Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Recommended Articles

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

Causality between technological innovation and economic growth: evidence from the economies of developing countries.

1. Introduction

- It is considered an important applied research design in studying the relationship between technological innovation and economic growth.

- It intensifies the research and development process for the purpose of changing the traditional structures in developing countries, and thus provides new goods that would improve the financial conditions and consequently the economic growth of countries.

- It highlights the transition from that of the traditional economy to the innovative one, by acquiring various skills that enable countries to improve their financial performance.

- The researcher expects, through this study, to motivate researchers to conduct more research in the field of technological innovation, especially on the relationship between innovation, sustainable development, and competitiveness.

2. Theoretical Background

- Supply-leading Hypothesis (SLH) suggests a unidirectional causality between innovation activities and economic growth (see, for example, Yang, [ 62 ]; Guloglu and Tekin, [ 40 ]; Cetin, [ 31 ]; Pradhan et al.) [ 63 ].

- Demand-following Hypotheses (DFH) suggest unidirectional causality from economic growth to innovation activities (see, for example, Sinha, [ 64 ]; Cetin, [ 31 ]; Sadraoui et al., [ 65 ]; Pradhan et al., [ 63 ].

- The Feedback Hypothesis (FBH) suggests a bidirectional causality between economic growth and innovation practices (see, for example, Guloglu and Tekin, [ 40 ]; Cetin, [ 31 ]; Pradhan et al. [ 63 ].

- The Neutrality Hypothesis (NLH) suggests no association between economic growth and innovation activities (see, for example, Cetin, [ 31 ]; Pradhan et al., [ 63 ].

- Throughout history, nations seeking a successful future have relied on the discovery of the next “great idea,” which often follows the accidental discovery of a great idea that propelled the country forward. Nevertheless, for the country to succeed in competition, and for its growth to continue in the current and ever-changing business environment, it must learn how to develop a thriving innovation culture—that is, a continuous ability to generate, accept, and implement creative ideas—within the country, as can be seen in Figure 2 .

3. Research Model

3.1. economic methodology, 3.2. standard methodology.

- ( Y i t X i t ) Study variable vectors.

- Panel data cross-sectional directions ( i = 1, …, N ),

- (N) represents the number of units (people, companies, industries, countries... etc.),

- (t = 1, …, T) time direction.

3.3. Availability of Data and Material

4. estimating and analyzing results.

- The minimum value of the PAR over all the sample is 0.23 while the maximum is 1233, with average = 42.8 and standard deviation = 85.4.

- The minimum value of the PAN over all the sample is 0.91 while the maximum is 1524, with average = 55.3 and standard deviation = 121.7

- The minimum value of the RDE over all the samples is 0 while the maximum is 0.534, with average = 0.022 and standard deviation = 0.041.

- The minimum value of the PRD over all the samples is 0.28 while the maximum is 660.3, with average = 45.2 and standard deviation = 103.6.

- The minimum value of the THE overall the sample is 0.0016 while the maximum is 2.9, with average = 0.28 and standard deviation = 0.48.

- The minimum value of the STJ over all the sample is 0.69 while the maximum is 1966, with average = 153.5 and standard deviation = 207.8.

- The minimum value of the EDU over all the sample is 0 while the maximum is 1.27, with average = 0.135 and standard deviation = 0.157.

- The minimum value of the GDP per capita growth overall the samples is −14.351 while the maximum is 13.636, with average = 2.974 and standard deviation = 3.841. The following figures show the highest and lowest averages of innovation variables for all developing countries during the period 1990–2018, shown in Figure 3 , Figure 4 , Figure 5 , Figure 6 , Figure 7 , Figure 8 , Figure 9 and Figure 10 . We can conclude the following: Mexico has the highest average PAR, followed by Hungary, while Tunisia has the lowest one ( Figure 3 ). The lowest. Figure 4 shows that Argentina had the highest average for PAN. Regarding Figure 5 , Hungary has the highest average RDE, while China and Indonesia have the lowest averages. Figure 6 shows that Hungary has the highest PRD average, while China, Indonesia, and the Philippines have the lowest averages. According to Figure 7 and Figure 8 , Hungary has the highest average for THE and DUE., While China has the lowest average of these two variables. Figure 9 shows that Poland had the highest average for STJ, while the Philippines had the lowest average. China recorded the highest average per capita GDP, while Argentina had the lowest ( Figure 10 ).

- Sargan-Hansen test or Sargan‘s test is a statistical test used in the statistical model to assess over-identifying limitations. In other words, it checks whether the instrument variables used are correct. This test’s null hypothesis is, “no over-identification.” If the null hypothesis is not dismissed, the model is correct.

- The Arellano-Bond method tests whether the errors are correlated. This test’s null hypothesis is “no self-correlation”. If the null hypothesis is not dismissed, the model is correct. The findings are provided in Table 7 and Table 8 and it is possible to infer that there is a significant negative impact of education (percent of expenditure in GDP) on GDP per capita growth, and this effect = −3.5, with 95% confidence, as the p -value of the coefficient is less than 5%. Moreover, findings show a significant positive impact of research development and expenditure on GDP per capita growth, with an effect = 0.00269, and with a 95% confidence as the p -value of the coefficient is less than 5%. While there is a significant positive impact of scientific and technical journal articles on GDP per capita growth, and this effect = 0.004503, with 95% confidence as the p -value of the coefficient is less than 5%. However, there is a significant positive impact of high technology exports on GDP per capita growth, and this effect = 0.740, with 95% confidence as the p -value of the coefficient is less than 5%. Finally, there is an insignificant impact of each of PAN, PAR, and RDE on GDP per capita, with 95% confidence as the p -value for these coefficients are greater than 5%. Regarding the goodness of fit of the model and analysis of the results of the dynamic model estimation for GMM, the empirical results from estimating the dynamic models of panel data by GMM are good if the estimated values of the regression coefficients of these models by this method are consistent and consistency is achieved with the actual values of the regression coefficients. This can be illustrated by the graph in Figure 12 showing the consistency of the actual, estimated, and residual values with each other. Additionally, to determine the validity of these variables, Sargan’s statistical test was used, and it was greater than 5%. Therefore, the null hypothesis was accepted, which states the quality and suitability of the tools used in the model and the validity of the moment conditions used in the estimation. It was also clear through Sargan’s test that the delay variables were valid and that the first-degree differences were statistically acceptable. On the other hand, the statistical value of the Arellano-Bond test for second-order serial correlation between the estimated errors with the first step indicates that the null hypothesis of this test is not rejected, which is the absence of this correlation. This means that the original error term is not sequentially related. This is because the estimation results in Table 7 show that the probability of this test statistic is greater than 5%, equal to (0.9907) that is, accepting the null hypothesis that there is no second-order serial correlation to the random error, and this indicates the validity of the moment constraints used in the estimation.

5. Discussion

6. conclusions and recommendations, author contributions, institutional review board statement, informed consent statement, data availability statement, conflicts of interest.

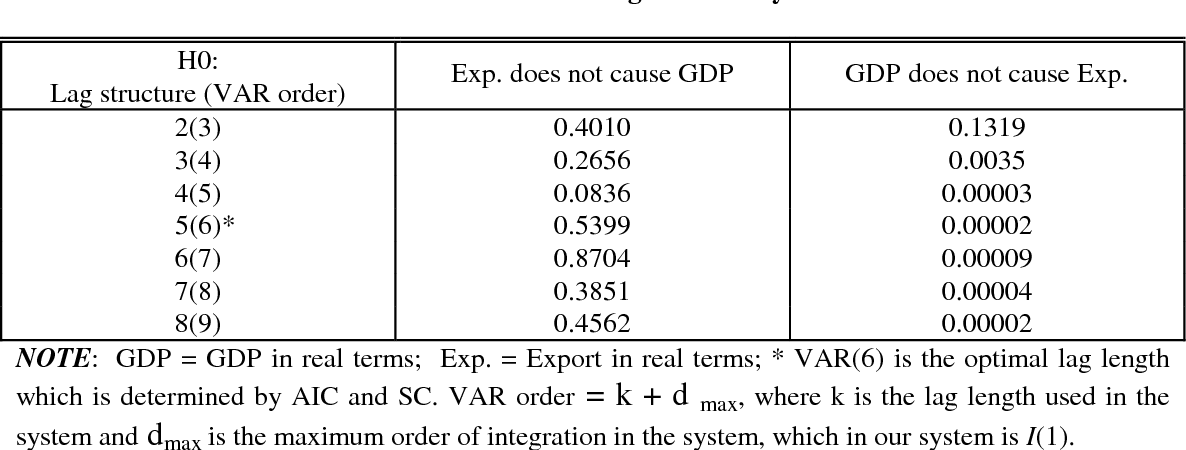

| Pairwise Granger Causality Tests. | |||

|---|---|---|---|

| Sample: 1990 2018 IF COUNTRY1 = 1 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 3.45139 | 0.0497 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.65959 | 0.5270 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.28866 | 0.7521 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.54733 | 0.5862 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.41770 | 0.6637 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.35729 | 0.2781 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.19865 | 0.8213 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.11666 | 0.8904 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.88593 | 0.4265 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.72180 | 0.4970 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 5.55960 | 0.0111 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.87955 | 0.4291 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.06448 | 0.9377 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.08922 | 0.9150 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 2 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 1.85640 | 0.1713 |

