5 Professional Actuary Cover Letter Examples for 2024

Your actuary cover letter must immediately highlight your proficiency in statistical analysis and risk assessment. Demonstrate your expertise with real-world examples of how you've successfully managed complex calculations and data interpretation. In this letter, it's crucial to also convey your understanding of the business and its actuarial needs. Show them that you're not just a numbers person, but someone who applies mathematical skills to drive informed business decisions.

All cover letter examples in this guide

Entry Level Actuary

Actuary Internship

Experienced Actuary

Pension Actuary

Cover letter guide.

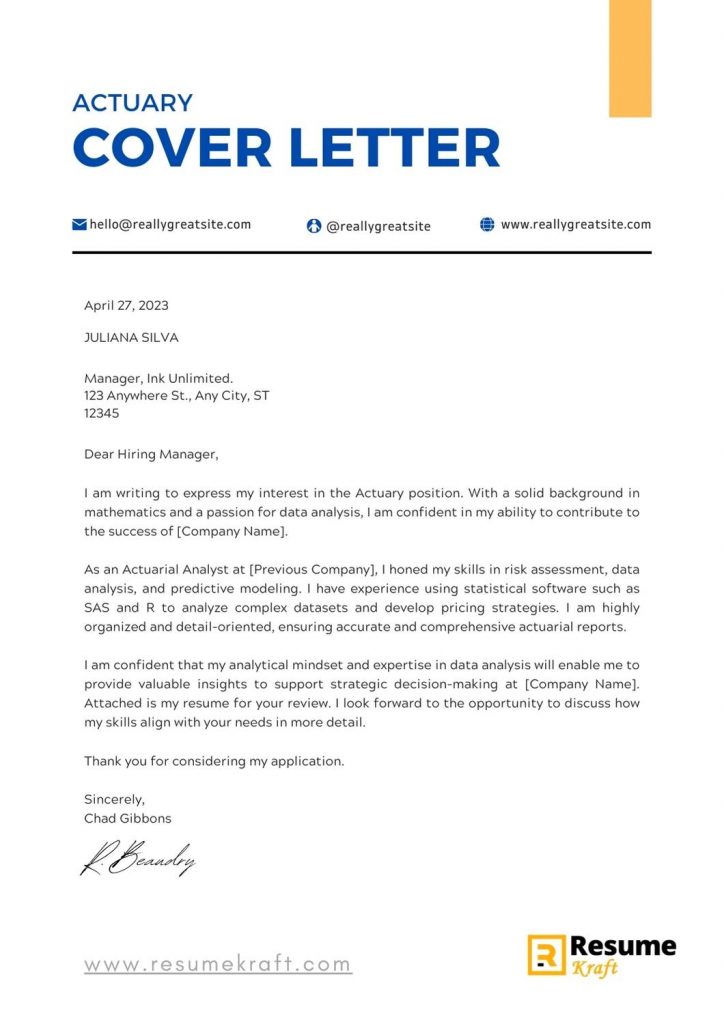

Actuary Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Actuary Cover Letter

Key Takeaways

By Experience

Embarking on your actuarial career, you've likely hit the common snag of crafting the perfect cover letter. While your resume showcases your credentials, your cover letter should be a narrative of your proudest professional achievement, not a repeat of your resume. It's about striking a balance between formal tone and originality, steering clear of tired clichés. Remember, brevity is key—your compelling story must captivate in just one page. Let's dive into how you can make that happen.

- Making excellent use of job-winning real-life professional cover letters;

- Writing the first paragraphs of your actuary cover letter to get attention and connect with the recruiters - immediately;

- Single out your most noteworthy achievement (even if it's outside your career);

- Get a better understanding of what you must include in your actuary cover letter to land the job.

Let the power of Enhancv's AI work for you: create your actuary cover letter by uploading your resume.

If the actuary isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Actuary resume guide and example

- Banking cover letter example

- Financial Planning Analyst cover letter example

- Financial Operations Manager cover letter example

- Purchasing Director cover letter example

- Phone Banking cover letter example

- Hotel Accounting cover letter example

- Public Accounting cover letter example

- Entry Level Actuary cover letter example

- Accountant cover letter example

- Project Accounting cover letter example

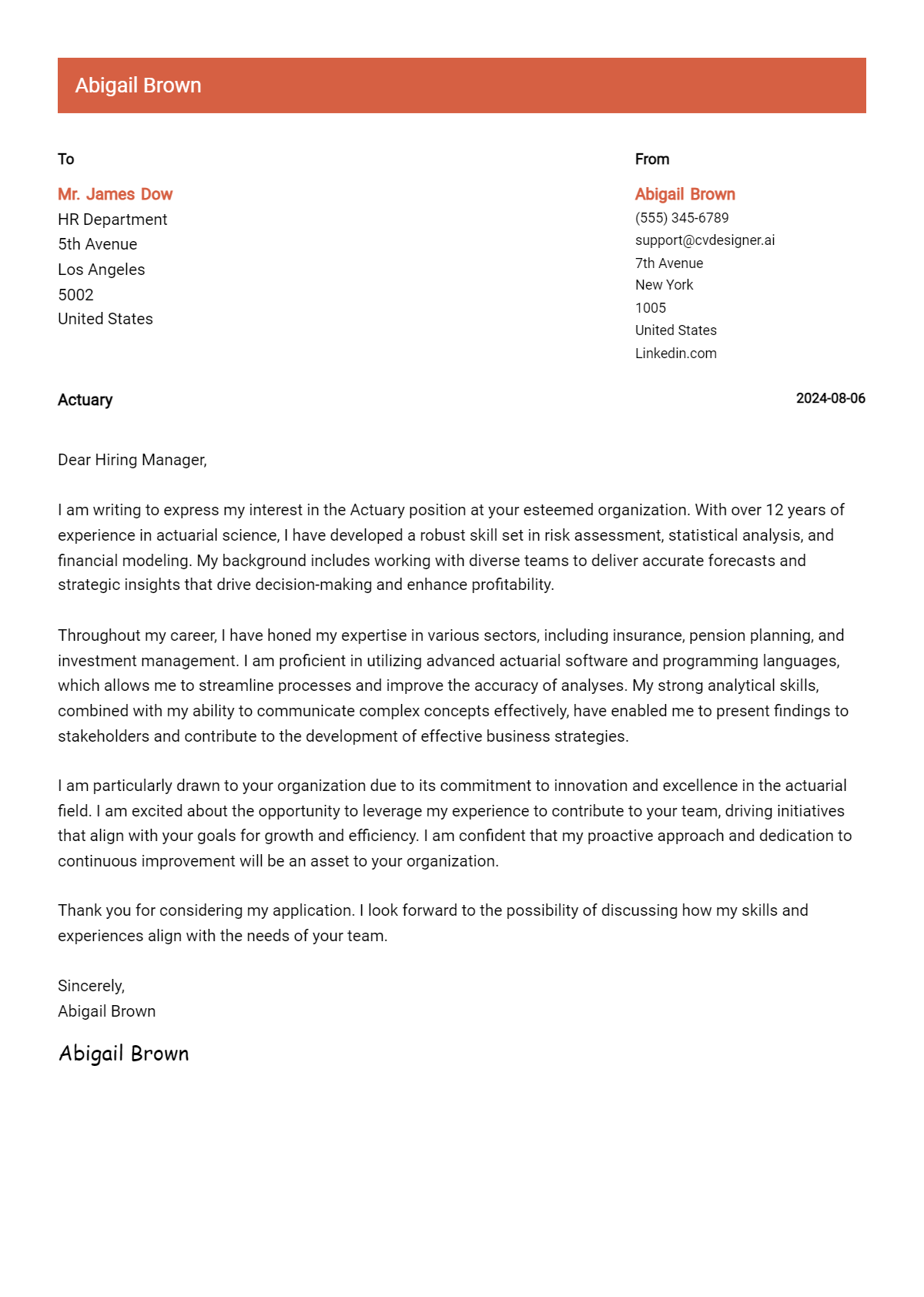

Actuary cover letter example

Alexander Taylor

New York City, New York

+1-(234)-555-1234

- Relevant Experience: The letter mentions the candidate's tenure at MetLife and a specific project that showcases experience directly relevant to the role, emphasizing their capacity to revamp risk evaluation models.

- Quantifiable Achievements: It highlights a significant accomplishment (20% reduction in forecast errors), which demonstrates the candidate's ability to deliver measurable results, a key aspect in actuarial and risk assessment positions.

- Technical Skillset: The cover letter references expertise in predictive analytics and advanced statistical techniques, showing the candidate's technical competency, which is essential for an actuarial role that depends heavily on data analysis.

- Leadership and Teamwork: It showcases the candidate's leadership experience by mentioning the successful management of a team and the collaborative nature of their work, essential skills for a senior position where leadership is expected.

