28 Questionnaire Examples, Questions, & Templates to Survey Your Clients

Published: May 15, 2023

The adage "the customer is always right" has received some pushback in recent years, but when it comes to conducting surveys , the phrase is worth a deeper look. In the past, representatives were tasked with solving client problems as they happened. Now, they have to be proactive by solving problems before they come up.

Salesforce found that 63% of customers expect companies to anticipate their needs before they ask for help. But how can a customer service team recognize these customer needs in advance and effectively solve them on a day-to-day basis?

![example of a research survey questionnaire → Free Download: 5 Customer Survey Templates [Access Now]](https://no-cache.hubspot.com/cta/default/53/9d36416b-3b0d-470c-a707-269296bb8683.png)

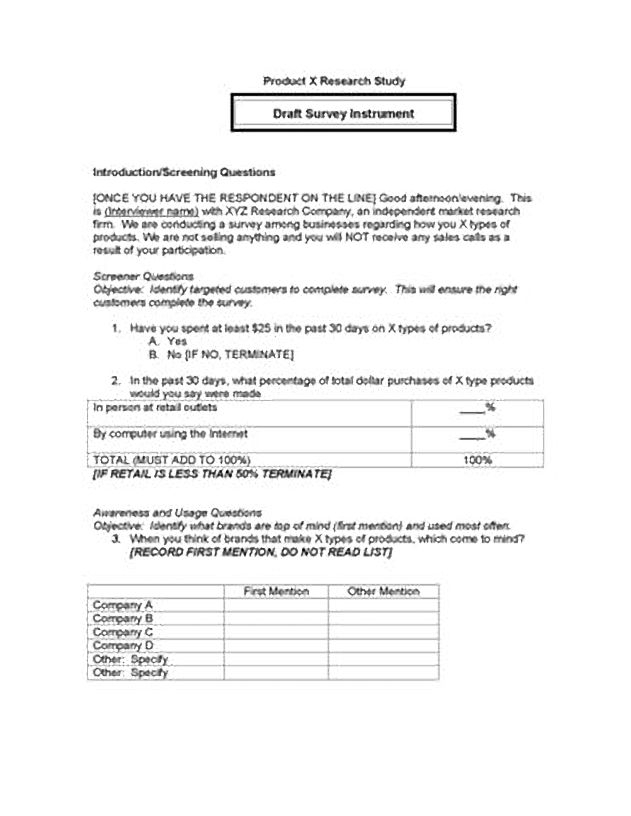

A customer questionnaire is a tried-and-true method for collecting survey data to inform your customer service strategy . By hearing directly from the customer, you'll capture first-hand data about how well your service team meets their needs. In this article, you'll get free questionnaire templates and best practices on how to administer them for the most honest responses.

Table of Contents:

Questionnaire Definition

Survey vs. questionnaire, questionnaire templates.

- Questionnaire Examples

Questionnaire Design

Survey question examples.

- Examples of Good Survey Questions

How to Make a Questionnaire

.webp)

5 Free Customer Satisfaction Survey Templates

Easily measure customer satisfaction and begin to improve your customer experience.

- Net Promoter Score

- Customer Effort Score

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A questionnaire is a research tool used to conduct surveys. It includes specific questions with the goal to understand a topic from the respondents' point of view. Questionnaires typically have closed-ended, open-ended, short-form, and long-form questions.

The questions should always stay as unbiased as possible. For instance, it's unwise to ask for feedback on a specific product or service that’s still in the ideation phase. To complete the questionnaire, the customer would have to imagine how they might experience the product or service rather than sharing their opinion about their actual experience with it.

Ask broad questions about the kinds of qualities and features your customers enjoy in your products or services and incorporate that feedback into new offerings your team is developing.

What makes a good questionnaire?

Define the goal, make it short and simple, use a mix of question types, proofread carefully, keep it consistent.

A good questionnaire should find what you need versus what you want. It should be valuable and give you a chance to understand the respondent’s point of view.

Make the purpose of your questionnaire clear. While it's tempting to ask a range of questions simultaneously, you'll get more valuable results if you stay specific to a set topic.

According to HubSpot research , 47% of those surveyed say their top reason for abandoning a survey is the time it takes to complete.

So, questionnaires should be concise and easy to finish. If you're looking for a respondent’s experience with your business, focus on the most important questions.

5 Customer Survey Templates

Featured resource.

Your questionnaire should include a combination of question types, like open-ended, long-form, or short-ended questions.

Open-ended questions give users a chance to share their own answers. But closed-ended questions are more efficient and easy to quantify, with specific answer choices.

If you're not sure which question types are best, read here for more survey question examples .

While it's important to check spelling and grammar, there are two other things you'll want to check for a great questionnaire.

First, edit for clarity. Jargon, technical terms, and brand-specific language can be confusing for respondents. Next, check for leading questions. These questions can produce biased results that will be less useful to your team.

Consistency makes it easier for respondents to quickly complete your questionnaire. This is because it makes the questions less confusing. It can also reduce bias.

Being consistent is also helpful for analyzing questionnaire data because it makes it easier to compare results. With this in mind, keep response scales, question types, and formatting consistent.

In-Depth Interviews vs. Questionnaire

Questionnaires can be a more feasible and efficient research method than in-depth interviews. They are a lot cheaper to conduct. That’s because in-depth interviews can require you to compensate the interviewees for their time and give accommodations and travel reimbursement.

Questionnaires also save time for both parties. Customers can quickly complete them on their own time, and employees of your company don't have to spend time conducting the interviews. They can capture a larger audience than in-depth interviews, making them much more cost-effective.

It would be impossible for a large company to interview tens of thousands of customers in person. The same company could potentially get feedback from its entire customer base using an online questionnaire.

When considering your current products and services (as well as ideas for new products and services), it's essential to get the feedback of existing and potential customers. They are the ones who have a say in purchasing decisions.

A questionnaire is a tool that’s used to conduct a survey. A survey is the process of gathering, sampling, analyzing, and interpreting data from a group of people.

The confusion between these terms most likely stems from the fact that questionnaires and data analysis were treated as very separate processes before the Internet became popular. Questionnaires used to be completed on paper, and data analysis occurred later as a separate process. Nowadays, these processes are typically combined since online survey tools allow questionnaire responses to be analyzed and aggregated all in one step.

But questionnaires can still be used for reasons other than data analysis. Job applications and medical history forms are examples of questionnaires that have no intention of being statistically analyzed. The key difference between questionnaires and surveys is that they can exist together or separately.

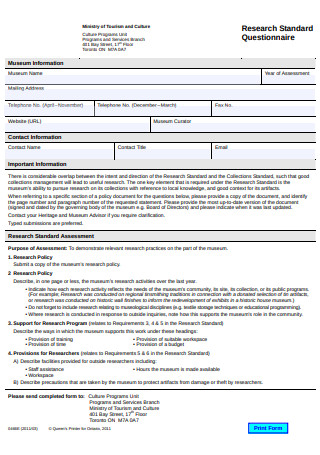

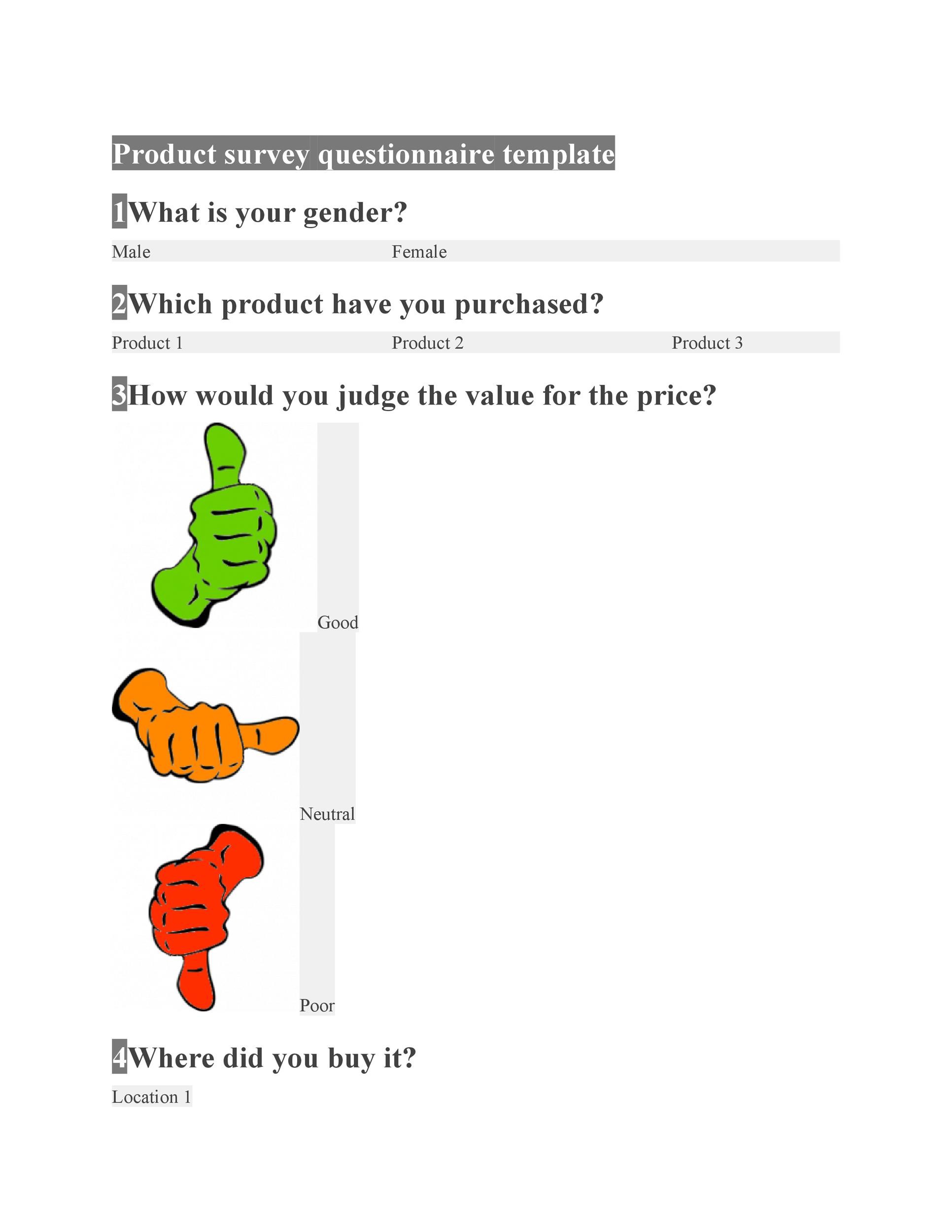

Below are some of the best free questionnaire templates you can download to gather data that informs your next product or service offering.

What makes a good survey question?

Have a goal in mind, draft clear and distinct answers and questions, ask one question at a time, check for bias and sensitivity, include follow-up questions.

To make a good survey question, you have to choose the right type of questions to use. Include concise, clear, and appropriate questions with answer choices that won’t confuse the respondent and will clearly offer data on their experience.

Good survey questions can give a business good data to examine. Here are some more tips to follow as you draft your survey questions.

To make a good survey, consider what you are trying to learn from it. Understanding why you need to do a survey will help you create clear and concise questions that you need to ask to meet your goal. The more your questions focus on one or two objectives, the better your data will be.

You have a goal in mind for your survey. Now you have to write the questions and answers depending on the form you’re using.

For instance, if you’re using ranks or multiple-choice in your survey, be clear. Here are examples of good and poor multiple-choice answers:

Poor Survey Question and Answer Example

California:

- Contains the tallest mountain in the United States.

- Has an eagle on its state flag.

- Is the second-largest state in terms of area.

- Was the location of the Gold Rush of 1849.

Good Survey Question and Answer Example

What is the main reason so many people moved to California in 1849?

- California's land was fertile, plentiful, and inexpensive.

- The discovery of gold in central California.

- The East was preparing for a civil war.

- They wanted to establish religious settlements.

In the poor example, the question may confuse the respondent because it's not clear what is being asked or how the answers relate to the question. The survey didn’t fully explain the question, and the options are also confusing.

In the good example above, the question and answer choices are clear and easy to understand.

Always make sure answers and questions are clear and distinct to create a good experience for the respondent. This will offer your team the best outcomes from your survey.

It's surprisingly easy to combine multiple questions into one. They even have a name — they’re called "double-barreled" questions. But a good survey asks one question at a time.

For example, a survey question could read, "What is your favorite sneaker and clothing apparel brand?" This is bad because you’re asking two questions at once.

By asking two questions simultaneously, you may confuse your respondents and get unclear answers. Instead, each question should focus on getting specific pieces of information.

For example, ask, "What is your favorite sneaker brand?" then, "What is your favorite clothing apparel brand?" By separating the questions, you allow your respondents to give separate and precise answers.

Biased questions can lead a respondent toward a specific response. They can also be vague or unclear. Sensitive questions such as age, religion, or marital status can be helpful for demographics. These questions can also be uncomfortable for people to answer.

There are a few ways to create a positive experience with your survey questions.

First, think about question placement. Sensitive questions that appear in context with other survey questions can help people understand why you are asking. This can make them feel more comfortable responding.

Next, check your survey for leading questions, assumptions, and double-barreled questions. You want to make sure that your survey is neutral and free of bias.

Asking more than one survey question about an area of interest can make a survey easier to understand and complete. It also helps you collect more in-depth insights from your respondents.

