The Student Loan Debt Crisis: A Narrative Review

- Published: 02 December 2023

- Volume 9 , pages 3–9, ( 2024 )

Cite this article

- April C. Bowie-Viverette ORCID: orcid.org/0000-0001-7269-8987 1 &

- Stephanie Saulnier ORCID: orcid.org/0000-0002-7556-9432 2

832 Accesses

6 Altmetric

Explore all metrics

Education is one undeniable pathway from poverty. Research has consistently shown the positive effects of higher education level on lifetime earnings. Financing to achieve this can lead to student loan debt, which has become a crisis affecting financial and health wellbeing among some borrowers and disparities in higher education access further exacerbated by the COVID-19 pandemic. Despite the fact that access to higher education has been deemed a right in Article 26 of the Universal Declaration of Human Rights, the student loan crisis threatens access for some. Lack of ratification of the document by the U.S. further pushes the need for critical discussion. Therefore, the purpose of this narrative review was to examine the state of the student loan debt crisis and raise implications for policy. WorldCat, SocINDEX, and Academic Search Complete databases were searched utilizing a combination of key words associated with college student loans and debt, economic justice. Findings showed student loan debt, repayment challenges, and inequities in higher education access remain widespread. There is a need for more social work–based empirical research on student loan debt and social work engagement that promotes critical conversations utilizing an economic justice perspective. Implications for social work practice, policy, and research are discussed.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Education loan repayment: a systematic literature review

Nothing to show for it: Financial Distress and Re-Enrollment Aspirations for those with non-degreed debt

Does Student Loan Debt Hinder Community Well-Being?

Alonso, J. (2023, May 10). Seeking payments for social work internships . Inside Higher Ed. https://www.insidehighered.com/news/students/careers/2023/05/10/seeking-payment-social-work-internships

Anong, S. T., & Henager, R. (2021). Student loans and health-related financial hardship. Journal of Student Financial Aid, 50 (2), 3. https://doi.org/10.55504/0884-9153.1715

Article Google Scholar

Belfield, C. R., & Bailey, T. (2011). The benefits of attending community college: A review of the evidence. Community College Review, 39 (1), 46–68. https://doi.org/10.1177/0091552110395575

Brooks, J. R., & Levitin, A. J. (2020). Redesigning education finance: How student loans outgrew the “debt” paradigm. Georgetown Law Journal, 109 (1), 5–80. https://ssrn.com/abstract=3550070

Google Scholar

Carnevale, A. P., Cheah, B., & Hanson, A. R. (2015). The economic value of college majors . Center on Education and the Workforce. https://cew.georgetown.edu/wp-content/uploads/The-Economic-Value-of-College-Majors-Full-Report-web-FINAL.pdf

Collins, B. & Dortch, C. (2022, August 4). The FAFSA Simplification Act. CRS Report R46909, Version 6. Updated. Department of Education Institute of Education Sciences. https://eric.ed.gov/?id=ED626268

Craig, J. D., & Raisanen, S. R. (2014). Institutional determinants of American undergraduate student debt. Journal of Higher Education Policy and Management, 36 (6), 661–673. https://doi.org/10.1080/1360080X.2014.957892

Duncan, L. (2021, August 17). News: College spending trends are out of control, families paying the price. American Council of Trustees and Alumni. https://www.goacta.org/news-item/news-college-spending-trends-are-out-of-control-families-paying-the-price/

Eichelberger, B., Heather, M., & Rachel, F. (2017). Uncovering barriers to financial capability: Underrepresented students’ access to financial resources. Journal of Student Financial Aid, 47 (3), 5. https://doi.org/10.55504/0884-9153.1634

Fan, X., & Sturman, M. (2019). Has higher education solved the problem? Examining the gender wage gap of recent college graduates entering the workplace. Compensation and Benefits Review, 51 (1), 5–12. https://doi.org/10.1177/0886368719856268

Federal Student Aid. (n.d.). COVID-19 emergency relief and student federal financial aid . https://studentaid.gov/announcements-events/covid-19

Flaherty, A., Haslett, C., & Jones II, A. (2023, July 1). Anger, defiance, fear over Supreme Court decision to block student loan forgiveness . ABC News. https://abcnews.go.com/Politics/anger-defiance-fear-supreme-court-decision-block-student/story?id=100496587

