- Paragraph Generator

- Cover Letter

- Authorization Letter

- Application Letter

- Letter of Intent

- Letter of Recommendation

- Business Plan

- Incident Report

- Reference Letter

- Minutes of Meeting

- Letter of Resignation

- Excuse Letter

- Research Proposal

- Job Application

- Acknowledgement

- Employment Letter

- Promissory Note

- Business Proposal

- Statement of Purpose

- Offer Letter

- Deed of Sale

- Letter of Interest

- Power of Attorney

- Solicitation Letter

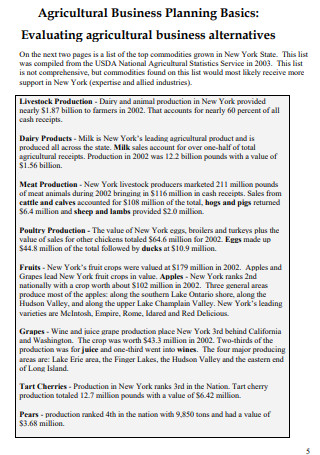

Agriculture Business Plan

Agriculture business plan format, agriculture business plan samples, what is an agriculture business plan, benefits of agriculture business plan, tips on agriculture business plan, how to write an agriculture business plan, what is the use of an agriculture business plan, is there a great income in an agriculture business, how often should an agriculture business plan be updated, how does market research impact an agriculture business plan, how can technology enhance an agriculture business plan, what makes an executive summary effective in a business plan, is a mission statement necessary for an agriculture business plan, why is sustainability important in an agriculture business plan.

1. Executive Summary

- Introduction: Briefly introduce the business, mission, vision, and goals.

- Business Idea: Highlight the specific agricultural products or services offered.

- Target Market: Summarize the market analysis and the intended customer base.

- Financial Overview: Present an outline of projected income, expenses, and profitability.

2. Company Overview

- Business Name and Structure: Mention the name and legal structure (e.g., sole proprietorship, partnership).

- Location: Provide details of the business location (e.g., farm, office, etc.).

- Business History: If applicable, include background information about the farm or company.

- Mission Statement: State the mission that guides the business.

- Vision Statement: Define the long-term vision for the agriculture business.

3. Industry and Market Analysis

- Agricultural Trends: Analyze current trends in the agriculture sector.

- Target Market: Describe the demographics and needs of the target customers.

- Market Size and Growth: Provide an estimate of the market size and potential for growth.

- Competitor Analysis: List key competitors, their strengths and weaknesses, and your competitive advantage.

- Regulatory Considerations: Note any agriculture-specific regulations or requirements.

4. Products and Services

- Product Line: Describe the agricultural products or services offered (e.g., crops, livestock, organic produce).

- Production Process: Explain how products will be grown, harvested, or produced.

- Unique Selling Proposition (USP): Highlight what makes your products/services different (e.g., organic farming, eco-friendly methods).

5. Marketing and Sales Strategy

- Marketing Plan: Detail strategies for promoting products (e.g., digital marketing, farmer’s markets, partnerships).

- Pricing Strategy: Define how products will be priced (e.g., cost-based, value-based pricing).

- Distribution Channels: Outline the channels used to reach customers (e.g., wholesalers, direct-to-consumer).

- Sales Plan: Include projected sales volumes and strategies for reaching sales goals.

6. Operations Plan

- Production Plan: Detail how crops or livestock will be cultivated, cared for, and harvested.

- Suppliers and Inputs: List suppliers of seeds, fertilizers, equipment, etc.

- Equipment and Machinery: Describe the equipment and machinery needed for operations.

- Facilities: Explain the physical setup of the farm, processing units, or other facilities.

- Staffing Plan: Outline the roles, responsibilities, and number of employees required.

7. Management and Organization

- Management Team: Provide bios and roles of key management personnel.

- Organizational Structure: Display the organizational hierarchy of the business.

- Advisory Board (if any): Mention any advisors or experts consulted for business guidance.

8. Financial Plan

- Startup Costs: List all costs for starting the business (e.g., land, equipment, seeds).

- Projected Income Statement: Present revenue, expenses, and profits for the first 3-5 years.

- Cash Flow Projection: Include cash flow forecasts for 3-5 years.

