Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, sizing up the competition: how to conduct competitive research.

Competitive research can reveal trends in the marketplace and gaps in your own business plan.

Competitive research is a crucial part of any good marketing plan. This term may elicit some negative images but competitive research has nothing to do with spying. It has everything to do with paying attention to your competition and what they are doing.

Many people will lose out on business to competitors they have never even heard of simply because they’ve never taken the time to do competitive research. Understanding what your competition is doing will help you position yourself, and your product or service, within the market.

What is competitive research?

Competitive research involves identifying your competitors, evaluating their strengths and weaknesses and evaluating the strengths and weaknesses of their products and services. By looking at your biggest competitors, you can see how your own products and services stack up and what kind of threat they pose to your business. It also helps you identify industry trends you may have been missing.

Four benefits to doing competitive research are:

- Understanding your market . Competitive research can reveal trends in the marketplace that might have otherwise been missed. The ability to identify and predict trends is a huge asset for any business, helping to improve value proposition for customers. This is an important component of competitive research that you should constantly be doing.

- Improving your marketing . Your customers care about how your product or service is going to make their lives better. If they are leaving to go to one of your competitors, it’s probably because that company does a better job of explaining the benefits to the customer base, or does in fact provide a better product or service. Competitive research helps you understand why customers choose to buy from you or your competitors and how your competition is marketing their products. Over time, this can help you improve your own marketing programs.

- Identifying market gaps . When you do competitive research, you’re analyzing the strengths and weaknesses of your competitors. You’ll often find that, by looking at the data, there is a segment of the population that is being underserved. This could put your business in a unique position to reach those customers.

- Planning for the future . The most important byproduct of competitive research is that it will help you create a strategic plan for your business. This includes things like improving your product or service, using more strategic pricing strategies, and improving the promotion of your products.

Good competitive research could put your business in a unique position to reach customers who are being underserved.

6 steps to competitive research

It may sound obvious, but the first step is to simply identify who your top competitors are . There are two different types of competitors to identify: direct and indirect.

Direct competitors are targeting the same customer base you’re targeting. They are solving the same problem that you are trying to solve and sell a similar product or service.

Indirect competitors may sell something similar to your product or service but target a different audience, or they may target your same customer base but have a slightly different product or service.

It’s important to understand this segment of your market for two reasons: (1) it could provide you with growth opportunities for your own business, and (2) it could also highlight a threat to your business of which you would otherwise be unaware.

Here are six steps to getting started on competitive research:

Identify main competitors.

The most obvious way to do this is simply by searching your product or service category on the web and seeing what comes up. You can also check websites like Crunchbase or Product Hunt . You may find competitors that you might not have noticed before.

The goal is to cast a wide net and get an idea of who your main competitors are. Another good way to identify direct and indirect competitors is to ask your potential customers what services they are already using.

Analyze competitors' online presence

Once you’ve identified your main competitors, you want to look at their website, the type of content they are publishing, and their social media presence. Then, look for any blogs, white papers, and social media content being provided about their products and how to use them. Ask yourself these questions:

- What is the user experience like on their website?

- Is it easy to navigate?

- Do you clearly understand the products or services they offer?

- Is their website mobile-optimized?

- How often do they blog and most importantly, is the quality of their content good?

- What topics do they blog about most frequently?

- What social platforms are they actively using to talk about their products and services?

- Is this content engaging their target audience?

The answers to these questions show you opportunities where you can outperform your competitors. You will want to pay close attention to anything they are doing well that you aren’t doing. This will help give you a better understanding of where you should be focusing your attention and resources.

Gather information

The best way to gather information about your competitors is by acting like one of their customers. Sign up for their email list so you can get an idea of how they communicate.

Also, follow their blog and social media accounts and watch how they interact with their customers online. What kind of experience do customers have with your competitors?

You should consider shopping from them so you can see what their product looks like and what the experience is like from a customer perspective.

Track your findings

Make sure you track your competitors' findings on a spreadsheet; it will help with ongoing monitoring. This isn’t a complicated process, you just need to keep track of what they are doing over time so that you can see how they change everything from pricing to marketing and promotional activities.

You’ll start by dividing your competitors into direct and indirect customer columns. You’ll then track the following information:

- Company name

- Social media sites

- Unique features

- Pros and cons

- Screenshots and additional links

Check online reviews

Try to find as many reviews of your competitors as possible. Read their social media reviews, comments on their blogs, and case studies on their website. If they offer and present Google reviews, read them as well. It’s a good idea to understand not only the good things that your competitors may be doing, but the bad things as well. Include mentions with the Better Business Bureau about them in your research.

How customer-focused are they? This could be an opportunity for you to stand out. And, if they sell a product similar to yours, this will be a good way to find out if a lot of people are interested in it.

Any negative feedback will help you identify areas where you can improve your own product or service.

Identify areas for improvement

Now that you’ve taken note of some of the biggest differences between you and your competitors, it’s time to think about how you can use this information to improve your own business results.

Your competitive research should reveal at least one area your business can stand to improve in. This will help you learn how to engage better with your customers and online followers.

Keep in mind that competitive research is never a "one-and-done" event. Ongoing monitoring, such as observing how competitors evolve, is necessary to ensure that you are staying competitive in the marketplace.

Tools for competitive research

Software and technology now make it easier than ever to conduct competitive research. However, there are hundreds of competitive research tools on the market and narrowing down the right software can feel overwhelming.

This is why we’ve done the legwork and narrowed it down for you. Here are four tools you should consider using to conduct your competitive research:

SEMrush : This is one of the best competitive research tools on the market. It contains over 30 tools that can track things like SEO, PPC, keyword research, competitive research, and more. SEMrush will help you discover new competitors, find their best-used keywords, and analyze their ad copy. They have flexible pricing plans depending on your business needs.

SpyFu : This search analytics tool reveals the keywords websites buy on Google. So, once you’ve identified your biggest competitors, you can track every keyword they’ve bought. Plus, you can track every keyword they are ranking for and find the content and backlinks that helped them rank in the first place.

BuzzSumo : BuzzSumo lets you see how your content is matching up to your competitors’ content. You can see which content is shared more frequently on social media compared to others, and you can even schedule alerts on your competitors’ content which will make it easier to continue tracking them.