Flannery, M. E. (2022, October 25.) State funding for higher education still lagging . National Education Association. https://www.nea.org/advocating-for-change/new-from-nea/state-funding-higher-education-still-lagging

Fletcher, K. E., & Fuller, M. B. (2021). Does the house always win? An analysis to barriers of wealth building and college borrowing. Journal of Student Financial Aid, 50 (1), 1–20. https://doi.org/10.55504/0884-9153.1638

Gilchrist, H. R. (2018). Higher education is a human right. Washington University Global Studies Law Review, 17 (3), 645–676. https://openscholarship.wustl.edu/law_globalstudies/vol17/iss3/9

Grand Challenges for Social Work. (n.d.). Build financial capability and assets for all . https://grandchallengesforsocialwork.org/build-financial-capability-for-all/

Hanson, M. (2021, December 19). Student loan default data . Education Data Initiative. https://educationdata.org/student-loan-default-rate

Hanson, M. (2022). College tuition inflation rate . Education Data Initiative. https://educationdata.org/college-tuition-inflation-rate

Jackson, V., & Mustaffa, J. V. (2022). Student debt is harming the mental health of black borrowers . The Education Trust. https://files.eric.ed.gov/fulltext/ED622829.pdf

Jaschik, S. (2022, March 3). Education department clarifies rules on income share agreements . Inside Higher Ed. https://www.insidehighered.com/news/2022/03/04/education-department-clarifies-rules-income-share-agreements

Johnson, C. L., O’Neill, B., Worthy, S. L., Lown, J. M., & Bowen, C. F. (2016). What are student loan borrowers thinking? Insights from focus groups on college selection and student loan decision making. Journal of Financial Counseling and Planning, 27 (2), 184–198. https://doi.org/10.1891/1052-3073.27.2.184

Jones, J., & Schmitt, J. (2014). A college degree is not a guarantee . Center for Economic Policy Research. https://cepr.net/documents/black-coll-grads-2014-05.pdf

Kakar, V., Daniels, G. E., Jr., & Petrovska, O. (2019). Does student loan debt contribute to racial wealth gaps? A decomposition analysis. The Journal of Consumer Affairs, 53 (4), 1920–1947.

Kim, J., & Chatterjee, S. (2021). Financial debt and mental health of young adults. Journal of Financial Counseling and Planning, 32 (2). https://doi.org/10.1891/JFCP-18-00048

Kromydas, T. (2017). Rethinking higher education and its relationship with social inequalities: Past knowledge, present state, and future potential. Palgrave Communications, 3( 1). https://doi.org/10.1057/s41599-017-0001-8

Lambert, C. P., & Siegel, D. H. (2018). Social workers in higher education. Social Work Today , 18 (5), 16–19. https://www.socialworktoday.com/archive/SO18p16.shtml

Lee, T. (2022). Potential consequences of continued student loan forbearance, and blanket loan forgiveness . American Forum. https://www.americanactionforum.org/insight/potential-consequences-of-continued-student-loan-forbearance-and-blanket-loan-forgiveness/

Lin, J. T., Bumcrot, C., Ulicny, T., Lusardi, A., Mottola, G., Kieffer, C., & Walsh, G. (2016). Financial capability in the United States 2016 . FINRA Investor Education Foundation.

Lin, J. T., Bumcrot, C., Mottola, G., Valdes, O., Ganem, R., Kieffer, C., Lusardi, A., & Walsh, G. (2022). Financial capability in the United States: Highlights from the FINRA Foundation National Financial Capability Study (5th Edition) . FINRA Investor Education Foundation. www.FINRAFoundation.org/NFCSReport2021

Looney, A., & Yannells, C. (2015). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions, they attended contributed to rising loan defaults . Brookings. https://www.brookings.edu/wp-content/uploads/2015/09/LooneyTextFall15BPEA.pdf

MacNaughton, G., & McGill, M. (2012). Economic and social rights in the United States: Implementation without ratification. Northeastern University Law Journal, 4 (20), 365–406. https://ssrn.com/abstract=2054736

McCowan, T. (2012). Is there a universal right to higher education? British Journal of Educational Studies, 60 (2), 111–128. https://doi.org/10.1080/00071005.2011.648605

McLendon, M. K., & Hearn, J. C. (2013). The resurgent interest in performance-based funding for higher education. Academe, 99 (6), 25–30.