Five tips on formatting your actuary cover letter

Do you want to make a good impression on recruiters and, at the same time, follow the best industry advice on writing your actuary cover letter?

Make sure to include the following:

- Header and Salutation;

- Introductory paragraph;

- Body paragraph;

- Closing paragraph;

- Signature (this one is up to you).

Remember to use the same modern, simple font for your actuary cover letter as you did for your resume (e.g. Lato, Rubik, etc.)

Ensure your actuary cover letter is single-spaced and is wrapped around a one-inch margin, like in our cover letter templates .

Once completed, use our cover letter builder to export your actuary cover letter in the best format to keep your information intact - PDF.

At the end of the day, your actuary cover letter won't be assessed by the Applicant Tracker System (ATS) software, but by the recruiters. Your information should thus be legible, organized, and follow a structured logic.

The top sections on a actuary cover letter

Header: This includes your contact information, the date, and the recipient's details, and it ensures your cover letter looks professional and is directed to the correct person or department.

Opening Greeting: A personalized salutation addresses the hiring manager by name and demonstrates your attention to detail and interest in establishing a personal connection.

Introduction: Introduce yourself by mentioning your actuarial qualifications and express your enthusiasm for the position, as it sets the tone and engages the reader from the start.

Professional Experience and Skills: Highlight specific instances of your analytical skills, risk assessment experience, and any relevant actuarial exams passed, as these are key competencies that recruiters look for in candidates for actuary roles.

Closing Section: Reiterate your interest in the role, summarize why you are a great fit, thank the recruiter for their time, and include a call to action such as looking forward to discussing your qualifications in further detail, which shows proactiveness and eagerness.

Key qualities recruiters search for in a candidate’s cover letter

Strong mathematical and statistical analysis skills: Actuaries use these skills to assess risk and the financial implications of uncertainty and to make predictions about future events.

Proficiency in actuarial software: Recruiters look for candidates familiar with relevant tools like Prophet, MoSes, or similar actuarial software to model and evaluate financial risks efficiently.

Knowledge of insurance and finance principles: A solid understanding of the insurance industry, finance, and economics allows actuaries to design, test, and manage insurance policies and pension plans.

Detail-oriented mindset: Attention to detail ensures accurate calculations, which is crucial in an actuary's role since small errors can lead to significant financial consequences.

Strong communication skills: Actuaries must clearly explain complex mathematical concepts to non-experts, including clients, managers, and other stakeholders.

Professional certification progress: Recruiters often look for candidates who have started or completed actuarial exams and are on the path to becoming an Associate or Fellow of recognized actuarial societies (e.g., Society of Actuaries or Casualty Actuarial Society).

Personalizing your actuary cover letter salutation

Always aim to address the recruiter from the get-go of your actuary cover letter.

- the friendly tone (e.g. "Dear Paul" or "Dear Caroline") - if you've previously chatted up with them on social media and are on a first-name basis;

- the formal tone (e.g. "Dear Ms. Gibbs" or "Dear Ms. Swift") - if you haven't had any previous conversation with them and have discovered the name of the recruiter on LinkedIn or the company website;

- the polite tone (e.g. "Dear Hiring Manager" or "Dear HR Team") - at all costs aim to avoid the "To whom it may concern" or "Dear Sir/Madam", as both greetings are very old-school and vague.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Recruiter,

- Dear Mr./Ms. [Last Name],

- Dear Members of the [Team Name] Team,

- Dear Recruitment Committee,

Your actuary cover letter intro: showing your interest in the role

On to the actual content of your actuary cover letter and the introductory paragraph .

The intro should be no more than two sentences long and presents you in the best light possible.

Use your actuary cover letter introduction to prove exactly what interests you in the role or organization. Is it the:

- Company culture;

- Growth opportunities;

- Projects and awards the team worked on/won in the past year;

- Specific technologies the department uses.

When writing your actuary cover letter intro, be precise and sound enthusiastic about the role.

Your introduction should hint to recruiters that you're excited about the opportunity and that you possess an array of soft skills, e.g. motivation, determination, work ethic, etc.

That one achievement in your actuary cover letter body

The lengthiest part of your actuary cover letter is the body.

Within the next three to six middle paragraphs, present yourself as the best candidate for the role .

How can you do that without retelling your whole professional resume?

Select one key achievement that covers job-crucial skills and technologies (and is memorable).

Within the body of your actuary cover letter, aim to tell the story of how you achieved your success. Also, write about how this would help out your potential team.

Thinking about the closing paragraph of your actuary cover letter

Before your signature, you have extra space to close off your actuary cover letter .

Use it to either make a promise or look to the future.

Remind recruiters how invaluable of a candidate you are by showing what you plan to achieve in the role.

Also, note your availability for a potential next meeting (in person or over the telephone).

By showing recruiters that you're thinking about the future, you'd come off as both interested in the opportunity and responsible.

Is it beneficial to mention that you have no experience in your actuary cover letter?

Lacking professional experience isn't the end of the world for your actuary cover letter .

Just be honest that you may not have had roles in the industry, but bring about so much more.

Like, your transferable skills, attained thanks to your whole work and life experience (e.g. the skills your summer spent working abroad taught you).

Or, focus on what makes you, you, and that one past success that can help you stand out and impress recruiters (think of awards you've attained and how they've helped you become a better professional).

Alternatively, write about your passion and drive to land the job and the unique skill set you would bring to enhance the workplace culture.

Key takeaways

Winning at your job application game starts with a clear and concise actuary cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the actuary resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.

Actuary cover letter examples

Explore additional actuary cover letter samples and guides and see what works for your level of experience or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

Curating GitHub Links on Your Resume: Projects, Seniority, and How to Guide

Should you include irrelevant experience on your resume, why can’t i find a job the real reasons why you’re struggling to find one, google docs resume templates, how to answer "why should we hire you", destinee, an ambitious techie that never settles.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- AI Resume Review

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- [email protected]

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

Made with love by people who care.

© 2024 . All rights reserved.

16+ Actuary Cover Letter Examples & Samples

Discover over 15 actuary cover letter examples tailored for 2024, along with expert tips on format and best practices. Whether you’re applying for an entry-level position or an internship, this comprehensive guide will help you craft a standout cover letter that highlights your professional skills and experience, even if you're new to the field.

As a vital component of the financial and insurance sectors, actuaries play a crucial role in helping organizations assess risk and make informed decisions. Employers seek candidates who exhibit a unique blend of analytical prowess, mathematical expertise, and strong problem-solving abilities, along with soft skills like communication and teamwork. Crafting a well-tailored actuary cover letter is essential to stand out in today’s competitive job market—it's your opportunity to showcase your professional skills and genuine passion for the field. In this comprehensive guide, you'll discover over 15 actuary cover letter examples for 2024, along with essential tips on formatting and best practices. Whether you’re applying for an entry-level position or an internship, we’ll provide you with the tools you need to create a compelling cover letter that effectively complements your resume. Take the first step toward securing your desired role by exploring our expertly curated examples and guidance on how to write an actuary cover letter that captures the attention of hiring managers.

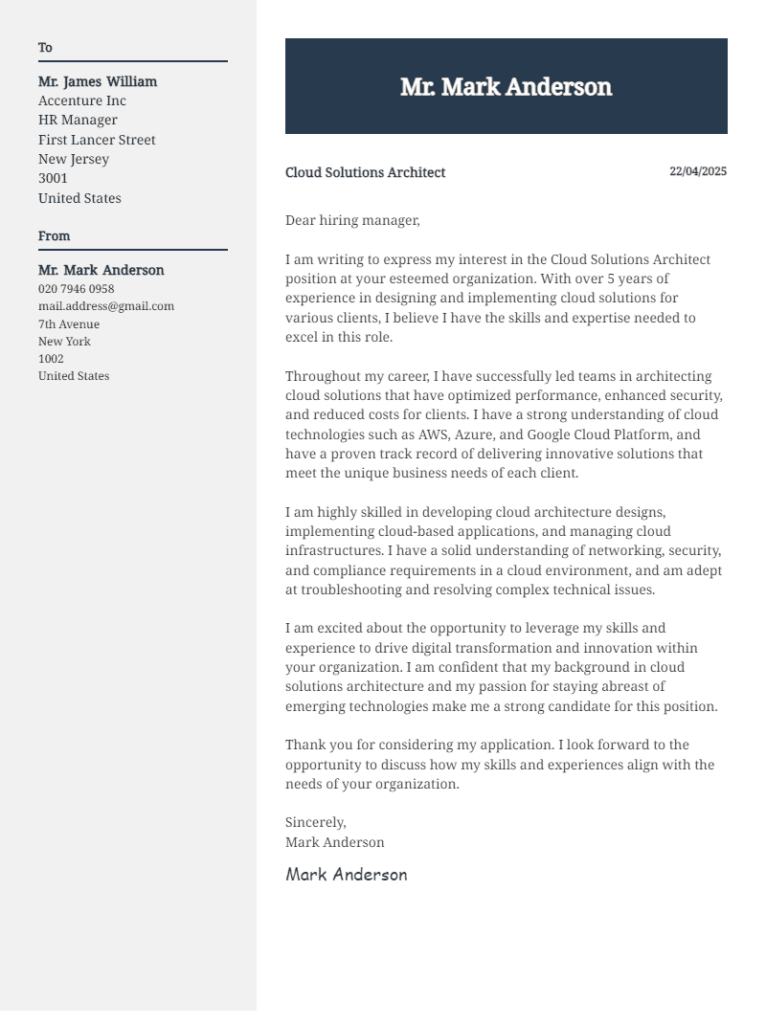

Actuary Cover Letter Example

How to write an actuary cover letter.