Owletter : Owletter tracks and analyzes emails sent from a website. This allows you to track your competitors’ email marketing and see what is and isn’t working for them. To get started, you’ll need to sign up to join your competitors’ email list. Then, every time you receive an email, Owletter will take a screenshot, analyze it, and alert you to any useful information.

Competitive research can seem daunting at first but it’s an essential part of running a successful business. When you incorporate the right tools into your research, you may find that it’s not as difficult as you imagined.

On some level, understanding your competitors is just as important as understanding your customers. Your competitors have valuable lessons to teach you and it’s important to regularly monitor their online activity. Doing so will strengthen your business and improve your own value for your customers.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

What Is a Competitive Analysis — and How Do You Conduct One?

Updated: October 04, 2024

Published: June 19, 2017

Every time I work with a new brand, one of my highest priorities is conducting a competitive analysis.

A competitive analysis report helps me understand the brand’s position in the market, map competitors’ strengths/weaknesses, and discover growth opportunities.

In this article, I’ll break down the steps I follow to conduct competitor analysis and identify ways to one-up top brands in the market.

Table of Contents

What is competitive analysis?

Why do a competitor analysis, what is competitive market research, competitive analysis in marketing, how to conduct competitive analysis in 5 quick steps, how to do a competitive analysis (the extended cut), competitive analysis templates, competitive product analysis, competitive analysis example, competitive analysis: faqs.

Competitive analysis is the process of comparing your competitors against your brand to understand their core differentiators, strengths, and weaknesses. It’s an in-depth breakdown of each competitor’s market position, sales & marketing tactics, growth strategy, and other business-critical aspects to see what they’re doing right and find opportunities for your business.

Competitive analysis gives you a clearer picture of the market landscape to make informed decisions for your growth.

That said, you have to remember that competitive analysis is an opportunity to learn from others. It isn’t:

- Copying successful competitors to a T.

- Trying to undercut others’ pricing.

- A one-and-done exercise.

Let’s look at how this exercise can help your business before breaking down my 5-step competitive analysis framework.

.webp)

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

If you’re unsure about investing time and effort in analyzing your competitors, know that it will give you a complete picture of the market and your position in it.

Here are six main reasons I perform a competitive analysis exercise whenever working with a brand for the first time.

1. Find competitors’ strengths and weaknesses.

What are your competitors doing right to drive their growth? Analyzing the ins and outs of an industry leader will tell you what they did well to reach the top position in the market.

By looking at competitor strengths and weaknesses, you will identify opportunities for your own business.

I personally love analyzing competitor strengths. It’s easy to become short-sighted when looking internally only at your website, marketing, and business. Analyzing competitors will open your eyes to what the market is up to, what looks good, functions well, and would benefit your business.

Competitor weaknesses are of equal importance, particularly if the competitor is quite aspirational in that you’d love to get to where they are. Analyze areas in which they fall short and devise a plan to avoid making the same mistakes.

Pro tip: Look at company and product reviews to find the weaknesses that most bother your audiences. Commonalities can be used in marketing messaging to persuade people to try you instead, or you can go into product development knowing exactly what problem to solve.

2. Identify opportunities.

Conducting a competitor analysis can be hugely beneficial for brands. It can be an affordable way to identify many opportunities to improve your business.

As an example of opportunities you might find, you can build a picture of messaging that works by analyzing what your competitors say about their products or USPs. This information might inspire your marketing.

Rachel Andrea Go is a marketing director who uses competitor analysis to learn what messages resonate with her audiences. She recommends, “Instead of saying, ‘Best project management software,’ one of your competitors might say, ‘Get time back by letting our software manage your projects.’

“By framing their software as ‘time-saving,’ your competition positions their software not only as a solution for project managers but also as a way to save time.

“Look at the language they employ on their websites, landing pages, and social media posts to communicate their USPs and pay attention to how their followers react.”

There are tools available that will help you analyze a competitor thoroughly. I do a lot of digital competitor analysis. In most cases, I can find so many opportunities through competitor analysis alone that I could keep my client’s team busy for months .

Top tip: It’s easy to get carried away with competitor analysis and lose sight of what really matters and drives your business. Don’t get too hung up on closing the gap on competitors. You must keep your business front of mind at all times. Do the analysis, but think carefully about the opportunities you will seize. They must be a) right for your business and b) likely to move the needle.

3. Identify your differentiators.

Think of competitor analysis as a chance to reflect on your own business and discover what sets you apart from the crowd.

There’s no doubt that there will be some key differentiators between your business and your competitors. Many will be for good reason, and you’ll be glad to see it.

But if you keep an open mind while conducting your analysis, there’s a good chance you’ll find differentiators in messaging, word choices, and USPs, some of which may make you think about your own business differently.

Top tip: You should be fairly strategic about competitor analysis. It’s common for brands to focus on the most aspirational competitors, but you need to get honest with yourself and consider your market position. Don’t be afraid to dream big, but balance analysis of the biggest players with some that are closer to where your business is, too.

5. Get closer to your target audience.

A good competitor analysis framework zooms in on your audience. It gives you a pulse of your customers by evaluating what they like, dislike, prefer, and complain about when reviewing competing brands.

You can discover how your audience talks about competitors, what they love so you can emulate it if it makes sense, and what they loathe so you can avoid it or use that to your advantage.

Top tip: Social media, forums, and review sites are excellent sources of qualitative data where you can learn your audience's feelings in their own words.

6. Discover new competitors.

This one might sound backward. Don’t you need your competitors before you can start competitive analysis? Well, yes … and no.

As mentioned above, I’ve seen many brands fall into the trap of analyzing aspirational competitors and miss out on brands that are attracting their audiences and winning business where they should be.

Dan White is an SEO consultant who conducts competitor analysis for his clients. White says, “One of the big things I tend to focus on is who [my clients] share similar keywords with. It opens their eyes to understanding who they think their competitors are and who their competitors are, which are two very different things in Google.”

White raises an excellent point. When it comes to digital competitor research, SEO, and content, I often refer to competitors as “business competitors” and “content competitors.”

Think of your business competitors as the businesses who do the same kind of work you do, the businesses you might lose business to. Content competitors, however, may be serving your audience online, bringing them into communities, or providing alternative solutions that could leave you forgotten.

In a digital world, it’s almost impossible to know who all your competitors are, and those local may not be the only competitors to keep an eye on.