Mirzoyan, S. (2020). The impacts and outcomes of the Higher Education Act of 1965 fifty-five years later (Master’s Thesis) . Northridge: California State University. https://scholarworks.calstate.edu/downloads/bn9999317 . ScholarWorks.

Mitchell, M., Leachman, M., & Saenz, M. (2019). State higher education funding cuts have pushed costs to students, worsened inequality. Center on Budget & Policy Priorities. https://www.cbpp.org/research/state-budget-and-tax/state-higher-education-funding-cuts-have-pushed-costs-to-students

National Center for Education Statistics. (2022). Price of attending an undergraduate institution . Condition of Education. https://nces.ed.gov/programs/coe/indicator/cua

Soler, M. C. (2020). International evidence on income share agreements: Perceptions and characteristics of ISAs recipients . https://doi.org/10.2139/ssrn.3452929

Book Google Scholar

Strumbos, D., Linderman, D., & Hicks, C. C. (2018). Postsecondary pathways out of poverty: City University of New York accelerated study in associate programs and the case for national policy. Journal of the Social Sciences, 4 (3), 100–117. https://doi.org/10.7758/rsf.2018.4.3.06

Tan, E. (2014). Human capital theory: A holistic criticism. Review of Educational Research , 84 (3), 411–445. http://www.jstor.org/stable/24434243

The White House. (2023). Fact sheet: President Biden announces new actions to provide debt relief and support for student loan borrowers . https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/30/fact-sheet-president-biden-announces-new-actions-to-provide-debt-relief-and-support-for-student-loan-borrowers/

Ulbrich, T. R., & Kirk, L. M. (2017). It’s time to broaden the conversation about the student debt crisis beyond rising tuition costs. American Journal of Pharmaceutical Education, 81 (6), 101–101. https://doi.org/10.5688/ajpe816101

United Nations. (n.d.). Universal declaration of human rights . https://www.un.org/en/about-us/universal-declaration-of-human-rights

United States Government Accountability Office. (2023). Higher education: Department of Education should improve enforcement procedures regarding substantial misrepresentation by colleges. https://www.gao.gov/products/gao-23-104832

U.S. Department of Education. (2022a). Biden-Harris student debt relief plan explained . https://studentaid.gov/debt-relief-announcement

U.S. Department of Education (2022b). Education department announces permanent improvements to the public service loan forgiveness program and one-time payment count adjustment to bring borrowers closer to forgiveness . https://www.ed.gov/news/press-releases/education-department-announces-permanent-improvements-public-service-loan-forgiveness-program-and-one-time-payment-count-adjustment-bring-borrowers-closer-forgiveness

U.S. Department of Education. (2023). Release of revised student loan estimator . https://fsapartners.ed.gov/knowledge-center/library/electronic-announcements/2023-09-21/release-revised-federal-student-aid-estimator

U.S. Department of Education (n.d.). The Biden-Harris administration’s student debt relief plan explained . https://studentaid.gov/debt-relief-announcement

West, L., & Denten, B. (2022). Students with loans face financial barriers to degree completion. Pew Charitable Trust. https://www.pewtrusts.org/en/research-and-analysis/articles/2022/10/24/students-with-loans-face-financial-barriers-to-degree-completion

Williams, A. J., & Oumlil, B. (2015). College student financial capability: A framework for public policy, research, and managerial action for financial exclusion prevention. International Journal of Bank Marketing, 33 (5), 637–653. https://doi.org/10.1108/IJBM-06-2014-0081

Xiao, J. J., Porto, N., & McIvor M. I. (2019). Financial capability of student loan holders: Comparing college graduates, dropouts, and enrollees . SSRN. https://doi.org/10.2139/ssrn.3321898

Yoder, S. (2022). Twilight of income share agreements to pay for college . The Hechinger Report. https://hechingerreport.org/twilight-of-income-share-agreements-to-pay-for-college/

Zhan, M. (2020). Student loan debt and financial hardship among young adults. Social Development Issues , 42 (2). https://doi.org/10.3998/sdi.17872073.0042.203

Zimmerman, S. D. (2014). The returns to college admission for academically marginal students. Journal of Labor Economics, 32 (4), 711–754. https://doi.org/10.1086/676661

Download references

Author information

Authors and affiliations.