Creating an impactful actuary cover letter is essential for standing out in a competitive job market. A strong cover letter not only communicates your skills and experiences but also reflects your attention to detail and professionalism—traits that are highly valued in the actuarial field. In this section, we will guide you through the necessary components of an actuary cover letter format that can help you effectively convey your qualifications and enthusiasm for the role.

Purpose of This Section

This section aims to provide you with a clear framework for formatting your actuary cover letter, including essential tips and examples related to the profession. By following these guidelines, you can better articulate your professional skills and make a compelling case for why you are a great fit for the position.

Key Components of an Actuary Cover Letter

Cover Letter Header

- Your header should include your name, contact information, and the date. This section establishes the professionalism of your letter and ensures hiring managers can easily reach you.

Cover Letter Greeting

- Begin with a respectful greeting addressing the hiring manager by name. This personal touch demonstrates your genuine interest in the position and the company.

Cover Letter Introduction

- Your introduction should grab the reader's attention and provide a brief overview of why you’re applying. Mention the specific position and share a strong first impression that highlights your motivation for becoming an actuary.

Cover Letter Body

- In this central section, provide detailed examples of your experiences and skills relevant to the actuary role. Make sure to include key professional skills for actuaries, such as analytical thinking, mathematical proficiency, and problem-solving abilities. Tailor your content to reflect the requirements of the specific job.

Cover Letter Closing

- Conclude your cover letter with a strong closing paragraph that reiterates your interest in the position and expresses your eagerness to discuss your qualifications further. A call to action, such as suggesting a meeting or interview, adds a proactive touch.

Each part of your actuary cover letter is essential in showcasing your professionalism and dedication to the field. Let’s dive into each section and highlight what to focus on to make your cover letter stand out with our actuary cover letter examples and best practices for actuary cover letters .

Cover Letter Header Examples for Actuary

Great header.

Emily Johnson

(123) 456-7890

Explanation

The cover letter header is a crucial component of your application as an Actuary. It establishes your professional identity and provides essential information about how to contact you. For an Actuary position, a well-structured header not only showcases your attention to detail and professionalism—key traits in the field of risk assessment and calculations—but also ensures that your application is taken seriously. A meticulously crafted header sets a positive tone for your entire letter and can enhance your chances of making a good impression on hiring managers.

What to Focus on with Your Cover Letter Header

For an Actuary role, focus on clarity and professionalism in your cover letter header. Include your full name, a reliable phone number, and a professional email address—avoid casual nicknames or unprofessional email domains. Emphasize the importance of accuracy in your contact information, as it reflects your precision-oriented mindset. Additionally, provide the date and ensure that the recipient's name and title are formatted correctly. Avoid unnecessary personal details, such as your home address, unless specifically required. A clean, well-formatted header will communicate your thoroughness and respect for the hiring process.

Common Mistakes to Avoid

- Using an unprofessional email address (e.g., [email protected])

- Having incomplete or ambiguous recipient details

- Including irrelevant personal information like your address

To make your cover letter header stand out as an Actuary, choose a professional font that matches the tone of your letter. Use bold for your name to make it prominent while ensuring that all other details are neatly aligned. Consistency in the formatting of this header with the rest of your letter is key to a polished and professional appearance, which reflects your analytical skills and attention to detail essential in the actuarial field.

Cover Letter Greeting Examples for Actuary

Great greeting.

Dear Mr. Smith,

Bad greeting

The greeting of your cover letter is essential as it sets the tone for your application and introduces you to the hiring manager or recruitment committee. For an actuary position, a well-crafted greeting can demonstrate not only your professionalism but also your understanding of the industry where precision and attention to detail are paramount. It conveys respect and helps create a positive first impression, showing that you have invested time in addressing your application thoughtfully.

How to Get Your Cover Letter Greeting Right

When applying for an actuary position, it's crucial to begin your cover letter with a greeting that is both formal and respectful. Always strive to address your letter to a specific individual, such as the hiring manager or the head of the actuarial department, if their name is available. If you cannot find a specific name, addressing it to 'The Actuarial Recruitment Team' is a suitable alternative. Avoid generic phrases like 'To Whom It May Concern' or informal greetings like 'Hi there.' A strong greeting example would be 'Dear [Hiring Manager's Name],' or 'Dear Actuarial Recruitment Team.' This approach shows your professionalism and attention to detail, which are vital qualities for an actuary.

When crafting your cover letter greeting as an Actuary, prioritize professionalism and specificity. Use the hiring manager's name if available; if not, opt for a formal title like 'Actuarial Recruitment Team'. Personalization highlights your interest in the role and respect for the hiring process.

Cover Letter Intro Examples for Actuary

Great intro.

As a dedicated actuary with over five years of experience specializing in life insurance and pension planning, I am excited to apply for the actuary position at your company. My commitment to leveraging data analysis and risk assessment aligns seamlessly with your firm’s mission to provide innovative financial solutions. I admire your dedication to integrity and client service, and I am eager to contribute my skills to help you navigate complex actuarial challenges.

I am writing to apply for the actuary position. I have a degree in actuarial science and experience in the field. I would like to work for your company because I think it’s a good place to work.

The introduction of your cover letter is crucial in making a strong first impression on hiring managers. For an Actuary, this section should highlight your analytical skills and attentiveness to detail, as well as your understanding of risk management and financial mathematics. An effective introduction not only showcases your qualifications and relevant experience but also demonstrates your enthusiasm for the company and its mission. A compelling opening is vital for setting the right tone and encouraging the reader to engage with the rest of your application.

How to Craft an Effective Cover Letter Introduction

Begin your cover letter by indicating your years of experience in the actuarial field and any specific areas of expertise, such as pricing, reserving, or risk assessments. Clearly express your interest in the actuary position at the company, mentioning why you are drawn to their values or projects. Highlighting relevant certifications or memberships, such as being a Fellow or Associate of a recognized actuarial society, can enhance your introduction. Ensure your enthusiasm for applying your mathematical and analytical skills to contribute positively to the company’s goals comes through clearly.

- Using a generic introduction that could apply to any position in any company.

- Failing to specify how your skills directly relate to the job you're applying for.

- Not expressing a genuine interest in the company's specific projects or values.

- Being overly technical in your language, which may confuse or disengage non-technical readers.

To make your cover letter introduction stand out, emphasize your passion for the actuarial profession and the value you bring through your quantitative skills. Include specific examples of your achievements or problem-solving capabilities that relate to the job. Clearly convey how your professional aspirations align with the company's mission, showing that you’re not only a qualified candidate but also a perfect fit for their culture.

Cover Letter Body Examples for Actuary

As a dedicated actuary with over five years of experience in risk assessment and financial modeling, I have successfully developed predictive models that have increased accuracy rates by 30% in our firm's client forecasts. My proficiency in tools such as R and Python allows me to manipulate large datasets effectively. For instance, during my tenure at XYZ Insurance, I led a project that reduced underwriting costs by 15% through rigorous statistical analysis and risk evaluation procedures. I pride myself on my ability to communicate intricate concepts to stakeholders, ensuring that strategic decisions are based on data-driven insights. I am eager to bring my expertise in actuarial science to your organization and contribute to its continued success.

I have been working as an actuary for a few years and have experience with analyzing data and creating reports. I think I’m a good candidate for this position because I have a degree in mathematics and I enjoy working with numbers. My previous job involved some risk assessment work, and I believe that I am capable of handling this new role. I like analyzing financial data and hope to contribute positively to your company.

The body of your cover letter is crucial for presenting your analytical skills and understanding of actuarial science to potential employers. As an actuary, this section allows you to showcase your relevant experience, technical expertise, and problem-solving abilities. Employers are looking for candidates who can analyze complex data, assess risk, and make informed decisions that will impact their organization. Providing specific, quantifiable results is essential to demonstrate your effectiveness in past roles and your suitability for the position.