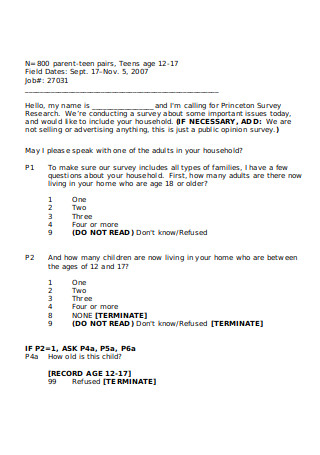

1. Free HubSpot Questionnaire Template

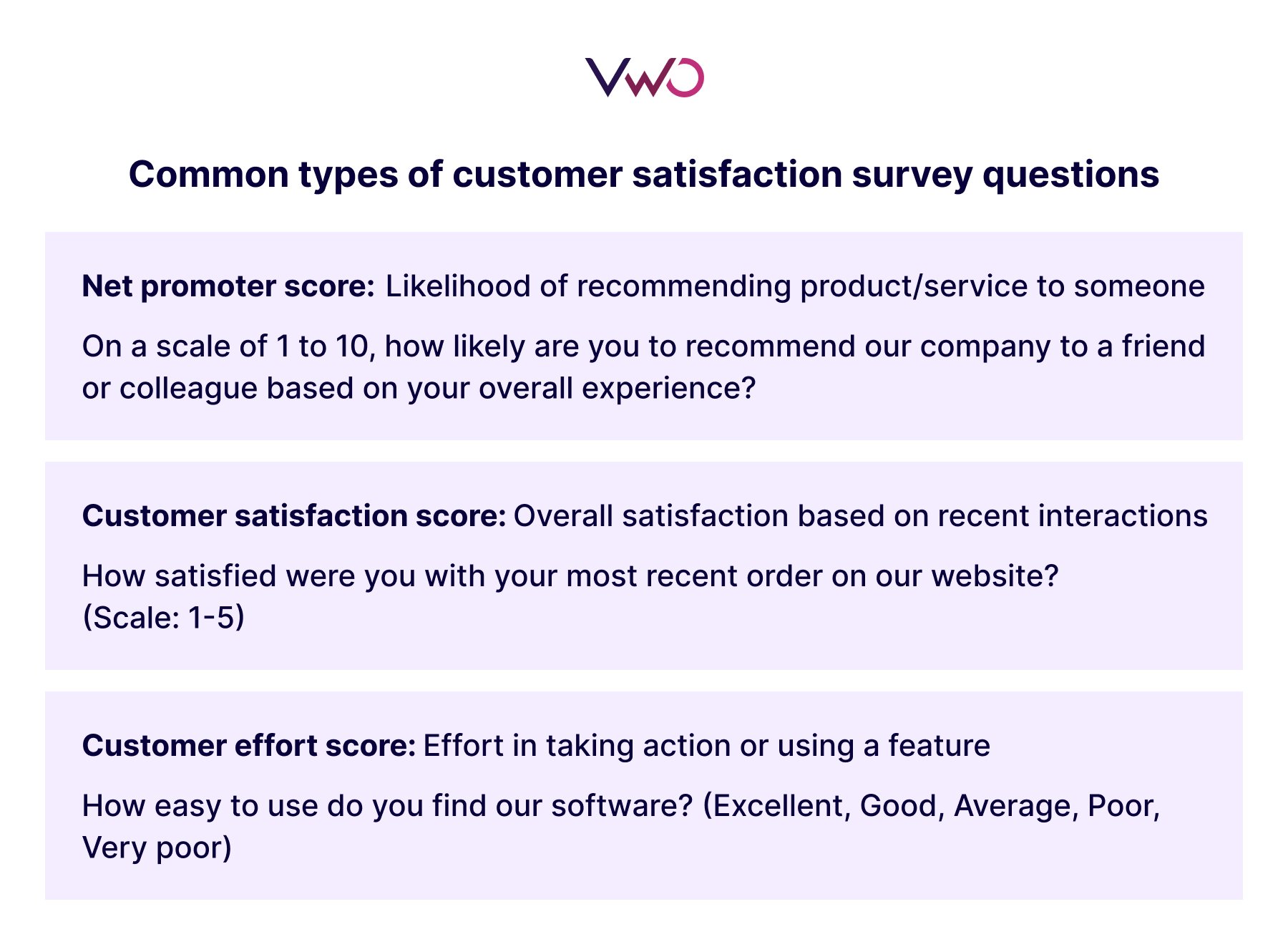

HubSpot offers a variety of free customer surveys and questionnaire templates to analyze and measure customer experience. Choose from five templates: net promoter score, customer satisfaction, customer effort, open-ended questions, and long-form customer surveys.

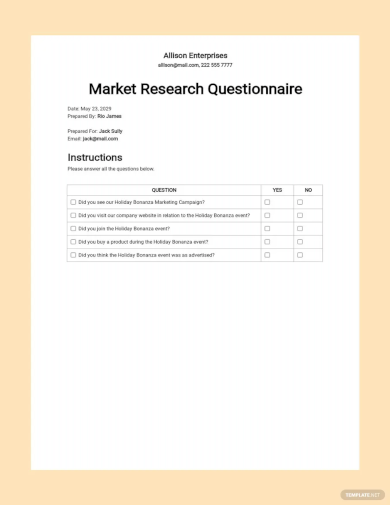

2. Client Questionnaire Template

It's a good idea to gauge your clients' experiences with your business to uncover opportunities to improve your offerings. That will, in turn, better suit their lifestyles. You don't have to wait for an entire year to pass before polling your customer base about their experience either. A simple client questionnaire, like the one below, can be administered as a micro survey several times throughout the year. These types of quick survey questions work well to retarget your existing customers through social media polls and paid interactive ads.

1. How much time do you spend using [product or service]?

- Less than a minute

- About 1 - 2 minutes

- Between 2 and 5 minutes

- More than 5 minutes

2. In the last month, what has been your biggest pain point?

- Finding enough time for important tasks

- Delegating work

- Having enough to do

3. What's your biggest priority right now?

- Finding a faster way to work

- Problem-solving

- Staff development

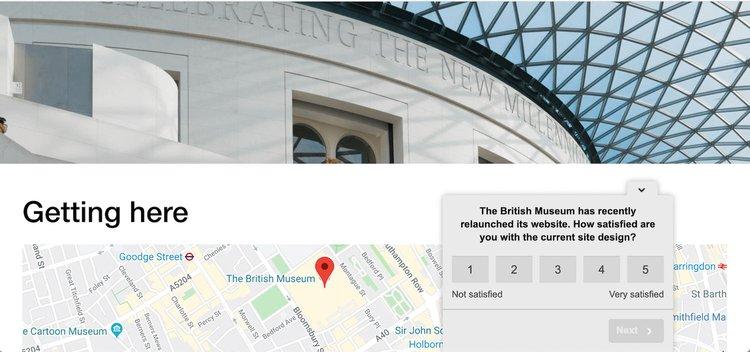

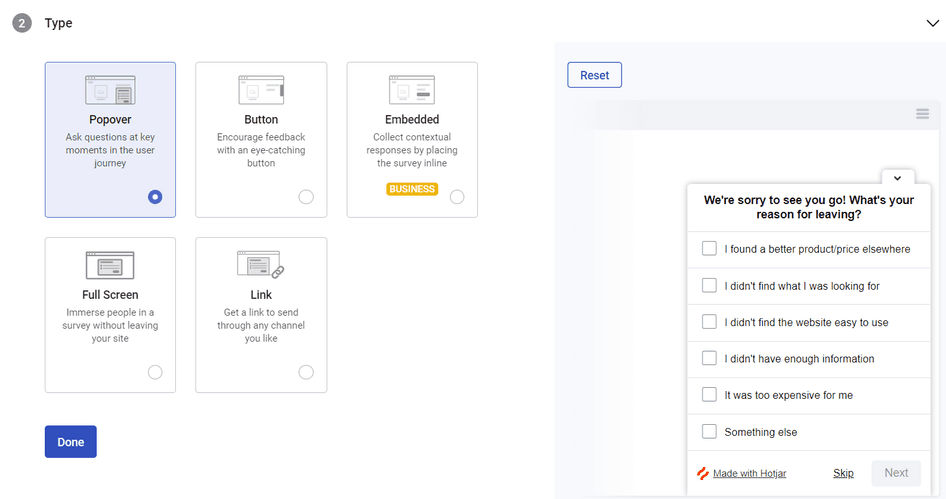

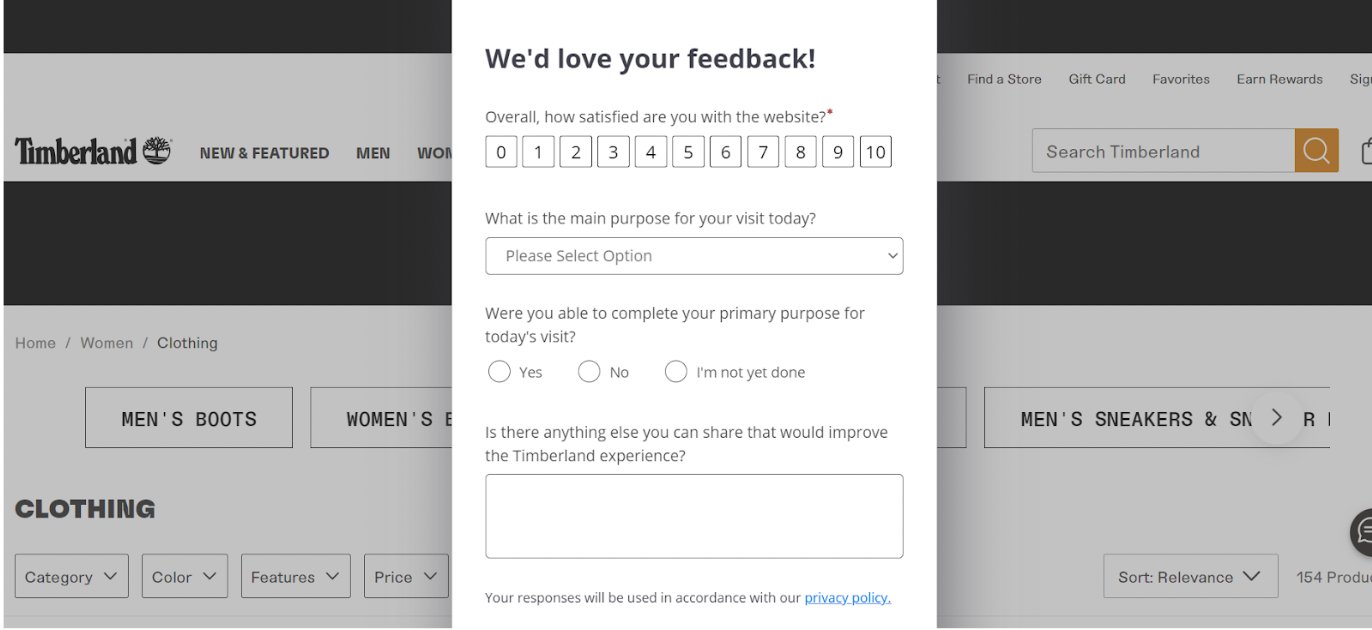

3. Website Questionnaire Template

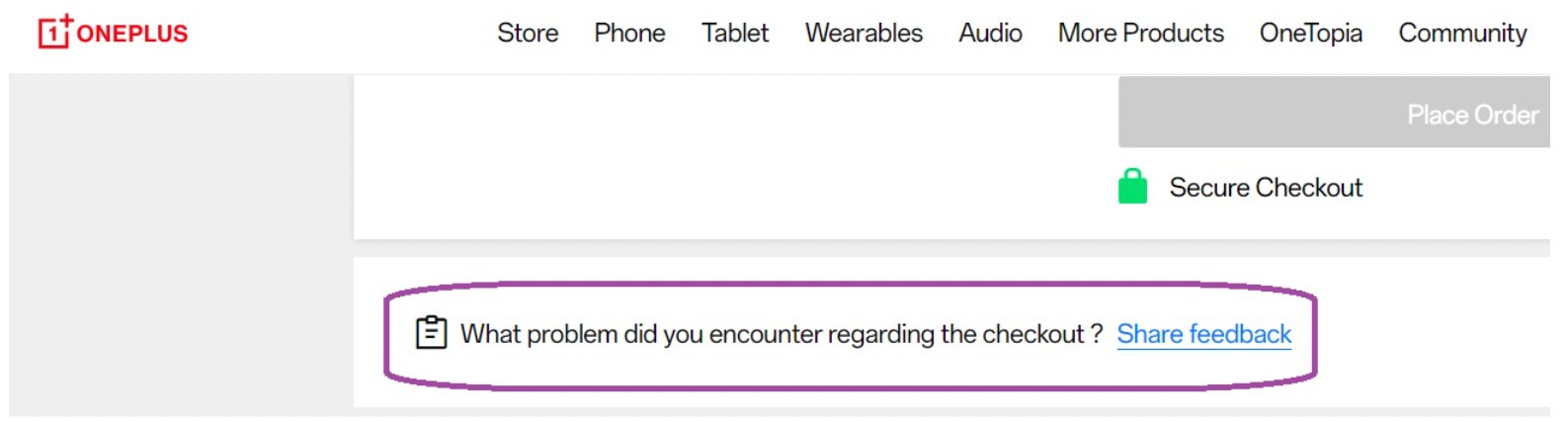

Whether you just launched a brand new website or you're gathering data points to inform a redesign, you'll find customer feedback to be essential in both processes. A website questionnaire template will come in handy to collect this information using an unbiased method.