Katy, TX, USA

April C. Bowie-Viverette

Eastern Kentucky University, Richmond, KY, USA

Stephanie Saulnier

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to April C. Bowie-Viverette .

Ethics declarations

Ethics approval and consent to participate.

This is a narrative review. There are no human subjects involved in this study.

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Literature search

Rights and permissions.

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Bowie-Viverette, A.C., Saulnier, S. The Student Loan Debt Crisis: A Narrative Review. J. Hum. Rights Soc. Work 9 , 3–9 (2024). https://doi.org/10.1007/s41134-023-00281-0

Download citation

Accepted : 25 October 2023

Published : 02 December 2023

Issue Date : March 2024

DOI : https://doi.org/10.1007/s41134-023-00281-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Student loan debt crisis

- Human rights

- Narrative review

- Economic justice

- Find a journal

- Publish with us

- Track your research

Public Opinion and Policy Implications of Student Loan Debt Forgiveness in the U.S.

By nia holland 2024 w.e.b. du bois fellow.

1. Introduction and significance

After the Servicemen's Readjustment Act of 1944, or the GI Bill, was signed into law by President Franklin D. Roosevelt, the United States experienced a significant increase in college enrollment. The GI Bill was designed to aid veterans in their readjustment to civilian life by covering the costs to pursue further education at a college or university. In the decade following the bill's enactment, the number of degrees awarded by colleges and universities in the United States more than doubled, largely due to the opportunities the bill provided (National Archives, 2022). This surge in educational access set a precedent for higher education as a pathway to economic stability and social mobility.

Since that time, college enrollment has continued to rise, along with the associated costs of attendance. According to the National Center for Education Statistics, college enrollment peaked between 2010 and 2011, with approximately 18.1 million students enrolled across the United States. However, the cost of attending college has risen even more dramatically. Between 2010 and 2022, tuition rose an average of 12% per year, and since 1963, it has increased 749% on an inflation-adjusted basis (Hanson, 2023). This substantial [JS1] increase in tuition has outpaced income growth, making higher education increasingly unaffordable for many (Council on Foreign Relations, 2024).

The rising cost of education has necessitated large student loan debt for many students, especially those from marginalized communities, who often have less generational wealth and face greater financial barriers. Currently, U.S. borrowers collectively owe nearly two trillion dollars in student loan debt. Students from Black, Latino, and American Indian communities often take on more debt than their White counterparts and are more likely to default on their loans. This is significant because these students are often in greater need of the social mobility that higher education can provide. Yet, the burden of student debt can prevent them from fully benefiting from their education, perpetuating cycles of poverty and inequality [JS2] .

Given the history of higher education financing in the U.S. and the disparate impact of student loan debt, it is crucial to explore broader public opinion on this issue. Although education and student loan debt have long been central issues in American politics, polling suggests that the issue is sometimes overshadowed by other concerns. For example, a 2017 CNN poll found that 24% of respondents named health care as the most important issue facing the country, compared to just 2% naming education. However, more recent polling by Reuters in January 2024 found that nearly half of those surveyed indicated government efforts to lower student debt burdens would be at least somewhat important in determining their vote, with 3% identifying it as the most critical issue, suggesting that student loan debt and affordability of higher education remain salient issues in the current American political landscape.

This exploratory paper examines current public opinion on student loan debt relief in the United States and discusses implications for education policy and future research.

2. Discussion and future implications

Public opinion on education, including the accessibility of higher education and student loan debt, has been a focus of various market research and polling organizations for years. These polls are critical not only for understanding current viewpoints but also for predicting which issues may shape upcoming state and national elections. They provide a framework for politicians to address these concerns during their terms in office.