| GDP_PER_CAPITA does not Granger Cause PAN | 1.20757 | 0.3340 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 2.75374 | 0.0709 |

| GDP_PER_CAPITA does not Granger Cause PAR | 1.69911 | 0.2010 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 3.75307 | 0.0285 |

| GDP_PER_CAPITA does not Granger Cause PRD | 2.52407 | 0.0884 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 3.80148 | 0.0273 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.31620 | 0.2983 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 3.80122 | 0.0273 |

| GDP_PER_CAPITA does not Granger Cause STJ | 2.78491 | 0.0689 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 2.11193 | 0.1325 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.21826 | 0.3303 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 2.50999 | 0.0896 |

| GDP_PER_CAPITA does not Granger Cause EDU | 1.46903 | 0.2547 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 3 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.02088 | 0.9794 |

| GDP_PER_CAPITA does not Granger Cause PAN | 3.50598 | 0.0477 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.05750 | 0.3643 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.92123 | 0.4128 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.61420 | 0.5501 |

| GDP_PER_CAPITA does not Granger Cause PRD | 3.58595 | 0.0449 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.93278 | 0.4085 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.57160 | 0.2302 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 3.85557 | 0.0367 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.82624 | 0.4508 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.48506 | 0.6221 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.26147 | 0.7723 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 3.45232 | 0.0497 |

| GDP_PER_CAPITA does not Granger Cause EDU | 3.39050 | 0.0521 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 4 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.55365 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAN | 4.24517 | 0.0499 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.55365 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAR | 4.24517 | 0.0499 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 2.08852 | 0.1608 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.31153 | 0.2630 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 2.25745 | 0.1455 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.08045 | 0.3085 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 24.2234 | 5.E-05 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.47384 | 0.4976 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 9.65160 | 0.0047 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.68544 | 0.2061 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.17195 | 0.6819 |

| GDP_PER_CAPITA does not Granger Cause EDU | 2.04251 | 0.1653 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 5 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 6.42670 | 0.0179 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.16010 | 0.6925 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 6.42670 | 0.0179 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.16010 | 0.6925 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.93974 | 0.3416 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.70005 | 0.4107 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.25433 | 0.6185 |

| GDP_PER_CAPITA does not Granger Cause RDE | 4.69006 | 0.0401 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.70643 | 0.4086 |

| GDP_PER_CAPITA does not Granger Cause STJ | 8.69955 | 0.0068 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 2.18918 | 0.1515 |

| GDP_PER_CAPITA does not Granger Cause THE | 5.95758 | 0.0221 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.54776 | 0.4661 |

| GDP_PER_CAPITA does not Granger Cause EDU | 4.74801 | 0.0390 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 6 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.07652 | 0.9266 |

| GDP_PER_CAPITA does not Granger Cause PAN | 4.13486 | 0.0299 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.07652 | 0.9266 |

| GDP_PER_CAPITA does not Granger Cause PAR | 4.13486 | 0.0299 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.59115 | 0.2263 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.71315 | 0.2035 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.63068 | 0.5416 |

| GDP_PER_CAPITA does not Granger Cause RDE | 6.14284 | 0.0076 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 4.29613 | 0.0266 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.72200 | 0.2019 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 5.98152 | 0.0084 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.04888 | 0.9524 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.08946 | 0.9148 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.13876 | 0.8712 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 7 | |||

| Lags: 1 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 7.85133 | 0.0097 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.05001 | 0.8249 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 7.85133 | 0.0097 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.05001 | 0.8249 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.01360 | 0.3237 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.50835 | 0.4825 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.12053 | 0.7314 |

| GDP_PER_CAPITA does not Granger Cause RDE | 6.87595 | 0.0147 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.02424 | 0.8775 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.20223 | 0.2833 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.06169 | 0.8059 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.60651 | 0.2167 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 18.0285 | 0.0003 |

| GDP_PER_CAPITA does not Granger Cause EDU | 6.94753 | 0.0142 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 8 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.11664 | 0.7356 |

| GDP_PER_CAPITA does not Granger Cause PAN | 1.36300 | 0.2540 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.11664 | 0.7356 |

| GDP_PER_CAPITA does not Granger Cause PAR | 1.36300 | 0.2540 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.23194 | 0.2776 |

| GDP_PER_CAPITA does not Granger Cause PRD | 6.58574 | 0.0167 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 4.35234 | 0.0473 |

| GDP_PER_CAPITA does not Granger Cause RDE | 53.1925 | 1.E-07 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 4.47252 | 0.0446 |

| GDP_PER_CAPITA does not Granger Cause STJ | 2.96970 | 0.0972 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 3.48594 | 0.0737 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.65908 | 0.2095 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 1.07799 | 0.3091 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.00019 | 0.9892 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 9 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.60294 | 0.5560 |

| GDP_PER_CAPITA does not Granger Cause PAN | 5.20243 | 0.0141 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.60294 | 0.5560 |

| GDP_PER_CAPITA does not Granger Cause PAR | 5.20243 | 0.0141 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 4.82837 | 0.0183 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.11963 | 0.8878 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.01557 | 0.9846 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.51660 | 0.6036 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.02185 | 0.9784 |

| GDP_PER_CAPITA does not Granger Cause STJ | 2.43003 | 0.1113 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 1.54441 | 0.2357 |

| GDP_PER_CAPITA does not Granger Cause THE | 6.48804 | 0.0061 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 1.45638 | 0.2547 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.39204 | 0.6803 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 10 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 3.28536 | 0.0819 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.25676 | 0.6168 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 3.28536 | 0.0819 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.25676 | 0.6168 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 8.85677 | 0.0064 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.09699 | 0.7581 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 9.04547 | 0.0059 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.07771 | 0.7827 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 3.93442 | 0.0584 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.50925 | 0.4821 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 4.39407 | 0.0463 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.07888 | 0.7811 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 2.43955 | 0.1309 |

| GDP_PER_CAPITA does not Granger Cause EDU | 3.25965 | 0.0831 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 11 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.33389 | 0.7197 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.11052 | 0.8959 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.33389 | 0.7197 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.11052 | 0.8959 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.28754 | 0.7529 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.09579 | 0.9090 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.31281 | 0.7346 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.18231 | 0.8346 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.26862 | 0.7669 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.67510 | 0.2103 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.29089 | 0.7504 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.01289 | 0.9872 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.32060 | 0.7290 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.02119 | 0.9791 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 12 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 26 | 0.89077 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAN | 3.30388 | 0.0425 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 26 | 0.89077 | 0.4638 |

| GDP_PER_CAPITA does not Granger Cause PAR | 3.30388 | 0.0425 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 26 | 0.45675 | 0.7157 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.24709 | 0.3205 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 26 | 3.90725 | 0.0249 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.69901 | 0.5642 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 26 | 0.74834 | 0.5367 |

| GDP_PER_CAPITA does not Granger Cause STJ | 3.48123 | 0.0363 | |

| THE does not Granger Cause GDP_PER_CAPITA | 26 | 1.98610 | 0.1503 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.64873 | 0.2117 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 26 | 0.59479 | 0.6261 |

| GDP_PER_CAPITA does not Granger Cause EDU | 1.69819 | 0.2012 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 13 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.97908 | 0.3914 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.66307 | 0.5253 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.97908 | 0.3914 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.66307 | 0.5253 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.27895 | 0.7592 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.45400 | 0.6409 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.91969 | 0.4134 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.36466 | 0.6986 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.09426 | 0.9104 |

| GDP_PER_CAPITA does not Granger Cause STJ | 5.11692 | 0.0150 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.93801 | 0.4065 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.91330 | 0.4159 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.03313 | 0.9675 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.17291 | 0.8423 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 14 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 1.32599 | 0.2859 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.14147 | 0.8689 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.37618 | 0.2734 |

| GDP_PER_CAPITA does not Granger Cause PAR | 1.62187 | 0.2203 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.33509 | 0.7189 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.69119 | 0.5115 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 4.55742 | 0.0221 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.67502 | 0.5194 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.15912 | 0.8539 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.41448 | 0.6657 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 1.78683 | 0.1910 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.26876 | 0.7668 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 3.61820 | 0.0438 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.98913 | 0.3878 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 15 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 3.94050 | 0.0242 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.95690 | 0.4332 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 0.58816 | 0.6302 |