1. How many times have you visited [website] in the past month?

- More than once

2. What is the primary reason for your visit to [website]?

- To make a purchase

- To find more information before making a purchase in-store

- To contact customer service

3. Are you able to find what you're looking for on the website homepage?

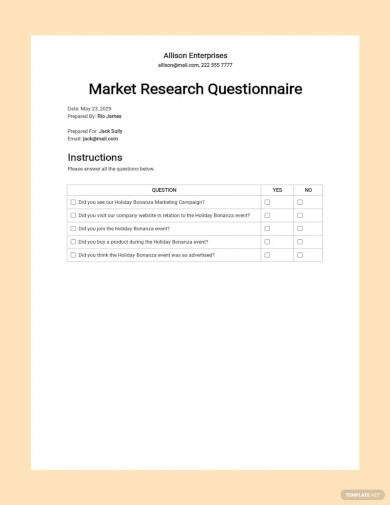

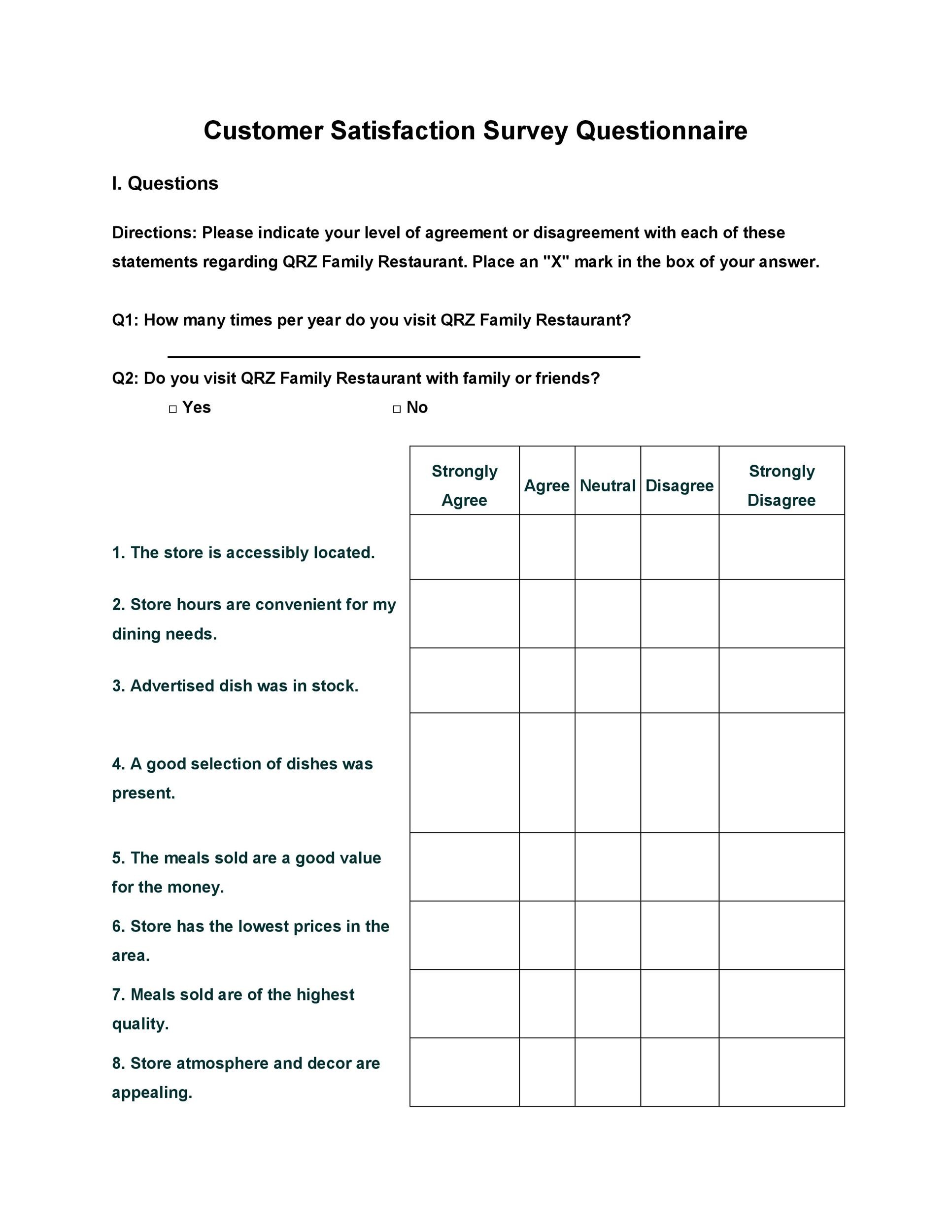

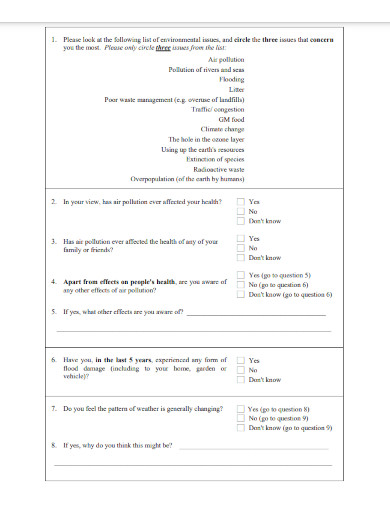

4. Customer Satisfaction Questionnaire Template

If you've never surveyed your customers and are looking for a template to get started, this one includes some basic customer satisfaction questions. These will apply to just about any customer your business serves.

1. How likely are you to recommend us to family, friends, or colleagues?

- Extremely unlikely

- Somewhat unlikely

- Somewhat likely

- Extremely likely

2. How satisfied were you with your experience?

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10

3. Rank the following items in terms of their priority to your purchasing process.

- Helpful staff

- Quality of product

- Price of product

- Ease of purchase

- Proximity of store

- Online accessibility

- Current need

- Appearance of product

4. Who did you purchase these products for?

- Family member

- On behalf of a business

5. Please rate our staff on the following terms:

- Friendly __ __ __ __ __ Hostile

- Helpful __ __ __ __ __ Useless

- Knowledgeable __ __ __ __ __ Inexperienced

- Professional __ __ __ __ __ Inappropriate

6. Would you purchase from our company again?

7. How can we improve your experience for the future?

________________________________.

5. Customer Effort Score Questionnaire Template

The following template gives an example of a brief customer effort score (CES) questionnaire. This free template works well for new customers to measure their initial reaction to your business.

1. What was the ease of your experience with our company?

- Extremely difficult

- Somewhat difficult

- Somewhat easy

- Extremely easy

2. The company did everything it could to make my process as easy as possible.

- Strongly disagree

- Somewhat disagree

- Somewhat agree

- Strongly agree

3. On a scale of 1 to 10 (1 being "extremely quickly" and 10 being "extremely slowly"), how fast were you able to solve your problem?

4. How much effort did you have to put forth while working with our company?

- Much more than expected

- Somewhat more than expected

- As much as expected

- Somewhat less than expected

- Much less than expected

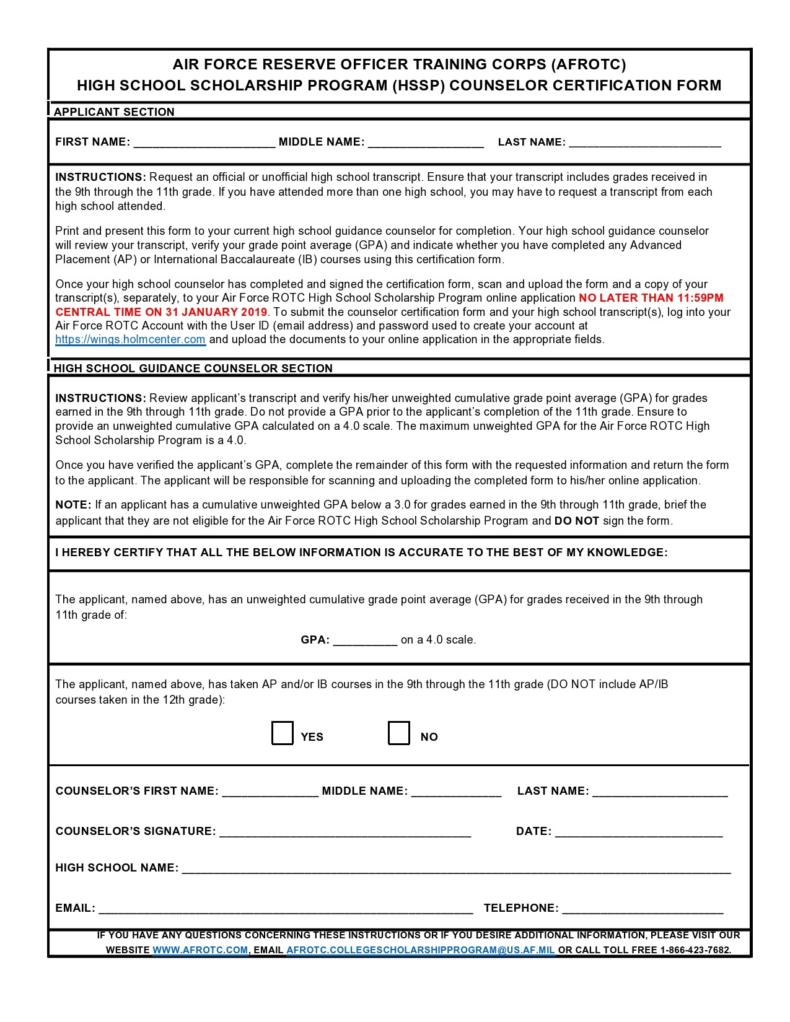

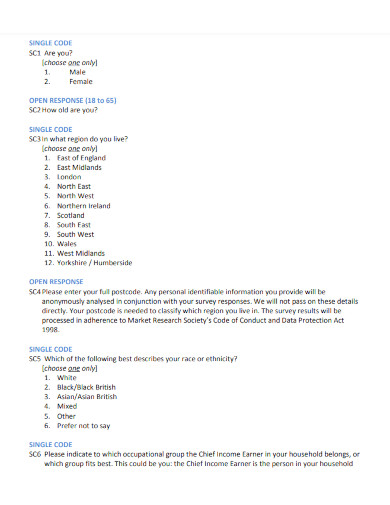

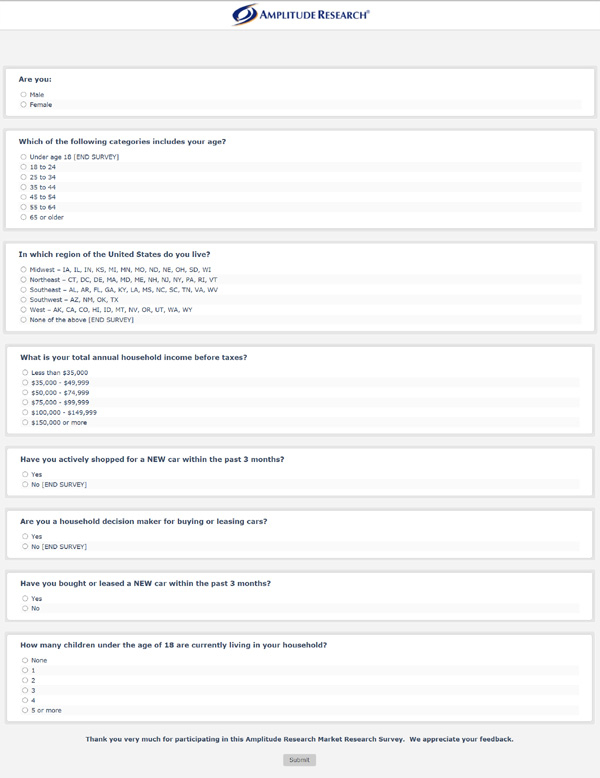

6. Demographic Questionnaire Template

Here's a template for surveying customers to learn more about their demographic background. You could substantiate the analysis of this questionnaire by corroborating the data with other information from your web analytics, internal customer data, and industry data.