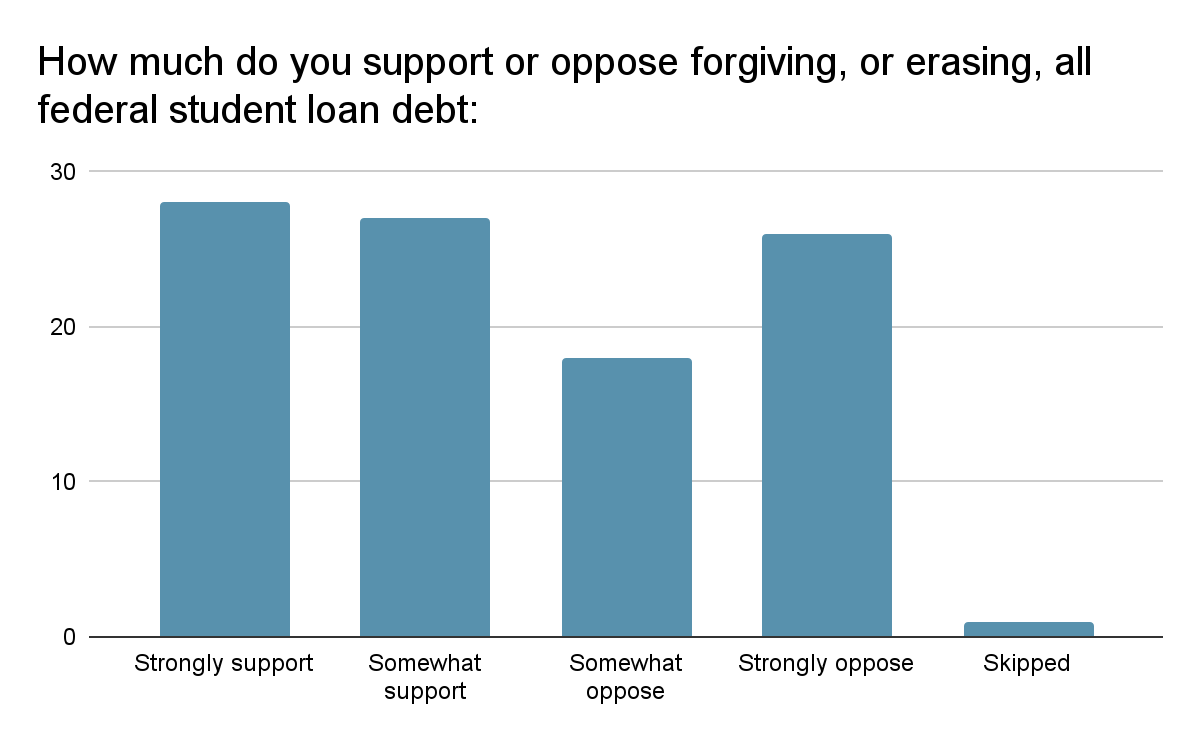

In a 2021 web-based poll sponsored by Axios, approximately 2,000 U.S. adults were asked about various social issues, including the cost and value of higher education. One survey question asked, “How much do you support or oppose the following policies regarding higher education?...Forgiving, or erasing, all federal student loan debt?”. Over 50% of respondents said they either “Strongly support” or “Somewhat support” the complete erasure of all federal student loan debt, compared to only 26% who indicated they “Strongly oppose” federal student loan debt forgiveness (see Figure 1).

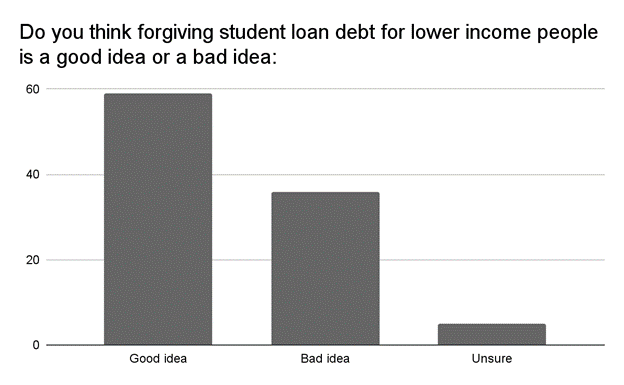

In a similar 2019 poll sponsored by NPR and PBS NewsHour, respondents were asked whether they believed forgiving student loan debt for lower-income individuals was a good or bad idea. The results were even more striking, with nearly 60% indicating it was a good idea, compared to only 36% who thought it was a bad idea (see Figure 2).

In both polls, support for federal student loan debt relief was significantly higher among Democrats than among Republicans or Independents. For example, 45% of Democratic respondents said they “strongly support” forgiving or erasing all federal student loan debt, compared to only 12% of Republican respondents. Regarding debt forgiveness for lower-income individuals, 85% of Democratic respondents supported the idea, compared to only 32% of Republican respondents.