7. Set benchmarks for success.

A competitor analysis gives you a realistic idea of mapping your progress with success metrics. While every business has its own path to success, you can always look at a competitor’s trajectory to assess whether you’re on the right track.

Top tip: If you have the privilege of checking in regularly, say every quarter, every six months, or even every year, you can keep a note of some KPIs to monitor business growth. I tend to do competitor analysis every year or so for my clients. You can compare reports to years previous to track everyone’s trajectory.

The bottom line: Whether you’re starting a new business or revamping an existing one, a competitive analysis eliminates guesswork and gives you concrete information to build your business strategy.

Competitive market research is a vital exercise that goes beyond merely comparing products or services. It involves an in-depth analysis of the market metrics that distinguish your offerings from those of your competitors.

A thorough market research doesn't just highlight these differences but leverages them, laying a solid foundation for a sales and marketing strategy that truly differentiates your business in a bustling market.

In the next section, we’ll explore the nuts and bolts of conducting a detailed competitive analysis tailored to your brand.

Essential Aspects to Cover in Competitive Analysis Research

Before we walk through our step-by-step process for conducting competitor analysis, let’s look at the main aspects to include for every competitor:

- Overview. A summary of the company — where it’s located, target market, and target audience.

- Primary offering. A breakdown of what they sell and how they compare against your brand.

- Pricing strategy. A comparison of their pricing for different products with your pricing.

- Positioning. An analysis of their core messaging to see how they position themselves. Customer feedback: A curation of what customers have to say about the brand.

Now, it’s time to learn how to conduct a competitive analysis with an example to contextualize each step.

Every brand can benefit from regular competitor analysis. By performing a competitor analysis, you'll be able to:

- Identify gaps in the market.

- Develop new products and services.

- Uncover market trends.

- Market and sell more effectively.

As you can see, learning any of these four components will lead your brand down the path of achievement.

Next, let's dive into some steps you can take to conduct a comprehensive competitive analysis.

As a content marketer, I’ve performed a competitive analysis for several brands to improve their messaging, plan their marketing strategy, and explore new channels.

The good news for the most savvy marketers is that competitor analysis is getting easier and less time-consuming. According to HubSpot’s 2024 State of Marketing report , AI is helping considerably with research. 33% ranked it as #1, above context creation (31%) and data analysis and reporting (30%).

Here are the five quick steps I follow to analyze competitors. For extra steps, keep reading onto the next section where I share even more.

1. Identify and categorize all competitors.

The first step is a simple yet strategic one. You have to identify all possible competitors in your industry, even the lesser-known ones. The goal here is to be aware of all the players in the market instead of arbitrarily choosing to ignore a few.

As you find more and more competitors, categorize them into these buckets:

- Direct competitors. These brands offer the same product/service as you to the same target audience. People will often compare you to these brands when making a buying decision. For example, Arcade and Storylane are direct competitors in the demo automation category.

- Indirect competitors. These businesses solve the same problem but with different solutions. They present opportunities for you to expand your offering. For example, Scribe and Whatfix solve the problem of documentation + internal training, but in different ways.

- Legacy competitors. These are established companies operating in your industry for several years. They have a solid reputation in the market and are a trusted name among customers. For example, Ahrefs is a legacy competitor in the SEO industry.

- Emerging competitors. These are new players in the market with an innovative business model and unique value propositions that pose a threat to existing brands. For example, ChatGPT came in as a disruptor in the conversational AI space and outperformed several brands.

Here’s a competitive matrix classifying brands in the community and housing space:

The Beginner's Guide to the Competitive Matrix [+ Templates]

![researching competitors 9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]](https://www.hubspot.com/hubfs/marketing-research-methods-featured.png)

9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]

![researching competitors SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

28 Tools & Resources for Conducting Market Research

Market Research: A How-To Guide and Template

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![researching competitors How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![researching competitors 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

10 free templates to help you understand and beat the competition.

The weekly email to help take your career to the next level. No fluff, only first-hand expert advice & useful marketing trends.

Must enter a valid email

We're committed to your privacy. HubSpot uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time. For more information, check out our privacy policy .

This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

You've been subscribed

7 Competitor Analysis Frameworks To Give You an Edge

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

A competitor analysis framework is a must for anyone looking to survive and conquer their industry.

Competitive analysis frameworks differ from other types of market analysis in that they focus on understanding a company’s competitors in order to gain a better understanding of the competitive landscape. With a deeper understanding of your top competitors across different metrics, you’ll be armed with the strategic insights needed to develop a much more impactful digital research strategy , whether it aims to grow your audience, launch into a new market , or increase market share .

So, without further ado, let’s dive into the seven types of competitor analysis frameworks for industry analysis . Including what they are, and how to use them to survive and thrive in your market.

What is a competitor analysis framework?

A competitor analysis framework, market analysis framework or competitor analysis model, as they’re sometimes known, is a structure that business professionals use to research and evaluate their competitors. In other words, the art of knowing your enemy. Competitive frameworks gather vital information, such as a competitor’s business strategies, products, offerings, marketing efforts, sales, etc., into an organized visual model. And though competitive analysis might seem daunting, with the right frameworks, you’ll know exactly what information you need to gather — with zero guesswork.

Benefits of using a competitor analysis framework

Plugging your competitive analysis into a good framework can strengthen your business’ research strategy. If you’ve had trouble achieving any of these, competitor analysis models could be the answer:

- Identify market shifts: Frameworks can make it easy to discover market shifts that you might’ve missed if your competitor analysis wasn’t previously visually organized well.

- Locate gaps you didn’t even know you had: Examining businesses within a specific industry can reveal gaps in your own strategy compared to your industry at large, which may spark inspiration for a new business idea, product, or offerings.

- Target the most effective marketing strategies: By pinpointing the marketing channels that worked well for your competitors, you can create a data-backed roadmap to march confidently forward with your own marketing plans.

- Avoid mistakes: In the same vein, you can avoid costly mistakes by looking at what didn’t work for your competitors.

- Create measurable (and achievable) goals : A good competitive analysis framework helps businesses build specific performance goals based on their competitors’ data.

- Make data more digestible : Frameworks help display dull or confusing information in a visually appealing and organized manner, making it much easier to share your findings with the rest of the team and investors or C-level executives.

