For Teachers

Home » Teachers

Budgeting Projects for High School Students

Here are our favorite budgeting projects to give to high school students.

Games and worksheets about budgeting are very helpful and deserve a place in the money education classroom. However, many students thrive in projects and learn much more deeply when they complete hands-on, extended activities. If you are searching for the best budgeting projects for high school students, look no further. Head over to my budgeting lesson plans center for more curriculum tips.

End-Of-The-Year Party Budgeting

This project requires students to create and maintain a budget for an end-of-the-year party. Students raise money and plan out all the necessary steps to reach their goals while sticking to a detailed plan. Kids work in pairs, groups, or independently to perform tasks. They need to figure out how much of their funds they will apply to various categories: food, decorations, entertainment, etc.

Students learn best through hands-on learning, and planning for their own party is a surefire path to success. They can monitor and adjust their budgets throughout the year, giving them valuable practice, team-building, and an ambitious goal to work towards.

Budgeting Project

This project has all the materials you need to teach your students budgeting. The first step is a spending log, which shows kids how to track their expenses and payments throughout the year. They use these logs to compile data and create a pie graph displaying the results. They balance their income and spending to come up with percentages and, ultimately, a picture of their budgets. The culminating component is an essay reflecting on their spending and saving habits.

Kids learn a lot about budgeting and how to translate data from logs and demonstrate it in charts and graphs. They see how to work in groups and make goals they can reach along the way.

Trip Itinerary and Budget Project

This project provides students a chance to make a budget for travel, research how to book trips, and other real-life applications like how to save money on vacation. The description is detailed and supplies all the information learners will need to complete their activities. Students need to record all of their expenses and savings; if they go over budget, they lose points. This emphasizes the importance of sticking to a plan and understanding the many costs they will encounter on vacation.

Students learn practical information and see how decision-making skills are critical. They understand why planning to the dollar matters.

Compound Interest and Budgets

Students learn about compound interest in high school and likely associate it with saving and investing. Teachers can connect it to budgeting, as well. You can make cards with different interest rates and have students pick one randomly. Tell them that is the interest rate for their account. Have each school day equal 5-10 years of compounding and after a week, check to see how much their accounts have grown, comparing the amounts with their peers.

When you first begin the project, have students create detailed budgets. They will learn how to modify budgets based on income, expenses, investments, and saving. Afterward, have them make new budgets with the power of compounding included, showing students that they can increase their wealth and adjust their budgets based on ever-changing data and increased cash flow.

Pay Yourself First

The idea of “paying yourself first” is a focal point for many money experts. The idea is to save as much as possible and guarantee you boost your finances, and teachers can work this idea into budgeting. Have students set aside money for saving or investing before paying any bills, and have them include it in their budgets. Give individual students a random amount of money to pay themselves first, and calculate how much their accounts would have grown over one, five, and ten years.

Reminding learners that the more detailed a budget is, the better. Focus on the positive and show them how budgets can do more than keep tabs on your spending: they can help build wealth, especially when they prioritize themselves in their spending.

Get a Life Budget Project

This project has all the materials you’ll need – including a WebQuest, Google Slides, budget trackers, check templates, and grocery list templates. Students are assigned a job to do and build budgets using their income. They take a field trip to a grocery store (real or virtual) and find the ingredients they need based on their meal plans and available money. They research how to buy a house and factor mortgages and down payments into their budgets.

When the project is complete, students present their findings, explaining how they managed to figure out their budgets using the income from their job. They also gain valuable experience in Google Drive, creating and using materials found there.

Budget: Life Cycle Project

This project shows students how people modify budgets as they enter different phases in life. The phases included are high school, college, newlywed, and married. Students are put into groups of 2-3 and focus on one of the timeframes. They research the various expenses and potential income that many people encounter during these times and create a presentation. They report their budgets to the class and contribute them to a class-wide display.

Many students may not think about how budgets change depending on life circumstances. This project shows kids that different phases of life require varying budgets, and which expenses may come up in those times.

Personal Budget Project

In this project , students create PowerPoints to summarize their research on different careers and salaries. They practice balancing expenses and income, breaking down their budget details across twelve slides and a written response. It goes into more depth than many other budget projects in every area. For example, they break their annual salaries into monthly amounts, use online real estate engines to search for real-time home prices, and calculate car-specific costs.

This project is great for your high school students as it results in practical and applicable information for their future. They calculate student loans and even gift expenses and factor those costs into budgets.

Budget Planning and Budgeting Lessons

Budgeting teaching budget lesson plans learning worksheet household family planning exercises classroom unit teacher resources activity free tutorial curriculum basics.

Lessons appropriate for: 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders.

First Grade - Second Grade - Third Grade - Fourth Grade - Fifth Grade - Sixth Grade - Seventh Grade - Eighth Grade - Ninth Grade - Tenth Grade - Eleventh Grade - Twelfth Grade - K12 - Middle School - High School Students - Adults - Special Education - Secondary Education - Teens - Teenagers - Kids - Children - Homeschool - Young People

Teaching Special Needs - Adult Education - Budgeting for Kids - Children - Young Adults

Our Budgeting section delivers an array of educational tools. Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of financial planning. Tailored to fit various learning environments, these resources are adaptable for both group lessons and self-paced studies. Our instructive videos provide a vibrant approach to understanding budgeting, bringing to life the nuances of financial planning with compelling animations and lucid breakdowns of intricate topics. Meanwhile, our detailed articles delve into the finer points of budgeting, offering expert commentary and profound insights into managing personal finances effectively. Whether you're a visual learner, a reading enthusiast, or someone in search of structured lessons, the Budgeting section of Money Instructor is equipped with resources to ensure you grasp the essentials of financial planning and lead a financially sound life.

Lessons and worksheets, suggestions or need help.

Do you have a recommendation for an enhancement to this budgeting money lesson page, or do you have an idea for a new lesson? Then leave us a suggestion .

More Teaching Earning and Spending Money Worksheets and Lessons

To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page .

Teach and learn money skills, personal finance, money management, business, careers, real life skills, and more.... MoneyInstructor ®

- New Member Registration

- Teaching Lessons

© Copyright 2002-2024 Money Instructor® All Rights Reserved.

19 Free Financial Literacy Games for High School Students

By: Author Amanda L. Grossman

Posted on Last updated: May 2, 2024

- 2.5K shares

- Facebook 185

- Pinterest 2.3K

- LinkedIn 11

- Flipboard 15

These 19 free financial literacy games for high school students add engagement and FUN to teaching personal finance.

How do you make financial literacy fun?

One way is to assign one of these free financial literacy games for high school students from below.

These games will teach your students lots of really important financial lessons, such as:

- How loans work and how loan sharks take advantage of people

- How choices made right now and during college can greatly affect their future finances

- How the stock market works, and look at rewards in light of risks

- How much they’ll need to earn from a job in order to live their dream life

- And much more…

You could even base one of these around a financial literacy week theme , or personal finance topic for high school students !

Let’s get on with it.

Free Financial Literacy Games for High School Students

Financial literacy games for the classroom can teach your teens a whole lot more about how money works in the real world (and not only in the real world – but in THEIR world).

Psst: got elementary students? Here are free online financial games for elementary students .