3. Discussion and future implications

This exploratory analysis provides important insight into current public opinion regarding federal student loan debt forgiveness, suggesting that many Americans support some form of debt relief in response to the student debt crisis. Given the rapidly increasing cost of college and the resulting rise in student loan debt, this issue remains highly pertinent to public opinion and public policy.

Future research should explore other demographic factors, such as race and age, that may influence public opinion on student loan debt relief, as well as how these factors affect voting behavior. Additionally, a comparative politics approach could provide valuable insights into why and how the United States' approach to higher education policy and funding differs so significantly from other wealthy nations. Understanding these differences may be key to developing more equitable and effective education policies in the United States.

Axios. (2021). Axios/Ipsos Hard Truths Higher Education Poll: August 2021 (Version 2) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31118577 Cable News Network (CNN). (2017). CNN Poll: August 2017 - Poll 7 (Version 3) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31114428 Council on Foreign Relations. (2023). U.S. student loan debt: Trends and economic impact . https://www.cfr.org/backgrounder/us-student-loan-debt-trends-economic-impact Hanson, Melanie. “College Tuition Inflation Rate” EducationData.org, August 13, 2023, https://educationdata.org/college-tuition-inflation-rate Looney, A., & Yannelis, C. (2015, September 15). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attended contributed to rising loan defaults . Brookings. https://www.brookings.edu/articles/a-crisis-in-student-loans-how-changes-in-the-characteristics-of-borrowers-and-in-the-institutions-they-attended-contributed-to-rising-loan-defaults/ National Archives. (2022, May 3). Servicemen's Readjustment Act (1944) . https://www.archives.gov/milestone-documents/servicemens-readjustment-act NPR/PBS NewsHour. (2019). NPR/PBS NewsHour/Marist Poll: December 2019 (Version 2) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31116969 Reuters. (2024). Reuters/Ipsos Large Sample Survey 1: January 2024 (Version 2) [Dataset]. Roper Center for Public Opinion Research. doi:10.25940/ROPER-31120717 U.S. Department of Education. (2023, July 18). Biden-Harris administration releases first set of draft rules to provide debt relief for millions of borrowers . https://www.ed.gov/news/press-releases/biden-harris-administration-releases-first-set-draft-rules-provide-debt-relief-millions-borrowers U.S. Department of Veterans Affairs. (2024, July 17). Post-9/11 GI Bill (Chapter 33) payment rates for 2022-2023 . U.S. Department of Veterans Affairs. https://www.va.gov/education/about-gi-bill-benefits/post-9-11/#:~:text=What%20benefits%20can%20I%20get,update%20those%20rates%20each%20year

Join Our Newsletter

Sign up for the Data Dive newsletter with quarterly news, data stories and more. Read our updated privacy policy here.

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Student Loans

First-generation college graduates lag behind their peers on key economic outcomes.

College graduates without a college-educated parent have lower incomes and less wealth, on average, than those with a parent who has a bachelor’s or higher degree.

The Changing Profile of Student Borrowers

In 2012, a record 69% of the nation’s new college graduates had taken out student loans to finance their education. Graduates from more affluent families are much more likely to borrow today than 20 years ago.

By many measures, more borrowers struggling with student-loan payments

More people are having trouble keeping up with their student-loan payments than in years past, several studies show.

5 key findings about student debt

A record 37% of young households had outstanding student loans in 2010 and a median student debt of $13,000.

Young Adults, Student Debt and Economic Well-Being

Student debt burdens are weighing on the economic fortunes of today’s young adults. Among the college-educated, those with outstanding student debt are lagging far behind those who are debt free in terms of household wealth.

Fed report says household borrowing is rebounding from Great Recession

Outstanding household debt increased $241 billion during last October-December, the biggest quarterly jump since 2007.

Chart of the Week: How Americans pay for college

U.S. families are relying less on their own resources and more on outside sources (scholarships, loans and the like) to pay for college.

Households owing student loan debts at record levels

About one out of five of the nation’s households owed student debt in 2010, more than double the share two decades earlier.

In time for graduation season, a look at student debt

College is a pretty pricey proposition, even after grants and scholarships are factored in. And the millions of students graduating this spring will soon learn just how expensive their degrees were when they start getting student-loan bills. As a Pew Research Center analysis noted last year, nearly one in five U.S. households (19%) owed money […]

Record Levels of Student Loan Debt Hit Younger Households Hard

A record 40% of all households headed by someone younger than age 35 owe money on their student loans, by far the highest share among any age group

REFINE YOUR SELECTION

Research teams.

