Essay on Central Bank | Banking

In this essay we will discuss about central bank. After reading this essay you will learn about: 1. Essay on the Definition of a Central Bank 2. Essay on the Functions of a Central Bank 3. Essay on the Objectives of Credit Control by the Central Bank 4. Essay on the Role of Central Bank in a Developing Economy 5. Essay on the Need for Central Bank.

Essay Contents:

- Essay on the Need for Central Bank

1. Essay on the Definition of a Central Bank:

A central bank has been defined in terms of its functions. According to Vera Smith, “The primary definition of central banking is a banking system in which a single bank has either complete control or a residuary monopoly of note issue.” W.A. Shaw defines a central bank as a bank which control credit. To Hawtrey, a central bank is that which is the lender of the last resort. According to A.C.L. Day, a central bank is “to help control and stabilise the monetary and banking system.”

ADVERTISEMENTS:

According to Sayers, the central bank “is the organ of government that undertakes the major financial operations of the government and by its conduct of these operations and by other means, influences the behaviour of financial institutions so as to support the economic policy of the Government.” Sayers refers only to the nature of the central bank as the government’s bank. All these definitions are narrow because they refer only to one particular function of a central bank.

On the other hand, Samuelson’s definition is wide. According to him, a central bank “is a bank of bankers. Its duty is to control the monetary base…. and through control of this ‘high-powered money’ to control the community’s supply of money.” But the broadest definition has been given by De Kock.

In his words, a central bank is “a bank which constitutes the apex of the monetary and banking structure of its country and which performs as best as it can in the national economic interest, the following functions:

(i) The regulation of currency in accordance with the requirements of business and the general public for which purpose it is granted either the sole right of note issue or at least a partial monopoly thereof,

(ii) The performance of general banking and agency for the state,

(iii) The custody of the cash reserves of the commercial banks,

(iv) The custody and management of the nation’s reserves of international currency,

(v) The granting of accommodation in the form of re-discounts and collateral advances to commercial banks, bill brokers and dealers, or other financial institutions and the general acceptance of the responsibility of lender of the last resort,

(vi) The settlement of clearance balances between the banks,

(vii) The control of credit in accordance with the needs of business and with a view to carrying out the broad monetary policy adopted by the state.” De Kock’s definition is too long to be called a definition. For, a definition must be brief.

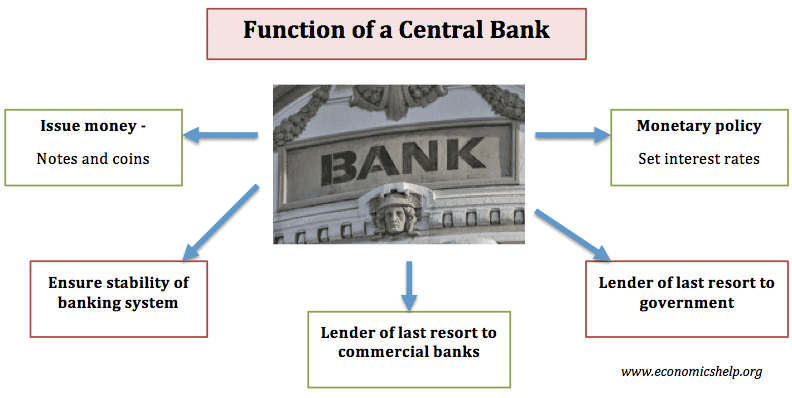

2. Essay on the Functions of Central Bank:

A central bank performs the following functions, as given by De Kock and accepted by the majority of economists:

1. Regulator of currency :

The central bank is the bank of issue. It has the monopoly of note issue. Notes issued by it circulate as legal tender money. It has its issue department which issues notes and coins to commercial banks. Coins are manufactured in the government mint but they are put into circulation through the central bank.

Central banks have been following different methods of note issue in different countries. The centred bank is required by law to keep a certain amount of gold and foreign securities against the issue of notes. In some countries, the amount of gold and foreign securities bears a fixed proportion, between 25 to 40 per cent of the total notes issued.

In other countries, a minimum fixed amount of gold and foreign currencies is required to be kept against note issue by the central bank. This system is operative in India whereby the Reserve Bank of India is required to keep Rs115crores in gold and Rs85crores in foreign securities. There is no limit to the issue of notes after keeping this minimum amount of Rs200crores in gold and foreign securities.

The monopoly of issuing notes vested in the central bank ensures uniformity in the notes issued which helps in facilitating exchange and trade within the country. It brings stability in the monetary system and creates confidence among the public.

The central bank can restrict or expand the supply of cash according to the requirements of the economy. Thus it provides elasticity to the monetary system. By having a monopoly of note issue, the central bank also controls the banking system by being the ultimate source of cash. Last but not the least, by entrusting the monopoly of note issue to the central bank, the government is able to earn profits from printing notes whose cost is very low as compared with their face value.

2. Banker, fiscal agent and adviser to the g overnment :

Central banks everywhere act as bankers, fiscal agents and advisers to their respective governments. As banker to the government, the central bank keeps the deposits of the central and state governments and makes payments on behalf of governments. But it does not pay interest on governments deposits. It buys and sells foreign currencies on behalf of the government., It keeps the stock of gold of the government.

Thus it is the custodian of government money and wealth. As a fiscal agent, the central bank makes short-term loans to the government for a period not exceeding 90 days. It floats loans, pays interest on them, and finally repays them on behalf of the government. Thus it manages the entire public debt.

The central bank also advises the government on such economic and money matters as controlling inflation or deflation, devaluation or revaluation of the currency, deficit financing, balance of payments, etc. As pointed out by De Kock, “Central banks everywhere operate as bankers to the state not only because it may be more convenient and economical to the state, but also because of the intimate connection between public finance and monetary affairs.”

3. Custodian of cash reserves of commercial banks :

Commercial banks are required by law to keep reserves equal to a certain percentage of both time and demand deposits liabilities with the central banks. It is on the basis of these reserves that the central bank transfers funds from one bank to another to facilitate the clearing of cheques. Thus the central bank acts as the custodian of the cash reserves of commercial banks and helps in facilitating their transactions.

There are many advantages of keeping the cash reserves of the commercial banks with the central bank, according to De Kock.

In the first place, the centralisation of cash reserves in the central bank is a source of great strength to the banking system of a country.

Secondly, centralised cash reserves can serve as the basis of a large and more elastic credit structure than if the same amount were scattered among the individual banks.

Thirdly, centralised cash reserves can be utilised fully and most effectively during periods of seasonal strains and in financial crises or emergencies.

Fourthly, by varying these cash reserves the central bank can control the credit creation by commercial banks. Lastly, the central bank can provide additional funds on a temporary and short term basis to commercial banks to overcome their financial difficulties.

4. Custody and management of foreign exchange reserves :

The central bank keeps and manages the foreign exchange reserves of the country. It is an official reservoir of gold and foreign currencies. It sells gold at fixed prices to the monetary authorities of other countries. It also buys and sells foreign currencies at international prices. Further, it fixes the exchange rates of the domestic currency in terms of foreign currencies.