Seven types of competitive analysis frameworks

1. SWOT Analysis

Talk about an old faithful. The SWOT analysis has been around for decades, and for good reason. It organizes a company’s information into the following categories:

- Strengths: internal factors that provide benefits, like a highly trained staff.

- Weaknesses: internal factors that cause disadvantages, like a small marketing budget.

- Opportunities: external factors that pose opportunities, like high demand for a product offering.

- Threats: external factors that pose challenges, like an increase in the cost of supplies.

We recommend using SWOT analysis best practices to hone in on the strengths or weaknesses of your competitors. This is especially helpful for identifying potential competitive advantages your business may have over others, as well as finding areas for improvement.

SWOT Analysis Templates

Visualize how you stack up against the competition.

2. Porter’s Five Forces

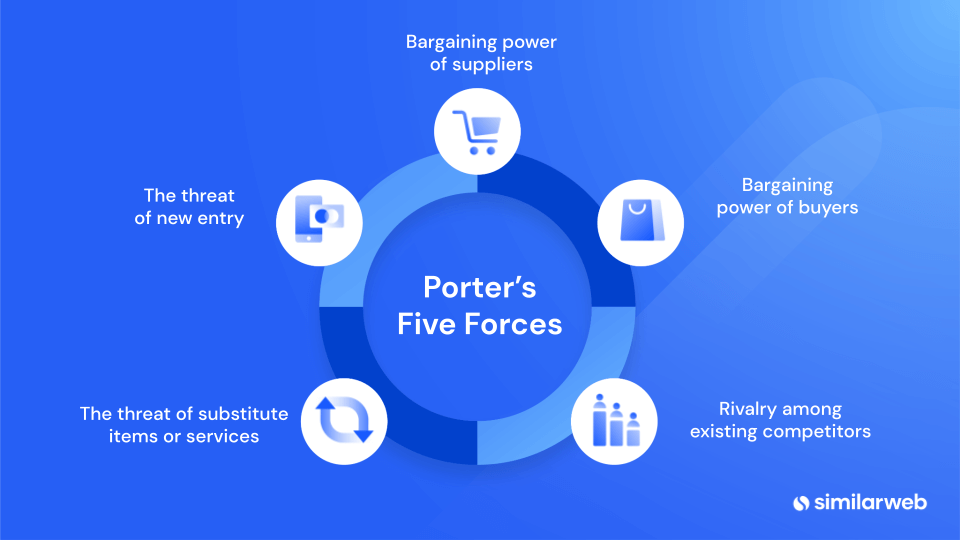

Porter’s Five Forces is a formidable framework created by Michael Porter, a professor at Harvard Business School. This competitive framework examines the five key market forces in any given industry, including:

- Intensity of competitive rivalry

- Threat of new entrants

- Bargaining power of new buyers

- Bargaining power of suppliers

- Threat of substitutes

Porter’s Five Forces is especially useful for analyzing the competitive structure of an entire industry. This information will be helpful when shaping business strategies and creating targeted goals amid the expansive competitive landscape . However, you can also apply this framework to niche industries or specific market segments .

3. Strategic group analysis

A strategic group analysis does exactly what it says—it organizes competitors into groups based on the similarity of strategy.

There’s a wide range of ways you can group companies. Perhaps you’d like to group competitors by their marketing tactics , pricing strategies, or range of offerings. Don’t forget to place your own company into the analysis to get a better sense of who you’re most closely competing with and better understand the impact different strategies provide. For instance, if you discover that the top three most successful companies in your niche are all grouped into the same pricing strategy , it may be time to see if doing the same will benefit your own business.

4. Growth-share matrix

The growth-share matrix classifies your company’s products against the competitive landscape . This is an example of a competitor analysis that’s especially useful for big organizations with a large portfolio of products or offerings. A growth-share matrix is a chart divided into four quadrants to classify products or business units into:

- Stars : products with high growth and high market share . Invest more in these.

- Question marks : products (usually new ones) with high growth, but low market share. Decide whether to invest more (if convinced it will become a star) or give up on it.

- Cash cows : products with low growth but high market share that are usually used to fund investment in stars.

- Pets : products with low growth and low market share. Decide whether to reposition or give up on it.

Using this market analysis framework can help determine what’s worth giving priority to, what to reposition, and what to ditch.

Read More – How To Make The Most Of A Competitive Matrix

5. Perceptual mapping

Perceptual mapping, also known as positioning mapping, visualizes the perception of a company and its competitors on a plot graph. To use this competitive analysis framework, choose two factors to use as the basis for comparison, like perceived quality and price. Then, plot where your business and competitors fall on those two factors’ spectrum.

It’s great for obtaining a bird’s eye view of how customers perceive your company in relation to your competitors. Armed with that knowledge, your company can identify market trends and gaps and make adjustments to improve its existing positioning strategy. Smart and strong.

6. Business model canvas

This framework strips a business model to its bare bones, improving clarity and focusing on the most important factors. A business model canvas is a single analysis that’s divided up into nine elements:

- Customer segments : Who are the customers?

- Value propositions: Why do customers buy/use the proposition?

- Channels: How are propositions promoted, sold, and delivered?

- Customer relationships : How is the customer treated throughout their buyer journey?

- Revenue streams : How is revenue earned?

- Activities : What unique strategies does the business use to deliver its propositions?

- Resources : What unique strategic assets are required to compete?

- Partnerships: What can the business outsource so it can focus on its key activities?

- Cost structure: What are the major cost drivers and how are they linked to revenue?

7. Customer journey map

A customer journey map, also known as a user journey map, is a visual story of customers’ interactions with a brand.

First, all customer channels are mapped out—i.e., a company’s website, social channels, paid media, newsletters, email support, phone services, and face-to-face services (if the brand has brick-and-mortar locations). Customer journeys can then be mapped across these channels for each buyer persona . The customer experience at each touchpoint should be tacked on to the map, including key engagement metrics the customer hits. Below that, add how the brand responds to address the customers’ concerns. Finally, jot down what opportunities exist to improve the experience at each channel.

Utilizing customer journey maps can help gain insights into common customer pain points and how to improve them—not only within your own company, but for your competitors’ customers as well.

Pro Tip: Use Similarweb Consumer Journey Analytics to uncover competitor strategies and performance metrics through all stages of the conversion funnel.

