Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Journal Proposal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Recommended Articles

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

The impact of fintech and digital financial services on financial inclusion in india.

1. Introduction

2. reviews of literature, 3. research gap and objectives, 4. research methodology, 4.1. sample design, 4.2. data collection method, 4.3. results, 4.4. estimates, 5. conclusions, 6. implications, 7. scope of future research, author contributions, informed consent statement, data availability statement, conflicts of interest.

- Ajzen, Icek. 1991. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [ Google Scholar ] [ CrossRef ]

- Anagnostopoulos, Ioannis. 2018. Fintech and Regtech: Impact on Regulators and Banks. Journal of Economics and Business 100: 7–25. [ Google Scholar ] [ CrossRef ]

- Aron, Janine. 2018. Mobile Money and the Economy: A Review of the Evidence. The World Bank Research Observer 33: 135–88. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Bagozzi, Richard P., and Youjae Yi. 1988. On the Evaluation of Structural Equation Models. Journal of the Academy of Marketing Science 16: 74–94. [ Google Scholar ] [ CrossRef ]

- Banna, Hasanul, M. Kabir Hassan, and Mamunur Rashid. 2021. Fintech-Based Financial Inclusion and Bank Risk-Taking: Evidence from OIC Countries. Journal of International Financial Markets, Institutions and Money 75: 101447. [ Google Scholar ] [ CrossRef ]

- Black, William, and Barry. J. Babin. 2019. Multivariate Data Analysis: Its Approach, Evolution, and Impact. In The Great Facilitator . Berlin/Heidelberg: Springer, pp. 121–30. [ Google Scholar ] [ CrossRef ]

- Burns, Scott. 2018. M-Pesa and the ‘Market-Led’ Approach to Financial Inclusion. Economic Affairs 38: 406–21. [ Google Scholar ] [ CrossRef ]

- Cecchetti, Stephen G., and Kermit Schoenholtz. 2020. Finance and Technology: What Is Changing and What Is Not. CEPR Discussion Papers 15352: 1–40. [ Google Scholar ]

- Chang, Victor, Partricia Baudier, Hui Zhang, Qianwen Xu, Jingqi Zhang, and Mitra Arami. 2020. How Blockchain can Impact Financial Services–the Overview, Challenges and Recommendations from Expert Interviewees. Technological Forecasting and Social Change 158: 120–66. [ Google Scholar ] [ CrossRef ]

- Chavan, Palavi, and Bhaskar Birajdar. 2009. Micro Finance and Financial Inclusion of Women: An Evaluation. Reserve Bank of India Occasional Papers 30: 109–29. [ Google Scholar ]

- Chouhan, Vineet, Bibhas Chandra, Pranav Saraswat, and Shubham Goswami. 2020. Developing Sustainable Accounting Framework for Cement Industry: Evidence from India. Finance India 34: 1459–74. [ Google Scholar ]

- Chouhan, Vineet, Raj Bahadur Sharma, and Shubham Goswami. 2021a. Factor Affecting Audit Quality: A study of the companies listed in Bombay Stock Exchange (BSE.). International Journal of Management 25: 989–99. [ Google Scholar ]

- Chouhan, Vineet, Raj Bahadur Sharma, and Shubham Goswami. 2021b. Sustainable Reporting: A Case Study of Selected Cement Companies of India. Accounting 7: 151–60. [ Google Scholar ] [ CrossRef ]

- Chouhan, Vineet, Raj Bahadur Sharma, Shubham Goswami, and Abdul Wahid Ahmed Hashed. 2021c. Measuring Challenges in Adoption of Sustainable Environmental Technologies in Indian Cement Industry. Accounting 7: 339–48. [ Google Scholar ] [ CrossRef ]

- Chouhan, Vineet, Shubham Goswami, and Raj Bahadur Sharma. 2021d. Use of Proactive Spare Parts Inventory Management (PSPIM) Techniques for Material Handling Vis-À-Vis Cement Industry. Materials Today: Proceedings 45: 4383–89. [ Google Scholar ] [ CrossRef ]

- Chouhan, Vineet, Shubham Goswami, Manish Dadhich, Pranav Saraswat, and Pushpkant Shakdwipee. 2021e. Chapter 5 Emerging Opportunities for the Application of Blockchain for Energy Efficiency. In Blockchain 3.0 for Sustainable Development . Edited by Deepak Khazanchi, Ajay Kumar Vyas, Kamal Kant Hiran and Sanjeevikumar Padmanaban. Boston: De Gruyter, pp. 63–88. [ Google Scholar ] [ CrossRef ]

- Dang, Van Cuong, and Quang Khai Nguyen. 2021. Internal Corporate Governance and Stock Price Crash Risk: Evidence from Vietnam. Journal of Sustainable Finance & Investment . [ Google Scholar ] [ CrossRef ]

- Davis, Fred D., and Davis Fred. 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly 13: 319. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Demir, Ayse, Vanesa Pesqué-Cela, Yener Altunbas, and Victor Murinde. 2022. Fintech, Financial Inclusion and Income Inequality: A Quantile Regression Approach. The European Journal of Finance 28: 86–107. [ Google Scholar ] [ CrossRef ]

- Duncombe, Richard, and Richard Boateng. 2009. Mobile Phones and Financial Services in Developing Countries: A Review of Concepts, Methods, Issues, Evidence and Future Research Directions. Third World Quarterly 30: 1237–58. [ Google Scholar ] [ CrossRef ]

- Frost, Jon, Leonardo Gambacorta, Yi Huang, Hyun Song Shin, and Pablo Zbinden. 2019. BigTech and the Changing Structure of Financial Intermediation. Economic Policy 34: 761–99. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Gautam, Amit, and Siddhartha Rawat. 2017. Cashless and Digital Economy and its Effect on Financial Inclusion in India. Financial Sector in India 20: 77–85. [ Google Scholar ]

- Ghosh, Saibal. 2020. Financial Inclusion in India: Does Distance Matter? South Asia Economic Journal 21: 216–38. [ Google Scholar ] [ CrossRef ]

- Haque, Sabrina Sharmin, Monica Yanez-Pagans, Yurani Arias-Granada, and George Joseph. 2020. Water and Sanitation in Dhaka Slums: Access, Quality, and Informality in Service Provision. Water International 45: 791–811. [ Google Scholar ] [ CrossRef ]

- Iqbal, Sana, Ahmad Nawaz, and Sadaf Ehsan. 2019. Financial Performance and Corporate Governance in Microfinance: Evidence from Asia. Journal of Asian Economics 60: 1–13. [ Google Scholar ] [ CrossRef ]

- Jack, William, and Tavneet Suri. 2014. Risk Sharing and Transactions Costs: Evidence from Kenya’s Mobile Money Revolution. American Economic Review 104: 183–223. [ Google Scholar ] [ CrossRef ]

- Khan, Harun R. 2012. Issues and Challenges in Financial Inclusion: Policies, Partnerships, Processes and Products. Korea 18: 84–17. [ Google Scholar ]

- Khan, Shagufta, Vineet Chouhan, Bibhas Chandra, and Shubham Goswami. 2014. Sustainable Accounting Reporting Practices of Indian Cement Industry: An Exploratory Study. Uncertain Supply Chain Management 2: 61–72. [ Google Scholar ] [ CrossRef ]

- Kim, Minjin, Hanah Zoo, Heejin Lee, and Juhee Kang. 2018. Mobile Financial Services, Financial Inclusion, and Development: A Systematic Review of Academic Literature. The Electronic Journal of Information Systems in Developing Countries 84: e12044. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Li, Feng, Hui Lu, Meiqian Hou, Kangle Cui, and Mehdi Darbandi. 2021. Customer Satisfaction with Bank Services: The Role of Cloud Services, Security, E-Learning and Service Quality. Technology in Society 64: 101487. [ Google Scholar ] [ CrossRef ]

- Mader, Philip. 2018. Contesting Financial Inclusion. Development and Change 49: 461–83. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Maina, Enock M., Vineet Chouhan, and Shubham Goswami. 2020. Measuring Behavioral Aspect of IFRS Implementation in India and Kenya. International Journal of Scientific and Technology Research 9: 2045–48. [ Google Scholar ]

- Mannan, Morshed, and Simon Pek. 2021. Solidarity in the Sharing Economy: The Role of Platform Cooperatives at the Base of the Pyramid. In Sharing Economy at the Base of the Pyramid . Singapore: Springer, pp. 249–79. [ Google Scholar ] [ CrossRef ]

- Masino, Serena, and Miguel Niño-Zarazúa. 2018. Improving Financial Inclusion through the Delivery of Cash Transfer Programmes: The Case of Mexico’s Progresa-Oportunidades-Prospera Programme. The Journal of Development Studies 56: 151–68. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Mbiti, Isaac, and David N. Weil. 2013. The Home Economics of E-Money: Velocity, Cash Management, and Discount Rates of M-Pesa Users. American Economic Review 103: 369–74. [ Google Scholar ]

- Menz, Markus, Sven Kunisch, Julian Birkinshaw, David J. Collis, Nicolas J. Foss, Robert E. Hoskisson, and John E. Prescott. 2021. Corporate Strategy and the Theory of the Firm in the Digital Age. Journal of Management Studies 58: 1695–720. [ Google Scholar ] [ CrossRef ]

- Metzger, Martina, Tim Riedler, and Jennifer Pédussel Wu. 2019. Migrant Remittances: Alternative Money Transfer Channels, Working Paper, No. 127/2019 . Berlin: Hochschule für Wirtschaft und Recht Berlin, Institute for International Political Economy (IPE). Available online: https://www.econstor.eu/bitstream/10419/204586/1/1678825786.pdf (accessed on 12 January 2023).

