11 = $21.3x

For more details, have a look at Trailing PE vs. Forward PE

Question #13 – Can Terminal value be Negative?

This is a tricky equity research interview question. Please note that it can happen but only in theory. Please see the formula below for Terminal Value.

If for some reason, WACC is less than the growth rate, then Terminal Value can be negative. High growth companies may get negative terminal values only due to misuse of this formula. Please note that no company can sustain growth at a high pace for an infinite period. The growth rate used here is a steady growth rate that the company can generate over a long period. For more details, please look at this detailed Guide to Terminal value .

Question #14 – If you were a portfolio manager with $10 million to invest, how would you do it?

This equity research interview question is asked repetitively.

The ideal way to answer this question is to pick a few good stocks large cap , mid-cap stock , & small cap, etc.) and pitch the interviewer about the same. You would tell the interviewer that you would invest $10 million in these stocks. You need to know about the key management executives, a few valuation metrics (PE multiples, EV/EBITDA, etc.), and a few operational statistics of these stocks to use the information to support your argument.

Similar types of questions where you would give similar answers are –

- What makes a company attractive to you?

- Pitch me a stock etc.

Question #15 – What PE ratio of a high-tech company is higher than the PE of a mature company?

The basic reason for which the high tech company's PE is higher is that the high tech company may have higher growth expectations.

- Why is it relevant? Because the expected growth rate is a PE multiplier –

- Here, g = growth rate; ROE = Return on Equity & r = cost of equity.

It would help if you used a PEG Ratio for high-growth companies instead of a PE Ratio.

Question #16 – What is BETA?

This is among the top 5 most expected equity research interview questions. Beta is a historical measure representing a tendency of a stock's return compared to the change in the market. Beta is usually calculated by using regression analysis .

A beta of 1 would represent that a company's stock would be equally proportionate to the change in the market. A beta of 0.5 means the stock is less volatile than the market. And a beta of 1.5 means the stock is more volatile than the market. Beta is a useful measure, but it's a historical one. So, beta can't accurately predict what the future holds. That's why investors often find unpredictable results using beta as a measure.

Let us now look at Starbucks Beta Trends over the past few years. The beta of Starbucks has decreased over the past five years. This means that Starbucks stocks are less volatile than the stock market. We note that the Beta of Starbucks is at 0.805x.

Question #17 – Between EBIT and EBITDA, which is better?

Another tricky equity research interview question. EBITDA stands for Earnings before interest, taxes, depreciation, and amortization. And EBIT stands for Earnings before interest and taxes. Many companies use EBITDA multiples in their financial statements. The issue with EBITDA is that it considers the depreciation and amortization as they are "non-cash expenses." So even if EBITDA is used to understand how much a company can earn, it still doesn't account for the cost of debt and its tax effects.

For the above reasons, even Warren Buffett dislikes EBITDA multiples and never likes companies that use it. According to him, EBITDA can be used where there is no need to spend on "capital expenditure," but it rarely happens. So every company should use EBIT, not EBITDA. He also gives examples of Microsoft, Wal-Mart & GE, which never use EBITDA.

Question #18 – What are the weaknesses of PE valuation?

This equity research interview question should be very simple to answer. However, there are a few weaknesses of PE valuation, even if PE is an important ratio for investors.

- Firstly, the PE ratio is too simplistic. Just take the current price of the share and then divide it by the company's recent earnings. But does it take other things into account? No.

- Secondly, PE needs context to be relevant. If you look at only the PE ratio, there is no meaning.

- Thirdly, PE doesn't take growth/any growth into account. Many investors always take growth into account.

- Fourthly, P (the price of share) doesn't consider debt. As the market price is not a great measurement of market value, debt is an integral part of it.

Question #19 Let's say that you run a Donut franchise. You have two options. The first is to increase the price of each of your existing products by 10% (imagining that there is price inelasticity). And the second option would be to increase the total volume by 10% due to a new product. Which one should you do and why?

This equity research interview question is purely based on economics. So you need to think through and then answer the question.

First of all, let's examine the first option.

- In the first option, the price of each product is increased by 10%. As the price is inelastic, there would be a meager change in the quantity demanded , even if the price of each product gets increased. So that means it would generate more revenue and better profits.

- The second option is to increase the volume by 10% by introducing a new product. In this case, introducing a new product needs more overhead and production costs. And no one knows how this new product would do. So even if the volume increases, there would be two downsides – one, there would be uncertainty about the sales of the new product, and two, the cost of production would increase.

After examining these two options, the first option would be more profitable for you as a franchise owner of KFC.

Question #20 – How would you analyze a chemical company (chemical company – WHAT?)?

