- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

Excel Financial Modeling Templates

Download our free Excel and financial modeling templates to take your finance career to the next level.

Income Statement Template

Download WSO's free Income (P&L) Statement Excel template. Practice by entering your own numbers in the actual and expected columns.

3 Statement Financial Model

Download WSO's free 3 statement financial model to understand how the income statement, balance sheet, and cash flow are linked.

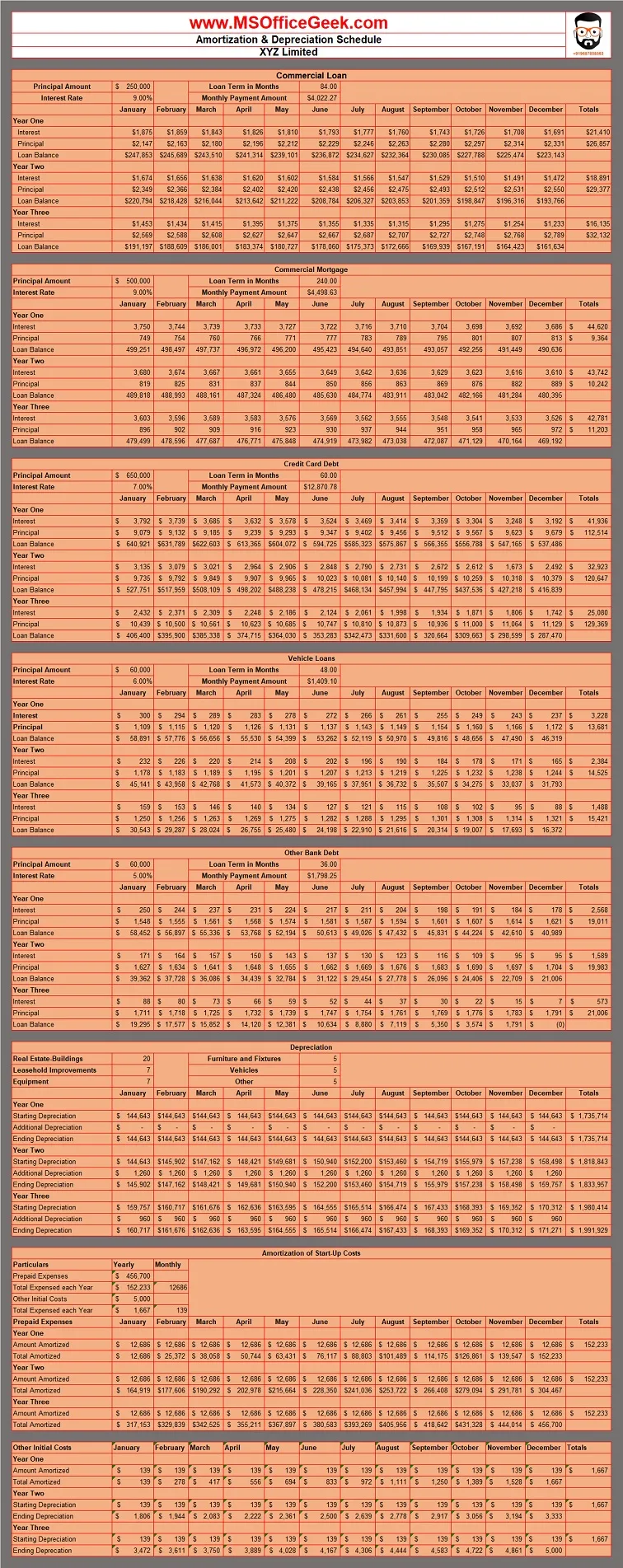

Debt Schedule Template

Download WSO's free debt schedule template to model for debt obligations and understand the affect of debt on valuations.

Free Cash Flow to Equity (FCFE)

Get the free Excel Free Cash Flow to Equity Template to learn more about how the final piece of the valuation model works.

DCF Model Template

Download WSO's free DCF model template to calculate the net present value (NPV) using a discount rate and free cash flow.

Sensitivity Analysis Table

Download the free sensitivity analysis table template to analyze the effects of various inputs on your valuation.

List of Free Excel Financial Model Templates

Explore and download our free Excel Financial Modeling templates below, designed to be flexible and help you perform various kinds of financial analysis and build financial models. Use these to expand your knowledge and develop your Excel financial modeling skills.

We have divided them based on industry (investment banking, private equity, hedge fund ).

Investment Banking Model Templates

All financial modeling templates - download free excel templates resources:, private equity model templates.

- Leveraged Buyout (LBO) Model Template

- Private Equity (PE) Returns Model Template

- Private Equity (PE) Distribution Waterfall Template

Hedge Fund Model Templates

- Pharma Healthcare Stock Pitch

- Real Estate Private Equity (REPE)

- Public To Private LBO

- Accretion Calculation

- Dilution Calculation

- Unlevering Betas

The Only Program You Need to Land in High Finance Careers

The most comprehensive curriculum and support network to break into high finance.

Additional Free WSO Resources

To continue learning and advancing your career in finance, check out these additional free WSO templates:

- Word Resume Templates

- Presentation Templates

- Excel Shortcuts for Windows and Mac

- Free Career Guides

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

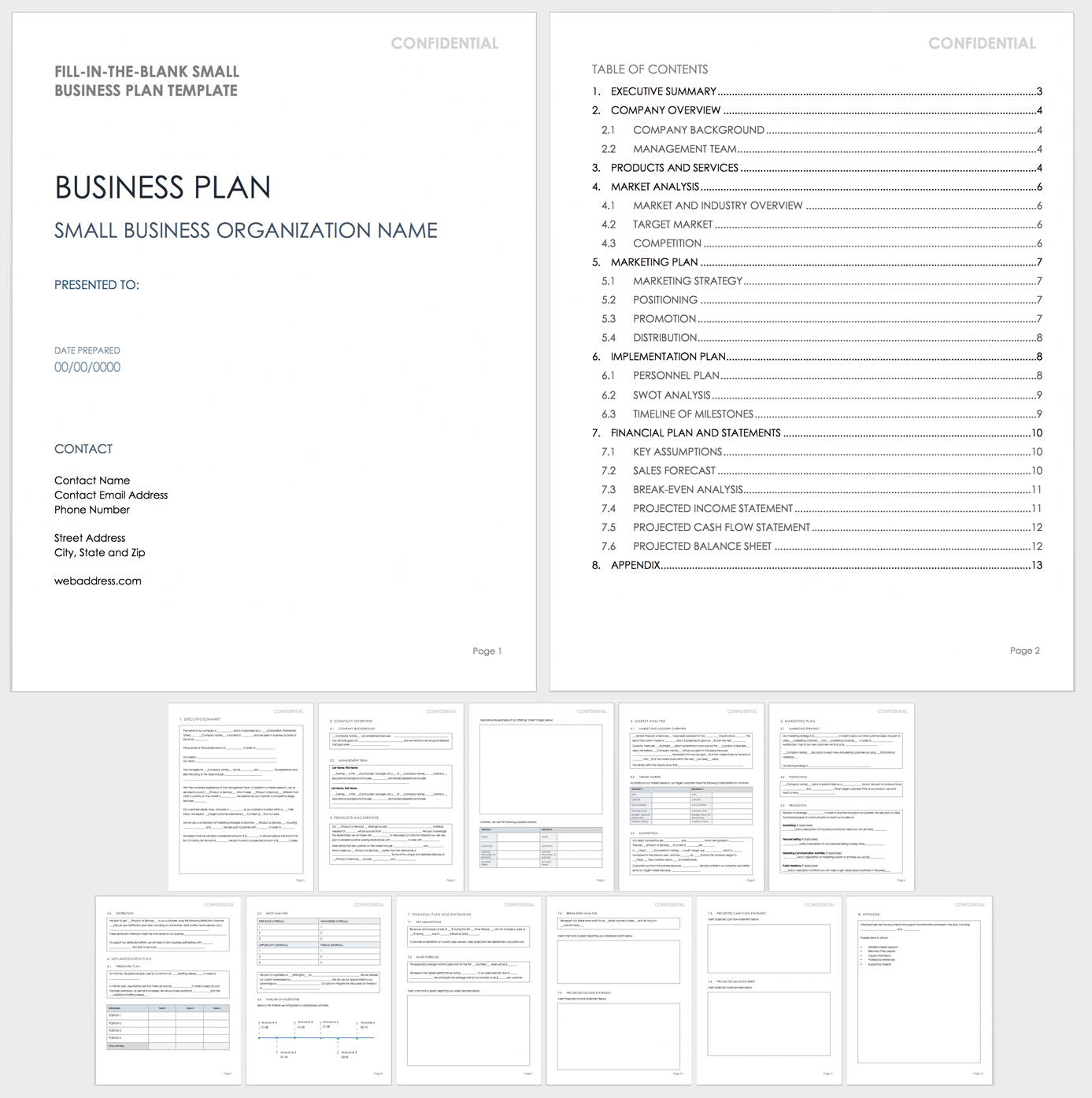

Expert-built business plan and financial model templates

Download the template for your business. Customise it. Get funded.

Try restaurant business plan ecommerce financial model

Trusted by 12,000+ entrepreneurs, consultants and investors

Vetted by professionals at leading organizations

BuSINESS PLANS

Professional powerpoint business plan templates to raise funding.

- 30+ slides already completed

- Business overview

- Updated market research

- Sales & marketing plan

- SWOT, competitive landscape

Financial models

Easy-to-use excel financial models for serious entrepreneurs.

- Profit and loss

- Cash flow statement

- Balance sheet

- Business valuation (DCF)

- 20+ charts and metrics

Start free. Upgrade if you need to.

Start here if you need a solid yet simple financial plan, one-size-fits-all starter 3-year financial model.

This is our 3-year financial model for entrepreneurs who need a rock-solid template to get started.

Works for most businesses.

- One-size-fits-all

- 3-year Excel financial model

- Break-even analysis

- Return on investment

- Business valuation report

- No email support

or UPGRADE TO A CUSTOMIZED ADVANCED FINANCIAL PLAN

200+ advanced 5-year financial models.