- Mia, Md Aslam, Miao Zhang, Cheng Zhang, and Yoomi Kim. 2018. Are Microfinance Institutions in South-East Asia Pursuing Objectives of Greening the Environment? Journal of the Asia Pacific Economy 23: 229–45. [ Google Scholar ] [ CrossRef ]

- Nguyen, Quang Khai. 2022. The effect of FinTech development on financial stability in an emerging market: The role of market discipline. Research in Globalization 5: 100105. [ Google Scholar ] [ CrossRef ]

- Okoye, Lawrence Uchenna, Kehinde Adekunle Adetiloye, Olayinka Erin, and Nwanneka Judith. 2017. Financial Inclusion as a Strategy for Enhanced Economic Growth and Development. Journal of Internet Banking and Commerce 22: 1–14. [ Google Scholar ]

- Omojolaibi, Joseph A., Adaobi Geraldine Okudo, and Deborah A. Shojobi. 2019. Are Women Financially Excluded from Formal Financial Services? Analysis of Some Selected Local Government Areas in Lagos State, Nigeria. Journal of Economic and Social Thought 6: 16–47. [ Google Scholar ]

- Orlov, Evgeniy Vladimirovi, Tatyana Mikhailo Rogulenko, Oleg Alexandr Smolyakov, Nataliya Vladimiro Oshovskaya, Tatiana Ivan Zvorykina, Victor Grigore Rostanets, and Elena Petrov Dyundik. 2021. Comparative Analysis of the Use of Kanban and Scrum Methodologies in IT Projects. Universal Journal of Accounting and Finance 9: 693–700. [ Google Scholar ] [ CrossRef ]

- Oskarsson, Patrik. 2018. Landlock: Paralyzing Dispute over Minerals on Adivasi Land in India . Canberra: Austrialian National University Press, p. 204. [ Google Scholar ] [ CrossRef ]

- Rathod, Saikumar, and Shiva Krishna Prasad Arelli. 2013. Aadhaar and Financial Inclusion: A Proposed Framework to Provide Basic Financial Services in Unbanked Rural India. In Driving the Economy through Innovation and Entrepreneurship . New Delhi: Springer New Delhi, pp. 731–44. [ Google Scholar ] [ CrossRef ]

- Reddy, Amith Kumar. 2021. Impact of E-Banking on Customer Satisfaction. PalArch’s Journal of Archaeology of Egypt/Egyptology 18: 4220–31. [ Google Scholar ]

- Russell, James A. 1980. A circumplex model of affect. Journal of Personality and Social Psychology 39: 1161–78. [ Google Scholar ] [ CrossRef ]

- Schuetz, Sebastian, and Viswanath Venkatesh. 2020. Blockchain, Adoption, and Financial Inclusion in India: Research Opportunities. International Journal of Information Management 52: 101936. [ Google Scholar ] [ CrossRef ]

- Singh, N. Dhaneshwar, and H. Ramananda Singh. 2012. Social Impact of Microfinance on SHG Members: A Case Study of Manipur. Prabandhan: Indian Journal of Management 5: 43–50. [ Google Scholar ] [ CrossRef ]

- Singh, Surender, S. K. Goyal, and Supran Kumar Sharma. 2013. Technical Efficiency and its Determinants in Microfinance Institutions in India: A Firm Level Analysis. Journal of Innovation Economics Management 1: 15–31. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Thomas, Howard, and Yuwa Hedrick-Wong. 2019. How Digital Finance and Fintech Can Improve Financial Inclusion 1. In Inclusive Growth . Bingley: Emerald Publishing Limited, pp. 27–41. [ Google Scholar ]

- Wieser, Christina, Miriam Bruhn, Johannes Philipp Kinzinger, Christian Simon Ruckteschler, and Soren Heitmann. 2019. The Impact of Mobile Money on Poor Rural Households: Experimental Evidence from Uganda. World Bank Policy Research Working Paper No. 8913. Available online: https://openknowledge.worldbank.org/handle/10986/31978 (accessed on 12 January 2023).

- Wry, Tyler, and Yanfei Zhao. 2018. Taking Trade-offs Seriously: Examining the Contextually Contingent Relationship between Social Outreach Intensity and Financial Sustainability in Global Microfinance. Organization Science 29: 507–28. [ Google Scholar ] [ CrossRef ]

Click here to enlarge figure

| Construct | Code | Variable |

|---|---|---|

| Behavioral intention (BI) | BI1 | I intend to contribute to the expansion of access to financial services through the application of fintech. |

| BI2 | I will always give first priority to using mobile services based on financial technology whenever possible. | |

| BI3 | I intend to keep implementing fintech for financial inclusion. | |

| BI4 | It is my Intention to contribute to financial inclusion through the application of fintech. | |

| Social influence (S.I.) | SI1 | Financial technology and services for the financially excluded are things I am supposed to use. |

| SI2 | Peers who have an impact on my decisions recommended that I try out financial inclusion offerings powered by fintech. | |

| SI3 | It is more likely that I will use financial inclusion services based on fintech if they are judged well by people whose opinion I value. | |

| Service trust (S.T.) | ST1 | Services for the financially excluded that are based on fintech have been proven to be reliable. |

| ST2 | Financial technology (fintech)-based services for the underserved must be handled with care. | |

| ST3 | Due to my prior positive experience with such services, I have faith in services based on financial technology. | |

| Usability (U.B.) | UB1 | When it comes to financial inclusion, I am likely to use services powered by financial technology. |

| UB2 | I regularly make use of services that promote financial inclusion that are enabled by advances in financial technology. | |

| UB3 | Several of the services that are based on fintech are quite important to me. | |

| Use of fintech for financial inclusion | FTFI1 | It is possible to employ fintech to expand access to banking services in India’s rural areas. |

| FTFI2 | Financial inclusion in India’s rural areas can be achieved through the usage of fintech by increasing household income. | |

| FTFI3 | Financial inclusion in rural India can be achieved through the usage of Fintech by increasing savings rates. |

| Number of Observations | 400 |

|---|---|

| Free parameters | 85 |

| Model | Behavioral intention = I1 + BI2 + BI3 + BI4 |

| Service trust = ST1 + ST2 + ST3 | |

| Usability = UB2 + UB3 | |

| Social influence = SI1 + SI2 + SI3 | |

| Fintech for financial inclusion = FTFI1 + FTFI2 + FTFI3 | |

| Fintech for financial inclusion behavioral intention + service trust + usability + social influence |

| Model | |

|---|---|

| Comparative fit index (CFI) | 0.997 |

| Tucker–Lewis index (TLI) | 0.996 |

| 95% Confidence Intervals | ||||||||

|---|---|---|---|---|---|---|---|---|

| Dep | Pred | Estimate | SE | Lower | Upper | β | z | p |

| Fintech for financial inclusion | Behavioral intention | 0.2221 | 0.0860 | 0.0535 | 0.391 | 0.0902 | 2.58 | 0.010 |

| Fintech for financial inclusion | Service trust | 0.3823 | 0.1560 | 0.0764 | 0.688 | 0.3968 | 2.45 | 0.014 |

| Fintech for financial inclusion | Usability | 0.0839 | 0.0247 | 0.0355 | 0.132 | 0.0721 | 3.40 | <0.001 |

| Fintech for financial inclusion | Social influence | 0.2304 | 0.1795 | −0.1215 | 0.582 | 0.1794 | 1.28 | 0.199 |