How to use a competitive analysis framework?

Now let’s see this all in action. Below is a case study of a digital analysis using competitive insights to make faster and better business decisions. All of the data collected can be used to plug into any of the various competitive analysis framework templates we have covered so far.

Overview : Steve is a Category Analyst at a market-leading homeware and furniture retailer in the U.S. His company has several business lines across categories such as sofas, bedding, kitchenware, and outdoor furniture.

Steve’s company has one to two competitors that are particularly strong in the sofa category. An email from senior management says that sofa sales at the company have been on a downward trend, and now Steve has to pinpoint why this is the case and present a recovery plan. No pressure, right?

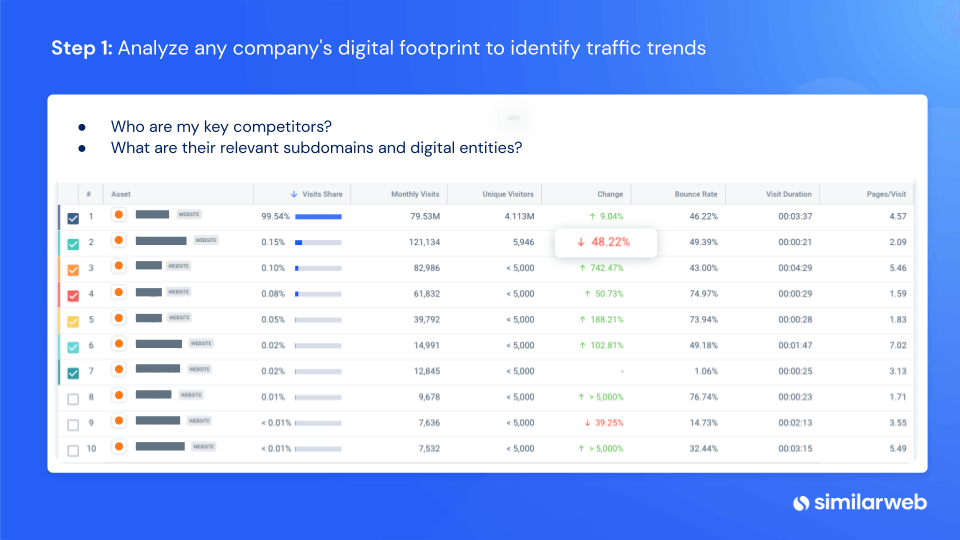

Analyze the competitor’s digital footprint

For Steve to truly understand his competitors, he needs to build a digital view of each company and break down assets such as subdomains to spotlight any trends that indicate a competitor’s digital performance. For example, he can identify the unique number of visitors the competitor generates over time to compare online reach relative to his own company’s performance.

Steve can then use this data to see where the company is growing or losing traction. In the example below, the percent change column indicates one of the domains has had a 42% downward growth in the last 12 months.

This information gives Steve a quick and easy snapshot of his competitor’s online performance and its strengths and weaknesses.

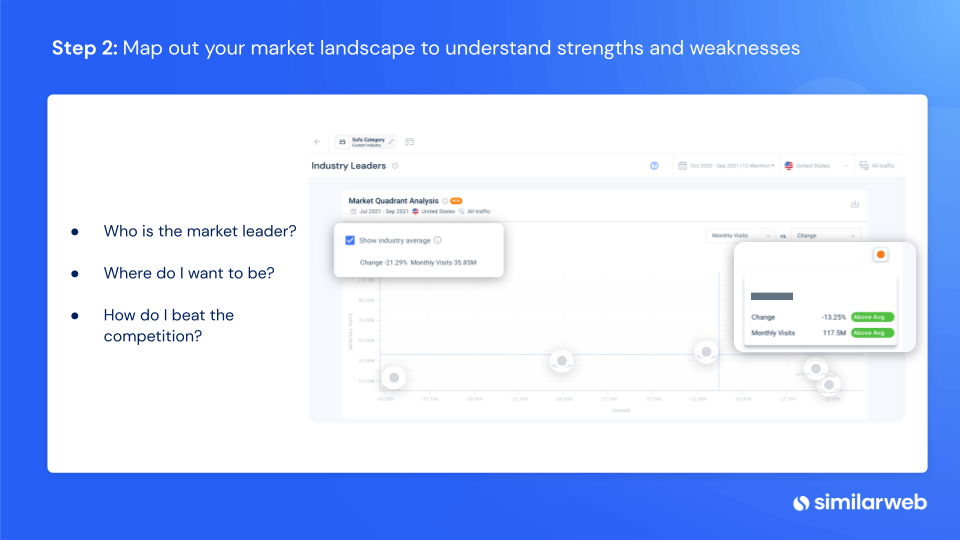

2: Map out your market landscape

Once Steve has built a company view of his direct competitors, he can also analyze their websites to benchmark traffic and engagement data against his company’s overall performance. This will enable him to instantly identify who the market leader is and where he needs to be to improve his digital strategy . Utilizing Similarweb’s DaaS tools , he can integrate vast datasets directly into analytical platforms like Google Cloud or AWS, allowing for real-time visualization and more dynamic market landscape mapping.

Try plotting out graph-specific metrics such as monthly visits vs. percent month-over-month change to know exactly how he’s performing.