- Balance Sheet: Offer a projected balance sheet for 3-5 years.

- Break-Even Analysis: Calculate when the business is expected to break even.

- Funding Requirements: State the amount of funding required and its intended use.

9. Risk Analysis

- SWOT Analysis: Detail the business’s strengths, weaknesses, opportunities, and threats.

- Risk Management Plan: Describe measures to mitigate potential risks (e.g., crop failure, market fluctuations).

10. Appendix

- Supporting Documents: Include any supporting documents, like market research data, licenses, contracts, etc.

- Visuals: Add diagrams of farm layout, production plans, or organizational charts if necessary.

Agriculture Business Financial Plan

Agriculture Consulting Business Plan

Agriculture Services Business Plan

Regenerative Agriculture Business Plan

Agriculture Farm Business Plan

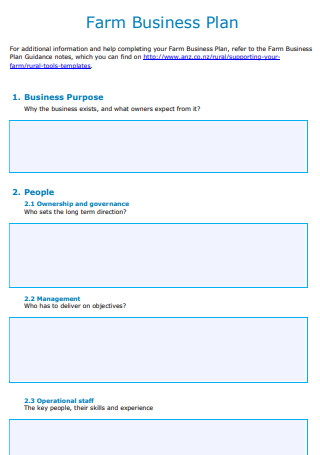

Farm Business Plan

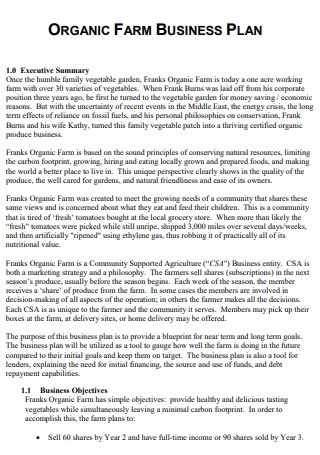

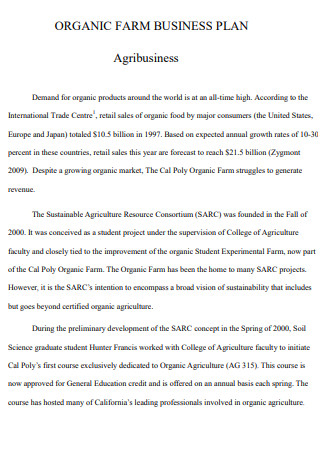

Organic Farm Business Plan

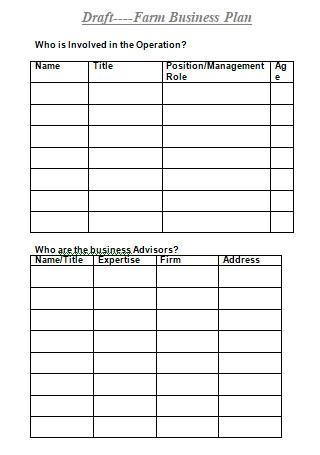

Draft Farm Business Plan

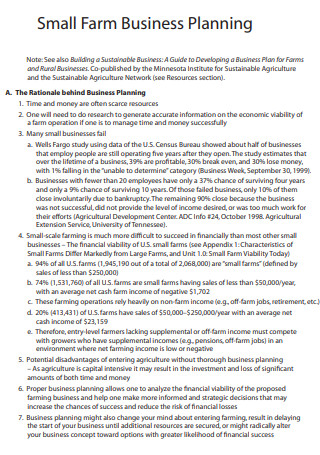

Small Farm Business Plan

Simple Farm Business Plan

Vegetable Farm Business Plan

Agri-Business Plan

Farm Business Succession Plan

Sample Agriculture Business Plan

Hop Farming Business Plan

Farm Tour Business Plan

Partnership Business Plan for Farm

Farm Business Planning Model

Community Farm Business Plan

Urban Farm Business Plan

Agriculture Farms Business Plan

Organic Farm & Agriculture Business Plan

Sustainable Agriculture Farm Business Plan

Agriculture and Forestry Business Plan

Value Added Agriculture Business Plan

Agriculture Sector Business Plan

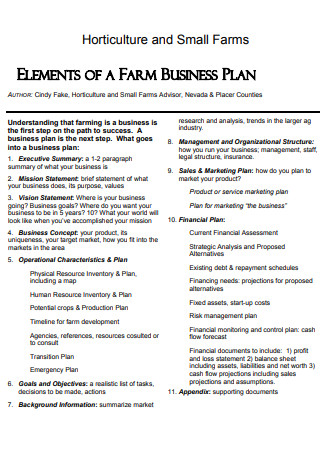