It holds these rates within narrow limits in keeping with its obligations as a member of the International Monetary Fund and tries to bring stability in foreign exchange rates. Further, it manages exchange control operations by supplying foreign currencies to importers and persons visiting foreign countries on business, studies, etc. in keeping with the rules laid down by the government.

5. Lender of the last resort :

De Kock regards this function as a sine qua non of central banking. By granting accommodation in the form of re-discounts and collateral advances to commercial banks, bill brokers and dealers, or other financial institutions, the central bank acts as the lender of the last resort. The central bank lends to such institutions in order to help them in times of stress so as to save the financial structure of the country from collapse.

It acts as lender of the last resort through discount house on the basis of treasury bills, government securities and bonds at “the front door”. The other method is to give temporary accommodation to the commercial banks or discount houses directly through the “back door”.

The difference between the two methods is that lending at the front door is at the bank rate and in the second case at the market rate. Thus the central bank as lender of the last resort is a big source of cash and also influences prices and market rates,

6. Clearing house for transfer and settlement :

As bankers’ bank, the central bank acts as a clearing house for transfer and settlement of mutual claims of commercial banks. Since the central bank holds reserves of commercial banks, it transfers funds from one bank to other banks to facilitate clearing of cheques.

This is done by making transfer entries in their accounts on the principle of book-keeping. To transfer and settle claims of one bank upon others, the central bank operates a separate department in big cities and trade centres. This department is known as the “clearing house” and it renders the service free to commercial banks.

When the central bank acts as a clearing agency, it is time-saving and convenient for the commercial banks to settle their claims at one place. It also economises the use of money. “It is not only a means of economising cash and capital but is also a means of testing at any time the degree of liquidity which the community is maintaining.”

7. Controller of credit :

The most important function of the central bank is to control the credit creation power of commercial bank in order to control inflationary and deflationary pressures within this economy. For this purpose, it adopts quantitative methods and qualitative methods.

Quantitative methods aim at controlling the cost and quantity of credit by adopting bank rate policy, open market operations, and by variations in reserve ratios of commercial banks. Qualitative methods control the use and direction of credit. These involve selective credit controls and direct action. By adopting such methods, the central bank tries to influence and control credit creation by commercial banks in order to stabilise economic activity in the country.

Besides the above noted functions, the central banks in a number of developing countries have been entrusted with the responsibility of developing a strong banking system to meet the expanding requirements of agriculture, industry, trade and commerce. Accordingly, the central banks possess some additional powers of supervision and control over the commercial banks.

They are the issuing of licences; the regulation of branch expansion; to see that every bank maintains the minimum paid up capital and reserves as provided by law; inspecting or auditing the accounts of banks; to approve the appointment of chairmen and directors of such banks in accordance with the rules and qualifications; to control and recommend merger of weak banks in order to avoid their failures and to protect the interest of depositors; to recommend nationalisation of certain banks to the government in public interest; to publish periodical reports relating to different aspects of monetary and economic policies for the benefit of banks and the public; and to engage in research and train banking personnel etc.

3. Essay on the Objectives of Credit Control by the Central Bank :

Credit control is the means to control the lending policy of commercial banks by the central bank.

The central bank controls credit to achieve the following objectives:

1. To stabilise the internal price level:

One of the objective of controlling credit is to stabilise the price level in the country. Frequent changes in prices adversely affect the economy. Inflationary or deflationary trends need to be prevented. This can be achieved by adopting a judicious policy of credit control.

2. To stabilise the rate of foreign exchange:

With the change in the internal prices level, exports and imports of the country are affected. When prices fall, exports increase and imports decline. Consequently, the demand for domestic currency increases in the foreign market and its exchange rate rises. On the contrary, a rise in domestic prices leads to a decline in exports and an increase in imports.

As a result, the demand for foreign currency increases and that of domestic currency falls, thereby lowering the exchange rate of the domestic currency. Since it is the volume of credit money that affects prices, the central bank can stabilise the rate of foreign exchange by controlling bank credit.

3. To protect the outflow of gold:

The central bank holds the gold reserves of the country in its vaults. Expansion of bank credit leads to rise in prices which reduce exports and increase imports, thereby creating an unfavourable balance of payments. This necessitates the export of gold to other countries. The central bank has to control credit in order to prevent such outflows of gold to other countries.

4. To control business cycles:

Business cycles are a common phenomenon of capitalist countries which lead to periodic fluctuations in production, employment and prices. They are characterised by alternating periods of prosperity and depression. During prosperity, there is large expansion in the volume of credit, and production, employment and prices rise.

During depression, credit contracts, and production, employment and prices fall. The central bank can counteract such cyclical fluctuations through contraction of bank credit during boom periods, and expansion of bank credit during depression.

5. To meet business needs:

According to Burgess, one of the important objectives of credit control is the “adjustment of the volume of credit to the volume of business.” Credit is needed to meet the requirements of trade and industry. As business expands, larger quantity of credit is needed, and when business contracts less credit is needed. Therefore, it is the central bank which can meet the requirements of business by controlling credit.

6. To have growth with stability:

In recent years, the principal objective of credit control is to have growth with stability. The other objectives, such as price stability, foreign exchange rate stability, etc., are regarded as secondary. The aim of credit control is to help in achieving full employment and accelerated growth with stability in the economy without inflationary pressures and balance of payments deficits.

4. Essay on the Role of Central Bank in a Developing Economy :

The central bank in a developing economy performs both traditional and non-traditional functions. The principal traditional functions performed by it are the monopoly of note issue, banker to the government, bankers’ bank, lender of the last resort, controller of credit and maintaining stable exchange rate. But all these functions are related to the foremost function of helping in the economic development of the country.

The central bank in a developing country aims at the promotion and maintenance of a rising level of production, employment and real income in the country. The central banks in the majority of underdeveloped countries have been given wide powers to promote the growth of such economies.

They, therefore, perform the following functions towards this end:

Creation and expansion of financial institutions:

One of the aims of a central bank in an underdeveloped country is to improve its currency and credit system. More banks and financial institutions are required to be set up to provide larger credit facilities and to divert voluntary savings into productive channels. Financial institutions are localised in big cities in underdeveloped countries and provide credit facilities to estates, plantations, big industrial and commercial houses.

In order to remedy this, the central bank should extend branch banking to rural areas to make credit available to peasants, small businessmen and traders. In underdeveloped countries, the commercial banks provide only short-term loans. Credit facilities in rural areas are mostly non-existent.

The only source is the village moneylender who charges exorbitant interest rates. The hold of the village moneylender in rural areas can be slackened if new institutional arrangements are made by the central bank in providing short-term, medium term and long-term credit at lower interest rates to the cultivators.

A network of co-operative credit societies with apex banks financed by the central bank can help solve the problem. Similarly, it can help the establishment of lead banks and through them regional rural banks for providing credit facilities to marginal farmers, landless agricultural workers and other weaker sections.

With the vast resources at its command, the central bank can also help in establishing industrial banks and financial corporations in order to finance large and small industries.

