106+ Market Research Statistics: Market Size, Trends & Growth

Dive into the power of market research statistics, your compass in a dynamic business world. Learn how data-driven insights transform challenges into opportunities, guiding your path to resilience and growth.

Top Stats At A Glance

- The global market research industry generates more than $118 billion in annual revenue. 1

- Pharmaceutical companies account for 16.6% of global market research spending . 1

- 89% of market research suppliers and clients regularly use online surveys. 2

- 23% of organizations don’t have a clear market research strategy. 3

- 71% of market researchers are investing in CX software. 3

In the fast-paced realm of business, where change is constant and competition is fierce, market research statistics serve as the guiding stars for successful enterprises.

These statistics are the pulse of consumer behavior, industry trends, and strategic opportunities, providing businesses with the insights needed to navigate complexities and make informed decisions. This article explores the pivotal role of market research statistics in today's dynamic landscape.

Do you know? 👇🏻

What market share does the United States hold for market research?

The United States has a 53% market share in the market research industry.

From decoding consumer preferences to staying ahead of competitors, we'll uncover how leveraging statistical data can be a game-changer for businesses aiming not just to survive but to thrive in the modern marketplace. Join us as we unravel the transformative potential of data-driven decision-making.

General Market Research Industry Statistics 💨

Market research trends 📈, market research approaches 📝, wrapping up 🎁.

This section delves into the overarching trends, shifts, and dynamics that shape the global market research industry. Beyond the numbers, it unravels the intricate tapestry of challenges, successes, and the pivotal role market research plays in guiding business decisions.

- The global market research industry boasts an annual revenue exceeding $118 billion , with the United States alone contributing $62.64 billion to this total. 1

- Demonstrating a remarkable upward trajectory, global market research revenue has surged by 358% since 2009. 1

- Nielsen, securing its position as the leading market research company for the 6th consecutive year, reported $5.24 billion in revenue. 1

- Following closely, IQVIA secured a strong position as a top performer with $5.21 billion in revenue. 1

- Gartner demonstrated impressive financial performance, reporting $4.73 billion in revenue. 1

- SalesForce performed well, achieving a revenue of $3.9 billion . 1

- Adobe Systems also stood out as a top performer, with reported revenue of $3.87 billion . 1

- The United States dominates the market research industry with a substantial 53% market share, leaving the United Kingdom as its closest competitor with a 9% market share. 1

- Notable global market shares include China ( 3% ), India ( 2% ), and Australia ( 2% ), while the rest of the world collectively contributes 31% to the overall market. 1

- A significant portion, 20% of global market research spending , is allocated to CRM and customer satisfaction surveys. 1

- The majority, over 70% , of market research spending focuses on five key areas. 1

- The largest portion, 20.7% , is allocated to CRM and customer satisfaction surveys.

- User experience surveys account for 14.2% of market research spending .

- Audience research is a significant focus, representing 13.4% of the total spending .

- Usage and behavioral studies contribute significantly, comprising 11.7% of market research spending .

- Market measurement is also a priority, accounting for 11.6% of the overall spending .

Key Areas Of Market Research Spending

- Pharmaceutical companies take the lead, accounting for 16.6% of global market research spending . 1

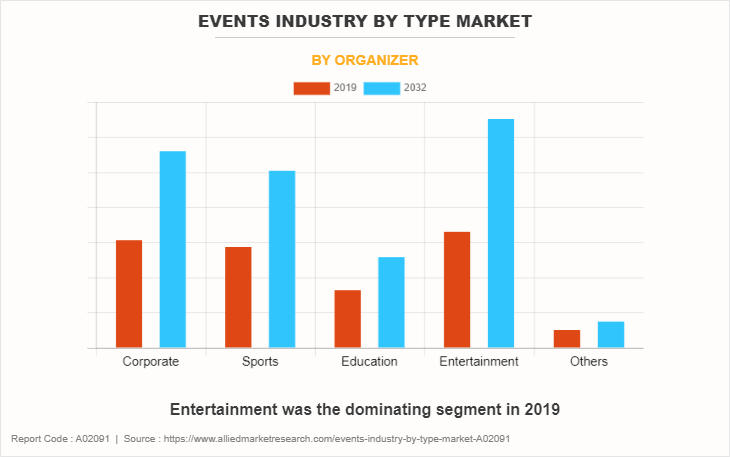

- The primary contributors to market research spending are pharmaceutical companies ( 16.6% ), media and entertainment groups ( 15.5% ), and consumer goods producers ( 14.9% ). 1

- Other contributors include research institutes ( 1.8% ), tourism and recreation ( 1.6% ), and non-profit organizations ( 0.9% ). 1

In the realm of market research

70% of buyers prioritize business knowledge as a top skill for development, a sentiment shared by 56% of suppliers.

- Despite the industry's dynamism, 23% of organizations lack a clear market research strategy, and 26% of market researchers identify budget constraints as a hindrance to their strategies. 3

What is the global annual revenue of the market research industry, and how has it evolved over the years?

The global market research industry generates over $118 billion in annual revenue, reflecting a remarkable 358% increase since 2009.

Which country holds the largest market share in the market research industry, and what is the significance of its dominance?

The United States commands a substantial 53% market share in the market research industry, surpassing its closest competitor, the United Kingdom, which holds a 9% market share .

How is market research spending allocated across different sectors, and what are the key areas that attract the majority of investment?

Over 70% of all market research spending is directed towards five key areas: CRM and customer satisfaction surveys ( 20.7% ), user experience surveys ( 14.2% ), audience research ( 13.4% ), usage and behavioral studies ( 11.7% ), and market measurement ( 11.6% ).

Embarking on an exploration of Market Research Trends opens a window into the ever-evolving landscape where insights are gleaned and strategies are honed. In this section, we delve into the dynamic shifts that shape the methodologies and approaches within the market research sphere.

A substantial 90% of market researchers express regular utilization of online surveys. 4

- Industry experts predict a steady annual growth of 16% in the popularity of the online survey market until 2026. 4

- In contrast, only 60% of market researchers report regular use of mobile surveys. 4

- A significant 80% of market researchers express interest in acquiring best practice solutions for multicultural insights, research, and strategy. 5

of market researchers indicating increased usage of online/video focus groups compared to three years ago.

- Moreover, 90% are utilizing consumers' online video submissions and in-depth video interviews more frequently than in the past three years. 6

- A noteworthy shift is observed, with over half of market researchers estimating a decrease in their reliance on full-service research vendors. 7

- The inclination toward Do-It-Yourself (DIY) tools is prominent, as 70% of market researchers express a likelihood of transitioning to more DIY tools in the coming year. 7

- Despite a continued demand for market research, 56% of companies grapple with limited or shrinking budgets. 7

- The industry undergoes transformation as 60% of market researchers acknowledge that automation accelerates result delivery. 8

- Cost reduction benefits are reported by 50% of market researchers as a direct outcome of automation integration. 8

- A strong consensus of 80% of market researchers predicts the continued growth of automation as a prominent trend in the industry. 8

How prevalent are online surveys in current market research practices, and what is the projected growth of the online survey market?

Online surveys are extensively utilized, with nearly 90% of market researchers reporting regular use. The online survey market is expected to experience a robust 16% annual growth through 2026.

What level of interest exists among market researchers regarding multicultural insights, and how is this reflected in current industry trends?

A significant 80% of market researchers express interest in learning best practice solutions for multicultural insights, research, and strategy, indicating a growing focus on diverse perspectives within the industry.

How is the industry responding to the trend of increasing automation in market research, and what benefits do market researchers associate with this shift?

Automation is reshaping market research, with 60% of researchers leveraging it to deliver results faster, 50% experiencing cost reduction benefits, and an overwhelming 80% foreseeing continued growth in this transformative trend.

As technology evolves, so do the tools at the disposal of market researchers, and this journey through approaches illuminates the varied paths they navigate in the pursuit of comprehensive understanding.