901 E St. NW, Suite 300 Washington, DC 20004 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan, nonadvocacy fact tank that informs the public about the issues, attitudes and trends shaping the world. It does not take policy positions. The Center conducts public opinion polling, demographic research, computational social science research and other data-driven research. Pew Research Center is a subsidiary of The Pew Charitable Trusts , its primary funder.

© 2024 Pew Research Center

Notifications

- About the Levy Economics Institute

- Board of Governors

- Board of Advisors

- Staff Directory

- Employment at the Levy Institute

- Visit the Levy Institute

- Research Programs:

- The State of the US and World Economies

- Monetary Policy and Financial Structure

- The Distribution of Income and Wealth

- • Levy Institute Measure of Economic Well-Being

- • Levy Institute Measure of Time and Income Poverty

- Gender Equality and the Economy

- Employment Policy and Labor Markets

- Immigration, Ethnicity, and Social Structure

- Economic Policy for the 21st Century

- • Federal Budget Policy

- • Explorations in Theory and Empirical Analysis

- • INET–Levy Institute Project

- Equality of Educational Opportunity in the 21st Century

- Special Projects:

- Ford-Levy Institute Project

- Levy Institute M.S. in Economic Theory and Policy

- Greek Labor Institute Partnership

- Minsky Archive

- Multiplier Effect

- Levy Institute M.S. in Economic Policy and Theory

- Economics Program at Bard

- Bard Program in Economics and Finance

- Greek Labour Institute Partnership

- Economists for Peace and Security

- Economists for Full Employment

- Current Research Topics:

- Greek economic crisis

- Labor force participation

- Income inequality

- Employment policy

- Job guarantee

- Climate Change and Economic Policy

- Financial instability

- Stock-flow consistent (SFC) modeling

- Time deficits

- Fiscal austerity

- Research Project Reports

- Strategic Analysis

- Public Policy Briefs

- Policy Notes

- Working Papers

- LIMEW Reports

- e-pamphlets

- Book Series

- Conference Proceedings

- Biennial Reports

- Public Policy Brief Highlights

- In Translation Δημοσιεύσεις στα Ελληνικά

- Press Releases

- In the Media

- Request an Interview

- Sign Up for eNews

- Ford-Levy Institute Projects

- Στα Ελληνικά

- Graduate Programs in Economic Theory and Policy

- Publications

The Macroeconomic Effects of Student Debt Cancellation

Related Publications

- Inequality Update: Who Gains When Income Grows? Policy Note 2017/1 April 2017

- Debt Relief and the Fed's Money-creation Power Policy Note 2013/7 August 2013

Publication Highlight

Scope and effects of reducing time deficits via intrahousehold redistribution of household production, evidence from sub-saharan africa, quick search.

From the Press Room

IMAGES

COMMENTS

While some countries have only recently introduced student loan programs, many American students have relied on student loans to nance college for decades. Still, the rising returns and costs of education, coupled with increased labor market uncertainty, have generated new interest in the e cient design of government student loan programs.

For people across the United States, student loan debt is a growing portion of the household balance sheet. More than 40 million Americans have . outstanding student loan balances. 1. In 2019, the total amount of student debt owed surpassed $1.5 trillion, now the largest source of non-mortgage debt. 2. The burden of student loan debt is causing ...

Understanding student loan borrowers' repayment behav-iors and borrowing satisfaction is a critical yet challeng-ing issue. A study of student loan borrowers' mental health revealed that having student loans is negatively associated with psychological function (Walsemann et al., 2015). Specifically, among all borrowers, those who completed two

Education is one undeniable pathway from poverty. Research has consistently shown the positive effects of higher education level on lifetime earnings. Financing to achieve this can lead to student loan debt, which has become a crisis affecting financial and health wellbeing among some borrowers and disparities in higher education access further exacerbated by the COVID-19 pandemic. Despite the ...

According to a recent report from the Federal Reserve, the national student debt amount in the third quarter of 2023 was over $1.7 trillion spread across over 43 million borrowers (Board of Governors of the Federal Reserve System, 2023).At the same time, roughly four million student loans enter default each year—affecting millions of borrowers and their families (Hanson 2023).

