Trending Courses

Course Categories

Certification Programs

Free Courses

Audit Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

FEW SEATS LEFT- COURSES UPTO 90%OFF

Management representation letter.

Last Updated :

21 Aug, 2024

Blog Author :

Kosha Mehta

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What Is Management Representation Letter?

A management representation letter is a document provided by management to auditors to confirm the accuracy and completeness of financial information and disclosures. Its purpose is to attest to the accuracy and completeness of the information the management provided to the auditors.

The letter is an important part of the audit process, assuring auditors that the financial information they are examining is reliable. The letter is usually signed by senior management, such as the CEO or CFO , and is included in the audit documentation. Management acknowledges its responsibility for the financial statements and the information's accuracy by signing the letter.

Table of contents

Management representation letter explained.

- Management Representation Letter vs. Management Letter

Frequently Asked Questions (FAQs)

Recommended articles.

- A management representation letter is a formal document issued by senior management of an organization confirming the accuracy and completeness of financial information presented in the financial statements.

- It is a critical document that helps auditors or other parties to obtain reasonable assurance that the financial statements are reliable.

- The letter should include specific representations regarding financial statements, disclosures, and other significant matters that could impact the financial statements.

- Management representation letter is required as part of an audit engagement and may be requested in other types of engagements such as reviews and compilations.

A management representation letter is a document management provides to auditors to confirm the accuracy and completeness of financial information and disclosures. Also, It attests to the accuracy and completeness of management's information to the auditors. Thus, it confirms that management has provided all the relevant information required for the audit and that it is accurate and complete.

The letter also confirms that management has disclosed any potential legal or financial liabilities that could impact the organization's financial statements. Thus, it assures auditors that the financial information they are examining is reliable. Also, it is signed by senior management as part of the audit documentation .

The letter asks management to confirm that they have provided all the required information for the audit. Also, that information is accurate and complete. The letter also confirms that management has disclosed any potential legal or financial liabilities that could impact the organization's financial statements.

Let us look at the following examples to understand the concept better.

Consider a company, Amacon Corporation, that provides management representation letters to their auditors.

In the letter, the senior management of Amacon Corporation will confirm that they have provided all the financial information and disclosures required for the audit and that the information is accurate and complete. They will also confirm that they have disclosed any potential legal or financial liabilities that could impact the organization's financial statements.

For example, the management representation letter may confirm that Amacon Corporation has disclosed any potential lawsuits or regulatory investigations that could impact its financial statements. It may also confirm that all financial transactions have been accurately recorded and all financial reports are complete and correct. Thus, by providing the letter, Amacon Corporation assures its auditors that the financial information is reliable and accurate.

Suppose a nonprofit organization, HappyLives Foundation, is seeking funding from a government age government agency that may require a management representation letter from the senior management of HappyLives Foundation. It confirms the accuracy of the financial information and disclosures in the grant application.

In this case, the management representation letter would attest that all the financial information presented in the grant application is accurate. The letter would also confirm that all financial transactions have been accurately recorded. Also, all financial reports are complete and correct. Thus, by providing the letter, HappyLives Foundation assures the government agency that the financial information in the grant application is reliable and accurate.

The specific format may vary depending on the requirements of the recipient of the letter. However, the letter is prepared clearly and concisely, and all required information is included to ensure the recipient's effectiveness.

The format of a management representation letter typically includes the following elements:

- Date: The date on which the letter is prepared.

- Addressee: The letter is addressed to the auditors or the party that requires the letter.

- Introduction: A brief introduction that identifies the management providing the representation, the letter's purpose, and the audit's scope.

- Management's Responsibility: A statement acknowledging their responsibility for the financial statements and the information's accuracy.

- Specific Representations: A list of specific representations that management makes, which may include disclosures of potential liabilities, completeness of financial information, and accuracy of financial statements.

- Signature: The letter is signed by senior management, such as the CEO or CFO, to indicate their agreement with the representations being made.

There are several benefits of providing a management representation letter:

#1 - Provides Assurance

The letter assures the auditors or other parties that the financial information in the financial statements is reliable and accurate.

#2 - Demonstrates Responsibility

The letter demonstrates that management is taking responsibility for the financial statements and the information contained within them.

#3 - Identifies Potential Issues

The letter requires management to identify potential legal or financial liabilities impacting the organization's financial statements. Thus, it allows for early identification and management of its potential issues.

#4 - Reduces Auditor's Risk

By providing a letter, management can help to reduce the auditor's risk and increase their confidence in the financial information provided. In addition, it potentially reduces the amount of work required during the audit.

#5 - Improves Communication

The letter can help to improve communication between management and the auditors or other parties. Thus, it ensures that all relevant information is provided and potential issues are identified and addressed.

Management Representation Letter vs Management Letter

Management Representation Letters are not required for reviews as they are less extensive than audits and do not require the same level of assurance. However, in some cases, the reviewer may request a representation letter to provide additional assurance regarding the accuracy and completeness of the financial information provided.

Yes, a Management Representation Letter should be on the company's official letterhead to ensure it is a formal representation of the organization. In addition, the use of official letterhead helps to identify the letter's source and assures that it is genuine communication from the organization.