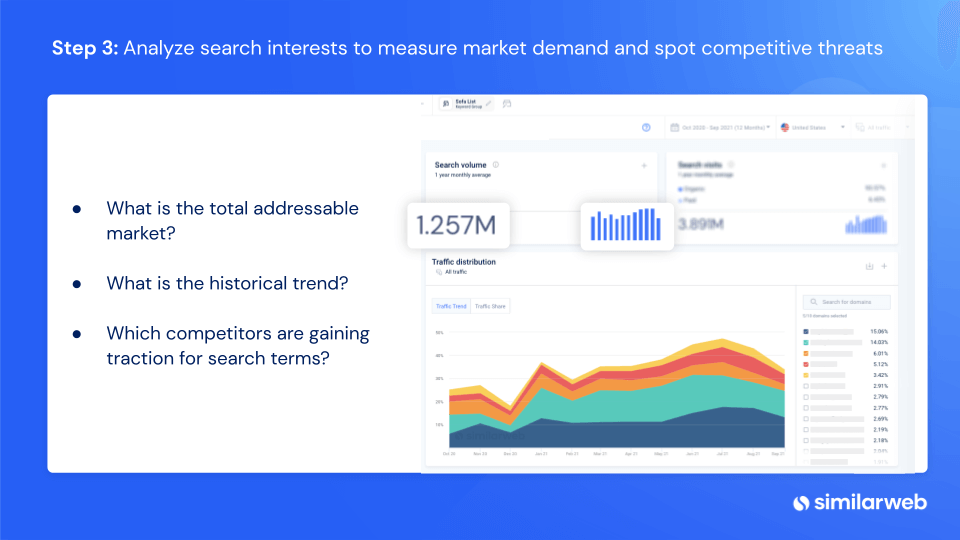

3: Analyze search interest

Next, Steve can assess the market demand for the sofa category and use search interests as a way to identify any emerging competitors that are gaining traffic share for related search terms within the United States. In this example, he can measure the search volume of traffic, see the overall search trend over time, and analyze which competitor is winning digital market share.

With these insights, Steve understands the overall trend for the market and can spot any specific competitors that he may not have considered before during his competitive analysis.

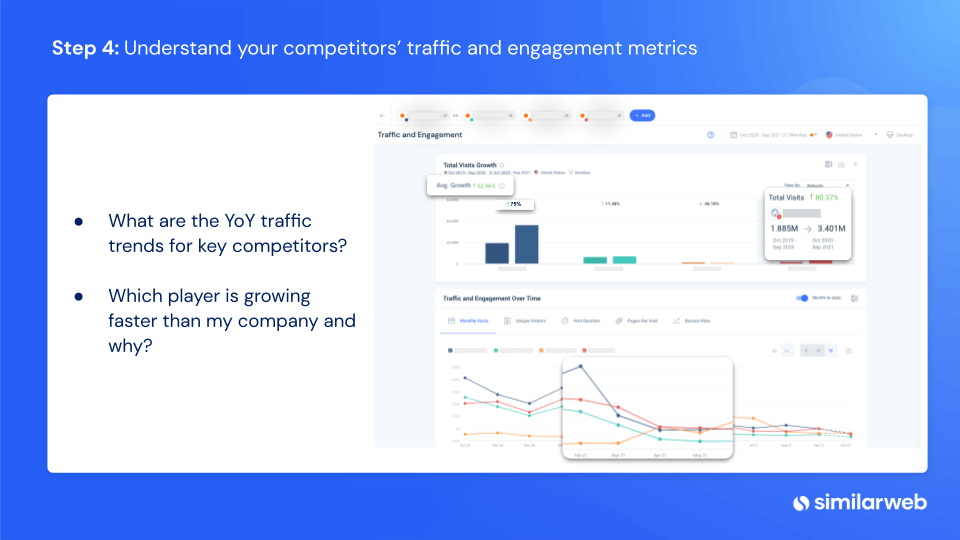

4: Understand traffic and engagement metrics

To learn how your competitor’s traffic and engagement metrics have grown or declined over time, benchmark your growth to your competitors’ to reveal if they’re growing at a faster rate, and that’s why they’re potentially winning market share.

In this example, Steve can see the year-over-year traffic growth for his competitive set and can see that one of his competitors grew its traffic by 80%, which is 5% more than his company’s website. Aha! At this point, Steve can use Similarweb to deep dive into the digital marketing strategy of his competitors to understand what’s causing that spike. He could discover that his competitor has an optimized paid search strategy, a marketing channel he previously overlooked.

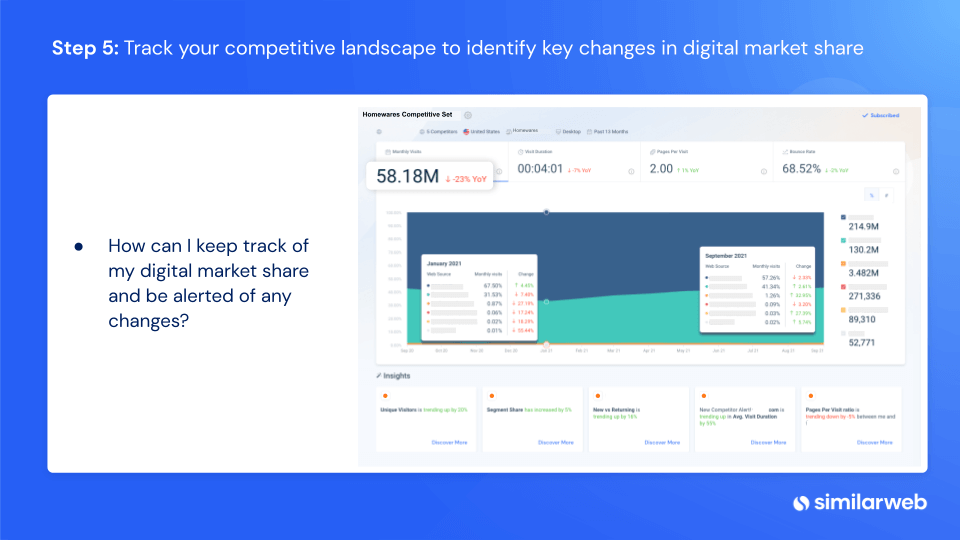

5: Continuously track the competitive landscape

The last step for Steve is to continuously track and monitor the competitive landscape to identify potential threats and emerging players. This way, he can quickly react to any changes in his competitive landscape and investigate the root cause using smart insights.

Start crafting your competitor analysis framework

Now that you know how to use all seven competitor analysis frameworks, it’s time to decide which ones work best for you and then get to it!

Try Similarweb for free and find out for yourself how our research tools can strengthen your competitive analysis.

Similarweb Competitor Analysis Frameworks

Whether your B2B or B2C, get started with our free and easy to use template

What is a competitor analysis framework? A competitive analysis framework is a model or tool marketing professionals can use to compare their business plan or marketing strategy with their competitors.

How do competitive analysis frameworks differ from other types of market analysis?

Competitive analysis frameworks differ from other types of market analysis in that they focus on understanding a company’s competitors in order to gain a better understanding of the competitive landscape.

Which tools are used in competitor analysis? Some of the tools used in competitor analysis include a customer journey map, growth-share matrix, SWOT analysis, and Data-as-a-Service (DaaS) to access expansive datasets that feed directly into competitor analysis tools, enhancing the granularity and scope of competitive insights.