How to Craft an Effective Cover Letter Body

When writing the body of your cover letter as an Actuary, begin by summarizing your educational background and any relevant certifications, such as passing certain actuarial exams. Highlight specific experiences where you utilized mathematical and statistical skills to solve real-world problems, such as analyzing financial risk or projecting future trends. Be sure to provide numbers or outcomes to back up your claims—such as improvements in accuracy of forecasts, cost savings your analysis has provided, or successful projects you have led. Additionally, emphasize your analytical prowess and your ability to communicate technical findings to non-technical stakeholders.

- Using overly technical jargon that may not resonate with all readers.

- Failing to quantify achievements or providing vague descriptions of past work.

- Neglecting to tailor your cover letter to the specific job description or company values.

- Writing in a generic tone that doesn’t reflect your passion for the actuarial profession.

To make your cover letter body stand out, focus on specific accomplishments and their measurable impact on your previous employers. Use data and examples to demonstrate your analytical skills and ability to communicate complex information simply and clearly. Highlight your passion for actuarial work and your commitment to continuing professional development in the field.

Cover Letter Closing Paragraph Examples for Actuary

Great closing.

As a detail-oriented actuary with over five years of experience in risk assessment and financial modeling, I am excited about the opportunity to contribute to your team. I am particularly impressed by your organization’s commitment to innovative risk management strategies, and I am eager to bring my analytical skills and passion for data-driven decision-making to your firm. I would welcome the chance to discuss how my background and goals align with the needs of your team in more detail during an interview.

Bad closing

I think I would be a good actuary because I have done some math and have a bit of experience. I hope that you consider my application, and I look forward to your response.

The closing paragraph of your cover letter is your final chance to reinforce your expertise as an actuary and to leave a lasting impression on the hiring manager. It should encapsulate your enthusiasm for the role, summarize your relevant qualifications, and demonstrate your readiness to contribute to the organization. For an actuary position, the closing is vital as it reflects not only your analytical skills and attention to detail but also your ability to communicate complex information effectively.

How to Craft an Effective Cover Letter Closing

When crafting your closing paragraph as an Actuary, emphasize your analytical capabilities and how your specialized knowledge aligns with the organization's objectives. Mention any relevant experiences or achievements that showcase your fit for the role. Express eagerness to provide further details about your qualifications in an interview, showcasing your confidence and readiness to tackle the challenges of the position.

- Being overly generic or lacking specificity about your skills or experiences related to actuarial work.

- Failing to express clear enthusiasm for the position and the company.

- Using jargon that may not be understood by all hiring managers.

- Not requesting an interview or showing willingness to discuss your application further.

To close your cover letter effectively, reiterate your enthusiasm for the actuarial role and connect your skills to the organization's mission. Clearly express your interest in discussing your qualifications in an interview and showcase your confidence in your ability to add value to their team.

Cover Letter Writing Tips for Actuaries

Highlight your analytical and statistical skills.

When applying for an Actuary position, your cover letter should emphasize your strong analytical and statistical skills. Discuss your proficiency with data modeling, probability, and risk assessment. Provide examples of specific projects where your analytical abilities led to successful outcomes, such as improved pricing strategies or better risk management practices. Mention any actuarial software, such as SAS or R, that you are adept at using, as this showcases your technical proficiency.

Demonstrate Your Understanding of Insurance and Financial Concepts

As actuaries often work in the insurance and finance sectors, it's crucial to convey your understanding of relevant industry concepts. Use your cover letter to illustrate your knowledge of how actuarial science informs business decisions. Discuss your experience in evaluating insurance policies, pension plans, or investment risks. Highlighting your comprehension of financial principles and their practical applications will reinforce your capability to add value to potential employers.

Quantify Your Achievements with Relevant Metrics

Quantifying your achievements can significantly enhance the impact of your cover letter. Whenever possible, include specific metrics that demonstrate your effectiveness in past roles. For example, you could mention how your analysis helped reduce costs by 20% or improved profitability by 15% through better risk assessment. Providing these statistics not only showcases your competencies but also illustrates your potential to deliver similar results for the hiring company.

Tailor Your Cover Letter for Each Position

Avoid generic cover letters when applying for Actuary positions; instead, tailor your letter to the specific requirements of each role. Research the company’s recent projects, unique challenges, and industry standing. Reference your findings in your cover letter and explain how your skills and experiences align with their needs. This customization indicates your genuine interest in the role and your proactive approach to understanding the organization.

Maintain a Professional Tone and Clear Structure

Your cover letter should convey professionalism and clarity. Use a structured format with a strong introduction, detailed body paragraphs, and a succinct conclusion. Ensure your language is precise and free from jargon that may not be familiar to all readers. Thoroughly proofread your cover letter to eliminate any grammatical errors or typos, as these mistakes can detract from your attention to detail—an essential quality for any successful actuary.

Cover Letter Mistakes to Avoid as an Actuary

Failing to quantify achievements.

One of the most common mistakes actuaries make in their cover letters is failing to quantify their achievements. Hiring managers are looking for specific metrics that demonstrate your impact, such as "Reduced client risk assessments by 15% through improved statistical modeling." Without quantifiable data, your cover letter may come off as vague and not compelling enough to capture attention.

Overlooking Soft Skills

Actuaries often emphasize technical skills at the expense of soft skills, which are equally important. While proficiency in statistical analysis and financial modeling is crucial, employers also seek candidates who can communicate complex ideas clearly and collaborate effectively. Your cover letter should include examples of how you’ve used skills like teamwork or effective communication in your past roles, such as presenting findings to stakeholders or working in cross-functional teams.

Ignoring the Importance of Tailoring

Another frequent error is neglecting to tailor the cover letter to the specific job description. Actuaries should meticulously read the job posting and align their skills and experiences with the qualifications mentioned. This means highlighting relevant experience with specific actuarial methods or software listed in the job description. Tailoring your cover letter demonstrates your genuine interest in the position and shows you possess the appropriate skills for that specific job.

Using Excessive Technical Jargon

While it’s essential to showcase your analytical skills, using too much technical jargon can alienate readers who may not have a background in actuarial science, such as HR professionals. Make sure your cover letter is clear and accessible; avoid overcomplicating explanations. Instead, focus on articulating your contributions and skills in simple terms, ensuring comprehension by all audiences involved in the hiring process.

Neglecting Proofreading

Even seasoned actuaries can sometimes overlook the necessity of proofreading their cover letters. A cover letter filled with spelling or grammatical errors can signal a lack of attention to detail—one of the most critical traits in the actuarial profession. Ensure you thoroughly proofread your cover letter or get a colleague to review it, making sure it is error-free and presents you as a meticulous and professional candidate.

Cover Letter FAQs

How do i structure my actuary cover letter.

Start your cover letter with a formal greeting and a brief introduction highlighting your current academic status or job title. Follow this with a paragraph detailing your relevant coursework, certifications, and any internships or work experience you've had in the actuarial field. Make sure to mention important skills such as statistical analysis, risk assessment, and proficiency with programs like Excel or R. Conclude by expressing your enthusiasm for the role and how your background aligns with the company’s goals.

What should I emphasize in my actuary cover letter?

Emphasize your analytical skills, attention to detail, and your ability to communicate complex information clearly. Discuss any actuarial exams you have passed, and relate them to the requirements mentioned in the job description. Include examples of projects or tasks where you successfully analyzed risk or created financial forecasts, and don't forget to mention your proficiency with analytical tools.

How long should an actuary cover letter be?

Your cover letter should ideally be one page long. Aim for three to four paragraphs that directly address the requirements of the job you're applying for. This ensures you are providing a concise yet informative narrative that complements your resume.

What key skills should I highlight in my actuary cover letter?

Key skills include strong mathematical ability, proficiency with actuarial software, analytical thinking, and communication skills. Additionally, highlight any experience with data modeling or financial forecasting, as these are crucial for the actuarial profession.

How can I demonstrate my industry knowledge in an actuary cover letter?

Showcase your industry knowledge by referencing current trends relevant to actuarial science, such as advancements in data analytics or changes in insurance regulations. Mention specific areas of interest within the actuarial profession that appeal to you, and how your education or experiences have prepared you for these changes.

What are common mistakes to avoid in an actuary cover letter?

Avoid overly generic statements and ensure that your cover letter is tailored to the specific job. Do not repeat your resume verbatim; rather, use this opportunity to highlight how your unique experiences and qualifications meet the needs of the employer. Typos and grammatical errors can also undermine your professionalism, so be sure to proofread carefully.

How can I effectively convey my passion for becoming an actuary in my cover letter?

Share a personal story that illustrates your interest in the actuarial profession. This could include a specific experience from your studies, a project you worked on, or a challenge you overcame that sparked your passion for risk analysis or financial forecasting.