Proper adjustment between demand for and supply of money:

The central bank plays an important role in bringing about a proper adjustment between demand for and supply of money. An imbalance between the two is reflected in the price level. A shortage of money supply will inhibit growth while an excess of it will lead to inflation. As the economy develops, the demand for money is likely to go up due to gradual monetization of the non-monetized sector and the increase in agricultural and industrial production and prices.

The demand for money for transactions and speculative motives will also rise. So the increase in money supply will have to be more than proportionate to the increase in the demand for money in order to avoid inflation. There is, however, the likelihood of increased money supply being used for speculative purposes, thereby inhibiting growth and causing inflation.

The central bank controls the uses of money and credit by an appropriate monetary policy. Thus in an underdeveloped economy, the central bank should control the supply of money in such a way that the price level is prevented from rising without affecting investment and production adversely.

A suitable interest rate policy:

In an underdeveloped country the interest rate structure stands at a very high level. There are also vast disparities between long-term and short-term interest rates and between interest rates in different sectors of the economy. The existence of high interest rates acts as an obstacle to the growth of both private and public investment, in an underdeveloped economy. A low interest rate is, therefore, essential for encouraging private investment in agriculture and industry.

Since in an underdeveloped country businessmen have little savings out of undistributed profits, they have to borrow from the banks or from the capital market for purposes of investment and they would borrow only if the interest rate is low.

A low interest rate policy is also essential for encouraging public investment. A low interest rate policy is a cheap money policy. It makes public borrowing cheap, keeps the cost of servicing public debt low, and thus helps in financing economic development.

In order to discourage the flow of resources into speculative borrowing and investment, the central bank should follow a policy of discriminatory interest rates, charging high rates for non-essential and unproductive loans and low rates for productive loans.

But this does not imply that savings are interest-elastic in an underdeveloped economy. Since the level of income is low in such economies, a high rate of interest is not likely to raise the propensity to save.

In the context of economic growth, as the economy develops, a progressive rise in the price level is inevitable. The value of money falls and the propensity to save declines further. Money conditions become tight and there is a tendency for the rate of interest to rise automatically. This would result in inflation. In such a situation any effort to control inflation by raising the rate of interest would be disastrous. A stable price level is, therefore, essential for the success of a low interest rate policy which can be maintained by following a judicious monetary policy by the central bank.

Debt management:

Debt management is one of the important functions of the central bank in an underdeveloped country. It should aim at proper timing and issuing of government bonds, stabilizing their prices and minimizing the cost of servicing public debt. It is the central bank which undertakes the selling and buying of government bonds and making timely changes in the structure and composition of public debt.

In order to strengthen and stabilize the market for government bonds, the policy of low interest rates is essential. For, a low rate of interest raises the price of government bonds, thereby making them more attractive to the public and giving an impetus to the public borrowing programmes of the government.

The maintenance of structure of low interest rates is also called for minimizing the cost of servicing the national debt. Further, it encourages funding of debt by private firms. However, the success of debt management would depend upon the existence of well-developed money and capital markets in which wide range of securities exist both for short and long periods. It is the central bank which can help in the development of these markets.

Credit control:

Central Bank should also aim at controlling credit in order to influence the patterns of investment and production in a developing economy. Its main objective is to control inflationary pressures arising in the process of development. This requires the use of both quantitative and qualitative methods of credit control.

Open market operations are not successful in controlling inflation in underdeveloped countries because the bill market is small and undeveloped. Commercial banks keep an elastic cash-deposit ratio because the central bank’s control over them is not complete. They are also reluctant to invest in government securities due to their relatively low interest rates.

Moreover, instead of investing in government securities, they prefer to keep their reserves in liquid form such as gold, foreign exchange and cash. Commercial banks are also not in the habit of rediscounting or borrowing from the central bank.

The bank rate policy is also not so effective in controlling credit in LDCs due to:

(a) The lack of bills of discount;

(b) The narrow size of the bill market;

(c) A large non-monetized sector where barter transactions take place;

(d) The existence of a large unorganised money market;

(e) The existence of indigenous banks which do not discount bills with the central banks; and

(f) The habit of commercial banks to keep large cash reserves.

The use of variable reserve ratio as method of credit control is more effective than open market operations and bank rate policy in LDCs. Since the market for securities is very small, open market operations are not successful. But a rise or fall in the reserve ratio by the central bank reduces or increases the cash available with the commercial banks without affecting adversely the prices of securities. Again, the commercial banks keep large cash reserves which cannot be reduced by a raise in the bank rate or sale of securities by the central bank.

But raising the cash-reserve ratio reduces liquidity with the banks. However, the use of variable reserve ratio has certain limitations in LDCs. First, the non-banking financial intermediaries do not keep deposits with the central bank so they are not affected by it. Second, banks which do not maintain excess liquidity are not affected than those who maintain it.

The qualitative credit control measures are, however, more effective than the quantitative measures in influencing the allocation of credit, and thereby the pattern of investment. In underdeveloped countries, there is a strong tendency to invest in gold, jewellery, inventories, real estate, etc., instead of in alternative productive channels available in agriculture, mining, plantations and industry.

The selective credit controls are more appropriate for controlling and limiting credit facilitates for such unproductive purposes. They are beneficial in controlling speculative activities in food grains and raw materials. They prove more useful in controlling ‘sectional inflations’ in the economy. They curtail the demand for imports by making it obligatory on importers to deposit in advance an amount equal to the value of foreign currency.

This has also the effect of reducing the reserves of the banks in so far as their deposits are transferred to the central banks in the process. The selective credit control measures may take the form of changing the margin requirements against certain types of collateral, the regulation of consumer credit and the rationing of credit.

Solving the balance of payments problem:

The central bank should also aim at preventing and solving the balance of payments problem in a developing economy. Such economies face serious balance of payments difficulties to fulfill the targets of development plans. An imbalance is created between imports and exports which continues to widen with development.

The central bank manages and controls the foreign exchange of the country and also acts as the technical adviser to the government on foreign exchange policy. It is the function of the central bank to avoid fluctuations in the foreign exchange rates and to maintain stability. It does so through exchange controls and variations in the bank rate. For instance, if the value of the national currency continues to fall, it may raise the bank rate and thus encourage the inflow of foreign currencies.

5. Essay on the Need for Central Bank:

It is widely recognised that the central bank is a valuable and indispensable institution for the proper functioning of a modern economy. But, there is a difference of opinion regarding the necessity and usefulness of the central bank in economically backward countries having underdeveloped money markets.

Some people argue that the central bank is not necessary in such countries for various reasons: such as the absence of well-organised banking institutions over which the central bank exercises its supervision and control, the absence of short-term money markets and of well-developed bill markets to enable the central bank to perform the rediscounting operations properly, the fear of political pressure of the governments of these countries over the normal working of the central bank, and others. For all these reasons it is argued that the central bank in the under-developed countries cannot execute its monetary policy and control-techniques properly and effectively.

But, the fact remains that the central bank is as indispensable in the underdeveloped countries as it is in the developed countries.

For this reason it is now established that every country, whether developed or underdeveloped, must set up a central bank for the following reasons:

(a) Economic stability:

The central bank is indispensable for maintaining stability in the economy of a country. It can maintain both price and foreign exchange stability through the exercise of proper and effective control over the country’s total money supply.