- A significant 89% of both market research suppliers and clients regularly employ online surveys in their methodologies. 2

- Mobile surveys emerge as a widely adopted approach, with 60% of both clients and suppliers incorporating them into regular use. 2

- Proprietary panels gain prominence, with 45% of clients and suppliers reporting regular utilization of this market research approach. 2

- Online communities play a significant role, with 31% of clients and suppliers regularly employing them as part of their market research strategies. 2

- Online in-depth interviews conducted via webcam are a prevalent choice, with 41% of both clients and suppliers routinely employing this method.

- Online focus groups conducted through webcam interactions are widely used, with 40% of clients and suppliers regularly engaging in this qualitative market research approach.

- Online communities play a significant role, with 35% of clients and suppliers routinely utilizing them for qualitative market research.

- Telephone in-depth interviews constitute a notable approach, with 31% of both clients and suppliers incorporating them into their qualitative research strategies.

- In-person focus groups remain relevant, with 31% of clients and suppliers regularly opting for this traditional qualitative research method.

Utilization Of Qualitative Market Research Approaches

- The emergence of mobile-first surveys is noteworthy, with 64% already incorporating this technology, and an additional 13% considering its adoption in the near future. 2

- Customer surveys exhibit a 33% average response rate, with in-person surveys leading with the highest response rates at 57% . Conversely, in-app surveys perform less favorably with just a 13% response rate. 9

- A substantial 56.6% of global survey responses originate from mobile devices, surpassing the 40.2% from non-mobile users. 9

- Post the peak in May 2020, less than 2% of contemporary surveys make mention of the COVID-19 pandemic. 8

- A significant 71% of market researchers are investing in Customer Experience (CX) software, with other top investment areas including online consumer panels ( 69% ), market research online communities ( 63% ), and product testing software ( 62% ). 3

What is the prevalence of online surveys in market research, and how do they compare to other approaches?

Online surveys dominate market research approaches, with 89% of both suppliers and clients regularly utilizing them. Additional noteworthy approaches include mobile surveys ( 60% ), proprietary panels ( 45% ), and online communities ( 31% ).

How do different survey types vary in terms of response rates, and what are the preferred methods among respondents?

In-person surveys exhibit the highest response rates at 57% , outperforming other types such as mail surveys ( 50% ), email surveys ( 30% ), online surveys ( 29% ), and telephone surveys ( 18% ). In-app surveys have the lowest response rate at 13% .

What emerging trends are shaping market research, and how are researchers adapting to technological advancements?

A notable trend is the rise of mobile-first surveys, with 64% already incorporating this technology. Additionally, 56.6% of global survey responses come from mobile devices. Beyond survey methods, 71% of market researchers are investing in Customer Experience (CX) software, indicative of the industry's embrace of technological advancements.

In the dynamic world of market research statistics, the prevalence of online surveys, the rise of mobile-first approaches, and strategic investments in Customer Experience (CX) software paint a picture of an industry navigating consumer trends and technological shifts.

These numbers aren't just data; they signify an adaptable industry shaping the strategies of the future. As we wrap up this exploration, market research stands as a powerful tool, continuously innovating in the ever-evolving landscape of business decision-making.

- Market Research Services Global Market Report by Globenewswire

- BUSINESS & INNOVATION by Greenbook

- Market Research Trends by Qualtrics

- Market Research Industry by Statista

- A Diversity Tool for Market Research and Insights Professionals by Medium

- Market Research Transcription Services by Verbit

- Market Research Survival Guide by Surveymonkey

- Marketing Research And Automation Can Co-Exist by Quirks

- What’s The Average Survey Response Rate? by Pointerpro

Subscribe to our newsletter

Subscribe to be notified of new content on marketsplash..

Find Keyword Ideas in Seconds

Boost SEO results with powerful keyword research

19 Key Market Research Statistics

Written by Backlinko Team In collaboration with Semrush

Market research is a growing multi-billion-dollar industry.

Brands leverage market research insights to introduce customer-focused offerings and improve their experiences.

From mobile-first surveys to social media analytics, researchers have access to a growing toolkit helping companies make data-driven business decisions.

Here’s a breakdown of what you’ll find on this page:

- Market Research Industry Statistics

- Market Research Methods Statistics

- AI in Market Research Statistics

Market Research Statistics (Highlights)

- The global market research industry is forecasted to bring in $140 billion in revenue in 2024.

- Online/mobile quantitative research services accounted for 35% of worldwide revenues of market research companies.

- Around 47% of researchers worldwide state that they use AI regularly in their market research activities.

- Online surveys rank as the most used quantitative method among market research professionals with 85% of respondents who say they use this method regularly.

- Online in-depth interviews with webcams rank as the most used qualitative research method, with over one-third ( 34% ) of researchers using it regularly.

1. Market Research Industry Statistics

This section presents key statistics to show market research industry revenues, leading players in the industry and revenue breakdown by market research services.

- Between 2021 and 2024, the market research industry grew by 37.25% from $102 billion to $140 billion – ESOMAR

2. Market Research Methods Statistics

There’s a growing number of market research methods from traditional surveys to eye tracking available to market research professionals. In this section, we’ll cover recent stats on most used market research methods.

- More than 6-in-10 (62%) researchers say that their “company depends on their research and insights significantly” – Qualtrics

- A majority of researchers have reported an increase in their budgets allocated for customer experience (CX) research (53%), consumer trends (52%), UX research (51%), qualitative research (51%) and brand strategy (50%) – Qualtrics

3. AI in Market Research Statistics

AI is disrupting nearly every industry and job function. Market research is no exception and there are various AI use cases to apply in the everyday work of market researchers. We’ll explore the latest stats on AI adoption rate among market researchers in this section.

- The vast majority (73%) of researchers worldwide claim they’re “very confident” or “extremely confident” on how to apply AI to their market research activities – Qualtrics

- Around 1-in-4 researchers state they’re concerned about AI impact outpacing their personal or team skills – Qualtrics

That’s it for my list of market research statistics.

While market research has been around for a while, it has been undergoing constant transformation. It will be interesting to see how AI impacts market research projects.

We update this list of statistics from time to time so feel free to check it later for new insights.

- Media Center

- E-Books & White Papers

- Knowledge Center

Key Facts About the Market Research Industry

by Sarah Schmidt , on October 10, 2022

In this data-driven blog post, we’ll take a look at key statistics and expert analysis from a variety of new reports covering the global market research industry. Read on to gain a quick overview of the industry’s performance and important new trends to watch.

Market Sizing and Forecast

The global market research services market increased from $69.6 billion in 2016 to $76.37 billion in 2021 at a compound annual growth rate (CAGR) of 1.87 percent, according to a recent report by The Business Research Company .

An even higher growth rate is expected in the future. The global market research services market is forecast to grow from $76.37 billion in 2021 to $108.57 billion in 2026 at a CAGR of 7.29 percent.

The Role of Market Research

Companies in this industry gather, analyze, and present marketing and public opinion data. They conduct qualitative and quantitative research on behalf of clients to identify the needs and preferences of specific demographics or consumer groups. These insights can help companies customize their products, services, and marketing efforts to fit the intended target market.

In addition, the market intelligence that research firms provide can help clients make broad strategic decisions such as how to expand business operations, enter new markets, or establish distribution channels effectively.

Top Market Research Companies

Leading market research companies identified by First Research, Inc , include:

- Forrester Research

Key Market Drivers

Demand for market research services is driven by the strength of the economy and corporate profits. When profit margins rise, corporations seek out the help of market research companies to identify avenues for growth and improve their product and service offerings.

The U.S. Market Research Industry

From 2014 to 2019, the U.S. market research industry grew at a strong pace, propelled by increasing expenditures on research and development and internet advertising, according to a report by IBISWorld . Acquisitions were widespread among leading industry players, and large advertising firms also acquired market research companies to expand their portfolio of services.

As noted by First Research, the U.S. market research industry is known to be concentrated. The top 50 companies generate about 60% of industry revenue. “Large companies have advantages in providing a variety of research and ancillary services to large customers, and in achieving economies of scale in marketing and computerized operations,” according to First Research. “Small companies can compete successfully by specializing in a research methodology or in emerging niche knowledge areas.”