200+ financial models for entrepreneurs who need more flexibility by using a template made specifically for their business .

200+ businesses. Choose yours.

- Choose from 200+ businesses

- 5-year Excel financial model

- Free email support

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Financial Model Templates for Startups

Create an instant financial model in Excel, Google Sheets, or any spreadsheet application. Use our templates to raise money and run your business better!

START YOUR MODEL TODAY

Financial Modeling Made Simple

Forecastr is an online tool that lets you build great financial models quickly and easily. Our analysts work alongside you as a founder to help you build the perfect model and get the most out of it.

Of course, we think every founder should use Forecastr. But we understand that some startups aren't ready for a premium solution yet. So, in the spirit of #GiveFirst , we've created these financial model templates you can use today for free in Excel or Google Sheets.

Choose the Financial Model Template That Matches Your Business Model

Monthly SaaS Template

Spreadsheet template formatted to accommodate a SaaS startup with a monthly subscription model.

Annual SaaS Template

Financial model template formatted for a SaaS startup with an annual subscription model.

Per Unit Monthly SaaS

Template to accommodate a SaaS startup with a monthly subscription model and per unit reporting.

Per Unit Annual SaaS

Template created to fit a SaaS startup with an annual subscription model and per unit reporting.

Marketplace Template

Financial model template customized to accommodate a business using a marketplace model.

Ecommerce Template

Spreadsheet template built with the appropriate inputs and assumptions for an ecommerce startup.

Transactional Template

Spreadsheet template formatted to fit a startup following a simple transactional business model.

Hourly Services

Template created with the necessary inputs and assumptions to support an hourly services startup.

User Application

Financial model template built to accommodate a startup with a typical user application business model.

Custom Contracts

Financial model template formatted to fit a startup with a business model built around custom contracts.

Annual SaaS Monthly Billing

Template for a SaaS startup with an annual subscription model billed monthly.

Spreadsheet template built with the appropriate inputs and assumptions to accommodate a CPG startup.

QUICK START

How To Use the Templates

- Choose the excel template (or Google Sheets template) that best matches your business model. Enter your email to access the template.

- The template will open in Google Sheets. Choose File/Download , and select your desired file format.

- Update the template with your company's data and start projecting your finances up to 60 months into the future.

SUPPORT AVAILABLE

Getting Help

Feel free to reach out if you need assistance with your financial model. We have a few support options available, and we're always happy to help.

- You can sign up for Forecastr Launch for guided training and support from one of our financial analysts.

- You can contact us with your questions here .

- You can request a demo of Forecastr's financial modeling software here .

Why Financial Model Templates Are Essential For Startups

Leveraging financial model templates for startups is a strategic step towards achieving your business objectives effectively and efficiently.

Saves Time and Resources

Developing financial models from scratch is time-consuming and resource-intensive. Startups can save a significant amount of time and manpower by using customizable templates.

Facilitates Strategic Planning

Financial model templates provide a structured approach to financial planning to focus on strategic objectives. They help in identifying key drivers of revenue and costs, analyzing cash flow, and forecasting future financial performance.

Enhances Credibility

Enhance your startup's credibility with potential investors, lenders, and partners. Financial models demonstrate your seriousness about the brand, knowledge of financial aspects, and preparedness to manage finances effectively.

Performance Indicators

By regularly updating models with actual financial data, startups can track their performance against the projections, identify variances, and make necessary adjustments to their strategy or operations.

Improves Risk Management

Financial model templates helps identify potential risks and impacts on the business. This proactive approach to risk management enables startups to devise strategies to mitigate these risks, ensuring long-term sustainability.

Facilitates Opportunities

For startups seeking funding, a robust financial model is a key component of the investment proposal. It helps potential investors understand the business model, revenue projections, and ROI, making it easier for them to make a funding decision.

See ALL Startup Resources >>

Small Business Financial Plan Template

What is a Small Business Financial Plan?

A small business financial plan outlines a strategy for achieving future financial goals. It should include an assessment of historical performance, current resources, and target goals that must be achieved. Additionally, a financial plan should include a budget, cash flow projections, and strategies to manage risks and maximize opportunities. The financial plan should be tailored to the individual needs of the business. It should be reviewed regularly and adjusted to reflect changes in the business.

What's included in this Small Business Financial Plan template?

- 3 focus areas

- 6 objectives

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Small Business Financial Plan template for?

The Small Business Financial Plan template is designed for entrepreneurs, startups, and small businesses in various industries. It provides an easy-to-follow framework for creating a comprehensive financial plan that can be used to manage cash flow, plan for growth, and ensure the long-term success of the business.

1. Define clear examples of your focus areas

Focus areas are the broad topics that a financial plan should address. For example, a focus area for a small business might be cash flow management, market expansion, or employee retention. Under each focus area, there should be specific objectives and related tasks that will help the business achieve its goals.

2. Think about the objectives that could fall under that focus area

Objectives are specific goals that a small business should strive to achieve in order to improve its financial health. They should be related to the focus area and should be measurable so that progress can be tracked. Examples of some objectives for the focus area of Cash Flow Management could be: Increase Cash Reserves, and Improve Profit Margins.

3. Set measurable targets (KPIs) to tackle the objective

KPIs (Key Performance Indicators) are measurements of progress towards objectives. They help to track progress and measure success. KPIs should be specific, measurable, achievable, relevant, and timely. An example of a KPI for the focus area of Cash Flow Management could be: Decrease operational costs by 15%.

4. Implement related projects to achieve the KPIs

Projects are the specific actions that will help a business achieve its objectives. Examples of projects for a small business include reducing operational costs, increasing sales, and increasing customer acquisition. Each project should have a measurable target, an initial value, and a target value.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

Cascade Strategy Execution Platform is an easy-to-use solution that helps small businesses quickly create and manage a financial plan. With Cascade, businesses can track progress, measure success, and make adjustments to ensure that their financial goals are achieved on time.

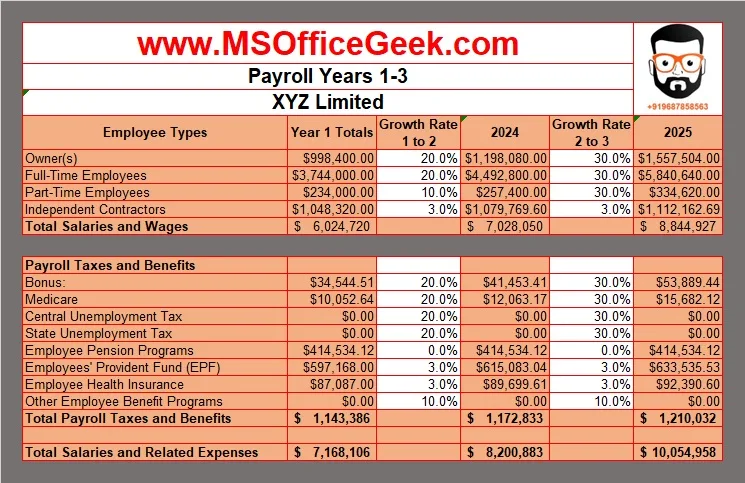

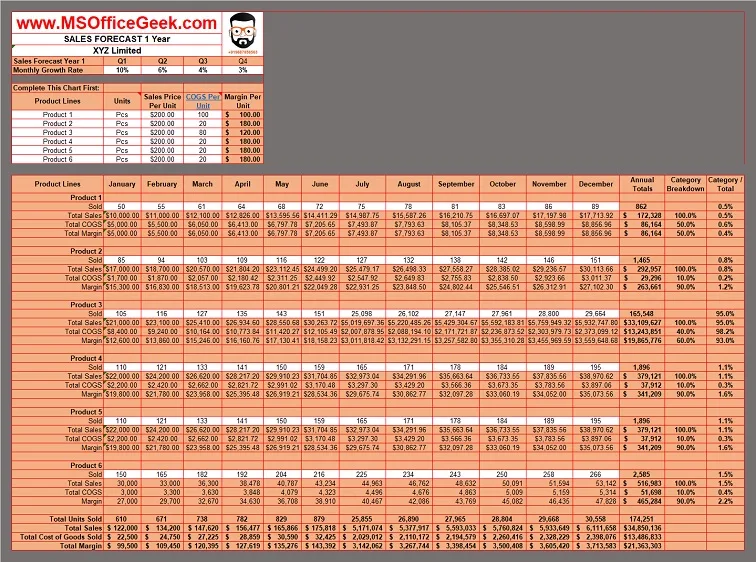

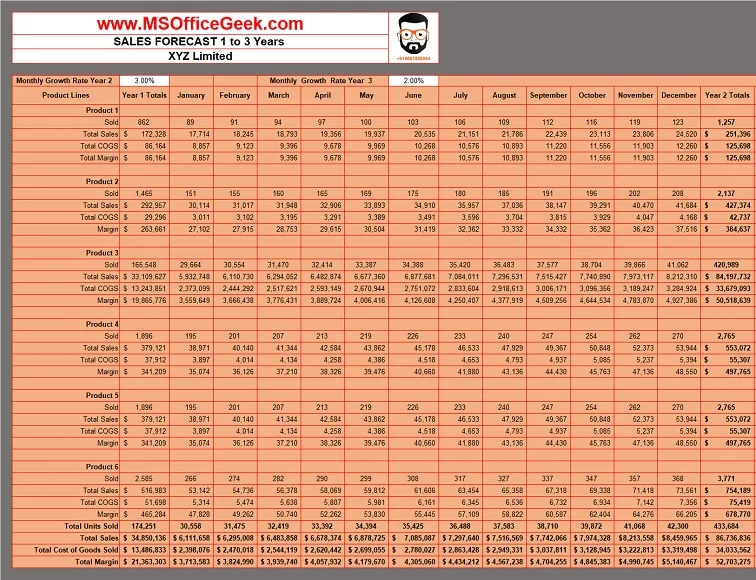

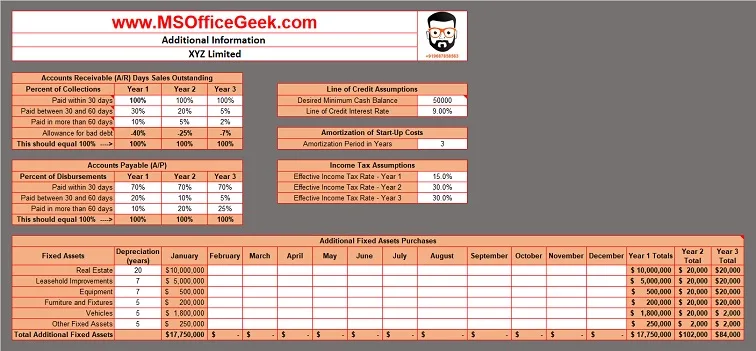

Free Business Plan Excel Template [Excel Download]

Written by Dave Lavinsky

A business plan is a roadmap for growing your business. Not only does it help you plan out your venture, but it is required by funding sources like banks, venture capitalists and angel investors.