Such economic stability is as essential for underdeveloped countries as for developed ones, for promoting rapid economic growth. No other institutions except the central bank is competent enough to maintain this overall economic stability.

(b) Control over bank credit:

The central bank is necessary to exercise a judicious control over bank credit. As bank credit constitutes the most important component of the money supply, its supply is to be properly regulated in time for avoiding instability in the price-level and for regulating its supply in accordance with the country’s requirements.

(c) Control and supervision over the activities of other banks:

The central bank of a country can develop the banking system by exercising proper control and supervision over the operations of other banks. In the absence of the central bank, it becomes a difficult task to bring about proper co-ordination among the banks and to develop these institutions along a sound line.

(d) Proper execution of the monetary policy:

The central bank is the leader of the money market of a country. Therefore, its existence is of utmost importance for pursuing the country’s monetary (credit) policy.

(e) Special role of the central bank in a developing economy:

The central bank has a special role to play in a developing economy in promoting economic growth with stability, in providing special finance for agriculture, industry and other top priority sectors.

(f) Foreign exchange regulations and international dealings:

Every country, whether a developed or an underdeveloped one, must have a monetary institution like the central bank for foreign exchange regulations Sid for dealing with international institutions like the International Monetary Fund and the Bank for International Settlements. When the gold standard was in existence, it had some special importance.

(g) Control over the money supply:

The central bank is also necessary for the control over the money supply and for the regulation of the country s interest rates. For this reason the central bank enjoys the monopoly power regarding the issue of paper notes, and its rate of interest (i.e., the bank rate) acts as the pace-setter to other rates such as market rates of interest.

Conclusion:

The above description shows that every country, whether a developed or an underdeveloped one, must set up a Central Bank of its own.

Related Articles:

- Top 12 Functions of the Central Bank | Banking

- Difference between Central Bank and Commercial Bank

- Top 10 Functions of Central Bank according to De Kock

- Difference between a Central Bank and Commercial Bank

Central Bank: Understanding its Role and Impact on the Economy

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Central Bank Definition

A central bank is a financial institution given privileged control over the production and distribution of money and credit for a nation or a group of nations. Its primary function is to manage the nation’s money supply (monetary policy), controlling inflation, printing money, setting interest rates, maintaining the health of the financial system, and ensuring economic stability.

Roles and Responsibilities of a Central Bank

The main roles and responsibilities of a central bank involve overseeing monetary policy, ensuring financial stability, and managing the release of currency notes and coins.

Monetary Policy

The central bank's role in steering monetary policy involves managing the rate of inflation and controlling interest rates. When the economy is performing well, the central bank might raise interest rates to prevent overheating and the potential for high inflation. When economic growth is slow, the central bank might lower interest rates to stimulate spending and investment. It's through these actions that monetary policy helps to create stable economic environments.

Financial Stability

Another crucial responsibility of the central bank is to ensure the financial stability of the country or territory it governs. To promote stability, central banks monitor commercial banks and other financial institutions, looking for signs of stress that could lead to a crisis. In case of a bank failure, the central bank serves as a lender of last resort, providing loans to prevent bankruptcy and protect the overall economy.

Release of Currency Notes and Coins

Central banks also have the responsibility of managing the supply of money in the economy. They do this by releasing (and sometimes removing) currency notes and coins in circulation. This function helps control inflation and stabilize the value of the country's currency. In addition, the central bank may use tools such as open market operations, where it buys or sells government securities in the market to manage the amount of money in circulation.

These roles and responsibilities—all designed to maintain price stability, protect the financial system, and manage the money supply—enable central banks to foster sound economic conditions. By monitoring and responding to economic indicators, central banks work to prevent economic instability and promote sustainable economic growth.

Monetary Policy and Central Banks

A notable obligation of central banks is implementing monetary policy, a critical force shaping economic trends. It employs tools like interest rate adjustments, open-market operations, and reserve requirements. These methods enable central banks to control money supply, impacting various economic indicators such as inflation, exchange rates, and unemployment.

Interest Rate Adjustments

Central banks utilize interest rates as a lever for economic regulation. Specifically, they alter the policy rates, affecting the interest rates commercial banks impose on their depositors and borrowers. A reduction in interest rates can encourage business investments and consumer spending, injecting economic activity. Alternatively, elevated interest rates can decelerate the economy by making borrowing costlier, thereby taming inflation.

Open-market Operations

A central bank's open-market operations involve buying and selling government bonds from or to commercial banks and financial institutions. When the central bank purchases bonds, it injects money into the banking system, making loans easier to obtain and stimulating economic growth. Conversely, selling government bonds drains money from the banking system, making loans less accessible and slowing economic expansion.

Reserve Requirements

A more direct tool is the alteration of reserve requirements, the minimum amount of funds that commercial banks must hold against their deposits. By raising the reserve requirements, central banks can limit the amount of loans and investments banks make, thereby slowing economic activity. On the other hand, reducing these requirements can open up the economy, encouraging banks to lend more and stimulate growth.

Each of these policy tools used by central banks has distinct impacts on the economy, and they are usually deployed in a coordinated way to navigate complex economic environments.

Role in Financial Stability

Maintaining financial stability in an economy is one of the pivotal roles of a central bank. They employ numerous strategies and tactics to ensure the financial sector does not face undue stress and remains resilient in the face of typical and extraordinary economic events.

One of the most effective strategies used by central banks is to serve as the lender of last resort . This essentially means that when commercial banks and other financial institutions face the risk of failing due to a sudden demand of fund withdrawals or inability to secure loans elsewhere, central banks step in. They provide these institutions with necessary credit facilities to avoid potential bankruptcy and consequential economic disruption.

Policy Communication

Another significant strategy used by central banks is policy communication . Transparency in policies can reduce uncertainty and increase the predictiveness of financial markets. Central banks communicate their policy intentions, their readings of current economic conditions, and how they intend to respond to potential future developments. This communication strategy helps shape public expectations and behavior in a way that's conducive to maintaining financial stability.

Supervisory and Regulatory Functions

Furthermore, central banks carry out supervisory and regulatory functions . They monitor the operations of commercial banks and other financial institutions to restrain them from necessary risk-taking. Through regular inspections, they ensure these institutions operate according to the rules laid down to protect the interests of the depositors.

In case of financial crises, central banks come to the forefront to manage the turmoil. They infuse liquidity into the market by purchasing government securities, decrease reserve requirements to allow commercial banks to lend more, and lower interest rates to stimulate borrowing.

In a nutshell, by facilitating money supply via monetary policy measures, serving as a backstop for financial institutions, maintaining transparency in policy communication, and meticulously supervising the financial market, central banks play a significant role in maintaining financial stability. Their actions help in managing financial crises effectively and in reducing periodical economic stress.

Central Banks and Inflation Control

Keeping a lid on inflation is one of the pivotal roles that Central Banks play. Economists widely recognize inflation as a necessary evil in a growing economy but it's the degree of inflation that becomes a cause for concern. If inflation is too high, it can wreak havoc on the economy. It erases the purchasing power of money, resulting in a sluggish economy as real incomes decline and savings are devalued. In the worst scenario, hyperinflation may occur which can destroy an economy entirely.