What should I do if I don't have all the qualifications listed in the actuary job description?

Focus on the qualifications you do possess and relate them to the job. Emphasize your willingness to learn and your capability to adapt. You can mention relevant coursework, skills you've developed, and any related extracurricular activities or internships that showcase your commitment to fulfilling the role.

How do I showcase my problem-solving abilities in an actuary cover letter?

Provide a specific example where you used your analytical skills to solve a problem. This could involve a project related to risk assessment where you identified potential issues, modeled outcomes, and presented your findings. Demonstrating your thought process in tackling real-world scenarios can effectively highlight your problem-solving abilities.

Insurance Analyst Cover Letter Example

Pricing actuary cover letter example, health actuary cover letter example, life insurance actuary cover letter example, pension actuary cover letter example, risk analyst cover letter example, quantitative analyst cover letter example, data scientist in insurance cover letter example, fellow of the society of actuaries cover letter example, entry-level actuarial associate cover letter example, senior actuarial analyst cover letter example, actuarial consultant cover letter example, reinsurance actuary cover letter example, actuarial technician cover letter example, student actuary cover letter example, related cover letter samples.

Pricing Analyst

Telecommunications Analyst

Public Health Statistician

HR Data Analyst

Statistician

Data Analyst

Data Scientist

Biostatistician

Clinical Data Manager

Get Hired Fast — with AI-Powered Job Applications

Just upload your resume, and let our genius AI auto-apply to hundreds of jobs for you.

Actuary Cover Letter Examples with Writing Tips for 2024

Craft an exceptional Actuary Cover Letter with our online builder. Explore professional example cover letter templates tailored for all levels and specialties. Captivate employers with a refined, professional Cover Letter. Reach your dream job today!

Table of Contents

If you're considering a career as an actuary, crafting an exceptional cover letter is your first step towards standing out in a competitive job market. This guide will walk you through the essential elements of writing a compelling cover letter that not only showcases your skills but also reflects your passion for the field. You’ll find valuable insights and practical tips that will help you tailor your letter to resonate with potential employers. From understanding the key components of a successful cover letter to analyzing a sample letter, we’ve got you covered. Here’s what you can expect to learn:

- Understanding the Role : Insights into why the actuary position requires a unique approach in your cover letter.

- Key Components : Essential sections to include, such as the introduction, body, and conclusion.

- Tailoring Your Message : How to align your skills and experiences with the specific job requirements.

- Common Mistakes to Avoid : Pitfalls that could weaken your application and how to steer clear of them.

- Example Cover Letter : A practical example that illustrates the concepts discussed.

By the end of this article, you’ll be equipped with the knowledge to create a standout cover letter that paves the way for your success as an actuary. Let’s dive in!

What does a Actuary Cover Letter accomplish?

A cover letter for an actuary plays a crucial role in presenting not just qualifications but also the candidate's analytical skills and understanding of risk management, which are fundamental to the profession. It serves as a personalized introduction to the employer, elaborating on key experiences and accomplishments that are relevant to the actuarial field. The cover letter can highlight specific projects or analyses that demonstrate the candidate's ability to apply mathematical and statistical methods to assess risk, making it a vital tool for standing out in a competitive job market. For those looking to craft an effective cover letter, a comprehensive cover letter guide can provide valuable insights, while a cover letter builder can simplify the process of creating a professional and tailored document.

Key Components of a Actuary Cover Letter

- Introduction and Purpose : Begin your cover letter with a strong introduction that states the position you are applying for and expresses your enthusiasm for the role. Mention how you learned about the opportunity and briefly introduce your background in actuarial science.

- Relevant Skills and Experience : Highlight your key skills and experience that make you a suitable candidate for the actuary position. This could include your proficiency in statistical analysis, risk assessment, and experience with relevant software tools. Provide specific examples that demonstrate your capabilities and accomplishments in previous roles.

- Understanding of the Industry : Illustrate your understanding of the insurance or finance industry, including current trends and challenges. Discuss how your skills can contribute to the company's success and align with its goals. This shows that you have done your research and are genuinely interested in the position.

- Closing and Call to Action : Conclude your cover letter by reiterating your interest in the role and expressing your desire for an interview. Thank the employer for considering your application and provide your contact information. A well-crafted closing can make a lasting impression and encourage further communication.

For additional guidance, you can refer to cover letter examples and ensure your layout adheres to the appropriate cover letter format .

How to Format a Actuary Cover Letter

When applying for an actuary position, your cover letter should effectively highlight your analytical skills, attention to detail, and understanding of risk management. It should convey your enthusiasm for the role and your ability to contribute to the company's success. Here are key points to consider when formatting your actuary cover letter:

- Start with a professional greeting, addressing the hiring manager by name if possible.

- Open with a strong introductory sentence that states the position you are applying for and where you found the job listing.

- Briefly outline your educational background, emphasizing relevant degrees or certifications such as a degree in actuarial science, mathematics, or statistics.

- Highlight your actuarial exams passed and your progress towards becoming fully qualified, showcasing your commitment to the profession.

- Discuss your experience with statistical analysis, financial modeling, and risk assessment, providing specific examples of past projects or roles.

- Mention any software proficiency, such as Excel, R, SAS, or Python, and how you have used these tools to solve complex problems.

- Emphasize your strong analytical skills and attention to detail, illustrating how these traits have contributed to your success in past positions.

- Include examples of teamwork or collaboration in previous roles, demonstrating your ability to work effectively with others in a professional setting.

- Express your enthusiasm for the company and its goals, linking your skills and interests to the organization’s mission.

- Conclude with a call to action, inviting the hiring manager to discuss your application further and expressing your eagerness for an interview.

Actuary Entry-Level Cover Letter Example #1

I am writing to express my interest in the entry-level Actuary position at [Company Name], as advertised on [where you found the job listing]. With a strong foundation in mathematics and statistics, complemented by my recent completion of a Bachelor’s degree in Actuarial Science from [University Name], I am eager to apply my analytical skills and passion for data-driven decision-making in a dynamic environment.

During my academic career, I gained a solid understanding of key actuarial concepts, including risk assessment, financial modeling, and predictive analytics. My coursework included advanced statistics, calculus, and probability theory, which provided me with the technical skills necessary to analyze complex data sets and evaluate potential outcomes. In addition, I completed an internship at [Internship Company Name], where I assisted the actuarial team in conducting data analysis and preparing reports for client presentations. This experience honed my ability to communicate complex information clearly and effectively, and it instilled in me a deep appreciation for the role actuaries play in guiding financial strategies and ensuring organizational stability.

Furthermore, I am committed to continuous professional development and am currently preparing for the first two actuarial exams. My strong problem-solving abilities and attention to detail enable me to tackle challenging scenarios, and my collaborative spirit allows me to thrive in team-oriented settings. I am excited about the opportunity to contribute to [Company Name] and learn from experienced professionals in the field.

Thank you for considering my application. I look forward to the possibility of discussing how my background and skills align with the needs of your team. I am enthusiastic about the opportunity to grow as an actuary at [Company Name] and contribute to your mission of delivering innovative solutions in risk management.

Actuary Mid-Level Cover Letter Example #2

I am writing to express my interest in the mid-level actuary position at [Company Name], as advertised on [Job Board/Company Website]. With over five years of experience in actuarial analysis and a strong foundation in risk assessment and modeling, I am excited about the opportunity to contribute to your team and help drive informed decision-making through data-driven insights.

In my current role at [Current Company Name], I have successfully led multiple projects focused on developing complex predictive models to assess various financial risks. By utilizing advanced statistical methods and software tools such as R and Python, I have been able to improve our risk forecasting accuracy by 20%. This experience has not only honed my technical skills but has also enhanced my ability to communicate complex findings to stakeholders, ensuring that insights are actionable and aligned with business goals.

Additionally, I have a proven track record of collaborating effectively with cross-functional teams to achieve common objectives. At [Previous Company Name], I worked closely with underwriting and finance departments to streamline the pricing strategy for new insurance products. My analytical contributions helped identify key factors influencing pricing decisions, leading to a 15% increase in profitability for the new line of business. I am particularly proud of my role in training junior analysts, as mentoring others has not only reinforced my knowledge but has also fostered a collaborative and innovative team environment.

I am drawn to [Company Name] because of its commitment to leveraging data analytics to enhance customer experiences and drive growth. I am eager to bring my expertise in risk assessment and my passion for continuous improvement to your organization. I am confident that my proactive approach and analytical mindset would make a valuable addition to your team.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am excited about the possibility of contributing to your team and am available for an interview at your earliest convenience.