What are the main components of a competitive analysis framework? The main components of a competitive analysis framework include researching competitors’ product offerings, pricing models, marketing strategies, and customer service approaches.

What are the benefits of using a competitive analysis framework?

The benefits of using a competitive analysis framework include gaining insight into competitor strengths and weaknesses, understanding the potential impact of new entrants to the market, and developing an effective strategy to differentiate your own product or service. It can also provide a more holistic view of the market by uncovering emerging trends, changes in customer preferences, and opportunities to explore opportunities.

by Molly Winik

Senior Content Marketing Manager

Molly has 8+ years of experience in marketing, content creation, and PR. Her work has been featured on Mention, The Times of Israel, and Culture Trip.

Related Posts

Market Sizing: Measuring Your TAM, SAM, and SOM

Competitive Matrix Types: Which Is Right For You?

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Most Popular Messaging Apps Worldwide 2023

How to Research a Company: The Ultimate Guide

How To Create Better Competitive Analysis Reports

Track your digital metrics and grow market share.

Contact us to set up a call with a market research specialist

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Competitor Research: What it is + How to conduct one

Having the feeling that your company is falling behind the competition is frustrating, right? Competitor research is one efficient strategy for staying one step ahead of the game. You can learn about your competitors’ strengths and weaknesses, gain valuable insights into their strategies, and ultimately improve your own business through competitive analysis.

In this post, I’ll discuss competitor research in detail and give you actionable tips on how to conduct it effectively. So brace yourself to overcome the competition.

What is Competitor Research?

Competitor research is the process of identifying your competitors, finding out what their strengths and weaknesses are, and evaluating their products or services. It helps you understand the market and find ways to differentiate your business.

You may learn a lot about the target market and the competition by analyzing the products and services of your big competitors. It also assists in identifying previously unnoticed industry trends in the business world.

LEARN ABOUT: Market Evaluation

Why is Competitor Research Important?

Competitor research is an important aspect of business strategy because it allows companies to learn about their competitors’ strengths and weaknesses. Businesses can identify opportunities for improvement and areas where they can gain a competitive advantage by conducting a competitive analysis of their product or service, pricing, and marketing strategies.

Businesses may adapt their strategy to better serve their potential customers and position themselves to succeed in their industries by keeping up to date with what their competitors are doing. Following are some reasons for the importance of competitor analysis:

- To Understand the Market: Competitive market research helps to find market trends, consumer preferences, and other important elements that have an impact on their industry by researching their competitors.

- To Identify Opportunities: Businesses can identify market gaps where they can gain a competitive advantage by researching their competitors. For instance, they might identify market opportunities or brand-new customer groups to focus on.

- To Develop Better Strategies: By conducting a comprehensive competitive analysis, you can better understand why customers choose to buy from you vs. your competitors. Businesses may identify what works and what doesn’t by analyzing what their major competitors are doing and then modifying their marketing strategy accordingly.

LEARN ABOUT: market research trends

Is competitor research qualitative or quantitative?

Competitor research can use both qualitative and quantitative methods based on the particular research objective and the data that needs to be collected.

- Qualitative research collects non-numerical data and is frequently employed to better understand customer behavior, attitudes, and opinions. Conducting customer interviews, evaluating interactions on social media, and reviewing online reviews are examples of qualitative research methods.

- Quantitative research contains the collection of numerical data and is frequently used to measure market trends and the behavior of customers. Quantitative research approaches include conducting surveys or questionnaires, evaluating sales data, or making use of web analytics tools to measure website traffic

The appropriate strategy will depend on the goals of the research, the resources available, and the exact information you want to learn from the research.

Both qualitative and quantitative research approaches have their advantages and disadvantages. In many cases, a mix of qualitative and quantitative research methods can offer a complete picture of the competitive market.

LEARN ABOUT: Qualitative Interview

What should be included in competitor research?

A comprehensive competitor analysis or research should include some key elements to provide a complete picture of the market environment. Here are a few important things to consider:

Identify competitors

Analyzing the online presence of competitors.

- Website Design and Layout: It covers your competitor’s website’s layout, design, user-friendliness, and mobile responsiveness.

- Content Quality: It involves the accuracy, relevancy, and audience-usefulness of the content on your competitor’s website.

- Search Engine Optimization (SEO): It analyzes the on-page and off-page SEO tactics used by your competitors, including how they make use of keywords, meta descriptions, headings, URL structures, domain authority, and link-building strategies.

- Traffic Analysis: Find out how much organic and sponsored traffic your competitor’s website gets, including their use of calls-to-action, landing pages, and forms.

- Social Media Integration: Check out how your competitors use social networking symbols and widgets on their websites.

- Lead Generation: Check your competitor’s website for pop-ups, lead magnets, and other lead collection methods.

Competitive analysis of Products or Services

- Identify the gaps: Product or service that your competitors provide but you do not.

- Differentiators: Product or service that you provide but not by your competitors.

Pricing research

Marketing audit.

- Sponsored Ad Campaigns

- Social media advertisements

- Newsletters

SWOT analysis

Gathering information and tracking your findings.

- Business name

- Social media

- Special features

- Pros and cons

- additional details

Improvements and conclusions

Competitive research is a continuous process. For you to remain competitive in the market, ongoing monitoring is required, such as watching how competitors change. Creating a competitor analysis template will make future market research easier for you.

LEARN ABOUT: Market research industry

Dumpster Diving vs. Value Driving: Which would you pick?

Instead of spending all of our time and money figuring out what the competition is doing — shouldn’t we just give our customers what they want?

Yeah. It was getting ridiculous. That little sentence almost got me fired. But, I had honestly had enough.

I was the 1-woman competitive intelligence department for a large pharmaceutical packaging company who had suddenly had a reality check moment when they saw bits and pieces of their multi-million dollar business start vanishing before their eyes.

Suddenly, I realized that other companies were providing the same products, and they went from one extreme to the other.

Over the next year or so, I did phone interviews, customer interviews, and even some dumpster diving, all for competitor analysis and with the intent of trying to figure out what was going on.