This research paper surveys the literature on the impacts of federal student loans in the United States at different life stages, from college enrollment to debt repayment. ... While research on student loans spans the international context with studies in Chile (Solis, 2017; Card and Solis, 2022), Sweden (Joensen and Mattana, 2021), and others ...

The ordered probit results in Column 1 Table 4 for the student-borrower subsample indicate that student-borrowers report higher levels of financial stress when they hold increasingly higher student loan debt amounts; log odds increase from 0.137 among students who borrow $10,000-19,999 to 0.424 among those who borrow $60,000 or more compared ...

Student loan debt is unprecedented and rising in many democracies (Antonucci 2016; Goldrick-Rab 2016; Callender & Mason 2017). ... the paper points to potential avenues for future research about student debt and wellbeing by considering indicative comments made by New Zealand university students as part of a series of in-depth interviews ...

A growing body of research suggests that student loan aid can increase undergraduate students' attainment and earnings.1 At ... Several papers document a negative relationship between student loan debt and other life-cycle outcomes, such as graduate school enrollment (Chakrabarti et al.2022), homeownership (Mezza et al.2020), job match ...

Research; Working Papers; Student Loans and Repayment: Theory,… Student Loans and Repayment: Theory, Evidence and Policy. Lance Lochner & Alexander Monge-Naranjo. Share. X LinkedIn Email. Working Paper 20849 DOI 10.3386/w20849 Issue Date January 2015. Rising costs of and returns to college have led to sizeable increases in the demand for ...

We evaluate the effects of the 2020 student debt moratorium that paused payments for student loan borrowers. Using administrative credit panel data, we show that the payment pause led to a sharp drop in student loan payments and delinquencies for borrowers subject to the debt moratorium, as well as an increase in credit scores.

This exploratory paper examines current public opinion on student loan debt relief in the United States and discusses implications for education policy and future research. 2. Discussion and future implications ... Future research should explore other demographic factors, such as race and age, that may influence public opinion on student loan ...

other hand feel overburdened with the cost of paying back their loans. This paper also provides a foundation for future research and identifies public policy shortcomings and suggests solutions. Keywords: student ... student loan debt has grown 60% in the last ten years and is forecast to grow to $2 trillion by 2021 (Byrne, 2018). ...

Indebted college graduates have lower net worth, less home equity, and compromised ability to accumulate assets, as compared to their peers with the same level of education but no student debt. They may also experience poorer educational outcomes, with independent effects on earning power and, then, later wealth accumulation.

This paper primarily joins a literature within household finance on student loans. This pa-per presents a simple framework for computing the present value of student loans, and uses it to present new results on the progressivity of loan forgiveness options. Amromin and Eberly

largest loan program, accounting for 75 percent of student-loan volume (labeled as unsubsidized 7 Total fall enrollment (undergraduate and graduate) rose from 15.9 to 21.0 million between 2001

A record 37% of young households had outstanding student loans in 2010 and a median student debt of $13,000. report May 14, 2014 Young Adults, Student Debt and Economic Well-Being

Socioeconomic backgrounds and borrowing through student loans. Although human capital theory is a common framework for understanding the impact of financial aid (Goldrick-Rab, Harris, and Trostel Citation 2009), two sociological theories relating to educational inequality, among others, provide important insight into borrowing behaviour.First, rational choice theory inherits the idea from ...

The report, by Scott Fullwiler, Research Associate Stephanie Kelton, Catherine Ruetschlin, and Marshall Steinbaum analyzes households' mounting reliance on debt to finance higher education, including the distributive implications of student debt and debt cancellation; describes the financial mechanics required to carry out the cancellation of debt held by the Department of Education (which ...

on student enrollment and degree attainment.Dynarski and Scott-Clayton(2013) present a broad overview of research on ˙nancial aid programs. 2For clarity throughout this paper, we refer to institutions that grant bachelor's degrees as "universities" and institutions that

This paper examines the history student loan debt crisis, examines the two propose solutions mentioned above, and does offers an analysis of them. iii ... A Snapshot of Student Loan Debt, Congressional Research Service, March 23, 2015. 5 David P. Smole, A Snapshot of Student Loan Debt, Congressional Research Service, ...