| 95% Confidence Intervals | ||||||||

|---|---|---|---|---|---|---|---|---|

| Latent | Observed | Estimate | SE | Lower | Upper | β | z | p |

| Behavioral intention | BI1 | 1.000 | 0.00000 | 1.000 | 1.000 | 0.187 | ||

| BI2 | 0.814 | 0.12667 | 0.566 | 1.062 | 0.152 | 6.43 | <0.001 | |

| BI3 | 2.988 | 0.35217 | 2.297 | 3.678 | 0.557 | 8.48 | <0.001 | |

| BI4 | 3.030 | 0.35601 | 2.333 | 3.728 | 0.565 | 8.51 | <0.001 | |

| Service trust | ST1 | 1.000 | 0.00000 | 1.000 | 1.000 | 0.477 | ||

| ST2 | 1.183 | 0.23975 | 0.713 | 1.653 | 0.564 | 4.94 | <0.001 | |

| ST3 | 0.915 | 0.16722 | 0.588 | 1.243 | 0.437 | 5.47 | <0.001 | |

| Usability | UB1 | 1.000 | 0.00000 | 1.000 | 1.000 | 0.395 | ||

| UB2 | 0.983 | 0.00503 | 0.973 | 0.993 | 0.389 | 195.42 | <0.001 | |

| Social influence | SI1 | 1.000 | 0.00000 | 1.000 | 1.000 | 0.358 | ||

| SI2 | 1.307 | 0.37785 | 0.566 | 2.048 | 0.468 | 3.46 | <0.001 | |

| SI3 | 1.313 | 0.37914 | 0.570 | 2.056 | 0.470 | 3.46 | <0.001 | |

| Fintech for financial inclusion | FTFI1 | 1.000 | 0.00000 | 1.000 | 1.000 | 0.460 | ||

| FTFI2 | 1.148 | 0.24792 | 0.662 | 1.634 | 0.528 | 4.63 | <0.001 | |

| FTFI3 | 0.592 | 0.16694 | 0.265 | 0.919 | 0.272 | 3.55 | <0.001 | |

| The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

Share and Cite

Asif, M.; Khan, M.N.; Tiwari, S.; Wani, S.K.; Alam, F. The Impact of Fintech and Digital Financial Services on Financial Inclusion in India. J. Risk Financial Manag. 2023 , 16 , 122. https://doi.org/10.3390/jrfm16020122

Asif M, Khan MN, Tiwari S, Wani SK, Alam F. The Impact of Fintech and Digital Financial Services on Financial Inclusion in India. Journal of Risk and Financial Management . 2023; 16(2):122. https://doi.org/10.3390/jrfm16020122

Asif, Mohammad, Mohd Naved Khan, Sadhana Tiwari, Showkat K. Wani, and Firoz Alam. 2023. "The Impact of Fintech and Digital Financial Services on Financial Inclusion in India" Journal of Risk and Financial Management 16, no. 2: 122. https://doi.org/10.3390/jrfm16020122

Article Metrics

Article access statistics, further information, mdpi initiatives, follow mdpi.

Subscribe to receive issue release notifications and newsletters from MDPI journals

The future of fintech — Towards ubiquitous financial services

- Open access

- Published: 04 January 2024

- Volume 34 , article number 3 , ( 2024 )

Cite this article

You have full access to this open access article

- Rainer Alt ORCID: orcid.org/0000-0002-6395-0658 1 ,

- Gilbert Fridgen ORCID: orcid.org/0000-0001-7037-4807 2 &

- Younghoon Chang ORCID: orcid.org/0000-0003-1421-5777 3

5925 Accesses

4 Citations

2 Altmetric

Explore all metrics

Avoid common mistakes on your manuscript.

Fintech has transformed the financial industry for almost 15 years now. Although banks and insurance companies have a long tradition of applying information technology (IT), fintech was a wake-up call. From this perspective, financial (information) technologies may be conceived as an evolution as well as a revolution since the impact of the fintech movement was profound. The latter becomes visible in the rise of an entirely new fintech industry sector since the 2010s. Following a recent report, the worldwide value of investments in fintech companies grew substantially from 9 billion USD in 2010 to 247.2 billion USD in 2021. Although momentum stalled in 2020 when investments dropped below 140 billion USD in 2020 and to 209.3 billion USD in 2022, investments were still estimated at 52.4 billion USD in the first half of 2023 (Statista, 2023b ). This activity is also reflected in the number of fintech startup businesses worldwide. As of May 2023, BCG reported a total of 11,651 fintech startups in the Americas (up from 5686 in 2018), making it the region with the most fintech startups globally. In comparison, there were 9681 fintech startups in the EMEA region (up from 3581 in 2018) and 5061 in the Asia Pacific region (up from 2864 in 2018) (Statista, 2023a ). It may be expected that, in view of intensified competition between fintech (startup) companies and between fintech companies and incumbents, the number of fintech companies will decrease in the long run. Nevertheless, a bright future may be expected for fintech since aspects of financial technology are ubiquitous in economic life, as argued in the present preface of this third special issue of Electronic Markets on the fintech topic.

The early days of banking IT

The close relationship between the financial sector and the so-called real economy (i.e., the agriculture, manufacturing and service sectors of an economy) is visible when looking back at its evolution. Footnote 1 Over the centuries, financial companies provided funds to supplement earnings to keep organizations and their people competitive (Chandler, 1990 , p. 139). Financial businesses are typically known as representatives of an economy’s service sector. Functions such as creating, storing, providing, and moving money were among the main activities of banks, and preparing against risks and handling incidents were core activities of insurance companies. Although money and contracts may have a physical form of representation (e.g., coins, paper bills, and contractual documents), most financial functions do not rely on this physical form. This is different from physical goods such as cars, clothing or nutrition, which can be complemented with information but not replaced by information. In essence, financial products are information goods, which explains why companies in the financial sector have also been pioneers in the use of IT.

Assuming that there are analog and digital forms of IT, the former date back to physical ledgers, cash books, or payment orders, as well as punched cards. The latter form of IT emerged with the evolution of electronic data processing systems since the mid-twentieth century. As described in the development of Deutsche Bank in Germany, financial institutions became operators of computing facilities as well as developers of application software systems, which became later known as core banking systems (Lamberti & Büger, 2009 ). It was from the 1950s onwards that especially large banks and insurance companies established large IT organizations, and since the 1970s industry-wide electronic networks like Swift (Society for Worldwide Interbank Financial Telecommunication) were founded. They were followed by the first electronic stock exchanges in the 1980s and the first mention of the term “fintech” (Bettinger, 1972 ), which saw fintech as “an acronym which stands for financial technology, combining bank expertise with modern management science techniques and the computer” (p. 62). At the same time, the financial sector has been a “digital laggard” in many other aspects. For example, paper checks were a dominating form of payment in (otherwise technologically highly developed) countries like the USA even in the 2000s, where internet presences of banks as well as online self-services only evolved with a delay compared to other industries (e.g., electronics, automotive, and telecommunications). Despite the early definition by Bettinger, the notion of “fintech” was mostly unknown during this period, which has therefore been referred to as the “banking IT” period (Alt et al., 2018 ).

After the recovery from the first e-commerce crash in the early 2000s, IT companies gained momentum, and the innovative spirit of the IT industry sparked new startup businesses. Some of them have grown to become big tech players and operators of large digital platforms (i.e., “GAMAM” or “BATX”) but they have included dedicated financial services only from the mid-2010s onward. Remarkably, compared to other industries like manufacturing or retailing, providers of packaged enterprise software only grew with delay in the financial sector and slowly faciitated an “industrialization of banking technology” (Lamberti & Büger, 2009 , p. 33). For banks, these standard core banking systems were offered by providers like Misys from the UK (now Finastra), FIS and SAP from Germany, or Temenos and Avaloq from Switzerland. In contrast to the banking industry, most insurance companies still relied on individual software solutions in the 2010s and were lagging the banking industry (e.g., Kumar et al., 2015 ). In this era, the main goal of applying IT was to improve operational efficiency (the cost-income ratio, CIR) within the banking value chain (Bons et al., 2012 ) and to (out- or in-)source services. It was driven by the high levels of vertical integration in the financial sector, which amounted to up to 80% for European banks and included many inefficiencies, which were due to process redundancies and little specialization (Lammers et al., 2004 ).

These movements reflect prior discussions in the information systems literature, whereas IT-driven transaction cost reductions enable outsourcing and vertical quasi-integration relationships (Clemons & Row, 1992 , p. 12). The shift towards closer relationships within the value chain, was termed as “move to the middle”. This wording was chosen since transaction cost economics recognizes close mid-term relationships as hybrid (network-based) forms of organization, which are positioned between long-term hierarchical and short-term market relationships. A second hypothesis assumed that reduced transaction costs favor market-like relationships and lead to more coordination via electronic market platforms. This “move to the market” hypothesis became visible in the financial world with the emergence of the electronic exchanges for stocks and derivates as well as with numerous platform-based business models in the first fintech era as described below. A strong rationale may be seen in the structure of the international and national financial systems, which have remained rather stable since the inception of digital technologies. In fact, many of the intermediation drivers identified by Giaglis et al., ( 2002 , p. 244) were present at that time: low levels of transparency on market offerings (except for financial exchanges), high levels of information richness of products, the existence of component products that also feature bundling opportunities, a high relevance of economies of scale and skill, the presence of many customers and service providers, and the strong role of innovative settlement schemes.