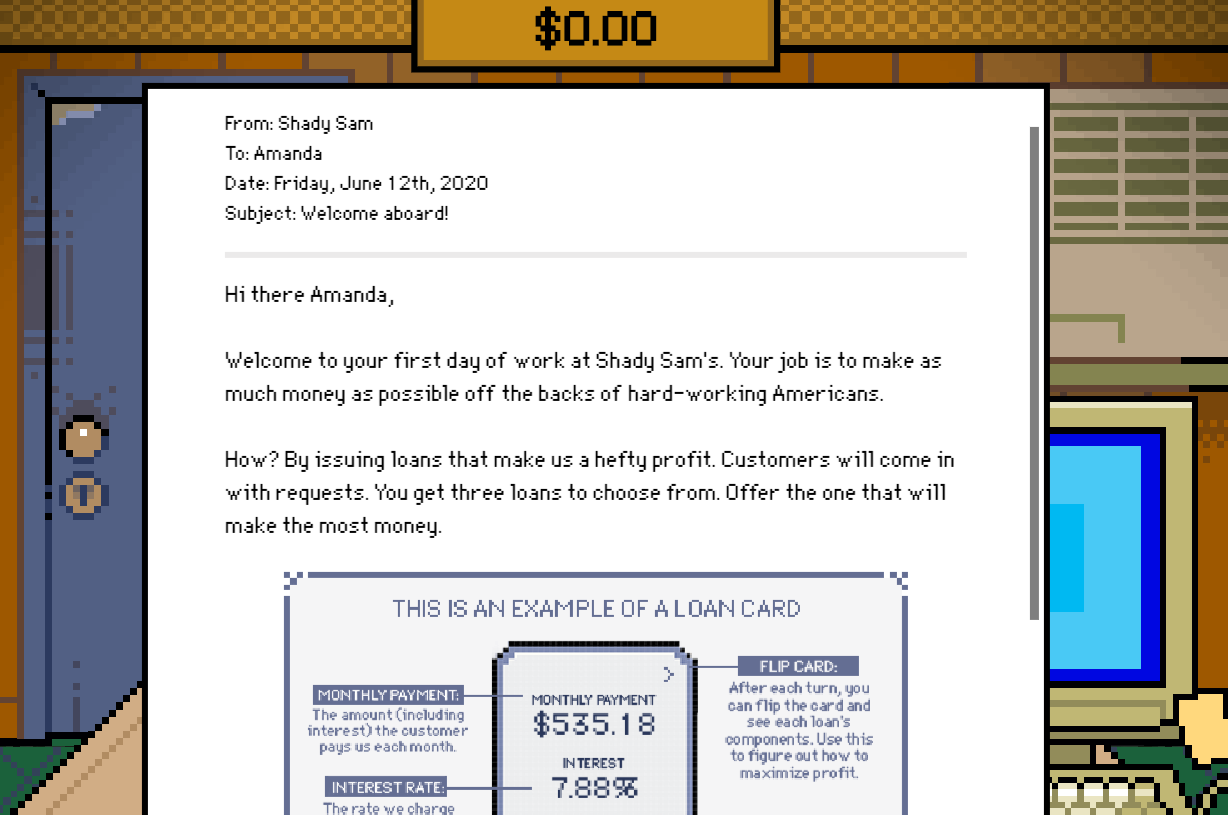

1. ShadySam

Your students get to play “loan shark” in this finance game – predatory loan lender and collector – in order to learn all about risky loans and loans in general (like interest rates, what a loan is, loan collections, etc.).

It’s an eye-opening way to show your students how lenders can and do take advantage of people who take out loans. Hopefully one day, this can save them from the payday loan cycle!

2. Lights, Camera, Budget

Your students are movie producers, and they've been given a $100 million budget to create a 5-star movie.

You can play this personal finance game as a high schooler or as a middle schooler (you choose which). With each question your group answers correctly, they earn more money to put towards a movie they're going to produce.

They must also make good financial decisions in order to produce a star-rated movie (12 different financial decisions they'll make).

Psst: in charge of teaching students to budget? Here's my article on how to teach budgeting , even with varying skill levels.

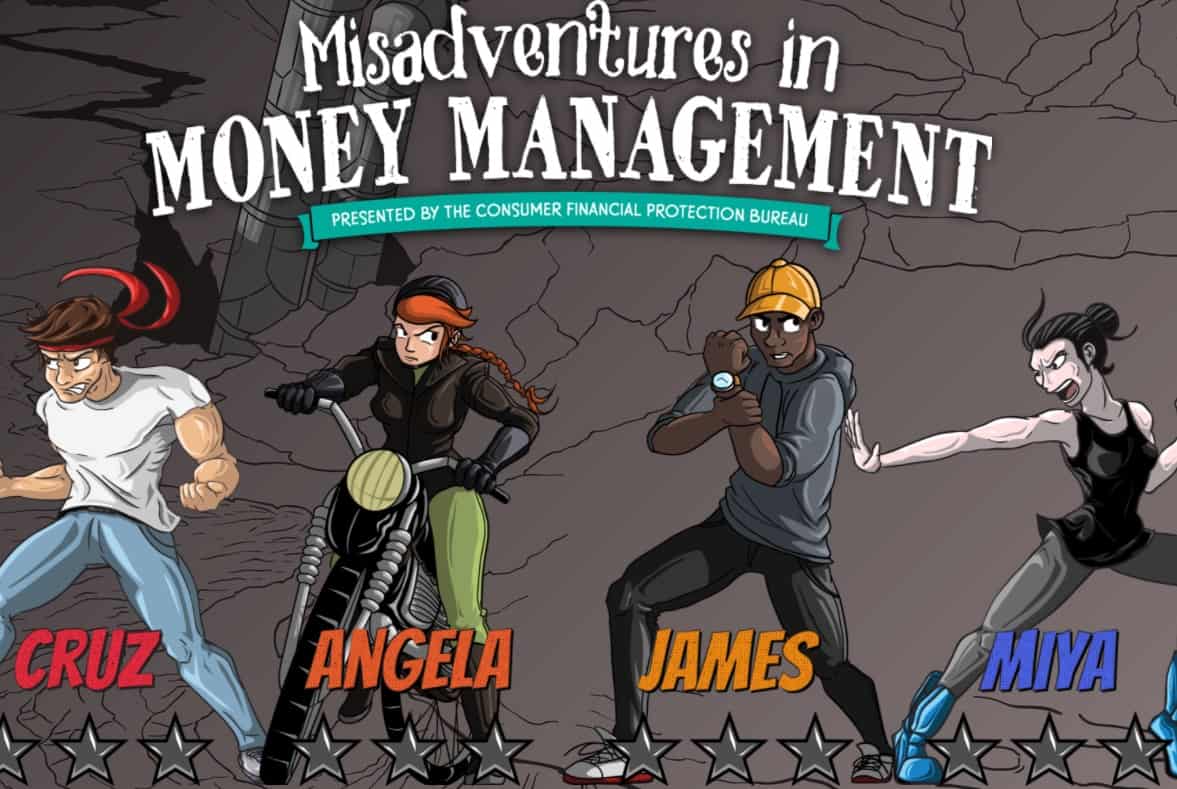

3. Misadventures in Money Management

The Consumer Financial Protection Bureau create a pretty fun online money management game for teens using a graphic-novel theme.

Topics covered include:

- Avoiding impulse purchases

- How debt can affect a military career

- Importance of building savings

- Protections servicemen and their families can get through the Servicemembers Civil Relief Act (SCRA)

Hint: while this is semi-geared towards service members and their families, anyone can play.

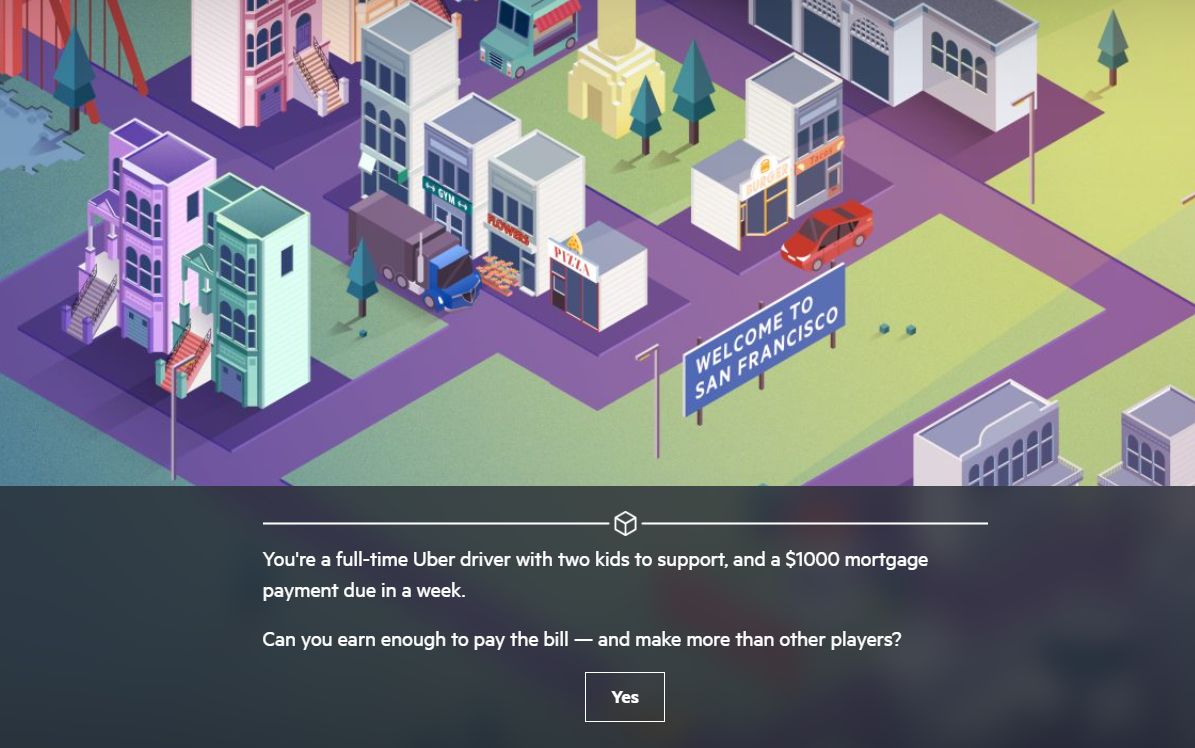

4. The Uber Game

Can a person survive on a job in the “gig economy”? That’s what this game attempts to reveal to your students.