Download our Ultimate Business Plan Template here >

The body of your business plan describes your company and your strategies for growing it. The financial portion of your plan details the financial implications of your business: how much money you need, what you project your future sales and earnings to be, etc.

Below you will be able to download our free business plan excel template to help with the financial portion of your business plan. You will also learn about the importance of the financial model in your business plan.

Download the template here: Financial Plan Excel Template

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less! It includes a simple, plug-and-play financial model and a fill-in-the-blanks template for completing the body of your plan.

What’s Included in our Business Plan Excel Template

Our business plan excel template includes the following sections:

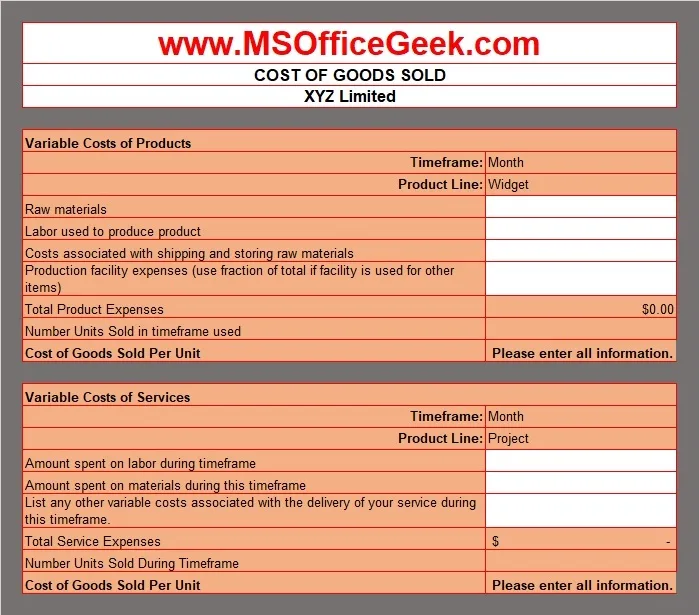

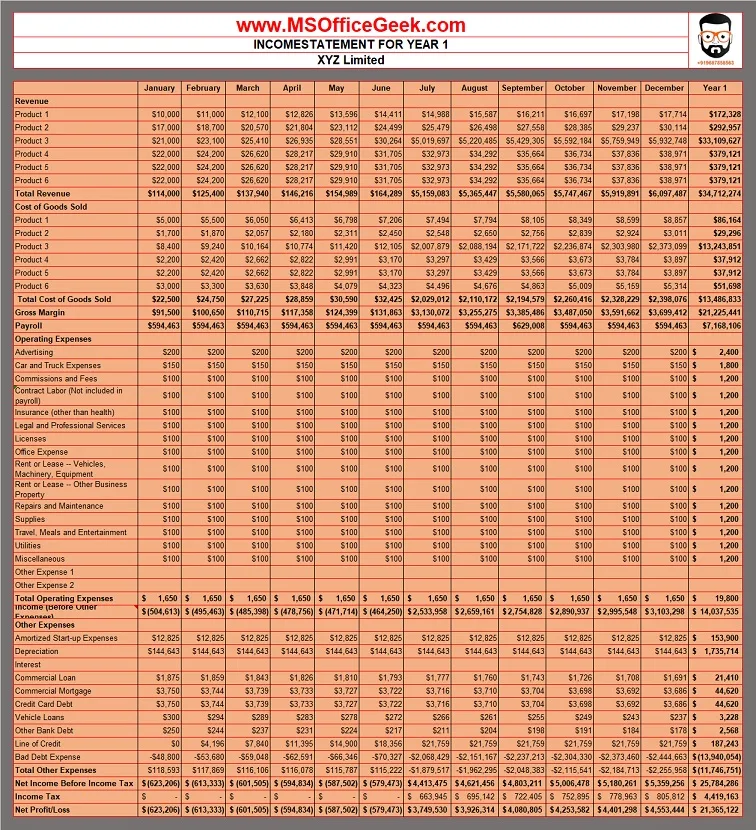

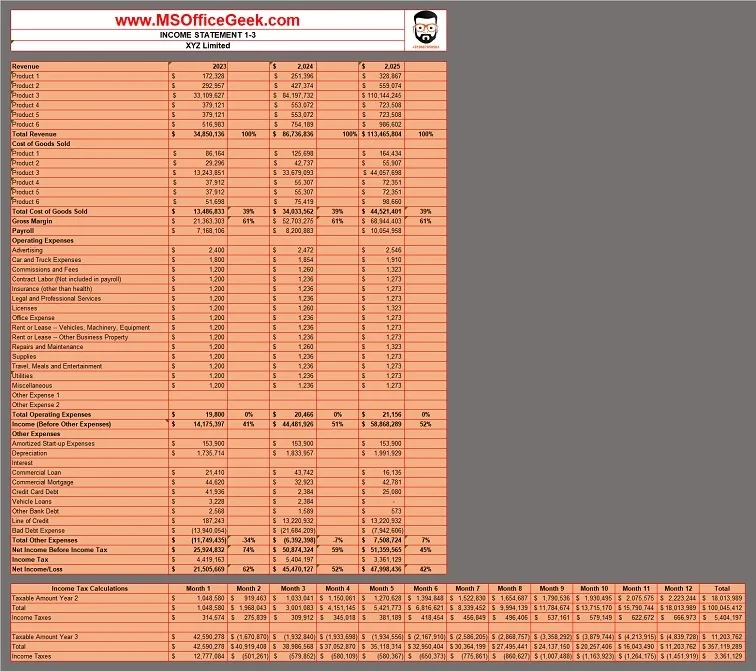

Income Statement : A projection of your business’ revenues, costs, and expenses over a specific period of time. Includes sections for sales revenue, cost of goods sold (COGS), operating expenses, and net profit or loss.

Example 5 Year Annual Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Revenues | $368,306 | $402,786 | $440,494 | $481,732 | $526,831 | |

| Direct Costs | ||||||

| Direct Costs | $10,475 | $10,901 | $11,343 | $11,804 | $12,283 | |

| Salaries | $58,251 | $60,018 | $61,839 | $63,715 | $65,648 | |

| Marketing Expenses | $0 | $0 | $0 | $0 | $0 | |

| Rent/Utility Expenses | $0 | $0 | $0 | $0 | $0 | |

| Other Expenses | $12,135 | $12,503 | $12,883 | $13,274 | $13,676 | |

| Depreciation | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Amortization | $0 | $0 | $0 | $0 | $0 | |

| Interest Expense | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $273,443 | $305,362 | $340,428 | $378,938 | $421,222 | |

| Income Tax Expense | $95,705 | $106,877 | $119,149 | $132,628 | $147,427 | |

| Net Profit Margin (%) | 48.3% | 49.3% | 50.2% | 51.1% | 52% |

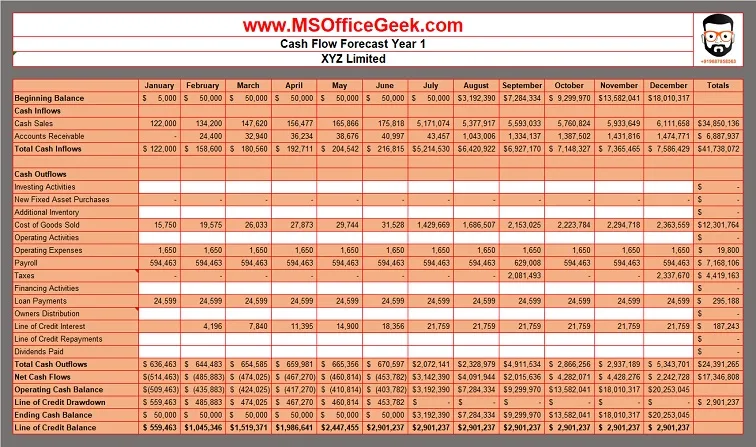

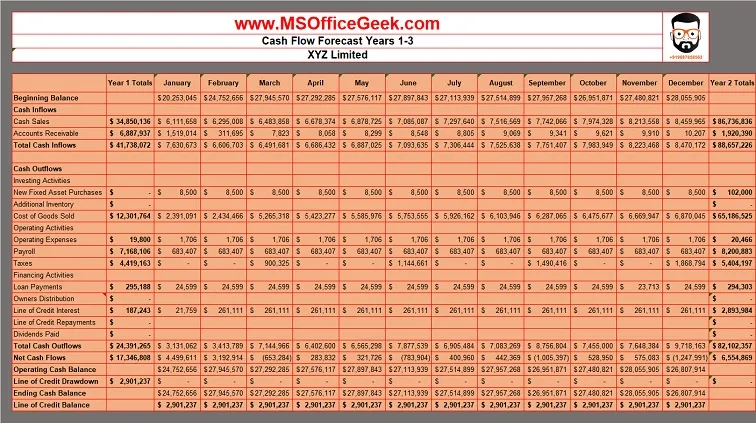

Cash Flow Statement : A projection of your business’ cash inflows and outflows over a specific period of time. Includes sections for cash inflows (such as sales receipts, loans, and investments), cash outflows (such as expenses, salaries, and loan repayments), and net cash flow.