The evolution of fintech

Although providers of core banking software may be conceived as early financial technology startup businesses, whose products influenced sourcing decisions, their systems have primarily aimed at supporting existing processes in the financial industry. Seeds of new financial intermediaries flourished slowly, with PayPal (founded in 1998) being an example that featured two key aspects of the first fintech phase: the business model was customer-centric and offered an innovative payment process between payer and payee. The pioneering role of PayPal may also be illustrated by a recent review of the fintech evolution by Cai et al. ( 2022 ). Their analysis of practitioner and academic literature on the fintech topic reveals that the world of practitioners discussed the topic in the mid-1990s while the theme spread in academic publications only after 2014. The authors concluded that “the practitioner-oriented literature foreshadowed the rise of FinTech by extensively reporting on algorithm-based and electronic trading (2009 onwards), followed by reporting on FinTech startups and funding successes (2014 onwards)” (p. 819). For the academic literature, they state that “FinTech began to rise from 2014 onwards focusing initially on the development of FinTech in the aftermath of the 2007–2008 global financial crisis. Research attention subsequently shifted to FinTech innovations (alternative finance, cryptocurrency and blockchain, machine-based methods for financial analysis and forecasting, including AI) as well as risk and regulatory issues” (p. 819). It should be noted that during this period, most incumbents (i.e., the established financial companies) still remained passive and saw little threat (if any) in the new IT-driven competitors.

This attitude only changed slowly in the 2010s when incumbents realized the disruptive force of digital transformation. It involved a radical change in mindset, which was dominated by the (erroneous) belief whereas the complex and bureaucratic structures that evolved over decades would represent sources of competitive advantage and effective barriers against competitors to enter the market. In fact, these structures reflected domain expertise and working procedures, but involved high maintenance costs, little flexibility, and legacy technologies that still burden incumbents today (Keller et al., 2019 ). Fintech startups on the other hand lacked any legacy structures and were able to implement their innovative and often more focused business concepts on a greenfield. Most of these initiatives were driven by innovative IT, such as cloud computing, social media, big data, artificial intelligence, or distributed ledgers, which have, especially when combined, generated an unprecedented transformative potential (Alt, 2021 ). At the same time, the term fintech also recalls the well-known principle in the information systems discipline, whereby technology is not an end in itself. IT should instead be conceived as a key enabler for business innovation with competitive advantage and business value emerging only from the combination of the technological potential with business use cases. Simply adopting a novel technology is not enough (Wigand et al., 1998 , p. 159).

Although the combination of a technological potential and a specific application domain (the financial industry) is typically conveyed in the existing definitions of fintech (see Zavolokina et al., 2016 ; Breidbach et al., 2020 ), an important distinction may be observed in the exemplary definitions shown in Table 1 . On the one hand, fintech follows a functional interpretation along the early definition of Bettinger mentioned above. It denotes the application of a technology for a product or process in the financial industry. Innovation may be triggered by an innovative application (i.e., product/service/process/business model design), an innovative technology, or a combination of both. This functional interpretation is reflected in the early definitions of banking technology and banking innovations (definitions 1 and 2 in Table 1 ), as well as in some fintech definitions (definitions 5 and 6 in Table 1 ). In addition, the term fintech can follow an institutional interpretation and then denotes “born digital” financial technology companies (Werth et al., 2023 , p. 1). These startup businesses typically account for the growth of the fintech sector mentioned at the beginning of this preface and are reflected in definitions 3 and 4 in Table 1 . It is evident that with today’s growing activity of incumbents and big tech companies launching innovative fintech solutions, the institutional interpretation of fintech also includes the functional interpretation.

In view of the collaborations and investments between startup businesses, incumbents or big tech companies (see Drasch et al., 2018 ), an institutional distinction seems increasingly difficult. To avoid confusion, researchers should therefore clarify to which of the two interpretations they refer (e.g., on startup companies that are offering fintech solutions only, as in the analysis of Chemmanur et al., 2020 ). The definitions serve different and complementary purposes. The institutional perspective sheds light on the distinction of actors in the value chains and is valuable for strategic evaluations, such as partnering and positioning in the value chain. For example, Bons et al. ( 2012 ) proposed for the banking industry the roles of customers, channel providers (e.g., mobile/social platforms), providers of financial services (e.g., startup businesses, banks, nonbanks), and service providers in the interbanking area (e.g., exchanges, networks like Swift). The functional perspective is particularly valuable in assessing the functional scope of fintech solutions. It shows that fintech solutions may be mapped along the banking value chain, which typically distinguishes the areas of financial information, planning and advisory, payments, investments, and financing (see Alt & Puschmann, 2012 ). These solutions differ in important aspects from the solutions in the previous era, in particular, regarding their internal organization (e.g., customer-centricity, online-first, platform-orientation, automated processes, modular systems), the organization of the business network (e.g., many partnerships, startup and nonbank competitors, cooperative and agile culture) and the external conditions (e.g., increase in regulation, noncash payments, online and mobile services) (see Alt et al., 2018 , p. 238f).

With the number of fintech startup businesses that have emerged since 2010, the fintech landscape has not only become more competitive but has also moved towards a more comprehensive fintech ecosystem . This is reflected in various survey articles which were published on the evolution of fintech. The first surveys from 2017 shown in Table 2 identify archetypical fintech business models and key dimensions, while the two surveys from 2020 illustrate that over time a variety of segments or subsectors emerged. Besides specific aspects within the key banking and insurance functions (e.g., payments, funding, advisory), they also include insurtech, proptech, and regtech solutions. From these sources, the size of the respective market segments differs significantly with the payment- and funding-related segments showing the largest size. A similar emphasis is present in the two surveys from 2022, which analyzed research streams and topics. These include implications of key applications and technologies such as bitcoin, cryptocurrencies, blockchain, and machine learning, but also the risks in trading as well as the design of the associated business models (see also the recent survey by Jourdan et al. 2023 in this special issue below). In summary, these surveys suggest a diverse and heterogeneous fintech sector that still awaits an alignment (see Table 3 ). While this will entail consolidation and interoperability, the technological evolution is ongoing and will spark new ideas for fintech solutions.

The view towards the future of fintech

These observations mark the outset for this third special issue on fintech in Electronic Markets . It is titled “Financial technology (fintech): The continuing revolution in financial services” and aims to discuss the ongoing evolution of fintech solutions, which have awakened the financial sector and initiated a fundamental digital transformation. Although such “revolutionary” effects may already have occurred within the past years, profound changes in how financial solutions are created, operated, and used may still be expected. As mentioned above, fintech is particularly relevant for the journal Electronic Markets since the financial sector was one of the pioneering industries for electronic marketplaces (i.e., the financial exchanges) and electronic networks (e.g., Swift, credit card schemes). This emphasis on platform-based business models is described by Dhar and Stein ( 2017 ) and has become visible with crowdsourcing platforms, crypto exchanges and core banking platforms. Both archetypes of digital platforms — innovation and transaction platforms (Cusumano et al., 2021 ) — could be found in the fintech domain. Similarly to operating systems, innovation platforms like Amazon Web services, Apple iOS, or Microsoft Azure were infrastructural enablers to efficiently launch fintech offerings. A key feature of these platforms is their modular architecture, which allows the integration of (internal or external) functional modules via defined interfaces. If these application programming interfaces (API) are open and widely accessible, such as the interfaces to payment services as required by the current European Payment Services Directive (PSD2), they represent fertile soil for innovative financial services. Here, the more business- and industry-related transaction platforms come in and have spread with numerous examples for customer interaction (e.g., multibanking and advisory services), digital payments (e.g., cryptocurrencies, buy now pay later schemes), investments (e.g., crowdinvesting) or alternative financing (e.g., crowdlending) platforms (Alt & Puschmann, 2012 ). They illustrate that “platformization” can foster a “move to the middle” by allowing fintech and incumbent companies to efficiently establish close relationships with business partners. A “move to the market” can be observed with emerging platforms that improve market transparency (e.g., comparison/matchmaking platforms) and liquidity (e.g., crypto exchanges) and nurture new forms for investments and financing (e.g., crowd sourcing platforms). The role of platformization in enabling a closer connection between investment objects and subjects is also reflected in the repeated reference to crowd-x business models in Table 2 .