They’ll be given an urgent financial need (such as – your mortgage of $1,000 is due in a week), and then will need to accept gig jobs from Uber in order to try and save up enough to pay their bills.

Can they do it?

Pssst: you might also be interested in my article on 15 free financial literacy activities for high school students PDFs , and these 14 free financial literacy worksheets pdf .

5. Claim Your Future

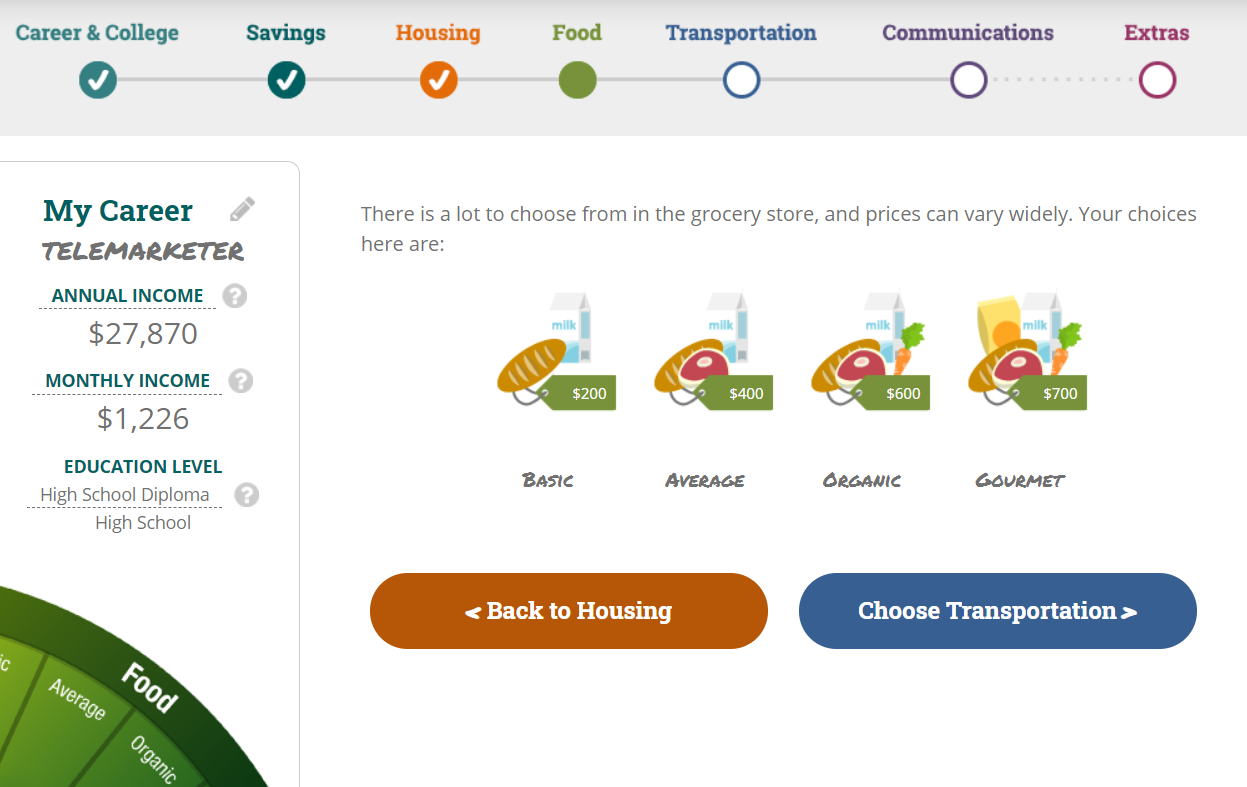

Students are given a career with an annual salary, and then are asked to make certain budget and lifestyle choices based off of that salary.

Will they be able to afford the house they want, or have to rent with an apartment they share? Is their career choice enough to sustain their organic food tastes, or are they better off eating “basic” food?

Psst: here's a free printable money activity for a group where you teach kids and teens how to pay bills .

6. Consumer Financial Protection Bureau Games for Students

The Consumer Financial Protection Bureau has a whole section on lesson plans for teen financial literacy games – all are free to use.

Examples include:

- Investigating investing

- Handling a lost or stolen credit/debit card

- Playing a credit and debit game

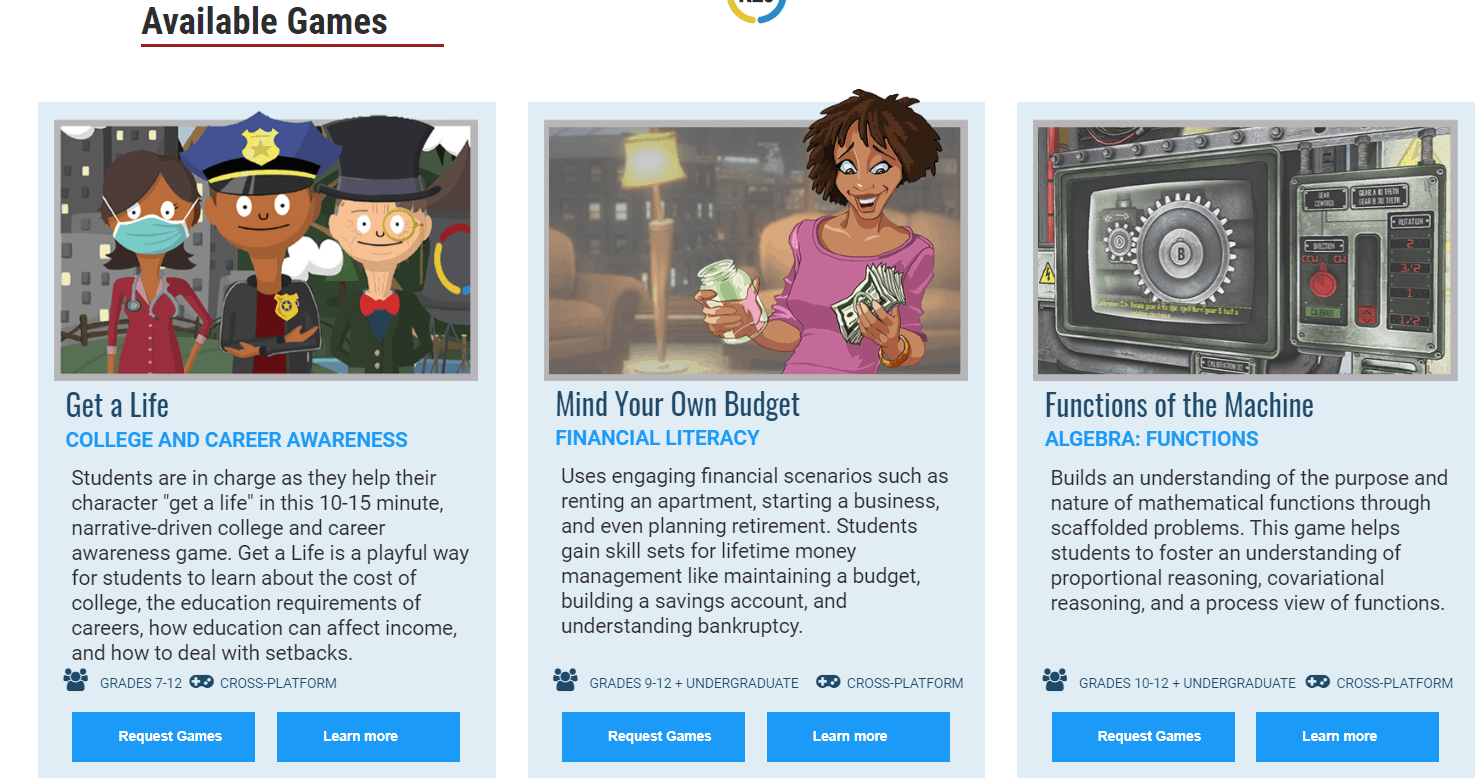

7. Various Game-Based Learning Financial Games (University of Ohio)

The University of Ohio offers several financial literacy games that teachers can request permissions to, for free.

These include:

- Get a Life (Grades 7-12)

- Mind Your Budget (Grades 9-12)

8. Rento Monopoly Game

Monopoly can be a great game for kids and teens to play to learn some financial literacy lessons (and they'll learn even more if you play it with my free financial hardships Monopoly printable ).

This site offers a free, online version of this game that can be played online versus friends, offline versus robots, or even on the same phone as another friend.