U.S. Revenue Forecast to 2029

The U.S. industry for business intelligence, market research, and opinion polling is expected to reach $24.96 billion by 2029. For complete benchmarking of the industry and its top companies, see a 58-page report published by Plunkett Research in September 2022 .

Market Research Trends to Watch

The rising use of the internet among consumers and advertisers created an opening for new market research companies to enter the market and prompted some established firms to adopt more innovative methods.

In the future, increasingly complex data analysis and changing consumption activity is expected to drive the demand for consumer market research, but some headwinds remain.

“Instituted interest rate hikes and increases in commodity prices are projected to put slight downward pressure on corporate profit growth, which typically has a relatively direct downstream impact on advertising and R&D expenditure,” according to IBISWorld.

However, the uncertainty created by supply chain and inflation pressures will also drive a continued need for “greater granularity” in market data, according to Freedonia Custom Research , as clients refine datasets and assumptions “that may have changed over the last 18-24 months that were fairly consistent in the past.”

Where to Find Out More

Whether you are interested in media buying agencies, public opinion polling, or statistical services, MarketResearch.com offers a variety of reports covering different market segments and geographical areas. Search our website to find out more.

To keep up with the latest industry trends, subscribe to the MarketResearch.com blog .

About the Author : Sarah Schmidt is a Managing Editor at MarketResearch.com, a leading provider of global market intelligence products and services.

About This Blog

Our goal is to help you better understand your customer, market, and competition in order to help drive your business growth.

Popular Posts

- A CEO’s Perspective on Harnessing AI for Market Research Excellence

- 7 Key Advantages of Outsourcing Market Research Services

- How to Use Market Research for Onboarding and Training Employees

- 10 Global Industries That Will Boom in the Next 5 Years

- Primary Data vs. Secondary Data: Market Research Methods

Recent Posts

Posts by topic.

- Industry Insights (826)

- Market Research Strategy (272)

- Food & Beverage (134)

- Healthcare (125)

- The Freedonia Group (121)

- How To's (108)

- Market Research Provider (89)

- Manufacturing & Construction (81)

- Pharmaceuticals (79)

- Packaged Facts (78)

- Telecommunications & Wireless (70)

- Heavy Industry (69)

- Marketing (58)

- Profound (56)

- Retail (56)

- Software & Enterprise Computing (54)

- Transportation & Shipping (54)

- House & Home (50)

- Materials & Chemicals (47)

- Medical Devices (46)

- Consumer Electronics (45)

- Energy & Resources (42)

- Public Sector (40)

- Biotechnology (37)

- Demographics (37)

- Business Services & Administration (36)

- Education (36)

- Custom Market Research (35)

- Diagnostics (34)

- Academic (33)

- Travel & Leisure (33)

- E-commerce & IT Outsourcing (32)

- Financial Services (29)

- Computer Hardware & Networking (26)

- Simba Information (24)

- Kalorama Information (21)

- Knowledge Centers (19)

- Apparel (18)

- Cosmetics & Personal Care (17)

- Social Media (16)

- Advertising (14)

- Big Data (14)

- Market Research Subscription (14)

- Holiday (11)

- Emerging Markets (8)

- Associations (1)

- Religion (1)

MarketResearch.com 6116 Executive Blvd Suite 550 Rockville, MD 20852 800.298.5699 (U.S.) +1.240.747.3093 (International) [email protected]

From Our Blog

Subscribe to blog, connect with us.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Audience

Market Research Industry: Current Stats and Future Trends

The market research industry has grown steadily over the last five years. But innovations could rapidly increase potential market research revenue in the research industry in the future. What should companies in this Industry expect in the years to come? Here are a few market research stats and trends.

Here, we’ll look at key market research stats and trends from various new reports covering the market research industry. Read on to gain a quick overview of the Industry’s performance and important new trends to watch.

What is the market research industry?

The market research industry is a sector that focuses on gathering, analyzing, and interpreting data about markets, consumers, competitors, and various business-related trends.

Its primary goal is to provide valuable insights and information to businesses, organizations, and governments to make informed decisions about their products, services, marketing strategies, and overall business operations.

The global market research industry plays a crucial role in helping businesses understand their target audience, identify market opportunities, evaluate the potential demand for products or market analysis services, and assess the competitive landscape. It involves collecting and analyzing both qualitative and quantitative data to understand consumer behavior, preferences, attitudes, market trends, and dynamics.

The key drivers of market research demand

Companies that provide market research services help their clients gather and interpret information about individuals or organizations, with the insights (market size, competition, market need, consumer behavior, etc) leveraged to shape strategies and marketing/sales activities.

Also, studies like the 2018 Global Brand Health Report , where tech workers reveal the companies they want to work for and what they value in a job offer, are studies that are important to industries.

To arrive at their findings and infer insights, market researchers use a range of qualitative techniques such as in-depth interviews, focus groups, and ethnography, as well as quantitative techniques such as customer surveys, analysis of secondary data, and statistical/ analytical research methods. Here are the key drivers of market research demand:

- Speed: Researchers need results fast, and with faster results, one sees more evidence-based decision-making.

- Cost: Costs have always been an issue. Making decisions based on accurate research studies helps eliminate unnecessary costs.

- Quality: Quality is particularly important in market research when the current offering is not good enough.

SELECT YOUR RESPONDENTS

North America Dominates

- The market research stats and trends favor the U.S.

- According to a recent report by First Research Inc. , the market research industry globally produces $45 billion in revenue each year.

- Europe and the United States lead the industry overall. Other countries such as China, Brazil, Russia, and India are experiencing increasing demand for market research-related statistical services.

How is the industry performing in the U.S.?

The Market Research industry in the U.S. has undergone strong growth over the five years. They conduct qualitative and quantitative research on behalf of customers to determine the needs and choices of specific demographics or consumer groups.

This has been supported by the increase in research and development (R&D) and internet advertising expenditure, which have driven demand for industry services.

There are 44,000 establishments offering market research services in the United States. They generate approximately $23 billion in combined annual revenue. In this case, “establishments” refer to market research companies with a single location as well as units of multi-location companies.

2018 market research stats and trends

- Many of you know that 2016 gave way to wearable technology, big data, mobile research, and many more innovative market research trends.

- 2018 saw these trends grow, gaining traction, and we anticipate their growth further into 2019.

The future of market research is already here

According to the market research stats and trends, many of these industry trends have bubbled underneath the surface for the last few years. And are now ready to take center stage.

Getting a handle on the key trends for market research will position you well to assist your brand with sensible consumer insight. This keeps your organization competitive while building strong customer relationships that will endure for years to come.

LEARN ABOUT: market research trends

Also, expect to see more automation, standardization, and many claims about artificial intelligence. The key drivers of success for these systems are ease of use, speed, and cost. However, a key element in their success is the ability to leverage existing brands and reputations.

The market research industry is growing fast, and businesses now understand the importance of using data to make smart decisions. Market research tools play a crucial role in providing valuable insights to companies, helping them understand customers and the market better.

QuestionPro emerges as a key player in this changing landscape, offering a user-friendly platform that makes data collection and analysis easier. With automation and AI-powered features, QuestionPro simplifies the research process, saving time and effort for researchers.

It provides quick and accurate insights, enabling businesses to make informed choices. QuestionPro’s commitment to data security and compliance ensures that researchers can conduct ethical data collection, protecting the privacy of participants’ information. As the market research industry looks to the future, QuestionPro’s advanced analytics and A.I. capabilities will continue to shape its trajectory. Researchers can rely on QuestionPro to predict market trends and gain a competitive advantage.

With its user-friendly interface and dedication to providing meaningful results, QuestionPro remains a valuable asset for market researchers, empowering businesses to succeed in an ever-changing market.

FREE TRIAL LEARN MORE

Frequently Asking Questions (FAQ)

Key trends include AI-driven insights, mobile research, ethical data collection, and virtual reality integration.

Media rating services help measure the popularity and effectiveness of media content, providing valuable insights for businesses and advertisers.

MORE LIKE THIS

The Best Email Survey Tool to Boost Your Feedback Game

May 7, 2024

Top 10 Employee Engagement Survey Tools

Top 20 Employee Engagement Software Solutions

May 3, 2024

15 Best Customer Experience Software of 2024

May 2, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

Market Research Report

2021 market research global trends.