At the same time, electronic marketplaces and networks have demonstrated the risks associated with fintech. On the one hand, the platform logic implies that participation is key. Similarly to the saying in the financial industry whereas liquidity attracts liquidity, platform models require that a large portion of the main stakeholders affirms and/or uses the solution. It is reported that the Diem (formerly Libra) cryptocurrency lacked support from regulatory bodies and that many intended users of the blockchain-based tracking solution in the container shipping industry TradeLens were skeptical and refrained from using the system. Although numerous pilot projects delivered convincing results, economically sustainable blockchain-based solutions remain rare. The same applies to many neo- or mobile-only banks: while some have survived (e.g., N26 in Germany, Nubank in Brazil, Revolut in the UK), others (e.g., Volt or Bank North; see Fintechnews Switzerland, 2022 ) encountered difficulties in either attracting sufficient customers and/or in covering their operational costs. On the other hand, centralized marketplaces are also known as single points of failure (SPOF) (Aljohani et al., 2023 ) and fraudulent practices have especially surfaced in the context of crypto exchanges (e.g., Mt. Gox, FTX, Binance). It suggests that, similar to other startup ideas, fintech solutions require an aligned set of factors in addition to a compelling initial idea to be sustainable. Based on the long-term experience of the authors of this preface, three developments shall be accentuated for the continuing (r)evolution of fintech solutions and business models:

The move from centralized to decentralized solutions. As decentralized platform technologies promise efficiency gains, they might foster disintermediation and enable fintech’s “revolutionary” potential in changing existing business models. With the growing number of decentralized platform technologies in the financial sector, the technological infrastructure has experienced a differentiation in terms of architecture and functionality. Several of the early characteristics of the original bitcoin system (e.g., immutability, transparency, distribution, peer-to-peer) have been diluted (e.g., with enterprise blockchains) and enlarged their functional spectrum as well as their applicability in diverse settings. In particular, this relates to the decentralized systems’ ability to be configured (e.g., user authorizations), to handle diverse assets (e.g., tokens and NFTs), to execute program code (e.g., with smart contracts and decentralized applications), as well as to integrate with other decentralized ledgers (e.g., cross-ledger integration) or even off-chain resources (e.g., oracles). The work on distributed ledgers also boosted research on further cryptographic functionality, such as identification (e.g., decentralized identifiers, DID), or privacy (e.g., zero-knowledge proofs, ZKP). With increasing interoperability between the various decentralized technologies, more functionality of centralized systems can be transferred to decentralized infrastructures with decentralized finance (DeFi) frameworks pointing in this direction (see Auer et al., 2023 ; Gramlich et al., 2023 ). However, a high degree of technical decentralization of DeFi platforms not necessarily coincides with decentralized governance. Despite the claims of many DeFi platforms, their governance often maintains a centralized element (Barbereau et al., 2023 ). DeFi is thus unlikely to fully substitute centralized finance solutions (CeFi) even in the long term, and we expect an increasing integration of centralized and decentralized solutions (CeDeFi), e.g., with digital currencies emitted by central banks (CBDC).

The move from static to adaptive solutions. Due to the pioneering role of financial institutions in adopting IT, applications that analyze large amounts of data and generate statistical reports have a long tradition and date back to the 1970s (see Lamberti & Büger, 2009 ). Later referred to as business intelligence (BI) applications, these systems served to support managerial decision-making as well as to identify fraud and to safeguard compliance with regulatory requirements. While these systems proved critical in containing operational risks and regulatory costs, their application logic remained static and often followed the ETL pattern (extract, transform, load). In recent years, these architectures were complemented with big data technologies, which included a larger and broader spectrum of data types (e.g., structured and unstructured information). Combined with adaptive program logic, which is the domain of artificial intelligence (AI) methods, such as machine learning, we can expect large potentials for these AI-based applications. Potential application fields are customer-focused (e.g., credit scoring, know your customer), operations-focused (e.g., capital optimization, fraud detection), trading-focused (e.g., trade execution, portfolio management), and regulatory-focused (e.g., macroprudential surveillance, data quality assurance) (see Kaya & Schildbach, 2019 , p. 5, King, 2018 , pp. 219ff, Breidbach et al., 2020 ; Suryono et al., 2020 ). In view of the strong rise in AI investments, the high fragmentation of applications in large financial organizations and the formalization of many processes and documents, it may be expected that adaptability will be infused in many banking processes and profoundly change the workplaces within banks (Hartwich et al., 2023 ). This may especially affect the areas of process automation (e.g., credit assessment, compliance), document processing and customer interaction (e.g., advisory supported by generative AI/large language models). Evidently, many open questions (e.g., explainability of AI algorithms, data protection regulations, manipulations of data) remain, but finding the value-adding combination between humans and machines will be challenging and exciting alike.

The move from multimodal to hybrid interfaces is partly related to AI but requires separate attention. By highlighting the channel element in the banking value chain (see above), it denotes the availability of multiple modes in the interaction with customers, but may also be extended to internal interactions and to interactions with (upstream) value chain partners. From their very nature, “multimodal interfaces support user input and processing of two or more modalities, such as speech, pen, touch and multi-touch, gestures, gaze, and virtual keyboard” (Oviatt & Cohen, 2015 , p. 1). These traditional modes have not only been present on an increasing variety of devices to support financial processes (e.g., online, mobile, social), but they have received important enhancements with assistant and metaverse technologies. Although a complete substitution of existing interfaces will again be unlikely, and compelling metaverse use cases are still to be found, the complexity of interactions supported by voice- and text-based assistants is expected to increase and to replace a large proportion of routine interactions. These declarative interfaces will merge with other modes and lead to hybrid interfaces, which allow the seamless interaction (or amalgamation) of the required modes for a specific use case (Nüesch et al. 2015 ). This hybridization is closely connected to the coordinating role of digital platforms. For example, voice assistants like Alexa or Siri and text assistants like ChatGPT or Claude are assuming platform characteristics and allow the combination of skills or plugins from various providers (Schmidt et al., 2023 ). On the one hand, it may be expected that financial service firms embark on defining their own language models to avoid that sensitive (customer) data is fed into the generative AI systems. On the other hand, they might provide plugin modules to the public assistant platforms (e.g., ChatGPT’s platform) and yield access to banking services. Similar platform avenues are conceivable for the metaverse, albeit several challenges exist (e.g., the availability of suitable devices and the benefits of complete virtual realities) and practical use cases seem to favor augmented reality solutions.

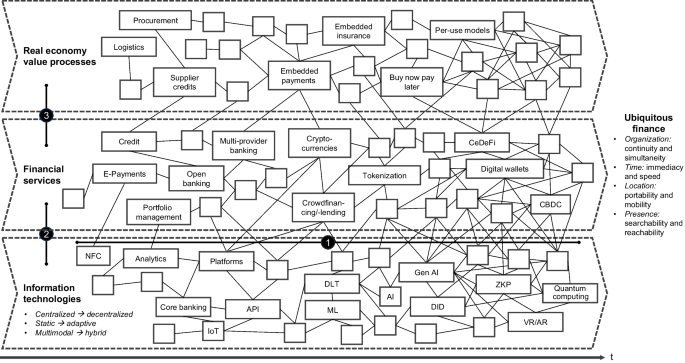

A glimpse on ubiquitous finance

This preface argues that the trajectory of these developments points towards a ubiquity of financial services (see Fig. 1 ). Although ubiquity is a complex notion, prior literature on mobile services has identified four characterizing facets for ubiquity. These are (1) continuity and simultaneity, (2) immediacy and speed, (3) portability and mobility, and (4) searchability and reachability (Okazaki & Mendez, 2013 , p. 99). They require a substantial convergence of infrastructures, applications, and processes. Some of these converging forces are already present in the fintech area:

First, ubiquitous finance is based on the three technologically driven developments mentioned above. They entail a technological convergence (dimension 1 in Fig. 1 ), whereby multiple forms of IT (e.g., artificial intelligence, distributed ledgers, augmented reality) need to be used in combination to enable meaningful innovation for financial solutions. Foremost, the infrastructure should ensure a timewise ubiquity, i.e., an immediate and real-time connectivity to access the relevant data and services, as well as a spatial ubiquity, i.e., the accessability of data and services from anywhere (maybe even location-specific). DeFi and IoT infrastructures point in this direction but still require standardization of data and interfaces. Ensuring accountability for transactions while following principles of data minimization or privacy might also require advances in cryptographic technologies, especially in view of the (longer-term) quantum computing potentials (Alt, 2022 ).