Actuary Experienced Cover Letter Example #3

I am writing to express my interest in the Actuary position at [Company Name], as advertised on [Job Board/Company Website]. With over [X years] of experience in the actuarial field, including extensive work in risk assessment, financial modeling, and insurance analytics, I am excited about the opportunity to contribute to your team and help drive data-informed decision-making.

In my most recent role at [Current/Previous Company Name], I successfully led a team of actuaries in developing pricing models for various insurance products, resulting in a [specific percentage or dollar amount] increase in profitability over [time period]. My deep understanding of statistical analysis and proficiency in software tools such as [specific software or programming languages, e.g., SAS, R, Python] allowed me to streamline our modeling processes, reducing the time required for analysis by [specific percentage or number of hours]. Additionally, I played a pivotal role in implementing a new risk assessment framework that improved our ability to identify emerging risks and adjust our strategies accordingly.

Throughout my career, I have been committed to professional development, earning my [specific actuarial designation, e.g., FSA, FCAS] and continuously seeking opportunities to enhance my skills. I have also served as a mentor to junior actuaries and interns, fostering a collaborative learning environment that supports the growth of future talent in the industry. My ability to communicate complex actuarial concepts to non-technical stakeholders has been instrumental in driving cross-departmental initiatives and ensuring alignment with corporate goals.

I am particularly impressed by [Company Name]'s commitment to innovation and excellence in the actuarial space. I believe that my extensive experience in [specific areas of expertise related to the job description] aligns well with your team's objectives, and I am eager to bring my analytical skills and strategic mindset to [Company Name]. I am confident that my proactive approach and dedication to delivering high-quality results will make a significant impact on your organization.

Thank you for considering my application. I look forward to the opportunity to discuss how my background, skills, and enthusiasms align with the goals of [Company Name]. I am excited about the possibility of contributing to your team and helping to navigate the complex challenges facing the actuarial profession today.

Cover Letter Tips for Actuary

When crafting a cover letter for an actuary position, it's essential to emphasize your analytical skills, attention to detail, and proficiency with statistical software. Your cover letter should not only introduce you as a candidate but also showcase your understanding of risk assessment and financial modeling. Tailor your letter to the specific job by referencing the company's values and how your experience aligns with their needs. A strong cover letter should convey your enthusiasm for the role while demonstrating your technical expertise and ability to communicate complex ideas clearly.

Cover Letter Tips for Actuary:

- Research the Company: Familiarize yourself with the company’s mission, values, and recent projects to tailor your cover letter effectively.

- Highlight Relevant Experience: Focus on specific experiences that showcase your actuarial skills, such as internships, coursework, or relevant projects.

- Use Quantifiable Achievements: Where possible, include metrics or examples that demonstrate your impact, such as cost savings or improvements in processes.

- Showcase Technical Proficiency: Mention your experience with relevant software and programming languages, such as SAS, R, or Excel.

- Demonstrate Problem-Solving Skills: Provide examples of how you have used your analytical skills to solve complex problems.

- Communicate Clearly: Use clear and concise language to explain your qualifications and avoid jargon that may not be understood by HR personnel.

- Express Enthusiasm: Convey your passion for the actuarial profession and the specific role you are applying for to make a lasting impression.

- Proofread: Ensure there are no spelling or grammatical errors, as attention to detail is crucial in the actuarial field.

How to Start a Actuary Cover Letter

As you embark on the journey of crafting an impactful cover letter for an actuary position, it’s essential to capture the reader's attention right from the start. An engaging introduction can set the tone for the rest of your letter and highlight your enthusiasm for the role. Here are several effective examples to consider:

“ As a detail-oriented and analytical professional with a strong foundation in mathematics and statistics, I am excited to apply for the Actuary position at [Company Name]. My passion for risk assessment and financial modeling aligns perfectly with your team's commitment to providing innovative solutions in the insurance industry. ”

“ With a solid background in data analysis and a deep understanding of actuarial principles, I am eager to bring my expertise to [Company Name] as an Actuary. The opportunity to contribute to your esteemed firm, known for its innovative approach to risk management, deeply resonates with my career aspirations. ”

“ Having recently completed my actuarial examinations and gained valuable experience through internships, I am thrilled to apply for the Actuary role at [Company Name]. I admire your commitment to fostering a culture of excellence and innovation, and I am eager to contribute my skills to your team. ”

“ I am writing to express my interest in the Actuary position at [Company Name], as advertised. With my extensive training in statistical analysis and predictive modeling, coupled with my passion for problem-solving, I am well-prepared to provide valuable insights and help drive strategic decisions. ”

“ As an aspiring actuary with a keen analytical mind and a passion for financial strategy, I am excited about the opportunity to join [Company Name]. I have always admired your dedication to maximizing client outcomes through data-driven decisions, and I am eager to be a part of such an impactful team. ”

How to Close a Actuary Cover Letter

As you conclude your cover letter for an actuary position, it's crucial to reinforce your enthusiasm and summarize your qualifications succinctly. Here are some effective closing statements you can use:

“I am eager to bring my analytical skills and expertise in risk assessment to your team, and I look forward to discussing how my background can contribute to the continued success of your organization.”

“Thank you for considering my application. I am excited about the opportunity to leverage my actuarial knowledge and drive impactful results at your company.”

“I appreciate your time and consideration, and I am looking forward to the possibility of discussing my application in more detail during an interview.”

“I am confident that my strong quantitative skills and passion for data analysis make me a perfect fit for your team, and I hope to discuss my candidacy further.”

Common Mistakes to Avoid in a Actuary Cover Letter

When applying for an actuary position, your cover letter is your opportunity to make a strong first impression. It's essential to convey not only your technical skills and qualifications but also your understanding of the role and the value you can bring to the organization. However, many candidates make critical mistakes that can undermine their chances of landing an interview. Here are some common pitfalls to avoid when crafting your cover letter:

- Failing to customize the cover letter for the specific job and company.

- Overlooking the importance of a professional format and structure.

- Using jargon or technical terms without explaining them, assuming the reader understands.

- Neglecting to highlight relevant experience and achievements related to actuarial tasks.

- Writing a generic introduction that lacks a compelling hook or personal touch.

- Ignoring the importance of proofreading for grammatical and spelling errors.

- Being overly verbose or including irrelevant information that distracts from your key qualifications.

- Not clearly articulating your passion for the field of actuarial science and the specific role.

- Forgetting to include a strong closing statement that encourages further discussion or action.

- Failing to address the letter to a specific person or using a generic salutation.

Key Takeaways for a Actuary Cover Letter

In conclusion, a well-crafted cover letter is an essential tool for an actuary to showcase their unique skills and qualifications. By effectively highlighting your analytical abilities, problem-solving expertise, and proficiency in statistical software, you can set yourself apart from other candidates. Remember to tailor your cover letter to the specific job description, emphasizing how your experiences align with the needs of the organization. Utilizing cover letter templates can provide you with a solid foundation to develop a compelling narrative that captures your professional journey.

Additionally, taking advantage of a cover letter builder can streamline the process, allowing you to focus on the content while ensuring a polished and professional format. Highlight your passion for risk assessment and your commitment to continuous learning within the field of actuarial science. A strong cover letter not only complements your resume but also serves as a critical opportunity to convey your enthusiasm for the role and the value you can bring to the team.

Build your Cover Letter in minutes

Use an AI-powered cover letter builder and have your letter done in 5 minutes. Just select your template and our software will guide you through the process.

Make a cover letter in minutes

Pick your template, fill in a few details, and our builder will do the rest.

5+ Actuary Cover Letter Examples and Templates

Home » Cover Letter Examples » 5+ Actuary Cover Letter Examples and Templates

Create the simple Actuary cover letter with our top examples and expert guidance. Use our sample customizable templates to craft a cover letter that’ll impress recruiters and get you that interview today. Start now and make your dream job come true!

Are you looking to kickstart your career as an Actuary? A well-crafted cover letter is an essential tool to showcase your skills, passion, and suitability for the role. By effectively highlighting your qualifications, achievements, and enthusiasm, you can grab the attention of potential employers and increase your chances of landing an interview.

In this comprehensive guide, we will provide you with examples and templates for writing a captivating cover letter specifically tailored for an Actuary position. Whether you are an experienced professional or a recent graduate, our tips and techniques will help you create a persuasive cover letter that stands out.

Actuary Cover Letter Examples and Templates

1. Actuary Cover Letter Example

Dear Hiring Manager,

I am writing to apply for the Actuary position at [Company Name]. With a strong background in mathematics and a passion for data analysis, I believe I am a perfect fit for this role.

During my previous role as an Actuarial Analyst at [Previous Company], I was responsible for conducting risk assessments, analyzing data to determine insurance premiums, and developing pricing models. I also have experience in using statistical software such as SAS and R to analyze large datasets and develop predictive models.