Monetary Policy as a Tool for Inflation Control

Central banks use various tools of monetary policy to manage inflation. They use instruments such as interest rates, reserve requirements, and open market operations to influence the amount of money in circulation, and hence the rate of inflation.

The key tool is setting the interest rate, also known as the base or benchmark interest rate. By changing this rate, Central Banks can influence borrowing costs. If the central bank wants to curb inflation, it will raise the interest rate. That makes borrowing more expensive, reducing spending and slowing economic growth. Conversely, to boost a sluggish economy, the central bank might lower interest rates to encourage borrowing and investment.

Open Market Operations

Another primary tool for inflation control is Open Market Operations. This involves the buying and selling of government securities to control the supply of money. When the central banks want to reduce inflation, they sell securities. This sucks money out of the economy and reduces the money supply, which helps to keep inflation in check. The opposite occurs when they buy securities, increasing the money supply and potentially boosting inflation.

Reserve Requirement Adjustments

The reserve requirements are the amount of money that banks must hold in reserve against deposits made by their customers. This rate is set by the central bank. By increasing or decreasing this rate, the central bank can control how much money the banks can lend. If the economy is overheating, the central bank might increase the reserve requirement, reducing the amount banks can lend, and slowing economic activity.

It's important to note that while central banks have the power to control inflation, their actions can only influence, not dictate, economic activity. Other factors such as government fiscal policy, international economic conditions and investor behavior all play a part. But on balance, the role of the central bank in maintaining stable prices through inflation control is critical to a nation's economic well-being.

Currency Supply Management by Central Banks

Central banks have a cardinal role in managing the supply of money in circulation in an economy. This is typically accomplished through three primary methods: open market operations, changing reserve requirements, and adjusting the discount rate.

The most commonly used method is what's known as 'open market operations', which involves the buying and selling of government securities, such as bonds. When a central bank wants to increase the money supply, it buys government securities. This injects cash into the commercial banks, who can then lend to the general public. Conversely, when a central bank wants to reduce the money supply, it sells government securities. This reduces the reserves of commercial banks, limiting their ability to lend.

Secondly, central banks can manipulate reserve requirements — the percentage of depositors' balances that banks must have on hand as cash. When a central bank raises the reserve requirement, banks have less money to lend, causing a contraction of the money supply. When the reserve requirement is lowered, banks have more money to lend, leading to an expansion.

Discount Rate

The last tool is adjusting the discount rate, which is the interest rate that central banks charge commercial banks for short-term loans. A lower discount rate encourages banks to borrow more and thereby increase their lending, which expands the money supply. Raising the discount rate makes borrowing more costly, which causes a contraction.

By skilfully manipulating these three tools, central banks can control how much money is in circulation in an economy. This control over the supply of money is critical for maintaining economic stability. Central banks must strive to keep a handle on inflation—when the general level of prices is rising—and deflation—where those general price levels are falling.

Decisions about whether to expand or contract the money supply are based on numerous economic indicators, including inflation rate, unemployment rate, and GDP growth. The goal is to ensure that there is just enough money circulating—no more, no less. Too much money in the economy can lead to inflation, while too little can lead to recession and unemployment. By making measured adjustments to the money supply, central banks aim to achieve a balance that supports stable, healthy economic growth.

The Function of Central Banks in Interest Rate Setting

The primary mechanism through which a central bank influences interest rates is its monetary policy. Broadly characterized, this policy encompasses all the decisions and actions a central bank takes to regulate the money supply and stabilize the economy. A key aspect of this policy is the setting and adjustment of interest rates.

Influence on Interest Rates

Central banks regulate the interest rates in an economy by altering the 'base' or 'benchmark' interest rate. This rate influences the cost at which commercial banks can borrow from the central bank.

If a central bank wants to stimulate growth in the economy, it lowers the base rate. This strategy makes borrowing from commercial banks cheaper for individuals and companies, due to lower interest rates. Hence, it encourages borrowing and spending, which boosts economic growth. Conversely, if a central bank wants to curb inflation, it raises the base rate. This move makes lending more expensive, slowing down borrowing and spending, which helps to cool down the economy.

Importance for the Overall Economy

Interest rate changes by central banks are critical for the overall economy. Lower interest rates expedite growth by making loans cheaper, which stimulate investment and consumption. Increased investment often leads to job creation and improved profitability of businesses, thus boosting the economy. However, too much growth can lead to inflation, which erodes the value of money.

On the other hand, higher rates discourage borrowing and spending. While this may seem negative, it is often necessary to keep inflation in check. Otherwise, inflation could decrease the standard of living if prices rise faster than wages.

Impact on Personal and Business Financing

When interest rates are low, both individuals and businesses are more inclined to take on loans since the repayment cost is lower.

Individuals might take out loans to buy property or invest in the stock market. Low rates can also encourage spending on big-ticket items like cars or appliances.

For businesses, low interest rates can spur expansion activities since borrowing to finance such initiatives becomes more affordable. Conversely, when rates are high, borrowing costs rise. This shift can discourage individuals from taking on loans and companies from investing, hence slowing down economic activity.

In conclusion, the role of central banks in setting interest rates is critical. It aids in stabilizing economic growth, controlling inflation, and indirectly influences socio-economic aspects like employment levels, growth of businesses, and the standard of living.

Central Banks and the Foreign Exchange Market

Central banks play a crucial part in the financial aspect of a country, and one of these roles involves the foreign exchange market. This pertains to the open market where the currencies of different countries are exchanged. Central banks ensure the smooth running of these markets by either directly participating in trades or executing monetary policies that influence forex markets.

Central Bank's Role in Managing Forex Reserves

Forex reserves are essentially foreign currency holdings of a country's central bank. They use these reserves to influence the foreign exchange market and stabilize the nation's currency.

Therefore, the management of forex reserves by central banks is a critical way of administering a nation's money supply and stabilizing its economy.

Impact on Exchange Rates

Apart from managing forex reserves, central banks heavily influence exchange rates. Central banks often directly participate in the market to synchronize the value of their currency, a policy often referred to as "pegging". They could also use indirect methods such as changing the nation's interest rates. Higher interest rates could attract foreign investment leading to an increased demand for the nation's currency, thus improving its exchange rate.

Interaction with International Markets

Central banks also interact with the foreign exchange market and other international markets to strengthen their country’s economy and ensure financial stability.

In line with this, central banks might also implement hedge agreements to curb the risk associated with exchange rates. By doing so, they further stabilize the nation's economy.

In sum, a central bank's role in the foreign exchange market is multifaceted and far-reaching. They oversee and manage forex reserves, influence exchange rates, and interact with international markets to maintain the economic equilibrium of their respective nations.

Governance and Accountability of Central Banks

Structure and governance of central banks.

Central banks typically bear a hierarchical and well-defined structure. At the helm, there's often a board of directors, led by a Governor or Chairman. These positions are typically politically appointed, for example in the United States, the chairman of the Federal Reserve is appointed by the President and confirmed by the Senate.

Central banks are also divided into multiple departments, each handling a specific aspect of its function. There's usually a monetary policy department, a financial stability department, banking supervision department, et cetera.