Second, fintech per se denotes the convergence between IT and financial services (dimension 2 in Fig. 1 ), which leads to finance-related and technology-driven innovations in products, processes, and business models. Continuity and simultaneity call for a seamless interaction and a close alignment of fintech solutions. In this sense, ubiquity has a strong organizational and regulatory connotation. IT will assume an important role as coordination and compliance technology in orchestrating digital financial services. Among the examples are open banking initiatives, which are based on (intelligently) linking modular banking services via (centralized or decentralized) digital platforms, the exchange of tokenized values between economic actors (Sunyaev et al., 2021 ), or the opening of APIs as required by regulation such as PSD2.

Third, the advancing digitalization of value processes and business models in the real economy (e.g., markets for goods and products) allows a closer, sometimes even real-time, link with solutions from the financial world. This convergence of the financial and the real economy sectors (dimension 3 in Fig. 1 ) is related to the fourth facet of ubiquity, which means that financial information may be searched, and that financial services may be reachable from various locations’ points of usage. With supplier credits, financing is “embedded” in supply chain solutions (Ioannou & Demirel, 2022 ) and in embedded banking initiatives financial processes become inherent elements of customer journeys. For instance, customers may access payment, lending, and insurance services from their financial provider directly from an e-commerce platform (Harris et al., 2022 ) or even from an IoT device (Hartwich et al., 2023 ).

Ubiquitous finance enabled by three increasing convergences. (Legend: (1)–(3) dimensions of convergence; CeDeFi , centralized decentralized finance; BI , business intelligence; API , application programming interface; IoT , Internet of things; DLT , distributed ledger technology; ML , machine learning; Gen AI , generative artificial intelligence; DID , decentralized identifiers; ZKP , zero-knowledge proof; VR/AR , virtual/augmented reality)

It may be observed that the need for change has grown steadily with the increasing pace of technological change and innovation. Ubiquitous finance means that financial services are available anywhere and anytime, i.e. when- and wherever they are needed. They will be attached to any object, regardless of whether it is an information, physical, or hybrid object, and enable new forms of payment as well as investments (e.g., pay-per-use, automatic payments/investments/financing). Through specialization in even smaller granularity and their modular design (e.g., tokenization, microlending), financial services will interact frictionless and enable personalized combinations of services and platforms. Real-time and adaptive processes will automate many financial tasks and offset efficiencies for organizations. Digitally identified consumers may decide whether to use sophisticated tools to support their financial strategies or to be relieved by financial agents (or digital twins or “butlers”) from the hassle of dealing with financial duties. At the same time, the complexity of the entire system of actors, services, and systems will rise substantially and create numerous new challenges. Besides the interoperability of all services and (decentralized) infrastructures, the question of responsibility and governance arises in a world where existing (credible) actors are replaced. Whether algorithms will fill this regulatory gap, whether the interaction of decentralized autonomous agents will offset unforeseen actions, and how undesired effects may be avoided are just some of the open questions for future research.

In summary, this phase of ubiquitous finance may be termed as fintech 3.0. Coming from today’s fintech 2.0 this will entail another step of evolution in financial services (see Table 3 ). Incumbents and startups alike should grasp the opportunities and (re)position themselves within the new world of ubiquitous finance.

Special issue articles

The present special issue is a contribution to advance fintech research. It continues the two special issues which were already published in Electronic Markets on the digital transformation of the financial industry. The first special issue in 2012 was titled “Banking in the Internet and mobile era” (Bons et al., 2012 ), while the 2018 special issue already used the notion of fintech and was named “FinTech and the transformation of the financial industry” (Alt et al., 2018 ). Now this third special issue on the continuing revolution in financial services sheds light on the developments that may be positioned in the areas of fintech 1.0 and 2.0 (see Table 3 ). It consists of a set of eleven articles that can be clustered into three groups. Following three overview papers, three contributions investigate centralized fintech platforms and five papers focus on the potentials and challenges of DeFi.

The first paper of the special issue links to the evolution of fintech, which was already addressed in this preface. By analyzing a total of 70 papers, the authors Zack Jourdan, J. Ken Corley, Randall Valentine, and Arthur M. Tran report on the number of publications, the adopted methodologies, and the research topics in the finance and information systems literature from the past 20 years. The research shows that the majority of research articles on fintech have been published in the past 4 years and that the number has increased significantly during this period. In their structured and representative literature analysis, the authors observe that most articles focus on the topics in the fields of banking, credit, lending, as well as intermediaries. Four clusters of fintech research topics are proposed to see whether fintech research investigates the enhancement of already existing financial products or the creation of new ones. The impact of fintech on existing structures in the financial industry or on the larger context, such as individuals and the society, is also examined. The article concludes that “fintech research is in its infancy” and that “many other subjects are yet to be covered” beyond banking, credits, lending, and intermediaries (Jourdan et al., 2023 ).

This leads to the second article, which focuses on the success of fintech ventures and starts off by stating that “Still, limited systematic research provides a structured and holistic view of FinTechs’ success” (Werth et al., 2023 , p. 1). The authors Oliver Werth, Davinia Rodriguez Cardona, Albert Torno, Michael H. Breitner, and Jan Muntermann address this gap by conducting a literature review, which included seven iterations and led to the identification of 231 publications. Based on these results, they established a taxonomy of fintech success factors with seven dimensions and 31 characteristics that were observed across the ten fintech archetype business model clusters from Eickhoff et al. ( 2017 ). Based on a validation of their taxonomy, six “grand challenges” are formulated for the success of fintech businesses. These are a positive cost–benefit proposition for innovation, the adoption of technology by (potential) customers, the handling of security, privacy and transparency issues, the trust of users in fintech offerings and their (perceived) quality as well as and rivalry with competitors in the respective fintech segments. The authors conclude that these grand challenges and the success factors are helpful in developing sustainable fintech business models and in overcoming the currently high failure rate — the authors cite failure rates of up to 75% — of fintech business models (Werth et al., 2023 ).

An important success factor for several fintech business models in the research by Werth et al. was regulation. The third special issue paper focuses on this topic from an empirical perspective. It is titled “Promise Not Fulfilled: FinTech, Data Privacy, and the GDPR” and authored by Gregor Dorfleitner, Lars Hornuf, and Julia Kreppmeier. Using text analysis methods, the authors compare 276 privacy statements of fintech companies, each before and after the European General Data Protection Regulation (GDPR) became binding. As a major result, they find that after GDPR, the length of the statements has grown and the readability has decreased due to an increased use of standardized technical and legal terms. This may contradict the original purpose of the GDPR, to be more transparent to the user in terms of privacy. The results are thus highly relevant for policymakers in the EU and other countries (Dorfleitner et al., 2023 ).

Two papers in the special issue focus on lending services. They may be attributed to the fintech 1.0 phase and the centralized finance (CeFi) model. One of these research papers is authored by Nisha Mary Thomas and aims to advance the understanding of the dynamics for fintech lending services in India. Based on an overview of existing fintech terminology and fintech services, a literature review is conducted and yields a set of 16 enablers for fintech services specialized in lending services for small and medium-sized enterprises. Following a multistep methodology, these enablers are then assessed by fintech experts, fintech practitioners, and fintech investors. The analysis proposes three policy recommendations (i.e., the collaboration between fintech businesses and incumbents, the availability and accessibility of alternate data sources and financial literacy as well as the more general awareness of digital financial solutions) and two managerial recommendations (i.e., the offering of end-to-end credit solutions and the safeguarding of data security) (Thomas, 2023 ).

The second crowdlending paper was authored by Arif Perdana, Pearpilai Jutasompakorn, and Sunghun Chung. It is titled “Shaping crowdlending investors' trust: Technology, social and economic exchanges perspectives” and unpacks the topic of trust between lenders and borrowers on crowdlending platforms, which is a natural obstacle to their adoption. The authors derived six hypotheses from the literature that they tested using an extensive survey with 50 respondents in a pilot test and 300 respondents during their primary data collection. An important finding of their research asserts that borrower cues, risk mitigation, and perceived quality significantly influence investor trust. As a practical consequence, they recommend that crowdlending platforms integrate with third-party institutions to ensure borrowers’ credibility and to implement risk mitigation strategies (Perdana et al., 2023 ).

Another article that analyzes the effects of centralized financial platforms shows how information on (social networking) digital platforms influences the trading patterns on (financial market) digital platforms. For their research, the authors Kwansoo Kim, Sang-Yong Tom Lee, and Robert J. Kauffman chose postings on the Reddit platform and linked them to the irrational trading behavior that was observed for GameStop shares on the New York Stock Exchange Euronext. Their in-depth empirical analysis reveals that the information distributed on social media about a firm’s stock strongly impacts the trading of this stock on other digital platforms. The research is an impressive example of how digital platforms are related and leads the authors to call for a tighter monitoring of social news platforms (Kim et al., 2023 ).