This was all in the days before the internet, so there was a lot of hands-on, feet-on-the-ground, kind of competitor analysis that I did. And my conclusion-customer satisfaction was a way better investment of time and money. But that doesn’t mean that you should ignore the competition and not do competitor analysis; no way.

How to begin the competitor research process

Figure out what do you want to know and why.

When I first started doing competitive intelligence, it was a knee-jerk reaction to seeing sales and profits dwindle.

- Where did the money go?

- Why aren’t they ordering the same number of parts as last year?

- Who took my business?

And ultimately, the most important questions underlying all of these were “WHY were our customers leaving us?” and “What are we going to do about it?”

This was a good place to start our competitive analysis and competitive intelligence journey. The first step is knowing that you have competitors (duh! EVERYONE has competitors) and then understanding exactly what was important to our customers that we weren’t fulfilling on and our competitors were.

What’s your competitive dilemma?

- Do you see a competitor getting more of your ideal customer than you are?

- Do you see customers spending more on your type of product or service with someone else?

- Do you see customers “doing it themselves” when you can do it better?

Get as specific as you can about exactly what you want to know and why.

What decisions are you going to make, and what information do you need to make them?

This is a sister question to the first and will often come only after you understand exactly what’s going on in your competitive landscape. But it’s a critical piece of information to have in your competitor’s research because it will drive your time, money, and resources for a good amount of time.

So, the clearer you are on what decisions you’re going to make and what information you need to make them, the faster the process will go and the more effective you’re going to be.

What is it about this “competitive situation” that have you stumped?

- Are you trying to launch a new product and not sure if customers would switch from a competitor to you?

- Are you considering getting into a new market and wondering how to position yourself against an entrenched competitor?

- How many customers would you need to be successful?

Imagine that competition was NOT an issue; what would you need to know to be successful? This will help you identify and focus on very specific questions that will move your story and strategy forward and keep you from getting mired in “nice to know” information.

Decide on who your actual competition is in your competitor research

You probably believe that your greatest competitor is the person who lives next door, lives across the country, or offers the same service as you do. Is that right? Your competitors are any other possibilities that your customer may have to get the result that you promise. That is how I would define it. Keep reading to find out.

Types of Competition

As you can see, there are three categories of competition:

Direct competitors

Indirect competitors, secondary competitors.

Take a moment to list some of your direct and indirect competitors, as well as secondary competitors, now. This will really help you get some context around your competitor research.

Here are some Cool Tools That Will Help You Track Your Competition . Meanwhile, you can use some of our product survey templates and find out where your competitive advantage lies.

What tools can I use to do competitor analysis?

Competitive analysis is now more accessible than ever because of developments in software and technology. With so many options available, choosing the best tool for conducting market research might be difficult.

Because of this, I’ve done the research and narrowed it down for you. Let’s take a look:

- Google Alerts: Set up a Google Alert to be notified whenever your competitor’s name, product, or brand name, or maybe even their management team, is mentioned.

- Social Media Tracking: Use HootSuite to keep an eye on your competitors. I like this platform because it’s free, and you can make separate tabs for whatever you’re doing. So, make a tab that searches for the most important hashtags in your industry. Then, make another tab that searches for your competitors’ names and brand names.

- Email Promotions: If your competitors use email marketing, SIGN UP to get their emails. Sure, they can take you off the list, but you’ll still get information in your inbox.

- BuzzSumo: I started using BuzzSumo to come up with ideas for blog posts, but I’ve since learned that it’s also a great tool for figuring out how your competitors are doing. Just look up the name or brand of a competitor and see how many social shares they have.

- HubSpot’s Marketing Grader: This was originally made as a way to get people to sign up for your email list and show you how to make your website better. But why not use it to rate the website of your competitor instead? It’s a simple way to see where they can’t reach customers (oh, and you can use it for your own site for the same thing).

- Market research, Academic research, capturing qualitative and quantitative insights, and social media sentiment analysis .

- Analyze pricing research data to determine market factors, including competition intelligence, purchase behavior, and pricing sensitivity.

- A/B testing across questions, segments, and ideas.

Competitor Analysis FAQ

Is competitor analysis the same as swot analysis, why do we do competitor analysis, what are the types of competitor analysis, what are the objectives of competitor research.

LEARN ABOUT: Test Market Demand

Final Words

Competitor research can be difficult initially, but it’s crucial to successful business management. It might not be as difficult as you thought when using the appropriate research tools.

QuestionPro is a set of research tools that let researchers make surveys, polls, online focus groups, and even mobile surveys. The platform has an easy-to-use interface and advanced customization options that let researchers make their surveys fit their specific research needs while collecting accurate data.

QuestionPro also has powerful tools for analyzing data, such as data visualization and real-time reporting , which make it easy for researchers to understand and present their findings. The automation features of the platform also make it easy for researchers to collect and look at data.

LEARN MORE FREE TRIAL

MORE LIKE THIS

Maximize Employee Feedback with QuestionPro Workforce’s Slack Integration

Nov 6, 2024

2024 Presidential Election Polls: Harris vs. Trump

Nov 5, 2024

Your First Question Should Be Anything But, “Is The Car Okay?” — Tuesday CX Thoughts

QuestionPro vs. Qualtrics: Who Offers the Best 360-Degree Feedback Platform for Your Needs?

Nov 4, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

IMAGES

VIDEO

COMMENTS

Get a full competitive analysis framework that's been real-world tested, and learn the tips and tricks for capturing competitor data and conducting research. You will learn. The value of running a competitor analysis and how to get your stakeholders on board; Clear and actionable steps for figuring out who your competitors are

By looking at your biggest competitors, you can see how your own products and services stack up and what kind of threat they pose to your business. It also helps you identify industry trends you may have been missing. Four benefits to doing competitive research are: Understanding your market.

Competitive analysis is the process of comparing your competitors against your brand to understand their core differentiators, strengths, and weaknesses.

A competitor analysis framework, market analysis framework or competitor analysis model, as they’re sometimes known, is a structure that business professionals use to research and evaluate their competitors.

Competitor research is the process of identifying your competitors, finding out what their strengths and weaknesses are, and evaluating their products or services. It helps you understand the market and find ways to differentiate your business.

A competitive analysis is the process of gathering data about the products, sales, and marketing strategies of your competitors (i.e., other businesses in the same industry). Businesses use that data to identify their strengths and weaknesses and discover potential opportunities.