For market researchers, COVID-19 accelerated a transformation that’s been a decade in the making — and it will completely reshape the industry in the coming years.

In our first annual study into the state of the market research industry, we surveyed more than 2,000 market research professionals from 16 countries to better understand how the industry reacted to COVID-19 in 2020 and how the dynamics of market research have changed.

Explore how organizations are adapting their approach to market research and what their top priorities and challenges are for 2021 as they look to design the experiences people want next.

Download Now

In this report you’ll learn:.

- Key priorities for research leaders in 2021

- How technology is transforming how researchers work

- Market research’s role in helping organizations move forward

12,000+ brands and the top 100 business schools have switched to Qualtrics

Request demo.

Ready to learn more about Qualtrics?

Market Research Industry Statistics: Emerging Analysis Broadly

Updated · Sep 26, 2023

At Market.us Scoop, we strive to bring you the most accurate and up-to-date information by utilizing a variety of resources, including paid and free sources, primary research, and phone interviews. Our data is available to the public free of charge, and we encourage you to use it to inform your personal or business decisions. If you choose to republish our data on your own website, we simply ask that you provide a proper citation or link back to the respective page on Market.us Scoop. We appreciate your support and look forward to continuing to provide valuable insights for our audience.

Table of Contents

Introduction

Editor’s choice, market research industry statistics by size, market research industry statistics by key players, market research industry statistics by regional analysis, market research industry statistics by spending, market research industry statistics by methods, market research industry statistics by client response in sector, most demanded skills by market research clients, market research industry statistics by challenges.

Market Research Industry Statistics: The market research industry is a vital component of modern business strategy, serving as the “eyes and ears” of organizations by offering crucial insights into market dynamics, consumer behavior, and competition.

Its core functions encompass market analysis, consumer behavior analysis, competitor assessment, product development support, marketing optimization, and strategic planning.

Evolving with technology, it has transitioned from traditional data collection methods to online surveys, social media analysis, and AI-driven data analytics.

While facing challenges like data privacy and information overload, the industry also presents opportunities for specialization, ethical data practices, and advanced analytics, ensuring its continued importance in guiding businesses through a complex and data-driven marketplace.

- In 2022 , the global market research sector generated an impressive total revenue that exceeded $82 billion , representing growth of more than double compared to 2008 .

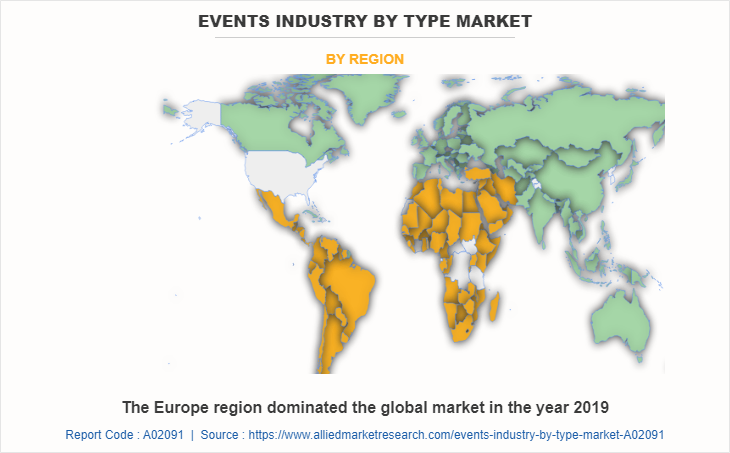

- In 2021 , North America played a dominant role in contributing to the industry’s revenue, contributing over half of the global total. Europe closely followed , accounting for approximately one-fourth of the global market share .

- Notable market research firms include Nielsen Holdings (USA), Kantar (UK), IQVIA (USA), Ipsos (France), and GfK Group (Germany)

- IQVIA led the industry in terms of revenue in 2021 .

- In traditional quantitative research methods, online surveys emerged as the most widely used globally in 2022, employed by over 90% of market research professionals .

- Concurrently, phone and face-to-face interviews constituted 80% and 39% of quantitative research methods .

- Regarding qualitative research techniques, online in-depth interviews stood out as the predominant approach, accounting for more than two-thirds of such research conducted in 2022.

- The market research industry has experienced notable growth and fluctuations in market size over the past decade. In 2011, the market size stood at $39.47 billion, remaining relatively stable in 2012 at $39.52 billion.

- However, a significant uptick occurred in 2013, reaching $43.2 billion, followed by further growth in 2014, when it reached $46.09 billion.

- Subsequently, in 2015, there was a minor dip to $44.03 billion, but the market rebounded to $44.42 billion in 2016.

- The most substantial leap occurred in 2017, with the market size surging to $66.37 billion, showcasing remarkable growth .

- This upward trajectory continued in 2018, reaching $70.44 billion, and in 2019 when it peaked at $73.38 billion.

- Although 2022 figures indicate a market size of $82 billion, the industry’s journey over the past decade underscores its dynamic nature, with periods of expansion and stabilization shaping its evolution.

- Europe demonstrated the most substantial increase in market research revenue in 2021 , while Africa and the Middle East were the only regions that experienced a decline in growth rate .

(Source: Statista)

- Throughout 2021, Nielsen held its top spot as the leading market research company for the sixth year, reporting a revenue of $5.24 billion .

- Other prominent players in 2021 included IQVIA, which generated $5.21 billion; Gartner, with $4.73 billion; Salesforce, at $3.9 billion; and Adobe Systems, with $3.87 billion in revenue .

(Source: ESOMAR)

Nielsen Holdings

- Nielsen Holdings, a prominent market research company in the United States and a global leader in market measurement, achieved a global revenue of nearly $3.5 billion in 2021 .

- Nielsen’s revenue consistently grew from 2006 to 2017, reaching its peak at $6.57 billion in 2017 .

- However, it experienced a slight decline in 2018, 2019, and 2020, followed by a substantial decrease in 2021 .

- Operating under the name The Nielsen Company, it is headquartered in New York City, with approximately 6,200 full-time employees in the United States in 2021 .

- The company analyses consumer viewing and purchasing habits and serves notable clients like The Coca-Cola Company and Walmart .

- Despite recent reductions, the cost of revenue for Nielsen Holdings remained significant, exceeding $1.2 billion in 2021 .

- One of Nielsen Holding’s primary competitors, Ipsos , independently generated a global revenue of approximately $2.15 billion in 2021 .

Kantar Group

- Kantar Group, headquartered in London, serves as a data and consulting company with a global presence spanning 100 countries , engaging in diverse research activities.

- Market research is indispensable for businesses, equipping them with vital insights for effective strategy development tailored to their target markets.

- In 2021, Kantar secured its position as the fifth-largest global market research firm based on revenue .

- During that same year, the company generated nearly $606 million in market research revenue within the United States .

- When considering geographical breakdown, most of Kantar’s research revenue stemmed from regions outside the United States .

- Kantar achieved a remarkable global research revenue of approximately $3.7 billion in 2022 .

- The number of full-time employees at Kantar in North America exhibited significant fluctuations from 2007 to 2022 .

- In 2022, Kantar employed approximately 4,700 full-time personnel in the North American region , marking the highest employment level within this timeframe.

- In 2022, Ipsos achieved a revenue of approximately 2.41 billion euros , marking a noteworthy increase of approximately 250 million euros compared to the previous year.

- Despite its origin in France in 1975 , Ipsos embarked on an extensive global expansion, particularly in the 1990s.

- It has consistently competed with significant global market research industry players regarding research revenue. It has become a prominent employer in the United States market research sector .

- Following the 2019 general election in Australia, Ipsos faced a setback. Several Australian newspapers ceased using them as their primary source for political polling due to their inaccurate prediction of the closely contested election. Nevertheless, Ipsos continues to provide valuable data and insights in other areas of polling and research.

- The number of Ipsos employees worldwide has fluctuated over the past decade. In 2012, there were 15,297 employees , and this figure steadily increased over the following years, reaching 17,059 in 2013 .