I am highly skilled in problem-solving and critical thinking, which are essential skills for actuaries. Additionally, my strong communication skills allow me to effectively present complex actuarial concepts in a clear and concise manner.

I am confident that my analytical skills, attention to detail, and ability to interpret complex data will greatly contribute to the success of [Company Name]. I am eager to leverage my expertise to assess risks accurately, develop pricing strategies, and support strategic decision-making.

Thank you for considering my application. I am eager to discuss how my qualifications align with your needs further. Please find attached my resume for your review. I look forward to the opportunity to interview with you and further demonstrate my suitability for the Actuary role.

Sincerely, [Your Name]

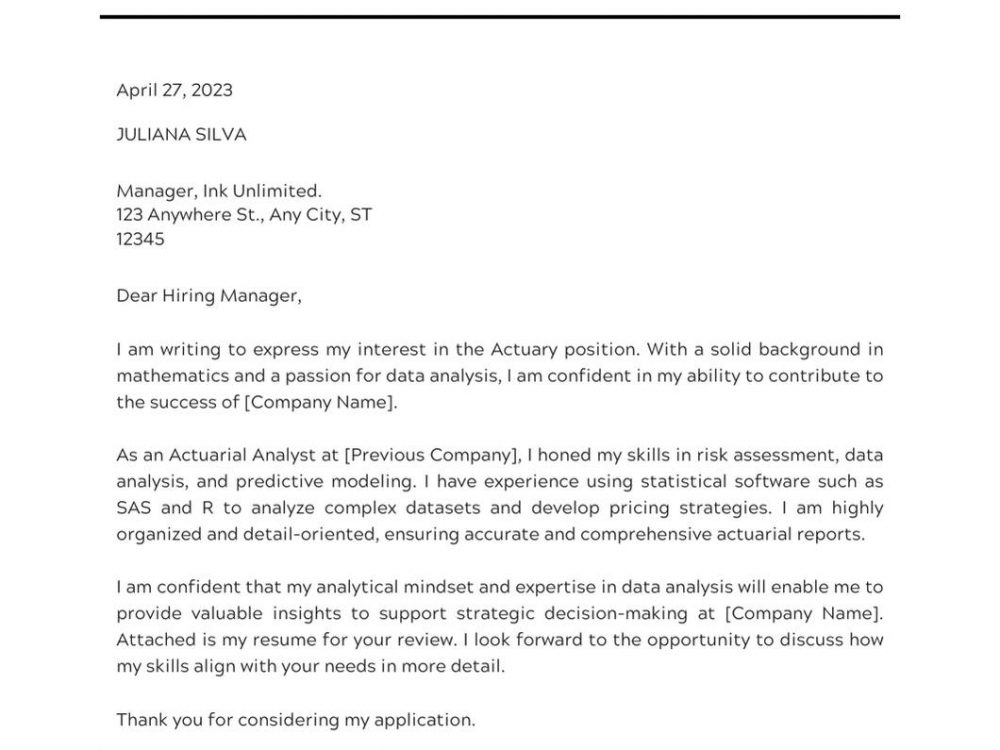

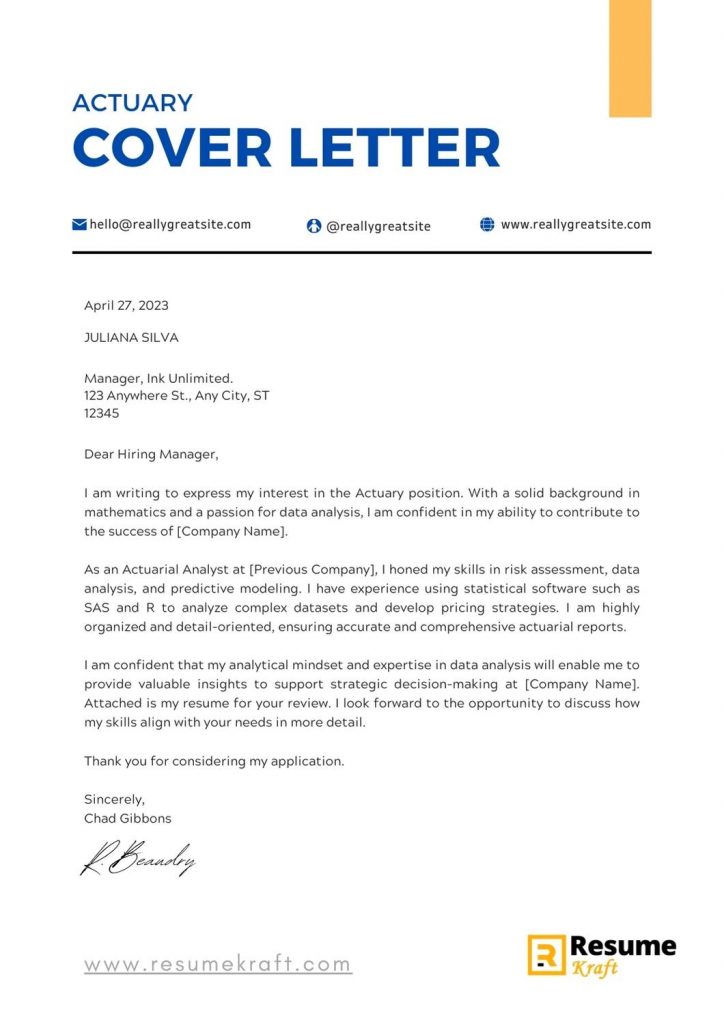

2. Short Actuary Cover Letter Sample

I am writing to express my interest in the Actuary position. With a solid background in mathematics and a passion for data analysis, I am confident in my ability to contribute to the success of [Company Name].

As an Actuarial Analyst at [Previous Company], I honed my skills in risk assessment, data analysis, and predictive modeling. I have experience using statistical software such as SAS and R to analyze complex datasets and develop pricing strategies. I am highly organized and detail-oriented, ensuring accurate and comprehensive actuarial reports.

I am confident that my analytical mindset and expertise in data analysis will enable me to provide valuable insights to support strategic decision-making at [Company Name]. Attached is my resume for your review. I look forward to the opportunity to discuss how my skills align with your needs in more detail.

Thank you for considering my application.

3. Actuary Cover Letter for Job Application

Dear [Recipient’s Name],

I am writing to apply for the Actuary position at [Company Name] as advertised on [Job Board/Company Website]. With a strong background in mathematics and a passion for data analysis, I am confident in my ability to contribute to [Company Name]’s success.

In my previous role as an Actuarial Analyst at [Previous Company], I successfully conducted risk assessments, developed pricing models, and analyzed complex data sets to support strategic decision-making. I have experience in using statistical software such as SAS and R to analyze large datasets and develop predictive models.

I am confident in my ability to analyze complex data, identify trends, and provide actionable recommendations. Furthermore, my strong communication and presentation skills enable me to effectively communicate actuarial findings to stakeholders.

I am excited about the opportunity to contribute to [Company Name]’s growth and success as an Actuary. Attached is my resume for your consideration. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

Thank you for considering my application. I look forward to the opportunity to interview with you.

4. Actuary Cover Letter for a Candidate with no Experience

I am writing to express my interest in the Actuary position at [Company Name]. Although I have recently graduated with a degree in Mathematics, I am eager to apply my knowledge and skills to contribute to [Company Name]’s success.

During my academic studies, I developed a strong foundation in mathematics, statistics, and data analysis. My coursework and projects provided me with hands-on experience in using statistical software such as SAS and R to analyze complex datasets. I am a quick learner with a strong analytical mindset and attention to detail.

I am confident that my ability to analyze data, along with my excellent problem-solving skills, make me a strong candidate for the Actuary role. Additionally, my internship experience in a different field has equipped me with valuable transferable skills such as teamwork, time management, and effective communication.

I am eager to contribute to [Company Name]’s success as an Actuary. Attached is my resume for your consideration. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

5. Sample Application Letter for Actuary with Experience

I am excited to apply for the Actuary position at [Company Name]. With over [Number of Years] years of experience in risk assessment, data analysis, and predictive modeling, I bring a wealth of knowledge and expertise to support [Company Name]’s growth.

In my current role as an Actuarial Analyst at [Current Company], I have successfully provided strategic insights and supported decision-making through data analysis. I am well-versed in using statistical software such as SAS and R to analyze complex datasets and develop pricing models. Moreover, I have a proven track record of developing comprehensive actuarial reports to drive business performance and optimize risk management.

I am highly skilled in analyzing data, conducting risk assessments, and developing pricing strategies. My strong communication and presentation skills have enabled me to effectively communicate complex actuarial information to stakeholders at various levels.