Even if you don't know anything about this equity research interview question, it's common sense that chemical companies spend a lot of their money on research & development. So, if one can look at their D/E (Debt/Equity) ratio, it would be easier for the analyst to understand how well the chemical company utilizes its capital. A lower D/E ratio always indicates that the chemical company has strong financial health. Along with D/E, we can also look at Net Profit margin and P/E ratio.

This article has been a guide to Equity Research Interview Questions. Here we provide you with the list of most common techniques and nontechnical equity research interview questions with answers. You may have a look at these other recommended resources to learn more –

- Top Financial Modeling Interview Questions (With Answers)

- Valuation Interview Questions

- Private Equity Interview

- Corporate Finance Interview Questions (with Answers)

Prepare well and give your best shot. All the best for your Equity Research interview!

30 Equity Research Analyst Interview Questions and Answers

Common Equity Research Analyst interview questions, how to answer them, and example answers from a certified career coach.

In the world of finance, equity research analysts play a pivotal role in uncovering investment opportunities and providing valuable insights to investors. To excel in this field, you need not only exceptional analytical skills but also strong communication abilities to convey complex financial information effectively. As you prepare to enter an interview for an Equity Research Analyst position, showcasing your expertise in these areas will be paramount.

To help guide you through the interview process and highlight your strengths as a candidate, we’ve compiled a list of common Equity Research Analyst interview questions along with tips on how to approach them with confidence and competence.

1. Can you explain the difference between top-down and bottom-up approaches in equity research?

This question aims to assess your understanding of the two main methodologies used in equity research. Demonstrating your knowledge of top-down and bottom-up approaches not only showcases your expertise in the field but also highlights your ability to apply different analytical techniques to evaluate investment opportunities based on macroeconomic factors, industry trends, or company-specific attributes.

Example: “Certainly. In equity research, the top-down approach starts with a macroeconomic analysis to identify industries or sectors that are expected to perform well in the current economic environment. Analysts then narrow down their focus within those promising sectors to find individual companies with strong fundamentals and growth potential. This method emphasizes the importance of broader market trends and sector performance in driving stock prices.

On the other hand, the bottom-up approach focuses primarily on the analysis of individual companies, regardless of the industry or sector they belong to. Analysts examine company-specific factors such as financial statements, management quality, and competitive advantages to determine the intrinsic value of a stock. The idea behind this approach is that if a company has strong fundamentals, it will eventually outperform its peers and deliver returns to investors, irrespective of the overall market conditions.

Both approaches have their merits, and many analysts use a combination of both methods to make informed investment decisions. While the top-down approach helps identify attractive sectors in a given economic climate, the bottom-up approach ensures that investments are made in fundamentally sound companies.”

2. What is your experience with financial modeling, and which types of models have you built?

Your ability to create and analyze financial models is a cornerstone skill for an equity research analyst. Interviewers want to gauge your expertise in this area and understand your experience with different types of models such as discounted cash flow, leveraged buyout, and mergers & acquisitions. These models are essential for making investment recommendations, understanding market trends, and assessing the financial health of companies. Showcasing your proficiency in financial modeling can help demonstrate your value as a potential candidate for the role.

Example: “Throughout my career as an equity research analyst, I have gained extensive experience in financial modeling. I have built various types of models to analyze and forecast company performance, which has been instrumental in making informed investment decisions.

Some of the key models I’ve worked on include discounted cash flow (DCF) models for valuation purposes, three-statement models that project income statements, balance sheets, and cash flow statements, and sensitivity analysis models to assess how changes in certain variables impact a company’s value. Additionally, I have experience with merger and acquisition (M&A) models, where I analyzed potential synergies and accretion/dilution scenarios.

My proficiency in financial modeling software, such as Excel, along with my strong understanding of accounting principles and industry-specific drivers, allows me to create accurate and insightful models that support strategic decision-making processes.”

3. How do you determine a company’s intrinsic value using discounted cash flow (DCF) analysis?

A deep understanding of financial valuation methods is essential for an equity research analyst. The DCF analysis is a widely used technique to evaluate a company’s intrinsic value. Interviewers want to ensure that you have a strong grasp of this method and can apply it in real-life scenarios to provide accurate valuations that will guide investment decisions and recommendations. Your answer should demonstrate your knowledge of the DCF process and your ability to critically analyze a company’s financial health.

Example: “To determine a company’s intrinsic value using discounted cash flow (DCF) analysis, I start by projecting the company’s free cash flows for a specific period, usually five to ten years. Free cash flow is calculated as operating cash flow minus capital expenditures. These projections are based on historical financials, industry trends, and any relevant information about the company’s growth prospects.