| GDP_PER_CAPITA does not Granger Cause PAR | 2.94843 | 0.0590 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.26065 | 0.8528 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.80394 | 0.5071 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 1.05090 | 0.3930 |

| GDP_PER_CAPITA does not Granger Cause RDE | 3.07919 | 0.0523 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 2.19014 | 0.1226 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.18275 | 0.9068 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.81335 | 0.5022 |

| GDP_PER_CAPITA does not Granger Cause THE | 4.74172 | 0.0124 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.04317 | 0.9877 |

| GDP_PER_CAPITA does not Granger Cause EDU | 1.17654 | 0.3449 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 16 | |||

| Lags: 2 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 2.56142 | 0.1000 |

| GDP_PER_CAPITA does not Granger Cause PAN | 6.73806 | 0.0052 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 2.40498 | 0.1136 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.14059 | 0.8696 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.85992 | 0.4369 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.29628 | 0.7465 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 1.02146 | 0.3765 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.13856 | 0.8714 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 9.11119 | 0.0013 |

| GDP_PER_CAPITA does not Granger Cause STJ | 19.9675 | 1.E-05 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.35056 | 0.7082 |

| GDP_PER_CAPITA does not Granger Cause THE | 11.8021 | 0.0003 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 2.68070 | 0.0908 |

| GDP_PER_CAPITA does not Granger Cause EDU | 2.94423 | 0.0736 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 17 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.13404 | 0.8753 |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.34464 | 0.7122 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.79948 | 0.1889 |

| GDP_PER_CAPITA does not Granger Cause PAR | 9.57892 | 0.0010 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.56537 | 0.2314 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.02108 | 0.3767 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.27437 | 0.7626 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.95295 | 0.1657 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 0.98285 | 0.3901 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.50109 | 0.6126 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 1.00865 | 0.3810 |

| GDP_PER_CAPITA does not Granger Cause THE | 1.46224 | 0.2534 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.59774 | 0.5587 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.34051 | 0.7151 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 18 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 4.52198 | 0.0226 |

| GDP_PER_CAPITA does not Granger Cause PAN | 1.67446 | 0.2104 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 1.14622 | 0.3361 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.80727 | 0.4589 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 1.54357 | 0.2359 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.21407 | 0.3161 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 0.76778 | 0.4761 |

| GDP_PER_CAPITA does not Granger Cause RDE | 2.69477 | 0.0898 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 6.39219 | 0.0065 |

| GDP_PER_CAPITA does not Granger Cause STJ | 4.38578 | 0.0249 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 8.52687 | 0.0018 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.56740 | 0.5751 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 5.85179 | 0.0092 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.02474 | 0.9756 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 19 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.25761 | 0.6162 |

| GDP_PER_CAPITA does not Granger Cause PAN | 7.66646 | 0.0104 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 3.59486 | 0.0696 |

| GDP_PER_CAPITA does not Granger Cause PAR | 6.67297 | 0.0160 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.04494 | 0.8338 |

| GDP_PER_CAPITA does not Granger Cause PRD | 2.59188 | 0.1200 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 9.86050 | 0.0043 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.16887 | 0.2900 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 2.20958 | 0.1497 |

| GDP_PER_CAPITA does not Granger Cause STJ | 16.5676 | 0.0004 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.10476 | 0.7489 |

| GDP_PER_CAPITA does not Granger Cause THE | 15.6075 | 0.0006 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.00675 | 0.9352 |

| GDP_PER_CAPITA does not Granger Cause EDU | 7.53871 | 0.0110 | |

| Pairwise Granger Causality Tests | |||

| Sample: 1990 2018 IF COUNTRY1 = 19 | |||

| Null Hypothesis: | Obs | F-Statistic | Prob. |

| PAN does not Granger Cause GDP_PER_CAPITA | 27 | 0.25761 | 0.6162 |

| GDP_PER_CAPITA does not Granger Cause PAN | 7.66646 | 0.0104 | |

| PAR does not Granger Cause GDP_PER_CAPITA | 27 | 3.59486 | 0.0696 |

| GDP_PER_CAPITA does not Granger Cause PAR | 6.67297 | 0.0160 | |

| PRD does not Granger Cause GDP_PER_CAPITA | 27 | 0.04494 | 0.8338 |

| GDP_PER_CAPITA does not Granger Cause PRD | 2.59188 | 0.1200 | |

| RDE does not Granger Cause GDP_PER_CAPITA | 27 | 9.86050 | 0.0043 |

| GDP_PER_CAPITA does not Granger Cause RDE | 1.16887 | 0.2900 | |

| STJ does not Granger Cause GDP_PER_CAPITA | 27 | 2.20958 | 0.1497 |

| GDP_PER_CAPITA does not Granger Cause STJ | 16.5676 | 0.0004 | |

| THE does not Granger Cause GDP_PER_CAPITA | 27 | 0.10476 | 0.7489 |

| GDP_PER_CAPITA does not Granger Cause THE | 15.6075 | 0.0006 | |

| EDU does not Granger Cause GDP_PER_CAPITA | 27 | 0.00675 | 0.9352 |

| GDP_PER_CAPITA does not Granger Cause EDU | 7.53871 | 0.0110 | |

- Grossman, G.M.; Helpman, E. Endogenous innovation in the theory of growth. J. Econ. Perspect. 1994 , 8 , 23–44. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Tew, J.H.; Lee, K.J.X.; Lau, H.C.; Hoh, Y.C.; Woon, S.P. Linkage between the Role of Knowledge and Economic Growth: A Panel Data Analysis. Ph.D. Thesis, UTAR, Kampar, Malaysia, 2017. [ Google Scholar ]

- Hussaini, N. Economic Growth and Higher Education in South Asian Countries: Evidence from Econometrics. Int. J. High. Educ. 2020 , 9 , 118–125. [ Google Scholar ] [ CrossRef ]

- Dusange, P.; Ramanantsoa, B. Technologie Et Stratégie D’entreprise, Édition International ; Ediscience International: Paris, France, 1994; Volume 1, p. 248. [ Google Scholar ]

- Millier, P. Stratégie Et Marketing De L’innovation Technologique-3ème Édition: Lancer Avec Succès Des Produits Qui N’existent Pas Sur Des Marchés Qui N’existent Pas Encore ; Dunod: Paris, France, 2011; Available online: https://www.dunod.com (accessed on 10 January 2022).

- Diaconu, M. Technological innovation: Concept, process, typology and implications in the economy. Theor. Appl. Econ. 2011 , 18. [ Google Scholar ]

- Dodgson, M.; Gann, D.M.; Salter, A. The Management of Technological Innovation: Strategy and Practice ; Oxford University Press on Demand: Oxford, UK, 2008; Available online: https://www.researchgate.net/publication/43478333 (accessed on 10 January 2022).

- Şener, S.; Sarıdoğan, E. The effects of science-technology-innovation on competitiveness and economic growth. Procedia-Soc. Behav. Sci. 2011 , 24 , 815–828. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Tidd, J.; Bessant, J.; Pavitt, K. Management De L’innovation: Intégration Du Changement Technologique, Commercial Et Organisationnel ; De Boeck Supérieur: Paris, France, 2006; Available online: https://www.lavoisier.fr/livre/economie/management-de-l-innovation-integration-du-changement-technologique-commercial-et-organisationnel/tidd/descriptif_2157630 (accessed on 10 January 2022).

- Atalay, M.; Anafarta, N.; Sarvan, F. The relationship between innovation and firm performance: An empirical evidence from Turkish automotive supplier industry. Procedia-Soc. Behav. Sci. 2013 , 75 , 226–235. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Zorrilla, D.M.N.; Gracia, T.J.H.; Velazquez, M.D.R.G.; Gracia, J.F.H.; Duran, J.G.I.; Sevilla, J.A.C. Relevance of technological innovation in the business competitiveness of medium enterprises in Hidalgo State. Eur. Sci. J. 2014 , 10 . Available online: https://eujournal.org/index.php/esj/article/view/3532 (accessed on 10 January 2022).

- Rice, C.F.; Yayboke, E. Innovation-Led Economic Growth: Transforming Tomorrow’s Developing Economies through Technology and Innovation ; Rowman & Littlefield: Washington, DC, USA, 2017; Available online: https://www.amazon.com/Innovation-Led-Economic-Growth-Transforming-Developing (accessed on 10 January 2022).