Elements of Agriculture Business Plan

New Farmers Business Plan

Agricultural Producers Business Plan

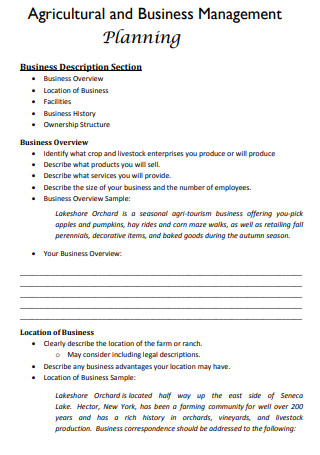

Agricultural and Business Management Business Plan

Beginning Farmer Business Plan

Agricultural Co-operatives Business Plan

Agricultural Business Plan Example

Standard Agricultural Business Plan

Agricultural Entrepreneurs Business Plan

Agricultural Sales 3 Year Business Plan

Agricultural Innovation Business Plan Request Proposal

Agricultural Business Digital Marketing Plan

Precision Agricultural Business Plan

Food Hub Business Plan

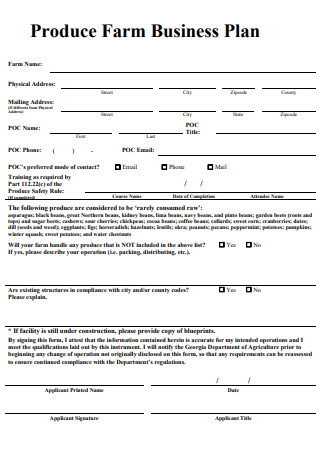

Produce Farm Business Plan

Agriculture Business Initiative Plan

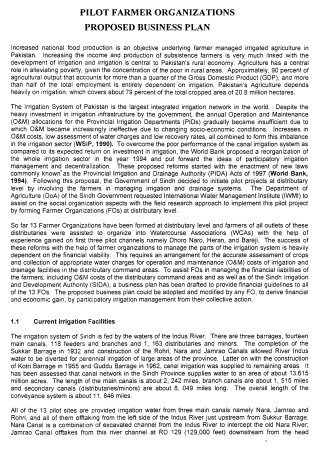

Pilot Framers Business Plan

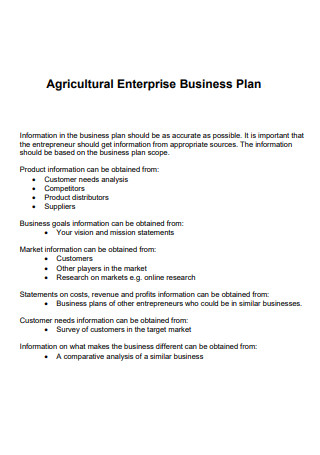

Agricultural Enterprise Business Plan

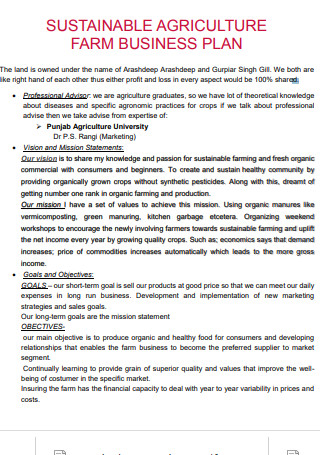

Sample Sustainable Agriculture Farm Business Plan

Step 1: Develop an Executive Summary

Step 2: define goals and objectives, step 3: craft an engaging introduction, step 4: present a mission statement, step 5: highlight your company history, share this post on your network, you may also like these articles, school business plan.

A school business plan is a comprehensive document outlining the objectives, strategies, and operational framework for establishing or managing a school. It details the vision, target audience, financial projections,…

Boutique Business Plan

A boutique business plan is a comprehensive roadmap tailored to the unique needs of boutique owners. It outlines the business's goals, market strategies, and financial projections while capturing the…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

IMAGES

VIDEO