1. How would you describe your employment status?

- Employed full-time

- Employed part-time

- Freelance/contract employee

- Self-employed

2. How many employees work at your company?

3. How would you classify your role?

- Individual Contributor

4. How would you classify your industry?

- Technology/software

- Hospitality/dining

- Entertainment

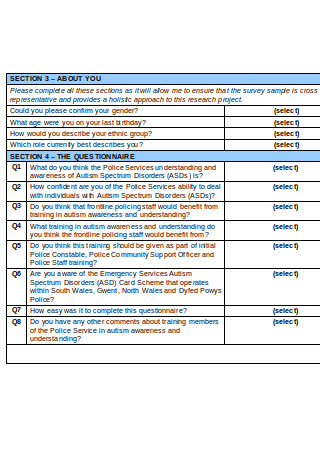

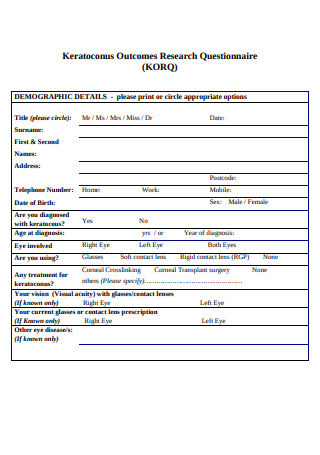

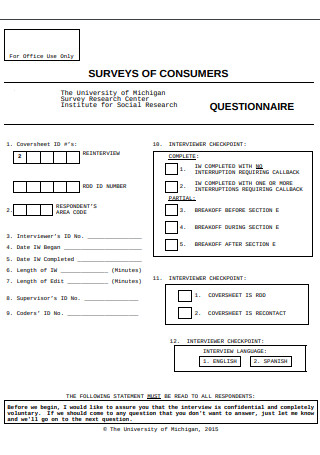

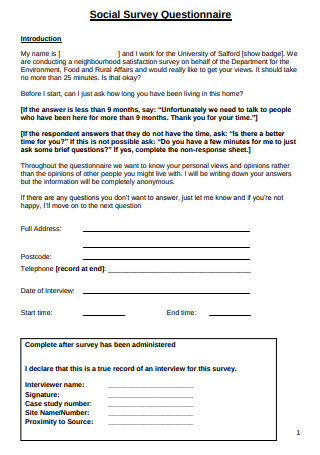

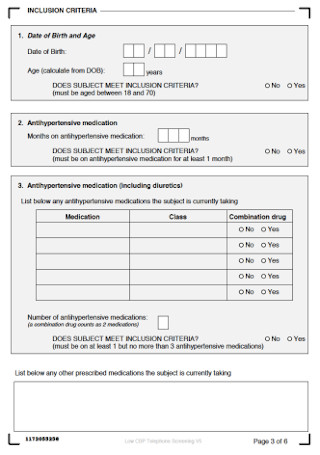

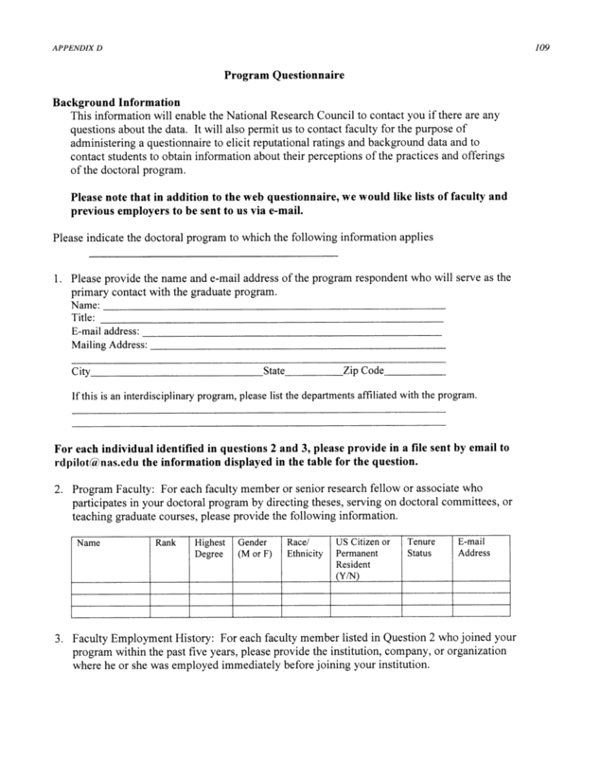

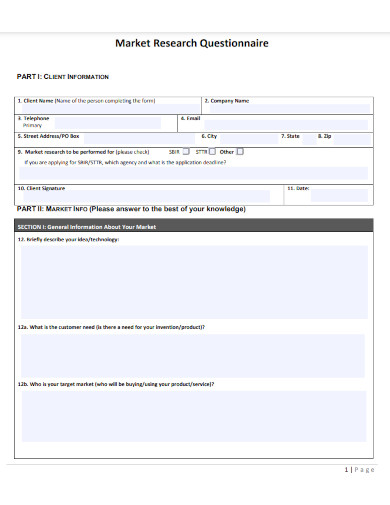

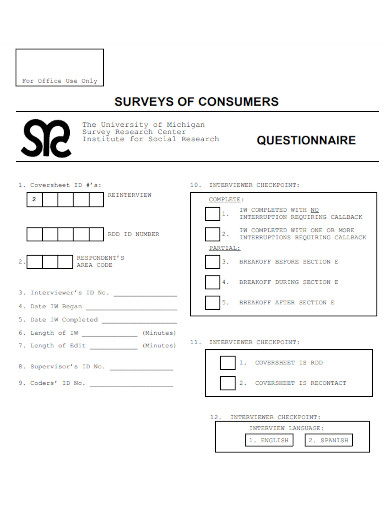

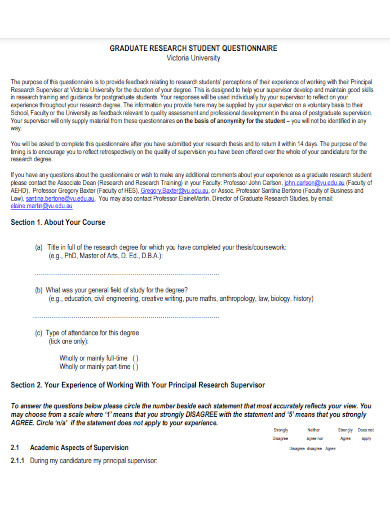

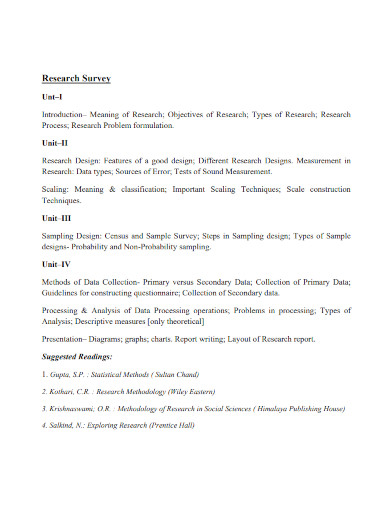

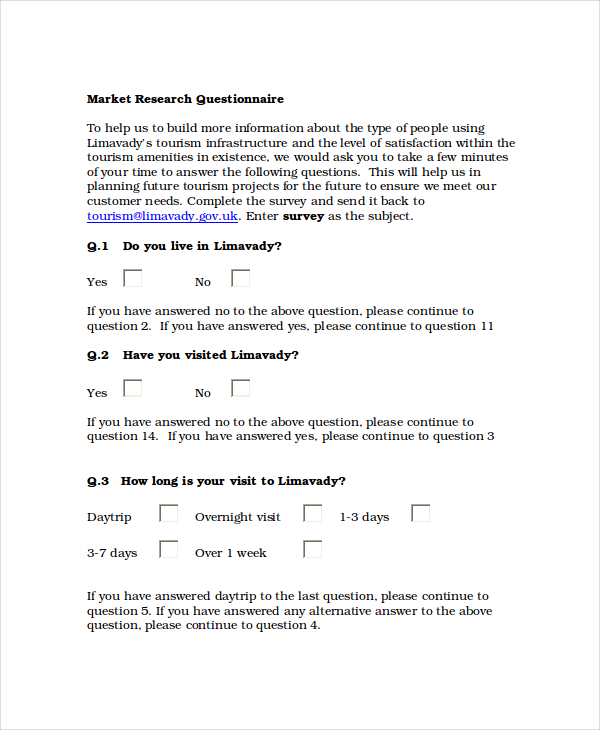

Below, we have curated a list of questionnaire examples that do a great job of gathering valuable qualitative and quantitative data.

4 Questionnaire Examples

1. customer satisfaction questions.

Learn more about HubSpot's Customer Survey software.

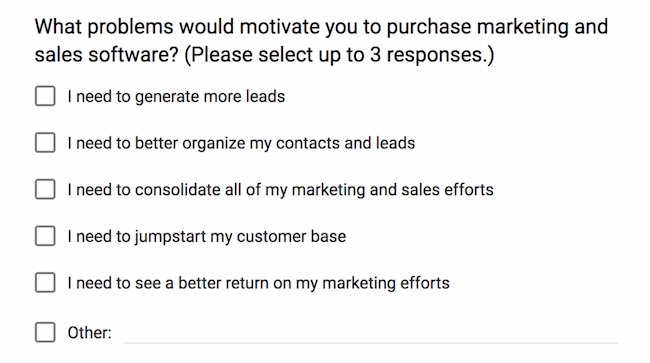

Multiple-Choice

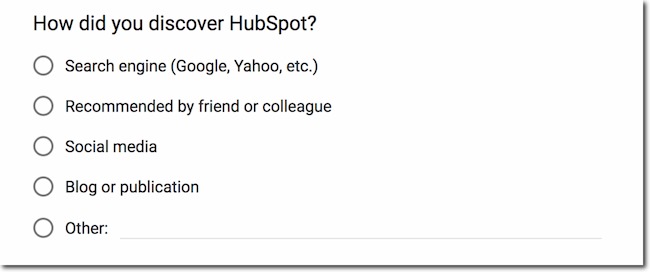

Multiple-choice questions offer respondents several answers to choose from. This is a popular choice of questionnaire format since it's simple for people to fill out and for companies to analyze.

Multiple-choice questions can be in single-answer form (respondents can only choose one response) or multiple-answer form (respondents can choose as many responses as necessary).

Multiple-choice survey question examples : "Which of the following social media platforms do you use most often?"

Image Source

Rating Scale

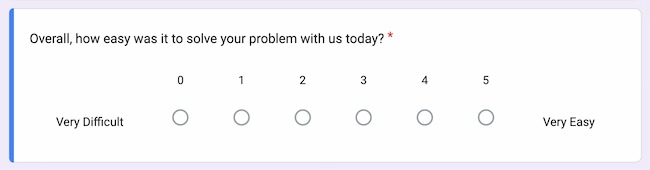

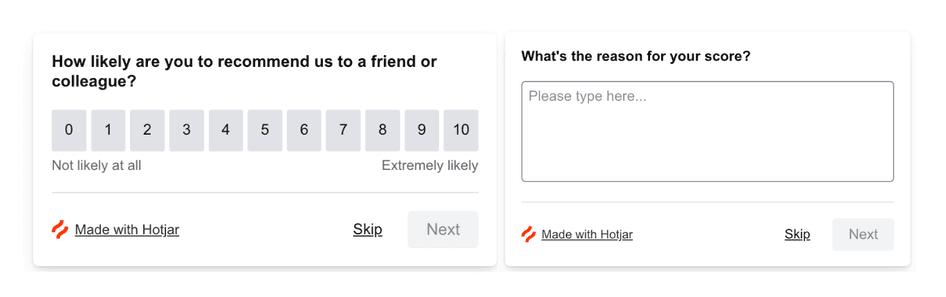

Rating scale questions offer a scale of numbers and ask respondents to rate topics based on the sentiments assigned to that scale. This is effective when assessing customer satisfaction.

Rating scale survey question examples : "Rate your level of satisfaction with the customer service you received today on a scale of 1-10."

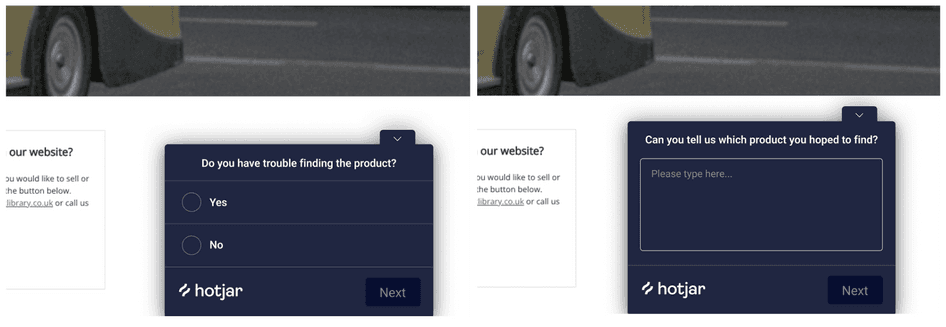

Yes or no survey questions are a type of dichotomous question. These are questions that only offer two possible responses. They’re useful because they’re quick to answer and can help with customer segmentation.

Yes or no survey questions example : "Have you ever used HubSpot before?"

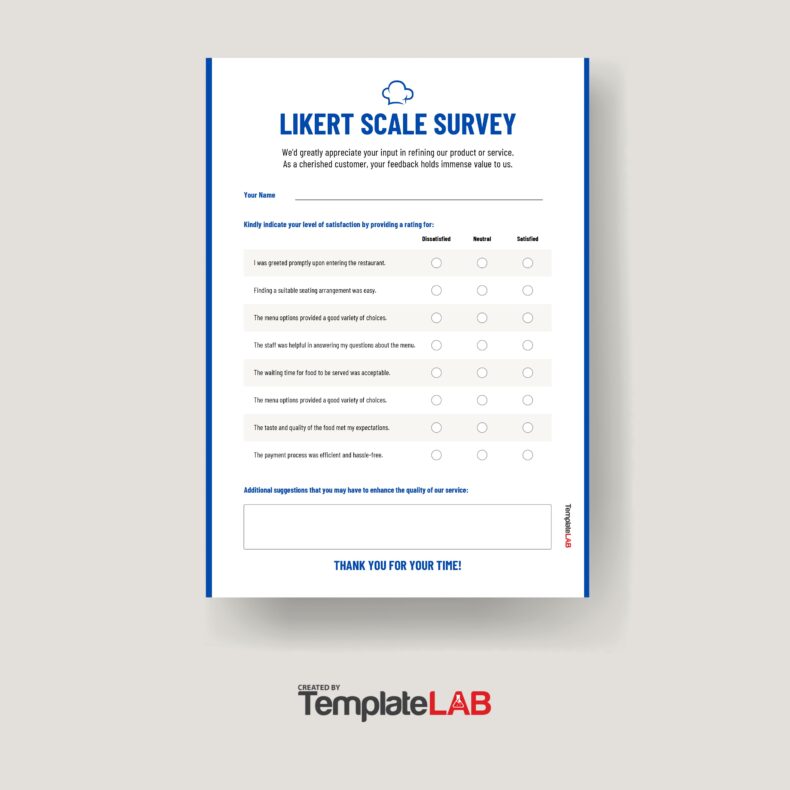

Likert Scale

Likert scale questions assess whether a respondent agrees with the statement, as well as the extent to which they agree or disagree.

These questions typically offer five or seven responses, with sentiments ranging from items such as "strongly disagree" to "strongly agree." Check out this post to learn more about the Likert scale .

Likert scale survey question examples : “How satisfied are you with the service from [brand]?”

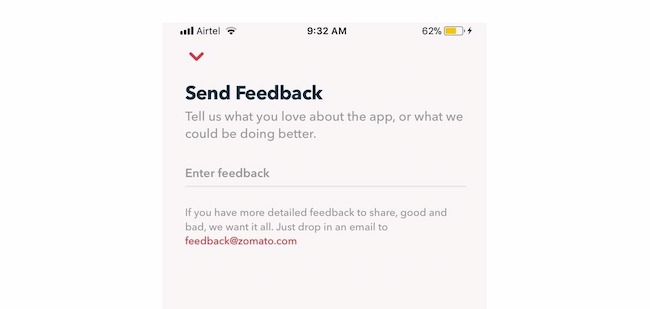

Open-ended questions ask a broader question or offer a chance to elaborate on a response to a close-ended question. They're accompanied by a text box that leaves room for respondents to write freely. This is particularly important when asking customers to expand on an experience or recommendation.

Open-ended survey question examples : "What are your personal goals for using HubSpot? Please describe."

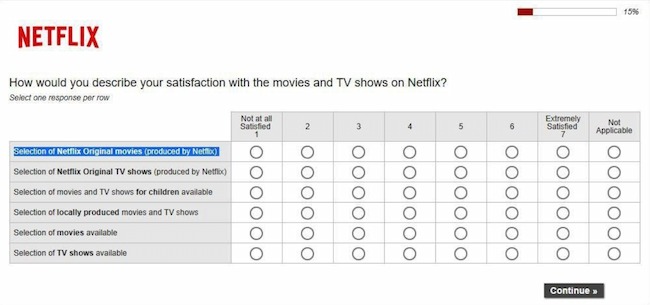

Matrix Table

A matrix table is usually a group of multiple-choice questions grouped in a table. Choices for these survey questions are usually organized in a scale. This makes it easier to understand the relationships between different survey responses.

Matrix table survey question examples : "Rate your level of agreement with the following statements about HubSpot on a scale of 1-5."

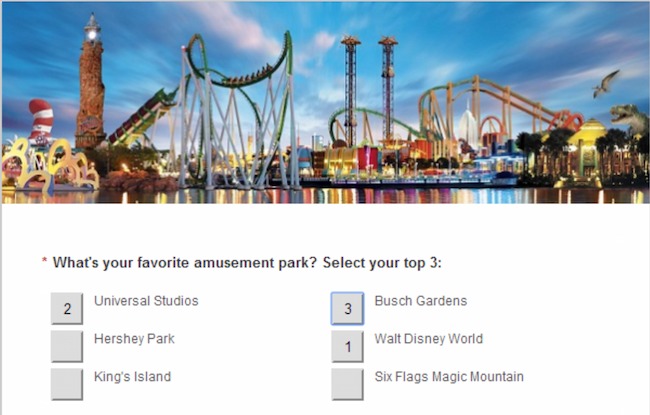

Rank Order Scaling

These questions ask respondents to rank a set of terms by order of preference or importance. This is useful for understanding customer priorities.

Rank order scaling examples : "Rank the following factors in order of importance when choosing a new job."

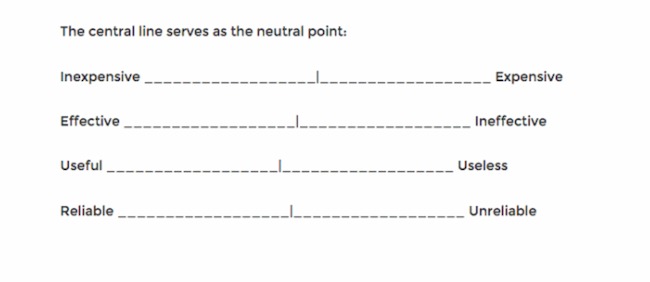

Semantic Differential Scale

This scale features pairs of opposite adjectives that respondents use for rating, usually for a feature or experience. This type of question makes it easier to understand customer attitudes and beliefs.