I am confident that my extensive experience, analytical mindset, and attention to detail make me an ideal candidate for the Actuary role. Attached is my resume for your review. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

How to Write an Actuary Cover Letter

Writing an effective Actuary cover letter involves following a clear structure and including relevant information that showcases your qualifications and demonstrates your commitment to the field. Let’s explore the step-by-step guide to help you craft a compelling cover letter that captures the attention of potential employers.

Objective of an Actuary Cover letter:

- Introduce yourself and express your interest in the position.

- Highlight your relevant skills, experiences, and achievements.

- Demonstrate your knowledge of actuarial concepts and methodologies.

- Show your passion for analyzing data, assessing risks, and making informed decisions.

- Thank the employer for considering your application.

Key Components For Actuary Cover Letters:

- Contact Information: Include your name, address, phone number, and email address at the top of the cover letter.

- Salutation: Begin the cover letter with a professional greeting, such as “Dear Hiring Manager” or “Dear [Company Name] Recruiting Team.”

- Introduction Paragraph: In a concise and engaging manner, introduce yourself, mention the position you are applying for, and briefly indicate your motivation for applying.

- Body Paragraphs:

- Skills and Qualifications: Highlight your relevant technical skills, such as proficiency in statistical analysis, data modeling, programming languages, and actuarial software.

- Experience and Achievements: Discuss your experience in the field of actuarial science, including internships, projects, or any relevant work experience. Highlight any achievements or recognition you have received.

- Knowledge of Actuarial Concepts: Demonstrate your understanding of actuarial concepts, methodologies, and regulations. Discuss your ability to apply these concepts to real-world scenarios.

- Passion for the Field: Express your enthusiasm for working as an Actuary and your dedication to continuous learning and professional development.

- Closing Paragraph: Conclude your cover letter by restating your interest in the position and expressing your availability for an interview or further discussion. Mention any further enclosed documents, like your resume or references.

- Formal Closing: End the letter with a professional closing, such as “Sincerely” or “Best Regards,” followed by your full name.

- Signature: Sign your name between the closing and your printed name. If the cover letter will be sent electronically, you can type your name instead.

Formatting Tips for an Actuary Cover Letter:

- Keep the cover letter length to one page.

- Use a professional and well-structured format, using bullets or paragraphs to highlight key information.

- Use consistent font sizing and alignment throughout the letter.

- Proofread your letter carefully for spelling, grammar, and formatting errors.

Tips for Writing Your Actuary Cover Letter:

- Customize the cover letter to the specific job requirements and company information.

- Highlight your technical skills and expertise in statistical analysis, data modeling, and actuarial software.

- Emphasize your ability to work with complex data sets and analyze risks accurately.

- Showcase your experience in applying actuarial concepts and methodologies to solve real-world problems.

- Mention any certifications or professional memberships you hold, such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Provide evidence of your success in previous actuarial roles, such as cost savings, improved risk management, or accurate forecasting.

- Use industry-related keywords throughout the cover letter to demonstrate your familiarity with key concepts.

- Maintain a professional tone and language throughout the letter, while injecting your personality and enthusiasm.

- End the cover letter on a positive and hopeful note, expressing gratitude for the opportunity to apply.

How long should a cover letter be for an Actuary?

Ideally, an Actuary cover letter should be concise but impactful, usually not exceeding one page. Aim for 3-4 paragraphs that cover your key qualifications and leave the hiring manager eager to learn more about you. Remember to be specific, concise, and emphasize your most relevant experiences and accomplishments.

How do I write a cover letter for an Actuary with no experience?

If you are a recent graduate or have limited experience in the field of actuarial science, focus on transferable skills and demonstrate your passion for the industry. Here are a few tips to help you compose a cover letter without direct actuarial experience:

- Highlight transferable skills, such as strong analytical abilities, mathematical aptitude, attention to detail, and problem-solving skills.

- Emphasize your coursework or projects related to actuarial science, statistics, mathematics, or finance.

- Discuss any internships or part-time positions where you gained exposure to data analysis, risk assessment, or financial modeling.

- Showcase your ability to learn quickly and adapt to new concepts and methodologies.

- If possible, provide examples of personal qualities that make you well-suited for an actuarial role, such as being detail-oriented, meticulous, or a strong team player.

Remember, while experience is valuable, highlighting your skills, passion, and willingness to learn can be equally valuable when applying for an entry-level Actuary position.

Key Takeaways

A well-written and tailored cover letter is your opportunity to make a strong impression as an Actuary candidate. Remember the following:

- Customize the cover letter for each job application.

- Showcase your technical skills and expertise in actuarial science.

- Provide specific examples of accomplishments and experiences.

- Express your industry knowledge and passion.

In Conclusion

Writing an attention-grabbing and well-crafted cover letter as an Actuary can significantly increase your chances of securing an interview. Tailor your letter to portray your suitability for the role, highlight your skills and achievements, and demonstrate your passion for the field. By following the guidelines provided in this article, you’ll be equipped to create a standout cover letter that puts you a step ahead of the competition.

Now, put your skills into action and start crafting your tailor-made Actuary cover letter, tailored to the job and company you are applying to. Good luck!

Career Expert Tips:

- If you're stepping into the professional world, understanding the basics is crucial. Learn What is a cover letter and its role in the job application process.

- How to start a cover letter can be a challenging task. Get a comprehensive guide on how to kickstart your cover letter and make a strong first impression.

- Looking for inspiration to draft your own cover letter? Browse through these Cover letter examples to find a style that fits your profession.

- Why start from scratch? Use these Cover Letter Templates tailored for various professions to simplify your job application process.

- How long should a cover letter be : The length of a cover letter is vital in conveying your message concisely. Discover the optimal length to make sure your cover letter is not too short nor too long.

- Ensure that you know how to write a resume in a way that highlights your competencies.

- Check the expert curated popular good CV and resume examples

Privacy Overview

Resume Worded | Career Strategy

14 actuarial analyst cover letters.

Approved by real hiring managers, these Actuarial Analyst cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Actuarial Analyst

- Senior Actuarial Analyst

- Entry-Level Actuarial Analyst

- Alternative introductions for your cover letter

- Actuarial Analyst resume examples

Actuarial Analyst Cover Letter Example

Why this cover letter works in 2024, analyzing data sets.

In this cover letter, the applicant showcases their ability to interpret complex data sets and identify patterns. This is a crucial skill for an Actuarial Analyst, and mentioning it early on helps set the tone for the rest of the letter.

Effective Communication

Highlighting the importance of effective communication when presenting findings to a diverse team is a great way to show that the applicant is not only skilled in data analysis but also understands the need to communicate results in a clear and concise manner.

Implementing New Systems

By mentioning a specific accomplishment - implementing a risk modeling system that increased revenue - the applicant demonstrates their ability to make a significant impact in their previous role. This is a strong selling point for any job seeker.

Showcase of Achievements

What strikes me about this is your self-assuredness in highlighting your accomplishments. You've nicely quantified your success, stating that your risk models led to a 15% increase in policyholder profitability. Employers love to see results, and you've delivered them with tangible numbers.

Highlighting Strengths in Key Skills

You've done well in pointing out your strong mathematical skills and ability to identify trends and patterns. This gives me a sense of your strengths and how they've played a part in your achievements. It sends a clear message that these are your key skills, and they've contributed to your success.

Expressing Genuine Interest

Employers want to feel that you want the job, not just any job. You've made it clear why you're interested in this role specifically - wanting to work on a larger scale and have a more significant impact. It really shows you've thought about why this role could be a good fit for you.

Show genuine interest in the company

This cover letter immediately stands out because it shows a deep connection and interest in the company. When you specifically mention why you're attracted to the company, it tells me that you're not just applying for any job, you're applying for this job at this company. It demonstrates that you know what we're about and that you're passionate about the same things.

Highlight your quantifiable achievements

Showing me your quantifiable achievements, just like you did here, is a really effective way of demonstrating your skills and potential. It tells me exactly what you've accomplished and it makes me think about what you could potentially do for us. Plus, it shows me that you're about action and results, not just talk.

Express your excitement for specific opportunities

When you mention specific projects or opportunities at our company that excite you, it shows me that you've done your homework. It tells me that you're informed about what we do and that you're genuinely interested in contributing to our efforts. It also shows that you're not just looking for any job, but the right job where you can make an impact.

Emphasize your alignment with company's values

Showing me that you identify with our company's values and mission, like you did in this cover letter, is a real plus. It tells me that you're not just about the paycheck, but about making a meaningful contribution to our team. And that's the type of person we want to hire.

End on a strong, positive note

Ending your cover letter by thanking me for considering your application and expressing your eagerness to contribute to our team's success leaves a lasting positive impression. It shows me that you're keen, motivated, and genuinely interested in the job. Always leave them wanting more.

Show your early passion for actuarial tasks

Telling a story about your early interest in math and prediction makes your application memorable and shows your genuine passion for the actuarial field.

Quantify your internship achievements