Example 5 Year Annual Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Net Income (Loss) | $177,738 | $198,485 | $221,278 | $246,310 | $273,794 | |

| Change in Working Capital | ($24,912) | ($2,754) | ($3,025) | ($2,052) | ($3,523) | |

| Plus Depreciation | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Plus Amortization | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | ($30,000) | $0 | $0 | $0 | $0 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Cash from Equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from Debt financing | $80,000 | $0 | $0 | $0 | ($80,000) | |

| Cash at Beginning of Period | $0 | $208,826 | $410,557 | $634,809 | $885,067 | |

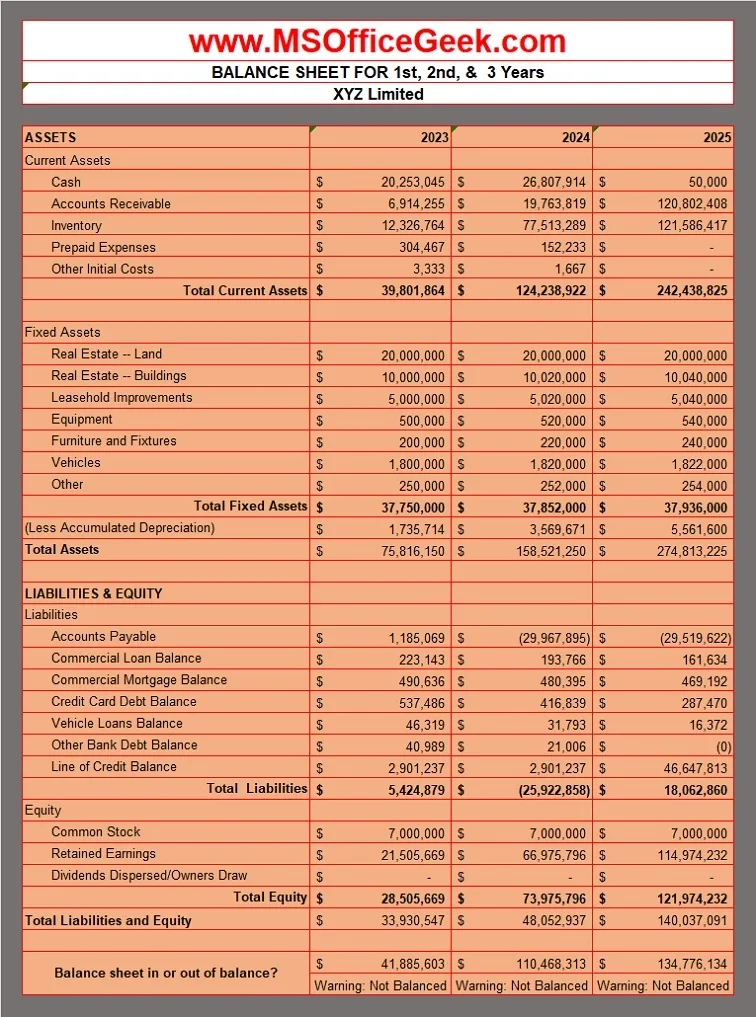

Balance Sheet : A snapshot of your business’ financial position at a specific point in time. Includes sections for assets (such as cash, inventory, equipment, and property), liabilities (such as loans, accounts payable, and salaries payable), and owner’s equity (such as retained earnings and capital contributions).

Example 5 Year Annual Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Cash | $208,826 | $410,557 | $634,809 | $885,067 | $1,081,338 | |

| Other Current Assets | $31,729 | $34,700 | $37,948 | $40,144 | $43,902 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Acc Amortization | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | |

| Accum Depreciation | $6,000 | $12,000 | $18,000 | $24,000 | $30,000 | |

| Preliminary Exp | $0 | $0 | $0 | $0 | $0 | |

| Current Liabilities | $6,817 | $7,033 | $7,256 | $7,399 | $7,634 | |

| Debt outstanding | $80,000 | $80,000 | $80,000 | $80,000 | $0 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $177,738 | $376,224 | $597,502 | $843,812 | $1,117,606 | |

Download the template here: Business Plan Excel Template

The template is easy to customize according to your specific business needs. Simply input your own financial data and projections, and use it as a guide to create a comprehensive financial plan for your business. Remember to review and update your financial plan regularly to track your progress and make informed financial decisions.

Finish Your Business Plan Today!

The importance of the financial model in your business plan.

A solid financial model is a critical component of any well-prepared business plan. It provides a comprehensive and detailed projection of your business’ financial performance, including revenue, expenses, cash flow, and profitability. The financial model is not just a mere set of numbers, but a strategic tool that helps you understand the financial health of your business, make informed decisions, and communicate your business’ financial viability to potential investors, lenders, and other stakeholders. In this article, we will delve into the importance of the financial model in your business plan.

- Provides a roadmap for financial success : A well-structured financial model serves as a roadmap for your business’ financial success. It outlines your revenue streams, cost structure, and cash flow projections, helping you understand the financial implications of your business strategies and decisions. It allows you to forecast your future financial performance, set financial goals, and measure your progress over time. A comprehensive financial model helps you identify potential risks, opportunities, and areas that may require adjustments to achieve your financial objectives.

- Demonstrates financial viability to stakeholders : Investors, lenders, and other stakeholders want to see that your business is financially viable and has a plan to generate revenue, manage expenses, and generate profits. A robust financial model in your business plan demonstrates that you have a solid understanding of your business’ financials and have a plan to achieve profitability. It provides evidence of the market opportunity, pricing strategy, sales projections, and financial sustainability. A well-prepared financial model increases your credibility and instills confidence in your business among potential investors and lenders.

- Helps with financial decision-making : Your financial model is a valuable tool for making informed financial decisions. It helps you analyze different scenarios, evaluate the financial impact of your decisions, and choose the best course of action for your business. For example, you can use your financial model to assess the feasibility of a new product launch, determine the optimal pricing strategy, or evaluate the impact of changing market conditions on your cash flow. A well-structured financial model helps you make data-driven decisions that are aligned with your business goals and financial objectives.

- Assists in securing funding : If you are seeking funding from investors or lenders, a robust financial model is essential. It provides a clear picture of your business’ financials and shows how the funds will be used to generate revenue and profits. It includes projections for revenue, expenses, cash flow, and profitability, along with a breakdown of assumptions and methodology used. It also provides a realistic assessment of the risks and challenges associated with your business and outlines the strategies to mitigate them. A well-prepared financial model in your business plan can significantly increase your chances of securing funding as it demonstrates your business’ financial viability and growth potential.

- Facilitates financial management and monitoring : A financial model is not just for external stakeholders; it is also a valuable tool for internal financial management and monitoring. It helps you track your actual financial performance against your projections, identify any deviations, and take corrective actions if needed. It provides a clear overview of your business’ cash flow, profitability, and financial health, allowing you to proactively manage your finances and make informed decisions to achieve your financial goals. A well-structured financial model helps you stay on top of your business’ financials and enables you to take timely actions to ensure your business’ financial success.

- Enhances business valuation : If you are planning to sell your business or seek investors for an exit strategy, a robust financial model is crucial. It provides a solid foundation for business valuation as it outlines your historical financial performance, future projections, and the assumptions behind them. It helps potential buyers or investors understand the financial potential of your business and assess its value. A well-prepared financial model can significantly impact the valuation of your business, and a higher valuation can lead to better negotiation terms and higher returns on your investment.

- Supports strategic planning : Your financial model is an integral part of your strategic planning process. It helps you align your financial goals with your overall business strategy and provides insights into the financial feasibility of your strategic initiatives. For example, if you are planning to expand your business, enter new markets, or invest in new technologies, your financial model can help you assess the financial impact of these initiatives, including the investment required, the expected return on investment, and the timeline for achieving profitability. It enables you to make informed decisions about the strategic direction of your business and ensures that your financial goals are aligned with your overall business objectives.

- Enhances accountability and transparency : A robust financial model promotes accountability and transparency in your business. It provides a clear framework for setting financial targets, measuring performance, and holding yourself and your team accountable for achieving financial results. It helps you monitor your progress towards your financial goals and enables you to take corrective actions if needed. A well-structured financial model also enhances transparency by providing a clear overview of your business’ financials, assumptions, and methodologies used in your projections. It ensures that all stakeholders, including investors, lenders, employees, and partners, have a clear understanding of your business’ financial performance and prospects.

In conclusion, a well-prepared financial model is a crucial component of your business plan. It provides a roadmap for financial success, demonstrates financial viability to stakeholders, helps with financial decision-making, assists in securing funding, facilitates financial management and monitoring, enhances business valuation, supports strategic planning, and enhances accountability and transparency in your business. It is not just a set of numbers, but a strategic tool that helps you understand, analyze, and optimize your business’ financial performance. Investing time and effort in creating a comprehensive and robust financial model in your business plan is vital for the success of your business and can significantly increase your chances of achieving your financial goals.

Startup Financial Model Template

Download our free startup financial model templates below. It is used by hundreds of successful founders.

Or have our modeling team build it for you! Learn more →

Free Startup Financial Model Template

As investors and advisers, we have built hundreds and reviewed thousands of startup financial models, and have formed views/developed best practices in the process.

What type of company are you?

Financial Model

SaaS / Recurring Revenue Model

Ecomm / dtc / cpg model, download: financial model template.

Simply fill out the form below to download our free financial model template!

Or have our skilled finance team build one for you! Learn more here .

Don't waste your time building models.

Let us do it for you. Graphite was born out of a VC fund and we take a thorough deep dive into your startup’s operations, develop customized financial models, and can act as your fractional CFO.

WE’VE WRITTEN EXTENSIVELY ON THE TOPIC:

- Breaking Down the Importance of Early-Stage Revenue Projections

- Data-Driven Approach to Investing in Salespeople

- 18 Ways to Make Your Financial Model Stand Out to Investors

*Note that as Graphite is a new entity, these were originally authored and attributed to ff Venture Capital, from which we were formed.