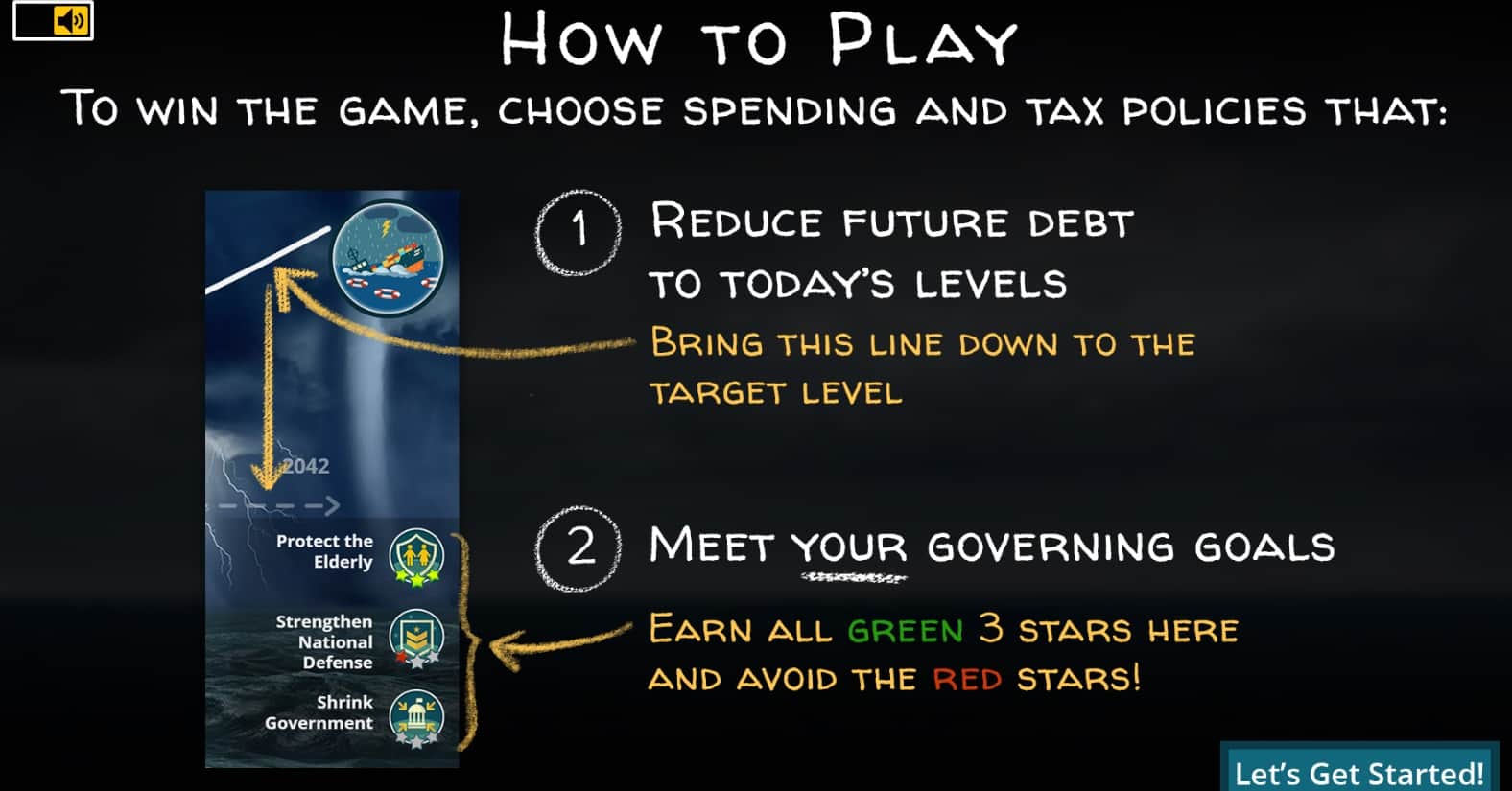

9. Fiscal Ship

Just like in personal budgeting, if there's a gap between revenue (income) and spending, then that's a problem.

Students may or may not be aware that the current tax income will not pay for all of the government's obligations in the future (such as retirement and health benefits promised to the aging, and basic services).

With this game, your high schooler will need to choose which tax and spending changes to make over the next 25 years.

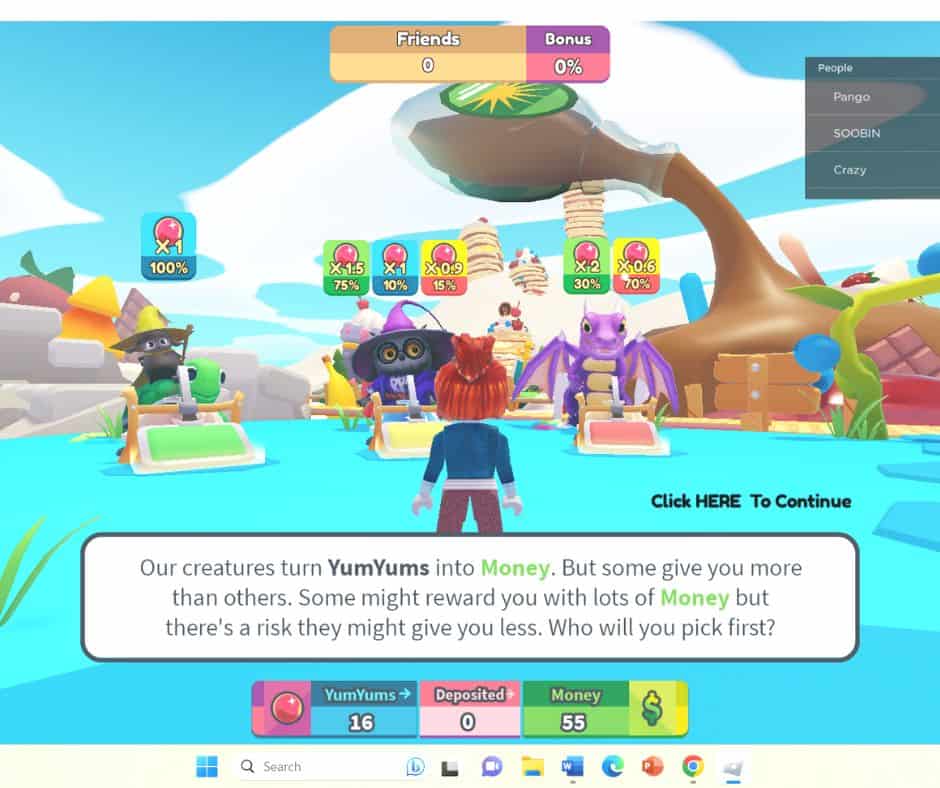

10. Fidelity's Pancake Empire Tower Tycoon (on Roblox)

Here's a new one – students work on building skills around spending, saving, and investing their money (all while playing a Roblox game).

Players gather yum-yums, which they can then convert to currency to build their pancake empire while learning how to balance risk and reward.

There are opportunities to get different rewards, and each comes with its own risk.

This game is definitely more self-directed than some of the other free financial literacy games on here. Your students really take charge of figuring out what to do, then getting rewarded when they do something good (and they do point out what financial step they took that earned them a reward, so that they'll know to do it again).

There are arrows to help the complete newbie (that was me!) get started.

Psst: players will need a new, free account with Roblox, or can use an existing one, to sign in. Downloading and installing Roblox is required as well (free).

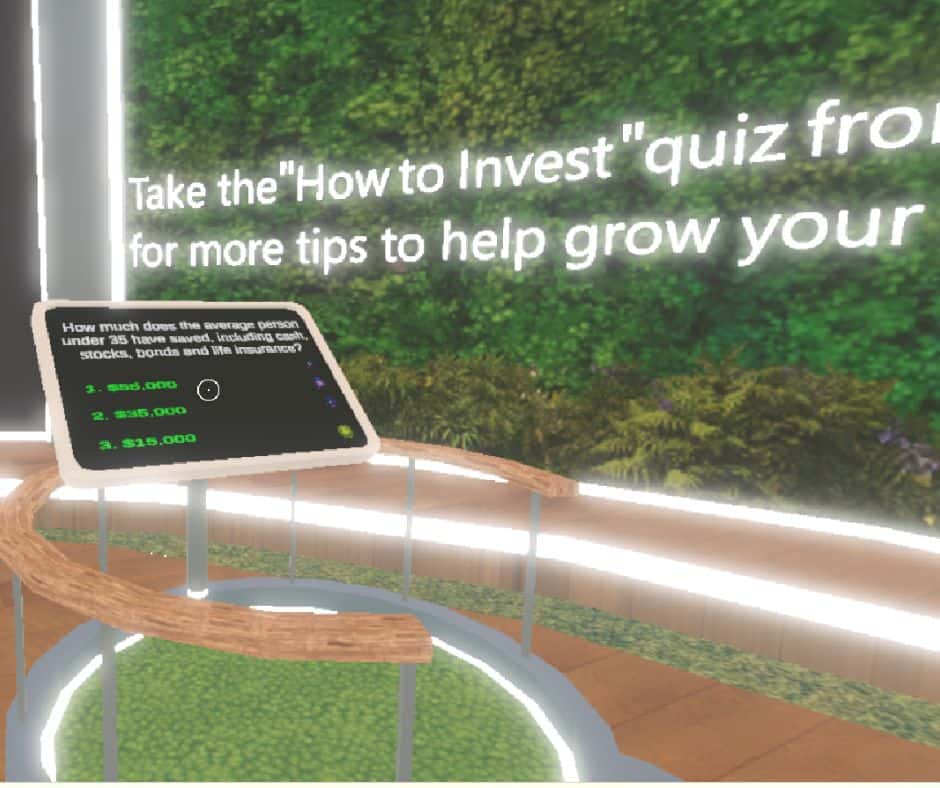

11. Fidelity's Bloom-o-Rama (in the Metaverse through Decentraland)

Bloom-o-Rama is Fidelity's metaverse experience. It teaches students money mindfulness – helping students to feel calm and collected when saving, investing, and spending money – plus more financial basics.