Semantic differential scale question examples : "Rate your overall impression of this brand as friendly vs. unfriendly, innovative vs. traditional, and boring vs. exciting."

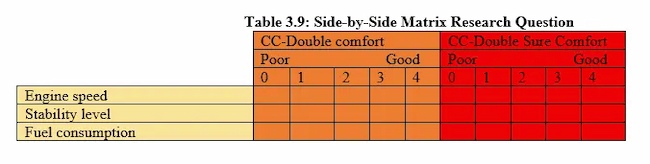

Side-By-Side Matrix

This matrix table format includes two sets of questions horizontally for easy comparison. This format can help with customer gap analysis.

Side-by-side matrix question examples : "Rate your level of satisfaction with HubSpot's customer support compared to its ease of use."

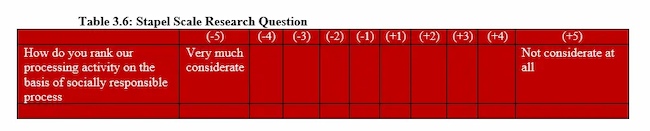

Stapel Scale

The Stapel rating scale offers a single adjective or idea for rating. It uses a numerical scale with a zero point in the middle. This survey question type helps with in-depth analysis.

Stapel scale survey question examples : "Rate your overall experience with this product as +5 (excellent) to -5 (terrible)."

Constant Sum Survey Questions

In this question format, people distribute points to different choices based on the perceived importance of each point. This kind of question is often used in market research and can help your team better understand customer choices .

Constant sum survey question examples : "What is your budget for the following marketing expenses: Paid campaigns, Events, Freelancers, Agencies, Research."

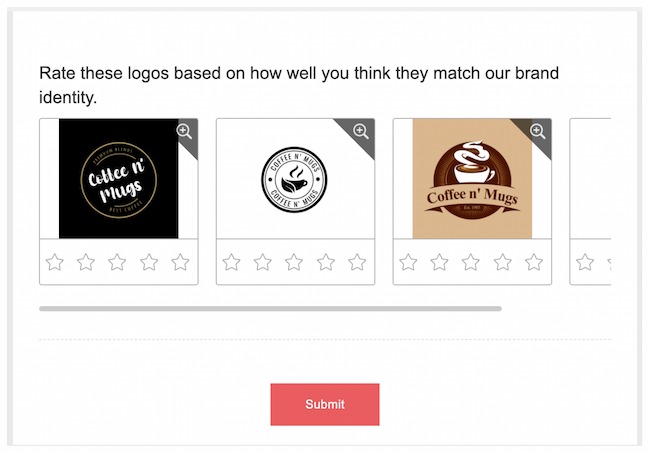

Image Choice

This survey question type shows several images. Then, it asks the respondent to choose the image that best matches their response to the question. These questions are useful for understanding your customers’ design preferences.

Image choice survey questions example : "Which of these three images best represents your brand voice?"

Choice Model

This survey question offers a hypothetical scenario, then the respondent must choose from the presented options. It's a useful type of question when you are refining a product or strategy.

Choice model survey questions example : "Which of these three deals would be most appealing to you?"

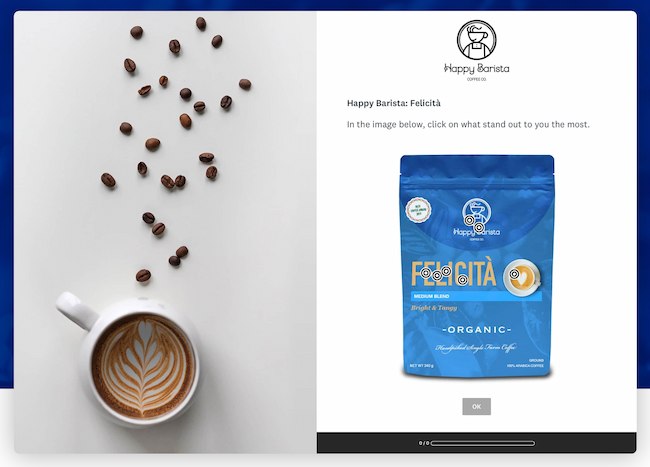

Click Map Questions

Click map questions offer an image click on specific areas of the image in response to a question. This question uses data visualization to learn about customer preferences for design and user experience.

Click map question examples : "Click on the section of the website where you would expect to find pricing information."

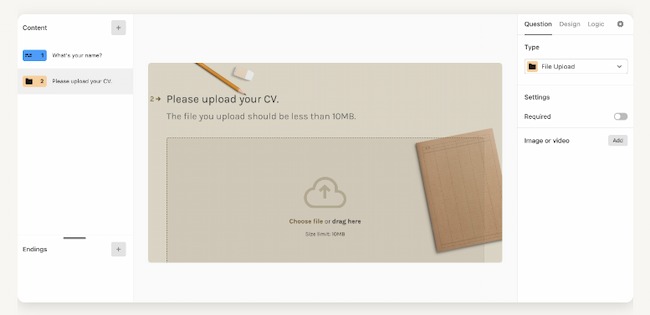

Data Upload

This survey question example asks the respondent to upload a file or document in response to a question. This type of survey question can help your team collect data and context that might be tough to collect otherwise.

Data upload question examples : "Please upload a screenshot of the error you encountered during your purchase."

Benchmarkable Questions

This question type asks a respondent to compare their answers to a group or benchmark. These questions can be useful if you're trying to compare buyer personas or other customer groups.

Benchmarkable survey questions example : "Compare your company's marketing budget to other companies in your industry."

Good Survey Questions

- What is your favorite product?

- Why did you purchase this product?

- How satisfied are you with [product]?

- Would you recommend [product] to a friend?

- Would you recommend [company name] to a friend?

- If you could change one thing about [product], what would it be?

- Which other options were you considering before [product or company name]?

- Did [product] help you accomplish your goal?

- How would you feel if we did not offer this product, feature, or service?

- What would you miss the most if you couldn't use your favorite product from us?

- What is one word that best describes your experience using our product?

- What's the primary reason for canceling your account?

- How satisfied are you with our customer support?

- Did we answer all of your questions and concerns?

- How can we be more helpful?

- What additional features would you like to see in this product?

- Are we meeting your expectations?

- How satisfied are you with your experience?

1. "What is your favorite product?"

This question is a great starter for your survey. Most companies want to know what their most popular products are, and this question cuts right to the point.

It's important to note that this question gives you the customer's perspective, not empirical evidence. You should compare the results to your inventory to see if your customers' answers match your actual sales. You may be surprised to find your customers' "favorite" product isn't the highest-selling one.

2. "Why did you purchase this product?"

Once you know their favorite product, you need to understand why they like it so much. The qualitative data will help your marketing and sales teams attract and engage customers. They'll know which features to advertise most and can seek out new leads similar to your existing customers.

3. "How satisfied are you with [product]?"

When you have a product that isn't selling, you can ask this question to see why customers are unhappy with it. If the reviews are poor, you'll know that the product needs reworking, and you can send it back to product management for improvement. Or, if these results are positive, they may have something to do with your marketing or sales techniques. You can then gather more info during the questionnaire and restrategize your campaigns based on your findings.

4. "Would you recommend [product] to a friend?"

This is a classic survey question used with most NPS® surveys. It asks the customer if they would recommend your product to one of their peers. This is extremely important because most people trust customer referrals more than traditional advertising. So, if your customers are willing to recommend your products, you'll have an easier time acquiring new leads.

5. "Would you recommend [company name] to a friend?"

Similar to the question above, this one asks the customer to consider your business as a whole and not just your product. This gives you insight into your brand's reputation and shows how customers feel about your company's actions. Even if you have an excellent product, your brand's reputation may be the cause of customer churn . Your marketing team should pay close attention to this question to see how they can improve the customer experience .

6. "If you could change one thing about [product], what would it be?"

This is a good question to ask your most loyal customers or ones that have recently churned. For loyal customers, you want to keep adding value to their experience. Asking how your product can improve helps your development team find flaws and increases your chances of retaining a valuable customer segment.

For customers that have recently churned, this question gives insight into how you can retain future users that are unhappy with your product or service. By giving these customers a space to voice their criticisms, you can either reach out and offer solutions or relay feedback for consideration.

7. "Which other options were you considering before [product or company name]?"

If you're operating in a competitive industry, customers will have more than one choice when considering your brand. And if you sell variations of your product or produce new models periodically, customers may prefer one version over another.

For this question, you should offer answers to choose from in a multiple-selection format. This will limit the types of responses you'll receive and help you get the exact information you need.

8. "Did [product] help you accomplish your goal?"

The purpose of any product or service is to help customers reach a goal. So, you should be direct and ask them if your company steered them toward success. After all, customer success is an excellent retention tool. If customers are succeeding with your product, they're more likely to stay loyal to your brand.

9. "How would you feel if we did not offer this product, feature, or service?"

Thinking about discontinuing a product? This question can help you decide whether or not a specific product, service, or feature will be missed if you were to remove it.

Even if you know that a product or service isn't worth offering, it's important to ask this question anyway because there may be a certain aspect of the product that your customers like. They'll be delighted if you can integrate that feature into a new product or service.

10. "If you couldn't use your favorite product from us, what would you miss the most about it?"

This question pairs well with the one above because it frames the customer's favorite product from a different point of view. Instead of describing why they love a particular product, the customer can explain what they'd be missing if they didn't have it at all. This type of question uncovers "fear of loss," which can be a very different motivating factor than "hope for gain."

11. "What word best describes your experience using our product?"

Your marketing team will love this question. A single word or a short phrase can easily sum up your customers’ emotions when they experience your company, product, or brand. Those emotions can be translated into relatable marketing campaigns that use your customers’ exact language.

If the responses reveal negative emotions, it's likely that your entire customer service team can relate to that pain point. Rather than calling it "a bug in the system," you can describe the problem as a "frustrating roadblock" to keep their experience at the forefront of the solution.

12. "What's the primary reason for canceling your account?"

Finding out why customers are unhappy with your product or service is key to decreasing your churn rate . If you don't understand why people leave your brand, it's hard to make effective changes to prevent future turnover. Or worse, you might alter your product or service in a way that increases your churn rate, causing you to lose customers who were once loyal supporters.

13. "How satisfied are you with our customer support?"

It's worth asking customers how happy they are with your support or service team. After all, an excellent product doesn't always guarantee that customers will stay loyal to your brand. Research shows that one in six customers will leave a brand they love after just one poor service experience.

14. "Did we answer all of your questions and concerns?"

This is a good question to ask after a service experience. It shows how thorough your support team is and whether they're prioritizing speed too much over quality. If customers still have questions and concerns after a service interaction, your support team is focusing too much on closing tickets and not enough on meeting customer needs .

15. "How can we be more helpful?"

Sometimes it's easier to be direct and simply ask customers what else you can do to help them. This shows a genuine interest in your buyers' goals which helps your brand foster meaningful relationships with its customer base. The more you can show that you sincerely care about your customers' problems, the more they'll open up to you and be honest about how you can help them.

16. What additional features would you like to see in this product?

With this question, your team can get inspiration for the company's next product launch. Think of the responses as a wish list from your customers. You can discover what features are most valuable to them and whether they already exist within a competitor's product.

Incorporating every feature suggestion is nearly impossible, but it's a convenient way to build a backlog of ideas that can inspire future product releases.

17. "Are we meeting your expectations?"

This is a really important question to ask because customers won't always tell you when they're unhappy with your service. Not every customer will ask to speak with a manager when they're unhappy with your business. In fact, most will quietly move on to a competitor rather than broadcast their unhappiness to your company. To prevent this type of customer churn, you need to be proactive and ask customers if your brand is meeting their expectations.

18. "How satisfied are you with your experience?"

This question asks the customer to summarize their experience with your business. It gives you a snapshot of how the customer is feeling in that moment and their perception of your brand. Asking this question at the right stage in the customer's journey can tell you a lot about what your company is doing well and where you can stand to improve.

Next, let's dig into some tips for creating your own questionnaire.

Start with templates as a foundation. Know your question types. Keep it brief when possible. Choose a simple visual design. Use a clear research process. Create questions with straightforward, unbiased language. Make sure every question is important. Ask one question at a time. Order your questions logically. Consider your target audience. Test your questionnaire.

1. Use questionnaire templates.

Rather than build a questionnaire from scratch, consider using questionnaire templates to get started. HubSpot's collection of customer-facing questionnaire templates can help you quickly build and send a questionnaire to your clients and analyze the results right on Google Drive.

.png?width=375&height=275&name=Image%20Hackathon%20%E2%80%93%20Horizontal%20(24).png)

Download Now

2. Know your question types.

A simple "yes" or "no" doesn't cut it. To get feedback that actually matters, you need to give customers options that go in-depth. There's a method to getting accurate feedback from your questionnaire, and it starts by choosing the appropriate types of questions for the information you want to know.

Vrnda LeValley , customer training manager at HubSpot, recommends starting with an alignment question like, "Does this class meet your expectations?" because it gives more context to any positive or negative scores that follow. She continues, "If it didn't meet expectations, then there will potentially be negative responses across the board (as well as the reverse)."

3. Keep it brief, when possible.

Most questionnaires don't need to be longer than a page. For routine customer satisfaction surveys, it's unnecessary to ask 50 slightly varied questions about a customer's experience when those questions could be combined into 10 solid questions.

The shorter your questionnaire is, the more likely a customer will complete it. Plus a shorter questionnaire means less data for your team to collect and analyze. Based on the feedback, it will be a lot easier for you to get the information you need to make the necessary changes in your organization and products.

4. Choose a simple visual design.

There's no need to make your questionnaire a stunning work of art. As long as it's clear and concise, it will be attractive to customers. When asking questions that are important to furthering your company, it's best to keep things simple. Select a font that’s common and easy to read, like Helvetica or Arial. Use a text size that customers of all abilities can navigate.

A questionnaire is most effective when all the questions are visible on a single screen. The layout is important. If a questionnaire is even remotely difficult to navigate, your response rate could suffer. Make sure that buttons and checkboxes are easy to click and that questions are visible on both computer and mobile screens.

5. Use a clear research process.

Before planning questions for your questionnaire, you'll need to have a definite direction for it. A questionnaire is only effective if the results answer an overarching research question. After all, the research process is an important part of the survey, and a questionnaire is a tool that's used within the process.

In your research process, you should first come up with a research question. What are you trying to find out? What's the point of this questionnaire? Keep this in mind throughout the process.

After coming up with a research question, it's a good idea to have a hypothesis. What do you predict the results will be for your questionnaire? This can be structured in a simple "If … then …" format. A structured experiment — yes, your questionnaire is a type of experiment — will confirm that you're only collecting and analyzing data necessary to answer your research question. Then, you can move forward with your survey .

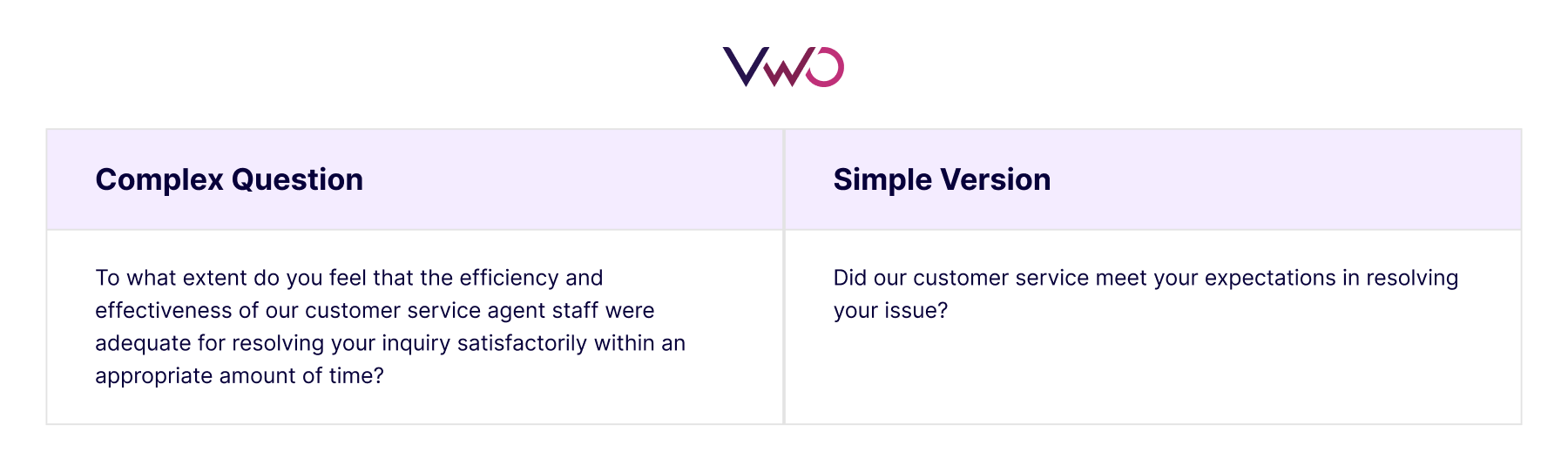

6. Create questions with straightforward, unbiased language.

When crafting your questions, it's important to structure them to get the point across. You don't want any confusion for your customers because this may influence their answers. Instead, use clear language. Don't use unnecessary jargon, and use simple terms in favor of longer-winded ones.

You may risk the reliability of your data if you try to combine two questions. Rather than asking, "How was your experience shopping with us, and would you recommend us to others?" separate it into two separate questions. Customers will be clear on your question and choose a response most appropriate for each one.

You should always keep the language in your questions unbiased. You never want to sway customers one way or another because this will cause your data to be skewed. Instead of asking, "Some might say that we create the best software products in the world. Would you agree or disagree?" it may be better to ask, "How would you rate our software products on a scale of 1 to 10?" This removes any bias and confirms that all the responses are valid.

7. Ask only the most important questions.

When creating your questionnaire, keep in mind that time is one of the most valuable commodities for customers. Most aren't going to sit through a 50-question survey, especially when they're being asked about products or services they didn't use. Even if they do complete it, most of these will be half-hearted responses from fatigued customers who simply want to be finished with it.

If your questionnaire has five or 55 questions, make sure each has a specific purpose. Individually, they should be aimed at collecting certain pieces of information that reveal new insights into different aspects of your business. If your questions are irrelevant or seem out of place, your customers will be easily derailed by the survey. And, once the customer has lost interest, it'll be difficult to regain their focus.

8. Ask one question at a time.

Since every question has a purpose, ask them one at a time. This lets the customer focus and encourages them to share a thoughtful response. This is particularly important for open-ended questions where customers need to describe an experience or opinion.

By grouping questions together, you risk overwhelming busy customers who don't have time for a long survey. They may think you're asking them too much, or they might see your questionnaire as a daunting task. You want your survey to appear as painless as possible. Keeping your questions separated will make it more user-friendly.

9. Order your questions logically.

A good questionnaire is like a good book. The beginning questions should lay the framework, the middle ones should cut to the core issues, and the final questions should tie up all loose ends. This flow keeps customers engaged throughout the entire survey.

When creating your questionnaire, start with the most basic questions about demographics. You can use this information to segment your customer base and create different buyer personas.

Next, add in your product and services questions. These are the ones that offer insights into common customer roadblocks and where you can improve your business's offerings. Questions like these guide your product development and marketing teams looking for new ways to enhance the customer experience.

Finally, you should conclude your questionnaire with open-ended questions to understand the customer journey. These questions let customers voice their opinions and point out specific experiences they've had with your brand.

10. Consider your target audience.

Whenever you collect customer feedback, you need to keep in mind the goals and needs of your target audience. After all, the participants in this questionnaire are your active customers. Your questions should be geared toward the interests and experiences they've already had with your company.

You can even create multiple surveys that target different buyer personas. For example, if you have a subscription-based pricing model, you can personalize your questionnaire for each type of subscription your company offers.

11. Test your questionnaire.

Once your questionnaire is complete, it's important to test it. If you don't, you may end up asking the wrong questions and collecting irrelevant or inaccurate information. Start by giving your employees the questionnaire to test, then send it to small groups of customers and analyze the results. If you're gathering the data you're looking for, then you should release the questionnaire to all of your customers.

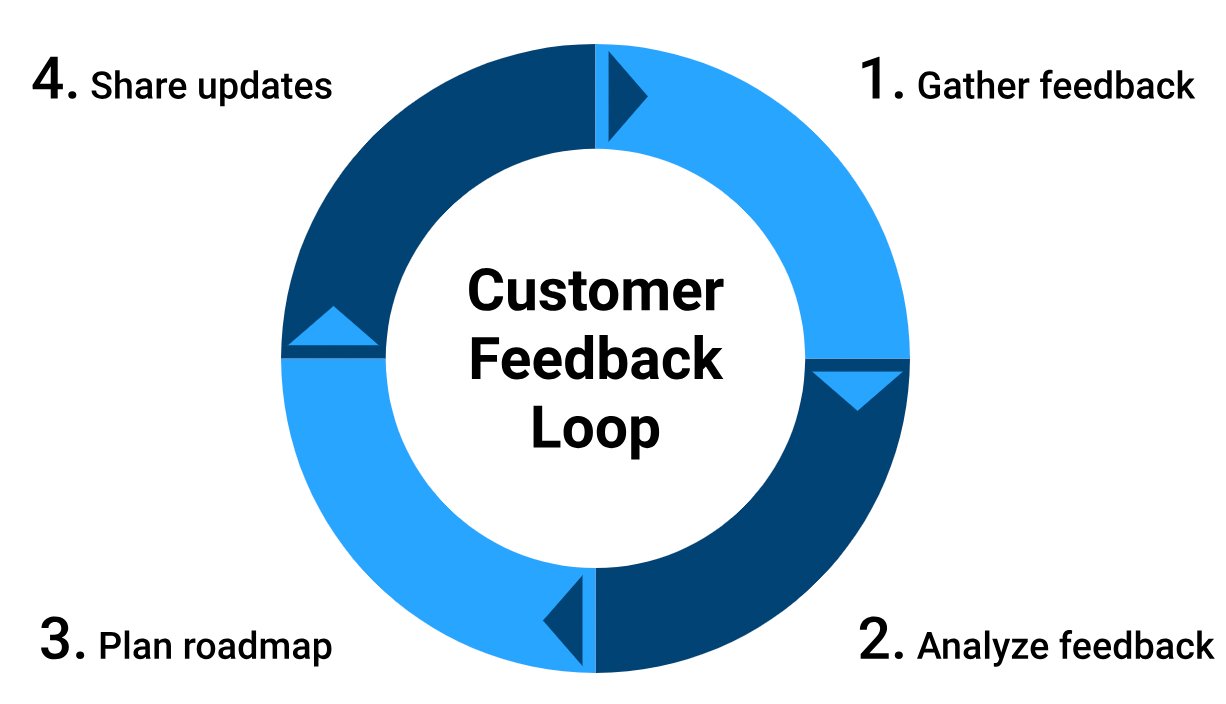

How Questionnaires Can Benefit Your Customer Service Strategy

Whether you have one customer or 1000 customers, their opinions matter when it comes to the success of your business. Their satisfaction with your offerings can reveal how well or how poorly your customer service strategy and business are meeting their needs. A questionnaire is one of the most powerful, cost-effective tools to uncover what your customers think about your business. When analyzed properly, it can inform your product and service launches.

Use the free questionnaire templates, examples, and best practices in this guide to conduct your next customer feedback survey.

Now that you know the slight difference between a survey and a questionnaire, it’s time to put it into practice with your products or services. Remember, a good survey and questionnaire always start with a purpose. But, a great survey and questionnaire give data that you can use to help companies increase the way customers respond to their products or services because of the questions.

Net Promoter, Net Promoter System, Net Promoter Score, NPS, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Editor's note: This post was originally published in July 2018 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

Nonresponse Bias: What to Avoid When Creating Surveys

How to Make a Survey with a QR Code

50 Catchy Referral Slogans & How to Write Your Own

![example of a research survey questionnaire How Automated Phone Surveys Work [+Tips and Examples]](https://www.hubspot.com/hubfs/phone-survey.webp)

How Automated Phone Surveys Work [+Tips and Examples]

Online Panels: What They Are & How to Use Them Effectively

The Complete Guide to Survey Logic (+Expert Tips)

Focus Group vs. Survey: Which One Should You Use?

![example of a research survey questionnaire Leading Questions: What They Are & Why They Matter [+ Examples]](https://www.hubspot.com/hubfs/leading-questions-hero.webp)

Leading Questions: What They Are & Why They Matter [+ Examples]

What are Survey Sample Sizes & How to Find Your Sample Size

24 Diversity, Equity, and Inclusion Survey Questions to Ask Your Employees

5 free templates for learning more about your customers and respondents.

Service Hub provides everything you need to delight and retain customers while supporting the success of your whole front office

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

Your ultimate guide to questionnaires and how to design a good one

The written questionnaire is the heart and soul of any survey research project. Whether you conduct your survey using an online questionnaire, in person, by email or over the phone, the way you design your questionnaire plays a critical role in shaping the quality of the data and insights that you’ll get from your target audience. Keep reading to get actionable tips.

What is a questionnaire?

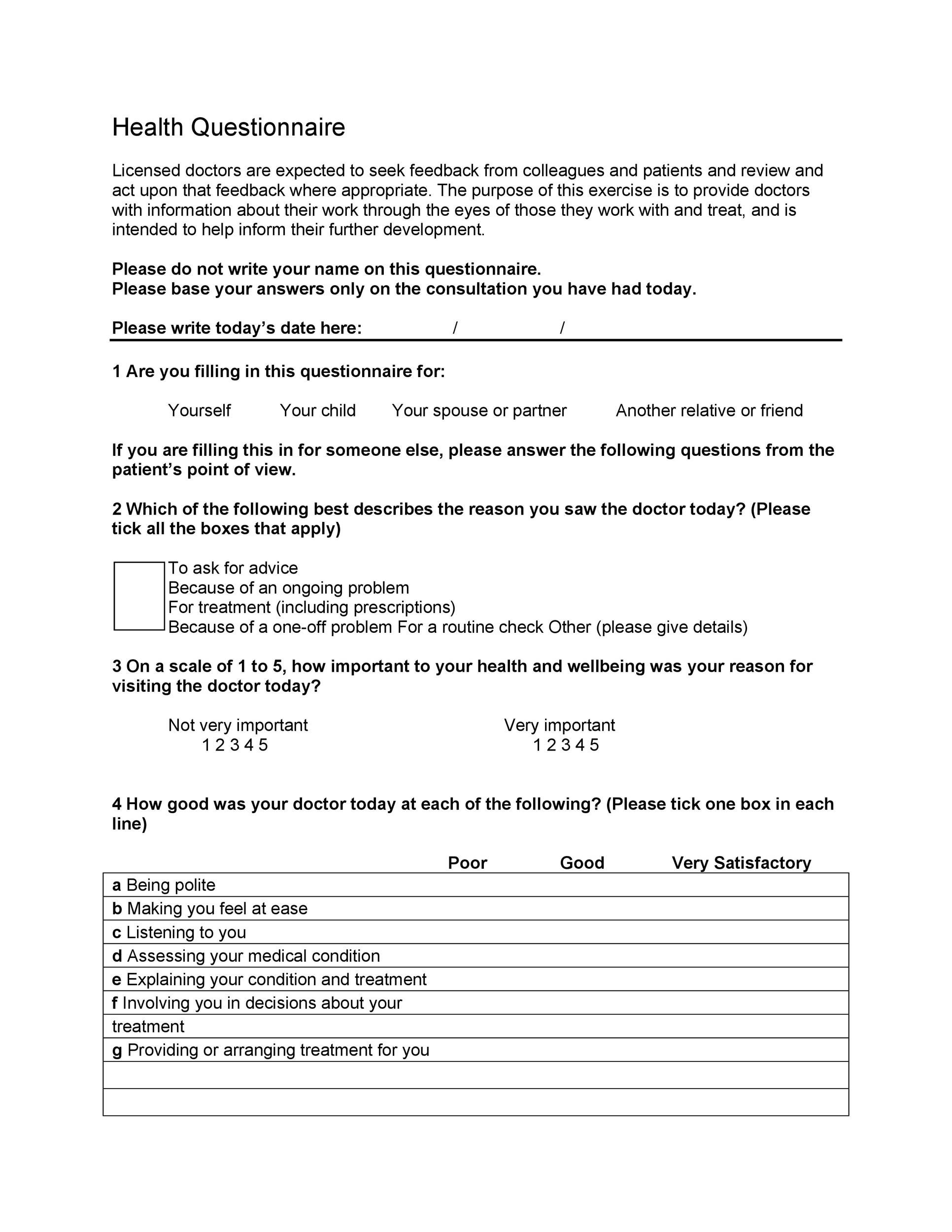

A questionnaire is a research tool consisting of a set of questions or other ‘prompts’ to collect data from a set of respondents.

When used in most research, a questionnaire will consist of a number of types of questions (primarily open-ended and closed) in order to gain both quantitative data that can be analyzed to draw conclusions, and qualitative data to provide longer, more specific explanations.

A research questionnaire is often mistaken for a survey - and many people use the term questionnaire and survey, interchangeably.

But that’s incorrect.

Which is what we talk about next.

Get started with our free survey maker with 50+ templates

Survey vs. questionnaire – what’s the difference?

Before we go too much further, let’s consider the differences between surveys and questionnaires.

These two terms are often used interchangeably, but there is an important difference between them.

Survey definition

A survey is the process of collecting data from a set of respondents and using it to gather insights.

Survey research can be conducted using a questionnaire, but won’t always involve one.

Questionnaire definition

A questionnaire is the list of questions you circulate to your target audience.

In other words, the survey is the task you’re carrying out, and the questionnaire is the instrument you’re using to do it.

By itself, a questionnaire doesn’t achieve much.

It’s when you put it into action as part of a survey that you start to get results.

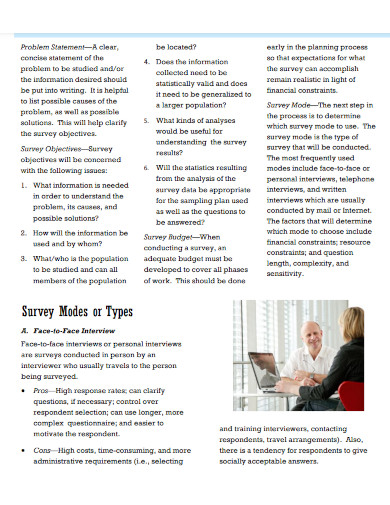

Advantages vs disadvantages of using a questionnaire

While a questionnaire is a popular method to gather data for market research or other studies, there are a few disadvantages to using this method (although there are plenty of advantages to using a questionnaire too).

Let’s have a look at some of the advantages and disadvantages of using a questionnaire for collecting data.

Advantages of using a questionnaire

1. questionnaires are relatively cheap.

Depending on the complexity of your study, using a questionnaire can be cost effective compared to other methods.

You simply need to write your survey questionnaire, and send it out and then process the responses.

You can set up an online questionnaire relatively easily, or simply carry out market research on the street if that’s the best method.

2. You can get and analyze results quickly

Again depending on the size of your survey you can get results back from a questionnaire quickly, often within 24 hours of putting the questionnaire live.

It also means you can start to analyze responses quickly too.

3. They’re easily scalable

You can easily send an online questionnaire to anyone in the world and with the right software you can quickly identify your target audience and your questionnaire to them.

4. Questionnaires are easy to analyze

If your questionnaire design has been done properly, it’s quick and easy to analyze results from questionnaires once responses start to come back.

This is particularly useful with large scale market research projects.

Because all respondents are answering the same questions, it’s simple to identify trends.

5. You can use the results to make accurate decisions

As a research instrument, a questionnaire is ideal for commercial research because the data you get back is from your target audience (or ideal customers) and the information you get back on their thoughts, preferences or behaviors allows you to make business decisions.

6. A questionnaire can cover any topic

One of the biggest advantages of using questionnaires when conducting research is (because you can adapt them using different types and styles of open ended questions and closed ended questions) they can be used to gather data on almost any topic.

There are many types of questionnaires you can design to gather both quantitative data and qualitative data - so they’re a useful tool for all kinds of data analysis.

Disadvantages of using a questionnaire

1. respondents could lie.

This is by far the biggest risk with a questionnaire, especially when dealing with sensitive topics.

Rather than give their actual opinion, a respondent might feel pressured to give the answer they deem more socially acceptable, which doesn’t give you accurate results.

2. Respondents might not answer every question

There are all kinds of reasons respondents might not answer every question, from questionnaire length, they might not understand what’s being asked, or they simply might not want to answer it.

If you get questionnaires back without complete responses it could negatively affect your research data and provide an inaccurate picture.

3. They might interpret what’s being asked incorrectly

This is a particular problem when running a survey across geographical boundaries and often comes down to the design of the survey questionnaire.

If your questions aren’t written in a very clear way, the respondent might misunderstand what’s being asked and provide an answer that doesn’t reflect what they actually think.

Again this can negatively affect your research data.

4. You could introduce bias

The whole point of producing a questionnaire is to gather accurate data from which decisions can be made or conclusions drawn.

But the data collected can be heavily impacted if the researchers accidentally introduce bias into the questions.

This can be easily done if the researcher is trying to prove a certain hypothesis with their questionnaire, and unwittingly write questions that push people towards giving a certain answer.

In these cases respondents’ answers won’t accurately reflect what is really happening and stop you gathering more accurate data.

5. Respondents could get survey fatigue

One issue you can run into when sending out a questionnaire, particularly if you send them out regularly to the same survey sample, is that your respondents could start to suffer from survey fatigue.

In these circumstances, rather than thinking about the response options in the questionnaire and providing accurate answers, respondents could start to just tick boxes to get through the questionnaire quickly.

Again, this won’t give you an accurate data set.

Questionnaire design: How to do it

It’s essential to carefully craft a questionnaire to reduce survey error and optimize your data . The best way to think about the questionnaire is with the end result in mind.

How do you do that?

Start with questions, like:

- What is my research purpose ?

- What data do I need?

- How am I going to analyze that data?

- What questions are needed to best suit these variables?

Once you have a clear idea of the purpose of your survey, you’ll be in a better position to create an effective questionnaire.

Here are a few steps to help you get into the right mindset.

1. Keep the respondent front and center

A survey is the process of collecting information from people, so it needs to be designed around human beings first and foremost.

In his post about survey design theory, David Vannette, PhD, from the Qualtrics Methodology Lab explains the correlation between the way a survey is designed and the quality of data that is extracted.

“To begin designing an effective survey, take a step back and try to understand what goes on in your respondents’ heads when they are taking your survey.

This step is critical to making sure that your questionnaire makes it as likely as possible that the response process follows that expected path.”

From writing the questions to designing the survey flow, the respondent’s point of view should always be front and center in your mind during a questionnaire design.

2. How to write survey questions

Your questionnaire should only be as long as it needs to be, and every question needs to deliver value.

That means your questions must each have an individual purpose and produce the best possible data for that purpose, all while supporting the overall goal of the survey.

A question must also must be phrased in a way that is easy for all your respondents to understand, and does not produce false results.

To do this, remember the following principles:

Get into the respondent's head

The process for a respondent answering a survey question looks like this:

- The respondent reads the question and determines what information they need to answer it.

- They search their memory for that information.

- They make judgments about that information.

- They translate that judgment into one of the answer options you’ve provided. This is the process of taking the data they have and matching that information with the question that’s asked.

When wording questions, make sure the question means the same thing to all respondents. Words should have one meaning, few syllables, and the sentences should have few words.

Only use the words needed to ask your question and not a word more .

Note that it’s important that the respondent understands the intent behind your question.

If they don’t, they may answer a different question and the data can be skewed.

Some contextual help text, either in the introduction to the questionnaire or before the question itself, can help make sure the respondent understands your goals and the scope of your research.

Use mutually exclusive responses

Be sure to make your response categories mutually exclusive.

Consider the question:

What is your age?

Respondents that are 31 years old have two options, as do respondents that are 40 and 55. As a result, it is impossible to predict which category they will choose.

This can distort results and frustrate respondents. It can be easily avoided by making responses mutually exclusive.

The following question is much better:

This question is clear and will give us better results.

Ask specific questions

Nonspecific questions can confuse respondents and influence results.

Do you like orange juice?

- Like very much

- Neither like nor dislike

- Dislike very much

This question is very unclear. Is it asking about taste, texture, price, or the nutritional content? Different respondents will read this question differently.

A specific question will get more specific answers that are actionable.

How much do you like the current price of orange juice?

This question is more specific and will get better results.

If you need to collect responses about more than one aspect of a subject, you can include multiple questions on it. (Do you like the taste of orange juice? Do you like the nutritional content of orange juice? etc.)

Use a variety of question types

If all of your questionnaire, survey or poll questions are structured the same way (e.g. yes/no or multiple choice) the respondents are likely to become bored and tune out. That could mean they pay less attention to how they’re answering or even give up altogether.

Instead, mix up the question types to keep the experience interesting and varied. It’s a good idea to include questions that yield both qualitative and quantitative data.

For example, an open-ended questionnaire item such as “describe your attitude to life” will provide qualitative data – a form of information that’s rich, unstructured and unpredictable. The respondent will tell you in their own words what they think and feel.

A quantitative / close-ended questionnaire item, such as “Which word describes your attitude to life? a) practical b) philosophical” gives you a much more structured answer, but the answers will be less rich and detailed.

Open-ended questions take more thought and effort to answer, so use them sparingly. They also require a different kind of treatment once your survey is in the analysis stage.

3. Pre-test your questionnaire

Always pre-test a questionnaire before sending it out to respondents. This will help catch any errors you might have missed. You could ask a colleague, friend, or an expert to take the survey and give feedback. If possible, ask a few cognitive questions like, “how did you get to that response?” and “what were you thinking about when you answered that question?” Figure out what was easy for the responder and where there is potential for confusion. You can then re-word where necessary to make the experience as frictionless as possible.

If your resources allow, you could also consider using a focus group to test out your survey. Having multiple respondents road-test the questionnaire will give you a better understanding of its strengths and weaknesses. Match the focus group to your target respondents as closely as possible, for example in terms of age, background, gender, and level of education.

Note: Don't forget to make your survey as accessible as possible for increased response rates.

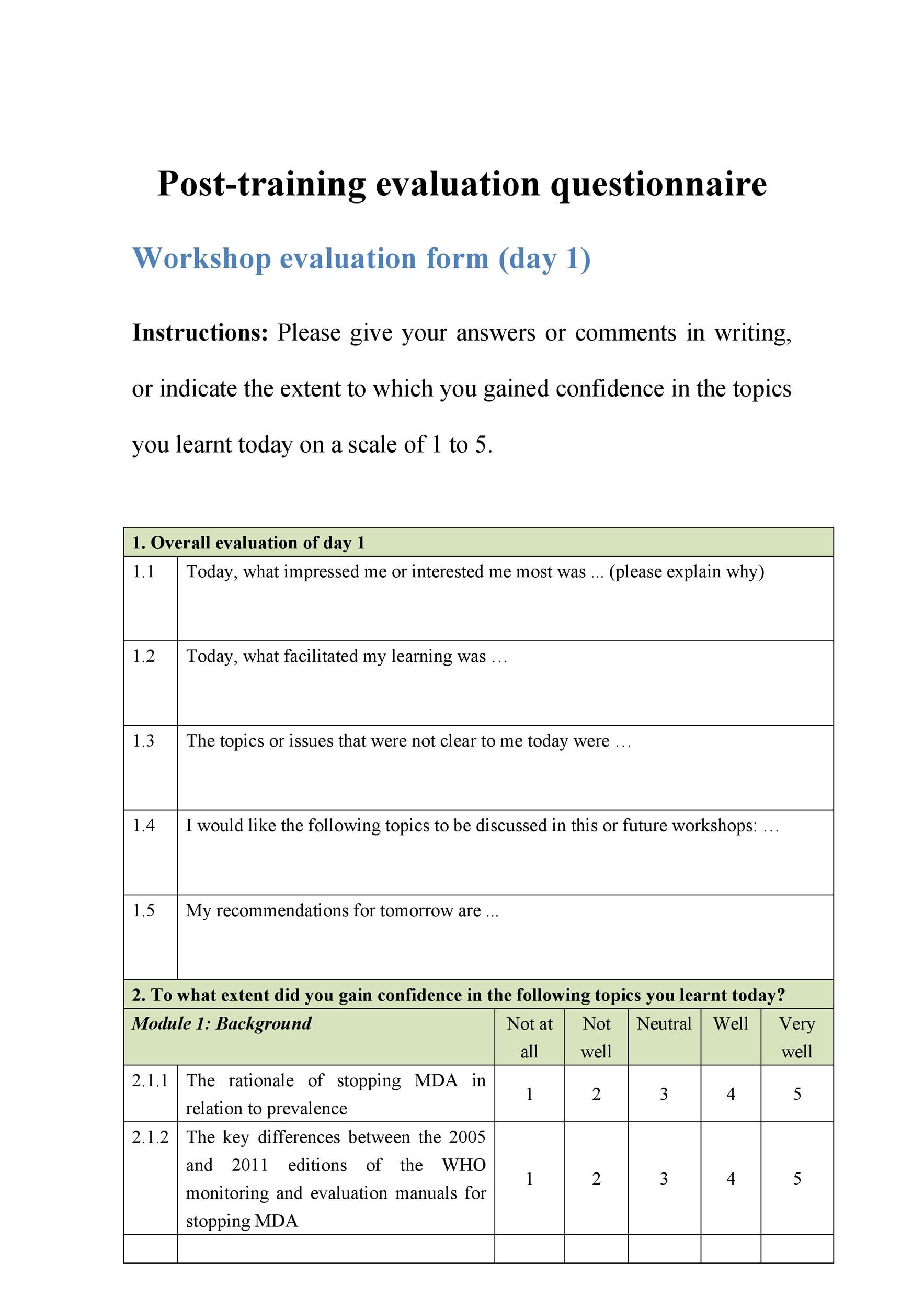

Questionnaire examples and templates

There are free questionnaire templates and example questions available for all kinds of surveys and market research, many of them online. But they’re not all created equal and you should use critical judgement when selecting one. After all, the questionnaire examples may be free but the time and energy you’ll spend carrying out a survey are not.

If you’re using online questionnaire templates as the basis for your own, make sure it has been developed by professionals and is specific to the type of research you’re doing to ensure higher completion rates. As we’ve explored here, using the wrong kinds of questions can result in skewed or messy data, and could even prompt respondents to abandon the questionnaire without finishing or give thoughtless answers.

You’ll find a full library of downloadable survey templates in the Qualtrics Marketplace , covering many different types of research from employee engagement to post-event feedback . All are fully customizable and have been developed by Qualtrics experts.

Qualtrics // Experience Management

Qualtrics, the leader and creator of the experience management category, is a cloud-native software platform that empowers organizations to deliver exceptional experiences and build deep relationships with their customers and employees.

With insights from Qualtrics, organizations can identify and resolve the greatest friction points in their business, retain and engage top talent, and bring the right products and services to market. Nearly 20,000 organizations around the world use Qualtrics’ advanced AI to listen, understand, and take action. Qualtrics uses its vast universe of experience data to form the largest database of human sentiment in the world. Qualtrics is co-headquartered in Provo, Utah and Seattle.

Related Articles

May 20, 2024

Best strategy & research books to read in 2024

May 13, 2024

Experience Management

X4 2024 Strategy & Research Showcase: Introducing the future of insights generation

November 7, 2023

Brand Experience

The 4 market research trends redefining insights in 2024

June 27, 2023

The fresh insights people: Scaling research at Woolworths Group

June 20, 2023

Bank less, delight more: How Bankwest built an engine room for customer obsession

April 1, 2023

Academic Experience

How to write great survey questions (with examples)

March 21, 2023

Sample size calculator

November 18, 2022

Statistical analysis software: your complete guide to getting started

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Writing Survey Questions

Perhaps the most important part of the survey process is the creation of questions that accurately measure the opinions, experiences and behaviors of the public. Accurate random sampling will be wasted if the information gathered is built on a shaky foundation of ambiguous or biased questions. Creating good measures involves both writing good questions and organizing them to form the questionnaire.

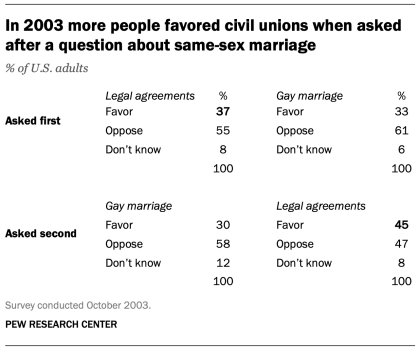

Questionnaire design is a multistage process that requires attention to many details at once. Designing the questionnaire is complicated because surveys can ask about topics in varying degrees of detail, questions can be asked in different ways, and questions asked earlier in a survey may influence how people respond to later questions. Researchers are also often interested in measuring change over time and therefore must be attentive to how opinions or behaviors have been measured in prior surveys.

Surveyors may conduct pilot tests or focus groups in the early stages of questionnaire development in order to better understand how people think about an issue or comprehend a question. Pretesting a survey is an essential step in the questionnaire design process to evaluate how people respond to the overall questionnaire and specific questions, especially when questions are being introduced for the first time.

For many years, surveyors approached questionnaire design as an art, but substantial research over the past forty years has demonstrated that there is a lot of science involved in crafting a good survey questionnaire. Here, we discuss the pitfalls and best practices of designing questionnaires.

Question development

There are several steps involved in developing a survey questionnaire. The first is identifying what topics will be covered in the survey. For Pew Research Center surveys, this involves thinking about what is happening in our nation and the world and what will be relevant to the public, policymakers and the media. We also track opinion on a variety of issues over time so we often ensure that we update these trends on a regular basis to better understand whether people’s opinions are changing.

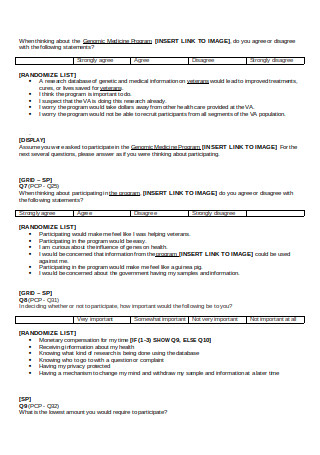

At Pew Research Center, questionnaire development is a collaborative and iterative process where staff meet to discuss drafts of the questionnaire several times over the course of its development. We frequently test new survey questions ahead of time through qualitative research methods such as focus groups , cognitive interviews, pretesting (often using an online, opt-in sample ), or a combination of these approaches. Researchers use insights from this testing to refine questions before they are asked in a production survey, such as on the ATP.

Measuring change over time

Many surveyors want to track changes over time in people’s attitudes, opinions and behaviors. To measure change, questions are asked at two or more points in time. A cross-sectional design surveys different people in the same population at multiple points in time. A panel, such as the ATP, surveys the same people over time. However, it is common for the set of people in survey panels to change over time as new panelists are added and some prior panelists drop out. Many of the questions in Pew Research Center surveys have been asked in prior polls. Asking the same questions at different points in time allows us to report on changes in the overall views of the general public (or a subset of the public, such as registered voters, men or Black Americans), or what we call “trending the data”.

When measuring change over time, it is important to use the same question wording and to be sensitive to where the question is asked in the questionnaire to maintain a similar context as when the question was asked previously (see question wording and question order for further information). All of our survey reports include a topline questionnaire that provides the exact question wording and sequencing, along with results from the current survey and previous surveys in which we asked the question.

The Center’s transition from conducting U.S. surveys by live telephone interviewing to an online panel (around 2014 to 2020) complicated some opinion trends, but not others. Opinion trends that ask about sensitive topics (e.g., personal finances or attending religious services ) or that elicited volunteered answers (e.g., “neither” or “don’t know”) over the phone tended to show larger differences than other trends when shifting from phone polls to the online ATP. The Center adopted several strategies for coping with changes to data trends that may be related to this change in methodology. If there is evidence suggesting that a change in a trend stems from switching from phone to online measurement, Center reports flag that possibility for readers to try to head off confusion or erroneous conclusions.

Open- and closed-ended questions

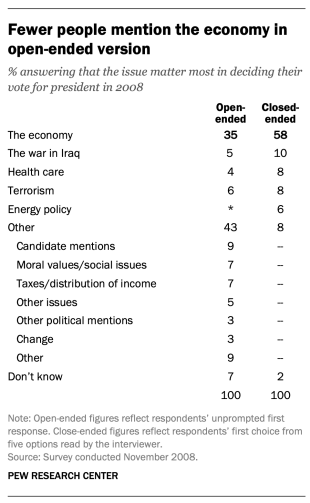

One of the most significant decisions that can affect how people answer questions is whether the question is posed as an open-ended question, where respondents provide a response in their own words, or a closed-ended question, where they are asked to choose from a list of answer choices.

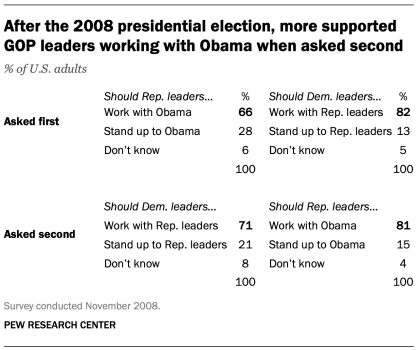

For example, in a poll conducted after the 2008 presidential election, people responded very differently to two versions of the question: “What one issue mattered most to you in deciding how you voted for president?” One was closed-ended and the other open-ended. In the closed-ended version, respondents were provided five options and could volunteer an option not on the list.

When explicitly offered the economy as a response, more than half of respondents (58%) chose this answer; only 35% of those who responded to the open-ended version volunteered the economy. Moreover, among those asked the closed-ended version, fewer than one-in-ten (8%) provided a response other than the five they were read. By contrast, fully 43% of those asked the open-ended version provided a response not listed in the closed-ended version of the question. All of the other issues were chosen at least slightly more often when explicitly offered in the closed-ended version than in the open-ended version. (Also see “High Marks for the Campaign, a High Bar for Obama” for more information.)

Researchers will sometimes conduct a pilot study using open-ended questions to discover which answers are most common. They will then develop closed-ended questions based off that pilot study that include the most common responses as answer choices. In this way, the questions may better reflect what the public is thinking, how they view a particular issue, or bring certain issues to light that the researchers may not have been aware of.

When asking closed-ended questions, the choice of options provided, how each option is described, the number of response options offered, and the order in which options are read can all influence how people respond. One example of the impact of how categories are defined can be found in a Pew Research Center poll conducted in January 2002. When half of the sample was asked whether it was “more important for President Bush to focus on domestic policy or foreign policy,” 52% chose domestic policy while only 34% said foreign policy. When the category “foreign policy” was narrowed to a specific aspect – “the war on terrorism” – far more people chose it; only 33% chose domestic policy while 52% chose the war on terrorism.

In most circumstances, the number of answer choices should be kept to a relatively small number – just four or perhaps five at most – especially in telephone surveys. Psychological research indicates that people have a hard time keeping more than this number of choices in mind at one time. When the question is asking about an objective fact and/or demographics, such as the religious affiliation of the respondent, more categories can be used. In fact, they are encouraged to ensure inclusivity. For example, Pew Research Center’s standard religion questions include more than 12 different categories, beginning with the most common affiliations (Protestant and Catholic). Most respondents have no trouble with this question because they can expect to see their religious group within that list in a self-administered survey.

In addition to the number and choice of response options offered, the order of answer categories can influence how people respond to closed-ended questions. Research suggests that in telephone surveys respondents more frequently choose items heard later in a list (a “recency effect”), and in self-administered surveys, they tend to choose items at the top of the list (a “primacy” effect).

Because of concerns about the effects of category order on responses to closed-ended questions, many sets of response options in Pew Research Center’s surveys are programmed to be randomized to ensure that the options are not asked in the same order for each respondent. Rotating or randomizing means that questions or items in a list are not asked in the same order to each respondent. Answers to questions are sometimes affected by questions that precede them. By presenting questions in a different order to each respondent, we ensure that each question gets asked in the same context as every other question the same number of times (e.g., first, last or any position in between). This does not eliminate the potential impact of previous questions on the current question, but it does ensure that this bias is spread randomly across all of the questions or items in the list. For instance, in the example discussed above about what issue mattered most in people’s vote, the order of the five issues in the closed-ended version of the question was randomized so that no one issue appeared early or late in the list for all respondents. Randomization of response items does not eliminate order effects, but it does ensure that this type of bias is spread randomly.

Questions with ordinal response categories – those with an underlying order (e.g., excellent, good, only fair, poor OR very favorable, mostly favorable, mostly unfavorable, very unfavorable) – are generally not randomized because the order of the categories conveys important information to help respondents answer the question. Generally, these types of scales should be presented in order so respondents can easily place their responses along the continuum, but the order can be reversed for some respondents. For example, in one of Pew Research Center’s questions about abortion, half of the sample is asked whether abortion should be “legal in all cases, legal in most cases, illegal in most cases, illegal in all cases,” while the other half of the sample is asked the same question with the response categories read in reverse order, starting with “illegal in all cases.” Again, reversing the order does not eliminate the recency effect but distributes it randomly across the population.

Question wording

The choice of words and phrases in a question is critical in expressing the meaning and intent of the question to the respondent and ensuring that all respondents interpret the question the same way. Even small wording differences can substantially affect the answers people provide.

[View more Methods 101 Videos ]

An example of a wording difference that had a significant impact on responses comes from a January 2003 Pew Research Center survey. When people were asked whether they would “favor or oppose taking military action in Iraq to end Saddam Hussein’s rule,” 68% said they favored military action while 25% said they opposed military action. However, when asked whether they would “favor or oppose taking military action in Iraq to end Saddam Hussein’s rule even if it meant that U.S. forces might suffer thousands of casualties, ” responses were dramatically different; only 43% said they favored military action, while 48% said they opposed it. The introduction of U.S. casualties altered the context of the question and influenced whether people favored or opposed military action in Iraq.

There has been a substantial amount of research to gauge the impact of different ways of asking questions and how to minimize differences in the way respondents interpret what is being asked. The issues related to question wording are more numerous than can be treated adequately in this short space, but below are a few of the important things to consider:

First, it is important to ask questions that are clear and specific and that each respondent will be able to answer. If a question is open-ended, it should be evident to respondents that they can answer in their own words and what type of response they should provide (an issue or problem, a month, number of days, etc.). Closed-ended questions should include all reasonable responses (i.e., the list of options is exhaustive) and the response categories should not overlap (i.e., response options should be mutually exclusive). Further, it is important to discern when it is best to use forced-choice close-ended questions (often denoted with a radio button in online surveys) versus “select-all-that-apply” lists (or check-all boxes). A 2019 Center study found that forced-choice questions tend to yield more accurate responses, especially for sensitive questions. Based on that research, the Center generally avoids using select-all-that-apply questions.

It is also important to ask only one question at a time. Questions that ask respondents to evaluate more than one concept (known as double-barreled questions) – such as “How much confidence do you have in President Obama to handle domestic and foreign policy?” – are difficult for respondents to answer and often lead to responses that are difficult to interpret. In this example, it would be more effective to ask two separate questions, one about domestic policy and another about foreign policy.

In general, questions that use simple and concrete language are more easily understood by respondents. It is especially important to consider the education level of the survey population when thinking about how easy it will be for respondents to interpret and answer a question. Double negatives (e.g., do you favor or oppose not allowing gays and lesbians to legally marry) or unfamiliar abbreviations or jargon (e.g., ANWR instead of Arctic National Wildlife Refuge) can result in respondent confusion and should be avoided.

Similarly, it is important to consider whether certain words may be viewed as biased or potentially offensive to some respondents, as well as the emotional reaction that some words may provoke. For example, in a 2005 Pew Research Center survey, 51% of respondents said they favored “making it legal for doctors to give terminally ill patients the means to end their lives,” but only 44% said they favored “making it legal for doctors to assist terminally ill patients in committing suicide.” Although both versions of the question are asking about the same thing, the reaction of respondents was different. In another example, respondents have reacted differently to questions using the word “welfare” as opposed to the more generic “assistance to the poor.” Several experiments have shown that there is much greater public support for expanding “assistance to the poor” than for expanding “welfare.”

We often write two versions of a question and ask half of the survey sample one version of the question and the other half the second version. Thus, we say we have two forms of the questionnaire. Respondents are assigned randomly to receive either form, so we can assume that the two groups of respondents are essentially identical. On questions where two versions are used, significant differences in the answers between the two forms tell us that the difference is a result of the way we worded the two versions.

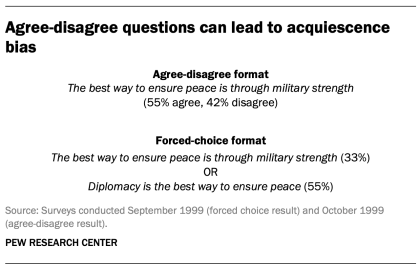

One of the most common formats used in survey questions is the “agree-disagree” format. In this type of question, respondents are asked whether they agree or disagree with a particular statement. Research has shown that, compared with the better educated and better informed, less educated and less informed respondents have a greater tendency to agree with such statements. This is sometimes called an “acquiescence bias” (since some kinds of respondents are more likely to acquiesce to the assertion than are others). This behavior is even more pronounced when there’s an interviewer present, rather than when the survey is self-administered. A better practice is to offer respondents a choice between alternative statements. A Pew Research Center experiment with one of its routinely asked values questions illustrates the difference that question format can make. Not only does the forced choice format yield a very different result overall from the agree-disagree format, but the pattern of answers between respondents with more or less formal education also tends to be very different.