- Search Search Please fill out this field.

What Is a Personal Loan Agreement?

- What's in Personal Loan Agreements?

Other Clauses You May Find in Business Loans

Example of a personal loan agreement, the bottom line.

- Personal Loans

How to Write a Personal Loan Agreement

A step-by-step guide for lenders and borrowers

:max_bytes(150000):strip_icc():format(webp)/picture-53878-1440082644-5bfc2a8ac9e77c00517fa300.jpg)

Investopedia / Zoe Hansen

A personal loan agreement is a contract between a lender and borrower spelling out the terms of a loan. Having one is usually a good idea whether you're lending money to family or friends or borrowing from them. It's a way to ensure that both parties understand their obligations. Additionally, a personal loan agreement document can be enforced in court if something goes wrong, such as the borrower failing to make payments. Here's what you need to know about writing a personal loan agreement.

Key Takeaways

- A personal loan agreement document provides the borrower and lender with a way to formalize loan terms and expectations.

- Personal loan agreements are used when individuals lend money, not when banks or other financial institutions do.

- Your personal loan agreement should include identifying information for all parties, clear terms (including the interest rate), and a repayment schedule.

- Personal loan agreements are enforceable by courts if that becomes necessary.

Personal loan agreements, sometimes called personal loan contracts, are legally binding documents that outline the repayment terms of a loan, which helps the borrower and lender understand the expectations of both parties.

A personal loan contract can also stipulate whether the arrangement includes any collateral . While most personal loans are unsecured (i.e., there's no valuable asset used to back up the loan), it's possible for these arrangements to involve some collateral. A secured personal loan contract should include the situations in which a lender could claim the collateral if the debt goes unpaid.

Most personal loan agreement documents include information about the borrower and lender, the loan amount, interest rate , fees, and repayment schedule, as well as how any disputes are to be settled, and what type of collateral (if any) will secure the loan.

Personal loan documents are considered enforceable in court, so a borrower who doesn't meet their obligations could have a judgment levied against them, such as a lien or wage garnishment .

What Should Be Included in a Personal Loan Agreement?

When you take out a personal loan from a traditional lender like a bank, the lender will supply the contract. If you're lending to or borrowing from friends and family, you might need to write your own personal loan agreement.

If there's only a small amount of money involved, a simple promissory note might be sufficient. However, in some cases, you may need a more complicated contract. Here are some of the items that should be included when creating such a contract:

- Identification. Those involved in the contract should share their full names and addresses. Driver's licenses and Social Security numbers might also be used for identity verification.

- Date. Dates for signatures, the time the agreement goes into effect, and other important times and dates should be identified in the document.

- Loan amount. Include the total amount being borrowed. This is the principal of the loan.

- Collateral. If applicable, describe what is being used to secure the loan, its value, and the conditions under which the lender can claim the property.

- Interest rate. The agreed-upon interest rate of the loan should be included, as well as whether it's a fixed rate or variable rate . Variable rates should include the provisions for determining a new rate and how often the rate can change. If you're charging any fees (such as origination fees ), you also need to show the annual percentage rate (APR) , which incorporates both interest and fees.

- Repayment schedule. Often repayment happens monthly, but your agreement could differ. Make sure the date of the last payment is clear.

- Penalties. Any personal loan contract should include penalties for late payments, in addition to spelling out the consequences of default.

- Jurisdiction. This is the state where the agreement will be enforceable. Double-check state laws, as well as mediation requirements, when choosing a jurisdiction.

- Severability clause. This portion of the agreement is designed to ensure that most of the rest of the agreement remains intact even if one part of it is found to be illegal or unenforceable.

- Entire agreement clause. Many contracts, including personal loan agreement documents, feature a section noting that any other arrangements outside of what's documented in the contract aren't part of the agreement.

- Signatures. Finally, don't forget to have the borrower and lender each sign the document.

While not always necessary, it might make sense to have others witness the signatures (and sign as well) or to get the services of a notary to officiate over the signing.

While many personal loan documents are quite simple, those for business-related loans can become more complicated. Some additional clauses you might consider:

- Successors. This clause explains what happens if one of the parties passes away before the agreement is fulfilled.

- Legal expenses. This specifies who's responsible for paying the various legal fees depending on the outcome of a dispute.

- Modification. You may want to include some steps the parties might take if they want to alter the agreement.

- Credit verification. Signing the agreement typically grants permission for the lender to request documentation designed to help verify the borrower's income. There might also be a clause granting the lender permission to review the borrower's credit history.

You can find personal loan agreement templates online, such as this one from the LawDistrict website:

While you can write your own agreement from scratch, templates like the one above can make it easier. Here are some examples of how you might fill in a hypothetical template's sections. The Xs show which option you might have picked in sections where there are choices.

1. Parties. This Personal Loan Agreement (this "Agreement"), dated as of September 19, 2025 (the "Effective Date"), is by and between Jane Doe (the "Borrower"), with the mailing address of 123 Main Street, in the City of Anytown, in the State of Delaware, and John Doe (the "Lender"), with the mailing address of 123 Any Street, in the City of Everyplace, in the State of New Jersey.

2. Loan Amount. The sum loaned by the Lender to the Borrower will be: Ten Thousand Dollars ($10,000).

3. Payment. This Loan Agreement, which covers the entirety of the principal sum and any interest accrued, will be due and payable via the method specified below:

☐ Single payment: The loan, any unpaid interest, and all other charges and fees are due either: On the demand of the lender / On or before ______/_____/20____

☐ Weekly installments of __________ Dollars ($________) beginning on ____/_____/20___ and continuing every 7 days until the entire balance is paid in full.

X Monthly installments of one-hundred and eighty-eight Dollars ($188) beginning on 10/19/2025 and continuing every month until the entire balance is paid in full.

☐Quarterly installments of __________Dollars ($________) beginning on the ____ day of each quarter and continuing every quarter until the entire balance is paid in full.

☐Other:__________________________________

4. Interests. (Check one of the options below)

X This Loan Agreement bears interest at a rate of 4.95 percent (4.95%) compounded annually. (This must be equal to or less than the maximum usury rate in the borrower’s state.)

☐ This Loan Agreement does NOT bear interest.

5. Late fee. (Check one of the options below)

☐ There is a late fee in this Loan Agreement if the Borrower does not make a payment within_________ days of the contractual due date. Under this provision, the Borrower agrees to pay the Lender a late fee of ________% of the amount due at the time of the missed payment.

☐ There is NO late fee in this Loan Agreement.

6. Prepayment. (Check one of the options below)

X The Borrower of this Loan Agreement may pay back the loan in full or make additional payments at any time without incurring a penalty.

☐ The Borrower will incur a surcharge of ________% of the amount paid in surplus to the agreed payment schedule.

7. Income Verification.

The Lender reserves the right to require an income verification to the Borrower. This Verification may include, at least, the following:

- Earnings statement or W-2 form identifying employee and showing amount earned period of time covered by employment.

8. Events of Acceleration.

If any of the following events occur, this will constitute an "Event of Acceleration" under this Loan Agreement:

- The Borrower fails to pay any part of the principal or interest when it is due under the terms of this Loan Agreement; or

- The Borrower becomes insolvent or refuses to pay any debts when they become due.

9. Acceleration. If one of the Events of Acceleration above occurs, the Lender can, at their sole and exclusive option, declare this Loan Agreement immediately due and payable.

10. Remedies. The Lender has the right to remedy any breach of this Loan Agreement. Delays or omissions in exercising the rights granted under this Agreement by the lender do NOT constitute a waiver of these rights. Additionally, no omission, waiver, or delay may invalidate any of the stated terms, nor shall they restrict the Lender from enforcing this Agreement. The Lender's rights and remedies shall be cumulative and can be pursued singly, successively, or together at their sole discretion.

11. Subordination. The Borrower's obligations under this Loan Agreement supersede and subordinate all other indebtedness, if any, of the Borrower, to any unrelated third-party lender.

12. Waivers. The Lender cannot be deemed to have waived any rights provided under this Loan Agreement unless they are provided in writing. This shall not, however, be construed as a future waiver of said rights or any other covered by these terms and conditions.

13. Legal Expenses. In the event any payment made under this Loan Agreement is not paid when due, the Borrower agrees to pay, in addition to the principal and interest owed, reasonable attorneys' fees. The amount of these expenses shall NOT exceed the maximum usury rate in the State of New Jersey upon the outstanding balance owed by the Borrower under this Loan Agreement. This sum shall be added to any other reasonable expenses the Lender has incurred in exercising their rights and remedies upon default by the Borrower.

14. Governing Law. This Loan Agreement shall be governed by, and construed in accordance with, the laws of the State of New Jersey.

15. Successors. This Loan Agreement binds the Borrower and the Borrower's successors, heirs, and assigns, however, the Lender may not assign any of their rights or delegate any of its obligations without the prior written consent of the holder of this Agreement.

16. Signatures. IN WITNESS WHEREOF, the Borrower has executed this Agreement as of the day and year first written above.

Lender's Signature: Jane Doe Date: 9/19/2025

Print Name: Jane Doe

Borrower's Signature: John Doe Date: 9/19/2025

Print Name: John Doe

The Securities and Exchange Commission (SEC) also has a template online that you can use to make a personal loan agreement.

Does a Personal Loan Agreement Need to Be Notarized?

No, notarizing a personal loan agreement isn't usually required. However, it can help to have an "official" record of the contract to encourage both parties to take the terms seriously.

Can a Personal Loan Agreement Be Changed Over Time?

Yes, if all parties concerned are willing to change the agreement, it's possible to modify it. However, there should be a previously agreed-upon process to follow.

If I'm Lending Money, How Much Interest Can I Charge on a Personal Loan?

In general, you should charge interest in line with the prevailing market. However, you are limited by state laws (usually the borrower's state) regarding usury .

How Is a Promissory Note Different From a Loan Agreement?

A promissory note can be considered a type of loan agreement. However, many promissory notes are much simpler than a full contract, simply stating the amount borrowed and when it should be repaid.

Whenever you lend or borrow a significant amount of money, consider having a written loan agreement in place to protect both parties, especially when family and friends are involved . Putting a personal loan agreement down on paper can provide all parties with clear information about the terms of the loan, reduce any misunderstandings, and help prevent possible ill feelings in the future.

Cornell Law School Legal Information Institute. " 5 CFR § 1655.12 – Loan Agreement ."

Consumer Financial Protection Bureau. " What Is a Judgment? "

LawDistrict. " Personal Loan Agreement ."

Compare Personal Loan Rates with Our Partners at Fiona.com

:max_bytes(150000):strip_icc():format(webp)/7-best-peertopeer-lending-websites_final-60cab66bfba240b3b3e5486f88407f40.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

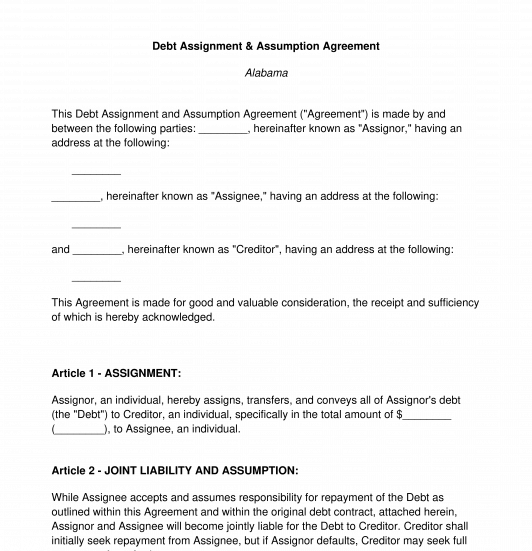

Debt Assignment and Assumption Agreement

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Debt Assignment and Assumption Agreement - FREE

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

IMAGES

VIDEO

COMMENTS

The assignment is a legal transfer to the other party, who then becomes the owner of the debt. In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to...

A personal loan agreement can protect both you and the borrower when you lend money. Use our step-by-step guide for how to write a personal loan agreement.

A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed, the repayment schedule and what should be done if there’s a dispute over paying it back.

Loan Assignment Agreement. A loan assignment agreement is when another entity agrees to take over the debt of someone else. This is when the debtor has changed for any type of event such as when a business or real estate is purchased.

A personal loan agreement, as mentioned above, is a document that details exactly what is being agreed to on both sides of a personal loan — lender and borrower. At the very least, it will state how much money is being loaned and the terms and conditions of the borrower’s repayment responsibilities.

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.