For example, students go over mindful spending. Students earn wearables for their metaverse avatar by answering questions correctly.

The first thing they'll do is create their avatar. Then, there's this little assistant that guides students through how to use their keyboard and mouse to navigate the metaverse.

Finally, your student is off and running and able to experience Bloom-o-Rama.

Psst: students can play as a guest in Decentraland, so they don't need an account to use it.

12. Dollars & Decisions

Here's a new game that's really great – I find it to be up-to-date and very accurate on digital financial literacy terms.

Students take a 10-question quiz ahead of time to measure their basic financial literacy knowledge before playing.

Then, they choose an avatar, a job, and meet their new roommates.

They're asked to do things like:

- Decide on a budget for groceries (a cheaper, or more expensive option)

- Pay their roommates their portion of rent

- Sign up for direct deposit on their first day of their job

Lots of good learning, like paycheck taxes, fixed vs. variable expenses, etc.

Online Budget Simulations for High School Students

You can really help to bring a budget alive when you have students go through a budget simulation – meaning, they take a budget that they’ve either made, or was given to them, and they attempt to see if they can “make it” without overspending.

Here’s a few online budget simulations to help high school students test out a budget.

Psst: be sure to check out these financial literacy books for high school students I've personally reviewed.

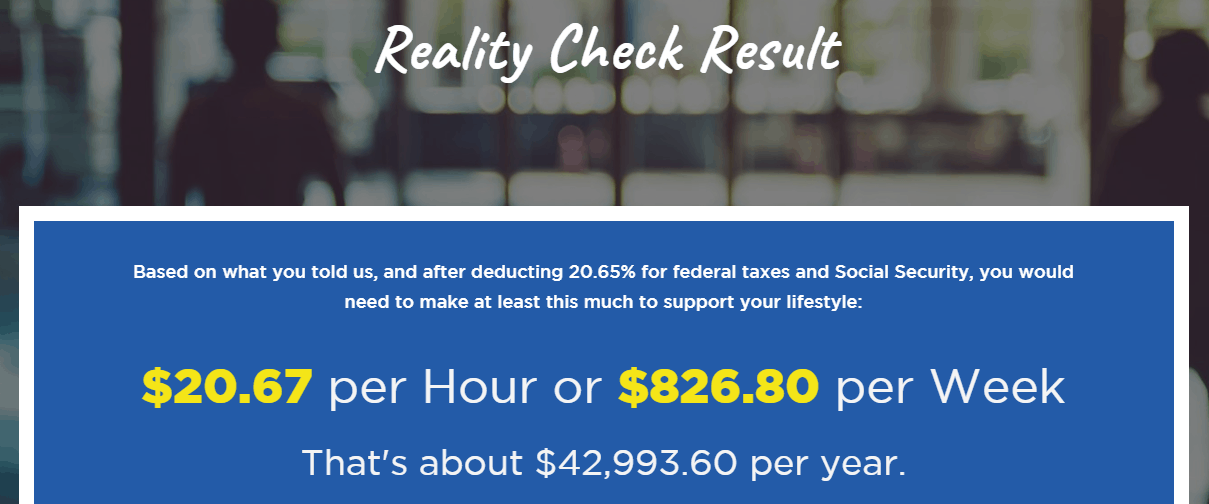

1. Reality Check

JumpStart’s Reality Check is an eye-opening way to show your students how their wants can dramatically affect the amount of money they’ll need to earn in a career.

They take a student through 1 of X questions, asking them things like what type of housing they want, and what type of car they want.

Then, in the end, they spit out how much the teen will need to earn in order to afford that type of lifestyle.

Really can make a child think about their choices!

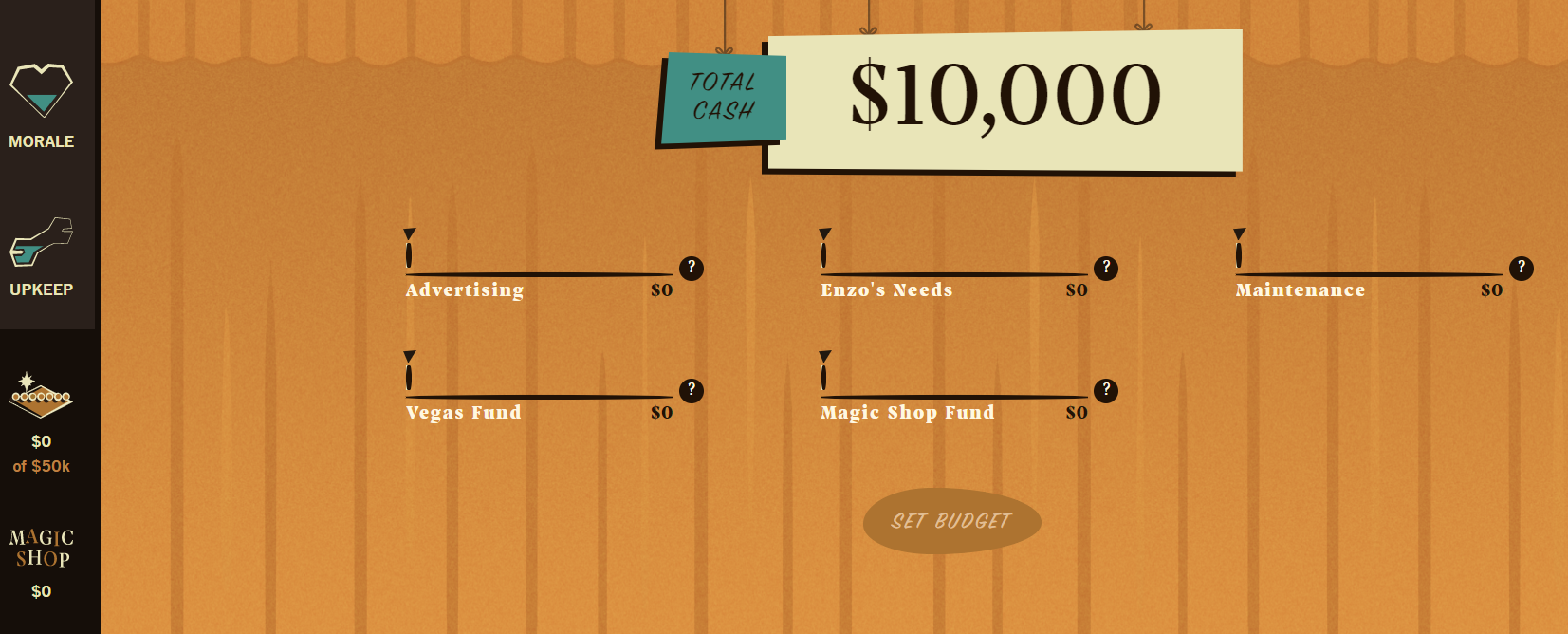

2. Money Magic

Students will help Enzo, a magician, save up $50,000 so that he can go to Las Vegas and have a venue to perform.

They’ll be asked to figure out how to spend Enzo’s money to get to his savings goal, with the spending categories being:

- Advertising

- Enzo’s Needs

- Magic Shop Fund

- Maintenance

Sometimes I hear from parents that they have no idea how to teach their kids about poverty and homelessness.