With the seventh special issue paper, the emphasis shifts to fintech 2.0 solutions, which are summarized under the umbrella term of DeFi. The first of the five articles in this cluster is titled “A multivocal literature review of decentralized finance: Current knowledge and future research avenues” and authored by Vincent Gramlich, Tobias Guggenberger, Marc Principato, Benjamin Schellinger, and Nils Urbach. Based on an analysis of 79 research papers, they present a consolidated definition of DeFi and paint the current state of research in the DeFi field. They conclude that DeFi has not reached broad adoption and that CeFi and DeFi solutions will likely co-exist (Gramlich et al., 2023 ). In addition, the paper proposes a research agenda that lists 35 research questions in three segments (fields of design and features, measurement and values, management, and organization) indicating the nascent state and the need for future research in this area.

The second article in the DeFi cluster focuses on the performance of blockchain-based token offerings. Using signaling theory, the authors Marten Risius, Christoph F. Breidbach, Mathieu Chanson, Ruben von Krannichfeldt, and Felix Wortmann analyze the impact of social media information for 305 initial token offerings (Risius et al., 2023 ). They reveal that for initial coin as well as for initial exchange offerings, the volume and sentiment of social media postings (signals) serve as valuable predictors of fundraising performance. In the third DeFi article, Jan Schwiderowski, Asger Balle Pedersen, Jonas Kasper Jensen, and Roman Beck address non-fungible tokens (NFT) as a class of digital assets to understand the value dynamics in decentralized finance markets. They interviewed 14 experts in the relevant industry to identify their motivations and strategic options. Building on these interviews, they theorize about the mechanisms of value creation and value capture in this domain. They find that NFTs are not an entirely new asset class, but that their value may be separated into an intrinsic and extrinsic part, that is, the value driven by the artistic content of the NFT and the value driven by external market forces, respectively (Schwiderowski et al., 2023 ).

Another research on coin offerings is authored by Moritz Bruckner, Dennis Steininger, Jason Thatcher, and Daniel Veit. They conducted an experimental study to analyze the effect of lockup periods and persuasion on online investment decisions using the example of initial coin offerings (ICOs). Lock-up periods are of special relevance for ICOs, as they can be enforced by technology. Building on signaling theory and a 2 × 2 factorial experiment with 473 participants, the authors find that persuasion signals only have an encouraging effect on investments when these investments do not involve a technology-enforced lock-up. Therefore, their results are highly relevant to ICO issuers, potential investors, and policymakers who seek to regulate ICOs (Bruckner et al., 2023 ).

Last but not least, the fifth DeFi article and the final article of the special issue takes again a view on regulatory questions around DeFi. Nadia Pocher, Mirko Zichichi, Fabio Merizzi, Muhammad Zohaib Shafiq, and Stefano Ferretti seek to apply machine learning-based forensics to check for anti-money laundering/combating the financing of terrorism (AML/CFT) compliance in cryptocurrency transactions. They model bitcoin transactions as a directed graph network and use graph-based data analysis methods to classify transactions. After a comprehensive comparison, they argue that DeFi might need constant experimentation with various forensic methods to reap their full benefits. They find that graph convolutional networks outperform more traditional techniques and they are the first to experiment with graph attention networks that lie closely behind (Pocher et al., 2023 ).

This overview on special issue papers concludes this preface. The guest editors wish to thank all authors and reviewers who were involved in making this third fintech special issue in Electronic Markets possible. This also goes to the authors of numerous submissions, which could not be considered for publication in this special issue. However, the bottom line of the many papers was that fintech research is still in an early stage and merits substantial further research. It remains to be seen, whether ubiquitous finance will be a widely used term in the future, but one aspect of this evolution has a ready seen a continuation: The fourth special issue on fintech in Electronic Markets has been announced and is titled “Fintech and Decentralized Finance” (Ferretti et al. 2023 ).

For an extended description of the fintech evolution see Zavolokina et al. (2016), Nicoletti (2017, pp. 14ff), Breidbach et al. (2020) and Gupta et al. (2023). An example of the evolution of IT in a large German bank may be found in Lamberti and Büger (2009).

Aljohani, M., Mukkamala, R., & Olarin, S. (2023). A framework for a blockchain-based decentralized data marketplace. Proceedings 15th EAI International Conference (WiCON 2022) , Springer, Cham, pp. 59–75. https://doi.org/10.1007/978-3-031-27041-3_5

Alt, R. (2021). Electronic Markets on the next convergence. Electronic Markets, 31 (1), 1–9. https://doi.org/10.1007/s12525-021-00471-6

Article Google Scholar

Alt, R. (2022). On the potentials of quantum computing – An interview with Heike Riel from IBM Research. Electronic Markets, 32 (4), 2537–2543. https://doi.org/10.1007/s12525-022-00616-1

Alt, R., & Puschmann, T. (2012). The rise of customer-oriented banking - Electronic markets are paving the way for change in the financial industry. Electronic Markets, 22 (4), 203–215. https://doi.org/10.1007/s12525-012-0106-2

Alt, R., Beck, R., & Smits, M. T. (2018). FinTech and the transformation of the financial industry. Electronic Markets, 28 (3), 235–243. https://doi.org/10.1007/s12525-018-0310-9

Auer, R., Haslhofer, B., Kitzler, S., Sagesse, P., & Friedhelm, V. (2023). The technology of decentralized finance (DeFi). Digital Finance , 5 . https://doi.org/10.1007/s42521-023-00088-8

Bajwa, I. A., Ur Rehman, S., Iqbal, A., Anwer, Z., Ashiq, M., & Khan, M. A. (2022). Past, present and future of FinTech research: A bibliometric analysis. SAGE Open, 12 (4), 1–22. https://doi.org/10.1177/21582440221131242

Barbereau, T., Smethurst, R., Papageorgiou, O., Sedlmeir, J., & Fridgen, G. (2023). Decentralised Finance’s timocratic governance: The distribution and exercise of tokenised voting rights. Technology in Society, 73 , 102251. https://doi.org/10.1016/j.techsoc.2023.102251

Bettinger, A. (1972). FINTECH: A series of 40 time shared models used at manufacturers Hanover Trust Company. Interfaces , 2 (4), 62–63. https://www.jstor.org/stable/25058931

Bons, R. W. H., Alt, R., Lee, H. G., & Weber, B. (2012). Banking in the Internet and mobile era. Electronic Markets, 22 (4), 197–202. https://doi.org/10.1007/s12525-012-0110-6

Breidbach, C. F., Keating, B. W., & Lim, C. (2020). Fintech: Research directions to explore the digital transformation of financial service systems. Journal of Service Theory and Practice, 30 (1), 79–102. https://doi.org/10.1108/JSTP-08-2018-018

Bruckner, M. T., Steininger, D. M., Thatcher, J. B., & Veit, D. (2023). The effect of lockup and persuasion on online investment decisions: An experimental study in ICOs. Electronic Markets, 33 , 31. https://doi.org/10.1007/s12525-023-00648-1

Cai, C., Marrone, M., & Linnenluecke, M. (2022). Trends in fintech research and practice: Examining the intersection with the information systems field. Communications of the Association for Information Systems, 50 (1), 803–834. https://doi.org/10.17705/1CAIS.05036

Chandler, A. D. (1990). The enduring logic of industrial success. Harvard Business Review, 68 (2), 130–140.

Google Scholar

Chemmanur, T. J., Imerman, M. B., Rajaiya, H., & Yu, Q. (2020). Recent developments in the fintech industry. Journal of Financial Management, Markets and Institutions, 8 (1), 1–31. https://doi.org/10.1142/S2282717X20400022

Clemons, E. K., & Row, M. C. (1992). Information technology and industrial cooperation: The changing economics of coordination and ownership. Journal of Management Information Systems, 9 (2), 9–28. https://doi.org/10.1080/07421222.1992.11517956

Cusumano, M. A., Gawer, A., & Yoffie, D. B. (2021). The future of platforms. MIT Sloan Management Review , 28–34. https://doi.org/10.7551/mitpress/13768.003.0014

Dhar, V., & Stein, R. M. (2017). FinTech platforms and strategy - Integrating trust and automation in finance. Communications of the ACM, 60 (10), 32–35. https://doi.org/10.1145/3132726

Dorfleitner, G., Hornuf, L., & Kreppmeier, J. (2023). Promise not fulfilled: FinTech, data privacy, and the GDPR. Electronic Markets, 33 , 33. https://doi.org/10.1007/s12525-023-00622-x

Drasch, B. J., Schweizer, A., & Urbach, N. (2018). Integrating the ‘Troublemakers’: A taxonomy for cooperation between banks and fintechs. Journal of Economics and Business, 100 , 26–42. https://doi.org/10.1016/j.jeconbus.2018.04.002