Yes, a compilation engagement requires a Management Representation Letter. The letter is required to assure the accountant that the financial statements and disclosures are accurate and complete to the best of management's knowledge. Therefore, the letter is an important component of the compilation engagement and helps to assure the financial statements.

To obtain a Management Representation Letter, you should request it from senior management, provide a template that includes all the necessary elements, review the letter for accuracy and completeness, and have it signed by the appropriate signatories. The letter should be obtained during an audit, review, or compilation engagement.

This article has been a guide to what is Management Representation Letter. We explain it with its format, examples, difference with management letter, and benefits. You may also find some useful articles here -

- Interim Audit

- Board Members

The Role of Management Representation Letters in Audits

Explore the significance of management representation letters in audits, their preparation process, and common misunderstandings in this insightful overview.

Audits are a critical component of financial transparency and corporate governance. Within this process, management representation letters play an essential role that often goes unnoticed by those outside the accounting profession.

These documents serve as a written assertion from company management regarding the accuracy and completeness of information provided to auditors. Their importance cannot be overstated, as they underpin the trust and integrity of the entire audit process.

Purpose of Management Representation Letters

Management representation letters serve as a formal attestation from a company’s executives to the auditors, confirming the veracity of the financial statements and disclosures. These letters are a professional necessity, providing auditors with assurances that all relevant information has been disclosed. They are a testament to the management’s confidence in their financial reporting and their commitment to transparency.

The letters also support the auditor’s assessment of the risk of material misstatement in the financial statements. By obtaining written confirmations, auditors can reduce the extent of substantive testing required, which can streamline the audit process. This efficiency is beneficial for both the auditors and the company being audited, as it can lead to a more focused and timely audit.

Moreover, these letters can be a safeguard against potential disputes or legal issues that may arise post-audit. In instances where inaccuracies are discovered after the audit has been completed, the letter serves as a record that management had affirmed the completeness and accuracy of the information at the time of the audit. This can be particularly important in cases where financial statements are later found to be fraudulent or misleading.

Preparing a Management Representation Letter

The preparation of a management representation letter is a meticulous process that requires careful attention to detail and a comprehensive understanding of the company’s financial affairs. It is a collaborative effort between management and auditors to ensure that all significant information is accurately reflected.

Necessary Statements Identification

Identifying the necessary statements to be included in the management representation letter is a foundational step. These statements typically cover a range of areas such as the acknowledgment of responsibility for the fair presentation of financial statements in conformity with the applicable financial reporting framework, confirmation of the completeness of the information provided, and the disclosure of any subsequent events that may affect the financial statements. Management must also confirm that they have made the auditors aware of all known instances of fraud or suspected fraud affecting the company. The identification process is guided by professional auditing standards, such as those issued by the American Institute of Certified Public Accountants (AICPA) or the International Auditing and Assurance Standards Board (IAASB).

Information Completeness

Ensuring the completeness of information in the management representation letter is paramount. This involves a thorough review of the company’s financial records and disclosures to verify that all relevant information has been included. Management must confirm that all transactions have been recorded and are reflected in the financial statements. They must also attest to the appropriateness of the accounting policies applied and whether any unrecorded liabilities exist. This step is critical as it directly impacts the credibility of the financial statements and the audit’s outcome. The completeness of information also extends to the disclosure of any related party transactions and the effects of any uncorrected misstatements identified during the audit.

Review and Approval

The final step in preparing a management representation letter is the review and approval by the company’s top executives, typically the CEO and CFO. This review process is not merely a formality; it is an active examination to ensure that the letter accurately reflects the company’s financial position and that all statements can be substantiated. The approval signifies that management has taken ownership of the representations made within the letter. It is also an opportunity for management to discuss any concerns or clarifications with the auditors before the letter is finalized. The signed letter is then dated as of the last day of fieldwork, signifying that the representations are relevant and up-to-date with the findings of the audit.

Misconceptions About Representation Letters

A common misunderstanding about management representation letters is that they are a mere formality, a routine sign-off without substantial impact on the audit’s outcome. This view underestimates the letter’s function as a document that auditors rely upon for assurance beyond the financial data and records they examine. It is not simply a procedural step, but a declaration that can have legal implications for the signatories, particularly if it is later found that the information provided was knowingly false or misleading.

Another misconception is that the letter is solely for the benefit of the auditors. While it is true that auditors use these letters to corroborate information and reduce audit risk, the benefits extend to the management and the company as well. The process of preparing the letter encourages a comprehensive review of the company’s financial disclosures, which can lead to the identification and rectification of errors before the audit is finalized. This proactive approach can enhance the quality of financial reporting and potentially prevent future financial discrepancies.

There is also a belief that once the letter is signed and the audit is complete, the responsibilities of management in relation to the representations made are concluded. However, the representations have a lasting effect, as they are a testament to the financial condition of the company at the point of the audit. Should any issues arise from the period covered by the audit, the representations made can be scrutinized for their accuracy and completeness.

The Importance of the Going Concern Assumption in Financial Reporting and Analysis

Strategic supplier management in the financial sector, you may also be interested in..., key elements and impacts of dawn raids on businesses, detecting and preventing overstated debtors in financial statements, key factors in managing first-year audit costs, effective inventory cycle counting techniques.

Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

- Owner’s Profile

- Homeowner’s Association

- Reserve Study Services

- Individuals

- New! Associations & Taxes

- Treasurer’s Handbook

- The Condo Book

Understanding the Representation Letter

Written by David T. Schwindt, CPA

What is a Representation Letter? As a Board member or manager of a community management company, you may be asked to sign a representation letter at the conclusion of an audit or a reviewed financial statement engagement. Although the letter is from the Association/management company to the CPA, the CPA will generally draft the letter on behalf of the Association. The letter includes certain assertions about the Association during the period covered by the financial statements. Those assertions include but are not limited to the following:

- The Association/management company has provided the CPA with all requested financial information.

- The Association/management company has disclosed all related party transactions.

- The Association/management company has disclosed all existing and potential litigation.

- The Association/management company has disclosed any knowledge of fraud or financial irregularities.

- The Association takes responsibility for the design and implementation of a system of internal controls. These controls include but are not limited to safeguarding assets, approving transactions and minimizing the risk of someone perpetrating a theft of money or information and not being discovered in a reasonable amount of time. Although the Board is ultimately responsible for this activity, it is common that Boards rely upon the management company to assist in this responsibility.

In some instances, the management company may sign a different representation letter because the responsibilities are slightly different.

Why is the Representation Letter necessary? The American Institute of Certified Public Accounts has determined that those charged with governance (the board of directors and the community management company) should take responsibility for the assertions in the representation letter. CPAs are mandated to obtain the signed representation letter before issuing the final financial statements.

Who should sign the representation letter? Most often, the Board Chair, Board Treasurer and community manager signs the letter.

When does the Representation Letter need to be signed? The letter needs to be signed at the end of the engagement generally after a draft of the financial statements are issued. Schwindt & Co combines the representation letter with the management letter comments and proposed adjusting journal entries for ease of review. When the signed document is received by our office, we are then able to issue the final financial statements.

Should a new Board member or community manager who was not involved with Association management or governance during the period under audit or review be hesitant about signing the representation letter? This is a common question and the answer is simple. No! The first paragraph of the representation states that whoever signs the letter does so based on the best knowledge and belief of the person signing. This means that even though you may be new to the Board or management company, it is perfectly fine to sign the letter because you will only be asserting to issues that you have knowledge. It is very common for Board members/managers to sign a representation letter even though they were not involved during the period being audited or reviewed.

- Representation letters are normal and required before the issuance of audited/reviewed financial statements.

- Board members are only asserting to issues that they are aware of and new board members and managers frequently are required to sign representation letters.

- The Board Chair, Board Treasurer and community manager are generally required to sign the representation letter.

Questions regarding this article may be directed to David T. Schwindt, CPA at Schwindt & Co. (503) 227-1165.

10121 SE Sunnyside Road, Suite 300 Clackamas, OR 97015 (503) 227-1165

Copyright 2017-2024 Schwindt & Co. | All Rights Reserved

COMMENTS

Management Representations. (Supersedes SAS No. 19.) Source: SAS No. 85; SAS No. 89; SAS No. 99; SAS No. 113. See section 9333 for interpretations of this section. Effective for audits of financial statements for periods ending on or after June 30, 1998, unless otherwise indicated.

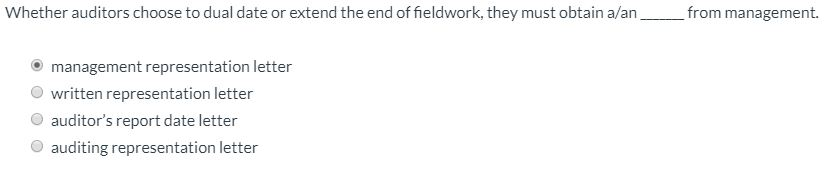

Exhibit A—Illustrative Representation Letter. The following illustrative letter includes written representations that are re-quired by this and other AU-C sections in effect for audits of financial state-ments for periods ending on or after December 15, 2012.

AS 2805: Management Representations. Amendments to footnote 1 to paragraph .02 have been adopted by the PCAOB and approved by the U.S. Securities and Exchange Commission. The amendments will be effective for audits of financial statements for fiscal years beginning on or after December 15, 2024.

A management representation letter is a form letter written by a company's external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

To obtain a Management Representation Letter, you should request it from senior management, provide a template that includes all the necessary elements, review the letter for accuracy and completeness, and have it signed by the appropriate signatories.

Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. [1] The representations letter covers all periods encompassed by the audit report, and is dated the same date of audit work completion.

Should any issues arise from the period covered by the audit, the representations made can be scrutinized for their accuracy and completeness. Explore the significance of management representation letters in audits, their preparation process, and common misunderstandings in this insightful overview.

Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

What is a Representation Letter? As a Board member or manager of a community management company, you may be asked to sign a representation letter at the conclusion of an audit or a reviewed financial statement engagement.

ISA (UK) 580 requires auditors to request written representations from management with appropriate responsibilities and knowledge of the matters concerned before their report is issued.