Once I have projected the free cash flows, I calculate the present value of these cash flows by discounting them using the company’s weighted average cost of capital (WACC). WACC represents the required rate of return for both equity and debt holders and serves as an appropriate discount rate in DCF analysis. After obtaining the present value of the projected cash flows, I estimate the terminal value, which represents the present value of all future cash flows beyond the projection period. The terminal value is typically calculated using either the perpetuity growth method or the exit multiple method.

Finally, I add the present value of the projected cash flows and the terminal value to arrive at the company’s intrinsic enterprise value. To obtain the intrinsic equity value, I subtract the net debt from the enterprise value and divide the result by the number of outstanding shares. This gives me the estimated intrinsic value per share, which can be compared with the current market price to identify potential investment opportunities.”

4. Describe your process for conducting industry and competitive analysis.

Hiring managers are keen to know whether you have a solid methodology for researching and analyzing industries and competitors, as this is a core responsibility of an equity research analyst. Your approach to gathering data, identifying trends, and analyzing financial statements will be critical in delivering accurate and insightful recommendations to clients and stakeholders. A well-structured and efficient process speaks to your expertise and ability to effectively perform in the role.

Example: “When conducting industry and competitive analysis, I start by identifying the key players in the market and their respective market shares. This helps me understand the competitive landscape and determine which companies are dominating or emerging within the sector.

I then analyze macroeconomic factors that may impact the industry, such as regulatory changes, technological advancements, and consumer trends. This provides a broader context for understanding how external forces might influence the performance of individual companies.

To assess each company’s competitiveness, I examine their financial statements, management team, product offerings, and growth strategies. Additionally, I perform SWOT (Strengths, Weaknesses, Opportunities, Threats) analyses to identify potential advantages and challenges they face compared to their competitors. Finally, I synthesize all this information into actionable insights and investment recommendations, ensuring my clients have a comprehensive understanding of the industry dynamics and the relative strengths of the companies within it.”

5. What are some key financial ratios that you use to evaluate a company’s performance?

Understanding financial ratios is essential for an equity research analyst, as they provide a snapshot of a company’s financial health and performance. When interviewers ask this question, they want to know if you have the necessary knowledge and analytical skills to make informed decisions and recommendations based on these ratios. Showcasing your ability to efficiently analyze financial data using key ratios demonstrates your competency and value as an equity research analyst.

Example: “As an equity research analyst, I rely on several key financial ratios to evaluate a company’s performance. Some of the most important ones include:

1. Price-to-Earnings (P/E) Ratio: This ratio compares the market price of a stock to its earnings per share, helping me assess whether a company is overvalued or undervalued relative to its peers and historical averages.

2. Debt-to-Equity Ratio: This metric measures a company’s leverage by comparing its total debt to shareholders’ equity. A higher ratio may indicate increased risk, while a lower ratio suggests more conservative financing practices.

3. Return on Equity (ROE): ROE calculates the return generated on shareholders’ investments by dividing net income by average shareholders’ equity. It helps me gauge management’s effectiveness in generating profits from invested capital.

4. Gross Margin: Calculating gross profit as a percentage of revenue, this ratio provides insight into a company’s pricing strategy and cost structure, which can be useful for comparing companies within the same industry.

5. Current Ratio: This liquidity measure compares a company’s current assets to its current liabilities, indicating its ability to meet short-term obligations. A higher ratio suggests better financial health and lower liquidity risk.

These ratios, among others, provide valuable insights into a company’s financial health, profitability, and overall performance, allowing me to make informed investment recommendations.”

6. Explain how you would analyze a company’s balance sheet, income statement, and cash flow statement.

Delving into a company’s financial statements is a critical aspect of an equity research analyst’s role, as it helps to determine the overall financial health and value of the organization. By asking this question, interviewers want to gauge your ability to analyze and interpret financial data, your understanding of key financial concepts, and your attention to detail, all of which are important for making informed investment recommendations.

Example: “When analyzing a company’s financial statements, I start with the balance sheet to assess its overall financial health. I examine key ratios such as the current ratio, quick ratio, and debt-to-equity ratio to understand the company’s liquidity, solvency, and capital structure. This helps me determine if the company has sufficient resources to meet short-term obligations and how it manages long-term debt.

Moving on to the income statement, I focus on revenue growth, gross margin, operating margin, and net profit margin to evaluate the company’s profitability and efficiency. Analyzing trends in these metrics over time can reveal potential strengths or weaknesses in the business model. Additionally, I compare these figures to industry peers to gauge the company’s performance relative to competitors.

Finally, I analyze the cash flow statement to gain insight into the company’s ability to generate cash from operations, investing activities, and financing activities. Free cash flow is a particularly important metric, as it indicates the amount of cash available for reinvestment or distribution to shareholders. A positive trend in free cash flow suggests that the company is effectively managing its resources and has the potential for future growth.”