- Mohamed, M.; Liu, P.; Nie, G. Are technological innovation and foreign direct investment a way to boost economic growth? an egyptian case study using the autoregressive distributed lag (ardl) model. Sustainability 2021 , 13 , 3265. [ Google Scholar ] [ CrossRef ]

- Dincer, O. Does corruption slow down innovation? Evidence from a cointegrated panel of US states. Eur. J. Political Econ. 2019 , 56 , 1–10. [ Google Scholar ] [ CrossRef ]

- Broughel, J.; Thierer, A.D. Technological innovation and economic growth: A brief report on the evidence. Mercatus Res. Pap. 2019 . [ Google Scholar ]

- Smith, K.; Estibals, A. Innovation and Research Strategy for Growth. 2011. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/32445/11-1386-economics-innovation-and-research-strategy-for-growth.pdf (accessed on 10 January 2022).

- Jaumotte, F.; Pain, N. Innovation in the Business Sector. 2005. Available online: https://ideas.repec.org/p/oec/ecoaaa/459-en.html (accessed on 10 January 2022).

- Asheim, B. Localised learning, innovation and regional clusters. Clust. Policies–Clust. Dev. 2001 , 39–58. Available online: https://www.sv.uio.no (accessed on 10 January 2022).

- Bhuiyan, A.A.M. Financing education: A route to the development of a country. J. Educ. Dev. 2019 , 7 , 209–217. [ Google Scholar ]

- Porter, M.E. The competitive advantage of nations harvard business review. Harv. Bus. Rev. 1990 , 91. [ Google Scholar ]

- Cooper, R.G. From experience: The invisible success factors in product innovation. J. Prod. Innov. Manag. 1999 , 16 , 115–133. [ Google Scholar ] [ CrossRef ]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990 , 98 , S71–S102. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Aghion, P.; Harmgart, H.; Weisshaar, N. Fostering growth in CEE countries: A country-tailored approach to growth policy. In Challenges for European Innovation Policy ; Edward Elgar Publishing: Cheltenham, UK, 2011; Available online: https://www.ebrd.com/downloads/research/economics/workingpapers/wp0118.pdf (accessed on 10 January 2022).

- Aubert, J.-E. Promoting Innovation in Developing Countries: A Conceptual Framework ; World Bank Publications: Washington, DC, USA, 2005; Volume 3554, Available online: https://openknowledge.worldbank.org/handle/10986/8965 (accessed on 10 January 2022).

- Maradana, R.P.; Pradhan, R.P.; Dash, S.; Gaurav, K.; Jayakumar, M.; Chatterjee, D. Does innovation promote economic growth? Evidence from European countries. J. Innov. Entrep. 2017 , 6 , 1–23. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Sylwester, K. R&D and economic growth. Knowl. Technol. Policy 2001 , 13 , 71–84. [ Google Scholar ]

- Pala, A. Innovation and economic growth in developing countries: Empirical implication of Swamy’s random coefficient model (RCM). Procedia Comput. Sci. 2019 , 158 , 1122–1130. [ Google Scholar ] [ CrossRef ]

- Sadraoui, T.; Ali, T.B.; Deguachi, B. testing for panel granger causality relationship between international R&D cooperation and economic growth. Int. J. Econom. Financ. Manag. 2014 , 2 , 7–21. [ Google Scholar ]

- Freimane, R.; Bāliņa, S. Research and development expenditures and economic growth in the EU: A panel data analysis. Econ. Bus. 2016 , 29 , 5–11. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Schumpeter, J.A.; Redvers, O. Theorie Der Wirtschaftlichen Entwicklung. The Theory of Economic Development. An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Redvers Opie. 1934. Available online: https://www.hup.harvard.edu/catalog.php?isbn=9780674879904 (accessed on 10 January 2022).

- ÇETİN, M. The hypothesis of innovation-based economic growth: A causal relationship. Uluslararası İktisadi ve İdari İncelemeler Dergisi 2013 , 1–16. [ Google Scholar ]

- Antonelli, C. The economics of innovation: From the classical legacies to the economics of complexity. Econ. Innov. New Technol. 2009 , 18 , 611–646. [ Google Scholar ] [ CrossRef ]

- Conte, A. The Evolution of the Literature on Technological Change over Time: A Survey. 2006. Available online: https://www.researchgate.net/publication/5018301 (accessed on 10 January 2022).

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957 , 39 , 312–320. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Sofuoğlu, E.; Kizilkaya, O.; Koçak, E. Assessing the impact of high-technology exports on the growth of the turkish economy. J. Econ. Policy Res. 2022 , 9 , 205–229. [ Google Scholar ] [ CrossRef ]

- Idris, J.; Yusop, Z.; Habibullah, M.S. Trade openness and economic growth: A causality test in panel perspective. Int. J. Bus. Soc. 2016 , 17. [ Google Scholar ] [ CrossRef ]

- Zahonogo, P. Trade and economic growth in developing countries: Evidence from sub-Saharan Africa. J. Afr. Trade 2016 , 3 , 41–56. [ Google Scholar ] [ CrossRef ]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986 , 94 , 1002–1037. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988 , 22 , 3–42. [ Google Scholar ] [ CrossRef ]

- Guloglu, B.; Tekin, R.B. A panel causality analysis of the relationship among research and development, innovation, and economic growth in high-income OECD countries. Eurasian Econ. Rev. 2012 , 2 , 32–47. [ Google Scholar ]

- Romer, P.M. The origins of endogenous growth. J. Econ. Perspect. 1994 , 8 , 3–22. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Jones, C.I. Paul Romer: Ideas, nonrivalry, and endogenous growth. Scand. J. Econ. 2019 , 121 , 859–883. [ Google Scholar ] [ CrossRef ]

- Aghion, P.; Ljungqvist, L.; Howitt, P.; Howitt, P.W.; Brant-Collett, M.; García-Peñalosa, C. Endogenous Growth Theory ; MIT Press: Cambridge, MA, USA, 1998; Available online: https://mitpress.mit.edu/books/endogenous-growth-theory (accessed on 10 January 2022).

- Zeng, J. Reexamining the interaction between innovation and capital accumulation. J. Macroecon. 2003 , 25 , 541–560. [ Google Scholar ] [ CrossRef ]

- Chu, S.-Y. Internet, economic growth and recession. Sci. Res. 2013 , 4 , 3A. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Nelson, R.R. Why do firms differ, and how does it matter? Strateg. Manag. J. 1991 , 12 , 61–74. [ Google Scholar ] [ CrossRef ]

- Kim, L. Imitation to Innovation: The Dynamics of Korea’s Technological Learning ; Harvard Bus School Press: Boston, MA, USA, 1997. [ Google Scholar ]

- Nelson, R.R. National Innovation Systems: A Comparative Analysis ; Oxford University Press on Demand: Oxford, UK, 1993; Available online: https://www.academia.edu/28567904 (accessed on 10 January 2022).

- Carlo, P.P.; Vandana, C.; Deniz, E. Innovation and Growth Chasing a Moving Frontier: Chasing a Moving Frontier ; OECD Publishing: Washington, DC, USA, 2009; Available online: https://www.oecd.org/innovation/innovationandgrowthchasingamovingfrontier.htm (accessed on 10 January 2022).

- Hargadon, A.; Sutton, R.I. Technology brokering and innovation in a product development firm. Adm. Sci. Q. 1997 , 716–749. [ Google Scholar ] [ CrossRef ]

- Fagerberg, J.; Srholec, M. National innovation systems, capabilities and economic development. Res. Policy 2008 , 37 , 1417–1435. [ Google Scholar ] [ CrossRef ]

- Arocena, R.; Sutz, J. Research and innovation policies for social inclusion: An opportunity for developing countries. Innov. Dev. 2012 , 2 , 147–158. [ Google Scholar ] [ CrossRef ]

- Freeman, C. Continental, national and sub-national innovation systems—Complementarity and economic growth. Res. Policy 2002 , 31 , 191–211. [ Google Scholar ] [ CrossRef ]

- Castellacci, F.; Natera, J.M. The dynamics of national innovation systems: A panel cointegration analysis of the coevolution between innovative capability and absorptive capacity. Res. Policy 2013 , 42 , 579–594. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Wu, Y. Innovation and Economic Growth in China. Business School the University of Western Australia. DISCUSSION PAPER 10.10. VAL. TECH. 2012. Available online: https://econpapers.repec.org/paper/uwawpaper/10-10.htm (accessed on 10 January 2022).

- Tuna, K.; Kayacan, E.; Bektaş, H. The relationship between research & development expenditures and economic growth: The case of Turkey. Procedia-Soc. Behav. Sci. 2015 , 195 , 501–507. [ Google Scholar ]

- Abdelaoui, T.M.L.; Abdelaoui, O. The impact of innovation on economic development in Arab countries: The Case of Selected Arab Countries from 2007 to 2016. J.N. Afr. Econ. 2020 , 16 , 33–54. [ Google Scholar ]

- Lomachynska, I.; Podgorna, I. Innovation potential: Impact on the national economy’s competitiveness of the EU developed countries. Balt. J. Econ. Stud. 2018 , 4 , 262–270. [ Google Scholar ] [ CrossRef ]

- Pece, A.M.; Simona, O.E.O.; Salisteanu, F. Innovation and economic growth: An empirical analysis for CEE countries. Procedia Econ. Financ. 2015 , 26 , 461–467. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Solomon, O.; Samuel, J.; Samuel, A. Study of the relationship between economic growth, volatility and innovation for the Eu-27 and ceec countries. J. Inf. Syst. Oper. Manag. 2011 , 5 , 82–90. [ Google Scholar ]

- Economists Understand Little about the Causes of Growth, 2 April 2018. Available online: https://www.economist.com/finance-and-economics/2018/04/12/economists-understand-little-about-the-causes-of-growth (accessed on 12 April 2018).

- Yang, C.-H. Is innovation the story of Taiwan’s economic growth? J. Asian Econ. 2006 , 17 , 867–878. [ Google Scholar ] [ CrossRef ]

- Pradhan, R.P.; Arvin, M.B.; Hall, J.H.; Nair, M. Innovation, financial development and economic growth in Eurozone countries. Appl. Econ. Lett. 2016 , 23 , 1141–1144. [ Google Scholar ] [ CrossRef ]

- Sinha, D. Patents, Innovations and economic Growth in Japan and South Korea: Evidence from individual country and Panel Data. Appl. Econom. Int. Dev. 2008 , 8 . Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1308261 (accessed on 12 April 2018).

- Sadraoui, T.; Ali, T.B.; Deguachi, B. Economic growth and international R&D cooperation: A panel granger causality analysis. Int. J. Econom. Financ. Manag. 2014 , 2 , 7–21. [ Google Scholar ]

- Fagerberg, J.; Srholec, M.; Knell, M. The competitiveness of nations: Why some countries prosper while others fall behind. World Dev. 2007 , 35 , 1595–1620. [ Google Scholar ] [ CrossRef ]

- Kuo, H.-C.; Tseng, Y.-C.; Yang, Y.-T.C. Promoting college student’s learning motivation and creativity through a STEM interdisciplinary PBL human-computer interaction system design and development course. Think. Ski. Creat. 2019 , 31 , 1–10. [ Google Scholar ] [ CrossRef ]

- Aghion, P.; Howitt, P. A Model of Growth through Creative Destruction ; National Bureau of Economic Research: Cambridge, MA, USA, 1990; pp. 898–2937. Available online: https://dash.harvard.edu/bitstream/handle/1/12490578/A%20Model%20of%20Growth%20through%20Creative%20Destruction.pdf (accessed on 12 April 2018).

- Silva, M.A.P.M.d. Teaching Aghion and Howitt’s model of schumpeterian growth to graduate students: A diagrammatic approach. Australas. J. Econ. Educ. 2012 , 9 , 15–36. [ Google Scholar ]

- Stiglitz, J.E. Capital-market liberalization, globalization, and the IMF. Oxf. Rev. Econ. Policy 2004 , 20 , 57–71. [ Google Scholar ] [ CrossRef ]

- Hsiao, C. Analysis of Panel Data ; Cambridge University Press: Cambridge, UK, 2014; Available online: https://doi.org/10.1017/CBO9781139839327 (accessed on 12 April 2018).

- Baltagi, B.H.; Song, S.H.; Koh, W. Testing panel data regression models with spatial error correlation. J. Econom. 2003 , 117 , 123–150. [ Google Scholar ] [ CrossRef ]

- Narayan, P.K.; Smyth, R. Energy consumption and real GDP in G7 countries: New evidence from panel cointegration with structural breaks. Energy Econ. 2008 , 30 , 2331–2341. [ Google Scholar ] [ CrossRef ]

- Dimitrios, A.; Stephen, G. Hall, Applied Econometrics: A Modern Approach, Revised ; Palgrave Macmillan: London, UK, 2007; Available online: https://www.pdfdrive.com/applied-econometrics-a-modern-approach-using-eviews-and-microfit-revised-edition-d157033339.html (accessed on 12 April 2018).

- MacKinnon, J.G. Numerical distribution functions for unit root and cointegration tests. J. Appl. Econom. 1996 , 11 , 601–618. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Han, L.; Cui, W.; Zhang, W. A Relevance Study of Economic Time Series Data. In Proceedings of the LISS 2020: The 10th International Conference on Logistics, Informatics and Service Sciences ; Springer: Berlin/Heidelberg, Germany, 2021; p. 405. [ Google Scholar ] [ CrossRef ]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econom. J. Econom. Soc. 1981 , 83 , 1057–1072. Available online: https://econpapers.repec.org/article/ecmemetrp/v_3a49_3ay_3a1981_3ai_3a4_3ap_3a1057-72.htm (accessed on 12 April 2018). [ CrossRef ]

- Yaya, O.S.; Ogbonna, A.E.; Furuoka, F.; Gil-Alana, L.A. A New Unit Root Test for Unemployment Hysteresis Based on the Autoregressive Neural Network. Oxf. Bull. Econ. Stat. 2021 , 83 , 960–981. [ Google Scholar ] [ CrossRef ]

- Engle, R.F.; Granger, C.W.J. Co-integration and Error Correction: Representation, Estimation, and Testing. Econom. J. Econom. Soc. 1987 , 55 , 176–251. [ Google Scholar ] [ CrossRef ]

- Padder, A.H.; Mathavan, B. The Relationship between Unemployment and Economic Growth in India: Granger Causality Approach. NVEO-Nat. Volatiles Essent. Oils J. NVEO 2021 , 8 , 1265–1271. [ Google Scholar ]

- Naimoğlu, M. Impact on Economic Growth of Energy Consumption and Foreign Direct Investment: The Case of Turkey, Conference: 7. In Proceedings of the International Conference on Economics (IceTea2021): Unpacking the Economic Impacts of COVID-1; Available online: https://teacongress.com/ (accessed on 10 January 2022).

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969 , 37 , 424–438. [ Google Scholar ] [ CrossRef ]

- Damodar, N.G. Basic Econometrics ; The Mc-Graw Hill: New York, NY, USA, 2004; Available online: https://www.academia.edu/40263427/BASIC_ECONOMETRICS_FOURTH_EDITION (accessed on 12 April 2018).

- Husain, F.; Abbas, K. Money, Income, Prices, and Causality in Pakistan. A Trivariate Analysis. PIDE-Working Papers 2000:178, Pakistan Institute of Development Economics. 2020. Available online: https://ideas.repec.org/p/pid/wpaper/2000178.html (accessed on 10 January 2022).

- Gujarati, D.N. Basic Econometrics , 4th ed.; McGraw-Hill: Singapore, 2003; Available online: http://zalamsyah.staff.unja.ac.id/wp-content/uploads/sites/286/2019/11/7-Basic-Econometrics-4th-Ed.-Gujarati.pdf (accessed on 12 April 2018).

- Liang, Z. Financial development and income distribution: A system GMM panel analysis with application to urban China. J. Econ. Dev. 2006 , 31 , 1. [ Google Scholar ]

- Pham, T.T.; Dao, L.K.O.; Nguyen, V.C. The determinants of bank’s stability: A system GMM panel analysis. Cogent Bus. Manag. 2021 , 8 , 1963390. [ Google Scholar ] [ CrossRef ]

- Oppong, G.K.; Pattanayak, J.K.; Irfan, M. Impact of intellectual capital on productivity of insurance companies in Ghana: A panel data analysis with system GMM estimation. J. Intellect. Cap. 2019 , 20 , 763–783. [ Google Scholar ] [ CrossRef ]

Click here to enlarge figure

| Indices | PAR | PAN | EDU | RDE | PRD | STJ | THE | GDP_PER_CAPITA_GROWT |

|---|---|---|---|---|---|---|---|---|

| Mean | 42.79799 | 55.28742 | 0.135374 | 0.022152 | 45.21019 | 153.5121 | 0.282907 | 2.974121 |

| Median | 15.97560 | 21.55963 | 0.097227 | 0.007254 | 9.439463 | 73.27613 | 0.104898 | 3.253375 |

| Maximum | 1232.796 | 1524.110 | 1.269957 | 0.533769 | 660.2663 | 1966.061 | 2.879151 | 13.63634 |

| Minimum | 0.227269 | 0.905273 | 0.000000 | 4.14 × 10 | 0.281453 | 0.689034 | 0.001584 | −14.35055 |

| Std. Dev. | 85.36316 | 120.7277 | 0.157449 | 0.041215 | 103.6293 | 206.7747 | 0.483565 | 3.840783 |

| Skewness | 7.890280 | 7.811967 | 2.788900 | 5.492087 | 3.643645 | 2.860077 | 3.270931 | −0.767087 |

| Kurtosis | 93.38687 | 77.77401 | 14.05681 | 54.31703 | 17.32591 | 16.78431 | 14.29189 | 4.782198 |

| Jarque-Bera | 203454.6 | 141018.8 | 3706.320 | 66557.17 | 6243.125 | 5382.580 | 4115.652 | 133.6397 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Sum | 24822.83 | 32066.70 | 78.51690 | 12.84793 | 26221.91 | 89037.02 | 164.0861 | 1724.990 |

| Sum Sq. Dev. | 4219097. | 8439034. | 14.35357 | 0.983534 | 6217899. | 24755592 | 135.3906 | 8541.184 |

| Observations | 580 | 580 | 580 | 580 | 580 | 580 | 580 | 580 |

| Items | GDP_PER_CAPITA_GROWTH__A | PAR | PAN | RDE | PRD | STJ | THE | EDU |

|---|---|---|---|---|---|---|---|---|

| GDP_PER_CAPITA_GROWT | 1.000000 | −0.004692 | −0.047889 | 0.011245 | 0.061354 | 0.038487 | 0.056533 | −0.009516 |

| PAR | −0.004692 | 1.000000 | 0.746965 | 0.204002 | 0.149051 | 0.324532 | 0.311667 | 0.277678 |

| PAN | −0.047889 | 0.746965 | 1.000000 | 0.217452 | 0.142241 | 0.402496 | 0.367943 | 0.441065 |

| RDE | 0.011245 | 0.204002 | 0.217452 | 1.000000 | 0.583682 | 0.389245 | 0.494083 | 0.635408 |

| PRD | 0.061354 | 0.149051 | 0.142241 | 0.583682 | 1.000000 | 0.539553 | 0.797042 | 0.739735 |

| STJ | 0.038487 | 0.324532 | 0.402496 | 0.389245 | 0.539553 | 1.000000 | 0.501469 | 0.552201 |

| THE | 0.056533 | 0.311667 | 0.367943 | 0.494083 | 0.797042 | 0.501469 | 1.000000 | 0.685608 |

| EDU | −0.009516 | 0.277678 | 0.441065 | 0.635408 | 0.739735 | 0.552201 | 0.685608 | 1.000000 |

| Country | PARLV (FD) | PANLV (FD) | RDELV (FD) | PRDLV (FD) | THELV (FD) | STJLV (FD) | EDULV (FD) | GDP per Capita Growth (Annual %) LV (FD) |

|---|---|---|---|---|---|---|---|---|

| Algeria | 2.158 (20.7 ***) | 2.206 (24.03 ***) | 22.12 *** | 0.217 (34.836) | 8.37 ** | 5.7 × 10 15.7 *** | 12.17 *** | 1.798 (17.034 ***) |

| Argentina | 18.42 *** | 18.42 *** | 20.12 *** | 18.79 *** | 19.445 *** | 18.42 *** | 18.46 *** | 0.289 (14.99 ***) |

| Brazil | 6.373 ** | 1.127 (13.05 ***) | 1.17 (23.2 ***) | 1.287 (31.22 ***) | 5.298 * (8.62 ***) | 0.00784 (16.87 ***) | 5.64 * (26.29 ***) | 0.573 (8.63 **) |

| Bulgaria | 0.911 (17.6 ***) | 0.911 (17.6 ***) | 2.503 (22.9 ***) | 0.031 (14.86 ***) | 0.0237 (15.06 ***) | 0.02188 (20.067 ***) | 1.535 (24.89 ***) | 0.99145 (7.67 **) |

| Chile | 7.498 ** | 7.498 ** | 0.212 (15.9 ****) | 1.59 (34.1 ***) | 1.813 (25.85 ***) | 0.0025 (18.42 ***) | 1.36 (7.22 ***) | 0.7916 (6.304 **) |

| China | (13.6 ***) | 13.63 *** | 0.036 (19.8 ***) | 0.319 (16.9 ***) | 1.9007 (6.3 ***) | 0.0011 (14.085 ***) | 7.43 ** | 0.3077 (15.12 ***) |

| Egypt | 2.52 (16.96 ***) | 5.52 (16.97 ***) | 9.553 *** | 3.96 (18.95 ***) | 12.8 *** | 0.01555 (33.65 ***) | 4.826 * (18.42 ***) | 2.2902 (21.65 ***) |

| Hungary | 0.9131 (8.27 **) | 2.37 (8.27 **) | 2.5 (14.47 ***) | 0.227 (19.47 ***) | 2.05 (13.25 ***) | 1.83 (23.47 ***) | 1.79 (9.62 ***) | 0.02018 (19.29 ***) |

| Indonesia | 3.011 (23.8 ***) | 3.011 (26.5 ***) | 1.39 (32.5 ***) | 2.9 (29.86 ***) | 2.33 (18.86 ***) | 0.0039 (24.82 ***) | 3.0074 (25.9 ***) | 0.40005 (18.42 ***) |

| Iran | 0.544 (19.3 ***) | 0.544 (19.3 ***) | 17.08 *** | 4.97 * (17.47 ***) | 2.24 (21.17 ***) | 0.01927 (6.911 **) | 1.039 (20.83 ***) | 4.568 (11.74 ***) |

| Mexico | 16.57 *** | 16.57 *** | 1.79 (22.4 ***) | 17.025 *** | 16.0697 *** | 15.74 *** | 16.56 *** | 2.839 (15.006 ***) |

| Morocco | 0.00061 (6.66**) | 0.00061 (6.66 **) | 18.4 *** | 0.00053 (15.73 ***) | 1.56 (11.16 ***) | 2.0E-05 (31.9 ***) | 9.016 ** | 0.233 (11.956 ***) |

| Peru | 4.08 (15.9 ***) | 5.212 * (16.18 ***) | 8.1 ** | 3.34 (13.67 ***) | 5.11 * (18.74 ***) | 3.1E09 (34.064 ***) | 5.234 * (30.51 ***) | 0.17077 (9.222 ***) |

| Philippines | 0.13564 (8.71 ***) | 9.708 ** | 0.143 8.4 ** | 1.37 (17.6 ***) | 1.28 (9.38 ***) | 5.4E-08 (24.77 ***) | 2.799 (15.55 ***) | 0.1331 (13.0118 ***) |

| Poland | 0.5878 (12.94 ***) | 0.859 (12.78 ***) | 0.143 (8.4 ***) | 13.22 *** | 0.0338 (10.33 ***) | 0.024 (16.76 ***) | 5.83 * (11.42 ***) | 2.9957 (13.548 ***) |

| Romania | 14.93 *** | 0.45044 (22.47 ***) | 5.62 * (27.7 ***) | 40.25 *** | 1.288 (10.96 ***) | 0.44 (12.8 ***) | 5.38 * (31.14 ***) | 0.10418 (11.128 ***) |

| Sri Lanka | 0.816 (33.47 ***) | 2.433 (20.9 ***) | 3.22 (13.8 ***) | 0.618 (13.98 ***) | 4.37 (10.6 ***) | 6.2E-07 (7.06 **) | 1.88 (22.42 ***) | 0.03594 (6.326 **) |

| Thailand | 2.05 (26.26 ***) | 6.65 ** | 1.46 (6.003 **) | 3.5E-06 (18.97 ***) | 6.11573** | 0.0002 (13.32 ***) | 11.55 ** | 0.2262 (7.845 ***) |

| Tunisia | 0.823 (22.3 ***) | 0.76 (8.196 ***) | 1.066 (9.85 ***) | 0.13077 (11.196 ***) | 0.583 (23.55 ***) | 0.00112 (28.24 ***) | 3.68 (27.87 ***) | 2.050 (11.174 ***) |

| Turkey | 0.0064 (12.72**) | 2.841 (7.123 **) | 1.137 (22.7 ***) | 0.01690 (15.05 ***) | 6.077 ** | 0.313 (30.084 ***) | 2.66 (30.33 ***) | 0.528 (16.75 ***) |

| Variables | PAR | PAN | RDE | PRD | THE | STJ | EDU | GDP |

|---|---|---|---|---|---|---|---|---|

| Degree of integration | I (1) | I (1) | I (1) | I (1) | I (1) | I (1) | I (1) | I (1) |

| Null Hypothesis: | Algeria | Argentina | Brazil | Bulgaria | Chile | |

|---|---|---|---|---|---|---|

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 3.45139 ** | 1.85640 | 0.02088 | 0.55365 | 6.42670 ** |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.65959 | 1.20757 | 3.50598 ** | 4.24517 ** | 0.16010 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 0.28866 | 2.75374 * | 1.05750 | 0.55365 | 6.42670 ** |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.54733 | 1.69911 | 0.92123 | 4.24517 ** | 0.16010 | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 0.41770 | 3.75307 ** | 0.61420 | 2.08852 | 0.93974 |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.35729 | 2.52407 * | 3.58595 ** | 1.31153 | 0.70005 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 0.19865 | 3.80148 ** | 0.93278 | 2.25745 | 0.25433 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.11666 | 1.31620 | 1.57160 | 1.08045 | 4.69006 ** | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 0.88593 | 3.80122 ** | 3.85557 ** | 24.2234 *** | 0.70643 |

| GDP_PER_CAPITA does not Granger Cause STJ | 0.72180 | 2.78491* | 0.82624 | 0.47384 | 8.69955 *** | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 5.55960 ** | 2.11193 | 0.48506 | 9.65160 *** | 2.18918 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.87955 | 1.21826 | 0.26147 | 1.68544 | 5.95758 ** | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 0.06448 | 2.50999 * | 3.45232 ** | 0.17195 | 0.54776 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.08922 | 1.46903 | 3.39050 * | 2.04251 | 4.74801 ** | |

| Null Hypothesis: | China | Egypt | Hungary | Indonesia | Iran | |

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 0.07652 | 7.85133 *** | 0.11664 | 0.60294 | 3.28536 * |

| GDP_PER_CAPITA does not Granger Cause PAN | 4.13486 ** | 0.05001 | 1.36300 | 5.20243 ** | 0.25676 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 0.07652 | 7.85133 *** | 0.11664 | 0.60294 | 3.28536 * |

| GDP_PER_CAPITA does not Granger Cause PAR | 4.13486 ** | 0.05001 | 1.36300 | 5.20243 ** | 0.25676 | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 1.59115 | 1.01360 | 1.23194 | 4.82837 ** | 8.85677 *** |

| GDP_PER_CAPITA does not Granger Cause PRD | 1.71315 | 0.50835 | 6.58574 ** | 0.11963 | 0.09699 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 0.63068 | 0.12053 | 4.35234 ** | 0.01557 | 9.04547 *** |

| GDP_PER_CAPITA does not Granger Cause RDE | 6.14284 *** | 6.87595 ** | 53.1925 *** | 0.51660 | 0.07771 | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 4.29613 ** | 0.02424 | 4.47252 ** | 0.02185 | 3.93442 * |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.72200 | 1.20223 | 2.96970 * | 2.43003 | 0.50925 | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 5.98152 ** | 0.06169 | 3.48594 * | 1.54441 | 4.39407 ** |

| GDP_PER_CAPITA does not Granger Cause THE | 0.04888 | 1.60651 | 1.65908 | 6.48804 *** | 0.07888 | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 0.08946 | 18.0285 *** | 1.07799 | 1.45638 | 2.43955 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.13876 | 6.94753 ** | 0.00019 | 0.39204 | 3.25965 * | |

| Null Hypothesis: | Mexico | Morocco | Peru | Philippines | Poland | |

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 0.33389 | 0.89077 | 0.97908 | 1.32599 | 3.94050 ** |

| GDP_PER_CAPITA does not Granger Cause PAN | 0.11052 | 3.30388 ** | 0.66307 | 0.14147 | 0.95690 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 0.33389 | 0.89077 | 0.97908 | 1.37618 | 0.58816 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.11052 | 3.30388 ** | 0.66307 | 1.62187 | 2.94843 * | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 0.28754 | 0.45675 | 0.27895 | 0.33509 | 0.26065 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.09579 | 1.24709 | 0.45400 | 0.69119 | 0.80394 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 0.31281 | 3.90725 ** | 0.91969 | 4.55742 ** | 1.05090 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.18231 | 0.69901 | 0.36466 | 0.67502 | 3.07919 * | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 0.26862 | 0.74834 | 0.09426 | 0.15912 | 2.19014 |

| GDP_PER_CAPITA does not Granger Cause STJ | 1.67510 | 3.48123 ** | 5.11692 ** | 0.41448 | 0.18275 | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 0.29089 | 1.98610 | 0.93801 | 1.78683 | 0.81335 |

| GDP_PER_CAPITA does not Granger Cause THE | 0.01289 | 1.64873 | 0.91330 | 0.26876 | 4.74172 ** | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 0.32060 | 0.59479 | 0.03313 | 3.61820 ** | 0.04317 |

| GDP_PER_CAPITA does not Granger Cause EDU | 0.02119 | 1.69819 | 0.17291 | 0.98913 | 1.17654 | |

| Null Hypothesis: | Romania | Sri Lanka | Thailand | Tunisia | Turkey | |

| PAN | PAN does not Granger Cause GDP_PER_CAPITA | 2.56142 | 0.13404 | 4.52198 ** | 0.25761 | 5.64758 ** |

| GDP_PER_CAPITA does not Granger Cause PAN | 6.73806 *** | 0.34464 | 1.67446 | 7.66646 *** | 1.47880 | |

| PAR | PAR does not Granger Cause GDP_PER_CAPITA | 2.40498 | 1.79948 | 1.14622 | 3.5948 * | 0.36393 |

| GDP_PER_CAPITA does not Granger Cause PAR | 0.14059 | 9.57892 *** | 0.80727 | 6.67297 ** | 2.40591 | |

| PRD | PRD does not Granger Cause GDP_PER_CAPITA | 0.85992 | 1.56537 | 1.54357 | 0.04494 | 0.77162 |

| GDP_PER_CAPITA does not Granger Cause PRD | 0.29628 | 1.02108 | 1.21407 | 2.59188 | 1.20477 | |

| RDE | RDE does not Granger Cause GDP_PER_CAPITA | 1.02146 | 0.27437 | 0.76778 | 9.86050 *** | 0.29961 |

| GDP_PER_CAPITA does not Granger Cause RDE | 0.13856 | 1.95295 | 2.69477 * | 1.16887 | 4.26462 ** | |

| STJ | STJ does not Granger Cause GDP_PER_CAPITA | 9.11119 *** | 0.98285 | 6.39219 *** | 2.20958 | 8.52400 *** |

| GDP_PER_CAPITA does not Granger Cause STJ | 19.9675 *** | 0.50109 | 4.38578 ** | 16.5676 *** | 0.25703 | |

| THE | THE does not Granger Cause GDP_PER_CAPITA | 0.35056 | 1.00865 | 8.52687 *** | 0.10476 | 1.62364 |

| GDP_PER_CAPITA does not Granger Cause THE | 11.8021 *** | 1.46224 | 0.56740 | 15.6075 *** | 1.12907 | |

| EDU | EDU does not Granger Cause GDP_PER_CAPITA | 2.68070 | 0.59774 | 5.85179 *** | 0.00675 | 0.41114 |

| GDP_PER_CAPITA does not Granger Cause EDU | 2.94423 | 0.34051 | 0.02474 | 7.53871 ** | 1.06322 |

| Variable | Statistic | Asymp. Sig. (Two-Tailed) |

|---|---|---|

| GDP per capita growth | 12.326 | 0.0021 |

| Variable | Coefficient | Standard Error | t-Statistic | Probability |

|---|---|---|---|---|

| EDU | −3.500127 | 0.390585 | −8.961248 | 0.0000 |

| PAN | −0.000345 | 0.001832 | −0.188131 | 0.8508 |

| PAR | 0.000147 | 0.001754 | 0.084037 | 0.9331 |

| PRD | 0.002690 | 0.001332 | 2.019151 | 0.0440 |

| RDE | −0.686891 | 1.316314 | −0.521829 | 0.6020 |

| STJ | 0.004503 | 0.001514 | 2.974776 | 0.0031 |

| THE | 0.740715 | 0.245014 | 3.023156 | 0.0026 |

| Effects Specification | ||||

| Cross-section fixed (first differences) | ||||

| Mean dependent var | 0.047455 | S.D. dependent var | 0.206800 | |

| S.E. of regression | 0.501957 | Sum squared resid | 139.3344 | |

| J-statistic | 13.90493 | Instrument rank | 21 | |

| Prob (J-statistic) | 0.456818 | |||

| Test order | m-Statistic | rho | SE (rho) | Prob. |

|---|---|---|---|---|

| AR (2) | −0.011694 | −0.320535 | 27.409643 | 0.9907 |

| MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

Share and Cite

Mohamed, M.M.A.; Liu, P.; Nie, G. Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries. Sustainability 2022 , 14 , 3586. https://doi.org/10.3390/su14063586

Mohamed MMA, Liu P, Nie G. Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries. Sustainability . 2022; 14(6):3586. https://doi.org/10.3390/su14063586

Mohamed, Maha Mohamed Alsebai, Pingfeng Liu, and Guihua Nie. 2022. "Causality between Technological Innovation and Economic Growth: Evidence from the Economies of Developing Countries" Sustainability 14, no. 6: 3586. https://doi.org/10.3390/su14063586

Article Metrics

Article access statistics, further information, mdpi initiatives, follow mdpi.

Subscribe to receive issue release notifications and newsletters from MDPI journals

Click through the PLOS taxonomy to find articles in your field.

For more information about PLOS Subject Areas, click here .

Loading metrics

Open Access

Peer-reviewed

Research Article

Re-assessing causality between energy consumption and economic growth

Roles Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing

Affiliation Newcastle University, Newcastle, United Kingdom

* E-mail: [email protected]

Affiliation Universidad Isabel I. Calle de Fernán González, Burgos, Spain

Affiliation IEI and Universitat Jaume I, Campus del Riu Sec, Castellón, Spain

- Atanu Ghoshray,

- Yurena Mendoza,

- Mercedes Monfort,

- Javier Ordoñez

- Published: November 12, 2018

- https://doi.org/10.1371/journal.pone.0205671

- Reader Comments

The energy consumption-growth nexus has been widely studied in the empirical literature, though results have been inconclusive regarding the direction, or even the existence, of causality. These inconsistent results can be explained by two important limitations of the literature. First, the use of bivariate models, which fail to detect more complex causal relations, or the ad hoc approach to selecting variables in a multivariate framework; and, second, the use of linear causal models, which are unable to capture more complex nonlinear causal relationships. In this paper, we aim to overcome both limitations by analysing the energy consumption-growth nexus using a Flexible Fourier form due to Enders and Jones (2016). The analysis focuses on the US over the period 1949 to 2014. From our results we can conclude that, where the linear methodology supports the neutrality hypothesis (no causality between energy consumption and growth), the Flexible Fourier form points to the existence of causality from energy consumption to growth. This is contrary to the linear analysis, suggesting that lowering energy consumption would adversely affect US economic growth. Thus, by employing the Flexible Fourier form we find the conclusions can be quite different.

Citation: Ghoshray A, Mendoza Y, Monfort M, Ordoñez J (2018) Re-assessing causality between energy consumption and economic growth. PLoS ONE 13(11): e0205671. https://doi.org/10.1371/journal.pone.0205671

Editor: María Carmen Díaz Roldán, Universidad de Castilla-La Mancha, SPAIN

Received: April 8, 2018; Accepted: September 29, 2018; Published: November 12, 2018

Copyright: © 2018 Ghoshray et al. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Data Availability: All relevant data are available at https://doi.org/10.5061/dryad.4h92834 .

Funding: JO acknowledges financial support from the Spanish Ministry of Science and Innovation through grant ECO2014-58991-C3-2-R and AEI/FEDER ECO2017-83255-C3-3-P. JO acknowledges financial support from PROMETEO project PROMETEO II/2014/053. AG and JO thank the Generalitat Valenciana project AICO/2016/038. JO and MM are grateful for support from the University Jaume I research project P1.1B2014-7 and UJI-B2017-33. YM is grateful for support from the University Isabel I research project. The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript.

Competing interests: The authors have declared that no competing interests exist.

Introduction

It has been argued that economic growth may exhaust resources and cause environmental degradation [ 1 ], compromising future growth. The fear that today's growth can cause other significant economic problems, especially for future generations, has propelled sustainable growth to the top of the political agenda for the vast majority of developed countries. Sustainability will depend on how the substitutability or complementarity between energy and production factors and the interplay with technical progress and productivity, impact economic growth. Consequently, and with the ultimate aim of assessing whether sustainable growth can be achieved, the causal relationship between economic growth and energy consumption has been widely debated in empirical studies. The energy-growth nexus has important policy implications. If increased energy consumption causes economic growth, sustainability can only be achieved by ensuring access to a cheap, safe, environmentally-friendly energy supply. Alternatively, if economic growth causes increased energy demand, the challenge is to reduce energy demand through market-oriented policies and regulatory instruments. A review of previous studies on growth-energy consumption using vector autoregressive (hereafter VAR) methodology is presented in Table 1 . Till date, from Table 1 , the results are inconsistent on the direction of causality between energy consumption and economic growth and even about the existence of causality [ 2 – 4 ]. Several factors lie behind these conflicting results. First, the data used in previous studies include different countries and time periods. Secondly, there are also differences in the variable selection; for example, most studies use aggregate energy consumption data, whereas a number of others examine various disaggregated measures. Thirdly, the studies also differ in terms of the econometric methodology.

- PPT PowerPoint slide

- PNG larger image

- TIFF original image

https://doi.org/10.1371/journal.pone.0205671.t001

The majority of the early studies confine the analysis to the bivariate causal relationship between energy consumption and real output. A common problem with the bivariate model specification is the possibility of omitted variable bias [ 17 , 18 ], with the consequent loss of information that may be relevant in determining the direction of causality. Over recent years, several authors have attempted to overcome this problem by including additional variables in the causal analysis of the relationship between energy consumption and growth. However, as pointed out by [ 19 ], these additional variables have been selected on a rather ad hoc basis and the results on causality may be influenced by variable selection bias. Related to this problem of selection bias and variable omission, [ 20 ] point out that the absence of a prior theoretical model may cause the causality test to deliver mixed results. To address the lack of statistical motivation when choosing the control variables for the causal analysis, [ 19 ] apply a robust Bayesian probabilistic model to select the explanatory variables to be considered in the causal analysis of the relationship between energy consumption and economic growth. This approach allows for the evaluation of the posterior probability of including in the model a control variable selected from a large group of possible candidates; to the best of our knowledge, it is the first time in the literature that a robust variable selection method has been applied for this purpose. [ 19 ] use this method to select control variables for the analysis of the relationship between energy consumption and growth in the US from 1949 and 2010, for both aggregated and disaggregated data.

Most empirical studies test for causality in a linear framework (for example using Granger-Sims causality tests and/or unit root and cointegration techniques with either time series or panel data), neglecting the possibility of nonlinear causality. However, given the growing evidence of the presence of possible nonlinearity in several macroeconomic time series which could be caused as a result of several structural breaks, there has been an increasing reliance on nonlinear techniques that could capture causal relations between such variables. Some authors argue that the linear approach to causality testing is limited in its capacity to detect certain kinds of nonlinear causal relationships and so recommend the use of nonlinear techniques [ 21 – 23 ].

While the linear VAR model has advantages in incorporating a large number of variables to be analyzed for Granger causality, there remain limitations, particularly relating to the underlying characteristics of the variables chosen in the model. The variables chosen in the present study are subject to structural breaks as documented by various studies. For example, [ 24 ] conclude structural breaks in oil prices, [ 25 ] find evidence of structural breaks in energy consumption and [ 26 ] conclude the presence of breaks in economic growth. Taking account of the recent studies in the area of energy consumption-economic growth nexus, the VAR modelling approach remains popular. However, as shown by [ 27 ] it is not straightforward to control for breaks in a VAR since a break in one variable will manifest itself in other variables of the VAR model, leading to model misspecification [ 28 ]. Accordingly, we propose to adopt a Flexible Fourier Form VAR (FFF-VAR) framework that allows for smooth breaks that increase the power and size properties of the model.

Therefore, our contribution to the extant literature is to add new findings to the energy consumption-economic growth literature using an alternative modelling approach. We test for causality between energy consumption and economic growth in the US in a multivariate framework, including variables such as those with the highest posterior probability of inclusion according to the results reported by [ 19 ], and at the same time, recognise the presence of the variables included in the VAR model to contain structural breaks and thereby choose an appropriate specification, the FFF-VAR to test for causality between the variables. This approach would be more conducive for the type of variables employed given the possibility of several gradual breaks which can be approximated by smooth breaks couched in the FFF-VAR model.

The remainder of this paper is organized as follows: in the next section, we discuss why it is important to consider nonlinearities when analysing the energy-growth nexus; we explain the econometric methodology in section 3 and present the results of our analysis in section 4. Finally, we outline our conclusions in section 5.

Nonlinearities and the energy-growth nexus

In addition to the selection of relevant variables prior to the study of causality, as stated above, another potential cause of ambiguity in the empirical results on causality is the selection of the functional form of the test. The importance of not neglecting the nonlinearity in energy studies has been widely discussed in the literature. Table 2 summarizes the reasons suggested in the energy literature that motivates the use of a nonlinear framework. Specifically, [ 29 ] conclude that “Due to the influences of economic cycle fluctuations, macroeconomic policies, international oil price fluctuations, technological progress, and industrial adjustment, there may be a nonlinear relationship among economic growth, energy consumption, and CO2 emission” (pp. 1153).

https://doi.org/10.1371/journal.pone.0205671.t002