NOW WE’RE PUTTING OUT A SIMPLE FINANCIAL MODEL TEMPLATE FOR THE WORLD TO USE

- It’s a three-statement model, meaning it has an Income Statement, Balance Sheet and Statement of Cash Flow. Any model that doesn’t have all three will not project cash burn accurately.

- It tells you what you need to know. The model cleanly spits out relevant, digestible, summary information in a board-ready format.

- It bridges the gap between real-life and projections. It takes into account things like “real” Accounts Receivable and Accounts Payable.

- It lets you know when you’ve made a mistake. The model has a series of tests that will let you know if something is broken on each page, so you’ll know when you need to press Control-Z.

- Just remember, this is a template, or a shell. There is no one size fits all solution. Every business is different, and you will need to customize this for your business. This is of course something we have extensive experience with and can assist with.

Need CFO or Accounting Help?

Born out of a VC fund, Graphite fully understands the strategic and financial needs of high growth companies. If you need accounting support or simply have a question about accounting at your company, feel free to connect with us!

Free Download

Financial Services Business Plan Template

Download this free financial services business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

Business Plan Template

Simple Business Plan Outline

How to Write a Business Plan for Investors

Industry Business Planning Guides

10 Qualities of a Good Business Plan

How to Write a Business Plan

How to Start a Business With No Money

How to Create a Business Plan Presentation

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Financial Model Template for Startups

Build a diverse range of perfect financial models for a startup at a fraction of the cost, time, and effort.

Building financial models is not easy, so we guide you from the start.

Building a well-structured, easy to use, and accurate financial model for your startup takes dozens of hours - so we decided to do most of the work for you and came up with a template. Watch our walkthrough video to see all features and the great design of the financial modeling template.

Easy to Understand & Edit

Our basic structure and instructions on every input field guide you through the whole process of putting your assumptions in to automatically calculated values for the future.

Financial Statements

We automatically combine all of your inputs and generate the most important financial statements (P&L) for the next five years in your financial modeling.

Beautiful charts & projections

The Financial Model automatically generates the most important charts in a visually appealing way, ready to use for your pitch deck or investor presentation.

EASY TO EDIT MODEL

We guide you the whole way

Start with your basic company data.

First, you need to set up your company by giving the model basic information about when you started, which currency you use, and the business model you have.

How do you generate revenue

The second area of the financial model is all about generating revenue. Which marketing channel do you use to attract customers? How much does it cost for you to attract them? What is your conversion rate? You can use real data or, if you do not have real data, make assumptions. This information will then be used to predict future revenues.

Hiring Plan & Team Costs

For most companies, the team is the most important and simultaneously the most expensive part of their business. Use the HR tab to model the growth of your organization and the corresponding HR expenses. You can also work with dynamic salaries and track your headcount down the road.

Model your other costs

Besides product and team-related costs, there are a lot more costs that need to be considered. Legal fees, payment processing, and travel costs are just some to mention. Our model helps you to keep track of everything.

What is your runway?

Most startups these days are financing their initial growth through external capital. Our funding tab helps you to understand how much money you need and how much time you have left to raise the next funding round.

TESTIMONIAL

But what do others think?

For one of my projects, I was struggling to build a financial plan because I did not know where to start. The Financial Modeling Template was really helpful to guide me through the most important financial aspects of the business.

Really love the product! I tested a lot of different financial models and this one is very good. BaseTemplates built something simple but yet powerful enough.

Super clean template! Everything is clear and well-organized.

Bought the financial model template for startups and was not disappointed! It does what they claimed: an easy-to-use and easy-to-understand financial model for SaaS startups.

The SaaS financial model was really easy to use and straight forward! Totally recommend it!

DIFFERENT ASSUMPTIONS & DRIVERS

Choose your business category

Saas financial model.

Five-year financial model build around recurring revenues, marketing and sales activities, and SaaS-centric assumptions like churn.

👉 Download Preview

E-Commerce / DTC Financial Model

Five-year financial model built around marketing related revenues, costs of goods sold and other company related expenses.

Plain / Blank Financial Model

Five-year model for most of the other business types, that can easily be adopted. It is based on sales generated by marketing.

DOWNLOAD & PRICING

Start building your financial model now!

For other business models

.xls Excel file + Google Sheets file

How-To Video

Example + Blank Version

Full template library

Lifetime updates

For SaaS business models

Let's answer some questions

Here are the brief answers to some frequently asked questions about financial modeling templates. We strive to make each answer as complete as possible but don’t hesitate to request more details anytime. You’ll likely have questions not covered in the FAQs — we’re most interested in answering those.

How to create a financial modeling for a startup?

Creating a financial model for your startup can be simple and complex, depending on the future situation you’re trying to visualize and your knowledge of business and Microsoft Excel or Google Sheets. Financial modeling involves creating and combining formulas that can be difficult for novices because it requires advanced knowledge of mathematical applications like Microsoft Excel and Google Sheets. While you can acquire some of these skills from our pitch deck course, you’re better off using a ready-made financial modeling template for startups with detailed instructions, as they save you time, money, and plenty of headaches. To create a financial model, you need to know what future answers you’re looking for and then consider all the variables that affect the final result. You’ll deal with a range of formulas, do a lot of critical thinking, and use fixed values, such as percentages, that will be applied to specific cells. You should also be able to make logical assumptions on influential factors that numbers cannot represent accurately. In short, it’s a complex task for Excel or Google Sheets amateurs. BaseTemplates makes financial modeling easy.

What are the elements of a startup financial model?

There are three main elements of a startup financial model, and they include the following: - Income statement - Cash flow statement - Balance sheet Income statement Your present income statement forms the basis for creating basic financial models for the future. Financial modeling for talent acquisition, expansion, selling to an acquirer, and other business objectives require an income overview because many decisions depend on your business’s present and future financial standing. For example, expanding your business will increase its fixed and variable costs. Likewise, the income statement influences your funding campaign — it’s the first thing investors would want to see since that’s where profit and loss are. We provide free and master financial modeling templates you can practice with and create a range of basic designs. Cash Flow Statement The net cash flow statements display the amount of cash that enters and leaves your company. It provides a detailed picture of how well your company makes money and meets its financial obligations. Typically, money enters your company through one or more of three channels: external investments, business operations, and financing activities. The Cash Flow statements essentially complement the balance sheet and the income statement. Balance sheet The balance sheet is a financial modeling statement that shows your company’s net worth after you deduct its liabilities from its total worth in monetary terms. Investors look at your balance sheet to know how much gain they can make from your business. Basically, you want to know how much your company owns and owes at any point in time; the balance sheet gives that financial modeling information.

How do you format startup financial models?

The format of your startup financial models is critical to their utility. Financial modeling is essential to ensure all your financial models are easy to audit, study, and work with. Financial modeling is critical to ensure all your financial models are easy to audit, study, and work with. The better organized your financial modeling tool and presentation, the fewer errors and time waste you’ll deal with, and the better will be your financial performance. The model can be separated into several distinct components; make sure to clearly separate inputs, all the calculations, and outputs. The inputs section is for keying in raw data; the calculations segment will contain your formulas and other calculated values; and the outputs section will display the result of your calculations.

How do I create a financial model in Excel?

To create a financial model spreadsheet in Excel, you may find that you need to be an advanced user of the software. Financial modeling is an intricate process where you’ll create a variety of formulas that must work together for your results to materialize and be accurate. We can’t provide a step-by-step guide here on how to build your blueprint using Excel as that’s not the aim of this page and because it’s a process that can’t be satisfactorily explained in one post. Planning is the first step of every great financial model — a well-planned financial model is easy to modify even by third-party users. Jumping right into the design without any prior planning takes more time and is prone to errors that may require sweeping structural changes. To plan your model, you need to define its purpose, timeline, and for how long it’ll be used. You should also decide whether it’ll apply to different uses and how you can adapt it to the purposes for which it was created. To save you the hassle, we recommend you take advantage of our financial modeling template.

What is a good financial model?

A good financial model has these five characteristics: - Completeness (accounts for all factors) - Organization (formatted for easy use and modification) - Accurate forecasts (the formulas must be correct) - Long useful life (can be used for many years) - Very flexible (can be adapted into larger models) As a business owner or manager, you’ll often make decisions that impact the future of your business negatively or positively. Many businesses get into trouble because of poor decisions they made in the past. Our templates are carefully calculated and designed to offer the best prediction and most accurate assessment of the future business landscape. You’ll read it; some employees will read it; investors, partners, and other businesses, organizations, and individuals will also read it. This is why we go to any extent to ensure our models are as simple as possible. You can present it with great confidence anywhere. Reviewing it won’t give you any problems as the components are well organized, and the format is easy to skim.

Is financial modeling difficult?

The answer to whether financial modeling is difficult depends on your level of expertise and ability to learn fast. Not everyone can build financial models from start to finish, even if they try to. Yet, it’s very critical for a business’s present and future. Businesses use it to make crucial decisions that may bring profits or losses. Experts have independent courses on financial modeling because of the many technical steps involved. While acquiring the knowledge is great, you usually won’t have the patience or even schedule to sit through a manual financial modeling exercise. It takes time and hundreds of mouse clicks to build a world-class financial model from start to finish. You can start with financial modeling using Excel or Google Sheets, but only after acquiring in-depth technical knowledge of it — perhaps from an online course or independent research and practice. This method demands about 1–4 weeks of your precious time, maybe several hundred dollars, and probably over 1 hour every time you make a new model. You’re also prone to mistakes whose correction may reside in a fundamental formula that could be difficult to trace. As a result, we recommend taking advantage of our adaptable, organized, and complete financial modeling template for startups. They’ll save you time and money and also help convince investors better.

Why should I buy the Financial Model Template?

It's simple. Our financial modeling template gives you the power to rapidly build your own financial plan for the next 5 years. You can use our pre-built structure, insert your own information and the model will do the rest. This will save you hours and raise the quality of your financial plan.