7. How do you stay up-to-date on market trends and news relevant to the industries you cover?

Keeping your finger on the pulse of market trends and news is essential for an equity research analyst. Employers want to know that you have effective strategies in place to stay informed and up-to-date on the industries you cover. This demonstrates your commitment to providing accurate and insightful analysis, which ultimately helps your firm make well-informed decisions about investments and portfolio management.

Example: “Staying up-to-date on market trends and news is essential for an Equity Research Analyst, as it directly impacts the quality of our analysis and recommendations. To ensure I’m well-informed, I start my day by reading financial news from reputable sources such as The Wall Street Journal, Financial Times, and Bloomberg. This helps me stay current with any major events or announcements that could affect the industries I cover.

Furthermore, I subscribe to industry-specific newsletters and follow relevant blogs, podcasts, and social media accounts to gain insights into emerging trends and developments. Additionally, I attend conferences and webinars to learn from experts in the field and network with other professionals. This combination of daily news updates, targeted industry resources, and continuous learning opportunities allows me to maintain a comprehensive understanding of the industries I cover and provide valuable insights to clients.”

8. Have you ever had to change your recommendation on a stock due to new information or changing circumstances? If so, please describe the situation.

Being an equity research analyst requires adaptability and an openness to changing perspectives based on new information or market shifts. When interviewers ask this question, they’re looking for evidence of your ability to analyze new data and adjust your investment recommendations accordingly. They want to know that you’re not stubbornly clinging to your initial views but are instead able to recognize when a change in strategy is warranted for the best interest of clients and stakeholders.

Example: “Yes, I have experienced a situation where I had to change my recommendation on a stock due to new information. I was covering a pharmaceutical company that was in the process of developing a promising drug for a rare disease. My initial analysis and valuation indicated a strong buy recommendation based on the potential market size and the company’s solid financial position.

However, during the clinical trial phase, the company released an update stating that the drug had failed to meet its primary endpoint, which significantly impacted its chances of receiving regulatory approval. This new information prompted me to reevaluate my recommendation. I conducted a thorough reassessment of the company’s pipeline, factoring in the setback and its implications on future revenue projections.

After this comprehensive review, I changed my recommendation from a strong buy to a hold, as the risk associated with the company’s growth prospects had increased substantially. In situations like these, it is essential to remain adaptable and responsive to new information, ensuring that our clients receive accurate and timely advice to make informed investment decisions.”

9. What factors do you consider when determining a target price for a stock?

Analyzing stocks is a complex process that requires a deep understanding of both financial fundamentals and the broader market environment. Interviewers ask this question to gauge your proficiency in assessing a company’s intrinsic value and determining an appropriate target price. They want to ensure you can take into account various factors, such as financial performance, industry trends, competitor analysis, and macroeconomic factors, and synthesize them into a coherent investment recommendation.

Example: “When determining a target price for a stock, I consider several factors to ensure a comprehensive analysis. First, I analyze the company’s financial statements, focusing on key metrics such as revenue growth, profit margins, and return on equity. This helps me understand the company’s historical performance and its ability to generate profits.

Another critical factor is industry trends and competitive landscape. I research market dynamics, potential disruptors, and competitors’ strategies to gauge the company’s position within the sector and identify any threats or opportunities that may impact its future performance.

I also incorporate valuation multiples into my analysis, comparing the company’s current valuation with its peers and historical averages. Commonly used multiples include Price-to-Earnings (P/E), Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Sales (P/S). These ratios help me determine if the stock is overvalued or undervalued relative to its industry and historical norms.

Taking these factors into account, along with any qualitative aspects specific to the company, I develop a financial model to project future earnings and cash flows. Based on these projections, I use discounted cash flow (DCF) analysis to estimate the intrinsic value of the stock, which ultimately informs my target price recommendation.”

10. Can you discuss any recent mergers or acquisitions in the sector(s) you follow and their implications for the companies involved?

As an equity research analyst, staying informed about current market trends, mergers, and acquisitions is a fundamental part of your job. Your ability to analyze these events and their potential impact on the companies you follow demonstrates your knowledge and understanding of the industry. Interviewers ask this question to gauge your expertise and ensure that you’re up-to-date with the latest events, capable of providing valuable insights to clients or colleagues.

Example: “One recent merger that caught my attention was the acquisition of Slack Technologies by Salesforce in December 2020. This deal, valued at $27.7 billion, aimed to strengthen Salesforce’s position in the enterprise software market and expand its product offerings beyond customer relationship management (CRM) solutions.