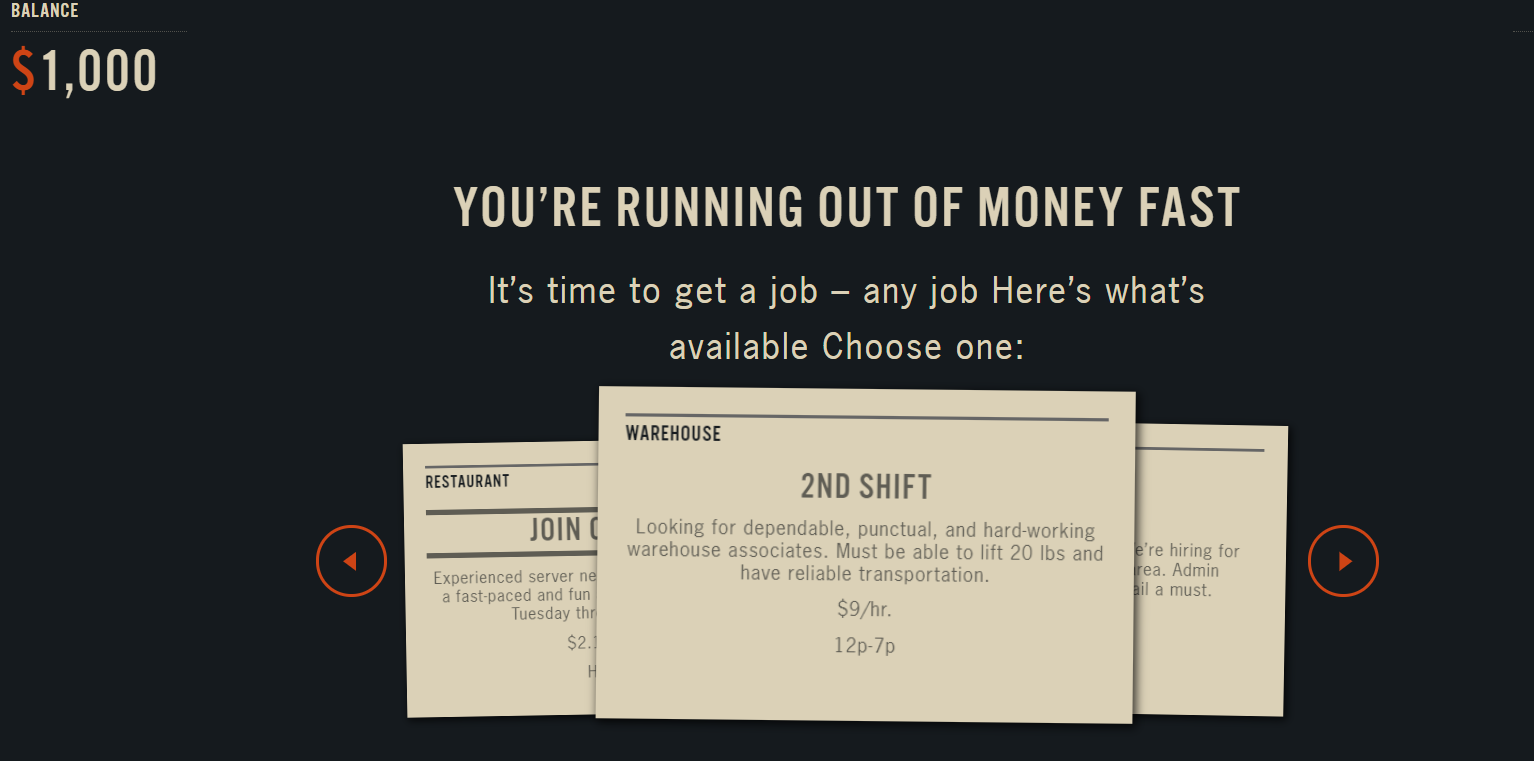

This is a wonderful simulation if you’d like to make your students more aware of how difficult it can be to live on a low income. It also can build some empathy to the problem, as teens start to understand how it is someone might end up on the corner of a street, asking for money.

Students are told they are unemployed, have lost their house, and are down to their last $1,000. They must make it to the end of the month with that $1,000.

Can they do it?

Pssst: you’ll definitely want to check out my article on budgeting scenarios for high school students – chocked full of free resources.

4. Hit the Road Financial Adventure

You are going to take a cross-country road trip with your friends, and need to keep within a budget (without going hungry, stalling your car because you forgot to buy gas, and actually making it to your destination).

Can your students stay within budget and keep enough money to make it all the way to their destination?

Financial Simulation Games – Personal Finance Games Simulations

Financial simulations games are different from what we’ve discussed above, as they attempt to make financial situations more “real” with students and engage them in decision-making that has actual consequences to their results.

1. Stock Market Games

If your students are learning about investing, then a free online stock market game could be just the thing to help them understand it better.

Kids sign up either in groups, as a class, or as individuals, and everyone is given a certain amount of money to invest at the beginning. Then, students follow along with the real market to see how their decisions are stacking up.

Some competitions even have reward money and prizes that they give out!

Free online stock market games for kids include:

- Personal Finance Lab's Stock Market Game

- The Stock Market Game

- How the Market Works

- Fantasy Stock Exchange

- Build Your Stax

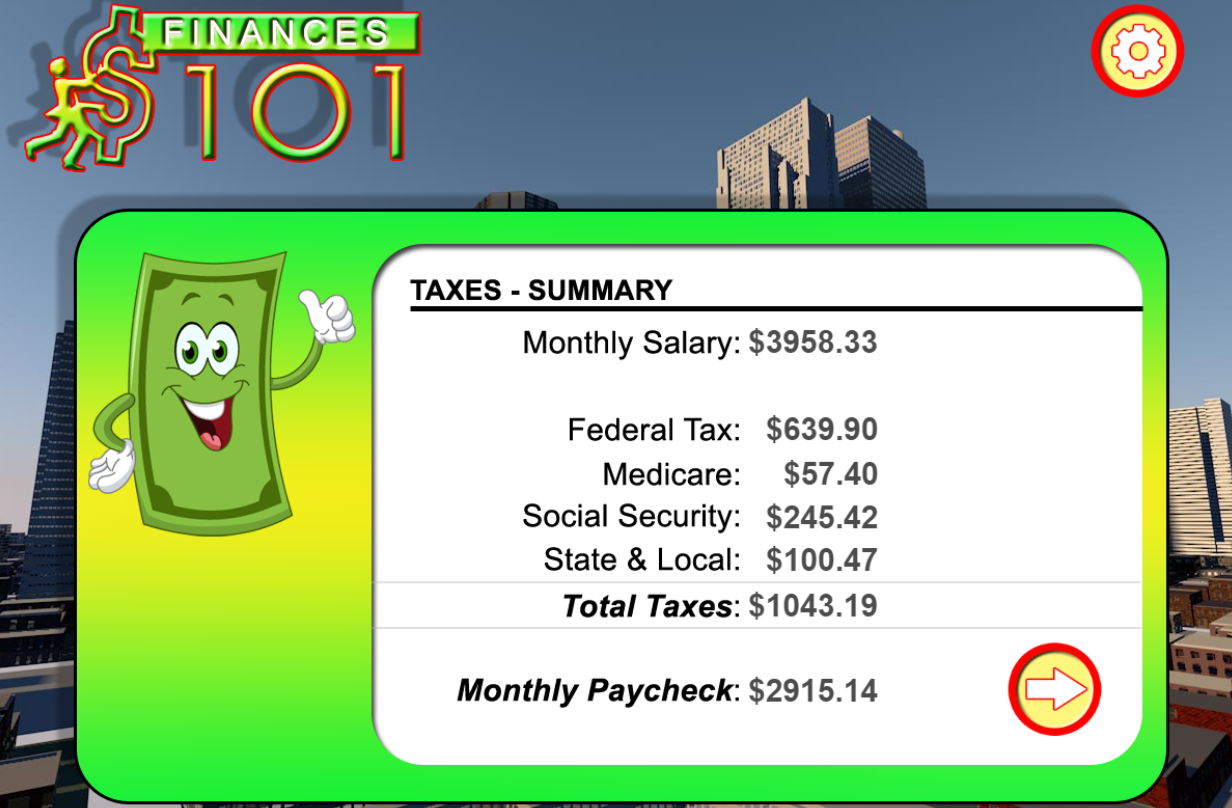

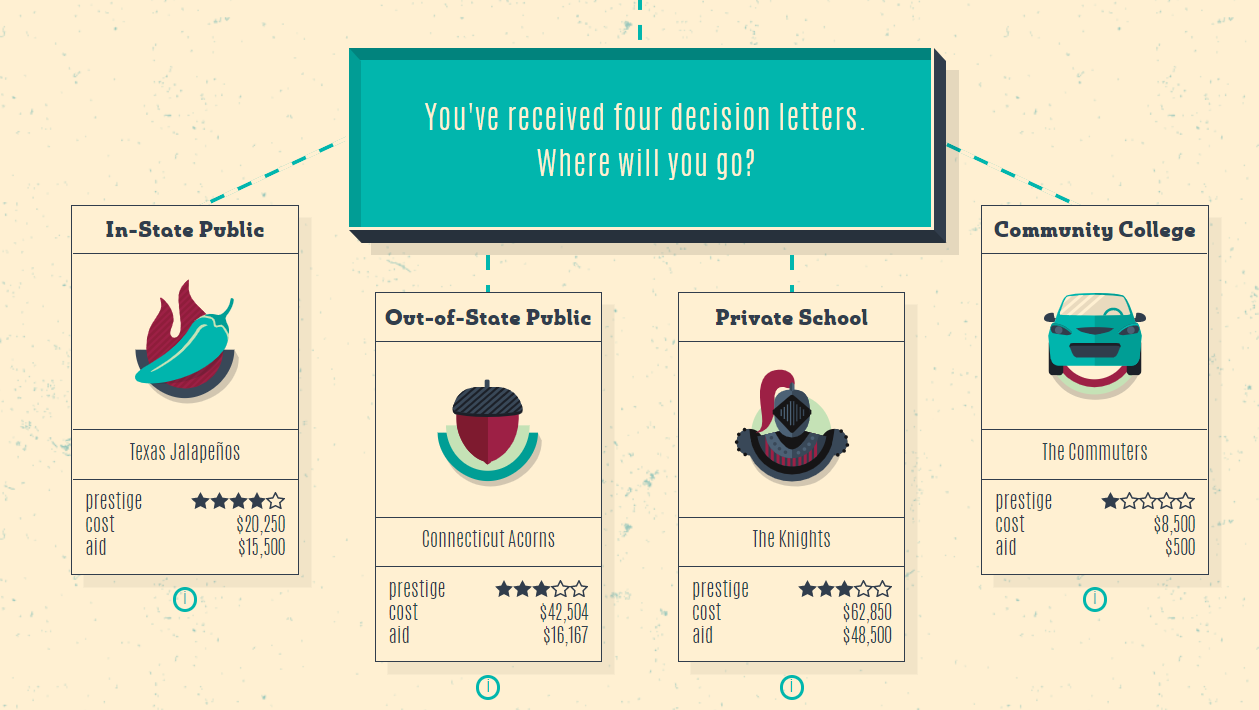

2. Finance 101

This is a decision-based, online financial simulation game with changing scenarios depending on what your students choose.

Your student is given a random profession, one of the 13 stops they’ll make that will greatly impact their decisions, finances, and game play.

For example, I went through the game and was given the profession of Accountant. My salary was broken down for me, and then I was shown how much I’ll pay in taxes. Then, I was asked which type of checking and savings account I would like to open, and how much money I want to save from my paycheck.

Paying back student loans has proved to be too much for some students, especially if they fail to find a job on a career path.

This financial simulation game can help your teen students better pick out careers and majors based on simulating what kinds of jobs they might find when they graduate, and how much their student loans might be.

They’ll be asked to make critical decisions that will have a direct effect on their budgets and finances post-college, such as what type of college they want to attend (i.e., 4-year, 2-year, community, in-state, out-of-state).

Also, they’ll decide on more immediate needs, such as whether or not to buy a new laptop for college, or if they should take a low-paying, labor job to help pay the bills.

Financial Literacy Board Games for Teens

Let’s not forget about good, old-fashioned board games that can help teens and high school students understand finances better.

1. Act Your Wage! Board Game

Suggested Age Range: 10 years+ Players: 2-4 players

Everyone starts off in debt in this game. Then, each player is given a life persona that will determine what kind of salary and how much debt they have.

Players choose a “Life” card, and three “Debt” cards to begin the game.

For my round, I was given the following:

- $6,000 in student loan debt

- $5,000 in business loan debt

Yikes! That's $17,000 in debt to start, which feels slightly overwhelming.

Good thing it's just a game, but one that will show your students how destabilizing debt can be (and also, how to work through it). Kids are also given a salary, and $1,000 in an emergency fund to start.

Free financial literacy games for high school students and kids can really add fun and self-discovery to financial literacy teachings. Tell me below which one your own kids are trying and learning from!

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- 7 Simple Food Market Day Ideas for Kids to Sell at School - October 25, 2024

- 11 Easy Things Kids Can Make and Sell at School (Non-Food) - September 10, 2024

- 7 Fun Halloween Candy Games for Kids (from Dollar Tree) - September 5, 2024

25 Meaningful Budgeting Activities for High School Students

If we let students graduate high school without learning key skills like saving and budgeting, we’re doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit. Give teens the knowledge they need to make smart financial choices now and in the future!

Classroom Saving and Budgeting Activities

Try the Jellybean Game

Before you get into the nitty-gritty of numbers, start with this clever activity that gives kids practice allocating assets in a low-stakes way. They’ll use jellybeans to decide what they need, want, and can truly afford.

Learn more: The Jellybean Game

Use budget-planning worksheets

The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money. Show kids how to use their Income Tracker, Spending Tracker, Bill Calendar, and Budget Worksheet (all at the link below). Start by having kids consider their current financial situation. Then, give them hypothetical “adult” situations to plan for, with income and expenses drawn from typical people in your area.

Learn more: Budgeting Worksheet Tools

Create a buying plan

This activity encourages kids to think about purchases, especially major ones. Saving money is just one part of the process—they also need to consider what makes a good purchase and whether they should pay up front or borrow the money instead.

Learn more: Creating a Buying Plan

Practice grocery shopping

Most kids probably have no idea how much groceries cost. Use grocery store websites to your advantage, and have kids take a virtual shopping trip. They can plan meals and determine what they’ll need to buy. Or have them start with a weekly food budget and work backwards from there. Either way, remind them to make sure their menus include healthy options.

Learn more: Make a Great Grocery List at WebMD

Build a savings “first-aid kit”

It’s no secret that things can and do go wrong. Budgeting activities like this one help students learn what to do when unexpected expenses crop up. Students learn about real-world costs and come up with ways to save in advance and adjust on the fly.

Learn more: Savings First Aid Kit

Discover what jobs actually pay

Ask students to list some jobs they think they’d like to do someday. Then, have them research average salaries for those jobs. Encourage them to factor in where they plan to live (salary ranges can be dramatically different across the country). Plus, ask them to think about the education they’ll need to land those jobs, and how long it will take them to earn the money to pay back any loans they’ll have to take.

Learn more: Job Salaries by Field

Find out how credit cards work

These days, most people pay with plastic instead of cash. Sometimes they use debit cards, but often they’re credit cards. If you’re going to use them, you need to know how they work. Divide your class into groups, and ask each to research a different question about credit cards, like how they work, what interest they charge, and how to use them safely.

Learn more: Best Credit Cards at Money Under 30

Experiment with different budget models

There’s no one right way to set up a budget. Expose students to a variety of models, like proportional budgets, the “pay yourself first” model, the envelope budget, and more. Ask them to think about which kind of person each model works best for and which one they’d choose.

Learn more: 6 Different Ways To Budget Your Money at Young Adult Money

Explore Budgeting Apps

Teens are usually pretty attached to their phones, so show them one way to make really good use of screen time: budgeting apps. Learn how to choose a good one in this video.

Calculate compound interest

When you invest your money in an interest-bearing account, it earns money just by sitting there! That money can really grow over time too. Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time. Explore local bank offerings, and take into account things like fees too.

Learn more: Compound Interest Calculator

Learn what “living expenses” means

Kids generally don’t think about all the costs of daily living. Start by brainstorming a big list as a class of all the things people need to spend money on each month: rent or mortgage, car payments, credit card payments, food, entertainment, utilities, Internet access, and more. Break kids into groups and have each group research the average costs of those items in your area. Come back together as a class and add up their findings to see what “living expenses” can really be.

Learn more: Monthly Expenses at Inspired Budget

Get a reality check

Everybody’s got dreams, but how realistic are they? That’s where the Jump$tart Reality Check program comes in. By making choices about the future they want, teens will learn what they’ll need to earn to make it happen. The answers might really surprise them.

Learn more: Reality Check—Online Tool for Students

Reflect on needs vs. wants

Ask students to reflect on what they truly need to survive vs. things that just make life easier or more fun. Budgeting activities like this can help them identify items they can eliminate when funds get really tight.

Learn more: Needs vs. Wants

Learn to protect your money

If teens don’t learn smart skills like avoiding phishing scams, how to choose good passwords, or identifying fraudulent sites, they can lose everything they save. Take time to learn about the most common fraud issues, and teach them how to be responsible online.

Learn more: 8 Ways To Protect Your Money That All Students Should Know at We Are Teachers

Savings and Budgeting Online Games

How Not To Suck at Money

The title pretty much says at it all: By playing this game, students learn how to manage their money and use it responsibly.