Independence of Central Banks

Though central banks come under the purview of government authorities, they generally operate with a high degree of independence. This independence is crucial to keep the central banks insulated from short-term political pressures. Take for instance, the monetary policy decisions might not always be in accordance with the government's current political agenda but they are necessary to ensure long-term economic stability. Hence central banks are given the liberty to operate independently.

Yet, this independence doesn't imply a lack of control or oversight. Importantly, the head of the central bank is usually appointed by the government, thus keeping prudential control.

Accountability Mechanisms of Central Banks

As significant as it is, central banks' independence doesn’t absolve them of responsibility. They possess several accountability mechanisms that ensure they remain answerable to the public and the government.

One such mechanism is transparency. Central banks are expected to provide clear and consistent explanations of their decisions and policies. They regularly publish minutes of their meetings and reports on their actions. These publications typically explain decision-making process in detail and analyze the state of the economy.

Additionally, central bank heads are routinely required to testify before legislative bodies They answer questions about their policy decisions and detail their plans for future action.

Ultimately, while central banks have substantial autonomous power, they must also satisfy rigorous scrutiny from both public and government. This delicate balance ensures that central banks are independent, yet are held accountable, thereby continually reinforcing public trust.

Share this article with a friend:

About the author.

Inspired Economist

Related posts.

Accounting Close Explained: A Comprehensive Guide to the Process

Accounts Payable Essentials: From Invoice Processing to Payment

Operating Profit Margin: Understanding Corporate Earnings Power

Capital Rationing: How Companies Manage Limited Resources

Licensing Revenue Model: An In-Depth Look at Profit Generation

Operating Income: Understanding its Significance in Business Finance

Cash Flow Statement: Breaking Down Its Importance and Analysis in Finance

Human Capital Management: Understanding the Value of Your Workforce

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Start typing and press enter to search

What is a central bank?

Guiding growth: The US Federal Reserve Building in Washington Image: REUTERS/Kevin Lamarque

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Sophie Hardach

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved .chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} with our crowdsourced digital platform to deliver impact at scale

Jerome Powell will take over from Janet Yellen as Chair of the U.S. Federal Reserve, and is expected to continue her policy of gradually unwinding the economic stimulus. But what does that actually mean? What is the role of central bankers, and why can they move entire financial markets with a single word? Here is a quick guide to how central banks actually work, why they matter so much in the modern economy, and how they might evolve in the future.

What do central banks actually do?

Central banks like the Federal Reserve set official interest rates to support steady economic growth. This is one of their most important tasks, since it determines the cost of borrowing and lending money. When interest rates go up, so does your mortgage and any other debt, for example business loans. As a result, fewer people buy houses, or borrow money to invest in their businesses, and the economy slows. To stimulate the economy, central banks can lower the official interest rate, which makes it cheaper to borrow money. Borrowing goes up, and the economy gathers pace - at least in theory.

Why does this matter?

Economic growth is directly tied to employment. Broadly speaking, faster growth means more jobs. But if the economy grows too fast, it can overheat. People take on too much debt, and may not be able to repay it. The central bank supplies too much money, and prices rise too fast. In the worst case, an oversupply of money can lead to out-of-control inflation. Hyperinflation ravaged the German economy in the early 1920s, for example, after the government tried to print its way out of its First World War debt. At its most extreme, hyperinflation was so severe that the price of two cups of coffee rose while a customer was drinking them. Many historians argue that such economic turmoil paved the way for the rise of fascism.

How do central bankers hint at a future rate rise?

Investors generally want central bankers to be stable and predictable. They need to know what's ahead, so they can plan their investments accordingly. It's difficult to build a business or manage a portfolio if you are constantly tripped up by surprise interest rate moves that jolt the entire economy. This is why many central bankers try to signal an increase or decrease in rates well in advance (though they may sometimes resort to the power of a sudden move). Successfully decoding their subtle warnings can be an art in itself.

For example, when Jean-Claude Trichet was president of the European Central Bank from 2003 to 2011, one of his recurring phrases was that the bank needed to remain 'vigilant' about inflation. Whenever he slightly altered his message and said that ' strong vigilance' was warranted, investors knew from experience that this signalled a rate rise, often the very next month. As a result, the euro usually fell right after such an announcement - all because of the addition of a single word. Trichet's successor, Mario Draghi, has also used the word 'vigilant' to signal monetary policy action (in his case, to stimulate rather than restrain the economy), and markets have moved in response.

What other responsibilities does a central bank have?

Central banks like the Federal Reserve increase and decrease the money supply by buying and selling bonds. The more money circulates, the easier it is to lend and borrow. Central banks also manage foreign exchange reserves and act as a lender of last resort. They decide how much banks can lend and how much money they must retain. Lowering the reserve requirement - the proportion of capital that banks must hold - can also stimulate the economy since it frees up money for lending.

Since the wake of the 2008 financial crisis, central banks have resorted to a range of unconventional measures to revive economic growth. They have injected money into commercial banks by buying bonds from them, in the hope that the banks will then lend this money to investors. Europe's and Japan's central banks have cut their key interest rates to below zero, effectively penalising banks for saving rather than issuing loans.

Powell is taking over the Fed at a time when central bankers are under pressure to eventually return to more normal economic conditions, since super-low interest rates hurt an economy in the long run. They distort saving and lending behaviour, and leave the central bank with no room for manoeuvre when a big crisis hits.

Have central banks always been this important?

Arguably, central banks play a particularly important role in the modern, globalised economy, where the effect of a single rate rise in a major economy ripples around the world. On the other hand, central banks have influenced global politics and economics ever since they came into being. The world's oldest central bank, Sweden's Riksbank, was founded in 1668, and soon after financed a war against Denmark.

So central banks are all-powerful?

Yes and no. Their decisions shape the economy, but other factors also matter. A skilled workforce, technological innovation, good infrastructure and access to equal opportunities are crucial in creating strong, healthy growth, to name just a few obvious elements.

How was Powell appointed, and what are his main challenges in his new job?

In the U.S., the president appoints the chair of the Fed. President Obama appointed Yellen, and President Trump appointed Powell, a lawyer by training who had been a Fed governor since 2011. Under Yellen, the Fed raised its benchmark interest rate four times as it gradually moved towards unwinding its economic stimulus. Powell is expected to broadly continue this policy of slowly returning rates to more normal levels.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} Weekly

A weekly update of the most important issues driving the global agenda

What is the function of a Central Bank?

A Central Bank is an integral part of the financial and economic system. They are usually owned by the government and given certain functions to fulfil. These include printing money, operating monetary policy, the lender of last resort and ensuring the stability of financial system. Examples of Central Banks include

- Federal Reserve – US

- Bank of England – UK

- European Central Bank (ECB) – EU

- Reserve Bank of India

Functions of Central Bank

- Issue money . The Central Bank will have responsibility for issuing notes and coins and ensure people have faith in notes which are printed, e.g. protect against forgery. Printing money is also an important responsibility because printing too much can cause inflation .

- Lender of Last Resort to Commercial banks . If banks get into liquidity shortages then the Central Bank is able to lend the commercial bank sufficient funds to avoid the bank running short. This is a very important function as it helps maintain confidence in the banking system. If a bank ran out of money, people would lose confidence and want to withdraw their money from the bank. Having a lender of last resort means that we don’t expect a liquidity crisis with our banks, therefore people have high confidence in keeping our savings in banks. For example, the US Federal Reserve was created in 1907 after a bank panic was averted by intervention from J.P.Morgan; this led to the creation of a Central Bank who would have this function.

- Lender of Last Resort to Government . Government borrowing is financed by selling bonds on the open market. There may be some months where the government fails to sell sufficient bonds and so has a shortfall. This would cause panic amongst bond investors and they would be more likely to sell their government bonds and demand higher interest rates. However, if the Bank of England intervene and buy some government bonds then they can avoid these ‘liquidity shortages’. This gives bond investors more confidence and helps the government to borrow at lower interest rates. A problem in the Eurozone in 2011, is that the ECB was not willing to act as lender of last resort – causing higher bond yields.

- Target low inflation. Many governments give the Central Bank a target for inflation, e.g. the Bank of England has an inflation target of 2% +/- 1. See: Bank of England inflation target . Low inflation helps to create greater economic stability and preserves the value of money and savings.

- Target growth and unemployment . As well as low inflation a Central Bank will consider other macroeconomic objectives such as economic growth and unemployment. For example, in a period of temporary cost-push inflation , the Central Bank may accept a higher rate of inflation because it doesn’t want to push the economy into a recession.

- Operate monetary policy/interest rates. The Central Bank set interest rates to target low inflation and maintain economic growth. Every month the MPC will meet and evaluate whether inflationary pressures in the economy justify a rate increase. To make a judgement on inflationary pressures they will examine every aspect of the economic situation and look at a variety of economic statistics to get a picture of the whole economy. See: how the Bank of England set interest rates.

- Unconventional monetary policy . The Central Bank may also need to use other monetary instruments to achieve macroeconomic targets. For example, in a liquidity trap, lower interest rates may be insufficient to boost spending and economic growth. In this situation, the Central Bank may resort to more unconventional monetary policies such as quantitative easing . This involves creating money and using this money to buy bonds; the aim of quantitative easing is to reduce interest rates and boost bank lending

- Ensure stability of the financial system. For example, regulate bank lending and financial derivatives.

Central Bank Independence

In some countries government’s take responsibility for Monetary policy. However, recently there has been a trend towards giving Central Banks independence for setting interest rates and controlling monetary policy. For example, the Bank of England was made independent in 1997.

However, the government often retains some control over monetary policy. For example, the UK government still set the inflation target CPI = 2% +/-1.

- What does the Bank of England do? (Bank of England)

- ECB v Bank of England

1 thought on “What is the function of a Central Bank?”

- Pingback: The Role of Price Expectations in Inflation | Economics Blog

Comments are closed.

- Search Search Please fill out this field.

The Rise of the Central Bank

- Influences on the Economy

Transitional Economies

The bottom line.

- Monetary Policy

What Central Banks Do

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-d90f2cc61d274246a2be03cdd144f699.jpeg)

- Federal Reserve System: What It Is and How It Works

- Central Bank CURRENT ARTICLE

- Central Banks and Interest Rates

- Financial Regulators

- Who Determines Interest Rates?

- Monetary Policy vs. Fiscal Policy

- 1913 Federal Reserve Act

- How the Federal Reserve was Formed

- Federal Reserve Board

- Federal Open Market Committee (FOMC)

- Why Is the Federal Reserve Independent?

- What Do the Federal Reserve Banks Do?

- The Federal Reserve Chair's Responsibilities

- How the Federal Reserve Creates Money

- Federal Reserve Balance Sheet

- Reserve Requirements

- Reserve Ratio Definition

- Interest Rate Cuts and Consumers

- Fed Fund Rate Hikes and the US Dollar

- Open Market Operations

- Tight Monetary Policy

- Expansionary Policy

- Taylor's Rule

A central bank has been described as the " lender of last resort ," which means it is responsible for providing its nation's economy with funds when commercial banks cannot cover a supply shortage. In other words, the central bank prevents the country's banking system from failing.

However, the primary goal of central banks is to provide their countries' currencies with price stability by controlling inflation. A central bank also acts as the regulatory authority of a country's monetary policy and is the sole provider and printer of notes and coins in circulation.

Time has proved that the central bank can best function in these capacities by remaining independent from government fiscal policy and therefore uninfluenced by the political concerns of any regime. A central bank should also be completely divested of any commercial banking interests.

Key Takeaways

- Central banks carry out a nation's monetary policy and control its money supply, often mandated with maintaining low inflation and steady GDP growth.

- On a macro basis, central banks influence interest rates and participate in open market operations to control the cost of borrowing and lending throughout an economy.

- Central banks also operate on a micro-scale, setting the commercial banks' reserve ratio and acting as lenders of last resort when necessary.

Historically, the role of the central bank has been growing, some may argue, since the establishment of the Bank of England in 1694. It is, however, generally agreed upon that the concept of the modern central bank did not appear until the 20th century, in response to problems in commercial banking systems.

Between 1870 and 1914, when world currencies were pegged to the gold standard (GS), maintaining price stability was a lot easier because the amount of gold available was limited. Consequently, monetary expansion could not occur simply from a political decision to print more money, so inflation was easier to control. The central bank at that time was primarily responsible for maintaining the convertibility of gold into currency; it issued notes based on a country's reserves of gold.

At the outbreak of World War I, the GS was abandoned, and it became apparent that, in times of crisis, governments facing budget deficits (because it costs money to wage war) and needing greater resources would order the printing of more money. As governments did so, they encountered inflation.

After the war, many governments opted to go back to the GS to try to stabilize their economies. With this rose the awareness of the importance of the central bank's independence from any political party or administration.

During the unsettling times of the Great Depression and the aftermath of World War II, world governments predominantly favored a return to a central bank dependent on the political decision-making process. This view emerged mostly from the need to establish control over war-shattered economies; furthermore, newly independent nations opted to keep control over all aspects of their countries—a backlash against colonialism.

The rise of managed economies in the Eastern Bloc was also responsible for increased government interference in the macroeconomy. Eventually, however, the independence of the central bank from the government came back into fashion in Western economies and prevailed as the optimal way to achieve a liberal and stable economic regime.

How the Central Bank Influences an Economy

A central bank can be said to have two main kinds of functions: (1) macroeconomic when regulating inflation and price stability and (2) microeconomic when functioning as a lender of last resort.

Macroeconomic Influences

As it is responsible for price stability, the central bank must regulate the level of inflation by controlling money supplies by means of monetary policy. Their actions directly influence market sentiment . The central bank performs open market transactions (OMO) that either inject the market with liquidity or absorb extra funds, directly affecting the level of inflation.

To increase the amount of money in circulation and decrease the interest rate (cost) for borrowing, the central bank can buy government bonds, bills, or other government-issued notes. This buying can, however, also lead to higher inflation. When it needs to absorb money to reduce inflation, the central bank will sell government bonds on the open market, which increases the interest rate and discourages borrowing.

Open market operations are the key means by which a central bank controls inflation, money supply, and prices.

The Fed increased interest rates from 0.08% in Feb. 2022 all the way to 5.08% in June 2023 to combat high inflation.

Microeconomic Influences

The establishment of central banks as lenders of last resort has pushed the need for their freedom from commercial banking. A commercial bank offers funds to clients on a first-come, first-serve basis.

If the commercial bank does not have enough liquidity to meet its clients' demands (commercial banks typically do not hold reserves equal to the needs of the entire market), the commercial bank can turn to the central bank to borrow additional funds. This provides the system with stability in an objective way; central banks cannot favor any particular commercial bank. As such, many central banks will hold commercial-bank reserves that are based on a ratio of each commercial bank's deposits.

Thus, a central bank may require all commercial banks to keep, for example, a 1:10 reserve/deposit ratio . Enforcing a policy of commercial bank reserves functions as another means to control the money supply in the market. Not all central banks, however, require commercial banks to deposit reserves.

The United Kingdom, for example, does not, while the United States traditionally does. However, the U.S. Central Bank dropped its reserve requirements to zero percent effective March 26, 2020, during the 2020 COVID-19 pandemic.

The rate at which commercial banks and other lending facilities can borrow short-term funds from the central bank is called the discount rate (which is set by the central bank and provides a base for interest rates).

It has been argued that, for open market transactions to become more efficient, the discount rate should keep the banks from perpetual borrowing, which would disrupt the market's money supply and the central bank's monetary policy. By borrowing too much, the commercial bank will be circulating more money in the system. The use of the discount rate can be restricted by making it unattractive when used repeatedly.

Today developing economies are faced with issues such as the transition from managed to free market economies. The main concern is often controlling inflation. This can lead to the creation of an independent central bank but can take some time, given that many developing nations want to maintain control over their economies. But government intervention, whether direct or indirect through fiscal policy, can stunt central bank development.

Unfortunately, many developing nations are faced with civil disorder or war, which can force a government to divert funds away from the development of the economy as a whole. Nonetheless, one factor that seems to be confirmed is that, for a market economy to develop, a stable currency (whether achieved through a fixed or floating exchange rate ) is needed; however, the central banks in both industrial and emerging economies are dynamic because there is no guaranteed way to run an economy, regardless of its stage of development.

Are Central Banks Government Banks?

Generally, central banks are not government agencies and operate independently of the government; however, many central bank positions can be appointed by the government, and they are required to abide by the law, just as they are protected by the law.

What Are the Essential Roles of a Central Bank?

The essential roles of a central bank are to affect monetary policy, be the lender of last resort, and oversee the banking system. Central banks set interest rates, lend money to other banks, and control the money supply.

How Is the Federal Reserve Funded?

The Fed is primarily funded by the interest earned on the securities it owns. It is also funded by fees charged for priced services provided to depository institutions, such as check clearing, fund transfers, and automated clearing house (ACH) operations. It is not funded by congressional money.

Central banks are responsible for overseeing the monetary system for a nation (or group of nations), along with a wide range of other responsibilities, from overseeing monetary policy to implementing specific goals such as currency stability, low inflation, and full employment.

The role of the central bank has grown in importance in the last century. To ensure the stability of a country's currency, the central bank should be the regulator and authority in the banking and monetary systems.

Contemporary central banks are government-owned, but separate from their country's ministry or department of finance. Although the central bank is frequently termed the "government's bank" because it handles the buying and selling of government bonds and other instruments, political decisions should not influence central bank operations.

Of course, the nature of the relationship between the central bank and the ruling regime varies from country to country and continues to evolve with time.

Bank of England. " Our History ."

World Gold Council. " The Classical Gold Standard ."

Britannica. " The Decline of Gold ."

International Monetary Fund. " Been There, Done That ."

Federal Reserve History. " The Great Depression ."

St. Louis Fed. " Federal Funds Effective Rate ."

Bank for International Settlements. " United Kingdom ."

Board of Governors of the Federal Reserve System. " Regulation D: Reserve Requirements of Depository Institutions 12 CFR 204 ."

United States Federal Reserve System. " The Fed Explained ," Page 4.

:max_bytes(150000):strip_icc():format(webp)/FederalFundsRate-8064baabc82d47bf81b735e57a5c4557.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Essays on Central Bank

Search Results

What is a central bank?

10 July 2015

A central bank is a public institution that manages the currency of a country or group of countries and controls the money supply – literally, the amount of money in circulation. The main objective of many central banks is price stability . In some countries, central banks are also required by law to act in support of full employment.

One of the main tools of any central bank is setting interest rates – the “cost of money” – as part of its monetary policy. A central bank is not a commercial bank. An individual cannot open an account at a central bank or ask it for a loan and, as a public body, it is not motivated by profit.

It does act as a bank for the commercial banks and this is how it influences the flow of money and credit in the economy to achieve stable prices. Commercial banks can turn to a central bank to borrow money, usually to cover very short-term needs. To borrow from the central bank they have to give collateral – an asset like a government bond or a corporate bond that has a value and acts as a guarantee that they will repay the money.

Because commercial banks might lend long-term against short-term deposits, they can face “liquidity” problems – a situation where they have the money to repay a debt but not the ability to turn it into cash quickly. This is where a central bank can step in as a “lender of last resort.” This helps keep the financial system stable. Central banks can have a wide range of tasks besides monetary policy. They usually issue banknotes and coins, often ensure the smooth functioning of payment systems for banks and traded financial instruments, manage foreign reserves, and play a role in informing the public about the economy. Many central banks also contribute to the stability of the financial system by supervising the commercial banks to make sure the lenders are not taking too many risks.

- Central banking

- Monetary policy

- Price stability

Find out more about related content

More information, our website uses cookies.

We are always working to improve this website for our users. To do this, we use the anonymous data provided by cookies. Learn more about how we use cookies

We have updated our privacy policy

We are always working to improve this website for our users. To do this, we use the anonymous data provided by cookies. See what has changed in our privacy policy

Your cookie preference has expired

The role of Central bank

What are the roles and functions of central banks? Why do they need Economic staff? How far should central banks get involved in data collection and areas such as seasonal adjustment, as well as economic analysis?

Introduction Though Central Bank is viewed as one of the primary mechanisms of macroeconomic stabilization there are a number of arguments about other areas of Central Bank’s involvement. This paper will explore the different areas, including the role of Central Bank in effecting monetary policy and intervening body in exchange rate trades, Central Bank as a Last Lender Resort (LLR), and Central Bank as a regulatory body of the financial sector. Prior to further discussion, it is important to stress that the role of Central Bank and the scope of its involvement may vary due to the effect of different legislations and the presence of various stakeholders. Thus, US Central Bank does not act as a regulatory body of the financial sector (Driffill et al. , 2005), whereas the intervention activity of Japan Central Bank requires the approval of other governmental bodies (Fujiwara, 2005).

This paper discusses the importance of Central Bank’s publications of economic forecasts and other information related to Central Bank’s views of the further state of macroeconomic trends. The discussion shows that this information is highly important for other market players and forecasting agencies as it reduces the information asymmetry.