Eickhoff, M., Muntermann, J., & Weinrich, T. (2017). What do Fintechs actually do? A taxonomy of Fintech business models. Proceedings 38th International Conference on Information Systems (ICIS) , 22. https://aisel.aisnet.org/icis2017/EBusiness/Presentations/22

Ferretti, S., D'Angelo, G., Bao, T., & Zhang, L. (2023). Special issue on "Fintech and Decentralized Finance" . Call for Papers, Electronic Markets. https://link.springer.com/collections/hjiffhehga

Fintechnews Switzerland (2022). Fintech startup failures pile up . Fintechnews Switzerland, November 28. https://fintechnews.ch/funding/fintech-startup-failures-pile-up/56812/ . accessed 29.09.23

Giaglis, G. M., Klein, S., & O’Keefe, R. M. (2002). The role of intermediaries in electronic marketplaces: Developing a contingency model. Information Systems Journal, 12 (3), 231–246. https://doi.org/10.1046/j.1365-2575.2002.00123.x

Gimpel, H., Rau, D., & Röglinger, M. (2018). Understanding FinTech start-ups – A taxonomy of consumer-oriented service offerings. Electronic Markets, 28 (3), 245–264. https://doi.org/10.1007/s12525-017-0275-0

Gomber, P., Koch, J.-A., & Siering, M. (2017). Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics, 87 (5), 537–580. https://doi.org/10.1007/s11573-017-0852-x

Gramlich, V., Guggenberger, T., Principato, M., Schellinger, B., & Urbach, N. (2023). A multivocal literature review of decentralized finance: Current knowledge and future research avenues. Electronic Markets, 33 , 11. https://doi.org/10.1007/s12525-023-00637-4

Gupta, R., Kaur, H., & Kaur, M. (2023). Evolution of Fintech ensuring sustainability in financial markets: A bibliometric analysis. International Management Review, 19 , 163–186.

Harris, M., Adams, B., Davis, A., & Tijssen, J. (2022). Embedded finance: What it takes to prosper in the new value chain . Bain & Company, https://www.bain.com/insights/embedded-finance/ . accessed 31 08 23

Hartwich, E., Rieger, A., Sedlmeir, J., Jurek, D., & Fridgen, G. (2023). Machine economies. Electronic Markets, 33 , 36. https://doi.org/10.1007/s12525-023-00649-0

Imerman, M. B., & Fabozzi, F. J. (2020). Cashing in on innovation: A taxonomy of FinTech. Journal of Asset Management, 21 (3), 167–177. https://doi.org/10.1057/s41260-020-00163-4

Ioannou, I., & Demirel, G. (2022). Blockchain and supply chain finance: A critical literature review at the intersection of operations, finance and law. Journal of Banking and Financial Technology, 6 (1), 83–107. https://doi.org/10.1007/s42786-022-00040-1

Jourdan, Z., Corley, J. K., Valentine, R., & Tran, A. M. (2023). Fintech: A content analysis of the finance and information systems literature. Electronic Markets, 33 , 2. https://doi.org/10.1007/s12525-023-00624-9

Kaya, O., & Schildbach, J. (2019). Artificial intelligence in banking . Deutsche Bank Research, June 4, Frankfurt.

Keller, R., Ollig, P., & Fridgen, G. (2019). Decoupling, information technology, and the tradeoff between organizational reliability and organizational agility. Proceedings of the 27th European Conference on Information Systems (ECIS) , 118. https://aisel.aisnet.org/ecis2019_rp/118

Kim, K., Lee, S.-Y.T., & Kauffman, R. J. (2023). Social informedness and investor sentiment in the GameStop short squeeze. Electronic Markets, 33 , 23. https://doi.org/10.1007/s12525-023-00632-9

King, B. (2018). Bank 4.0: Banking everywhere, never at a bank . Wiley, Chichester

Kumar, A., Bannon, A., van Druten, E., & Sawan, R. (2015). Simplifying the banking architecture . Capgemini, https://www.capgemini.com/co-es/resource/simplifying-the-banking-architecture/ . accessed 11.11.23

Lagna, A., & Ravishankar, M. N. (2022). Making the world a better place with Fintech research. Information Systems Journal, 32 (1), 61–102. https://doi.org/10.1111/isj.12333

Lamberti, J., & Büger, M. (2009). Lessons learned - 50 years of IT in the banking industry. Business Information Systems Engineering, 2 (1), 26–36. https://doi.org/10.1007/s12599-008-0033-0

Lammers, M., Löhndorf, N., & Weitzel, T. (2004). Strategic sourcing in banking - A framework. Proceedings European Conference on Information Systems (ECIS) , Turku, 87. https://aisel.aisnet.org/ecis2004/87

Nicoletti, B. (2017). The future of fintech: Integrating finance and technology in financial services. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-51415-4

Nüesch, R., Alt, R., & Puschmann, T. (2015). Hybrid customer interaction. Business & Information Systems Engineering, 57 (1), 73–78. https://doi.org/10.1007/s12599-014-0366-9

Okazaki, S., & Mendez, F. (2013). Perceived ubiquity in mobile services. Journal of Interactive Marketing, 27 (2), 98–111. https://doi.org/10.1016/j.intmar.2012.10.001

Oviatt, S., & Cohen, P.R. (2015). The paradigm shift to multimodality in contemporary computer interfaces . Springer, Cham. https://doi.org/10.1007/978-3-031-02213-5

Perdana, A., Jutasompakorn, P., & Chung, S. (2023). Shaping crowdlending investors’ trust: Technological, social, and economic exchange perspectives. Electronic Markets, 33 , 25. https://doi.org/10.1007/s12525-023-00650-7

Pocher, N., Zichichi, M., Merizzi, F., Shafiq, M. Z., & Ferretti, S. (2023). Detecting anomalous cryptocurrency transactions: An AML/CFT application of machine learning-based forensics. Electronic Markets, 33 , 37. https://doi.org/10.1007/s12525-023-00654-3

Ravi, V. (2008). Advances in banking technology and management . Hershey/New York: IGI Global. https://doi.org/10.6.20.12:80/handle/123456789/51468

Risius, M., Breidbach, C. F., Chanson, M., von Krannichfeldt, R., & Wortmann, F. (2023). On the performance of blockchain-based token offerings. Electronic Markets, 33 , 32. https://doi.org/10.1007/s12525-023-00652-5

Schmidt, R., Alt, R., & Zimmermann, A. (2023). Assistant platforms. Electronic Markets, 33 , 59. https://doi.org/10.1007/s12525-023-00671-2

Schwiderowski, J., Pedersen, A. B., Jensen, J. K., & Beck, R. (2023). Value creation and capture in decentralized finance markets: Non-fungible tokens as a class of digital assets. Electronic Markets, 33 , 45. https://doi.org/10.1007/s12525-023-00658-z

Statista (2023). Number of fintech startups worldwide from 2018 to 2023, by region . Statista, https://www.statista.com/statistics/893954/number-fintech-startups-by-region/ . accessed 31.08.23

Statista (2023). The total value of investments into fintech companies worldwide from 2010 to H1 2023 (in billion U.S. dollars) . Statista, https://www.statista.com/statistics/719385/investments-into-fintech-companies-globally/ . accessed 31.08.23

Sunyaev, A., Kannengießer, N., Beck, R., Treiblmaier, H., Lacity, M., Kranz, J., Fridgen, G., Spankowski, U., & Luckow, A. (2021). Token economy. Business & Information Systems Engineering, 63 , 457–478. https://doi.org/10.1007/s12599-021-00684-1

Suryono, R. R., Budi, I., & Purwandari, B. (2020). Challenges and trends of financial technology (Fintech): A systematic literature review. Information, 11 (12), 590. https://doi.org/10.3390/info11120590

Thomas, N. M. (2023). Modeling key enablers influencing FinTechs offering SME credit services: A multi-stakeholder perspective. Electronic Markets, 33 , 18. https://doi.org/10.1007/s12525-023-00627-6

Werth, O., Cardona, D. R., Torno, A., Breitner, M. H., & Muntermann, J. (2023). What determines FinTech success? A taxonomy-based analysis of FinTech success factors. Electronic Markets, 33 , 21. https://doi.org/10.1007/s12525-023-00626-7

Wigand, R. T., Picot, A., & Reichwald, R. (1998). Information, organization and management: Expanding corporate boundaries . Wiley.

Zavolokina, L., Dolata, M., & Schwabe, G. (2016). FinTech - What’s in a name? Proceedings 37th International Conference on Information Systems . Dublin. https://doi.org/10.5167/uzh-126806

Download references

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and affiliations.

Leipzig University, Leipzig, Germany

University of Luxembourg, Esch-Sur-Alzette, Luxembourg

Gilbert Fridgen

University of Nottingham Ningbo China, Ningbo, China

Younghoon Chang

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Rainer Alt .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions