Trending Courses

Course Categories

Certification Programs

Free Courses

Audit Resources

- Career Guides

- Interview Prep Guides

- Free Practice Tests

- Excel Cheatsheets

By Dheeraj Vaidya, CFA, FRM

(ex. J.P. Morgan & CLSA Equity Analyst with 20+ years of training experience)

Management Representation Letter

Last Updated :

21 Aug, 2024

Blog Author :

Kosha Mehta

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya, CFA, FRM

Table Of Contents

What Is Management Representation Letter?

A management representation letter is a document provided by management to auditors to confirm the accuracy and completeness of financial information and disclosures. Its purpose is to attest to the accuracy and completeness of the information the management provided to the auditors.

The letter is an important part of the audit process, assuring auditors that the financial information they are examining is reliable. The letter is usually signed by senior management, such as the CEO or CFO , and is included in the audit documentation. Management acknowledges its responsibility for the financial statements and the information's accuracy by signing the letter.

Table of contents

Management representation letter explained.

- Management Representation Letter vs. Management Letter

Frequently Asked Questions (FAQs)

Recommended articles.

- A management representation letter is a formal document issued by senior management of an organization confirming the accuracy and completeness of financial information presented in the financial statements.

- It is a critical document that helps auditors or other parties to obtain reasonable assurance that the financial statements are reliable.

- The letter should include specific representations regarding financial statements, disclosures, and other significant matters that could impact the financial statements.

- Management representation letter is required as part of an audit engagement and may be requested in other types of engagements such as reviews and compilations.

A management representation letter is a document management provides to auditors to confirm the accuracy and completeness of financial information and disclosures. Also, It attests to the accuracy and completeness of management's information to the auditors. Thus, it confirms that management has provided all the relevant information required for the audit and that it is accurate and complete.

The letter also confirms that management has disclosed any potential legal or financial liabilities that could impact the organization's financial statements. Thus, it assures auditors that the financial information they are examining is reliable. Also, it is signed by senior management as part of the audit documentation .

The letter asks management to confirm that they have provided all the required information for the audit. Also, that information is accurate and complete. The letter also confirms that management has disclosed any potential legal or financial liabilities that could impact the organization's financial statements.

Let us look at the following examples to understand the concept better.

Consider a company, Amacon Corporation, that provides management representation letters to their auditors.

In the letter, the senior management of Amacon Corporation will confirm that they have provided all the financial information and disclosures required for the audit and that the information is accurate and complete. They will also confirm that they have disclosed any potential legal or financial liabilities that could impact the organization's financial statements.

For example, the management representation letter may confirm that Amacon Corporation has disclosed any potential lawsuits or regulatory investigations that could impact its financial statements. It may also confirm that all financial transactions have been accurately recorded and all financial reports are complete and correct. Thus, by providing the letter, Amacon Corporation assures its auditors that the financial information is reliable and accurate.

Suppose a nonprofit organization, HappyLives Foundation, is seeking funding from a government age government agency that may require a management representation letter from the senior management of HappyLives Foundation. It confirms the accuracy of the financial information and disclosures in the grant application.

In this case, the management representation letter would attest that all the financial information presented in the grant application is accurate. The letter would also confirm that all financial transactions have been accurately recorded. Also, all financial reports are complete and correct. Thus, by providing the letter, HappyLives Foundation assures the government agency that the financial information in the grant application is reliable and accurate.

The specific format may vary depending on the requirements of the recipient of the letter. However, the letter is prepared clearly and concisely, and all required information is included to ensure the recipient's effectiveness.

The format of a management representation letter typically includes the following elements:

- Date: The date on which the letter is prepared.

- Addressee: The letter is addressed to the auditors or the party that requires the letter.

- Introduction: A brief introduction that identifies the management providing the representation, the letter's purpose, and the audit's scope.

- Management's Responsibility: A statement acknowledging their responsibility for the financial statements and the information's accuracy.

- Specific Representations: A list of specific representations that management makes, which may include disclosures of potential liabilities, completeness of financial information, and accuracy of financial statements.

- Signature: The letter is signed by senior management, such as the CEO or CFO, to indicate their agreement with the representations being made.

There are several benefits of providing a management representation letter:

#1 - Provides Assurance

The letter assures the auditors or other parties that the financial information in the financial statements is reliable and accurate.

#2 - Demonstrates Responsibility

The letter demonstrates that management is taking responsibility for the financial statements and the information contained within them.

#3 - Identifies Potential Issues

The letter requires management to identify potential legal or financial liabilities impacting the organization's financial statements. Thus, it allows for early identification and management of its potential issues.

#4 - Reduces Auditor's Risk

By providing a letter, management can help to reduce the auditor's risk and increase their confidence in the financial information provided. In addition, it potentially reduces the amount of work required during the audit.

#5 - Improves Communication

The letter can help to improve communication between management and the auditors or other parties. Thus, it ensures that all relevant information is provided and potential issues are identified and addressed.

Management Representation Letter vs Management Letter

Management Representation Letters are not required for reviews as they are less extensive than audits and do not require the same level of assurance. However, in some cases, the reviewer may request a representation letter to provide additional assurance regarding the accuracy and completeness of the financial information provided.

Yes, a Management Representation Letter should be on the company's official letterhead to ensure it is a formal representation of the organization. In addition, the use of official letterhead helps to identify the letter's source and assures that it is genuine communication from the organization.

Yes, a compilation engagement requires a Management Representation Letter. The letter is required to assure the accountant that the financial statements and disclosures are accurate and complete to the best of management's knowledge. Therefore, the letter is an important component of the compilation engagement and helps to assure the financial statements.

To obtain a Management Representation Letter, you should request it from senior management, provide a template that includes all the necessary elements, review the letter for accuracy and completeness, and have it signed by the appropriate signatories. The letter should be obtained during an audit, review, or compilation engagement.

This article has been a guide to what is Management Representation Letter. We explain it with its format, examples, difference with management letter, and benefits. You may also find some useful articles here -

- Interim Audit

- Board Members

- AR-C 90: Definitive Guide to Review Engagements

By Charles Hall | Preparation, Compilation & Review

- You are here:

- Preparation, Compilation & Review

Review engagements provide limited assurance using AR-C 90, Review of Financial Statements . And these engagements can be done with much less effort than audits.

So, what are the requirements of a review engagement? When might a review be preferable to an audit? Must the CPA be independent? Can the CPA prepare the financial statements and perform the review engagement? Can a special purpose reporting framework be used? Who might desire a review report (rather than an audit or a compilation report)?

I'll answer these questions below, but, first here's a quick video introduction to the post.

Review Engagement Guidance

The guidance for reviews can be found in AR-C 90, Review of Financial Statements . AR-C 90 is part of the AICPA's Statements on Standards for Accounting and Reporting Services (SSARS)..

Though this article is long, it's not intended to be comprehensive. It's an overview.

Applicability of AR-C 90

You should perform a review engagement when engaged to do so . If your client asks for this service and you accept, you are engaged.

A review engagement letter should be prepared and signed by the accountant or the accountant’s firm and management or those charged with governance. See engagement letter guidance below.

AR-C 90 Objectives

The objective of the accountant in a review engagement is to provide limited assurance regarding the financial statements. Other historical information such as supplementary information can also be included.

So how does an accountant perform a review engagement? Primarily with inquiries and analytics.

How does the limited assurance in a review engagement compare with compilations and audits?

In a compilation engagement, no assurance is provided. What procedures are employed in a compilation? Primarily, the accountant reads the financial statements for appropriateness. Why perform a compilation rather than a review? Economy and cost. Since procedures are minimal, it's easier to perform a compilation and less costly to the client.

In an audit, the accountant provides a high level of assurance. The accountant performs procedures beyond inquires and analytics such as confirmations. Audit risk assessment and planning requirements are much more rigorous than that of a review. While audits provide a higher level of assurance, they are more time-consuming. Consequently, the additional time raises the cost for the client. This is why reviews are sometimes performed rather than an audit.

Prior to performing a review engagement, make sure all stakeholders will accept this product. Some lenders might require an audit.

Review Reports

A review report is always required in a review engagement .

The standard review report states that no material modifications are necessary for the financial statements to be in accordance with the reporting framework. (See a sample review report below.)

If material misstatements are identified and relate to specific amounts in the financial statements, you will issue a review report with a basis for qualified conclusion paragraph and you'll have a qualified conclusion. See Exhibit C, illustration 5 in AR-C 90 for a sample review report with a departure from GAAP. If the effects of the departure are determined, they are disclosed in the report. If not known, the paragraph states that the effects have not been determined.

If misstatements are material and pervasive, an adverse conclusion is appropriate. The review report will also have a basis for adverse conclusion paragraph. See Exhibit C, illustration 7 in AR-C 90 for a sample review report with an adverse conclusion.

Review Financial Statements

The accountant prepares financial statements as directed by management or those charged with governance. The financials should be prepared using an acceptable reporting framework including any of the following:

- Regulatory basis

- Contractual basis

- Other basis (as long as the basis uses reasonable, logical criteria that are applied to all material items)

- Generally accepted accounting principles (GAAP)

All of the above bases of accounting, with the exception of GAAP, are referred to as special purpose frameworks. When such a framework is used, a description is required and can be included in:

- The financial statement titles

- The notes to the financial statements, or

- Otherwise on the face of the financial statements

The financial statement should disclose how the special purpose framework differs from generally accepted accounting principles. If, for example, a company uses accelerated depreciation in tax-basis statements, the financial statements should disclose how this method differs from straight-line (the usual GAAP method).

The review report language changes when a company uses a special purpose reporting framework. See Exhibit C, illustration 3 in AR-90 for a tax-basis review report.

Which Financial Statements?

Management specifies the financial statements to be prepared. Normally a company desires a balance sheet, an income statement, and a cash flow statement. The accountant can, however, issue just one financial statement (e.g., income statement).

Who prepares the financial statements? The company or the CPA firm can prepare them.

Can the cash flow statement be omitted? GAAP requires a cash flow statement when a statement of financial condition and an income statement are included. Compilation standards allow for the omission of the GAAP cash flow statement if the omission is noted in the compilation report. Not so in a review engagement. The cash flow statement must be included when GAAP is used.

But is the cash flow statement required when the tax-basis of accounting is used? No, the cash flow statement can be omitted when the financial statements are tax-basis.

Disclosures in Reviewed Financial Statements

What about disclosures? Are they required in a review engagement?

In compilation engagements , disclosures can be omitted. Not so in a review engagement. Full disclosure is required, regardless of the reporting framework.

References to Review Report and Notes

Should a reference to the review report and the notes be included at the bottom of each financial statement page? While not required by the SSARS, it is acceptable to add a reference such as:

- See Accountant’s Report and accompanying notes

- See Accountant’s Review Report and accompanying notes, or

- See Independent Accountant’s Review Report and accompanying notes

Review Engagement Documentation Requirements

The accountant should prepare and retain the following documentation:

- Engagement letter

- A copy of the reviewed financial statements

- Accountant’s review report

- Communications with management and those charged with governance about significant matters arising during the engagement

- Communications with other accountants that reviewed or audited financial statements of significant components

- Emphasis-of-matter or other-matter paragraph communications with management or others

- The representation letter (see Exhibit B of AR-C 90 for sample wording)

- Information about how any inconsistencies were addressed when the accountant identified information that was inconsistent with the accountant's findings regarding significant matters affecting the financial statements

The review documentation should be sufficient to enable an experienced accountant, having no previous connection to the engagement to understand:

- the nature, timing, and extent of the review procedures,

- the evidence obtained and the accountant's conclusions based on that evidence

- significant matters and the related conclusions and judgments

Review Engagement Letter

While it is possible for the accountant to perform only a review and not prepare the financial statements, most review engagement letters will state that the following will be performed by the accountant:

- Preparation of the financial statements (a nonattest service)

- A review engagement (an attest service)

Since a nonattest service and an attest service are being provided, the accountant will add language to the engagement letter describing the client’s responsibility for the nonattest service.

See illustrative engagement letters in Exhibit A of AR-C 90 .

AICPA independence standards require the accountant to consider whether he is independent when the CPA performs an attest service (e.g., review) and a nonattest service (e.g., preparation of financial statements) for the same client. If management does not possess the skill, knowledge, and experience to oversee the preparation of the financial statements and accept responsibility, the accountant may not be independent.

So, must the accountant be independent? Yes, independence is required in review engagements.

AR-C 90 Review Procedures

The accountant should:

- Make inquiries,

- Perform analytical procedures, and

- Perform other procedures, as appropriate

Direct your procedures to areas with increased risks of material misstatement. An understanding of the entity and the industry in which the entity operates will better enable you to identify potential misstatements.

1. Review Inquiries

AR-90.29 provides a series of inquiries that should be made of management and others. Those questions include matters such as fraud, subsequent events, related party transactions, and litigation. Additionally, once you create your analytical procedures, you may have questions regarding unexpected changes.

The accountant should remain alert for related party transactions outside the normal business course. Inquiries should be made about such transactions.

2. Review Analytical Procedures

Apply analytical procedures to the numbers. What kind? Well, that depends. What numbers are most important? What numbers are most likely to be misstated? What types of analytics illuminate the client's business? Consideration of such factors will lead you to the right analytics.

Here are examples:

- Comparing the current year's financial statement numbers with the prior year

- Comparing the current year trial balance numbers with the prior year

- Ratios such as debt/equity or current assets/current liabilities or depreciation/total depreciable assets

- Computing numbers with nonfinancial information such as the number of units sold times the average price

- Comparing quarterly revenues by location

As you can see, judgment is required. Moreover, you need to develop expectations before computing the numbers. AR-C 90 says that the expectations should enable you to identify material misstatements. So the expectations have to be precise enough to yield that result.

Here are the five steps I use:

- Develop expectations

- Compute the numbers

- See if the numbers align with expectations

- Follow up with additional inquiries if expectations are not met

- Develop a conclusion

I find that many accountants fail to document their expectations. Or if expectations are documented, a second problem occurs: The numbers don't align with the expectation and there's no documented follow-up. If the numbers don't align with expectations, make sure you determine why.

Expectations

How do we develop expectations?

It is helpful to discuss current operations with management before computing your numbers. You want to know, for example, if sales rose during the year or if there were reductions in the workforce. The conversation informs your expectations.

Also, if you've previously worked with the client, you are familiar with their profit margins or debt levels. This prior knowledge informs your expectations.

Finally, you might also read the minutes (if there are any) before computing your numbers.

3. Other Review Procedures

AR-C 90 states that procedures include inquiry, analytics, and other procedures. The third element--other procedures-- is a general category that encompasses reading the financial statements and responding to risks. You might, for example, identify potential misstatements as you perform analytical procedures. If revenues are up 25% but you expected them to be stable, you'll perform additional procedures to see why.

Interestingly (at least to me), AR-C 90.A45 states that you can perform audit procedures in a review engagement. Though your review engagement letter states you are not performing an audit, your review file can include audit procedures. Why would the AICPA provide this latitude? To give you the ability to reach beyond your typical review procedures (inquiry and analytics). You need a basis for the limited assurance you are providing. And in some situations, you may need audit procedures to get you there.

Materiality in Review Engagements

AR-C 90 requires accountants to determine and use materiality. This makes sense given the review report says the following:

Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America.

You can't know what a "material modification" is without knowing what materiality is. So, the accountant should use materiality in the planning and conduct of the review engagement. AR-C 90 says the determination of materiality is a matter of professional judgment.

Review Representation Letter

A signed representation letter is required in all review engagements.

The date of the representation letter will agree with the date of the review report. In no event should the date of the representation letter precede the date of the review report. (The accountant is not required to have physical possession of the letter on the date of the review report. But the accountant should have the signed letter before releasing the financial statements.)

Provide the draft of the financial statements to the client promptly so they can review them and assume responsibility. Thereafter, the client can sign the representation letter.

Additionally, the representation letter should cover all financial statements and all periods in the report.

Exhibit B of AR-90 provides a sample representation letter.

Review Report Sample

The following is a review report sample (sometimes referred to as an accounting review report):

Independent Accountant's Review Report

[ Appropriate Addressee ]

I (We) have reviewed the accompanying financial statements of XYZ Company, which comprise the balance sheets as of December 31, 20X2 and 20X1, and the related statements of income, changes in stockholders' equity, and cash flows for the years then ended, and the related notes to the financial statements. A review includes primarily applying analytical procedures to management's (owners') financial data and making inquiries of company management (owners). A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole. Accordingly, I (we) do not express such an opinion.

Management's Responsibility for the Financial Statements

Management (Owners) is (are) responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement whether due to fraud or error.

Accountant's Responsibility

My (Our) responsibility is to conduct the review engagements in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. Those standards require me (us) to perform procedures to obtain limited assurance as a basis for reporting whether I am (we are) aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. I (We) believe that the results of my (our) procedures provide a reasonable basis for my (our) conclusion.

We are required to be independent of XYZ Company and to meet our ethical responsibilities, in accordance with the relevant ethical requirements related to our reviews.

Accountant's Conclusion

Based on my (our) reviews, I am (we are) not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance with accounting principles generally accepted in the United States of America.

[ Signature of accounting firm or accountant, as appropriate ]

[ Accountant's city and state ]

[ Date of the accountant's review report ]

Exhibit C of AR-C 90 provides seven review report illustrations.

Reporting When There are Other Accountants

What are your responsibilities if you are performing the review of a consolidated entity that includes a subsidiary audited or reviewed by another accountant?

First, obtain and read the subsidiary report.

Second, decide whether to refer to the other accountants in your review report. If reference is made, AR-C 90.122 states the accountant should clearly indicate in the accountant's review report that the accountant used the work of other accountants. The report should also include the magnitude of the portion of the financial statements audited or reviewed by the other accountants." See Illustration 6 in Appendix C of AR-C 90 for sample report language. If you refer to the other accountant, you will state that your conclusion, as it relates to the entity reviewed by the other accountants, is based solely on their report.

Third, regardless of whether you decide to refer to the other accountants, communicate with the other accountants. Determine the following:

- That the other accountants are familiar with the relevant reporting framework and review or auditing standards, as applicable.

- Advise them that you are including the subsidiary's financials in the consolidation and that their report will be relied upon, and when applicable, that the other accountant's report will be referred to in your review report.

- Communicate the ethical requirements of the engagement, mainly independence.

- And finally, advise them that you are reviewing matters affecting the intercompany eliminations.

Going Concern in Review Engagements

If the reporting framework requires that management evaluate going concern (FASB has such a requirement), then you should perform going concern review procedures. Those procedures include:

- Determining whether the going concern basis of accounting is appropriate

- Reviewing management's evaluation of whether substantial doubt exists

- When there is substantial doubt, reviewing management's plans to mitigate the conditions

- Reviewing going concern disclosures

See my article about going concern in relation to FASB standards.

If the applicable reporting framework does not require management to evaluate going concern but you become aware of conditions or events that raise substantial doubt about the entity's ability to continue as a going concern, do the following:

- Ask management if the going concern basis of accounting is appropriate

- Ask management about their plans to address the adverse effects of the conditions or events

- Review the going concern disclosures to see if they are appropriate

Other Historical Information in Review Engagements

In addition to historical financial statements, AR-C 90 may be applied to the following:

- Profit participation, or

- Income tax provisions

- Supplementary information

- Required supplementary information

- Tax return information

Review Engagements Conclusion

There you have it. Now you know how to perform a review engagement.

The main purpose of a review is to provide limited assurance in regard to the information. Inquiries and analytics are required. A signed representation letter is also required.

If you desire to issue financial statements without a compilation or review report, consider the use of AR-C 70, Preparation of Financial Statements .

If you desire to issue financial statements without a review report, consider using AR-C 80, Compilation Engagements .

The AICPA provides the full text of AR-C 90 online . You can download the PDF if you like. Once you download the document, you can use control-f to find particular words. I find this useful.

For additional SSARS-related articles see:

- AR-C 70: The Definitive Guide to Preparations

- AR-C 80: The Definitive Guide to Compilations

About the Author

Charles Hall is a practicing CPA and Certified Fraud Examiner. For the last thirty-five years, he has primarily audited governments, nonprofits, and small businesses. He is the author of The Little Book of Local Government Fraud Prevention, The Why and How of Auditing, Audit Risk Assessment Made Easy, and Preparation of Financial Statements & Compilation Engagements. He frequently speaks at continuing education events. Charles consults with other CPA firms, assisting them with auditing and accounting issues.

Hello Charles – My client is selling his business (Sch C). The buyer’s bank is requesting reviewed financial statements prior to closing. The person paying for the work is the buyer. For the engagement letter, do both the seller (I am thinking here about the management representations) and the buyer need to sign the EL? Do you have another suggestion? Thank you.

It’s permissible for you to prepare the financial statements in a review engagement as long as management reviews them (after you prepare them) and assumes responsibility for them. The client (designated person) assuming responsibility for the financial statements must have sufficient skill, knowledge, and experience to perform this role. If the client does not understand the financials, they can’t assume responsibility, and you would not be independent–and could not perform the review engagement.

Lyli, I’d consider whether the records are sufficient before accepting the engagement. It sounds like the transaction detail from the general ledger is not available. If not, you may not want to accept the engagement. You can do a compilation or a review on an entity that has sufficient records. If your independence is impaired, you cannot perform a review engagement. A compilation can be performed, even when your independence is impaired, but you’ll need to disclose your lack of independence in your compilation report. I hope this helps.

Can a CPA prepare financial statements as part of a review engagement? Long story short. A new property management company took over after some irregularities of the previous management company. No tax returns were filed for 2021 and 2022. The current board obtained some bookkeeping records (balance sheet and the general ledger), but only printed reports, not the actual records from the accounting system. At first, we were engaged to do a compilation but the mistatements are so significant that a review would be more appropriate. The client intended to use the new financials for applying to loans, going to litigation proceedings against the former management company and for filing taxes. Can we modified our engagement to a review and as part of such review issue new financial statements? If yes, the reviewed financials should be part of the Independent Accountant’s Report? Our independence would be impaired considering we had to prepare the financials almost from scratch, because the records provided are not reliable? In this case, management was not responsible for preparing the financials under reviewed, who will sign the management representation letter? I couldn’t find a template for this case. Thanks.

I would subject all numbers to review procedures (inquiry and analytics). You may want to use quarterly or monthly comparisons within the first year.

The following if from an audit article I wrote, but should help:

First Option One option is to compute expected numbers using non-financial information. Then compare the calculated numbers to the general ledger to search for unexpected variances.

Second Option A second option is to calculate ratios common to the entity’s industry and compare the results to industry benchmarks.

While industry analytics can be computed, I’m not sure how useful they are for a new company. An infant company often does not generate numbers comparable to more mature entities. But we’ll keep this choice in our quiver–just in case.

Third Option A more useful option is the third: comparing intraperiod numbers.

Discuss the expected monthly or quarterly revenue trends with the client before you examine the accounting records. The warehouse foreman might say, “We shipped almost nothing the first six months. Then things caught fire. My head was spinning the last half of the year.” Does the general ledger reflect this story? Did revenues and costs of goods sold significantly increase in the latter half of the year?

Fourth Option The last option we’ve listed is a review of the budgetary comparisons. Some entities, such as governments, lend themselves to this alternative. Others, not so–those that don’t adopt budgets.

When performing a financial statement Review for the first year can you cover the income statement and cashflow as Reviewed or do they have to be Compiled since the prior year was not Reviewed?

It’s fine to manually create your analytics. Most people still use Excel to do so. The main thing is to document your expectations and then create analytics for material areas. I hope your peer review goes well.

With review analytics, is it acceptable to do it manually or use some type of computer system to assist? Can you recommend a few if the latter? I’m worried about peer review and if it’s done manually, will that be less acceptable?

You can provide a balance sheet using GAAP and it can be subject to a review engagement. But you will need disclosures in addition to the balance sheet. You’ll also need to follow all AR-C 90 guidance.

Licensing bureau is requesting review balance sheet only. Is this in conformity with GAAP

Naina, either is fine, but I prefer the first since it highlights that you are independent. Charles

Hello Mr.Charles,

I have been looking for some illustrative reviewed financial statements. On the report I have seen some firms say “Financial Statements and Independent Accountant’s Report” and few say “Reviewed Financial Statements”. Can you please advice what is the correct title to be disclosed on a Review report. Any help is highly appreciated.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

The Role of Management Representation Letters in Audits

Explore the significance of management representation letters in audits, their preparation process, and common misunderstandings in this insightful overview.

Audits are a critical component of financial transparency and corporate governance. Within this process, management representation letters play an essential role that often goes unnoticed by those outside the accounting profession.

These documents serve as a written assertion from company management regarding the accuracy and completeness of information provided to auditors. Their importance cannot be overstated, as they underpin the trust and integrity of the entire audit process.

Purpose of Management Representation Letters

Management representation letters serve as a formal attestation from a company’s executives to the auditors, confirming the veracity of the financial statements and disclosures. These letters are a professional necessity, providing auditors with assurances that all relevant information has been disclosed. They are a testament to the management’s confidence in their financial reporting and their commitment to transparency.

The letters also support the auditor’s assessment of the risk of material misstatement in the financial statements. By obtaining written confirmations, auditors can reduce the extent of substantive testing required, which can streamline the audit process. This efficiency is beneficial for both the auditors and the company being audited, as it can lead to a more focused and timely audit.

Moreover, these letters can be a safeguard against potential disputes or legal issues that may arise post-audit. In instances where inaccuracies are discovered after the audit has been completed, the letter serves as a record that management had affirmed the completeness and accuracy of the information at the time of the audit. This can be particularly important in cases where financial statements are later found to be fraudulent or misleading.

Preparing a Management Representation Letter

The preparation of a management representation letter is a meticulous process that requires careful attention to detail and a comprehensive understanding of the company’s financial affairs. It is a collaborative effort between management and auditors to ensure that all significant information is accurately reflected.

Necessary Statements Identification

Identifying the necessary statements to be included in the management representation letter is a foundational step. These statements typically cover a range of areas such as the acknowledgment of responsibility for the fair presentation of financial statements in conformity with the applicable financial reporting framework, confirmation of the completeness of the information provided, and the disclosure of any subsequent events that may affect the financial statements. Management must also confirm that they have made the auditors aware of all known instances of fraud or suspected fraud affecting the company. The identification process is guided by professional auditing standards, such as those issued by the American Institute of Certified Public Accountants (AICPA) or the International Auditing and Assurance Standards Board (IAASB).

Information Completeness

Ensuring the completeness of information in the management representation letter is paramount. This involves a thorough review of the company’s financial records and disclosures to verify that all relevant information has been included. Management must confirm that all transactions have been recorded and are reflected in the financial statements. They must also attest to the appropriateness of the accounting policies applied and whether any unrecorded liabilities exist. This step is critical as it directly impacts the credibility of the financial statements and the audit’s outcome. The completeness of information also extends to the disclosure of any related party transactions and the effects of any uncorrected misstatements identified during the audit.

Review and Approval

The final step in preparing a management representation letter is the review and approval by the company’s top executives, typically the CEO and CFO. This review process is not merely a formality; it is an active examination to ensure that the letter accurately reflects the company’s financial position and that all statements can be substantiated. The approval signifies that management has taken ownership of the representations made within the letter. It is also an opportunity for management to discuss any concerns or clarifications with the auditors before the letter is finalized. The signed letter is then dated as of the last day of fieldwork, signifying that the representations are relevant and up-to-date with the findings of the audit.

Misconceptions About Representation Letters

A common misunderstanding about management representation letters is that they are a mere formality, a routine sign-off without substantial impact on the audit’s outcome. This view underestimates the letter’s function as a document that auditors rely upon for assurance beyond the financial data and records they examine. It is not simply a procedural step, but a declaration that can have legal implications for the signatories, particularly if it is later found that the information provided was knowingly false or misleading.

Another misconception is that the letter is solely for the benefit of the auditors. While it is true that auditors use these letters to corroborate information and reduce audit risk, the benefits extend to the management and the company as well. The process of preparing the letter encourages a comprehensive review of the company’s financial disclosures, which can lead to the identification and rectification of errors before the audit is finalized. This proactive approach can enhance the quality of financial reporting and potentially prevent future financial discrepancies.

There is also a belief that once the letter is signed and the audit is complete, the responsibilities of management in relation to the representations made are concluded. However, the representations have a lasting effect, as they are a testament to the financial condition of the company at the point of the audit. Should any issues arise from the period covered by the audit, the representations made can be scrutinized for their accuracy and completeness.

The Importance of the Going Concern Assumption in Financial Reporting and Analysis

Strategic supplier management in the financial sector, you may also be interested in..., creating an effective and comprehensive audit plan, enhancing auditor judgment and decision-making skills, shareholder influence on auditor ratification and independence, annual audit conference: sessions, networking, and innovations.

Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

All Formats

Table of Contents

11+ management representation letter templates in doc | pdf, 1. management representation letters template, 2. illustrative management representation letter template, 3. management representation letter template in pdf, 4. sample management representation letter template, 5. management representation letter format, 6. management representation letter for profit entities template, 7. general management representation letter template, 8. basic management representation letter template, 9. attestation management representation letter template, 10. draft management representation letter template, 11. management report & representation letter, 12. management representation letter template in doc, who approves a management representation letter, what is the purpose of writing a management representation letter, a better understanding on management representation letter:, what are the concerns that are highlighted in a management representation letter, what are the clauses in a management representation letter, the necessities or the importance of a management representation letter:, audit templates.

A management representation letter is a structure letter composed by an organization’s outer reviewers, which is marked by a senior organization the board. The letter verifies the precision of the financial reports that the organization has submitted to the examiners for their investigation. For samples of different letters, check out our collection of more representation letter templates on our official website template.net that you can use. You may also see more different types of representation letters in Word from our official website template.net.

- Generally, the letter expresses that the entirety of the data submitted is precise and that all material data has been uncovered to the reviewers. The evaluators utilize this letter as a feature of their review proof. View a wider selection of Creative Letter Templates right here.

- The letter likewise moves some fault to the board, on the off chance that things being what they are, a few components of the examined fiscal summaries don’t reasonably speak to the money related outcomes, monetary position, or incomes of the business.

- Consequently, the explanations that the reviewer remembers for the letter are very expansive extending, enveloping each conceivable zone in which the board’s failings could prompt the issuance of off base or deceiving budget summaries. Looking for more insights? Dive into our blog post about representative cover letter templates.

- The executives are answerable for the best possible introduction of the budget summaries as per the pertinent bookkeeping system. Find more Letter Format Templates by visiting this link.

- Every single money related record have been made accessible to the examiners

- All governing body minutes are finished

- The board has made accessible all letters from administrative organizations concerning monetary revealing resistance

- There are no unrecorded exchanges

- The net impact of every uncorrected misquote is insignificant

- The supervisory crew recognizes its duty regarding the arrangement of budgetary controls. You can also find a wider variety of management representation letters in Pdf format on our official website at template.net.

- All related gathering exchanges have been revealed; Explore a variety of Professional Letter Templates here.

- Every unforeseen risk have been revealed;

- All unasserted cases or evaluations have been revealed;

- The organization has revealed all liens and different encumbrances on its advantages;

- Every material exchange have been appropriately recorded;

- The board is liable for frameworks intended to distinguish and forestall extortion;

- The board has no information on misrepresentation inside the organization;

- The budget reports comply with the relevant bookkeeping system.

- Evaluators regularly don’t enable the administration to roll out any improvements to the substance of this letter before marking it, since this would successfully lessen the risk of the executives. Check out more Personal Letter Templates available here.

- An inspector regularly won’t give a supposition on an organization’s fiscal summaries without first getting a marked administration portrayal letter.

- An administration portrayal letter is a particular letter composed by an organization’s outer reviewers and afterward marked by the senior organization the executives. The date of the archive can’t be later than the date at which the review wraps up. The letter confirms that the data gave is precise and revealed to the examiners.

- On the off chance that for reasons unknown it’s discovered that a few components of the evaluated budget summaries are not exact then evaluators should lead further examinations. As you can envision, to state there’s a ton of strain to hit the nail on the head the first run-through is putting it mildly. You can also discover a greater variety of management representation letters in Pages on our official website, template.net.

- All dangers, vulnerabilities, liens, encumbrances, unrecorded and recorded exchanges, legitimate infringement, unexpected liabilities, and unasserted cases or evaluations have been sufficiently recorded and uncovered.

- Every money related record has been made accessible to the evaluators. You may also see more on Business Letter templates here.

- All board and investor meeting minutes have been made accessible to the examiner.

- The executives are liable for frameworks intended to recognize and forestall extortion and have no information on misrepresentation inside the organization.

- The executives don’t expect to have changes that will affect the estimation of organization resources or liabilities.

- The board is answerable for the correct introduction of the fiscal reports by the relevant bookkeeping structure and the group recognizes its duty regarding the arrangement of money related controls.

- The board has made accessible all letters from administrative offices concerning money related detailing rebelliousness. For the best experience, explore a wider range of management representation letters in Google Docs directly from our official website, template.net.

More in Audit Templates

Aesthetic health & safety cover page template, professional health %26 safety cover page template, standard health & safety cover page template, hotel training policy template, hotel overtime policy template, hotel outsourcing policy template, hotel workplace report template, hotel salary memo template, hotel housekeeping job description template, hotel quarterly schedule template.

- 3+ Audit Debrief Templates in PDF | MS Word

- 11+ Audit Confirmation Templates in MS Word | Excel | PDF

- 11+ Audit Corrective Action Plan Templates in MS Word | Excel | PDF

- 10+ Free Audit Findings Report Templates in PDF | MS Word

- 6+ Audit Findings Letter Templates in PDF | MS Word

- 15+ Audit Confirmation Letter Templates in MS Word | PDF

- 11+ Audit Committee Report Templates in PDF | MS Word

- 11+ Audit Executive Summary Templates in PDF | MS Word

- 10+ Audit Engagement Letter Templates in PDF | MS Word

- 11+ Audit Evidence Templates in PDF | MS Word

- 10+ Access Audit Templates in PDF | MS Word

- 10+ Audit Assessment Templates in PDF | MS Word

- 10+ Revenue Cycle Management Templates in Google Docs | Google Sheets | Excel | Word | Numbers | Pages | PDF

- 9+ Office Audit Templates in DOC | PDF | XLS

- 11+ Project Audit Checklist Templates in PDF | DOC

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Illustrative Management Representation Letter: SOC 2® Type 1

AICPA MEMBER

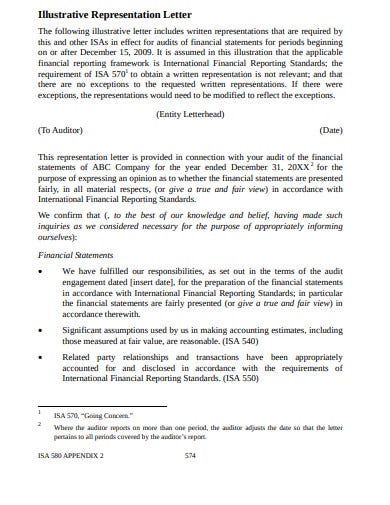

AT-C section 205, Assertion-Based Examinations, requires the service auditor to request written representations from the responsible party in a SOC 2 engagement. These representation should be in the form of a letter addressed to the service auditor. The following illustrative management representation letter includes the representations required by AT-C section 205 as well as additional representations specific to a SOC 2 Type 1 examination and should be used for engagements with reports dated on or after June 15, 2022. This

Download the Illustrative Management Rep Letter: SOC 2® Type 1

File name: illustrative-mgmt-rep-letter-for-soc-2-type-1.pdf

Reserved for AICPA® & CIMA® Members

Already a member of the aicpa or cima, log in with your account, not a member of the aicpa or cima, mentioned in this article, related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

IMAGES

VIDEO

COMMENTS

The letter is signed at the end of the engagement and is dated at the time of the review report. The management representation letter has three basic parts, the introduction, statements about the financials and declarations on the information management has provided. Care should be taken in producing this letter. It contains many items that if ...

Reliance on Management Representations.02 During an audit, management makes many representations to the au-ditor, both oral and written, in response to specific inquiries or through the fi-nancial statements. Such representations from management are part of the audit evidence the independent auditor obtains, but they are not a substitute

Example #1. Consider a company, Amacon Corporation, that provides management representation letters to their auditors. In the letter, the senior management of Amacon Corporation will confirm that they have provided all the financial information and disclosures required for the audit and that the information is accurate and complete.

Provide the draft of the financial statements to the client promptly so they can review them and assume responsibility. Thereafter, the client can sign the representation letter. Additionally, the representation letter should cover all financial statements and all periods in the report. Exhibit B of AR-90 provides a sample representation letter.

CPA FIRM'S NAME AND ADDRESS. We are providing this letter in connection with your audit of the financial statements of PROJECT NAME which comprise the statements of financial position as of DATE, and the related statements of activities and changes in net assets and cash flows and related footnotes for the Period then ended for the purpose of ...

The final step in preparing a management representation letter is the review and approval by the company's top executives, typically the CEO and CFO. This review process is not merely a formality; it is an active examination to ensure that the letter accurately reflects the company's financial position and that all statements can be ...

An example of an engagement letter for a review of financial statements is presentedinReviewExhibitA,"IllustrativeEngagementLetter.".05 An understanding with management or,if applicable,those charged ... written representations from current management for all such periods. The

A management representation letter is a form letter written by a company's external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually ...

5. Review and Seek Approval. Prioritize review and approval from the relevant parties within the management to ensure that the letter is legally binding and aligns with the company's policies and regulatory frameworks. Best Practices and Tips Clear Communication. Clarity in the representation letter is as critical as the accuracy of the ...

Appendix 3: Example of a Management Representation Letter Appendix 4: Examples of Review Reports on Interim Financial Information Appendix 5: Examples of Review Reports with a Qualified Conclusion for a Departure from the Applicable Financial Reporting Framework Appendix 6: Examples of Review Reports with a Qualified Conclusion for

LaPorte CPAs and Business Advisors 111 Veterans Boulevard, Suite 600 Metairie, Louisiana 70005. This representation letter is provided in connection with your review of the financial statements of The Friends of Fisher House Sothern Louiaian (the Organization), which comprise the statement of financial position as of April 30, 2020, and the ...

Written Representations About Management's Responsibilities (Ref: par. .10-.11) ... sibilities.For example,theauditorcould notconcludethatmanagementhas ... ever,possession of the signed management representation letter prior to re-

A management representation letter is a form letter written by a company's external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are ...

Corporation X 500 7th Street #924 Los Angeles CA 90017. pshire 03301August 10, 2020To: Ernest Tomkiewicz CPAThis representation letter is provided in connection with your review of the financial statements of Corporation X, (the Company), which comprise the balance sheet as of December 31, 2019, and the related statements of income, changes in ...

A management representation letter is a structure letter composed by an organization's outer reviewers, which is marked by a senior organization the board. The letter verifies the precision of the financial reports that the organization has submitted to the examiners for their investigation. For samples of different letters, check out our ...

MANAGEMENT REPRESENTATION LETTERS. AUDIT. AND ASSURANCE FACULTY. TECHNICAL RELEASE 04/02AAF. ORY NOTELast updated 27 Mar 2018This guidance was issued by the Audit and Assurance Faculty of the Institute of Chartered Accountants in England and Wales in Novemb. r 2002 and updated in March 2018.The purpose of this guidance is to remind auditors of ...

Obtaining Written Representations. .05 Written representations from management should be obtained for all financial statements and periods covered by the auditor's report. 2 For example, if comparative financial statements are reported on, the written representations obtained at the completion of the most recent audit should address all periods ...

The following illustrative management representation letter includes the representations required by AT-C section 205 as well as additional representations specific to a SOC 2 Type 1 examination and should be used for engagements with reports dated on or after June 15, 2022. This.

Review of Financial Statements 4577 AR-CSection90 Review of Financial Statements Source:SSARSNo.21;SSARSNo.23;SSARSNo.24;SSARSNo.25. ... example,a corporate trustee) with responsibility for overseeing the ... .17 The engagement letter or other suitable form of written agreement shouldbesignedby

officer and chief financial officer sign the representation letter. Management's refusal to provide a representation letter results in a scope limitation that is sufficient to preclude an unmodified opinion and is ordinarily sufficient to cause an auditor to disclaim an opinion or withdraw from the engagement. Exhibit 17-3 Example of a ...