- However, by 2014, the number had dipped slightly to 16,530 . Subsequent years saw relatively stable employee numbers, with 16,450 in 2015 and 16,598 in 2016 .

- A slight upward trajectory resumed in 2017, with 16,664 employees that year, and a more substantial increase to 18,127 in 2018 .

- This growth continued into 2019 when there were 18,448 employees .

- However, in 2020, the numbers dropped to 16,472, likely influenced by external factors such as the global pandemic.

- The workforce rebounded in 2021, reaching 18,266 employees , and further expanded in 2022 , totaling 20,156 employees worldwide .

- The income of GfK Group, measured in million Euros, exhibits a pattern of fluctuations over six years from 2010 to 2015 .

- In 2010 the income stood at 84 million Euros , followed by a slight increase to 88.1 million Euros in 2011 .

- However, 2012 saw a noticeable dip in income to 64.1 million Euros .

- Subsequently, there was a gradual recovery, with an income of 72.5 million Euros in 2013 , followed by further growth to 78.9 million Euros in 2014 and 80.1 million Euros in 2015 .

- These fluctuations likely reflect shifts in market dynamics, economic conditions, and business strategies during this period, contributing to GfK Group’s income variations.

Gartner Inc.

- Gartner Inc., a leading IT advisory and benchmarking service player, is renowned for its 100+ “magic quadrants” enterprises use to assess and bolster their technology credibility.

- Their recent Q4 2021 earnings report exceeded Wall Street expectations, with a remarkable return on equity exceeding 100% .

- Since April 2021 , Gartner’s stock price has surged by a remarkable 181%, driven by the growing demand for digital expertise.

- Gartner operates in two key segments: Global Technology Sales (GTS), constituting 80% of their contract value at $3.4 billion in fiscal 2021, and Global Business Sales (GBS), contributing 20% at $874 million .

- Revenue composition leans heavily towards research (80%), with consulting (8%) and conferences (4%) making up the rest .

- Notably , 91% of Gartner’s revenue stems from subscription services , providing a robust recurring revenue model.

- Geographically, 64% of sales come from the U.S. and Canada , with a significant presence in the Europe, Middle East, and Africa regions accounting for 24% of sales .

(Source: Yahoo Finance)

- In 2015, Europe recorded revenues of $16.43 billion , while North America led with $19.45 billion .

- Asia-Pacific and Latin America generated $5.91 billion and $1.49 billion , respectively, while the Middle East and Africa contributed $0.76 billion . The United States accounted for a significant portion of North America’s revenue.

- By 2016, Europe’s revenue decreased slightly to $15.82 billion , while North America maintained its position at $19.83 billion .

- Asia-Pacific’s revenue rose to $6.44 billion, and Latin America reached $1.47 billion , with the Middle East & Africa at $0.86 billion .

- In 2017, North America’s revenue substantially increased to $41.02 billion , outpacing Europe’s $15.95 billion .

- Asia-Pacific, Latin America, the Middle East, and Africa also experienced revenue growth. This trend continued in 2018, with North America at $44.21 billion and Europe at $16.56 billion .

- By 2019 , North America’s revenue climbed to $47.76 billion , while Europe’s revenue decreased slightly to $15.83 billion .

- In 2020 , there was a notable surge in revenue across regions, with North America leading at $48.01 billion , followed by Europe, Asia-Pacific, and Latin America .

- The Middle East and Africa also saw an increase. In 2021, the growth continued, particularly in North America and Europe, which reported revenues of $62.64 billion and $29.71 billion , respectively. These figures reflect the dynamic shifts in revenue among these regions over the years.

Spending According to Different Activities

- Organizations in this sector exhibit a varied focus in allocating their spending. Customer relationship management (CRM) and customer satisfaction surveys claim the largest share at 20.7%, underscoring the emphasis on maintaining and enhancing customer relationships.

- User experience surveys follow closely behind, with a significant allocation of 14.2% , highlighting the priority placed on optimizing user interactions.

- Audience research commands 13.4% of spending , reflecting a commitment to understanding and catering to specific target audiences.

- Meanwhile, investments in usage and behavioral studies stand at 11.7% , and market measurement closely trails at 11.6% , demonstrating the significance of data-driven insights for decision-making within this domain.

- These allocations underscore the multifaceted nature of research spending in this sector, emphasizing the importance of a balanced approach to gathering valuable insights.

Spending According to Different Industries

- Market research spending across different industry sectors reveals diverse priorities. Pharmaceutical companies allocate a significant portion at 16.6% , reflecting their commitment to research and development.

- Media and entertainment groups follow closely at 15.5% , emphasizing the importance of understanding audience preferences and trends.

- Consumer goods producers allocate 14.9% , emphasizing consumer behavior and market dynamics.

- Research institutes, at 1.8%, and tourism and recreation, at 1.6%, have more modest allocations, indicating their research objectives may be narrower or more specialized.

- Non-profit organizations allocate the least, at 0.9%, which aligns with their typically constrained budgets. These varying percentages reflect how different sectors prioritize market research to inform decision-making and strategy within their respective domains.

– Quantitative Research

- In 2022, among traditional quantitative research methods , online surveys emerged as the dominant choice in the global market research industry.

- A substantial 85% of professionals reported using online surveys regularly, while 9% employed them occasionally .

- Mobile surveys followed, with 47% using them regularly and 33% occasionally.

- Proprietary panels and online communities were also frequently utilized, with 32% and 26% reporting regular use, respectively .

- In contrast, Computer-Assisted Telephone Interviewing (CATI) and face-to-face surveys were used less frequently, with 13% and 12% respectively employing them regularly.

- Other methods like Computer-Assisted Personal Interviewing (CAPI), automated measures/people meters, mail surveys, Interactive Voice Response (IVR), neuroscience measurements, and biometrics had lower regular usage rates . These findings underline the significant prevalence of online surveys as the preferred quantitative research method in the industry, reflecting the influence of digital advancements in the field.

– Qualitative Research

- In 2022, online in-depth interviews conducted with webcams emerged as the most widely adopted approach within traditional qualitative research methodologies in the global market research industry. Approximately 15% of professionals reported using this method , reflecting its growing popularity in the digital age.

- In-person focus groups were a close second, with 58% employing this traditional method , highlighting its enduring relevance.

- In-person Individual Depth Interviews (IDIs) followed, with 42% of researchers utilizing this face-to-face approach.

- Telephone IDIs and online community discussions were also common, with 27% and 25% reporting their usage .

- Other methods, such as mobile research, in-store or shopping observations, and bulletin board studies, had varying levels of adoption.

- These findings underscore the diversified landscape of qualitative research techniques, with online in-depth interviews via webcams gaining prominence alongside well-established methods like in-person focus groups and IDIs .

- Here’s a comprehensive breakdown of various survey types and their average response rates. In-person surveys lead the pack with an impressive 57% response rate , underscoring the effectiveness of face-to-face interactions.

- Mail surveys follow closely, garnering a respectable 50% response rate , indicating the enduring relevance of traditional postal surveys.

- Email surveys exhibit a response rate of 30%, showcasing their popularity as a digital survey medium.

- Online surveys, conducted through web forms , capture a slightly lower but substantial response rate of 29% .

- While widely used, telephone surveys yield an 18% response rate , reflecting the challenges of phone-based data collection.

- In-app surveys, delivered through mobile applications, secure a 13% response rate , highlighting their unique place in the survey landscape. These response rates provide valuable insights for survey designers, helping them choose the most suitable method for effective data collection.

(Source: Pointerpro)

- The findings highlighted distinct preferences in skill development priorities in a survey encompassing 3,342 respondents, comprising both buyers and suppliers in the market research field.

- Notably, 70% of buyers strongly emphasized nurturing business knowledge as a vital skill.

- In contrast, 56% of suppliers echoed this sentiment .

- What stands out is that for suppliers , the paramount skill for development was identified as market research expertise, garnering a substantial 70% agreement .

- Conversely, among buyers , the significance of market research expertise in skill development was acknowledged by a comparatively lower proportion, precisely 34%.

(Source: GreenBook)

- Within organizations, a notable 23% lack a well-defined strategy for market research .