Does the model work with Google Sheets?

Yes. Our models work with both Google Sheets and Microsoft Excel. You'll find the dedicated version in your download.

What is included in the download?

After you purchased the template you will get a .zip folder that contains a plain version of the model, an example version, and instruction material. You can start building your financial model immediately. With your download you'll get a version for Microsoft Excel and one version for Google Sheets.

I have never worked with a financial model before? Will I be able to use it?

Absolutely. We decided to build our model as easy as possible. We will give you a lot of guidance during the process and make sure you don't miss out on important data.

FINANCIAL MODEL FOR STARTUPS 101

What is a financial model and why do you need it?

As an entrepreneur, our financial modeling templates will be among your best low-cost assets. They are 100% complete with all the components of a financial model, including the nonessential ones. You can add as many variables as you want without getting errors.

Financial modeling is made easy with our concise, clear, complete, and easy-to-use templates. You can include only necessary information for specific purposes without disturbing its clarity. We also provide how-to videos to speed up your understanding of the templates and financial modeling accuracy. Benefit from our expertise and experience, whether you’re a novice or a professional in business management.

We have a template for all kinds of businesses. We can also help with any aspect of business that uses financial modeling, even if it’s a new concept. When it comes to being up-to-date on the latest financial modeling tricks, our models never lag behind in the industry. Kickstart your business today with a simple startup financial model template from us.

Minimize financial model errors.

Use our carefully-designed financial modeling templates for greater confidence in your forecasts. We offer three different financial modeling templates, at least one of which must work for your business, be it SaaS , eCommerce, wholesale, or manufacturing. Our modern and complete financial modeling and designs are your best defenses against decisional errors — there are no design, formatting, or formula mistakes in any of our financial model templates.

Save time and effort.

Do you need a financial modeling template with clear-cut instructions for populating the cells and generating answers?

Use our financial modeling templates for eCommerce, SaaS , and any type of business to build realistic forecasts in minutes. The simple designs and detailed instructions unravel the processes clearly, so you don’t take much time to build a complex or basic financial model.

Use a variety of models.

A financial model template should be versatile to cover as many aspects of your business as possible. Our templates let you build a wide range of financial models for your startup or established company, enabling thorough financial analysis. Design unique financial models for each occasion and purpose. These models cover your in-house financial projections and external collaborations, facilitating comprehensive financial analysis.

Easily reuse your models.

Some financial models only work for specific business models, meaning you can’t integrate them with other business model they weren’t originally built for. This may force you to design every independent business model from the beginning — our models save you this hassle. You can fuse different sub-models into a single coherent model, and the formulas and data harmonize. That’s because we have a blank template as well as templates for eCommerce and SaaS businesses.

Enjoy great value for your money.

It’s crucial to save operating costs whenever possible. As far as financial modeling goes, our solutions are designed to save you as much money as possible.

Our packages are calculated to solve various modeling problems that might have required separate models if you used an incomplete template. The wide range of components and variables we cover makes it unlikely that you’ll find any feature missing. A great business financial model should start saving your company money right from building the model.

Our models have beautiful designs.

Even financial models for in-house use ought to be attractive, let alone that intended for investors or other third parties. Use our templates to build financial models that whoever catches a glimpse of would want to see more.

We’ll help you make the right choices for color separation, making your models easier to fill, work with, and skim. It’s important to clearly separate the distinct components of your models to forestall mistakes and save time.

Well-organized models for easy use.

The first thing investors notice in your financial model is the aesthetics and organization/structure. If you present a seemingly chaotic model, your audiences will start to wonder whether you aren’t a waste of time.

One of the most critical functions of a basic financial model is to paint a simple but complete picture of your business’s future finances. Investors want to understand your model as quickly as possible. This is why our templates have all components arranged in a simple and easily predictable order.

Our templates are timeless.

Our financial modeling templates, created with investment banking in mind, are designed with the future in mind. That means you can use them for many years to come without them becoming outdated for insufficient coverage or irrelevant inputs.

The business management industry is seeing rapid advances in management technology due to the ferocity of online competition. You need an investment banking-focused modeling template that helps you stay competitive by accounting for all the factors your competitors use in their business operations.

Get all the support you need.

You’ll likely need help working with financial models even if you are an expert, not to mention a novice. We pride ourselves in helping and supporting with financial analysis. You’re encouraged to ask us as many questions as you want. The confusing nature of financial modeling makes your choice of service providers critical. Using a business financial plan template for Excel designed by amateurish companies or companies that neglect customer support will most likely lead to regrets — unless you’re an expert who doesn’t mind exerting a lot of effort to find answers your seller is supposed to provide.

Incorporating investment banking financial analysis into your decision-making process is essential for a comprehensive understanding of your business's performance and potential. Whether you're a seasoned professional or new to financial modeling, our investment banking team is dedicated to assisting you throughout the process. Feel free to reach out with any questions or concerns.

The confusing nature of financial modeling makes your choice of investment banking service providers critical. Using a business financial plan template for Excel designed by amateurish investment banking companies or companies that neglect customer support will most likely lead to regrets — unless you’re an expert who doesn’t mind exerting a lot of effort to find answers your investment banking seller is supposed to provide.

Startup Cockpit

One of our major jobs here is helping startups achieve their goals for venture capital funding through pitch decks . Aside from future-predicting financial modeling templates for startups, we provide a wide range of services that help run your business professionally and profitably.

Use our innovations alongside other documents to demonstrate to investors the huge financial potential of your startup. You can also use it to manage limited resources for your startup or team, evaluate your business’s net worth, and more.

Revenue Forecast

Revenue modeling has broad applications in business, especially when you have multiple income streams from various products or services. It'll help you to track income from different sources and visualize the future prospect for each revenue source.

Our templates let you accomplish this with ease. Input data on costs, advertising, net income, and into our templates, and you can predict future costs, revenue, and best advertising channels. We provide only the perfect financial model template for any business plan.

Staff Acquisition Models

Hiring staff for your startup is easy with the right data, assumptions, and financial models. Our models are designed to be flexible, easy to use, and capable of producing accurate results for different datasets and assumptions. You can schedule hiring based on time, revenue, and other milestones.

The template will help you convince investors that the staff acquisition plan for your startup is solid and realistic. You can also tie your hiring to funding , customer acquisition costs, and other hurdles. You’ll receive all the guidance you need to achieve any hiring plan with our models.

Cost Modeling

With these templates, you can easily segment all your operating expenses according to rules set by regulatory bodies in your society. Our templates accommodate all kinds of expenses, no matter how unpredictable. Even cost drivers can be included in your calculations, and our template will still produce accurate results.

Adding net income once, use these templates to create a standard costing system and allocate expenditures to suppliers according to specific key metrics. We’re the right choice for any early-stage startup seeking a financial model template to download.

Fundraising Model

Convince a more risk-averse venture investor by using data to demonstrate the future prospects of your business. Show them financial models that accurately track performance, revenue, and profitability with easy-to-read financial models. These models clearly outline your startup’s future value, sales, and growth potential. Our models enable you to incorporate data into your business idea to increase your chances of convincing all kinds of investors.

5-Year Financial Plan Template

Whether you are already running a business, or making plans to start one up, financial planning is a vital part of ensuring your success. Not knowing your expected income and expenditure will make it difficult to plan, and hard to find investors.

This 5-Year Financial Plan spreadsheet will make it easy for you to calculate profit and loss, view your balance sheet and cash flow projections, as well as calculate any loan payments you may have. Whilst the wording on this spreadsheet is focussed around products, it can just as easily be used for businesses who largely provide services to their customers.

5-Year Financial Plan Projection

How to use Financial Plan

Model inputs.

Use the Model Inputs sheet to enter information about your business that will be used to model results seen on the other pages.

Forecasted Revenue

The forecasted revenue section allows you to estimate your revenue for 4 different products. Simply use the white boxes to enter the number of units you expect to sell, and the price you expect to sell them for, and the spreadsheet will calculate the total revenue for each product for the year. If you want to give your products names, simply type over the words "Product 1", "Product 2" etc. and these names will be carried through to the rest of the spreadsheet.

Cost of Goods Sold

Your margins are unlikely to be the same on all of your products, so the cost of goods sold allows you to enter your expected gross margin for each product into the white boxes in Column B. The spreadsheet will automatically calculate the annual cost of goods sold based on this information, along with your forecasted revenue.

Annual Maintenance, Repair and Overhaul

As the cost of annual maintenance, repair and overhaul is likely to increase each year, you will need to enter a percentage factor on your capital equipment in the white box in Column B. This will be used to calculate your operating expenses in the profit and loss sheet.

Asset Depreciation

Use the white box to enter the number of years you expect your assets to depreciate over. This may vary greatly from business to business, as assets in some sectors depreciate much more quickly than they do in others.

In most parts of the world, you will have to pay income on your earnings. Enter the annual tax rate that applies to your circumstances in the white box in Column B. If you have to pay any other taxes, these can be entered later on the Profit and Loss sheet.

Although you cannot be certain of the level of inflation, you will still need to try and plan for it when coming up with a 5-year financial plan. The International Monetary Fund provide forecasts for a number of countries, so is a good place to look if you are unsure what to enter here. Simply enter your inflation rate in the white box.

Product Price Increase

As a consumer, you are no doubt aware that the price of products goes up over time. Enter a number in the white box to show the expected annual price increase of your products to enable the spreadsheet to calculate income in future years. If you are unsure what to put here, increasing your product price in line with inflation is a good starting point. If your business is just starting out, you may be able to command higher prices for your products or services as the years go on, as you build up brand recognition and a good reputation.

The funding section allows you to enter information about your business loan. To use this section, simply fill in the three white boxes representing the amount of the loan, the annual interest rate and the term of the loan in months - for example, 12 for 1 year, 24 for 2 years, 36 for 3 years, 48 for 4 years, or 60 for a 5 year loan.