Learn more: How Not To Suck at Money

The Uber Game

Let students imagine life as an Uber driver. This game is based on actual Uber driver experiences and can be a real eye-opener.

Learn more: The Uber Game

Hit the Road

Think of this like Oregon Trail for the modern age. A group of friends is setting off on a cross-country trip, but they’ve got to manage their funds to get where they want to go. Try this one as a group activity so kids have to work together to make smart choices.

Learn more: Hit the Road

Budgeting and saving is important, but students should also learn about the importance of having the right kind of insurance. Because sometimes life really is just a bummer!

Learn more: Bummer

College-bound kids might figure they’ll take loans now and figure out how to pay them back later, but do they really have a handle on the true costs? These interesting online simulations let you pick your school, then walk through four years of potential expenses and income opportunities to find out how you fare in the end.

Learn more: Payback

Misadventures in Money Management

This online game feels a bit like a graphic novel, and it helps kids learn the basics of budgeting and money management. Explore multiple topics and complete missions to learn valuable skills.

Learn more: Misadventures in Money Management

Lights, Camera, Budget!

Managing your own money can feel a little dull, so why not try your hand at managing a multimillion-dollar movie budget instead? This one has levels for both middle and high school students too.

Learn more: Lights, Camera, Budget!

Living on the financial edge is a sad reality for so many people. Show kids what that can feel like with this online simulation. When the game starts, you have no housing and no job and just $1,000 in the bank. Can you get a job and make it to the end of the month?

Learn more: Spent

Claim Your Future

This cool online game assigns you a career (or lets you choose one) and tailors your experience to your location. You get to make choices about housing and other expenses, and the game calculates how those things fit into a responsible budget.

Learn more: Claim Your Future

The Biggest Bang for Your Buck

This online game guides kids through a shopping trip with financial literacy questions along the way. It’s simple but a terrific way to introduce a discussion on spending, saving, and budgeting.

Learn more: The Biggest Bang for Your Buck

For kids who are sure they can make enough money to live on with their social media accounts, this game might be a bit of a reality check.

Learn more: Influenc’d

Budgeting activities are just the start! Check out these life skills every teen should learn .

Plus, get all the best teaching tips and ideas straight to your inbox when you sign up for our free newsletters .

Source link

We Love This Hack for Getting a Good Teaching Observation

New project to lift student learning in needy schools, you may also like, teacher exhaustion stories are making us laugh (and..., 30 history jokes we dare you not to..., cause and effect graphic organizer bundle (free printables), we adore this pre-k teacher who dressed up..., compare and contrast graphic organizer bundle (free printables), 2025 new year goals template: free goal tracker, classroom deal of the day: save on our..., storm: teaching with the stanford-designed ai system, 20 best nonfiction books for teens (teacher recommended), is year-round school the way to prevent learning....

A Financial Literacy Project Focused on the Future

A financial literacy project helps high school students plan for the lives they hope to lead through discussions of values and budgets.

Your content has been saved!

All of us can probably remember being asked as children, “What do you want to be when you grow up?” Even at a young age, I always knew I wanted to be a teacher, but I never stopped to think about how that would impact my adult budget or lifestyle, nor did I stop to imagine how the world might change between when I was in elementary school and when I entered the workforce in 2017.

A new project I developed helps high school students tackle that question by grounding it in financial literacy and “futures thinking”—thinking about possible futures. This project, which I call Gen Z Money, gives students the chance to think carefully about the life they hope to lead, while also opening up authentic opportunities for meaningful conversations around personal values, finances, budgeting, and future college and career decision-making. It helps students better understand that the path toward success isn’t always linear, a lesson that I am still learning.

Although I use this project in an after-school setting with students who have interests in business, Gen Z Money can easily be adapted for other classes such as English or economics.

What Is Futures Thinking?

In a recent Medium article, Laura McBain and Lisa Kay Solomon argue that we have an opportunity to support students so that they are not just “prepared” for their futures, “but capable of envisioning and building the futures they want to bring to life.” McBain and Solomon suggest that educators can use futures thinking to help students look beyond probable futures and imagine all their possible futures. In doing so, we can assist students in shaping futures that are more equitable and empathetic.

Using McBain and Solomon’s ideas as a guide, I developed Gen Z Money. For this project, students backwards-plan possible futures for themselves, using CNBC’s Millennial Money series as an exemplar. In each Millennial Money video, CNBC Make It profiles a young adult, spotlighting their career, budget, lifestyle, and personal values.

My students have particularly connected with the story of Destiny Adams , a 29-year-old Black woman living in Michigan who makes $158,000 a year by working a state job, running a small business, and managing her own YouTube channel. After watching Destiny’s story, I ask the class to imagine what their lives might look like at Destiny’s age. This question, “What will your life look like at age 30?” kicks off our Gen Z Money project.

Gen Z Money Project Steps

Futures Thinking Activity: Before thinking about their own lives at age 30, students engage in a futures thinking exercise by answering the following question: “What do you think the world will look like when you turn 30?” In small groups, students brainstorm what postsecondary education, the environment, the economy and jobs, and public health might look like in 2035. This forms the foundation for students’ work moving forward.

Personal Values: Next, students identify their personal values from a list I provide . We talk about how one’s values can impact the life they choose to lead. Are they prioritizing success, service, family, etc.? Do these values align with the futures thinking ethos of creating a world that is more equitable? What happens when two of these values come into conflict?

Vision Board: Next, students create a vision board for one possible future life at age 30. Using the futures thinking activity as a guide, students identify their ideal:

- Location—city, state, country

- Housing—apartment, house, etc.

- Transportation—car, bus, train, etc.

- Miscellaneous—subscriptions, fun purchases, savings, investments, donations, etc.

Students view all these components of their vision board through the lens of what they think the future will look like. If students think that pollution and global warming will be a continuing issue, for instance, they might choose to live in a location that is farther north or prioritize public transportation over a personal car.

Budget and Salary: After completing their vision boards, students calculate their monthly cost of living, keeping in mind that location impacts cost (Boston is a more expensive city than Tulsa, Oklahoma, for example). They then use their monthly budget to calculate the minimum yearly salary they need to make in order to afford the lifestyle they want.

Career: Next, students identify jobs that they think will continue to exist in 10+ years, align with their values, and pay the minimum salary they require. Many students also identify side hustles that might bring in extra income, allow them to monetize their hobbies, and/or raise awareness for causes they care about.

Presentations of Learning: Finally, students create presentations using a Google Slides template showcasing their possible futures in a format similar to the Millennial Money videos.

Extension Opportunities

While completing this project, students may have many questions about budgeting, taxes, and investing. They may also have questions about how the cost of living, salaries, and work-life balance might change by the time they are age 30. Teachers and guidance counselors can use these questions to launch into a longer unit on financial literacy. This project can also serve as a jumping-off point for an assignment to, for instance, write a letter to your future self or create a YouTube playlist of student presentations just like the Millennial Money series.

Students’ lives may not pan out in the way they envision in our Gen Z Money project, but this project can provide them with the tools to explore new, exciting possibilities and confidently navigate whichever futures they choose to pursue.

IMAGES

VIDEO

COMMENTS

Here are our favorite budgeting projects to give to high school students. Games and worksheets about budgeting are very helpful and deserve a place in the money education classroom. However, many students thrive in projects and learn much more deeply when they complete hands-on, extended activities. If you are searching for the best budgeting ...

Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of financial planning.

Making a Budget. St. Louis Fed has a set of slides, teacher guide, and worksheets to teach kids things like: Gross income vs. net income; Saving money; Spending money; Prioritizing using a budget; Financial Literacy Games for High School Students

19 free financial literacy games for high school students to add engagement and FUN to teaching personal finance. Financial literacy & budget simulations, too.

If we let students graduate high school without learning key skills like saving and budgeting, we’re doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit.

Browse high school student budget resources on Teachers Pay Teachers, a marketplace trusted by millions of teachers for original educational resources.

• Ways to make the most of their monthly budget and save for things they want and need. • The nuts and bolts of a basic spending plan. • How to make decisions and distinguish their wants from their needs. • How to apply a spending plan to real-life issues they may be facing. Use the content and resources on pages 2 and 3 of the high school

This project, which I call Gen Z Money, gives students the chance to think carefully about the life they hope to lead, while also opening up authentic opportunities for meaningful conversations around personal values, finances, budgeting, and future college and career decision-making.

This budget project is a great assignment for high school seniors learning how to create a monthly budget. This project begins one month after graduation and asks students to create a budget including projected income, expenses and savings goals.

This budget project is a great assignment for high school seniors learning how to create a monthly budget. This project begins one month after graduation and asks students to create a budget including projected income, expenses and savings goals.