- The primary hurdle hindering market strategists is the prevailing uncertainty, which impedes the progress of 34% of them .

- Meanwhile, 26% of market researchers encounter obstacles due to budget limitations in executing their research strategies.

- Additional challenges include effectively communicating return on investment, inspiring team members, contending with internal priorities, and addressing gaps in skills and expertise .

(Source: Qualtrics)

Market Research Industry Statistics – The market research industry is at the forefront of transformative change, offering invaluable insights to businesses in an ever-evolving global landscape. It has exhibited significant growth, driven by technological advancements like AI and big data analytics. However, challenges such as data privacy and ethical considerations demand ongoing attention.

The industry’s future is promising, marked by even more profound insights and global expansion. To thrive, industry players must remain agile, embrace diversity in methodologies, and uphold ethical standards. As a trusted ally, market research will continue to empower businesses with the insights needed to make informed decisions and succeed in a dynamic marketplace, shaping the industry’s future.

Market research is the process of gathering, analyzing, and interpreting information about a market, including its size, trends, and consumer preferences. Businesses must make informed decisions, identify opportunities, and understand their target audience better.

Market research employs both quantitative and qualitative methods. Quantitative research includes surveys, experiments, and observational studies, while qualitative methods encompass focus groups, in-depth interviews, and ethnography.

Technology, including artificial intelligence, big data analytics, and mobile research tools, is revolutionizing market research by enabling faster data collection, deeper insights, and more efficient analysis.

Emerging trends include using AI for predictive analytics, increased focus on mobile and geo-location data, and a growing emphasis on sustainability and ethical research practices.

Market research helps businesses make informed decisions, refine their products and services, identify competitive advantages, and tailor their marketing strategies to meet customer needs effectively.

Tajammul Pangarkar

Tajammul Pangarkar is a CMO at Prudour Pvt Ltd. Tajammul longstanding experience in the fields of mobile technology and industry research is often reflected in his insightful body of work. His interest lies in understanding tech trends, dissecting mobile applications, and raising general awareness of technical know-how. He frequently contributes to numerous industry-specific magazines and forums. When he’s not ruminating about various happenings in the tech world, he can usually be found indulging in his next favorite interest - table tennis.

Latest from Author

- Cloud Telephony Service Market Soar to USD 52.3 Billion by 2033

- Top 10 Wearable Sensor Companies | Best Health Tech

- Telecom API Statistics 2024 By Tools, Technology, Networks

- Smart Home Statistics 2024 By Technology, Features, Security

- Smart TV Statistics 2024 By Technology, Quality, Content

- Technology, Media, and IT

- Media and Advertising

Digital Marketing Market

Global Digital Marketing Market to Grow at a CAGR of 13.1% Over the Forecast Period of 2024-2032

Global Digital Marketing Market Share, Size, Value, Growth: By Digital Channel: Email Marketing, Search Engine Optimisation (SEO), Interactive Consumer Website, Online/Display Advertising, Blogging and Podcasting, Social Network Marketing, Mobile Marketing, Others; By End User; Regional Analysis; Competitive Landscape; 2024-2032

- Report Summary

- Table of Contents

- Pricing Detail

- Request Sample

Global Digital Marketing Industry Outlook

The global digital marketing market size reached a value of nearly USD 363.05 billion in 2023. The market is projected to grow at a CAGR of 13.1% between 2024 and 2032, reaching a value of around USD 1099.33 billion by 2032.

Key Takeaways

- Short-term video content is the most popular content strategy and 91% of businesses use video marketing for advertising.

- Around 56% of businesses globally are planning on increasing their TikTok marketing budget, due to its surging popularity.

- The Asia Pacific is expected to be an emerging market for digital marketing, owing to increasing social media penetration.

Digital marketing is the digital promotion of products or services, primarily through the internet, but also include mobile phones, advertisement displays, and any other new digital medium. Some common aspects of digital marketing include search engine optimisation (SEO), search engine marketing (SEM), content marketing, content management, campaign marketing, display advertising, and social media advertising (SEM) that facilitate customer engagement with the brand’s offerings and solutions. In addition, digital marketing now also applies to non-internet platforms that provide digital media, such as mobile phones (SMS and MMS), call-backs, and on-site mobile ring tones.

Increased penetration of the internet across the globe is one of the major factors driving the digital marketing industry growth. This growth is further aided by the proliferation of smartphones and other smart devices that allow widespread internet access to users and provide ample digital marketing opportunities. The rising usage of social media is another crucial factor boosting the market expansion, as social media platforms offer businesses and enterprises a direct platform to engage and interact with their target audience. Therefore, several businesses have established social media pages on Instagram and Facebook for direct communication with their existing as well as potential customers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Rising popularity of short-length video content; increasing focus of brands on enhancing business transparency to create a loyal customer base; emergence of social media as a prominent marketing tool; and the growing integration of AI and marketing tools are the major trends impacting the market.

Jan 3rd 2024

Accenture acquired Jixie, an intelligent media and marketing company, to offer a more personalised experience to its customers.

Jan 12th 2024

Picklejar announced the launch of FanVivo, a digital marketing solution, which can aid music artists and venues in enhancing their fan engagement.

Jan 17th 2024

LS Digital launched a transformative marketing data infrastructure (MDI), which allows businesses to leverage user insights to enhance the capabilities of its products and services.

Jan 18th 2024

UnFoldMart secured the social media and SEO mandate for Atmosly to enhance latter’s brand awareness and digital presence.

Rising trend of short video content

With the burgeoning popularity of TikTok and Instagram reels, businesses are focusing on video marketing content such as product demonstrations and customer testimonials for increased engagement.

Improved business transparency to create loyal customer base

In the age of transparency, businesses are increasingly demonstrating their vision, production processes, and practices, to establish a foundation of trust with their customers.

Use of social media to target potential customers

Social media platforms are increasingly being used as an effective marketing tool, for instance, LinkedIn is estimated to hold nearly 25 per cent of US B2B display ad spending by 2024.

Increased integration of AI in digital marketing

AI technology offers businesses sophisticated tools for personalised customer interactions so the companies can address specific customer needs and enhance customer satisfaction.

The digital marketing market demand is primarily supported by the growing adoption of digital tools by businesses to forge strong connections with customers, further highlighting their practices and sustainability initiatives to achieve brand loyalty. Several companies are taking initiatives to educate customers regarding the potential risks involved with their products and solutions to offer complete transparency. Businesses that put customer well-being over others are more likely to attract new customers as well as retain the old ones.

LD Digital, an India-based company, has launched a marketing data infrastructure (MDI), which comprises three main elements, collect, connect, and cultivate, to offer a seamless customer experience. It is a user-friendly platform that can integrate with marketing tools to offer businesses valuable insights on customer segmentation, sales forecasting, and brand sentiment analysis, so they can gain a better understanding of their customers.

Digital Marketing Market Segmentation

“Digital Marketing Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Digital Channel

- Email Marketing

- Search Engine Optimisation (SEO)

- Interactive Consumer Website

- Online/Display Advertising

- Blogging and Podcasting (Including Microblogging)

- Social Network Marketing

- Mobile Marketing

- Viral Marketing

- Digital OOH Media

- Online Video Marketing

Market Breakup by End User

- Media and Entertainment

Market Segmentation by Region

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

Online/display advertising is a leading strategy adopted by businesses owing to its eye-catching attributes

According to our analysis of the digital marketing market size, the online/display advertising segment occupies a significant market share as display ads are visually appealing and capture the attention of the audience easily. Display ads are targeted, and businesses can choose the geographic area or demographic age for which the display ads should be visible, which further makes them an effective form of digital marketing.

The expenditure on mobile advertisements, which once accounted for nearly 13 to 18% of total digital spending in 2016, currently accounts for about 39–42% of the digital spending in the major Western European markets, such as the United Kingdom, Germany and Spain, and is expected to cross 60% in the next few years.

Mobile marketing is expected to continue to grow in the coming years as businesses focus on leveraging the extensive reach of smartphones to enhance their visibility and engagement. With increasing emphasis on mobile-friendly campaigns and websites, they are increasing their investments to provide a seamless user experience.