Profit and loss

This sheet calculates your profit and loss for each year over a 5 year period. The profit and loss assumptions, along with income, are automatically calculated using information entered in the model inputs sheet.

Non-Operation Income

You may have, or be expecting some income in addition to your operating income. These can be entered manually in the white cells in Column B for Year 1, Column C for Year 2 and so on. There are pre-entered categories for rental, lost income and loss (or gain) on the sale of assets, as well as an additional row where you can enter your own non-operation income.

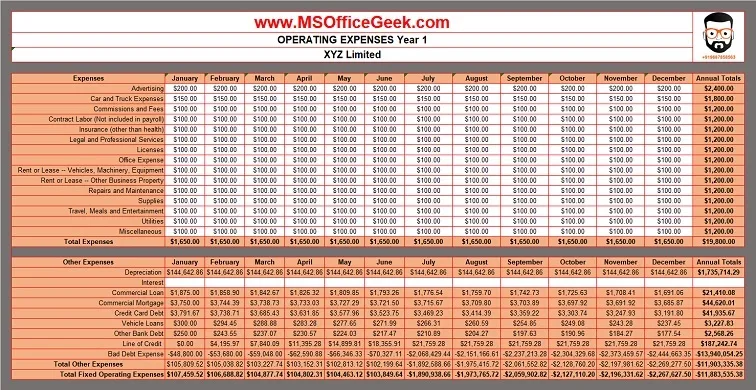

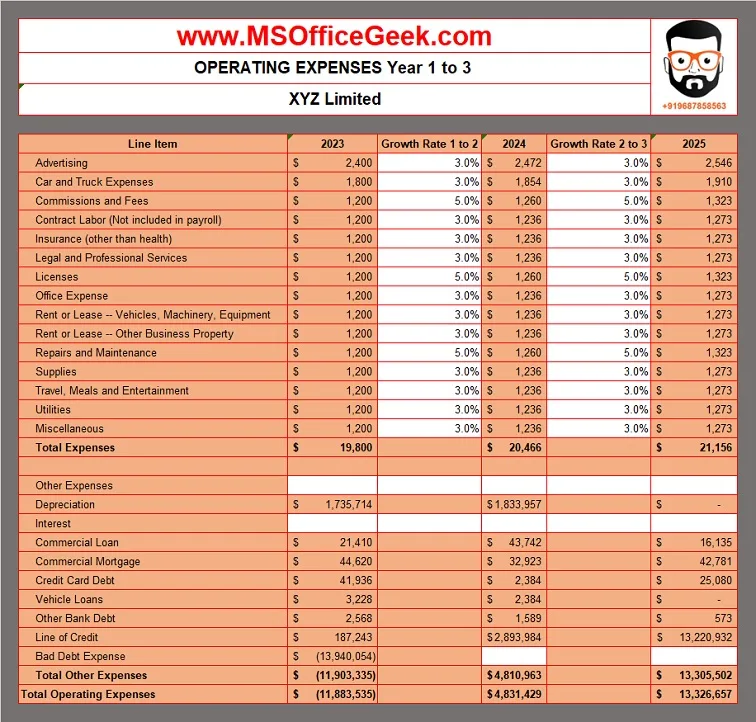

Operating Expenses

Some parts of this are already filled in based on information you put on the Model Inputs, for example, depreciation, maintenance and interest on long-term debt. Years 2-5 are also filled in for you across all categories based on the inflation information entered in the Model Inputs sheet. You therefore only need to enter your Sales and Marketing, Insurance, Payroll and Payroll Tax, Property Taxes, Utilities, Administration Fees and any Other Expenses into the white cells in Column B for Year 1.

Non-recurring Expenses

This section is for entering any expenses that you will not be paying on an annual basis. The Unexpected Expenses row allows you to enter a contingency for unexpected expenses, whilst the Other Expenses row allows you to enter any other one off expenses you may be expecting to make, for example the purchase of new equipment part way into your 5 year plan.

Income Tax is filled in based on the information you enter into the model inputs. Depending on where your business is based, you may find yourself having to pay other taxes. These can be entered in the Other Tax row. You can rename this row by typing over the "Other Tax (specify)" text.

Balance Sheet

The annual balances for Years 1-5 are, in most cases, filled in for you, based on the information you have entered on the Model Inputs sheet and in the Initial Balance column of the Balance Sheet column itself. This makes it very easy to use.

Current Assets

This is where you can enter the value of any of your current assets, with spaces to enter information about Cash and Short-term Investments, Accounts Receivable, Inventory, Prepaid Expenses and Deferred Income Tax. At the bottom of this section is a space for you to enter any other current assets you may have that do not fall into any of these categories.

Property and Equipment

Depending on the nature of your business, you may have assets such as Buildings, Land, Capital Improvements and Machinery. Enter the value of these assets into Column B, and these values will be copied over to each of the 5 years of the plan. The depreciation information entered into the Model Inputs sheet will be used to calculate the depreciation expenses, which allows a total for property and equipment to be calculated automatically.

Other Assets

This section is for entering information on any assets that don't fit in the other sections. These could be Goodwill Payments, Deferred Income Tax, Long-term Investments, Deposits, or any Other long-term assets. Enter the information into Column B, and it will be carried across to the yearly columns automatically.

Current Liabilities

As well as assets, your business is likely to have liabilities. There are spaces to enter Accounts Payable, Accrued Expenses, Notes Payable and Short-term Debt, Capital Leases and Other current liabilities. Just leave blank any rows where you do not have any liabilities, and the totals will be calculated for you.

Your long-term debt/loan information will have already been entered in the Model Inputs sheet, so the only thing to do here is to enter any other long-term debt. Unlike much of the rest of the Balance Sheet, you can manually enter different amounts for each year, as you may, for example, be expecting to take on another loan to purchase some new equipment in Year 3 as your business expands.

Other Liabilities

Use this section to enter any liabilities not covered by the pre-defined labels. You can amend the text in Column A, in order to specify the liabilities, and then enter the cost of these liabilities in Column B.

Your business is likely to have some equity, and this can be entered into this section. You can fill out the Owner's Equity, Paid-in Capital and Preferred Equity in Column B. Your retained earnings are automatically calculated based on the Profit and Loss sheet.

Much of the information on the cash flow sheet is based on calculations in the Balance Sheet. It is important to plan your cash flow carefully, so that you know what funds you will have available to buy new stock and equipment.

Operating Activities

Much of this section is automatically filled in based on your balance sheet. There are only three rows to fill out, which are Amortization, Other Liabilities and Other Operating Cash Flow. You only need to fill out the white boxes in Column B for Year 1, as these values will automatically be carried over into subsequent years for you.

Investing Activities

Your capital expenditures and sale of fixed assets will be automatically populated if you have filled out the relevant sections of the Balance Sheet. They will be blank if they do not apply. As investing activities can vary year on year, you will need to fill out any investment activities for each of the 5 years in the appropriate columns for Acquisition of Business, and any Other Investing Cash Flow items.

Financing Activities

The long-term debt/financing row will be pre-filled based on the loan information previously entered. Use Column B to fill out your Preferred Stock, Total Cash Dividends Paid, Common Stock and Other Financing Cash Flow items for Year 1. This information will automatically carried over to Years 2-5.

Loan Payment Calculator

There is nothing to enter on this sheet, as it is for information only. Whether or not you already have a loan, or are using this spreadsheet as a part of a business plan to help you obtain one, it allows you to easily see how much you will be paying each month, showing how much you are paying off your loan, and how much you are paying in interest. This will allow you to get an idea of whether or not you can afford to borrow a bit extra, if you feel it would allow you to push your business into higher places, or whether you need to shop around for a better interest rate or adjust the loan term in order to afford the loan payments.

Related Templates

Original text

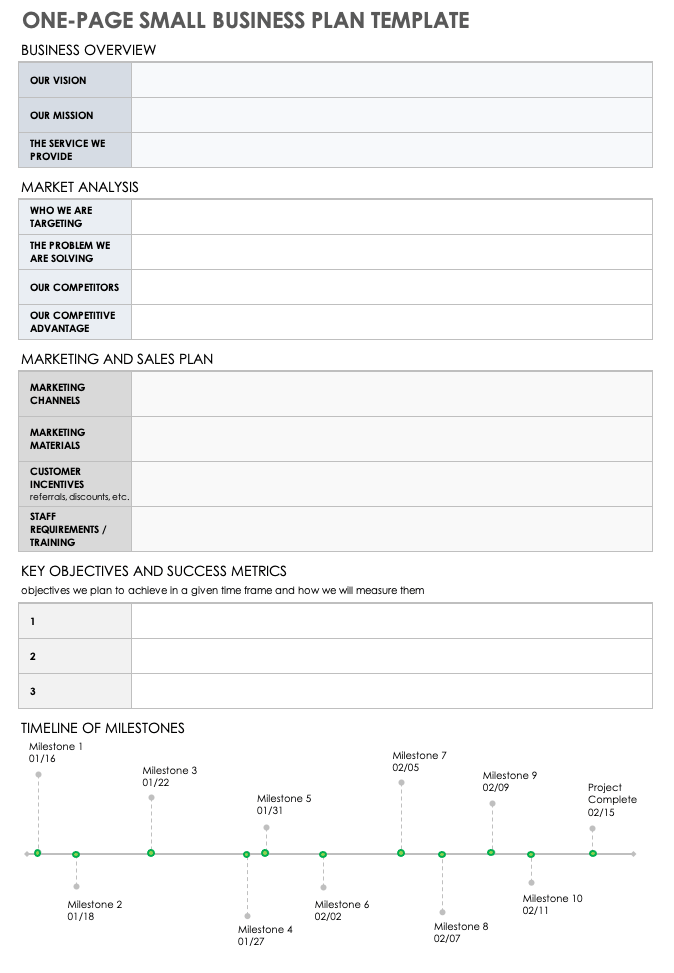

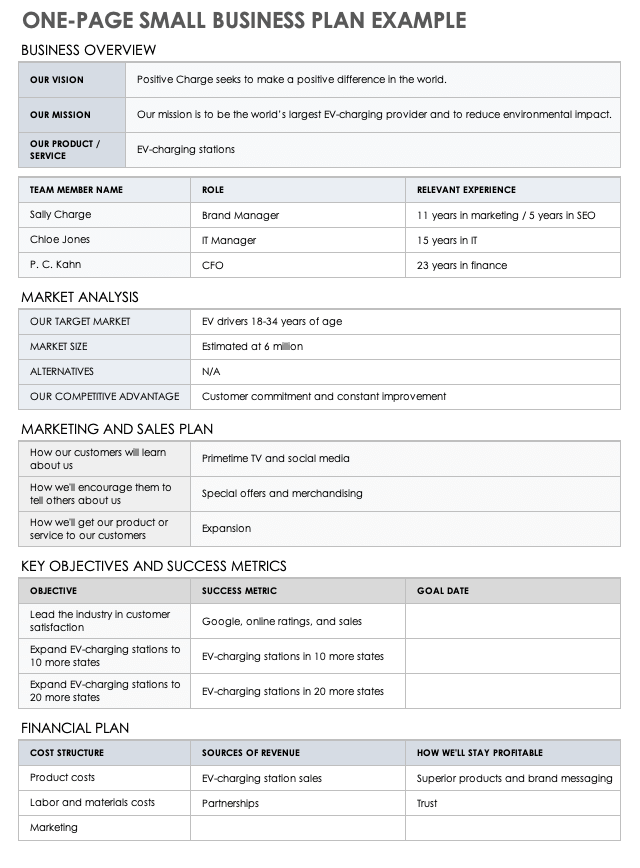

Access our collection of user-friendly templates for business planning, finance, sales, marketing, and management, designed to assist you in developing strategies for either launching a new business venture or expanding an existing one.

You can use the templates below as a starting point to create your startup business plan or map out how you will expand your existing business. Then meet with a SCORE mentor to get expert business planning advice and feedback on your business plan.

If writing a full business plan seems overwhelming, start with a one-page Business Model Canvas. Developed by Founder and CEO of Strategyzer, Alexander Osterwalder, it can be used to easily document your business concept.

Download this template to fill out the nine squares focusing on the different building blocks of any business:

- Value Proposition

- Customer Segments

- Customer Relationships

- Key Activities

- Key Resources

- Key Partners

- Cost Structure

- Revenue Streams

For help completing the Business Model Canvas Template, contact a SCORE business mentor for guidance by phone

From creating a startup budget to managing cash flow for a growing business, keeping tabs on your business’s finances is essential to success. The templates below will help you monitor and manage your business’s financial situation, create financial projections and seek financing to start or grow your business.

This interactive calculator allows you to provide inputs and see a full estimated repayment schedule to plan your capital needs and cash flow.

A 12-month profit and loss projection, also known as an income statement or statement of earnings, provides a detailed overview of your financial performance over a one-year period. This projection helps you anticipate future financial outcomes by estimating monthly income and expenses, which facilitates informed decision-making and strategic planning.

If you’re trying to get a loan from a bank, they may ask you for a personal financial statement. You can use this free, downloadable template to document your assets, liabilities and net worth.

A Personal Financial Statement is a snapshot of

Marketing helps your business build brand awareness, attract customers and create customer loyalty. Use these templates to forecast sales, develop your marketing strategy and map out your marketing budget and plan.

How healthy is your business? Are you missing out on potential growth opportunities or ignoring areas of weakness? Do you need to hire employees to reach your goals? The following templates will help you assess the state of your business and accomplish important management tasks.

Whether you are starting your business or established and looking to grow, our Business Healthcheck Tool will provide practical information and guidance.

Learn how having a SCORE mentor can be a valuable asset for your business. A SCORE mentor can provide guidance and support in various areas of business, including finance, marketing, and strategy. They can help you navigate challenges and make important decisions based on their expertise and experience. By seeking out a SCORE mentor, you can gain the guidance and support you need to help grow your business and achieve success.

SCORE offers free business mentoring to anyone that wants to start, currently owns, or is planning to close or sell a small business. To initiate the process, input your zip code in the designated area below. Then, complete the mentoring request form on the following page, including as much information as possible about your business. This information is used to match you with a mentor in your area. After submitting the request, you will receive an email from your mentor to arrange your first mentoring session.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

The budget spreadsheet for founders

20,000+ companies use our Financial Model spreadsheet to manage their company budget

Enter a valid email address.

Your download is on the way! 📨

Ready-to-use templates, subscription model, ecommerce model, marketplace model, mobile app model.

Financial Model templates for every industry

Download a fully-functional financial model template, built by experts in each respective industry

A complete model for SaaS businesses, with MRR, LTV and churn functionality

An eCommerce model for online sales, including an inventory tracker

For companies that connect buyers and sellers, and charge transaction fees

A model to estimate in-app purchases, subscriptions, and ad revenue

Blog/News Site

A template for Media companies, that make revenue on traffic, newsletters ,and sponsors

Custom Model

Hire our team to build a custom financial model for your startup

Financial modeling bootcamp for startup founders

A LIVE 1-week bootcamp to create investor-proof projections, estimate your fundraising needs, and track the core KPIs for any kind of startup

"Slidebean understood a complex financial model with ease and helped us raise $425k"

Having the validation of our financial model, plus all the tips, was super cool. Slidebean opened up our minds a lot"

The session was informative. The financial model sheets available with the Slidebean account are a bit daunting on their own - having this walkthrough was great, as well as the practical applications of the data and ability to ask specific questions on modeling and different scenarios.

Get help from our team

We’ve built a monthly program that helps founders understand the logic behind financial modeling. This is not a one-off template but a collaborative, one-on-one process for you to learn the trade from our business analysts on how to model and project your financial data. Our goal is to empower founders like you to make better decisions about their budgets and ultimately help them reach their company goals.

Understanding financial modeling templates

Do you need a model template.

If there is one quintessential task a startup CEO needs to be in charge of, it is not letting the company run out of money. Being on top of your Financial Model and business budget can make a huge difference and allow managers and founders to make game-changing decisions. For example, about nine months ago a quick prediction in our financial model enabled us to make our company profitable while duplicating our marketing budget. Our spreadsheet is an evolution of a financial model template created by our investors at Carao Ventures. Over the years, we've simplified it to remove unnecessary modules and adapted it to serve the purposes of our SaaS business model. We’ll elaborate on the main features we used to make the model work in our favor- it should work for most companies. You can get it here .

What is a financial model?

Financial modeling calculates the impact of an event on a company’s future. We typically use a spreadsheet for these calculations and sum up several variables in a model to forecast the future performance of a business. The idea is for these docs to allow startup decisions based on strong and quantitative reasons.

Our Free Startup Financial Model Template

All financial models are spreadsheets, and our best suggestion is to go with Google Sheets, which will not only allow you to keep it in sync with other teammates but to automate certain tasks and data inputs based on your other spreadsheets in the cloud. A quick Google Search for 'Startup Financial Model Template' will reveal a few subscription tools that offer this service, but we encourage you to use a more 'universal' platform that will allow you to share it with anyone. All the formulas used in our model template were found with Google Searches and adapted to our needs.

Financial Model Sections:

Summary Spreadsheet: this is a custom page that you should build based on your most immediate needs. No formulas should be calculated here; this should just reflect important lines and results for your current company status: if you're running low on cash, this should be very focused on your bank statements. If you've just raised money using a great pitch deck, then this should be modified to look into your expansion budget. The Summary Spreadsheet also holds the Dashboard. A list of variables that you can comfortably adjust here, and measure their impact on the financials for the future.

FS-Month/FS-Annual: this is a standard Financial Statement sheet taking into account Income, Balance Sheet, and Cash Flow.

Revenue: this sheet should be adapted based on your Business Model. A SaaS product, for example, should have MRR and Churn as the core drivers/variables, while also accounting for estimated user cost of acquisition vs. monthly marketing budget.

SG&A: this is the main expenses sheet and the one you will want to update regularly based on your week-over-week spending.

COGS: there's a little debate over what should go here on an internet business. While COGS usually tracks the cost of production goods, we've started using it for services that are essential for our app to be live, including for example AWS and Intercom (one of the most important tools in our growth and customer success efforts).

WK+CAPEX: finally, this is where you manage physical assets and equipment. As a tech company, most of our CAPEX is on laptops and some office furniture, but we account for it nonetheless, along with its estimated depreciation.

GET THIS TEMPLATE

Getting the startup financial model to work for you.

We’ll begin by highlighting certain parts of the sheets to give you an idea of projections that you can eventually automate using our template. It's hard to fake such complex data, so some of the screenshots you’ll see here actually belong to our working model.

There's a very simple nomenclature:

Gray text: variables and manual inputs.

Blue text: formula results (avoid modifying).

Black text: historical/confirmed data.

Predictable Revenue:

Predictable Revenue is one of the reasons why I love SaaS businesses: once you have a good idea of your CAC and your Churn, you can pretty accurately estimate you much money you are going to be making in X amount of time or increasing your marketing budget by Y. These values are tracked in the Revenue Spreadsheet. In our model, we have a formula that takes into account the following variables:

- CAC: Cost of Acquisition.

- CAC Trend: as your budget grows, your CAC will tend to increase, and you should account for that in your model.

- Max/Min CAC: maximum and minimum Cost of Acquisition.

- Marketing Budget: The estimated marketing spend for a given month (this data is imported from the SG&A spreadsheet).

- Marketing Budget Scale: how much is the budget climbing month over month; this is usually a percentage increase.

- Churn Rate: expected cancellations every month.

Here's a sample of how that spreadsheet could look:

The idea on this spreadsheet is that you add actual data as you gather it. In this section, we have some historical data from 2015 that we've used as a starting example.

Note that most of this data is calculated automatically based on a few inputs (blue font = formulas/automatic data; gray font = variables/manual inputs).

In our particular case, we use ChartMogul to track our SaaS metrics, so we make a CSV export every month to make sure we update this data with the actual numbers.