The media and entertainment sector holds a leading position due to the heavy reliance of streaming platforms on digital mediums for promotions.

The media and entertainment sector heavily relies on digital marketing campaigns to drive user engagement and reach a broader audience. For example, Netflix, a streaming service, heavily relies on different mediums of digital marketing to promote their shows and movies depending on the user’s preferences and region.

The education sector is also expected to flourish in the forecast period as several educational institutions are leveraging social media platforms to showcase their campus life, amenities, and standout features to gain a competitive edge.

Competitive Landscape

The market players are increasing their collaboration and research and development activities to gain a competitive edge in the market

Dentsu Group Inc.

Dentsu Group, founded in 1901 and based in Tokyo, Japan, is an international advertising corporation. Some of its specialities include advertising, media planning, and media buying, among others.

Saudi Research and Media Group (SRMG)

SRMG, a media group in the MENA, announced in 2024, that it is developing digital platforms for some of its newspapers, amid the rising popularity of digital and audio-visual media platforms.

Havas Group

It is a global advertising and public relations company, based in Paris, France. The company offers innovative solutions through its three business units, including Havas Creative Network and Havas Media Network.

WebFX, founded in 2008, is a digital marketing solutions provider, based in Pennsylvania, the US. The company comprises over 400 experts who aid SMEs and large enterprises with digital marketing services.

Several market players are working strategically to develop platforms that can help businesses navigate through a complex marketing landscape by optimising customer data effectively. By leveraging insights offered by such platforms, manufacturers and brand owners can work together to create efficient digital marketing industry solutions to target customers, as these marketing solutions are expected to be reliable and result-driven, ensuring consistent business growth.

North America is a leading regional market and is expected to continue to maintain its dominance in the coming years. The region is expected to contribute about 38% to 42% to the total digital marketing expenditure in the forecast period. The region is a technological hub and offers ample opportunities for innovation in the digital marketing sphere. The growing adoption of high-end technologies by market players to enhance their capabilities and offer improved marketing solutions creates a positive market outlook.

The digital advertising investment in the Asia Pacific has surpassed Europe, and this increase is driven mainly by regions like China and other emerging Asian markets, due to a growing investment in technology and increasing use of digital platforms in these countries. The Asia Pacific region is expected to be the major contributor to the digital marketing market share over the coming years due to the region’s high population density, the growing internet penetration, and the increased smartphone ownership. The Asia Pacific has the largest population of smartphone users in comparison to other regions. Also, a large proportion of mobile phone users in the region have access to social media, creating significant growth prospects for the online advertising segment.

The increasing adoption of real-time bidding (RTB) of online display advertisement slots, as well as the increasing consumption of video advertisements and rich media, is expected to enhance the display advertising expenditure in Western Europe. The digital out-of-home (OOH) media is expected to be largely limited to developed countries, for example, the installation of digital televisions in gas stations, among other places.

Key Highlights of the Report

Our best selling reports.

Outdoor Flooring Market

Guatemala Cheese Market

Medical Education Market

Permanent Magnets Market

Silicon Photonics Market

TFT-LCD Display Panel Market

Vacuum Truck Market

Chromium Market

Forklift Market

Lighting Market

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface 2 Report Coverage – Key Segmentation and Scope 3 Report Description 3.1 Market Definition and Outlook 3.2 Properties and Applications 3.3 Market Analysis 3.4 Key Players 4 Key Assumptions 5 Executive Summary 5.1 Overview 5.2 Key Drivers 5.3 Key Developments 5.4 Competitive Structure 5.5 Key Industrial Trends 6 Market Snapshot 6.1 Global 6.2 Region 7 Opportunities and Challenges in the Market 8 Global Digital Marketing Market Analysis 8.1 Key Industry Highlights 8.2 Global Digital Marketing Historical Market (2018-2023) 8.3 Global Digital Marketing Market Forecast (2024-2032) 8.4 Global Digital Marketing Market by Digital Channel 8.4.1 Email Marketing 8.4.1.1 Historical Trend (2018-2023) 8.4.1.2 Forecast Trend (2024-2032) 8.4.2 Search Engine Optimisation (SEO) 8.4.2.1 Historical Trend (2018-2023) 8.4.2.2 Forecast Trend (2024-2032) 8.4.3 Interactive Consumer Website 8.4.3.1 Historical Trend (2018-2023) 8.4.3.2 Forecast Trend (2024-2032) 8.4.4 Online/Display Advertising 8.4.4.1 Historical Trend (2018-2023) 8.4.4.2 Forecast Trend (2024-2032) 8.4.5 Blogging and Podcasting (Including Microblogging) 8.4.5.1 Historical Trend (2018-2023) 8.4.5.2 Forecast Trend (2024-2032) 8.4.6 Social Network Marketing 8.4.6.1 Historical Trend (2018-2023) 8.4.6.2 Forecast Trend (2024-2032) 8.4.7 Mobile Marketing 8.4.7.1 Historical Trend (2018-2023) 8.4.7.2 Forecast Trend (2024-2032) 8.4.8 Viral Marketing 8.4.8.1 Historical Trend (2018-2023) 8.4.8.2 Forecast Trend (2024-2032) 8.4.9 Digital OOH Media 8.4.9.1 Historical Trend (2018-2023) 8.4.9.2 Forecast Trend (2024-2032) 8.4.10 Online Video Marketing 8.4.10.1 Historical Trend (2018-2023) 8.4.10.2 Forecast Trend (2024-2032) 8.4.11 Others 8.5 Global Digital Marketing Market by End Use 8.5.1 Automotive 8.5.1.1 Historical Trend (2018-2023) 8.5.1.2 Forecast Trend (2024-2032) 8.5.2 BFSI 8.5.2.1 Historical Trend (2018-2023) 8.5.2.2 Forecast Trend (2024-2032) 8.5.3 Education 8.5.3.1 Historical Trend (2018-2023) 8.5.3.2 Forecast Trend (2024-2032) 8.5.4 Government 8.5.4.1 Historical Trend (2018-2023) 8.5.4.2 Forecast Trend (2024-2032) 8.5.5 Healthcare 8.5.5.1 Historical Trend (2018-2023) 8.5.5.2 Forecast Trend (2024-2032) 8.5.6 Media and Entertainment 8.5.6.1 Historical Trend (2018-2023) 8.5.6.2 Forecast Trend (2024-2032) 8.5.7 Others 8.6 Global Digital Marketing Market by Region 8.6.1 North America 8.6.1.1 Historical Trend (2018-2023) 8.6.1.2 Forecast Trend (2024-2032) 8.6.2 Europe 8.6.2.1 Historical Trend (2018-2023) 8.6.2.2 Forecast Trend (2024-2032) 8.6.3 Asia Pacific 8.6.3.1 Historical Trend (2018-2023) 8.6.3.2 Forecast Trend (2024-2032) 8.6.4 Latin America 8.6.4.1 Historical Trend (2018-2023) 8.6.4.2 Forecast Trend (2024-2032) 8.6.5 Middle East and Africa 8.6.5.1 Historical Trend (2018-2023) 8.6.5.2 Forecast Trend (2024-2032) 9 North America Digital Marketing Market Analysis 9.1 Market by Digital Channel 9.2 Market by End Use 9.3 Market by Country 9.3.1 United States of America 9.3.1.1 Historical Trend (2018-2023) 9.3.1.2 Forecast Trend (2024-2032) 9.3.2 Canada 9.3.2.1 Historical Trend (2018-2023) 9.3.2.2 Forecast Trend (2024-2032) 10 Europe Digital Marketing Market Analysis 10.1 Market by Digital Channel 10.2 Market by End Use 10.3 Market by Country 10.3.1 United Kingdom 10.3.1.1 Historical Trend (2018-2023) 10.3.1.2 Forecast Trend (2024-2032) 10.3.2 Germany 10.3.2.1 Historical Trend (2018-2023) 10.3.2.2 Forecast Trend (2024-2032) 10.3.3 France 10.3.3.1 Historical Trend (2018-2023) 10.3.3.2 Forecast Trend (2024-2032) 10.3.4 Italy 10.3.4.1 Historical Trend (2018-2023) 10.3.4.2 Forecast Trend (2024-2032) 10.3.5 Others 11 Asia Pacific Digital Marketing Market Analysis 11.1 Market by Digital Channel 11.2 Market by End Use 11.3 Market by Country 11.3.1 China 11.3.1.1 Historical Trend (2018-2023) 11.3.1.2 Forecast Trend (2024-2032) 11.3.2 Japan 11.3.2.1 Historical Trend (2018-2023) 11.3.2.2 Forecast Trend (2024-2032) 11.3.3 India 11.3.3.1 Historical Trend (2018-2023) 11.3.3.2 Forecast Trend (2024-2032) 11.3.4 ASEAN 11.3.4.1 Historical Trend (2018-2023) 11.3.4.2 Forecast Trend (2024-2032) 11.3.5 Australia 11.3.5.1 Historical Trend (2018-2023) 11.3.5.2 Forecast Trend (2024-2032) 11.3.6 Others 12 Latin America Digital Marketing Market Analysis 12.1 Market by Digital Channel 12.2 Market by End Use 12.3 Market by Country 12.3.1 Brazil 12.3.1.1 Historical Trend (2018-2023) 12.3.1.2 Forecast Trend (2024-2032) 12.3.2 Argentina 12.3.2.1 Historical Trend (2018-2023) 12.3.2.2 Forecast Trend (2024-2032) 12.3.3 Mexico 12.3.3.1 Historical Trend (2018-2023) 12.3.3.2 Forecast Trend (2024-2032) 12.3.4 Others 13 Middle East and Africa Digital Marketing Market Analysis 13.1 Market by Digital Channel 13.2 Market by End Use 13.3 Market by Country 13.3.1 Saudi Arabia 13.3.1.1 Historical Trend (2018-2023) 13.3.1.2 Forecast Trend (2024-2032) 13.3.2 United Arab Emirates 13.3.2.1 Historical Trend (2018-2023) 13.3.2.2 Forecast Trend (2024-2032) 13.3.3 Nigeria 13.3.3.1 Historical Trend (2018-2023) 13.3.3.2 Forecast Trend (2024-2032) 13.3.4 South Africa 13.3.4.1 Historical Trend (2018-2023) 13.3.4.2 Forecast Trend (2024-2032) 13.3.5 Others 14 Market Dynamics 14.1 SWOT Analysis 14.1.1 Strengths 14.1.2 Weaknesses 14.1.3 Opportunities 14.1.4 Threats 14.2 Porter’s Five Forces Analysis 14.2.1 Supplier’s Power 14.2.2 Buyer’s Power 14.2.3 Threat of New Entrants 14.2.4 Degree of Rivalry 14.2.5 Threat of Substitutes 14.3 Key Indicators for Demand 14.4 Key Indicators for Price 15 Competitive Landscape 15.1 Market Structure 15.2 Company Profiles 15.2.1 Accenture Plc 15.2.1.1 Company Overview 15.2.1.2 Product Portfolio 15.2.1.3 Demographic Reach and Achievements 15.2.1.4 Certifications 15.2.2 IBM Corporation 15.2.2.1 Company Overview 15.2.2.2 Product Portfolio 15.2.2.3 Demographic Reach and Achievements 15.2.2.4 Certifications 15.2.3 Dentsu Group Inc. 15.2.3.1 Company Overview 15.2.3.2 Product Portfolio 15.2.3.3 Demographic Reach and Achievements 15.2.3.4 Certifications 15.2.4 Havas Group 15.2.4.1 Company Overview 15.2.4.2 Product Portfolio 15.2.4.3 Demographic Reach and Achievements 15.2.4.4 Certifications 15.2.5 WebFX 15.2.5.1 Company Overview 15.2.5.2 Product Portfolio 15.2.5.3 Demographic Reach and Achievements 15.2.5.4 Certifications 15.2.6 RAPP Worldwide Inc. 15.2.6.1 Company Overview 15.2.6.2 Product Portfolio 15.2.6.3 Demographic Reach and Achievements 15.2.6.4 Certifications 15.2.7 Disruptive Advertising 15.2.7.1 Company Overview 15.2.7.2 Product Portfolio 15.2.7.3 Demographic Reach and Achievements 15.2.7.4 Certifications 15.2.8 Thrive Internet Marketing Agency 15.2.8.1 Company Overview 15.2.8.2 Product Portfolio 15.2.8.3 Demographic Reach and Achievements 15.2.8.4 Certifications 15.2.9 TopSpot Internet Marketing 15.2.9.1 Company Overview 15.2.9.2 Product Portfolio 15.2.9.3 Demographic Reach and Achievements 15.2.9.4 Certifications 15.2.10 PB&J Promotions LLC 15.2.10.1 Company Overview 15.2.10.2 Product Portfolio 15.2.10.3 Demographic Reach and Achievements 15.2.10.4 Certifications 15.2.11 Others 16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Digital Marketing Market: Key Industry Highlights, 2018 and 2032 2. Global Digital Marketing Historical Market: Breakup by Digital Channel (USD Million), 2018-2023 3. Global Digital Marketing Market Forecast: Breakup by Digital Channel (USD Million), 2024-2032 4. Global Digital Marketing Historical Market: Breakup by End User (USD Million), 2018-2023 5. Global Digital Marketing Market Forecast: Breakup by End User (USD Million), 2024-2032 6. Global Digital Marketing Historical Market: Breakup by Region (USD Million), 2018-2023 7. Global Digital Marketing Market Forecast: Breakup by Region (USD Million), 2024-2032 8. North America Digital Marketing Historical Market: Breakup by Country (USD Million), 2018-2023 9. North America Digital Marketing Market Forecast: Breakup by Country (USD Million), 2024-2032 10. Europe Digital Marketing Historical Market: Breakup by Country (USD Million), 2018-2023 11. Europe Digital Marketing Market Forecast: Breakup by Country (USD Million), 2024-2032 12. Asia Pacific Digital Marketing Historical Market: Breakup by Country (USD Million), 2018-2023 13. Asia Pacific Digital Marketing Market Forecast: Breakup by Country (USD Million), 2024-2032 14. Latin America Digital Marketing Historical Market: Breakup by Country (USD Million), 2018-2023 15. Latin America Digital Marketing Market Forecast: Breakup by Country (USD Million), 2024-2032 16. Middle East and Africa Digital Marketing Historical Market: Breakup by Country (USD Million), 2018-2023 17. Middle East and Africa Digital Marketing Market Forecast: Breakup by Country (USD Million), 2024-2032 18. Global Digital Marketing Market Structure.

What was the global digital marketing market value in 2023?

In 2023, the market reached an approximate value of USD 363.05 billion.

What is the growth rate of the global digital marketing market?

The market is estimated to grow at a CAGR of 13.1% between 2024 and 2032.

What is the global digital marketing market forecast for 2024-2032?

The market is estimated to witness a healthy growth during 2024-2032 to reach around USD 1099.33 billion by 2032.

What are the major industry drivers?

The major drivers of the market include the rising number of online video and mobile advertising, increasing adoption of real-time bidding (RTB) of online display advertisement slots, increasing consumption of video advertisements and rich media, rising number of end users, growing internet penetration, and the rising smartphone ownership.

What are the key digital marketing market trends?

The key trends aiding the market include the rising trend of short video content, the growing focus on ethical marketing by brands, the emergence of LinkedIn as a prominent B2B advertiser, and the increased integration of AI in digital marketing.

What are the major regional markets of digital marketing, according to the EMR report?

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

What are the significant end uses of digital marketing?

The significant end uses include BFSI, pharmaceuticals, and retail, among others.

Who are the key market players, according to the global digital marketing market report?

The major players in the market are Accenture Plc, IBM Corporation, Dentsu Group Inc., Havas Group, WebFX, RAPP Worldwide Inc., Disruptive Advertising, Thrive Internet Marketing Agency, TopSpot Internet Marketing, and PB&J Promotions LLC, among others.

Purchase Options 10% off

Methodology

Request Customisation

Report Sample

Request Brochure

Ask an Analyst

( USA & Canada ) +1-415-325-5166 [email protected]